Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CENTERPOINT ENERGY INC | d355284dex991.htm |

| 8-K - FORM 8-K - CENTERPOINT ENERGY INC | d355284d8k.htm |

May 5, 2017 1st Quarter 2017 Earnings Call Q1 2017 EPS of $0.44 versus $0.36 in Q1 2016 Q1 2017 guidance basis EPS of $0.37 versus $0.32 in Q1 2016 Company reiterates 2017 EPS guidance of $1.25 - $1.33 Potential $250 million increase to the five-year capital plan with Freeport, Texas electric transmission expansion Exhibit 99.2

Cautionary Statement This presentation and the oral statements made in connection herewith contain statements concerning our expectations, beliefs, plans, objectives, goals, strategies, future operations, events, financial position, earnings, growth, costs, prospects, capital investments or performance or underlying assumptions (including future regulatory filings and recovery, liquidity, capital resources, balance sheet, cash flow, capital investments and management, financing costs, and rate base or customer growth) and other statements that are not historical facts. These statements are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You should not place undue reliance on forward-looking statements. Actual results may differ materially from those expressed or implied by these statements. You can generally identify our forward-looking statements by the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “objective,” “plan,” “potential,” “predict,” “projection,” “should,” “target,” “will,” or other similar words. The absence of these words, however, does not mean that the statements are not forward-looking. Examples of forward-looking statements in this presentation include statements about our acquisition of Atmos Energy Marketing, including statements about future financial performance, margin, number of customers and operating income and growth, guidance, including earnings and dividend growth, future financing plans and expectation for liquidity and capital resources and expenditures, tax and interest rates, among other statements. We have based our forward-looking statements on our management’s beliefs and assumptions based on information currently available to our management at the time the statements are made. We caution you that assumptions, beliefs, expectations, intentions, and projections about future events may and often do vary materially from actual results. Therefore, we cannot assure you that actual results will not differ materially from those expressed or implied by our forward-looking statements. Some of the factors that could cause actual results to differ from those expressed or implied by our forward-looking statements include but are not limited to the timing and impact of future regulatory, legislative and IRS decisions, financial market conditions, future market conditions, economic and employment conditions, customer growth, Enable Midstream’s performance and ability to pay distributions, and other factors described in CenterPoint Energy, Inc.’s Form 10-K for the fiscal year ended December 31, 2016 and Form 10-Q for the period ended March 31, 2017 under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Certain Factors Affecting Future Earnings” and in other filings with the SEC by CenterPoint Energy, which can be found at www.centerpointenergy.com on the Investor Relations page or on the SEC’s website at www.sec.gov. This presentation contains time sensitive information that is accurate as of the date hereof. Some of the information in this presentation is unaudited and may be subject to change. We undertake no obligation to update the information presented herein except as required by law. Investors and others should note that we may announce material information using SEC filings, press releases, public conference calls, webcasts and the Investor Relations page of our website. In the future, we will continue to use these channels to distribute material information about the Company and to communicate important information about the Company, key personnel, corporate initiatives, regulatory updates and other matters. Information that we post on our website could be deemed material; therefore, we encourage investors, the media, our customers, business partners and others interested in our Company to review the information we post on our website. Use of Non-GAAP Financial Measures In addition to presenting its financial results in accordance with generally accepted accounting principles (GAAP), including presentation of net income and diluted earnings per share, CenterPoint Energy also provides guidance based on adjusted net income and adjusted diluted earnings per share, which are non-GAAP financial measures. Generally, a non-GAAP financial measure is a numerical measure of a Company’s historical or future financial performance that excludes or includes amounts that are not normally excluded or included in the most directly comparable GAAP financial measure. CenterPoint Energy’s adjusted net income and adjusted diluted earnings per share calculation excludes from net income and diluted earnings per share, respectively, the impact of ZENS and related securities and mark-to-market gains or losses resulting from the Company’s Energy Services business. A reconciliation of net income and diluted earnings per share to the basis used in providing 2017 guidance is provided in this presentation on slide 21. CenterPoint Energy is unable to present a quantitative reconciliation of forward-looking adjusted net income and adjusted diluted earnings per share because changes in the value of ZENS and related securities and mark-to-market gains or losses resulting from the Company’s Energy Services business are not estimable. Management evaluates the Company’s financial performance in part based on adjusted net income and adjusted diluted earnings per share. We believe that presenting these non-GAAP financial measures enhances an investor’s understanding of CenterPoint Energy’s overall financial performance by providing them with an additional meaningful and relevant comparison of current and anticipated future results across periods. The adjustments made in these non-GAAP financial measures exclude items that Management believes do not most accurately reflect the Company’s fundamental business performance. These excluded items are reflected in the reconciliation tables on slides 20, 21 and 22 of this presentation. CenterPoint Energy’s adjusted net income and adjusted diluted earnings per share non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, or superior to, net income and diluted earnings per share, which respectively are the most directly comparable GAAP financial measures. These non-GAAP financial measures also may be different than non-GAAP financial measures used by other companies.

Agenda Scott Prochazka – President and CEO First Quarter Results Business Segment Highlights Houston Electric Natural Gas Distribution Energy Services Midstream Investments Full Year Outlook Bill Rogers – Executive Vice President and CFO Business Segment Performance Utility Operations EPS Drivers Consolidated EPS Drivers Investment and Financing Appendix Regulatory Update Core Operating Income Reconciliation Net Income Reconciliation

