Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CENTURY CASINOS INC /CO/ | c147-20170504xex99_1.htm |

| 8-K - 8-K - CENTURY CASINOS INC /CO/ | c147-20170504x8k.htm |

CENTURY CASINOSFinancial ResultsQ1 2017

CENTURY CASINOSFinancial ResultsQ1 2017

Forward-Looking Statements,Business Environment and Risk FactorsThis presentation may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Private Securities Litigation Reform Act of 1995. In addition, Century Casinos, Inc. (together with its subsidiaries, the “Company”) may make other written and oral communications from time to time that contain such statements. Forward-looking statements include statements as to industry trends and future expectations of the Company and other matters that do not relate strictly to historical facts and are based on certain assumptions by management at the time such statements are made. Forward-looking statements in this presentation include statements regarding future results of operations, operating efficiencies, synergies and operational performance, the prospects for and timing and costs of new projects, projects in development and other opportunities, including the Century Mile project, debt repayment, investments in joint ventures, outcomes of legal proceedings and plans for our casinos and our Company. These statements are often identified by the use of words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intend,” “could,” “estimate,” or “continue,” and similar expressions or variations. These statements are based on the beliefs and assumptions of the management of the Company based on information currently available to management. Such forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Important factors that could cause actual results to differ materially from the forward-looking statements include, among others, the risks described in the section entitled “Risk Factors” under Item 1A in our Annual Report on Form 10-K for the year ended December 31, 2016. We caution the reader to carefully consider such factors. Furthermore, such forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements.In this presentation the term “USD” refers to US dollars, the term “CAD” refers to Canadian dollars and the term “PLN” refers to Polish zloty. Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin.The 2016 financial statements reflect adjustments to net operating revenue, earnings from operations, net earnings attributable to Century Casinos, Inc. shareholders and Adjusted EBITDA to correct an erroneously recognized reduction in pari-mutuel revenue totaling $0.7 million (CAD 0.9 million) in the first quarter of 2016.Amounts presented are rounded. As such, rounding differences could occur in period over period changes and percentages reported throughout this presentation.

Forward-Looking Statements,Business Environment and Risk FactorsThis presentation may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Private Securities Litigation Reform Act of 1995. In addition, Century Casinos, Inc. (together with its subsidiaries, the “Company”) may make other written and oral communications from time to time that contain such statements. Forward-looking statements include statements as to industry trends and future expectations of the Company and other matters that do not relate strictly to historical facts and are based on certain assumptions by management at the time such statements are made. Forward-looking statements in this presentation include statements regarding future results of operations, operating efficiencies, synergies and operational performance, the prospects for and timing and costs of new projects, projects in development and other opportunities, including the Century Mile project, debt repayment, investments in joint ventures, outcomes of legal proceedings and plans for our casinos and our Company. These statements are often identified by the use of words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intend,” “could,” “estimate,” or “continue,” and similar expressions or variations. These statements are based on the beliefs and assumptions of the management of the Company based on information currently available to management. Such forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Important factors that could cause actual results to differ materially from the forward-looking statements include, among others, the risks described in the section entitled “Risk Factors” under Item 1A in our Annual Report on Form 10-K for the year ended December 31, 2016. We caution the reader to carefully consider such factors. Furthermore, such forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements.In this presentation the term “USD” refers to US dollars, the term “CAD” refers to Canadian dollars and the term “PLN” refers to Polish zloty. Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin.The 2016 financial statements reflect adjustments to net operating revenue, earnings from operations, net earnings attributable to Century Casinos, Inc. shareholders and Adjusted EBITDA to correct an erroneously recognized reduction in pari-mutuel revenue totaling $0.7 million (CAD 0.9 million) in the first quarter of 2016.Amounts presented are rounded. As such, rounding differences could occur in period over period changes and percentages reported throughout this presentation.

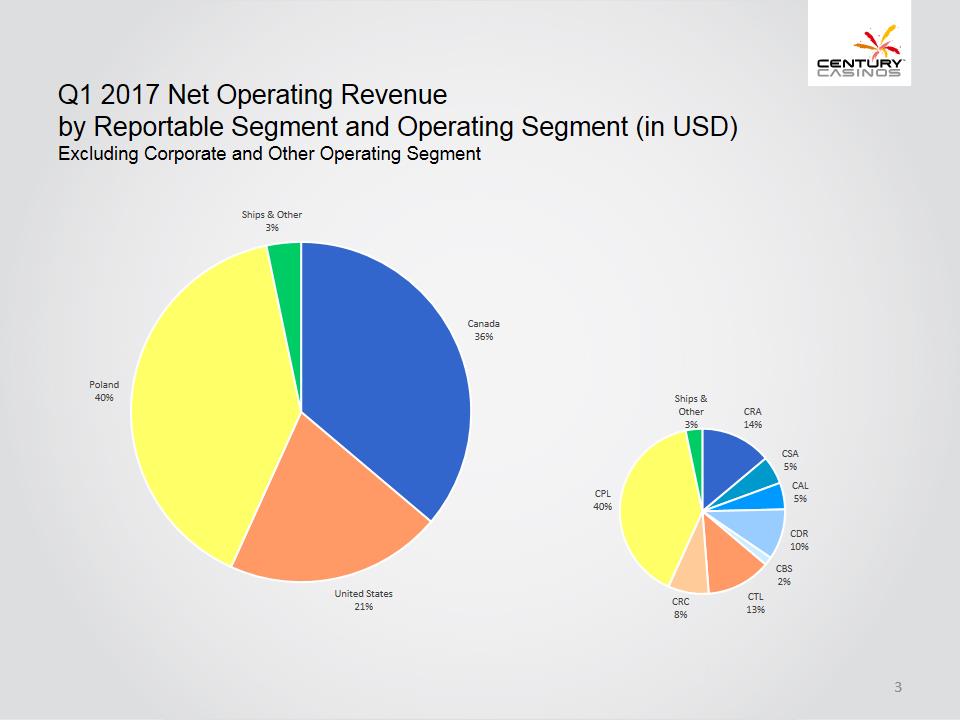

Q1 2017 Net Operating Revenue by Reportable Segment and Operating Segment (in USD)Excluding Corporate and Other Operating SegmentCanada36%United States21%Poland40%Ships & Other3%CRA14%CSA5%CAL5%CDR10%CBS2%CTL13%CRC8%CPL40%Ships & Other3%

Q1 2017 Net Operating Revenue by Reportable Segment and Operating Segment (in USD)Excluding Corporate and Other Operating SegmentCanada36%United States21%Poland40%Ships & Other3%CRA14%CSA5%CAL5%CDR10%CBS2%CTL13%CRC8%CPL40%Ships & Other3%

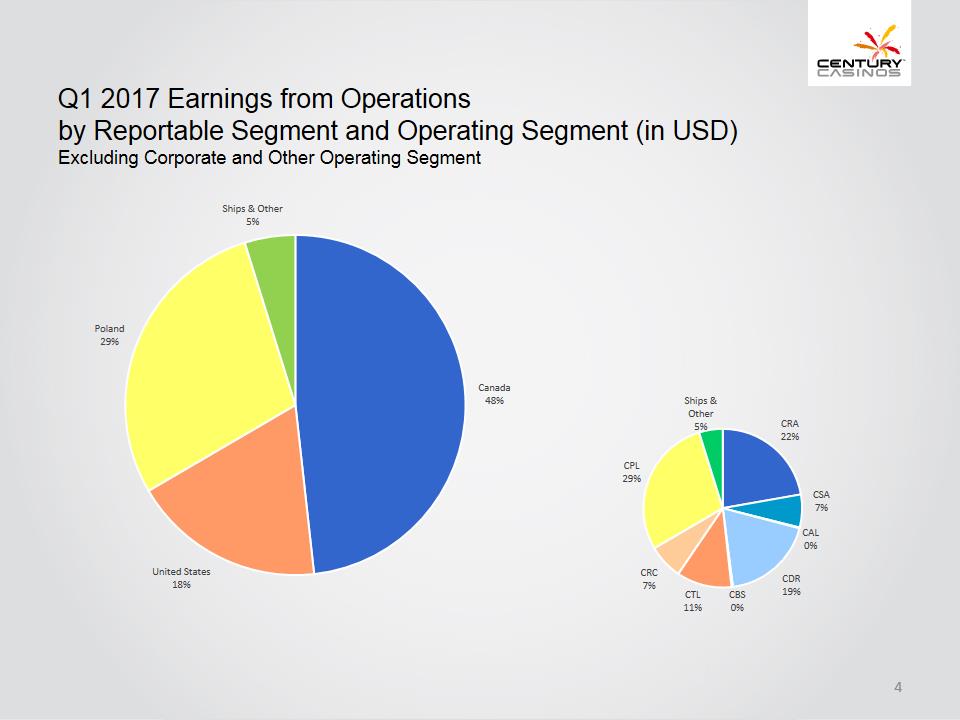

Q1 2017 Earnings from Operationsby Reportable Segment and Operating Segment (in USD)ExcludingCorporate and Other Operating SegmentCanada48%United States18%Poland29%Ships & Other5%CRA22%CSA7%CAL0%CDR19%CBS0%CTL11%CRC7%CPL29%Ships & Other5%

Q1 2017 Earnings from Operationsby Reportable Segment and Operating Segment (in USD)ExcludingCorporate and Other Operating SegmentCanada48%United States18%Poland29%Ships & Other5%CRA22%CSA7%CAL0%CDR19%CBS0%CTL11%CRC7%CPL29%Ships & Other5%

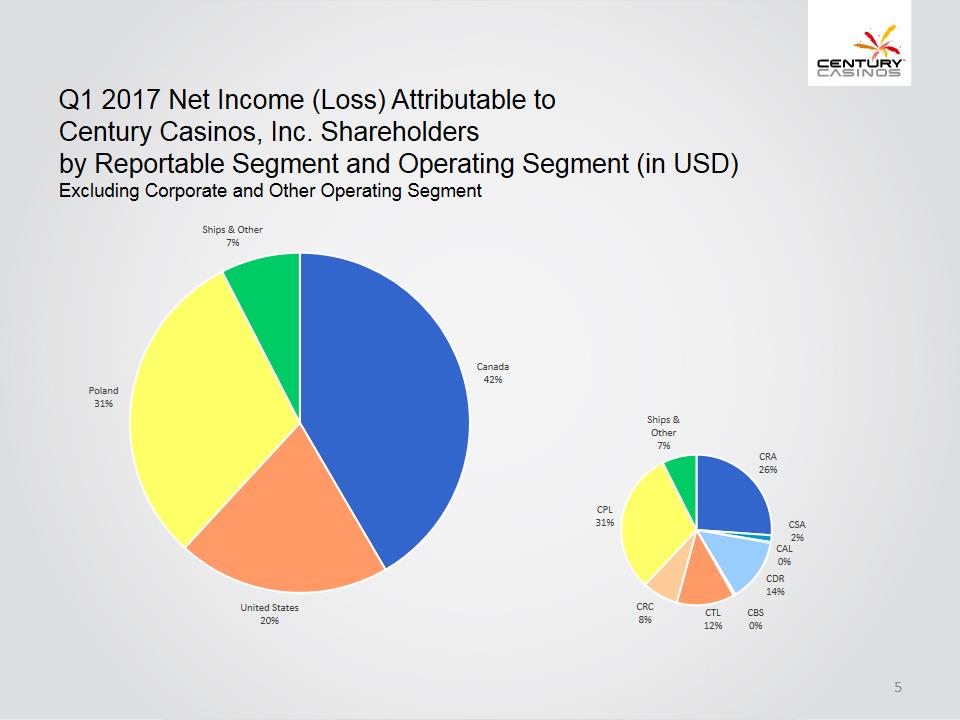

Q1 2017 Net Income (Loss) Attributable to Century Casinos, Inc. Shareholdersby ReportableSegment and Operating Segment (in USD)ExcludingCorporate and Other Operating SegmentCanada42%United States20%Poland31%Ships & Other7%CRA26%CSA2%CAL0%CDR14%CBS0%CTL12%CRC8%CPL31%Ships & Other7%

