Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Altabancorp | pub-8k_20170509.htm |

Investor Presentation May 2017 Richard Beard, President & CEO Wolf Muelleck, EVP & CFO Exhibit 99.1

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to risks and uncertainties, including, but not limited to: •The credit and concentration risks of our lending activities; •Changes in general economic conditions, either nationally or in our market areas; •Competitive market pricing factors and interest rate risks; •Market interest rate volatility; •Investments in new branches and new business opportunities; •Balance sheet (for example, loans) concentrations; •Fluctuations in demand for loans and other financial services in our market areas; •Changes in legislative or regulatory requirements or the results of regulatory examinations; •The ability to recruit and retain key management and staff; •Risks associated with our ability to implement our expansion strategy and merger integration; •Stability of funding sources and continued availability of borrowings; •Adverse changes in the securities markets; •The inability of key third-party providers to perform their obligations to us; •Changes in accounting policies and practices and the use of estimates in determining fair value of certain of our assets, which estimates may prove to be incorrect and result in significant declines in valuation; and •These and other risks as may be detailed from time to time in our filings with the Securities and Exchange Commission. The Company cautions readers not to place undue reliance on any forward-looking statements. Moreover, you should treat these statements as speaking only as of the date they are made and based only on information then actually known to the Company. The Company does not undertake and specifically disclaims any obligation to revise any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements. These risks could cause our actual results in 2016 and beyond to differ materially from those expressed in any forward-looking statements by, or on behalf of, us, and could negatively affect the Company’s operating results, financial condition and stock price performance. Safe Harbor

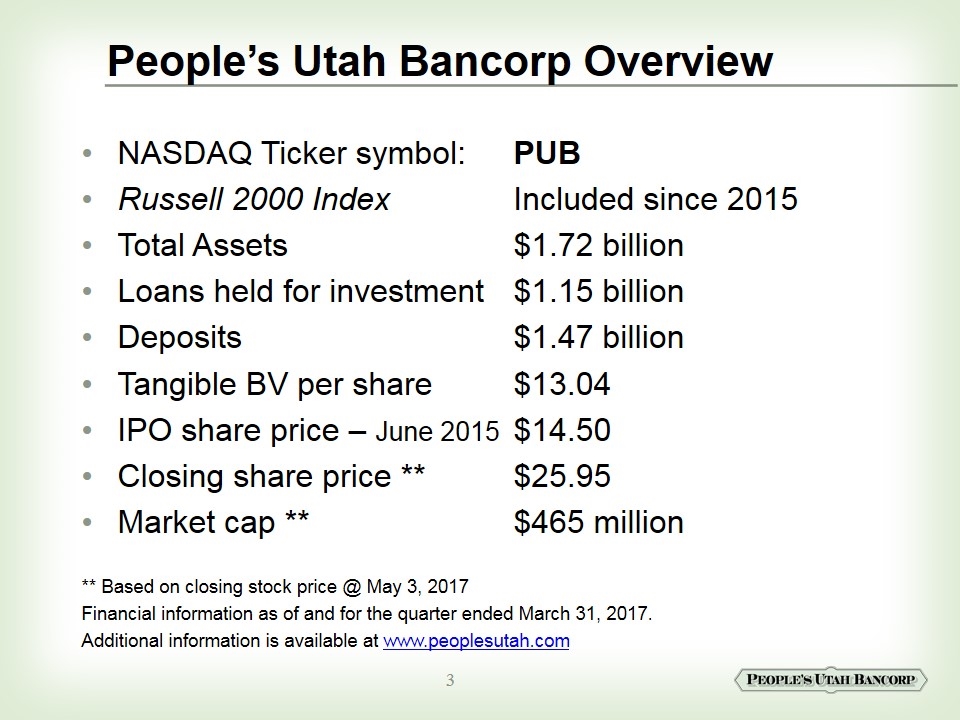

NASDAQ Ticker symbol: PUB Russell 2000 IndexIncluded since 2015 Total Assets$1.72 billion Loans held for investment$1.15 billion Deposits$1.47 billion Tangible BV per share$13.04 IPO share price – June 2015$14.50 Closing share price **$25.95 Market cap **$465 million ** Based on closing stock price @ May 3, 2017 Financial information as of and for the quarter ended March 31, 2017. Additional information is available at www.peoplesutah.com People’s Utah Bancorp Overview

