Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Conifer Holdings, Inc. | a8-k20171stqearnings.htm |

News Release

For Further Information:

Jessica Gulis, 248.559.0840

ir@cnfrh.com

For Immediate Release

Conifer Holdings Reports 2017 First Quarter Financial Results

Company to Host Conference Call at 8:30 AM ET on Thursday, May 11, 2017

Birmingham, MI, May 10, 2017 - Conifer Holdings, Inc. (Nasdaq: CNFR) (“Conifer” or the

“Company”) today announced results for the first quarter ended March 31, 2017.

First Quarter 2017 Highlights (all comparisons to prior year period)

• Gross written premiums increased 4.3% to $26.5 million; driven by a 13.1% increase in core

commercial lines growth offset by lower personal lines premiums

• Net earned premiums increased 20% to $24.1 million

• Combined ratio was 109.1%, compared to 112.2% in the prior year period and 118.7% in the

fourth quarter of 2016

• Net loss of $1.8 million, or $0.24 per diluted share

Management Comments

James Petcoff, Chairman and CEO, commented, “For the first quarter of 2017, our efforts remain

focused on growth in our core underwriting markets where we reported a 13.1% increase in gross

written premiums for our commercial lines of business. This growth originated primarily from

Conifer’s specialty niche insurance products such as liquor liability, security guards, and quick

service restaurants. We are now expanding these businesses even more across our existing base of

long-term independent agents, and each line has performed at or above their historical

underwriting results.”

Mr. Petcoff continued, “We continue to deemphasize lines where the underwriting performance has

not been aligned with our long-term goals, for example, Florida homeowners. While the first

quarter did include higher than anticipated losses (mainly surrounding our commercial property

business), we are pleased to report an accident year loss ratio of 51.7% during the first quarter. Our

continued strong accident year results coupled with incremental improvements in our expense ratio

(44.9% in Q1 2017) better position the Company for sustained, profitable growth going forward.”

Conifer Holdings, Inc. Page 2

May 10, 2017

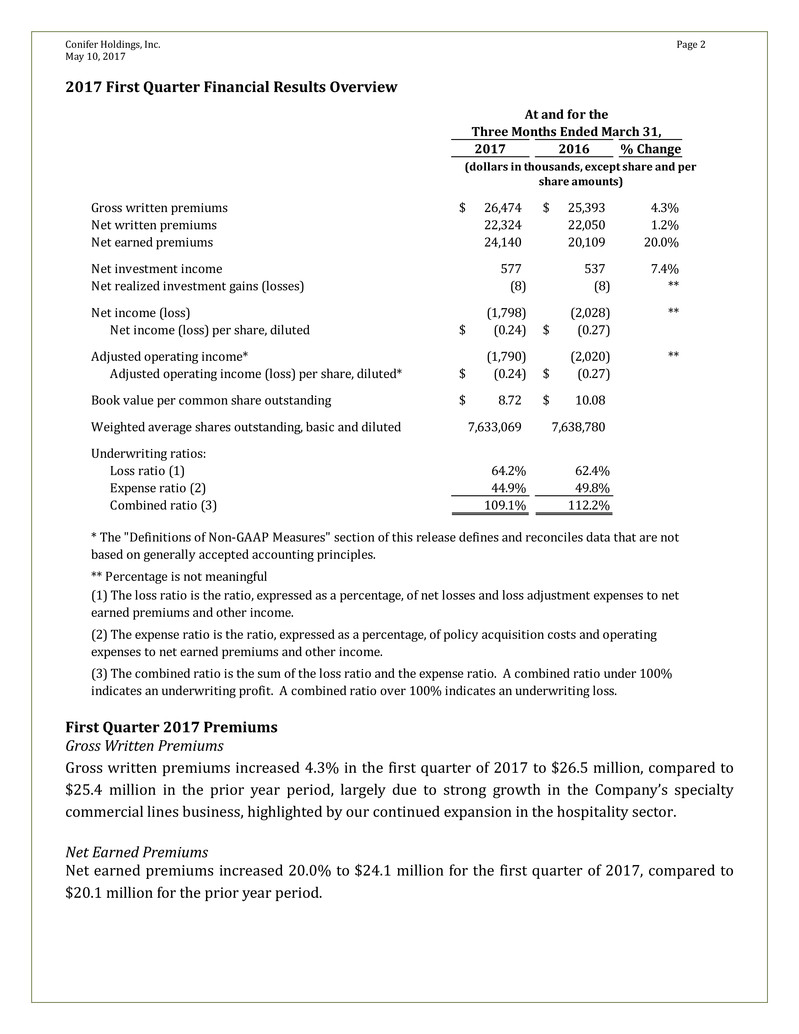

2017 First Quarter Financial Results Overview

First Quarter 2017 Premiums

Gross Written Premiums

Gross written premiums increased 4.3% in the first quarter of 2017 to $26.5 million, compared to

$25.4 million in the prior year period, largely due to strong growth in the Company’s specialty

commercial lines business, highlighted by our continued expansion in the hospitality sector.

Net Earned Premiums

Net earned premiums increased 20.0% to $24.1 million for the first quarter of 2017, compared to

$20.1 million for the prior year period.

