Attached files

| file | filename |

|---|---|

| EX-32 - EX-32 - WisdomTree Investments, Inc. | d379196dex32.htm |

| EX-31.2 - EX-31.2 - WisdomTree Investments, Inc. | d379196dex312.htm |

| EX-31.1 - EX-31.1 - WisdomTree Investments, Inc. | d379196dex311.htm |

| EX-10.1 - EX-10.1 - WisdomTree Investments, Inc. | d379196dex101.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2017

or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number 001-10932

WisdomTree Investments, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 13-3487784 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

| 245 Park Avenue, 35th Floor New York, New York |

10167 | |

| (Address of principal executive officers) | (Zip Code) |

212-801-2080

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

As of April 27, 2017, there were 136,610,528 shares of the registrant’s Common Stock, $0.01 par value per share, outstanding.

Table of Contents

WISDOMTREE INVESTMENTS, INC.

Form 10-Q

For the Quarterly Period Ended March 31, 2017

2

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements that are based on our management’s beliefs and assumptions and on information currently available to our management. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other comparable terminology. These statements are only predictions. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect results. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed in the section entitled “Risk Factors” included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016. If one or more of these or other risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those implied or projected by the forward-looking statements. No forward-looking statement is a guarantee of future performance. You should read this Report and the documents that we reference in this Report and have filed with the Securities and Exchange Commission, or the SEC, as exhibits to this Report, completely and with the understanding that our actual future results may be materially different from any future results expressed or implied by these forward-looking statements.

In particular, forward-looking statements in this Report may include statements about:

| • | anticipated trends, conditions and investor sentiment in the global markets and exchange traded products, or ETPs, which include exchange traded funds, or ETFs; |

| • | anticipated levels of inflows into and outflows out of our ETPs; |

| • | our ability to deliver favorable rates of return to investors; |

| • | our ability to develop new products and services; |

| • | our ability to maintain current vendors or find new vendors to provide services to us at favorable costs; |

| • | our ability to successfully expand our business into non-U.S. markets; |

| • | competition in our business; and |

| • | the effect of laws and regulations that apply to our business. |

The forward-looking statements in this Report represent our views as of the date of this Report. We anticipate that subsequent events and developments may cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. Therefore, these forward-looking statements do not represent our views as of any date other than the date of this Report.

3

Table of Contents

| ITEM 1. | FINANCIAL STATEMENTS |

WisdomTree Investments, Inc. and Subsidiaries

Consolidated Balance Sheets

(In Thousands, Except Per Share Amounts)

| March 31, 2017 |

December 31, 2016 |

|||||||

| (Unaudited) | ||||||||

| Assets |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 79,637 | $ | 92,722 | ||||

| Securities owned, at fair value |

57,611 | 58,907 | ||||||

| Securities held-to-maturity |

3,997 | 3,994 | ||||||

| Accounts receivable |

19,234 | 17,668 | ||||||

| Prepaid expenses |

3,219 | 3,346 | ||||||

| Other current assets |

534 | 555 | ||||||

|

|

|

|

|

|||||

| Total current assets |

164,232 | 177,192 | ||||||

| Fixed assets, net |

11,642 | 11,748 | ||||||

| Securities held-to-maturity |

19,205 | 18,502 | ||||||

| Deferred tax asset, net |

3,596 | 9,826 | ||||||

| Investment, carried at cost |

20,000 | 20,000 | ||||||

| Goodwill |

1,799 | 1,799 | ||||||

| Intangible asset |

9,953 | 9,953 | ||||||

| Other noncurrent assets |

748 | 747 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 231,175 | $ | 249,767 | ||||

|

|

|

|

|

|||||

| Liabilities and stockholders’ equity |

||||||||

| Liabilities |

||||||||

| Current liabilities: |

||||||||

| Fund management and administration payable |

$ | 13,229 | $ | 13,584 | ||||

| Compensation and benefits payable |

4,923 | 14,652 | ||||||

| Income taxes payable |

4,518 | 4,700 | ||||||

| Acquisition payable |

— | 3,537 | ||||||

| Securities sold, but not yet purchased, at fair value |

27 | 1,248 | ||||||

| Accounts payable and other liabilities |

6,033 | 5,806 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

28,730 | 43,527 | ||||||

| Deferred rent payable |

4,839 | 4,896 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

33,569 | 48,423 | ||||||

|

|

|

|

|

|||||

| Commitments and Contingencies (Note 8) |

||||||||

| Stockholders’ equity |

||||||||

| Preferred stock, par value $0.01; 2,000 shares authorized: |

— | — | ||||||

| Common stock, par value $0.01; 250,000 shares authorized; issued and outstanding: 136,622 and 136,475 at March 31, 2017 and December 31, 2016, respectively |

1,366 | 1,365 | ||||||

| Additional paid-in capital |

220,858 | 224,739 | ||||||

| Accumulated other comprehensive income/(loss) |

98 | (44 | ) | |||||

| Accumulated deficit |

(24,716 | ) | (24,716 | ) | ||||

|

|

|

|

|

|||||

| Total stockholders’ equity |

197,606 | 201,344 | ||||||

|

|

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | 231,175 | $ | 249,767 | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these consolidated financial statements

4

Table of Contents

WisdomTree Investments, Inc. and Subsidiaries

Consolidated Statements of Operations

(In Thousands, Except Per Share Amounts)

(Unaudited)

| Three Months Ended March 31, | ||||||||

| 2017 | 2016 | |||||||

| Revenues: |

||||||||

| Advisory fees |

$ | 53,262 | $ | 60,615 | ||||

| Other income |

1,337 | 263 | ||||||

|

|

|

|

|

|||||

| Total revenues |

54,599 | 60,878 | ||||||

| Expenses: |

||||||||

| Compensation and benefits |

17,874 | 15,226 | ||||||

| Fund management and administration |

9,600 | 10,044 | ||||||

| Marketing and advertising |

3,537 | 3,832 | ||||||

| Sales and business development |

2,962 | 2,447 | ||||||

| Professional and consulting fees |

1,558 | 2,835 | ||||||

| Occupancy, communications and equipment |

1,353 | 1,222 | ||||||

| Depreciation and amortization |

337 | 316 | ||||||

| Third-party sharing arrangements |

932 | 907 | ||||||

| Acquisition payment |

— | 745 | ||||||

| Other |

1,624 | 1,632 | ||||||

|

|

|

|

|

|||||

| Total expenses |

39,777 | 39,206 | ||||||

|

|

|

|

|

|||||

| Income before taxes |

14,822 | 21,672 | ||||||

| Income tax expense |

7,942 | 9,600 | ||||||

|

|

|

|

|

|||||

| Net income |

$ | 6,880 | $ | 12,072 | ||||

|

|

|

|

|

|||||

| Net income per share—basic |

$ | 0.05 | $ | 0.09 | ||||

|

|

|

|

|

|||||

| Net income per share—diluted |

$ | 0.05 | $ | 0.09 | ||||

|

|

|

|

|

|||||

| Weighted-average common shares—basic |

134,385 | 135,467 | ||||||

|

|

|

|

|

|||||

| Weighted-average common shares—diluted |

135,509 | 136,457 | ||||||

|

|

|

|

|

|||||

| Cash dividends declared per common share |

$ | 0.08 | $ | 0.08 | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these consolidated financial statements

5

Table of Contents

WisdomTree Investments, Inc. and Subsidiaries

Consolidated Statements of Comprehensive Income

(In Thousands)