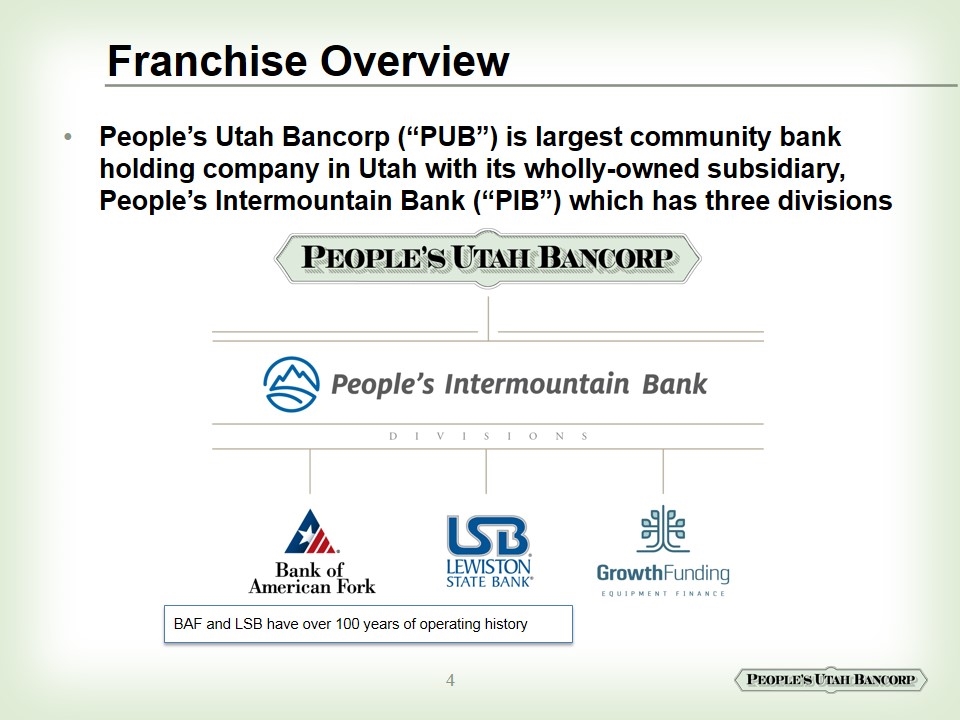

People’s Utah Bancorp (“PUB”) is largest community bank holding company in Utah with its wholly-owned subsidiary, People’s Intermountain Bank (“PIB”) which has three divisions Franchise Overview BAF and LSB have over 100 years of operating history

PUB – only public community bank holding company in Utah 18 full-service branch locations 17 in Utah and 1 in Idaho 2 branches will be open in first half of 2017 387 full-time equivalent associates (3/31/17) 5-year CAGRs(1) Assets – 13.4% Loans – 13.7% Deposits – 12.8% Franchise Overview - Continued (1) For the five years ended December 31, 2016. Includes the merger with Lewiston State Bank in 2013

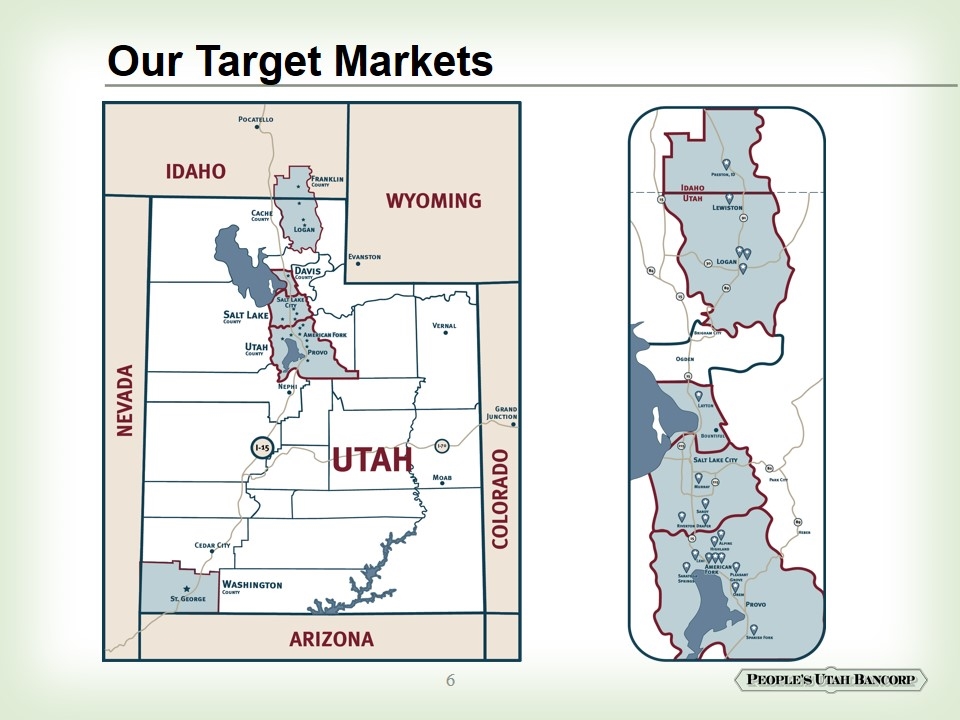

Our Target Markets

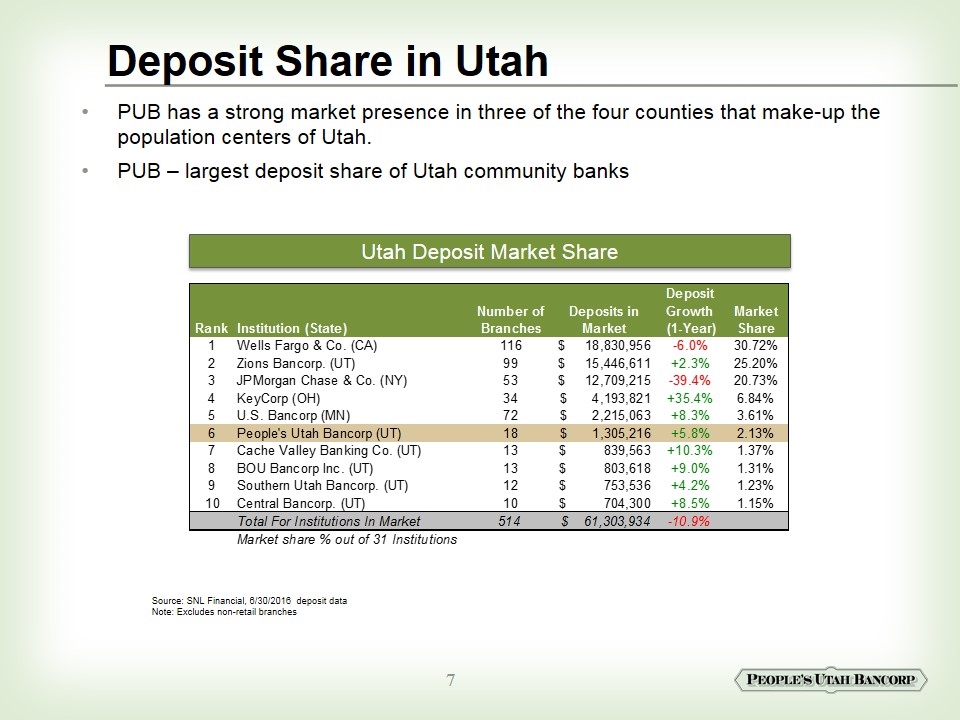

PUB has a strong market presence in three of the four counties that make-up the population centers of Utah. PUB – largest deposit share of Utah community banks Deposit Share in Utah Utah Deposit Market Share Source: SNL Financial, 6/30/2016 deposit data Note: Excludes non-retail branches

