Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GARTNER INC | it-03312017x8xk.htm |

| EX-99.1 - EXHIBIT 99.1 - GARTNER INC | it-03312017xex991.htm |

0 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

First Quarter 2017 Results

May 4th, 2017

1 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

Statements contained in this presentation regarding the growth and prospects of the business, the Company’s projected

2017 financial results, long-term objectives and all other statements in this presentation other than recitation of historical

facts are forward looking statements (as defined in the Private Securities Litigation Reform Act of 1995). Such forward

looking statements involve known and unknown risks, uncertainties and other factors; consequently, actual results may

differ materially from those expressed or implied thereby.

Factors that could cause actual results to differ materially include, but are not limited to, the ability to achieve and effectively

manage growth, including the ability to integrate our recent CEB acquisition, other acquisitions and consummate

acquisitions in the future; the ability to pay Gartner’s debt obligations, which have increased substantially with the recent

CEB acquisition; the ability to maintain and expand Gartner’s products and services; the ability to expand or retain Gartner’s

customer base; the ability to grow or sustain revenue from individual customers; the ability to attract and retain a

professional staff of research analysts and consultants upon whom Gartner is dependent; the ability to achieve continued

customer renewals and achieve new contract value, backlog and deferred revenue growth in light of competitive pressures;

the ability to carry out Gartner’s strategic initiatives and manage associated costs; the ability to successfully compete with

existing competitors and potential new competitors; the ability to enforce and protect our intellectual property rights;

additional risks associated with international operations including foreign currency fluctuations; the impact of restructuring

and other charges on Gartner’s businesses and operations; general economic conditions; risks associated with the credit

worthiness and budget cuts of governments and agencies; and other risks listed from time to time in Gartner’s reports filed

with the Securities and Exchange Commission, including Gartner’s most recent Annual Report on Form 10-K and Quarterly

Reports on Form 10-Q.

The Company’s SEC filings can be found on Gartner’s website at investor.gartner.com and on the SEC’s website at

www.sec.gov.. Forward looking statements included herein speak only as of May 4, 2017 and the Company disclaims

any obligation to revise or update such statements to reflect events or circumstances after this date or to reflect the

occurrence of unanticipated events or circumstances.

Forward Looking Statements

2 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

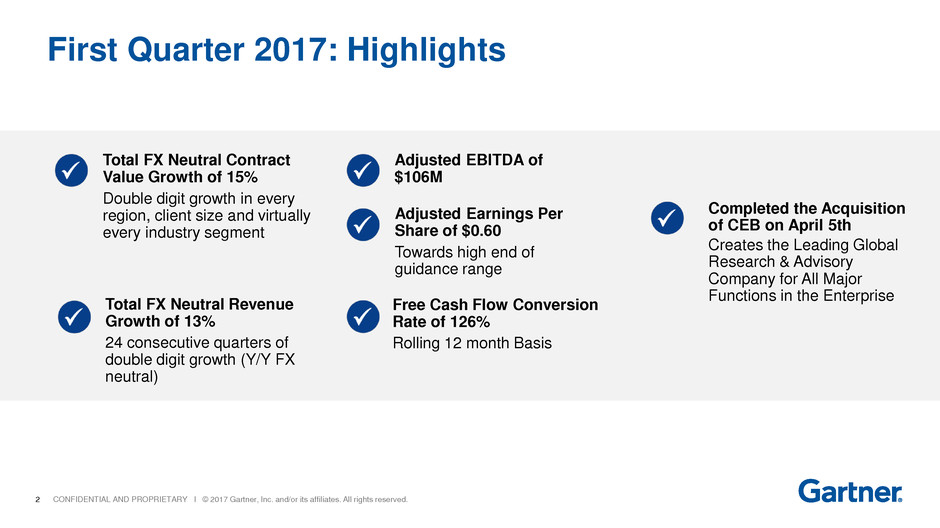

First Quarter 2017: Highlights

Total FX Neutral Contract

Value Growth of 15%

Double digit growth in every

region, client size and virtually

every industry segment

Total FX Neutral Revenue

Growth of 13%

24 consecutive quarters of

double digit growth (Y/Y FX

neutral)

