Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 PRESS RELEASE - DARLING INGREDIENTS INC. | exh991-pressreleaseq12017.htm |

| 8-K - 8-K - DARLING INGREDIENTS INC. | dar-20170511x8k.htm |

Randall C. Stuewe, Chairman and CEO

Patrick C. Lynch, EVP Chief Financial Officer

Melissa A. Gaither, VP IR and Global Communications

First Quarter 2017

Earnings Conference Call

May 12, 2017

Exhibit 99.2

2

This presentation contains “forward-looking” statements regarding the business operations and prospects of Darling Ingredients Inc., including its Diamond Green

Diesel joint venture, and industry factors affecting it. These statements are identified by words such as “believe,” “anticipate,” “expect,” “estimate,” “intend,”

“could,” “may,” “will,” “should,” “planned,” “potential,” “continue,” “momentum,” “assumption,” and other words referring to events that may occur in the future.

These statements reflect Darling Ingredient’s current view of future events and are based on its assessment of, and are subject to, a variety of risks and

uncertainties beyond its control, each of which could cause actual results to differ materially from those indicated in the forward-looking statements. These factors

include, among others, existing and unknown future limitations on the ability of the Company's direct and indirect subsidiaries to make their cash flow available to

the Company for payments on the Company's indebtedness or other purposes; global demands for bio-fuels and grain and oilseed commodities, which have

exhibited volatility, and can impact the cost of feed for cattle, hogs and poultry, thus affecting available rendering feedstock and selling prices for the Company’s

products; reductions in raw material volumes available to the Company due to weak margins in the meat production industry as a result of higher feed costs,

reduced consumer demand or other factors, reduced volume from food service establishments, or otherwise; reduced demand for animal feed; reduced finished

product prices, including a decline in fat and used cooking oil finished product prices; changes to worldwide government policies relating to renewable fuels and

greenhouse gas emissions that adversely affect programs like the Renewable Fuel Standards Program (RFS2), low carbon fuel standards (LCFS) and tax credits for

biofuels both in the Unites States and abroad; possible product recall resulting from developments relating to the discovery of unauthorized adulterations to food

or food additives; the occurrence of Bird Flu including, but not limited to H5N1 flu, bovine spongiform encephalopathy (or "BSE"), porcine epidemic diarrhea

("PED") or other diseases associated with animal origin in the United States or elsewhere; unanticipated costs and/or reductions in raw material volumes related to

the Company’s compliance with the existing or unforeseen new U.S. or foreign regulations (including, without limitation, China) affecting the industries in which the

Company operates or its value added products (including new or modified animal feed, Bird Flu, PED or BSE or similar or unanticipated regulations); risks associated

with the renewable diesel plant in Norco, Louisiana owned and operated by a joint venture between Darling Ingredients and Valero Energy Corporation, including

possible unanticipated operating disruptions and issues related to the announced expansion project; difficulties or a significant disruption in our information

systems or failure to implement new systems and software successfully, including our ongoing enterprise resource planning project; risks relating to possible third

party claims of intellectual property infringement; increased contributions to the Company’s pension and benefit plans, including multiemployer and employer-

sponsored defined benefit pension plans as required by legislation, regulation or other applicable U.S. or foreign law or resulting from a U.S. mass withdrawal

event; bad debt write-offs; loss of or failure to obtain necessary permits and registrations; continued or escalated conflict in the Middle East, North Korea, Ukraine

or elsewhere; uncertainty regarding the likely exit of the U.K. from the European Union; and/or unfavorable export or import markets. These factors, coupled with

volatile prices for natural gas and diesel fuel, climate conditions, currency exchange fluctuations, general performance of the U.S. and global economies,

disturbances in world financial, credit, commodities and stock markets, and any decline in consumer confidence and discretionary spending, including the inability

of consumers and companies to obtain credit due to lack of liquidity in the financial markets, among others, could negatively impact the Company's results of

operations. Among other things, future profitability may be affected by the Company’s ability to grow its business, which faces competition from companies that

may have substantially greater resources than the Company. The Company’s announced share repurchase program may be suspended or discontinued at any time

and purchases of shares under the program are subject to market conditions and other factors, which are likely to change from time to time. Other risks and

uncertainties regarding Darling Ingredients Inc., its business and the industries in which it operates are referenced from time to time in the Company’s filings with

the Securities and Exchange Commission. Darling Ingredients Inc. is under no obligation to (and expressly disclaims any such obligation to) update or alter its

forward-looking statements whether as a result of new information, future events or otherwise.

Safe Harbor Statement

3

$50

$60

$70

$80

$90

$100

$110

$120

$130

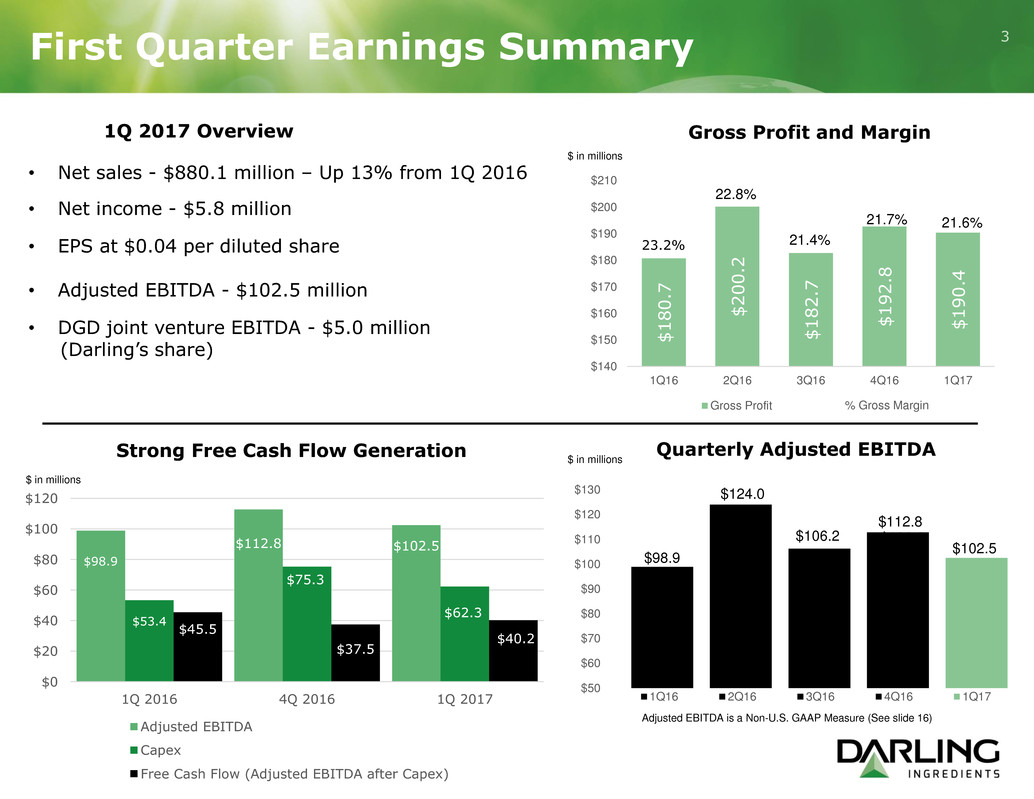

Quarterly Adjusted EBITDA

1Q16 2Q16 3Q16 4Q16 1Q17

$124.0

$106.2

$98.9

$106.2

$102.5

Gross Profit and Margin

$

1

8

0

.7

$

2

0

0

.2

$

1

8

2

.7

$

1

9

2

.8

$

1

9

0

.4

$140

$150

$160

$170

$180

$190

$200

$210

1Q16 2Q16 3Q16 4Q16 1Q17

Gross Profit

22.8%

21.7%

% Gross Margin

21.4%

21.6%

1Q 2017 Overview

$ in millions

$ in millions

$ in millions

Strong Free Cash Flow Generation

Adjusted EBITDA is a Non-U.S. GAAP Measure (See slide 16)

$98.9

$112.8 $102.5

$53.4

$75.3

$62.3

$45.5

$37.5

$40.2

$0

$20

$40

$60

$80

$100

$120

1Q 2016 4Q 2016 1Q 2017

Adjusted EBITDA

Capex

Free Cash Flow (Adjusted EBITDA after Capex)

$98.9

$112.8

23.2%

• Net sales - $880.1 million – Up 13% from 1Q 2016

• Net income - $5.8 million

• EPS at $0.04 per diluted share

• Adjusted EBITDA - $102.5 million

• DGD joint venture EBITDA - $5.0 million

(Darling’s share)