CNBC Utah ranked #1 among “America's Top States for Business 2016” Population Growth Utah’s population growth was the fastest in the nation with 1.9% growth from 2015 to 2016. Job Growth Year-over year job growth of 3.3% as of February 2017 vs. the national estimate of 1.5% Utah unemployment rate of 3.1% vs. national rate of 4.7% - December 2016 Income Growth Personal income grew at 5% in 3rd Quarter 2016 compared to same quarter in 2015. Utah ranked 1st in nation in personal income growth Strong Dynamics in Utah Sources: 2016 Economic Report to the Governor, Forbes, Bureau of Economic and Business Research Utah Department of Workforce Services – Unemployment rates Utah Ranked The #1 State for Business in the U.S. by Forbes 6 out of the last 7 years most recently in 2016 Gross State Product 2.7% annual growth rate between 2000 - 2014 Employers Corporate employers and startup technology companies drawn to the Utah market Liveability.com: Provo & Salt Lake City, Utah among the top 50 states for entrepreneurs Major shipping/ transportation hub Housing Activity Forecast for residential housing units constructed at 20,500 in 2017 vs.19,000 estimated for 2016. Forecast for permit authorized construction is $7.4 billion in 2017 vs. $7.5 billion estimated for 2016.

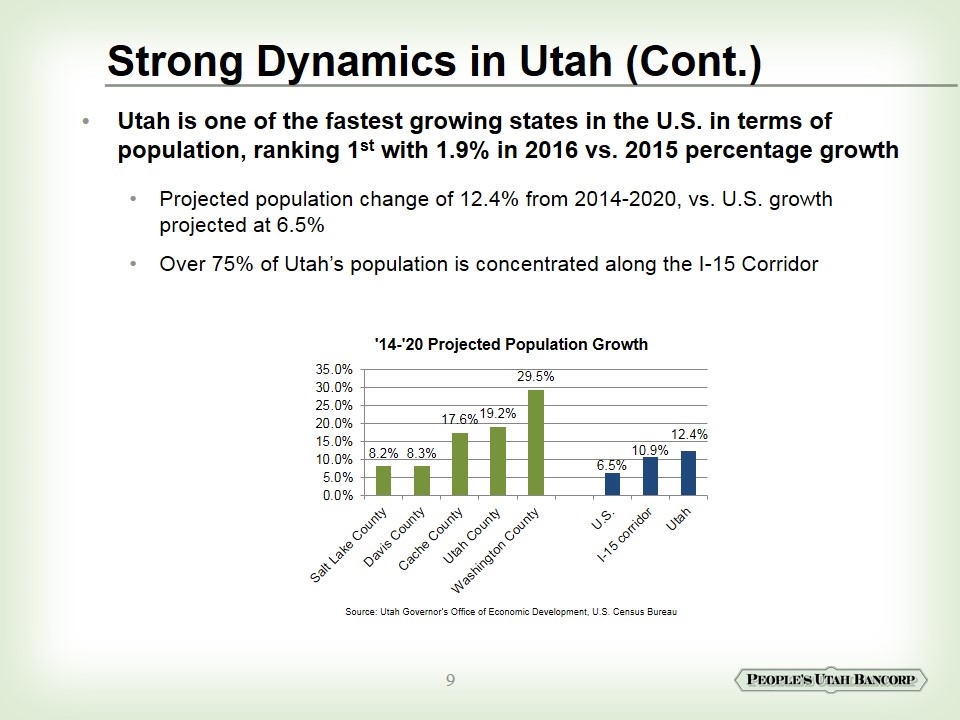

Utah is one of the fastest growing states in the U.S. in terms of population, ranking 1st with 1.9% in 2016 vs. 2015 percentage growth Projected population change of 12.4% from 2014-2020, vs. U.S. growth projected at 6.5% Over 75% of Utah’s population is concentrated along the I-15 Corridor Strong Dynamics in Utah (Cont.) Source: Utah Governor’s Office of Economic Development, U.S. Census Bureau