Q1 2017 Net Income (Loss) Attributable to Century Casinos, Inc. Shareholdersby ReportableSegment and Operating Segment (in USD)ExcludingCorporate and Other Operating SegmentCanada42%United States20%Poland31%Ships & Other7%CRA26%CSA2%CAL0%CDR14%CBS0%CTL12%CRC8%CPL31%Ships & Other7%

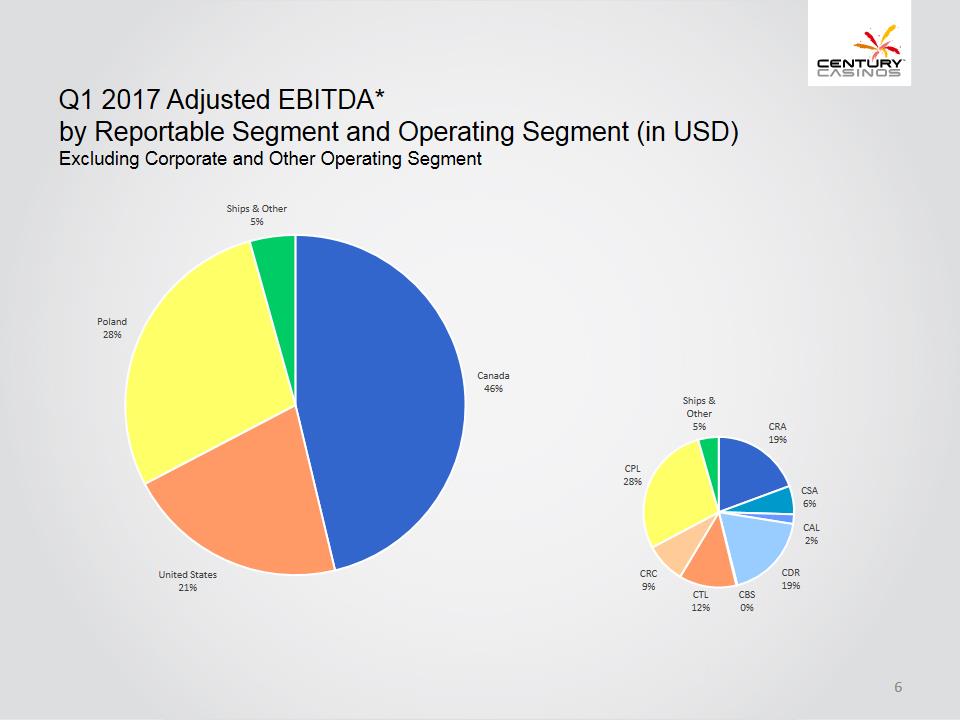

Q1 2017 Adjusted EBITDA*by Reportable Segment and Operating Segment (in USD)ExcludingCorporate and Other Operating SegmentCanada46%United States21%Poland28%Ships & Other5%CRA19%CSA6%CAL2%CDR19%CBS0%CTL12%CRC9%CPL28%Ships & Other5%

Q1 2017 Adjusted EBITDA*by Reportable Segment and Operating Segment (in USD)ExcludingCorporate and Other Operating SegmentCanada46%United States21%Poland28%Ships & Other5%CRA19%CSA6%CAL2%CDR19%CBS0%CTL12%CRC9%CPL28%Ships & Other5%

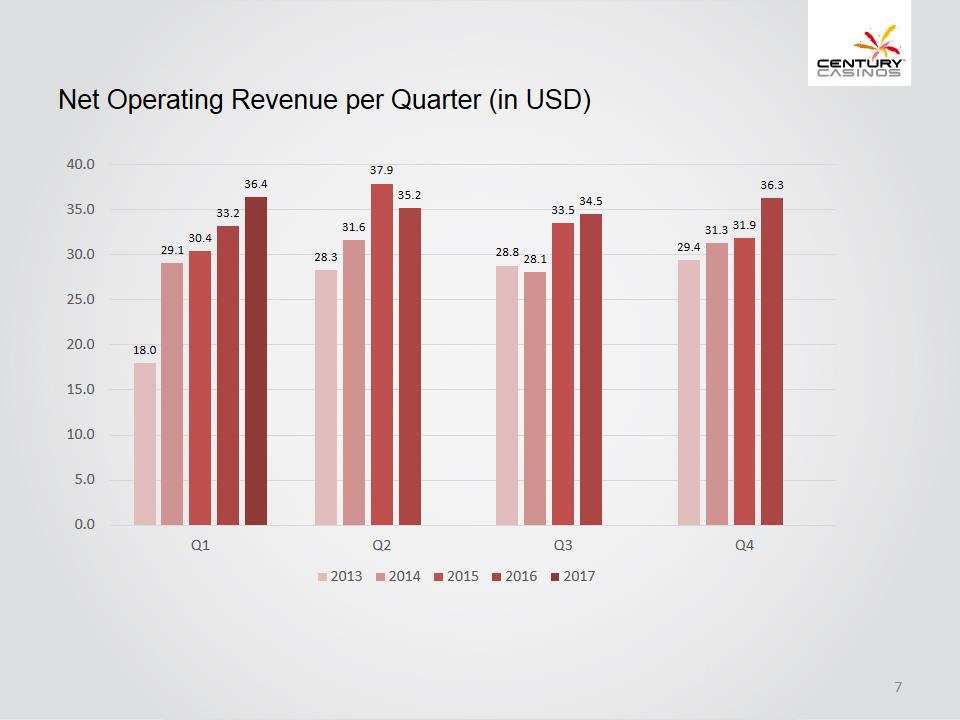

Net Operating Revenue per Quarter(in USD)18.028.328.829.429.131.628.131.330.437.933.531.933.235.234.536.336.40.05.010.015.020.025.030.035.040.0Q1Q2Q3Q420132014201520162017

Net Operating Revenue per Quarter(in USD)18.028.328.829.429.131.628.131.330.437.933.531.933.235.234.536.336.40.05.010.015.020.025.030.035.040.0Q1Q2Q3Q420132014201520162017

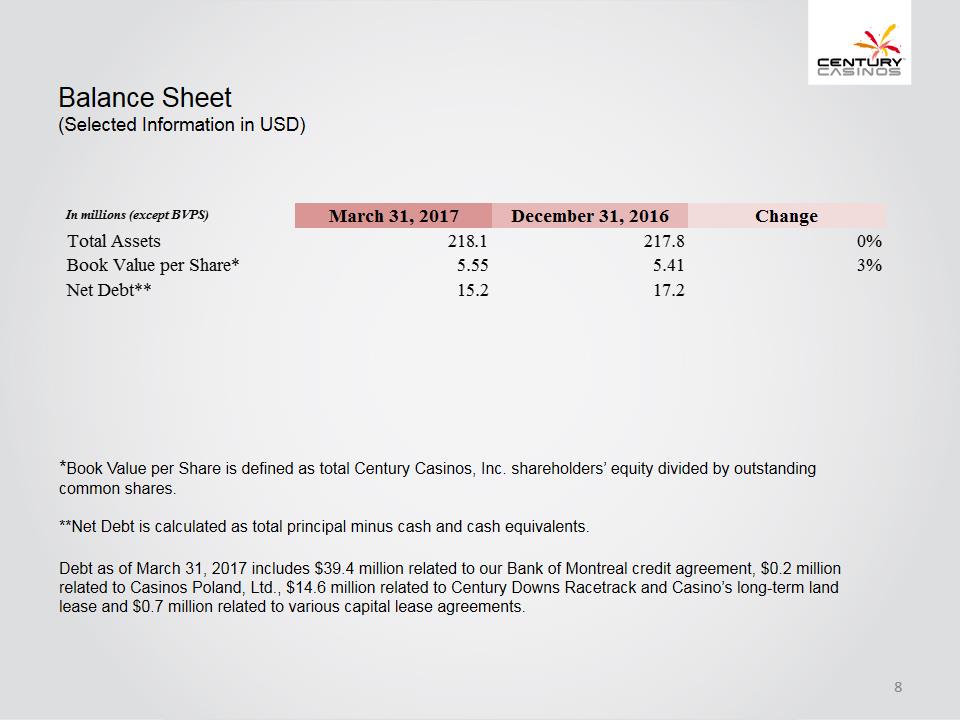

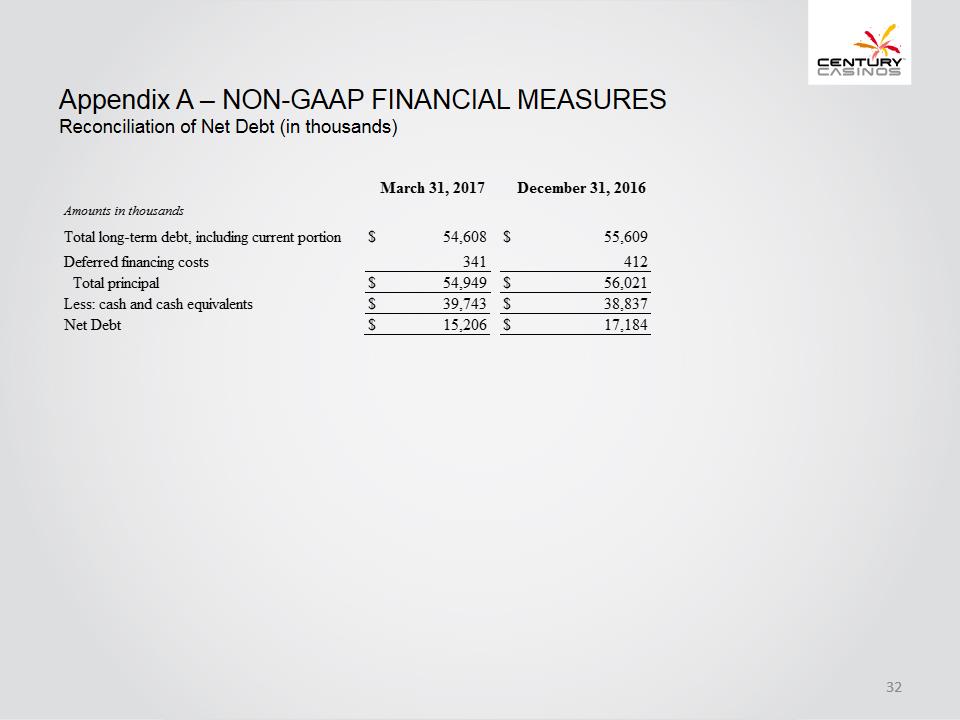

Balance Sheet (Selected Information in USD)*Book Value per Share is defined as total Century Casinos, Inc. shareholders’ equity divided by outstanding common shares.**Net Debt is calculated as total principal minus cash and cash equivalents. Debt as of March 31, 2017 includes $39.4 million related to our Bank of Montreal credit agreement, $0.2 million related to Casinos Poland, Ltd., $14.6 million related to Century Downs Racetrack and Casino’s long-term land lease and $0.7 million related to various capital lease agreements.In millions (except BVPS) March 31, 2017 December 31, 2016 ChangeTotal Assets 218.1 217.8 0%Book Value per Share*5.55 5.41 3%Net Debt**15.2 17.2

Balance Sheet (Selected Information in USD)*Book Value per Share is defined as total Century Casinos, Inc. shareholders’ equity divided by outstanding common shares.**Net Debt is calculated as total principal minus cash and cash equivalents. Debt as of March 31, 2017 includes $39.4 million related to our Bank of Montreal credit agreement, $0.2 million related to Casinos Poland, Ltd., $14.6 million related to Century Downs Racetrack and Casino’s long-term land lease and $0.7 million related to various capital lease agreements.In millions (except BVPS) March 31, 2017 December 31, 2016 ChangeTotal Assets 218.1 217.8 0%Book Value per Share*5.55 5.41 3%Net Debt**15.2 17.2

