Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - BROADRIDGE FINANCIAL SOLUTIONS, INC. | ex991earningsrelease-20170.htm |

| EX-99.3 - EXHIBIT 99.3 - BROADRIDGE FINANCIAL SOLUTIONS, INC. | ex993supplement51017.htm |

| 8-K - 8-K - BROADRIDGE FINANCIAL SOLUTIONS, INC. | form8-k3q2017earnings.htm |

1© 2014 |

Earnings Webcast &

Conference Call

Third Quarter and Nine Months of Fiscal 2017

May 10, 2017

EXHIBIT 99.2

2

Forward-Looking Statements

This presentation and other written or oral statements made from time to time by representatives of Broadridge Financial Solutions, Inc. ("Broadridge" or the

"Company") may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not

historical in nature, and which may be identified by the use of words such as “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,”

“could be” and other words of similar meaning, are forward-looking statements. In particular, information appearing in the “Fiscal Year 2017 Financial

Guidance” section are forward-looking statements.

These statements are based on management’s expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ

materially from those expressed. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on

Form 10-K for the fiscal year ended June 30, 2016 (the “2016 Annual Report”), as they may be updated in any future reports filed with the Securities and

Exchange Commission. All forward-looking statements speak only as of the date of this presentation and are expressly qualified in their entirety by reference

to the factors discussed in the 2016 Annual Report.

These risks include: the success of Broadridge in retaining and selling additional services to its existing clients and in obtaining new clients; Broadridge’s

reliance on a relatively small number of clients, the continued financial health of those clients, and the continued use by such clients of Broadridge’s services

with favorable pricing terms; changes in laws and regulations affecting Broadridge’s clients or the services provided by Broadridge; any material breach of

Broadridge security affecting its clients’ customer information; declines in participation and activity in the securities markets; the failure of Broadridge’s

outsourced data center services provider to provide the anticipated levels of service; a disaster or other significant slowdown or failure of Broadridge’s

systems or error in the performance of Broadridge’s services; overall market and economic conditions and their impact on the securities markets;

Broadridge’s failure to keep pace with changes in technology and demands of its clients; Broadridge’s ability to attract and retain key personnel; the impact

of new acquisitions and divestitures; and competitive conditions. Broadridge disclaims any obligation to update or revise forward-looking statements that

may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, other than as required by

law.

3

Use of Non-GAAP Financial Measures

Explanation and Reconciliation of the Company’s Use of Non-GAAP Financial Measures

The Company’s results in this presentation are presented in accordance with U.S. GAAP except where otherwise noted. In certain circumstances, results have

been presented that are not generally accepted accounting principles measures (“Non-GAAP”). These Non-GAAP measures are Adjusted Operating income,

Adjusted Operating income margin, Adjusted Net earnings, Adjusted earnings per share, and Free cash flow. These Non-GAAP financial measures should be

viewed in addition to, and not as a substitute for, the Company’s reported results.

The Company believes its Non-GAAP financial measures help investors understand how management plans, measures and evaluates the Company’s business

performance. Management believes that Non-GAAP measures provide consistency in its financial reporting and facilitates investors’ understanding of the

Company’s operating results and trends by providing an additional basis for comparison. Management uses these Non-GAAP financial measures to, among other

things, evaluate the Company's ongoing operations, for internal planning and forecasting purposes and in the calculation of performance-based compensation. In

addition, and as a consequence of the importance of these Non-GAAP financial measures in managing its business, the Company’s Compensation Committee of

the Board of Directors incorporates Non-GAAP financial measures in the evaluation process for determining management compensation.

Adjusted Operating Income, Adjusted Operating Income Margin, Adjusted Net Earnings and Adjusted Earnings per Share

These Non-GAAP measures reflect Operating income, Operating income margin, Net earnings, and Diluted earnings per share, as adjusted to exclude the impact

of certain costs, expenses, gains and losses and other specified items that management believes are not indicative of the Company's ongoing operating

performance. These adjusted measures exclude the impact of Amortization of Acquired Intangibles and Purchased Intellectual Property, Acquisition and

Integration Costs and the Message Automation Limited ("MAL") investment gain. Amortization of Acquired Intangibles and Purchased Intellectual Property

represents non-cash expenses associated with the Company's acquisition activities. Acquisition and Integration Costs represent certain transaction and

integration costs associated with the Company’s acquisition activities. The MAL investment gain represents a non-cash, nontaxable gain on the Company’s 25%

investment of shares of MAL. The Company excludes Amortization of Acquired Intangibles and Purchased Intellectual Property, Acquisition and Integration Costs

and the MAL investment gain from these measures because excluding such information provides the Company with an understanding of the results from the

primary operations of its business and these items do not reflect ordinary operations or earnings. Management believes these measures may be useful to an

investor in evaluating the underlying operating performance of the Company's business.