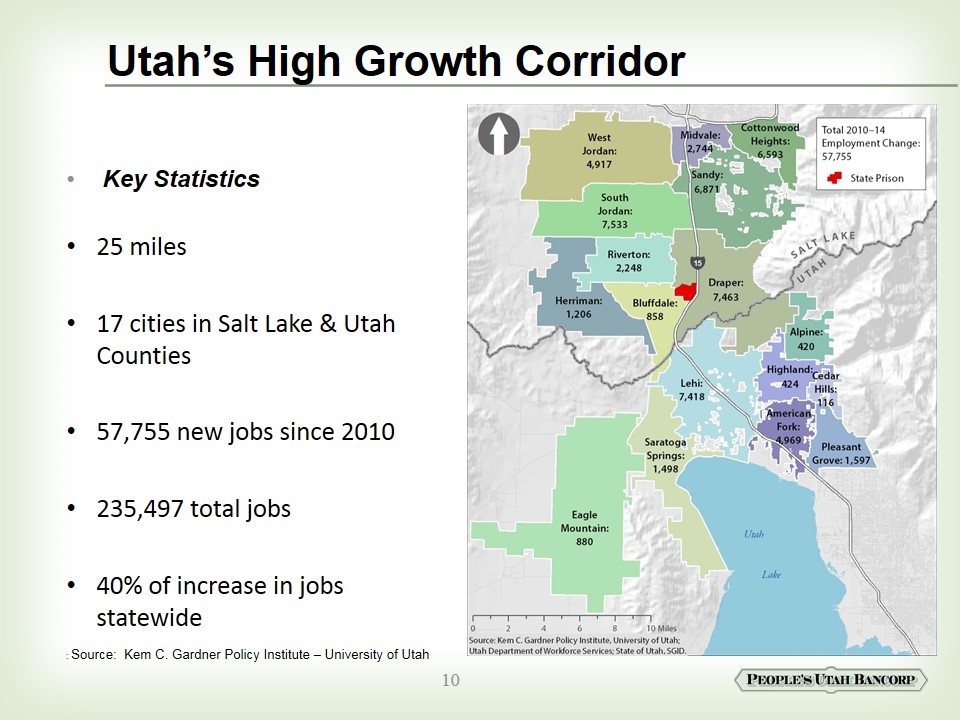

Key Statistics 25 miles 17 cities in Salt Lake & Utah Counties 57,755 new jobs since 2010 235,497 total jobs 40% of increase in jobs statewide Utah’s High Growth Corridor : Source: Kem C. Gardner Policy Institute – University of Utah

Companies with Utah Operations

PUB’s Strategy is to preserve the community banking model with legacy bank names and people while consolidating regulatory and back-office functions to gain efficiencies. Continue to Grow Organically Increase share in current markets and enter new markets (converted LPOs into branches in St. George and Layton) Two new branches opening in the 1st half of 2017– one branch in Bountiful and the other branch in Preston, Idaho Capitalize on expertise in real-estate loans Grow and Diversify our Loan Portfolio Expand C&I lending and SBA lending Grow the Leasing Division Strategy / Model - Moving Forward

Manage Operating Efficiencies Balancing organic growth with cost structure to further enhance earnings Invest in future growth opportunities Operation model is scalable Up-to-date technology and experienced team Hire Additional Motivated and Service-Oriented Personnel Seek talented individuals living in our current and prospective market areas Strong Risk Management and Capital Levels Identify and evaluate risks and trends and adopt strategies to manage such risks Strategy / Model – Moving Forward (Cont.)

Growth through Mergers and Acquisitions Community banking & financial services environment provides opportunities in the long-run No non-FDIC-assisted M & A activity in Utah since 2008 other than our LSB merger. PUB is successful acquirer as evidenced by successful LSB merger PIB has satisfactory CRA rating Good working relationships with our regulators Strategy / Model - Moving Forward (Cont.)

Growth Opportunities Hiring people / teams Opening new branches in our market Branch acquisition opportunities Whole bank opportunities in Utah Whole bank opportunities in surrounding states Non-bank acquisition opportunities

Financial / Operating Highlights Note: Financial information as of and for the quarters are unaudited.