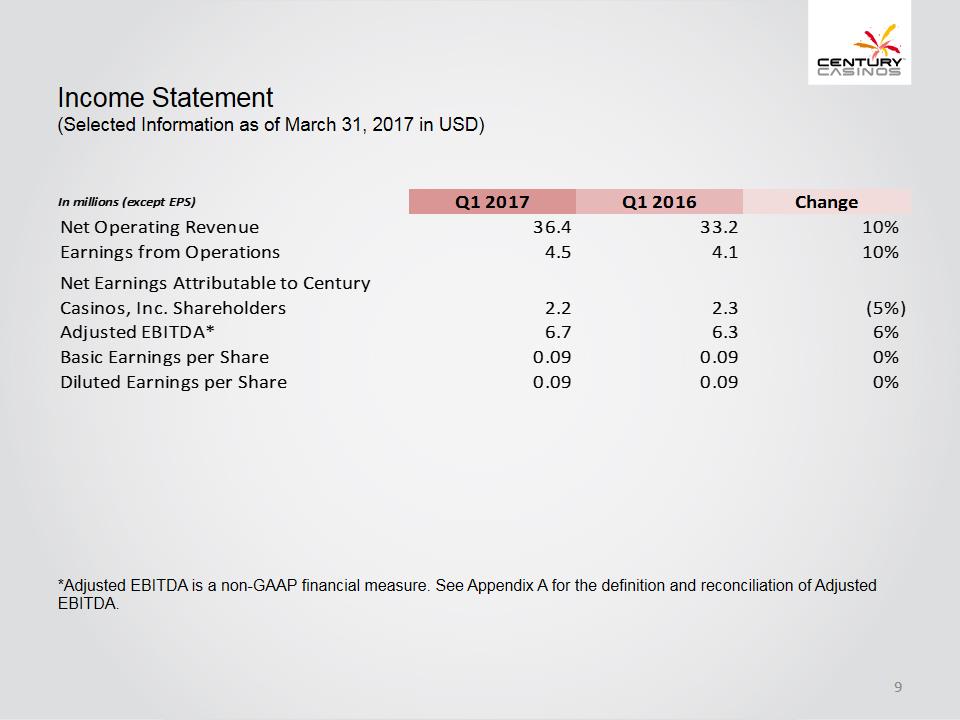

Income Statement (Selected Information as of March 31, 2017 in USD)*Adjusted EBITDA is a non-GAAP financial measure. See Appendix A for the definition and reconciliation of Adjusted EBITDA.In millions (except EPS) Q1 2017 Q1 2016 Change Net Operating Revenue 36.4 33.2 10%Earnings from Operations 4.5 4.1 10%Net Earnings Attributable to Century Casinos, Inc. Shareholders 2.2 2.3 (5%)Adjusted EBITDA* 6.7 6.3 6%Basic Earnings per Share 0.09 0.09 0%Diluted Earnings per Share 0.09 0.09 0%

Income Statement (Selected Information as of March 31, 2017 in USD)*Adjusted EBITDA is a non-GAAP financial measure. See Appendix A for the definition and reconciliation of Adjusted EBITDA.In millions (except EPS) Q1 2017 Q1 2016 Change Net Operating Revenue 36.4 33.2 10%Earnings from Operations 4.5 4.1 10%Net Earnings Attributable to Century Casinos, Inc. Shareholders 2.2 2.3 (5%)Adjusted EBITDA* 6.7 6.3 6%Basic Earnings per Share 0.09 0.09 0%Diluted Earnings per Share 0.09 0.09 0%

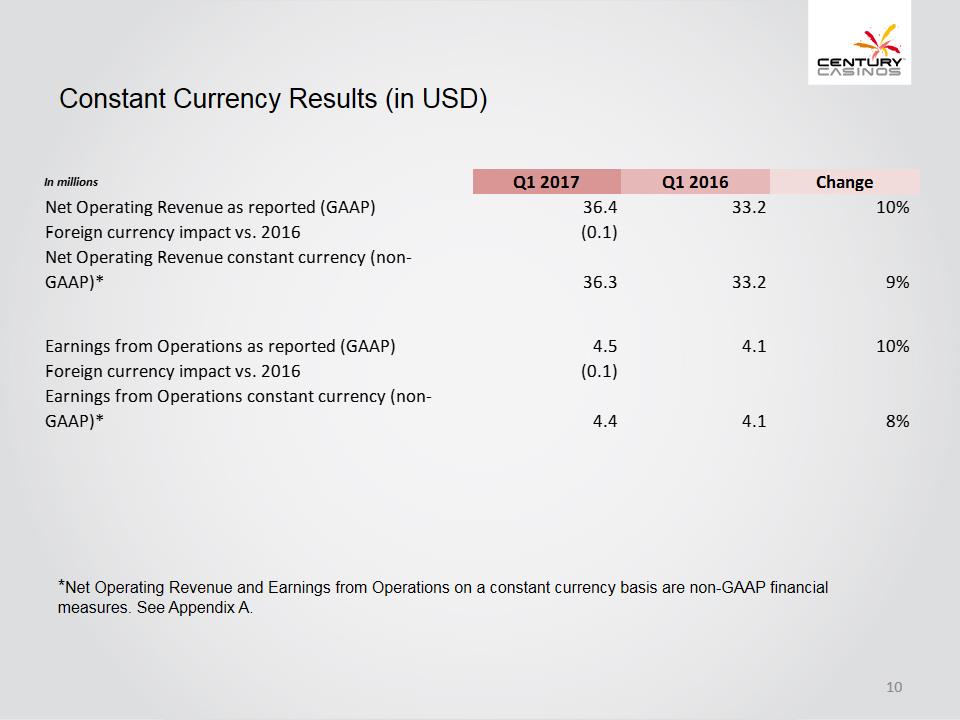

Constant Currency Results (in USD)*Net Operating Revenue and Earnings from Operations on a constant currency basis are non-GAAP financial measures. See Appendix A.In millions Q1 2017 Q1 2016 Change Net Operating Revenue as reported (GAAP) 36.4 33.2 10%Foreign currency impact vs. 2016 (0.1)Net Operating Revenue constant currency (non-GAAP)* 36.3 33.2 9%Earnings from Operations as reported (GAAP) 4.5 4.1 10%Foreign currency impact vs. 2016 (0.1)Earnings from Operations constant currency (non-GAAP)* 4.4 4.1 8%

Constant Currency Results (in USD)*Net Operating Revenue and Earnings from Operations on a constant currency basis are non-GAAP financial measures. See Appendix A.In millions Q1 2017 Q1 2016 Change Net Operating Revenue as reported (GAAP) 36.4 33.2 10%Foreign currency impact vs. 2016 (0.1)Net Operating Revenue constant currency (non-GAAP)* 36.3 33.2 9%Earnings from Operations as reported (GAAP) 4.5 4.1 10%Foreign currency impact vs. 2016 (0.1)Earnings from Operations constant currency (non-GAAP)* 4.4 4.1 8%

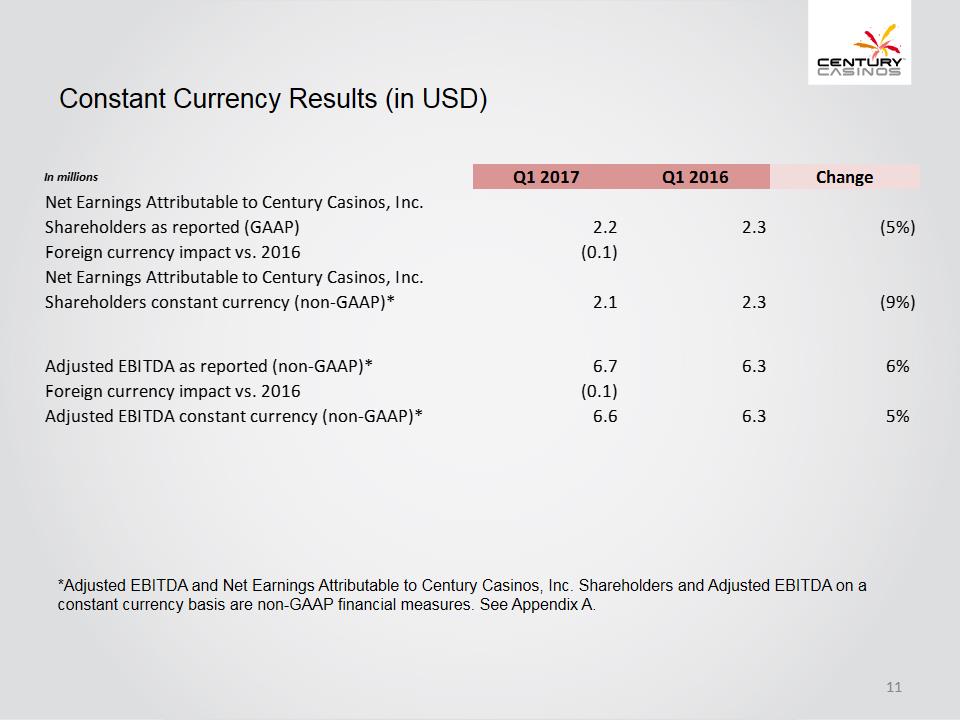

Constant Currency Results (in USD)*Adjusted EBITDA and Net Earnings Attributable to Century Casinos, Inc. Shareholders and Adjusted EBITDA on a constant currency basis are non-GAAP financial measures. See Appendix A.In millions Q1 2017 Q1 2016 Change Net Earnings Attributable to Century Casinos, Inc. Shareholders as reported (GAAP) 2.2 2.3 (5%)Foreign currency impact vs. 2016 (0.1)Net Earnings Attributable to Century Casinos, Inc. Shareholders constant currency (non-GAAP)* 2.1 2.3 (9%)Adjusted EBITDA as reported (non-GAAP)* 6.7 6.3 6%Foreign currency impact vs. 2016 (0.1)Adjusted EBITDA constant currency (non-GAAP)* 6.6 6.3 5%

Constant Currency Results (in USD)*Adjusted EBITDA and Net Earnings Attributable to Century Casinos, Inc. Shareholders and Adjusted EBITDA on a constant currency basis are non-GAAP financial measures. See Appendix A.In millions Q1 2017 Q1 2016 Change Net Earnings Attributable to Century Casinos, Inc. Shareholders as reported (GAAP) 2.2 2.3 (5%)Foreign currency impact vs. 2016 (0.1)Net Earnings Attributable to Century Casinos, Inc. Shareholders constant currency (non-GAAP)* 2.1 2.3 (9%)Adjusted EBITDA as reported (non-GAAP)* 6.7 6.3 6%Foreign currency impact vs. 2016 (0.1)Adjusted EBITDA constant currency (non-GAAP)* 6.6 6.3 5%