First Quarter Earnings Summary

4

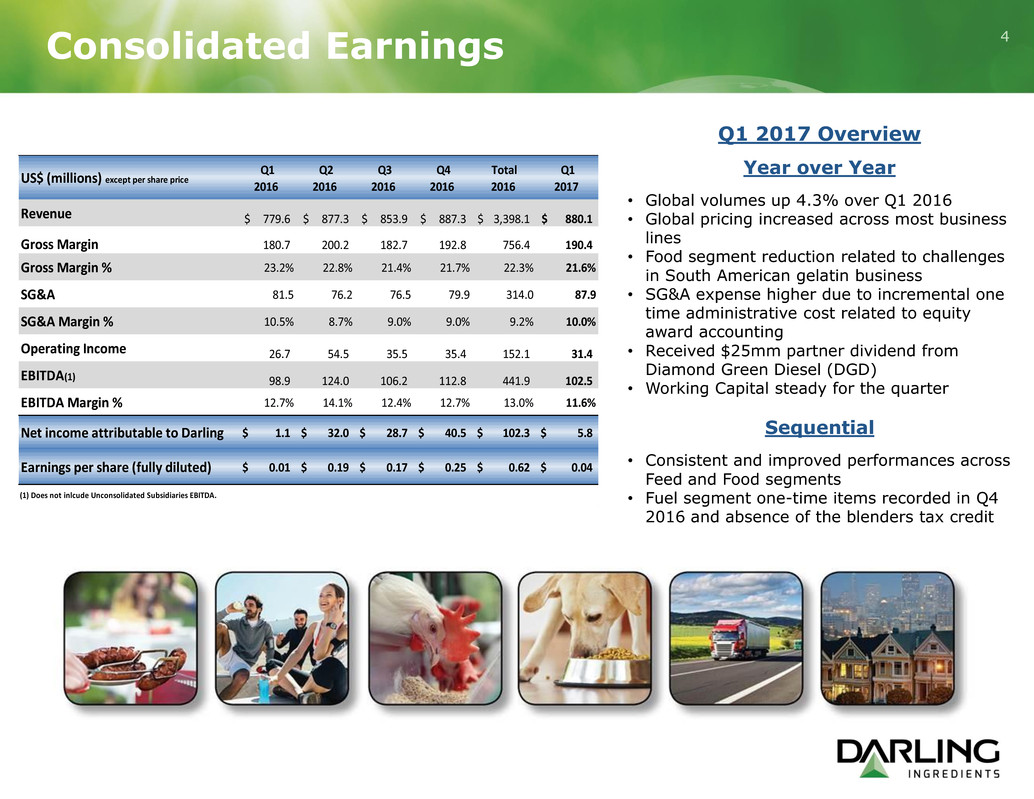

Q1 2017 Overview

Year over Year

• Global volumes up 4.3% over Q1 2016

• Global pricing increased across most business

lines

• Food segment reduction related to challenges

in South American gelatin business

• SG&A expense higher due to incremental one

time administrative cost related to equity

award accounting

• Received $25mm partner dividend from

Diamond Green Diesel (DGD)

• Working Capital steady for the quarter

Sequential

• Consistent and improved performances across

Feed and Food segments

• Fuel segment one-time items recorded in Q4

2016 and absence of the blenders tax credit

Consolidated Earnings

US$ (millions) except per share price

Q1

2016

Q2

2016

Q3

2016

Q4

2016

Total

2016

Q1

2017

Revenue 779.6$ 877.3$ 853.9$ 887.3$ 3,398.1$ 880.1$

Gross Margin 180.7 200.2 182.7 192.8 756.4 190.4

Gross Margin % 23.2% 22.8% 21.4% 21.7% 22.3% 21.6%

SG&A 81.5 76.2 76.5 79.9 314.0 87.9

SG&A Margin % 10.5% 8.7% 9.0% 9.0% 9.2% 10.0%

Operating Income 26.7 54.5 35.5 35.4 152.1 31.4

EBITDA(1) 98.9 124.0 106.2 112.8 441.9 102.5

EBITDA Margin % 12.7% 14.1% 12.4% 12.7% 13.0% 11.6%

Net income attributable to Darling 1.1$ 32.0$ 28.7$ 40.5$ 102.3$ 5.8$

Earnings per shar (fully diluted) 0.01$ 0.19$ 0.17$ 0.25$ 0.62$ 0.04$

(1) Does not inlcude Unco s lidated Subsidiaries EBITDA.

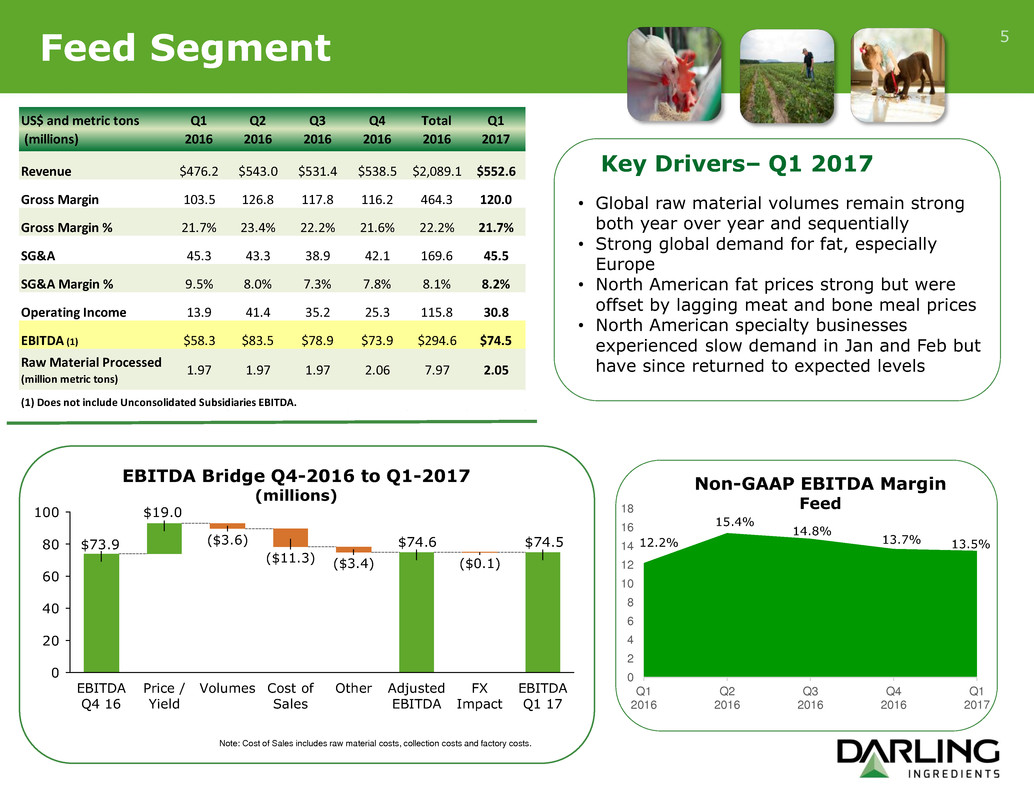

Key Drivers– Q1 2017

5

Non-GAAP EBITDA Margin

Feed

Note: Cost of Sales includes raw material costs, collection costs and factory costs.

EBITDA Bridge Q4-2016 to Q1-2017

(millions)

Feed Segment

$74.5$74.6

$19.0

$73.9

0

20

40

60

80

100

EBITDA

Q1 17

FX

Impact

($0.1)

Adjusted

EBITDA

Other

($3.4)

Cost of

Sales

($11.3)

Volumes

($3.6)

Price /

Yield

EBITDA

Q4 16

0

2

4

6

8

10

12

14

16

18

Q1

2016

Q2

2016

Q3

2016

Q4

2016

Q1

2017

15.4%

14.8%

13.7%12.2% 13.5%

• Global raw material volumes remain strong

both year over year and sequentially

• Strong global demand for fat, especially

Europe

• North American fat prices strong but were

offset by lagging meat and bone meal prices

• North American specialty businesses

experienced slow demand in Jan and Feb but

have since returned to expected levels

US$ and metric tons

(millions)

Q1

2016

Q2

2016

Q3

2016

Q4

2016

Total

2016

Q1

2017

Revenue $476.2 $543.0 $531.4 $538.5 $2,089.1 $552.6

Gross Margin 103.5 126.8 117.8 116.2 464.3 120.0

Gross Margin % 21.7% 23.4% 22.2% 21.6% 22.2% 21.7%

SG&A 45.3 43.3 38.9 42.1 169.6 45.5

SG&A Margin % 9.5% 8.0% 7.3% 7.8% 8.1% 8.2%

Operating Income 13.9 41.4 35.2 25.3 115.8 30.8

EBITDA (1) $58.3 $83.5 $78.9 $73.9 $294.6 $74.5

Raw Material Processed

(million metric tons)

1.97 1.97 1.97 2.06 7.97 2.05

(1) Does not include Unconsolidated Subsidiaries EBITDA.

Note: Cost of Sales includes raw material costs, collection costs and factory costs.

