Attached files

Confidential Materials omitted and filed separately with the

Securities and Exchange Commission. Double asterisks denote omissions.

OFFICE LEASE

PAPAGO BUTTES CORPORATE, LLC, a Delaware limited liability company (“Landlord”), hereby leases the Premises described below, for the Term and on the terms and conditions set forth in this Lease, to THE ENDURANCE INTERNATIONAL GROUP, INC., a Delaware corporation (“Tenant”).

1.SUMMARY OF BASIC TERMS

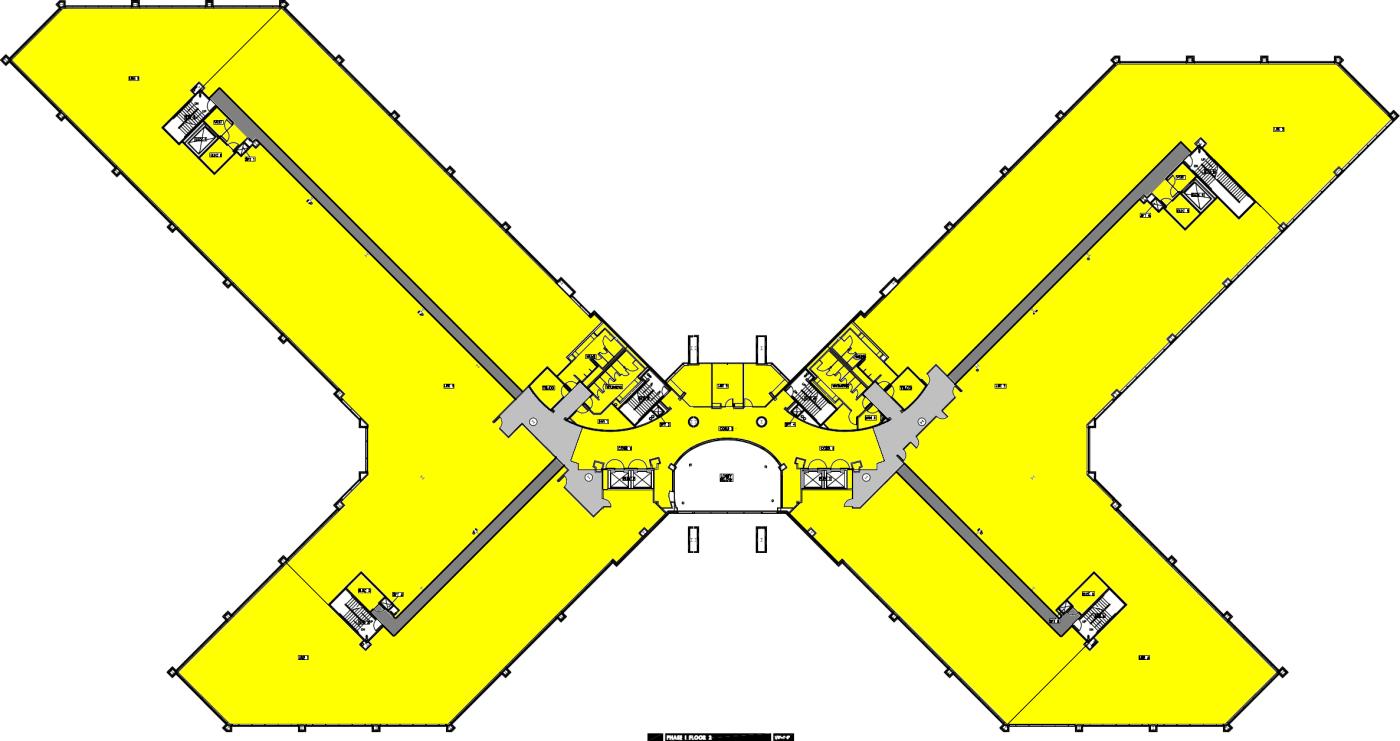

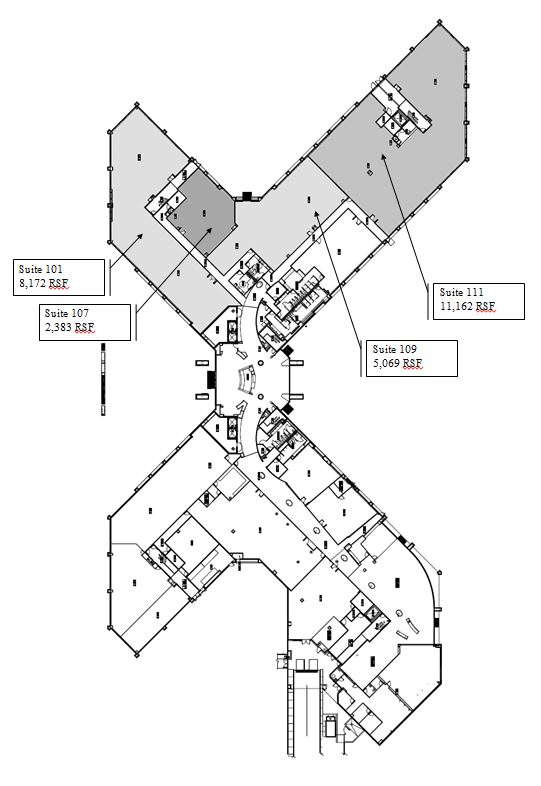

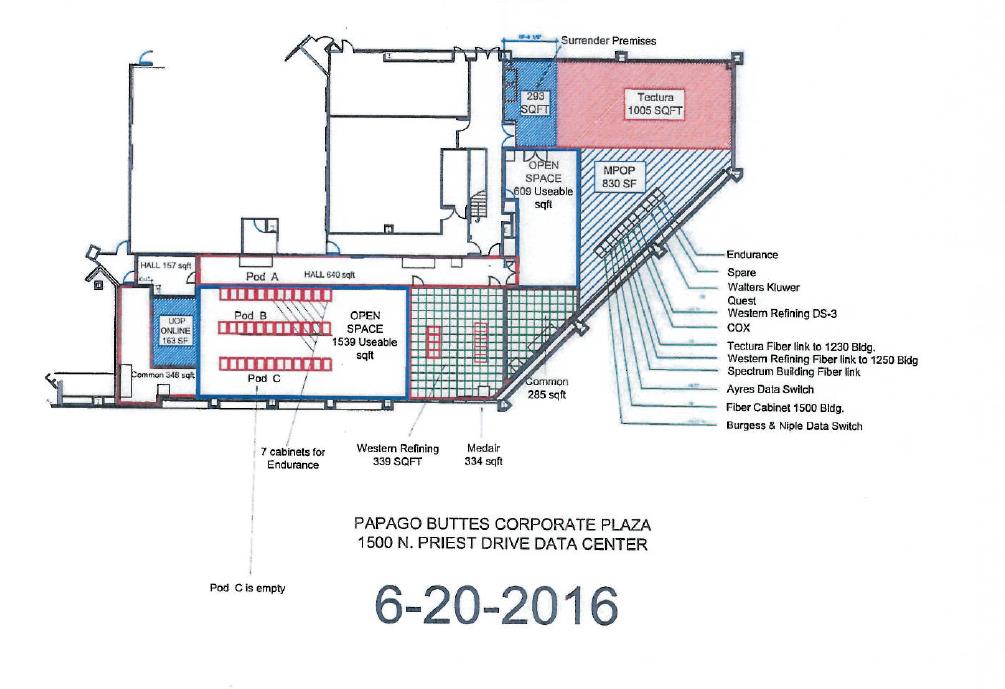

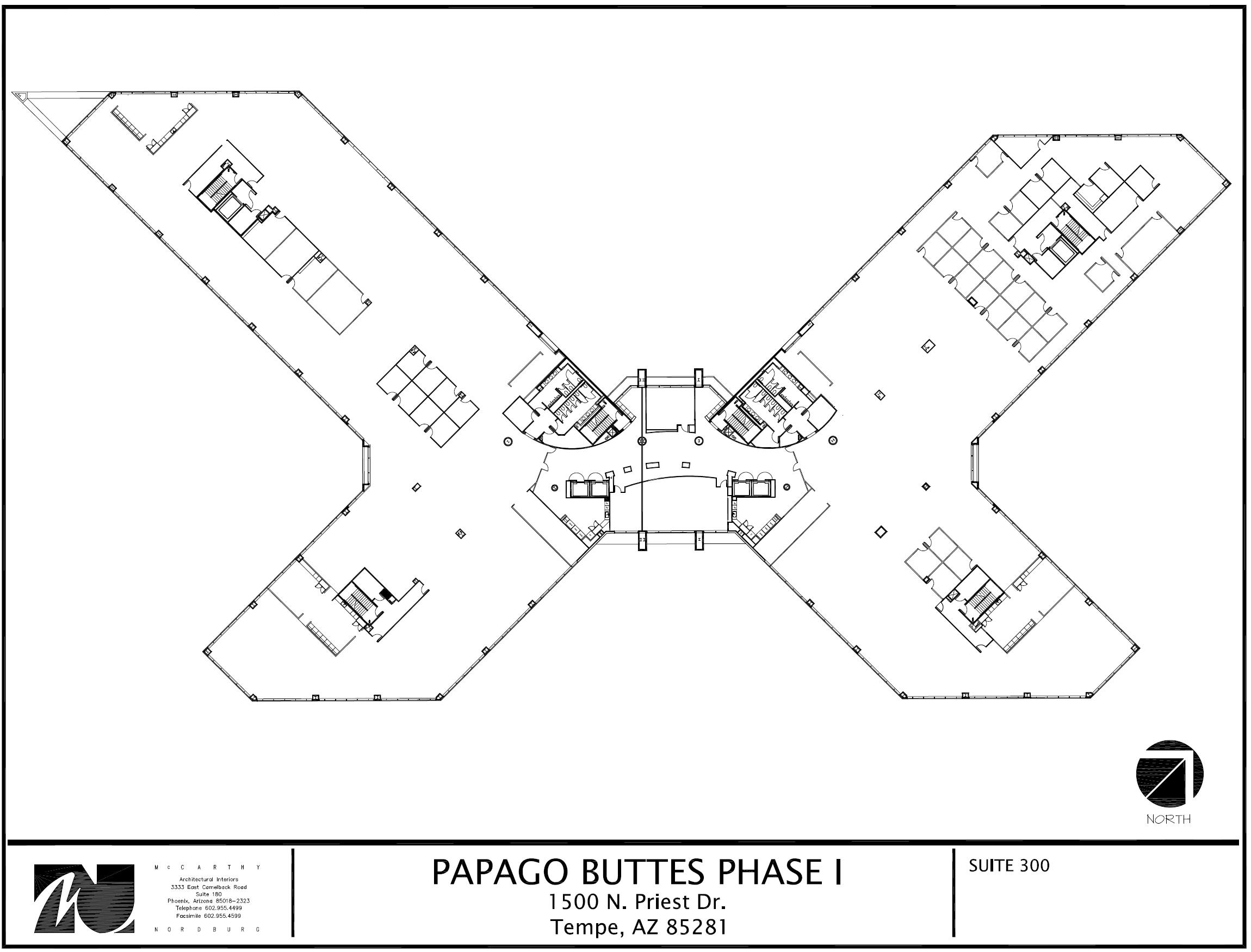

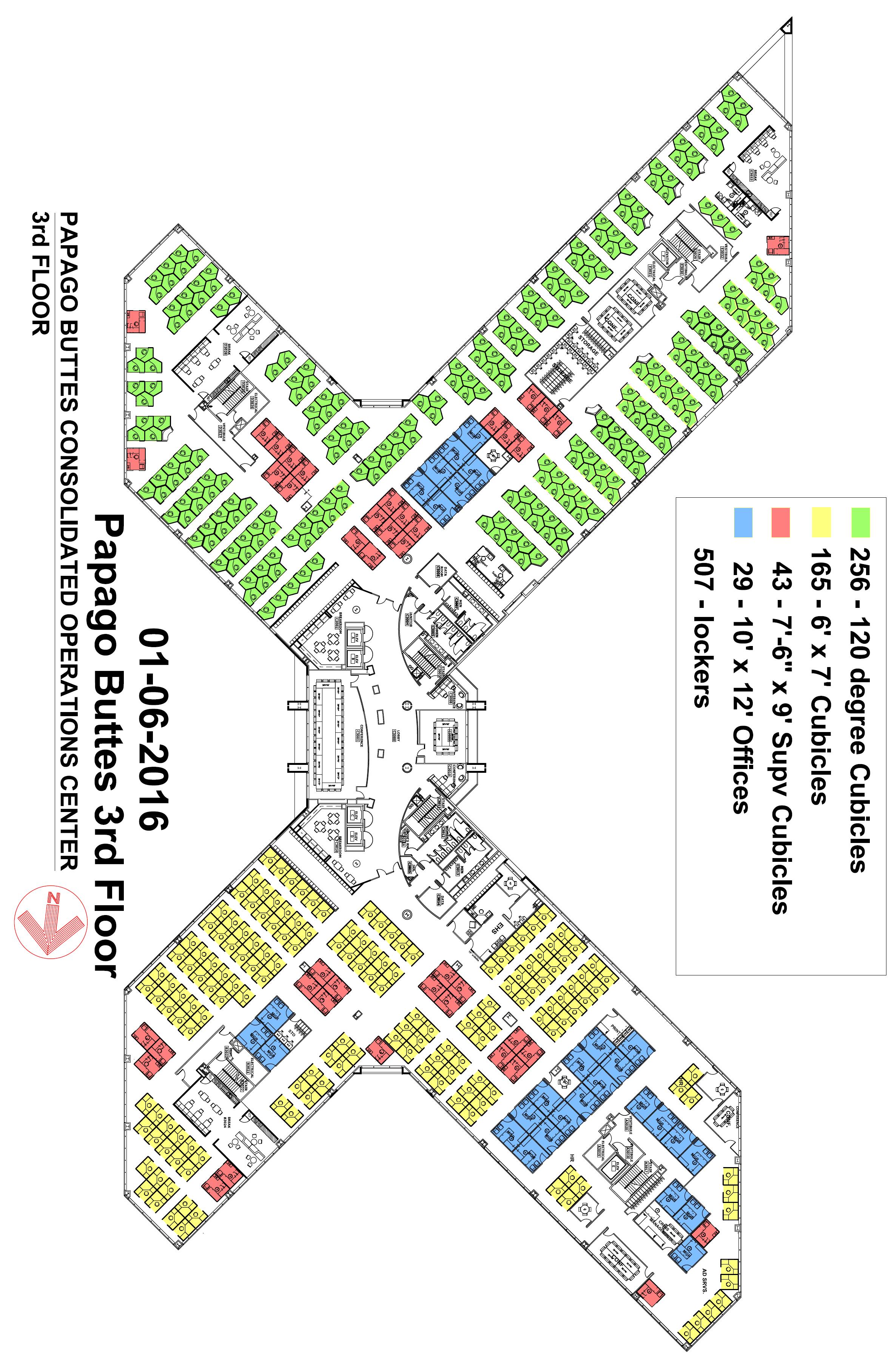

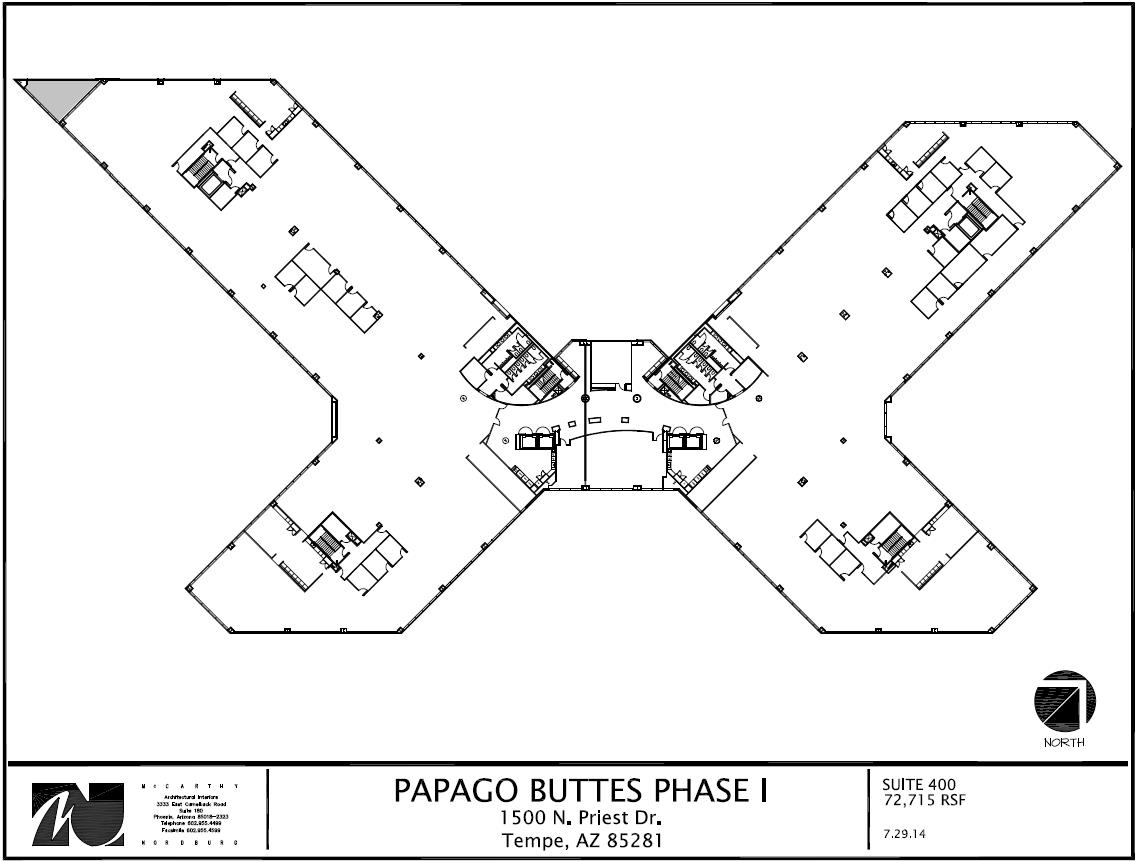

1.1 The Premises: Suite 200 in the Building, consisting of approximately 67,275 square feet of Rentable Area as illustrated on the attached Exhibit A, together with the space described in Section 32 below.

