Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GOLUB CAPITAL INVESTMENT Corp | gcicfy2017q2investorpresen.htm |

GOLUB CAPITAL

INVESTMENT

CORPORATION

INVESTOR PRESENTATION

QUARTER ENDED MARCH 31, 2017

Disclaimer

2

Some of the statements in this presentation constitute forward-looking statements,

which relate to future events or our future performance or financial condition. The

forward-looking statements contained in this presentation involve risks and

uncertainties, including statements as to: our future operating results; our business

prospects and the prospects of our portfolio companies; the effect of investments

that we expect to make and the competition for those investments; our contractual

arrangements and relationships with third parties; actual and potential conflicts of

interest with GC Advisors LLC ("GC Advisors"), our investment adviser, and other

affiliates of Golub Capital LLC (collectively, "Golub Capital"); the dependence of our

future success on the general economy and its effect on the industries in which we

invest; the ability of our portfolio companies to achieve their objectives; the use of

borrowed money to finance a portion of our investments; the adequacy of our

financing sources and working capital; the timing of cash flows, if any, from the

operations of our portfolio companies; general economic and political trends and

other external factors; the ability of GC Advisors to locate suitable investments for

us and to monitor and administer our investments; the ability of GC Advisors or its

affiliates to attract and retain highly talented professionals; our ability to qualify and

maintain our qualification as a regulated investment company and as a business

development company; general price and volume fluctuations in the stock markets;

the impact on our business of the Dodd-Frank Wall Street Reform and Consumer

Protection Act and the rules and regulations issued thereunder and any actions

toward repeal thereof; and the effect of changes to tax legislation and our tax

position.

Such forward-looking statements may include statements preceded by, followed by

or that otherwise include the words “may,” “might,” “will,” “intend,” “should,” “could,”

“can,” “would,” “expect,” “believe,” “estimate,” “anticipate,” “predict,” “potential,” “plan”

or similar words.

We have based the forward-looking statements included in this presentation on

information available to us on the date of this presentation. Actual results could differ

materially from those anticipated in our forward-looking statements and future

results could differ materially from historical performance. You are advised to

consult any additional disclosures that we may make directly to you or through

reports that we have filed or in the future may file with the Securities and Exchange

Commission (“SEC”).

This presentation contains statistics and other data that have been obtained from or

compiled from information made available by third-party service providers. We have

not independently verified such statistics or data.

In evaluating prior performance information in this presentation, you should

remember that past performance is not a guarantee, prediction or projection of

future results, and there can be no assurance that we will achieve similar results in

the future.

Summary of Quarterly Results

3

Second Fiscal Quarter 2017 Highlights

− Net increase in net assets resulting from operations (i.e. net income) for the quarter ended March 31, 2017 was $12.7 million, or $0.30 per

share, resulting in an annualized return on equity of 8.2%. This compares to net income of $14.6 million, or $0.35 per share and an

annualized return on equity of 9.4% for the quarter ended December 31, 2016.

− Net investment income for the quarter ended March 31, 2017 was $10.9 million, or $0.26 per share, as compared to $10.8 million, or $0.26

per share for the quarter ended December 31, 2016. Excluding a $0.4 million accrual for the capital gain incentive fee under GAAP, net

investment income for the quarter ended March 31, 2017 was $11.3 million, or $0.271 per share, as compared to $11.5 million, or $0.281

per share, when excluding a $0.7 million accrual for the capital gain incentive fee under GAAP for the quarter ended December 31, 2016.

− Net realized and unrealized gains on investments of $1.7 million, or $0.04 per share, for the quarter ended March 31, 2017 was the result of

a $0.1 million net realized gain and $1.6 million of net unrealized appreciation. This compares to net realized and unrealized gains on

investments of $3.8 million, or $0.09 per share, for the quarter ended December 31, 2016.

− New middle-market investment commitments totaled $101.2 million for the quarter ended March 31, 2017. Approximately 51% of the new

investment commitments were senior secured loans, 48% were one stop loans, and 1% were investments in equity securities. Overall, total

investments in portfolio companies at fair value increased by approximately 4.8%, or $53.6 million, during the quarter ended March 31, 2017.

1. As a supplement to U.S. generally accepted accounting principles (“GAAP”) financial measures, the Company has provided this non-GAAP performance result. The Company believes that this non-GAAP financial

measure is useful as it excludes the accrual of the capital gain incentive fee which is not contractually payable under the terms of the Company’s investment advisory agreement with GC Advisors ( the “Investment

Advisory Agreement”). The capital gain incentive fee payable as calculated under the Investment Advisory Agreement for the period ended March 31, 2017 is $0. However, in accordance with GAAP, the Company is

required to include aggregate unrealized appreciation on investments in the calculation and accrue a capital gain incentive fee on a quarterly basis as if such unrealized capital appreciation were realized, even though

such unrealized capital appreciation is not permitted to be considered in calculating the fee actually payable under the Investment Advisory Agreement. Although this non-GAAP financial measure is intended to

enhance investors’ understanding of the Company’s business and performance, this non-GAAP financial measure should not be considered an alternative to GAAP. Refer to slide 4 for a reconciliation to the nearest

GAAP measure, net investment income per share.

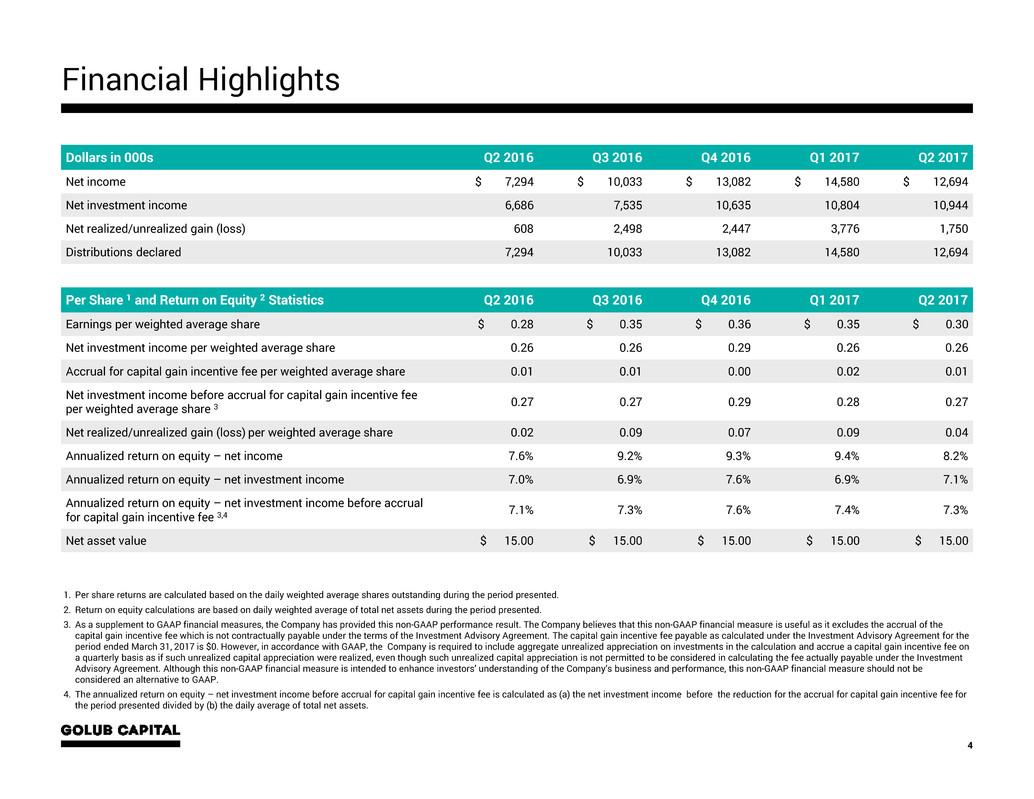

Dollars in 000s Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

Net income $ 7,294 $ 10,033 $ 13,082 $ 14,580 $ 12,694

Net investment income 6,686 7,535 10,635 10,804 10,944

Net realized/unrealized gain (loss) 608 2,498 2,447 3,776 1,750

Distributions declared 7,294 10,033 13,082 14,580 12,694

Per Share 1 and Return on Equity 2 Statistics Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