Free Cash Flow

In addition to the Non-GAAP financial measures discussed above, the Company provides Free cash flow information because it considers Free cash flow to be a

liquidity measure that provides useful information to management and investors about the amount of cash generated that could be used for dividends, share

repurchases, strategic acquisitions and other discretionary investments. Free cash flow is a Non-GAAP financial measure and is defined by the Company as Net

cash flows provided by operating activities less Capital expenditures and Software purchases and capitalized internal use software.

Reconciliations of such Non-GAAP measures to the most directly comparable financial measures presented in accordance with GAAP can be found in the tables

that are part of this presentation.

Use of Material Contained Herein

The information contained in this presentation is being provided for your convenience and information only. This information is accurate as of the date of its

initial presentation. If you plan to use this information for any purpose, verification of its continued accuracy is your responsibility. Broadridge assumes no duty to

update or revise the information contained in this presentation.

4

Third Quarter 2017 Summary

▪ Strong financial results

◦ Total revenues rose 46% and recurring fee revenues rose 30%

◦ Operating income rose 9% and Diluted EPS was up 21%

◦ Adjusted Operating income rose 22% and Adjusted EPS was up 19%

▪ Record Closed sales up 66%

◦ Record YTD Closed sales up 33%

◦ Strong sales reflect breadth of product line

▪ Balanced capital allocation

◦ Made tuck-in acquisition to strengthen GTO product suite

◦ 1.6 million shares repurchased in the quarter

▪ Reaffirming fiscal 2017 guidance

◦ On track to achieve three year objectives

5

Business Update

▪ Broad momentum across both GTO and ICS

◦ Mid-single digit growth from Net New Business

◦ Broad product breadth driving growth

▪ Stock position growth at 6% in third quarter - on track for another

year of mid-single digit growth

▪ Stronger mutual fund position growth in line with increase in overall

flows to mutual funds and ETFs

▪ Strong Closed sales results reflect broad strength of Broadridge's

solutions and client relationships

◦ Pipeline continues to grow

▪ Business environment is stable

◦ Event driven revenues expected to be strong in both 4Q17 and 1H18

◦ Regulatory update: BR technology and digital assets well-aligned with

key priorities of new administration

6

3Q 2017 Revenue Growth Drivers

▪ Third Quarter 2017 Recurring fee revenue grew 30% to $592 million

▪ Third Quarter 2017 Total revenue grew 46% to $1,009 million

3Q16 Total Revs. Recurring Event Driven Distribution FX 3Q17 Total Revs.

$1,009 M+20% +2%

+25%

0%

3Q16 Recurring Revs. Closed Sales Client Losses Internal Growth Acquisitions 3Q17 Recurring Revs.

$689 M

$455 M

$592 M

+7%

-2% -1%

+26% +30%

+46%

Organic Growth: 4%

7

Nine Months 2017 Revenue Growth Drivers

▪ Nine Months 2017 Recurring fee revenue grew 32% to $1.6 billion

▪ Nine Months 2017 Total revenue grew 45% to $2.8 billion

9M16 Total Revs. Recurring Event Driven Distribution Other 9M17 Total Revs.

$2.8 B

+21%

-1%

+26%

-1%

9M16 Recurring Revs. Closed Sales Client Losses Internal Growth Acquisitions 9M17 Recurring Revs.