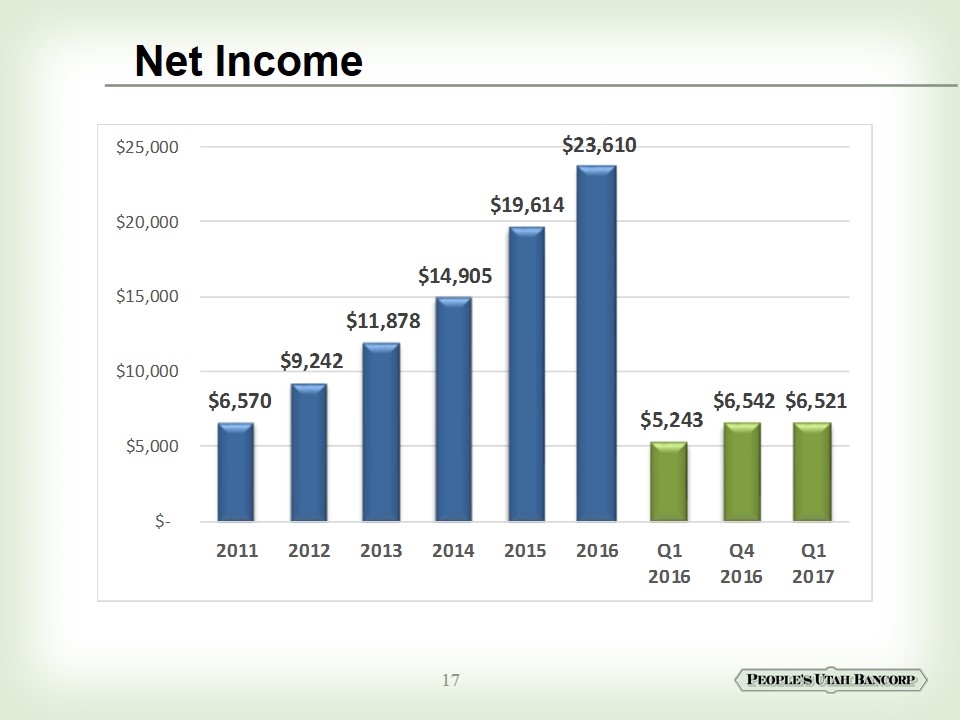

Net Income

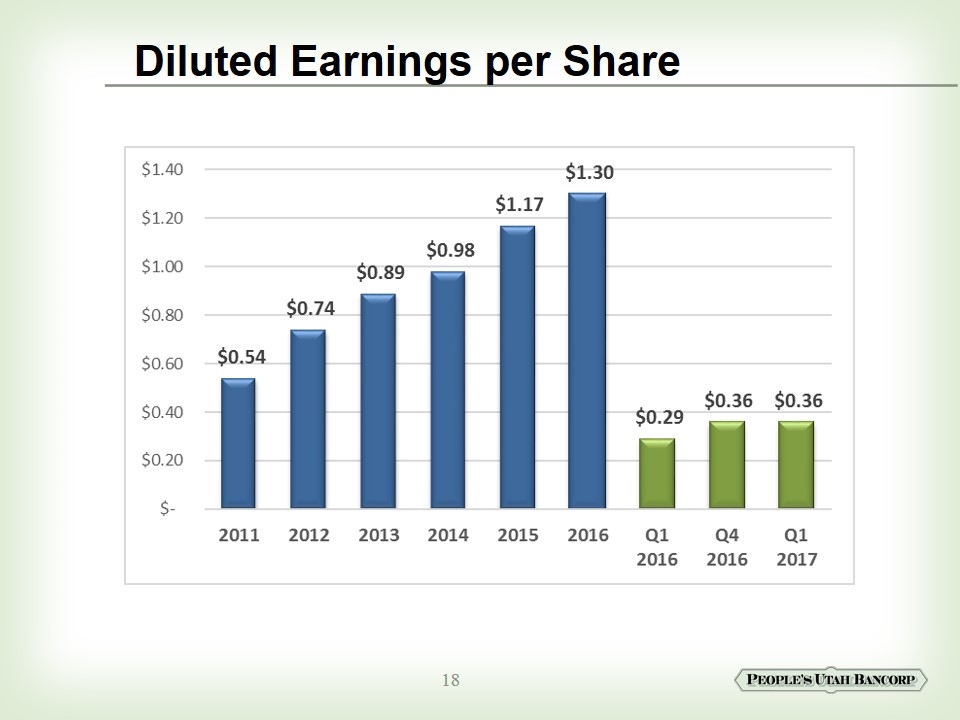

Diluted Earnings per Share

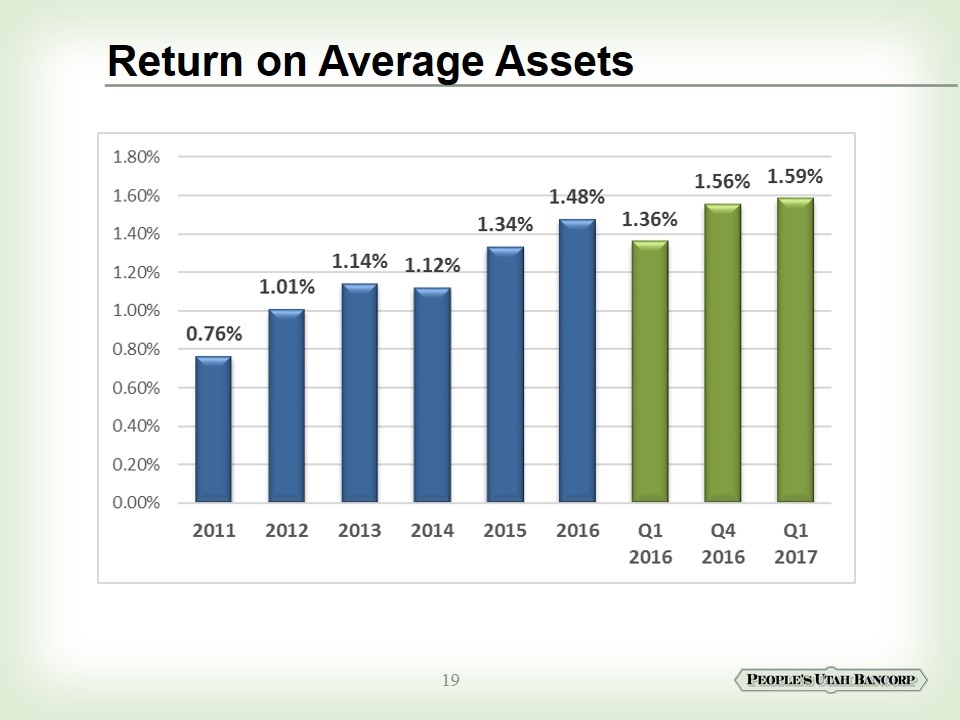

Return on Average Assets

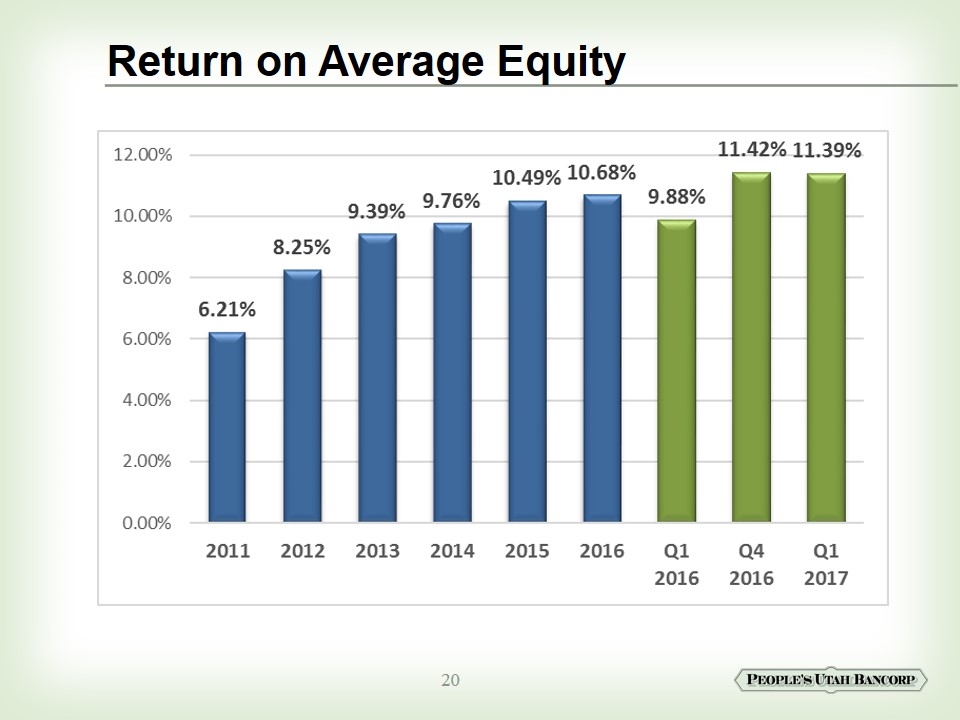

Return on Average Equity

