Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - AutoWeb, Inc. | ex99-1.htm |

| 8-K - FORM 8-K - AutoWeb, Inc. | abtl8k_may42017.htm |

Exhibit

99.2

AUTOBYTEL INC.

Moderator: Sean Mansouri

May 4, 2017

5:00 p.m. ET

Operator:

This is conference

# 9332168.

Good

afternoon, everyone. Thank you for participating in today's

conference call to discuss Autobytel financial results for the

first quarter ended March 31, 2017.

Joining

us today are Autobytel's President and CEO, Jeff Coats; the

company's CFO, Kimberly Boren; and the company's outside Investor

Relations Advisor, Sean Mansouri, with Liolios Group.

Following their

remarks, we will open the call for your questions. I would now like

to turn the call over to Mr. Mansouri for some introductory

comments.

Sean

Mansouri:

Thank

you.

Before

I introduce Jeff, I remind you that during today's call, including

the question-and-answer session, any projections and

forward-looking statements made regarding future events or

Autobytel's future financial performance are covered by the safe

harbor statements contained in today's press release, the slides

accompanying this presentation and the company's public filings

with the SEC.

Actual

events may differ materially from those forward-looking statements.

Specifically, please refer to the company's Form 10-Q for the

quarter ended March 31, 2017, which was filed prior to this call as

well as other filings made by Autobytel with the SEC from time to

time. These filings identify factors that could cause results to

differ materially from those forward-looking

statements.

There

are slides included with today's presentation to help illustrate

some of the points being made and discussed during the call. The

slides can be accessed by visiting Autobytel's website at

autobytel.com. When there, go to Investor Relations and then click

on “Events and Presentations.”

Please

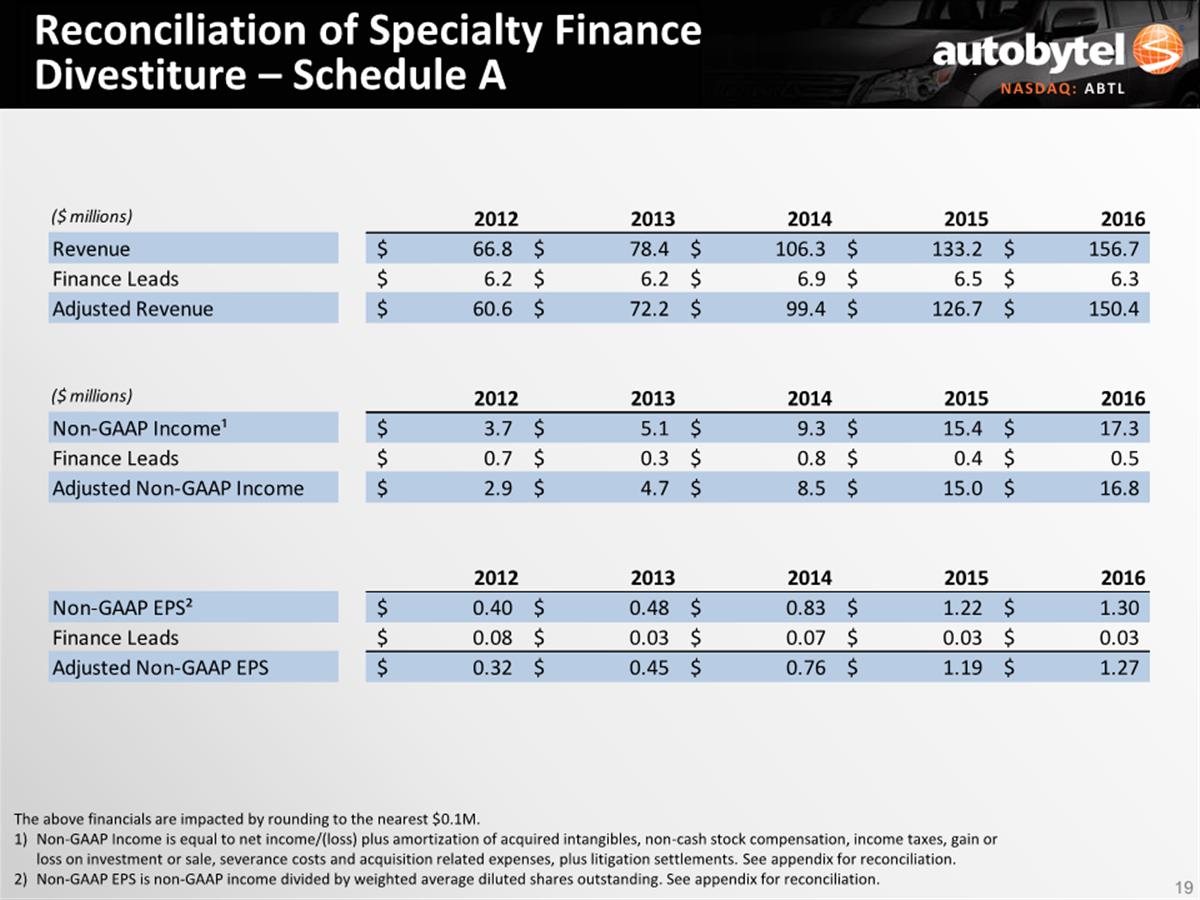

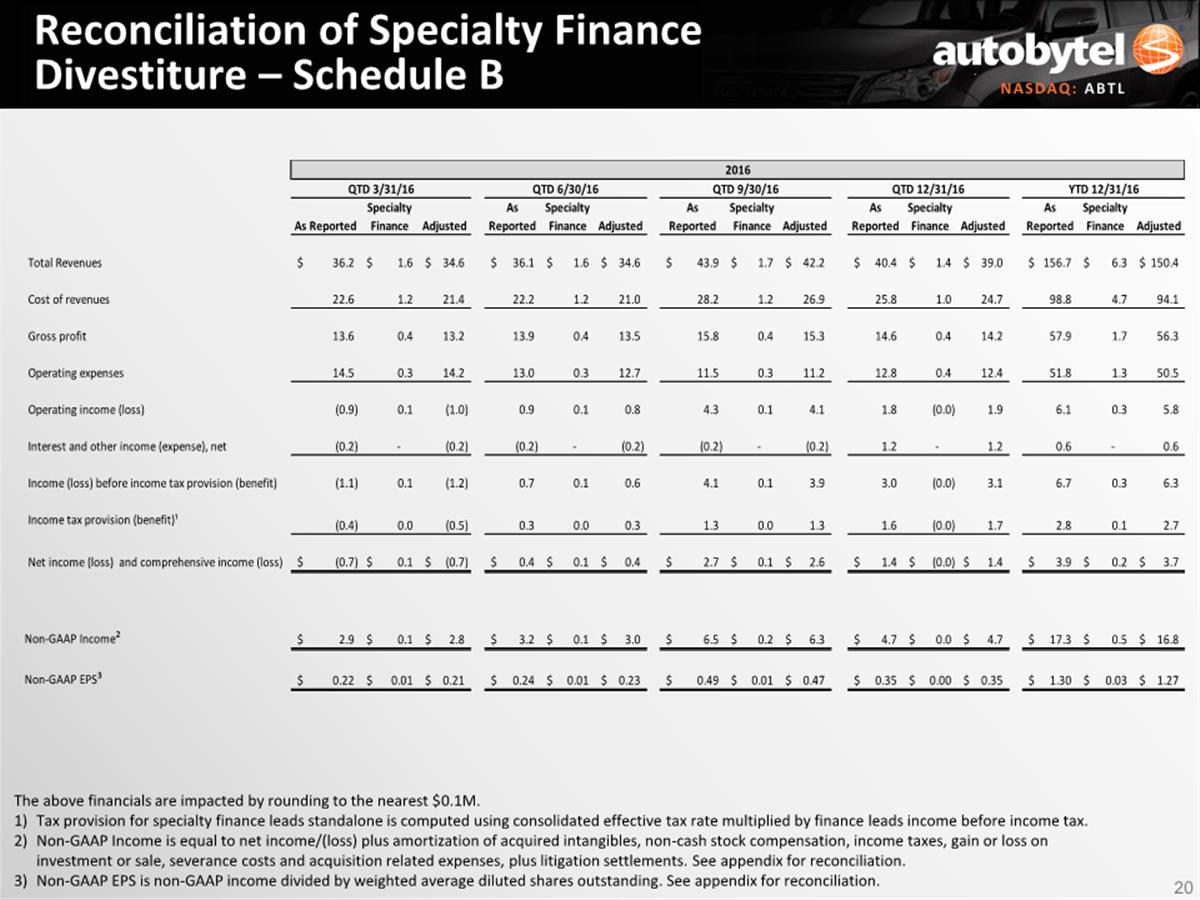

also note that during this call and/or in the accompanying slides,

management will be disclosing non-GAAP income and non-GAAP EPS. For

purposes of the 2017 guidance, we'll be adjusting 2016 revenues,

non-GAAP income and non-GAAP EPS to reflect the exclusion of the

company's specialty finance leads product that was divested at

December 31, 2016.

