Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AVADEL PHARMACEUTICALS PLC | avadel8k20170509slides.htm |

Q1 2017

Earnings Conference Call

May 9th, 2017

2

Safe Harbor

This presentation may include "forward-looking statements" within the meaning of the Private Securities Litigation

Reform Act of 1995. All statements herein that are not clearly historical in nature are forward-looking, and the words

"anticipate," "assume," "believe," "expect," "estimate," "plan," "will," "may," and the negative of these and similar

expressions generally identify forward-looking statements. All forward-looking statements involve risks, uncertainties

and contingencies, many of which are beyond Avadel’s control and could cause actual results to differ materially from

the results contemplated in such forward-looking statements. These risks, uncertainties and contingencies include the

risks relating to: our dependence on a small number of products and customers for the majority of our revenues; the

possibility that our Bloxiverz®, Vazculep® and Akovaz® products, which are not patent protected, could face substantial

competition resulting in a loss of market share or forcing us to reduce the prices we charge for those products; the

possibility that we could fail to successfully complete the research and development for the pipeline product we are

evaluating for potential application to the FDA pursuant to our "unapproved-to-approved" strategy, or that competitors

could complete the development of such product and apply for FDA approval of such product before us; our

dependence on the performance of third parties in partnerships or strategic alliances for the commercialization of some

of our products; the possibility that our products may not reach the commercial market or gain market acceptance; our

need to invest substantial sums in research and development in order to remain competitive; our dependence on

certain single providers for development of several of our drug delivery platforms and products; our dependence on a

limited number of suppliers to manufacture our products and to deliver certain raw materials used in our products; the

possibility that our competitors may develop and market technologies or products that are more effective or safer than

ours, or obtain regulatory approval and market such technologies or products before we do; the challenges in

protecting the intellectual property underlying our drug delivery platforms and other products; our dependence on key

personnel to execute our business plan; the amount of additional costs we will incur to comply with U.S. securities laws

as a result of our ceasing to qualify as a foreign private issuer; and the other risks, uncertainties and contingencies

described in the Company's filings with the U.S. Securities and Exchange Commission, including our annual report on

Form 10-K for the year ended December 31, 2016, all of which filings are also available on the Company's website.

Avadel undertakes no obligation to update its forward-looking statements as a result of new information, future events

or otherwise, except as required by law.

3

Strategy Execution: 1Q 2016 Overview

• Market Dynamics: Hospital Products

• Akovaz®

• Bloxiverz®

• Vazculep®

• REST-ON Phase III Trial Update

• Non-GAAP Financial Results

• GAAP Financial Results

• Product Sales

• Cash Flow

• 2017 Guidance

4

Market Dynamics: Akovaz®

Ephedrine Market Volume / Year

IMS Data Repackaging Market

• Three approved products in 1Q 2017

• Total vials per year ~7.5M

• ~5M vials captured by IMS data

• ~2.5M vials to private repackaging market

• Akovaz IMS share during 1Q 2017 was approximately 15% -

20%

• Total market share averaged approximately 40% for 1Q 2017

5

Market Dynamics: Bloxiverz®

0

200000

400000

600000

800000

1000000

1200000

1400000

1Q 2016 2Q 2016 3Q 2016 4Q 2016 1Q 2017

Neuromuscular Blockade Reversal Market Volume

Neostigmine Sugammadex

• IMS Data tracks neuromuscular blockade market at ~5M vials per year

• Neostigmine declined as a percent of the overall market on a y/y basis

• Bloxiverz has consistently held ~40% of total neostigmine volume

V

ials

/

Qu

arte

r

6

Market Dynamics: Vazculep®

0%

20%

40%

60%

80%

100%

1mL 5mL 10mL

Market Share by Vial Size

Avadel Other

• Vazculep held

approximately 40% of the

1mL market volume during

1Q 2017

• Vazculep 5mL & 10mL have

been sole source since

approval in 2014

• Relatively consistent share

and revenue over the last

year

7

Progress to Date

REST-ON Phase III Trial

• SPA in place with FDA

• Upfront agreement from FDA on powering and trial design

• Clinical sites actively recruiting patients

• USA

• Europe

• Canada

• Enrollment completion goal of year end 2017

8

Pediatric Products & Business Development

• Karbinal ER

• TRx up 26% quarter / quarter

• TRx up 67% year / year

• Launched Flexichamber® for use with

metered dose inhalers for the treatment

of asthma launched

$179.2M in Cash & Marketable Securities - Actively looking for acquisitions to

add new revenue streams and products for sales reps to leverage

9

Non-GAAP Financial Results

*Reconciliations from GAAP to Non-GAAP can be found in the appendix

(in 000s)

