Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - HERC HOLDINGS INC | herc2017q1pressrelease.htm |

| 8-K - 8-K - HERC HOLDINGS INC | herc2017q18-kearnings.htm |

Click to edit Master title style

Click to edit Master subtitle style

Herc Holdings Inc.

First Quarter Earnings Conference Call

for the period ending March 31, 2017

May 9, 2017

Agenda

2NYSE: HRI

Welcome and Introductions Elizabeth Higashi

Vice President, Investor Relations

Strategic Update and Industry

Outlook

Larry Silber

President and Chief Executive Officer

Q1 Financial Review Barbara Brasier

Senior Vice President and Chief Financial Officer

Q&A

Larry Silber

Barbara Brasier

Bruce Dressel

Senior Vice President and Chief Operating Officer

Safe Harbor Statements

3NYSE: HRI

Basis of Presentation

The financial information included in this presentation is based upon the condensed consolidated financial statements of the Company which are presented on a

basis of accounting that reflects a change in reporting entity and have been adjusted for the effects of the spin-off, which effected our separation from Hertz Rental

Car Holding Company, Inc. (“New Hertz”). These financial statements and financial information represent only those operations, assets, liabilities and equity that

form Herc Holdings Inc. on a stand-alone basis. Since the spin-off occurred on June 30, 2016, prior period amounts represent carve-out financial results.

Forward-Looking Statements

This presentation contains statements, including those related to 2017 guidance, that are not statements of historical fact, but instead are forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995. We caution readers not to place undue reliance on these statements, which speak only as

of the date hereof. There are a number of risks, uncertainties and other important factors that could cause our actual results to differ materially from those suggested

by our forward-looking statements, including:

• Risks related to material weaknesses in our internal control over financial reporting and the restatement of financial statements previously issued by Hertz Global

Holdings, Inc. (in its form prior to the spin-off, “Hertz Holdings”), including that: we have identified material weaknesses in our internal control over financial

reporting that may adversely affect our ability to report our financial condition and results of operations in a timely and accurate manner, which may adversely affect

investor and lender confidence in us and, as a result, the value of our common stock and our ability to obtain future financing on acceptable terms, and we may

identify additional material weaknesses as we continue to assess our processes and controls as a stand-alone company with lower levels of materiality; such

material weaknesses could result in a material misstatement of our consolidated financial statements that would not be prevented or detected; we receive certain

transition services from New Hertz pursuant to the transition services agreement covering information technology services and other areas, which impact our

control environment and, therefore, our internal control over financial reporting; we continue to expend significant costs and devote management time and attention

and other resources to matters related to our internal control over financial reporting and our material weaknesses and Hertz Holdings' restatement could adversely

affect our ability to execute our strategic plan; our efforts to design and implement an effective control environment may not be sufficient to remediate the material

weaknesses or prevent future material weaknesses; our material weaknesses and Hertz Holdings' restatement could expose us to additional risks that could

materially adversely affect our financial position, results of operations and cash flows, including as a result of events of default under the agreements governing our

indebtedness and/or government investigations, regulatory inquiries and private actions; we may experience difficulties implementing new information technology

systems to maintain our books and records and provide operational information to our management team; if we decide to not implement the new operational

system for our back office processes, we could need to expense items that were previously capitalized, which could have a material adverse effect on our results of

operations; we could experience disruptions to our control environment in connection with the relocation of our Shared Services Center, including as a result of the

failure to retain key employees who possess specific knowledge or expertise necessary for the timely preparation of our financial statements; and Hertz Holdings'

restatement has resulted in government investigations, books and records demands, and private litigation and could result in government enforcement actions and

private litigation that could have a material adverse impact on our results of operations, financial condition, liquidity and cash flows;

Safe Harbor Statements - Continued

4NYSE: HRI

• Risks related to the spin-off, which effected our separation from New Hertz, such as: we have limited operating history as a stand-alone public company, and our

historical financial information for periods prior to July 1, 2016, is not necessarily representative of the results that we would have achieved as a separate, publicly

traded company, and may not be a reliable indicator of our future results; the liabilities we have assumed and will share with New Hertz in connection with the spin-

off could have a material adverse effect on our business, financial condition and results of operations; if there is a determination that any portion of the spin-off

transaction is taxable for U.S. federal income tax purposes, including for reasons outside of our control, then we and our stockholders could incur significant tax

liabilities, and we could also incur indemnification liability if we are determined to have caused the spin-off to become taxable; if New Hertz fails to pay its tax

liabilities under the tax matters agreement or to perform its obligations under the separation and distribution agreement, we could incur significant tax and other

liability; our ability to engage in financings, acquisitions and other strategic transactions using equity securities is limited due to the tax treatment of the spin-off; the

loss of the Hertz brand and reputation could materially adversely affect our ability to attract and retain customers; the spin-off may be challenged by creditors as a

fraudulent transfer or conveyance; and if the spin-off is not a legal dividend, it could be held invalid by a court and have a material adverse effect on our business,

financial condition and results of operations;