And for

year-over-year comparisons, prior year results with the exception

of cash flow from operations for all periods presented are adjusted

to exclude the company's specialty finance leads product, which was

divested on December 31, 2016. These are non-GAAP financial

measures as defined by SEC Regulation G.

Reconciliations of

these non-GAAP financial measures to the most directly comparable

GAAP measures are included in today's press release and/or in the

slides, which are posted on the company's website.

And

with that, I'll turn the call over to Jeff.

Jeffrey

Coats:

Thank you, Sean,

and good afternoon, everyone. Thank you for joining us today to

discuss our first quarter 2017 results. As a reminder to those of

you who are new to Autobytel, we are a pioneer and leading provider

of online digital automotive services, connecting in-market car

buyers with our dealer and manufacturer customers.

We are

happy to announce that the momentum we gained from our record 2016

has carried into the first quarter of 2017. Our results were

highlighted by another quarter of triple-digit growth in our clicks

business, which is becoming a meaningful contributor to our overall

financial performance and continues to strengthen our position as a

digital leader in the automotive industry.

In line

with expectations, lead revenues for the quarter were down slightly

due to the effects of last year's initiative to systematically

reduce lower quality leads supply. It's worth noting that this

quality initiative continues to drive increased retention across

our customer base, while providing us with more control of our

high-quality leads supply as we begin to rely less and less on

third-party suppliers.

But

before commenting further, I'd like to turn the call over to Kim

and have her take us through the important details of our financial

results. Kim?

Kimberly

Boren:

Thanks, Jeff, and

good afternoon, everyone. As noted in our press release today, for

year-over-year comparative purposes, the results for all periods

presented and discussed on our call today exclude our specialty

finance leads product, which was divested on December 31,

2016.

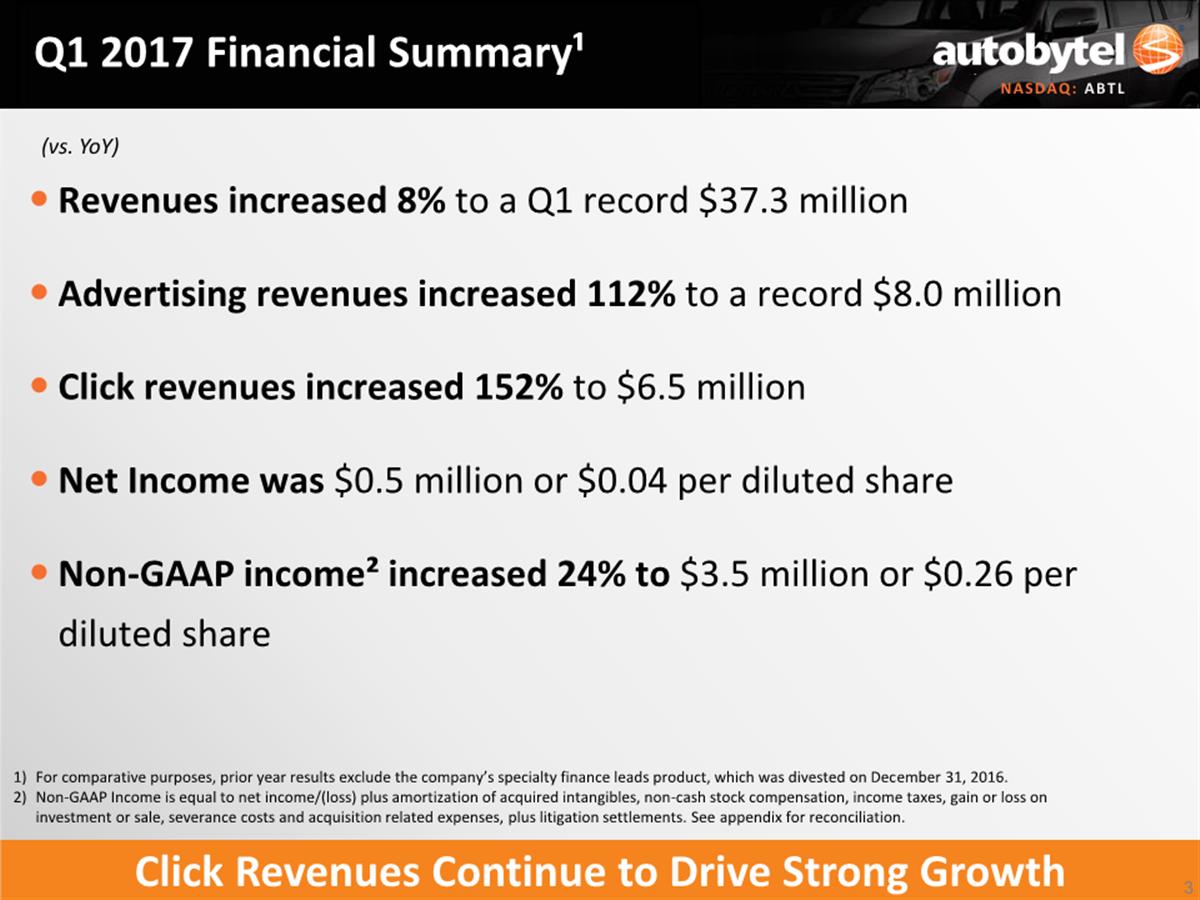

For

those of you following along with our earnings presentation, on

Slide 6, you see our first quarter revenues increase 8 percent to

$37.3 million compared to an adjusted $34.6 million in the year-ago

quarter. This was primarily driven by continued strong growth in

advertising click revenues, which increased 152 percent to $6.5

million.

For

listeners who have been following our story, you may recall that

we’ve historically broken out our leads business to

distinguish between our wholesale channel, which derives revenue

through automotive manufacturers for dealers participating in their

corporate leads program, and our retail channel, which comes

directly from automotive dealers.

Due to

evolving marketplace dynamics in the leads business, such as last

year's transition of 190 retail dealers into one comprehensive OEM

program as well as feedback from our shareholders and covering

analysts, we've elected to simplify our story and aggregate the two

channels, as it is no longer appropriate to look at these channel

dynamics separately.

With

that said, we will continue to break out new versus used car leads

given that used cars remains a growth story for Autobytel with a

long-term market opportunity. Jeff will expand on our used car

business later in the call.

Moving

to Slide 7, you'll see that we delivered approximately 2.2 million

automotive leads during the first quarter compared to 2.3 million

last year, a slight reduction as we work to replace a meaningful

amount of the eliminated low-quality volume with higher-quality

leads from our internal lead generation.