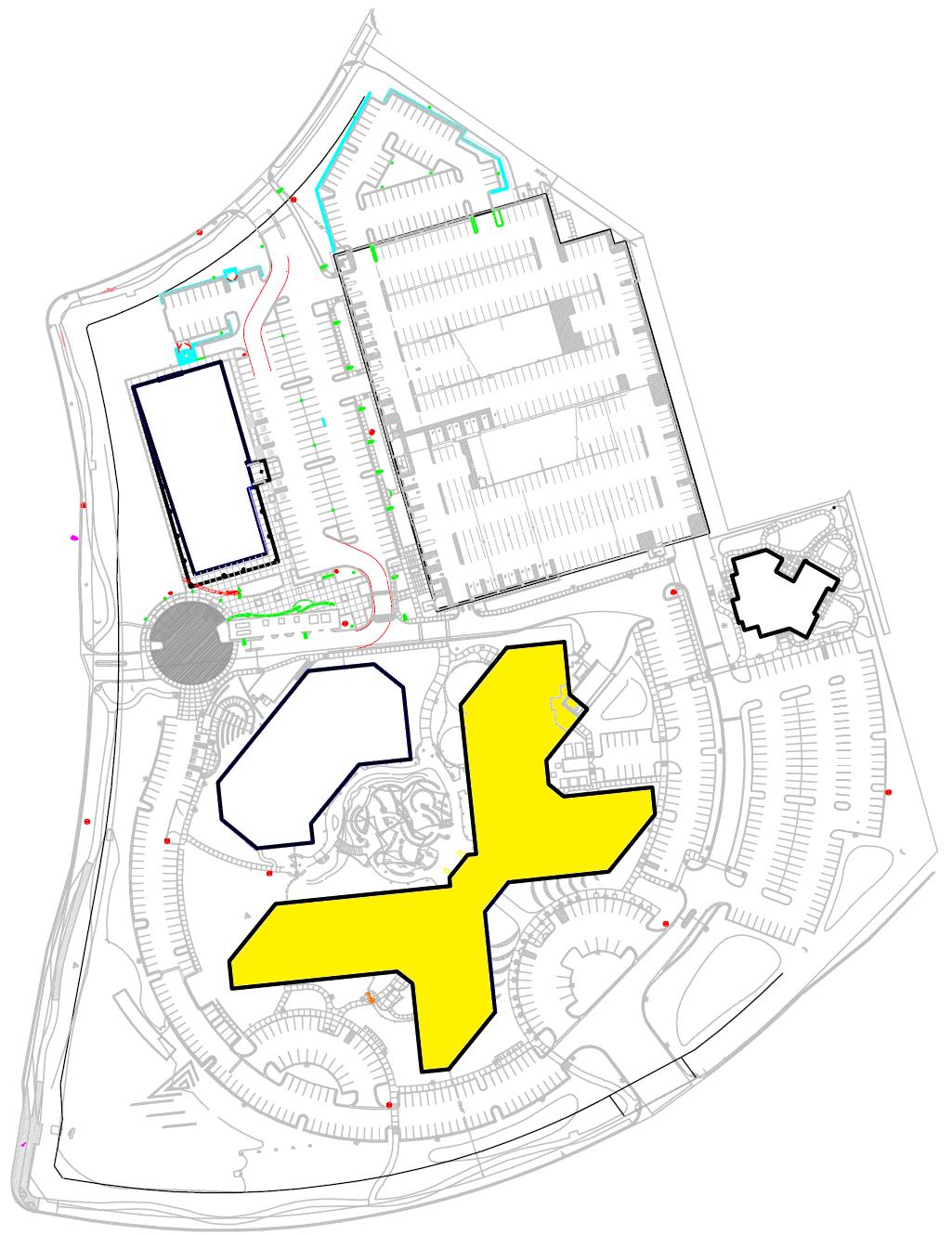

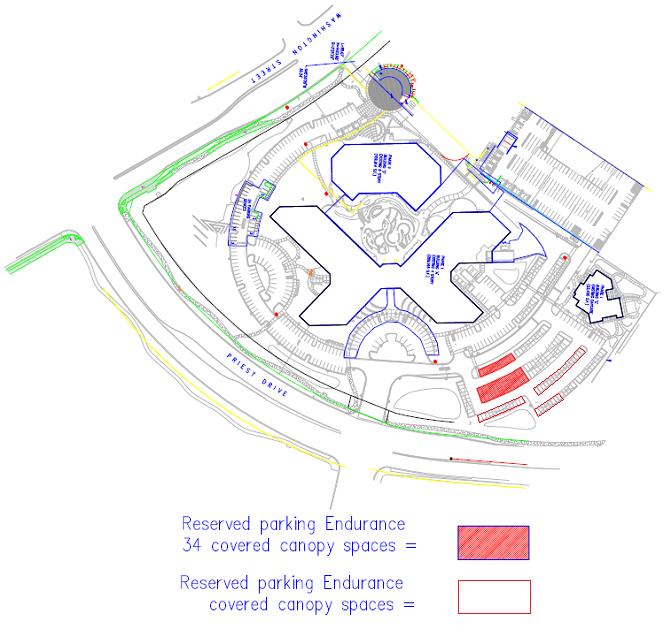

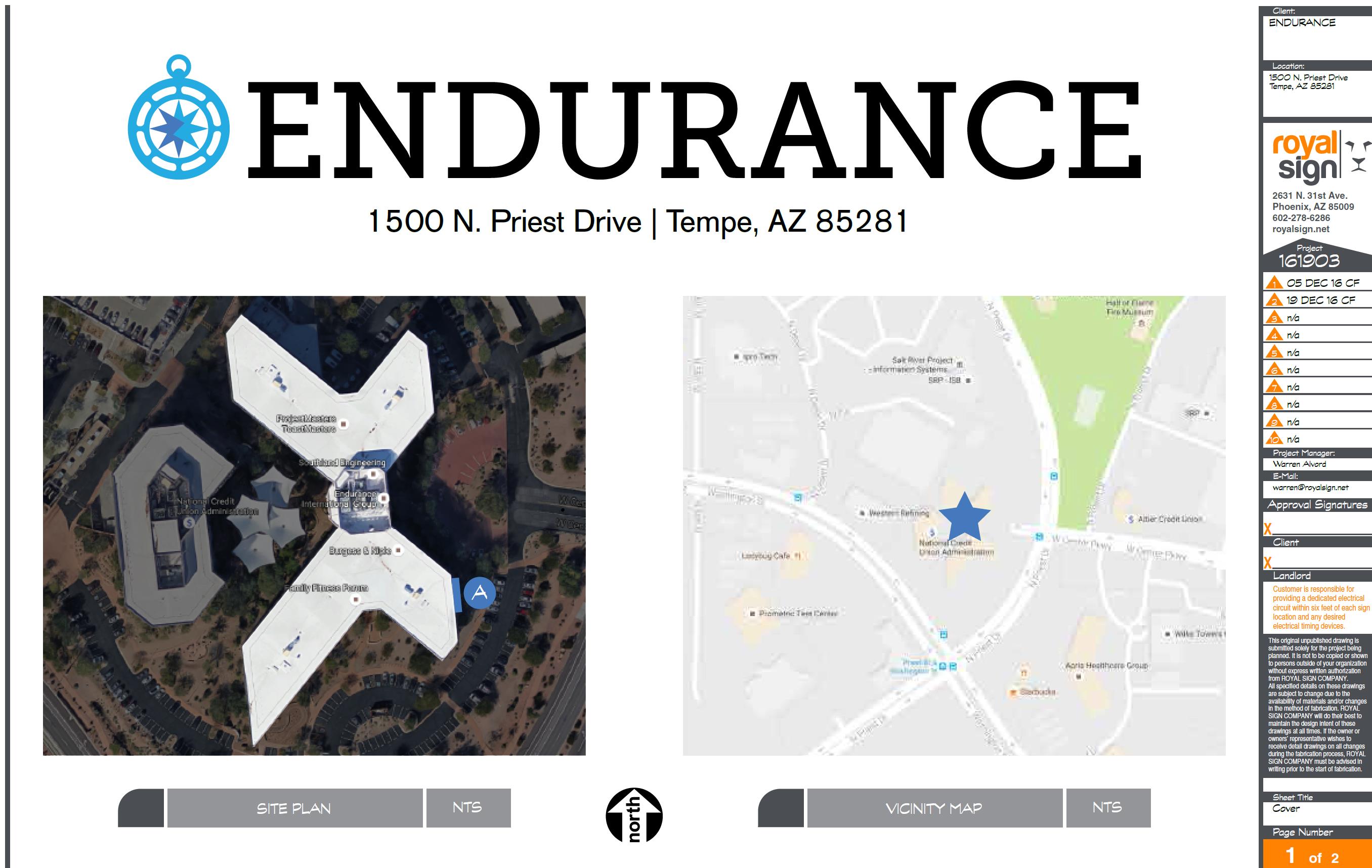

1.2 The Building: The building, associated parking facilities, landscaping and other improvements, located at 1500 N. Priest Drive, Tempe, Arizona (“the Building”). A site plan for the Building is attached as Exhibit B. The Building is part of an office complex (the “Project”), known as Papago Buttes Corporate Plaza, that also includes the buildings located at 1230 W. Washington Street, 1250 West Washington Street, and 1520 North Priest Drive, Tempe, Arizona. The Project consists of approximately 511,081 rentable square feet. Any reference in this Lease to “the Complex” shall mean the Project.

1.3 The Term: Ten (10) years and five (5) months, beginning on the Commencement Date, and provided that the Commencement Date has actually occurred as provided in section 2.6.

1.4 Scheduled Commencement Date: June 1, 2016, subject to the provisions of Section 2.1, 2.3, 2.6 and Exhibit C.

1.5 Base Rent:

doc89805

Period | Base Rent Per Rentable Sq.Ft. | Annual Base Rent | Monthly Base Rent Payment | ||||||

June 1, 2016 – October 31, 2016 | $0.00 | $0.00 | $.00 | ||||||

November 1, 2016 – October 31, 2017 | $25.00 | $1,681,875.00 | $140,156.25 | ||||||

November 1, 2017 – October 31, 2018 | $25.50 | $1,715,512.50 | $142,959.38 | ||||||

November 1, 2018 – October 31, 2019 | $26.00 | $1,749,150.00 | $145,762.50 | ||||||

November 1, 2019 – October 31, 2020 | $26.50 | $1,782,787.50 | $148,565.63 | ||||||

November 1, 2020 – October 31, 2021 | $27.00 | $1,816,425.00 | $151,368.75 | ||||||

November 1, 2021 – October 31, 2022 | $27.50 | $1,850,062.50 | $154,171.88 | ||||||

November 1, 2022 – October 31, 2023 | $28.00 | $1,883,700.00 | $156,975.00 | ||||||

November 1, 2023 – October 31, 2024 | $28.50 | $1,917,337.50 | $159,778.13 | ||||||

November 1, 2024 – October 31, 2025 | $29.00 | $1,950,975.00 | $162,581.25 | ||||||

November 1, 2025 – October 31, 2026 | $29.50 | $1,984,612.50 | $165,384.38 | ||||||

1.6 Tenant’s Proportionate Share: 13.16%, consisting of the proportion that the Rentable Area of the Premises (67,275 RSF) bears to the Rentable Area of the Project (511,081 RSF). Landlord reserves the right to adjust Tenant’s Proportionate Share during the Lease Term as a result of any changes in the Rentable Area of the Project arising from alterations to the size of improvements at the Project.

1.7 Base Year: 2016

1.8 Security Deposit: None

1.9 Names of Guarantors: None

1.10 Description of Tenant’s Business: Administrative offices, including a call center.

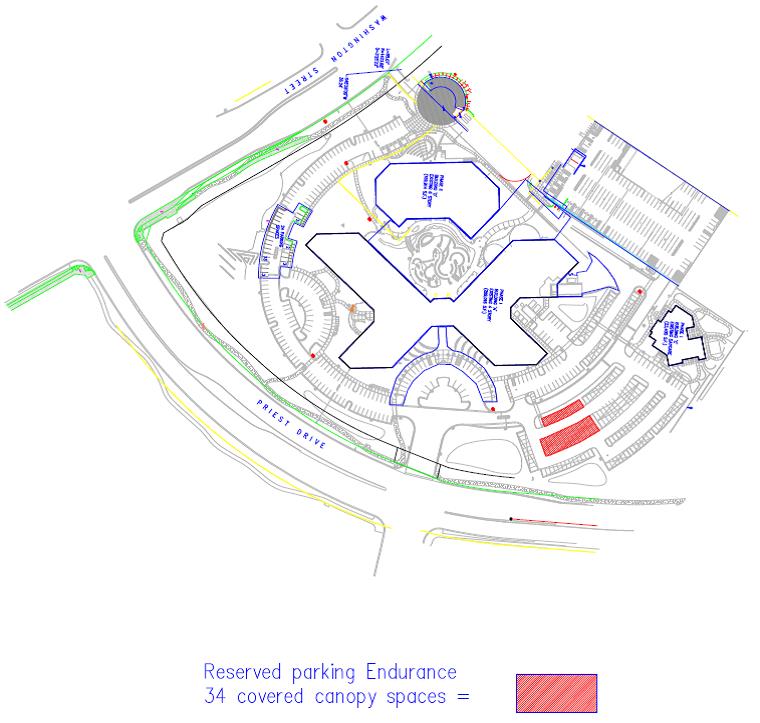

1.11 Parking Spaces: Thirty-Four (34) covered reserved canopy spaces (0.50 / 1000 RSF), at a rate of $45.00 per month, per space, plus applicable rental tax, Two Hundred Thirty-Six (236) covered unreserved canopy spaces (3.50 / 1000 RSF), at a rate of $35.00, per month, per space, plus applicable rental tax and 134 uncovered unreserved surface spaces and/or garage rooftop spaces (2.0 / 100 RSF) at a rate of $0.00, per month per space plus applicable rental tax. All charges for covered reserved and covered unreserved parking shall increase by $10.00 per month per space beginning on November 1, 2021 through the scheduled expiration date of the Lease Term. All parking charges shall be abated during the five months of June 2016 through October 2016.

1.12 Tenant Improvement Allowance: $807,300.00 ($12.00 per RSF) available in two installments of $470,925.00 ($7.00 per RSF) on or after June 1, 2017, and $336,375 ($5.00

2

per RSF) on or after June 1, 2019, per the terms and conditions further described per the Construction Provisions described in Exhibit C.

1.13 Tenant’s Notice Address:

The Endurance International Group, Inc.

10 Corporate Drive, Suite 300

Burlington, Massachusetts 01803

Attention: Mr. Ryan Buckley

1.14 Landlord’s Notice Address:

Papago Buttes Corporate, LLC

c/o Metro Commercial Properties

1500 North Priest Drive, Suite 132

Tempe, Arizona 85281

Attention: Marty J. Brook, CPM®

1500 North Priest Drive, Suite 132

Tempe, Arizona 85281

Attention: Marty J. Brook, CPM®

Vice President, Property Management Division

1.15 Tenant’s Designated Broker: Keith Lammersen and John Pierson of Jones Lang LaSalle Americas.

1.16 Landlord’s Designated Broker: Chris Walker and Mike Beall of Cassidy Turley; Tony Hepner and Janet Herlyck of Metro Commercial Properties.

2. DELIVERY, TERM AND CONSTRUCTION

2.1 Condition. Exhibit C sets forth the respective obligations of Landlord and Tenant with respect to the design and construction of Tenant Improvements for the Premises. Landlord shall have no obligation to make any improvements or alterations to the Premises except as provided in Exhibit C. Landlord may make changes in the size, configuration and design of the Building and the Project without Tenant’s consent so long as (a) the floor location size and utility of the Premises are not materially and adversely affected and (b) the changes do not affect the number of Tenant’s parking spaces. It is understood, acknowledged and agreed that Landlord intends to add an additional office building(s) and/or parking facilities at the Project, which may result in the relocation of parking spaces assigned to Tenant. The number of spaces available will not be affected.

3

However, Landlord reserves the right to substitute canopy and garage spaces interchangeably, which is expressly agreed to be acceptable.

2.2 Term. The Term of this Lease, and the Scheduled Commencement Date of the Term, are set forth in Sections 1.3 and 1.4. The Commencement Date shall be the date that Landlord delivers actual possession of the Premises to Tenant under this Lease with the work for which Landlord is responsible under Exhibit C (if any) substantially complete, provided that Tenant actually takes possession of the Premises under the terms of this Lease and the Lease Term has commenced, as limited by section 2.6. If Tenant does not take possession of the Premises under the provisions of this Lease, there shall be no Commencement Date and no Lease Term, but Landlord shall then have and retain its remedies as provided in sections 2.6, 2.7 and 19.2. “Substantially complete” or “substantial completion” means when Landlord completes construction of the work on the Premises in accordance with the Plans, with the exception of any punchlist items and any Tenant fixtures, work-stations, built-in furniture, or equipment to be installed by Tenant.