• Business risks could have a material adverse effect on our business, results of operations, financial condition and/or liquidity, including:

o the cyclicality of our business, a slowdown in economic conditions or adverse changes in the economic factors specific to the industries in which we operate,

in particular industrial and construction;

o the dependence of our business on the levels of capital investment and maintenance expenditures by our customers, which in turn are affected by numerous

factors, including the level of economic activity in their industries, the state of domestic and global economies, global energy demand, the cyclical nature of their

markets, expectations regarding government spending on infrastructure improvements or expansions, their liquidity and the condition of global credit and capital

markets;

o we may have difficulty obtaining the resources that we need to operate, or our costs to do so could increase significantly;

o intense competition in the industry, including from our own suppliers, that may lead to downward pricing or an inability to increase prices;

o any occurrence that disrupts rental activity during our peak periods given the seasonality of the business, especially in the construction industry;

o doing business in foreign countries exposes us to additional risks, including under laws and regulations that may conflict with U.S. laws and those under

anticorruption, competition, economic sanctions and anti-boycott regulations;

o our success as an independent company will depend on our new senior management team, the ability of other new employees to learn their new roles, and

our ability to attract and retain key management and other key personnel;

o some or all of our deferred tax assets could expire if we experience an “ownership change” as defined in the Internal Revenue Code;

o changes in the legal and regulatory environment that affect our operations, including with respect to taxes, consumer rights, privacy, data security and

employment matters, could disrupt our business and increase our expenses;

o an impairment of our goodwill or our indefinite lived intangible assets could have a material non-cash adverse impact;

Safe Harbor Statements - Continued

5NYSE: HRI

o other operational risks such as: any decline in our relations with our key national account customers or the amount of equipment they rent from us; our

equipment rental fleet is subject to residual value risk upon disposition, and may not sell at the prices we expect; we may be unable to protect our trade secrets

and other intellectual property rights; we may fail to respond adequately to changes in technology and customer demands; our business is heavily reliant upon

communications networks and centralized information technology systems and the concentration of our systems creates or increases risks for us, including the

risk of the misuse or theft of information we possess, including as a result of cyber security breaches or otherwise, which could harm our brand, reputation or

competitive position and give rise to material liabilities; failure to maintain, upgrade and consolidate our information technology networks could materially

adversely affect us; we may face issues with our union employees; we are exposed to a variety of claims and losses arising from our operations, and our

insurance may not cover all or any portion of such claims; environmental, health and safety laws and regulations and the costs of complying with them, or any

change to them impacting our customers’markets could materially adversely affect us; decreases in government spending could materially adversely affect us

and a lack of or delay in additional infrastructure spending may have a material adverse effect on our share price; maintenance and repair costs associated with

our equipment rental fleet could materially adversely affect us; and strategic acquisitions could be difficult to identify and implement and could disrupt our

business or change our business profile significantly;

• Risks related to our substantial indebtedness, such as: our substantial level of indebtedness exposes us or makes us more vulnerable to a number of risks that

could materially adversely affect our financial condition, results of operations, cash flows, liquidity and ability to compete; the secured nature of our indebtedness,

which is secured by substantially all of our consolidated assets, could materially adversely affect our business and holders of our debt and equity; an increase in

interest rates or in our borrowing margin would increase the cost of servicing our debt and could reduce our profitability; and any additional debt we incur could

further exacerbate these risks;

• Risks related to the securities market and ownership of our stock, including that: the market price of our common stock may fluctuate significantly; the market

price of our common stock could decline as a result of the sale or distribution of a large number of our shares or the perception that a sale or distribution could

occur and these factors could make it more difficult for us to raise funds through future stock offerings; and provisions of our governing documents could

discourage potential acquisition proposals and could deter or prevent a change in control; and

• Other risks and uncertainties set forth in our Annual Report on Form 10-K for the year ended December 31, 2016, under Item 1A "Risk Factors" and in our other

filings with the Securities and Exchange Commission (“SEC”).

All forward-looking statements are expressly qualified in their entirety by such cautionary statements. We do not undertake any obligation to release publicly any

update or revision to any of the forward-looking statements.

Information Regarding Non-GAAP Financial Measures

In addition to results calculated according to accounting principles generally accepted in the United States (“GAAP”), the Company has provided certain

information in this presentation which is not calculated according to GAAP (“non-GAAP”), such as adjusted EBITDA, free cash flow and normalized selling,

general and administrative expenses. Management uses these non-GAAP measures to evaluate operating performance and period-over-period performance of

our core business without regard to potential distortions, and believes that investors will likewise find these non-GAAP measures useful in evaluating the

Company’s performance. These measures are frequently used by security analysts, institutional investors and other interested parties in the evaluation of

companies in our industry.