2017 2016 % Change

Gross written premiums 26,474$ 25,393$ 4.3%

Net written premiums 22,324 22,050 1.2%

Net earned premiums 24,140 20,109 20.0%

Net investment income 577 537 7.4%

Net realized investment gains (losses) (8) (8) **

Net income (loss) (1,798) (2,028) **

Net income (loss) per share, diluted (0.24)$ (0.27)$

Adjusted operating income* (1,790) (2,020) **

Adjusted operating income (loss) per share, diluted* (0.24)$ (0.27)$

Book value per common share outstanding 8.72$ 10.08$

Weighted average shares outstanding, basic and diluted 7,633,069 7,638,780

Underwriting ratios:

Loss ratio (1) 64.2% 62.4%

Expense ratio (2) 44.9% 49.8%

Combined ratio (3) 109.1% 112.2%

** Percentage is not meaningful

* The "Definitions of Non-GAAP Measures" section of this release defines and reconciles data that are not

based on generally accepted accounting principles.

(3) The combined ratio is the sum of the loss ratio and the expense ratio. A combined ratio under 100%

indicates an underwriting profit. A combined ratio over 100% indicates an underwriting loss.

(2) The expense ratio is the ratio, expressed as a percentage, of policy acquisition costs and operating

expenses to net earned premiums and other income.

(1) The loss ratio is the ratio, expressed as a percentage, of net losses and loss adjustment expenses to net

earned premiums and other income.

At and for the

Three Months Ended March 31,

(dollars in thousands, except share and per

share amounts)

Conifer Holdings, Inc. Page 3

May 10, 2017

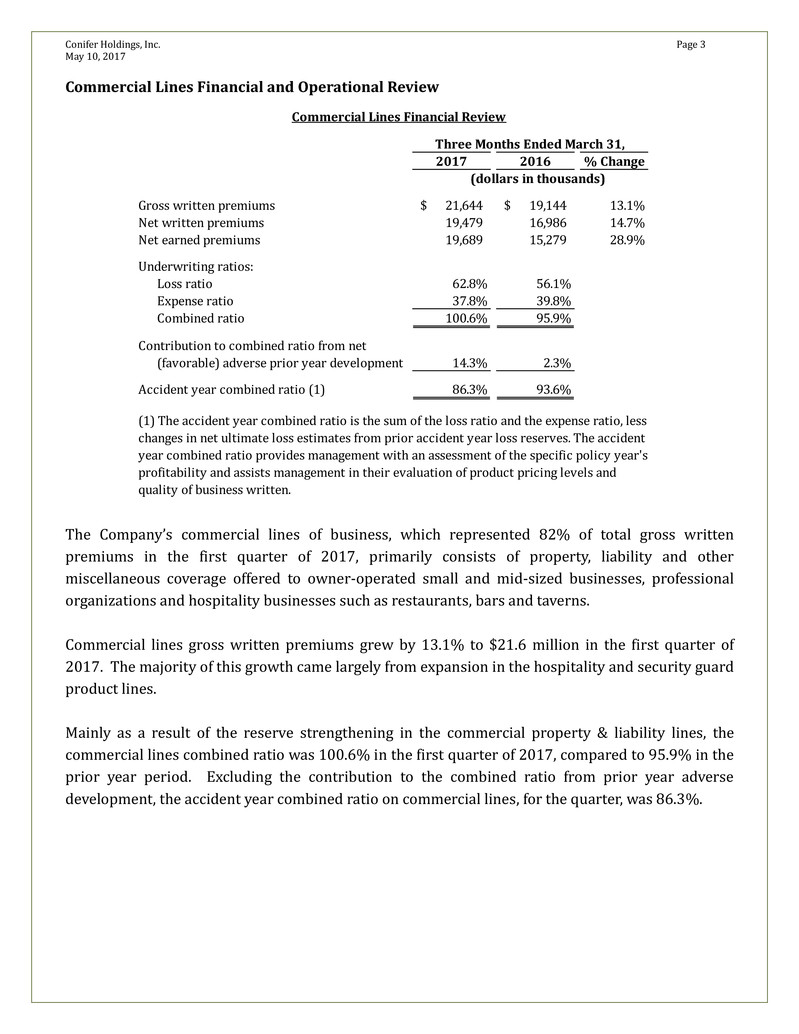

Commercial Lines Financial and Operational Review

The Company’s commercial lines of business, which represented 82% of total gross written

premiums in the first quarter of 2017, primarily consists of property, liability and other

miscellaneous coverage offered to owner-operated small and mid-sized businesses, professional

organizations and hospitality businesses such as restaurants, bars and taverns.

Commercial lines gross written premiums grew by 13.1% to $21.6 million in the first quarter of

2017. The majority of this growth came largely from expansion in the hospitality and security guard

product lines.

Mainly as a result of the reserve strengthening in the commercial property & liability lines, the

commercial lines combined ratio was 100.6% in the first quarter of 2017, compared to 95.9% in the

prior year period. Excluding the contribution to the combined ratio from prior year adverse

development, the accident year combined ratio on commercial lines, for the quarter, was 86.3%.