Earnings per weighted average share $ 0.28 $ 0.35 $ 0.36 $ 0.35 $ 0.30

Net investment income per weighted average share 0.26 0.26 0.29 0.26 0.26

Accrual for capital gain incentive fee per weighted average share 0.01 0.01 0.00 0.02 0.01

Net investment income before accrual for capital gain incentive fee

per weighted average share 3 0.27 0.27 0.29 0.28 0.27

Net realized/unrealized gain (loss) per weighted average share 0.02 0.09 0.07 0.09 0.04

Annualized return on equity – net income 7.6% 9.2% 9.3% 9.4% 8.2%

Annualized return on equity – net investment income 7.0% 6.9% 7.6% 6.9% 7.1%

Annualized return on equity – net investment income before accrual

for capital gain incentive fee 3,4 7.1% 7.3% 7.6% 7.4% 7.3%

Net asset value $ 15.00 $ 15.00 $ 15.00 $ 15.00 $ 15.00

Financial Highlights

4

1. Per share returns are calculated based on the daily weighted average shares outstanding during the period presented.

2. Return on equity calculations are based on daily weighted average of total net assets during the period presented.

3. As a supplement to GAAP financial measures, the Company has provided this non-GAAP performance result. The Company believes that this non-GAAP financial measure is useful as it excludes the accrual of the

capital gain incentive fee which is not contractually payable under the terms of the Investment Advisory Agreement. The capital gain incentive fee payable as calculated under the Investment Advisory Agreement for the

period ended March 31, 2017 is $0. However, in accordance with GAAP, the Company is required to include aggregate unrealized appreciation on investments in the calculation and accrue a capital gain incentive fee on

a quarterly basis as if such unrealized capital appreciation were realized, even though such unrealized capital appreciation is not permitted to be considered in calculating the fee actually payable under the Investment

Advisory Agreement. Although this non-GAAP financial measure is intended to enhance investors’ understanding of the Company’s business and performance, this non-GAAP financial measure should not be

considered an alternative to GAAP.

4. The annualized return on equity – net investment income before accrual for capital gain incentive fee is calculated as (a) the net investment income before the reduction for the accrual for capital gain incentive fee for

the period presented divided by (b) the daily average of total net assets.

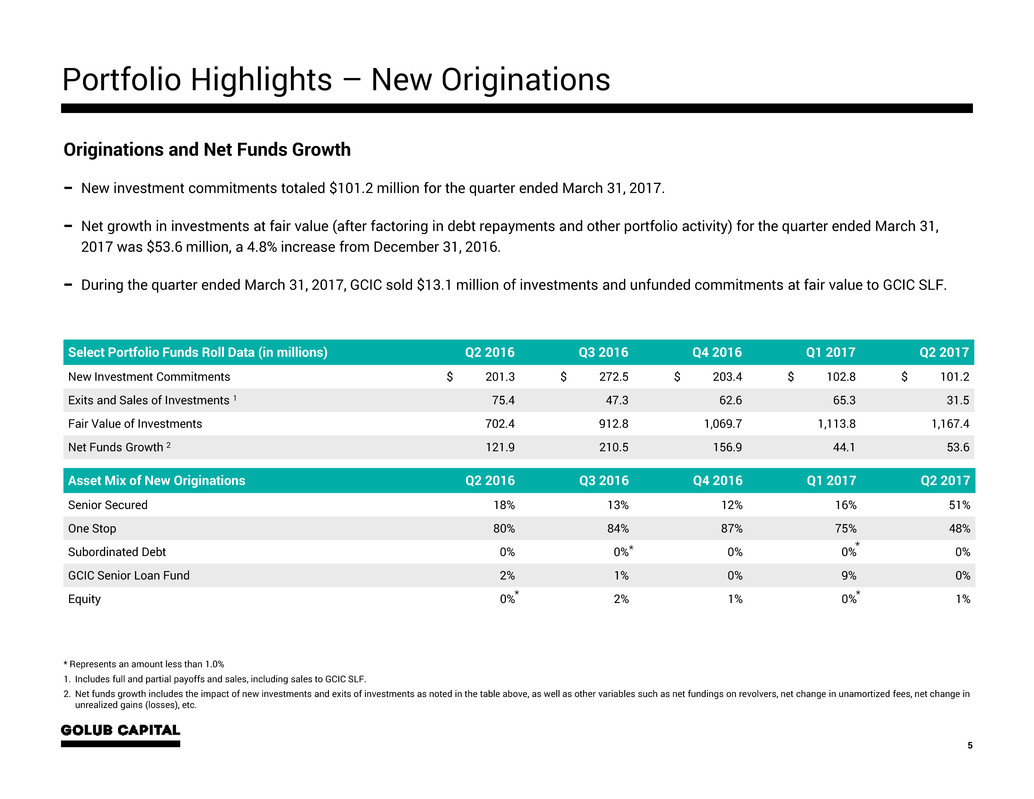

Select Portfolio Funds Roll Data (in millions) Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

New Investment Commitments $ 201.3 $ 272.5 $ 203.4 $ 102.8 $ 101.2

Exits and Sales of Investments 1 75.4 47.3 62.6 65.3 31.5

Fair Value of Investments 702.4 912.8 1,069.7 1,113.8 1,167.4

Net Funds Growth 2 121.9 210.5 156.9 44.1 53.6

Portfolio Highlights – New Originations

5

Originations and Net Funds Growth

− New investment commitments totaled $101.2 million for the quarter ended March 31, 2017.

− Net growth in investments at fair value (after factoring in debt repayments and other portfolio activity) for the quarter ended March 31,

2017 was $53.6 million, a 4.8% increase from December 31, 2016.

− During the quarter ended March 31, 2017, GCIC sold $13.1 million of investments and unfunded commitments at fair value to GCIC SLF.

* Represents an amount less than 1.0%

1. Includes full and partial payoffs and sales, including sales to GCIC SLF.

2. Net funds growth includes the impact of new investments and exits of investments as noted in the table above, as well as other variables such as net fundings on revolvers, net change in unamortized fees, net change in

unrealized gains (losses), etc.

Asset Mix of New Originations Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

