Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - TRECORA RESOURCES | v466170_ex99-1.htm |

| 8-K - FORM 8-K - TRECORA RESOURCES | v466170_8k.htm |

Exhibit 99.2

Click to edit Master title style TREC Your Specialty Chemical Partner First Quarter 2017 Financial Results May 4, 2017

2 Safe Harbor Statements in this presentation that are not historical facts are forward looking statements as defined in the Private Securities Litigation Reform Act of 1995 . Forward looking statements are based upon Management's belief, as well as, assumptions made by and information currently available to Management . Because such statements are based upon expectations as to future economic performance and are not statements of fact, actual results may differ from those projected . These risks, as well as others, are discussed in greater detail in Trecora Resources' filings with the Securities and Exchange Commission, including Trecora Resources' Annual Report on Form 10 - K for the year ended December 31 , 2016 , and the Company‘s subsequent Quarterly Reports on Form 10 - Q .

3 First Quarter 2017 Overview » Continued strong investment in transformational capital projects » Enable the Company to fully participate in the resurgence of the NA chemical industry » Excellent operational performance at South Hampton Resources » Prime Products sales at SHR impacted primarily by one customer » Advanced Reformer project start - up expected in Q4 » Continued strong annual revenue growth at Trecora Chemical » Acquisition of B Plant increased capabilities » Distillation Unit is operational and revenue generating starting in April » Hydrogenation Unit to start up this quarter » AMAK is steadily improving after restart of processing operations in December

4 SHR Update • Quarterly prime product volume decreased 5.0%; excluding Canadian oil sands up 7.6% • International sales impacted by reduced off - take by Canadian oil sands customer • Start up of major customer’s PE expansion on track for Q3 • Second Canadian oil sands customer expected to start in early 2018 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 2009 2010 2011 2012 2013 2014 2015 2016 1Q17 International % of petrochemical volume sold 1Q17 4Q16 1Q16 1Q15 All Products 17.3 18.4 20.4 18.1 Prime Products 13.9 14.5 14.7 14.1 Byproducts 3.4 3.9 5.7 4.0 Deferred Sales 1.6 1.5 1.4 2.5 (million gallons) Petrochemical Sales Volumes

5 SHR Update » No major refurbishment projects this quarter (A & C Trains completed in ‘16) » Extra capacity allows for significant flexibility » A Train continues to be used for new product trials/production » New Products » 80K gallons of first product sold at good margins. Working on a more cost effective production process » Successful customer trial for second product. Waiting to hear on commercial use » Continued work on economically producing the third product » Fourth product is on hold for now » SHR Advanced Reformer » $52 million; on schedule for start up in 4Q17 » Convert ~30 - 40 million gallons/year of byproducts sold at higher value aromatics; technology proven in trial at SHR » Add ~$12 - $14 M/year in EBITDA; 2018 - 2022