Adjusted EBITDA of

$106M

Free Cash Flow Conversion

Rate of 126%

Rolling 12 month Basis

Completed the Acquisition

of CEB on April 5th

Creates the Leading Global

Research & Advisory

Company for All Major

Functions in the Enterprise

Adjusted Earnings Per

Share of $0.60

Towards high end of

guidance range

3 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

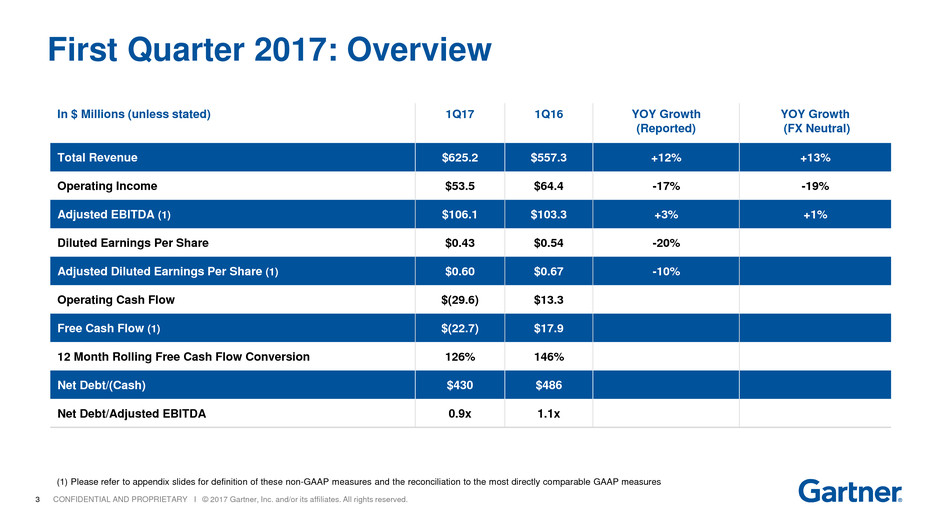

In $ Millions (unless stated) 1Q17 1Q16 YOY Growth

(Reported)

YOY Growth

(FX Neutral)

Total Revenue $625.2 $557.3 +12% +13%

Operating Income $53.5 $64.4 -17% -19%

Adjusted EBITDA (1) $106.1 $103.3 +3% +1%

Diluted Earnings Per Share $0.43 $0.54 -20%

Adjusted Diluted Earnings Per Share (1) $0.60 $0.67 -10%

Operating Cash Flow $(29.6) $13.3

Free Cash Flow (1) $(22.7) $17.9

12 Month Rolling Free Cash Flow Conversion 126% 146%

Net Debt/(Cash) $430 $486

Net Debt/Adjusted EBITDA 0.9x 1.1x

First Quarter 2017: Overview

(1) Please refer to appendix slides for definition of these non-GAAP measures and the reconciliation to the most directly comparable GAAP measures

4 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

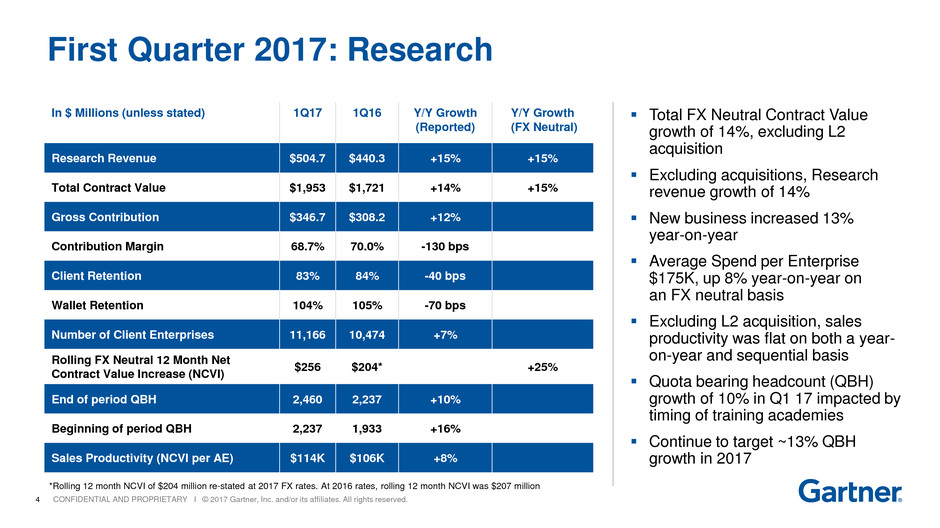

In $ Millions (unless stated) 1Q17 1Q16 Y/Y Growth

(Reported)

Y/Y Growth

(FX Neutral)

Research Revenue $504.7 $440.3 +15% +15%

Total Contract Value $1,953 $1,721 +14% +15%

Gross Contribution $346.7 $308.2 +12%

Contribution Margin 68.7% 70.0% -130 bps

Client Retention 83% 84% -40 bps

Wallet Retention 104% 105% -70 bps

Number of Client Enterprises 11,166 10,474 +7%

Rolling FX Neutral 12 Month Net

Contract Value Increase (NCVI)

$256 $204* +25%

End of period QBH 2,460 2,237 +10%

Beginning of period QBH 2,237 1,933 +16%

Sales Productivity (NCVI per AE) $114K $106K +8%

First Quarter 2017: Research

Total FX Neutral Contract Value

growth of 14%, excluding L2

acquisition

Excluding acquisitions, Research

revenue growth of 14%

New business increased 13%

year-on-year

Average Spend per Enterprise

$175K, up 8% year-on-year on

an FX neutral basis

Excluding L2 acquisition, sales

productivity was flat on both a year-

on-year and sequential basis

Quota bearing headcount (QBH)

growth of 10% in Q1 17 impacted by

timing of training academies

Continue to target ~13% QBH

growth in 2017

*Rolling 12 month NCVI of $204 million re-stated at 2017 FX rates. At 2016 rates, rolling 12 month NCVI was $207 million