Senior Secured 18% 13% 12% 16% 51%

One Stop 80% 84% 87% 75% 48%

Subordinated Debt 0% 0% 0% 0% 0%

GCIC Senior Loan Fund 2% 1% 0% 9% 0%

Equity 0% 2% 1% 0% 1%* *

**

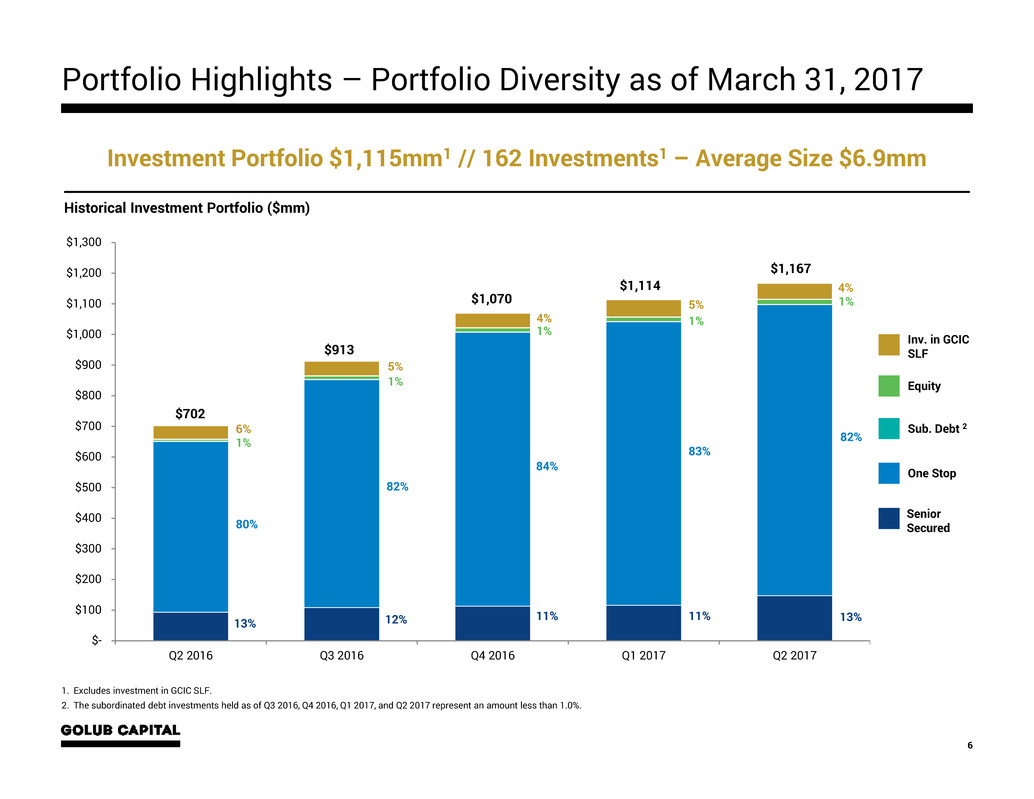

Portfolio Highlights – Portfolio Diversity as of March 31, 2017

6

$-

$100

$200

$300

$400

$500

$600

$700

$800

$900

$1,000

$1,100

$1,200

$1,300

Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

5%

Historical Investment Portfolio ($mm)

80%

13%

82%

12%

84%

11%

83%

11%

82%

13%

Equity

Inv. in GCIC

SLF

One Stop

Senior

Secured

Investment Portfolio $1,115mm1 // 162 Investments1 – Average Size $6.9mm

$1,167

$702

$913

$1,070

$1,114

1%

1%

1%

1%

4%

5%

4%

1. Excludes investment in GCIC SLF.

2. The subordinated debt investments held as of Q3 2016, Q4 2016, Q1 2017, and Q2 2017 represent an amount less than 1.0%.

Sub. Debt 26%

1%

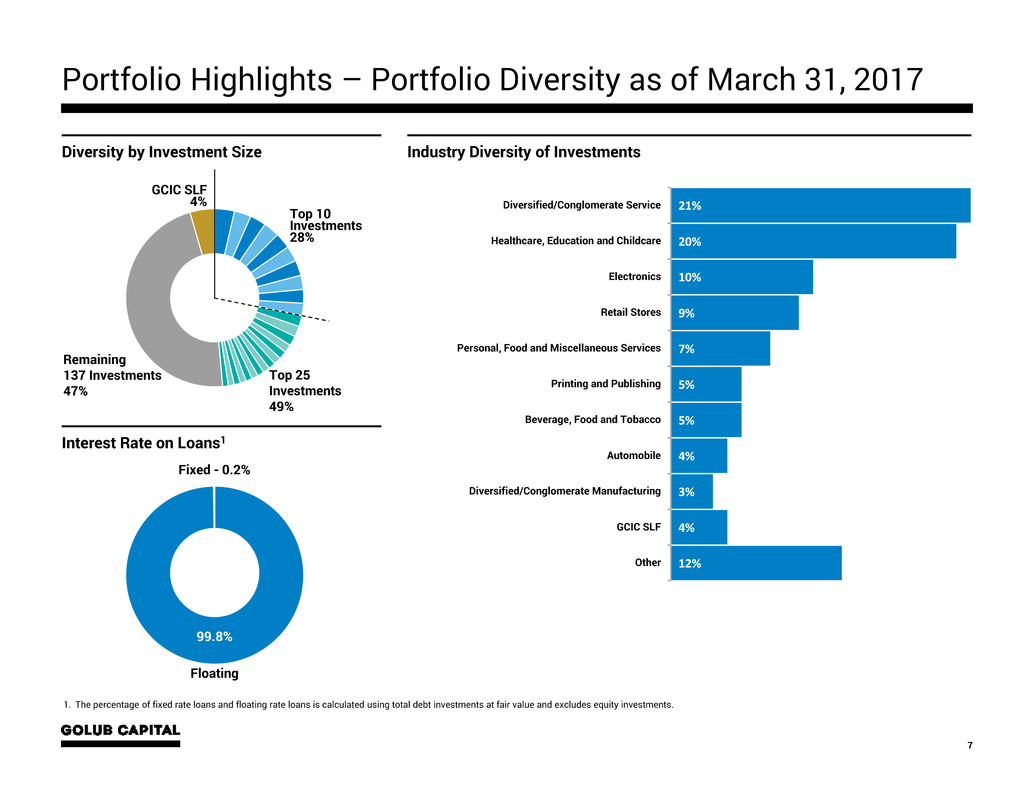

21%

20%

10%

9%

7%

5%

5%

4%

3%

4%

12%

Diversified/Conglomerate Service

Healthcare, Education and Childcare

Electronics

Retail Stores

Personal, Food and Miscellaneous Services

Printing and Publishing

Beverage, Food and Tobacco

Automobile

Diversified/Conglomerate Manufacturing

GCIC SLF

Other

Portfolio Highlights – Portfolio Diversity as of March 31, 2017

7

Industry Diversity of Investments

1. The percentage of fixed rate loans and floating rate loans is calculated using total debt investments at fair value and excludes equity investments.