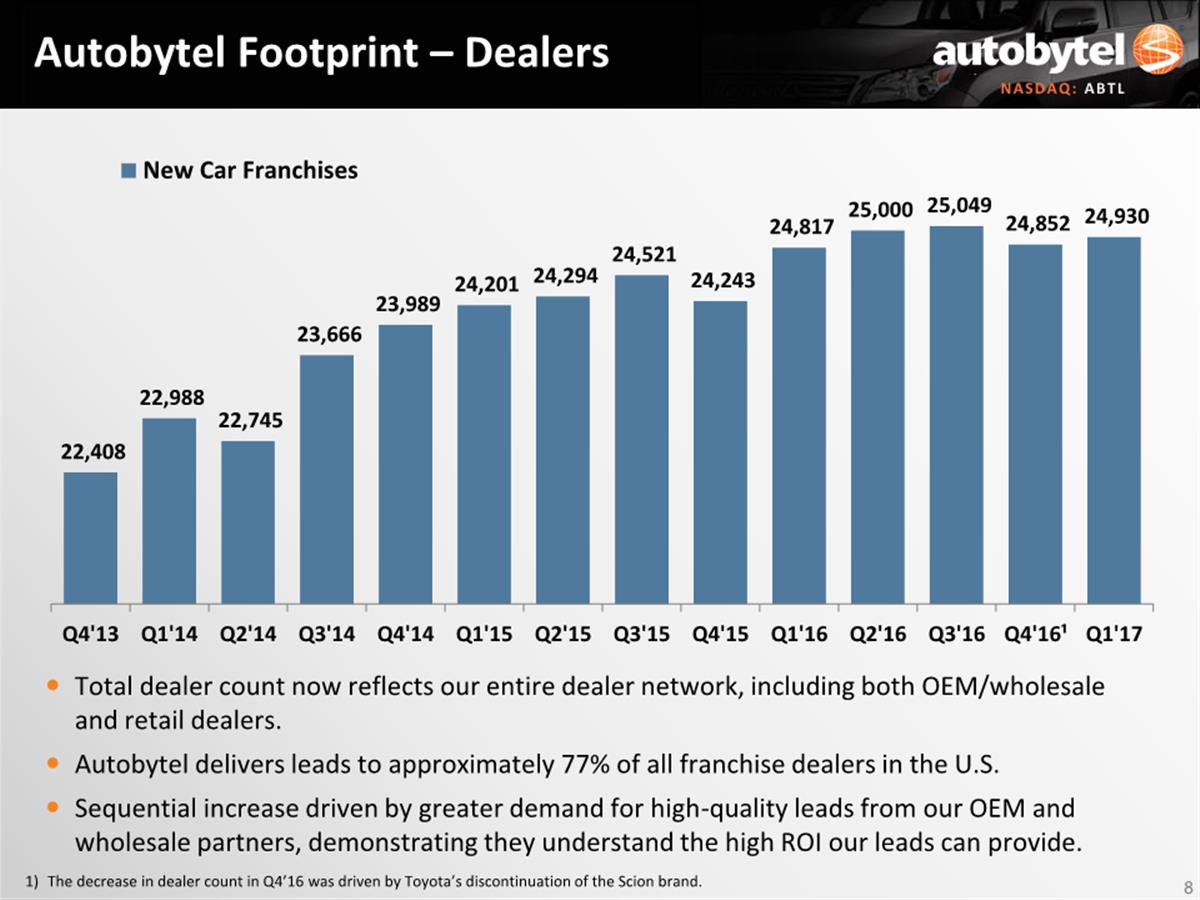

And on

Slide 8, you'll see that dealer counts stood at 24,930 at March

31st, a

slight increase from Q4. The increase was driven by greater demand

for high-quality leads from our OEM and wholesale

partners.

Similar

to our leads breakout described earlier, these dealer counts

reflect all of the dealers we sell leads to including both the

wholesale and retail channels for new cars.

Moving

on to advertising, our advertising revenues increased 112 percent

to a record $8 million compared to $3.8 million in the year-ago

quarter. The growth was once again due to a significant increase in

click revenues.

On

Slide 9, you'll see click revenues increase 152 percent to $6.5

million compared to $2.6 million in the same period last year. The

increase was driven by the continued strong growth of impressions,

click-through rates, and effective CPMs.

Now

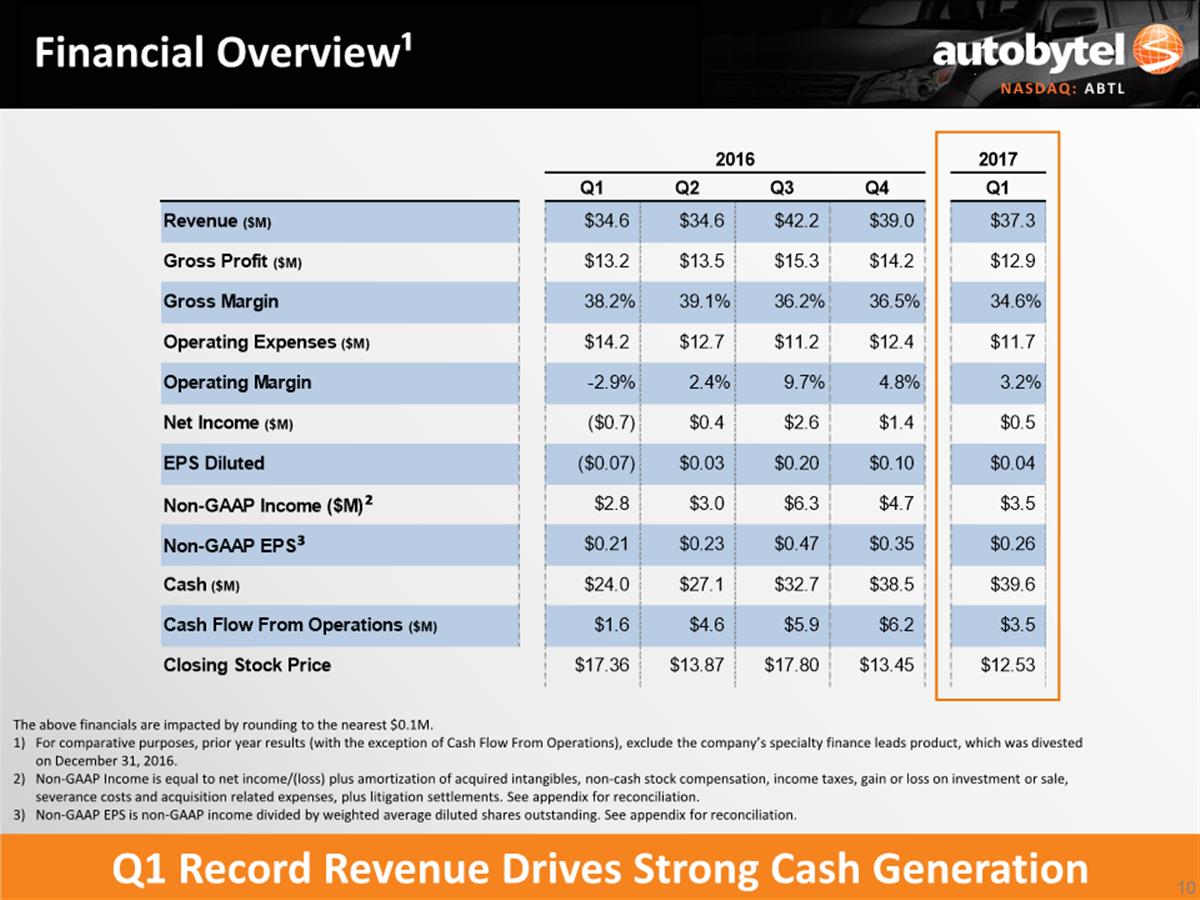

moving to Slide 10, gross profit during the first quarter was $12.9

million compared to an adjusted $13.2 million in the year-ago

quarter. In line with expectations, gross margin was 34.6 percent.

We continue to expect gross margins to remain in the mid-30 percent

range over the coming quarters as we focus on increasing traffic

and investing in technology.