5 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

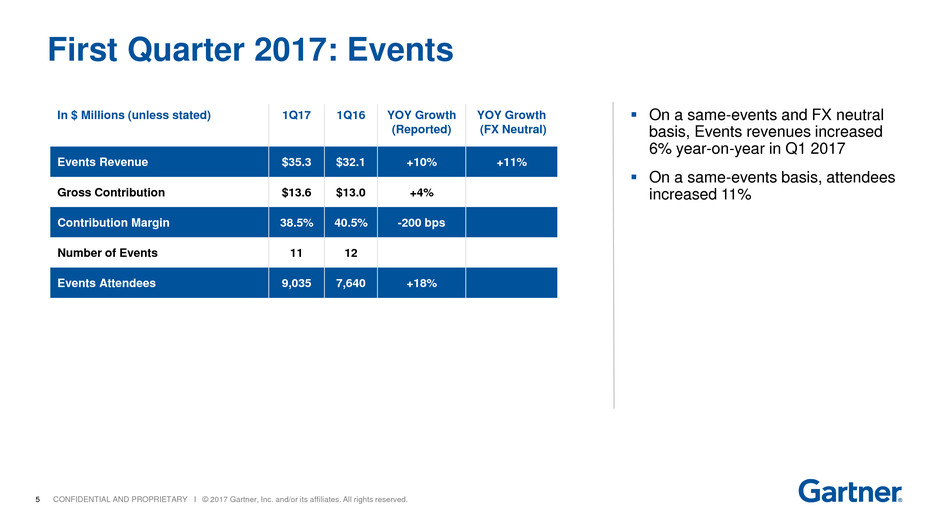

In $ Millions (unless stated) 1Q17 1Q16 YOY Growth

(Reported)

YOY Growth

(FX Neutral)

Events Revenue $35.3 $32.1 +10% +11%

Gross Contribution $13.6 $13.0 +4%

Contribution Margin 38.5% 40.5% -200 bps

Number of Events 11 12

Events Attendees 9,035 7,640 +18%

First Quarter 2017: Events

On a same-events and FX neutral

basis, Events revenues increased

6% year-on-year in Q1 2017

On a same-events basis, attendees

increased 11%

6 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

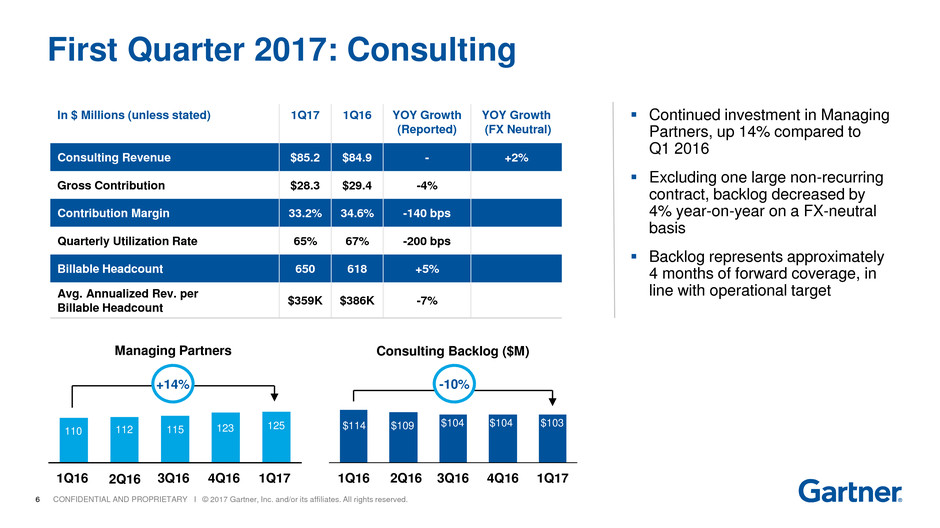

In $ Millions (unless stated) 1Q17 1Q16 YOY Growth

(Reported)

YOY Growth

(FX Neutral)

Consulting Revenue $85.2 $84.9 - +2%

Gross Contribution $28.3 $29.4 -4%

Contribution Margin 33.2% 34.6% -140 bps

Quarterly Utilization Rate 65% 67% -200 bps

Billable Headcount 650 618 +5%

Avg. Annualized Rev. per

Billable Headcount

$359K $386K -7%

First Quarter 2017: Consulting

Continued investment in Managing

Partners, up 14% compared to

Q1 2016

Excluding one large non-recurring

contract, backlog decreased by

4% year-on-year on a FX-neutral

basis

Backlog represents approximately

4 months of forward coverage, in

line with operational target

110 112 115 123

4Q163Q162Q161Q16 1Q17 3Q162Q161Q16

$114

4Q16 1Q17

Managing Partners Consulting Backlog ($M)