Interest Rate on Loans1

Fixed - 0.2%

99.8%

Floating

Diversity by Investment Size

Top 25

Investments

49%

Remaining

137 Investments

47%

GCIC SLF

4%

Top 10

Investments

28%

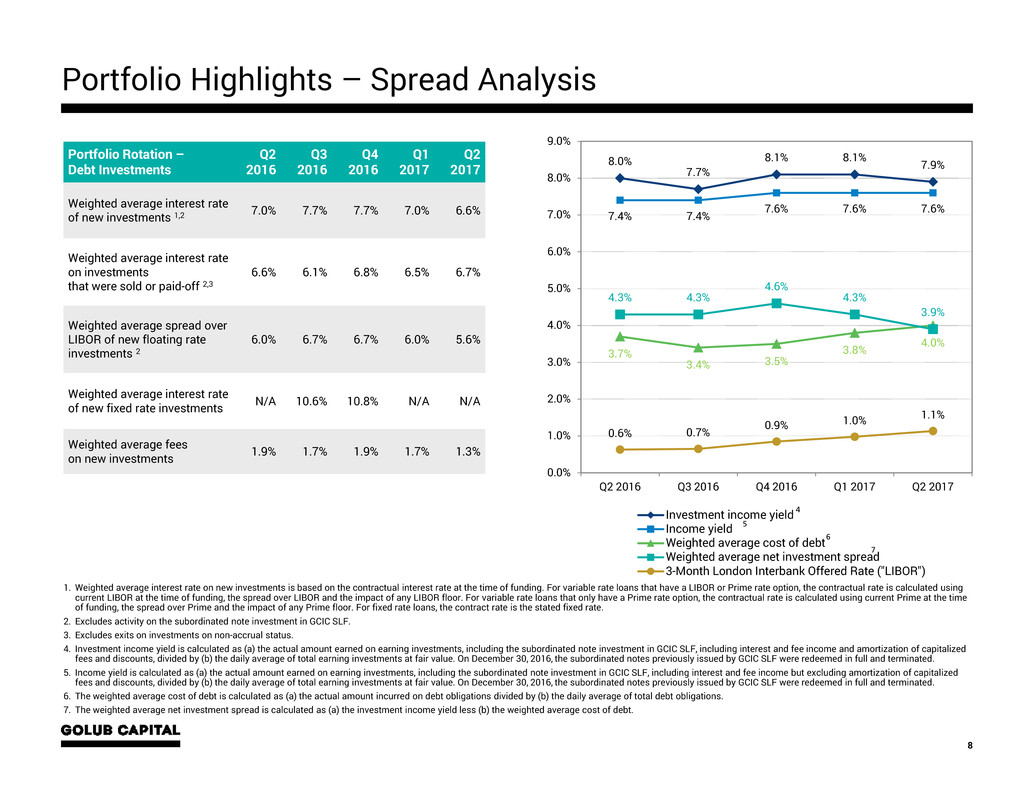

Portfolio Highlights – Spread Analysis

8

8.0%

7.7%

8.1% 8.1%

7.9%

7.4% 7.4%

7.6% 7.6% 7.6%

3.7%

3.4% 3.5%

3.8%

4.0%

4.3% 4.3%

4.6%

4.3%

3.9%

0.6% 0.7%

0.9% 1.0%

1.1%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

Investment income yield

Income yield

Weighted average cost of debt

Weighted average net investment spread

3-Month London Interbank Offered Rate ("LIBOR")

5

7

6

4

1. Weighted average interest rate on new investments is based on the contractual interest rate at the time of funding. For variable rate loans that have a LIBOR or Prime rate option, the contractual rate is calculated using

current LIBOR at the time of funding, the spread over LIBOR and the impact of any LIBOR floor. For variable rate loans that only have a Prime rate option, the contractual rate is calculated using current Prime at the time

of funding, the spread over Prime and the impact of any Prime floor. For fixed rate loans, the contract rate is the stated fixed rate.

2. Excludes activity on the subordinated note investment in GCIC SLF.

3. Excludes exits on investments on non-accrual status.

4. Investment income yield is calculated as (a) the actual amount earned on earning investments, including the subordinated note investment in GCIC SLF, including interest and fee income and amortization of capitalized

fees and discounts, divided by (b) the daily average of total earning investments at fair value. On December 30, 2016, the subordinated notes previously issued by GCIC SLF were redeemed in full and terminated.

5. Income yield is calculated as (a) the actual amount earned on earning investments, including the subordinated note investment in GCIC SLF, including interest and fee income but excluding amortization of capitalized

fees and discounts, divided by (b) the daily average of total earning investments at fair value. On December 30, 2016, the subordinated notes previously issued by GCIC SLF were redeemed in full and terminated.

6. The weighted average cost of debt is calculated as (a) the actual amount incurred on debt obligations divided by (b) the daily average of total debt obligations.

7. The weighted average net investment spread is calculated as (a) the investment income yield less (b) the weighted average cost of debt.

Portfolio Rotation –

Debt Investments

Q2

2016

Q3

2016

Q4

2016

Q1

2017

Q2

2017

Weighted average interest rate

of new investments 1,2 7.0% 7.7% 7.7% 7.0% 6.6%

Weighted average interest rate

on investments

that were sold or paid-off 2,3

6.6% 6.1% 6.8% 6.5% 6.7%

Weighted average spread over

LIBOR of new floating rate

investments 2

6.0% 6.7% 6.7% 6.0% 5.6%

Weighted average interest rate

of new fixed rate investments N/A 10.6% 10.8% N/A N/A

Weighted average fees

on new investments 1.9% 1.7% 1.9% 1.7% 1.3%

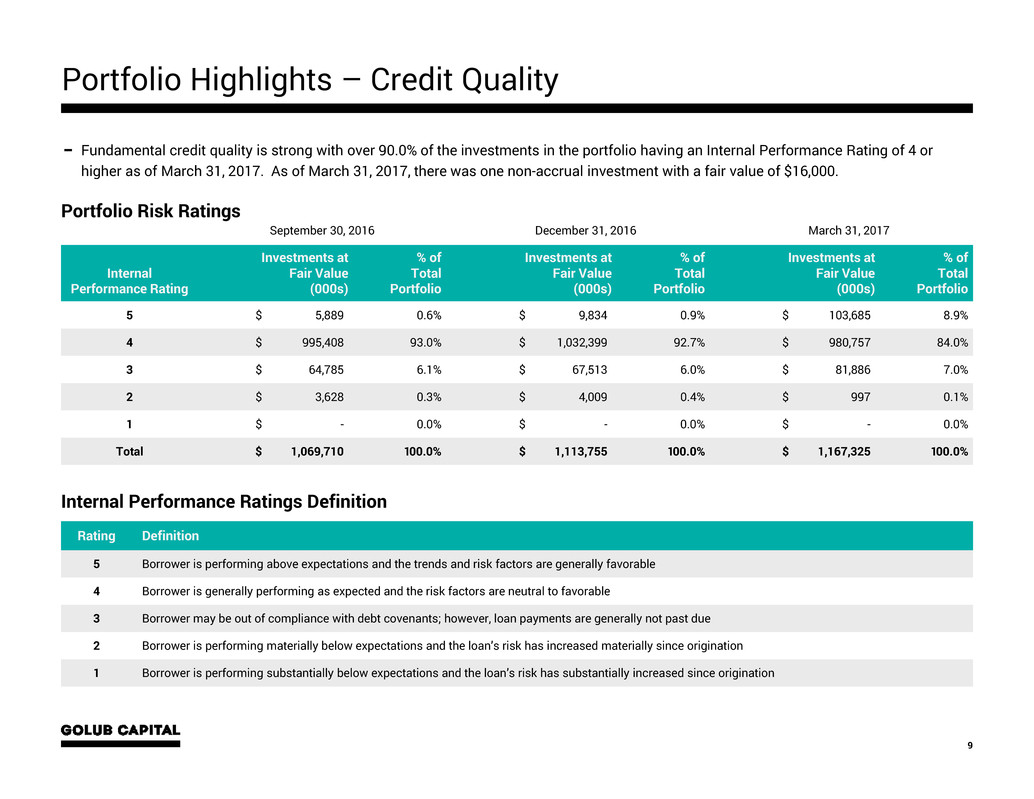

September 30, 2016 December 31, 2016 March 31, 2017

Internal

Performance Rating

Investments at

Fair Value

(000s)

% of

Total

Portfolio

Investments at

Fair Value

(000s)

% of

Total

Portfolio

Investments at

Fair Value

(000s)

% of

Total

Portfolio

5 $ 5,889 0.6% $ 9,834 0.9% $ 103,685 8.9%

4 $ 995,408 93.0% $ 1,032,399 92.7% $ 980,757 84.0%

3 $ 64,785 6.1% $ 67,513 6.0% $ 81,886 7.0%

2 $ 3,628 0.3% $ 4,009 0.4% $ 997 0.1%

1 $ - 0.0% $ - 0.0% $ - 0.0%

Total $ 1,069,710 100.0% $ 1,113,755 100.0% $ 1,167,325 100.0%

Portfolio Highlights – Credit Quality

9

− Fundamental credit quality is strong with over 90.0% of the investments in the portfolio having an Internal Performance Rating of 4 or

higher as of March 31, 2017. As of March 31, 2017, there was one non-accrual investment with a fair value of $16,000.

