Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - HERTZ GLOBAL HOLDINGS, INC | q12017pressrelease.htm |

| 8-K - 8-K - HERTZ GLOBAL HOLDINGS, INC | q12017earnings8-k.htm |

1

1Q 2017 Earnings Call

May 9, 2017

8:30am ET

2

Safe Harbor Statement

Certain statements made within this presentation contain forward-looking statements, within the

meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are

not guarantees of performance and by their nature are subject to inherent uncertainties. Actual

results may differ materially. Any forward-looking information relayed in this presentation speaks

only as of May 8, 2017, and Hertz Global Holdings, Inc (the “Company”). The Company undertakes

no obligation to update that information to reflect changed circumstances.

Additional information concerning these statements is contained in the Company’s press release

regarding its First Quarter 2017 results issued on May 8, 2017, and the Risk Factors and Forward-

Looking Statements sections of the Company’s 2016 Form 10-K filed on March 6, 2017, and First

Quarter 2017 Quarterly Report on Form 10-Q filed on May 8, 2017. Copies of these filings are

available from the SEC, the Hertz website or the Company’s Investor Relations Department.

1Q

3

Non-GAAP Measures

THE FOLLOWING KEY METRICS AND NON-GAAP* MEASURES WILL BE USED IN THE PRESENTATION:

Adjusted corporate EBITDA

Adjusted corporate EBITDA margin

Adjusted pre-tax income (loss)

Adjusted net income (loss)

Adjusted diluted earnings (loss) per share

(Adjusted diluted EPS)

Total RPD

Total RPU

Net depreciation per unit per month

Vehicle utilization

Rentable Utilization

1Q

*Definitions and reconciliations of these key metrics and non-GAAP measures are provided in the

Company’s first quarter 2017 press release issued on May 8, 2017 and in the Company’s Form

8-K filed on May 9, 2017.

4

Agenda

BUSINESS

OVERVIEW

Kathryn Marinello

President & Chief Executive Officer

Hertz Global Holdings, Inc.

FINANCIAL RESULTS

OVERVIEW

Tom Kennedy

Chief Financial Officer

Hertz Global Holdings, Inc.

1Q

5

Drivers of US RAC Long-Term Growth 1Q

• FLEET………………. Upgrade vehicle mix and optimize capacity

• SERVICE…………… Improve processes, restructure incentives, roll out Ultimate Choice platform

• MARKETING……….. Enhance digital applications

• TECHNOLOGY…….. Update suite of systems for greater flexibility, productivity and capabilities