+14% -10%

$109 $104$104 $103125

7 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

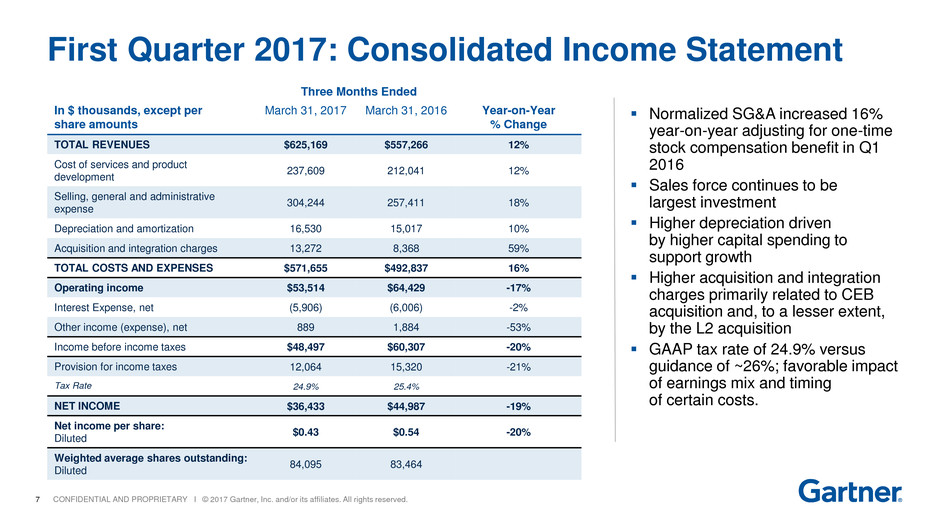

First Quarter 2017: Consolidated Income Statement

In $ thousands, except per

share amounts

March 31, 2017 March 31, 2016 Year-on-Year

% Change

TOTAL REVENUES $625,169 $557,266 12%

Cost of services and product

development

237,609 212,041 12%

Selling, general and administrative

expense

304,244 257,411 18%

Depreciation and amortization 16,530 15,017 10%

Acquisition and integration charges 13,272 8,368 59%

TOTAL COSTS AND EXPENSES $571,655 $492,837 16%

Operating income $53,514 $64,429 -17%

Interest Expense, net (5,906) (6,006) -2%

Other income (expense), net 889 1,884 -53%

Income before income taxes $48,497 $60,307 -20%

Provision for income taxes 12,064 15,320 -21%

Tax Rate 24.9% 25.4%

NET INCOME $36,433 $44,987 -19%

Net income per share:

Diluted

$0.43 $0.54 -20%

Weighted average shares outstanding:

Diluted

84,095 83,464

Normalized SG&A increased 16%

year-on-year adjusting for one-time

stock compensation benefit in Q1

2016

Sales force continues to be

largest investment

Higher depreciation driven

by higher capital spending to

support growth

Higher acquisition and integration

charges primarily related to CEB

acquisition and, to a lesser extent,

by the L2 acquisition

GAAP tax rate of 24.9% versus

guidance of ~26%; favorable impact

of earnings mix and timing

of certain costs.

Three Months Ended

8 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

First Quarter 2017: Adjusted Earnings Per Share(a)

In $ thousands, except per

share amounts

March 31, 2017 March 31, 2016 Year-on-Year

% Change

Net Income $36,433 $44,987 -19%

Acquisition and other adjustments:

Amortization of acquired intangibles (b) 6,196 6,089 N/M

Acquisition and integration adjustments (c) 13,415 8,368 N/M

Tax impact of adjustments (d) (5,406) (3,715) N/M

Adjusted net income $50,638 $55,729 -9%

Adjusted diluted earnings per share (e):

Diluted $0.60 $0.67 -10%

Weighted average shares outstanding:

Diluted 84,095 83,464

a) Adjusted earnings per share represents GAAP diluted earnings per share adjusted for the impact of certain items directly related to acquisitions and other items.

b) Consists of non-cash amortization charges from acquired intangibles.

c) Consists of directly-related incremental charges and adjustments from acquisitions.

d) The effective tax rates were 28% and 26% for the three months ended March 31, 2017 and 2016, respectively.

e) The EPS is calculated based on 84.1 million shares and 83.5 million shares for the three months ended March 31, 2017 and 2016, respectively.