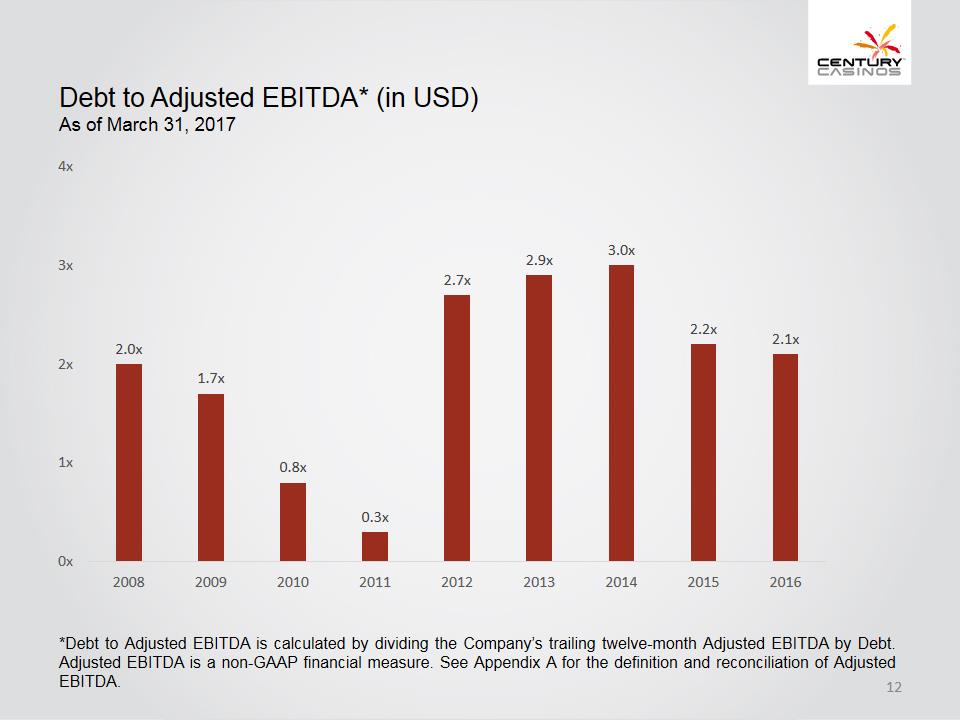

Debt to Adjusted EBITDA* (in USD)As of March 31, 20172.0x1.7x0.8x0.3x2.7x2.9x3.0x2.2x2.1x0x1x2x3x4x200820092010201120122013201420152016*Debt to Adjusted EBITDA is calculated by dividing the Company’s trailing twelve-month Adjusted EBITDA by Debt. Adjusted EBITDA is a non-GAAP financial measure. See Appendix A for the definition and reconciliation of Adjusted EBITDA.

Debt to Adjusted EBITDA* (in USD)As of March 31, 20172.0x1.7x0.8x0.3x2.7x2.9x3.0x2.2x2.1x0x1x2x3x4x200820092010201120122013201420152016*Debt to Adjusted EBITDA is calculated by dividing the Company’s trailing twelve-month Adjusted EBITDA by Debt. Adjusted EBITDA is a non-GAAP financial measure. See Appendix A for the definition and reconciliation of Adjusted EBITDA.

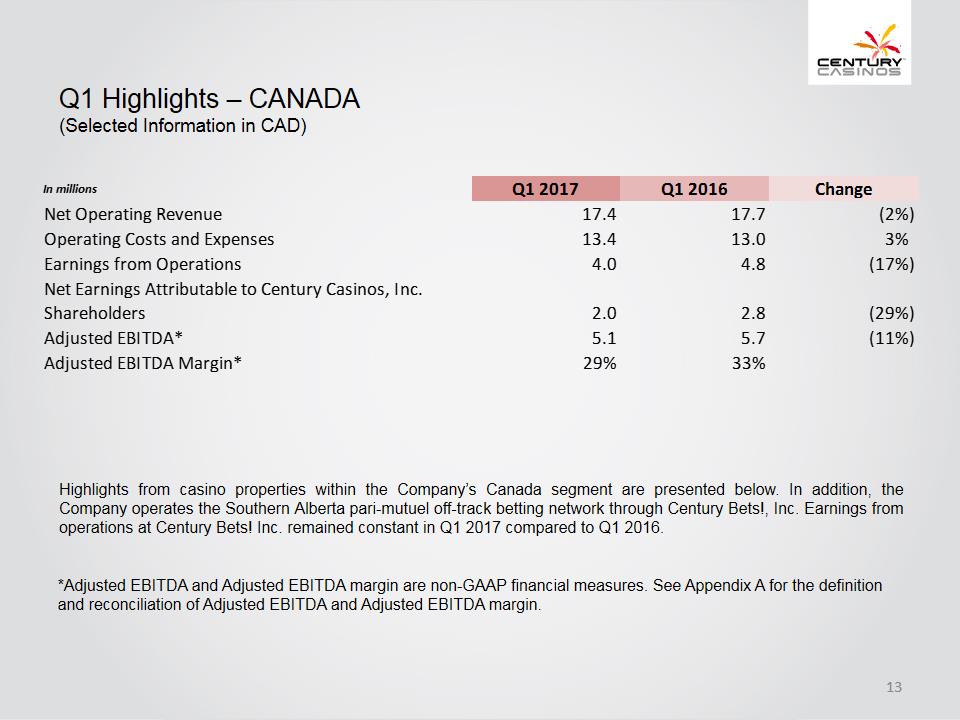

Q1 Highlights –CANADA (Selected Information in CAD)In millions Q1 2017 Q1 2016 Change Net Operating Revenue 17.4 17.7 (2%)Operating Costs and Expenses13.4 13.0 3%Earnings from Operations 4.0 4.8 (17%)Net Earnings Attributable to Century Casinos, Inc. Shareholders 2.0 2.8 (29%)Adjusted EBITDA* 5.1 5.7 (11%)Adjusted EBITDA Margin* 29% 33%Highlights from casino properties within the Company’s Canada segment are presented below. In addition, the Company operates the Southern Alberta pari-mutuel off-track betting network through Century Bets!, Inc. Earnings from operations at Century Bets! Inc. remained constant in Q1 2017 compared to Q1 2016.*Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin.

Q1 Highlights –CANADA (Selected Information in CAD)In millions Q1 2017 Q1 2016 Change Net Operating Revenue 17.4 17.7 (2%)Operating Costs and Expenses13.4 13.0 3%Earnings from Operations 4.0 4.8 (17%)Net Earnings Attributable to Century Casinos, Inc. Shareholders 2.0 2.8 (29%)Adjusted EBITDA* 5.1 5.7 (11%)Adjusted EBITDA Margin* 29% 33%Highlights from casino properties within the Company’s Canada segment are presented below. In addition, the Company operates the Southern Alberta pari-mutuel off-track betting network through Century Bets!, Inc. Earnings from operations at Century Bets! Inc. remained constant in Q1 2017 compared to Q1 2016.*Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin.

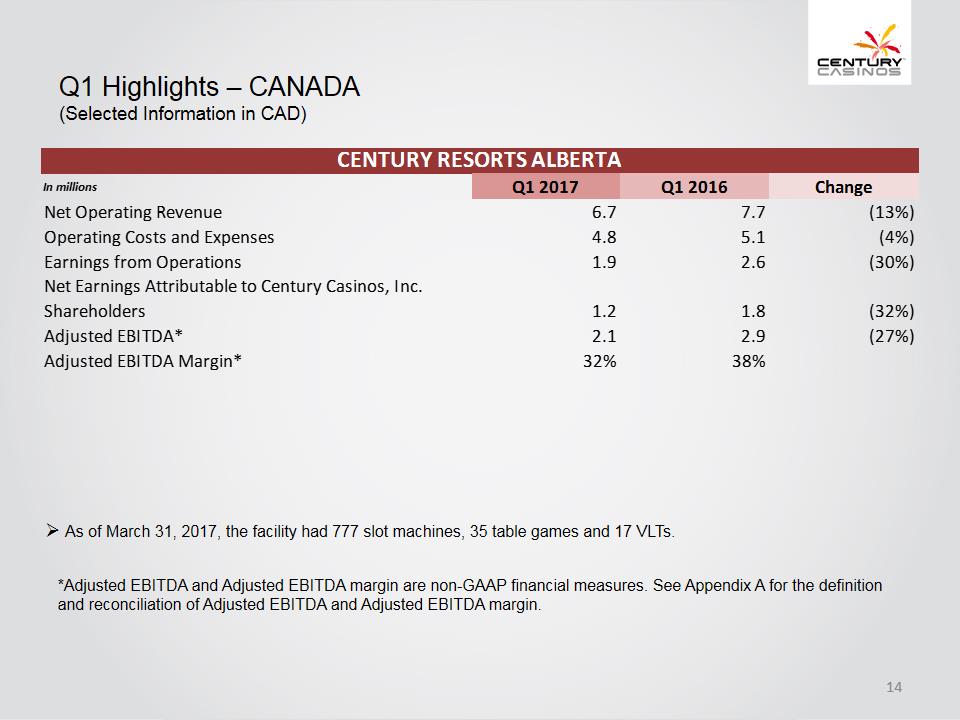

Q1 Highlights –CANADA (Selected Information in CAD)CENTURY RESORTS ALBERTAIn millions Q1 2017 Q1 2016 Change Net Operating Revenue 6.7 7.7 (13%)Operating Costs and Expenses 4.8 5.1 (4%)Earnings from Operations 1.9 2.6 (30%)Net Earnings Attributable to Century Casinos, Inc. Shareholders 1.2 1.8 (32%)Adjusted EBITDA* 2.1 2.9 (27%)Adjusted EBITDA Margin* 32% 38%As of March 31, 2017, the facility had 777 slot machines, 35 table games and 17 VLTs.*Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin.

Q1 Highlights –CANADA (Selected Information in CAD)CENTURY RESORTS ALBERTAIn millions Q1 2017 Q1 2016 Change Net Operating Revenue 6.7 7.7 (13%)Operating Costs and Expenses 4.8 5.1 (4%)Earnings from Operations 1.9 2.6 (30%)Net Earnings Attributable to Century Casinos, Inc. Shareholders 1.2 1.8 (32%)Adjusted EBITDA* 2.1 2.9 (27%)Adjusted EBITDA Margin* 32% 38%As of March 31, 2017, the facility had 777 slot machines, 35 table games and 17 VLTs.*Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin.

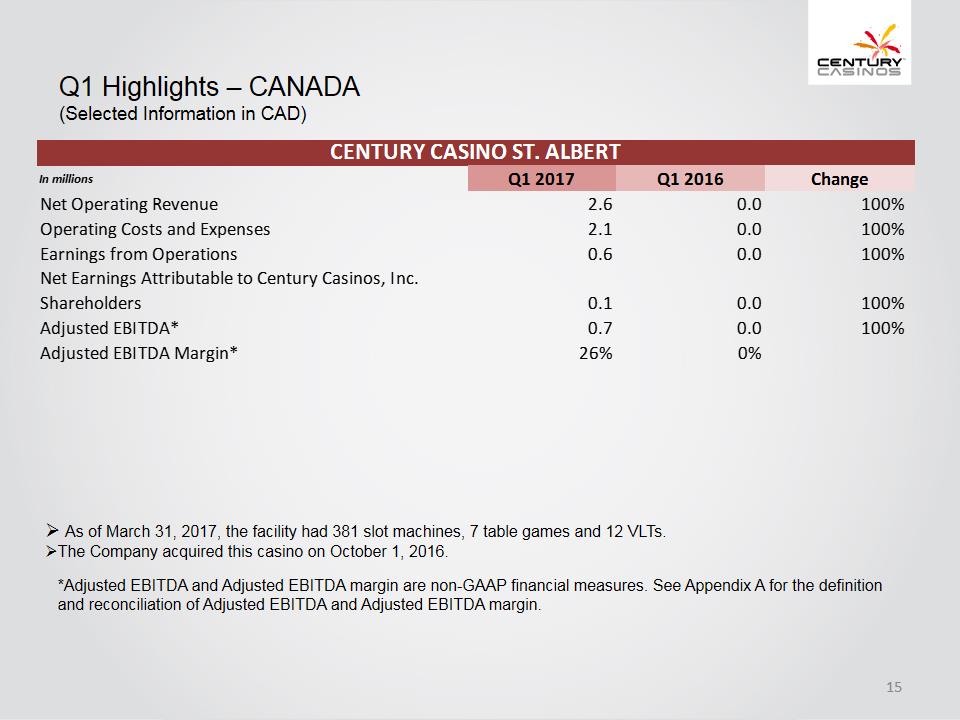

Q1 Highlights –CANADA (Selected Information in CAD) CENTURY CASINO ST. ALBERTIn millions Q1 2017 Q1 2016 Change Net Operating Revenue 2.6 0.0 100%Operating Costs and Expenses 2.1 0.0 100%Earnings from Operations 0.6 0.0 100%Net Earnings Attributable to Century Casinos, Inc. Shareholders 0.1 0.0 100%Adjusted EBITDA* 0.7 0.0 100%Adjusted EBITDA Margin* 26% 0%As of March 31, 2017, the facility had 381 slot machines, 7 table games and 12 VLTs.The Company acquired this casino on October 1, 2016.*Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin.