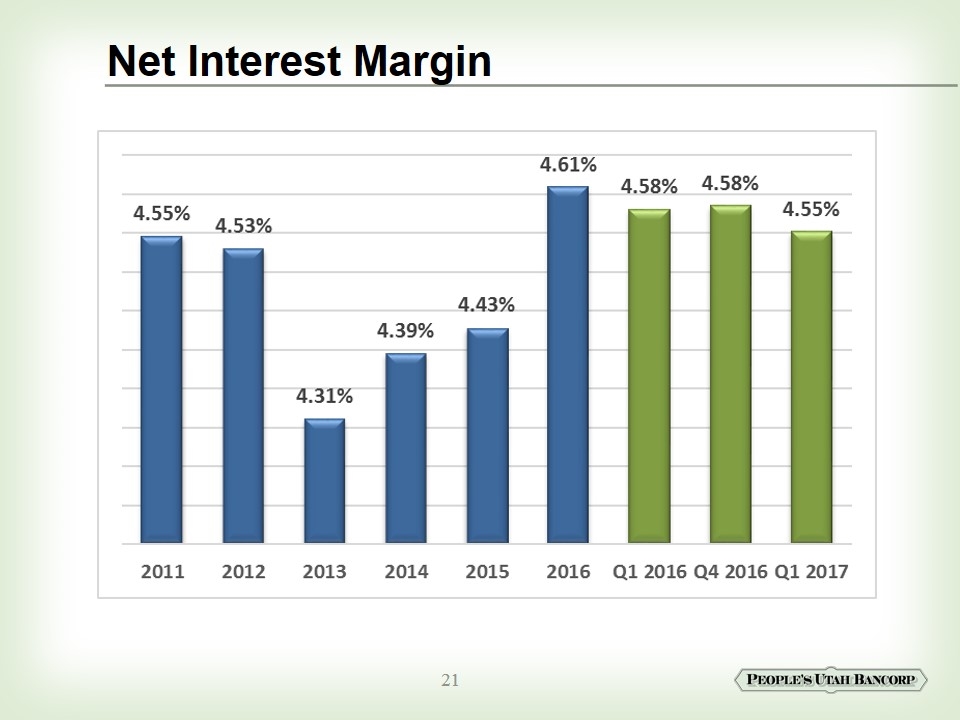

Net Interest Margin

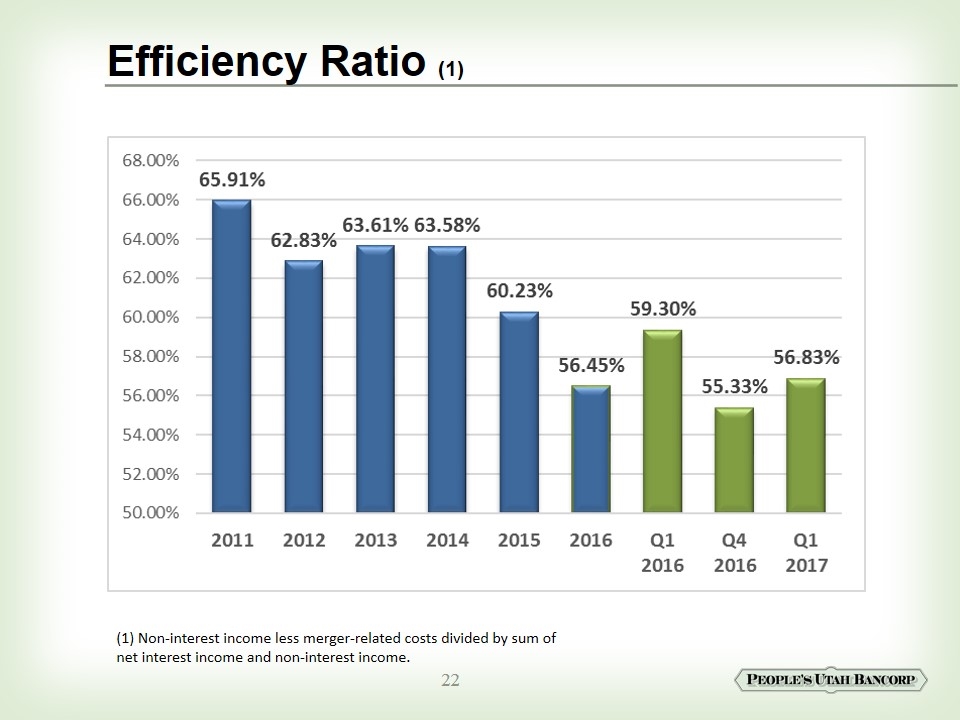

Efficiency Ratio (1) (1) Non-interest income less merger-related costs divided by sum of net interest income and non-interest income.