Three Months Ended

9 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

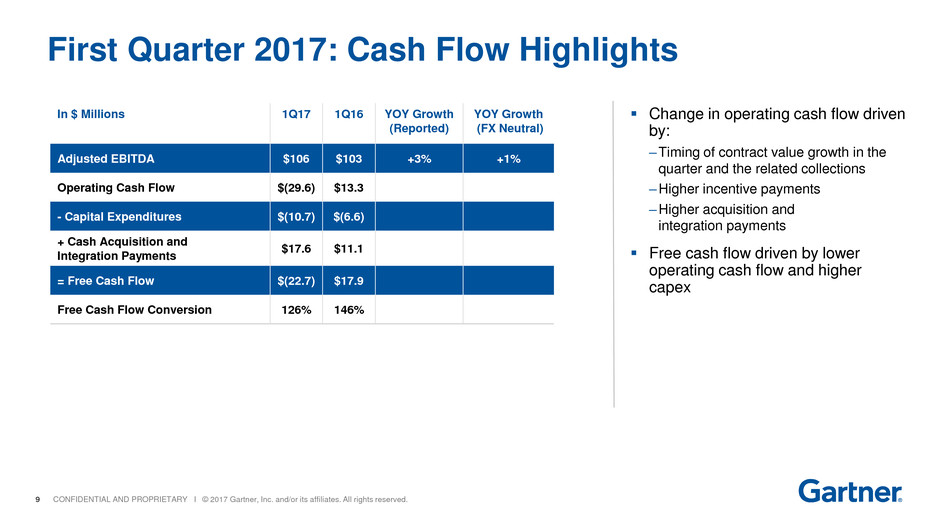

In $ Millions 1Q17 1Q16 YOY Growth

(Reported)

YOY Growth

(FX Neutral)

Adjusted EBITDA $106 $103 +3% +1%

Operating Cash Flow $(29.6) $13.3

- Capital Expenditures $(10.7) $(6.6)

+ Cash Acquisition and

Integration Payments

$17.6 $11.1

= Free Cash Flow $(22.7) $17.9

Free Cash Flow Conversion 126% 146%

First Quarter 2017: Cash Flow Highlights

Change in operating cash flow driven

by:

–Timing of contract value growth in the

quarter and the related collections

–Higher incentive payments

–Higher acquisition and

integration payments

Free cash flow driven by lower

operating cash flow and higher

capex

10 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

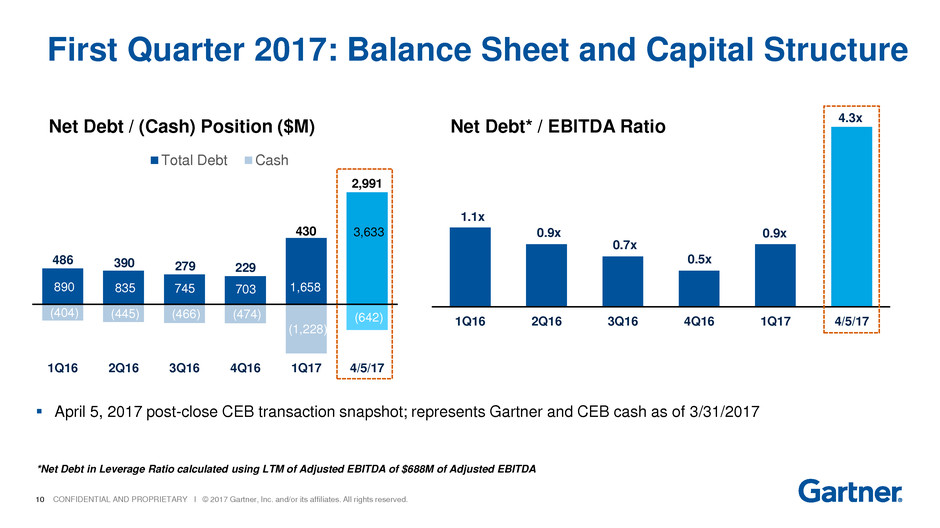

1.1x

0.9x

0.7x

0.5x

0.9x

4.3x

1Q16 2Q16 3Q16 4Q16 1Q17 4/5/17

April 5, 2017 post-close CEB transaction snapshot; represents Gartner and CEB cash as of 3/31/2017

Net Debt / (Cash) Position ($M) Net Debt* / EBITDA Ratio

First Quarter 2017: Balance Sheet and Capital Structure

890 835 745 703 1,658

3,633

(404) (445) (466) (474)

(1,228)

(642)

1Q16 2Q16 3Q16 4Q16 1Q17 4/5/17

Total Debt Cash

486 390 279 229

430

2,991

*Net Debt in Leverage Ratio calculated using LTM of Adjusted EBITDA of $688M of Adjusted EBITDA

