Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - JELD-WEN Holding, Inc. | jeld-wenq12017ex991.htm |

| 8-K - 8-K - JELD-WEN Holding, Inc. | jeld-wenq120178xk.htm |

1 P R I V I L E G E D A N D C O N F I D E N T I A L

\\intranet.barcapint.com\dfs-amer\group\Nyk\area\ibd\Industrial\Companies\Jeld-Wen\2015.07 Project Jamaica Dual Track\2015.10 IPO Execution\Presentation\Roadshow Presentation\Project Falcon_Roadshow Presentation_(1.13.17)_vNear Final_v10pm

Q1 2017 Results Presentation | May 9, 2017

2

Disclosures

Forward-Looking Statements

This presentation contains certain "forward-looking statements" regarding business strategies, market potential, future financial performance, the potential of our categories and

brands, and our expectations, beliefs, plans, objectives, prospects, assumptions, or other future events. Forward-looking statements are generally identified by our use of forward-

looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “seek”, or “should”, or the negative

thereof or other variations thereon or comparable terminology. Where, in any forward-looking statement, we express an expectation or belief as to future results or events, such

expectation or belief is based on the current plans, expectations, assumptions, estimates, and projections of our management. Although we believe that these statements are based

on reasonable expectations, assumptions, estimates and projections, they are only predictions and involve known and unknown risks, many of which are beyond our control that could

cause actual outcomes and results to be materially different from those indicated in such statements.

Our actual results could differ materially from the results contemplated by these forward-looking statements due to a number of factors, including the factors discussed in our

prospectus filed with the Securities and Exchange Commission on January 30, 2017, and our Annual Report on Form 10-K for the year ended December 31, 2016, to be filed with the

Securities and Exchange Commission.

The assumptions underlying the guidance provided for 2017 include the achievement of anticipated improvements in end markets, competitive position, and product portfolio; stable

macroeconomic factors; no changes in foreign currency exchange and tax rates; and favorable interest expense due to the recent debt reduction. The forward-looking statements

included in this presentation are made as of the date hereof, and except as required by law, we undertake no obligation to update, amend or clarify any forward-looking statements to

reflect events, new information or circumstances occurring after the date of this presentation.

Non-GAAP Financial Measures

This presentation presents certain “non-GAAP” financial measures. The components of these non-GAAP measures are computed by using amounts that are determined in

accordance with accounting principles generally accepted in the United States of America (“GAAP”). A reconciliation of non-GAAP financial measures used in this presentation to their

nearest comparable GAAP financial measures is included at the end of this presentation. The Company provides certain guidance on a non-GAAP basis because the Company

cannot predict certain elements that are included in certain reported GAAP results, including the variables and individual adjustments necessary for a reconciliation to GAAP.

We use Adjusted EBITDA and Adjusted EBITDA margin because we believe they assist investors and analysts in comparing our operating performance across reporting periods on a

consistent basis by excluding items that we do not believe are indicative of our core operating performance. Management believes Adjusted EBITDA and Adjusted EBITDA margin are

helpful in highlighting trends because they exclude the results of decisions that are outside the control of management, while other measures can differ significantly depending on

long-term strategic decisions regarding capital structure, the tax jurisdictions in which we operate, and capital investments. We use Adjusted EBITDA and Adjusted EBITDA margin to

measure our financial performance and also to report our results to our board of directors. Further, our executive incentive compensation is based in part on Adjusted EBITDA. In

addition, we use Adjusted EBITDA as calculated herein for purposes of calculating compliance with our debt covenants in certain of our debt facilities. Adjusted EBITDA should not be

considered as an alternative to net income (loss) as a measure of financial performance or to cash flows from operations as a liquidity measure.