Non-GAAP measures should not be considered in isolation or as a substitute for our reported results prepared in accordance with GAAP and, as calculated, may

not be comparable to similarly titled measures of other companies. For the definitions of these terms, further information about management’s use of these

measures as well as a reconciliation of these non-GAAP measures to the most comparable GAAP financial measures, please see the Appendix to this

presentation.

6NYSE: HRI

Q1 Key Takeaways

Our strategy is

driving strong top-

line growth

We are making

investments to

transform the

business

We are investing in

the activities to

support a stand-

alone public

company

We are affirming

our 2017 guidance

and are on track

with our five-year

business

transformation

We remain confident in our strategy

7

Financial Highlights – Q1 2017

8NYSE: HRI

1 Excluding impact of foreign currency translation.

2 Key markets are defined as markets we currently serve outside of upstream oil and gas markets, overall refers to all markets.

3 For a reconciliation to the most comparable GAAP financial measure, see the Appendix beginning on slide 24.

4 Herc Holdings does not provide forward-looking guidance for certain financial measures on a GAAP basis or a reconciliation of forward-looking non-GAAP

financial measures to the most directly comparable GAAP reported financial measures on a forward-looking basis because it is unable to predict certain items

contained in the GAAP measures without unreasonable efforts. Certain items that impact net income (loss) cannot be predicted with reasonable certainty,

such as restructuring and restructuring related charges, special tax items, borrowing levels (which affect interest expense), gains and losses from asset sales,