Portfolio Risk Ratings

Internal Performance Ratings Definition

Rating Definition

5 Borrower is performing above expectations and the trends and risk factors are generally favorable

4 Borrower is generally performing as expected and the risk factors are neutral to favorable

3 Borrower may be out of compliance with debt covenants; however, loan payments are generally not past due

2 Borrower is performing materially below expectations and the loan’s risk has increased materially since origination

1 Borrower is performing substantially below expectations and the loan’s risk has substantially increased since origination

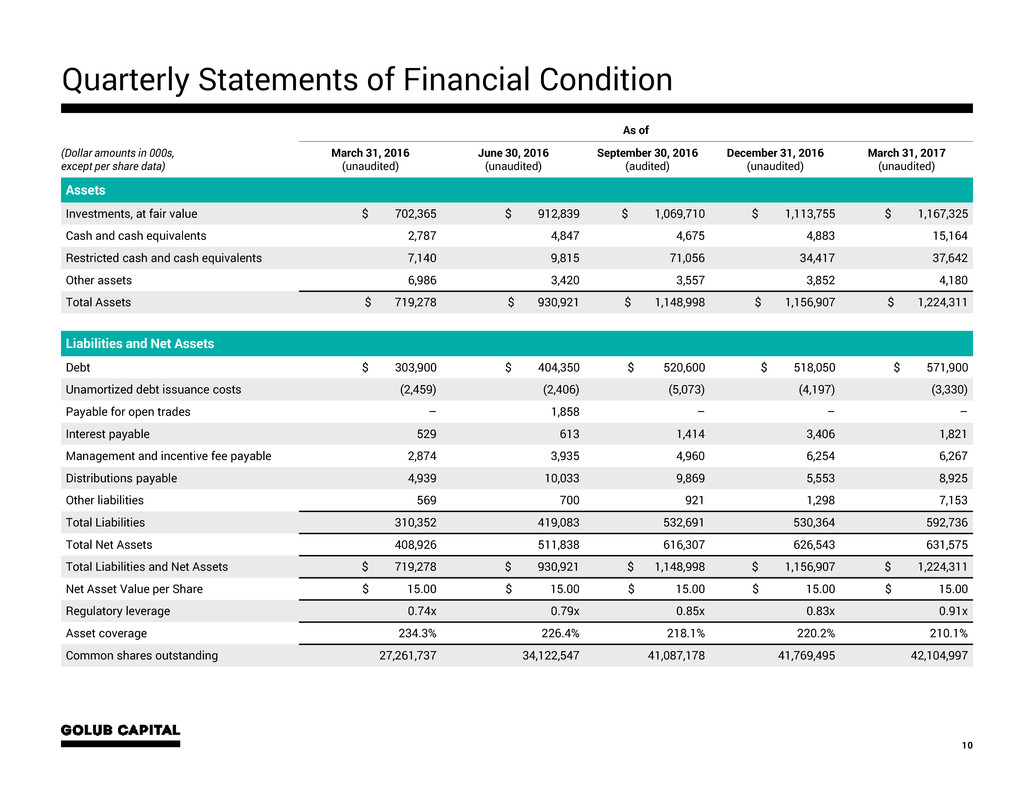

Quarterly Statements of Financial Condition

10

As of

(Dollar amounts in 000s,

except per share data)

March 31, 2016

(unaudited)

June 30, 2016

(unaudited)

September 30, 2016

(audited)

December 31, 2016

(unaudited)

March 31, 2017

(unaudited)

Assets

Investments, at fair value $ 702,365 $ 912,839 $ 1,069,710 $ 1,113,755 $ 1,167,325

Cash and cash equivalents 2,787 4,847 4,675 4,883 15,164

Restricted cash and cash equivalents 7,140 9,815 71,056 34,417 37,642

Other assets 6,986 3,420 3,557 3,852 4,180

Total Assets $ 719,278 $ 930,921 $ 1,148,998 $ 1,156,907 $ 1,224,311

Liabilities and Net Assets

Debt $ 303,900 $ 404,350 $ 520,600 $ 518,050 $ 571,900

Unamortized debt issuance costs (2,459) (2,406) (5,073) (4,197) (3,330)

Payable for open trades – 1,858 – – –

Interest payable 529 613 1,414 3,406 1,821

Management and incentive fee payable 2,874 3,935 4,960 6,254 6,267

Distributions payable 4,939 10,033 9,869 5,553 8,925

Other liabilities 569 700 921 1,298 7,153

Total Liabilities 310,352 419,083 532,691 530,364 592,736

Total Net Assets 408,926 511,838 616,307 626,543 631,575

Total Liabilities and Net Assets $ 719,278 $ 930,921 $ 1,148,998 $ 1,156,907 $ 1,224,311

Net Asset Value per Share $ 15.00 $ 15.00 $ 15.00 $ 15.00 $ 15.00

Regulatory leverage 0.74x 0.79x 0.85x 0.83x 0.91x

Asset coverage 234.3% 226.4% 218.1% 220.2% 210.1%

Common shares outstanding 27,261,737 34,122,547 41,087,178 41,769,495 42,104,997

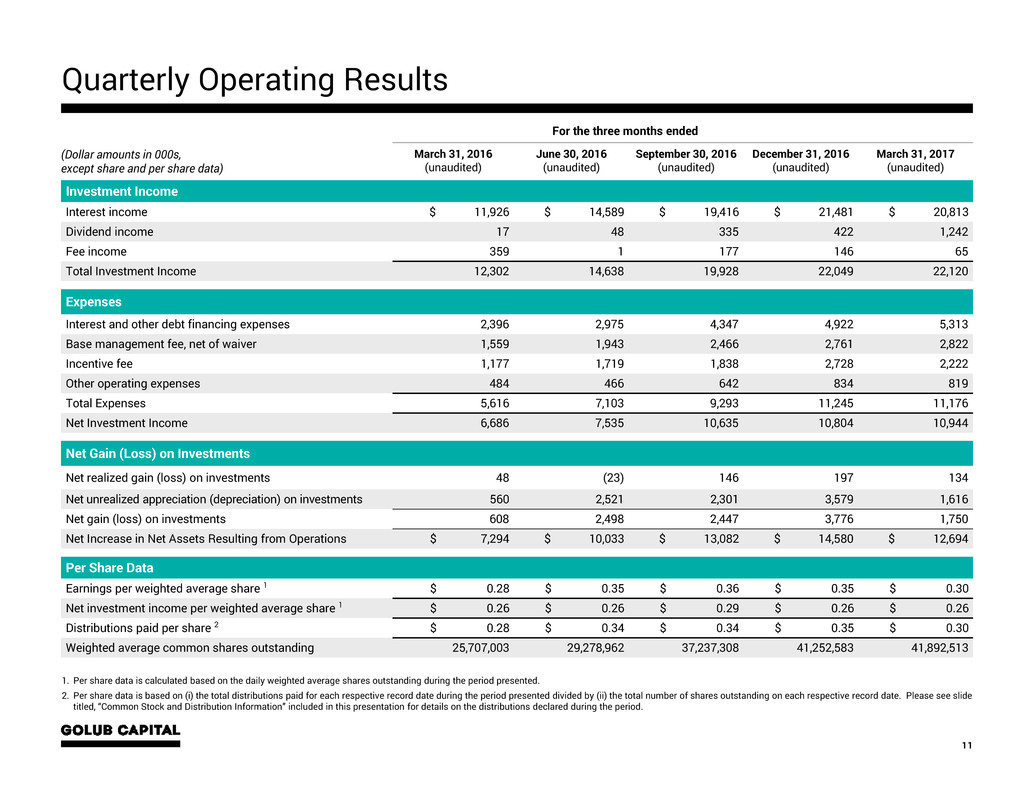

Quarterly Operating Results

11

1. Per share data is calculated based on the daily weighted average shares outstanding during the period presented.

2. Per share data is based on (i) the total distributions paid for each respective record date during the period presented divided by (ii) the total number of shares outstanding on each respective record date. Please see slide

titled, “Common Stock and Distribution Information” included in this presentation for details on the distributions declared during the period.