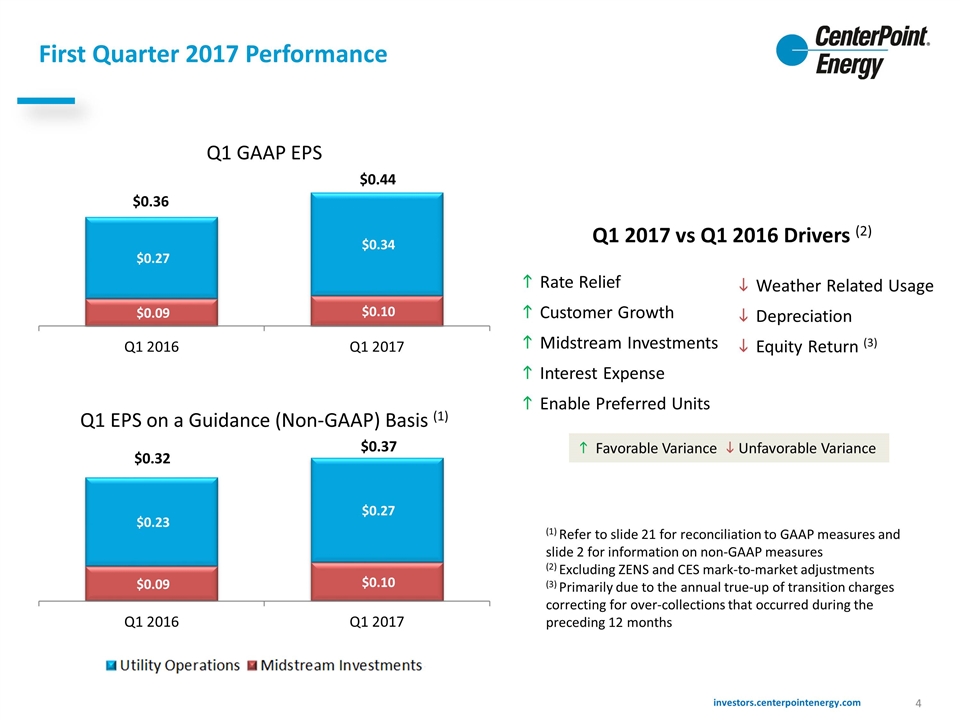

First Quarter 2017 Performance (1) Refer to slide 21 for reconciliation to GAAP measures and slide 2 for information on non-GAAP measures (2) Excluding ZENS and CES mark-to-market adjustments (3) Primarily due to the annual true-up of transition charges correcting for over-collections that occurred during the preceding 12 months Q1 2017 vs Q1 2016 Drivers (2) h Favorable Variance i Unfavorable Variance Rate Relief Customer Growth Midstream Investments Interest Expense Enable Preferred Units Weather Related Usage Depreciation Equity Return (3) Q1 GAAP EPS Q1 EPS on a Guidance (Non-GAAP) Basis (1)