Total

operating expenses in the first quarter decreased 18 percent to

$11.7 million compared to an adjusted $14.2 million in the year-ago

quarter. The decrease was driven by nonrecurring expenses in the

year-ago quarter including $1.3 million of severance expense, as

well as business optimization initiatives, and lower headcount in

the 2017 quarter. As a percentage of revenues, total operating

expenses were 31.3 percent compared to an adjusted 41.1 percent for

the year-ago quarter [Speaker

inadvertently stated 41.4 percent instead of 41.1 percent as

reflected in the accompanying Press Release].

We

expect our OpEx as a percent of revenue to continue in the low 30

percent range as we increase investments in technology, and sales

and marketing resources in 2017.

On a

GAAP basis, net income for the first quarter was $484,000 or $0.04

per diluted share on 13.3 million shares, compared to an adjusted

net loss of $749,000 or negative $(0.07) per share on 10.5 million

shares in the year-ago quarter. The increase was driven by the

aforementioned growth of advertising click revenues and reduced

operating expenses.

For the

first quarter, non-GAAP income, which adds back amortization on

acquired intangibles, noncash stock-based compensation, acquisition

costs, severance costs, gain or loss on investment or sale,

litigation settlements, and income taxes, increased 24 percent to

$3.5 million or $0.26 per diluted share, compared to an adjusted

$2.8 million or $0.21 per diluted share in the first quarter of

2016.

Cash

provided by operations in the first quarter improved to $3.5

million, compared to an unadjusted $1.6 million in the prior year

quarter.

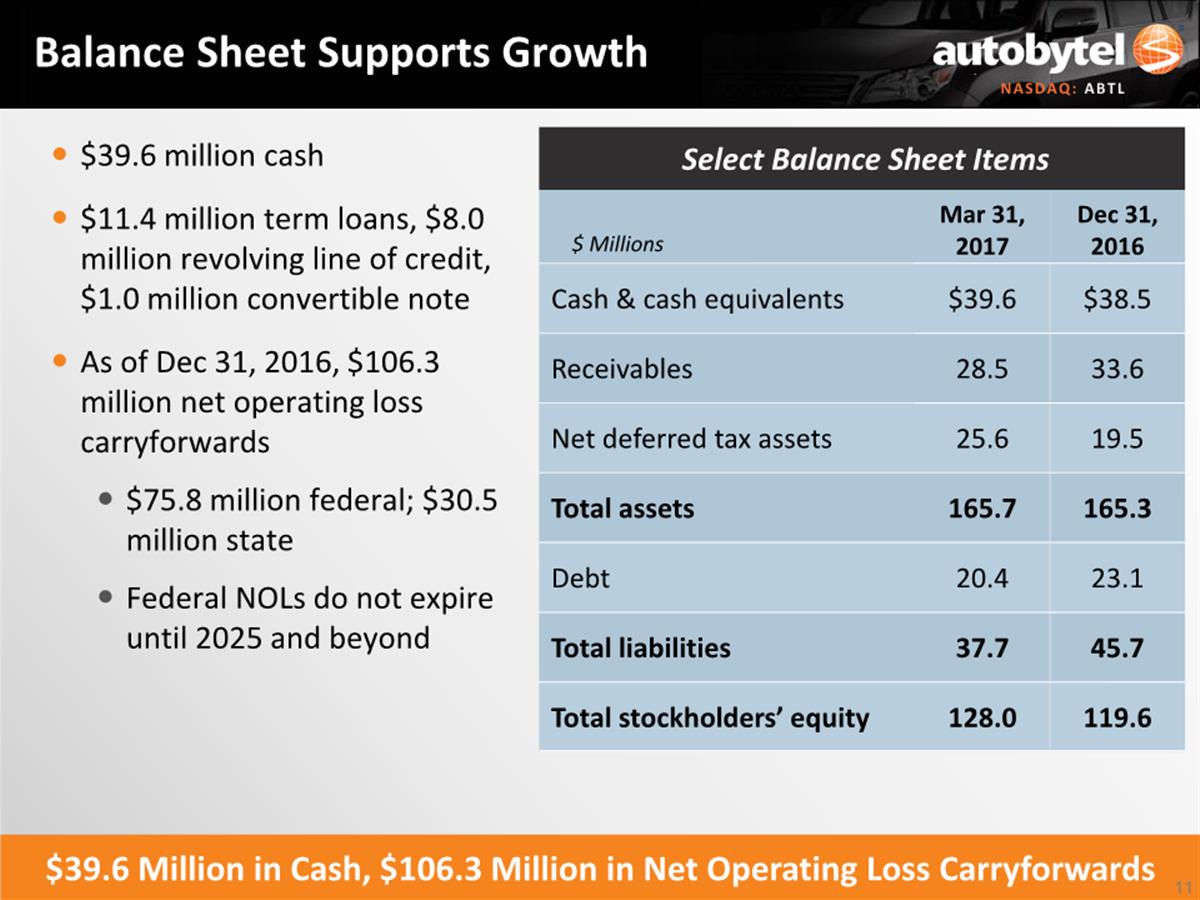

On

Slide 11, you'll see that our cash balance remains strong and

continues to grow despite debt pay down, with cash and cash

equivalents of $39.6 million at March 31, 2017, compared to $38.5

million at December 31, 2016. Total debt at March 31, 2017 was

reduced to $20.4 million compared to $23.1 million at the end of

2016.

With

that, I'll now turn the call back over to Jeff.

Jeffrey

Coats:

Thank you, Kim. As

I mentioned earlier, the first quarter of 2017 was highlighted by

the strong momentum in our clicks business. We are continuing to

increase click volumes with existing clients and have begun to add

OEMs, large dealer groups, dealer agencies and Tier-2 dealer

associations.

In

fact, one major Asian OEM has recently committed to a low 7-figure

marketing spend agreement in 2017 that would send our high-intent

traffic to their Tier-1 consumer websites. As I've mentioned in the

past, our strong growth in clicks up to this point has only come

from a small number of dealer and OEM customers with approximately

98 percent retention. Customer feedback remains very

positive.

In Q3

2016, we began heavily investing in traffic acquisition to

accelerate the continued growth of both of our high-quality clicks

product and our high-quality leads supply. OEMs typically have very

advanced digital marketing capabilities, and their increased demand

continues to demonstrate that they understand the high ROI from our

high-quality leads and clicks.

We have

actually been approached by several OEMs about restructuring our

relationships to transition all of their retail dealers on our

network into one comprehensive OEM program for each respective OEM,

similar to the 190 retail dealer transitions we had with a

different OEM last year. These discussions further reflect the

evolving dynamics in our leads business and were the contributing

factor in our decision to combine retail and wholesale leads in our

tracked metrics.

We’ve found

that these restructured agreements have several benefits to our

business. In addition to the customer service and administrative

relief of dealing with one OEM as opposed to hundreds of dealers,

the agreement provides us with the opportunity to supply leads to

even more dealers from the OEM that weren't previously on our

network.

Also,

this type of comprehensive relationship allows us to work closer

with the OEM field sales force on best practices and provides us

with a natural channel to introduce new products and

services.

Ultimately, the

benefit of this type of OEM program outweighs the loss of the

direct dealer relationships. For instance, the results of last

year's OEM program transition have already been very impressive

with lead volumes up 20 percent versus the same period in

2016.

At the

end of the third quarter last year, we launched a new version of

usedcars.com with fully responsive technology and mobile friendly

application. We remain very excited about the strength of the

“usedcars” domain and will continue to invest in it to

make it the premier used vehicle destination for consumers. Our

investments in the used car business have been paying off with our

traffic to the usedcars.com site increasing more than 25 percent

since the relaunch.

In

addition, our consumer acquisition team has begun launching SEM

campaigns to generate used car leads. This marks our first major

push into used car paid search and is built upon the usedcars.com

website infrastructure. This platform takes advantage of

proprietary techniques and technology acquired from Dealix and

Autotegrity combined with our existing expertise. In just a short

period of time, these SEM campaigns have contributed 17 percent of

our total used car volume.