Q1 Highlights –CANADA (Selected Information in CAD) CENTURY CASINO ST. ALBERTIn millions Q1 2017 Q1 2016 Change Net Operating Revenue 2.6 0.0 100%Operating Costs and Expenses 2.1 0.0 100%Earnings from Operations 0.6 0.0 100%Net Earnings Attributable to Century Casinos, Inc. Shareholders 0.1 0.0 100%Adjusted EBITDA* 0.7 0.0 100%Adjusted EBITDA Margin* 26% 0%As of March 31, 2017, the facility had 381 slot machines, 7 table games and 12 VLTs.The Company acquired this casino on October 1, 2016.*Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin.

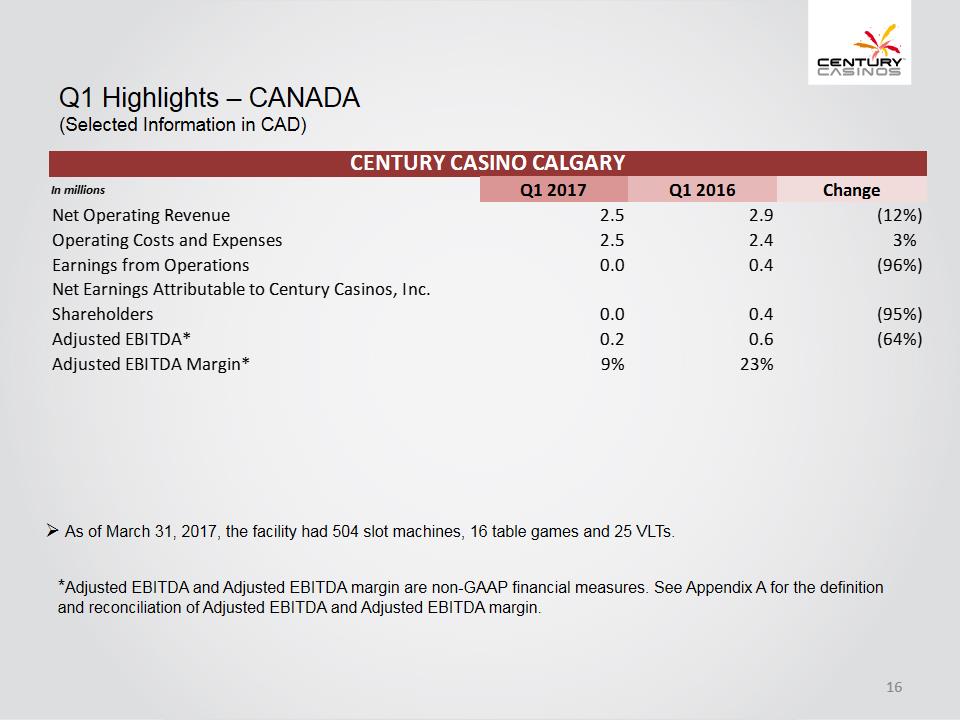

Q1 Highlights –CANADA (Selected Information in CAD)CENTURY CASINO CALGARYIn millions Q1 2017 Q1 2016 Change Net Operating Revenue 2.5 2.9 (12%)Operating Costs and Expenses 2.5 2.4 3%Earnings from Operations 0.0 0.4 (96%)Net Earnings Attributable to Century Casinos, Inc. Shareholders 0.0 0.4 (95%)Adjusted EBITDA* 0.2 0.6 (64%)Adjusted EBITDA Margin* 9% 23%As of March 31, 2017, the facility had 504 slot machines, 16 table games and 25 VLTs.*Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin.

Q1 Highlights –CANADA (Selected Information in CAD)CENTURY CASINO CALGARYIn millions Q1 2017 Q1 2016 Change Net Operating Revenue 2.5 2.9 (12%)Operating Costs and Expenses 2.5 2.4 3%Earnings from Operations 0.0 0.4 (96%)Net Earnings Attributable to Century Casinos, Inc. Shareholders 0.0 0.4 (95%)Adjusted EBITDA* 0.2 0.6 (64%)Adjusted EBITDA Margin* 9% 23%As of March 31, 2017, the facility had 504 slot machines, 16 table games and 25 VLTs.*Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin.

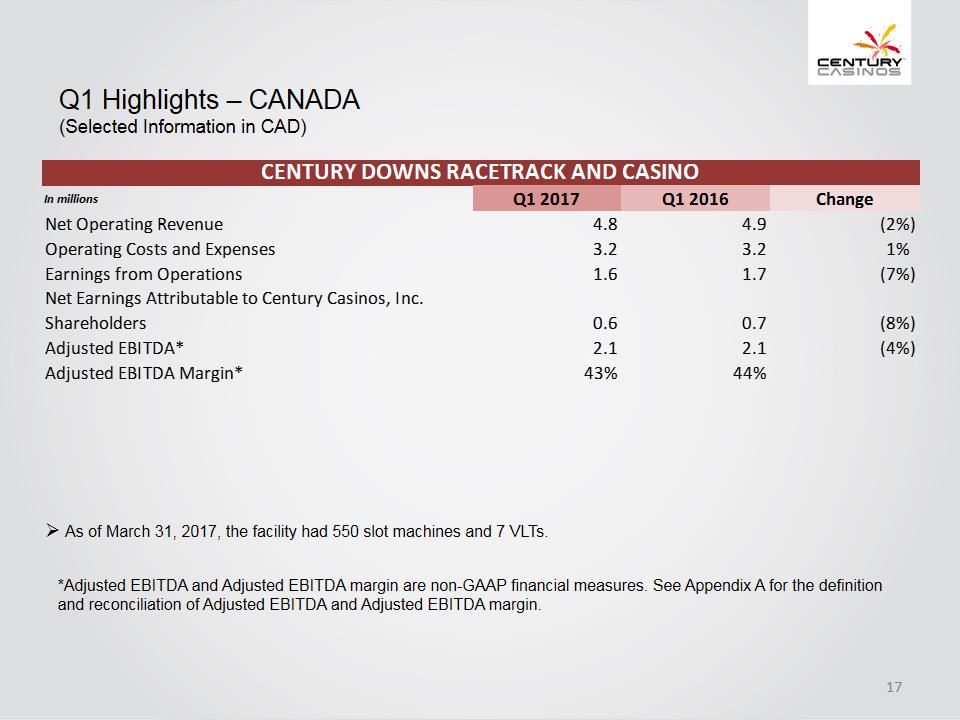

Q1 Highlights –CANADA (Selected Information in CAD)CENTURY DOWNS RACETRACK AND CASINOIn millions Q1 2017 Q1 2016 Change Net Operating Revenue 4.8 4.9 (2%)Operating Costs and Expenses 3.2 3.2 1%Earnings from Operations 1.6 1.7 (7%)Net Earnings Attributable to Century Casinos, Inc. Shareholders 0.6 0.7 (8%)Adjusted EBITDA* 2.1 2.1 (4%)Adjusted EBITDA Margin* 43% 44%As of March 31, 2017, the facility had 550 slot machines and 7 VLTs.*Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin.

Q1 Highlights –CANADA (Selected Information in CAD)CENTURY DOWNS RACETRACK AND CASINOIn millions Q1 2017 Q1 2016 Change Net Operating Revenue 4.8 4.9 (2%)Operating Costs and Expenses 3.2 3.2 1%Earnings from Operations 1.6 1.7 (7%)Net Earnings Attributable to Century Casinos, Inc. Shareholders 0.6 0.7 (8%)Adjusted EBITDA* 2.1 2.1 (4%)Adjusted EBITDA Margin* 43% 44%As of March 31, 2017, the facility had 550 slot machines and 7 VLTs.*Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin.

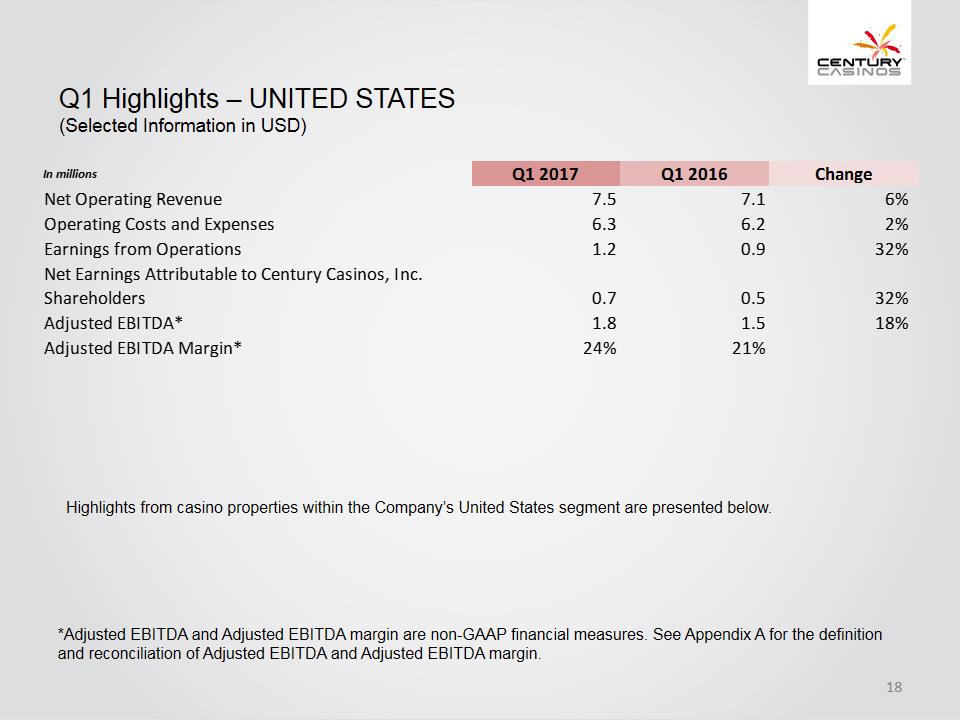

Q1 Highlights –UNITED STATES (Selected Information in USD)In millions Q1 2017 Q1 2016 Change Net Operating Revenue 7.5 7.1 6%Operating Costs and Expenses 6.3 6.2 2%Earnings from Operations 1.2 0.9 32%Net Earnings Attributable to Century Casinos, Inc. Shareholders 0.7 0.5 32%Adjusted EBITDA* 1.8 1.5 18%Adjusted EBITDA Margin* 24% 21%Highlights from casino properties within the Company’s United States segment are presented below.*Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin.

Q1 Highlights –UNITED STATES (Selected Information in USD)In millions Q1 2017 Q1 2016 Change Net Operating Revenue 7.5 7.1 6%Operating Costs and Expenses 6.3 6.2 2%Earnings from Operations 1.2 0.9 32%Net Earnings Attributable to Century Casinos, Inc. Shareholders 0.7 0.5 32%Adjusted EBITDA* 1.8 1.5 18%Adjusted EBITDA Margin* 24% 21%Highlights from casino properties within the Company’s United States segment are presented below.*Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin.