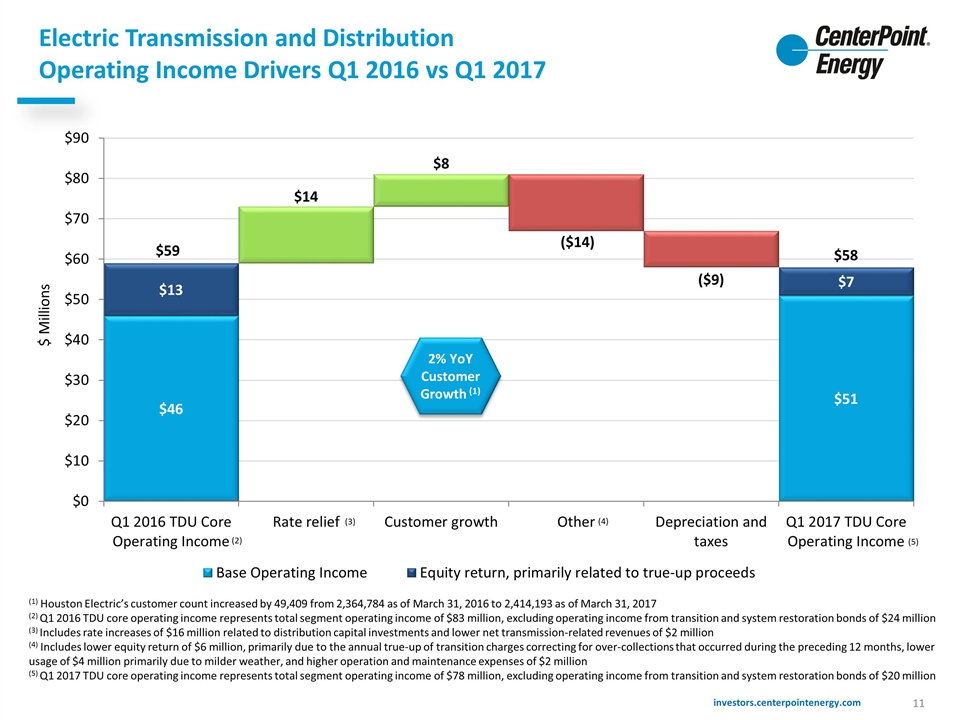

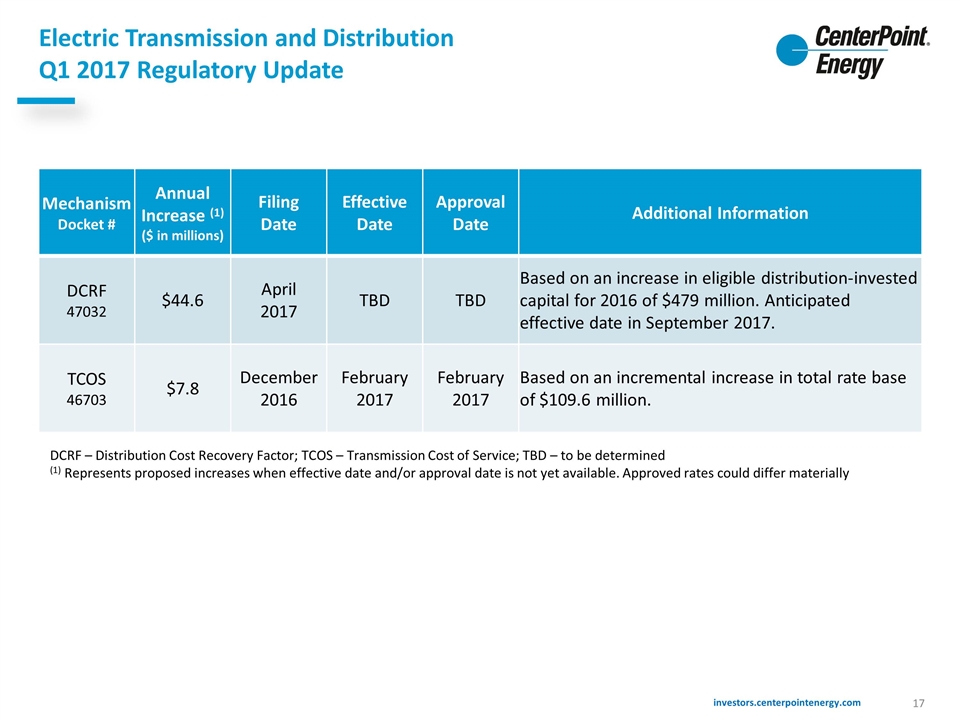

Electric Transmission and Distribution Highlights TDU core operating income was $58 million in Q1 2017 compared to $59 million in Q1 2016 Added more than 49,000 electric customers year over year, representing 2% customer growth Throughput increased 3% from Q1 2016 to Q1 2017 TCOS filing for $7.8 million annual increase approved by the PUCT and effective in February 2017 DCRF filed with the PUCT in April proposes a $44.6 million incremental annual increase; anticipated effective date in September 2017 Freeport LNG liquefaction facility construction Source: Freeport LNG Proposed $250 million transmission project submitted to ERCOT in April 2017 to address continued load growth from the petrochemical industry in the Freeport, Texas area Expected capital expenditures for the proposed project incremental to the previously disclosed five-year capital plan Anticipate decision from ERCOT later in 2017; if approved, will make the necessary filings with the PUCT TCOS – Transmission Cost of Service; PUCT – Texas Public Utility Commission; DCRF – Distribution Cost Recovery Factor; ERCOT – Electric Reliability Council of Texas

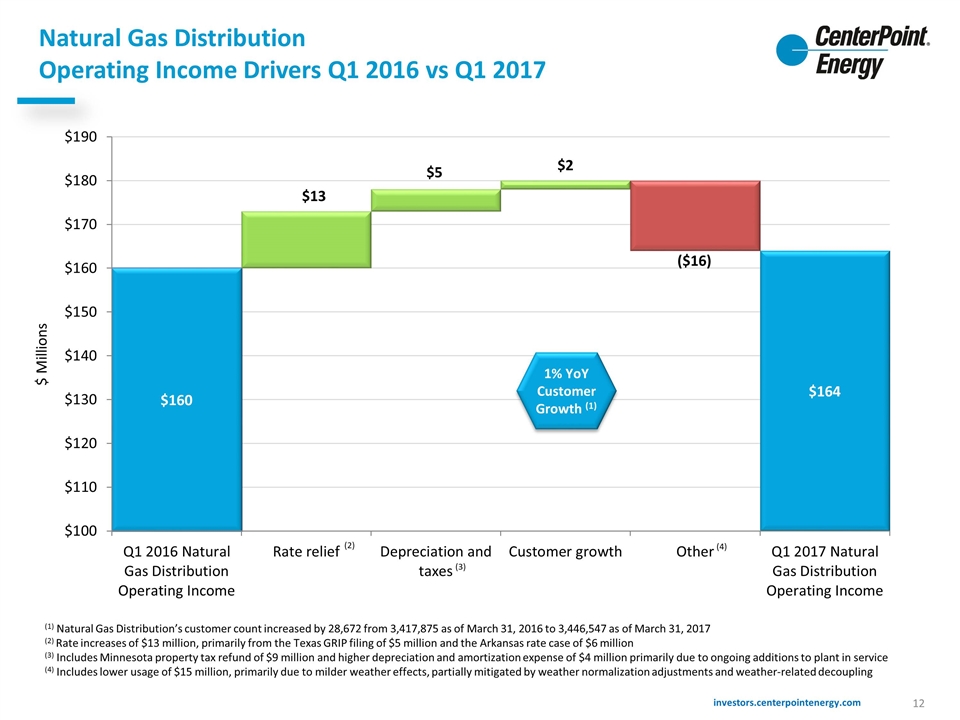

Natural Gas Distribution Highlights Natural Gas Distribution operating income was $164 million in Q1 2017 compared to $160 million in Q1 2016 Added more than 28,000 natural gas distribution customers year-over-year, representing 1% customer growth Houston/Texas Coast rate case settlement includes annual increase of $16.5 million and a 9.6% return on equity on a 55.15% equity capital structure; anticipate final order from RRC in Q2 2017 Arkansas FRP filed with the APSC in April 2017 for a proposed $9.3 million annual increase; effective in October 2017 South Texas and Beaumont/East Texas GRIP filed with the RRC in March 2017 for a proposed $7.6 million annual increase; effective in July 2017 FRP – Formula Rate Plan; GRIP – Gas Reliability Infrastructure Program; APSC – Arkansas Public Service Commission; RRC – Texas Railroad Commission

