Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CRA INTERNATIONAL, INC. | a17-12532_18k.htm |

Exhibit 10.1

FIRST AMENDMENT TO LEASE

FIRST AMENDMENT TO LEASE (this “Amendment”) dated as of the 21st day of April, 2017 by and between 1411 IC-SIC PROPERTY LLC, a Delaware limited liability company with an office at 1411 Broadway, Building Management Office, New York, New York 10018, as landlord (“Landlord”) and CRA INTERNATIONAL, INC., a Massachusetts corporation with an office at 1411 Broadway, 35th Floor, New York, New York 10018, as tenant (“Tenant”).

WITNESSETH:

WHEREAS, Landlord and Tenant entered into certain original lease dated as of July 15, 2015 (the “Original Lease”), covering the entire rentable area of the thirty-fifth (35th) floor (the “Existing Premises”) (the Existing Premises is sometimes referred to herein as the “Entire 35th Floor Premises”) in the building known as 1411 Broadway, New York, New York (the “Building”), consisting of approximately 25,261 rentable square feet (“RSF”);

WHEREAS, as of the date hereof, Tenant continues to occupy the Existing Premises; and

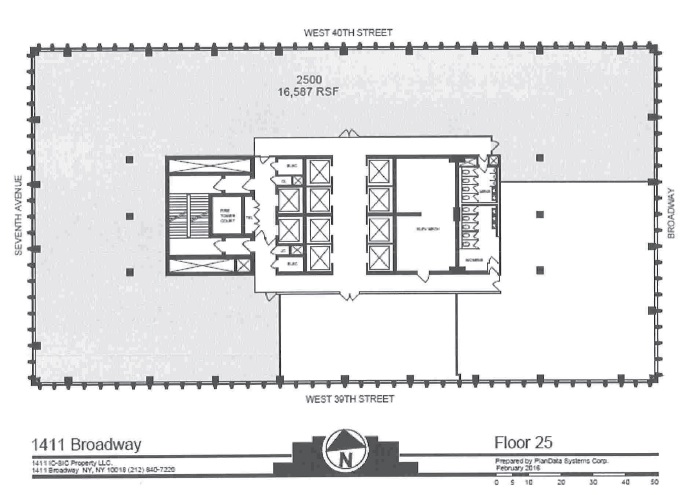

WHEREAS, pursuant to the terms set forth in this Amendment, Landlord and Tenant desire to amend the Lease to provide for, among other things, (i) an extension of the Term of the Lease, and (ii) the leasing by Landlord to Tenant of a portion of the rentable area of the twenty-fifth (25th) floor of the Building consisting of approximately 16,587 RSF as more particularly shown on the floor plan attached hereto as Exhibit A and made a part hereof (the “New Premises”), in accordance with the terms, covenants and conditions of the Lease, as hereby amended.

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

1. Definitions. Capitalized terms used but not otherwise defined herein shall have the meanings ascribed to them in the Lease. As used herein and in the Lease, the term “Lease” shall mean the Original Lease, as amended by this Amendment and as hereafter amended. From and after the New Premises Commencement Date (as hereinafter defined), the term “Premises,” as used in the Lease, shall mean the Existing Premises and the New Premises, collectively, unless otherwise expressly specified.

2. Extension of Term. Effective as of the date of this Amendment, the Term of the Lease is hereby extended through (such date, the “New Expiration Date”): (a) if the New Premises Rent Commencement Date (as defined in Section 7 below) is the first day of a calendar month, the date that immediately precedes the ten (10) year anniversary of the New Premises Rent Commencement Date, or (b) if the New Premises Rent Commencement Date is any date other than the first day of a calendar month, the date that is the last day of the calendar month in which occurs the ten (10) year anniversary of the New Premises Rent Commencement Date, unless, in either case, sooner terminated pursuant to the Lease, and in either case, on all of the same terms, covenants and conditions as are contained in the Lease. Henceforth, all references in the Lease to the “Expiration

Date” shall mean the New Expiration Date and all references in the Lease to the “Tenn” shall mean the period of time ending on the New Expiration Date. Tenant shall continue to occupy the Existing Premises in its “as-is”, “where-is” condition during the Term of the Lease as extended hereby, without any obligation on the part of Landlord to perform any work therein to prepare the Existing Premises for Tenant’s continued occupancy thereof. The foregoing, however, shall not be deemed or construed to release Landlord from any of its obligations set forth in the Lease, including its obligation to provide services and utilities under Article 7, or to repair, maintain and operate the Building in a manner consistent with comparable office buildings in midtown Manhattan (subject, in each case, to the applicable terms and provisions of the Lease).