Influencing Brand Preference through Product Quality and Service Excellence

2017 Earnings Impacted by Investment Strategy to Drive Long-term Growth

2018 Positioned to Benefit from Early Returns

6

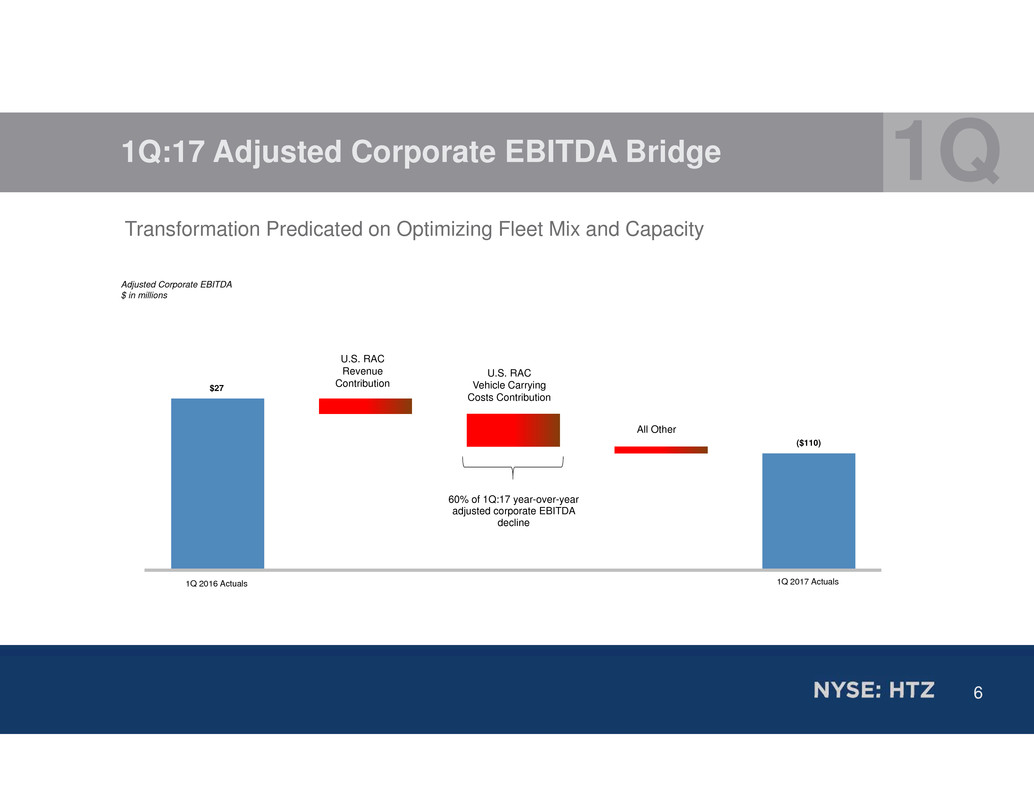

1Q:17 Adjusted Corporate EBITDA Bridge 1Q

Transformation Predicated on Optimizing Fleet Mix and Capacity

$27

($110)

60% of 1Q:17 year-over-year

adjusted corporate EBITDA

decline

All Other

U.S. RAC

Revenue

Contribution

U.S. RAC

Vehicle Carrying

Costs Contribution

Adjusted Corporate EBITDA

$ in millions

1Q 2016 Actuals 1Q 2017 Actuals

7

Long-term Outperformance Opportunity:

• Hertz brand strength

• Industry-leading loyalty programs

• Strong partnerships

• Ultimate Choice offering

• Mature, robust retail car-sales network

• Leading-edge systems platform

Execution is Key

Company is Structurally Capable of Achieving Historic Margins

1Q

8

TOM KENNEDY

CHIEF FINANCIAL OFFICER

Hertz Global Holdings, Inc.

Quarterly Overview

9

1Q:17 Consolidated Results

GAAP

1Q:17

Results

1Q:16

Results

YoY

Change

Revenue $1,916M $1,983M (3)%

Income (loss) from continuing operations

before income taxes

$(294)M $(76)M (287)%

Net Income (loss) from continuing operations $(223)M $(52)M (329)%

Diluted earnings (loss) per share from

continuing operations

$(2.69) $(0.61) (341)%

Weighted Average Shares outstanding: Diluted 83M 85M

Non-GAAP*

Adjusted corporate EBITDA $(110)M $27M NM

Adjusted corporate EBITDA margin (6)% 1% (710 bps)

Adjusted pre-tax income (loss) $(213)M $(106)M (101)%

Adjusted net income (loss) $(134)M $(67)M (100)%

Adjusted diluted EPS $(1.61) $(0.79) (104)%

1Q

*Definitions and reconciliations of Non-GAAP measures are provided in the Company’s first quarter

2017 press release issued on May 8, 2017 and in the Company’s Form 8-K filed on May 9, 2017.