2017 2016 % Change

Gross written premiums 21,644$ 19,144$ 13.1%

Net written premiums 19,479 16,986 14.7%

Net earned premiums 19,689 15,279 28.9%

Underwriting ratios:

Loss ratio 62.8% 56.1%

Expense ratio 37.8% 39.8%

Combined ratio 100.6% 95.9%

(favorable) adverse prior year development 14.3% 2.3%

Accident year combined ratio (1) 86.3% 93.6%

Commercial Lines Financial Review

(1) The accident year combined ratio is the sum of the loss ratio and the expense ratio, less

changes in net ultimate loss estimates from prior accident year loss reserves. The accident

year combined ratio provides management with an assessment of the specific policy year's

profitability and assists management in their evaluation of product pricing levels and

quality of business written.

Contribution to combined ratio from net

Three Months Ended March 31,

(dollars in thousands)

Conifer Holdings, Inc. Page 4

May 10, 2017

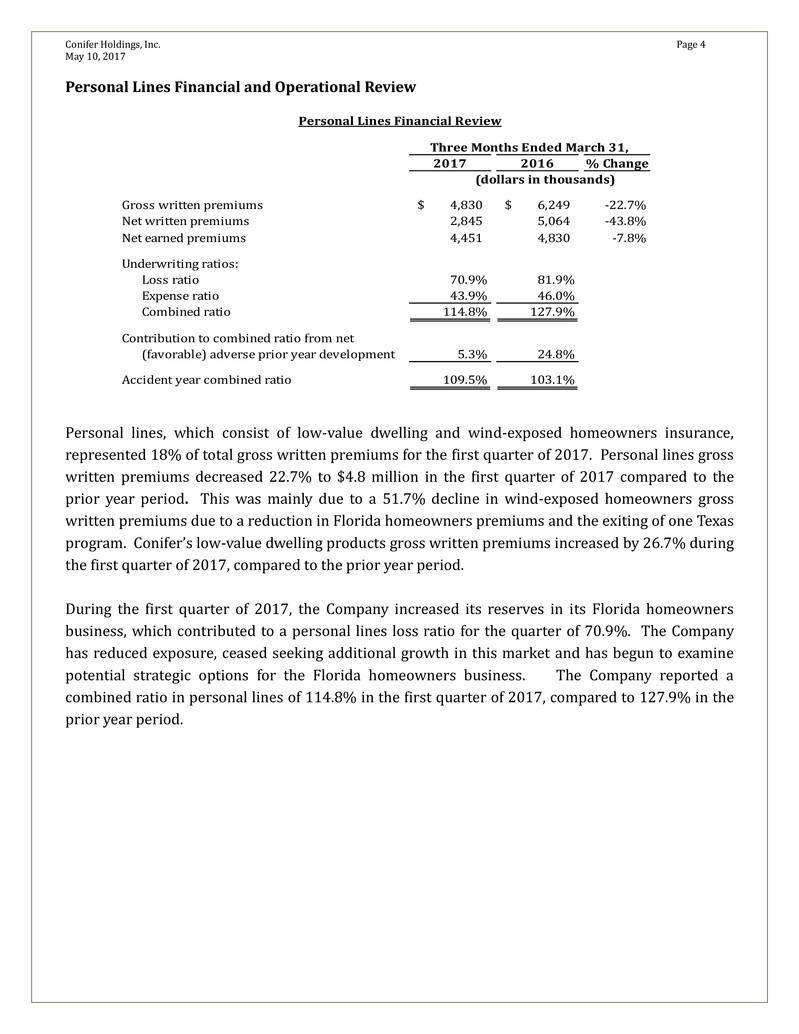

Personal Lines Financial and Operational Review

2017 2016 % Change

Gross written premiums 4,830$ 6,249$ -22.7%

Net written premiums 2,845 5,064 -43.8%

Net earned premiums 4,451 4,830 -7.8%

Underwriting ratios:

Loss ratio 70.9% 81.9%

Expense ratio 43.9% 46.0%

Combined ratio 114.8% 127.9%

(favorable) adverse prior year development 5.3% 24.8%

Accident year combined ratio 109.5% 103.1%

(dollars in thousands)

Contribution to combined ratio from net

Personal Lines Financial Review

Three Months Ended March 31,

Personal lines, which consist of low-value dwelling and wind-exposed homeowners insurance,

represented 18% of total gross written premiums for the first quarter of 2017. Personal lines gross

written premiums decreased 22.7% to $4.8 million in the first quarter of 2017 compared to the

prior year period. This was mainly due to a 51.7% decline in wind-exposed homeowners gross

written premiums due to a reduction in Florida homeowners premiums and the exiting of one Texas

program. Conifer’s low-value dwelling products gross written premiums increased by 26.7% during

the first quarter of 2017, compared to the prior year period.

During the first quarter of 2017, the Company increased its reserves in its Florida homeowners

business, which contributed to a personal lines loss ratio for the quarter of 70.9%. The Company

has reduced exposure, ceased seeking additional growth in this market and has begun to examine

potential strategic options for the Florida homeowners business. The Company reported a

combined ratio in personal lines of 114.8% in the first quarter of 2017, compared to 127.9% in the

prior year period.

