Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - ION GEOPHYSICAL CORP | ex991earningsrelease2017-q1.htm |

| 8-K - 8-K - ION GEOPHYSICAL CORP | a8k-2017xq1xearnings.htm |

ION Earnings Call – Q1 2017

Earnings Call Presentation

May 4, 2017

Corporate Participants and Contact Information

CONTACT INFORMATION

If you have technical problems during the call, please contact DENNARD–LASCAR Associates

at 713 529 6600.

If you would like to view a replay of today's call, it will be available via webcast in the Investor Relations

section of the Company's website at www.iongeo.com for approximately 12 months.

BRIAN HANSON

President and

Chief Executive Officer

STEVE BATE

Executive Vice President

and Chief Financial Officer

2

Forward-Looking Statements

The information included herein contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and Section 21E

of the Securities Exchange Act of 1934.

Actual results may vary fundamentally from those described in these

forward-looking statements.

All forward-looking statements reflect numerous assumptions and involve a

number of risks and uncertainties.

These risks and uncertainties include risk factors that are disclosed by ION

from time to time in its filings with the Securities and Exchange Commission.

3

Revenues $M

4

• Revenues of $33M

• Up 44% compared to Q1-16

• Driven in part by continued strong

sales of Campeche program and an

increase in data library sales

• Nearing completion on last major

financial challenge, patent

litigation with WesternGeco

• Recent ruling indicated that we will

be held to have willfully infringed

• We will be ordered to pay $5M

when the final order is issued, low

end of maximum range up to $44M

• Eight-year-old lawsuit does not

reflect the current spirit of

collaboration with WesternGeco

ION Q1-17 Financial Highlights

(3.30)

(1.55)

$(3.50)

$(3.00)

$(2.50)

$(2.00)

$(1.50)

$(1.00)

$(0.50)

$-

Adjusted EPS

Q1-16 Q1-17

(35)

(18)

($40)

($35)

($30)

($25)

($20)

($15)

($10)

($5)

$0

Adjusted Net Loss

Q1-16 Q1-17

23

35

33

$-

$5

$10

$15

$20

$25

$30

$35

$40

Q1-16 Q4-16 Q1-17

(17)

0

$(20)

$(15)

$(10)

$(5)

$-

Q1-16

Adjusted EBITDA $M

Q1-17

ION Q1-17 Highlights

5

E&P Technology & Services E&P Operations Optimization

Completed 39 deployments total of

Marlin, adding significant value for

clients

Received Scottish Enterprise funding

for Marlin software development

Renewed long-term command and

control contract with major customer

Ocean Bottom Seismic Services

Continue to work on, and are strongly

positioned for, tenders in the region

Aligned with E&P companies’

production objectives, OBS tender

activity increased significantly: 20

projects worth over $1B announced to

take place over the next two years

Significant increase in new venture

and data library revenues

Increase in Campeche sales pipeline

due to upcoming Mexico bid rounds

and new bid round regulations

– Continue receiving positive feedback on

turnaround time and imaging uplift

Imaging Services group close to fully

utilized, primarily on higher potential

projects

New venture activity picking up. We

sanctioned 3 programs, which met our

conservative underwriting standards,

to kick off in the next 90 days.

E&P Advisors awarded contract to

provide technical advice for Faroe

Islands Licensing Round

R&D Programs Positioning ION for Upturn

Maintained R&D programs through the downturn, which are key to

positioning ION to take advantage of the impending market upturn

Introducing a new nodal OBS solution, 4Sea®, providing a step change

in image quality and efficiency, driving down the cost of acquisition and

improving economics so it can be applied to more production projects

Industry-leading FWI imaging technology is new approach to develop

data-driven reservoir models, ultimately increasing resolution and

contrast to improve reservoir understanding and production

Devices group commercialized three new technologies that provide

valuable new capabilities for our marine contractor customers while

leveraging their existing equipment

6

DigiLIFT™

Rechargeable batteries Acoustics in Deployment

(3.30)

(1.55)

$(4.00)

$(3.00)

$(2.00)

$(1.00)

$-

Adjusted EPS

Q1-16

7

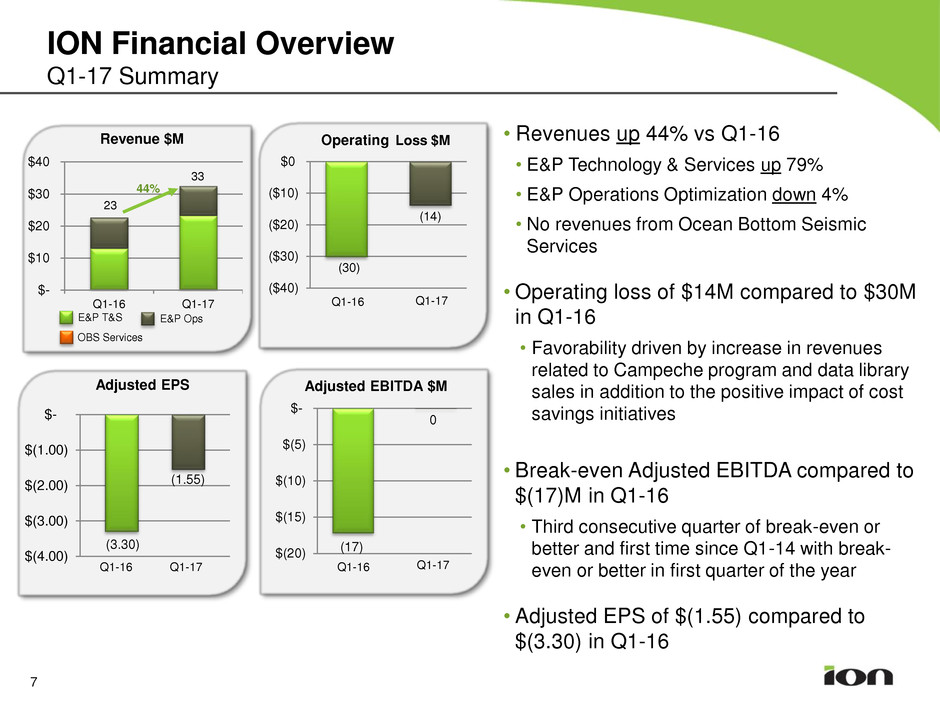

ION Financial Overview

Q1-17 Summary

$-

$10

$20

$30

$40

Q1-16 Q1-17

23

33

44%

OBS Services

E&P Ops E&P T&S

Revenue $M • Revenues up 44% vs Q1-16

• E&P Technology & Services up 79%

• E&P Operations Optimization down 4%

• No revenues from Ocean Bottom Seismic

Services

•Operating loss of $14M compared to $30M

in Q1-16

• Favorability driven by increase in revenues

related to Campeche program and data library

sales in addition to the positive impact of cost

savings initiatives

• Break-even Adjusted EBITDA compared to

$(17)M in Q1-16

• Third consecutive quarter of break-even or

better and first time since Q1-14 with break-

even or better in first quarter of the year

• Adjusted EPS of $(1.55) compared to

$(3.30) in Q1-16

(30)

(14)

($40)

($30)

($20)

($10)

$0

T

h

o

u

s

a

n

d

s

Q1-16 Q1-17

Q1-17

Operating Loss $M

(17)

0

$(20)

$(15)

$(10)

$(5)

$-

Q1-16

Adjusted EBITDA $M

Q1-17

ION Financial Overview

Cash Flow $M

8

• Net cash flows from operations

of $2.0M in Q1-17 vs $2.5M in

prior year

• Ability to generate cash from

operations in Q1-17

demonstrates rightsizing of

business

• Total net cash flows of $(3.0)M

in Q1-17 vs $(8.2)M in Q1-16

• Cash balance of $40M,

excluding borrowings under

credit facility

• Credit facility borrowings of $10M

• Remaining availability of $10M

hindered by exclusion of

Campeche non-qualifying high

quality receivables

• Canceled “at-the-market”

equity program

Q1-16 Q1-17

Net loss (35.0)$ (23.0)$

Non-cash adjustments 13.6 17.6

Working capital 23.9 7.4

Net cash from operations 2.5 2.0

Multi-client investment (6.3) (3.4)

PP&E capital expenditures (0.3) (0.1)

Net cash from investing activities (6.6) (3.4)

Repurchase of common stock (1.0) -

Payments of debt (2.2) (1.7)

ther financing activities (1.3) (0.3)

Net cash from fin cing activities (4.5) (2.0)

Effect of change n f/x 0.3 0.4

Net change cash (8.2) (3.0)

Cash & cash equiv. (beg. of period) 84.9 52.7

Cash & cash equiv. (end of period) 76.7$ 49.7$

Summary

Expect E&P market to start improving

– Expect a modest increase in 2017 E&P spending

– Expect growth in seismic spending to lag behind other oil and gas segments

– OBS tender activity has picked up and we are seeing renewed interest in

underwriting new venture programs for the first time in two years

– Well positioned with data libraries in areas of counter-cyclical activity ahead

of upcoming license rounds

– Excited about new technology we are commercializing and believe there is

significant potential around Marlin

Expect 2017 to be a transition year for ION

– Believe 2017 will be a modest improvement over 2016

– Believe first half will be softer than the back half, especially considering back

half license round activity and natural purchasing patterns of our customers

– Maintained our capabilities, our workforce and our R&D programs – we’re

actively positioning ourselves to take full advantage of a more normal 2018

9

10

Q&A