The

opportunity in the used car business will continue to be

significant. The used car market in the United States has

historically been 2 to 3x that of new, and growth in this market is

projected to outpace new cars for at least the next few years. That

said, our used car business remains a focal point for growth, and

we continue to increase the level of resources dedicated to ramping

our used car platforms for internal lead generation.

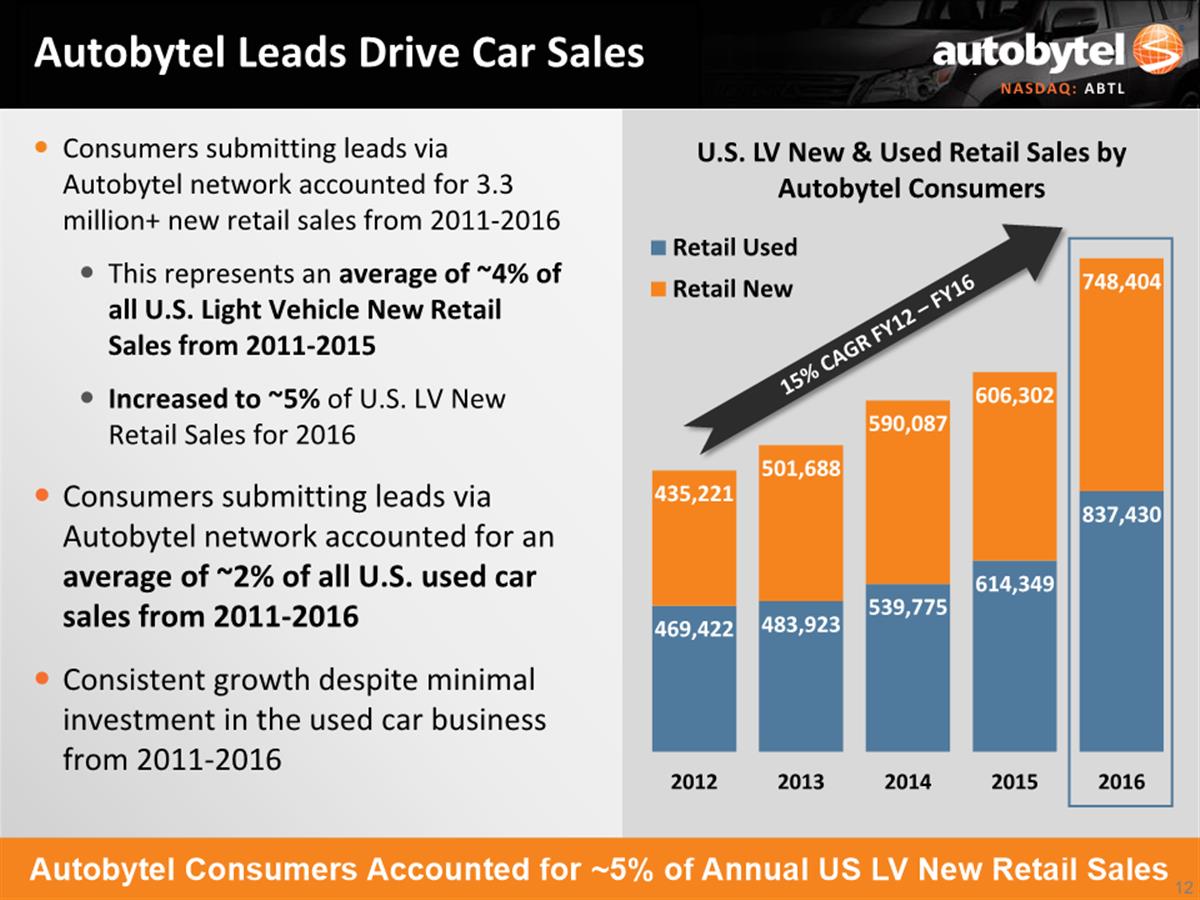

Turning

now to our usual industry metrics for the quarter, on Slide 12, you

can see that we estimate sales to consumers submitting new car

leads through Autobytel's network increased 23 percent to

approximately 748,000 units in 2016, which is estimated to have

accounted for approximately 5 percent of all new light vehicle

retail sales in the United States.

From a

used car perspective, we estimate that Autobytel leads accounted

for 837,000 unit sales in 2016, a 36 percent increase over the

prior year and approximately 2 percent of all used car retail sales

in the United States. This compares relatively to flat growth for

the industry at large for both new and used car sales.

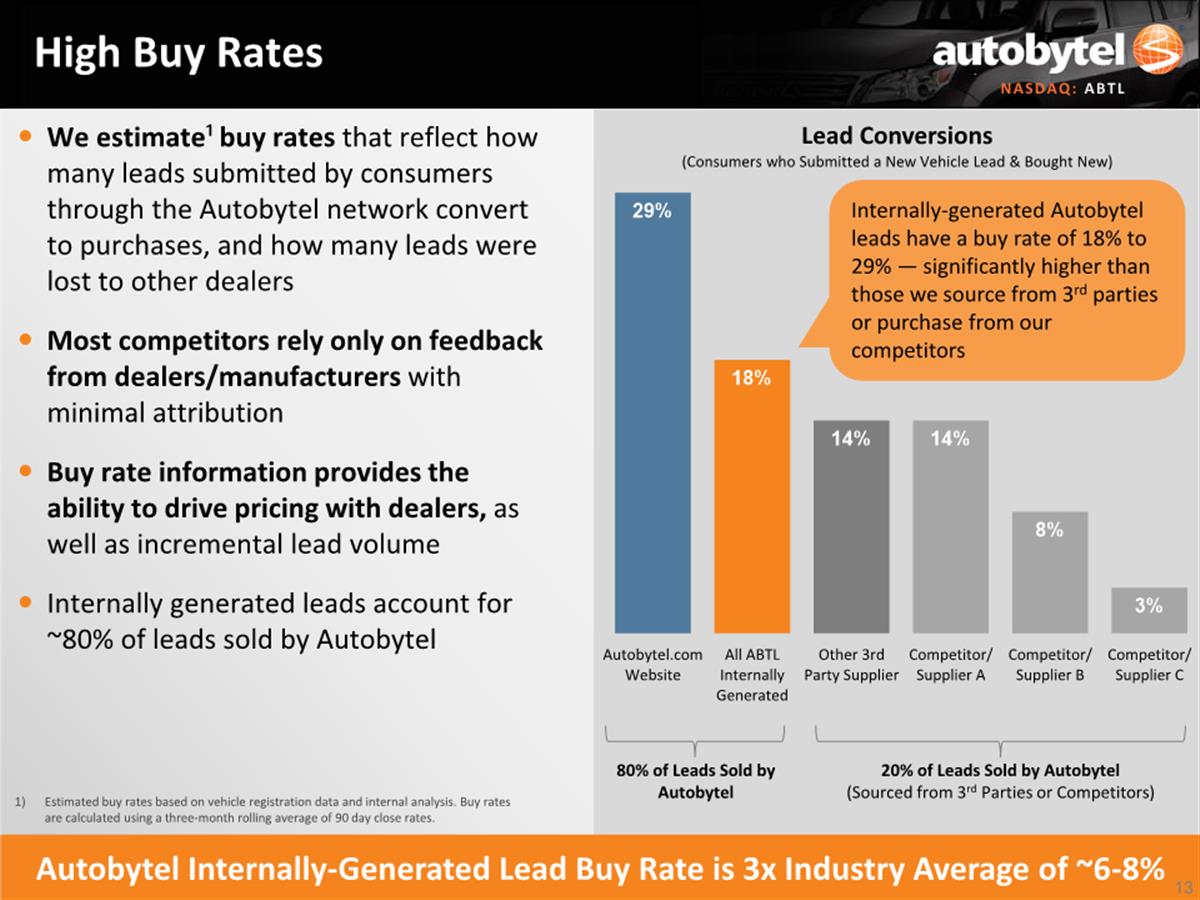

On

Slide 13, you'll see that our estimated average buy rate for

internally generated leads in the first quarter was 18 percent,

which remains in our targeted range of 16 percent to 24 percent.