the ultimate outcome of pending litigation and spin-related costs

5 For a calculation of net fleet capital expenditures, see slide 21.

Equipment Rental Revenues $320.6 million

Equipment Rental Revenue Growth1

+ 8.5% in Key Markets2

85% of total

+ 3.8% YoY Overall2

Pricing

+ 1.7% YoY in Key Markets

+ 1.1% YoY Overall

Net Income (Loss) ($39.2) million

Adjusted EBITDA3

$97.8 million

25.1% margin

Affirmed 2017 Guidance4

Adjusted EBITDA: $550 to $590 million

Net Fleet Capital Expenditures5 : $275 to $325 million

Strategic Direction

Disciplined

Capital

Management

Expand and

Diversify

Revenues

Improve

Operating

Effectiveness

Enhance

Customer

Experience

On the Path Forward

• Broaden

customer base

• Expand

products and

services

• Increase

density

• Grow ancillary

revenues

• Focus on safety

and labor

productivity

• Improve vendor

management

and fleet

availability

• Drive operating

performance

through mix and

volume

• Provide

premium

products and

services

• Introduce

innovative

technology

solutions

• Drive EBITDA

margin growth

• Emphasize

fleet

management

• Improve key

financial

metrics

9NYSE: HRI

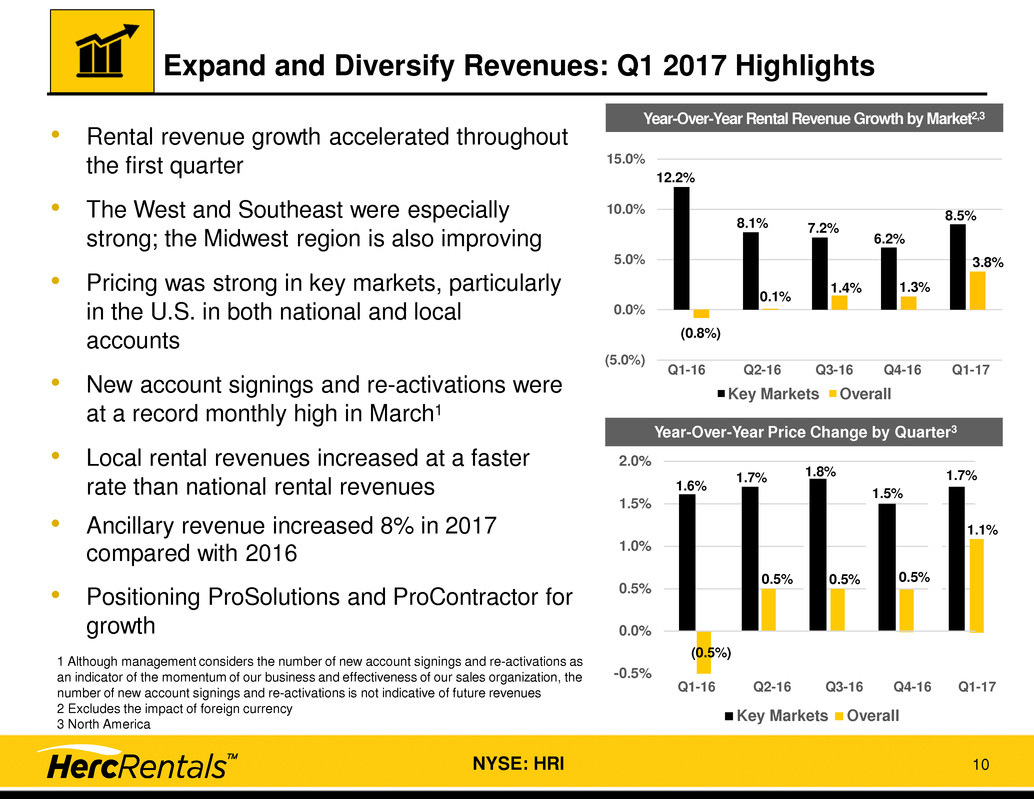

Expand and Diversify Revenues: Q1 2017 Highlights

• Rental revenue growth accelerated throughout

the first quarter

• The West and Southeast were especially

strong; the Midwest region is also improving

• Pricing was strong in key markets, particularly

in the U.S. in both national and local

accounts

• New account signings and re-activations were

at a record monthly high in March1

• Local rental revenues increased at a faster

rate than national rental revenues

• Ancillary revenue increased 8% in 2017

compared with 2016

• Positioning ProSolutions and ProContractor for

growth

-0.5%

0.0%

0.5%

1.0%

1.5%

2.0%

Key Markets Overall

Year-Over-Year Price Change by Quarter3

10NYSE: HRI

Year-Over-Year Rental Revenue Growth by Market2,3

(5.0%)

0.0%

5.0%

10.0%

15.0%

Key Markets Overall

12.2%

8.1% 7.2%

6.2%

8.5%

(0.8%)

0.1%

1.4% 1.3%

3.8%

Q1-16 Q2-16 Q3-16 Q4-16 Q1-17

1.6%

1.7% 1.8%

1.5%

1.7%

(0.5%)

0.5% 0.5% 0.5%

1.1%

Q1-16 Q2-16 Q3-16 Q4-16 Q1-17

1 Although management considers the number of new account signings and re-activations as

an indicator of the momentum of our business and effectiveness of our sales organization, the

number of new account signings and re-activations is not indicative of future revenues

2 Excludes the impact of foreign currency

3 North America

Improve Operating Effectiveness: Q1 2017 Highlights

• Safety performance continued to improve in the

first quarter compared with prior year – with the

YTD total recordable incident rate (TRIR) declining

approximately 14%

• Opened three greenfield locations

• Made additional investment in sales and

training programs for our sales and branch

operations teams

• Focused on improving branch efficiencies

through broader operating process applications

• Kept direct operating expense as a % of total

revenues in the first quarter flat compared with a

year ago

• FUR was 13.0% in March 2017 compared to 12.4%

in March 2016, primarily reflecting the timing of

seasonal equipment that came off rent in Canada

due to an early spring this year

11NYSE: HRI

Enhance Customer Experience: Q1 2017 Highlights

• New Customer Care and telesales initiatives

are paying off through increased sales and

new leads

• We are continuing to:

– Expand ProSolutions Centers of Excellence -

now in 32 locations

– Upgrade branches to showcase

ProContractor equipment

o 35 branch locations now updated

o More than 50% of targeted branches to

be completed by year-end

– Shift core OEC categories to premium

equipment with broader customer appeal

particularly to professional contractors

– Expand ProControl™ telematics to strategic

customers

• Introducing new e-Apply online credit

application

12NYSE: HRI

Industry Outlook Highlights

Positive market growth and further penetration of rental solutions expected to continue

1 The American Institute of Architects (AIA).

2 ARA / IHS Global Insight as of May 2017, excludes Party & Event data.

3 Dodge Analytics.

4 Industrial information resources.

($ in billions)

as of May 2017

N.A. Equipment Rental Market 2

Non-Residential Starts 3

Architecture Billings Index 1

Industrial Spending 4

$299.2

$306.4

2016 2017E

J

a

n

-9

6

J

a

n

-0

0

J

a

n

-0

4

J

a

n

-0

8

J

a

n

-1

2

J

a

n

-1

6

50

$235

$249

$272

$281

$

2016 2017E 2018E 2019E

($ in billions)

a$3s5 0 of April 2017

13NYSE: HRI

Mar

54.3

as of April 2017

($ in billions)

as of April 2017

• Key industry metrics

remain positive – non-

residential construction

growth of 4.6% projected

through 2019

• American Rental

Association (ARA)