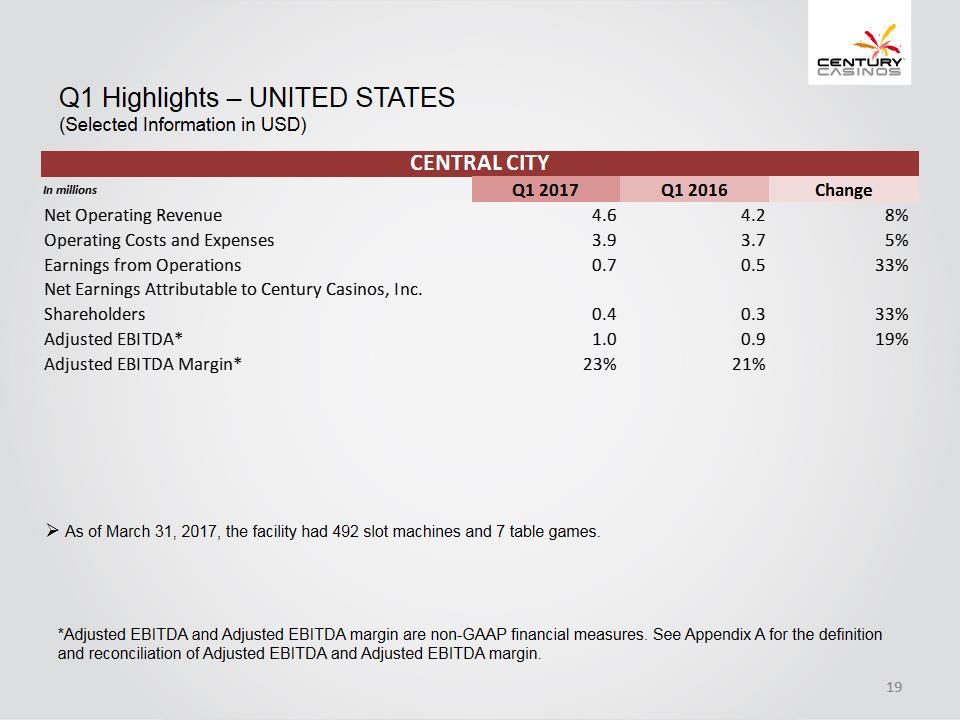

Q1 Highlights –UNITED STATES (Selected Information in USD)CENTRAL CITYIn millions Q1 2017 Q1 2016 Change Net Operating Revenue 4.6 4.2 8%Operating Costs and Expenses 3.9 3.7 5%Earnings from Operations 0.7 0.5 33%Net Earnings Attributable to Century Casinos, Inc. Shareholders 0.4 0.3 33%Adjusted EBITDA* 1.0 0.9 19%Adjusted EBITDA Margin* 23% 21%As of March 31, 2017, the facility had 492 slot machines and 7 table games.*Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin.

Q1 Highlights –UNITED STATES (Selected Information in USD)CENTRAL CITYIn millions Q1 2017 Q1 2016 Change Net Operating Revenue 4.6 4.2 8%Operating Costs and Expenses 3.9 3.7 5%Earnings from Operations 0.7 0.5 33%Net Earnings Attributable to Century Casinos, Inc. Shareholders 0.4 0.3 33%Adjusted EBITDA* 1.0 0.9 19%Adjusted EBITDA Margin* 23% 21%As of March 31, 2017, the facility had 492 slot machines and 7 table games.*Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin.

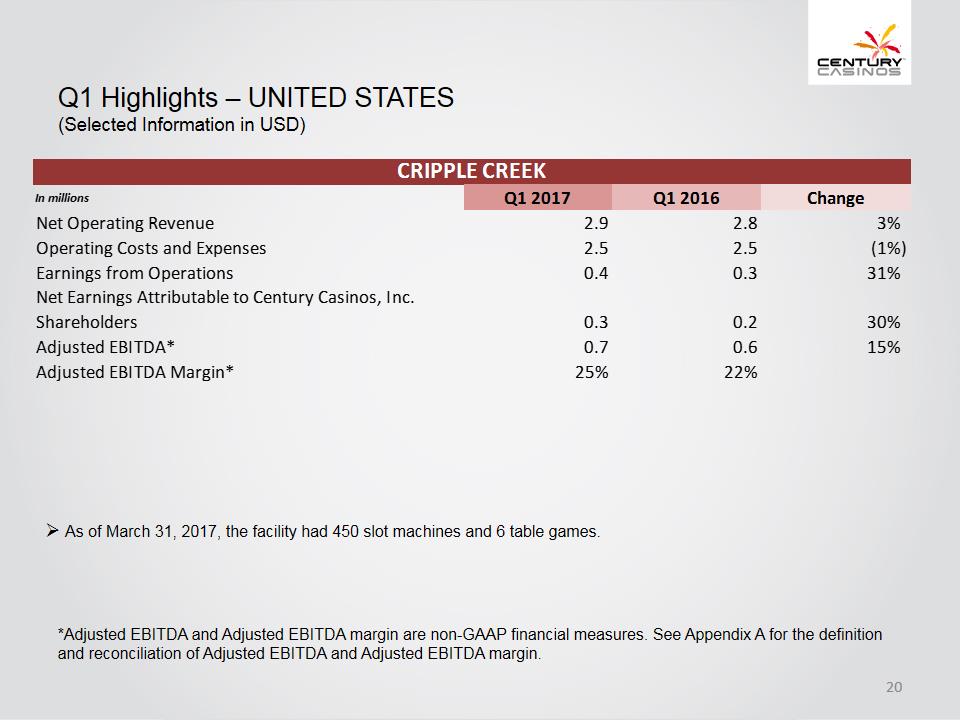

Q1 Highlights –UNITED STATES (Selected Information in USD)CRIPPLE CREEKIn millions Q1 2017 Q1 2016 Change Net Operating Revenue 2.9 2.8 3%Operating Costs and Expenses 2.5 2.5 (1%)Earnings from Operations 0.4 0.3 31%Net Earnings Attributable to Century Casinos, Inc. Shareholders 0.3 0.2 30%Adjusted EBITDA* 0.7 0.6 15%Adjusted EBITDA Margin* 25% 22%As of March 31, 2017, the facility had 450 slot machines and 6 table games.*Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin.

Q1 Highlights –UNITED STATES (Selected Information in USD)CRIPPLE CREEKIn millions Q1 2017 Q1 2016 Change Net Operating Revenue 2.9 2.8 3%Operating Costs and Expenses 2.5 2.5 (1%)Earnings from Operations 0.4 0.3 31%Net Earnings Attributable to Century Casinos, Inc. Shareholders 0.3 0.2 30%Adjusted EBITDA* 0.7 0.6 15%Adjusted EBITDA Margin* 25% 22%As of March 31, 2017, the facility had 450 slot machines and 6 table games.*Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin.

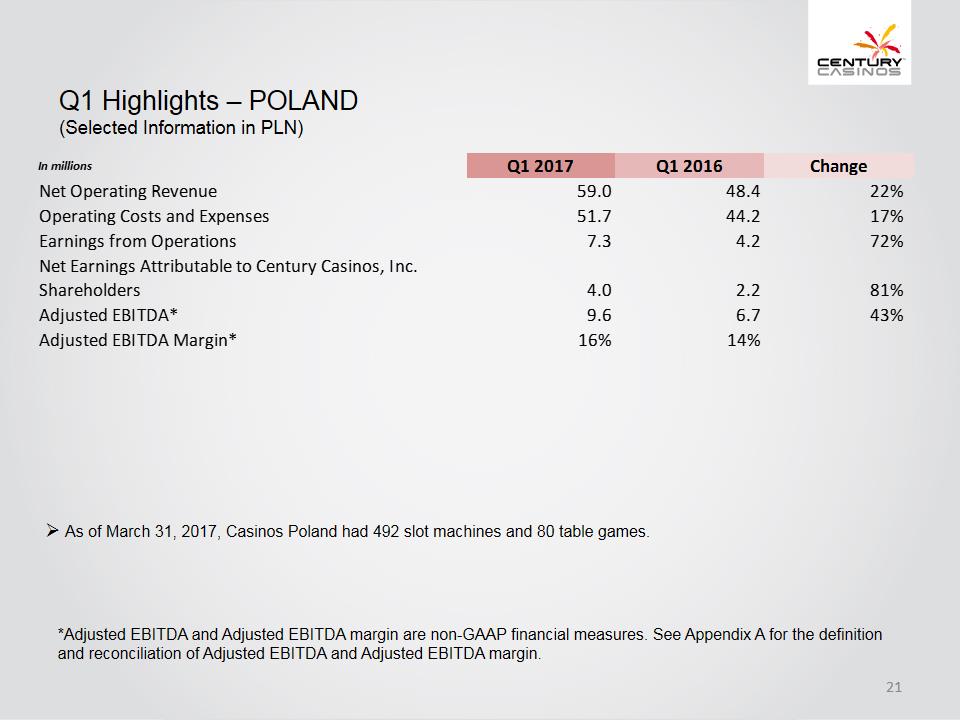

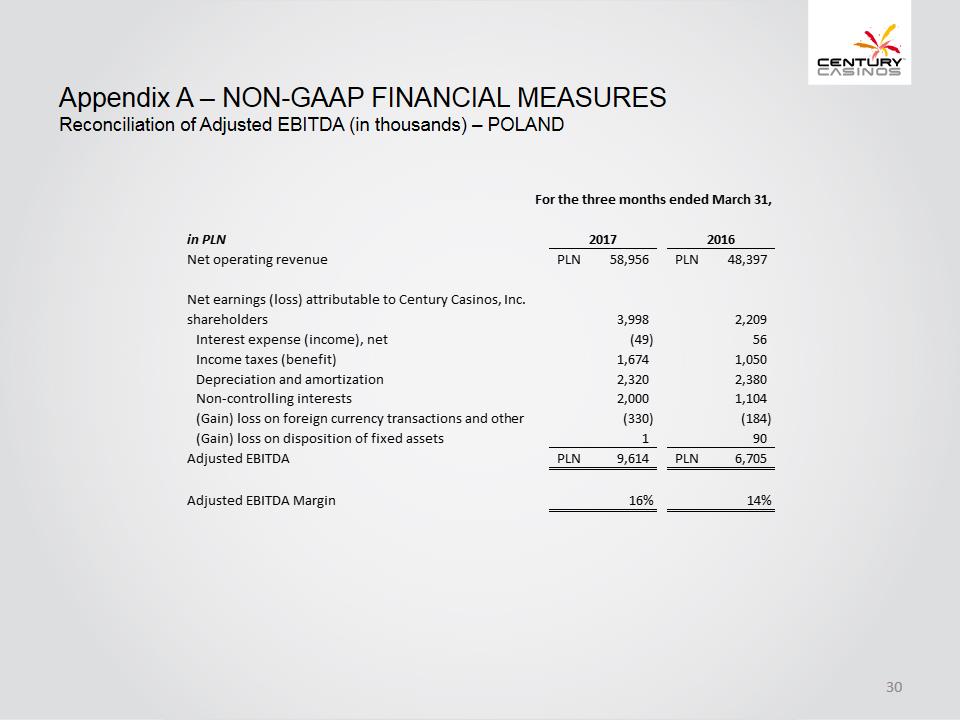

Q1 Highlights –POLAND (Selected Information in PLN)In millions Q1 2017 Q1 2016 Change Net Operating Revenue 59.0 48.4 22%Operating Costs and Expenses 51.7 44.2 17%Earnings from Operations 7.3 4.2 72%Net Earnings Attributable to Century Casinos, Inc. Shareholders 4.0 2.2 81%Adjusted EBITDA* 9.6 6.7 43%Adjusted EBITDA Margin* 16% 14%As of March 31, 2017, Casinos Poland had 492 slot machines and 80 table games.*Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin.

