Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Commercial Vehicle Group, Inc. | a8koppenheimer051017.htm |

Commercial Vehicle Group, Inc.

Oppenheimer Industrial Growth Conference

May 10, 2017

Patrick Miller

President and CEO

Tim Trenary

Chief Financial Officer

Terry Hammett

Treasurer and VP Investor Relations

Forward Looking Statement

This press release contains forward-looking statements that are subject to risks and uncertainties. These statements often include words such as

"believe," "expect," "anticipate," "intend," "plan," "estimate," or similar expressions. In particular, this press release may contain forward-looking

statements about Company expectations for future periods with respect to its plans to improve financial results and enhance the Company, the future of

the Company’s end markets, Class 8 North America build rates, performance of the global construction equipment business, expected cost savings,

enhanced shareholder value and other economic benefits of the consulting services, the Company’s initiatives to address customer needs, organic

growth, the Company’s economic growth plans to focus on certain segments and markets and the Company’s financial position or other financial

information. These statements are based on certain assumptions that the Company has made in light of its experience in the industry as well as its

perspective on historical trends, current conditions, expected future developments and other factors it believes are appropriate under the circumstances.

Actual results may differ materially from the anticipated results because of certain risks and uncertainties, including but not limited to: (i) general

economic or business conditions affecting the markets in which the Company serves; (ii) the Company's ability to develop or successfully introduce new

products; (iii) risks associated with conducting business in foreign countries and currencies; (iv) increased competition in the heavy-duty truck,

construction, aftermarket, military, bus, agriculture and other markets; (v) the Company’s failure to complete or successfully integrate strategic

acquisitions; (vi) the impact of changes in governmental regulations on the Company's customers or on its business; (vii) the loss of business from a

major customer or the discontinuation of particular commercial vehicle platforms; (viii) the Company’s ability to obtain future financing due to changes in

the lending markets or its financial position; (ix) the Company’s ability to comply with the financial covenants in its revolving credit facility and term loan

facility; (x) fluctuation in interest rates relating to its term loan facility and revolving credit facility; (xi) the Company’s ability to realize the benefits of its

cost reduction and strategic initiatives; (xii) a material weakness in our internal control over financial reporting which could, if not remediated, result in

material misstatements in our financial statements; (xiii) volatility and cyclicality in the commercial vehicle market adversely affecting us; (xiv) the

geographic profile of our taxable income and changes in valuation of our deferred tax assets and liabilities impacting our effective tax rate; (xv) changes

to domestic manufacturing initiatives impacting our effective tax rate related to products manufactured either in the United States or in international

jurisdictions; (xvi) implementation of tax changes, by the United States or another international jurisdiction, related to products manufactured in one or

more jurisdictions where we do business; and (xvii) various other risks as outlined under the heading "Risk Factors" in the Company's Annual Report on

Form 10-K for fiscal year ending December 31, 2016. There can be no assurance that statements made in this press release relating to future events

will be achieved. The Company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence

of unanticipated events or changes to future operating results over time. All subsequent written and oral forward-looking statements attributable to the

Company or persons acting on behalf of the Company are expressly qualified in their entirety by such cautionary statements.