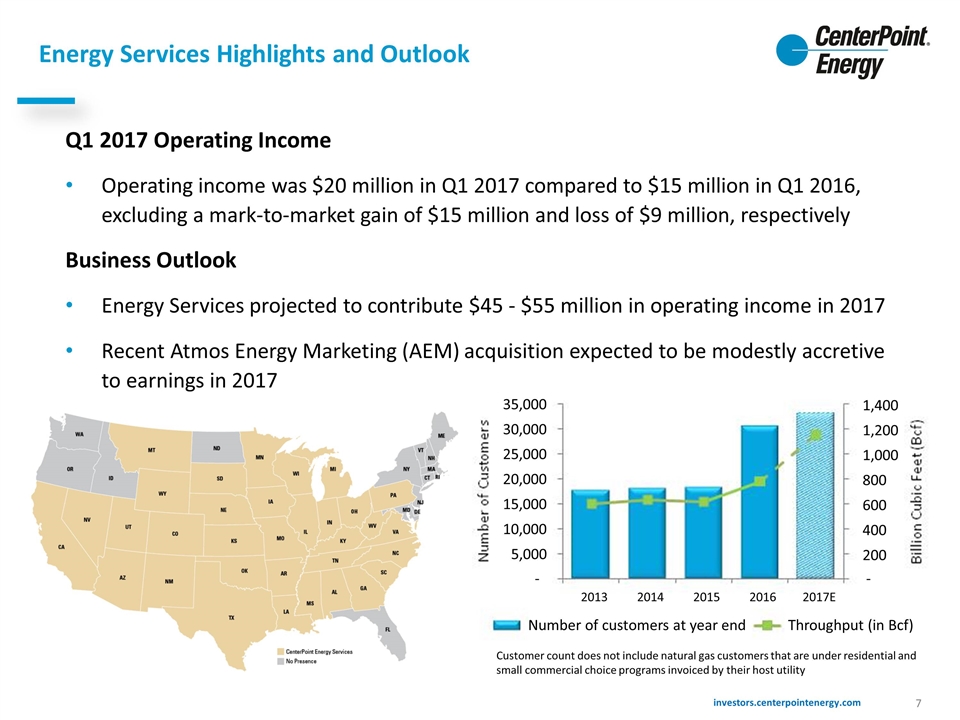

Energy Services Highlights and Outlook Q1 2017 Operating Income Operating income was $20 million in Q1 2017 compared to $15 million in Q1 2016, excluding a mark-to-market gain of $15 million and loss of $9 million, respectively Business Outlook Energy Services projected to contribute $45 - $55 million in operating income in 2017 Recent Atmos Energy Marketing (AEM) acquisition expected to be modestly accretive to earnings in 2017 Customer count does not include natural gas customers that are under residential and small commercial choice programs invoiced by their host utility 200 400 600 800 1,000 1,200 1,400 5,000 10,000 15,000 20,000 25,000 30,000 35,000 2013 2014 2015 2016 2017E Number of customers at year end Throughput (in Bcf) - -

Highlights from Enable Midstream’s Earnings Call on May 3, 2017 Source: Enable Midstream Partners, May 3, 2017, Press Release and Q1 Earnings Call. Please refer to these materials for an overview of Enable’s Q1 2017 performance Announcing Project Wildcat, providing premium market outlets for growing production out of the SCOOP and STACK plays in the Anadarko Basin and adding 400 million cubic feet per day (MMcf/d) of processing capacity Signed a 10-year, 205 MMcf/d firm natural gas transportation agreement with Newfield Exploration Company to transport Newfield’s production out of the Anadarko Basin Increased total revenues and net income attributable to limited partners and to common and subordinated units for first quarter 2017 compared to first quarter 2016 Increased per-day natural gas gathered, processed and transported volumes for first quarter 2017 compared to first quarter 2016 Quarterly cash distributions of $0.318 per unit on all outstanding common and subordinated units and $0.625 on all Series A Preferred Units

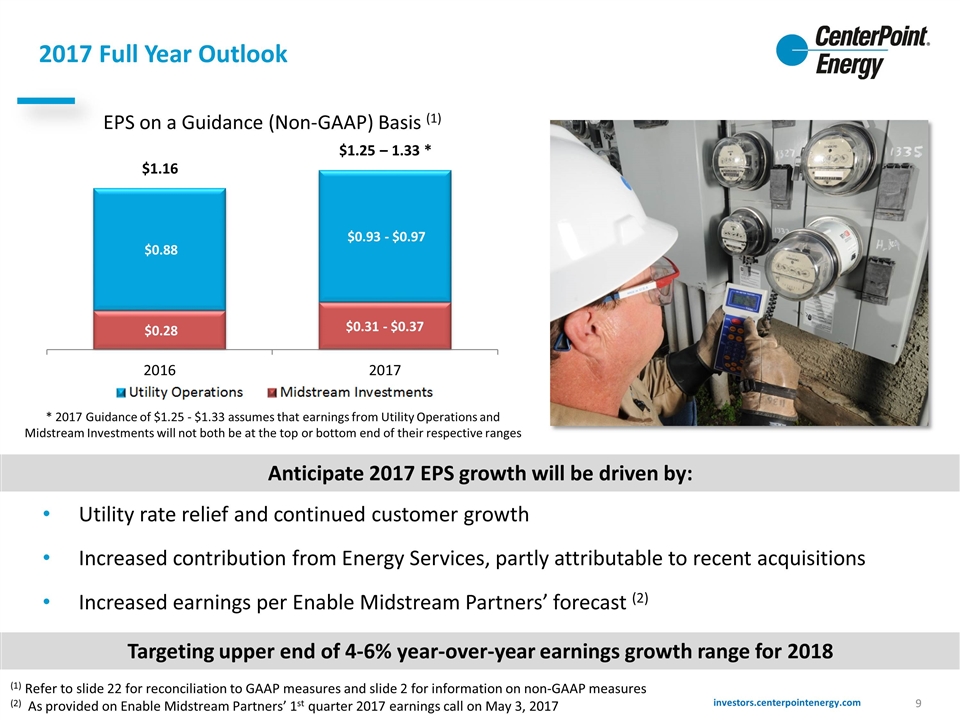

2017 Full Year Outlook Utility rate relief and continued customer growth Increased contribution from Energy Services, partly attributable to recent acquisitions Increased earnings per Enable Midstream Partners’ forecast (2) Anticipate 2017 EPS growth will be driven by: * 2017 Guidance of $1.25 - $1.33 assumes that earnings from Utility Operations and Midstream Investments will not both be at the top or bottom end of their respective ranges $1.16 $1.25 – 1.33 * (1) Refer to slide 22 for reconciliation to GAAP measures and slide 2 for information on non-GAAP measures (2) As provided on Enable Midstream Partners’ 1st quarter 2017 earnings call on May 3, 2017 EPS on a Guidance (Non-GAAP) Basis (1) Targeting upper end of 4-6% year-over-year earnings growth range for 2018

Scott Prochazka – President and CEO First Quarter Results Business Segment Highlights Houston Electric Natural Gas Distribution Energy Services Midstream Investments Full Year Outlook Bill Rogers – Executive Vice President and CFO Business Segment Performance Utility Operations EPS Drivers Consolidated EPS Drivers Investment and Financing Appendix Regulatory Update Core Operating Income Reconciliation Net Income Reconciliation