2.3 Delayed Delivery. If delivery of possession of the Premises to Tenant is delayed because of a delay in the completion of construction of the Tenant Improvements, because of a failure of an existing tenant to surrender possession of the Premises to Landlord, or for any other reason, then this Lease shall remain in full force and effect, and Landlord shall not be liable to Tenant for any damage occasioned by such delay. Notwithstanding the foregoing, if delivery of possession is delayed so that the Commencement Date is more than 180 days after the Scheduled Commencement Date as set forth in Section 1.4, excluding failure by Tenant to satisfy any of the conditions precedent to Commencement of the Term as described in section 32, then Tenant, by written notice to Landlord, may terminate this Lease prior to taking possession, and upon such termination both Landlord and Tenant shall be released from all further obligations hereunder.

2.4 Memorandum. At the request of either party at any time following initial occupancy of the Premises by Tenant, Landlord and Tenant shall execute a written memorandum reflecting the date of initial occupancy and confirming the Commencement Date, the Expiration Date, and the Rentable Area of the Premises.

2.5 Area Measurement. “Rentable Area” means rentable area measured in accordance with American National Standard Z65.1-1996, as published by BOMA International, as such may be amended (“BOMA Standards”), which is 67,275 square feet.

4

2.6 Failure of Conditions Precedent to Commencement Date. As provided in section 33 hereof, there are events which may occur under which the Landlord will not be required to allow Tenant possession of the Premises on the Commencement Date [“possession” specifically defined herein to exclude prior occupancy at the Project as a sublessee during the term of the U of P Lease further defined in section 32]. In that case, these shall be no Commencement Date, as defined in section 2.2, and no commencement of the Lease Term, but Tenant shall remain responsible for any costs, fees, charges, expenditures, losses or damages incurred by Landlord arising from or related to this Lease, including any costs of modification of the Premises, the Building or the Project, any costs of administering this Lease, and all brokerage commissions and attorney’s fees paid in connection with this Lease.

2.7. Effectiveness of Lease. The parties specifically understand and agree that for the reasons set forth in section 33, the Landlord may not under certain circumstances be required to allow possession of the Premises under this Lease as of Commencement Date. However, if that occurs and there is no Commencement Date, this Lease shall nonetheless remain in effect for purposes of the Landlord being allowed to pursue its remedies under sections 2.6 and 19.2 and recover all of the amounts set forth in either of those sections. The provisions of this section 2.7 are an integral part of the consideration of this Lease for Landlord, without which it would not have entered into this Lease.

3. USE OF PREMISES

3.1 Permitted Uses. Tenant may use and occupy the Premises for the purposes set forth in Section 1.10 and for no other purpose whatsoever without Landlord’s prior written consent.

3.2 Insurance Restrictions. Tenant shall not engage in any practice or conduct that would cause the cancellation of any insurance policies related to the Project. Tenant shall reimburse Landlord for any increases in insurance premiums paid by Landlord directly related to the nature of Tenant’s use of the Premises or the nature of Tenant’s business.

3.3 Prohibitions. Tenant shall not cause or maintain any nuisance in or about the Premises and shall keep the Premises free of debris, rodents, vermin and anything of a dangerous, noxious or offensive nature or which would create a fire hazard (through undue load on electrical circuits or otherwise) or undue vibration, noise or heat. Tenant shall not cause the safe floor loading

5

capacity of the Premises to be exceeded, which safe floor loading capacity is 100 pounds per square foot. Tenant shall not disturb or interfere with the quiet enjoyment of the premises of any other tenant. Furthermore, during the entire Term of this Lease and any extensions thereof, Tenant shall not use the Premises as a retail banking or credit union office, or for any use that violates a use restriction in favor of any other tenant that exists at the time of the Commencement Date.

3.4 Rules and Regulations. Tenant shall comply and shall cause its employees to comply with the Rules and Regulations and Parking Rules and Regulations for the Project. The current Rules and Regulations and Parking Rules and Regulations are attached as Exhibit D and Exhibit D-1, respectively. Landlord from time to time by notice to Tenant may amend the rules and regulations and establish other reasonable non-discriminatory rules and regulations for the Project.

3.5 Compliance with Environmental Laws. Tenant shall:

(a) comply with all federal, state and local laws, rules, orders, or regulations pertaining to health or the environment (“Environmental Laws”), including, without limitation, the Comprehensive Environmental Response, Compensation, and Liability Act of 1980, as amended (“CERCLA”) and the Resource Conservation and Recovery Act of 1987, as amended (“RCRA”);

(b) not dispose of or permit or acquiesce in the disposal of any waste products (including, but not limited to, paints, solvents, or paint thinners) on, under or around the Premises or the Project, other than in compliance with applicable law;

(c) not keep, store, or use within the Premises any substances regulated under any Environmental Law, except small quantities that are reasonably necessary for Tenant’s business and in compliance with Environmental Laws; and

(d) defend, indemnify and hold harmless Landlord from all costs, claims, demands, and damages, including attorneys’ fees and court costs and investigatory and laboratory fees, related to any breach of this Lease by Tenant, including, without limitation, any adverse health or environmental condition (including without limitation any violation of Environmental Laws) caused by Tenant. This indemnification obligation shall survive the termination of this Lease.

6

3.6 ADA. With respect to obligations arising under the Americans with Disabilities Act of 1990, regulations issued thereunder, the Accessibility Guidelines for Buildings and Facilities issued pursuant thereto, and any applicable requirements under comparable or related state law, as the same are in effect on the date hereof and may be hereafter modified or amended or supplemented (collectively the “ADA”):

(a) Landlord shall comply with the ADA with respect to operation of the Common Areas, work done in Common Areas (including, without limitation and as the case may be, alterations, barrier removal, or new construction) and reconstruction and restoration of the Premises by Landlord as a result of a casualty or taking. Landlord shall be solely responsible for causing the design of the Common Areas to satisfy all ADA requirements.

(b) Tenant shall comply with the ADA relating to operation of the Premises and alterations or improvements within the Premises. Tenant shall be solely responsible for causing the design of the initial Tenant Improvements constructed pursuant to Exhibit C to satisfy all ADA requirements. Tenant, at its sole expense, shall make any alterations to the Premises required by the ADA.

3.7 Compliance with Other Laws. Tenant shall comply with all other laws imposed by federal, state or local authority related to the operation of its business and its occupancy of the Premises. If due to the nature of Tenant’s use of the Premises, improvements or alterations are necessary to comply with any requirements imposed by law or with the requirements of insurance carriers, Tenant shall pay the entire cost of the improvements or alterations.

4. PARKING AND COMMON AREAS

4.1 Administration. All of the portions of the Project made available by Landlord for use in common by tenants and their employees and invitees (“Common Areas”) at all times shall remain subject to Landlord’s exclusive control, and Landlord shall be entitled to make such changes in the Common Areas as it deems appropriate without Tenant’s consent so long as (a) the size and utility of the Premises are not materially and adversely affected and (b) the changes do not affect the number of Tenant’s parking spaces. Landlord shall retain right to relocate Tenant’s parking spaces and types as provided in Section 2.1 The Common Areas shall include, but are not limited to restrooms located outside of the Premises, elevators, stairwells, public corridors and lobbies,

7

exterior grounds, driveways and parking areas. Landlord shall have the right to install, maintain, replace and operate cables, lines, wires, pipes or other facilities located above the ceiling grid or below the floor surface of the Premises for purposes of serving the Building or other tenants. Tenant shall not disturb any such facilities.

4.2 Electronic Security. Landlord shall install and operate an electronic system controlling access to the Building outside of normal business hours. Tenant shall comply with such reasonable security procedures and requirements as Landlord may establish from time to time. Landlord does not, however, undertake responsibility for the security of tenants or their property, and Landlord shall not be responsible or liable for any loss or damage that is caused by criminal conduct of third parties, despite whatever security measures Landlord may implement, or by any malfunction or deficiency of the electronic access control system. Landlord shall issue to each employee of Tenant a security badge that will allow entry to the parking areas, the patio area, and the fitness center and that will allow after-hours access to the Premises. The cost of each original badge shall be $15.00 and of each replacement badge shall be $20.00, in each case plus applicable sales or transaction privilege tax. Landlord will not charge another fee for badges that were issued during Tenant’s possession of Premises while a Subtenant, and the existing badges shall remain operational.

4.3 Parking. Tenant and its employees shall be entitled to the use of the Parking Spaces set forth in Section 1.11 in the parking structure and surface lot(s) for the Project. Tenant shall be provided parking at a ratio of 6.0 spaces per 1,000 RSF. Tenant’s rights granted herein under a parking ratio of 6.0 spaces per 1,000 RSF are in excess of the Project physical parking ratio of 4.56 spaces per 1000 RSF. Landlord reserves the right to provide all unreserved parking spaces to Tenant and third party tenants through a contractual oversell of the physical spaces at the Project, which shall not exceed 125% of the unreserved parking at the Project. Tenant specifically acknowledges, understands and agrees that Landlord does not have a sufficient number of parking spaces to accommodate the parking requirements of all tenant users if the Project were fully occupied and all employees of all tenants were present in vehicles at the same time. However, because of Project vacancy, tenant employee absenteeism, tenant usage staggered over extended business hours, and significant daily in-out-out traffic, Landlord will be able to provide Tenant with the parking required under this Lease. Therefore, any absence of physical parking spaces or any contractual parking

8

oversell shall not, by itself, ever be a default under this Lease. However, such contractual oversell shall not diminish Tenant’s right to parking at the maximum quantities described herein. If at any time, Tenant is unable to locate one or more parking spaces in accordance with its rights hereunder, and Tenant is not at that time attempting to utilize more than its parking allotment as provided in this section and Section 1.11, Tenant shall notify Landlord, and Landlord shall promptly attempt to provide available parking spaces. Unless Tenant is unable to locate one or more parking spaces in accordance with its rights hereunder, neither, neither Tenant nor its employees shall use spaces designated for visitor parking, and Landlord may impose and collect from Tenant reasonable fines for violation of this restriction. The location of Tenant’s covered reserved parking spaces initially shall be as shown on Exhibit E but shall be subject to reasonable relocation by Landlord upon not less than thirty days prior notice to Tenant. Tenant shall cooperate with such reasonable procedures and requirements for access to the parking facilities as Landlord may establish from time to time, including use of parking stickers, key cards, or other means. Tenant shall register with Landlord all vehicles parked in the Project by Tenant and its employees. Landlord shall have no responsibility or liability for damage to vehicles parked in the Parking Spaces, regardless of cause. Tenant shall pay to Landlord charges for the Parking Spaces, in advance on or before the first day of each month, in the amount of $45.00 per month per covered reserved space, plus applicable tax, $35.00 per month per covered unreserved space, plus applicable tax and no charge per uncovered space, provided, however, beginning on November 1, 2021, the amount of the parking charges shall be increased by $10.00 per month per covered space for each and every month through the expiration of the Lease Term.

5. INTENTIONALLY OMITTED

6. RENT

6.1 Base Rent. Tenant shall pay to Landlord, in advance, on the first day of each calendar month, beginning on the Commencement Date, Base Rent in the amount set forth in Section 1.5.

6.2 Intentionally Omitted.

6.3 Late Charges and Interest. If Base Rent or any other amount payable under this Lease is not paid within ten (10) days after the date it is due, Tenant shall pay to Landlord, as liquidated damages to compensate Landlord for costs and inconveniences of special handling and

9

disruption of cash flow, a late charge in the amount of 5% of the amount past due. The assessment or collection of a late charge shall not constitute the waiver of a default and shall not bar the exercise of other remedies for nonpayment. In addition to the late charge, all amounts not paid within ten days after the date due shall bear interest from the date due (i) until the happening of an Event of Default, at the rate of 10% per annum and (ii) thereafter, at the rate set forth in Section 19.2.