pg | 1

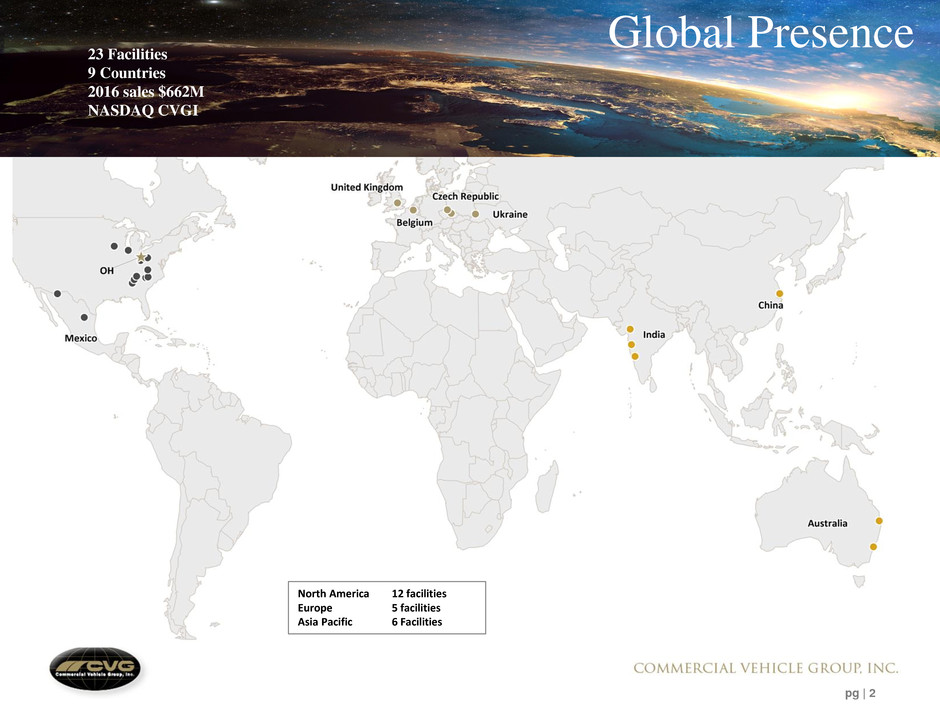

23 Facilities

9 Countries

2016 sales $662M

NASDAQ CVGI

Global Presence

pg | 2

North America 12 facilities

Europe 5 facilities

Asia Pacific 6 Facilities

Products

Seats & Seating

Systems

Cabs and Sleeper BoxesWiper Systems,

Mirrors & Controls

Wire Harnesses &

Controls

Interior Trim

pg | 3

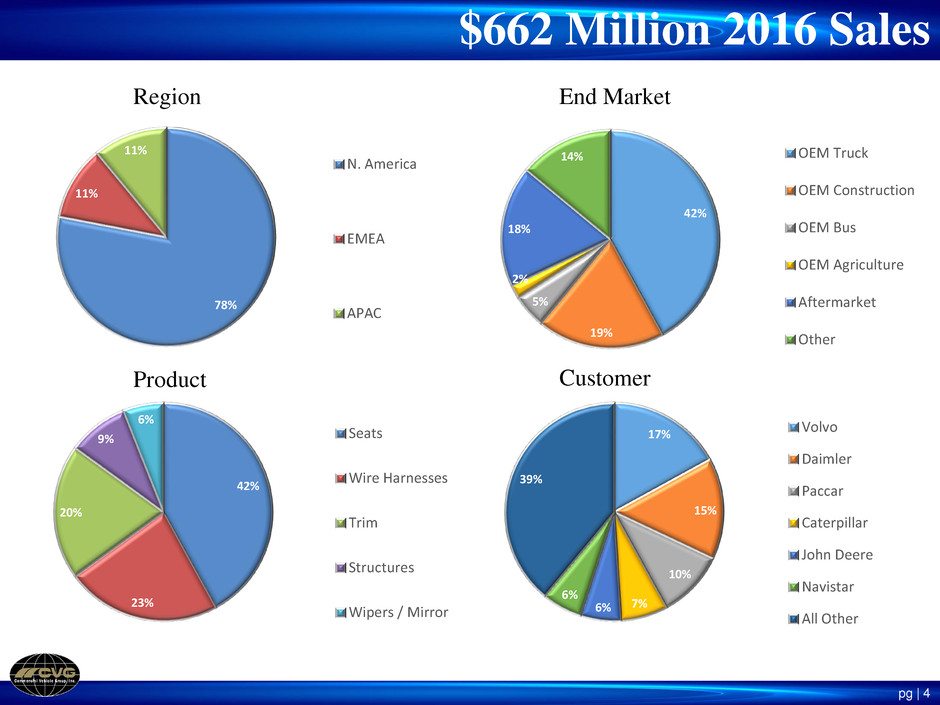

$662 Million 2016 Sales

pg | 4

78%

11%

11%

N. America

EMEA

APAC

42%

19%

5%

2%

18%

14% OEM Truck

OEM Construction

OEM Bus

OEM Agriculture

Aftermarket

Other

42%

23%

20%

9%

6%

Seats

Wire Harnesses

Trim

Structures

Wipers / Mirrors

17%

15%

10%

7%6%

6%

39%

Volvo

Daimler

Paccar

Caterpillar

John Deere

Navistar

All Other

Region End Market

Product Customer

2016 Business Segment Sales¹

pg | 5

1. Before intercompany sales eliminations

62%

19%

8%

2%

9% MD/HD Truck

OEMs

Aftermarket and

OE Service

Bus OEMs

Construction

OEMs

Other

Global Truck and Bus

$416 Million (62%)

47%

16%

14%

8%

5%

3%

7% Construction

Aftermarket and

OE Service

Automotive

Truck

Military

Agriculture

Global Construction and Agriculture

$254 Million (38%)

Industry Outlook – North America Truck

pg | 6

North American Truck Build Rates 2016 CVG Sales by End Market

(‘000s of units)

297 323 228 217 258

294 295 231

2014A 2015A 2016A 2017E 2018E 2019E 2020E 2021E

Heavy-Duty Truck (Class 8)

227 237 233

245 248 255

270 265

2014A 2015A 2016A 2017E 2018E 2019E 2020E 2021E

42%

19%

5%

2%

18%

14%

OEM Truck

OEM Bus

OEM

Agriculture

Aftermarket

*

Other

OEM Construction

Market Observations

Indicators point to a bottoming/recovery in the North American MD/HD

Truck market

HD Build rates projected to increase at 10.8% CAGR 2017 - 2020

Excess inventories are being reduced

Average age of class 8 fleet remains above historical averages

Indicators point to steady growth in medium-duty truck market

Medium-Duty Trucks (Class 5-7)

Source: Company website and filings, LMC Automotive, ACT Research, and Wall Street Research.

* Each segment has aftermarket exposure.

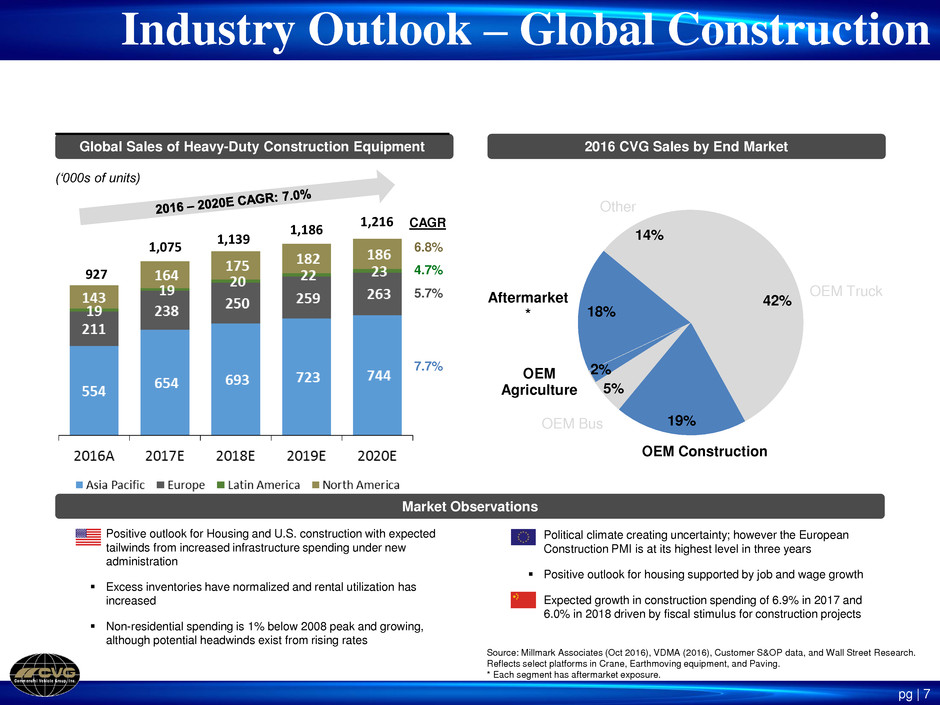

Industry Outlook – Global Construction

pg | 7

Global Sales of Heavy-Duty Construction Equipment

(‘000s of units)

2016 CVG Sales by End Market

42%

19%

5%

2%

18%

14%

OEM Truck

OEM Bus

OEM

Agriculture

Aftermarket

*

Other

Market Observations

CAGR

6.8%

4.7%

5.7%

7.7%

OEM Construction

Source: Millmark Associates (Oct 2016), VDMA (2016), Customer S&OP data, and Wall Street Research.

Reflects select platforms in Crane, Earthmoving equipment, and Paving.

* Each segment has aftermarket exposure.

927

1,075

1,139

1,186

1,216

Positive outlook for Housing and U.S. construction with expected

tailwinds from increased infrastructure spending under new

administration

Excess inventories have normalized and rental utilization has

increased

Non-residential spending is 1% below 2008 peak and growing,

although potential headwinds exist from rising rates

Political climate creating uncertainty; however the European

Construction PMI is at its highest level in three years

Positive outlook for housing supported by job and wage growth

Expected growth in construction spending of 6.9% in 2017 and

6.0% in 2018 driven by fiscal stimulus for construction projects

Strategies to Improve the Core

18% Fewer Sales

pg | 8

Restructuring and cost reductions

Executive leadership realigned

Major changes announced

Supply Chain - Leveraging globally, increasing standardization, and localizing supply

Lean/Six Sigma driving cost out

Over 600 belts granted in the past two years, including 47 black belts

Another 600 belts planned for 2017

Process investments

Interior trim in North America

More efficient seat assembly lines in US and UK

18% Fewer Sales

18% Fewer

Sales

pg | 9

Targets for Growth

New off-road seating product lines

Construction and Ag seats debut in Nov. 2016

(“SCIOX”); currently in development programs

with major OEMs. Includes light duty equipment

applications expanding market for CVG.

Global Ag market

Wire harness, interior trim, and

seats. Potential addressable

market ~ $900M.

Wire harnesses – Europe and North America

Winning in new segments – agriculture, truck

(powertrain), and power generation. Exploring

extension into digital components.

Global Truck and Bus

Major launch activities in North America.

Targeting seat growth in domestic India and

China. Interior trim and wiper options in

Europe.

Open to M&A

options that could

facilitate our targets

for growth

FINANCIAL UPDATE

Financial Results

pg | 11

ACT outlook for

medium and heavy

duty truck production

(000’s)*

Class 8 Class 5-7

* Source: ACT Research

See appendix for reconciliation of GAAP to non-GAAP financial measures

Q1 Q4 Q1

(Dollars in millions) 2016 2016 2017

Sales 180.3 150.0 173.4 Reflects Q1 market improvement

Gross Profit 25.7 18.3 21.5

Margin 14.3 % 12.2 % 12.4 %

SG&A 16.8 14.0 16.6 Litigation settlement

Operating Income 8.6 3.9 4.6

Margin 4.8 % 2.6 % 2.6 %

Adjusted Operating Income 9.5 5.1 8.0

Margin 5.3 % 3.4 % 4.6 % 120 bps improvement from Q4

N.A. Class 8 Production (000's) 64 47 51 Up 9% from Q4

N.A. Class 5 - 7 Production (000's) 64 54 64 Up 19% from Q4

Business Segments¹

pg | 12

1. Before intercompany sales eliminations

See appendix for reconciliation of GAAP to non-GAAP financial measures

(Dollars in millions)