6 SHR Advanced Reformer Project

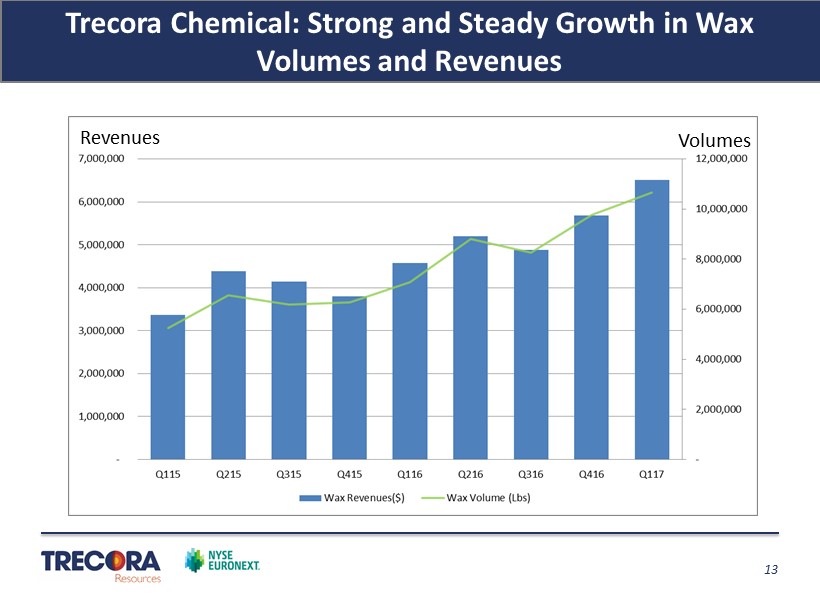

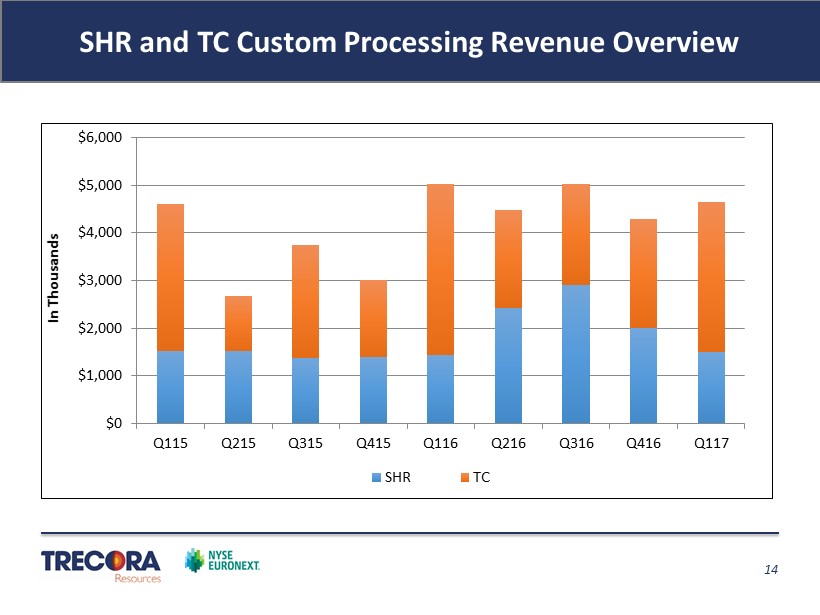

7 Trecora Chemical Update » Quarterly Revenue – up 19% year over year and 21% sequentially » Revenue up 50% year - over - year excluding a final non - use fees payment in first quarter of 2016 » Wax » Sales volumes for high margin Hot Melt Adhesives and PVC Lubricants wax are more than double from fourth quarter » Continued strong sales in Europe and Latin America » Custom Processing » Good progress notwithstanding loss of $1.7million in non - use fees » Thirteen proposals, three successful trials and four new contracts during the quarter » B Plant revenues of $1MM in first quarter; we expect $4 - $6 M/year in EBITDA in 2018 » TC Hydrogenation/Distillation Unit » Distillation Unit is on - line and revenue generating; Hydrogenation Unit expected to start up this quarter » Total capital estimate is now approximately $23 million. Additional costs due to, amongst other things, increases in metal prices and some used reactor fittings proving to be unsuitable » Doubles potential custom processing revenue - expect additional $6 - $8 M/year in EBITDA in ‘18