11 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

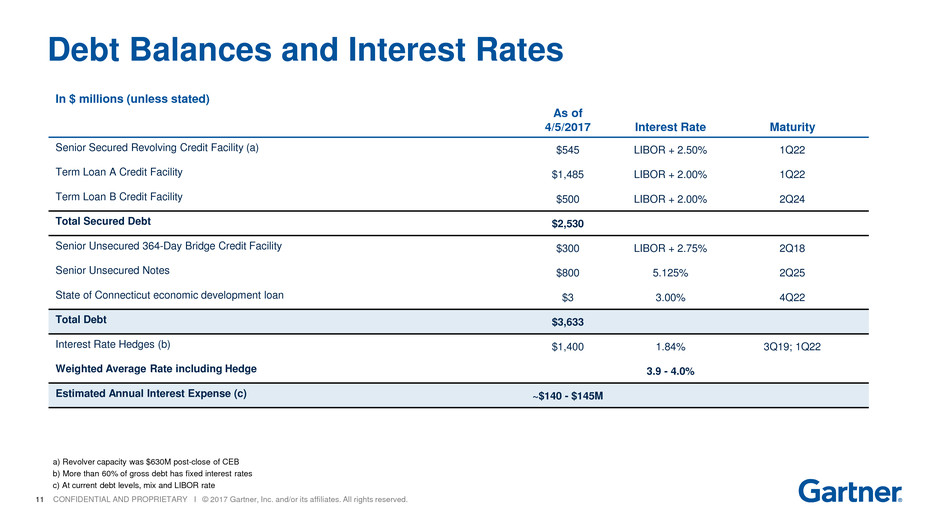

In $ millions (unless stated)

As of

4/5/2017 Interest Rate Maturity

Senior Secured Revolving Credit Facility (a) $545 LIBOR + 2.50% 1Q22

Term Loan A Credit Facility $1,485 LIBOR + 2.00% 1Q22

Term Loan B Credit Facility $500 LIBOR + 2.00% 2Q24

Total Secured Debt $2,530

Senior Unsecured 364-Day Bridge Credit Facility $300 LIBOR + 2.75% 2Q18

Senior Unsecured Notes $800 5.125% 2Q25

State of Connecticut economic development loan $3 3.00% 4Q22

Total Debt $3,633

Interest Rate Hedges (b) $1,400 1.84% 3Q19; 1Q22

Weighted Average Rate including Hedge 3.9 - 4.0%

Estimated Annual Interest Expense (c) ~$140 - $145M

Debt Balances and Interest Rates

a) Revolver capacity was $630M post-close of CEB

b) More than 60% of gross debt has fixed interest rates

c) At current debt levels, mix and LIBOR rate

12 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

First Quarter 2017

Financial Highlights

13 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

CEB First Quarter 2017: Highlights(1)

Total Adjusted

Revenue of $214M(2)

Adjusted EBITDA

of $36M(2)

CEB Segment Contract

Value declined by

approximately 1%*

Core CEB Wallet

Retention of 89%*

Increased 1pt

sequentially

*CEB Segment Contract Value and Wallet Retention based on constant currency

(1) Above results are what CEB would have reported as an independent company

(2) Please refer to appendix slides for definition of these non-GAAP measures and reconciliation to the most directly comparable GAAP measures

14 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

Fiscal Year 2017

Outlook

15 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

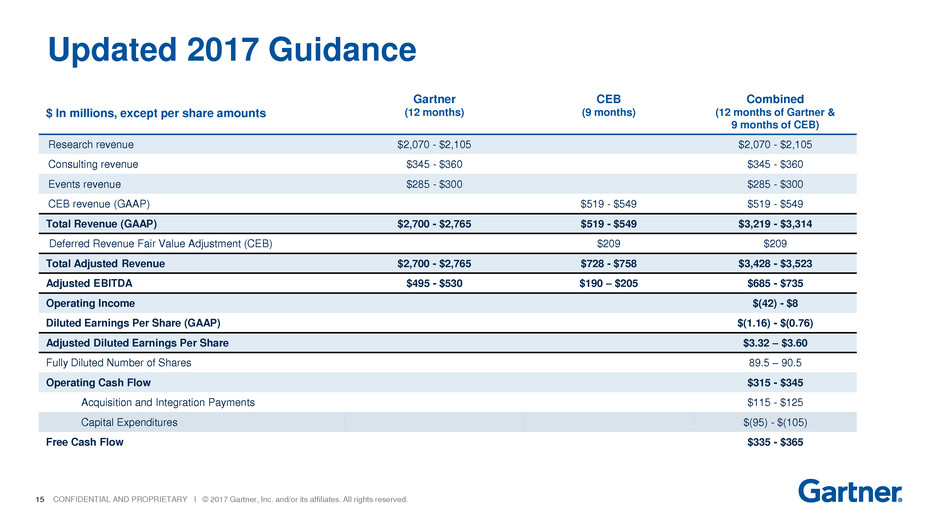

Updated 2017 Guidance

$ In millions, except per share amounts

Gartner

(12 months)

CEB

(9 months)

Combined

(12 months of Gartner &

9 months of CEB)

Research revenue $2,070 - $2,105 $2,070 - $2,105

Consulting revenue $345 - $360 $345 - $360

Events revenue $285 - $300 $285 - $300

CEB revenue (GAAP) $519 - $549 $519 - $549

Total Revenue (GAAP) $2,700 - $2,765 $519 - $549 $3,219 - $3,314

Deferred Revenue Fair Value Adjustment (CEB) $209 $209

Total Adjusted Revenue $2,700 - $2,765 $728 - $758 $3,428 - $3,523

Adjusted EBITDA $495 - $530 $190 – $205 $685 - $735

Operating Income $(42) - $8

Diluted Earnings Per Share (GAAP) $(1.16) - $(0.76)