forecasts North

American equipment

rental growth of 4.5%

through 2021

• Industrial spending is

expected to grow 2.4%

in 2017

• Continuing shift from

ownership to rental will

fuel growth

$38

$31 $32

$35

$38

$41

$44

$47 $49

$51 $53

$56 $59

$61

08 09 10 11 12 13 14 15 16 17E 18E 19E 20E 21E

Transformation in Process

Executing our strategy and driving

improvements in operating performance

Rebranding of U.S. locations is nearly 90%

complete

Successfully diversifying fleet mix to higher

dollar utilization equipment categories

Achieving above market growth in major urban

locations

Growing local rental revenues faster than

national accounts

Broadening Herc Rentals Operating Model to

improve branch efficiency

Reducing equipment, parts and service costs

through better vendor management

Enhancing customer service through key

initiatives such as premium brands and new

technologies

14NYSE: HRI

Financial Overview

15

Q1 Financial Summary

16NYSE: HRI

1 For a reconciliation to the most comparable GAAP financial measure, see the Appendix beginning on slide 24.

$ in millions, except EPS Three Months Ended March 31,

2017 2016

Equipment Rental Revenues $ 320.6 $ 307.8

Total Revenues 389.4 365.6

Net Income (Loss) (39.2) (1.5)

Diluted Earnings (Loss) Per Share (1.39) (0.05)

Adjusted EBITDA1 $ 97.8 $ 107.8

Q1 Equipment Rental Revenues

$ in millions

• Overall equipment rental revenues increased

4.2%

• Equipment rental revenue increased

+8.5% in key markets, excluding

currency

• Key markets represented 85% of rental

revenue

− Traction of urban market strategy

• Key markets increase attributable to:

– Strong growth in the West and

Southeast

– ProSolutions growth year-over- year

• Pricing increased 1.7% YoY in key markets

and 1.1% overall

Q1 Equipment Rental Revenue Bridge Q1 Summary

17NYSE: HRI

$ 320.6

$9.6$1.0

$21.4

$307.8

150

170

190

210

230

250

270

290

310

330

350

2016 Currency translation Key markets Oil and gas 2017

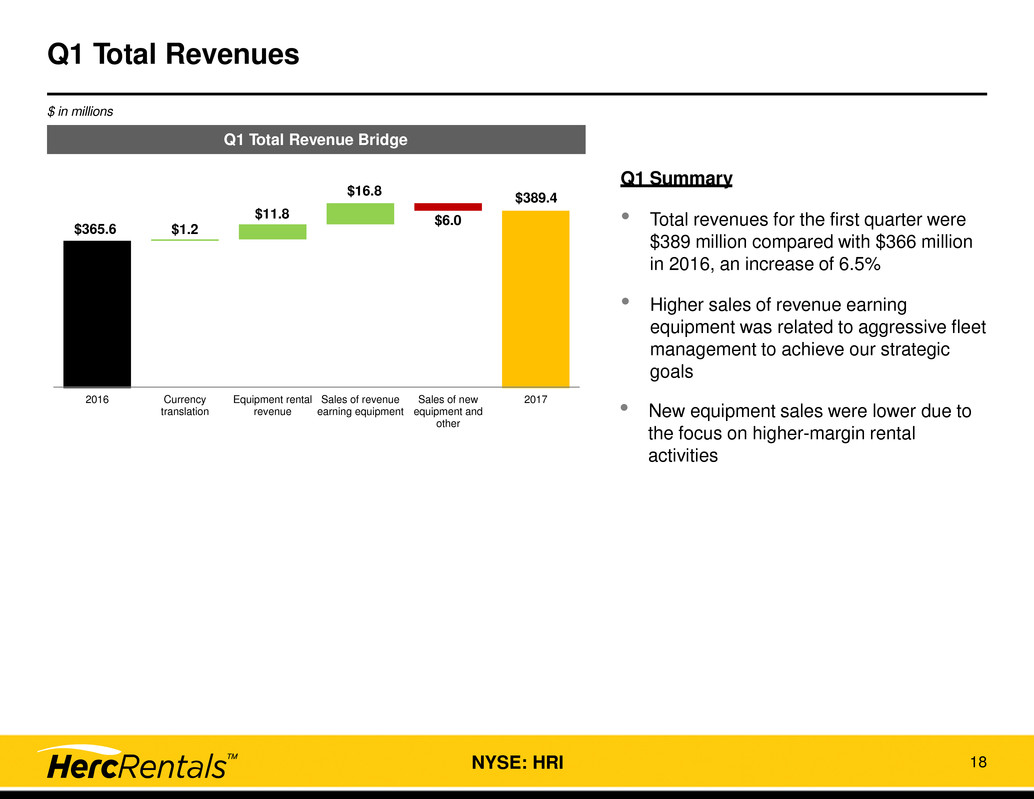

• Total revenues for the first quarter were

$389 million compared with $366 million

in 2016, an increase of 6.5%

• Higher sales of revenue earning

equipment was related to aggressive fleet

management to achieve our strategic

goals

• New equipment sales were lower due to

the focus on higher-margin rental

activities

Q1 Total Revenue Bridge

$ in millions

Q1 Summary

Q1 Total Revenues

18NYSE: HRI

$389.4

$6.0$11.8

$365.6 $1.2

$16.8

250

270

290

310

330

350

370

390

410

430

2016 Currency

translation

Equipment rental

revenue

Sales of revenue

earning equipment

Sales of new

equipment and

other

2017

$ in millions

• Interest expense reflects debt on a stand-

alone basis and includes $5.8 million

related to the cost of the redemption of

10% of the senior notes in the first quarter

• All Other includes the impact of increases

in SG&A and DOE as well as declines in oil

and gas contribution

• Fleet depreciation increased due to

fleet growth and carry over effect of

normal course rate adjustments made

in 2016

Q1 Summary

Q1 Net Income

Q1 Net Income Bridge

19NYSE: HRI

1 Excludes the impact of currency translation.

$(39.2)

$0.2

$31.3

$10.8

$12.1

$15.1

$1.6

($1.5)

(45)

(35)

(25)

(15)

(5)

5

15

25

2016 Currency

Translation

Income tax

benefit

Spin-off costs Interest

expense

Depreciation

of REE

All Other 2017

1

11

0

20

40

60

100

140

$ in millions

Q1 Adjusted EBITDA Bridge

Q1 Adjusted EBITDA1

• The improvement in the results of the

sales of revenue earning equipment

and key markets added positively to

adjusted EBITDA in the quarter

• Upstream oil and gas results were

impacted by continued headwinds

resulting in lower adjusted EBITDA

compared with 2016

• Business transformation costs totaled

$4.2 million

• Stand-alone public company costs

increased $5.5 million in the quarter

compared with 2016

• Professional fees related to year-end

reporting drove $4 million of additional

costs

• $2.3 million charge related to the

bankruptcy filing of a large customer

was recorded in the quarter

1 For a reconciliation to the most comparable GAAP financial measure, see the Appendix beginning on slide 24.

20NYSE: HRI

$97.8$5.5

$4.0 $2.3 $4.2 $5.6

$0.2

$7.4

$4.0$107.8

0

20

40

60

80

100

120

140

2016 Currency

translation

Loss on sales

of revenue

earning

equipment

Stand-alone

costs

Year-end

reporting

Customer

bankruptcy

Business

transformation

costs

Key

markets

Oil and gas 2017

Q1 SG&A was approximately $75 million, excluding

year-end reporting costs and the customer bankruptcy

charge1.

Q1 Summary

NYSE: HRI 21

1 Cash Flow Basis

2 Based on ARA guidelines.

Fleet Capital Expenditures

• Cash expenditures for revenue earning equipment were $56.2 million as we continued

to make progress in shifting fleet into high dollar utilization categories

• Cash proceeds from disposals was $44.7 million, resulting in net fleet capital expenditures of

$11.5 million

• Rental equipment at OEC 2 remained unchanged from year-end at $3.56 billion

• Average rental equipment at OEC2 for the quarter ended March 31, 2017, grew 5.3% versus

the prior year’s first quarter

$ in millions Three Months Ended March 31,

2017 2016 $ Variance

Total Revenue Earning Equipment Expenditures $ 56.2 $ 36.7 $ 19.5

Revenue Earning Equipment Disposals $ (44.7) $ (41.7) $ (3.0)

Net Fleet Capital Expenditures 1 $ 11.5 $ (5.0) $ 16.5

NYSE: HRI 22

Debt and Liquidity

Debt Ample Liquidity

$ in millions, as of 03/31/17

ABL Credit

Facility

$978.8

Senior Secured

Second Priority Notes

$549.0 $562.5

'17 '18 '19 '20 '21 '22 '23 '24

• Stable debt with long dated maturities provide financial flexibility

Total long-term debt of $2.2 billion as of March 31, 2017

• Utilizing borrowings under our ABL Credit Facility, we redeemed 10% or $123.5 million of the

outstanding senior notes and recorded a $5.8 million loss on the early extinguishment of debt

• Maintained ample liquidity during the quarter with $773 million as of March 31, 2017

• Net cash from operating activities totaled $86.2 million with free cash flow1 for the first quarter of $59

million positively impacted by changes in working capital

Capital

Leases

$66.5

1 For a reconciliation to the most comparable GAAP financial measure, see the Appendix beginning on slide 24.

Total Liquidity $ 772.6

Cash and Cash Equivalents

ABLAvailability

24.3

748.3

Facility

Outstanding

Letters of Credit

1,750.0

(978.8)

(22.9)

NYSE: HRI 23

Our strategy is

driving strong top-

line growth

We are making

investments to

transform the

business

We are investing in

the activities to

support a stand-

alone public

company

We are affirming

our 2017 guidance

and are on track

with our five-year

business

transformation

We remain confident in our strategy

Q1 Key Takeaways

NYSE: HRI 24

Appendix

24

25NYSE: HRI

1 OEC: Original Equipment Cost which is an operating measure based on the guidelines of the American Rental

Association, which is calculated as the cost of the asset at the time it was first purchased plus additional capitalized

refurbishment costs (with the basis of refurbished assets reset at the refurbishment date).