Because of our ongoing commitment to lead quality, we are

continuing to focus on enhanced methodologies to meaningfully

increase the mix of internally generated leads from the current 80

percent level, while only utilizing volume from a small number of

trusted suppliers who share our commitment to quality. As I

mentioned earlier, this has resulted in increased retention across

our customer base.

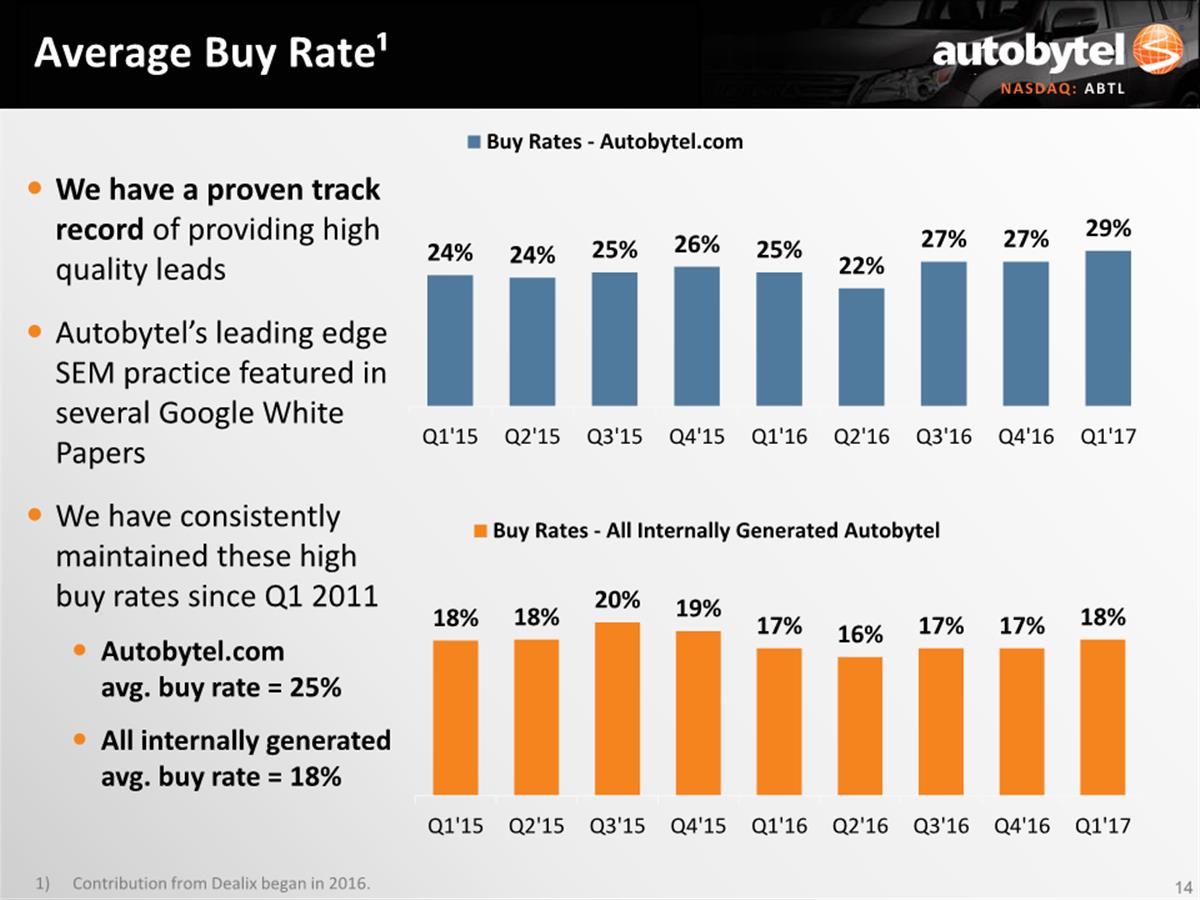

On

Slide 14, you'll also note that these estimated buy rates have

remained consistently strong since Q1 2011 with Autobytel.com

generating an average buy rate of 25 percent and all Autobytel

internally generated leads at about 18 percent.

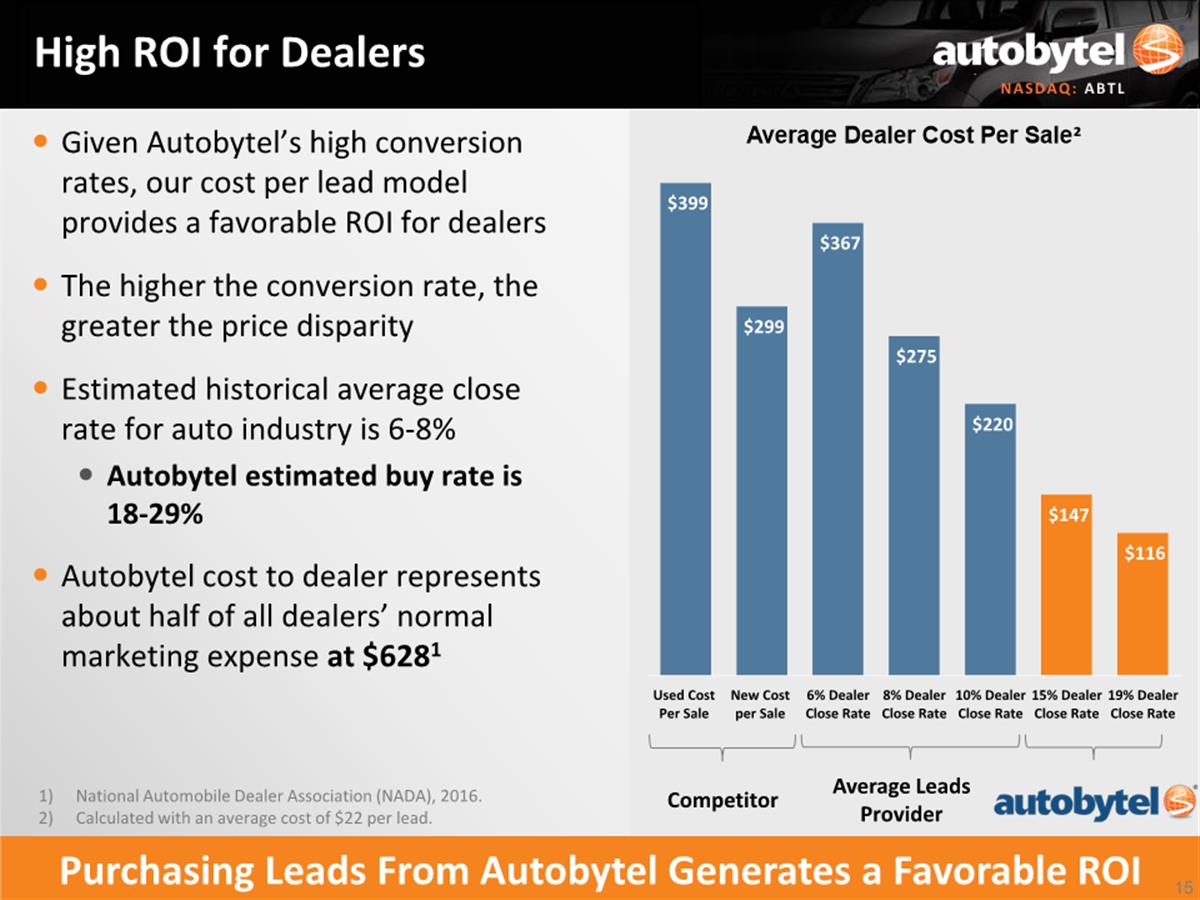

We are

often asked how we compare to other pay-per-sale models in the

marketplace. On Slide 15, you can see that at a conservative 15

percent to 19 percent buy rate for leads that we delivered to our

dealer customers, the hypothetical pay-per-sale in our model would

effectively range between $116 and $147 per car sold. This cost

would of course be even lower with our targeted 16 percent to 24

percent buy rates.