Conifer Holdings, Inc. Page 5

May 10, 2017

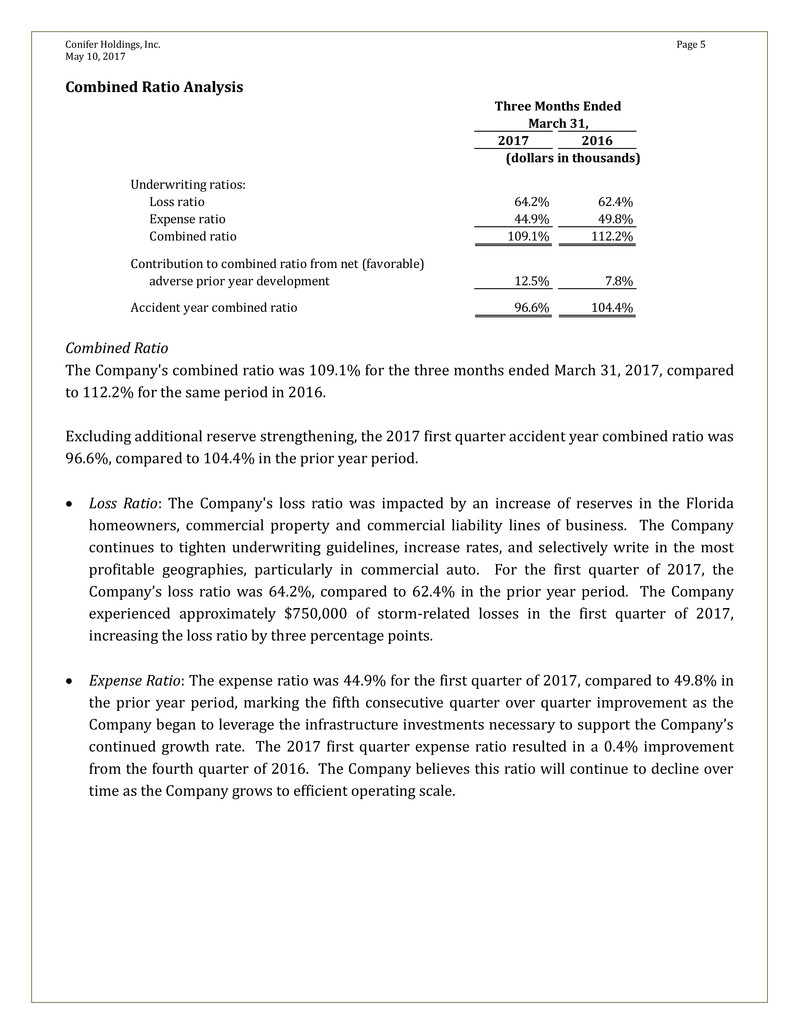

Combined Ratio Analysis

Combined Ratio

The Company's combined ratio was 109.1% for the three months ended March 31, 2017, compared

to 112.2% for the same period in 2016.

Excluding additional reserve strengthening, the 2017 first quarter accident year combined ratio was

96.6%, compared to 104.4% in the prior year period.

Loss Ratio: The Company's loss ratio was impacted by an increase of reserves in the Florida

homeowners, commercial property and commercial liability lines of business. The Company

continues to tighten underwriting guidelines, increase rates, and selectively write in the most

profitable geographies, particularly in commercial auto. For the first quarter of 2017, the

Company’s loss ratio was 64.2%, compared to 62.4% in the prior year period. The Company

experienced approximately $750,000 of storm-related losses in the first quarter of 2017,

increasing the loss ratio by three percentage points.

Expense Ratio: The expense ratio was 44.9% for the first quarter of 2017, compared to 49.8% in

the prior year period, marking the fifth consecutive quarter over quarter improvement as the

Company began to leverage the infrastructure investments necessary to support the Company’s

continued growth rate. The 2017 first quarter expense ratio resulted in a 0.4% improvement

from the fourth quarter of 2016. The Company believes this ratio will continue to decline over

time as the Company grows to efficient operating scale.

2017 2016

Underwriting ratios:

Loss ratio 64.2% 62.4%

Expense ratio 44.9% 49.8%

Combined ratio 109.1% 112.2%

adverse prior year development 12.5% 7.8%

Accident year combined ratio 96.6% 104.4%

Three Months Ended

March 31,

(dollars in thousands)

Contribution to combined ratio from net (favorable)