6.4 Obligations Are Rent. All amounts payable by Tenant to Landlord under this Lease, including without limitation Base Rent and Operating Costs, payable under Section 7.1, constitute rent and shall be payable without notice, demand, deduction or offset to such person and at such place as Landlord may from time to time designate by written notice to Tenant, provided, however, Tenant shall be entitled to offset against Base Rent and Operating Costs payable under Section 7.1 any amount to which Tenant is entitled solely under Section 1 of Exhibit C, “Work Letter – TI Allowance”, which Landlord fails to pay within twenty (20) days after notice of a default in any payment obligation for a portion of the Tenant Improvement Allowance under that section.

6.5 Proration. Base Rent payable with respect to a period consisting of less than a full calendar month, if any, shall be prorated.

7. OPERATING COSTS

7.1 Tenant’s Share. During the Term of this Lease, Tenant shall pay to Landlord Tenant’s Proportionate Share of Operating Costs for each calendar year in excess of the Operating Costs for the Base Year as set forth in Section 1.7.

7.2 Estimates. From time to time Landlord shall by written notice specify Landlord’s estimate of Tenant’s obligation under Section 7.1. Tenant shall pay one-twelfth of the estimated annual obligation on the first day of each calendar month. Tenant acknowledges that any amount of Operating Costs calculated by Landlord is only a good faith estimate of the Operating Costs for the Base Year, and that actual Operating Costs may be more or less than the estimate.

7.3 Annual Reconciliation. Within 120 days after the end of each calendar year, Landlord shall provide to Tenant a written summary of the Operating Costs for the calendar year, determined on an accrual basis and broken down by principal categories of expense. The statement also shall set forth Tenant’s Proportionate Share of Operating Costs and shall show the amounts paid by Tenant on account. Any difference between Tenant’s obligation and the amounts paid by

10

Tenant on account shall be paid or refunded, as the case may be, within fifteen days after the statement is provided. Late delivery of the annual statement of Operating Costs shall not relieve Tenant of any obligation with respect to payment of Tenant’s Proportionate Share of the Operating Costs as long as the annual statement is delivered on or before December 31 of the year after the year to which the annual statement pertains (and, in the event of any such failure, Tenant shall no longer be obligated to pay any additional Operating Costs with respect to such year). For at least two years after the end of each calendar year, Landlord shall maintain complete and accurate books and records regarding the Operating Costs for the previous calendar year. Such books and records shall be kept at a location in the continental United States known to Tenant, and Tenant or its auditors shall have the right, upon ten days prior written notice, to inspect, copy at Tenant’s expense, and audit such books and records at any time during normal business hours and in a manner that does not unreasonably disturb Landlord’s operations. Any overpayment or underpayment discovered in such audit shall be paid by the applicable party within thirty days after delivery of the written report of the auditor to Landlord. In each event, the audit must be performed by a CPA, or if not by a CPA, by another accounting professional with at least five years experience performing similar audits and such accounting professional shall not be paid upon a contingent fee basis or other method that compensates such accounting professional based upon the amount of discrepancies discovered.

7.4 Partial Year Proration; Variable Cost Adjustment. During the last years of the Term, Tenant’s responsibility for Operating Costs shall be adjusted in the proportion that the number of days of that calendar year during which the Lease is in effect bears to 365. Tenant’s and Landlord’s obligations under this Article 7 for the payment of any deficiency or reimbursement for any overpayment following receipt of the annual statement under Section 7.3, shall survive the expiration or termination of this Lease. If the mean level of occupancy of the Project during a calendar year is less than 95% of the Rentable Area, the Operating Costs shall be adjusted to reflect the fact that some costs, such as air conditioning and janitorial services, vary with level of occupancy while other costs, such as real estate taxes, may not. In order to allocate those variable costs to occupied space while allocating non-variable costs to occupied and unoccupied space alike, Landlord shall determine what the total Operating Costs would have been had the Project been at least 95% occupied during the entire calendar year on the average, and that adjusted total shall be the figure employed in the statement and calculations described in Sections 7.1 and 7.3. If the mean level of occupancy exceeds 95%, no adjustment shall be made.

11

7.5 “Operating Costs”. Subject to Section 7.6, Operating Costs shall consist of all costs of operating, maintaining and repairing the Project, including, without limitation, the following:

(a) Real Estate Taxes and expenses incurred in efforts to reduce Real Estate Taxes, and any and all charges, taxes, impositions, excise taxes or other governmental impositions of any kind or nature relating to or arising from the occupancy or possession of the Project or Premises by Landlord or Tenant, including any government property lease excise tax “GPLET” or similar tax or charge, whether now existing or arising in the future, based upon the occupancy or possession of real property which is owned by a governmental entity;

(b) Premiums for property, casualty, liability, rent interruption or other insurance;

(c) Salaries, wages and other amounts paid or payable for personnel including the Project manager, superintendent, operation and maintenance staff, and other employees of Landlord involved in the maintenance and operation of the Project, including contributions and premiums towards fringe benefits, unemployment and worker’s compensation insurance, pension plan contributions and similar premiums and contributions and the total charges of any independent contractors or managers engaged in the repair, care, maintenance and cleaning of any portion of the Project;

(d) Costs for cleaning, including sweeping of parking areas;

(e) Costs for policing and security;

(f) Costs for landscaping, including irrigating, trimming, mowing, fertilizing, seeding, and replacing plants;

(g) Costs for utilities, including fuel, gas, electricity, water, sewer, telephone, and other services;

(h) The cost of the rental of any equipment and the cost of supplies used in the maintenance and operation of the Project;

(i) Costs for maintaining, operating, repairing and replacing equipment;

12

(j) Other items of repair, maintenance or replacement for which Landlord is responsible under Article 12;

(k) Costs of alterations or modifications to the Project necessary to comply with requirements of applicable law, which become effective as to the Project after the Commencement Date;

(l) Intentionally Deleted;

(m) A fee for the administration and management of the Project appropriate to the nature of the Project as reasonably determined by the Landlord from time to time; and

(n) The cost of maintaining, repairing and replacing any kitchen, laundry and fitness equipment owned by the Landlord within any fitness, café and child care facilities at the Project, regardless of whether such facilities are operated by third party tenants, licensees or vendors.

If the level of services provided by Landlord (including, without limitation, those services described in Subsections (b) through (j) above) increases above the level of services actually provided by Landlord in the Base Year, then the Operating Costs for the Base Year shall retroactively increase by the actual cost of the increased level of services. Operating Costs shall be determined on a consistent basis, including, without limitation, the scaling of Operating Costs as noted above with respect to the scope of services provided by Landlord. Costs of capital expenditures incurred for the purpose of reducing Operating Costs, and costs of improvements, repairs, or replacements which otherwise constitute Operating Costs under this Article but which are properly charged to capital accounts, shall be included in Operating Costs as amortized over their estimated useful lives, as determined by the Landlord in accordance with generally accepted accounting principles, and only the annual amortization amount shall be included in Operating Costs. However, the cost of capital expenditures included in Operating Costs in 2017, shall not increase by more than five percent (5%) over those capital expenditures included in the 2016 Base Year. And thereafter in subsequent years, the cost of capital expenditures included in Operating Costs shall not increase by more than five percent (5%) over any immediately preceding year of the Term, computed cumulatively over the entire Lease Term.

13

7.6 Exclusions. Notwithstanding anything to the contrary in Section 7.5, “Operating Costs” shall not include:

(a) Amounts reimbursed by other sources, such as insurance proceeds, equipment warranties, judgments or settlements and amounts actually reimbursed hereunder.

(b) Ground rents;

(c) Payments on any mortgage, other encumbrance or other financing of the project;

(d) Construction of tenant improvements for any tenant, including Tenant;

(e) Replacements (but not repairs) of structural elements;

(f) Costs of correcting defects in the design, construction or equipment of, or latent defects in, the Building or the Project;

(g) Costs of negotiating or enforcing leases of tenants or occupants of the Building or the Project, including attorneys’ fees, accounting fees and other expenditures incurred in connection therewith;

(h) Leasing commissions, marketing expenses and other similar expenses incurred in connection with leases and prospective leases;

(i) General overhead and administrative expenses of Landlord not directly related to the operation of the Project;

(j) Taxes on Landlord’s business (such as income, excess profits, franchise, capital stock, estate, inheritance, etc.);

(k) Charitable or political contributions;

(l) Any liabilities, costs or expenses associated with or incurred in connection with the removal, enclosure, encapsulation or other handling of hazardous or toxic materials or substances not caused by Tenant; and

(m) Charges for water or other utilities and applicable taxes for which Landlord is reimbursed by any other tenant;

14

(n) Costs of alterations or modifications to the Project, including fines or penalties imposed by governmental entities as a result of such violation, which alterations or modifications are necessary to comply with violation of applicable law(s) which were effective as to the Project prior to the Commencement Date.

(o) Audit fees and the costs of accounting services incurred in the preparation of statements referred to in this Lease.

7.7 Cap on Controllable Operating Costs. In calculating Tenant’s Proportionate Share of Operating Costs in excess of the Operating Cost for the Base Year, commencing upon January 1, 2017, Tenant’s Proportionate Share of Operating Costs which are controllable by Landlord (specifically excluding without limitation, insurance premiums, taxes, Owners Association dues, and the cost of utilities) shall be limited by a Controllable Cost Cap. The “Controllable Cost Cap” in 2017 is 105% of the actual controllable Operating Costs for calendar year 2016, and the “Controllable Cost Cap” for each subsequent year shall be 105% of the Controllable Cost Cap for the previous year.

8. TAXES

8.1 Real Property Taxes and Assessments. Landlord shall pay before delinquent all general and special real property taxes and assessments that are levied on, or allocable to, the Project (collectively, “Real Estate Taxes”).

8.2 Taxes on Tenant. Tenant shall pay before delinquent all taxes levied or assessed upon, measured by, or arising from: (a) the conduct of Tenant’s business; (b) Tenant’s leasehold estate; or (c) Tenant’s property.

8.3 Excise Taxes. Tenant shall pay to Landlord all sales, use, transaction privilege, or other excise tax that may at any time be levied or imposed upon, or measured by, any amount payable by Tenant under this Lease.

9. INSURANCE AND INDEMNITY

9.1 Indemnification and Waiver. Tenant hereby assumes all risk of damage to property and injury to persons in, on or about the Project from any cause whatsoever, except resulting from the negligence or willful misconduct of Landlord or the Landlord Parties (as defined below), and

15

agrees that, to the extent not prohibited by law, Landlord, its partners and subpartners, and their respective officers, directors, shareholders, agents, property managers, employees and independent contractors (collectively, the "Landlord Parties") shall not be liable for, and are hereby released from any responsibility for, any damage either to person or property or resulting from the loss of use thereof, which damage is sustained by Tenant or by other persons claiming through Tenant, except resulting from the negligence or willful misconduct of Landlord or the Landlord Parties. Tenant shall indemnify, defend, protect and hold harmless the Landlord Parties from and against any and all loss, cost, damage, expense, cause of action, claims and liability, including without limitation court costs and reasonable attorneys' fees (collectively "Claims") incurred in connection with or arising from any cause in, on or about the Premises or Project, and/or any acts, omissions or negligence of Tenant or of any person claiming by, through or under Tenant, or of the contractors, agents, employees, licensees or invitees of Tenant or any such person in, on or about the Project, provided that the terms of the foregoing indemnity shall not apply to any Claims to the extent resulting from the negligence or willful misconduct of Landlord or the Landlord Parties and not insured (or required to be insured) by Tenant under this Lease. Tenant's agreement to indemnify Landlord pursuant to this Section 9.1 is not intended and shall not relieve any insurance carrier of its obligations under policies required to be carried by Tenant or Landlord pursuant to the provision of this Lease. The provisions of this Section 9.1 shall survive the expiration or sooner termination of this Lease with respect to any Claims occurring prior to such expiration or termination.