(Unaudited)

| Three Months Ended March 31, | ||||||||

| 2017 | 2016 | |||||||

| Net income |

$ | 6,880 | $ | 12,072 | ||||

| Other comprehensive income/(loss) |

||||||||

| Unrealized losses on available-for-sale securities, net of tax |

(103 | ) | — | |||||

| Foreign currency translation adjustment |

245 | 373 | ||||||

|

|

|

|

|

|||||

| Other comprehensive income |

142 | 373 | ||||||

|

|

|

|

|

|||||

| Comprehensive income |

$ | 7,022 | $ | 12,445 | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these consolidated financial statements

6

Table of Contents

WisdomTree Investments, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(In Thousands)

(Unaudited)

| Three Months Ended March 31, | ||||||||

| 2017 | 2016 | |||||||

| Cash flows from operating activities: |

||||||||

| Net income |

$ | 6,880 | $ | 12,072 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: |

||||||||

| Deferred income taxes |

6,302 | 9,219 | ||||||

| Stock-based compensation |

3,421 | 3,503 | ||||||

| Depreciation and amortization |

337 | 316 | ||||||

| Other |

120 | (59 | ) | |||||

| Changes in operating assets and liabilities: |

||||||||

| Securities owned, at fair value |

1,292 | — | ||||||

| Accounts receivable |

(1,553 | ) | 7,055 | |||||

| Prepaid expenses |

127 | (960 | ) | |||||

| Other assets |

64 | 186 | ||||||

| Acquisition payable |

(3,538 | ) | 745 | |||||

| Fund management and administration payable |

(400 | ) | (199 | ) | ||||

| Compensation and benefits payable |

(9,772 | ) | (22,973 | ) | ||||

| Income taxes payable |

177 | (2,879 | ) | |||||

| Securities sold, but not yet purchased, at fair value |

(1,222 | ) | — | |||||

| Accounts payable and other liabilities |

212 | 751 | ||||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

2,447 | 6,777 | ||||||

|

|

|

|

|

|||||

| Cash flows from investing activities: |

||||||||

| Purchase of fixed assets |

(193 | ) | (336 | ) | ||||

| Purchase of securities held-to-maturity |

(759 | ) | — | |||||

| Purchase of securities available-for-sale |

(21,340 | ) | — | |||||

| Proceeds from held-to-maturity securities maturing or called prior to maturity |

51 | 1,113 | ||||||

| Proceeds from sales and maturities of securities available-for-sale |

21,000 | — | ||||||

| Acquisition less cash acquired |

— | (11,818 | ) | |||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(1,241 | ) | (11,041 | ) | ||||

|

|

|

|

|

|||||

| Cash flows from financing activities: |

||||||||

| Dividends paid |

(10,930 | ) | (10,913 | ) | ||||

| Shares repurchased |

(3,628 | ) | (35,555 | ) | ||||

| Proceeds from exercise of stock options |

5 | 75 | ||||||

|

|

|

|

|

|||||

| Net cash used in financing activities |

(14,553 | ) | (46,393 | ) | ||||

|

|

|

|

|

|||||

| Increase in cash flow due to changes in foreign exchange rate |

262 | 348 | ||||||

|

|

|

|

|

|||||

| Net decrease in cash and cash equivalents |

(13,085 | ) | (50,309 | ) | ||||

| Cash and cash equivalents—beginning of period |

92,722 | 210,070 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents—end of period |

$ | 79,637 | $ | 159,761 | ||||

|

|

|

|

|

|||||

| Supplemental disclosure of cash flow information: |

||||||||

| Cash paid for taxes |

$ | 1,247 | $ | 3,594 | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these consolidated financial statements

7

Table of Contents

WisdomTree Investments, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

(In Thousands, Except Share and Per Share Amounts)

1. Organization and Description of Business

WisdomTree Investments, Inc., through its global subsidiaries (collectively, “WisdomTree” or the “Company”), is an exchange traded product (“ETP”) sponsor and asset manager headquartered in New York. WisdomTree offers ETPs covering equity, fixed income, currency, alternative and commodity asset classes. The Company has the following wholly-owned operating subsidiaries:

| • | WisdomTree Asset Management, Inc. (“WTAM”) is a New York based investment adviser registered with the SEC providing investment advisory and other management services to the WisdomTree Trust (“WTT”) and WisdomTree exchange traded funds (“ETFs”). |

| • | Boost Management Limited (“BML”) is a Jersey based management company providing investment and other management services to Boost Issuer PLC (“BI”) and Boost ETPs. |

| • | WisdomTree Europe Limited (“WisdomTree Europe”) is a U.K. based company registered with the Financial Conduct Authority providing management and other services to BML and WisdomTree Management Limited. |

| • | WisdomTree Management Limited (“WTML”) is an Ireland based management company providing investment and other management services to WisdomTree Issuer plc (“WTI”) and WisdomTree UCITS ETFs. |

| • | WisdomTree Japan Inc. (“WTJ”) is a Japan based company that is registered with Japan’s Ministry of Finance and serves the institutional market selling U.S. listed WisdomTree ETFs in Japan. |

| • | WisdomTree Commodity Services, LLC (“WTCS”) is a New York based company that serves as the managing owner and commodity pool operator of the WisdomTree Continuous Commodity Index Fund. WTCS is registered with the Commodity Futures Trading Commission (“CFTC”) and is a member of the National Futures Association (“NFA”). |

| • | WisdomTree Asset Management Canada, Inc. (“WTAMC”) is a Canada based investment fund manager registered with the Ontario Securities Commission providing fund management services to locally-listed WisdomTree ETFs. |

The WisdomTree ETFs are issued in the U.S. by WTT. WTT, a non-consolidated third party, is a Delaware statutory trust registered with the SEC as an open-end management investment company. The Company has licensed to WTT the use of certain of its own indexes on an exclusive basis for the WisdomTree ETFs in the U.S. The Boost ETPs are issued by BI. BI, a non-consolidated third party, is a public limited company organized in Ireland. The WisdomTree UCITS ETFs are issued by WTI. WTI, a non-consolidated third party, is a public limited company organized in Ireland.

The Board of Trustees and Board of Directors of WTT, BI and WTI, respectively, are separate from the Board of Directors of the Company. The respective Trustees and Directors of WTT, BI and WTI, as applicable, are primarily responsible for overseeing the management and affairs of the WisdomTree ETFs, Boost ETPs and the WisdomTree UCITS ETFs for the benefit of the WisdomTree ETF, Boost ETP and the WisdomTree UCITS ETF shareholders, respectively, and have contracted with the Company to provide for general management and administration services. The Company, in turn, has contracted with third parties to provide the majority of these administration services. In addition, certain officers of the Company provide general management services for WTT, BI and WTI.

2. Significant Accounting Policies

Basis of Presentation

These consolidated financial statements have been prepared in conformity with U.S. generally accepted accounting principles (“GAAP”) and in the opinion of management reflect all adjustments, consisting of only normal recurring adjustments, necessary for a fair statement of financial condition, results of operations, and cash flows for the periods presented. The consolidated financial statements include the accounts of the Company’s wholly owned subsidiaries.

All intercompany accounts and transactions have been eliminated in consolidation. Certain accounts in the prior years’ consolidated financial statements have been reclassified to conform to the current year’s consolidated financial statements presentation. These reclassifications had no effect on the previously reported operating results.

Consolidation

The Company consolidates entities in which it has a controlling financial interest. The Company determines whether it has a controlling financial interest in an entity by first evaluating whether the entity is a voting interest entity (“VOE”) or a variable interest entity (“VIE”). The usual condition for a controlling financial interest in a VOE is ownership of a majority voting interest. If the Company has a majority voting interest in a VOE, the entity is consolidated. The Company has a controlling financial interest in a VIE

8

Table of Contents

when the Company has a variable interest that provides it with (i) the power to direct the activities of the VIE that most significantly impact the VIE’s economic performance and (ii) the obligation to absorb losses of the VIE or the right to receive benefits from the VIE that could potentially be significant to the VIE.

