Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Spectrum Brands Holdings, Inc. | hrg8-k5917.htm |

May 9, 2017

2nd Quarter

Earnings Supplement

Disclaimers

2

Limitations on the Use of Information. This document has been prepared by HRG Group, Inc. (the “Company” or “HRG”) solely for informational purposes. Unless otherwise noted,

the information herein is presented as of March 31, 2017 and does provide an update or a forecast with respect to the results or operations of the Company or any of its affiliates.

The information provided herein is illustrative only. The estimated net value of our assets and liabilities has been determined based on the information and methods described

herein and is not intended to, and does not constitute, an appraisal or estimate of value based on any other method. The estimated net value of our assets and liabilities described

herein is not necessarily indicative of the value that could be realized in upon a liquidity event (if any). The methods used herein include the use of per share market prices for our

subsidiaries whose common stock is publicly traded, but these prices are not necessarily reflective of the actual value that we would receive if we were to sell or liquidate those

investments. We have used book value determined in accordance with GAAP for purposes of preparing our balance sheet to estimate the value of our assets for which there is no

trading market. These book value determinations are not necessarily reflective of the value that we would receive were we to sell or liquidate those investments. Our principal

liabilities represent our outstanding indebtedness (excluding indebtedness and other liabilities at our publicly traded subsidiaries). We have valued these liabilities at par as of the

date presented herein, including accrued interest on such indebtedness, in each case without giving effect to prepayment or other costs that we might incur were we to prepay such

indebtedness prior to maturity. As a result, you are cautioned not to place undue reliance on the estimated net valuations set forth herein and carefully consider alternatives to the

assumptions and methods described above. Actual results and value that may be available to our stockholders may differ significantly from those presented herein. This information

is subject to change without notice and should not be relied upon for any purpose. Neither the Company nor any of its affiliates makes any representation or warranty, express or

implied, as to the accuracy or completeness of the information contained herein and no such party shall have any liability for such information. In furnishing this information and

making any oral statements, neither the Company nor any of its affiliates undertakes any obligation to provide the recipient with access to any additional information or to update or

correct such information. The information herein or in any oral statements (if any) are prepared as of the date hereof or as of such earlier dates as presented herein; neither the

delivery of this document nor any other oral statements regarding the affairs of Company or its affiliates shall create any implication that the information contained herein or the

affairs of the Company or its affiliates have not changed since the date hereof or after the dates presented herein (as applicable); that such information is correct as of any time

subsequent to its date; or that such information is an indication regarding the valuation of the Company or any of its affiliates.

“Safe Harbor” Statement Under the Private Securities Litigation Reform Act of 1995: This document contains, and certain oral statements made by our representatives from time to

time may contain, forward-looking statements. Such statements may include statements regarding the evaluation of strategic alternatives by HRG and Fidelity & Guaranty Life

(“FGL”) and any expected or anticipated benefits therefrom, as applicable. There can be no assurance that the evaluation of strategic alternatives will result in a transaction, or that

any transaction, if pursued, will be consummated. The evaluation of strategic alternatives by HRG and/or FGL may be terminated at any time with or without notice. Neither the HRG

nor any of its affiliates intends to disclose any developments with respect to the HRG and/or FGL review process until such time that it determines otherwise in its sole discretion or

as required by applicable law. Forward-looking statements also include information concerning possible or assumed future distributions from subsidiaries, other actions, events,

results, strategies and expectations and are identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans,” “seeks,” “estimates,” “projects,” “may,” “will,”

“could,” “might,” or “continues” or similar expressions. Such forward-looking statements are subject to risks and uncertainties that could cause actual results, events and

developments to differ materially from those set forth in or implied by such statements. These forward-looking statements are based on the beliefs and assumptions of HRG’s

management and the management of HRG’s subsidiaries. Factors that could cause actual results, events and developments to differ include, without limitation: that the review of

strategic alternatives at FGL or HRG will result in a transaction, or if a transaction is undertaken, as to its terms or timing; the ability of HRG’s subsidiaries to generate sufficient net

income and cash flows to make upstream cash distributions; the decision of the boards of HRG’s subsidiaries to make upstream cash distributions, which is subject to numerous

factors such as restrictions contained in applicable financing agreements, state and regulatory restrictions and other relevant considerations as determined by the applicable board;

HRG’s liquidity, which may be impacted by a variety of factors, including the capital needs of HRG’s subsidiaries; capital market conditions; commodity market conditions;

foreign exchange rates; HRG’s and its subsidiaries’ ability to identify, pursue or complete any suitable future acquisition or disposition opportunities, including realizing such

transaction’s expected benefits and the timetable for, completing applicable financial reporting requirements; litigation; potential and contingent liabilities; management’s plans;

changes in regulations; taxes; and the risks identified under the caption “Risk Factors” in HRG’s most recent Annual Report on Form 10-K and subsequent Quarterly Reports on

Form 10-Q. All forward-looking statements described herein are qualified by these cautionary statements and there can be no assurance that the actual results, events or

developments referenced herein will occur or be realized. Neither HRG nor any of its affiliates undertake any obligation to update or revise forward-looking statements to reflect

changed assumptions, the occurrence of unanticipated events or changes to future operation results, except as required by law.