9.2 Tenant’s Compliance with Landlord's Fire and Casualty Insurance. Tenant shall, at Tenant’s expense, comply with all insurance company requirements, of which Tenant is aware, pertaining to the use of the Premises. If Tenant's conduct or use of the Premises causes any increase in the premium for any insurance policies carried by Landlord, then Tenant shall reimburse Landlord for any such increase. Tenant and Landlord shall each, at their own expense, comply with all rules, orders, regulations or requirements of the American Insurance Association (formerly the National Board of Fire Underwriters) and with any similar body.

9.3 Tenant's Insurance. Tenant shall, during the Lease Term, procure at its expense and keep in force the following insurance:

(a) Commercial general liability insurance naming the Landlord as an additional insured against any and all claims for bodily injury and property damage occurring in, or

16

about the Premises arising out of Tenant's use and occupancy of the Premises. Such insurance shall have a combined single limit of not less than One Million Dollars ($1,000,000) per occurrence with a Two Million Dollar ($2,000,000) aggregate limit and excess umbrella liability insurance in the amount of Five Million Dollars ($5,000,000). Such liability insurance shall be primary and not contributing to any insurance available to Landlord and Landlord's insurance shall be in excess thereto. In no event shall the limits of such insurance be considered as limiting the liability of Tenant under this lease.

(b) Personal property insurance insuring all equipment, trade fixtures, inventory, fixtures, and personal property located on or in the Premises for perils covered by the causes of loss - special form (all risk) and in addition, coverage for flood, wind, earthquake, terrorism and boiler and machinery (if applicable). Such insurance shall be written on a replacement cost basis in an amount equal to one hundred percent (100%) of the full replacement value of the aggregate of the foregoing.

(c) Business interruption and extra expense insurance in such amounts to reimburse Tenant for direct or indirect loss attributable to all perils commonly insured against by prudent tenants or attributable to prevention of access to the Premises or the Building as result of such perils.

(d) Workers' compensation insurance in accordance with statutory law and employers' liability insurance with a limit of not less than $1,000,000 per accident, $1,000,000 disease, policy limit and $1,000,000 disease limit each employee.

The policies required to be maintained by Tenant shall be with companies rated A-VIII or better by A.M. Best. Insurers shall be licensed to do business in the state in which the Premises are located and domiciled in the USA. Any deductible amounts under any insurance policies required hereunder shall not exceed $100,000.00. Certificates of insurance (certified copies of the policies may be required) shall be delivered to Landlord prior to the commencement date and annually thereafter upon request from Landlord. Tenant shall have the right to provide insurance coverage which it is obligated to carry pursuant to the terms hereof in a blanket policy, provided such blanket policy expressly affords coverage to the Premises and to Landlord as required by this Lease. Each policy of insurance shall provide notification to Landlord at least thirty (30) days prior to any cancellation or modification to reduce the insurance coverage.

17

In the event Tenant does not purchase the insurance required by this lease or keep the same in full force and effect, Landlord may, but shall not be obligated to purchase the necessary insurance and pay the premium. The Tenant shall repay to Landlord, as additional rent, the amount so paid promptly upon demand. In addition, Landlord may recover from Tenant and Tenant agrees to pay, as additional rent, any and all reasonable expenses (including attorneys' fees) and damages which Landlord may sustain by reason of the failure to Tenant to obtain and maintain such insurance.

9.4 Subrogation. Landlord and Tenant hereby mutually waive their respective rights of recovery against each other for any loss of, or damage to, either parties' property, to the extent that such loss or damage is insured by an insurance policy (or in the event either party elects to self insure any property coverage required) required to be in effect at the time of such loss or damage. Each party shall obtain any special endorsements, if required by its insurer whereby the insurer waives its rights of subrogation against the other party. The provisions of this clause shall not apply in those instances in which waiver of subrogation would cause either party's insurance coverage to be voided or otherwise made uncollectible.

9.5 Landlord’s Insurance. During the Term, Landlord shall maintain property insurance covering the Premises (excluding the property which Tenant is obligated to insure pursuant to the terms hereof). Such policy shall provide protection against “all risk of physical loss”. Landlord shall also maintain commercial general liability and property damage insurance with respect to the operation of the Premises. Such insurance shall be in such amounts and with such deductibles as Landlord reasonably deems appropriate. Landlord may, but shall not be obligated to, obtain and carry any other form or forms of insurance as Landlord or Landlord’s mortgagees or deed of trust beneficiaries may determine prudent. Tenant shall be liable for the payment of all premiums, deductibles, and self-insurance funds created for the specific use of assuming risk. Notwithstanding any contribution by Tenant to the cost of insurance as provided in this Lease, Tenant acknowledges that it has no right to receive any proceeds from any insurance policies maintained by Landlord and will not be named as an additional insured thereunder.

9.6 Additional Insurance Obligations. Tenant shall carry and maintain during the entire Lease Term, at Tenant's sole cost and expense, increased amounts of the insurance required to be carried by Tenant pursuant to this Section 9, and such other reasonable types of insurance coverage and in such reasonable amounts covering the Premises and Tenant's operations therein,

18

as may be reasonably requested by Landlord, but in no event shall such increased amounts of insurance or such other reasonable types of insurance be in excess of that required by landlords of comparable Class "A" buildings located in the Tempe area.

10. FIRE AND CASUALTY

10.1 Termination Rights. If all or part of the Premises is rendered untenantable by damage from fire or other casualty which in Landlord’s opinion cannot be substantially repaired (employing normal construction methods without overtime or other premium) under applicable laws and governmental regulations within 150 days from the date of the fire or other casualty, then either Landlord or Tenant may elect to terminate this Lease as of the date of such casualty by written notice delivered to the other not later than ten days after notice of Landlord’s estimate of the time required for restoration is given by Landlord. Landlord shall provide such notice as soon as is practicable after the fire or other casualty occurs, but in no event later than 60 days after the fire or other casualty occurs.

10.2 Restoration. If in Landlord’s opinion the damage caused by the fire or other casualty can be substantially repaired (employing normal construction methods without overtime or other premium) under applicable laws and governmental regulations within 180 days from the date of the fire or other casualty, or if neither party exercises its right to terminate under Section 10.1, Landlord shall, but only to the extent that insurance proceeds are available therefor, repair such damage other than damage to furniture, chattels or trade fixtures which do not belong to the Landlord, which shall be repaired by Tenant at its own expense.

10.3 Abatement. During any period of restoration, the Base Rent payable by Tenant shall be proportionately reduced to the extent that the Premises are thereby rendered untenantable from the date of casualty until completion by Landlord of the repairs to the Premises (or the part thereof rendered untenantable) or until Tenant again uses the Premises (or the part thereof rendered untenantable) in its business, whichever first occurs.

10.4 Demolition of Building; Damage Late in Term. Notwithstanding anything to the contrary in Section 10.1, if all or a substantial part (whether or not including the Premises) of the Building is rendered untenantable by damage from fire or other casualty to such a material extent that in the opinion of Landlord the Building must be totally or partially demolished, whether or not

19

to be reconstructed in whole or in part, or if a fire or casualty requiring substantial restoration or repair occurs during the last year of the Term, Landlord may elect to terminate this Lease as of the date of the casualty (or on the date of notice if the Premises are unaffected by such casualty) by written notice delivered to Tenant not more than sixty days after the date of the fire or casualty.

10.5 Agreed Remedies. Except as specifically provided in this Article, there shall be no reduction of rent and Landlord shall have no liability to Tenant by reason of any injury to or interference with Tenant’s business or property arising from fire or other casualty, howsoever caused, or from the making of any repairs resulting therefrom in or to any portion of the Building or the Premises. Tenant waives any statutory or other rights of termination by reason of fire or other casualty, it being the intention of the parties to provide specifically and exclusively in this Article for the rights of the parties with respect to termination of this Lease as a result of a casualty.

11. CONDEMNATION

11.1 Automatic Termination. If during the Term all or any part of the Premises is permanently taken for any public or quasi-public use under any statute or by right of eminent domain, or purchased under threat of such taking, this Lease shall automatically terminate on the date on which the condemning authority takes possession of the Premises.

11.2 Optional Termination. If during the term any part of the Building is taken or purchased by right of eminent domain or in lieu of condemnation, whether or not the Premises are directly affected, then if in the reasonable opinion of Landlord substantial alteration or reconstruction of the Building is necessary or desirable as a result thereof, or the amount of parking available to the Building is materially and adversely affected, Landlord shall have the right to terminate this Lease by giving Tenant at least thirty days written notice of such termination.

11.3 Award. Landlord shall be entitled to receive and retain the entire award or consideration for the affected lands and improvements and Tenant shall not have or advance any claims against Landlord for the value of its property or its leasehold estate or the unexpired term of this Lease, or for costs of removal or relocation or business interruption expenses or any other damages arising out of the taking or purchase. Nothing herein shall give Landlord any interest in or preclude Tenant from seeking and recovering on its own account from the condemning authority any award of compensation attributable to the taking or purchase of Tenant’s personal property or

20

trade fixtures or attributable to Tenant’s relocation expenses. If any award made or compensation paid to Tenant specifically includes an award or amount for Landlord, Tenant shall promptly account therefor to Landlord, and if any award made or compensation paid to Landlord specifically includes an award or amount for Tenant, Landlord shall promptly account therefor to Tenant.

12. MAINTENANCE AND OFFICE SERVICES

12.1 Maintenance by Tenant. Tenant shall maintain the interior of the Premises and the improvements therein (excluding services and maintenance for which Landlord is responsible pursuant to Sections 12.2 and 12.6) in good condition and repair.

12.2 Building Services. Landlord shall provide the following services to Tenant:

(a) Janitorial services to the Premises and to Common Areas five nights per week, including. light bulb replacements for Building Standard lights and Common Area restroom supplies [with the time of the nighttime janitorial service to the Premises reasonably agreed to in advance by Landlord and Tenant, provided that any alteration to Landlord’s general service schedule that results in a cost increase for such service shall be paid by Tenant as provided in Section 12.5];

(b) Monday – Friday daytime porter service and light maintenance for Tenant break rooms and restrooms;

(c) elevator service by means of the Building’s elevators;

(d) heating, ventilation, and air conditioning to the Premises appropriate to a first class office building;

(e) utility service as provided below in Sections 12.3 and 12.4;

(f) a minimum of one (1) security guard stationed on the first floor of the Building 24-hours per day, 7 days per week, 52 weeks per year; and

(g) trash removal in conjunction with janitorial and day porter service described above in Section 12.2(a) and 12.2(b).

12.3 Utilities and After-Hours Charges. Landlord shall, without further charge to Tenant, supply to the Premises electrical power for lighting and for the operation of normal office

21

equipment during the hours of 7:00 a.m. to 6:00 p.m., Monday through Friday, and 8:00 a.m. to 1:00 PM on Saturday, legal holidays excepted (“Extended Business Hours”). Landlord shall supply water and sewer services for any plumbing facilities in the Premises (including any restrooms contained within the Premises) and any public Common Area restrooms. If Tenant operates any facility, such as a computer room, that requires electrical power in excess of normal office demand or that requires cooling after normal business hours, Landlord may require such facilities to be separately metered or sub-metered to Tenant at Tenant’s expense. All utilities provided to the Premises other than those described above, including communications services, shall be arranged directly by Tenant with the utility supplier, including the posting of any required deposits, and paid directly to the utility supplier when due.