The Company had no variable interests in any VIEs at March 31, 2017 and December 31, 2016.

Segment and Geographic Information

The Company operates as an ETP sponsor and asset manager providing investment advisory services in the U.S., Europe, Canada and Japan. These activities are reported in the Company’s U.S. Business and International Business reportable segments. The U.S. Business segment includes the results of the Company’s U.S. operations and Japan sales office, which primarily engages in selling U.S. listed ETFs to Japanese institutions. The results of the Company’s European and Canadian operations are reported as the International Business segment.

Revenues are primarily derived in the U.S. and the vast majority of the Company’s AUM is currently located in the U.S.

Foreign Currency Translation

Assets and liabilities of subsidiaries whose functional currency is not the U.S. dollar are translated based on the end of period exchange rates from local currency to U.S. dollars. Results of operations are translated at the average exchange rates in effect during the period.

Use of Estimates

The preparation of the Company’s consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the balance sheet dates and the reported amounts of revenues and expenses for the periods presented. Actual results could differ materially from those estimates.

Revenue Recognition

The Company earns investment advisory fees from its ETPs, as well as licensing fees from third parties. ETP advisory fees are based on a percentage of the ETPs’ average daily net assets and recognized over the period the related service is provided. Licensing fees are based on a percentage of the average monthly net assets and recognized over the period the related service is provided.

Depreciation and Amortization

Depreciation is provided for using the straight-line method over the estimated useful lives of the related assets as follows:

| Equipment | 5 years | |

| Furniture and fixtures | 15 years |

Leasehold improvements are amortized over the term of their respective leases or service lives of the improvements, whichever is shorter. Fixed assets are stated at cost less accumulated depreciation and amortization.

Occupancy

The Company accounts for its office lease facilities as operating leases, which may include free rent periods and escalation clauses. The Company expenses the lease payments associated with operating leases on a straight-line basis over the lease term.

Marketing and Advertising

Advertising costs, including media advertising and production costs, are expensed when incurred.

Cash and Cash Equivalents

The Company considers all highly liquid investments with an original maturity of 90 days or less at the time of purchase to be classified as cash equivalents.

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable are customer and other obligations due under normal trade terms. An allowance for doubtful accounts is not provided since, in the opinion of management, all accounts receivable recorded are deemed collectible.

9

Table of Contents

Impairment of Long-Lived Assets

The Company performs a review for the impairment of long-lived assets when events or changes in circumstances indicate that the estimated undiscounted future cash flows expected to be generated by the assets are less than their carrying amounts or when other events occur which may indicate that the carrying amount of an asset may not be recoverable.

Earnings per Share

Basic earnings per share (“EPS”) is computed by dividing net income available to common stockholders by the weighted-average number of common shares outstanding for the period. Net income available to common stockholders represents net income of the Company reduced by an allocation of earnings to participating securities. Unvested share-based payment awards that contain non-forfeitable rights to dividends or dividend equivalents (whether paid or unpaid) are participating securities and are included in the computation of EPS pursuant to the two-class method. Share-based payment awards that do not contain such rights are not deemed participating securities and are included in diluted shares outstanding (if dilutive) under the treasury stock method. Diluted EPS reflects the reduction in earnings per share assuming dilutive options or other dilutive contracts to issue common stock were exercised or converted into common stock. Diluted EPS is calculated under both the treasury stock method and two-class method. The calculation that results in the most dilutive EPS amount for the common stock is reported in the Company’s consolidated financial statements.

Securities Owned and Securities Sold, but not yet Purchased (at fair value)

Securities owned and securities sold, but not yet purchased are securities classified as either trading or available-for-sale (“AFS”). These securities are recorded on their trade date and are measured at fair value. The Company classifies these financial instruments based primarily on the Company’s intent to hold or sell the security. Changes in the fair value of securities classified as trading are reported in other income in the period the change occurs. Unrealized gains and losses of securities classified as AFS are included within other comprehensive income. Once sold, amounts reclassified out of accumulated other comprehensive income and into earnings are determined using the specific identification method. AFS securities are assessed for impairment on a quarterly basis.

Securities Held-to-Maturity

The Company accounts for certain of its investments as held-to-maturity on a trade date basis, which are recorded at amortized cost. For held-to-maturity investments, the Company has the intent and ability to hold investments to maturity and it is not more-likely-than-not that the Company will be required to sell the investments before recovery of their amortized cost bases, which may be maturity. On a quarterly basis, the Company reviews its portfolio of investments for impairment. If a decline in fair value is deemed to be other-than-temporary, the security is written down to its fair value through earnings.

Investment, Carried at Cost

The Company accounts for equity securities that do not have a readily determinable fair value as cost method investments to the extent such investments are not subject to consolidation or the equity method. Income is recognized when dividends are received only to the extent they are distributed from net accumulated earnings of the investee. Otherwise, such distributions are considered returns of investment and are recorded as a reduction of the cost of the investment.

Cost method investments held by the Company are assessed for impairment on a quarterly basis.

Goodwill

Goodwill is the excess of the fair value of the purchase price over the fair values of the identifiable net assets at the acquisition date. The Company tests its goodwill for impairment at least annually and at the time of a triggering event requiring re-evaluation, if one were to occur. Goodwill may be impaired when the estimated fair value of the reporting unit that was allocated the goodwill is less than its carrying value. If the estimated fair value of such reporting unit is less than its carrying value, goodwill impairment is recognized if the implied fair value of the reporting unit’s goodwill is less than the carrying amount of that goodwill. A reporting unit is an operating segment or a component of an operating segment provided that the component constitutes a business for which discrete financial information is available and management regularly reviews the operating results of that component.

For impairment testing purposes, goodwill has been allocated to the Company’s U.S. Business reporting unit (See Note 14). The Company has designated April 30th as its annual goodwill impairment testing date. When performing its goodwill impairment test, the Company considers a qualitative assessment, when appropriate, and the income approach, market approach and its market capitalization when determining the fair value of its reporting units.

Intangible Assets

Indefinite-lived intangible assets are tested for impairment at least annually and are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Indefinite-lived intangible assets are impaired if their estimated fair values are less than their carrying values.

10

Table of Contents

Finite-lived intangible assets, if any, are amortized over their estimated useful life, which is the period over which the assets are expected to contribute directly or indirectly to the future cash flows of the Company. These intangible assets are tested for impairment at the time of a triggering event, if one were to occur. Finite-lived intangible assets may be impaired when the estimated undiscounted future cash flows generated from the assets are less than their carrying amounts.

The Company may rely on a qualitative assessment when performing its intangible asset impairment test. Otherwise, the impairment evaluation is performed at the lowest level of identifiable cash flows independent of other assets. The Company has designated November 30th as its annual impairment testing date for its indefinite-lived intangible assets.

Stock-Based Awards

Accounting for stock-based compensation requires the measurement and recognition of compensation expense for all equity awards based on estimated fair values. Stock-based compensation is measured based on the grant-date fair value of the award and is amortized over the relevant service period.

Income Taxes

The Company accounts for income taxes using the liability method, which requires the determination of deferred tax assets and liabilities based on the differences between the financial and tax basis of assets and liabilities using the enacted tax rates in effect for the year in which differences are expected to reverse. Deferred tax assets are adjusted by a valuation allowance if, based on the weight of available evidence, it is more-likely-than-not that some portion or all the deferred tax assets will not be realized.