3. New Premises; New Premises Commencement Date; Landlord’s Work; Landlord’s Additional Work; Tenant’s TI Work; Landlord’s Contribution; Failure to Give Possession.

3.1 Definitions.

(a) “Landlord’s Additional Work” means the work set forth on Exhibit B-2, which work shall be performed by Landlord in a good and workmanlike manner at Landlord’s cost using Building standard materials.

(b) “Landlord’s Work” shall mean the work required to prepare the New Premises for Tenant’s initial occupancy in accordance with Exhibit B-1, which work shall be, or has been, performed by Landlord at Landlord’s cost in a good and workmanlike manner using Building standard materials.

(c) “New Premises Commencement Date” shall mean the date on which Landlord shall deliver possession of the New Premises to Tenant (i) free of all tenancies (other than that of Tenant), licenses and rights of occupants, and (ii) with Landlord’s Work (but not Landlord’s Additional Work) Substantially Completed.

3.2 Condition of New Premises. Tenant has inspected the New Premises and agrees: (i) that by taking possession of any part of the New Premises hereunder, Tenant shall be deemed to have accepted the New Premises as being in good order, condition and repair, and otherwise in its then existing “as is” and “where is” condition as of the New Premises Commencement Date, subject to Substantial Completion of Landlord’s Additional Work and completion of the Punch List Items and other than latent defects in Landlord’s Work of which Tenant notifies Landlord promptly following discovery thereof, but in no event later than one (1) year following the New Premises Commencement Date, and (ii) except for the performance of Landlord’s Work and Landlord’s Additional Work, Landlord has no obligation to perform any work, supply any materials, incur any expense or make any alterations or improvements to the New Premises to prepare the New Premises for Tenant’s occupancy. The foregoing, however, shall not be deemed or construed to release Landlord from any of its obligations set forth in the Lease, including its obligation to provide services and utilities under Article 7 of the Lease, or to repair, maintain and operate the Building in a manner consistent with comparable office buildings in midtown Manhattan (subject, in each case, to the applicable terms and provisions of the Lease). Tenant acknowledges that, except as may otherwise be expressly provided in this Amendment, neither

Landlord, nor any employee, agent nor contractor of Landlord has made any representation or warranty concerning the Land, Building, Common Areas or New Premises, or the adequacy of Landlord’s Work or Landlord’s Additional Work for the conduct of Tenant’s business in the New Premises. Landlord reserves, for Landlord’s use, any of the following (other than those installed by or for Tenant’s exclusive use) that may be located in the New Premises: janitor closets, stairways and stairwells; fans, mechanical, electrical, telephone and similar rooms; and elevator, pipe and other vertical shafts, flues and ducts.

3.3 Landlord’s Work; Landlord’s Additional Work.

(a) To the extent not already performed as of the date of this Amendment, Landlord agrees to perform Landlord’s Work, at Landlord’s sole cost and expense, prior to the New Premises Commencement Date. Landlord shall use commercially reasonable efforts to prosecute Landlord’s Work to completion, without being required to employ overtime or other premium pay labor. Landlord shall endeavor to Substantially Complete Landlord’s Work by April 15, 2017 (the “Target Date”). In the event that Landlord’s Work is not Substantially Complete by May 15, 2017, then Tenant shall be entitled to an abatement of Base Rent for the New Premises (to be applied from and after the New Premises Rent Commencement Date) of one (1) day for each day from May 15, 2017 until Landlord’s Work is substantially completed. All time periods and deadlines set forth in this Section 3.3(a) are subject to extension on a day-for-day basis in the event that the substantial completion of Landlord’s Work is delayed as a result of Force Majeure and/or Tenant Delay.

(b) Following the New Premises Commencement Date, Landlord agrees to perform Landlord’s Additional Work and any Punch List Items, at Landlord’s sole cost and expense. Landlord shall use commercially reasonable efforts to Substantially Complete Landlord’s Additional Work prior to Tenant’s completion of the TI Work (as hereinafter defined), without being required to employ overtime or other premium pay labor. Landlord agrees to diligently perform all Punch List Items and to complete same within thirty (30) days after Substantial Completion of each of Landlord’s Work and Landlord’s Additional Work, as applicable. Landlord shall use commercially reasonable efforts to minimize any disruption to Tenant’s performance of the TI Work and/or its business activities as Landlord completes Landlord’s Additional Work and the Punch List Items.

(c) Landlord and its employees, contractors and agents shall be granted access to the New Premises at all reasonable times in order to perform Landlord’s Additional Work and Punch List Items, and for the storage of materials therein reasonably required in connection therewith. Tenant, its employees, contractors and agents shall use commercially reasonable efforts to minimize interference with the performance of Landlord’s Additional Work. Landlord, its employees, contractors and agents shall use commercially reasonable efforts to minimize interference with the performance of the TI Work; and work schedules shall be coordinated accordingly. There shall be no Rent abatement or allowance to Tenant for a diminution of rental value, no actual or constructive eviction of Tenant, in whole or in part, no relief from any of Tenant’s other obligations under the Lease, and no liability on the part of Landlord, by reason of inconvenience, annoyance or injury to business arising from the performance of Landlord’s

Additional Work, Punch List Items and/or the storage of any materials in connection therewith except to the extent expressly provided herein.

3.4 TI Work.

(a) Tenant intends to undertake renovations in the New Premises to prepare the same for Tenant’s occupancy (the “TI Work”). Subject to Landlord’s review and approval of Tenant’s Plans for the TI Work in accordance with the Lease and as set forth herein, Landlord agrees that Tenant shall have the right to perform the TI Work. As soon as is reasonably practical after the date of this Amendment, Tenant shall deliver to Landlord, for Landlord’s approval, construction drawings for the TI Work.

(b) Tenant shall perform the TI Work at Tenant’s own cost and expense, in compliance with Landlord’s Rules and Regulations for Alterations, all applicable Laws and provisions of the Lease (including without limitation Article 10 thereof), and in accordance with Tenant’s Plans as approved by Landlord in accordance with Section 5.2 of the Lease governing the performance of the Initial Improvements, which shall apply to Tenant’s performance of the TI Work, mutatis mutandis. Notwithstanding the foregoing sentence, provided no monetary or material non-monetary Event of Default shall be continuing at the time of any disbursement, Landlord shall contribute up to $1,409,895.00 (the “TI Allowance”) to the cost of the TI Work (up to fifteen percent (15%) of which may be used for Tenant’s costs for architectural, engineering, permits and filing fees directly related to the TI Work), which Landlord shall pay to Tenant in accordance with Section 5.3 of the Lease governing the distribution of Landlord’s Contribution, which shall apply to the TI Allowance, mutatis mutandis. If Tenant does not submit payment requests totaling the entire amount of the TI Allowance within twelve (12) months after the New Premises Commencement Date, any unused amount shall accrue to the sole benefit of Landlord, and Tenant shall not be entitled to any credit towards Rent, abatement, offset or other concession in connection therewith.

3.5 Completion Date. Tenant hereby waives any right to rescind the Lease or this Amendment under Section 223-a of the New York Real Property Law or any successor statute of similar import then in force and further waives the right to recover any damages which may result from Landlord’s failure to deliver possession of the New Premises on the date set forth herein and/or any other date for the commencement of the Term of the Lease as amended hereby with respect thereto. If Landlord shall be unable to give possession of the New Premises on any particular date, and provided that Tenant is not responsible for such inability to give possession, the Rent reserved and covenanted to be paid herein with respect to the New Premises shall not, with respect to the New Premises only, commence until the New Premises Rent Commencement Date, and no such failure to give possession on any particular date shall in any wise affect the validity of this Amendment or the obligations of Tenant hereunder or give rise to any claim for damages by Tenant or claim for rescission of the Lease and/or this Amendment, nor shall same be construed in any wise to extend the Term, except as otherwise expressly provided herein. Tenant shall not enter into possession of the New Premises prior to the New Premises Commencement Date without Landlord’s permission, which may be granted or withheld in Landlord’s sole discretion.

4. Existing Premises. Until the New Premises Commencement Date, Tenant shall

continue to lease the Existing Premises on all of the terms, covenants and conditions of the Lease. Subsequent to the New Premises Commencement Date, Tenant shall continue to pay Base Rent, Additional Rent and other charges for the Existing Premises at the rates set forth in the Lease.

5. Basic Lease Definitions. As of the New Premises Commencement Date, the following additional definitions and terms shall be amended or added, as applicable, in Section 1.1 of the Lease:

(e) “Area of the Premises” means, for the purposes of this Lease, (1) until the New Premises Commencement Date, approximately 25,261 RSF, and (2) after the New Premises Commencement Date, approximately 41,848 RSF, which represents the sum of 25,261 RSF in respect of the Existing Premises, plus 16,587 RSF in respect of the New Premises.

(i) “Base Rent” for the New Premises only means the Rent payable pursuant to Section 4.1, which shall be as follows:

(1) $1,194,264.00 per annum, payable at the rate of $99,522.00 per month, for the period from the New Premises Commencement Date through the date immediately preceding the fifth (5th) anniversary of the New Premises Rent Commencement Date; and

(2) $1,293,786.00 per annum, payable at the rate of $107,815.50 per month, for the period from the fifth (5th) anniversary of the New Premises Rent Commencement Date through the Expiration Date.

“Base Rent” for the Entire 35th Floor Premises only for the period from June 1, 2026 through the Expiration Date, shall be $1,995,619.00 per annum, payable at the rate of $166,301.58 per month (without any change to the Base Expense Year or Base Tax Year in respect thereof).

(k) “Tenant’s Expense Share,” for the New Premises, only means 1.4741%.

(1) “Tenant’s Tax Share,” for the New Premises only, means 1.4397%.

(m) “Base Expense Year,” for the New Premises only, means the average of the Operating Expenses payable in respect of each of the Fiscal Years ending December 31, 2017 and December 31, 2018.

(n) “Base Tax Year,” for the New Premises only, means the July 1, 2017 - June 30, 2018 tax fiscal year.

(p) “Security Deposit” means $1,265,965.40, subject to the provisions of Article 23 of the Lease.

(r) “Landlord’s General Address” means:

1411 IC-SIC Property LLC

Building Management Office

1411 Broadway

New York, New York 10018

Attention: Property Manager

with copies to:

1411 IC-SIC Property LLC

c /o Callahan Capital Properties LLC

3 Bryant Park, 24th Floor

New York, New York 10036

Attention: Michael W. McMahon, SVP — Asset Management

1411 IC-SIC Property LLC

do Callahan Capital Properties LLC

10 S. Riverside Plaza, Suite 2050

Chicago, Illinois 60606

Attention: Bansari Shah, General Counsel

and

Tarter Krinsky & Drogin LLP

1350 Broadway, 11th Floor

New York, NY 10018

Attn: Alan M. Tarter, Esq. and Arthur Zagorsky, Esq.

(u) “Broker” means CBRE, Inc., on behalf of Landlord and Tenant, respectively.”

6. Rent; Operating Expenses and Taxes. For the period commencing on the New Premises Commencement Date and ending on the New Expiration Date, Tenant shall pay Base Rent, Tenant’s Expense Share of Operating Expenses and Tenant’s Tax Share of Taxes applicable to the New Premises in accordance with the terms of the Lease.

7. Rent Abatement. Notwithstanding anything to the contrary contained in Section 6 above, provided that the Lease shall then be in full force and effect and no monetary or material non-monetary Event of Default shall be continuing, Tenant shall be entitled to an abatement of Base Rent in respect of the New Premises only in the amount of $99,522.00 per month from the New Premises Commencement Date through the date immediately preceding the one (1) year anniversary of the New Premises Commencement Date (such date, the “New Premises Rent Commencement Date,” and such period of abated Base Rent for the New Premises, the “New Premises Base Rent Abatement Period”). The amount of Base Rent abated in accordance with this Section 7 (the “New Premises Abated Base Rent”) does not include charges for electric and/or any other Additional Rent; as such, during the New Premises Base Rent Abatement Period, only Base Rent to the extent set forth above shall be abated, and the electric

charges as well as all Additional Rent and other costs and charges payable under the Lease shall remain due and payable pursuant to the terms hereof. Notwithstanding the foregoing, if Tenant cures any such Event of Default after the applicable notice and cure period set forth in Section 21.1 of the Lease and if such cure is accepted by Landlord, then Tenant shall again be entitled to the New Premises Abated Base Rent to the extent the same accrued but was not applied before such cure is effected by Tenant (i.e., was suspended) as well as any portion thereof accruing after such cure is effected by Tenant.

8. Electricity. Landlord shall furnish electricity to the New Premises and Tenant shall pay for such electricity in accordance with the terms of Article 8 of the Lease in all respects. The foregoing notwithstanding, commencing on the New Premises Commencement Date and through such time as the submeter(s) is (are) installed for the New Premises and operable, Tenant shall pay an electrical consumption charge of $1.00 per rentable square foot per annum.

9. Freight Elevator. Tenant shall be permitted to use the Building’s freight elevator for up to forty (40) overtime hours in the aggregate at such other days or times, without charge, in connection with Tenant’s construction and initial move into the New Premises, provided that such usage shall, in each case, be subject to Section 7.2(b) of the Lease concerning union rules and the rules and regulations of the Building regarding minimum blocks of overtime freight elevator use.

10. Ceiling Work Clause. Without limiting any of Landlord’s other rights in the Lease, but in accordance with the terms and conditions of the Lease, including, without limitation, those contained in Sections 10.2 and 14.4.3, Tenant acknowledges that both (I) Landlord and (II) each tenant occupying space on the floor immediately above the Premises (an “Above Neighboring Tenant”) shall have the right at any time, without the same constituting an eviction of Tenant and without incurring any liability to Tenant (except as otherwise expressly provided in the Lease), to perform work affecting the underside of the slab constituting the floor of the premises immediately above the Premises, i.e., the slab constituting the ceiling of the Premises, including without limitation (x) core drilling, (y) the running of plumbing lines, conduits and other lines along Tenant’s ceiling, and (z) installation of steel and other reinforcements to buttress installations requiring additional structural support (collectively, “Ceiling Work”). All Ceiling Work shall be performed at no cost or expense to Tenant. All conduit shall be installed close to the upper slab of the Premises and parallel or perpendicular to beams, where feasible, in order to reduce the visual or other impact of same on the Premises. Landlord and each Above Neighboring Tenant shall have the right to enter the Premises for the purpose of performing Ceiling Work, which shall be performed following reasonable notice to Tenant and shall not be performed during business hours. Landlord, such Above Neighboring Tenant and Tenant shall reasonably cooperate with each other, as applicable, in order to enable the Ceiling Work to be performed in a timely manner and, with respect to any Ceiling Work in the Premises, with as little inconvenience to the operation of Tenant’s business as is reasonably possible but without being required to pay overtime or other premium pay labor. Landlord (or the Above Neighboring Tenant) shall repair any damage to the Premises caused by the Ceiling Work, including repairing and restoring any finished ceiling disturbed by the Ceiling Work. All such Ceiling Work shall be above any finished ceiling within the Premises and shall not require any finished ceiling to be lowered. Prior to and as a condition of any entry into the Premises by an Above Neighboring Tenant, the Above Neighboring Tenant shall acknowledge and agree in writing that its entry into the Premises is subject to the applicable terms

and conditions of such tenant’s lease, which shall include terms and conditions substantially similar to those contained in Section 10.2 of the Lease relating to Renovations in the Premises and shall include an indemnification of the Tenant Indemnified Parties consistent with Section 14.4 of the Lease. The Above Neighboring Tenant shall also provide reasonable evidence to Tenant of insurance for such entry that is in compliance with the requirements of such tenant’s lease.

11. Right of First Offer. Effective as of the date hereof: (a) the “ROFO Space,” as such term is defined in Section 29.1 of the Lease, shall no longer refer to “any one (1) offer of space by Landlord of between approximately 5,000 and 10,000 rentable square feet on the 23rd through the 39th floors of the Building,” but shall, in lieu thereof, refer to the two (2) separate units of space on the twenty-fifth (25th) floor of the Building consisting of approximately 2,422 RSF and 5,330 RSF, respectively, each as more particularly shown on Exhibit C attached hereto and made a part hereof; (b) in the penultimate line of clause (a) of the definition of “Available ROFO Space” in Section 29.1 of the Lease, the word “Lease” shall be replaced with “First Amendment to Lease”; and (c) Section 29.3 of the Lease shall be deleted in its entirety and replaced with the following: “Notwithstanding anything to the contrary contained in this Lease, Landlord shall have no obligation to deliver a First Offer Notice to Tenant, and Tenant shall have no right to lease the ROFO Space, if the Term of this Lease with respect to the ROFO Space would be a period of less than five (5) years from the date on which the payment of Base Rent for the ROFO Space would commence (taking into account any applicable “free rent” period).” Further, the clause “from and after the Date of this Lease and through and including the day immediately preceding the seventh (7th) anniversary of the Rent Commencement Date” contained in the first sentence of Section 29.1 of the Lease shall be deleted and replaced with “subject to Section 29.3 hereof’.

12. Option to Extend. Tenant’s option to extend the Term of the Lease contained in Article 28 of the Lease is hereby ratified and confirmed, except that, effective as of the date hereof, the Extension Term shall be the five (5) year period commencing on the date immediately following the New Expiration Date, and the “Exercise Date” shall be the date that is fifteen (15) months prior to the New Expiration Date. For the avoidance of doubt, Tenant’s option to extend the Term shall apply to the entire Premises only (and not as to a portion).

13. Security Deposit.

13.1 Landlord acknowledges that it is currently holding a Letter of Credit in the amount of $922,026.50 (the “Existing LC”). Simultaneously herewith, Tenant shall deliver an amendment to the Existing LC effectively increasing the Security Deposit to $1,265,965.40 (the “Amended LC”) to Landlord.

13.2 Effective as of the date of this Amendment, Section 23.1.3 of the Lease shall be amended and restated in its entirety as follows:

On the fifth (5th) anniversary of the Rent Commencement Date, and upon the condition that (i) an Event of Default shall not then exist and be continuing, (ii) no Event of Default shall have occurred during the Term, (iii) Tenant shall never have been late in the payment of any Base Rent or Additional Rent beyond the applicable notice and grace period provided herein, if any, and (iv) Tenant shall then have a market capitalization, as reported by

NASDAQ and as certified by Tenant’s chief financial officer, equal to or in excess of $250,000,000.00, then the Security Deposit shall be reduced to $1,063,294.32. In such event, Tenant shall provide a replacement Letter of Credit complying with this Section in the amount of $1,063,294.32 to Landlord (in which case Landlord shall, simultaneously with Tenant’s delivery of such replacement Letter of Credit, return the original Letter of Credit to Tenant) or deliver an amendment to the Letter of Credit, pursuant to which the amount of the Letter of Credit shall be reduced to $1,063,294.32 and Landlord agrees that Landlord shall execute any such amendment and any other documentation reasonably required in connection therewith by the Issuing Bank, all at no cost, expense or additional liability to Landlord. In the instance of such reduction, Landlord agrees to reasonably comply with requests from Tenant or the Issuing Bank in obtaining a replacement Letter of Credit, at no cost or expense to Landlord, which replacement Letter of credit shall comply with this Article 23. If, at any time after the Security Deposit shall be reduced as provided above, (x) an Event of Default shall occur or (y) Tenant’s market capitalization, determined as provided above, shall fall below $250,000,000, then, subject to the following cure right in the case of clause (y) only, Landlord shall have the right to demand that the Security Deposit be immediately restored to its original full amount subsequent as of the First Amendment to Lease (i.e., $1,265,965.40) for the balance of the Term as if such reduction shall have never occurred, and Tenant shall so comply; provided, however, that, in the event Landlord shall have demanded that the Security Deposit be restored to its original full amount as a result of Tenant’s non-compliance with clause (y) only (and not as a result of Tenant’s non-compliance with clause (x)), then Tenant shall have the right to again seek a reduction of the Letter of Credit (as so restored) to $1,063,294.32 on the condition that Tenant’s market capitalization, determined as provided above, shall equal or exceed $250,000,000 and remain at or above such level for at least ninety (90) consecutive days, subject, nevertheless, to Landlord’s continuing right to demand restoration of the Security Deposit to its original full amount in accordance with the immediately preceding sentence.

14. Notices. The Lease is amended to provide that all notices to Landlord under the Lease shall be sent to Landlord at its address set forth above, Attn: Building Management, with copies to (i) 1411 IC-SIC Property LLC, 3 Bryant Park, 24th Floor, New York, New York 10036, Attn: Michael W. McMahon, SVP — Asset Management, (ii) Callahan Capital Partners, LLC, 10 S. Riverside Plaza, Suite 2050, Chicago, IL 60606, Attn: Bansari Shah, General Counsel, and (iii) Tarter Krinsky & Drogin LLP, 1350 Broadway, 11th Floor, New York, NY 10018, Attn: Alan M. Tarter, Esq. and Arthur Zagorsky, Esq.

15. Brokers. Landlord and Tenant represent that no broker or agent other than Savills Studley as Tenant’s agent, and CBRE, Inc., as Landlord’s agent (collectively, “Broker”) participated with Landlord and Tenant in or was a procuring cause of this transaction. Landlord and Tenant acknowledge that the payment for brokerage fees due and payable as a result of Landlord and Tenant executing this Amendment shall be the sole cost and responsibility of the Landlord pursuant to Landlord’s separate agreement(s) with the Broker. Landlord and Tenant agree to indemnify and hold each other harmless from and against any claim, loss and/or demand of any other broker or agent who claims that he, she or it participated with Landlord and/or Tenant, as applicable, in this transaction.

16. Counterparts. This Amendment may be executed in two (2) or more counterparts, each of which shall be deemed an original, but all of which counterparts together shall be deemed to be one and the same instrument. In any action or proceeding, any photographic, photostatic, or other copy of this Amendment may be introduced into evidence without foundation. This Amendment shall not be binding in any respect upon Landlord or Tenant until duplicate counterparts hereof are executed and exchanged by Landlord and Tenant. Executed copies of this Amendment may be delivered by electronic mail (e-mail), which shall be deemed effective to constitute delivery.

17. Affirmation; Ratification of Lease; Inconsistencies. Except as expressly amended hereby, the Lease and all covenants, agreements, terms and conditions thereof shall continue in full force and effect, and Landlord and Tenant hereby affirm and ratify all terms and conditions of the Lease. The provisions set forth herein will be deemed to be part of the Lease and shall supersede any contrary provisions in the Lease.

18. Entire Agreement. This Amendment embodies the entire understanding between Landlord and Tenant with respect to the modifications set forth herein. This Amendment may not be changed orally, but only by a writing signed by the party against whom enforcement thereof is sought.

19. Successors and Assigns. The covenants, agreements, terms and conditions contained in this Modification shall bind and inure to the benefit of the parties hereto and their respective successors and, except as otherwise provided in the Lease, their respective assigns.

[Signatures appear on the following page]

IN WITNESS WHEREOF, the parties hereto have caused this First Amendment to Lease to be executed as of the day and year first above written.

|

|

LANDLORD: | ||

|

|

| ||

|

|

1411 IC-SIC PROPERTY LLC, | ||

|

|

a Delaware limited liability company | ||

|

|

|

| |

|

|

By: |

1411 IC-SIC Holdings LLC, | |

|

|

|

its sole member | |

|

|

|

| |

|

|

By: |

IC 1411 Broadway Manager LLC, its managing member | |

|

|

|

| |

|

|

By: |

Callahan Capital Properties LLC, its non-member manager | |

|

|

|

| |

|

|

By: |

/s/ Michael W. McMahon | |

|

|

|

Name: Michael W. McMahon | |

|

|

|

Title: SVP — Asset Management | |

|

|

|

| |

|

|

|

| |

|

|

TENANT: | ||

|

|

| ||

|

|

CRA INTERNATIONAL, INC., | ||

|

|

a Massachusetts corporation | ||

|

|

|

| |

|

|

By: |

/s/ Chad M. Holmes | |

|

|

|

Name: Chad M. Holmes | |

|

|

|

Title: CFO | |

Exhibit B-1

Landlord’s Work

· The Premises will be delivered demolished and in broom clean condition;

· Landlord will provide Class-E availability of connection points for Tenant’s strobes and related Class-E connections. (Landlord, at Tenant’s expense, shall provide all points, tie-ins and software reprogramming; and Tenant will determine its requirements relative to the existing Class-E system.) All fire and safety systems, including alarms, speakers and communications will be in full service and available in the Premises;

· The HVAC system shall be delivered in good working order;

· Floors will be delivered reasonably smooth to accept Tenant’s flooring;

· Landlord will bring all Building Systems to the Premises for Tenant’s tie-in and such systems will be fully operational; and

· Provide code compliant demising walls for the New Premises,

Exhibit B-2

Landlord’s Additional Work

· Install submeter(s);

· Deliver and install induction unit covers throughout the New Premises; and

· Upgrade the common corridor and core bathrooms on the twenty-fifth (25th) floor of the Building in accordance with the Building standard (it being agreed that Landlord will allow Tenant to provide input into the finishes utilized for the Common Corridor (so long as they are consistent with the Building standard)).