2

Fleet Age: The OEC weighted age of the entire fleet.

Net Fleet Capital Expenditures: Capital expenditures of revenue earning equipment minus the proceeds from

disposal of revenue earning equipment.

3

Dollar Utilization ($ Ute): Dollar utilization is an operating measure calculated by dividing rental revenue by the

average OEC of the equipment fleet for the relevant time period.

4

Pricing: Change in pure pricing achieved in one period versus another period. This is applied both to year-over-year

and sequential comparisons. Rental rates are calculated based on the category class rate variance achieved either

year-over-year or sequentially for any fleet that qualifies for the fleet base and weighted by the prior year revenue mix.

5

FUR: Fleet unavailable for rent.

6

Glossary of Terms Commonly Used in the Industry

26NYSE: HRI

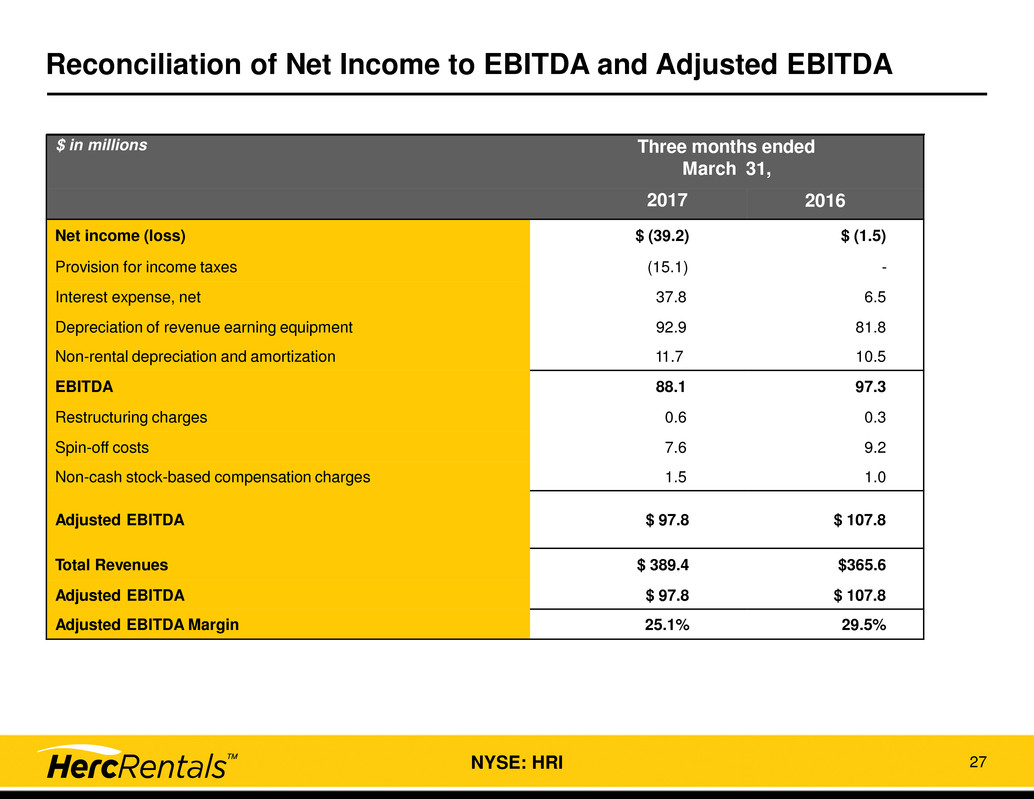

Reconciliation of Net Income to EBITDA and Adjusted EBITDA

EBITDA and Adjusted EBITDA are not recognized terms under GAAP and should not be

considered in isolation or as a substitute for our reported results prepared in accordance with GAAP.

Further, since all companies do not use identical calculations, our definition and presentation of

these measures may not be comparable to similarly titled measures reported by other companies.

EBITDA and Adjusted EBITDA - EBITDA represents the sum of net income (loss), provision for

income taxes, interest expense, net, depreciation of revenue earning equipment and non-rental

depreciation and amortization. Adjusted EBITDA represents EBITDA plus the sum of merger and

acquisition related costs, restructuring and restructuring related charges, spin-off costs, non-cash

stock based compensation charges, loss on extinguishment of debt (which is included in interest

expense, net), impairment charges, gain on disposal of a business and certain other items.