Electric Transmission and Distribution Operating Income Drivers Q1 2016 vs Q1 2017 (1) Houston Electric’s customer count increased by 49,409 from 2,364,784 as of March 31, 2016 to 2,414,193 as of March 31, 2017 (2) Q1 2016 TDU core operating income represents total segment operating income of $83 million, excluding operating income from transition and system restoration bonds of $24 million (3) Includes rate increases of $16 million related to distribution capital investments and lower net transmission-related revenues of $2 million (4) Includes lower equity return of $6 million, primarily due to the annual true-up of transition charges correcting for over-collections that occurred during the preceding 12 months, lower usage of $4 million primarily due to milder weather, and higher operation and maintenance expenses of $2 million (5) Q1 2017 TDU core operating income represents total segment operating income of $78 million, excluding operating income from transition and system restoration bonds of $20 million 2% YoY Customer Growth (1) $59 $58 (2) (3) (4) (5)

Natural Gas Distribution Operating Income Drivers Q1 2016 vs Q1 2017 (1) Natural Gas Distribution’s customer count increased by 28,672 from 3,417,875 as of March 31, 2016 to 3,446,547 as of March 31, 2017 (2) Rate increases of $13 million, primarily from the Texas GRIP filing of $5 million and the Arkansas rate case of $6 million (3) Includes Minnesota property tax refund of $9 million and higher depreciation and amortization expense of $4 million primarily due to ongoing additions to plant in service (4) Includes lower usage of $15 million, primarily due to milder weather effects, partially mitigated by weather normalization adjustments and weather-related decoupling (2) (3) (4) 1% YoY Customer Growth (1)

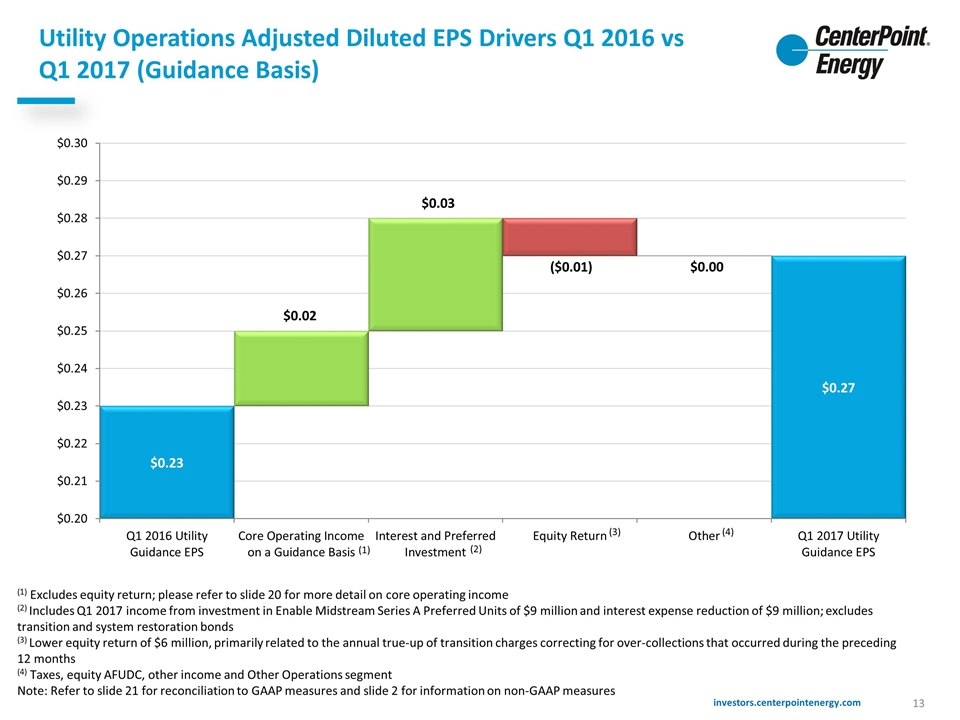

Utility Operations Adjusted Diluted EPS Drivers Q1 2016 vs Q1 2017 (Guidance Basis) (1) Excludes equity return; please refer to slide 20 for more detail on core operating income (2) Includes Q1 2017 income from investment in Enable Midstream Series A Preferred Units of $9 million and interest expense reduction of $9 million; excludes transition and system restoration bonds (3) Lower equity return of $6 million, primarily related to the annual true-up of transition charges correcting for over-collections that occurred during the preceding 12 months (4) Taxes, equity AFUDC, other income and Other Operations segment Note: Refer to slide 21 for reconciliation to GAAP measures and slide 2 for information on non-GAAP measures (1) (2) (3) (4)