For the three months ended

(Dollar amounts in 000s,

except share and per share data)

March 31, 2016

(unaudited)

June 30, 2016

(unaudited)

September 30, 2016

(unaudited)

December 31, 2016

(unaudited)

March 31, 2017

(unaudited)

Investment Income

Interest income $ 11,926 $ 14,589 $ 19,416 $ 21,481 $ 20,813

Dividend income 17 48 335 422 1,242

Fee income 359 1 177 146 65

Total Investment Income 12,302 14,638 19,928 22,049 22,120

Expenses

Interest and other debt financing expenses 2,396 2,975 4,347 4,922 5,313

Base management fee, net of waiver 1,559 1,943 2,466 2,761 2,822

Incentive fee 1,177 1,719 1,838 2,728 2,222

Other operating expenses 484 466 642 834 819

Total Expenses 5,616 7,103 9,293 11,245 11,176

Net Investment Income 6,686 7,535 10,635 10,804 10,944

Net Gain (Loss) on Investments

Net realized gain (loss) on investments 48 (23) 146 197 134

Net unrealized appreciation (depreciation) on investments 560 2,521 2,301 3,579 1,616

Net gain (loss) on investments 608 2,498 2,447 3,776 1,750

Net Increase in Net Assets Resulting from Operations $ 7,294 $ 10,033 $ 13,082 $ 14,580 $ 12,694

Per Share Data

Earnings per weighted average share 1 $ 0.28 $ 0.35 $ 0.36 $ 0.35 $ 0.30

Net investment income per weighted average share 1 $ 0.26 $ 0.26 $ 0.29 $ 0.26 $ 0.26

Distributions paid per share 2 $ 0.28 $ 0.34 $ 0.34 $ 0.35 $ 0.30

Weighted average common shares outstanding 25,707,003 29,278,962 37,237,308 41,252,583 41,892,513

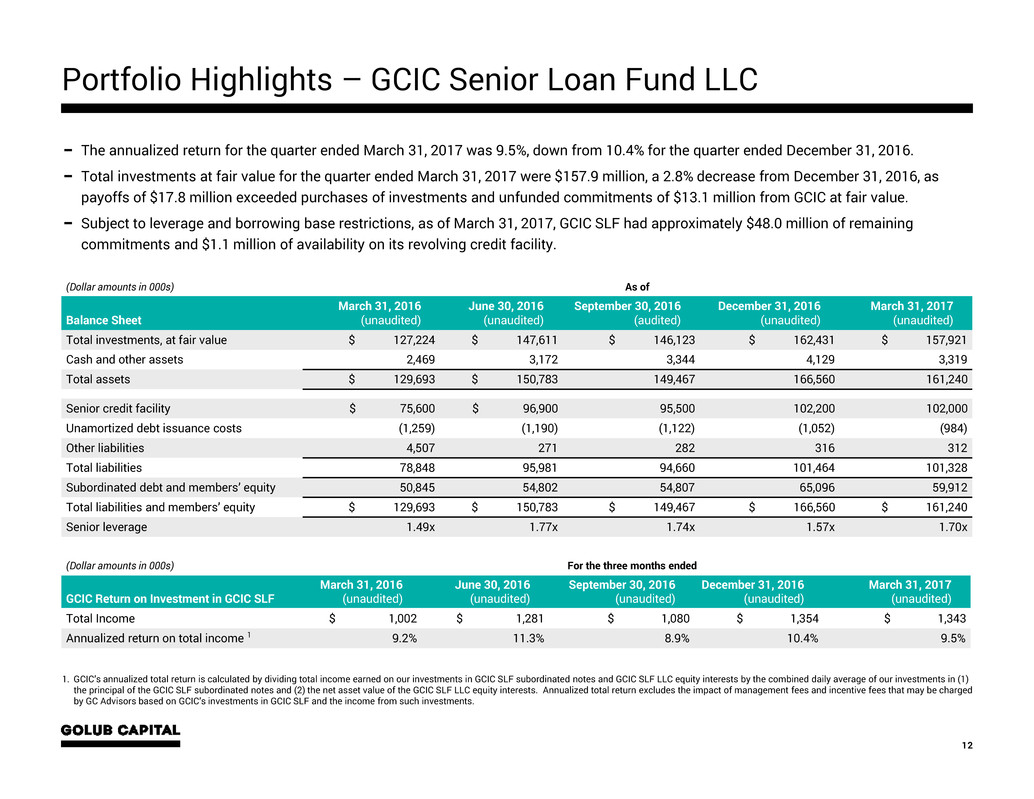

Portfolio Highlights – GCIC Senior Loan Fund LLC

12

− The annualized return for the quarter ended March 31, 2017 was 9.5%, down from 10.4% for the quarter ended December 31, 2016.

− Total investments at fair value for the quarter ended March 31, 2017 were $157.9 million, a 2.8% decrease from December 31, 2016, as

payoffs of $17.8 million exceeded purchases of investments and unfunded commitments of $13.1 million from GCIC at fair value.

− Subject to leverage and borrowing base restrictions, as of March 31, 2017, GCIC SLF had approximately $48.0 million of remaining

commitments and $1.1 million of availability on its revolving credit facility.

1. GCIC’s annualized total return is calculated by dividing total income earned on our investments in GCIC SLF subordinated notes and GCIC SLF LLC equity interests by the combined daily average of our investments in (1)

the principal of the GCIC SLF subordinated notes and (2) the net asset value of the GCIC SLF LLC equity interests. Annualized total return excludes the impact of management fees and incentive fees that may be charged

by GC Advisors based on GCIC’s investments in GCIC SLF and the income from such investments.

(Dollar amounts in 000s) As of

Balance Sheet

March 31, 2016

(unaudited)

June 30, 2016

(unaudited)

September 30, 2016

(audited)

December 31, 2016

(unaudited)

March 31, 2017

(unaudited)

Total investments, at fair value $ 127,224 $ 147,611 $ 146,123 $ 162,431 $ 157,921

Cash and other assets 2,469 3,172 3,344 4,129 3,319

Total assets $ 129,693 $ 150,783 149,467 166,560 161,240

Senior credit facility $ 75,600 $ 96,900 95,500 102,200 102,000

Unamortized debt issuance costs (1,259) (1,190) (1,122) (1,052) (984)

Other liabilities 4,507 271 282 316 312

Total liabilities 78,848 95,981 94,660 101,464 101,328

Subordinated debt and members’ equity 50,845 54,802 54,807 65,096 59,912

Total liabilities and members’ equity $ 129,693 $ 150,783 $ 149,467 $ 166,560 $ 161,240

Senior leverage 1.49x 1.77x 1.74x 1.57x 1.70x

(Dollar amounts in 000s) For the three months ended

GCIC Return on Investment in GCIC SLF

March 31, 2016

(unaudited)

June 30, 2016

(unaudited)

September 30, 2016

(unaudited)

December 31, 2016

(unaudited)

March 31, 2017

(unaudited)