We define Adjusted EBITDA as net income (loss), eliminating the impact of the following items: loss from discontinued operations, net of tax; gain (loss) on sale of discontinued

operations, net of tax; equity (earnings) loss of non-consolidated entities; income tax; depreciation and amortization; interest expense, net; impairment and restructuring charges; gain

on sale of property and equipment; share-based compensation expense; non-cash foreign exchange transaction/translation income (loss); other non-cash items; other items; and

costs related to debt restructuring, debt refinancing, and the Onex investment. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by net revenues.

We present free cash flow because we believe it assists investors and analysts in determining the quality of our earnings. We also use free cash flow to measure our financial

performance and to report to our board of directors. In addition, our executive incentive compensation is based in part on free cash flow. We define free cash flow as cash flow from

operations less purchases of property, equipment, and intangible assets. Free cash flow should not be considered as an alternative to cash flows from operations as a liquidity

measure.

Other companies may compute these measures differently. No non-GAAP metric should be considered as an alternative to any other measure derived in accordance with GAAP.

Due to rounding, numbers presented throughout this document may not sum precisely to the totals provided and percentages may not precisely reflect the absolute figures.

3

Introduction

Mark Beck, President and CEO

4

JELD-WEN at a Glance

Global market leader in windows and doors

Q1 2017 LTM Net Revenues of $3.7 billion and

Adj. EBITDA of $414 million (~11.1% margin)

Scaled platform creating competitive advantage

• 115 manufacturing facilities in 19 countries

• 20,000+ employees

• 13,000+ customers

Long-standing customer relationships with

home centers, builders and independent dealers

Six strategic acquisitions in the past 18

months – all on track to deliver strong ROI

Business Highlights

Key Brands

Net Revenues Mix(1)

ApplicationProduct Geography

(1) Based on FY2016 results.

GLOBAL MARKET LEADER WITH UNMATCHED SCALE

A us t ra l as i a

14%

E urope

27%

N .A .

59%

N on-R es i .

10%

R es i .

R epa i r &

R em ode l

45%

R es i . N ew

C ons t ruc t i o n

45%

Othe r

9%

W i ndows

24%

D oors

67%

5

An Extraordinary Transformation Underway

PROVEN TEAM DRIVING EARNINGS GROWTH AND FREE CASH FLOW

Adjusted EBITDA Margin %

Where We Are Today

Our Proven Operating Model

Early stages of a multi-year turnaround

A global platform with scale, iconic brands and

leading market positions

A team of accomplished leaders assembled

from the best Industrials (Danaher, Cooper,

UTC, etc.) executing a proven operating model

• Self-help: quality, productivity, sourcing

• Steady profitable growth: price, innovation,

share-gain

• Strategic M&A: as an industry consolidator

Where We Are Going

1

2

3

4.4%

11.1%

15%+

FY 2013 Target*LTM Q1 2017

*Note: This presentation includes long-term targets, which are for illustrative purposes only. These long-term targets should not be read as a guarantee of future

performance or results, and will not necessarily be accurate indications of the times at, or by which, if at all, such performance or results will be achieved.

6

Proven Operating Model

Target Identification

Target Cultivation

Stage Gate Process

Integration Playbook

Performance Tracking

Strategic M&AOperational Excellence

Talent Management, JELD-WEN Excellence Model (JEM), and Enabling Technology

WORLD-CLASS PERFORMANCE AND RETURNS

New Products and Innovation

Brand Strategy

Channel Management

Sales Force Effectiveness

Pricing Optimization

Profitable Organic Growth

Safety and Compliance

Quality System

Customer Experience

Productivity

Sourcing

7

Operational Excellence

JELD-WEN Excellence Model (JEM)

ESTABLISHING A CONTINUOUS IMPROVEMENT CULTURE

2016 2017 2018 20192014 2015

Phase I: Establish mindset of discipline

(e.g., Operating Cadence, Gemba Walks)

Phase II: Deploy fundamental JEM tools

(e.g., Daily Visual Management System, Basic Problem Solving, Standard

Work, Model Area, 5S)

Phase III: Deploy intermediate JEM tools

(e.g., Total Productive Maintenance Cycle Time

Reduction, Kaizen, Kanban, etc.)