Important Note Regarding the Presentation of our Insurance Segment. As discussed in greater detail in the Company’s most recent Quarterly Report on Form 10-Q, the Company’s

ownership interest in FGL continues to be classified as held for sale on the balance sheet and FGL's operations have been classified as discontinued operations.

Sum of the Parts Presentation as of March 31, 2017

3

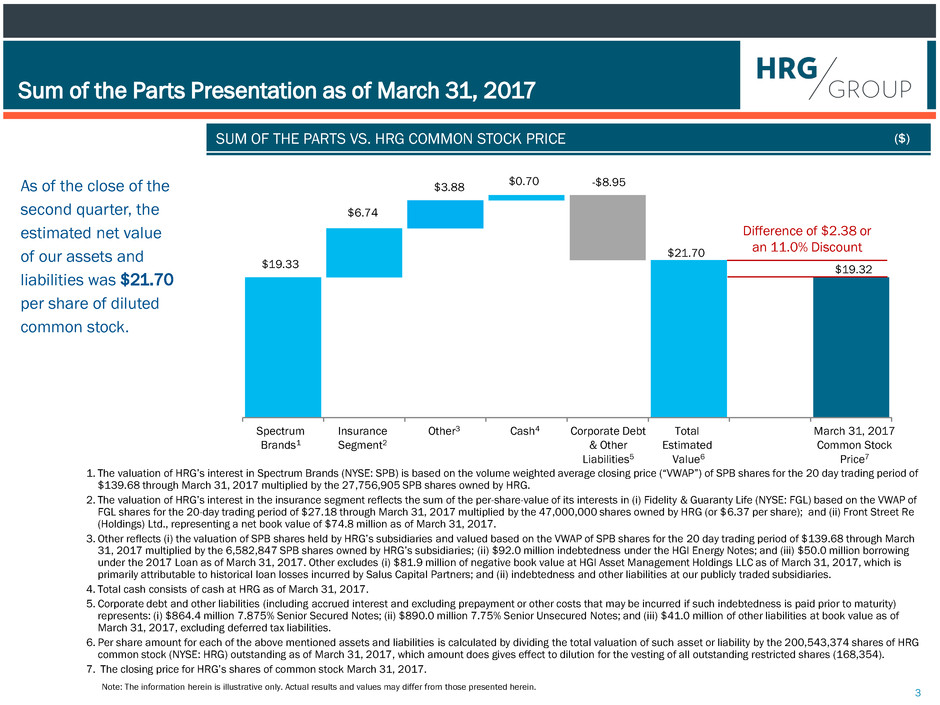

As of the close of the

second quarter, the

estimated net value

of our assets and

liabilities was $21.70

per share of diluted

common stock.

SUM OF THE PARTS VS. HRG COMMON STOCK PRICE ($)

$19.33

$6.74

$3.88

$0.70 -$8.95

$21.70

$19.32

Difference of $2.38 or

an 11.0% Discount

Spectrum

Brands1

Insurance

Segment2

Total

Estimated

Value6

March 31, 2017

Common Stock

Price7

Cash4 Corporate Debt

& Other

Liabilities5

Other3

1. The valuation of HRG’s interest in Spectrum Brands (NYSE: SPB) is based on the volume weighted average closing price (“VWAP”) of SPB shares for the 20 day trading period of

$139.68 through March 31, 2017 multiplied by the 27,756,905 SPB shares owned by HRG.

2. The valuation of HRG’s interest in the insurance segment reflects the sum of the per-share-value of its interests in (i) Fidelity & Guaranty Life (NYSE: FGL) based on the VWAP of

FGL shares for the 20-day trading period of $27.18 through March 31, 2017 multiplied by the 47,000,000 shares owned by HRG (or $6.37 per share); and (ii) Front Street Re

(Holdings) Ltd., representing a net book value of $74.8 million as of March 31, 2017.

3. Other reflects (i) the valuation of SPB shares held by HRG’s subsidiaries and valued based on the VWAP of SPB shares for the 20 day trading period of $139.68 through March

31, 2017 multiplied by the 6,582,847 SPB shares owned by HRG’s subsidiaries; (ii) $92.0 million indebtedness under the HGI Energy Notes; and (iii) $50.0 million borrowing

under the 2017 Loan as of March 31, 2017. Other excludes (i) $81.9 million of negative book value at HGI Asset Management Holdings LLC as of March 31, 2017, which is

primarily attributable to historical loan losses incurred by Salus Capital Partners; and (ii) indebtedness and other liabilities at our publicly traded subsidiaries.

4. Total cash consists of cash at HRG as of March 31, 2017.

5. Corporate debt and other liabilities (including accrued interest and excluding prepayment or other costs that may be incurred if such indebtedness is paid prior to maturity)

represents: (i) $864.4 million 7.875% Senior Secured Notes; (ii) $890.0 million 7.75% Senior Unsecured Notes; and (iii) $41.0 million of other liabilities at book value as of

March 31, 2017, excluding deferred tax liabilities.

6. Per share amount for each of the above mentioned assets and liabilities is calculated by dividing the total valuation of such asset or liability by the 200,543,374 shares of HRG

common stock (NYSE: HRG) outstanding as of March 31, 2017, which amount does gives effect to dilution for the vesting of all outstanding restricted shares (168,354).

7. The closing price for HRG’s shares of common stock March 31, 2017.

Note: The information herein is illustrative only. Actual results and values may differ from those presented herein.