03/31/17 12/31/16 03/31/16

Sales 52,507$ 43,085$ 36,216$

Cost of products and services sold 3,856 3,610 3,143

Research and development expenses 7,206 13,476 5,388

Selling, general and admin expenses 11,812 10,688 9,461

Intangible asset amortization - - -

Restructuring costs - - -

Operating expenses 22,874 27,774 17,992

Contingent consideration payments and accruals 9,616 7,645 6,445

Operating income (loss) 20,017 7,666 11,779

Interest and other expense (net) 266 294 25

Other Expense - changes in fair value of related party payable (1,299) (1,018) (892)

Income (loss) before income taxes 18,984 6,942 10,912

Income tax provision 7,692 6,875 9,078

Net income (loss) 11,292$ 67$ 1,834$

Diluted earnings (loss) per share 0.26$ -$ 0.04$

Three Months Ended

10

GAAP Financial Results

(in 000s)

03/31/17 12/31/16 03/31/16

Sales 52,507$ 43,085$ 36,216$

Cost of products and services sold 3,902 2,591 3,906

Research and development expenses 7,206 13,476 5,388

Selling, general and admin expenses 11,812 10,688 9,461

Intangible asset amortization 564 2,970 3,514

Restructuring costs 2,653 - -

Operating expenses 26,137 29,725 22,269

Fair value adjustments of contingent consideration (6,971) (3,704) 8,243

Operating income (loss) 33,341 17,064 5,704

Interest and other expense (net) 35 1,429 (2,916)

Other Expense - changes in fair value of related party payable 550 (413) (1,534)

Income (loss) before income taxes 33,926 18,080 1,254

Income tax provision 8,525 13,346 7,312

Net income (loss) 25,401$ 4,734$ (6,058)$

Diluted earnings (loss) per share 0.59$ 0.11$ (0.15)$

Three Months Ended

11

Product Sales

in $000's Q1 2016 Q4 2016 Q1 2016

Q1 2017

vs.

Q4 2016

Q1 2017

vs.