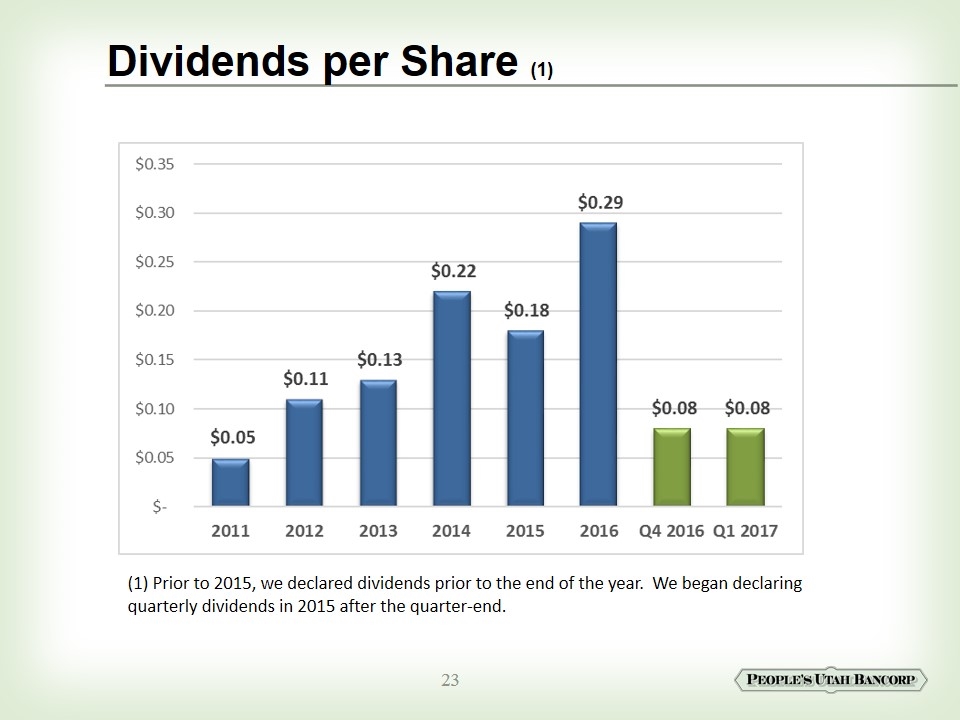

Dividends per Share (1) (1) Prior to 2015, we declared dividends prior to the end of the year. We began declaring quarterly dividends in 2015 after the quarter-end.