12.4 Electricity Beyond Extended Business Hours. As soon as reasonably practical following the execution of this Lease, but in no instance later than the earlier of thirty (30) days following (i) the Commencement Date, as defined in section 2.2 , or (ii) Lease execution and written approval of the installation and any resultant lease modification, without unreasonable condition, by the University of Phoenix (as Tenant under the U of P Lease defined in section 32), Landlord, at its expense, shall install four (4) pair of electric E-Mon/D-Mon sub-meters (“Sub-Meters”) within the Premises to record Tenant’s consumption of electricity within the Premises beyond Extended Business Hours. Tenant shall pay to Landlord (or directly to the utility company at Landlord’s written request) within thirty days after receipt of invoice for electricity, including but not limited to all electricity consumed within the Premises for lighting, heating, ventilation and air conditioning, provided to the Premises outside of Extended Business Hours based upon the monthly electricity consumption calculated by the Submeters at rates (inclusive all KwH energy charges, delivery charges, any incremental Kw demand charges, and all associated taxes thereon) then charged by Salt River Project or any successor electric utility. Simultaneous with execution of this Agreement, Landlord shall endeavor to modify Section 7.1 of the U of P Lease which shall allow Landlord to invoice the University of Phoenix for the actual cost of the Submeters in lieu of the current standard hourly rate of $2.00 per hour per heat pump (the “Hourly Charges”) described therein. Upon such modification of the U of P Lease, Tenant (as sub-tenant to University of Phoenix, Inc. under the U of P Lease), shall be bound by the terms of the U of P Lease as thereby modified.

12.5 Supplemental Services Beyond Extended Business Hours. Operating Costs described within this Lease are based upon use of the Premises by Tenant for office use during

22

Extended Business Hours. In the event Tenant operates within the Premises beyond Extended Business Hours, and such use by Tenant causes an increase to the Building Services provided by Landlord to operate and maintain the Project in a manner reasonably agreed to by Landlord and Tenant (including but not limited to additional janitorial, utilities, security labor, trash removal, and engineering maintenance, including any premiums for weekend or evening labor surcharges), Tenant’s occupancy of the Premises beyond Extended Business Hours shall be subject to Tenant’s written agreement to pay Landlord’s actual third party cost, competitively bid on an annual basis and shared “open-book” with Tenant (without mark-up by Landlord) for use outside Extended Business Hours.

12.6 Building and Common Area Maintenance. Landlord shall maintain the Building (including roof, structural elements, doors, plate glass, heating, air conditioning, ventilation, electrical and plumbing systems serving the Building, and exterior window washing), and all Common Areas in good condition and repair in accordance with standards then prevailing for comparable properties of like age and character.

12.7 Interruptions. Landlord shall not be liable or responsible for breakdowns or temporary interruptions in access, services, or utilities, nor for interference with Tenant’s business or Tenant’s access to the Premises during the course of repairs or remedial work. Landlord also shall not be liable or responsible for damage or inconvenience arising from interruption of utility services, regardless of cause, including without limitation quarterly interruptions in power supply to the Building related to testing of the Building’s uninterrupted power system (“UPS”) equipment. Tenant shall be provided advance notice of scheduled interruptions. Unless specifically otherwise provided in this Lease, Tenant shall not be connected to or be protected by the UPS.

12.8 Access. Landlord at all times shall have access to the Premises for purposes of inspection and performing Landlord’s repair, maintenance and janitorial obligations and exercising its rights under this Lease. Upon reasonable notice to Tenant, Landlord shall have access to the Premises for purposes of showing the Premises to current or prospective lenders, to prospective purchasers of the Building or Project, and, during the twelve-month period preceding the expiration of the term of this Lease, to prospective tenants.

12.9 Food Service; Day Care; Exercise Facility. Landlord agrees to use commercially reasonable efforts to maintain the services and facilities referred to in (a) through (c) below during

23

the Term of this Lease, which services are currently provided by for-profit businesses by third party tenants, licensees and/or vendors. However, Landlord shall not be in breach or default of this Lease or subject to any penalty, claim, right of recovery or offset if any such service is temporarily suspended or discontinued, provided that Landlord is using reasonable efforts to find a reasonably suitable replacement for such services. So long as Landlord continues to keep the facilities in operation, Tenant shall have access, for the use by its employees on the Premises, to: (a) child day care services in the day care facility located in the Project (on a waiting list basis to the extent that demand exceeds available capacity) on the same basis as Landlord’s employees; and (b) the food service facility located in the 1500 Building; and (c) an exercise facility in the 1500 Building. Use of the exercise facility may be made subject to reasonable conditions, including attendance at a training class and receipt of written approval from the employee’s physician. The initial monthly charge for such usage by an employee shall be $25.00 per month. The amount of the monthly charge may be changed in the future so long as the same charge is applicable to all persons working in the Project who have access to the exercise facility.

12.10. US Postal Service and Private Courier Parcel Delivery. Tenant acknowledges that the 1500 N. Priest Drive mailing address is for the exclusive use of mail deliveries through the delivery dock privately run by a private mail service licensee of the Landlord. The 1500 N. Priest Drive Building contains no individual tenant mailboxes for delivery of mail or private parcel deliveries directly to Tenant. Tenant may (i) separately contract for a mail and parcel handling agreement with the current mail/dock manager at the address listed below, or (ii) arrange for mail delivery through separate post office mail box located off site through the US Postal Service or other private mailing service, and in either case which fees for such service shall be the sole responsibility of Tenant. Tenant acknowledges that the private mail / dock operator licensee of the Building shall have no obligation to accept mail or private parcel packaging addressed to Tenant without a written handling agreement between the licensor and Tenant licensee and such operator shall refuse and return any such deliveries to the sending party/courier service.

13. TENANT ALTERATIONS AND SIGNAGE

13.1 Alterations. Tenant may from time to time at its own expense make changes, additions and improvements in the Premises, provided that subject to the last sentence of this Section 13.1, any such change, addition or improvement shall:

24

(a) comply with the requirements of any governmental or quasi-governmental authority having jurisdiction (including, without limitation, the requirements under the ADA), with the requirements of Landlord’s insurance carriers provided to Tenant, and with Landlord’s safety and access requirements provided to Tenant, including any restrictions on flammable materials and elevator usage;

(b) not be commenced until Landlord has received satisfactory evidence that all required permits have been obtained;

(c) be made only with the prior written consent of Landlord (which may be withheld in Landlord’s sole discretion, to the extent it relates in Landlord’s opinion to the structure or electrical, HVAC, plumbing or fire sprinkler systems of the Building, but which otherwise shall not be unreasonably withheld);

(d) be constructed in good workmanlike manner and if a building permit is required under applicable law, conform to complete working drawings prepared by a licensed architect and submitted to and approved by Landlord; which approval shall not be unreasonably withheld or delayed;

(e) be of a quality that equals or exceeds the then current Building Standard and comply with all building, fire and safety codes;

(f) be carried out only during hours approved by Landlord by licensed contractors selected by Tenant and approved in writing by Landlord, which approval shall not be unreasonably withheld or delayed. Tenant shall give Landlord an opportunity to perform or to bid on the work. If Tenant selects another contractor, that contractor shall deliver to Landlord before commencement of the work performance and payment bonds as well as proof of workers’ compensation and general liability insurance coverage, including coverage for completed operations and contractual liability, with Landlord and its agents and designees named as additional insureds, in amounts, with companies, and in form reasonably satisfactory to Landlord, which shall remain in effect during the entire period in which the work shall be carried out. Notwithstanding the foregoing, only subcontractors specifically approved by Landlord, which approval shall not be unreasonably withheld or

25

delayed, may be used to make connection with the Building’s main electrical, plumbing or HVAC systems; and

(g) upon completion, be shown on accurate “as built” reproducible drawings delivered to Landlord.

Notwithstanding anything to the contrary, Landlord’s consent shall not be required for changes to the Premises that are cosmetic in nature (i.e. changes in carpet, paint), or that are related to installation of modifications to tenant furniture, fixtures and equipment. Any changes impacting the Building structure, relocation of walls, and/or any modifications that impact the Building electrical, mechanical, plumbing, security or fire/life safety systems shall expressly require prior written Landlord approval.

13.2 Tenant Installations. Tenant may install in the Premises its usual trade fixtures and personal property in a proper manner, provided that no installation shall interfere with or damage the mechanical or electrical systems or the structure of the Building. Landlord may require that any work that may affect structural elements or mechanical, electrical, heating, air conditioning, plumbing or other systems be performed by Landlord at Tenant’s cost or by a contractor designated by Landlord.

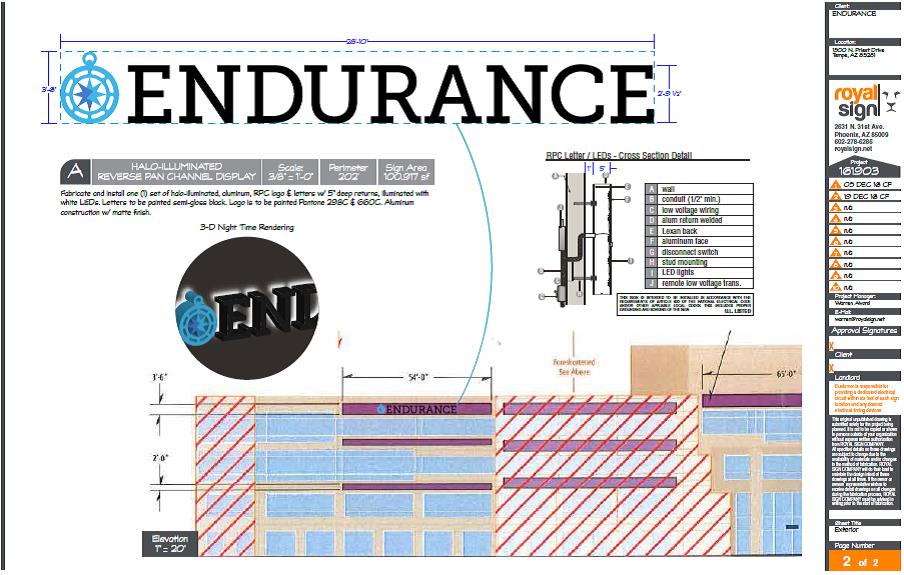

13.3 Signs. Tenant shall not place or permit to be placed any sign, picture, advertisement, notice, lettering or decoration on any part of the outside of the Premises or anywhere in the interior of the Premises which is visible from the outside of the Premises without Landlord’s prior written approval, which shall not be unreasonably withheld. Tenant shall be entitled, at Landlord’s expense, to an entry in the Building directory maintained by Landlord and to a Building Standard entry sign by the entry door to the Premises. Provided that Tenant continually occupies at least one (1) full floor in the Building, Landlord shall permit Tenant the right to use (A) one two-sided sign panel on the monument sign fronting Priest Drive, and (B) one sign band above the 2nd floor windows on the 1500 Priest Drive building facing Washington Street, subject to Landlord approval of such placement, which shall not be unreasonably withheld, Papago Park CC&R’s, and City of Tempe approvals. All signage shall be in conformance with Landlord’s comprehensive sign package. All rights of signage shall be personal to Tenant and shall not be assignable to any third party sub-tenants or assignees without the written consent of Landlord, which consent shall not be unreasonably withheld or conditioned.

26

13.4 Mechanics Liens. Tenant shall pay before delinquent all costs for work done or caused to be done by Tenant in the Premises which could result in any lien or encumbrance on Landlord’s interest in the Building, the Project or any part thereof, shall keep the title to the Building or the Project and every part thereof free and clear of any lien or encumbrance in respect of such work, and shall indemnify and hold harmless Landlord and Landlord’s agents and employees against any claim, loss, cost, demand or legal or other expense, whether in respect of any lien or otherwise, arising out of the supply of material, services or labor for such work. Tenant immediately shall notify Landlord of any such lien, claim of lien or other action of which it has or reasonably should have knowledge and that affects the title to the Building, the Project or any part thereof and shall cause it to be removed by bonding or otherwise within ten days, failing which Landlord may take such action as Landlord deems necessary to remove it and the entire cost thereof shall be immediately due and payable by Tenant to Landlord.