$1.9 B

$1.2 B

$1.6 B

+7%

-2%

0%

+27% +32%

+45%

Organic Growth: 5%

8

Third Quarter 2017 Operating Income and EPS

Comparison

$ in millions, except per share amounts

3Q17 Change in Operating Income and

Adjusted Operating Income

3Q 2017 Change in EPS and Adjusted EPS

Operating Income Adj. Operating Income

$140

$130

$120

$110

$100

$90

3Q 2016 3Q 2017

$101

$110$110

$134

Diluted EPS Adjusted EPS

$0.75

$0.70

$0.65

$0.60

$0.55

$0.50

$0.45

3Q 2016 3Q 2017

$0.52

$0.63

$0.58

$0.69

19%22%

9%

21%

9

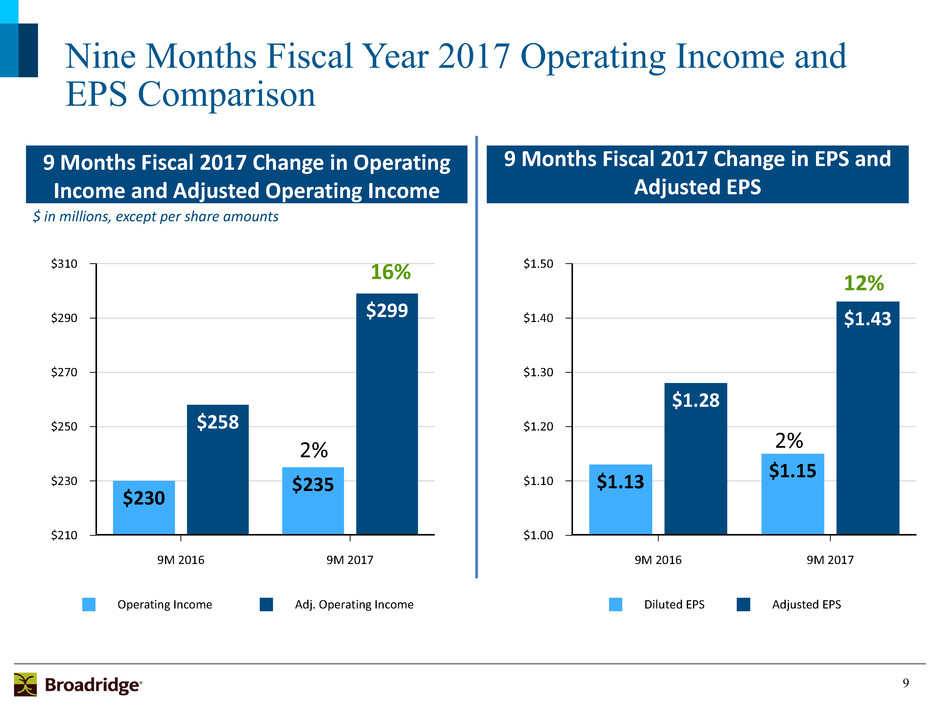

Nine Months Fiscal Year 2017 Operating Income and

EPS Comparison

$ in millions, except per share amounts

9 Months Fiscal 2017 Change in Operating

Income and Adjusted Operating Income

9 Months Fiscal 2017 Change in EPS and

Adjusted EPS

Operating Income Adj. Operating Income

$310

$290

$270

$250

$230

$210

9M 2016 9M 2017

$230

$235

$258

$299

Diluted EPS Adjusted EPS

$1.50

$1.40

$1.30

$1.20

$1.10

$1.00

9M 2016 9M 2017

$1.13 $1.15

$1.28

$1.43

12%16%

2% 2%

10

($ in millions)

Investor Communication Solutions ("ICS")

Q3 2016 Q3 2017 Change 9M 2016 9M 2017 Change

Recurring fee revenues $263 $389 48% $698 $1,053 51%

Total revenues $515 $826 60% $1,417 $2,259 59%

Earnings before income taxes $67 $74 10% $147 $125 (15)%

Pre-tax margins 13.0% 8.9% 10.4% 5.5%

Global Technology and Operations ("GTO")