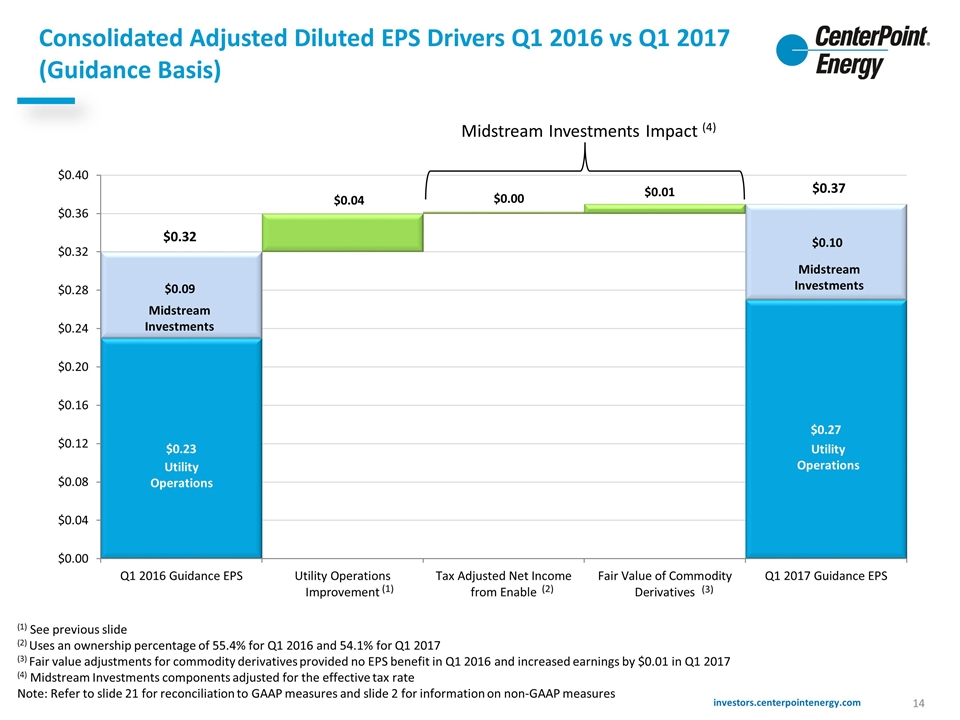

Consolidated Adjusted Diluted EPS Drivers Q1 2016 vs Q1 2017 (Guidance Basis) Utility Operations Midstream Investments $0.32 $0.37 Midstream Investments Utility Operations (1) See previous slide (2) Uses an ownership percentage of 55.4% for Q1 2016 and 54.1% for Q1 2017 (3) Fair value adjustments for commodity derivatives provided no EPS benefit in Q1 2016 and increased earnings by $0.01 in Q1 2017 (4) Midstream Investments components adjusted for the effective tax rate Note: Refer to slide 21 for reconciliation to GAAP measures and slide 2 for information on non-GAAP measures (1) (2) (3) Midstream Investments Impact (4)

Investment and Financing 2017 Investment and Financing Planned capital investment of approximately $1.5 billion (1) Net incremental borrowing anticipated of $200 - $500 million Equity issuance not anticipated Guidance EPS growth of 8% to 15% projected to reduce the 2017 payout ratio to be in the range of 80% to 86% (from $1.07/$1.33 to $1.07/$1.25) (2) 2017 Income Tax Q1 2017 Effective Tax Rate: 36% Expected Full Year 2017 Effective Tax Rate: 36% (1) 2017 – 2021 consolidated capital plan includes planned capital investment of approximately $7.0 billion; expected $250 million capital investment related to the proposed transmission project in the Freeport, Texas area would be incremental to the previously disclosed five-year capital plan (2) Refer to slide 2 for information on non-GAAP measures

Scott Prochazka – President and CEO First Quarter Results Business Segment Highlights Houston Electric Natural Gas Distribution Energy Services Midstream Investments Full Year Outlook Bill Rogers – Executive Vice President and CFO Business Segment Performance Utility Operations EPS Drivers Consolidated EPS Drivers Investment and Financing Appendix Regulatory Update Core Operating Income Reconciliation Net Income Reconciliation

Electric Transmission and Distribution Q1 2017 Regulatory Update Mechanism Docket # Annual Increase (1) ($ in millions) Filing Date Effective Date Approval Date Additional Information DCRF 47032 $44.6 April 2017 TBD TBD Based on an increase in eligible distribution-invested capital for 2016 of $479 million. Anticipated effective date in September 2017. TCOS 46703 $7.8 December 2016 February 2017 February 2017 Based on an incremental increase in total rate base of $109.6 million. DCRF – Distribution Cost Recovery Factor; TCOS – Transmission Cost of Service; TBD – to be determined (1) Represents proposed increases when effective date and/or approval date is not yet available. Approved rates could differ materially

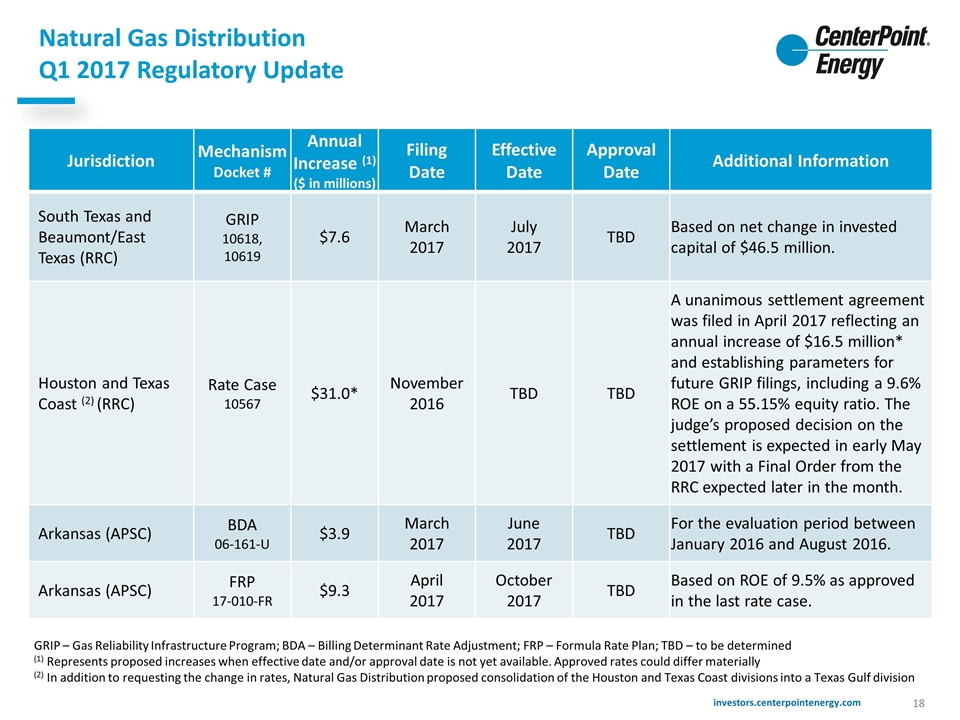

Natural Gas Distribution Q1 2017 Regulatory Update Jurisdiction Mechanism Docket # Annual Increase (1) ($ in millions) Filing Date Effective Date Approval Date Additional Information South Texas and Beaumont/East Texas (RRC) GRIP 10618, 10619 $7.6 March 2017 July 2017 TBD Based on net change in invested capital of $46.5 million. Houston and Texas Coast (2) (RRC) Rate Case 10567 $31.0* November 2016 TBD TBD A unanimous settlement agreement was filed in April 2017 reflecting an annual increase of $16.5 million* and establishing parameters for future GRIP filings, including a 9.6% ROE on a 55.15% equity ratio. The judge’s proposed decision on the settlement is expected in early May 2017 with a Final Order from the RRC expected later in the month. Arkansas (APSC) BDA 06-161-U $3.9 March 2017 June 2017 TBD For the evaluation period between January 2016 and August 2016. Arkansas (APSC) FRP 17-010-FR $9.3 April 2017 October 2017 TBD Based on ROE of 9.5% as approved in the last rate case. GRIP – Gas Reliability Infrastructure Program; BDA – Billing Determinant Rate Adjustment; FRP – Formula Rate Plan; TBD – to be determined (1) Represents proposed increases when effective date and/or approval date is not yet available. Approved rates could differ materially (2) In addition to requesting the change in rates, Natural Gas Distribution proposed consolidation of the Houston and Texas Coast divisions into a Texas Gulf division