Moving

on to the industry outlook, as you can see on Slide 16, Automotive

News has a seasonally adjusted annual run rate or SAAR for total

sales at 17.5 million units for April 2017, which is flat compared

to one year ago and up from 16.6 million units in

March.

And on

Slide 17, you'll see that in April, J.D. Power / LMC automotive

forecasted full year 2017 total light vehicle sales of 17.5 million

units and retail light vehicle sales at 14.2 million units, both

roughly flat from 2016.

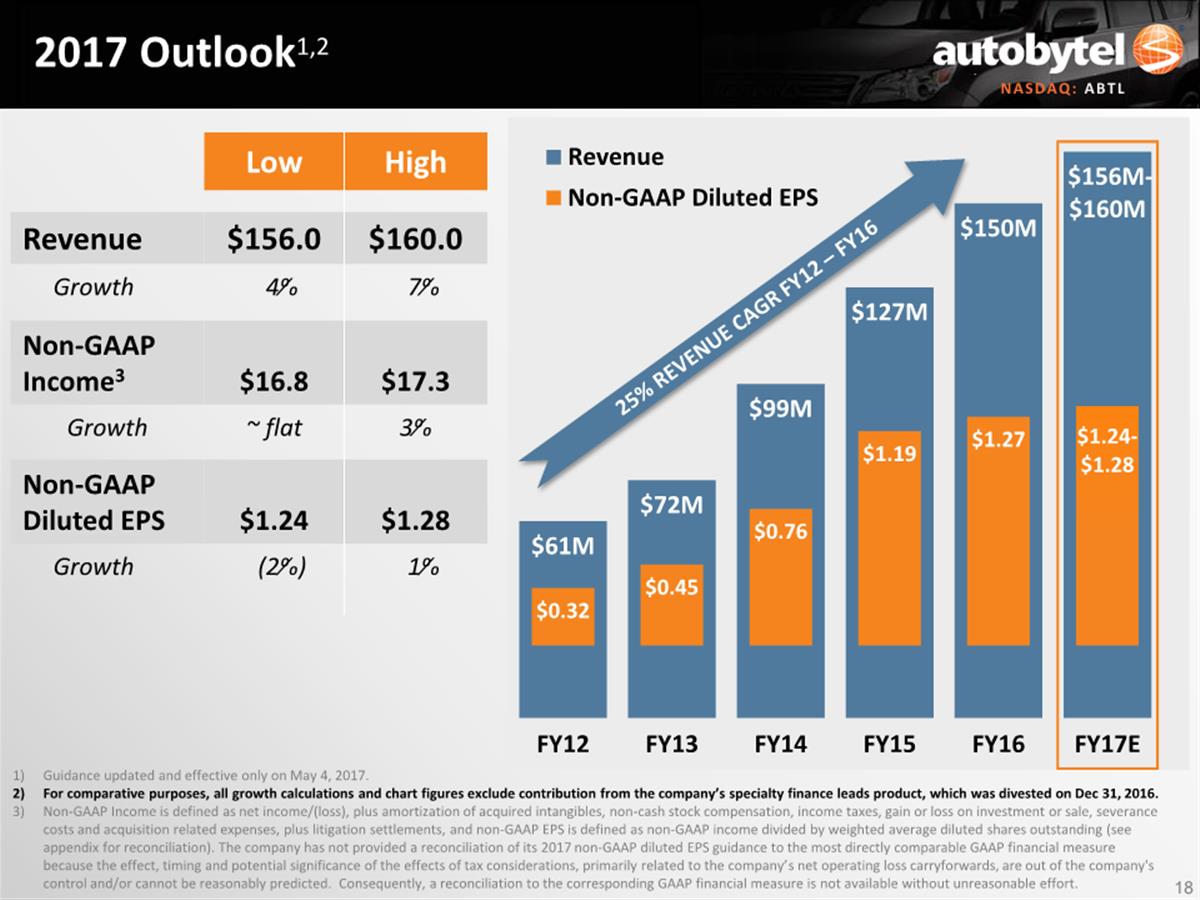

Moving

now to our 2017 business outlook highlighted on Slide 18, we

continue to expect revenue to range between $156 million and $160

million, representing an increase of approximately 4 percent to 7

percent from 2016 [Speaker

inadvertently stated 4 to 6 percent but actual range was 4 to 7

percent as reflected in the accompanying Press Release and

Slides]. We also expect non-GAAP income to range between

$16.8 million and $17.3 million, representing an increase of up to

approximately 3 percent for 2016 with non-GAAP diluted EPS ranging

between $1.24 and $1.28 on 13.5 million shares.

Note

that for comparative purposes, the foregoing percentage growth

calculations and 2016 non-GAAP diluted EPS exclude 2016 revenues,

non-GAAP income, and non-GAAP EPS related to the company's

specialty finance leads product that we divested on December 31,

2016.

2017

remains a year of growth and continued investment for Autobytel. We

will focus on investments in technology, including investment in

our consumer acquisition technology, the AutoWeb ad platform, and

our consumer-facing websites, which include Car.com, AutoWeb.com,

Autobytel.com and usedcars.com. We are also investing in an

enterprise data platform, which will combine all of our data into

one unified data

lake.

This

will enable us to continue to optimize the consumer experience,

increase efficiency of operations, and provide a more personalized

experience for our customers. We also expect to continue to

strengthen our U.S. and Guatemalan development teams to further

accelerate the growth of our click and core leads products,

especially the usedcars.com website. And, we expect these

investments to ultimately enhance and simplify the consumer's path

to purchase of new or used cars and trucks while providing access

to high-intent, in-market car buyers for our dealer, and OEM

customers.

At this

time, Operator, we’re happy to take questions.

Questions and

Answers

Operator:

Thank you, sir.

Ladies and gentlemen, at this time, if you have a question, please

press star, then one on your touchtone telephone. If your question

has been answered, or you wish to remove yourself from the queue,

please press the pound key.

Our

first question will come from Sameet Sinha with B. Riley. Please

proceed.

Sameet

Sinha:

A couple of

questions here. So talking about the used car business, you said 78

percent of your volume is coming through search engine marketing.

Where is the balance of the volume coming from?

And the

second question is, if we look at your revenue, the way you

maintained full year guidance despite having a very strong Q1. If

you assume a 5 percent sequential growth in revenue in the second

quarter, which is to be expected because of a seasonally strong

quarter, you're basically saying the second half, you're expecting

flat year-over-year revenue –adjusted revenue. Can you talk

about that? Then, I have a follow-up.

Jeffrey

Coats:

Sameet, I'll answer

your first question, and Kim can answer the second one. We (gain)

our used car lead volume through partnerships with other firms that

we buy the leads from, which is a large portion of our used car

volume as well as the pure organic leads that come off of our

website, in addition to what we're doing from an SEM

standpoint.

But we

are continuing to invest additional resources in our SEM

capabilities in order to drive a higher volume of that traffic

–of that volume. And of course, it just takes a little bit of

time because we are trying to make sure that we're generating the

same kind of quality. So overall, about 50 percent of our used

leads are organic in nature, and the remainder are leads that we

buy from partners on the outside.

Kimberly

Boren:

And then, Sameet,

for your second question regarding revenues. So one quick misnomer

in what you said. Q2 is typically lower than Q1. So Q1 and Q3 are

typically our stronger quarters whereas Q2 and Q4 are typically our

weaker quarters, although we've seen that changing a little bit

with the incentives in the markets in Black Friday in the fourth

quarter.