Q3 2016 Q3 2017 Change 9M 2016 9M 2017 Change

Total revenues $191 $203 6% $548 $592 8%

Earnings before income taxes $40 $44 10% $100 $129 29%

Pre-tax margins 21.0% 21.9% 18.2% 21.8%

Segment Results

11

Capital Allocation and Summary Balance Sheet

Select Uses of Cash

in 3Q 2017

• $37 million in capital

expenditures and software

investment

• $20 million* to acquire

Message Automation

• $100 million to acquire BR

shares

Summary Balance Sheet

as of March 31, 2017

Assets

Cash and equivalents $ 270

Other assets 2,972

Total assets $ 3,242

Liabilities and Stockholders' Equity

Total debt outstanding $ 1,267

Other liabilities 1,033

Total liabilities $ 2,300

Total stockholders' equity $ 942

* Net of cash acquired

Amounts may not sum due to rounding

$ in millions

12

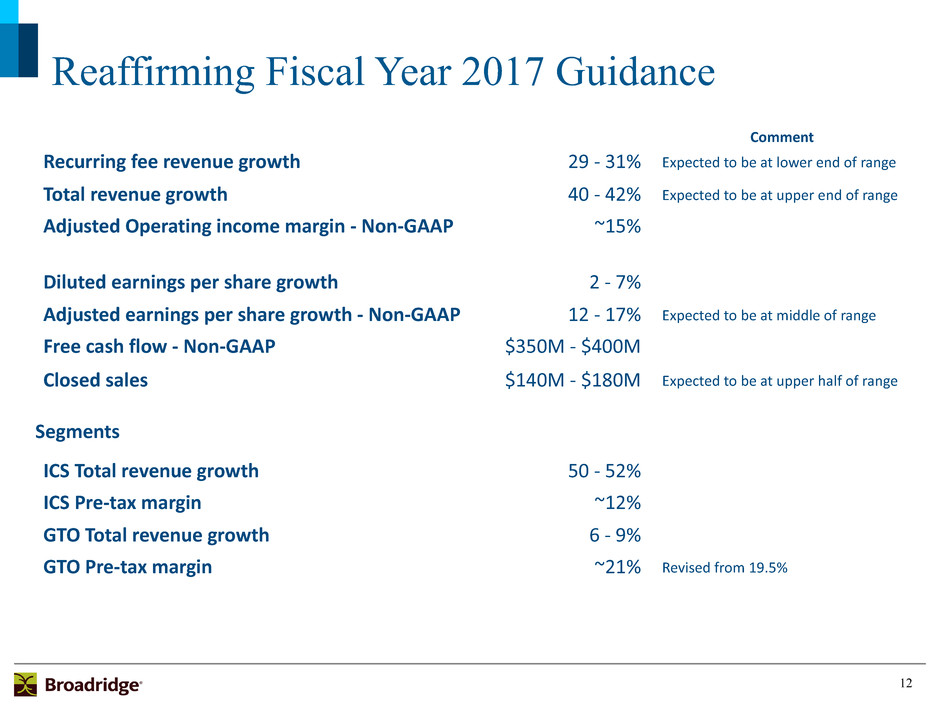

Reaffirming Fiscal Year 2017 Guidance

Comment

Recurring fee revenue growth 29 - 31% Expected to be at lower end of range

Total revenue growth 40 - 42% Expected to be at upper end of range

Adjusted Operating income margin - Non-GAAP ~15%

Diluted earnings per share growth 2 - 7%

Adjusted earnings per share growth - Non-GAAP 12 - 17% Expected to be at middle of range

Free cash flow - Non-GAAP $350M - $400M

Closed sales $140M - $180M Expected to be at upper half of range

Segments

ICS Total revenue growth 50 - 52%

ICS Pre-tax margin ~12%

GTO Total revenue growth 6 - 9%

GTO Pre-tax margin ~21% Revised from 19.5%

13

Closing Summary

▪ On pace for another "Broadridge year"

◦ Expecting 5-7% revenue growth excluding impact of NACC

◦ Expecting double digit growth in Adjusted EPS

▪ Balanced capital allocation enables internal investment

◦ Investments have aligned Broadridge with key industry growth

trends

▪ Further innovation key to sustaining Broadridge's growth and

enhancing the value we provide to clients

◦ Focus on delivering network value and enhanced technology to

our clients

▪ Save the date

◦ Broadridge Investor Day scheduled for December 5, 2017

14

Appendix

15

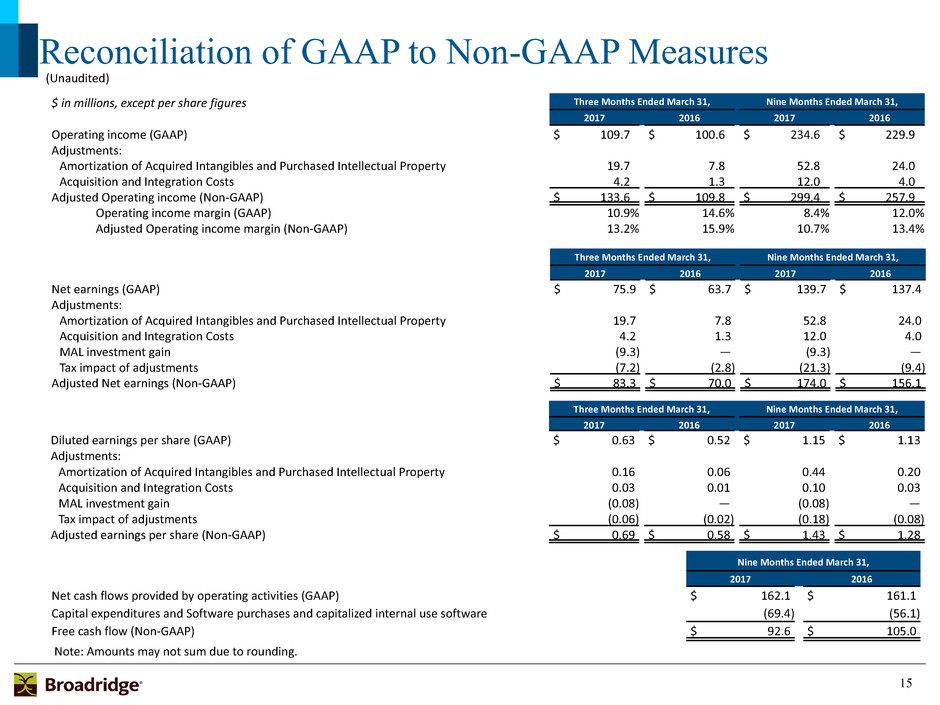

Reconciliation of GAAP to Non-GAAP Measures

$ in millions, except per share figures Three Months Ended March 31, Nine Months Ended March 31,