In order to recognize and measure any unrecognized tax benefits, management evaluates and determines whether any of its tax positions are more-likely-than-not to be sustained upon examination, including resolution of any related appeals or litigation processes, based on the technical merits of the position. Once it is determined that a position meets this recognition threshold, the position is measured to determine the amount of benefit to be recognized in the consolidated financial statements. The Company records interest expense and penalties related to tax expenses as income tax expense.

Non-income based taxes are recorded as part of other liabilities and other expenses.

Third Party Sharing Arrangements

The Company pays a percentage of its advisory fee revenues based on incremental growth in AUM, subject to caps or minimums, to marketing agents to sell WisdomTree ETFs and for including WisdomTree ETFs on third party customer platforms.

Business Combinations and Acquisitions

The Company includes the results of operations of the businesses that it acquires from the respective dates of acquisition. The fair values of the purchase price of the acquisitions are allocated to the assets acquired and liabilities assumed based on their estimated fair values. The excess of the fair value of purchase price over the fair values of these identifiable assets and liabilities is recorded as goodwill. The Company may allocate purchase price to identifiable intangible assets. The estimated fair value of identifiable intangible assets is based on critical estimates, judgments and assumptions derived from: analysis of market conditions; revenue and revenue growth assumptions; profitability assumptions; discount rates; customer retention rates; and estimated useful lives.

Recently Issued Accounting Pronouncements

In June 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2016-13, Financial Instruments-Credit Losses (Topic 326) – Measurement of Credit Losses on Financial Instruments (ASU 2016-13). The main objective of the standard is to provide financial statement users with more decision-useful information about the expected credit losses on financial instruments and other commitments to extend credit held by a reporting entity at each reporting date. To achieve this objective, the amendments in the standard replace the incurred loss impairment methodology with a methodology that reflects expected credit losses and requires consideration of a broader range of reasonable and supportable information to inform credit loss estimates. The standard is applicable to loans, accounts receivable, trade receivables, and other financial assets measured at amortized cost, loan commitments and certain other off-balance sheet credit exposures, debt securities (including those held-to-maturity) and other financial assets measured at fair value through other comprehensive income, and beneficial interests in securitized financial assets. Accordingly, the new methodology will be utilized when assessing the Company’s securities classified as AFS and held-to-maturity for impairment. ASU 2016-13 is effective for years beginning after December 15, 2019, including interim periods within those fiscal years under a modified retrospective approach. Early adoption is permitted for periods beginning after December 15, 2018. The Company is currently evaluating the impact that the standard will have on its consolidated financial statements.

In March 2016, the FASB issued ASU 2016-09, Compensation—Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting (ASU 2016-09). The standard is intended to simplify several areas of accounting for share-based compensation arrangements, including the income tax impact, classification on the statement of cash flows and forfeitures. ASU 2016-09 is effective for fiscal years, and interim periods within those years, beginning after December 15, 2016, and early adoption is permitted. The Company adopted this standard prospectively on January 1, 2017. The adoption of the standard increased volatility

11

Table of Contents

reported in income tax expense as income tax windfalls and shortfalls associated with the vesting of stock-based compensation is now recorded in income tax expense, rather than additional paid-in capital, when applicable. This new guidance resulted in the Company recognizing approximately $1.0 million of income tax expense for tax shortfalls related to stock-based compensation vesting occurring during this period, which reduced basic and diluted EPS by $0.01 (See Notes 11 and 12).

In February 2016, the FASB issued ASU 2016-02, Leases (ASU 2016-02), which requires lessees to include most leases on the balance sheet. ASU 2016-02 is effective for fiscal years (and interim reporting periods within those years) beginning after December 15, 2018 and early adoption is permitted. The Company is currently evaluating the impact that the standard will have on its consolidated financial statements (See Note 8).

In January 2016, the FASB issued ASU 2016-01, Financial Instruments – Recognition and Measurement of Financial Assets and Financial Liabilities (ASU 2016-01). The main objective of the standard is to enhance the reporting model for financial instruments to provide users of financial statements with more decision-useful information. The amendments in the update make targeted improvements to generally accepted accounting principles. These include requiring equity investments (except those accounted for under the equity method of accounting or those that result in consolidation of the investee) to be measured at fair value with changes in fair value recognized in net income. Available-for-sale classification for equity investments with readily determinable fair values will no longer be permissible. However, an entity may choose to measure equity investments that do not have readily determinable fair values at cost minus impairment, if any, plus or minus changes resulting from observable price changes in orderly transactions for the identical or similar investment of the same issuer. The update also simplifies the impairment assessment of equity investments without readily determinable fair values by requiring a qualitative assessment to identify impairment. When a qualitative assessment indicates that impairment exists, an entity is required to measure the investment at fair value. ASU 2016-01 is effective for fiscal years beginning after December 15, 2017, including interim periods within those fiscal years. Early adoption is not permitted for the updates currently applicable to the Company. The Company’s equity investments with readily determinable fair values are all currently measured at fair value with changes in fair value recognized in net income. The Company will apply the amendments in this update when assessing the carrying value of its investment, held at cost.

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers (ASU 2014-09), which is a new comprehensive revenue recognition standard on the financial reporting requirements for revenue from contracts entered into with customers. In July 2015, the FASB deferred this ASU’s effective date by one year, to interim and annual periods beginning after December 15, 2017. The deferral allows early adoption at the original effective date. During 2016, the FASB issued ASU 2016-08, which clarifies principal versus agent considerations, ASU 2016-10, which clarifies identifying performance obligations and the licensing implementation guidance, and ASU 2016-12, which amends certain aspects of the new revenue recognition standard pursuant to ASU 2014-09. ASU 2014-09 allows for the use of either the retrospective or modified retrospective adoption method. The Company is currently reviewing its contracts in order to evaluate the impact that the standard will have on its consolidated financial statements.

3. Cash and Cash Equivalents

Cash and cash equivalents of approximately $39,743 and $56,484 at March 31, 2017 and December 31, 2016, respectively, were held at one financial institution. At March 31, 2017 and December 31, 2016, cash equivalents were approximately $39,522 and $55,619, respectively.

4. Securities Owned and Securities Sold, but not yet Purchased (and Fair Value Measurement)

Securities owned and securities sold, but not yet purchased are measured at fair value. The fair value of securities is defined as the price that would be received to sell an asset or paid to transfer a liability (i.e., “the exit price”) in an orderly transaction between market participants at the measurement date. ASC 820, Fair Value Measurements, establishes a hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs are inputs that market participants would use in pricing the asset or liability developed based on market data obtained from independent sources. Unobservable inputs reflect assumptions that market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. The hierarchy is broken down into three levels based on the transparency of inputs as follows:

| Level 1 | – | Quoted prices for identical instruments in active markets. | ||

| Level 2 | – | Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations whose inputs are observable or whose significant value drivers are observable. | ||

| Level 3 | – | Instruments whose significant drivers are unobservable. | ||

The availability of observable inputs can vary from product to product and is effected by a wide variety of factors, including, for example, the type of product, whether the product is new and not yet established in the marketplace, and other characteristics particular to the transaction. To the extent that valuation is based on models or inputs that are less observable or unobservable in the

12

Table of Contents

market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised by management in determining fair value is greatest for instruments categorized in Level 3. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement in its entirety falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Fair Valuation Methodology

Cash and Cash Equivalents – These financial assets represent cash in banks or cash invested in highly liquid investments with original maturities less than 90 days. These investments are valued at par, which approximates fair value, and are considered Level 1 (See Note 3).

Securities (Held-to-Maturity) – These securities are Federal agency debt instruments which are instruments that are generally traded in active, quoted and highly liquid markets and are therefore classified as Level 1 within the fair value hierarchy (See Note 5).

Securities Owned/Sold But Not Yet Purchased – These securities consist of securities classified as trading and AFS, as follows:

| March 31, 2017 |

December 31, 2016 |

|||||||

| Securities Owned |

||||||||

| Trading securities |

$ | 264 | $ | 1,556 | ||||

| Available-for-sale securities |

57,347 | 57,351 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 57,611 | $ | 58,907 | ||||

|

|

|

|

|

|||||

| Securities Sold, but not yet Purchased |

||||||||

| Trading securities |

$ | 27 | $ | 1,248 | ||||

| Available-for-sale securities |

— | — | ||||||

|

|

|

|

|

|||||

| Total |

$ | 27 | $ | 1,248 | ||||

|

|

|

|

|

|||||

Trading securities are investments in exchange traded funds. These instruments are generally traded in active, quoted and highly liquid markets and are therefore classified as Level 1 within the fair value hierarchy. AFS securities are investments in short-term investment grade corporate bonds and are classified as Level 2. Fair value is generally derived from observable bids for these Level 2 financial instruments.

AFS Securities

The following table summarizes unrealized gains, losses and fair value of the AFS securities:

| March 31, 2017 |

December 31, 2016 |

|||||||

| Cost |

$ | 57,779 | $ | 57,615 | ||||

| Gross unrealized gains in other comprehensive income |

— | — | ||||||

| Gross unrealized losses in other comprehensive income |

(432 | ) | (264 | ) | ||||

|

|

|

|

|

|||||

| Fair value |

$ | 57,347 | $ | 57,351 | ||||

|

|

|

|

|

|||||

All the Company’s AFS securities are due within one year. The Company assesses the AFS securities for other-than-temporary impairment on a quarterly basis. No AFS securities were determined to be other-than-temporarily impaired at March 31, 2017 or December 31, 2016.

During the three months ended March 31, 2017, the Company received $21.0 million of proceeds from the sale and maturity of available-for-sale securities and recognized gross realized losses of $0.2 million. These losses have been reclassified out of accumulated other comprehensive income and into other income within the Consolidated Statements of Operations. Proceeds received were used to purchase additional AFS securities.

13

Table of Contents

5. Securities Held-to-Maturity

The following table is a summary of the Company’s securities held-to-maturity:

| March 31, 2017 |

December 31, 2016 |

|||||||

| Federal agency debt instruments (amortized cost) |

$ | 23,202 | $ | 22,496 | ||||

|

|

|

|

|

|||||

The following table summarizes unrealized gains, losses, and fair value of securities held-to-maturity:

| March 31, 2017 |

December 31, 2016 |

|||||||

| Cost/amortized cost |

$ | 23,202 | $ | 22,496 | ||||

| Gross unrealized gains |

12 | 13 | ||||||

| Gross unrealized losses |

(1,405 | ) | (1,353 | ) | ||||

|

|

|

|

|

|||||

| Fair value |

$ | 21,809 | $ | 21,156 | ||||

|

|

|

|

|

|||||

The Company assesses these securities for other-than-temporary impairment on a quarterly basis. No securities were determined to be other-than-temporarily impaired at March 31, 2017 or December 31, 2016. The Company does not intend to sell these securities and it is not more likely than not that the Company will be required to sell the securities before recovery of their amortized cost bases, which may be maturity.

The following table sets forth the maturity profile of the securities held-to-maturity; however, these securities may be called prior to maturity date:

| March 31, 2017 |

December 31, 2016 |

|||||||

| Due within one year |

$ | 3,997 | $ | 3,994 | ||||

| Due one year through five years |

1,020 | 1,023 | ||||||

| Due five years through ten years |

4,030 | 4,031 | ||||||

| Due over ten years |

14,155 | 13,448 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 23,202 | $ | 22,496 | ||||

|

|

|

|

|

|||||

6. Investment, Carried at Cost

On November 18, 2016, the Company made a $20,000 strategic investment in AdvisorEngine, Inc., an end-to-end wealth management platform which enables individual customization of investment philosophies. The Company and AdvisorEngine also entered into an agreement whereby the Company’s asset allocation models are made available through AdvisorEngine’s open architecture platform and the Company actively introduces the platform to its distribution network.

In consideration of its investment, the Company received 11,811,856 shares of Series A convertible preferred shares (“Series A Preferred”), for an aggregate equity ownership interest of approximately 42% (or 36% on a fully-diluted basis).

The Series A Preferred is convertible into common stock at the option of the Company and contains various rights and protections including a non-cumulative 6.0% dividend, payable if and when declared by the board of directors, and a liquidation preference that is senior to all other holders of capital stock of AdvisorEngine. The investment is accounted for under the cost method of accounting as it is not considered to be in-substance common stock.

This investment is assessed for impairment on a quarterly basis. No impairment existed at March 31, 2017 or December 31, 2016.

7. Fixed Assets

The following table summarizes fixed assets:

| March 31, 2017 |

December 31, 2016 |

|||||||

| Equipment |

$ | 1,839 | $ | 1,739 | ||||

| Furniture and fixtures |

2,414 | 2,393 | ||||||

| Leasehold improvements |

11,006 | 10,877 | ||||||

| Less accumulated depreciation and amortization |

(3,617 | ) | (3,261 | ) | ||||

|

|

|

|

|

|||||

| Total |

$ | 11,642 | $ | 11,748 | ||||

|

|

|

|

|

|||||

14

Table of Contents

8. Commitments and Contingencies

Contractual Obligations

The Company has entered into obligations under operating leases with initial non-cancelable terms in excess of one year for office space, telephone and data services. Expenses recorded under these agreements for the three months ended March 31, 2017 and 2016 were approximately $1,120 and $985, respectively.

Future minimum lease payments with respect to non-cancelable operating leases at March 31, 2017 were approximately as follows:

| Remainder of 2017 |

$ | 3,040 | ||

| 2018 |

3,437 | |||

| 2019 |

2,952 | |||

| 2020 |

2,867 | |||

| 2021 and thereafter |

24,079 | |||

|

|

|

|||

| Total |

$ | 36,375 | ||

|

|

|

Letter of Credit

The Company collateralized its U.S. office lease through a standby letter of credit totaling $1,384. The collateral is included in cash and cash equivalents on the Company’s Consolidated Balance Sheets.

Contingencies

The Company may be subject to reviews, inspections and investigations by regulatory authorities as well as legal proceedings arising in the ordinary course of business. The Company is not currently party to any litigation that is expected to have a material adverse impact on its business, financial position, results of operations or cash flows.

9. Related Party Transactions

The Company’s revenues are derived primarily from investment advisory agreements with related parties. Under these agreements, the Company has licensed to related parties the use of certain of its own indexes for the U.S. and Canadian WisdomTree ETFs and WisdomTree UCITS ETFs. The Board of Trustees and Board of Directors of the related parties are primarily responsible for overseeing the management and affairs of the U.S. and Canadian WisdomTree ETFs, Boost ETPs and WisdomTree UCITS ETFs for the benefit of their shareholders and have contracted with the Company to provide for general management and administration services. The Company is also responsible for certain expenses of the related parties, including the cost of transfer agency, custody, fund administration and accounting, legal, audit, and other non-distribution services, excluding extraordinary expenses, taxes and certain other expenses, which is included in fund management and administration on the Company’s Consolidated Statements of Operations. In exchange, the Company receives fees based on a percentage of the ETF average daily net assets. The advisory agreements may be terminated by the related parties upon notice. Certain officers of the Company also provide general management oversight of the related parties; however, these officers have no material decision making responsibilities and primarily implement the decisions of the Board of Trustees and Board of Directors of the related parties.

The following table summarizes accounts receivable from related parties which are included as a component of Accounts receivable on the Company’s Consolidated Balance Sheets:

| March 31, 2017 |

December 31, 2016 |

|||||||

| Receivable from WTT |

$ | 17,970 | $ | 16,506 | ||||

| Receivable from BI and WTI |

766 | 645 | ||||||

| Receivable from WTCS |

131 | 158 | ||||||

| Receivable from WTAMC |

31 | 40 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 18,898 | $ | 17,349 | ||||

|

|

|

|

|

|||||

15

Table of Contents

The following table summarizes revenues from advisory services provided to related parties:

| Three Months Ended | ||||||||

| March 31, 2017 |

March 31, 2016 |

|||||||

| Advisory services provided to WTT |

$ | 50,456 | $ | 58,642 | ||||

| Advisory services provided to BI and WTI |

2,155 | 1,523 | ||||||

| Advisory services provided to WTCS |

570 | 450 | ||||||

| Advisory services provided to WTAMC |

81 | — | ||||||

|

|

|

|

|

|||||

| Total |

$ | 53,262 | $ | 60,615 | ||||

|

|

|

|

|

|||||

The Company also had an investment in a WisdomTree ETF of approximately $1,300 at December 31, 2016. The investment was redeemed by the fund which was subsequently closed and liquidated during three months ended March 31, 2017.

10. Stock-Based Awards

The Company grants equity awards to employees and directors which include restricted stock awards, restricted stock units and stock options. Stock options may be issued for terms of ten years and may vest after at least one year and have an exercise price equal to the Company’s stock price on the grant date. Restricted stock awards and restricted stock units are generally valued based on the Company’s stock price on the grant date. The Company estimates the fair value for stock options using the Black-Scholes option pricing model. All restricted stock awards, restricted stock units and stock option awards require future service as a condition of vesting with certain awards subject to acceleration under certain conditions.

On June 20, 2016, the Company’s stockholders approved a new equity award plan under which the Company can issue up to 10,000,000 shares of common stock (less one share for every share granted under prior plans since March 31, 2016 and inclusive of shares available under the prior plans as of March 31, 2016) in the form of stock options and other stock-based awards. The Company also has issued from time to time stock-based awards outside a plan.

The Company recorded stock-based compensation expense of $3,421 and $3,503 for the three months ended March 31, 2017 and 2016, respectively.

A summary of unrecognized stock-based compensation expense and average remaining vesting period is as follows:

| March 31, 2017 | ||||||||

| Unrecognized Stock- Based Compensation |

Average Remaining Vesting Period |

|||||||

| Employees and directors restricted stock awards |

$ | 22,613 | 1.93 | |||||

A summary of stock options, restricted stock and restricted stock unit activity for the three months ended March 31, 2017 is as follows:

| Stock Options |

Restricted Stock Awards |

Restricted Stock Units |

||||||||||

| Balance at January 1, 2017 |

1,368,247 | 2,436,454 | — | |||||||||

| Granted |

— | 492,044 | 3,759 | |||||||||

| Exercised/vested |

(5,000 | ) | (819,247 | ) | — | |||||||

| Forfeitures |

— | (3,508 | ) | — | ||||||||

|

|

|

|

|

|

|

|||||||

| Balance at March 31, 2017 |

1,363,247 | 2,105,743 | 3,759 | |||||||||

|

|

|

|

|

|

|

|||||||

16

Table of Contents

11. Earnings Per Share

The following is a reconciliation of the basic and diluted earnings per share computation:

| Three Months Ended March 31, | ||||||||

| 2017 | 2016 | |||||||

| Net income |

$ | 6,880 | $ | 12,072 | ||||

|

|

|

|

|

|||||

| (shares in thousands) | ||||||||

| Shares of common stock and common stock equivalents: |

||||||||

| Weighted average common shares used in basic computation |

134,385 | 135,467 | ||||||

| Dilutive effect of common stock equivalents |

1,124 | 990 | ||||||

|

|

|

|

|

|||||

| Weighted average common shares used in dilutive computation |

135,509 | 136,457 | ||||||

|

|

|

|

|

|||||

| Basic earnings per share |

$ | 0.05 | $ | 0.09 | ||||

| Diluted earnings per share |

$ | 0.05 | $ | 0.09 | ||||

In the table above, unvested share-based awards that have non-forfeitable rights to dividends or dividend equivalents are treated as a separate class of securities in calculating EPS.

Diluted earnings per share reflects the reduction in earnings per share assuming options or other contracts to issue common stock were exercised or converted into common stock (if dilutive) under the treasury stock method. The Company excluded 1,549,440 and 2,017,005 common stock equivalents from its computation of diluted earnings per share for the three months ended March 31, 2017 and 2016, respectively, as they were determined to be anti-dilutive.

As further discussed in Note 12, the Company adopted ASU 2016-09 prospectively during the three-months ended March 31, 2017 which had the effect of reducing basic and diluted EPS by $0.01.

12. Income Taxes

Effective Income Tax Rate – Three Months Ended March 31, 2017 and March 31, 2016

The Company’s effective income tax rate for the three months ended March 31, 2017 of 53.6% resulted in income tax expense of $7.9 million. The Company’s tax rate differs from the federal statutory tax rate of 35% primarily due to a valuation allowance on foreign net operating losses, tax shortfalls associated with the vesting of stock-based compensation awards and state and local income taxes.

Effective January 1, 2017, US GAAP was amended with the intention to simplify the accounting for stock-based compensation. This includes the requirement to record the tax effects related to stock-based compensation within income tax expense, rather than additional paid-in capital, when applicable. Therefore, tax shortfalls (and tax windfalls) associated with the vesting of stock-based compensation awards are now included within income tax expense. This new guidance resulted in the recognition of $1.0 million of income tax expense associated with tax shortfalls recognized upon vesting of stock-based compensation awards during the quarter.

The Company’s effective income tax rate for the three months ended March 31, 2016 of 44.3% resulted in income tax expense of $9,600. The Company’s tax rate differs from the federal statutory tax rate of 35% primarily due to state and local income taxes, the acquisition payment expense (which is non-deductible) and a valuation allowance on foreign net operating losses.

Net Operating Losses – U.S.

The Company’s pre-tax federal net operating losses for tax purposes (“NOLs”) at March 31, 2017 was $3,671 which expire in 2024. The net operating loss carryforwards have been reduced by the impact of annual limitations described in the Internal Revenue Code Section 382 that arose as a result of an ownership change.

Net Operating Losses – International

The Company’s European and Canadian subsidiaries generated NOLs outside the U.S. These tax effected NOLs were $2.4 million at March 31, 2017. The Company established a full valuation allowance related to these NOLs as it is more-likely-than-not that some portion, or all, of the deferred tax assets will not be realized.

17

Table of Contents

Deferred Tax Assets

A summary of the components of the Company’s deferred tax asset at March 31, 2017 is as follows:

| March 31, 2017 |

December 31, 2016 |

|||||||

| Deferred tax assets: |

||||||||

| NOLs – Foreign |

$ | 2,414 | $ | 4,551 | ||||

| Stock-based compensation |

2,353 | 5,382 | ||||||

| Deferred rent liability |

2,005 | 2,024 | ||||||

| NOLs – U.S. |

1,410 | 1,611 | ||||||

| Accrued expenses |

1,207 | 4,552 | ||||||

| Unrealized losses |

163 | 101 | ||||||

| Other |

262 | 227 | ||||||

|

|

|

|

|

|||||

| Deferred tax assets |

9,814 | 18,448 | ||||||

|

|

|

|

|

|||||

| Deferred tax liabilities: |

||||||||

| Fixed assets |

2,405 | 2,405 | ||||||

| Incentive compensation |

1,023 | 1,365 | ||||||

| Goodwill and intangible assets |

376 | 301 | ||||||

|

|

|

|

|

|||||

| Deferred tax liabilities |

3,804 | 4,071 | ||||||

|

|

|

|

|

|||||

| Total deferred tax assets less deferred tax liabilities |

6,010 | 14,377 | ||||||

| Less: valuation allowance |

(2,414 | ) | (4,551 | ) | ||||

|

|

|

|

|

|||||

| Deferred tax assets, net |

$ | 3,596 | $ | 9,826 | ||||

|

|

|

|

|

|||||

13. Shares Repurchased

On October 29, 2014, the Company’s Board of Directors authorized a three-year share repurchase program of up to $100,000. On April 27, 2016, the Board of Directors approved a $60,000 increase to the Company’s share repurchase program and extended the term through April 27, 2019. Included under this program are purchases to offset future equity grants made under the Company’s equity plans and are made in open market or privately negotiated transactions. This authority may be exercised from time to time and in such amounts as market conditions warrant, and subject to regulatory considerations. The timing and actual number of shares repurchased depends on a variety of factors including price, corporate and regulatory requirements, market conditions and other corporate liquidity requirements and priorities. The repurchase program may be suspended or terminated at any time without prior notice. Shares repurchased under this program are returned to the status of authorized and unissued on the Company’s books and records.

During the three months ended March 31, 2017 and March 31, 2016, the Company repurchased 346,529 shares and 3,407,305 shares of its common stock, respectively, under this program for an aggregate cost of $3,628 and $35,555, respectively.

As of March 31, 2017, $92,877 remains under this program for future purchases.

14. Goodwill and Intangible Assets

Goodwill has been allocated to the Company’s U.S. Business reporting unit. The Company has designated April 30th as its annual goodwill impairment testing date. The following table summarizes the goodwill activity during the period:

| U.S. Business Reporting Unit |

||||

| Balance at January 1, 2017 |

$ | 1,799 | ||

| Increases/(decreases) |

— | |||

|

|

|

|||

| Balance at March 31, 2017 |

$ | 1,799 | ||

|

|

|

|||

18

Table of Contents

Intangible Asset (Indefinite-Lived)

As part of the GreenHaven acquisition which occurred on January 1, 2016, the Company identified an intangible asset related to its customary advisory agreement with the GreenHaven Commodities ETF for $9,953. This intangible asset (which is deductible for tax purposes) was determined to have an indefinite useful life. The Company has designated November 30th as its annual impairment testing date for this indefinite-lived intangible asset.

| Total | ||||

| Balance at January 1, 2017 |

$ | 9,953 | ||

| Increases/(decreases) |

— | |||

|

|

|

|||

| Balance at March 31, 2017 |

$ | 9,953 | ||

|

|

|

|||

15. Segment Reporting

The Company operates as an ETP sponsor and asset manager providing investment advisory services in the U.S., Europe, Canada and Japan. These activities are reported in the Company’s U.S. Business and International Business reportable segments. The U.S. Business segment includes the results of the Company’s U.S. operations and Japan sales office. The results of the Company’s European and Canadian operations are reported as the International Business segment.

Information concerning these reportable segments are as follows:

| Three Months Ended March 31, | ||||||||

| 2017 | 2016 | |||||||

| Revenues (U.S. Business segment) |

||||||||

| Advisory fees |

$ | 51,026 | $ | 59,092 | ||||

| Other income |

1,312 | 221 | ||||||

|

|

|

|

|

|||||

| Total revenues (U.S. Business segment) |

$ | 52,338 | $ | 59,313 | ||||

|

|

|

|

|

|||||

| Revenues (International Business segment) |

||||||||

| Advisory fees |

$ | 2,236 | $ | 1,523 | ||||

| Other income |

25 | 42 | ||||||

|

|

|

|

|

|||||

| Total revenues (International Business segment) |

$ | 2,261 | $ | 1,565 | ||||

|

|

|

|

|

|||||

| Total revenues |

$ | 54,599 | $ | 60,878 | ||||

|

|

|

|

|

|||||

| Income/(loss) before taxes |

||||||||

| U.S. Business segment |

$ | 17,908 | $ | 24,210 | ||||

| International Business segment |

(3,086 | ) | (2,538 | ) | ||||

|

|

|

|

|

|||||

| Total income before taxes |

$ | 14,822 | $ | 21,672 | ||||

|

|

|

|

|

|||||

Assets are not reported by segment as such information is not utilized by the chief operating decision maker. The vast majority of the Company’s assets are located in the U.S.

16. Subsequent Events

On April 27, 2017, the Company and AdvisorEngine jointly announced their commitment to providing advisor growth solutions through AdvisorEngine’s acquisition of Kredible Technologies, Inc., a technology enabled, research-driven practice management firm designed to help advisors acquire new clients. The Company invested an additional $5,000 in AdvisorEngine to help facilitate the Kredible acquisition and continue to fuel AdvisorEngine’s growth, leadership and innovation in the advisor solutions space. The Company received 2,646,062 shares of Series A-1 convertible preferred stock (“Series A-1 Preferred”) for an aggregate equity ownership interest of approximately 47% (or 41% on a fully-diluted basis). The Series A-1 Preferred has substantially the same terms as the Series A Preferred that the Company received in November 2016 in connection with its initial investment in AdvisorEngine as described in Note 6.

19

Table of Contents

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read together with our consolidated financial statements and the related notes and the other financial information included elsewhere in this Report. In addition to historical consolidated financial information, the following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to these differences include those discussed below. For a more complete description of the risks noted above and other risks that could cause our actual results to materially differ from our current expectations, please see Item 1A “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016. We assume no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, unless required by law.

Executive Summary

Introduction

We were the tenth largest ETP sponsor in the world (based on AUM), with AUM of $43.4 billion globally as of March 31, 2017. An ETP is a pooled investment vehicle that holds a basket of financial instruments, securities or other assets and generally seeks to track (index-based) or outperform (actively managed) the performance of a broad or specific equity, fixed income or alternatives market segment, commodity or currency (or an inverse or multiple thereof). ETPs are listed on an exchange with their shares traded in the secondary market at market prices, generally at approximately the same price as the net asset value of their underlying components. ETP is an umbrella term that includes ETFs, exchange-traded notes and exchange-traded commodities.

Through our operating subsidiaries, we provide investment advisory and other management services to the WisdomTree ETFs and Boost ETPs collectively offering ETPs covering equity, fixed income, currency, alternatives and commodity asset classes. In exchange for providing these services, we receive advisory fee revenues based on a percentage of the ETPs’ average daily AUM. Our expenses are predominantly related to selling, operating and marketing our ETPs. We have contracted with third parties to provide certain operational services for the ETPs. We distribute our ETPs through all major channels within the asset management industry, including brokerage firms, registered investment advisers, institutional investors, private wealth managers and discount brokers primarily through our sales force. Our sales efforts are not directed towards the retail segment but rather are directed towards financial or investment advisers that act as intermediaries between the end-client and us. Recent investments in technology-enabled services including portfolio construction, asset allocation, practice management services and the AdvisorEngine platform have been made in order to differentiate us in the market, expand our distribution and further enhance our relationships with financial advisors.

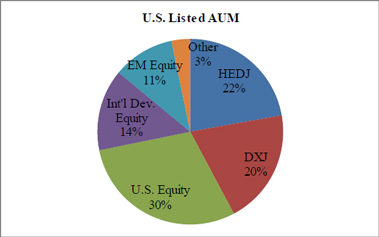

A significant portion of our AUM is invested in securities issued outside of the U.S. Therefore, our AUM and revenues are affected by movements in global capital market levels and the strengthening or weakening of the U.S. dollar against other currencies. As the chart below reflects, as of March 31, 2017, 42% of our U.S. AUM was concentrated in two products with similar strategies – HEDJ, our European equity ETF which hedges exposure to the Euro, and DXJ, our Japanese equity ETF which hedges exposure to the Yen. The strengthening of the Euro or Yen against the U.S. dollar, or the decline in European or Japanese equity markets, may have an adverse effect on our results.

20

Table of Contents

Market Environment

During the first quarter of 2017, U.S. market sentiment was favorable as investors focused on the potential for both regulatory and tax reform. Various economic indicators also continued to strengthen which led to a 25bps U.S. interest rate increase along with speculation that further increases may soon follow. International and emerging markets were also on an upswing supported by positive economic data.

The S&P 500 rose 6.1%, MSCI EAFE (local currency) rose 4.8% and MSCI Emerging Markets Index (U.S. dollar) rose 11.5% in the first quarter. In addition, the European equity market appreciated with the MSCI EMU Index rising 7.3% in local currency terms while the Japan equity market as evidenced by the MSCI Japan Index (local currency) was flat for the quarter. Also, the U.S. dollar weakened 4.8% versus the Yen and 1.3% versus the Euro during the first quarter.

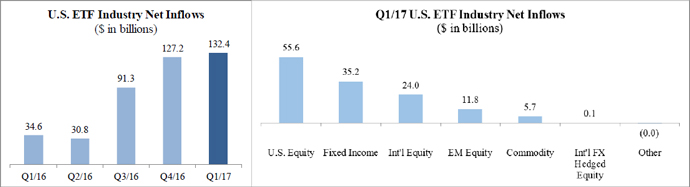

The vast majority of our global AUM is in U.S. listed ETFs. As the charts below reflect, industry flows for the first quarter of 2017 reached a record of $132.4 billion. U.S. equities and fixed income gathered the majority of those flows.

Source: Investment Company Institute, WisdomTree

Business Segments

We operate as an ETP sponsor and asset manager providing investment advisory services in the U.S., Europe, Canada and Japan. These activities are reported in our U.S. Business and International Business segments, as follows:

| • | U.S. Business segment: Our U.S. business and Japan sales office, which primarily engages in selling our U.S. listed ETFs to Japanese institutions; and |

| • | International Business segment: Our European business which commenced in April 2014 in connection with our acquisition of U.K. based ETP sponsor Boost ETP, LLP (“Boost”) and our Canadian business which launched its first six ETFs in July 2016. |

21

Table of Contents

Our Operating and Financial Results

U.S. Business Segment

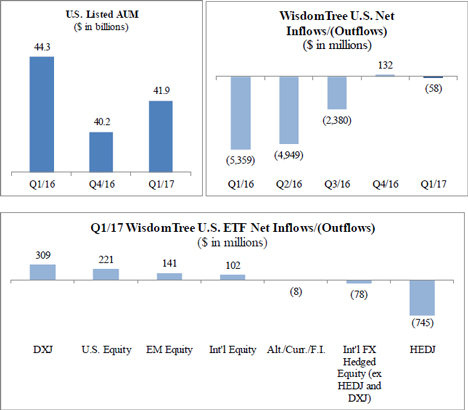

Outflows from our U.S. listed ETFs were muted in the first quarter of 2017. We continued to experience outflows from our European equity ETF (HEDJ), however those outflows were offset by inflows into our Japan equity ETF (DXJ) and our U.S. equity, emerging markets and international equity ETFs. Our U.S. listed AUM increased from $40.2 billion as of December 31, 2016 to $41.9 billion as of March 31, 2017 primarily due to $1.8 billion of market appreciation.

International Business Segment

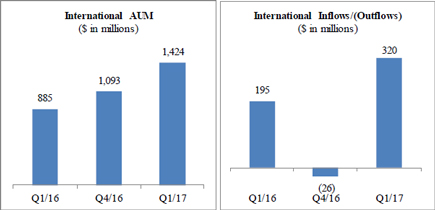

Our International ETFs had net inflows of $320.1 million in the first quarter of 2017. This was principally a result of inflows of $160.3 million into our European listed ETPs and $159.8 million into our UCITS ETFs. Our International AUM increased from $1.1 billion as of December 31, 2016 to $1.4 billion as of March 31, 2017 primarily due to net inflows and, to a lesser extent, market appreciation.

22

Table of Contents

Consolidated Operating Results

Our revenues, expenses and net income are as follows:

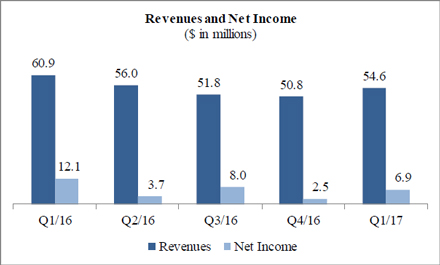

| • | Revenues – We recorded revenues of $54.6 million in the three months ended March 31, 2017, down 10.3% from the three months ended March 31, 2016 due to declines in our average AUM, primarily in our two largest ETFs and partly offset by an increase in average AUM resulting from $2.1 billion of net inflows into our U.S. equity ETFs and market appreciation. |

| • | Expenses – Total expenses increased 1.5% from the three months ended March 31, 2016 to $39.8 million primarily resulting from higher compensation partly offset by lower professional fees. |

| • | Net income – Net income declined 43.0% from the three months ended March 31, 2016 to $6.9 million. |

23

Table of Contents

Key Operating Statistics

The following table presents key operating statistics that serve as indicators for the performance of our business:

| Three Months Ended | ||||||||||||

| March 31, 2017 |

December 31, 2016 |

March 31, 2016 |

||||||||||

| U.S. LISTED ETFs (in millions) |

||||||||||||

| Beginning of period assets |

$ | 40,164 | $ | 37,704 | $ | 51,639 | ||||||

| Assets acquired |

— | — | 225 | |||||||||

| Inflows/(outflows) |

(58 | ) | 132 | (5,359 | ) | |||||||

| Market appreciation/(depreciation) |

1,834 | 2,328 | (2,249 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| End of period assets |

$ | 41,940 | $ | 40,164 | $ | 44,256 | ||||||

|

|

|

|

|

|

|

|||||||

| Average assets during the period |

$ | 41,292 | $ | 38,253 | $ | 45,475 | ||||||

| Revenue days |

90 | 92 | 91 | |||||||||

| Number of ETFs – end of the period |

88 | 94 | 93 | |||||||||

| ETF Industry and Market Share (in billions) |

||||||||||||

| ETF industry net inflows |

$ | 132.4 | $ | 127.2 | $ | 34.6 | ||||||

| WisdomTree market share of industry inflows |

n/a | 0.1 | % | n/a | ||||||||

| Average ETF advisory fee during the period |

||||||||||||

| Alternative strategy ETFs |

0.66 | % | 0.72 | % | 0.88 | % | ||||||

| Emerging markets equity ETFs |

0.70 | % | 0.70 | % | 0.71 | % | ||||||

| International developed equity ETFs |

0.56 | % | 0.56 | % | 0.56 | % | ||||||

| International hedged equity ETFs |

0.53 | % | 0.54 | % | 0.54 | % | ||||||

| Currency ETFs |

0.50 | % | 0.50 | % | 0.50 | % | ||||||

| Fixed income ETFs |

0.42 | % | 0.43 | % | 0.46 | % | ||||||

| U.S. equity ETFs |

0.35 | % | 0.35 | % | 0.35 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Blended total |

0.50 | % | 0.50 | % | 0.52 | % | ||||||

|

|

|

|

|

|

|