Phase IV: Continuously deploy

advanced tools

(e.g., Policy Deployment, Obeya, etc.)

Ongoing

Commitment

to Continuous

Improvement

JEM

Culture:

8

BUSINESS TRANSFORMATION DRIVING EARNINGS AND FCF IMPROVEMENT

Net Revenue Growth Free Cash Flow(1)

Financial Performance

USD in millions

$61.2

$81.0

7.7%

9.5%

Q1 2016 Q1 2017

% Margin

Adjusted EBITDA

(1) Free Cash Flow is defined as cash flow from operating activities minus (i) purchases of property and equipment and (ii) purchases of intangible assets.

$796.5

$847.8

Q1 2016 Q1 2017

($49.0)

($18.0)

Q1 2016 Q1 2017

6.4% increase 32.4% increase $31 mill ion increase

9

Financial Review

Brooks Mallard, EVP and Chief Financial Officer

10

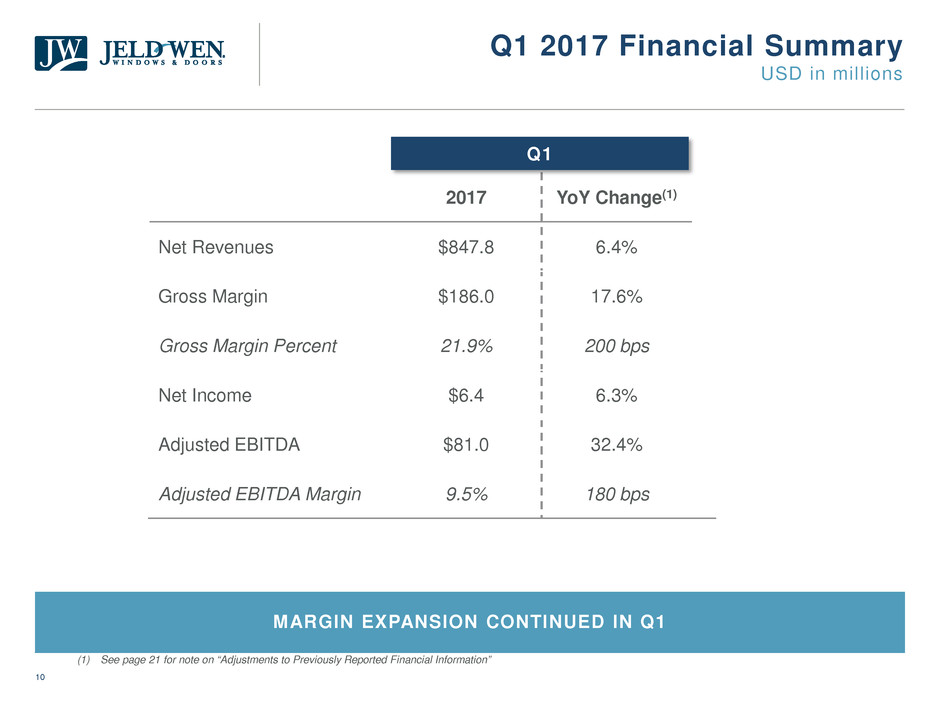

MARGIN EXPANSION CONTINUED IN Q1

2017 YoY Change(1)

Net Revenues $847.8 6.4%

Gross Margin $186.0 17.6%

Gross Margin Percent 21.9% 200 bps

Net Income $6.4 6.3%

Adjusted EBITDA $81.0 32.4%

Adjusted EBITDA Margin 9.5% 180 bps

Q1 2017 Financial Summary

USD in millions

Q1

(1) See page 21 for note on “Adjustments to Previously Reported Financial Information”