Conifer Holdings, Inc. Page 6

May 10, 2017

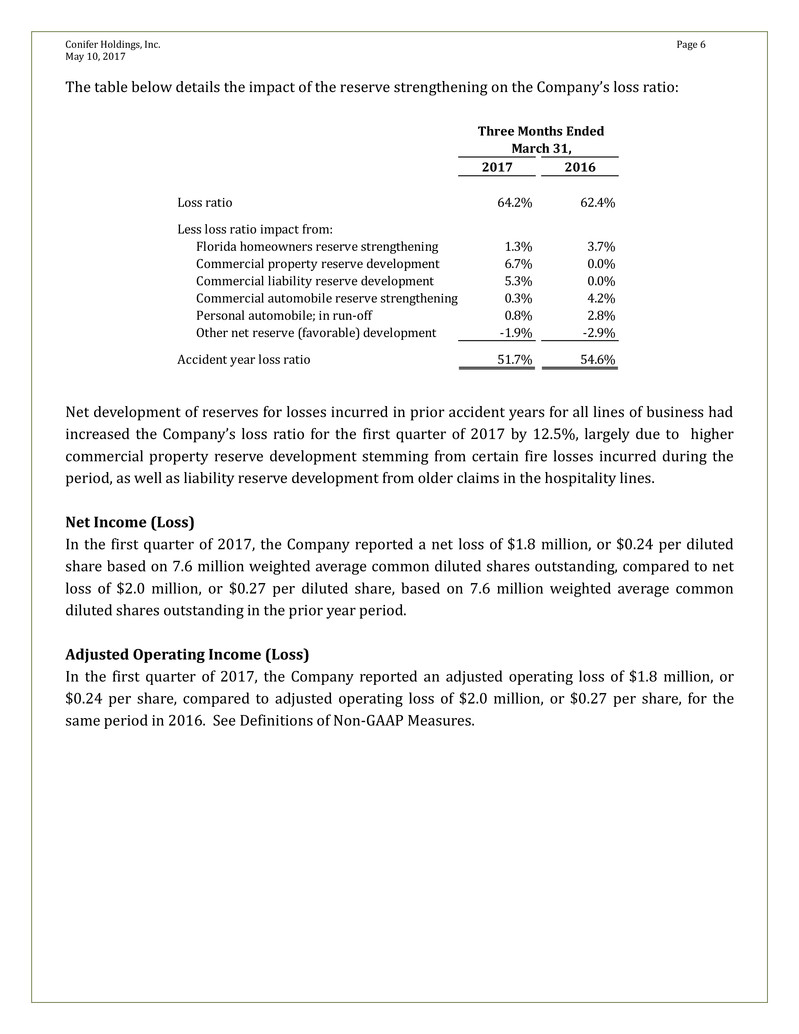

The table below details the impact of the reserve strengthening on the Company’s loss ratio:

Net development of reserves for losses incurred in prior accident years for all lines of business had

increased the Company’s loss ratio for the first quarter of 2017 by 12.5%, largely due to higher

commercial property reserve development stemming from certain fire losses incurred during the

period, as well as liability reserve development from older claims in the hospitality lines.

Net Income (Loss)

In the first quarter of 2017, the Company reported a net loss of $1.8 million, or $0.24 per diluted

share based on 7.6 million weighted average common diluted shares outstanding, compared to net

loss of $2.0 million, or $0.27 per diluted share, based on 7.6 million weighted average common

diluted shares outstanding in the prior year period.

Adjusted Operating Income (Loss)

In the first quarter of 2017, the Company reported an adjusted operating loss of $1.8 million, or

$0.24 per share, compared to adjusted operating loss of $2.0 million, or $0.27 per share, for the

same period in 2016. See Definitions of Non-GAAP Measures.

2017 2016

Loss ratio 64.2% 62.4%

Less loss ratio impact from:

Florida homeowners reserve strengthening 1.3% 3.7%

Commercial property reserve development 6.7% 0.0%

Commercial liability reserve development 5.3% 0.0%

Commercial automobile reserve strengthening 0.3% 4.2%

Personal automobile; in run-off 0.8% 2.8%

Other net reserve (favorable) development -1.9% -2.9%

Accident year loss ratio 51.7% 54.6%

Three Months Ended

March 31,

Conifer Holdings, Inc. Page 7

May 10, 2017

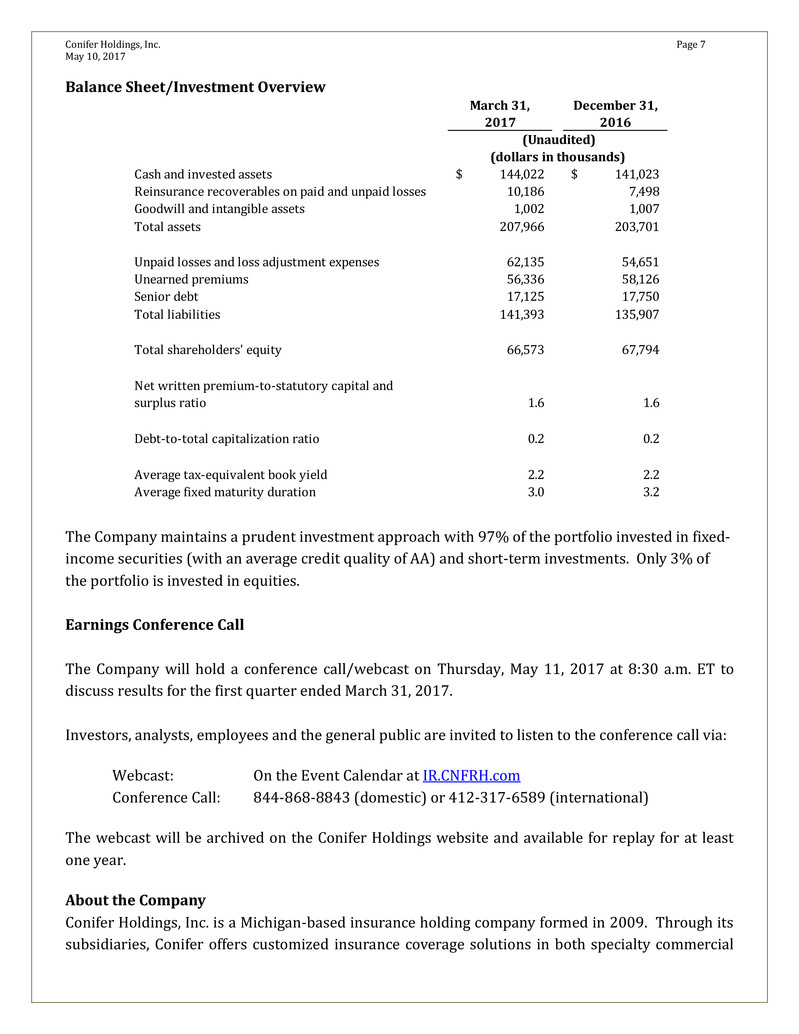

Balance Sheet/Investment Overview

The Company maintains a prudent investment approach with 97% of the portfolio invested in fixed-

income securities (with an average credit quality of AA) and short-term investments. Only 3% of

the portfolio is invested in equities.

