Attached files

| file | filename |

|---|---|

| EX-32 - EX-32 - Coca-Cola Consolidated, Inc. | coke-ex32_9.htm |

| EX-31.2 - EX-31.2 - Coca-Cola Consolidated, Inc. | coke-ex312_8.htm |

| EX-31.1 - EX-31.1 - Coca-Cola Consolidated, Inc. | coke-ex311_6.htm |

| EX-12 - EX-12 - Coca-Cola Consolidated, Inc. | coke-ex12_11.htm |

| EX-10.7 - EX-10.7 - Coca-Cola Consolidated, Inc. | coke-ex107_276.htm |

| EX-10.6 - EX-10.6 - Coca-Cola Consolidated, Inc. | coke-ex106_277.htm |

| EX-10.5 - EX-10.5 - Coca-Cola Consolidated, Inc. | coke-ex105_279.htm |

| EX-10.4 - EX-10.4 - Coca-Cola Consolidated, Inc. | coke-ex104_278.htm |

| 10-Q - FORM 10-Q - Coca-Cola Consolidated, Inc. | coke-10q_20170402.htm |

Exhibit 10.8

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY BRACKETED ASTERISKS, HAS BEEN OMITTED AND FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO RULE 24B-2 OF THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED.

COCA-COLA PLAZA

ATLANTA, GEORGIA

|

J. Alexander M. Douglas, Jr. President, Coca-Cola North America

|

|

P. O. Box 1734 Atlanta, GA 30301 ______ 404 676-4421 Fax 404-598-4421 |

March 31, 2017

J. Frank Harrison III

Chairman and Chief Executive Officer

Coca-Cola Bottling Co. Consolidated

4100 Coca-Cola Plaza

Charlotte, NC 28211

Dear Frank,

This letter agreement sets forth the mutual understanding and agreement of The Coca‑Cola Company, a Delaware corporation (“Company”), and Coca-Cola Bottling Co. Consolidated, a Delaware corporation (“Bottler”), regarding certain valuation adjustments agreed to by Company and Bottler and certain credits or payments to be made by Company to Bottler in connection with (a) Bottler’s acquisition of production facilities from Coca‑Cola Refreshments USA, Inc., a Delaware corporation and a wholly-owned subsidiary of Company (“CCR”), and (b) the conversion to the RMA (as defined below) of the bottle contracts authorizing Bottler to manufacture, produce and package certain Company‑owned and –licensed beverage products at its legacy production facilities. Capitalized terms used and not otherwise defined in this letter agreement have the respective meanings ascribed to such terms in the RMA.

As you know, in order to strengthen the competitiveness of the Coca-Cola finished goods production system and to support and enable each Regional Producing Bottler to realize a reasonable return on capital invested in the transfer sales businesses acquired as a result of each such Regional Producing Bottler’s purchases of certain Regional Manufacturing Facilities from CCR (“Expansion Facilities”), Company previously unilaterally determined that (a) Bottler’s RMA would require the price for Authorized Covered Beverages produced by Bottler and sold to other Regional Producing Bottlers to include [***]; and (b) each other Regional Producing Bottler would be required under its Regional Manufacturing Agreement with Company to include in the price for Authorized Covered Beverages sold by it to Bottler [***]. In addition, to partially offset the impact on Bottler of [***], Company previously agreed to provide certain adjustments to the values attributed to the expansion transactions between CCR and Bottler.

Classified – Confidential

[***] – THIS CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO A REQUEST FOR CONFIDENTIAL TREATMENT.

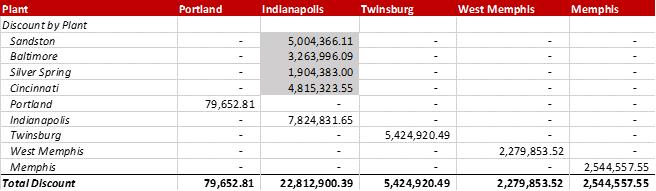

In lieu of the above-described approach, Company has determined to offer Bottler a valuation adjustment discount (the “Expansion Facility Discount”) on the purchase price for its Expansion Facilities. Company and Bottler have agreed on this Expansion Facility Discount approach and to an aggregate amount of the Expansion Facility Discount of $33,141,884.75, which amount is subject to adjustment as described below. For purposes of clarity, the foregoing does not include any adjustment amounts attributable to [***] at applicable Expansion Facilities prior to January 1, 2017.

The portion of such Expansion Facility Discount attributable to each of the Regional Manufacturing Facilities that have previously transferred or will transfer to Bottler is set forth on Exhibit A. The portion of the Expansion Facility Discount attributable to the Regional Manufacturing Facilities that will transition to Bottler on or after the date hereof will be applied at the closing of each such transaction (each, a “Closing”). Additionally, at the Closing of Bottler’s acquisition of CCR’s Indianapolis and Portland Regional Manufacturing Facilities (the “Indiana Production Closing”), the parties agree to apply an additional adjustment (in addition to the portion of the Expansion Facility Discount attributable to the Regional Manufacturing Facilities transitioning to Bottler at such Closing), of $14,988,068.75, which amount represents the portion of the Expansion Facility Discount attributable to all Expansion Facilities that CCR has sold to Bottler prior to the date hereof. Except as noted in the preceding sentence, each such Expansion Facility Discount will be made at the applicable Closing either by wire transfer of immediately available funds to the account or accounts specified by Bottler in writing or as a credit against amounts otherwise owed by Bottler at such Closing. Following each Closing, Company will recalculate the portion of the Expansion Facility Discount attributable to the Expansion Facilities that were transferred to Bottler at such Closing (and, in the case of the Indiana Production Closing, the portion thereof attributable each of the Expansion Facilities that CCR has sold to Bottler prior to the date hereof) based on the net book value of the applicable Expansion Facilities as of the earlier of each applicable Expansion Facility’s Closing date or December 31, 2016. Company or Bottler, as applicable, will pay to the other the difference between the amount set forth on Exhibit A with respect to the applicable Expansion Facilities and such recalculated amount as a part of the post-Closing adjustments contemplated by the Asset Purchase Agreement(s) between CCR and Bottler applicable to such Expansion Facilities.