11

Q1 2017

Pricing 2% 2% 1% 1%

Volume/Mix 4% 3% 5% 6%

Core Growth 6% 5% 6% 7%

Acquisitions 1% 0% 0% 12%

FX (1%) 0% (4%) 5%

Total 6.4% 5.2% 1.6% 24.1%

CORE GROWTH MOMENTUM CONTINUES ACROSS ALL REGIONS

Q1 Net Revenues Walk

JELD-WEN North America Europe Australasia

12

CORE GROWTH DRIVING GROWTH IN EARNINGS AND MARGIN

2017 YoY Change

Net Revenues $484.1 5.2%

Adjusted EBITDA $50.2 58.3%

Adjusted EBITDA Margin 10.4% 350 bps

North America Segment Performance

USD in millions

Q1

Wood Windows Vinyl Windows Interior Doors Exterior Doors Wall Systems

13

SIGNIFICANT MARGIN IMPROVEMENT ON FLAT USD REVENUES IN 2016

2017 YoY Change

Net Revenues $242.3 1.6%

Adjusted EBITDA $27.2 10.2%

Adjusted EBITDA Margin 11.2% 80 bps

Europe Segment Performance

USD in millions

Q1

Residential Doors Commercial Doors Fire Resistant Sound Dampening Security Doors

14

RECENT ACQUISITIONS DRIVING TOP-LINE GROWTH

2017 YoY Change

Net Revenues $121.4 24.1%

Adjusted EBITDA $13.2 48.5%

Adjusted EBITDA Margin 10.9% 180 bps

Australasia Segment Performance

USD in millions

Q1

Windows Doors Shower Enclosures Closet Systems Specialty Windows

15

Balance Sheet and Cash Flow

USD in millions

NET LEVERAGE REDUCED TO 2.56x; SIGNIFICANT LIQUIDITY

Balance Sheet and Liquidity April 1, 2017 December 31, 2016(1)

Total Debt $1,245.8 $1,620.0

Cash $185.5 $102.7

Total Net Debt $1,060.3 $1,517.3

Net Debt / Adjusted EBITDA 2.56x 3.85x

Liquidity (2) $448.4 $381.9

Cash Flow Q1 2017 Q1 2016

Cash Flow From Operations ($8.2) ($28.2)

Capital Expenditures (3) ($9.8) ($20.8)

Free Cash Flow ($18.0) ($49.0)

( 1 ) D o e s n o t r e f l e c t t h e i mp a c t o f p r o c e e d s r e c e i v e d f r o m i n i t i a l p u b l i c o f f e r i n g s u b s e q u e n t t o y e a r e n d .

( 2 ) L i q u i d i t y i n c l u d e s c a s h a n d a v a i l a b i l i t y f r o m u n d r a wn r e v o l v i n g c r e d i t f a c i l i t i e s .

( 3 ) I n c l u d e s p u r c h a s e s o f p r o p e r t y , e q u i p me n t , a n d i n t a n g i b l e a s s e t s .