Adjusted Diluted Earnings Per Share $3.32 – $3.60

Fully Diluted Number of Shares 89.5 – 90.5

Operating Cash Flow $315 - $345

Acquisition and Integration Payments $115 - $125

Capital Expenditures $(95) - $(105)

Free Cash Flow $335 - $365

16 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

$0.31

$(1.59)

Amortization

of acquired

intangibles

Deferred

Revenue Fair

Value Adjustment

GAAP EPS

Guidance Range

Adjusted EPS

Guidance

Range

Acquisition and

Integration

Charges

Real

Estate

Related &

Other

Charges

$0.94

$1.49

Reconciliation of 2017 Adjusted to GAAP EPS Outlook

~$(1.16)

~$(1.46)

~$(1.55)

~$(0.25)

$3.32 – $3.60

$(1.16) – $(0.76)

**Adjusting items calculated at the midpoint of guidance range

17 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

Appendix

18 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

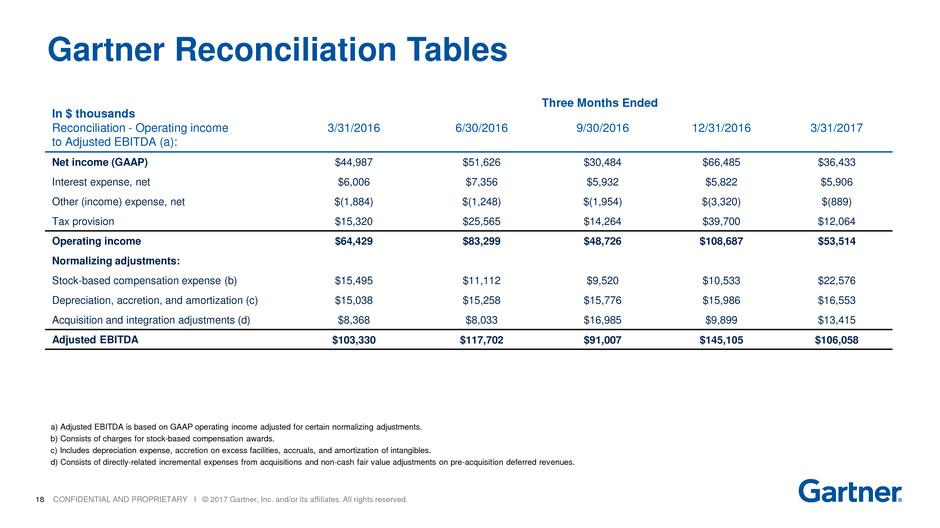

Gartner Reconciliation Tables

In $ thousands

Reconciliation - Operating income

to Adjusted EBITDA (a):

3/31/2016 6/30/2016 9/30/2016 12/31/2016 3/31/2017

Net income (GAAP) $44,987 $51,626 $30,484 $66,485 $36,433

Interest expense, net $6,006 $7,356 $5,932 $5,822 $5,906

Other (income) expense, net $(1,884) $(1,248) $(1,954) $(3,320) $(889)

Tax provision $15,320 $25,565 $14,264 $39,700 $12,064

Operating income $64,429 $83,299 $48,726 $108,687 $53,514

Normalizing adjustments:

Stock-based compensation expense (b) $15,495 $11,112 $9,520 $10,533 $22,576

Depreciation, accretion, and amortization (c) $15,038 $15,258 $15,776 $15,986 $16,553

Acquisition and integration adjustments (d) $8,368 $8,033 $16,985 $9,899 $13,415

Adjusted EBITDA $103,330 $117,702 $91,007 $145,105 $106,058

a) Adjusted EBITDA is based on GAAP operating income adjusted for certain normalizing adjustments.

b) Consists of charges for stock-based compensation awards.

c) Includes depreciation expense, accretion on excess facilities, accruals, and amortization of intangibles.

d) Consists of directly-related incremental expenses from acquisitions and non-cash fair value adjustments on pre-acquisition deferred revenues.