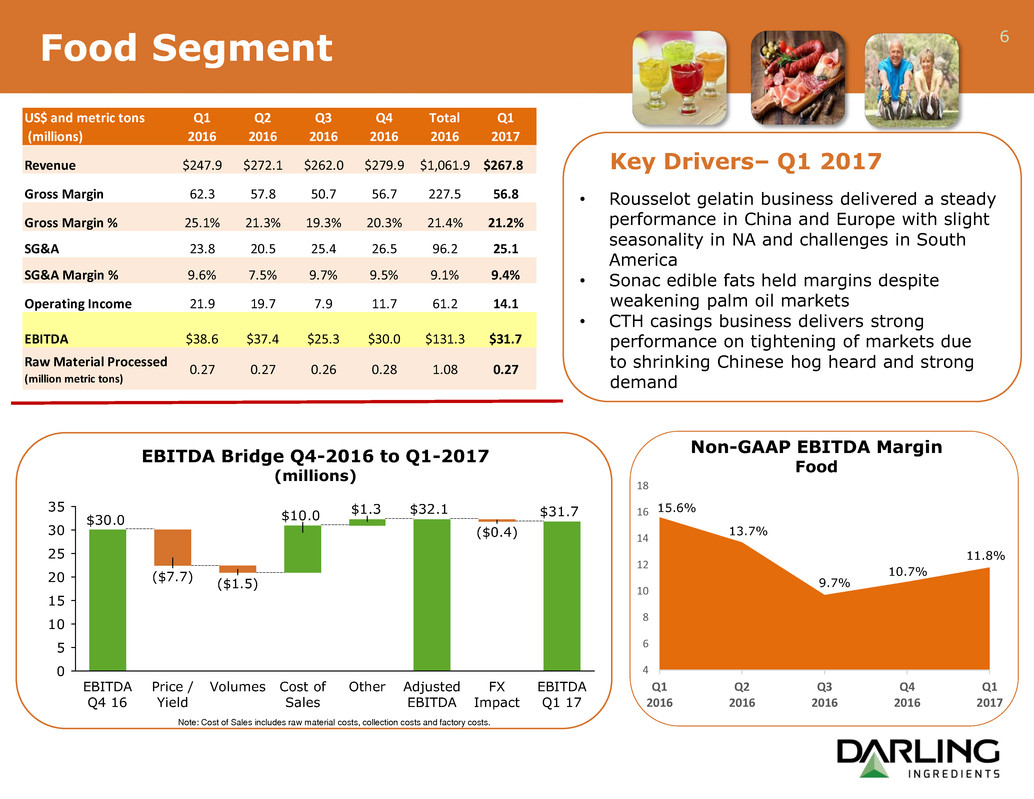

Non-GAAP EBITDA Margin

Food

Key Drivers– Q1 2017

• Rousselot gelatin business delivered a steady

performance in China and Europe with slight

seasonality in NA and challenges in South

America

• Sonac edible fats held margins despite

weakening palm oil markets

• CTH casings business delivers strong

performance on tightening of markets due

to shrinking Chinese hog heard and strong

demand

6

EBITDA Bridge Q4-2016 to Q1-2017

(millions)

Food Segment

$31.7 $32.1 $10.0 $30.0

$1.3

0

5

10

15

20

25

30

35

EBITDA

Q1 17

FX

Impact

($0.4)

Adjusted

EBITDA

OtherCost of

Sales

Volumes

($1.5)

Price /

Yield

($7.7)

EBITDA

Q4 16

4

6

8

10

12

14

16

18

Q1

2016

Q2

2016

Q3

2016

Q4

2016

Q1

2017

15.6%

13.7%

9.7%

10.7%

11.8%

US$ and metric tons

(millions)

Q1

2016

Q2

2016

Q3

2016

Q4

2016

Total

2016

Q1

2017

Revenue $247.9 $272.1 $262.0 $279.9 $1,061.9 $267.8

Gross Margin 62.3 57.8 50.7 56.7 227.5 56.8

Gross Margin % 25.1% 21.3% 19.3% 20.3% 21.4% 21.2%

SG&A 23.8 20.5 25.4 26.5 96.2 25.1

SG&A Margin % 9. % 7.5% 9.7% 9.5% 9.1% 9.4%

Operating Income 21.9 19.7 7.9 11.7 61.2 14.1

EBITDA $38.6 $37.4 $25.3 $30.0 $131.3 $31.7

Raw Material Proc ed

(million metric tons)

0.27 0.27 0.26 0.28 1.08 0.27

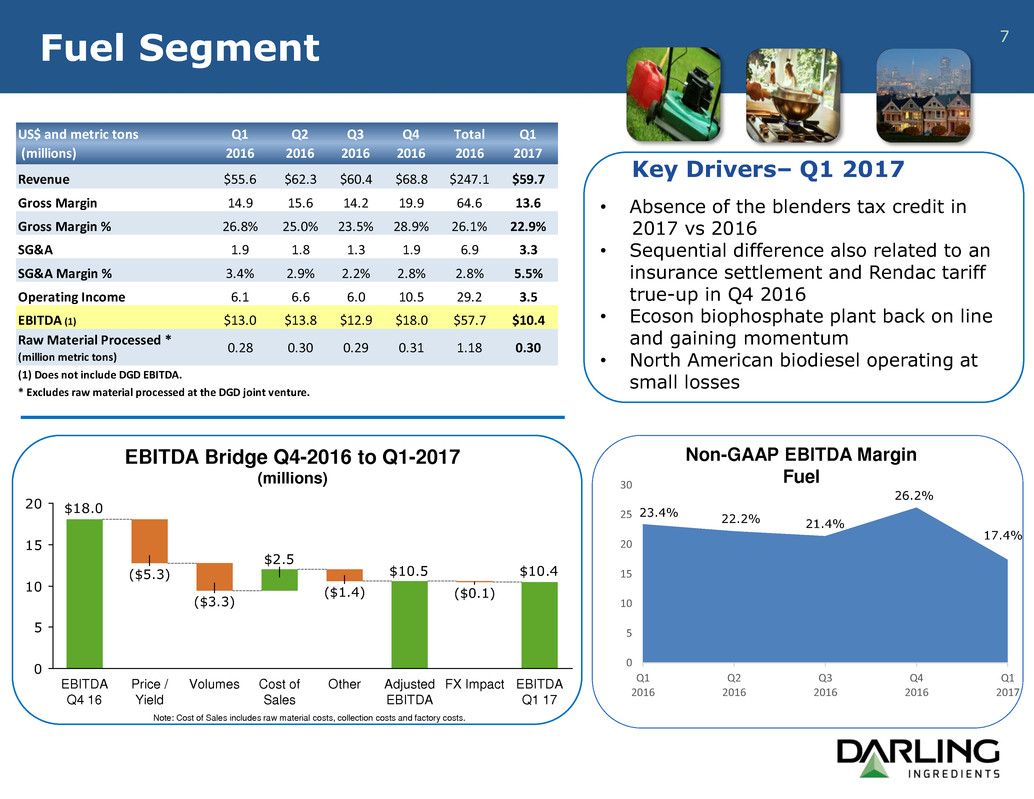

Key Drivers– Q1 2017

• Absence of the blenders tax credit in

2017 vs 2016

• Sequential difference also related to an

insurance settlement and Rendac tariff

true-up in Q4 2016

• Ecoson biophosphate plant back on line

and gaining momentum

• North American biodiesel operating at

small losses

Non-GAAP EBITDA Margin

Fuel

7

Note: Cost of Sales includes raw material costs, collection costs and factory costs.

EBITDA Bridge Q4-2016 to Q1-2017

(millions)

Fuel Segment

$10.4 $10.5

$18.0

$2.5

0

5

10

15

20

Adjusted

EBITDA

EBITDA

Q4 16

Cost of

Sales

Other

($1.4) ($0.1)

($3.3)

($5.3)

FX ImpactVolumes EBITDA

Q1 17

Price /

Yield

0

5

10

15

20

25

30

Q1

2016

Q2

2016

Q3

2016

Q4

2016

Q1

2017

21.4%

26.2%

23.4%

22.2%

17.4%

US$ and metric tons

(millions)

Q1

2016

Q2

2016

Q3

2016

Q4

2016

Total

2016

Q1

2017

Revenue $55.6 $62.3 $60.4 $68.8 $247.1 $59.7

Gross Margin 14.9 15.6 14.2 19.9 64.6 13.6

Gross Margin % 26.8% 25.0% 23.5% 28.9% 26.1% 22.9%

SG&A 1.9 1.8 1.3 1.9 6.9 3.3

SG&A Margin % 3.4% 2.9% 2.2% 2.8% 2.8% 5.5%

Operating Income 6.1 6.6 6.0 10.5 29.2 3.5

EBITDA (1) $13.0 $13.8 $12.9 $18.0 $57.7 $10.4

Raw Material Proce sed *

(million metric tons)

0.28 0.30 0.29 0.31 1.18 0.30

(1) Does not include DGD EBITDA.

* Excludes raw materia processed at the DGD joint venture.

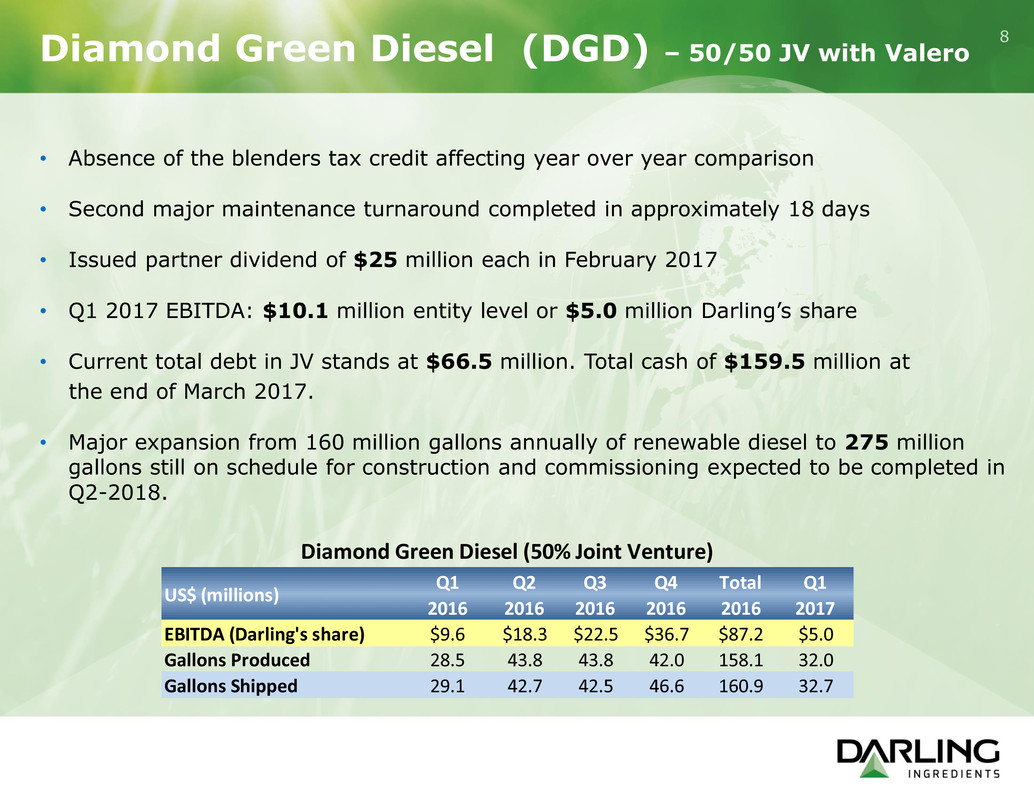

• Absence of the blenders tax credit affecting year over year comparison

• Second major maintenance turnaround completed in approximately 18 days

• Issued partner dividend of $25 million each in February 2017

• Q1 2017 EBITDA: $10.1 million entity level or $5.0 million Darling’s share

• Current total debt in JV stands at $66.5 million. Total cash of $159.5 million at

the end of March 2017.

• Major expansion from 160 million gallons annually of renewable diesel to 275 million

gallons still on schedule for construction and commissioning expected to be completed in

Q2-2018.

8

Diamond Green Diesel (DGD) – 50/50 JV with Valero

US$ (millions)

Q1

2016

Q2

2016

Q3

2016

Q4

2016

Total

2016

Q1

2017

EBITDA (Darling's share) $9.6 $18.3 $22.5 $36.7 $87.2 $5.0

Gallons Produced 28.5 43.8 43.8 42.0 158.1 32.0

Gallons Shipped 29.1 42.7 42.5 46.6 160.9 32.7

Diamond Green Diesel (50% Joint Venture)

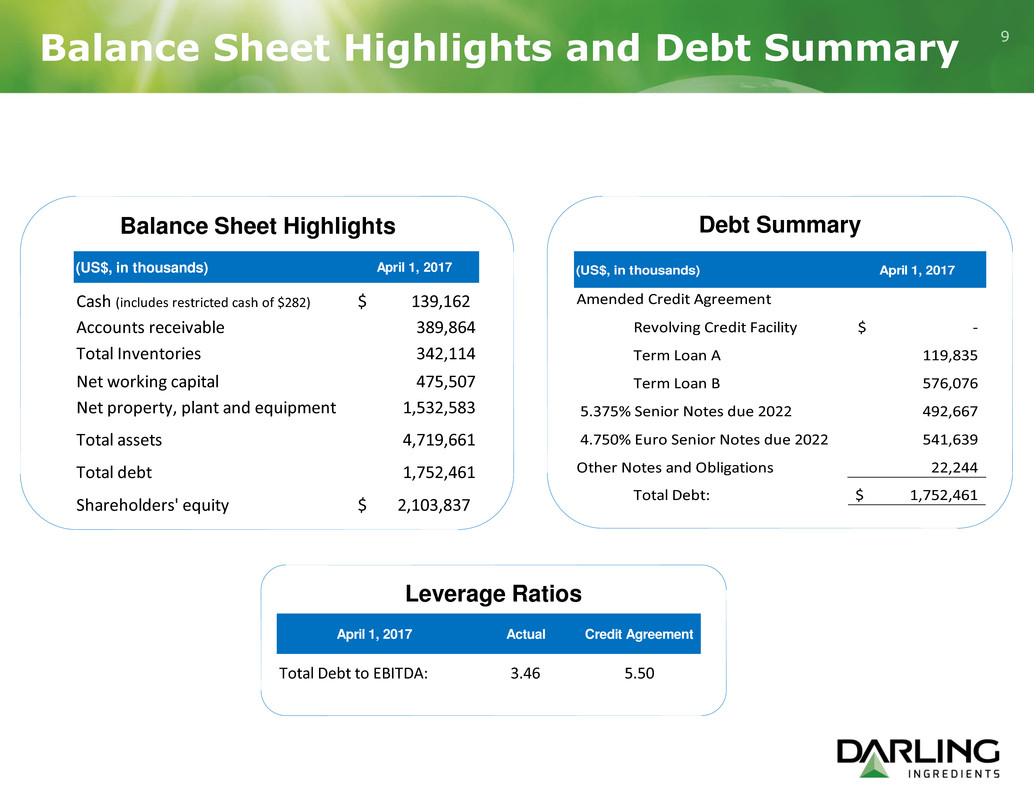

Balance Sheet Highlights

Leverage Ratios

9

Debt Summary

Balance Sheet Highlights and Debt Summary

April 1, 2017 Actual Credit Agreement

Total Debt to EBITDA: 3.46 5.50

(US$, in thousands) April 1, 2017

Cash (includes restricted cash of $282) 139,162$

Accounts receivable 389,864

Total Inventories 342,114

Net working capital 475,507

Net property, plant and equipment 1,532,583

Total assets 4,719,661

Total debt 1,752,461

Shareholders' equity 2,103,837$

(US$, in thousands) April 1, 2017

Amended Credit Agreement

Revolving Credit Facility -$

Term Loan A 119,835

Term Loan B 576,076

5.375% Sen or No es due 2022 492,667

4.750% Euro Senior Notes due 2022 541,639

Other Notes and Obligations 22,244

Total Debt: 1,752,461$

Appendix – Additional Information

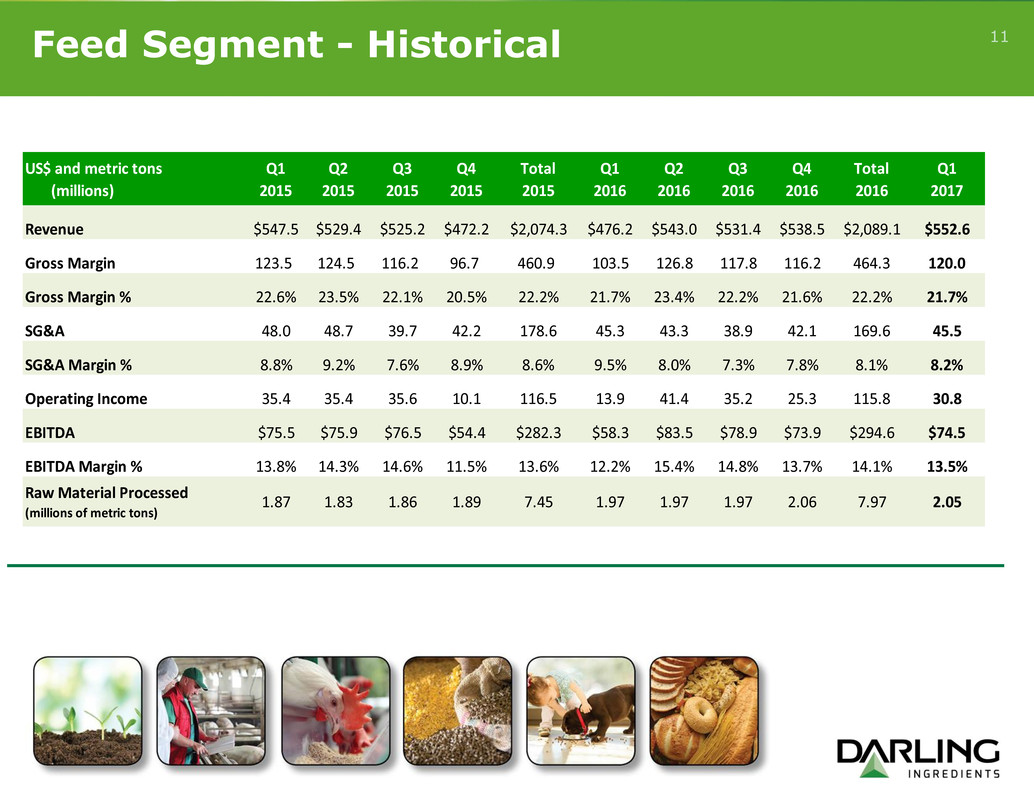

11Feed Segment - Historical

US$ and metric tons

(millions)

Q1

2015

Q2

2015

Q3

2015

Q4

2015

Total

2015

Q1

2016

Q2

2016

Q3

2016

Q4

2016

Total

2016

Q1

2017

Revenue $547.5 $529.4 $525.2 $472.2 $2,074.3 $476.2 $543.0 $531.4 $538.5 $2,089.1 $552.6

Gross Margin 123.5 124.5 116.2 96.7 460.9 103.5 126.8 117.8 116.2 464.3 120.0

Gross Margin % 22.6% 23.5% 22.1% 20.5% 22.2% 21.7% 23.4% 22.2% 21.6% 22.2% 21.7%

SG&A 48.0 48.7 39.7 42.2 178.6 45.3 43.3 38.9 42.1 169.6 45.5

SG&A Margin % 8.8% 9.2% 7.6% 8.9% 8.6% 9.5% 8.0% 7.3% 7.8% 8.1% 8.2%

Operating Income 35.4 35.4 35.6 10.1 116.5 13.9 41.4 35.2 25.3 115.8 30.8

EBITDA $75.5 $75.9 $76.5 $54.4 $282.3 $58.3 $83.5 $78.9 $73.9 $294.6 $74.5

EBITDA Margin % 13.8% 14.3% 14.6% 11.5% 13.6% 12.2% 15.4% 14.8% 13.7% 14.1% 13.5%

Raw Material Processed

(millions of metric tons)

1.87 1.83 1.86 1.89 7.45 1.97 1.97 1.97 2.06 7.97 2.05

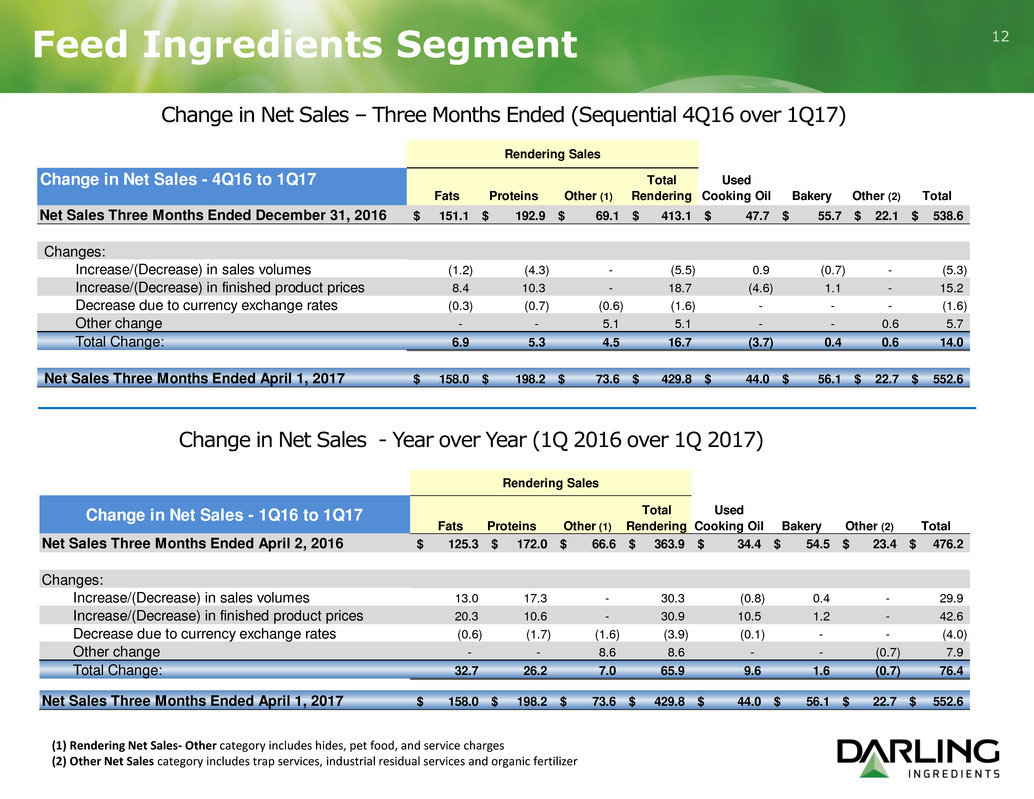

12

Change in Net Sales - Year over Year (1Q 2016 over 1Q 2017)

Change in Net Sales – Three Months Ended (Sequential 4Q16 over 1Q17)

(1) Rendering Net Sales- Other category includes hides, pet food, and service charges

(2) Other Net Sales category includes trap services, industrial residual services and organic fertilizer

Feed Ingredients Segment

Change in Net Sales - 4Q16 to 1Q17

Fats Proteins Other (1)

Total

Rendering

Used

Cooking Oil Bakery Other (2) Total

Net Sales Three Months Ended December 31, 2016 151.1$ 192.9$ 69.1$ 413.1$ 47.7$ 55.7$ 22.1$ 538.6$

Changes:

Increase/(Decrease) in sales volumes (1.2) (4.3) - (5.5) 0.9 (0.7) - (5.3)

Increase/(Decrease) in finished product prices 8.4 10.3 - 18.7 (4.6) 1.1 - 15.2

D crease due to currency exchange rates (0.3) (0.7) (0.6) (1.6) - - - (1.6)

Other change - - 5.1 5.1 - - 0.6 5.7

Total Change: 6.9 5.3 4.5 16.7 (3.7) 0.4 0.6 14.0

Net Sales Three Months Ended April 1, 2017 158.0$ 198.2$ 73.6$ 429.8$ 44.0$ 56.1$ 22.7$ 552.6$

Rendering Sales

Fats Proteins Other (1)

Total

Rendering

Used

Cooking Oil Bakery Other (2) Total

Net Sales Three Months Ended April 2, 2016 125.3$ 172.0$ 66.6$ 363.9$ 34.4$ 54.5$ 23.4$ 476.2$

Changes:

Incr ase/(D crease) in sales volumes 13.0 17.3 - 30.3 (0.8) 0.4 - 29.9

Increase/(Decrease) in finished product prices 20.3 10.6 - 30.9 10.5 1.2 - 42.6

Decrease due to currency exchange rates (0.6) (1.7) (1.6) (3.9) (0.1) - - (4.0)

Other change - - 8.6 8.6 - - (0.7) 7.9

Total Change: 32.7 26.2 7.0 65.9 9.6 1.6 (0.7) 76.4

Net Sales Three Months Ended April 1, 2017 158.0$ 198.2$ 73.6$ 429.8$ 44.0$ 56.1$ 22.7$ 552.6$

Rendering Sales

Ch nge in Net Sales - 1Q16 to 1Q17

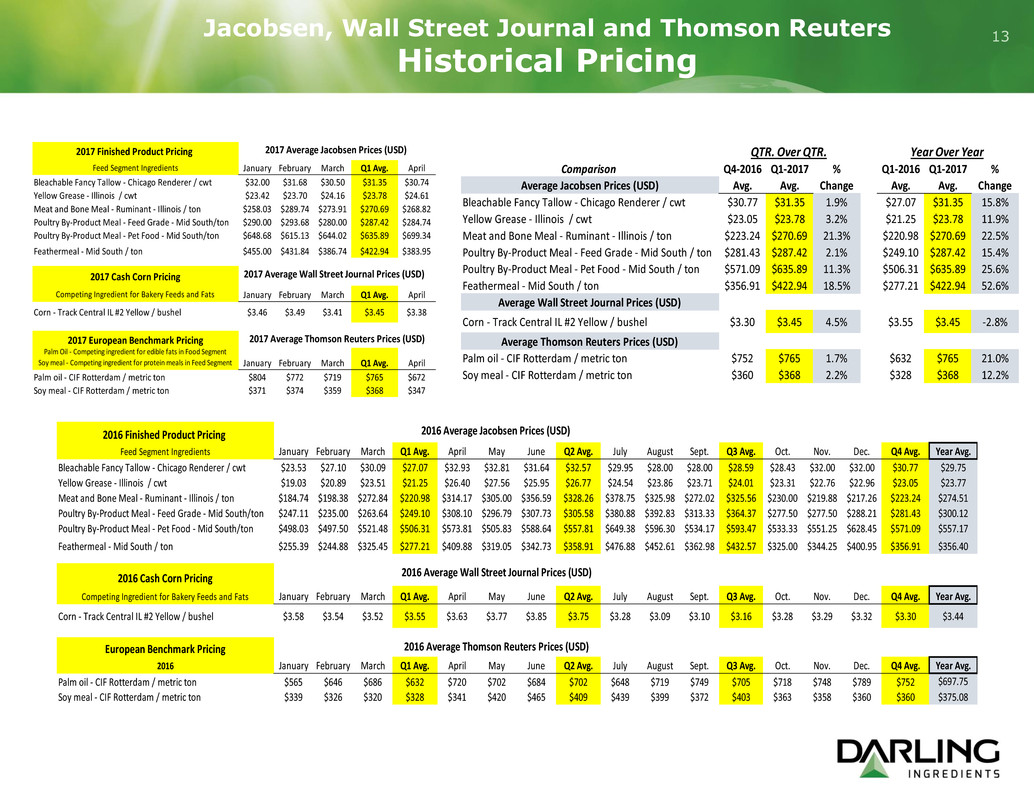

13Jacobsen, Wall Street Journal and Thomson Reuters

Historical Pricing

QTR. Over QTR. Year Over Year

Comparison Q4-2016 Q1-2017 % Q1-2016 Q1-2017 %

Average Jacobsen Prices (USD) Avg. Avg. Change Avg. Avg. Change

Bleachable Fancy Tallow - Chicago Renderer / cwt $30.77 $31.35 1.9% $27.07 $31.35 15.8%

Yellow Grease - Illinois / cwt $23.05 $23.78 3.2% $21.25 $23.78 11.9%

Meat and Bone Meal - Ruminant - Illinois / ton $223.24 $270.69 21.3% $220.98 $270.69 22.5%

Poultry By-Product Meal - Feed Grade - Mid South / ton $281.43 $287.42 2.1% $249.10 $287.42 15.4%

Poultry By-Product Meal - Pet Food - Mid South / ton $571.09 $635.89 11.3% $506.31 $635.89 25.6%

Feathermeal - Mid South / ton $356.91 $422.94 18.5% $277.21 $422.94 52.6%

Average Wall Street Journal Prices (USD)

Corn - Track Central IL #2 Yellow / bushel $3.30 $3.45 4.5% $3.55 $3.45 -2.8%

Average Thomson Reuters Prices (USD)

Palm oil - CIF Rotterdam / metric ton $752 $765 1.7% $632 $765 21.0%

Soy meal - CIF Rotterdam / metric ton $360 $368 2.2% $328 $368 12.2%

2016 Finished Product Pricing

Feed Segment Ingredients January February March Q1 Avg. April May June Q2 Avg. July August Sept. Q3 Avg. Oct. Nov. Dec. Q4 Avg. Year Avg.

Bleachable Fancy Tallow - Chicago Renderer / cwt $23.53 $27 10 $30.09 $27.07 $32.93 $32.81 $31.64 $32.57 $29.95 $28.00 $28.00 $28.59 $28.43 $32.00 $32.00 $30.77 $29.75

Yellow Gre se - Illin is / cwt $19.03 $20.89 $23.51 $21.25 $26.40 $27.56 $25.95 $26.77 $24.54 $23.86 $23.71 $24.01 $23.31 $22.76 $22.96 $23.05 $23.77

Meat and Bone al - Ruminant - Illinois / ton $184.74 $198.38 $272.84 $220.98 $314.17 $305.00 $356.59 $328.26 $378.75 $325.98 $272.02 $325.56 $230.00 $219.88 $217.26 $223.24 $274.51

Poultry By-Produ t Meal - Feed Grade - Mid South/ton $247.11 $235.00 $263.64 $249.10 $308.10 $296.79 $307.73 $305.58 $380.88 $392.83 $313.33 $364.37 $277.50 $277.50 $288.21 $281.43 $300.12

Poultry By-Produ t Meal - Pet Fo d - Mid South/ton $498.03 $497.50 $521.48 $506.31 $573.81 $505.83 $588.64 $557.81 $649.38 $596.30 $534.17 $593.47 $533.33 $551.25 $628.45 $571.09 $557.17

Feathermeal - Mi South / ton $255.39 $244.88 $325.45 $277.21 $409.88 $319.05 $342.73 $358.91 $476.88 $452.61 $362.98 $432.57 $325.00 $344.25 $400.95 $356.91 $356.40

2016 Cash Corn Pricing

Co peting Ingredient f r Bakery Feeds and Fats January February March Q1 Avg. April May June Q2 Avg. July August Sept. Q3 Avg. Oct. Nov. Dec. Q4 Avg. Year Avg.

Corn - Track Central IL #2 Yellow / bushel $3.58 $ .54 $3.52 $3.55 $3.63 $3.77 $3.85 $3.75 $3.28 $3.09 $3.10 $3.16 $3.28 $3.29 $3.32 $3.30 $3.44

European Benchmark Pricing

2016 January February March Q1 Avg. April May June Q2 Avg. July August Sept. Q3 Avg. Oct. Nov. Dec. Q4 Avg. Year Avg.

Palm oil - CIF Rotterdam / metric ton $565 $646 $686 $632 $720 $702 $684 $702 $648 $719 $749 $705 $718 $748 $789 $752 $697.75

Soy meal - CIF Rotterdam / metric ton $339 $326 $320 $328 $341 $420 $465 $409 $439 $399 $372 $403 $363 $358 $360 $360 $375.08

2016 Average Thomson Reuters Prices (USD)

2016 Average Jacobsen Prices (USD)

2016 Average Wall Street Journal Prices (USD)

2017 Finished Product Pricing

Feed Segment Ingredients January February March Q1 Avg. April

Bleachable Fancy Tallow - Chicago Renderer / cwt $32.00 $31.68 $30.50 $31.35 $30.74

Yellow Grease - Illinois / cwt $23.42 $23.70 $24.16 $23.78 $24.61

Meat and Bone Meal - Ruminant - Illinois / ton $258.03 $289.74 $273.91 $270.69 $268.82

Poultry By-Product Meal - Feed Grade - Mid South/ton $290.00 $293.68 $280.00 $287.42 $284.74

Poultry By-Product Meal - Pet Food - Mid South/ton $648.68 $615.13 $644.02 $635.89 $699.34

Feathermeal - Mid South / ton $455.00 $431.84 $386.74 $422.94 $383.95

2017 Cash Cor Pricing 2017 Average Wall Street Journal Prices (USD)

Competing Ingredient for Bakery Feeds and Fats January February March Q1 Avg. April

Corn - Track Central IL #2 Yellow / bushel $3.46 $3.49 $3.41 $3.45 $3.38

2017 European Benchmark Pricing

Palm Oil - Competing ingredient for edible fats in Food Segment

Soy meal - Competing ingredient for protein m als in Feed Segment January February March Q1 Avg. April

Palm oil - CIF Rotterdam / metric ton $804 $772 $719 $765 $672

Soy meal - CIF Rotterdam / metric to $371 $374 $359 $368 $347

2017 Average Jacobsen Prices (USD)

2017 Average Thomson Reuters Prices (USD)

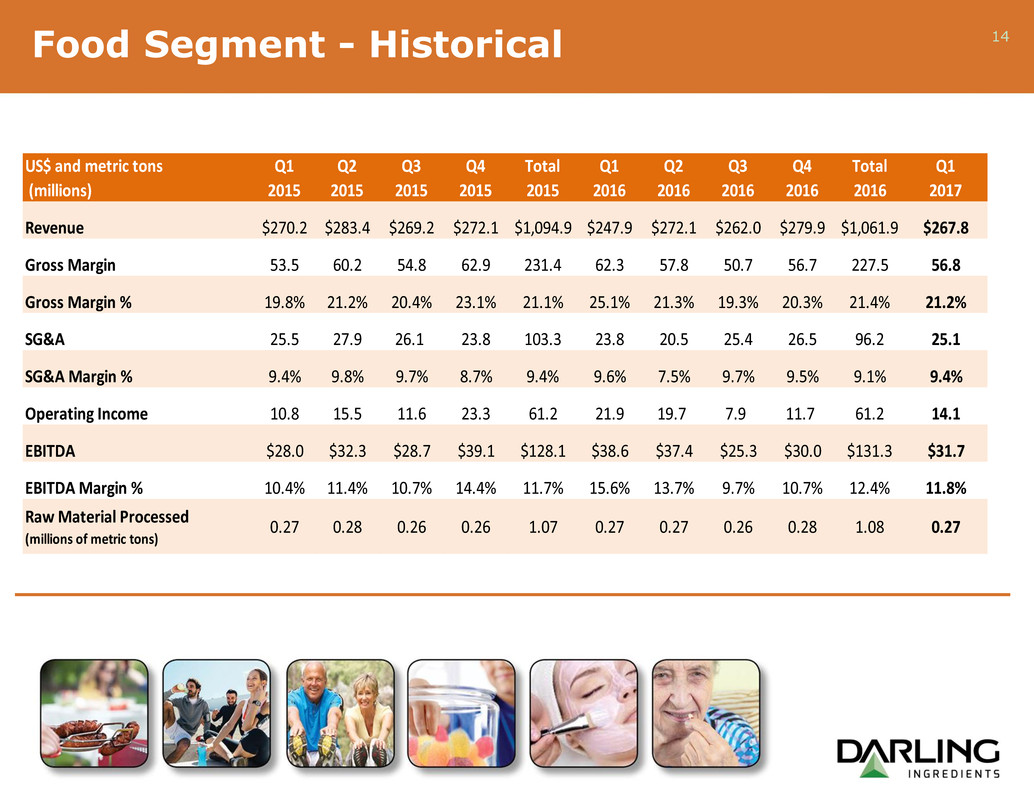

14Food Segment - Historical

US$ and metric tons

(millions)

Q1

2015

Q2

2015

Q3

2015

Q4

2015

Total

2015

Q1

2016

Q2

2016

Q3

2016

Q4

2016

Total

2016

Q1

2017

Revenue $270.2 $283.4 $269.2 $272.1 $1,094.9 $247.9 $272.1 $262.0 $279.9 $1,061.9 $267.8

Gross Margin 53.5 60.2 54.8 62.9 231.4 62.3 57.8 50.7 56.7 227.5 56.8

Gross Margin % 19.8% 21.2% 20.4% 23.1% 21.1% 25.1% 21.3% 19.3% 20.3% 21.4% 21.2%

SG&A 25.5 27.9 26.1 23.8 103.3 23.8 20.5 25.4 26.5 96.2 25.1

SG&A Margin % 9.4% 9.8% 9.7% 8.7% 9.4% 9.6% 7.5% 9.7% 9.5% 9.1% 9.4%

Operating Income 10.8 15.5 11.6 23.3 61.2 21.9 19.7 7.9 11.7 61.2 14.1

EBITDA $28.0 $32.3 $28.7 $39.1 $128.1 $38.6 $37.4 $25.3 $30.0 $131.3 $31.7

EBITDA Margin % 10.4% 11.4% 10.7% 14.4% 11.7% 15.6% 13.7% 9.7% 10.7% 12.4% 11.8%

Raw Material Processed

(millions of metric tons)

0.27 0.28 0.26 0.26 1.07 0.27 0.27 0.26 0.28 1.08 0.27

15

(1) Pro forma Adjusted EBITDA assumes blenders tax credit was received during quarters earned in 2015 and Q1 2017 for comparison to 2016 when the blenders tax credit was prospective.

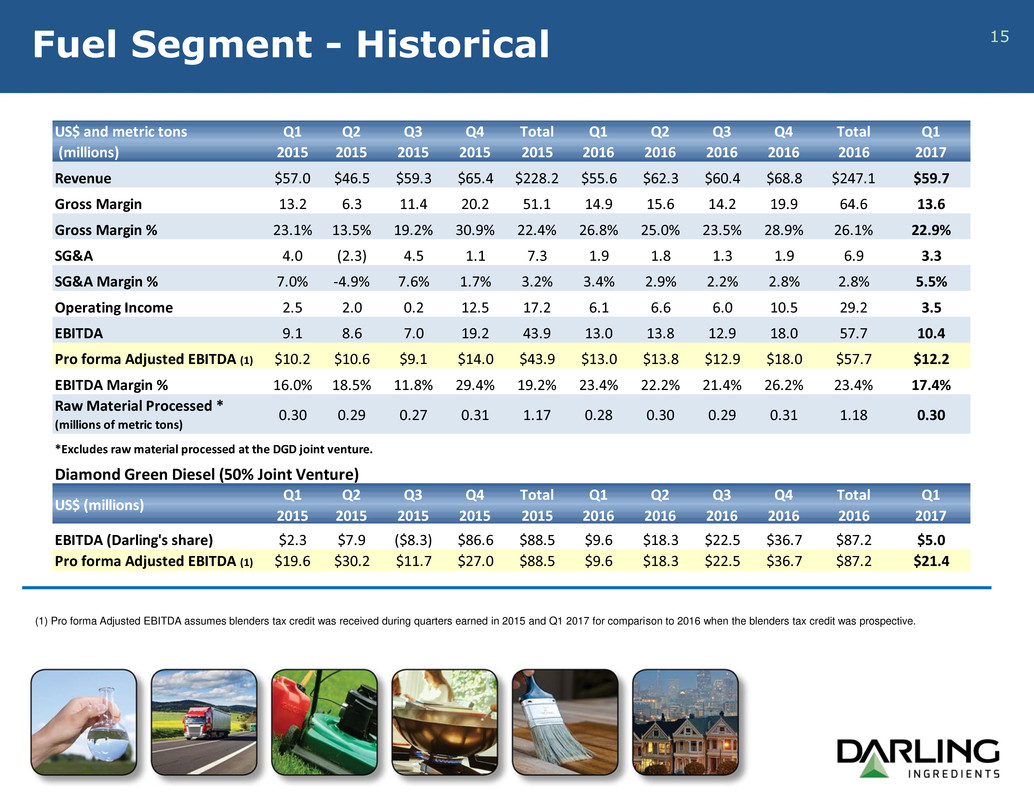

Fuel Segment - Historical

US$ and metric tons

(millions)

Q1

2015

Q2

2015

Q3

2015

Q4

2015

Total

2015

Q1

2016

Q2

2016

Q3

2016

Q4

2016

Total

2016

Q1

2017

Revenue $57.0 $46.5 $59.3 $65.4 $228.2 $55.6 $62.3 $60.4 $68.8 $247.1 $59.7

Gross Margin 13.2 6.3 11.4 20.2 51.1 14.9 15.6 14.2 19.9 64.6 13.6

Gross Margin % 23.1% 13.5% 19.2% 30.9% 22.4% 26.8% 25.0% 23.5% 28.9% 26.1% 22.9%

SG&A 4.0 (2.3) 4.5 1.1 7.3 1.9 1.8 1.3 1.9 6.9 3.3

SG&A Margin % 7.0% -4.9% 7.6% 1.7% 3.2% 3.4% 2.9% 2.2% 2.8% 2.8% 5.5%

Operating Income 2.5 2.0 0.2 12.5 17.2 6.1 6.6 6.0 10.5 29.2 3.5

EBITDA 9.1 8.6 7.0 19.2 43.9 13.0 13.8 12.9 18.0 57.7 10.4

Pro forma Adjusted EBITDA (1) $10.2 $10.6 $9.1 $14.0 $43.9 $13.0 $13.8 $12.9 $18.0 $57.7 $12.2

EBITDA Margin % 16.0% 18.5% 11.8% 29.4% 19.2% 23.4% 22.2% 21.4% 26.2% 23.4% 17.4%

Raw Material Processed *

(millions of metric tons)

0.30 0.29 0.27 0.31 1.17 0.28 0.30 0.29 0.31 1.18 0.30

*Excludes raw material processed at the DGD joint venture.

Diamond Green Diesel (50% Joint Venture)

US$ (millions)

Q1

2015

Q2

2015

Q3

2015

Q4

2015

Total

2015

Q1

2016

Q2

2016

Q3

2016

Q4

2016

Total

2016

Q1

2017

EBITDA (Darling's share) $2.3 $7.9 ($8.3) $86.6 $88.5 $9.6 $18.3 $22.5 $36.7 $87.2 $5.0

Pro forma Adjusted EBITDA (1) $19.6 $30.2 $11.7 $27.0 $88.5 $9.6 $18.3 $22.5 $36.7 $87.2 $21.4

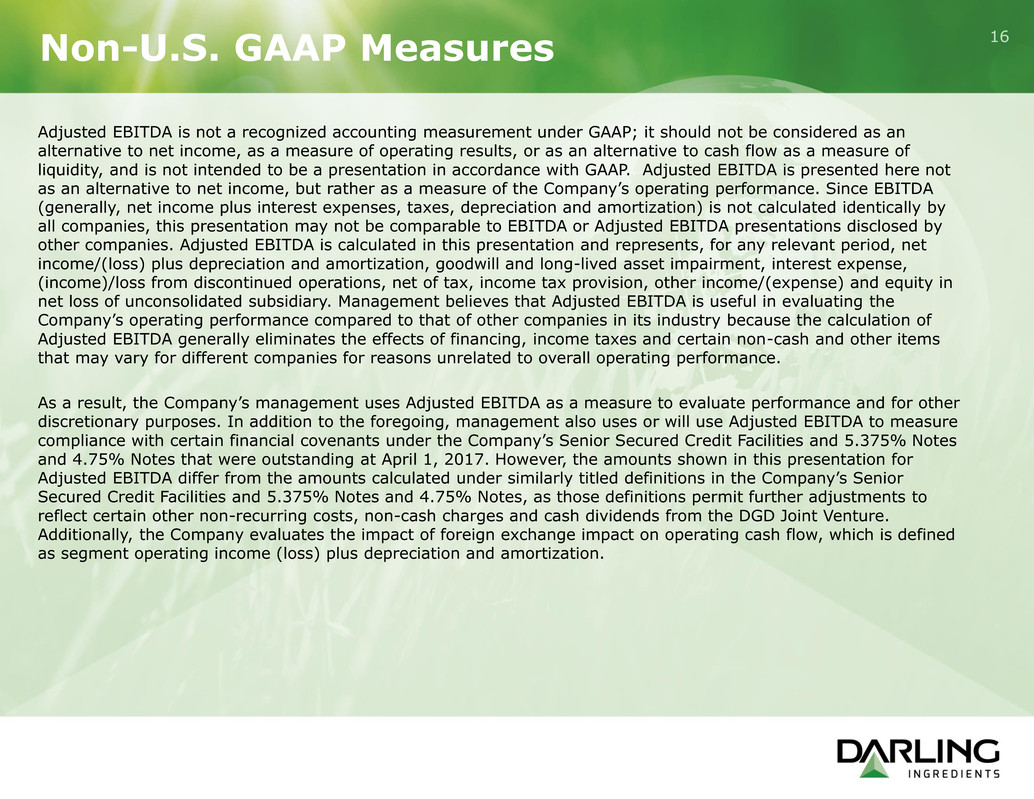

Adjusted EBITDA is not a recognized accounting measurement under GAAP; it should not be considered as an

alternative to net income, as a measure of operating results, or as an alternative to cash flow as a measure of

liquidity, and is not intended to be a presentation in accordance with GAAP. Adjusted EBITDA is presented here not

as an alternative to net income, but rather as a measure of the Company’s operating performance. Since EBITDA

(generally, net income plus interest expenses, taxes, depreciation and amortization) is not calculated identically by

all companies, this presentation may not be comparable to EBITDA or Adjusted EBITDA presentations disclosed by

other companies. Adjusted EBITDA is calculated in this presentation and represents, for any relevant period, net

income/(loss) plus depreciation and amortization, goodwill and long-lived asset impairment, interest expense,

(income)/loss from discontinued operations, net of tax, income tax provision, other income/(expense) and equity in

net loss of unconsolidated subsidiary. Management believes that Adjusted EBITDA is useful in evaluating the

Company’s operating performance compared to that of other companies in its industry because the calculation of

Adjusted EBITDA generally eliminates the effects of financing, income taxes and certain non-cash and other items

that may vary for different companies for reasons unrelated to overall operating performance.

As a result, the Company’s management uses Adjusted EBITDA as a measure to evaluate performance and for other

discretionary purposes. In addition to the foregoing, management also uses or will use Adjusted EBITDA to measure

compliance with certain financial covenants under the Company’s Senior Secured Credit Facilities and 5.375% Notes

and 4.75% Notes that were outstanding at April 1, 2017. However, the amounts shown in this presentation for

Adjusted EBITDA differ from the amounts calculated under similarly titled definitions in the Company’s Senior

Secured Credit Facilities and 5.375% Notes and 4.75% Notes, as those definitions permit further adjustments to

reflect certain other non-recurring costs, non-cash charges and cash dividends from the DGD Joint Venture.

Additionally, the Company evaluates the impact of foreign exchange impact on operating cash flow, which is defined

as segment operating income (loss) plus depreciation and amortization.

16

Non-U.S. GAAP Measures

17

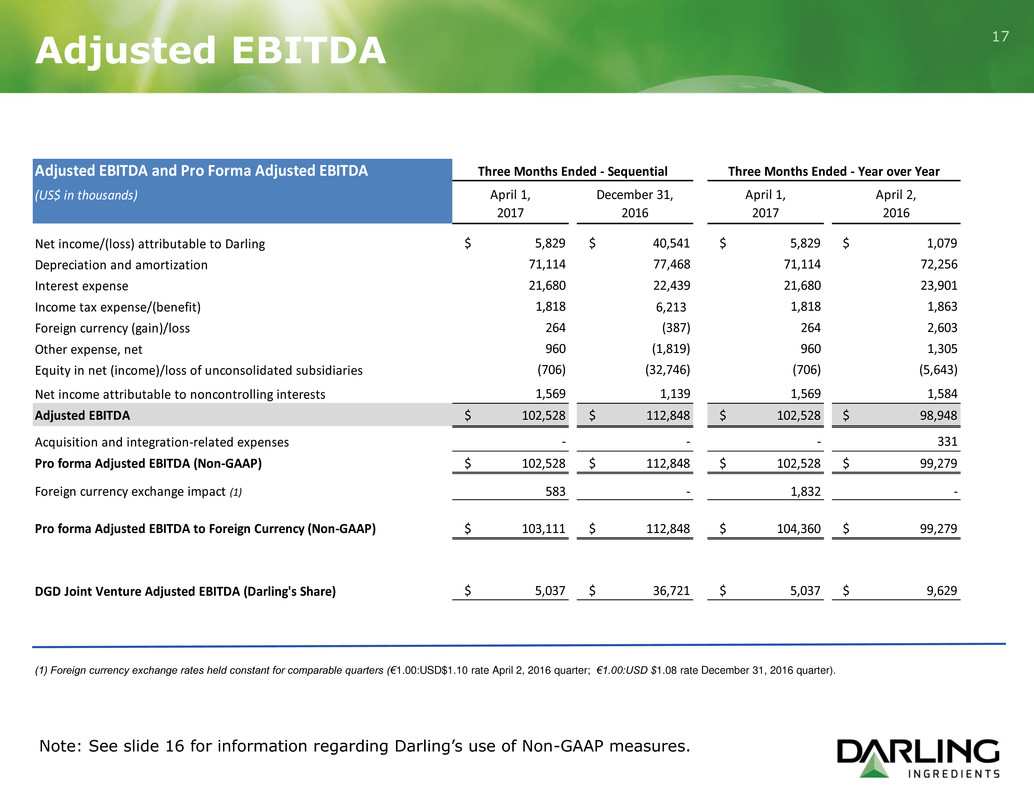

Note: See slide 16 for information regarding Darling’s use of Non-GAAP measures.

Adjusted EBITDA

(1) Foreign currency exchange rates held constant for comparable quarters (€1.00:USD$1.10 rate April 2, 2016 quarter; €1.00:USD $1.08 rate December 31, 2016 quarter).

Adjusted EBITDA and Pro Forma Adjusted EBITDA

(US$ in thousands) April 1, December 31, April 1, April 2,

2017 2016 2017 2016

Net income/(loss) attributable to Darling $ 5,829 $ 40,541 $ 5,829 $ 1,079

Depreciation and amortization 71,114 77,468 71,114 72,256

Interest expense 21,680 22,439 21,680 23,901

Income tax expense/(benefit) 1,818 6,213 1,818 1,863

Foreign currency (gain)/loss 264 (387) 264 2,603

Other expense, net 960 (1,819) 960 1,305

Equity in net (income)/loss of unconsolidated subsidiaries (706) (32,746) (706) (5,643)

Net income attributable to noncontrolling interests 1,569 1,139 1,569 1,584

Adjusted EBITDA $ 102,528 $ 112,848 $ 102,528 $ 98,948

Acquisition and integration-related expenses - - - 331

Pro forma Adjusted EBITDA (Non-GAAP) $ 102,528 $ 112,848 $ 102,528 $ 99,279

Foreign currency exchange impact (1) 583 - 1,832 -

Pro forma Adjusted EBITDA to Foreign Currency (Non-GAAP) $ 103,111 $ 112,848 $ 104,360 $ 99,279

DGD Joint Venture Adjusted EBITDA (Darling's Share) $ 5,037 $ 36,721 $ 5,037 $ 9,629

Three Months Ended - Sequential Three Months Ended - Year over Year