Total Income $ 1,002 $ 1,281 $ 1,080 $ 1,354 $ 1,343

Annualized return on total income 1 9.2% 11.3% 8.9% 10.4% 9.5%

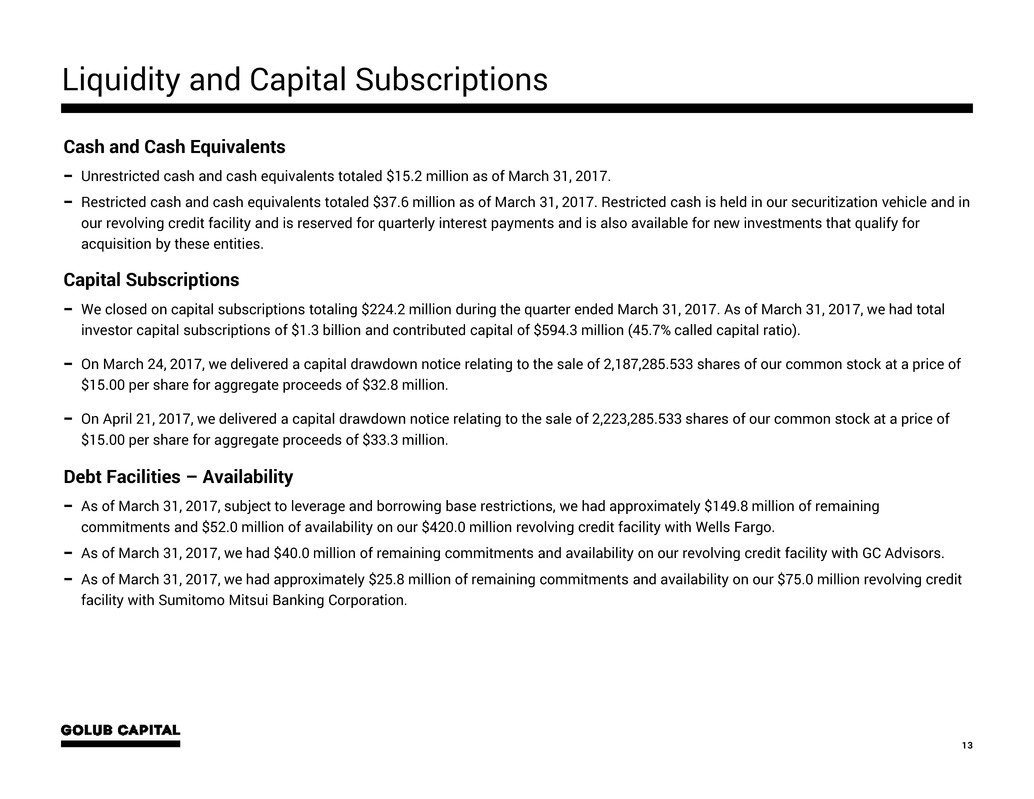

Liquidity and Capital Subscriptions

13

Cash and Cash Equivalents

− Unrestricted cash and cash equivalents totaled $15.2 million as of March 31, 2017.

− Restricted cash and cash equivalents totaled $37.6 million as of March 31, 2017. Restricted cash is held in our securitization vehicle and in

our revolving credit facility and is reserved for quarterly interest payments and is also available for new investments that qualify for

acquisition by these entities.

Capital Subscriptions

− We closed on capital subscriptions totaling $224.2 million during the quarter ended March 31, 2017. As of March 31, 2017, we had total

investor capital subscriptions of $1.3 billion and contributed capital of $594.3 million (45.7% called capital ratio).

− On March 24, 2017, we delivered a capital drawdown notice relating to the sale of 2,187,285.533 shares of our common stock at a price of

$15.00 per share for aggregate proceeds of $32.8 million.

− On April 21, 2017, we delivered a capital drawdown notice relating to the sale of 2,223,285.533 shares of our common stock at a price of

$15.00 per share for aggregate proceeds of $33.3 million.

Debt Facilities – Availability

− As of March 31, 2017, subject to leverage and borrowing base restrictions, we had approximately $149.8 million of remaining

commitments and $52.0 million of availability on our $420.0 million revolving credit facility with Wells Fargo.

− As of March 31, 2017, we had $40.0 million of remaining commitments and availability on our revolving credit facility with GC Advisors.

− As of March 31, 2017, we had approximately $25.8 million of remaining commitments and availability on our $75.0 million revolving credit

facility with Sumitomo Mitsui Banking Corporation.

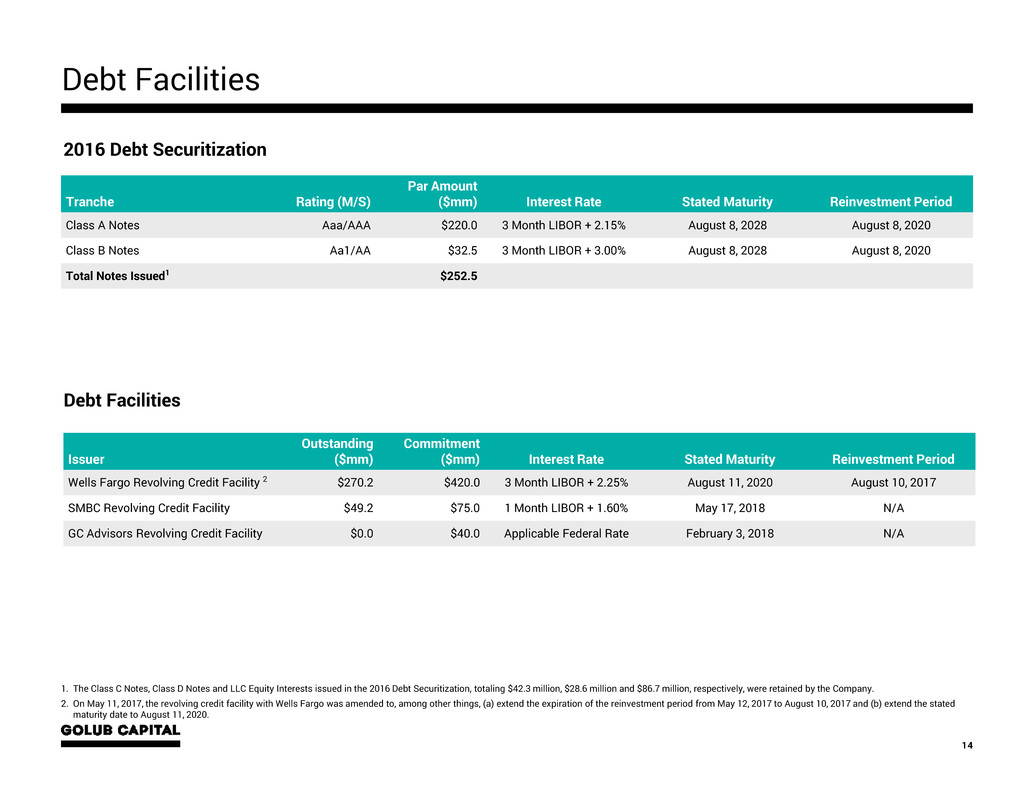

2016 Debt Securitization

Debt Facilities

Debt Facilities

14

Tranche Rating (M/S)

Par Amount

($mm) Interest Rate Stated Maturity Reinvestment Period

Class A Notes Aaa/AAA $220.0 3 Month LIBOR + 2.15% August 8, 2028 August 8, 2020

Class B Notes Aa1/AA $32.5 3 Month LIBOR + 3.00% August 8, 2028 August 8, 2020

Total Notes Issued1 $252.5

Issuer

Outstanding

($mm)

Commitment

($mm) Interest Rate Stated Maturity Reinvestment Period

Wells Fargo Revolving Credit Facility 2 $270.2 $420.0 3 Month LIBOR + 2.25% August 11, 2020 August 10, 2017

SMBC Revolving Credit Facility $49.2 $75.0 1 Month LIBOR + 1.60% May 17, 2018 N/A

GC Advisors Revolving Credit Facility $0.0 $40.0 Applicable Federal Rate February 3, 2018 N/A

1. The Class C Notes, Class D Notes and LLC Equity Interests issued in the 2016 Debt Securitization, totaling $42.3 million, $28.6 million and $86.7 million, respectively, were retained by the Company.

2. On May 11, 2017, the revolving credit facility with Wells Fargo was amended to, among other things, (a) extend the expiration of the reinvestment period from May 12, 2017 to August 10, 2017 and (b) extend the stated

maturity date to August 11, 2020.