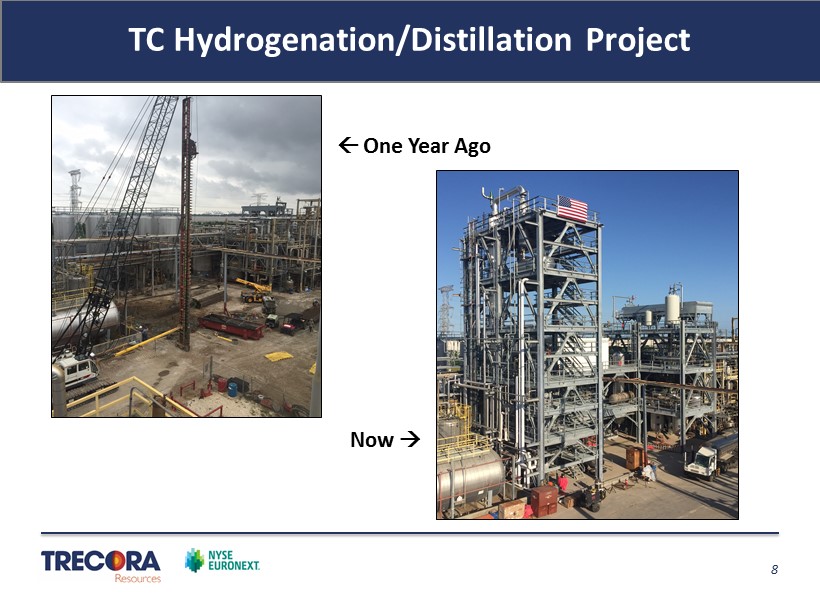

8 TC Hydrogenation/Distillation Project One Year Ago Now

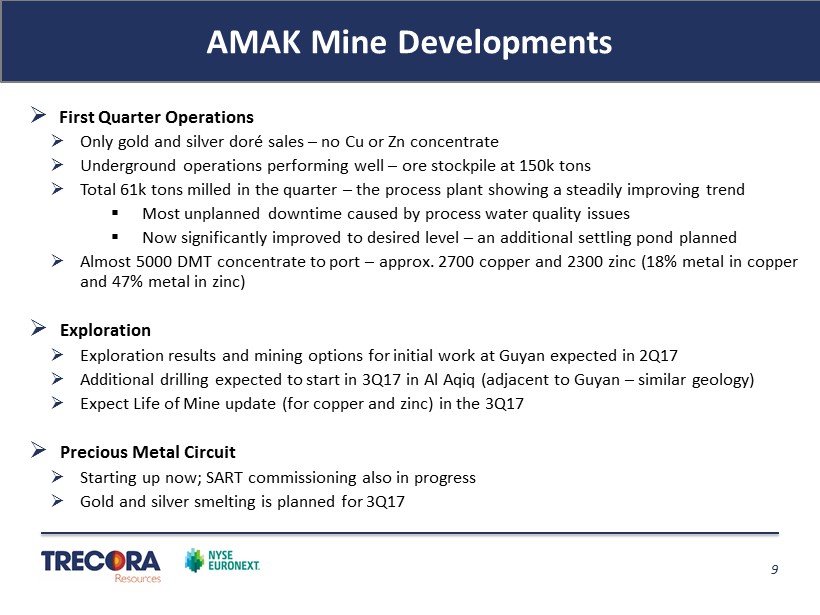

9 AMAK Mine Developments » First Quarter Operations » Only gold and silver doré sales – no Cu or Zn concentrate » Underground operations performing well – ore stockpile at 150k tons » Total 61k tons milled in the quarter – the process plant showing a steadily improving trend ▪ Most unplanned downtime caused by process water quality issues ▪ Now significantly improved to desired level – an additional settling pond planned » Almost 5000 DMT concentrate to port – approx. 2700 copper and 2300 zinc (18% metal in copper and 47% metal in zinc ) » Exploration » Exploration results and mining options for initial work at Guyan expected in 2Q17 » Additional drilling expected to start in 3Q17 in Al Aqiq (adjacent to Guyan – similar geology) » Expect Life of Mine update (for copper and zinc) in the 3Q17 » Precious Metal Circuit » Starting up now; SART commissioning also in progress » Gold and silver smelting is planned for 3Q17

10 Financial Overview – 1 st Quarter 2017 » Revenue was $55.5 million as compared to $52.2 million in the first quarter of 2016 and $54.2 million in the fourth quarter of 2016 » Prime Products sales volumes at South Hampton Resources were 13.9 million gallons compared to 14.4 million gallons in the fourth quarter due the impact from a major Canadian Oil Sands customer. » Feedstock costs up about 6% at SHR including impact of penalty fees compared to fourth quarter. » Trecora Chemical achieved record wax sales and quarterly total revenue » Diluted EPS was $0.06 includes equity in AMAK losses with an estimated after tax impact of ($0.03) per share » Adjusted EBITDA was $7.4 million as compared to $9.2 million first quarter of 2016 and $5.7 million in the fourth quarter of 2016