14. ASSIGNMENT AND SUBLETTING

14.1 Consent Required. Tenant shall not assign its interest under this Lease nor sublet all or any part of the Premises, other than to a Permitted Transferee (as defined below), without Landlord’s prior written consent, which shall not be unreasonably withheld. Tenant shall not at any time pledge, hypothecate, mortgage or otherwise encumber its interest under this Lease as security for the payment of a debt or the performance of a contract. Tenant shall not permit its interest under this Lease to be transferred by operation of law. A “Permitted Transferee” shall mean (a) a successor to all or substantially all of Tenant’s assets, (b) a parent of Tenant or (c) a successor to Tenant by merger, consolidation or reorganization, provided that in any and all events the Permitted Transferee shall have a tangible financial net worth equal to or greater than that of Tenant at the time of such transfer. As used herein “tangible financial net worth” shall mean the stockholders equity in Tenant, specifically excluding any intangible assets such as goodwill, as such term or like term may be described according to generally accepted accounting principles. Any purported assignment or sublease shall not be effective, however, until Tenant has provided Landlord with written notice of such Permitted Transfer along with supporting written evidence that such Tenant has satisfied the tangible financial net worth condition described above. Any purported assignment or sublease made without Landlord’s consent or without meeting the conditions described above shall be void. No consent shall constitute consent to any further assignment or subletting.

27

14.2 Indirect Transfers. Any change in the identities of the individuals owning or controlling Tenant (by transfers of interests or admission of new members or partners) [other than the normal and ongoing exchange of the existing float of publicly traded shares of common equity stock open for purchase and sale on a public exchange such as the NASDAQ or NYSE], such that less than fifty percent of such aggregate ownership and control is at any time held by the individuals who owned and controlled Tenant as of the date of this Lease, shall constitute an assignment subject to Landlord’s prior consent for purposes of Section 14.1.

14.3 Requests for Approval. Landlord shall be under no obligation to decide whether consent will be given or withheld unless Tenant has first provided to Landlord: (a) the name and legal composition of the proposed assignee or subtenant and the nature of its business; (b) the use to which the proposed assignee or subtenant intends to put the Premises; (c) the terms and conditions of the proposed assignment or sublease and of any related transaction between Tenant and the proposed assignee or subtenant; (d) information related to the experience and financial resources of the proposed assignee or subtenant; (e) such information as Landlord may request to supplement, explain or provide details of the matters submitted by Tenant pursuant to subparagraphs (a) through (d); and (f) reimbursement for all reasonable costs incurred by Landlord, including attorneys’ fees, in connection with evaluating the request and preparing any related documentation.

14.4 Continued Responsibility. Tenant shall remain fully liable for performance of this Lease, notwithstanding any assignment or sublease, for the entire Lease Term.

14.5 Excess Proceeds. If consent to an assignment or sublease is required and given, Tenant shall pay to Landlord, as additional rent, one half of all amounts received from the assignee or subtenant in excess of the amounts otherwise payable by Tenant to Landlord with respect to the space involved, measured on a per square foot basis, provided, however, in the event the assignment or sublease is in connection with a sale of all or substantially all of Tenant’s business, no consideration shall be payable to Landlord.

14.6 Limitations. Without limiting appropriate grounds for withholding consent, it shall not be unreasonable for Landlord to withhold consent: (i) if the proposed assignee or subtenant is a then current tenant of Landlord at the Project, (ii) if the proposed assignee or subtenant is a governmental agency, (iii) if the proposed assignee or subtenant is a direct competitor of Landlord or an affiliate of Landlord; (iv) if the use by the proposed assignee or subtenant would contravene

28

this Lease, applicable deed restriction, any underlying lease, any restrictive use covenant or exclusive rights granted by Landlord; (v) if the proposed assignee or subtenant does not intend to occupy the Premises for its own use or (vi) if the nature of the proposed assignee or subtenant is not compatible with the character of the Project.

14.7 Transfer by Landlord. Upon a sale or other transfer of the Building by Landlord, Landlord’s interest in this Lease shall automatically be transferred to the transferee, the transferee shall automatically assume all of Landlord’s obligations under this Lease accruing from and after the date of transfer, and, if the transferee confirms in writing to Tenant that the transferee has assumed all of Landlord’s obligations under this Lease. the transferor shall be released of all obligations under this Lease arising after the transfer. Tenant shall upon request attorn in writing to the transferee.

15. SUBORDINATION AND ATTORNMENT

15.1 Subordination. This Lease is and shall be subject and subordinate in all respects to all existing and future mortgages or deeds of trust now or hereafter encumbering the Building or any part hereof. The holder of any mortgage or deed of trust may elect to be subordinate to this Lease. This Lease is subject and subordinate to the Ground Lease dated as of July 31, 1997 between Salt River Project Agricultural Improvement and Power District, as ground lessor, and Landlord, as successor in interest to Tosco Corporation, as ground lessee (the “Salt River Ground Lease”).

15.2 Attornment to SRP. The following provision, required to be contained in this Lease by the terms of the Salt River Ground Lease, is binding on Tenant:

If the Ground Lease is terminated before the expiration of its Term, then, at the option of the Ground Lessor, either Tenant shall attorn to the Ground Lessor or this Lease shall automatically terminate.

15.3 Lender Protection. Upon a transfer in connection with foreclosure or trustee’s sale proceedings or in connection with a default under an encumbrance, whether by deed to the holder of the encumbrance in lieu of foreclosure or otherwise, Tenant, if requested, shall in writing attorn to the transferee, but the transferee shall not be:

(a) subject to any offsets or defenses which Tenant might have against Landlord;

29

(b) bound by any prepayment by Tenant of more than one month’s installment of rent;

(c) obligated to perform any construction obligations; or

(d) subject to any liability or obligation of Landlord except those arising after the transfer.

15.4 Documentation. The subordination provisions of this Article shall be self-operating and no further instrument shall be necessary. Nevertheless Tenant, within ten (10) days after request from Landlord, shall execute and deliver any and all instruments further evidencing such subordination.

15.5 Other Transactions. Landlord may at any time and from time to time grant, receive, dedicate, relocate, modify, surrender or otherwise deal with easements, rights of way, restrictions, covenants, equitable servitudes or other matters affecting the Building or Project without notice to or consent by Tenant.

15.6 Non Disturbance. Landlord shall undertake commercially reasonable efforts to request from Salt River Project Agricultural Improvement and Power District (the “Ground Lessor”) a written subordination, non-disturbance and attornment agreement (“SNDA”). Tenant acknowledges that per the Ground Lease, the Ground Lessor is not obligated to provide Tenant any rights of non-disturbance and that if such non-disturbance is granted in writing, such non-disturbance may be conditioned by the Ground Lessor. Landlord shall make written request to the Ground Lessor for such SNDA within thirty (30) days of the execution of this Agreement. However, it shall in no event be a breach, failure to preform or default under this Lease, and Landlord shall have no liability to Tenant, for any failure of the Ground Lessor to provide an SNDA, or for any conditions that the Ground Lessor may impose upon Tenant for the granting of a right of non-disturbance.

16. ESTOPPEL CERTIFICATES AND FINANCIAL STATEMENTS

16.1 Tenant Estoppel; Financial Statements. Tenant shall at any time within ten days after written request from Landlord execute, acknowledge and deliver to Landlord a statement in writing: (a) certifying that this Lease is unmodified and in full force and effect (or, if modified, stating the nature of such modification and certifying that this Lease, as so modified, is in full force

30

and effect), or if this Lease is not in full force and effect, stating that this Lease is not and the extent to which it is not) and the date to which the rent and other charges are paid in advance, if any; (b) confirming the commencement and expiration dates of the term; (c) confirming the amount of the LOC (as defined below) held by Landlord; (d) acknowledging that there are not, to Tenant’s knowledge, any uncured defaults on the part of Landlord hereunder, or specifying such defaults if any are claimed; and (e) confirming such other matters as to which Landlord may reasonably request confirmation. Any such statement may be conclusively relied upon by a prospective purchaser or lender with respect to the Building. If Landlord desires to finance or refinance the Building, within ten (10) day after request from Landlord, Tenant hereby agrees to deliver to any lender designated by Landlord such financial statements, provided however, that Tenant shall not be required to deliver to any lender such financial statements, provided such complete financial statements of Tenant are available to the general public through a current filing of such financial statements with and in full timely compliance with regulations imposed by the United States Securities and Exchange Commission.

16.2 Landlord Estoppel. Not more frequently than one time per year, and within ten days after written request from Tenant, Landlord shall execute, acknowledge and deliver to Tenant a statement in writing: (a) certifying that this Lease is unmodified and in full force and effect (or, if modified, stating the nature of such modification and certifying that this Lease, as so modified, is in full force and effect, or if this Lease is not in full force and effect, stating that this Lease is not and the extent to which it is not) and the date to which the rent and other charges are paid in advance, if any; (b) confirming the commencement and expiration dates of the term; (c) confirming the amount of the LOC held by Landlord; (d) acknowledging that there are not, to Landlord’s knowledge, any uncured defaults on the part of Tenant hereunder, or specifying such defaults if any are claimed; and (e) confirming such other matters as to which Tenant may reasonably request confirmation.

17. QUIET ENJOYMENT

If Tenant pays the rent and observes and performs the terms, covenants and conditions contained in this Lease, Tenant shall peaceably and quietly hold and enjoy the Premises for the Term without hindrance or interruption by Landlord, or any other person lawfully claiming by, through or under Landlord unless otherwise permitted by the terms of this Lease.

18. SURRENDER AND HOLDOVER

31

18.1 Surrender. Upon the expiration or termination of this Lease or of Tenant’s right to possession, Tenant shall surrender the Premises in a clean undamaged condition, reasonable wear and tear and damage by casualty excepted (Landlord hereby acknowledging and agreeing that it is aware that Tenant shall have the right to occupy the Premises twenty-four hours per day, seven days per week, and that reasonable wear and tear shall be determined on the assumption that the Premises are occupied twenty-four hours per day, seven days per week.) and shall remove all of Tenant’s equipment, fixtures and property, including without limitation all voice and data wiring and cabling installed by Tenant, and repair all damage caused by the removal. Tenant shall not remove permanent improvements that were provided by Landlord at the commencement of this Lease and shall not remove permanent improvements later installed by Tenant unless Tenant is directed to do so by Landlord, at the time that Landlord’s written consent to such improvements was given. Additionally, Tenant shall remove any structural improvements to the Premises made by Tenant that Landlord, at the time Landlord approved same in accordance with Section 13.1 or Exhibit C, designated to Tenant as being alterations required to be removed at the end of the Term of this Lease.

18.2 Holdover. If Tenant holds over without Landlord’s consent, Tenant shall, at Landlord’s election, be a tenant at will or a tenant from month-to-month. In either case rent shall be payable monthly in advance at a rate equal to (A) during the first ninety (90) days of holdover, at a rental rate equal to 125% of the Basic Rent plus any Base Year Recoveries, Parking Charges, and Rent Tax in effect immediately before the holdover began, and/or (B) after the first ninety (90) days of holdover, at a rental rate equal to 150% of the Basic Rent plus any Base Year Recoveries, Parking Charges, and Rent Tax in effect immediately before the holdover began. After the initial 90 day holdover period, Tenant shall also be liable to Landlord for any and all damages incurred by Landlord as a result of Tenant’s failure to vacate the Premises ninety (90) days after conclusion of the Lease Term or earlier contractual date of early termination. A holdover month-to-month tenancy may be terminated by either party as of the first day of a calendar month upon at least ten days’ prior notice. A holdover tenancy at will is terminable at any time by either party without notice, regardless of whether rent has been paid in advance. Upon a termination under this Section, unearned rent shall be refunded following the surrender of possession provided Tenant is not otherwise in breach of this Lease.

19. BREACH, DEFAULT, AND REMEDIES

32

19.1 Default. The following shall constitute “Events of Default”: