Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - Black Stallion Oil & Gas Inc. | blkg_ex321.htm |

| EX-31.2 - CERTIFICATION - Black Stallion Oil & Gas Inc. | blkg_ex312.htm |

| EX-31.1 - CERTIFICATION - Black Stallion Oil & Gas Inc. | blkg_ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the Fiscal Year Ended December 31, 2016

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE EXCHANGE ACT

For the transition period from ________ to ________

|

BLACK STALLION OIL AND GAS INC. |

|

(Exact name of registrant as specified in its charter) |

|

Delaware |

|

333-180230 |

|

99-0373017 |

|

(State or other jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification Number) |

633 W. 5th Street, 26th floor

Los Angeles, CA 90071

(Address of principal executive offices)

(213) 223-2071

(Registrant’s Telephone Number)

Securities registered under Section 12(b) of the Exchange Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

None |

|

Not Applicable |

Securities registered under Section 12(g) of the Exchange Act:

Title of class

Common Stock, Par Value $0.0001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

o |

|

Accelerated filer |

o |

|

Non-accelerated filer |

o |

(Do not check if a smaller reporting company) |

Smaller reporting company |

x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

On June 30, 2016, the last business day of the registrants most recently completed second quarter, the aggregate market value of the Common Stock held by non-affiliates of the registrant was $865,524, based upon the closing price on that date of the Common Stock of the registrant of $0.04. For purposes of this response, the registrant has assumed that its directors, executive officers and beneficial owners of 5% or more of its Common Stock are deemed affiliates of the registrant.

As of March 31, 2017, there were 249,879,538 shares of the registrant’s $0.0001 par value common stock issued and outstanding.

Documents incorporated by reference: None

| 2 |

FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors”, that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to the common shares in our capital stock.

As used in this annual report, the terms “Black Stallion”, “we”, “us”, “our” and “our company” refer to Black Stallion Oil and Gas, Inc., unless otherwise indicated.

| 3 |

| Table of Contents |

General Overview

We were incorporated in the state of Delaware on September 14, 2011. Our original business plan was to sell high end vinyl car wraps though the internet to garages and car accessories shops on-line and to eventually sell to the retail consumer, specific car wraps for customized to different cars and models.

Our principal business address is 633 W. 5th Street, 26th Floor, Los Angeles, CA 90071. Our headquarters are located in Buffalo, New York. We have established a fiscal year end of December 31.

On September 3, 2013, our board of directors and a majority of our shareholders approved a change of name of our company from Secure It Corp. to Black Stallion Oil and Gas, Inc.

A Certificate of Amendment to effect the change of name was filed and became effective with the Delaware Secretary of State on September 12, 2013.

In addition to the name change, our board of directors and a majority of our shareholders approved a 60 new for 1 old forward split of our issued and outstanding shares of common stock. Consequently, our issued and outstanding common stock increased from 731,200 to 43,872,000 shares, all with a par value of $0.0001.

These amendments were approved by the Financial Industry Regulatory Authority (FINRA). The forward split and name change became effective on the OTC Markets at the opening of trading on September 18, 2013. Our trading symbol is “BLKG”. Our CUSIP number is 09225H 102.

In connection with a change of management, our company changed our business plan to that of exploration and development of oil and gas properties.

Our company’s new focus is to engage in oil and gas exploration, acquire and develop oil and gas properties, and sell oil and gas produced by these efforts.

We plan to locate and lease existing wells for reactivation for the production of oil and gas that we will then sell, through an operator, to oil and gas brokers and gatherers. The gas sometimes may be sold directly to public utility companies.

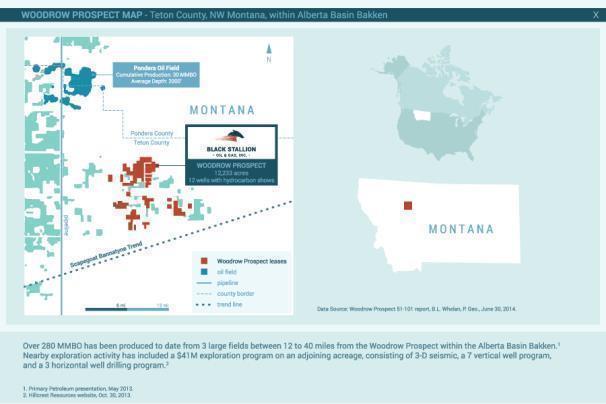

During the year ending 2015, our company consolidated a 100% working interest in 12,233.93 acres in oil and gas leases in Teton County, Montana. It also engaged an independent geological firm to identify the most prospective zones and recommendations for additional detailed analysis for these leases.

| 4 |

| Table of Contents |

Our Current Business

Effective February 23, 2014, the Company entered into a lease assignment agreement with West Bakken Energy Holdings, Ltd. Pursuant to the terms of the lease assignment agreement, we have acquired an undivided 100% interest in West Bakken’s interest (a net 50% working interest) in certain oil and gas properties comprising of 12,233.93 acres in Montana, owned by Hillcrest Resources Ltd.

As consideration, the Company agreed to issue 1,100,000 shares of our common stock to West Bakken and to issue one share of common stock at a cost basis of $0.50 per share for the $550,000 paid by West Bakken to Hillcrest. On August 17, 2015, we issued 1,100,000 shares of our common stock to West Bakken pursuant to the lease assignment agreement.

On October 17, 2014, our company entered into and closed a private placement for proceeds of $150,000. Pursuant to the private placement subscription agreement, we issued an aggregate of 300,000 units (each a “Unit”) to one investor at a subscription price of $0.50 per Unit, with each Unit consisting of one common share and one non-transferable share purchase warrant. Each a Warrant is exercisable at $1.00 until January 1, 2017. As of the date of this annual report the shares have not yet been issued by our company.

On September 18, 2015, the company entered into a Master Services Consulting Agreement with Sproule International Limited, a petroleum consulting firm. In accordance with the terms of the agreement, Sproule will conduct a work program on our Woodrow prospect.

On October 2, 2015, we entered into a lease assignment agreement to acquire the remaining 50% working interest in certain oil and gas properties comprising of 12,233.93 acres in Montana, owned by Hillcrest Resources Ltd. As consideration, we agreed to issue pay Hillcrest Resources Ltd. $50,000 in cash, 250,000 shares of our common stock on the closing date, and 250,000 shares of our common stock on the date on which Black Stallion spuds its first well on the property.

Effective October 15, 2015, we closed a private placement by issuing 300,000 units at a price of $0.50 per unit, for gross proceeds of $150,000. Each unit consists of one share of common stock and one non-transferable common stock purchase warrant. As of the date of this annual report the shares have not yet been issued by our company.

Effective October 15, 2015, we closed a private placement by issuing 50,000 units at a price of $1.00 per unit, for gross proceeds of $50,000. Each unit consists of one share of common stock and one non-transferable common stock purchase warrant. Each warrant is exercisable until January 1, 2017 at an exercise price of $1.50 per unit. As of the date of this annual report the shares have not yet been issued by our company.

Effective October 15, 2015, we closed a private placement by issuing 39,063 units at a price of $1.28 per unit, for gross proceeds of $50,000. Each unit consists of one share of common stock and one non-transferable common stock purchase warrant. Each warrant is exercisable until January 1, 2017 at an exercise price of $1.50 per unit. As of the date of this annual report the shares have not yet been issued by our company.

Effective October 15, 2015, we closed a private placement by issuing 27,027 units at a price of $1.85 per unit, for gross proceeds of $50,000. Each unit consists of one share of common stock and one non-transferable common stock purchase warrant. Each warrant is exercisable until January 1, 2017 at an exercise price of $2.00 per unit. As of the date of this annual report the shares have not yet been issued by our company.

Effective October 15, 2015, we closed a Purchase and Sale Agreement by issuing 250,000 units at a price of $1.00 per unit, for deemed proceeds of $250,000. Each unit consists of one share of common stock.

| 5 |

| Table of Contents |

On February 9, 2016, the Company entered into a contractor agreement with Rancho Capital Management Inc. Pursuant to the agreement, Rancho shall serve as a technical consultant in the field of petroleum based activities. Rancho Capital will be compensated $180,000 annually, for a term of five years.

On February 12, 2016, George Drazenovic resigned as president, secretary, treasurer and as a director of our company. Mr. Drazenovic’s resignation was not the result of any disagreements with our company regarding our operations, policies, practices or otherwise. Concurrently with the resignation of Mr. Drazenovic, Ira Morris was appointed as our president, secretary, treasurer and as the sole director of our board of directors.

On February 12, 2016, the Company entered into a twelve-month contracting arrangement with Ira Morris. As compensation for services the Company will pay fees of $5,000 a month, payable $3,400 in cash and $1,600 with common stock of the company valued at 50% of market at the date of conversion. Mr. Morris was entitled to cash compensation of $50,000 upon signing.

On April 8, 2016, the Company entered into a contractor agreement with Rancho Capital Management Inc. Pursuant to the agreement, Rancho will provide the company with financial filings, strategy and advice regarding debt and equity financings, PIPEs and technical knowledge on financings. Rancho Capital will be compensated $120,000 annually, for a term of five years.

On July 15, 2016, the Company entered into a contractor arrangement with Rancho Capital Management Inc. Pursuant to the agreement, Rancho Capital shall provide services related to expertise and experience in raising finance. Rancho Capital will be compensated $120,000 annually, for a term of five years.

On August 1, 2016, the Company entered into a one year contracting arrangement with an unrelated party for contracting services related to expertise and experience in raising finance. As compensation for services the Company will pay fees of $50,000 annually.

On December 21, 2016, the Company announced it has finalized a Memo of Understanding for the acquis ion of certain assets and intellectual property utilized for the establishment of a special purpose operating subsidiary collecting, analyzing and integrating Big Data Microservices information useful to assist in algorithmic development for the financial industry.

Details of Work Program & Sproule’s Involvement

Phase I: Initial Regional Review of Prospect

Regional compilation and synthesis of information on the study area, including a review of the following potential materials:

·

Any existing studies or databases such as the June 30, 2014 evaluation of prospective resources undertaken by B. Whelan

|

|

· | The Hydrodynamic Atlas of the Williston Basin |

|

|

· | Land sale data |

|

|

· | Well locations, tops, shows, production history |

|

|

· | The Exshaw Resource Play Microstudy |

|

|

· | Discovery Digest and Spark publications |

|

|

· | Internet search materials |

|

|

· | Montana State publicly available files |

|

|

· | Public ally available satellite imagery and digital elevation data |

|

|

· | A basemap from seismic vendors of available 2D & 3D seismic data for purchase |

|

|

· | Available data from nearby analogue fields along with their well test and production data |

|

|

· | Any available DST test reports, production test results, production logging interpretations, monthly production volumes by well and pressure histories obtained from the areas of interest |

|

|

· | Any available reservoir fluid property test reports as well as laboratory PVT test reports |

| 6 |

| Table of Contents |

Phase II: Enhanced Technical Studies

Phase II will summarize prospect identification and drilling recommendations. These studies may include:

· At the Company’s discretion, an NI51-101 compliant Prospective Resource report could be provided at the end of Phase II, summarizing the low, best, and high estimates of petroleum initially-in-place and the undiscovered prospective resources for any prospects identified during Phase II.

·

QC review of potentially purchased 2D or 3D seismic trade data from third party vendors

·

Interpretation of the purchased seismic data and integration with available or purchased well data

·

Identification of prospects and leads

·

Prepare a seismic acquisition program to compliment industry trade seismic data if required

·

Interpret potentially acquired seismic

·

Finalize geophysical interpretation and synthesis on analogue petrophysical, geophysical, geological, and engineering data

·

Identify and recommend a drilling location

·

Develop prognosis for exploration well target

·

Canvas drilling and completion service providers for indicative costs

·

Preliminary economics to determine if drilling warranted

·

Present report on drilling prospect including summary of actions for Phase III

Phase III: Drilling and Completion Recommendations

Phase III would involve work on finalizing plans for drilling and completions. These studies may include:

·

Finalize geophysical and geological interpretation

·

Finalize recommendations on drilling and completions programs

·

Final pre-drill economic evaluation

·

Establish development plan

·

Present report on above recommendations

Phase IV: Drilling and Completion of the Well

Should our company wish to proceed after review of the findings of the Phase III drilling and completion recommendations, Sproule will provide technical assistance to the Company’s drilling, completions and testing contractors as required.

Competition

We are engaged in the acquisition and exploration of oil and gas properties. We compete with other companies for both the acquisition of prospective properties and the financing necessary to develop such properties.

We conduct our business in an environment that is highly competitive and unpredictable. In seeking out prospective properties, we have encountered intense competition in all aspects of our proposed business as we compete directly with other development stage companies as well as established international companies. Many of our competitors are national or international companies with far greater resources, capital and access to information than us. Accordingly, these competitors may be able to spend greater amounts on the acquisition of prospective properties and on the exploration and development of such properties. In addition, they may be able to afford greater geological expertise in the exploration and exploitation of oil and gas properties. This competition could result in our competitors having resource properties of greater quality and attracting prospective investors to finance the development of such properties on more favorable terms. As a result of this competition, we may become involved in an acquisition with more risk or obtain financing on less favorable terms.

| 7 |

| Table of Contents |

Compliance with Government Regulation

Oil and gas operations are subject to various national, state and local governmental regulations. Matters subject to regulation include discharge permits for drilling operations, drilling and abandonment bonds, reports concerning operations, the spacing of wells, and pooling of properties and taxation. From time to time, regulatory agencies have imposed price controls and limitations on production by restricting the rate of flow of oil and gas wells below actual production capacity in order to conserve supplies of oil and gas. The production, handling, storage, transportation and disposal of oil and gas, by-products thereof, and other substances and materials produced or used in connection with oil and gas operations are also subject to regulation under federal, state and local laws and regulations relating primarily to the protection of human health and the environment. To date, expenditures related to complying with these laws, and for remediation of existing environmental contamination, have not been significant in relation to the results of operations of our company. The requirements imposed by such laws and regulations are frequently changed and subject to interpretation, and we are unable to predict the ultimate cost of compliance with these requirements or their effect on our operations.

Subsidiaries

We do not have any subsidiaries.

Bankruptcy or Similar Proceedings

We have not been subject to any bankruptcy, receivership or similar proceeding.

Research and Development Costs During the Last Two Years

We have expended $7,000 in research and development costs related to website creation and development during the last two fiscal years.

Intellectual Property

We do not own, either legally or beneficially, any patent or trademark. We own the domain name for our website, www.blackstallionoil.com.

Employees

We are a development stage company and currently have no employees, other than our officers and directors. Mr. Morris, our president, secretary and treasurer, currently devotes 25 hours per week to company matters.

REPORTS TO SECURITY HOLDERS

We are required to file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission and our filings are available to the public over the internet at the Securities and Exchange Commission’s website at http://www.sec.gov. The public may read and copy any materials filed by us with the Securities and Exchange Commission at the Securities and Exchange Commission’s Public Reference Room at 100 F Street N.E. Washington D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the Securities and Exchange Commission at 1-800-732-0330. The SEC also maintains an Internet site that contains reports, proxy and formation statements, and other information regarding issuers that file electronically with the SEC, at http://www.sec.gov.

| 8 |

| Table of Contents |

Much of the information included in this annual report includes or is based upon estimates, projections or other “forward looking statements”. Such forward looking statements include any projections and estimates made by us and our management in connection with our business operations. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein.

Such estimates, projections or other “forward looking statements” involve various risks and uncertainties as outlined below. We caution the reader that important factors in some cases have affected and, in the future, could materially affect actual results and cause actual results to differ materially from the results expressed in any such estimates, projections or other “forward looking statements”.

Risks Related to Our Business

We have a history of losses and no revenues, which raise substantial doubt about our ability to continue as a going concern.

As of December 31, 2016, we have incurred accumulated net losses of $1,963,406. We can offer no assurance that we will ever operate profitably or that we will generate positive cash flow in the future. In addition, our operating results in the future may be subject to significant fluctuations due to many factors not within our control. Our profitability will require the successful commercialization of our oil and gas properties. We may not be able to successfully commercialize our properties or ever become profitable.

Our company’s operations will be subject to all the risks inherent in the establishment of a developing enterprise and the uncertainties arising from the absence of a significant operating history. No assurance can be given that we may be able to operate on a profitable basis.

Due to the nature of our business and the early stage of our development, our securities must be considered highly speculative. We have not realized a profit from our operations to date and there is little likelihood that we will realize any profits in the short or medium term.

We will depend almost exclusively on outside capital to pay for the continued operations, exploration, and development of our properties. Such outside capital may include the sale of additional stock and/or commercial borrowing. Capital may not continue to be available if necessary to meet these continuing development costs or, if the capital is available, that it will be on terms acceptable to us. The issuance of additional equity securities by us would result in a significant dilution in the equity interests of our current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments.

If we are unable to obtain financing in the amounts and on terms deemed acceptable to us, we may be unable to continue our business and as a result may be required to scale back or cease operations for our business, the result of which would be that our stockholders would lose some or all of their investment.

| 9 |

| Table of Contents |

A decline in the price of our common stock could affect our ability to raise further working capital and adversely impact our operations.

A prolonged decline in the price of our common stock could result in a reduction in the liquidity of our common stock and a reduction in our ability to raise capital. Because our operations have been primarily financed through the sale of equity securities, a decline in the price of our common stock could be especially detrimental to our liquidity and our continued operations. Any reduction in our ability to raise equity capital in the future would force us to reallocate funds from other planned uses and would have a significant negative effect on our business plans and operations, including our ability to develop new products and continue our current operations. If our stock price declines, we may not be able to raise additional capital or generate funds from operations sufficient to meet our obligations.

We have a history of losses and fluctuating operating results. We expect to continue to incur operating losses and negative cash flow until we receive significant commercial production from our properties

Our loss from operations for the twelve months ended December 31, 2016 was $1,561,189. There is no assurance that we will operate profitably or will generate positive cash flow in the future. In addition, our operating results in the future may be subject to significant fluctuations due to many factors not within our control, such as the unpredictability of when customers will purchase our production and/or services, the size of customers’ purchases, the demand for our production and/or services, and the level of competition and general economic conditions. If we cannot generate positive cash flows in the future, or raise sufficient financing to continue our normal operations, then we may be forced to scale down or even close our operations. Until such time as we generate significant revenues, we expect an increase in development costs and operating costs. Consequently, we expect to continue to incur operating losses and negative cash flow until we receive significant commercial production from our properties.

We have a limited operating history and if we are not successful in continuing to grow our business, then we may have to scale back or even cease our ongoing business operations.

We have limited history of revenues from operations and have limited significant tangible assets. We have yet to generate positive earnings and there can be no assurance that we will ever operate profitably. Our company has a limited operating history and must be considered in the development stage. The success of our company is significantly dependent on a successful acquisition, drilling, completion and production program. Our company’s operations will be subject to all the risks inherent in the establishment of a developing enterprise and the uncertainties arising from the absence of a significant operating history. We may be unable to locate recoverable reserves, extract the reserves economically, and/or operate on a profitable basis. We are in the development stage and potential investors should be aware of the difficulties normally encountered by enterprises in the development stage. If our business plan is not successful, and we are not able to operate profitably, investors may lose some or all of their investment in our company.

Trading of our stock may be restricted by the SEC’s “Penny Stock” regulations, which may limit a stockholder’s ability to buy and sell our stock.

The U.S. Securities and Exchange Commission has adopted regulations which generally define “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors.” The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC, which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of, our common stock.

| 10 |

| Table of Contents |

The Financial Industry Regulatory Authority, or FINRA, has adopted sales practice requirements which may also limit a stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

Trading in our common shares on the OTC Bulletin Board is limited and sporadic making it difficult for our shareholders to sell their shares or liquidate their investments.

Our common shares are currently listed for public trading on the OTC Bulletin Board. The trading price of our common shares has been subject to wide fluctuations. Trading prices of our common shares may fluctuate in response to a number of factors, many of which will be beyond our control. The stock market has generally experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of companies with no current business operation. There can be no assurance that trading prices and price earnings ratios previously experienced by our common shares will be matched or maintained. These broad market and industry factors may adversely affect the market price of our common shares, regardless of our operating performance. In the past, following periods of volatility in the market price of a company’s securities, securities class-action litigation has often been instituted. Such litigation, if instituted, could result in substantial costs for us and a diversion of management’s attention and resources.

Because of the early stage of development and the nature of our business, our securities are considered highly speculative.

Our securities must be considered highly speculative, generally because of the nature of our business and the early stage of its development. Accordingly, we have not generated significant revenues nor have we realized a profit from our operations to date and there is little likelihood that we will generate significant revenues or realize any profits in the short term. Any profitability in the future from our business will be dependent upon attaining adequate levels of internally generated revenues through locating and developing economic reserves of oil and gas, which itself is subject to numerous risk factors as set forth herein. Since we have not generated significant revenues, we will have to raise additional monies through either securing industry reserve based debt financing, or the sale of our equity securities or debt, or combinations of the above in order to continue our business operations.

The potential profitability of oil and gas ventures depends upon factors beyond the control of our company.

The potential profitability of oil and gas properties is dependent upon many factors beyond our control. For instance, world prices and markets for oil and gas are unpredictable, highly volatile, potentially subject to governmental fixing, pegging, controls, or any combination of these and other factors, and respond to changes in domestic, international, political, social, and economic environments. Additionally, due to worldwide economic uncertainty, the availability and cost of funds for production and other expenses have become increasingly difficult, if not impossible, to project. These changes and events may materially affect our financial performance.

| 11 |

| Table of Contents |

Adverse weather conditions can also hinder drilling operations. A productive well may become uneconomic in the event water or other deleterious substances are encountered which impair or prevent the production of oil and/or gas from the well. In addition, production from any well may be unmarketable if it is impregnated with water or other deleterious substances. The marketability of oil and gas, which may be acquired or discovered, will be affected by numerous factors beyond our control. These factors include the proximity and capacity of oil and gas pipelines and processing equipment, market fluctuations of prices, taxes, royalties, land tenure, allowable production and environmental protection. These factors cannot be accurately predicted and the combination of these factors may result in our company not receiving an adequate return on invested capital.

Competition in the oil and gas industry is highly competitive and there is no assurance that we will be successful in acquiring the leases.

The oil and gas industry is intensely competitive. We compete with numerous individuals and companies, including many major oil and gas companies, which have substantially greater technical, financial and operational resources and staff. Accordingly, there is a high degree of competition for desirable oil and gas leases, suitable properties for drilling operations and necessary drilling equipment, as well as for access to funds. We cannot predict if the necessary funds can be raised or that any projected work will be completed. Our budget does not anticipate the potential acquisition of acreage although this may change at any time without notice. This acreage may not become available or if it is available for leasing, that we may not be successful in acquiring the leases. There are other competitors that have operations in these areas and the presence of these competitors could adversely affect our ability to acquire additional leases.

The marketability of natural resources will be affected by numerous factors beyond our control, which may result in us not receiving an adequate return on invested capital to be profitable or viable.

The marketability of natural resources, which may be acquired or discovered by us, will be affected by numerous factors beyond our control. These factors include market fluctuations in oil and gas pricing and demand, the proximity and capacity of natural resource markets and processing equipment, governmental regulations, land tenure, land use, regulation concerning the importing and exporting of oil and gas and environmental protection regulations. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in us not receiving an adequate return on invested capital to be profitable or viable.

Oil and gas operations are subject to comprehensive regulation, which may cause substantial delays or require capital outlays in excess of those anticipated causing an adverse effect on our company.

Oil and gas operations are subject to federal, state, and local laws relating to the protection of the environment, including laws regulating removal of natural resources from the ground and the discharge of materials into the environment. Oil and gas operations are also subject to federal, state, and local laws and regulations, which seek to maintain health and safety standards by regulating the design and use of drilling methods and equipment. Various permits from government bodies are required for drilling operations to be conducted; no assurance can be given that such permits will be received. Environmental standards imposed by federal, provincial, or local authorities may be changed and any such changes may have material adverse effects on our activities. Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus causing an adverse effect on us. Additionally, we may be subject to liability for pollution or other environmental damages, which it may elect not to insure against due to prohibitive premium costs and other reasons. To date we have not been required to spend any material amount on compliance with environmental regulations. However, we may be required to do so in future and this may affect our ability to expand or maintain our operations.

Exploration and production activities are subject to certain environmental regulations, which may prevent or delay the commencement or continuance of our operations.

In general, our exploration and production activities are subject to certain federal, state and local laws and regulations relating to environmental quality and pollution control. Such laws and regulations increase the costs of these activities and may prevent or delay the commencement or continuance of a given operation. Compliance with these laws and regulations has not had a material effect on our operations or financial condition to date. Specifically, we are subject to legislation regarding emissions into the environment, water discharges and storage and disposition of hazardous wastes. In addition, legislation has been enacted which requires well and facility sites to be abandoned and reclaimed to the satisfaction of state authorities. However, such laws and regulations are frequently changed and we are unable to predict the ultimate cost of compliance. Generally, environmental requirements do not appear to affect us any differently or to any greater or lesser extent than other companies in the industry.

| 12 |

| Table of Contents |

Exploratory and development drilling involves many risks and we may become liable for pollution or other liabilities, which may have an adverse effect on our financial position.

Drilling operations generally involve a high degree of risk. Hazards such as unusual or unexpected geological formations, power outages, labor disruptions, blow-outs, sour gas leakage, fire, inability to obtain suitable or adequate machinery, equipment or labor, and other risks are involved. We may become subject to liability for pollution or hazards against which it cannot adequately insure or which it may elect not to insure. Incurring any such liability may have a material adverse effect on our financial position and operations.

Any change to government regulation/administrative practices may have a negative impact on our ability to operate and our profitability.

The laws, regulations, policies or current administrative practices of any government body, organization or regulatory agency in the United States or any other jurisdiction, may be changed, applied or interpreted in a manner which will fundamentally alter the ability of our company to carry on our business.

The actions, policies or regulations, or changes thereto, of any government body or regulatory agency, or other special interest groups, may have a detrimental effect on us. Any or all of these situations may have a negative impact on our ability to operate and/or our profitably.

ITEM 1B. UNRESOLVED STAFF COMMENTS

As a “smaller reporting company” we are not required to provide the information required by this Item.

Principal Executive Offices

We do not own any real property. We currently maintain our executive offices at 633 W. 5th Street, 26th Floor, Los Angeles, CA 90071. Our company pays rent of $259.00 per month for this space. Our headquarters are located in Buffalo, New York.

Woodrow Prospect - Teton County, Montana

Effective February 23, 2014, we entered into a lease assignment agreement with West Bakken Energy Holdings, Ltd. Pursuant to the terms of the lease assignment agreement, we have acquired an undivided one-hundred percent interest in West Bakken’s interest (a net 50% working interest) in certain oil and gas properties comprising of 12,233.93 acres in Montana, owned by Hillcrest Resources Ltd.

On October 2, 2015, we entered into a lease assignment agreement to acquire the remaining 50% working interest in certain oil and gas properties comprising of 12,233.93 acres in Montana, owned by Hillcrest Resources Ltd. As a result of these two lease assignment agreements, our company owns a net 100% working interest in certain oil and gas properties comprising 12,233.93 acres in Teton County, Montana.

Our company’s Canadian National Instrument 51-101 Report (June 2014) estimates the Woodrow Prospect to represent net recoverable prospective resources for Black Stallion of 80.8 million barrels of oil (MMBO) and 16.9 billion cubic feet of natural gas (Bcf).1

____________________

1 Woodrow Prospect 51-101 report, B.L. Whelan, P. Geo., June 30, 2014.

| 13 |

| Table of Contents |

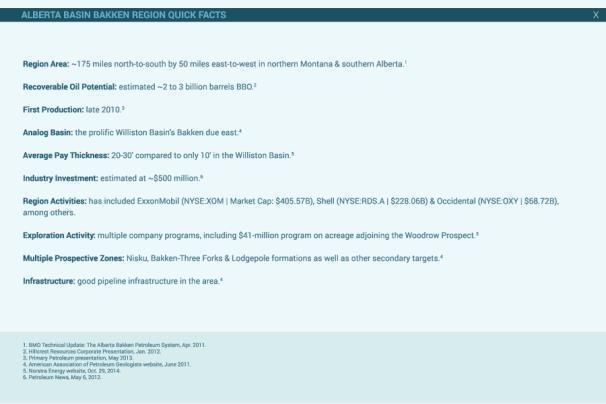

Located due west of Williston Basin’s prolific Montana-North Dakota Bakken, the Alberta Basin Bakken is expected to deliver approximately 2 to 3 billion barrels of recoverable oil.2

The province surrounding the Woodrow Prospect, meanwhile, may contain as much as 1 billion barrels of oil recoverable (Sandomierski et al., 2002).1

Advances in horizontal drilling and other modern techniques are being applied within the Alberta Basin Bakken, which features 20-30’ of pay in its critical Middle Member (Sappington) compared to an average pay of 10’ in the Williston Basin.3

Proximity to Production & Activity

Over 280 MMBO has been produced to date from 3 large fields between 12 to 40 miles from the Woodrow Prospect within the Alberta Basin Bakken.4

Interest in the Alberta Basin Bakken over the past few years has resulted in major industry players investing in excess of $180 million to acquire land in the fairway’s southern region,5 close to the Woodrow Prospect. Among the companies that have invested in the play are ExxonMobil (NYSE:XOM|Market Cap: $405.57B), Shell (NYSE:RDS.A|$228.06B), Occidental (NYSE:OXY|$68.72B), Encana (NYSE:ECA|$13.58B), and Crescent Point Energy (TSX:CPG|$16.38B), who is currently conducting high-impact exploration for conventional and unconventional oil opportunities.6

Exploration activity nearby the Woodrow Prospect has included a $41M exploration program on an adjoining acreage, consisting of 3-D seismic, a 7 vertical well program, and a 3 horizontal well drilling program.7

The Woodrow Prospect is approximately 6 miles from good pipeline infrastructure, which has served Canadian production and the once prolific Cut Bank oil and gas field;8 within 12 miles from the Pondera Field (30 MMBO); and 40 miles from a refinery at Great Falls, Montana.1

____________________

2 Hillcrest Resources Corporate Presentation, Jan. 2012.

3 Norstra Energy website, Oct. 29, 2014.

4 Primary Petroleum presentation, May 2013.

5 DeeThree Exploration Annual Report, 2010.

6 Crescent Point Energy website, Oct. 28, 2014.

7 Hillcrest Resources website, Oct. 30, 2013.

8 American Association of Petroleum Geologists website, June 2011.

| 14 |

| Table of Contents |

Horizons & Exploration Potential

In June 2014, our company received a Canadian National Instrument 51-101 Report from B.L. Whelan, P. Geo. on the 12-lease Woodrow Prospect.1 The author reviewed the available technical data, reports derived from the public domain, and information from wells within the leases and currently producing wells in adjacent fields.

The Whelan report concludes the Woodrow Prospect offers multiple opportunities for success in oil and gas production across multiple potential targets at shallow depths. The report also recommends an exploration program be carried out on the leases to determine the potential hydrocarbon content of the various formations.1 Our company is currently developing an exploration program to better determine the Woodrow Prospect’s production potential.

The initial phase of the exploration program is expected to include 3-D seismic procedures and computer treatment of geological and geophysical data.

Geology & Targets

The multi-reservoir Woodrow Prospect lies along the eastern flank of the productive Sweetgrass Arch and at the western end of a province of heavy oil shows in the Jurassic Swift sandstone. The area is considered to be of high potential due to the possibility of traps in multiple zones. The prospect’s shallow-depth targets include both heavy oil in the Jurassic Swift Formation (estimated at 1,500’), conventional oil in the Sun River (approximately 1,800’), Devonian Duperow and Nisku (estimated at 3,000’ to 3,200’), and the Mississippian Bakken (estimated below 2,000’). The prospect also represents potential gas production from the Duperow as well as the Cretaceous Blackleaf, Cretaceous Bow Island, Dakota, and Cutbank Sands that are found at depths of less than 1,000’.1

| 15 |

| Table of Contents |

Nearby Production & Prospect Shows

A major target of the Woodrow Prospect is the prolific Sun River Dolomite, which produces oil (30+ MMBO from approximately 350 wells) and gas at depths between 1,900’ to 2,000’ roughly 12 miles to the northwest in the Pondera Oilfield. A recent New Miami horizontal well to the northwest was successfully completed in the Sun River Dolomite with oil production tests in excess of 150 barrels of oil per day (bopd) next to vertical offsets producing 10 bopd, which indicates the economics of the Swift can be enhanced by horizontal drilling and completions.

Within the Woodrow Prospect leases, oil and gas have been produced from the Sun River in 4 wells. The Swift Formation has produced 1.5 MMBO in 2 fields 15 miles to the prospect’s northeast. Within the Woodrow Prospect leases, the Swift is well developed with a section that is typically 25 to 53’ thick, saturated with oil throughout, and possessing excellent porosity (14-30%) over large areas of the prospect. Reports of oil in the Swift have come from 3 wells drilled on the prospect.

Other hydrocarbon shows within the prospect have been associated with the Bow Island, Nisku and Duperow targets for a total of 12 wells within the Woodrow Prospect having hydrocarbon shows with 6 of those being vertical producers.1 The Bakken Formation continues to attract active leasing from various companies,1 including Anadarko Petroleum (NYSE: APC|$44.85B) taking 7 new Alberta Bakken permits and assuming ownership of 3 others in Toole County, Montana, in June 2014.9

Dee Three Exploration (TSX: DTX|$591.62M), meanwhile, has discovered an oil pool in the play running 14 miles long and 4 miles wide; had drilled 28 horizontal wells in the play as of year-end 2013 with reported production of approximately 4,000 barrels per day of light oil; and planned on drilling 18 more wells in the Alberta Bakken in 2014.10

Exploration & Development Program

Our company’s initial exploration phase includes plans for a new 3-D seismic program and computer manipulation of data to determine the hydrocarbon potential of the leases. Following the seismic survey, a vertical well will be drilled to test the section. Depending upon the results discovered in the vertical well, a horizontal well program could be initiated to develop the various potential productive zones.

In particular, the Duperow should be considered for a horizontal drilling program to maximize the production potential.

Region - Alberta Basin Bakken

According to the American Association of Petroleum Geologists (AAPG), the Alberta Basin Bakken, which stretches from northwest Montana into Alberta, is a significant new Bakken Shale oil play.11 While estimates vary, the consensus is that the Alberta Basin Bakken is expected to deliver approximately 2 to 3 billion barrels (BBO) of recoverable oil.12

The Alberta Basin Bakken is a proven hydrocarbon system,13 with its first wells coming on stream in late 2010.14

____________________

9 Oil and Gas Investor website, Aug. 18, 2014.

10 Oil and Gas Enquirer website, Apr. 30, 2014.

11 American Association of Petroleum Geologists website, June 2011.

12 Hillcrest Resources Corporate Presentation, Jan. 2012 & Jan. 2014.

13 BMO Technical Update: The Alberta Bakken Petroleum System, Apr. 2011

14 Primary Petroleum presentation, May 2013.

| 16 |

| Table of Contents |

Analog to Williston Basin Bakken

According to industry leaders, what makes the Alberta Bakken attractive is the potential and similarities it shares with the Williston Basin.15 The Williston Basin’s prolific Montana-North Dakota Bakken has become one of the most significant onshore oil developments in North America in decades.2

The US Geological Survey’s (USGS) assessment of the Williston Basin region in 2013 concluded it contains an estimated mean of 6.7 trillion cubic feet (TCF) of recoverable natural gas and 7.5 BBO of recoverable oil (a twofold increase over the USGS’s 2008 assessment).16 Since the time of the 2008 USGS assessment, the Williston Basin has produced approximately 450 million barrels of oil (MMBO).17

Located due west of the Williston Basin is the Alberta Basin Bakken, which the AAPG considers to be an analog to existing Devonian shale oil production.11 While sharing many characteristics with the Williston Basin, the Alberta Basin Bakken features 20-30’ of pay compared to an average of only 10’ in the Williston Basin,18 and lower drilling costs due to shallower burial depths and a different class of rig being required.12

Region Investment & Activity

Industry investment in the Alberta Basin Bakken to date, including investments in land, joint ventures, exploration and drilling, is estimated at approximately $500 million,15 with experienced companies largely tying up the region’s lands at different times.19

In June 2014, Anadarko Petroleum (NYSE: APC|Market Cap: $44.85B) took 7 new Alberta Bakken permits and assumed ownership of 3 others in Toole County, Montana, for horizontal wildcats seeking Bakken pay. Included in the 10 permits is Bill Barret Corp.’s 2012 horizontal well, which found the Bakken at 3,200 feet in Rattlesnake Coulee Field. Anadarko’s well completion plans filed with the state include 22 packers and 19 sleeves.20

DeeThree Exploration (TSX: DTX|$591.62M), meanwhile, has discovered an oil pool in the play running 14 miles long and 4 miles wide; had drilled 28 horizontal wells in the play as of year-end 2013 with reported production of approximately 4,000 barrels per day of light oil; and planned on drilling 18 more wells in the Alberta Bakken in 2014.21

While minimal news is available on the region’s wells due to most of them being classified as confidential,15 as of 2011, Montana’s most active driller, Newfield Exploration (NYSE:NFX|$4.01B), had drilled 7 vertical wells, completed and placed on production 2 horizontal wells, and announced that all of its Alberta Bakken wells to date had encountered oil.11

Other major players’ activities in the Alberta Basin Bakken have included Murphy Oil (NYSE:MUR|$9.35B) drilling 2 appraisal wells of a 6-well program in 2011, and later announcing it hit oil in the region’s Three Forks zone.15 As of early 2013, Murphy’s initial well in the Three Forks zone had been on production for over 300 days and was still achieving rates near 200 barrels a day.22 As of mid-2012, Shell (NYSE:RDS.A|$228.06B) had licensed 4 new wildcat horizontal wells in the Del Bonita area just north of the Montana border, with 1 well drilled.15

____________________

15 Petroleum News, May 6, 2012.

16 US Geological Survey (USGS) website, May 2, 2013.

17 USGS Assessment of Undiscovered Oil Resources in the Bakken and Three Forks Formations, 2013.

18 Norstra Energy website, Oct. 29, 2014.

19 Petroleum News, March 31, 2013.

20 Oil and Gas Investor website, Aug. 18, 2014.

21 Oil and Gas Enquirer website, Apr. 30, 2014.

22 Oil and Gas Inquirer website, Mar. 17, 2013.

| 17 |

| Table of Contents |

Other exploration plans by companies or their joint venture partners have included ExxonMobil (NYSE:XOM|$405.57B), Occidental (NYSE:OXY|$68.72B), Encana (NYSE:ECA|$13.58B), Rosetta Resources (NASDAQ:ROSE|$2.33B), and Crescent Point Energy (TSX:CPG|$16.38B), who is currently conducting high impact exploration on its Alberta Basin Bakken properties for both conventional and unconventional oil opportunities.23

____________________

23 Crescent Point Energy website, Oct. 29, 2014.

| 18 |

| Table of Contents |

Region Estimates & Production

Contributing to the overall consensus that the Alberta Basin Bakken will deliver approximately 2 to 3 BBO of recoverable oil is the estimate from global energy research firm, Wood Mackenzie, that 2.6 BBO may be recovered from the region.18

According to the AAPG, meanwhile, estimates of the total resource in place vary from 10 to 15 MMBO equivalent per square mile.11

Of the 130+ wells drilled in the Alberta Basin Bakken to test various reservoirs, most have used the modern technique of horizontal drilling,14 while 1 shale well in particular has been producing in northwest Montana for 35+ years.11

Region Exploration Details

While overall industry investment in the Alberta Basin Bakken is estimated at approximately $500 million,15 major industry players have invested in excess of $180 million in the region’s southern area,24 close to our company’s Woodrow Prospect.

In particular, Occidental Petroleum (NYSE:OXY|$68.72B) held a 32.5% interest in a property that directly adjoins Black Stallion’s Woodrow Prospect,25 where a $41-million exploration program for 2011/12 included 3-D seismic, a 7 vertical well program and 3 horizontal well drilling program.14

____________________

24 Dee Three Exploration Annual Report, 2010.

25 Fairfield Sun Times website, Jan. 22, 2013.

| 19 |

| Table of Contents |

Region & Geology

The Alberta Basin Bakken stretches for roughly 175 miles north-to-south by 50 miles east-to-west in northern Montana and southern Alberta.13

In Montana, the potential play area includes Glacier, Toole, Pondera and Teton counties. Where it extends across the border into Canada, the Bakken equivalent is known as the Exshaw.11 The region’s dark, organic-rich shale is recognized as an excellent source rock that has produced much of the oil found in conventional reservoirs in Alberta.19

According to BMO Capital Markets, the Alberta Basin Bakken is interpreted as a Deep Basin Light Tight Oil resource play, with characteristics including pervasive petroleum saturation, upper and lower carbonate reservoir units, and proven production and hydrocarbon recoveries.13

The AAPG indicates that, as with the Williston Basin’s Bakken to the east, the Alberta Basin Bakken represents attractive shale oil features, including multiple prospective zones – the Nisku, Bakken-Three Forks and Lodgepole formations – as well as other secondary targets.

The area also represents good pipeline infrastructure, which has served Canadian production and the once prolific Cut Bank oil and gas field.11

We know of no material, existing or pending legal proceedings against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial stockholder, is an adverse party or has a material interest adverse to our interest.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

| 20 |

| Table of Contents |

Market for our Common Stock

Our common shares are quoted on the OTC Markets under the symbol “BLKG.” Because we are quoted on the OTC Markets, our securities may be less liquid, receive less coverage by security analysts and news media, and generate lower prices than might otherwise be obtained if they were listed on a national securities exchange.

The following table sets forth the high and low bid prices for our Common Stock per quarter as reported by the OTCQB for the period from January 1, 2016 through December 31, 2016, and January 1, 2015 through December 31, 2015, based on our fiscal year end December 31. These prices represent quotations between dealers without adjustment for retail mark-up, markdown or commission and may not represent actual transactions.

|

|

|

First Quarter |

|

|

Second Quarter |

|

|

Third Quarter |

|

|

Fourth Quarter |

| ||||

|

2016 - High |

|

$ | 0.1000 |

|

|

$ | 0.0878 |

|

|

$ | 0.0800 |

|

|

$ | 0.0400 |

|

|

2016 - Low |

|

|

0.0220 |

|

|

|

0.0445 |

|

|

|

0.0299 |

|

|

|

0.0024 |

|

|

2015 - High |

|

|

5.0000 |

|

|

|

2.0000 |

|

|

|

2.3900 |

|

|

|

1.2500 |

|

|

2015 - Low |

|

|

0.5000 |

|

|

|

0.5000 |

|

|

|

0.8150 |

|

|

|

0.0750 |

|

Record Holders

As of December 31, 2016, we had outstanding 145,163,921 shares of common stock, which were held by 8 shareholders of record.

Dividends

Since our inception, we have not declared nor paid any cash dividends on our capital stock and we do not anticipate paying any cash dividends in the foreseeable future. Our current policy is to retain any earnings in order to finance our operations. Our board of directors will determine future declarations and payments of dividends, if any, in light of the then-current conditions it deems relevant and in accordance with applicable corporate law.

| 21 |

| Table of Contents |

Securities Authorized for Issuance under Equity Compensation Plans

We have no existing equity compensation plan.

Performance graph

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

Recent Sales of Unregistered Securities

On August 4, 2016, the Company issued 50,000,000 shares of common stock at a price of $0.001, pursuant to a debt settlement agreement.

On August 24, 2016, the holder of a convertible note converted a total of $10,000 of principal and $412 of interest into 370,470 shares of our common stock.

On September 8, 2016, the holder of a convertible note converted a total of $10,000 of principal and $436 of interest into 323,251 shares of our common stock.

On September 13, 2016, the holder of a convertible note converted a total of $8,850 of principal and $4 of interest into 315,646 shares of our common stock.

On September 14, 2016, the holder of a convertible note converted a total of $10,000 of principal into 356,506 shares of our common stock.

On September 16, 2016, the holder of a convertible note converted a total of $10,000 of principal and $462 of interest into 380,453 shares of our common stock.

On September 22, 2016, the holder of a convertible note converted a total of $10,000 of principal into 377,529 shares of our common stock.

On September 26, 2016, the holder of a convertible note converted a total of $10,000 of principal and $28 of interest into 379,340 shares of our common stock.

On September 28, 2016, the holder of a convertible note converted a total of $10,000 of principal and $489 of interest into 515,419 shares of our common stock.

On September 29, 2016, the holder of a convertible note converted a total of $10,000 of principal and $44 of interest into 482,683 shares of our common stock.

| 22 |

| Table of Contents |

On October 10, 2016, the holder of a convertible note converted a total of $10,000 of principal and $508 of interest into 764,254 shares of our common stock.

On October 11, 2016, the holder of a convertible note converted a total of $10,000 of principal and $61 of interest into 654,114 shares of our common stock.

On October 27, 2016, the holder of a convertible note converted a total of $10,000 of principal into 891,265 shares of our common stock.

On October 31, 2016, the holder of a convertible note converted a total of $5,000 of principal and $278 of interest into 465,875 shares of our common stock.

On November 7, 2016, the holder of a convertible note converted a total of $5,000 of principal into 473,485 shares of our common stock.

On November 9, 2016, the holder of a convertible note converted a total of $5,000 of principal and $290 of interest into 582,965 shares of our common stock.

On November 9, 2016, the holder of a convertible note converted a total of $20,000 of principal into 2,217,294 shares of our common stock.

On November 15, 2016, the holder of a convertible note converted a total of $5,000 of principal and $295 of interest into 992,463 shares of our common stock.

On November 15, 2016, the holder of a convertible note converted a total of $5,000 of principal and $26 of interest into 1,128,180 shares of our common stock.

On December 8, 2016, the holder of a convertible note converted a total of $5,000 of principal into 909,091 shares of our common stock.

On December 12, 2016, the holder of a convertible note converted a total of $10,000 of principal and $651 of interest into 2,727,519 shares of our common stock.

On December 12, 2016, the holder of a convertible note converted a total of $8,850 of principal into 1,835,490 shares of our common stock.

On December 15, 2016, the holder of a convertible note converted a total of $5,000 of principal into 1,280,410 shares of our common stock.

On December 16, 2016, the holder of a convertible note converted a total of $5,000 of principal into 2,217,295 shares of our common stock.

On December 20, 2016, the holder of a convertible note converted a total of $10,000 of principal and $664 of interest into 4,729,095 shares of our common stock.

On December 21, 2016, the holder of a convertible note converted a total of $7,000 of principal into 3,636,364 shares of our common stock.

On December 23, 2016, the holder of a convertible note converted a total of $7,500 of principal and $510 of interest into 4,550,903 shares of our common stock.

On December 27, 2016, the holder of a convertible note converted a total of $6,650 of principal into 4,105,572 shares of our common stock.

On December 28, 2016, the holder of a convertible note converted a total of $10,150 of principal into 6,158,358 shares of our common stock.

| 23 |

| Table of Contents |

On December 30, 2016, the holder of a convertible note converted a total of $1,200 of principal and $409 of interest into 1,148,968 shares of our common stock.

On December 30, 2016, the holder of a convertible note converted a total of $7,500 of principal and $518 of interest into 4,555,574 shares of our common stock.

Subsequent Issuances

On January 6, 2017, the holder of a convertible note converted a total of $7,500 of principal and $84 of interest into 5,995,130 shares of our common stock.

On January 19, 2017, the holder of a convertible note converted a total of $6,000 of principal and $84 of interest into 5,531,055 shares of our common stock.

On January 31, 2017, the holder of a convertible note converted a total of $5,000 of principal and $85 of interest into 4,843,314 shares of our common stock.

On February 13, 2017, the holder of a convertible note converted a total of $5,000 of principal and $94 of interest into 5,660,278 shares of our common stock.

On February 16, 2017, the holder of a convertible note converted a total of $7,000 of principal and $141 of interest into 7,934,611 shares of our common stock.

On February 22, 2017, the holder of a convertible note converted a total of $5,000 of principal and $104 of interest into 6,004,835 shares of our common stock.

On February 28, 2017, the holder of a convertible note converted a total of $5,000 of principal and $111 of interest into 6,814,247 shares of our common stock.

On March 8, 2017, the holder of a convertible note converted a total of $5,000 of principal and $119 of interest into 8,532,420 shares of our common stock.

On March 14, 2017, the holder of a convertible note converted a total of $5,250 of principal and $132 of interest into 8,970,548 shares of our common stock.

On March 16, 2017, the holder of a convertible note converted a total of $5,000 of principal and $130 of interest into 8,550,685 shares of our common stock.

On March 22, 2017, the holder of a convertible note converted a total of $5,000 of principal and $196 of interest into 8,660,274 shares of our common stock.

On March 22, 2017, the holder of a convertible note converted a total of $3,750 of principal and $104 of interest into 6,442,603 shares of our common stock.

On March 21, 2017, the holder of a convertible note converted a total of $6,000 of principal and $237 of interest into 10,394,521 shares of our common stock.

On March 29, 2017, the holder of a convertible note converted a total of $6,000 of principal and $241 of interest into 10,401,096 shares of our common stock.

Issuer Repurchases of Equity Securities

None.

| 24 |

| Table of Contents |

ITEM 6. SELECTED FINANCIAL DATA

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our audited financial statements and the related notes for the years ended December 31, 2016 and December 31, 2015 that appear elsewhere in this annual report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to those discussed below and elsewhere in this annual report, particularly in the section entitled “Risk Factors” beginning on page 8 of this annual report.

Our audited financial statements are stated in United States Dollars and are prepared in accordance with United States Generally Accepted Accounting Principles.

Results of Operations

The following summary of our results of operations should be read in conjunction with our audited financial statements for the years ended December 31, 2016 and 2015 which are included herein.

Our operating results for the years ended December 31, 2016 and 2015 are summarized as follows:

|

|

|

For the years ended |

| |||||

|

|

|

December 31, |

|

|

December 31, |

| ||

|

|

|

2016 |

|

|

2015 |

| ||

|

Revenue |

|

$ | - |

|

|

$ | - |

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

Amortization |

|

|

2,317 |

|

|

|

2,317 |

|

|

Consulting |

|

|

415,900 |

|

|

|

81,000 |

|

|

Filing |

|

|

17,357 |

|

|

|

20,857 |

|

|

Finder’s fee |

|

|

20,590 |

|

|

|

- |

|

|

Other G&A expenses |

|

|

12,937 |

|

|

|

22,947 |

|

|

Professional fees |

|

|

55,431 |

|

|

|

53,770 |

|

|

Rent expenses |

|

|

4,190 |

|

|

|

14,078 |

|

|

Website expenses |

|

|

- |

|

|

|

7,000 |

|

|

Total operating expenses |

|

|

528,721 |

|

|

|

201,969 |

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

|

(528,721 | ) |

|

|

(201,969 | ) |

|

|

|

|

|

|

|

|

|

|

|

Other income/ (expense) |

|

|

|

|

|

|

|

|

|

Change in derivative liability |

|

|

198,106 |

|

|

|

- |

|

|

Interest on convertible notes |

|

|

(1,222,574 | ) |

|

|

- |

|

|

Total other income/expenses |

|

|

(1,024,468 | ) |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

Net Profit (Loss) |

|

$ | (1,561,189 | ) |

|

$ | (201,969 | ) |

| 25 |

| Table of Contents |

We had no revenue for the years ended December 31, 2016 and 2015. For the year ended December 31, 2016, we had total operating expenses of $528,721 compared to $201,969 for the year ended December 31, 2015. The $321,053 increase in operating expenses in primarily due to consulting fees.

Other income (expense) consisted of gain or loss on derivative valuation, interest expense and uncollectible debt. The gain or loss on derivative valuation is directly attributable to the change in fair value of the derivative liability. Interest expense is primarily attributable the initial interest expense associated with the valuation of derivative instruments at issuance and the accretion of the convertible debentures over their respective terms.

Liquidity and Capital Resources

Working Capital

|

|

|

At |

|

|

At |

| ||

|

|

|

2016 |

|

|

2015 |

| ||

|

Current Assets |

|

$ | 160,441 |

|

|

$ | 28,842 |

|

|

Current Liabilities |

|

$ | 610,816 |

|

|

$ | 12,855 |

|

|

Working Capital (Deficit) |

|

$ | (450,405 | ) |

|

$ | 15,987 |

|

Cash Flows

|

|

|

Year Ended |

|

|

Year Ended |

| ||

|

|

|

2016 |

|

|

2015 |

| ||

|

Net Cash provided by (used in) Operating Activities |

|

$ | (1,374,002 | ) |

|

$ | (223,894 | ) |

|

Net Cash provided by (used in) Investing Activities |

|

$ | 0 |

|

|

$ | (50,000 | ) |

|

Net Cash provided by (used in) Financing Activities |

|

$ | 1,373,786 |

|

|

$ | 250,000 |

|

|

Increase (decrease) in cash and cash equivalents |

|

$ | (216 | ) |

|

$ | (23,894 | ) |

As of December 31, 2016, we had total assets of $1,011,599, total liabilities of $618,816, and stockholders’ equity of $392,782, as compared to total assets of $882,317, total liabilities of $12,855 and stockholders’ equity of $869,462 as of December 31, 2015.

We had cash and cash equivalents as of December 31, 2016, of $0 compared to $216 as of December 31, 2015. Our working capital was $(450,405) as at December 31, 2016 compared to a working capital of $15,987 as at December 31, 2015.

Net cash used in our operating activities during the year ended December 31, 2016 was $(1,374,002), as compared to net cash used in operating activities of $(223,894) for the year ended December 31, 2015.

Net cash used in investing activities in the year ended December 31, 2016 was $0, compared to $50,000 used in investing activities during the year ended December 31, 2015.

Net cash provided by financing activities in the year ended December 31, 2016 was $1,373,786, compared to $250,000 provided by financing activities in year ended December 31, 2015.

Going Concern

We have not attained profitable operations and are dependent upon obtaining financing to pursue any extensive acquisitions and activities. For these reasons, our auditors stated in their report on our audited financial statements that they have substantial doubt that we will be able to continue as a going concern without further financing.

| 26 |

| Table of Contents |

Limited Operating History; Need for Additional Capital

There is no historical financial information about us upon which to base an evaluation of our performance. We are an exploration stage corporation and have not generated revenues from operations. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources. To become profitable and competitive, we will need to realize revenue from our oil and gas sales.

Plan of Operation

We are an exploration stage company with no revenues and a short operating history. Our independent auditor has issued an audit opinion which includes a statement expressing substantial doubt as to our ability to continue as a going concern. This means that there is substantial doubt that we can continue as an on-going business for the next twelve months unless we generate sufficient revenues.

There is no assurance we will ever reach that point. In the meantime, the continuation of our company is dependent upon the continued financial support from our shareholders, our ability to obtain necessary equity financing to continue operations and the attainment of profitable operations.

Our cash balance as of December 31, 2016, is $0. We will require further capital to cover the expenses we will incur during the next twelve months.

Our plan of operation for the next twelve months is to pursue acquisition of leases and/or oil and gas wells which have potential for production, if revenues warrant.

We anticipate spending $150,000 on consulting fees, $50,000 on professional fees, which includes legal costs and fees payable for complying with our reporting obligations, $10,000 in general administrative costs and $15,000 in filing fees. Total expenditures over the next 12 months are therefore expected to be approximately $225,000.

Estimated Net Expenditures During the Next Twelve Months

|

Description |

|

Amount |

| |

|

Consulting fees |

|

$ | 150,000 |

|

|

Filing fees |

|

$ | 15,000 |

|

|

Professional fees |

|

$ | 50,000 |

|

|

Other costs |