The Bottler’s legacy Regional Manufacturing Facilities (“Legacy Facilities”) will become subject to the terms of the RMA at the Indiana Production Closing, including the terms regarding the pricing mechanisms described in Section 4 of the RMA on transfer sales made by Bottler to other U.S. Coca-Cola bottlers. Company has also agreed, where applicable, to provide certain Regional Producing Bottlers (including Bottler) with a credit or payment (the “Legacy Facility Credit”) to compensate such Regional Producing Bottlers for the loss of margins historically earned on sales of Authorized Covered Beverages produced by each such Regional Producing Bottler at its Legacy Facilities prior to implementation of the pricing mechanisms described in Section 4 of the RMA.

The Legacy Facility Credit for Bottler will be calculated by Company following the date hereof in accordance with the formula Legacy Facility Credit = [X]/[Y], where “[X]” is the pretax

Classified – Confidential

2

[***] – THIS CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO A REQUEST FOR CONFIDENTIAL TREATMENT.

annual return earned by Bottler on historical sales of Authorized Covered Beverages produced at the Legacy Facilities (the “Exports Return”), net of the cost difference to Bottler under the pricing set forth in the RMA for Bottler’s purchases for distribution in the First-Line Territory of Authorized Covered Beverages produced by other Regional Producing Bottlers (the “Imports Cost Difference”), and “[Y]” is [***]. For purposes of the foregoing formula, (a) the Exports Return will be an amount equal to (i) Bottler’s annual net revenue on sales to other U.S. Coca-Cola Bottlers of Authorized Covered Beverages produced at the Legacy Facilities (calculated as Bottler’s historic price by SKU in 2016 for such sales after any applicable deducts, credits, or other adjustments provided to the buyer multiplied by Bottler’s annual sales volume by SKU for all such transfer sales), less (ii) Bottler’s actual manufacturing cost of goods (calculated as Bottler’s standard manufacturing cost of goods per physical case in accordance with the NPSG Standard Methodology (as defined below) multiplied by Bottler’s annual sales volume by SKU for all such transfer sales), less (iii) Bottler’s centrally managed production expenses (calculated based on the per case rate agreed by Company and Bottler multiplied by Bottler’s 2016 annual sales volume by SKU for all such transfer sales), less (iv) Bottler’s actual freight cost for such sales (calculated per physical case in accordance with the NPSG Standard Methodology multiplied by Bottler’s annual sales volume by SKU for all such transfer sales); and (b) the Imports Cost Difference will be an amount equal to the sum of (i) (A) the difference between the actual manufacturing costs by SKU in 2016 of Authorized Covered Beverages purchased by Bottler from other applicable Regional Producing Bottlers’ Expansion Facilities (calculated in accordance with the NPSG Standard Methodology) and the price for such Authorized Covered Beverages under the Finished Goods Supply Agreements between CCR and Bottler in effect during 2016, multiplied by (B) the volume of Authorized Covered Beverages by applicable SKU purchased in 2016 by Bottler for distribution in its legacy territory from other Regional Producing Bottlers’ Expansion Facilities, plus (ii) (A) the difference between the historic price by SKU in 2016 charged to Bottler by other Regional Producing Bottlers for Authorized Covered Beverages in Bottler’s legacy distribution territory and the actual manufacturing costs of such Authorized Covered Beverages purchased by Bottler from such other Regional Producing Bottlers’ legacy facilities (calculated in accordance with a standard methodology as determined by the NPSG), multiplied by (B) the volume of Authorized Covered Beverages by applicable SKU purchased by Bottler in 2016 for distribution in its legacy territory from other Regional Producing Bottlers’ legacy facilities. As used herein, “NPSG Standard Methodology” means the standard methodology determined by the NPSG to calculate [***].

Company and Bottler will work together in good faith to calculate the Legacy Facility Credit in accordance with the foregoing formula as promptly as reasonably practicable following the date hereof, and such Legacy Facility Credit will be paid to Bottler at such time and in such manner as Company and Bottler may mutually reasonably agree following the date hereof.

As used herein, “RMA” means, collectively, each Initial Regional Manufacturing Agreement and each Regional Manufacturing Agreement executed by Bottler (or any of Bottler’s Affiliates) and Company prior to the date hereof and each Initial Regional Manufacturing Agreement and Regional Manufacturing Agreement executed by Bottler (or any of Bottler’s Affiliates) and Company following the date hereof, as any of the foregoing may be amended or supplemented from time to time.

Classified – Confidential

3

[***] – THIS CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO A REQUEST FOR CONFIDENTIAL TREATMENT.

Please acknowledge your acceptance of the foregoing by signing where indicated below and returning it to us.

[Remainder of page intentionally left blank; signature page follows]

Classified – Confidential

4

/s/ J. A. M. Douglas, Jr.

J. A. M. Douglas, Jr.

President, Coca-Cola North America

and Authorized Signatory for CCR

Accepted and Agreed to

On Behalf of Bottler:

COCA-COLA BOTTLING CO. CONSOLIDATED

By: /s/ James E. Harris

Name: James E. Harris

Title: Executive Vice President

ALLOCATION OF EXPANSION FACILITY DISCOUNT

AMONG EXPANSION FACILITIES

Classified - Confidential