Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Conifer Holdings, Inc. | a8-k1stquarterinvestorpres.htm |

FIRST QUARTER 2017

INVESTOR CONFERENCE CALL

May 11, 2017

1

SAFE HARBOR STATEMENT

This presentation contains “forward-looking” statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended,

that are based on our management’s beliefs and assumptions and on information currently available to

management. These forward-looking statements include, without limitation, statements regarding our

industry, business strategy, plans, goals and expectations concerning our market position, product

expansion, future operations, margins, profitability, future efficiencies, and other financial and operating

information. When used in this discussion, the words “may,” “believes,” “intends,” “seeks,” “anticipates,”

“plans,” “estimates,” “expects,” “should,” “assumes,” “continues,” “potential,” “could,” “will,” “future” and the

negative of these or similar terms and phrases are intended to identify forward-looking statements.

Forward-looking statements involve known and unknown risks, uncertainties, inherent risks and other

factors that may cause our actual results, performance or achievements to be materially different from any

future results, performance or achievements expressed or implied by the forward-looking statements.

Forward-looking statements represent our management’s beliefs and assumptions only as of the date of

this presentation. Our actual future results may be materially different from what we expect due to factors

largely outside our control, including the occurrence of severe weather conditions and other catastrophes,

the cyclical nature of the insurance industry, future actions by regulators, our ability to obtain reinsurance

coverage at reasonable rates and the effects of competition. These and other risks and uncertainties

associated with our business are described under the heading “Risk Factors” in our most recently filed

Annual Report on Form 10-K, which should be read in conjunction with this presentation. The company

and subsidiaries operate in a dynamic business environment, and therefore the risks identified are not

meant to be exhaustive. Risk factors change and new risks emerge frequently. Except as required by law,

we assume no obligation to update these forward-looking statements publicly, or to update the reasons

actual results could differ materially from those anticipated in the forward-looking statements, even if new

information becomes available in the future.

1

2

BUSINESS MIX – GROSS WRITTEN PREMIUM FOR Q1 2017

2

$19.1

$21.7

$6.2

$4.8

$0

$5

$10

$15

$20

$25

$30

Q1 2016 Q1 2017

M

I

L

L

I

O

N

S

Commercial Lines Personal Lines

Q1 2017 RESULTS OVERVIEW

Significant Net Earned Premium growth:

• Total gross written premium was $26.5 million

for Q1 2017

Up 4% over the same period in 2016

Net earned premium was $24.1 million,

up 20% for the same period

• Factors driving premium growth include:

Strong commercial lines experience in

hospitality & small business accounts,

particularly in commercial multi-peril

and other liability lines

Personal lines focus on low-value dwelling

business while reducing wind-exposed

homeowners

• Continuing Expense ratio improvement

Almost 500 basis point reduction quarter

over quarter from 49.8% in Q1 2016 to

44.9% in Q1 2017

Expect continued downward trend as earned

premiums ramp up

3

GROSS WRITTEN PREMIUM

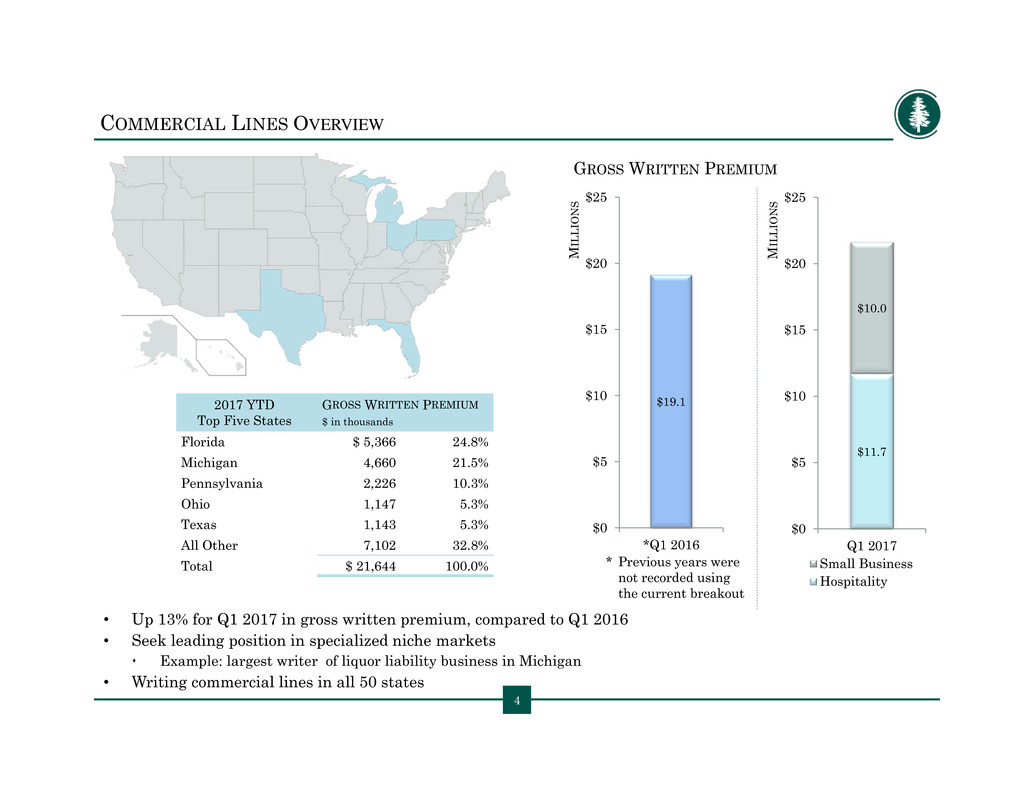

COMMERCIAL LINES OVERVIEW

• Up 13% for Q1 2017 in gross written premium, compared to Q1 2016

• Seek leading position in specialized niche markets

Example: largest writer of liquor liability business in Michigan

• Writing commercial lines in all 50 states

4

GROSS WRITTEN PREMIUM

2017 YTD

Top Five States

GROSS WRITTEN PREMIUM

$ in thousands

Florida $ 5,366 24.8%

Michigan 4,660 21.5%

Pennsylvania 2,226 10.3%

Ohio 1,147 5.3%

Texas 1,143 5.3%

All Other 7,102 32.8%

Total $ 21,644 100.0% * Previous years were

not recorded using

the current breakout

$19.1

$0

$5

$10

$15

$20

$25

*Q1 2016

M

I

L

L

I

O

N

S

$11.7

$10.0

$0

$5

$10

$15

$20

$25

Q1 2017

M

I

L

L

I

O

N

S

Small Business

Hospitality

$3.9

$1.9

$2.3

$2.9

$0

$1

$2

$3

$4

$5

$6

$7

Q1 2016 Q1 2017

M

I

L

L

I

O

N

S

Wind-Exposed Low-Value Dwelling

• Gross written premium was down 23% during Q1 2017, compared to Q1 2016

• Decrease in wind-exposed homeowners, specifically Florida homeowners

• Low-value dwelling ramp-up in southern states, such as Texas and northern Louisiana

PERSONAL LINES: LOW-VALUE DWELLING & WIND-EXPOSED HOMEOWNERS

GROSS WRITTEN PREMIUM

$ in thousands

2017 YTD

Top Five States

Texas $ 1,894 39.2%

Hawaii 981 20.3%

Florida 952 19.7%

Indiana 695 14.4%

Illinois 193 4.0%

All Other 115 2.4%

Total $ 4,830 100.0%

5

GROSS WRITTEN PREMIUM

23% decrease

6

49.8% 48.0% 46.3% 45.3% 44.9%

62.4% 61.7% 61.6%

73.4%

64.2%

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

Expense Ratio Loss Ratio

COMBINED RATIO REFLECTS IMPROVED BUSINESS MIX

• Changing the mix of business (reduced wind exposure) yielded positive results

• Continued premium growth will help drive ongoing combined ratio improvement as well

82% of total premiums in Q1 were from our core commercial business

For all of 2016, commercial lines accident year combined ratio was 88%

109.7%112.2% 107.9%

118.7%

109.1%

7

LOSS RATIO IMPROVEMENT: SHIFTING BUSINESS MIX TO DRIVE STABILITY

• The accident year loss ratio for Q1 2017 was 51.7%, versus 54.6% for Q1 2016

• With planned reduction in FL HO, expect loss ratio to continue improved trend.

Shifting away from wind exposed business and focusing on low value dwelling premium

(which runs at significantly improved loss ratios).

• Each renewal period has provided additional opportunities to re-underwrite, modify pricing

and adapt claims strategies.

• Even with prior year reserve development, the accident year Loss Ratios have consistently decreased

over 4 years – with 2016 AY Loss Ratio: 54%

NET EARNED PREMIUMS ACCIDENT YEAR NET LOSS RATIOS

Commercial Lines Personal Lines Consolidated

30.0%

40.0%

50.0%

60.0%

70.0%

80.0%

90.0%

2013 2014 2015 2016

-

10,000

20,000

30,000

40,000

50,000

60,000

70,000

2013 2014 2015 2016

8

• Total expense ratio of 44.9% in Q1 2017

• Sequential expense ratio improvement quarter to quarter

Versus 49.8% in Q1 2016

Versus 48.0% in Q2 2016

Versus 46.3% in Q3 2016

Versus 45.3% in Q4 2016

• 920 basis point improvement overall since Q4 2015

• Expect continuing downward trend in 2017

54.1%

49.8%

48.0%

46.3%

45.3% 44.9%

Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

EXPENSE RATIO TRENDING DOWNWARD

Near-term

Expense Ratio

Target: 37%

920 basis point

reduction

9

CONSERVATIVE INVESTMENT STRATEGY

• Investment philosophy is to maintain a

highly liquid portfolio of investment-grade

fixed income securities

• Total cash & investment securities of

$144.0M at March 31, 2017:

Average duration to worst: 3.0 years

Average tax-equivalent yield: ~2.2%

Average credit quality: AA

FIXED INCOME PORTFOLIO

CREDIT RATING

$ in thousands March 31, 2017

Fair Value % of Total

AAA $ 22,785 20.0%

AA 50,314 44.1%

A 26,509 23.2%

BBB 13,357 11.7%

BB 1,121 1.0%

TOTAL FIXED INCOME

INVESTMENTS

$ 114,086 100%

PORTFOLIO ALLOCATION

U.S.

Government

Obligations

6.0%

State & Local

Governments

11.0%

Corporate

Debt

32.0%

Commercial

Mortgage &

Asset-Backed

Securities

47.0%

Equity

Securities

4.0%

10

Q1 2017 INCOME STATEMENT

• Increased production in hospitality, small business, security services and select homeowners

lines of business

• 2015 investments in experienced underwriting teams are driving organic growth

• Adjusted operating loss of $0.24 per diluted share for Q1 2017

• $1.19 per share for valuation allowance against deferred tax assets not reflected in book value

• $8.72 per share, or $66.6 million, of shareholders’ equity

Three Months Ended March 31,

($ in thousands, except per share data and ratios) 2017 2016

Gross Written Premium $ 26,474 $ 25,393

Net Written Premium 22,324 22,050

Net Earned Premium 24,140 20,109

Net Income (Loss) (1,798) (2,028)

EPS, Basic and Diluted (0.24) (0.27)

Adjusted Operating Income (Loss) (1,790) (2,020)

Adjusted Operating Income (Loss) per share (0.24) (0.27)

10

APPENDIX

13

FINANCIAL RESULTS: CHI CONSOLIDATED BALANCE SHEET

SUMMARY BALANCE SHEET

$ in thousands

March 31, 2017 December 31, 2016

Cash and invested assets $ 144,022 $ 141,023

Reinsurance recoverables 10,186 7,498

Goodwill and intangible assets 1,002 1,007

Total assets $ 207,966 $ 203,701

Unpaid losses and loss adjustment expenses 62,135 54,651

Unearned premiums 56,336 58,126

Senior debt 17,125 17,750

Total Liabilities $ 141,393 $ 135,907

Total Shareholders' Equity $ 66,573 $ 67,794

14

SUMMARY FINANCIAL STATEMENTS: INCOME STATEMENT

14

OPERATING RESULTS Three Months Ended March 31,

$ in thousands, except per share data 2017 2016

Gross Written Premiums 26,474 25,393

Ceded Written Premiums 4,150 3,343

Net Written Premiums 22,324 22,050

Net Earned Premiums 24,140 20,109

Net investment income 577 537

Net realized investment gains (8) (8)