10

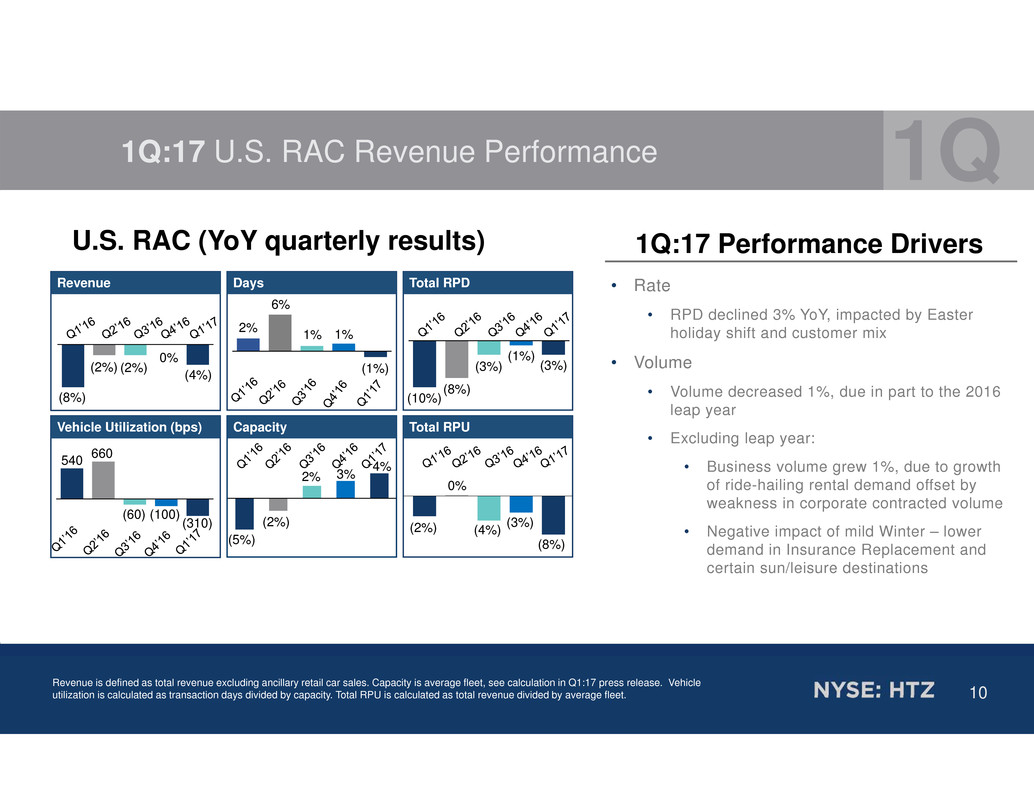

1Q:17 U.S. RAC Revenue Performance

Revenue Days Total RPD

Vehicle Utilization (bps) Capacity Total RPU

(2%)(2%)

(8%)

0%

6%

2% 1%1%

(8%)

(10%)

(3%)

660540

(60) (2%)

(5%)

2%

0%

(2%) (4%)

U.S. RAC (YoY quarterly results)

Revenue is defined as total revenue excluding ancillary retail car sales. Capacity is average fleet, see calculation in Q1:17 press release. Vehicle

utilization is calculated as transaction days divided by capacity. Total RPU is calculated as total revenue divided by average fleet.

1Q:17 Performance Drivers

(1%)

(100)

3%

(3%)

1Q

(4%) (1%)

(3%)

4%

(8%)

(310)

• Rate

• RPD declined 3% YoY, impacted by Easter

holiday shift and customer mix

• Volume

• Volume decreased 1%, due in part to the 2016

leap year

• Excluding leap year:

• Business volume grew 1%, due to growth

of ride-hailing rental demand offset by

weakness in corporate contracted volume

• Negative impact of mild Winter – lower

demand in Insurance Replacement and

certain sun/leisure destinations

11

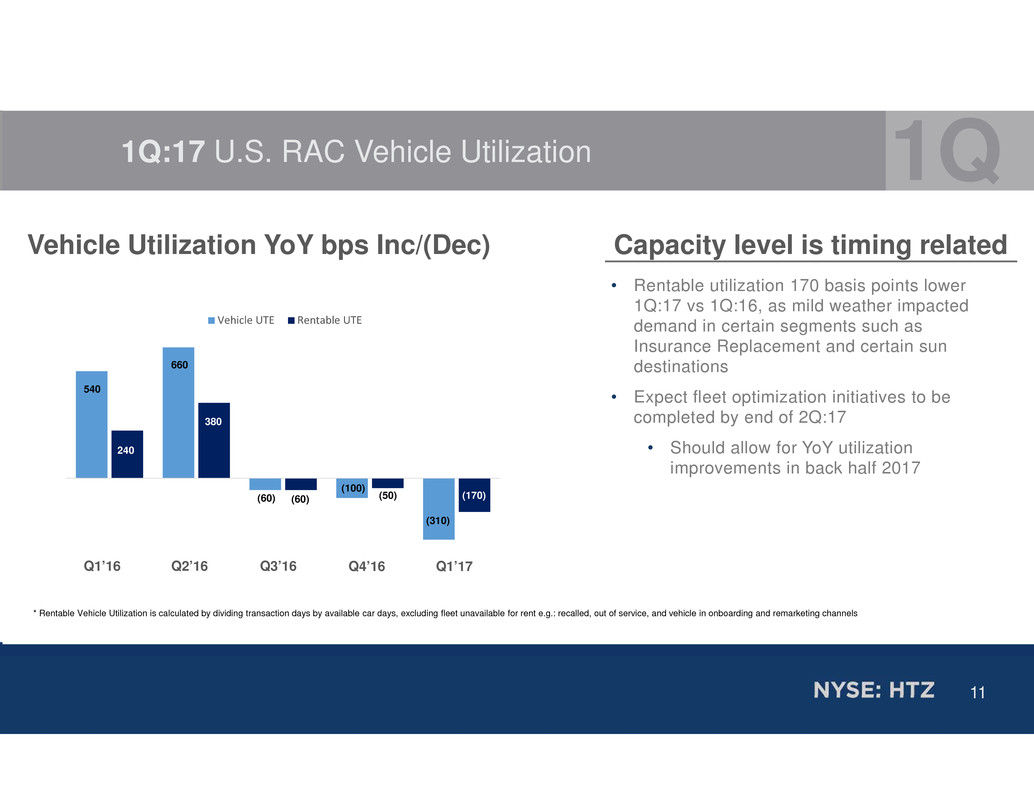

1Q:17 U.S. RAC Vehicle Utilization

Vehicle Utilization YoY bps Inc/(Dec) Capacity level is timing related

1Q

Q1’16 Q2’16 Q3’16 Q4’16 Q1’17

• Rentable utilization 170 basis points lower

1Q:17 vs 1Q:16, as mild weather impacted

demand in certain segments such as

Insurance Replacement and certain sun

destinations

• Expect fleet optimization initiatives to be

completed by end of 2Q:17

• Should allow for YoY utilization

improvements in back half 2017

Vehicle UTE Rentable UTE

660

(310)

(170)

380

540

240

(60) (60)

(100)

(50)

* Rentable Vehicle Utilization is calculated by dividing transaction days by available car days, excluding fleet unavailable for rent e.g.: recalled, out of service, and vehicle in onboarding and remarketing channels