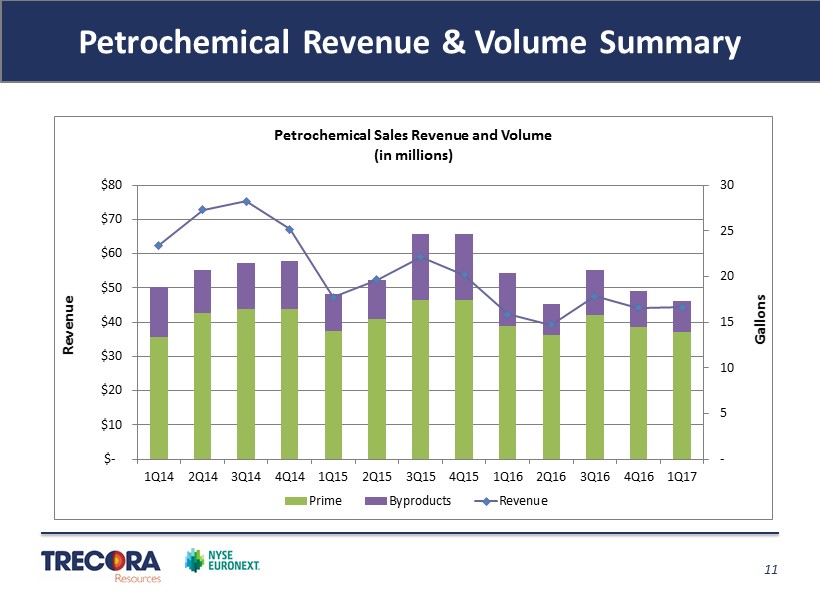

11 Petrochemical Revenue & Volume Summary - 5 10 15 20 25 30 $- $10 $20 $30 $40 $50 $60 $70 $80 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 Gallons Revenue Petrochemical Sales Revenue and Volume (in millions) Prime Byproducts Revenue

12 Petrochemical Feed Cost Summary Jan-15 Apr-15 Jul-15 Oct-15 Jan-16 Apr-16 Jul-16 Oct-16 Jan-17 Apr-17 Processed Feedstock Cost versus Market Price (per gallon) Processed Cost Market

13 Trecora Chemical: Strong and Steady Growth in Wax Volumes and Revenues Revenues Volumes

14 SHR and TC Custom Processing Revenue Overview $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 Q115 Q215 Q315 Q415 Q116 Q216 Q316 Q416 Q117 In Thousands SHR TC

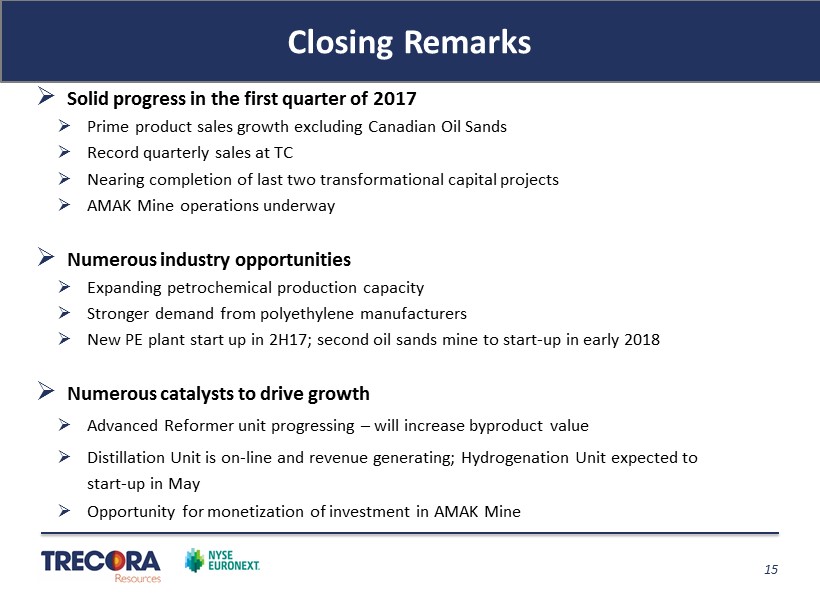

15 Closing Remarks » Solid progress in the first quarter of 2017 » Prime product sales growth excluding Canadian Oil Sands » Record quarterly sales at TC » Nearing completion of last two transformational capital projects » AMAK Mine operations underway » Numerous industry opportunities » Expanding petrochemical production capacity » Stronger demand from polyethylene manufacturers » New PE plant start up in 2H17; second oil sands mine to start - up in early 2018 » Numerous catalysts to drive growth » Advanced Reformer unit progressing – will increase byproduct value » Distillation Unit is on - line and revenue generating; Hydrogenation Unit expected to start - up in May » Opportunity for monetization of investment in AMAK Mine