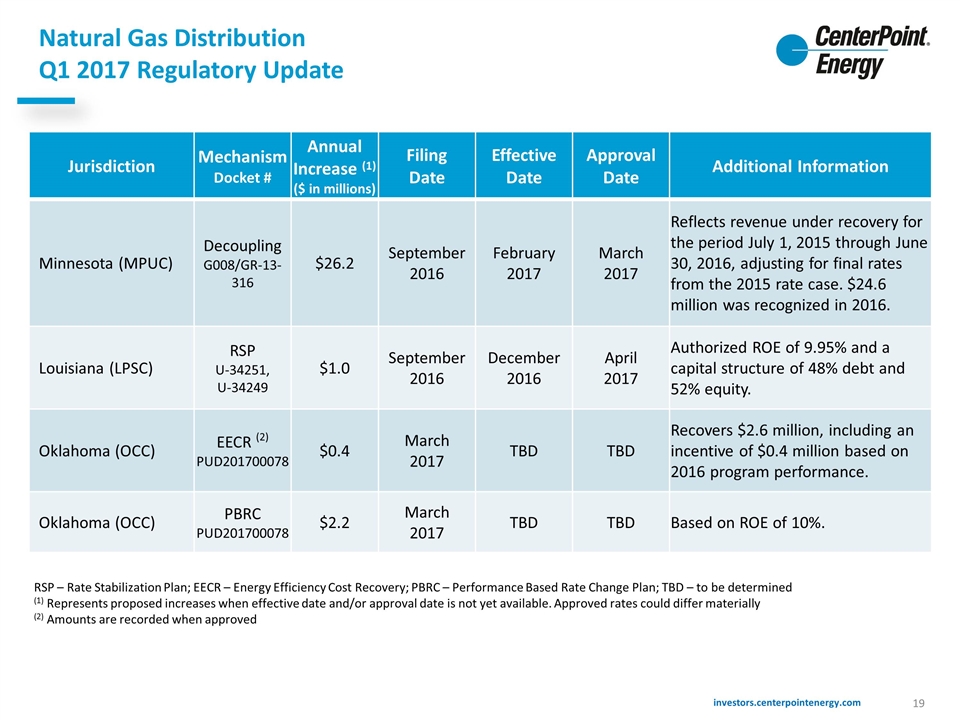

Natural Gas Distribution Q1 2017 Regulatory Update Jurisdiction Mechanism Docket # Annual Increase (1) ($ in millions) Filing Date Effective Date Approval Date Additional Information Minnesota (MPUC) Decoupling G008/GR-13-316 $26.2 September 2016 February 2017 March 2017 Reflects revenue under recovery for the period July 1, 2015 through June 30, 2016, adjusting for final rates from the 2015 rate case. $24.6 million was recognized in 2016. Louisiana (LPSC) RSP U-34251, U-34249 $1.0 September 2016 December 2016 April 2017 Authorized ROE of 9.95% and a capital structure of 48% debt and 52% equity. Oklahoma (OCC) EECR (2) PUD201700078 $0.4 March 2017 TBD TBD Recovers $2.6 million, including an incentive of $0.4 million based on 2016 program performance. Oklahoma (OCC) PBRC PUD201700078 $2.2 March 2017 TBD TBD Based on ROE of 10%. RSP – Rate Stabilization Plan; EECR – Energy Efficiency Cost Recovery; PBRC – Performance Based Rate Change Plan; TBD – to be determined (1) Represents proposed increases when effective date and/or approval date is not yet available. Approved rates could differ materially (2) Amounts are recorded when approved