Q1 Highlights –POLAND (Selected Information in PLN)In millions Q1 2017 Q1 2016 Change Net Operating Revenue 59.0 48.4 22%Operating Costs and Expenses 51.7 44.2 17%Earnings from Operations 7.3 4.2 72%Net Earnings Attributable to Century Casinos, Inc. Shareholders 4.0 2.2 81%Adjusted EBITDA* 9.6 6.7 43%Adjusted EBITDA Margin* 16% 14%As of March 31, 2017, Casinos Poland had 492 slot machines and 80 table games.*Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin.

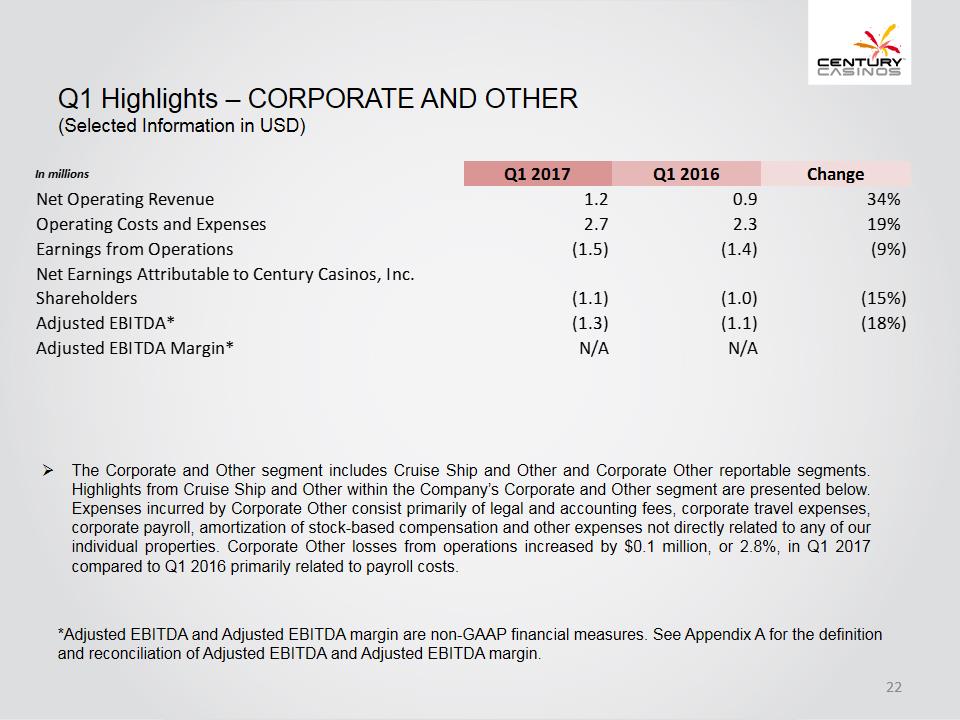

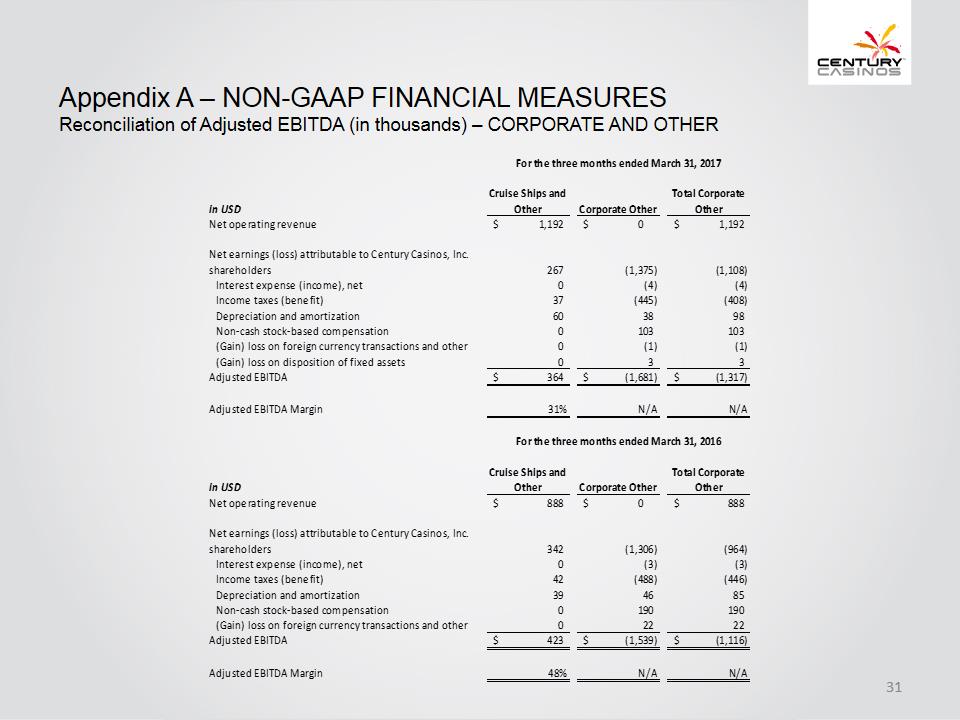

Q1 Highlights –CORPORATE AND OTHER (Selected Information in USD)In millions Q1 2017 Q1 2016 Change Net Operating Revenue 1.2 0.9 34%Operating Costs and Expenses 2.7 2.3 19%Earnings from Operations (1.5) (1.4) (9%)Net Earnings Attributable to Century Casinos, Inc. Shareholders (1.1) (1.0) (15%)Adjusted EBITDA* (1.3) (1.1) (18%)Adjusted EBITDA Margin* N/A N/AThe Corporate and Other segment includes Cruise Ship and Other and Corporate Other reportable segments. Highlights from Cruise Ship and Other within the Company’s Corporate and Other segment are presented below. Expenses incurred by Corporate Other consist primarily of legal and accounting fees, corporate travel expenses, corporate payroll, amortization of stock-based compensation and other expenses not directly related to any of our individual properties. Corporate Other losses from operations increased by $0.1 million, or 2.8%, in Q1 2017 compared to Q1 2016 primarily related to payroll costs.*Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin.

Q1 Highlights –CORPORATE AND OTHER (Selected Information in USD)In millions Q1 2017 Q1 2016 Change Net Operating Revenue 1.2 0.9 34%Operating Costs and Expenses 2.7 2.3 19%Earnings from Operations (1.5) (1.4) (9%)Net Earnings Attributable to Century Casinos, Inc. Shareholders (1.1) (1.0) (15%)Adjusted EBITDA* (1.3) (1.1) (18%)Adjusted EBITDA Margin* N/A N/AThe Corporate and Other segment includes Cruise Ship and Other and Corporate Other reportable segments. Highlights from Cruise Ship and Other within the Company’s Corporate and Other segment are presented below. Expenses incurred by Corporate Other consist primarily of legal and accounting fees, corporate travel expenses, corporate payroll, amortization of stock-based compensation and other expenses not directly related to any of our individual properties. Corporate Other losses from operations increased by $0.1 million, or 2.8%, in Q1 2017 compared to Q1 2016 primarily related to payroll costs.*Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin.

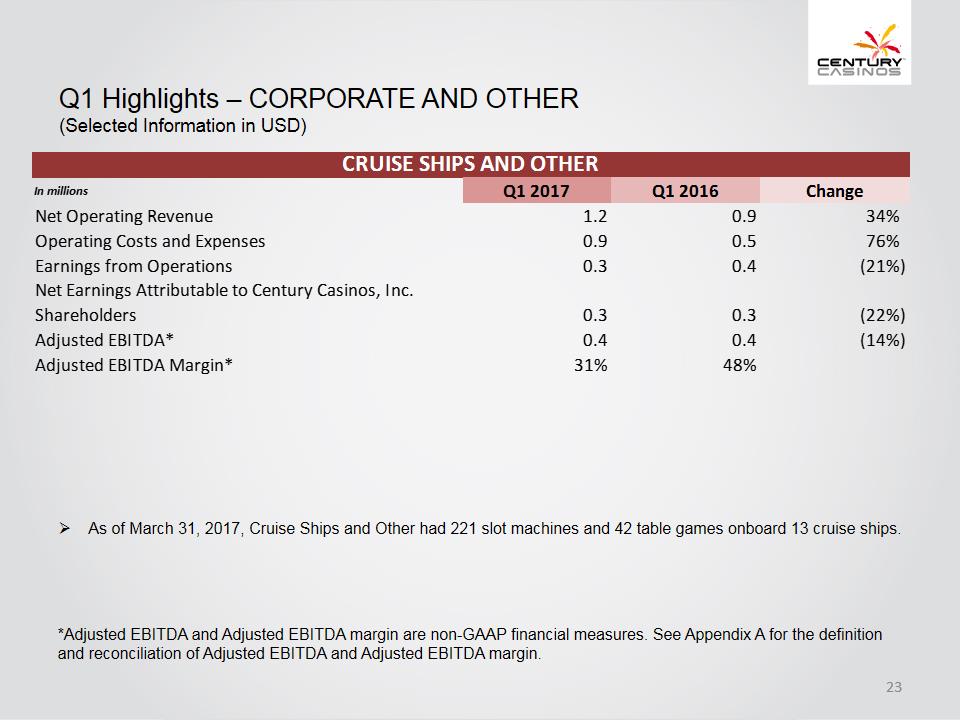

Q1 Highlights –CORPORATE AND OTHER (Selected Information in USD)CRUISE SHIPS AND OTHERIn millions Q1 2017 Q1 2016 Change Net Operating Revenue 1.2 0.9 34%Operating Costs and Expenses 0.9 0.5 76%Earnings from Operations 0.3 0.4 (21%)Net Earnings Attributable to Century Casinos, Inc. Shareholders 0.3 0.3 (22%)Adjusted EBITDA* 0.4 0.4 (14%)Adjusted EBITDA Margin* 31% 48%As of March 31, 2017, Cruise Ships and Other had 221 slot machines and 42 table games onboard 13 cruise ships.*Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin.

Q1 Highlights –CORPORATE AND OTHER (Selected Information in USD)CRUISE SHIPS AND OTHERIn millions Q1 2017 Q1 2016 Change Net Operating Revenue 1.2 0.9 34%Operating Costs and Expenses 0.9 0.5 76%Earnings from Operations 0.3 0.4 (21%)Net Earnings Attributable to Century Casinos, Inc. Shareholders 0.3 0.3 (22%)Adjusted EBITDA* 0.4 0.4 (14%)Adjusted EBITDA Margin* 31% 48%As of March 31, 2017, Cruise Ships and Other had 221 slot machines and 42 table games onboard 13 cruise ships.*Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See Appendix A for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin.

Q1 Highlights – ADDITIONAL PROJECTS UNDER DEVELOPMENTCentury MileIn September 2016, the Company was selected as the successful applicant by Horse Racing Alberta to own, build and operate a horse racing facility in the Edmonton market area, which the Company will operate as Century Mile. Century Mile will be a one-mile horse racetrack and multi-level racing and entertainment center. The proposed location is on Edmonton International Airport land and close to the city of Leduc, south of Edmonton and positioned off Queen Elizabeth II highway. The Company estimates that the project will cost approximately CAD 50.0 million. The Company estimates that construction of the project will take approximately 15 months and that it will be completed by the fourth quarter of 2018 or the first quarter of 2019. In March 2017, the Company received approval for the Century Mile project from the Alberta Gaming and Liquor Commission. Commencement of construction of the Century Mile project is subject to, among other things, the Company’s obtaining financing.Palace HotelThe Company has postponed the planned restoration and expansion of the historic Palace Hotel in Cripple Creek, Colorado.