Earnings Conference Call

The Company will hold a conference call/webcast on Thursday, May 11, 2017 at 8:30 a.m. ET to

discuss results for the first quarter ended March 31, 2017.

Investors, analysts, employees and the general public are invited to listen to the conference call via:

Webcast: On the Event Calendar at IR.CNFRH.com

Conference Call: 844-868-8843 (domestic) or 412-317-6589 (international)

The webcast will be archived on the Conifer Holdings website and available for replay for at least

one year.

About the Company

Conifer Holdings, Inc. is a Michigan-based insurance holding company formed in 2009. Through its

subsidiaries, Conifer offers customized insurance coverage solutions in both specialty commercial

March 31, December 31,

2017 2016

Cash and invested assets 144,022$ 141,023$

Reinsurance recoverables on paid and unpaid losses 10,186 7,498

Goodwill and intangible assets 1,002 1,007

Total assets 207,966 203,701

Unpaid losses and loss adjustment expenses 62,135 54,651

Unearned premiums 56,336 58,126

Senior debt 17,125 17,750

Total liabilities 141,393 135,907

Total shareholders' equity 66,573 67,794

Net written premium-to-statutory capital and

surplus ratio 1.6 1.6

Debt-to-total capitalization ratio 0.2 0.2

Average tax-equivalent book yield 2.2 2.2

Average fixed maturity duration 3.0 3.2

(dollars in thousands)

(Unaudited)

Conifer Holdings, Inc. Page 8

May 10, 2017

and specialty personal product lines marketing mainly through independent agents in all 50 states.

The Company completed its initial public offering in August 2015 and is traded on the Nasdaq

Global Market (Nasdaq: CNFR). Additional information is available on the Company’s website at

www.CNFRH.com.

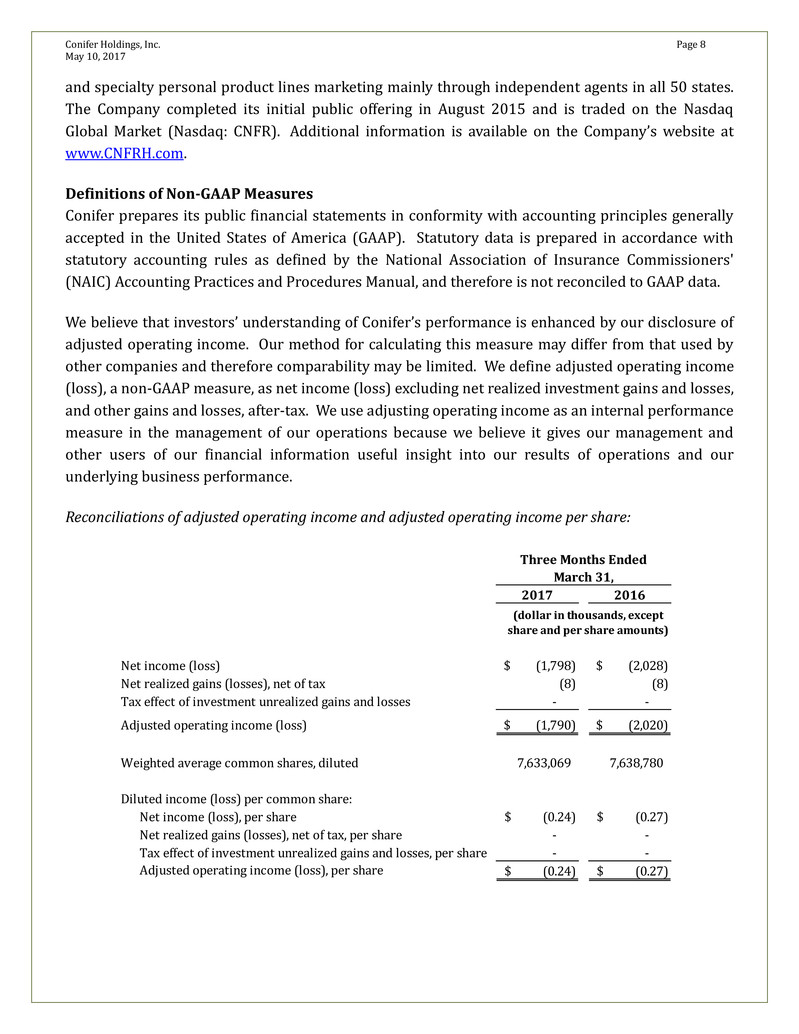

Definitions of Non-GAAP Measures

Conifer prepares its public financial statements in conformity with accounting principles generally

accepted in the United States of America (GAAP). Statutory data is prepared in accordance with

statutory accounting rules as defined by the National Association of Insurance Commissioners'

(NAIC) Accounting Practices and Procedures Manual, and therefore is not reconciled to GAAP data.