And

with automotive projections, we'd expect this year to be a little

bit choppy. But in any case, Q2 should be lower than Q1 from a

seasonal perspective. And then I also wonder if you're excluding

the specialty finance numbers when you said that there would be

little growth quarter –or year-over-year from a quarterly

perspective in the second half.

Sameet

Sinha:

Okay. It was, I

guess, the second quarter seasonality which I had not understood

properly. My follow-up question is, can you talk about the dealer

count? SAAR finally started to move up. What are the trends that

you think that's a sustainable trend at this point or is this

something that happened one time? Can you elaborate on that

please?

Jeffrey

Coats:

I don't think it's

a one-time thing, Sameet. It's really a function of the dealers

that are on our retail program and the dealers that are members of

the corporate leads programs of each of the 31 manufacturers or 31

brands that we do business with. So they have dealers coming in and

out of the corporate programs as they fill the volume that each of

those respective dealers want to buy from the program.

So

those numbers fluctuate. We experience something similar, as you

know, on the retail side, the churn in the dealer body. But to some

extent, the characteristics are somewhat same –somewhat the

same. We've come to realize that more dealers move in and out

during the course of the year than we've recognized historically,

and that's because they're using different products throughout

different times of the year.

We

would expect to see a better dealer profile, number of dealers with

whom we do business as we move forward.

Operator:

Our next question

will come from Gary Prestopino with Barrington

Research.

Gary

Prestopino:

A number of

questions here. Jeff, could you tell us what percentage of your

leads and percentage of your revenues were used? Are you giving out

those statistics anymore in the quarter, and how that shifted

year-over-year?

Kimberly

Boren:

Gary, so we didn't

give out revenues, but if you look in the slide presentation, you

can see the distribution between new and used leads.

Gary

Prestopino:

Yes, all right

–but that's kind of –all right, I can work with that.

The other thing is, Jeff, you've mentioned something about –I

didn't quite catch it. Thought process of focusing more on the

corporate lead programs versus dealers, specific dealers? And I

guess what happens there is, like you say, the OEM –the

dealers work with the OEM manufacturer and I guess sign-up for a

program through the OEM? Is that how that works?

Jeffrey

Coats:

Yes.

Gary

Prestopino:

Okay. So your

thought-process is possibly moving more resources to that channel

of distribution versus having the individual dealer touch

points?

Jeffrey

Coats:

Generally, the

answer to that question is we plan to focus on it a little more,

yes, but not really moving more resources to it per se because it's

already very efficiently managed by the people that we have

involved. We may have to beef that up a little bit over time. But

the manufacturers do a lot of the lifting. We get one invoice as

opposed to hundreds of invoices.

The

manufacturer –dealer –individual dealers will scrub out

leads or return leads to us. That's not really something that

happens in the manufacturer programs. There are a lot of benefits.

In addition, in the program that took place last year, part of the

reason we were willing to do it is they committed to work with us

to sell our other products to the dealers as part of their dealer

base either by co-opting it or just having their field salespeople

help with it or whatever.

And so

that has really helped us increase the sale of some of our other

dealer products in addition. So we think there's a lot of benefit

doing it that way. I don't necessarily expect that perhaps even a

majority of our retail business will evolve in that

direction.

But

there are several other manufacturers that we know are interested

in doing this, and so we'll see on a case-by-case basis whether

that makes sense. The one we've done so far does a lot –does

make a lot of sense, and we would expect some similar benefits in

some of the others. So we'll see.

And in

addition, it also positions us much more strongly for our clicks

product to have the manufacturers involve both as a customer of our

clicks product and assisting us with encouraging their dealers to

sign up for it, if not perhaps have some of that co-opted as well.

So there are multiple benefits of this approach.

Gary

Prestopino:

Okay. Just a couple

more questions and I'll jump off. In terms of the AutoWeb business,

I believe you had said that you were just kind of testing that out

with a small subset of dealers, and the plan is to roll it out

throughout 2017. If that's a correct statement, when will all of

this be –the ability, or the AutoWeb product –be rolled

out to all your customer base?

Jeffrey

Coats:

Well, it will take

some time to roll it out to all of the customer base. We've begun

discussions and meetings with various manufacturers and large

dealer groups. As I mentioned in the script, we've already signed

the deal with one particular Asian manufacturer that's committed to

a 7-figure spend on the clicks product for 2017.

Part of

the timing on some of these, particularly with the clicks products,

is we have to do some integration work with either the manufacturer

or the dealer, dealer agency involved in doing it. So it takes a

little bit of time to actually begin generating

revenue.

But we

are in the process of beginning to roll it out to a larger number

of our customers. And of course, we're targeting the larger

customers first, the manufacturers, the large dealer groups as we

get going with it.

Operator:

Thank you. As a

reminder, ladies and gentlemen, if you have a question at this

time, please press star then one on your touchtone

telephone.

Our

next question will come from Bruce Goldfarb with Lake Street

Capital. Please proceed.

Bruce

Goldfarb:

So my first

question has to do with just leads and pricing power. Given sort of

a flattish SAAR and some inventory buildup, dealer inventory

buildup, have you had any ability or you guys have been able to

increase prices on leads?

Jeffrey

Coats:

Well, we are

raising prices on leads and new contracts as we write them. And as

we have opportunities, we are raising prices at the dealer level,

yes. And we've also had some opportunities to do that at the

manufacturer level and have done so. So it's –we are doing

it. It's not across the board, but we are –we have been

increasing price.

Bruce

Goldfarb:

Thank you. And then

the pay-per-click business was up 152 percent. For the same

reasons, sort of a flattish SAAR, are you seeing a lot more demand

and interest in that business?

Jeffrey

Coats:

We are seeing a lot

of interest in that business. And the pricing in it, as I think you

know, is currently, we provide clicks to dealers –through

their agencies for the most part –at a flat $3.50 a click. On

the manufacturer side, the wholesale side, it's really more of an

auction driven approach. Where we started off originally one year

or two ago, (at) $0.50 per click. And today, those auctions run

between $1 and $2 per click, depending upon the make and the

geography.

So we

would expect the dynamics of supply and demand to further kick in,

and we should see some escalation in those prices as different

buyers are interested in buying limited click volume. And, we

benefit from that, which is of course the whole reason that the

clicks business is on an auction driven basis. Supply and

demand.

Bruce

Goldfarb:

And then it sounds

like the used –the traffic on the usedcars.com site is up

significantly. Do you guys have a timetable when do you want to try

to change the mix from organic to purchased in terms of the used

car leads?

Jeffrey

Coats:

Well, as I

mentioned before, currently, it's about 50 percent organic, the

volume. We are turning up the flame under the SEM side. So even

though we have to be careful and do it in a quality driven approach

–so we don't get too far ahead of ourselves –I would

think we'll have more success growing the paid side of the used car

volume quicker than we will the organic side.

But

candidly, that will actually be interesting and fun to be part of,

because as I mentioned, we are continuing to invest in the

usedcars.com website –that is the pivot, the center around

which we're building our used car business. That had been

historically an incredibly robust site for Dealix back when they

were operating it on a very focused basis a few years ago. And so

we are in the process of moving it back to that kind of historical,

robust approach.

So, we

remain extremely bullish about the growth opportunities for us in

the used car business. It's still probably less than 10 percent of

our overall revenue. So there's a big growth opportunity for us

there.

Operator:

Thank you. At this

time, this concludes our question-and-answer session. I would now

like to turn the call back over to Mr. Coats for closing

remarks.

Jeffrey

Coats:

Thank you. Thanks,

everyone, for joining the call today. I also want to thank our team

of hardworking and dedicated employees. We will be presenting at

the Barrington, B. Riley and Cowen conferences later this month and

in June and hope to catch some of you there. If not, we look

forward to providing you the next update on the Q2 call in August.

Thank you.

Operator:

Ladies and

gentlemen, this does conclude today's teleconference. You may now

disconnect your lines at this time. Thank you for your

participation.

END