Other gains 0 0

Other income 354 245

Total revenue 25,063 20,883

Losses and loss adjustment expenses, net 15,733 12,699

Policy acquisition costs 6,472 6,003

Operating expenses 4,530 4,139

Interest expense 224 157

Total expenses 26,959 22,998

Income (loss) before equity earnings and income taxes (1,896) (2,115)

Equity earnings (losses) of affiliates, net of tax 104 87

Income tax (benefit) expense 6 0

Net income (loss) (1,798) (2,028)

Earnings (loss) per common share, basic and diluted (0.24) (0.27)

Weighted average common shares outstanding, basic and diluted 7,633,069 7,638,780

15

REINSURANCE: PRUDENT RISK MANAGEMENT TO PROTECT CAPITAL

• Retain first $500,000 of each

specific loss/risk

Reinsurance coverage in excess

of $500,000 up to policy limits

• Catastrophe (CAT) reinsurance

program provides $165M of protection

All providers are rated minimum A-

Corresponds to the estimated

1-in-200 year probable

maximum loss (PML)

Net retention of $5M for first event

Following reinstatement, net retention

of $1M for each of the next two

subsequent events

• Equipment Breakdown Reinsurance Treaty

100% Quota Share through

Hartford Steam Boiler (A+)

$25M in coverage

$165,000,000

Retention

Property-

CAT:

$165M

XS

$5M

$5,000,000

$2,000,000

$20,000,000

$500,000

$1,000,000

$10,000,000

Multi-Line

Excess of

Loss

Workers’

Comp. /

Casualty

Clash

Retention

CIC / WPIC

Specific Loss Reinsurance Treaties

Effective 01/01/2017 to 01/01/2018

CIC / WPIC / ACIC

Property-CAT Reinsurance Treaties

All layers 06/01/2016 to 06/01/2017

16

REINSURANCE: PRUDENT RISK MANAGEMENT TO PROTECT CAPITAL

Commercial Property Per Risk

Reinsurance Treaty

Effective 07/01/16 to 01/01/18

$2,000,000

$500,000

$1,000,000

Retention

Multi-Line

Excess of

Loss

Property

Per Risk

Multi-Line

Excess of

Loss

$4,000,000

Homeowners Property Per Risk

Reinsurance Treaty

Effective 11/01/14 to 01/01/18

$300,000

Retention

Property

$3,000,000

17

CONIFER HOLDINGS, INC.

Insurance Holding Company

MI Domicile

Incorporated: 10/27/2009

SYCAMORE INSURANCE

AGENCY

DBA Blue Spruce Underwriters

Insurance Agency

100% owned by CHI

MI Domicile

Created: 5/9/2012

DBA: 10/8/2015

CONIFER INSURANCE

COMPANY

Property & Casualty

Insurance Company

100% owned by CHI

MI Domicile

Acquired: 12/21/2009

RED CEDAR

INSURANCE COMPANY

Pure Captive

Insurance Company

100% owned by CHI

DC Domicile

Formed: 10/12/2011

WHITE PINE INSURANCE

COMPANY

Property & Casualty

Insurance Company

100% owned by CHI

MI Domicile

Acquired: 12/28/2010

VENTURE AGENCY

HOLDINGS, INC.

50% owned by SIAI

50% owned by JB

MI Domicile

Created: 12/29/2013

AMERICAN COLONIAL

INSURANCE SERVICES

f/k/a EGI - FL

Managing General Agency

100% owned by CHI

FL Domicile

Acquired: 11/30/2013

ORGANIZATION STRUCTURE: CORPORATE OVERVIEW

CHANNEL OAK

GENERAL AGENCY, INC.

50% owned by SIAI

50% owned by AIH

MI Domicile

Created: 1/19/2016

DBA: 3/1/2016