2017 2016 2017 2016

Operating income (GAAP) $ 109.7 $ 100.6 $ 234.6 $ 229.9

Adjustments:

Amortization of Acquired Intangibles and Purchased Intellectual Property 19.7 7.8 52.8 24.0

Acquisition and Integration Costs 4.2 1.3 12.0 4.0

Adjusted Operating income (Non-GAAP) $ 133.6 $ 109.8 $ 299.4 $ 257.9

Operating income margin (GAAP) 10.9% 14.6% 8.4% 12.0%

Adjusted Operating income margin (Non-GAAP) 13.2% 15.9% 10.7% 13.4%

Three Months Ended March 31, Nine Months Ended March 31,

2017 2016 2017 2016

Net earnings (GAAP) $ 75.9 $ 63.7 $ 139.7 $ 137.4

Adjustments:

Amortization of Acquired Intangibles and Purchased Intellectual Property 19.7 7.8 52.8 24.0

Acquisition and Integration Costs 4.2 1.3 12.0 4.0

MAL investment gain (9.3) — (9.3) —

Tax impact of adjustments (7.2) (2.8) (21.3) (9.4)

Adjusted Net earnings (Non-GAAP) $ 83.3 $ 70.0 $ 174.0 $ 156.1

Three Months Ended March 31, Nine Months Ended March 31,

2017 2016 2017 2016

Diluted earnings per share (GAAP) $ 0.63 $ 0.52 $ 1.15 $ 1.13

Adjustments:

Amortization of Acquired Intangibles and Purchased Intellectual Property 0.16 0.06 0.44 0.20

Acquisition and Integration Costs 0.03 0.01 0.10 0.03

MAL investment gain (0.08) — (0.08) —

Tax impact of adjustments (0.06) (0.02) (0.18) (0.08)

Adjusted earnings per share (Non-GAAP) $ 0.69 $ 0.58 $ 1.43 $ 1.28

Note: Amounts may not sum due to rounding.

Nine Months Ended March 31,

2017 2016

Net cash flows provided by operating activities (GAAP) $ 162.1 $ 161.1

Capital expenditures and Software purchases and capitalized internal use software (69.4) (56.1)

Free cash flow (Non-GAAP) $ 92.6 $ 105.0

(Unaudited)

16

Reconciliation of GAAP to Non-GAAP Measures - FY17 Guidance

(Unaudited)

Adjusted Earnings Per Share Growth Rate (1)

Diluted earnings per share (GAAP) 2% - 7%

Adjusted earnings per share (Non-GAAP) 12% - 17%

Adjusted Operating Income Margin (2)

Operating income margin % (GAAP) ~13%

Adjusted Operating income margin % (Non-GAAP) ~15%

Free Cash Flow

Net cash flows provided by operating activities (GAAP) $470 - $550 million

Capital expenditures and Software purchases and capitalized internal use software (120) - (150) million

Free cash flow (Non-GAAP) $350 - $400 million

(1) Adjusted EPS growth (Non-GAAP) is adjusted to exclude the projected impact of Amortization of Acquired Intangibles and Purchased Intellectual Property,

Acquisition and Integration Costs and the MAL investment gain. Fiscal year 2017 Non-GAAP Adjusted EPS guidance estimates exclude Amortization of Acquired

Intangibles and Purchased Intellectual Property, Acquisition and Integration Costs, and the MAL investment gain, net of taxes, of approximately $0.42 per

share.

(2) Adjusted Operating income margin (Non-GAAP) is adjusted to exclude the projected impact of Amortization of Acquired Intangibles and Purchased

Intellectual Property, and Acquisition and Integration Costs. Fiscal year 2017 Non-GAAP Adjusted Operating income margin guidance estimates exclude

Amortization of Acquired Intangibles and Purchased Intellectual Property, and Acquisition and Integration Costs of approximately $92 million.

17

Broadridge Investor Relations

W. Edings Thibault

Head of Investor Relations

Tel: 516-472-5129

Email: edings.thibault@broadridge.com