We believe that investors’ understanding of Conifer’s performance is enhanced by our disclosure of

adjusted operating income. Our method for calculating this measure may differ from that used by

other companies and therefore comparability may be limited. We define adjusted operating income

(loss), a non-GAAP measure, as net income (loss) excluding net realized investment gains and losses,

and other gains and losses, after-tax. We use adjusting operating income as an internal performance

measure in the management of our operations because we believe it gives our management and

other users of our financial information useful insight into our results of operations and our

underlying business performance.

Reconciliations of adjusted operating income and adjusted operating income per share:

2017 2016

(1,798)$ (2,028)$

Net realized gains (losses), net of tax (8) (8)

Tax effect of investment unrealized gains and losses - -

Adjusted operating income (loss) (1,790)$ (2,020)$

Weighted a erage common shares, diluted 7,633,069 7,638,780

Diluted income (loss) per common share:

Net income (loss), per share (0.24)$ (0.27)$

Net realized gains (losses), net of tax, per share - -

Tax effect of investment unrealized gains and losses, per share - -

Adjusted operating income (loss), per share (0.24)$ (0.27)$

Three Months Ended

March 31,

(dollar in thousands, except

share and per share amounts)

Net income (loss)

Conifer Holdings, Inc. Page 9

May 10, 2017

Forward-Looking Statement

This press release contains forward-looking statements made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements give

current expectations or forecasts of future events or our future financial or operating performance,

and include Conifer’s expectations regarding premiums, earnings, its capital position, expansion,

and growth strategies. The forward-looking statements contained in this press release are based on

management’s good-faith belief and reasonable judgment based on current information. The

forward-looking statements are qualified by important factors, risks and uncertainties, many of

which are beyond our control, that could cause our actual results to differ materially from those in

the forward-looking statements, including those described in our form 10-K (“Item 1A Risk

Factors”) filed with the SEC on March 15, 2017 and subsequent reports filed with or furnished to the

SEC. Any forward-looking statement made by us in this report speaks only as of the date hereof or

as of the date specified herein. We undertake no obligation to publicly update any forward-looking

statement, whether as a result of new information, future developments or otherwise, except as may

be required by any applicable laws or regulations.

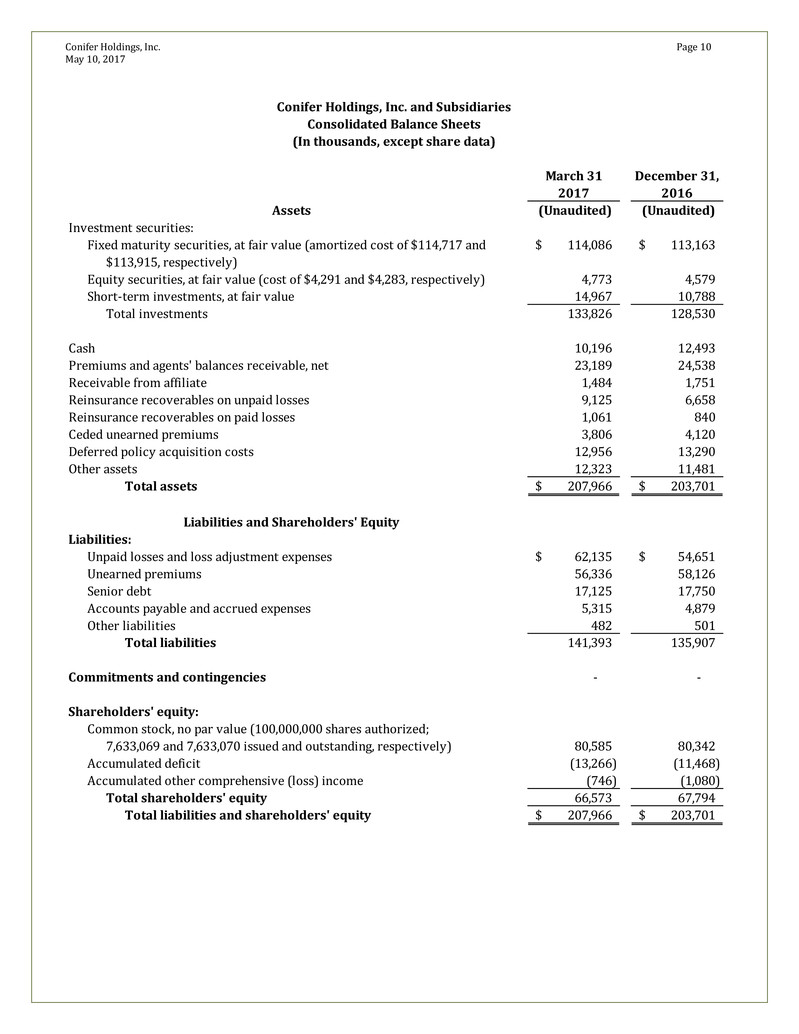

Conifer Holdings, Inc. Page 10

May 10, 2017

March 31 December 31,

2017 2016

(Unaudited) (Unaudited)

Investment securities:

Fixed maturity securities, at fair value (amortized cost of $114,717 and 114,086$ 113,163$

$113,915, respectively)