Common Stock and Distribution Information

15

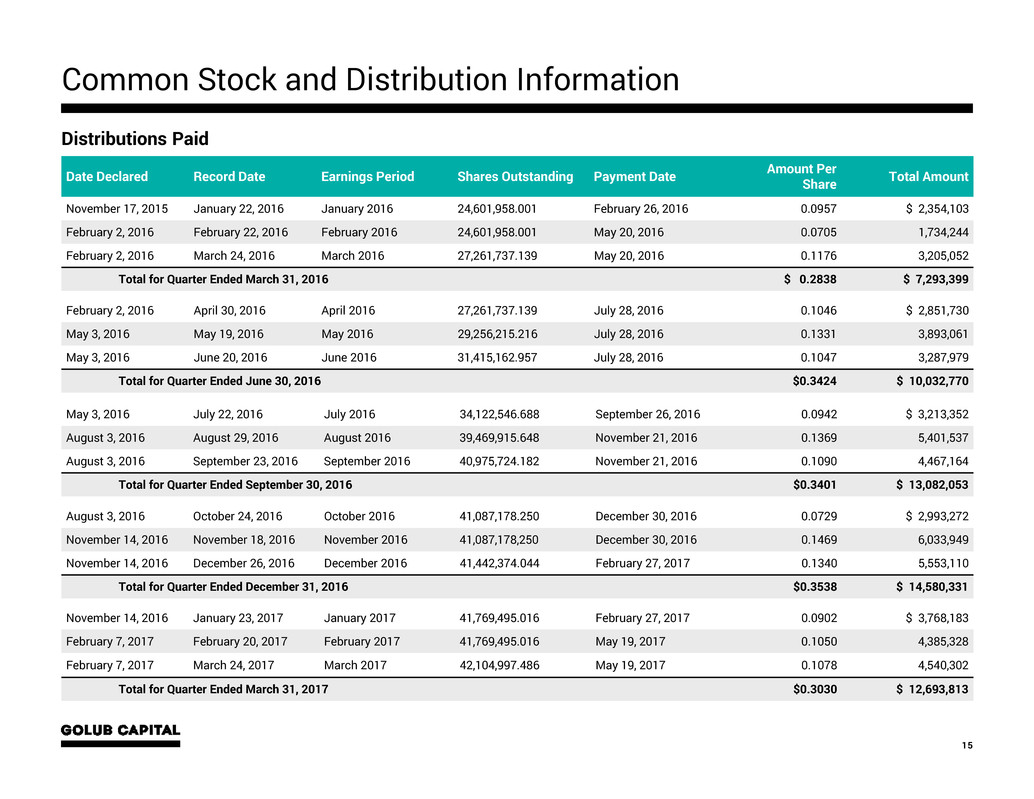

Distributions Paid

Date Declared Record Date Earnings Period Shares Outstanding Payment Date Amount Per Share Total Amount

November 17, 2015 January 22, 2016 January 2016 24,601,958.001 February 26, 2016 0.0957 $ 2,354,103

February 2, 2016 February 22, 2016 February 2016 24,601,958.001 May 20, 2016 0.0705 1,734,244

February 2, 2016 March 24, 2016 March 2016 27,261,737.139 May 20, 2016 0.1176 3,205,052

Total for Quarter Ended March 31, 2016 $ 0.2838 $ 7,293,399

February 2, 2016 April 30, 2016 April 2016 27,261,737.139 July 28, 2016 0.1046 $ 2,851,730

May 3, 2016 May 19, 2016 May 2016 29,256,215.216 July 28, 2016 0.1331 3,893,061

May 3, 2016 June 20, 2016 June 2016 31,415,162.957 July 28, 2016 0.1047 3,287,979

Total for Quarter Ended June 30, 2016 $0.3424 $ 10,032,770

May 3, 2016 July 22, 2016 July 2016 34,122,546.688 September 26, 2016 0.0942 $ 3,213,352

August 3, 2016 August 29, 2016 August 2016 39,469,915.648 November 21, 2016 0.1369 5,401,537

August 3, 2016 September 23, 2016 September 2016 40,975,724.182 November 21, 2016 0.1090 4,467,164

Total for Quarter Ended September 30, 2016 $0.3401 $ 13,082,053

August 3, 2016 October 24, 2016 October 2016 41,087,178.250 December 30, 2016 0.0729 $ 2,993,272

November 14, 2016 November 18, 2016 November 2016 41,087,178,250 December 30, 2016 0.1469 6,033,949

November 14, 2016 December 26, 2016 December 2016 41,442,374.044 February 27, 2017 0.1340 5,553,110

Total for Quarter Ended December 31, 2016 $0.3538 $ 14,580,331

November 14, 2016 January 23, 2017 January 2017 41,769,495.016 February 27, 2017 0.0902 $ 3,768,183

February 7, 2017 February 20, 2017 February 2017 41,769,495.016 May 19, 2017 0.1050 4,385,328

February 7, 2017 March 24, 2017 March 2017 42,104,997.486 May 19, 2017 0.1078 4,540,302

Total for Quarter Ended March 31, 2017 $0.3030 $ 12,693,813

Common Stock and Distribution Information

16

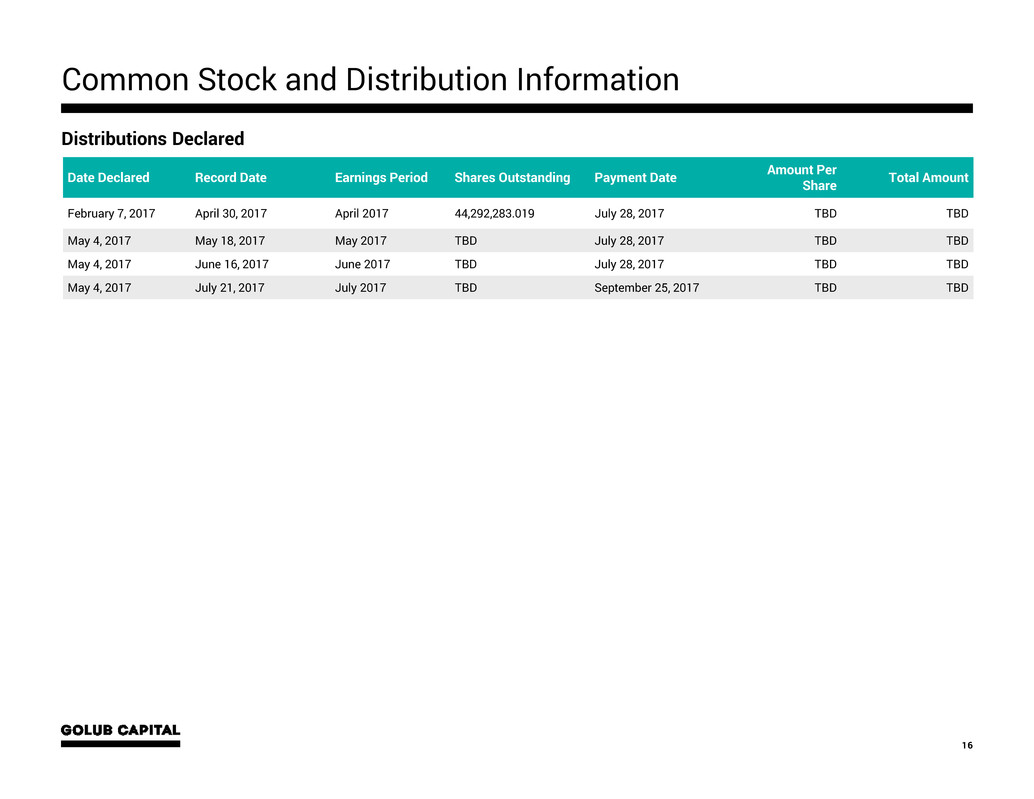

Date Declared Record Date Earnings Period Shares Outstanding Payment Date Amount Per Share Total Amount

February 7, 2017 April 30, 2017 April 2017 44,292,283.019 July 28, 2017 TBD TBD

May 4, 2017 May 18, 2017 May 2017 TBD July 28, 2017 TBD TBD

May 4, 2017 June 16, 2017 June 2017 TBD July 28, 2017 TBD TBD

May 4, 2017 July 21, 2017 July 2017 TBD September 25, 2017 TBD TBD

Distributions Declared