16 Q&A Thank You Please visit our websites: www.trecora.com www.southhamptonr.com www.TrecChem.com www.amak.com.sa

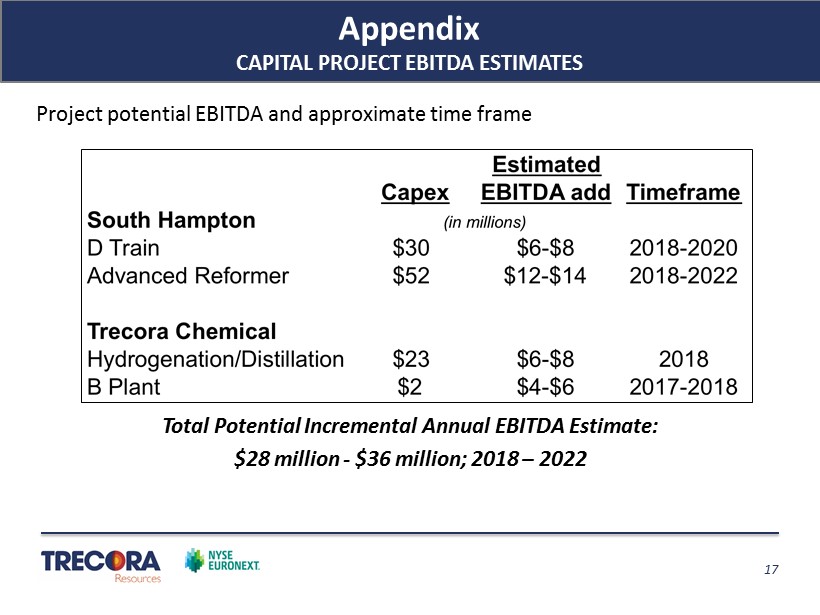

17 Appendix CAPITAL PROJECT EBITDA ESTIMATES Project potential EBITDA and approximate time frame Total Potential Incremental Annual EBITDA Estimate: $28 million - $36 million; 2018 – 2022

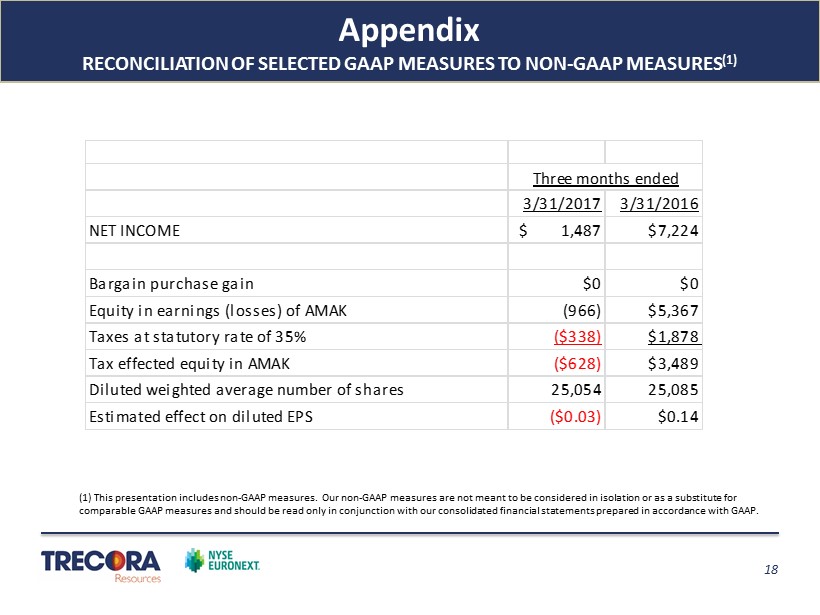

18 Appendix RECONCILIATION OF SELECTED GAAP MEASURES TO NON - GAAP MEASURES (1) (1) This presentation includes non - GAAP measures. Our non - GAAP measures are not meant to be considered in isolation or as a sub stitute for comparable GAAP measures and should be read only in conjunction with our consolidated financial statements prepared in accord anc e with GAAP. 3/31/2017 3/31/2016 NET INCOME $ 1,487 $7,224 Bargain purchase gain $0 $0 Equity in earnings (losses) of AMAK (966) $5,367 Taxes at statutory rate of 35% ($338) $1,878 Tax effected equity in AMAK ($628) $3,489 Diluted weighted average number of shares 25,054 25,085 Estimated effect on diluted EPS ($0.03) $0.14 Three months ended