Q1 Highlights – ADDITIONAL PROJECTS UNDER DEVELOPMENTCentury MileIn September 2016, the Company was selected as the successful applicant by Horse Racing Alberta to own, build and operate a horse racing facility in the Edmonton market area, which the Company will operate as Century Mile. Century Mile will be a one-mile horse racetrack and multi-level racing and entertainment center. The proposed location is on Edmonton International Airport land and close to the city of Leduc, south of Edmonton and positioned off Queen Elizabeth II highway. The Company estimates that the project will cost approximately CAD 50.0 million. The Company estimates that construction of the project will take approximately 15 months and that it will be completed by the fourth quarter of 2018 or the first quarter of 2019. In March 2017, the Company received approval for the Century Mile project from the Alberta Gaming and Liquor Commission. Commencement of construction of the Century Mile project is subject to, among other things, the Company’s obtaining financing.Palace HotelThe Company has postponed the planned restoration and expansion of the historic Palace Hotel in Cripple Creek, Colorado.

Appendix A –NON-GAAP FINANCIAL MEASURESThe Company supplements its condensed consolidated financial statements prepared in accordance with U.S. generally accepted accounting principles (“US GAAP”) by using the following non-GAAP financial measures, which management believes are useful in properly understanding the Company’s short-term and long-term financial trends. Management uses these non-GAAP financial measures to forecast and evaluate the operational performance of the Company as well as to compare results of current periods to prior periods on a consolidated basis.Adjusted EBITDAAdjusted EBITDA marginConstant currency resultsNet DebtManagement believes presenting the non-GAAP financial measures used in this presentation provides investors greater transparency to the information used by management for financial and operational decision-making and allows investors to see the Company’s results “through the eyes” of management. Management also believes providing this information better enables our investors to understand the Company’s operating performance and evaluate the methodology used by management to evaluate and measure such performance.The adjustments made to U.S. GAAP financial measures result from facts and circumstances that vary in frequency and impact on the Company’s results of operations. The following is an explanation of each of the adjustments that management excludes in calculating its non-GAAP financial measures.

Appendix A –NON-GAAP FINANCIAL MEASURESThe Company supplements its condensed consolidated financial statements prepared in accordance with U.S. generally accepted accounting principles (“US GAAP”) by using the following non-GAAP financial measures, which management believes are useful in properly understanding the Company’s short-term and long-term financial trends. Management uses these non-GAAP financial measures to forecast and evaluate the operational performance of the Company as well as to compare results of current periods to prior periods on a consolidated basis.Adjusted EBITDAAdjusted EBITDA marginConstant currency resultsNet DebtManagement believes presenting the non-GAAP financial measures used in this presentation provides investors greater transparency to the information used by management for financial and operational decision-making and allows investors to see the Company’s results “through the eyes” of management. Management also believes providing this information better enables our investors to understand the Company’s operating performance and evaluate the methodology used by management to evaluate and measure such performance.The adjustments made to U.S. GAAP financial measures result from facts and circumstances that vary in frequency and impact on the Company’s results of operations. The following is an explanation of each of the adjustments that management excludes in calculating its non-GAAP financial measures.

Appendix A – NON-GAAP FINANCIAL MEASURESThe Company defines Adjusted EBITDA as net earnings (loss) attributable to Century Casinos, Inc. shareholders before interest expense (income), net, income taxes (benefit), depreciation, amortization, non-controlling interest (earnings) losses and transactions, pre-opening expenses, acquisition costs, non-cash stock-based compensation charges, asset impairment costs, (gain) loss on disposition of fixed assets, discontinued operations, (gain) loss on foreign currency transactions and other, gain on business combination and certain other one-time items, such as acquisition costs. Intercompany transactions consisting primarily of management and royalty fees and interest, along with their related tax effects, are excluded from the presentation of net earnings (loss) and Adjusted EBITDA reported for each segment and property. Not all of the aforementioned items occur in each reporting period, but have been included in the definition based on historical activity. These adjustments have no effect on the consolidated results as reported under US GAAP. Adjusted EBITDA is not considered a measure of performance recognized under US GAAP. Management believes that Adjusted EBITDA is a valuable measure of the relative performance of the Company and its properties. The gaming industry commonly uses Adjusted EBITDA as a method of arriving at the economic value of a casino operation. Management uses Adjusted EBITDA to compare the relative operating performance of separate operating units by eliminating the above mentioned items associated with the varying levels of capital expenditures for infrastructure required to generate revenue, and the often high cost of acquiring existing operations. Adjusted EBITDA is used by the Company’s lending institution to gauge operating performance. The Company’s computation of Adjusted EBITDA may be different from, and therefore may not be comparable to, similar measures used by other companies within the gaming industry. Please see the reconciliation of Adjusted EBITDA to net earnings (loss) attributable to Century Casinos, Inc. shareholders below. The Company defines Adjusted EBITDA margin as Adjusted EBITDA divided by net operating revenue. Management uses this margin as one of several measures to evaluate the efficiency of the Company’s casino operations.

Appendix A – NON-GAAP FINANCIAL MEASURESThe Company defines Adjusted EBITDA as net earnings (loss) attributable to Century Casinos, Inc. shareholders before interest expense (income), net, income taxes (benefit), depreciation, amortization, non-controlling interest (earnings) losses and transactions, pre-opening expenses, acquisition costs, non-cash stock-based compensation charges, asset impairment costs, (gain) loss on disposition of fixed assets, discontinued operations, (gain) loss on foreign currency transactions and other, gain on business combination and certain other one-time items, such as acquisition costs. Intercompany transactions consisting primarily of management and royalty fees and interest, along with their related tax effects, are excluded from the presentation of net earnings (loss) and Adjusted EBITDA reported for each segment and property. Not all of the aforementioned items occur in each reporting period, but have been included in the definition based on historical activity. These adjustments have no effect on the consolidated results as reported under US GAAP. Adjusted EBITDA is not considered a measure of performance recognized under US GAAP. Management believes that Adjusted EBITDA is a valuable measure of the relative performance of the Company and its properties. The gaming industry commonly uses Adjusted EBITDA as a method of arriving at the economic value of a casino operation. Management uses Adjusted EBITDA to compare the relative operating performance of separate operating units by eliminating the above mentioned items associated with the varying levels of capital expenditures for infrastructure required to generate revenue, and the often high cost of acquiring existing operations. Adjusted EBITDA is used by the Company’s lending institution to gauge operating performance. The Company’s computation of Adjusted EBITDA may be different from, and therefore may not be comparable to, similar measures used by other companies within the gaming industry. Please see the reconciliation of Adjusted EBITDA to net earnings (loss) attributable to Century Casinos, Inc. shareholders below. The Company defines Adjusted EBITDA margin as Adjusted EBITDA divided by net operating revenue. Management uses this margin as one of several measures to evaluate the efficiency of the Company’s casino operations.

Appendix A –NON-GAAP FINANCIAL MEASURESThe impact of foreign exchange rates is highly variable and difficult to predict. The Company uses a constant currency basis to show the impact from foreign exchange rates on current period revenue compared to prior period revenue using the prior period’s foreign exchange rates. In order to properly understand the underlying business trends and performance of the Company’s ongoing operations, management believes that investors may find it useful to consider the impact of excluding changes in foreign exchange rates from the Company’s net operating revenue, net earnings (loss) attributable to Century Casinos, Inc. shareholders and Adjusted EBITDA.The Company defines Net Debt as total long-term debt (including current portion) plus deferred financing costs minus cash and cash equivalents. Net Debt is not considered a liquidity measure recognized under US GAAP. Management believes that Net Debt is a valuable measure of our overall financial situation. Net Debt provides investors with an indication of our ability to pay off all of our long-term debt if it became due simultaneously.

Appendix A –NON-GAAP FINANCIAL MEASURESThe impact of foreign exchange rates is highly variable and difficult to predict. The Company uses a constant currency basis to show the impact from foreign exchange rates on current period revenue compared to prior period revenue using the prior period’s foreign exchange rates. In order to properly understand the underlying business trends and performance of the Company’s ongoing operations, management believes that investors may find it useful to consider the impact of excluding changes in foreign exchange rates from the Company’s net operating revenue, net earnings (loss) attributable to Century Casinos, Inc. shareholders and Adjusted EBITDA.The Company defines Net Debt as total long-term debt (including current portion) plus deferred financing costs minus cash and cash equivalents. Net Debt is not considered a liquidity measure recognized under US GAAP. Management believes that Net Debt is a valuable measure of our overall financial situation. Net Debt provides investors with an indication of our ability to pay off all of our long-term debt if it became due simultaneously.

Appendix A –NON-GAAP FINANCIAL MEASURESReconciliation of Adjusted EBITDA (in thousands) –CANADA

Appendix A –NON-GAAP FINANCIAL MEASURESReconciliation of Adjusted EBITDA (in thousands) –CANADA

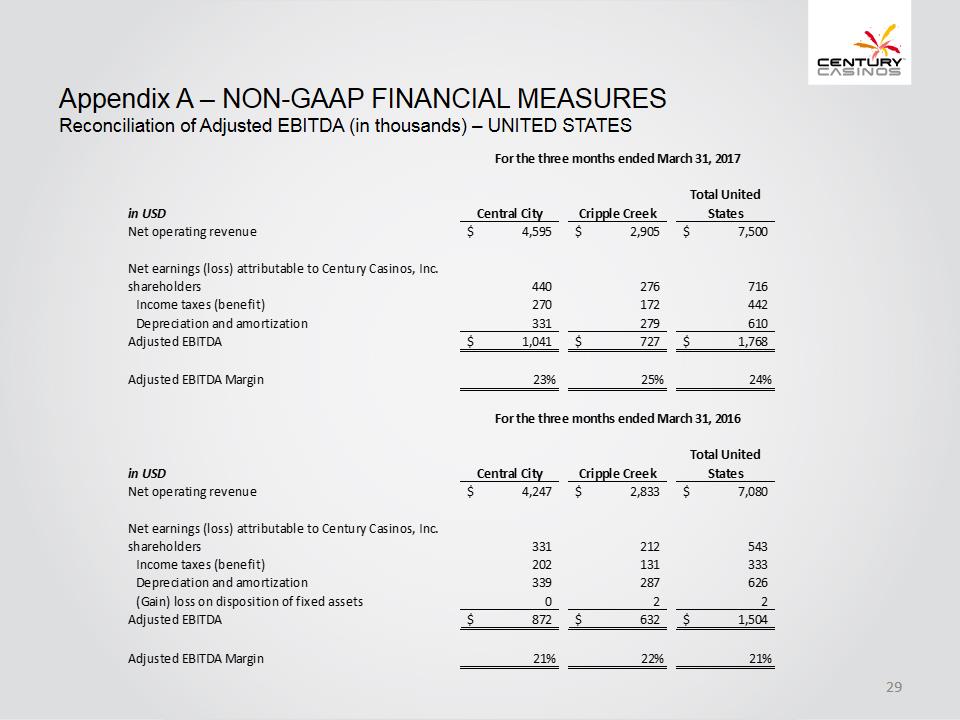

Appendix A –NON-GAAP FINANCIAL MEASURESReconciliation of Adjusted EBITDA (in thousands) –UNITED STATES

Appendix A –NON-GAAP FINANCIAL MEASURESReconciliation of Adjusted EBITDA (in thousands) –UNITED STATES

Appendix A –NON-GAAP FINANCIAL MEASURESReconciliation of Adjusted EBITDA (in thousands) –POLAND

Appendix A –NON-GAAP FINANCIAL MEASURESReconciliation of Adjusted EBITDA (in thousands) –POLAND

Appendix A –NON-GAAP FINANCIAL MEASURESReconciliation of Adjusted EBITDA (in thousands) –CORPORATE AND OTHER

Appendix A –NON-GAAP FINANCIAL MEASURESReconciliation of Adjusted EBITDA (in thousands) –CORPORATE AND OTHER

Appendix A –NON-GAAP FINANCIAL MEASURESReconciliation of Net Debt (in thousands)

Appendix A –NON-GAAP FINANCIAL MEASURESReconciliation of Net Debt (in thousands)