Equity securities, at fair value (cost of $4,291 and $4,283, respectively) 4,773 4,579

Short-term investments, at fair value 14,967 10,788

Total investments 133,826 128,530

Cash 10,196 12,493

Premiums and agents' balances receivable, net 23,189 24,538

Receivable from affiliate 1,484 1,751

Reinsurance recoverables on unpaid losses 9,125 6,658

Reinsurance recoverables on paid losses 1,061 840

Ceded unearned premiums 3,806 4,120

Deferred policy acquisition costs 12,956 13,290

Other assets 12,323 11,481

Total assets 207,966$ 203,701$

Liabilities:

Unpaid losses and loss adjustment expenses 62,135$ 54,651$

Unearned premiums 56,336 58,126

Senior debt 17,125 17,750

Accounts payable and accrued expenses 5,315 4,879

Other liabilities 482 501

Total liabilities 141,393 135,907

Commitments and contingencies - -

Shareholders' equity:

Common stock, no par value (100,000,000 shares authorized;

7,633,069 and 7,633,070 issued and outstanding, respectively) 80,585 80,342

Accumulated deficit (13,266) (11,468)

Accumulated other comprehensive (loss) income (746) (1,080)

Total shareholders' equity 66,573 67,794

Total liabilities and shareholders' equity 207,966$ 203,701$

Conifer Holdings, Inc. and Subsidiaries

Consolidated Balance Sheets

(In thousands, except share data)

Assets

Liabilities and Shareholders' Equity

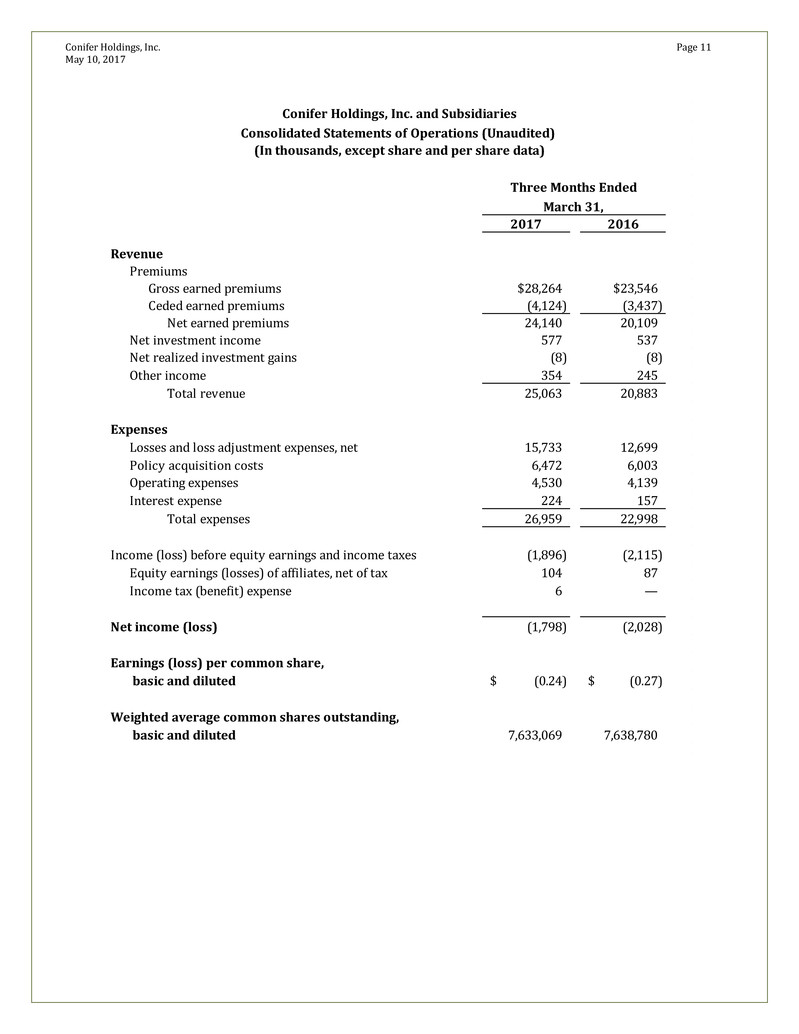

Conifer Holdings, Inc. Page 11

May 10, 2017

2017 2016

Revenue

Premiums

Gross earned premiums $28,264 $23,546

Ceded earned premiums (4,124) (3,437)

Net earned premiums 24,140 20,109

Net investment income 577 537

Net realized investment gains (8) (8)

Other income 354 245

Total revenue 25,063 20,883

Expenses

Losses and loss adjustment expenses, net 15,733 12,699

Policy acquisition costs 6,472 6,003

Operating expenses 4,530 4,139

Interest expense 224 157

Total expenses 26,959 22,998

Income (loss) before equity earnings and income taxes (1,896) (2,115)

Equity earnings (losses) of affiliates, net of tax 104 87

Income tax (benefit) expense 6 —

Net income (loss) (1,798) (2,028)

Earnings (loss) per common share,

basic and diluted (0.24)$ (0.27)$

Weighted average common shares outstanding,

basic and diluted 7,633,069 7,638,780

Conifer Holdings, Inc. and Subsidiaries

Consolidated Statements of Operations (Unaudited)

(In thousands, except share and per share data)

March 31,

Three Months Ended