12

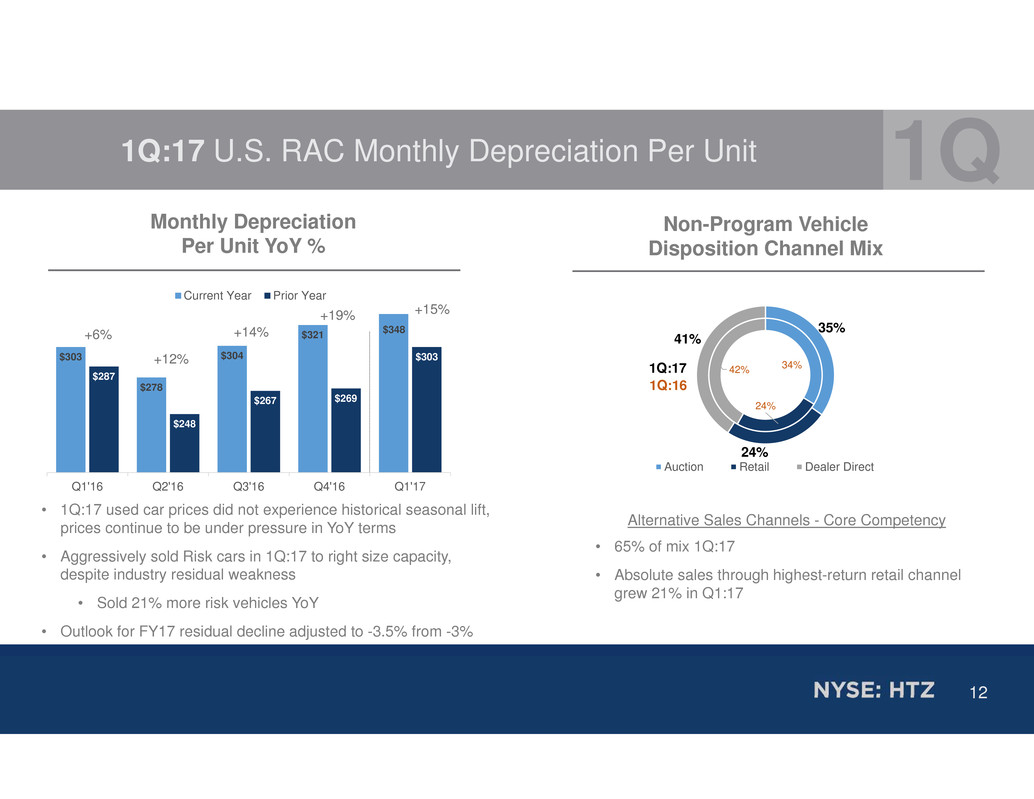

1Q:17 U.S. RAC Monthly Depreciation Per Unit

34%

24%

42%

35%

24%

41%

Auction Retail Dealer Direct

1Q:17

1Q:16

Non-Program Vehicle

Disposition Channel Mix

Monthly Depreciation

Per Unit YoY %

$303

$278

$304

$321

$287

$248

$267 $269

$303

Q1'16 Q2'16 Q3'16 Q4'16 Q1'17

Current Year Prior Year

$348

+19%

+6%

+12%

+14%

1Q

+15%

Alternative Sales Channels - Core Competency

• 65% of mix 1Q:17

• Absolute sales through highest-return retail channel

grew 21% in Q1:17

• 1Q:17 used car prices did not experience historical seasonal lift,

prices continue to be under pressure in YoY terms

• Aggressively sold Risk cars in 1Q:17 to right size capacity,

despite industry residual weakness

• Sold 21% more risk vehicles YoY

• Outlook for FY17 residual decline adjusted to -3.5% from -3%

13

1Q:17 International RAC

• 1Q:17 revenue decreased 5%, or 4% YoY when you exclude FX

- Transaction days increased 1% despite the impact of leap year, and exiting certain

underperforming accounts in the UK in 2H:16

- Total RPD declined 4% due primarily to the impact of the Easter holiday falling in second

quarter in 2017 versus the first quarter in 2016

• Total vehicle utilization was 75%, 30 bps higher than the prior-year period

• Monthly depreciation per unit decreased 1% YoY

• Direct operating and SG&A expenses per transaction day improved 5% YoY

• Adjusted corporate EBITDA margin declined 180 bps YoY primarily due to the revenue decline

and 80 bps of adverse claims development, partially offset by savings in operating costs

1Q

14

LIQUIDITY / BALANCE SHEET

OVERVIEW

TOM KENNEDY

CHIEF FINANCIAL OFFICER

Hertz Global Holdings, Inc.