Q1 2016

Bloxiverz 13,902$ 16,938$ 24,747$ (3,036)$ (10,845)$

Vazculep 10,179 10,629 9,406 (450) 773

Akovaz 25,638 11,263 - 14,375 25,638

Other 2,038 3,534 1,200 (1,496) 838

Total product sales and services 51,757$ 42,364$ 35,353$ 9,393$ 16,404$

License and research revenue 750$ 721$ 863$ 29$ (113)$

Total revenues 52,507$ 43,085$ 36,216$ 9,422$ 16,291$

12

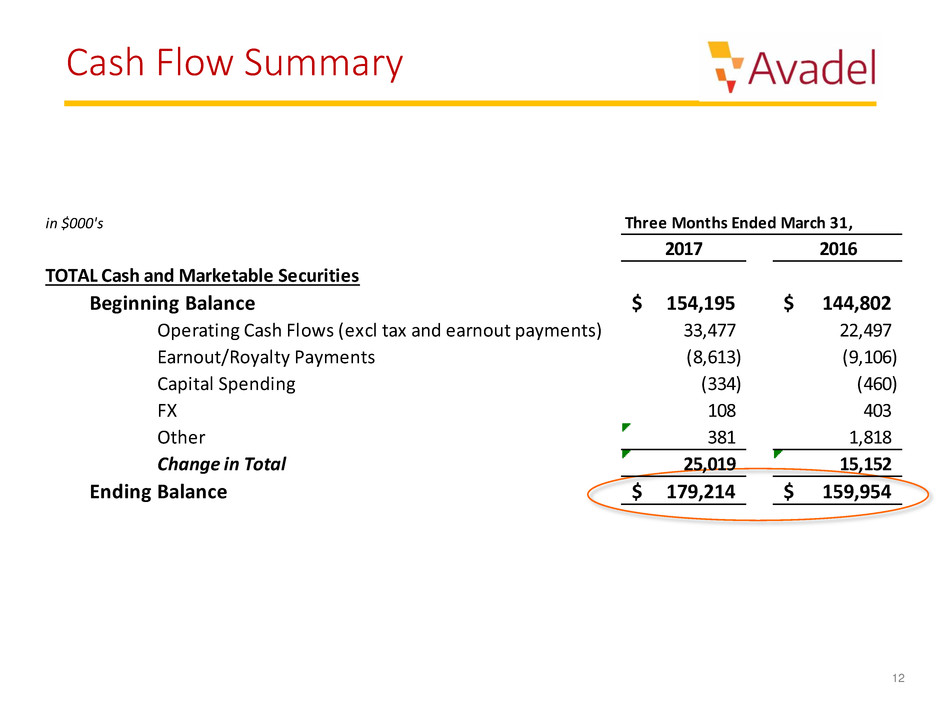

Cash Flow Summary

in $000's

2017 2016

TOTAL Cash and Marketable Securities

Beginning Balance 154,195$ 144,802$

Operating Cash Flows (excl tax and earnout payments) 33,477 22,497

Earnout/Royalty Payments (8,613) (9,106)

Capital Spending (334) (460)

FX 108 403

Other 381 1,818

Change in Total 25,019 15,152

Ending Balance 179,214$ 159,954$

Three Months Ended March 31,

13

Full Year 2017 Guidance - Updated

UPDATED PREVIOUS

Sales $170M - $185M $170M - $200M

R&D Expense $40M - $50M $40M - $50M

SG&A Expense ~$40M ~$40M

Income Tax Rate 60% - 70% 70% - 80%

Diluted EPS (Adjusted) $0.30 - $0.45 $0.20 - $0.35

2017 Guidance

14

Question & Answer

15

APPENDIX

16

GAAP to NON-GAAP Reconciliations

Three Months Ended March 31, 2017:

(in thousands - USD$) Include

GAAP

Intangible asset

amortization

Foreign

exchange

(gain)/loss

Restructuring

impacts

Purchase

accounting

adjustments -

FSC

Contingent

related party

payable

fair value

remeasurements

Contingent

related party

payable

paid/accrued

Total

Adjustments NON-GAAP

Product sales and services 51,757$ -$ -$ -$ -$ -$ -$ -$ 51,757$

License and research revenue 750 - - - - - - - 750

Total revenue 52,507 - - - - - - - 52,507

Cost of products and services sold 3,902 - - - (46) - - (46) 3,856

Research and development expenses 7,206 - - - - - - - 7,206

Selling, general and administrative expenses 11,812 - - - - - - - 11,812

Intangible asset amortization 564 (564) - - - - - (564) -

Changes in fair value of related party contingent

consideration (6,971) - - - - 6,971 9,616 16,587 9,616

Restructuring costs 2,653 - - (2,653) - - - (2,653) -

Total operating expenses 19,166 (564) - (2,653) (46) 6,971 9,616 13,324 32,490

Operating income (loss) 33,341 564 - 2,653 46 (6,971) (9,616) (13,324) 20,017

Investment Income 529 - - - - - - - 529

Interest Expense (263) - - - - - - - (263)

Other Expense - changes in fair value of related party

payable 550 - - - - (550) (1,299) (1,849) (1,299)

Foreign exchange gain (loss) (231) - 231 - - - - 231 -

Income (loss) before income taxes 33,926 564 231 2,653 46 (7,521) (10,915) (14,942) 18,984

Income tax provision 8,525 201 - - 17 (360) (691) (833) 7,692

Income Tax Rate 25% 36% - - 37% 5% 6% 6% 41%

Net Loss 25,401$ 363$ 231$ 2,653$ 29$ (7,161)$ (10,224)$ (14,109)$ 11,292$

Net loss per share - Diluted 0.59$ 0.01$ 0.01$ 0.06$ -$ (0.17)$ (0.24)$ (0.33)$ 0.26$

Weighted average number of shares outstanding - Diluted 42,810 42,810 42,810 42,810 42,810 42,810 42,810 42,810 42,810

Adjustments

Exclude

17

GAAP to NON-GAAP Reconciliations

Three Months Ended December 31, 2016:

(in thousands - USD$) Include

GAAP

Intangible asset

amortization

Foreign

exchange

(gain)/loss

Cross-border

merger impacts

Purchase

accounting

adjustments -

FSC

Contingent

related party

payable

fair value

remeasurements

Contingent

related party

payable

paid/accrued

Total

Adjustments NON-GAAP

Product sales and services 42,364$ -$ -$ -$ -$ -$ -$ -$ 42,364$

License and research revenue 721 - - - - - - - 721

Total revenue 43,085 - - - - - - - 43,085

Cost of products and services sold 2,591 - - - 1,019 - - 1,019 3,610

Research and development expenses 13,476 - - - - - - - 13,476

Selling, general and administrative expenses 10,688 - - - - - - - 10,688

Intangible asset amortization 2,970 (2,970) - - - - - (2,970) -

Changes in fair value of related party contingent

consideration (3,704) - - - - 3,704 7,645 11,349 7,645

Restructuring costs - - - - - - - - -

Total operating expenses 26,021 (2,970) - - 1,019 3,704 7,645 9,398 35,419

Operating income (loss) 17,064 2,970 - - (1,019) (3,704) (7,645) (9,398) 7,666

Investment Income 555 - - - - - - - 555

Interest Expense (261) - - - - - - - (261)

Other Expense - changes in fair value of related party

payable (413) - - - - 413 (1,018) (605) (1,018)

Foreign exchange gain (loss) 1,135 - (1,135) - - - - (1,135) -

Income (loss) before income taxes 18,080 2,970 (1,135) - (1,019) (3,291) (8,663) (11,138) 6,942

Income tax provision 13,346 1,066 - (6,754) (366) 82 (499) (6,471) 6,875

Income Tax Rate 74% 36% - - 36% (2%) 6% 58% 99%

Net Loss 4,734$ 1,904$ (1,135)$ 6,754$ (653)$ (3,373)$ (8,164)$ (4,667)$ 67$

Net loss per share - Diluted 0.11$ 0.04$ (0.03)$ 0.16$ (0.02)$ (0.08)$ (0.19)$ (0.11)$ -$

Weighted average number of shares outstanding - Diluted 42,808 42,808 42,808 42,808 42,808 42,808 42,808 42,808 42,808

Adjustments

Exclude

18

GAAP to NON-GAAP Reconciliations

Three Months Ended March 31, 2016:

(in thousands - USD$) Include

GAAP

Intangible asset

amortization

Foreign

exchange

(gain)/loss

Purchase

accounting

adjustments -

FSC

Contingent

related party

payable

fair value

remeasurements

Contingent

related party

payable

paid/accrued

Total

Adjustments NON-GAAP

Product sales and services 35,353$ -$ -$ -$ -$ -$ -$ 35,353$

License and research revenue 863 - - - - - - 863

Total revenue 36,216 - - - - - - 36,216

Cost of products and services sold 3,906 - - (763) - - (763) 3,143

Research and development expenses 5,388 - - - - - - 5,388

Selling, general and administrative expenses 9,461 - - - - - - 9,461

Intangible asset amortization 3,514 (3,514) - - - - (3,514) -

Changes in fair value of related party contingent

consideration 8,243 - - - (8,243) 6,445 (1,798) 6,445

Restructuring costs - - - - - - - -

Total operating expenses 30,512 (3,514) - (763) (8,243) 6,445 (6,075) 24,437

Operating income (loss) 5,704 3,514 - 763 8,243 (6,445) 6,075 11,779

Investment Income 200 - - - - - - 200

Interest Expense (175) - - - - - - (175)

Other Expense - changes in fair value of related party

payable (1,534) - - - 1,534 (892) 642 (892)

Foreign exchange gain (loss) (2,941) - 2,941 - - - 2,941 -

Income (loss) before income taxes 1,254 3,514 2,941 763 9,777 (7,337) 9,658 10,912

Income tax provision 7,312 1,262 - 274 551 (321) 1,766 9,078

Income Tax Rate 583% 36% - 36% 6% 4% 18% 83%

Net Loss (6,058)$ 2,252$ 2,941$ 489$ 9,226$ (7,016)$ 7,892$ 1,834$

Net loss per share - Diluted (0.15)$ 0.05$ 0.07$ 0.01$ 0.22$ (0.17)$ 0.19$ 0.04$

Weighted average number of shares outstanding - Diluted 41,241 41,241 41,241 41,241 41,241 41,241 41,241 41,241

Adjustments

Exclude