Management uses EBITDA and Adjusted EBITDA to evaluate operating performance and period-over-

period performance of our core business without regard to potential distortions, and believes that

investors will likewise find these non- GAAP measures useful in evaluating the Company’s

performance. These measures are frequently used by security analysts, institutional investors and

other interested parties in the evaluation of companies in our industry. However, EBITDA and Adjusted

EBITDA do not purport to be alternatives to net earnings as an indicator of operating performance.

Additionally, neither measure purports to be an alternative to cash flows from operating activities as a

measure of liquidity, as they do not consider certain cash requirements such as interest payments and

tax payments.

27NYSE: HRI

Reconciliation of Net Income to EBITDA and Adjusted EBITDA

$ in millions Three months ended

March 31,

2017 2016

Net income (loss) $ (39.2) $ (1.5)

Provision for income taxes (15.1) -

Interest expense, net 37.8 6.5

Depreciation of revenue earning equipment 92.9 81.8

Non-rental depreciation and amortization 11.7 10.5

EBITDA 88.1 97.3

Restructuring charges 0.6 0.3

Spin-off costs 7.6 9.2

Non-cash stock-based compensation charges 1.5 1.0

Adjusted EBITDA $ 97.8 $ 107.8

Total Revenues $ 389.4 $365.6

Adjusted EBITDA $ 97.8 $ 107.8

Adjusted EBITDA Margin 25.1% 29.5%

28NYSE: HRI

Reconciliation of Free Cash Flow

Free cash flow is not a recognized term under GAAP and should not be considered in isolation or

as a substitute for our reported results prepared in accordance with GAAP. Further, since all

companies do not use identical calculations, our definition and presentation of this measure may

not be comparable to similarly titled measures reported by other companies.

Free cash flow represents net cash provided by (used in) operating activities less revenue

earning equipment expenditures, proceeds from disposal of revenue earning equipment, property

and equipment expenditures, proceeds from disposal of property and equipment and other

investing activities. Free cash flow is used by management in analyzing the Company’s ability to

service and repay its debt and to forecast future periods. However, this measure does not

represent funds available for investment or other discretionary uses since it does not deduct cash

used to service debt or for other non-discretionary expenditures.

29NYSE: HRI

Reconciliation of Free Cash Flow

$ in millions Three Months Ended March 31,

2017 2016

Net cash provided by operating activities $ 86.2 $102.6

Revenue earning equipment expenditures ( (56.2) (36.7)

Proceeds from disposal of revenue earning equipment 44.7 41.7

Property and equipment expenditures (17.9) (4.7)

Proceeds from disposal of property and equipment 0.5 1.2

Other investing activities 1.4 2.9

Free Cash Flow $ 58.7 $107.0

30NYSE: HRI

Normalized Selling, General and Administrative Expenses

$ in millions Three Months Ended

March 31, 2017

Selling, general and administrative expenses $ 81.2

Less: Year-end reporting expenses (4.0)

Customer bankruptcy (2.3)

Normalized selling, general and administrative expenses $ 74.9

Normalized selling, general and administrative expenses is not a recognized term under GAAP

and should not be considered in isolation or as a substitute for our reported results prepared in

accordance with GAAP. Management uses normalized selling, general and administrative

expenses to evaluate operating performance and predict future performance without regard to

potential distortions, and believes that investors will likewise find this non-GAAP measure useful in

evaluating and predicting the Company’s performance.

Diversifying the Fleet to Maximize Dollar Utilization

31NYSE: HRI

Aerial - Booms

19.3%

Aerial -

Scissors &

Other

6.4%

Earthmoving -

Heavy

10.7%

Earthmoving -

Compact

7.5%Material Handling-

Telehandlers

13.5%

Material

Handling -

Industrial

3.2%

Trucks and

Trailers

12.9%

ProSolutions

13.4%

ProContractor

4.7%

Air Compressors

3.0%

Other

2.0%

Lighting

1.7% Compaction

1.7% Aerial -

Booms

19.1%

Aerial -

Scissors &

Other

6.8%

Earthmoving -

Heavy

10.1%

Earthmoving -

Compact

7.4%Material Handling-

Telehandlers

12.8%

Material

Handling -

Industrial

4.0%

Trucks and

Trailers

12.6%

ProSolutions

13.5%

ProContractor

5.2%

Air Compressors

3.0%

Other

2.0%

Lighting

1.8% Compaction

1.7%

OEC as of 12/31/2016 OEC as of 3/31/2017

Increased

• Aerial – Scissor Lifts

• Material Handling - Industrial

• ProContractorTM and ProSolutionsTM

Reduced

• Aerial – Booms

• Earthmoving - Heavy

• Material Handling - Telehandlers

32NYSE: HRI