15

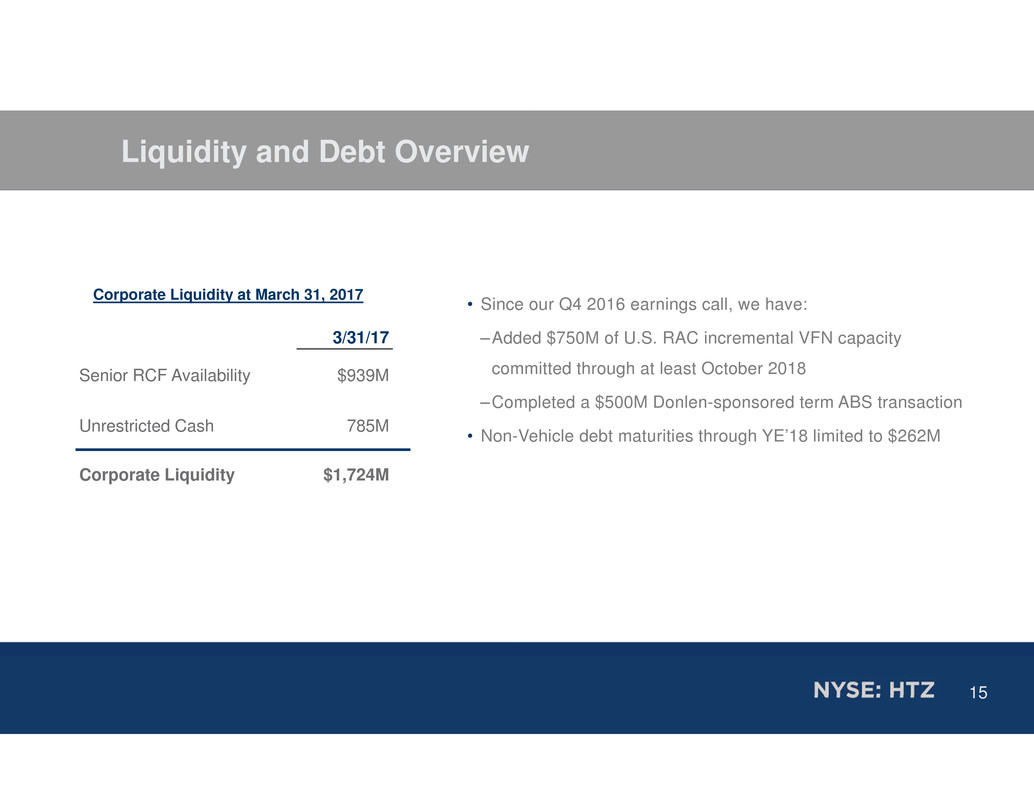

3/31/17

Senior RCF Availability $939M

Unrestricted Cash 785M

Corporate Liquidity $1,724M

Liquidity and Debt Overview

• Since our Q4 2016 earnings call, we have:

–Added $750M of U.S. RAC incremental VFN capacity

committed through at least October 2018

–Completed a $500M Donlen-sponsored term ABS transaction

• Non-Vehicle debt maturities through YE’18 limited to $262M

Corporate Liquidity at March 31, 2017

16

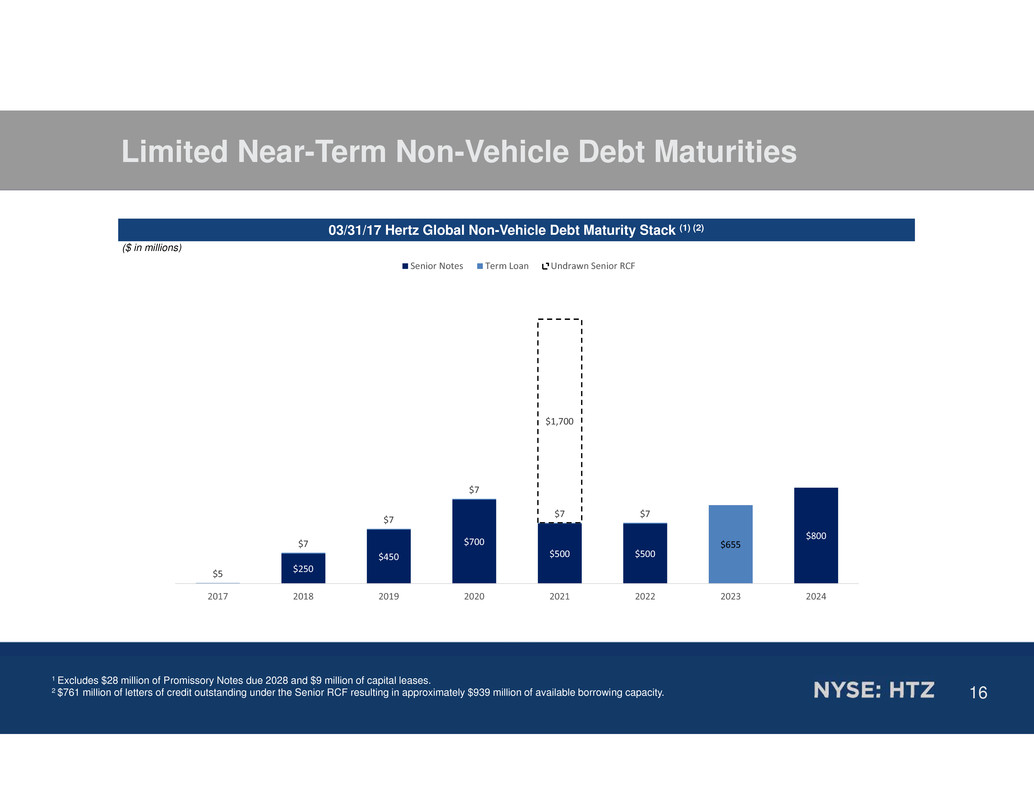

Limited Near-Term Non-Vehicle Debt Maturities

03/31/17 Hertz Global Non-Vehicle Debt Maturity Stack (1) (2)

($ in millions)

$250

$450

$700

$500 $500

$800

$5

$7

$7

$7

$7 $7

$655

$1,700

2017 2018 2019 2020 2021 2022 2023 2024

Senior Notes Term Loan Undrawn Senior RCF

1 Excludes $28 million of Promissory Notes due 2028 and $9 million of capital leases.

2 $761 million of letters of credit outstanding under the Senior RCF resulting in approximately $939 million of available borrowing capacity.