Global

Truck & Bus

Global

Construction

& Agriculture

Sales 102.1 73.5

Gross Profit 14.0 7.8

Margin 13.7 % 10.6 %

SG&A 5.5 4.5

Operating Income 8.3 3.3

Margin 8.1 % 4.5 %

Adjusted Operating Income 9.3 3.4

Margin 9.1 % 4.6 %

Three Months Ended March 31, 2017

See appendix for reconciliation of GAAP to non-GAAP financial measures

Capital Structure

pg | 13

Capital Allocation: 1.) liquidity 2.) growth 3.) de-leverage 4.) return capital to shareholders

Proforma

LTM Q1 Q1 2017

(Dollars in millions) 2015 2016 2017 (Refinancing)

Satisfaction & Discharge Filed - 4/12/17

Debt 235 235 235 175

Less: Cash 92 130 119 41

Net Debt 143 105 116 134 Principal Balance $ 175

Interest LIBOR + 600

Adjusted EBITDA 58 46 44 44 Due April 2023

Adjusted Gross Leverage 4.1 X 5.1 X 5.3 X 4.0 X

Adjusted Net Leverage 2.5 X 2.3 X 2.6 X 3.0 X Commitment $ 65

Availability $ 64

Letters of Credit $ 2

Liquidity: Accordion $ 40

Cash 41

ABL Borrowing Base 64

Less: LOC (2) Moody's B2 / Stable

Liquidity 103 S&P B / Stable

* Effective April 12, 2017

Term Loan*

Asset Based Credit Facility*

Agency Ratings

7.875% Senior Secured Notes

Commercial Vehicle Group, Inc.

Oppenheimer Industrial Growth Conference

May 10, 2017

Patrick Miller

President and CEO

Tim Trenary

Chief Financial Officer

Terry Hammett

Treasurer and VP Investor Relations

GAAP to Non-GAAP Reconciliation

APPENDIX

GAAP to Non-GAAP Reconciliation

Adjusted Operating Income Reconciliation

pg | 16

Q1 Q4 Q1

(Dollars in millions) 2016 2016 2017

Operating Income 8.6 3.9 4.6

Margin 4.8 % 2.6 % 2.6 %

Special Items:

Restructuring & Related 0.3 1.2 1.1

Litigation Settlement 2.3

Impaired Asset 0.6

Adjusted Operating Income 9.5 5.1 8.0

Margin 5.3 % 3.4 % 4.6 %

EBITDA & Adjusted EBITDA Reconciliation

GAAP to Non-GAAP Reconciliation

pg | 17

FY FY Q2 Q3 Q4 Q1 LTM

(Dollars in millions) 2015 2016 2016 2016 2016 2017 Q1 2017

Net Income 7.1 6.8 2.7 1.2 0.4 0.6 4.9

Interest Expense 21.4 19.3 4.9 5.0 4.5 4.9 19.3

Tax Provision (Benefit) 9.8 0.8 (1.5) (0.4) (0.6) (1.7)

Depreciation 16.4 15.2 3.7 3.8 3.6 3.6 14.7

Amortization 1.3 1.3 0.3 0.3 0.3 0.3 1.2

EBITDA 56.0 42.6 12.4 8.8 8.4 8.8 38.4

Restructuring & Related 2.3 3.5 0.5 1.5 1.2 1.1 4.3

Insurance Recovery (0.7) (0.7) (0.7)

Litigation Settlement 2.3 2.3

Impaired Asset 0.6

Adjusted EBITDA 58.3 46.0 12.9 10.3 8.9 12.2 44.3

GAAP to Non-GAAP Reconciliation

Business Segment Adjusted Operating Income Reconciliation

pg | 18

Three Months Ended March 31, 2017

(Dollars in millions)

Global Truck

& Bus

Global

Construction &

Agriculture

Operating Income 8.3 3.3

Special Items:

Restructuring & Related 1.0 0.1

Adjusted Operating Income 9.3 3.4

Margin 9.1 % 4.6%