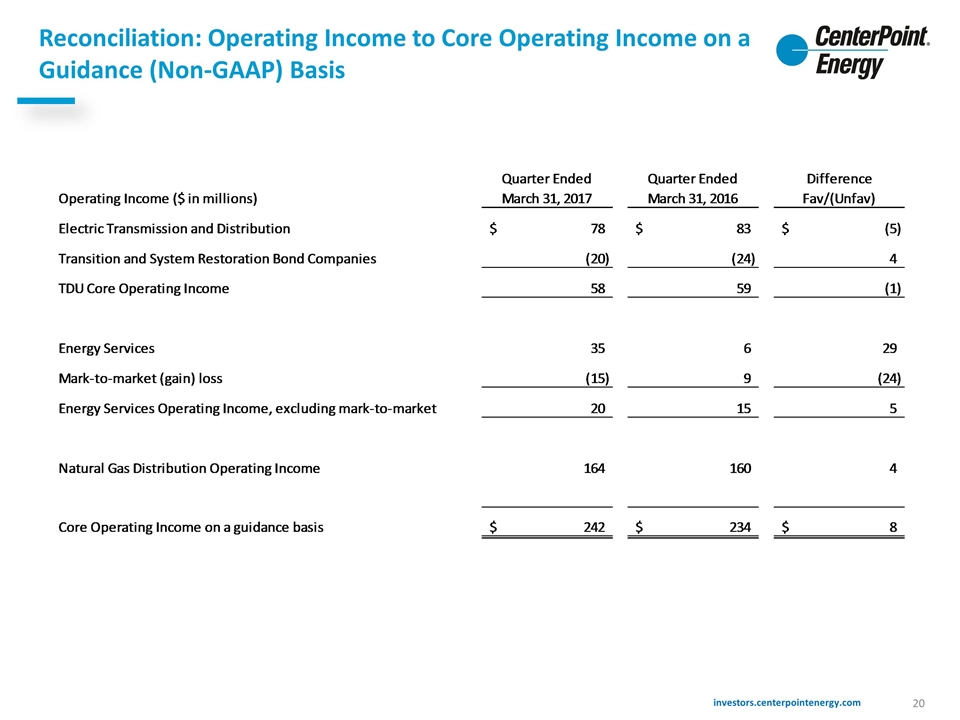

Reconciliation: Operating Income to Core Operating Income on a Guidance (Non-GAAP) Basis Operating Income ($ in millions) Quarter Ended March 31, 2017 Quarter Ended March 31, 2016 DifferenceFav/(Unfav) Electric Transmission and Distribution $78 $83 $-5 Transition and System Restoration Bond Companies -20 -24 4 TDU Core Operating Income 58 59 -1 Energy Services 35 6 29 Mark-to-market (gain) loss -15 9 -24 Energy Services Operating Income, excluding mark-to-market 20 15 5 Natural Gas Distribution Operating Income 164 160 4 Core Operating Income on a guidance basis $242 $234 $8

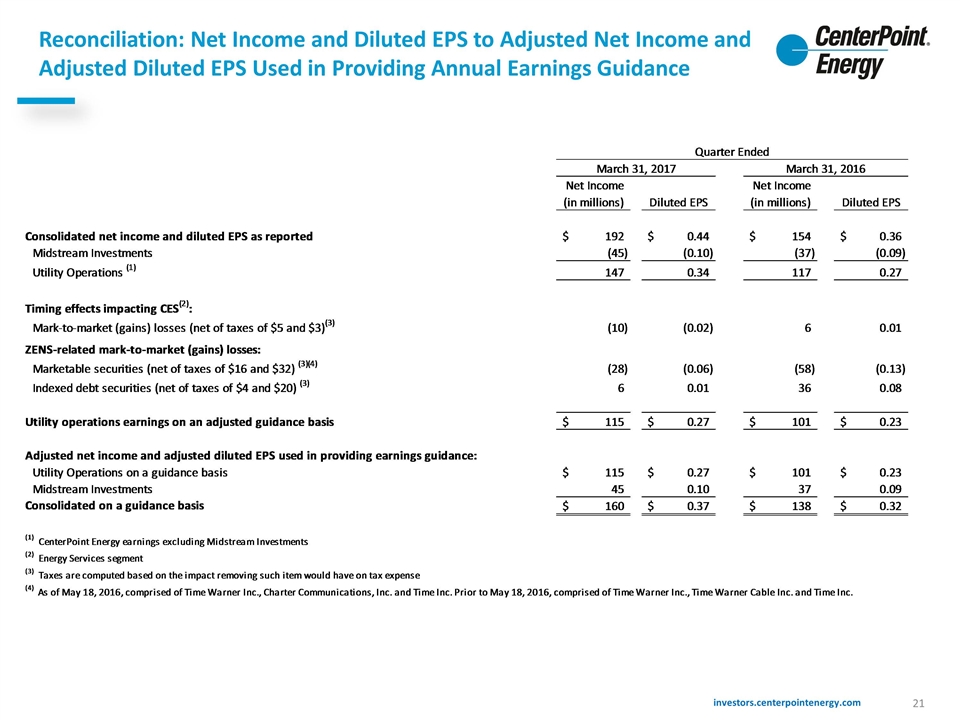

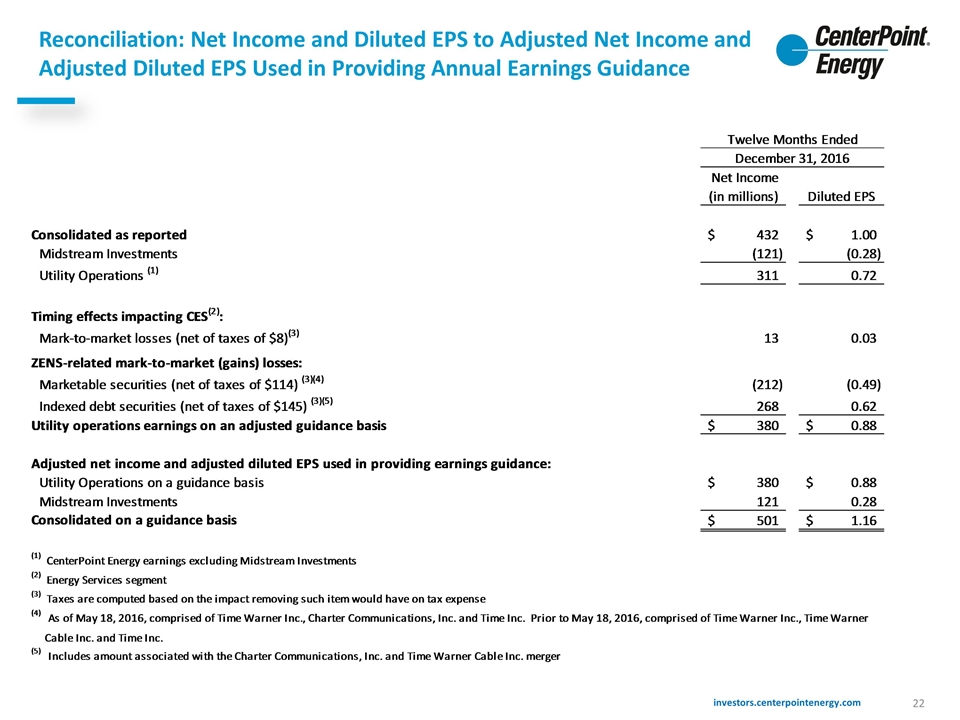

Reconciliation: Net Income and Diluted EPS to Adjusted Net Income and Adjusted Diluted EPS Used in Providing Annual Earnings Guidance

Reconciliation: Net Income and Diluted EPS to Adjusted Net Income and Adjusted Diluted EPS Used in Providing Annual Earnings Guidance