17

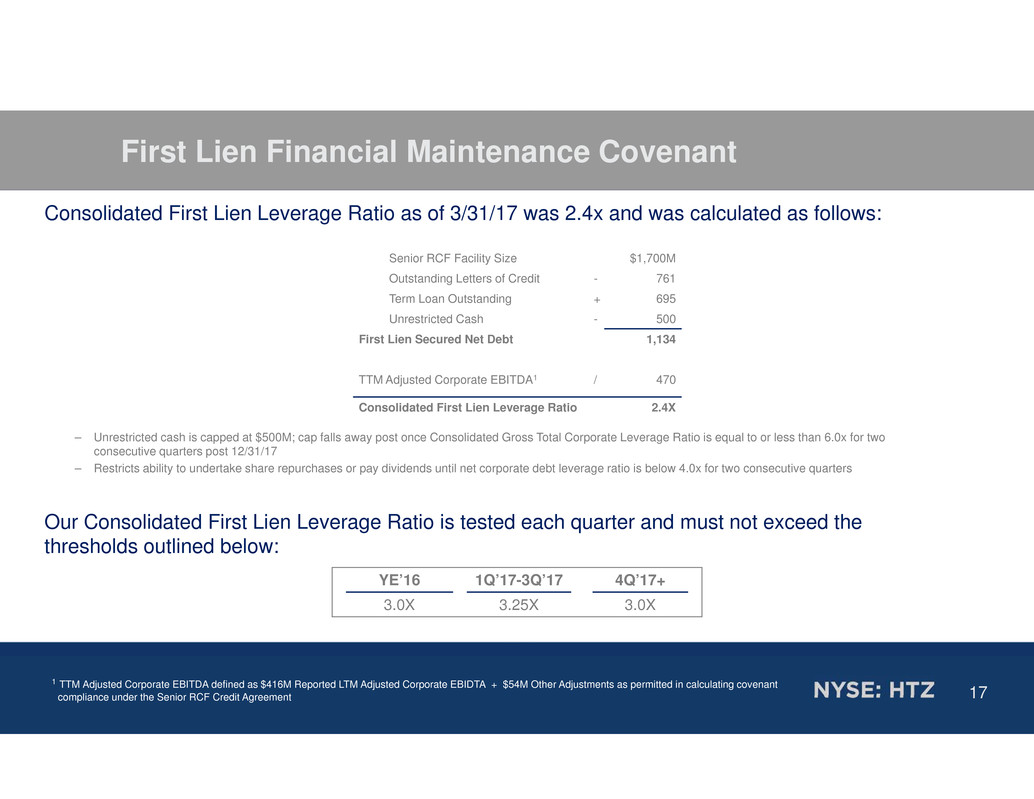

First Lien Financial Maintenance Covenant

Consolidated First Lien Leverage Ratio as of 3/31/17 was 2.4x and was calculated as follows:

– Unrestricted cash is capped at $500M; cap falls away post once Consolidated Gross Total Corporate Leverage Ratio is equal to or less than 6.0x for two

consecutive quarters post 12/31/17

– Restricts ability to undertake share repurchases or pay dividends until net corporate debt leverage ratio is below 4.0x for two consecutive quarters

Our Consolidated First Lien Leverage Ratio is tested each quarter and must not exceed the

thresholds outlined below:

Senior RCF Facility Size $1,700M

Outstanding Letters of Credit - 761

Term Loan Outstanding + 695

Unrestricted Cash - 500

First Lien Secured Net Debt 1,134

TTM Adjusted Corporate EBITDA1 / 470

Consolidated First Lien Leverage Ratio 2.4X

1 TTM Adjusted Corporate EBITDA defined as $416M Reported LTM Adjusted Corporate EBIDTA + $54M Other Adjustments as permitted in calculating covenant

compliance under the Senior RCF Credit Agreement

YE’16 1Q’17-3Q’17 4Q’17+

3.0X 3.25X 3.0X

18

Q&A