16

Summary and 2017 Outlook

Mark Beck, President and Chief Executive Officer

17

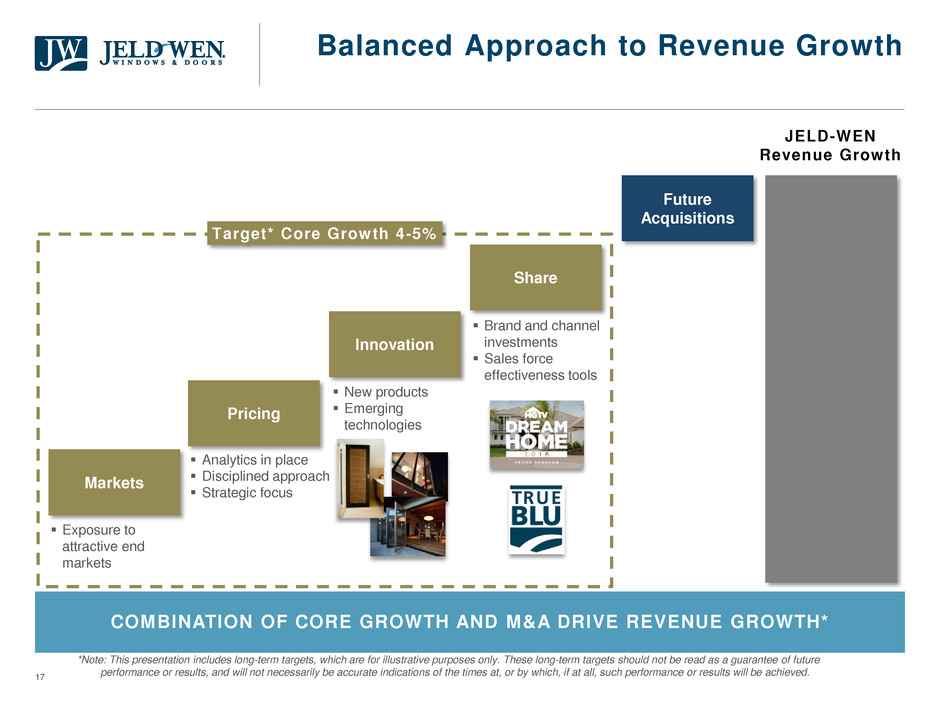

Balanced Approach to Revenue Growth

COMBINATION OF CORE GROWTH AND M&A DRIVE REVENUE GROWTH*

Future

Acquisitions

Markets

Pricing

Innovation

Share

Exposure to

attractive end

markets

Analytics in place

Disciplined approach

Strategic focus

New products

Emerging

technologies

Brand and channel

investments

Sales force

effectiveness tools

Target* Core Growth 4-5%

JELD-WEN

Revenue Growth

*Note: This presentation includes long-term targets, which are for illustrative purposes only. These long-term targets should not be read as a guarantee of future

performance or results, and will not necessarily be accurate indications of the times at, or by which, if at all, such performance or results will be achieved.