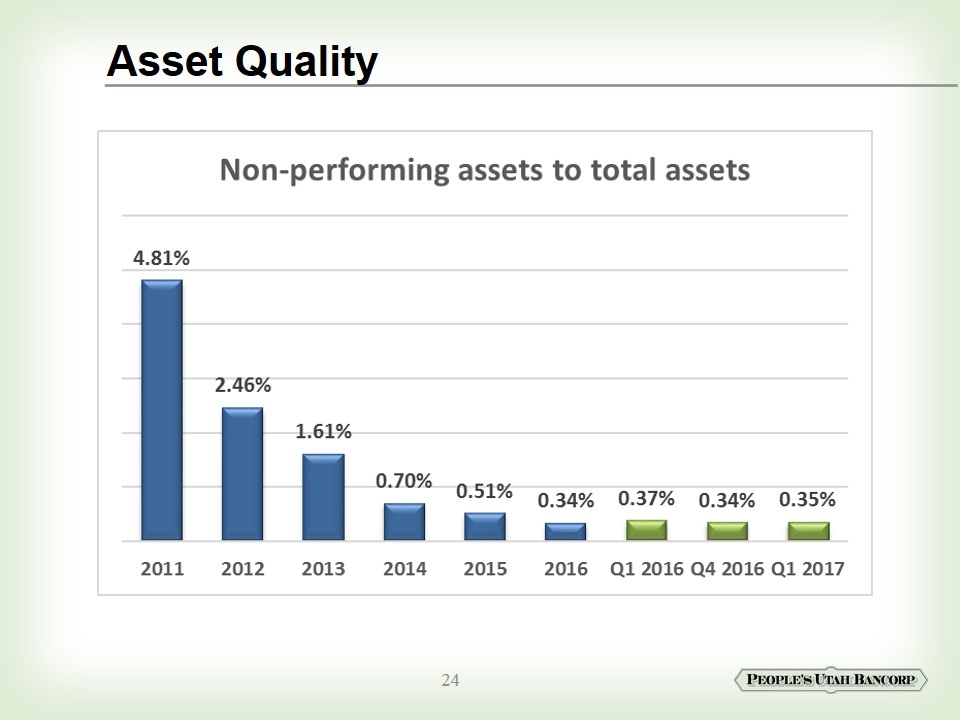

Asset Quality

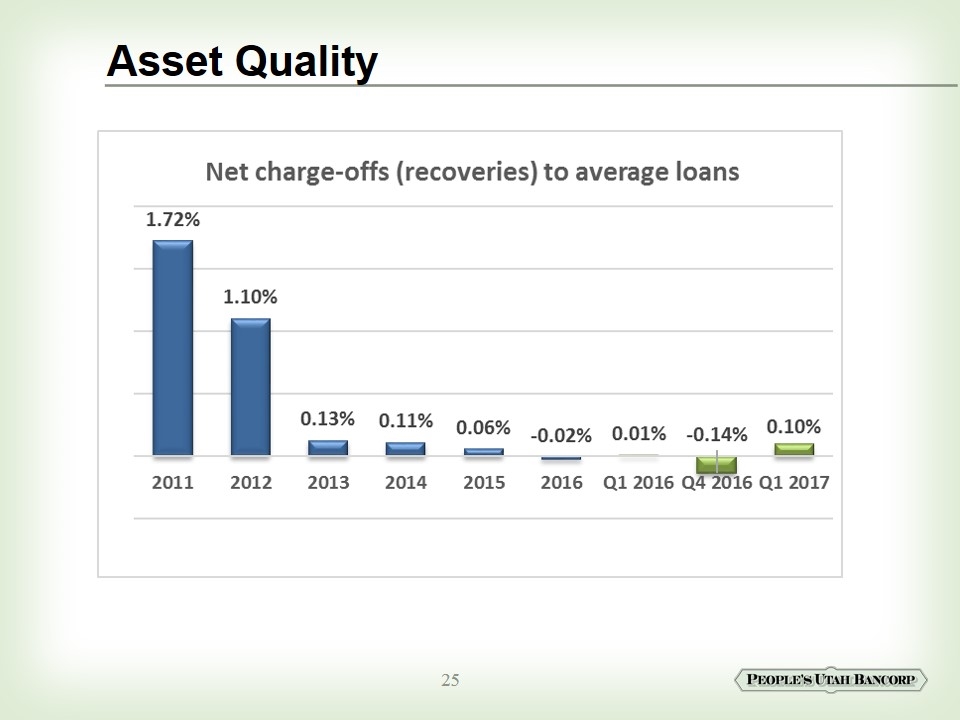

Asset Quality

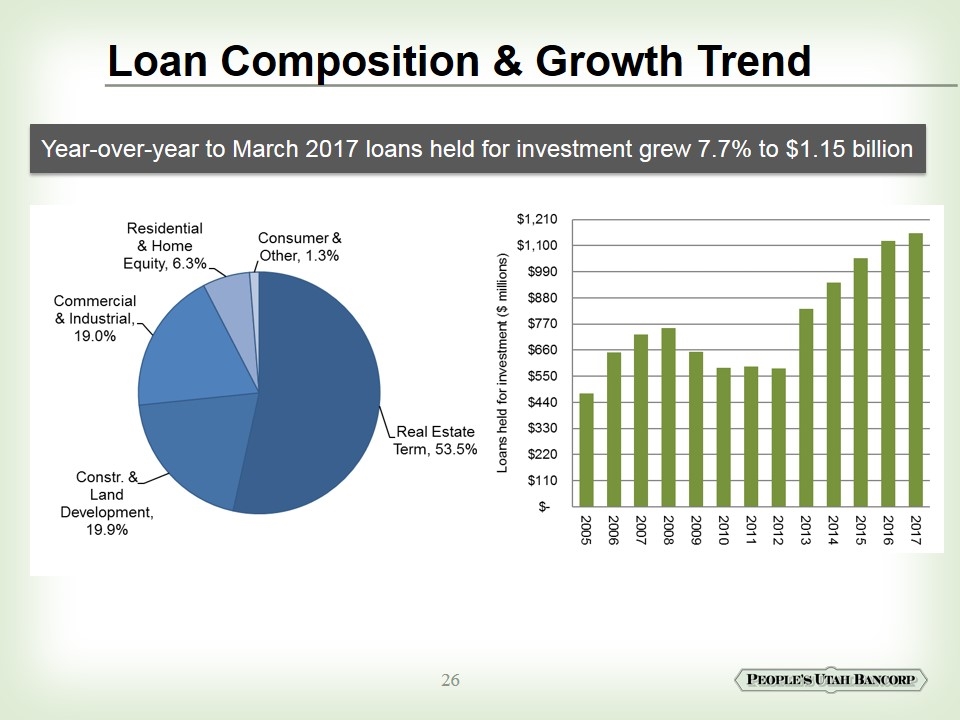

Loan Composition & Growth Trend Year-over-year to March 2017 loans held for investment grew 7.7% to $1.15 billion

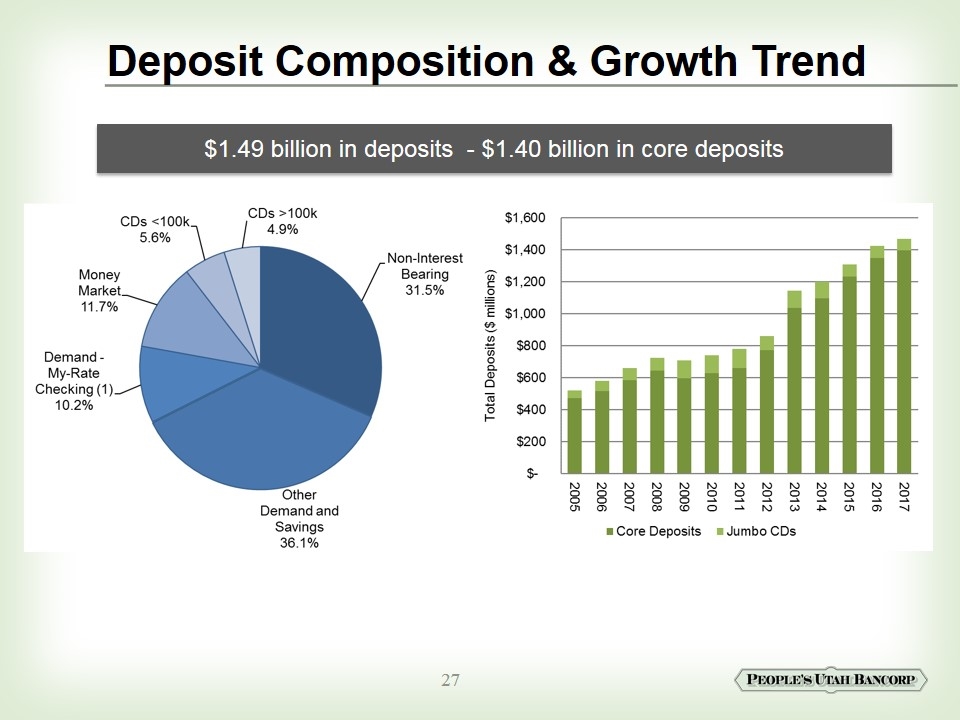

Deposit Composition & Growth Trend $1.49 billion in deposits - $1.40 billion in core deposits