18

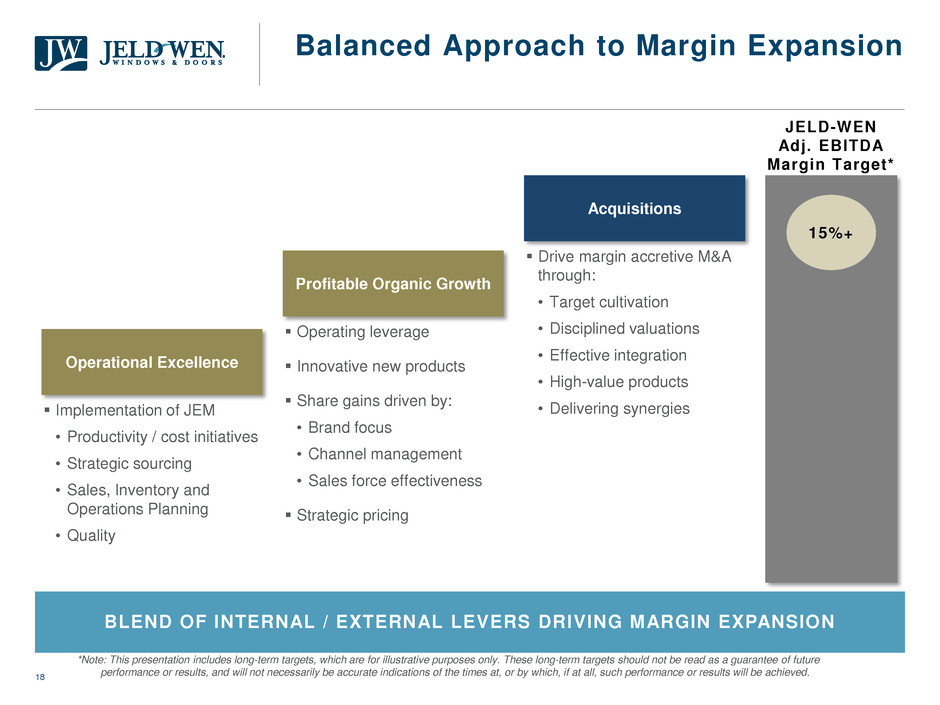

Balanced Approach to Margin Expansion

BLEND OF INTERNAL / EXTERNAL LEVERS DRIVING MARGIN EXPANSION

Acquisitions

15%+

JELD-WEN

Adj. EBITDA

Margin Target*

Profitable Organic Growth

Operational Excellence

Implementation of JEM

• Productivity / cost initiatives

• Strategic sourcing

• Sales, Inventory and

Operations Planning

• Quality

Operating leverage

Innovative new products

Share gains driven by:

• Brand focus

• Channel management

• Sales force effectiveness

Strategic pricing

Drive margin accretive M&A

through:

• Target cultivation

• Disciplined valuations

• Effective integration

• High-value products

• Delivering synergies

*Note: This presentation includes long-term targets, which are for illustrative purposes only. These long-term targets should not be read as a guarantee of future

performance or results, and will not necessarily be accurate indications of the times at, or by which, if at all, such performance or results will be achieved.

19

2017 Outlook

USD in millions

OUTLOOK BASED ON CONTINUED MARGIN IMPROVEMENT IN 2017

Original

Net Revenue Growth 1.5% – 3.5% 1.5% – 3.5%

Adjusted EBITDA $435 – $455 $440 – $460

Capital Expenditures $90 – $100 $90 – $100

Updated

20

Appendix

21

Adjusted EBITDA Reconciliation

USD in millions

NOTE: Adjustments to Previously Reported

Financial Information

During the first quarter ended April 1, 2017, we

identified errors related to the tax treatment of our

share-based compensation expense and the inter-

quarter allocation of a tax benefit associated with

the release of a valuation allowance in a foreign

jurisdiction reported for the year ended December

31, 2016. The amounts are not material to the

periods impacted, and we have elected to revise

our previously issued consolidated financial

statements in our upcoming filings to correct the

prior periods. In addition to the tax corrections, we

also revised the financial statements for other

accumulated misstatements impacting the period.

The cumulative impact of the corrections for the

three months ended March 26, 2016 was an

increase in share-based compensation expense of

$0.4 million and a decrease in tax expense of $0.1

million. The corrections had no impact on cash

flow or adjusted EBITDA. Please refer to our

Form 10-Q for the three-month period ended April

1, 2017 for additional details.

Three months ending

April 1, 2017 March 26, 2016

Net Income (loss) $6.4 $6.0

Adjustments:

Loss (income) from discontinued operations, net of tax $0.0 ($0.5)

Equity (earnings) loss of non-consolidated entities ($0.5) ($0.8)

Income tax expense (benefit) $2.3 $2.1

Depreciation and amortization $27.1 $25.7

Interest expense, net(a) $26.9 $17.0

Impairment and restructuring charges $1.2 $2.9

Gain on sale of property and equipment ($0.0) ($3.6)

Share-based compensation expense $5.4 $5.1

Non-cash foreign exchange transaction/translation (income) loss $4.4 $5.0

Other non-cash items $0.0 $0.4

Other items(b) $7.6 $1.8

Costs relating to debt restructuring and debt financing $0.3 $0.0

Adjusted EBITDA $81.0 $61.2

(a) For the tree months ended April 1, 2017, interest expense includes the write-off of $7.0 million of original issue

discount and deferred financing fees related to the repayment of $375 million of debt

(b) Other items not core to business activity include: (i) in the three-months ended April 1, 2017, (1) $5.7 million in legal

costs, (2) $0.5 million in facility shut down costs, and (3) $0.3 million in IPO costs; and (ii) in the three-months ended

March 26, 2016, (1) $0.9 million in acquisition costs, (2) $0.3 million in Dooria plant closure costs, and (3) $0.2 million

of tax consulting costs in Europe.