Three Months Ended

19 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

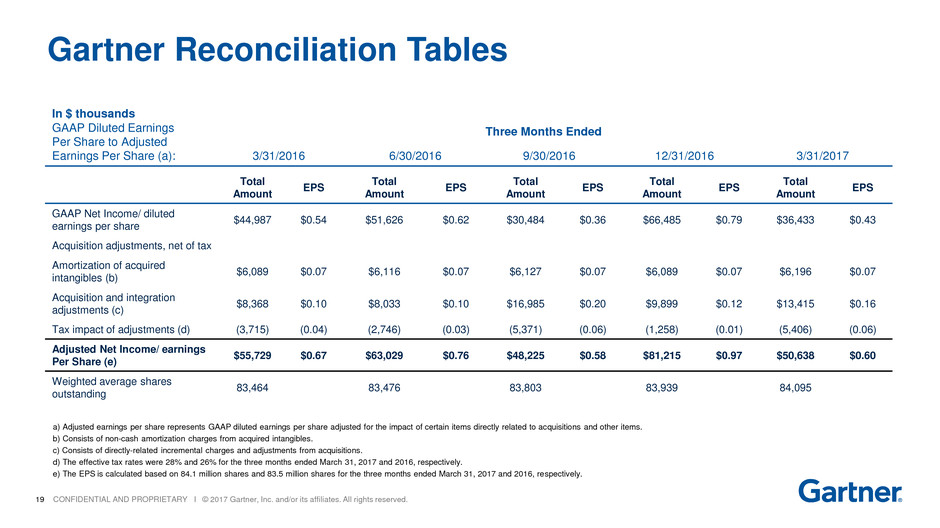

Gartner Reconciliation Tables

a) Adjusted earnings per share represents GAAP diluted earnings per share adjusted for the impact of certain items directly related to acquisitions and other items.

b) Consists of non-cash amortization charges from acquired intangibles.

c) Consists of directly-related incremental charges and adjustments from acquisitions.

d) The effective tax rates were 28% and 26% for the three months ended March 31, 2017 and 2016, respectively.

e) The EPS is calculated based on 84.1 million shares and 83.5 million shares for the three months ended March 31, 2017 and 2016, respectively.

In $ thousands

GAAP Diluted Earnings

Per Share to Adjusted

Earnings Per Share (a): 3/31/2016 6/30/2016 9/30/2016 12/31/2016 3/31/2017

Three Months Ended

Total

Amount

EPS

Total

Amount

EPS

Total

Amount

EPS

Total

Amount

EPS

Total

Amount

EPS

GAAP Net Income/ diluted

earnings per share

$44,987 $0.54 $51,626 $0.62 $30,484 $0.36 $66,485 $0.79 $36,433 $0.43

Acquisition adjustments, net of tax

Amortization of acquired

intangibles (b)

$6,089 $0.07 $6,116 $0.07 $6,127 $0.07 $6,089 $0.07 $6,196 $0.07

Acquisition and integration

adjustments (c)

$8,368 $0.10 $8,033 $0.10 $16,985 $0.20 $9,899 $0.12 $13,415 $0.16

Tax impact of adjustments (d) (3,715) (0.04) (2,746) (0.03) (5,371) (0.06) (1,258) (0.01) (5,406) (0.06)

Adjusted Net Income/ earnings

Per Share (e)

$55,729 $0.67 $63,029 $0.76 $48,225 $0.58 $81,215 $0.97 $50,638 $0.60

Weighted average shares

outstanding

83,464 83,476 83,803 83,939 84,095

20 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

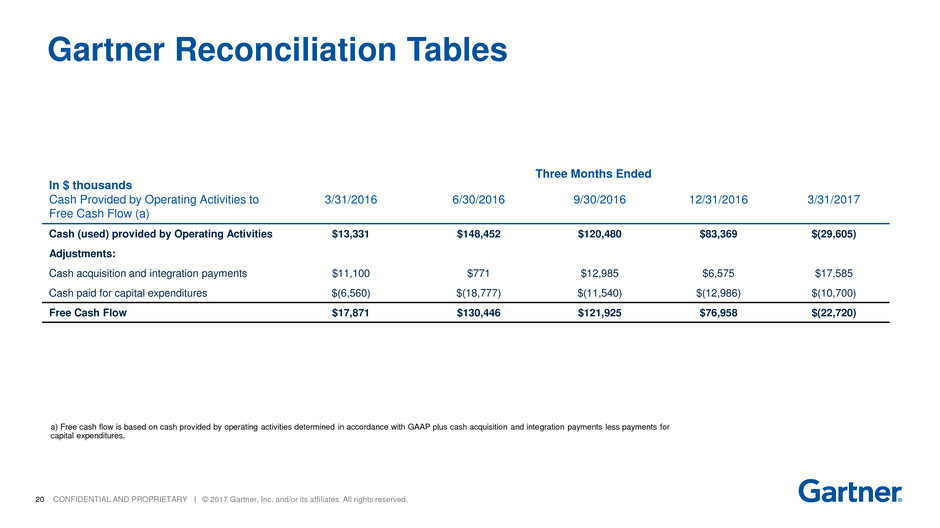

Gartner Reconciliation Tables

In $ thousands

Cash Provided by Operating Activities to

Free Cash Flow (a)

3/31/2016 6/30/2016 9/30/2016 12/31/2016 3/31/2017

Cash (used) provided by Operating Activities $13,331 $148,452 $120,480 $83,369 $(29,605)

Adjustments:

Cash acquisition and integration payments $11,100 $771 $12,985 $6,575 $17,585

Cash paid for capital expenditures $(6,560) $(18,777) $(11,540) $(12,986) $(10,700)

Free Cash Flow $17,871 $130,446 $121,925 $76,958 $(22,720)

a) Free cash flow is based on cash provided by operating activities determined in accordance with GAAP plus cash acquisition and integration payments less payments for

capital expenditures.

Three Months Ended

21 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

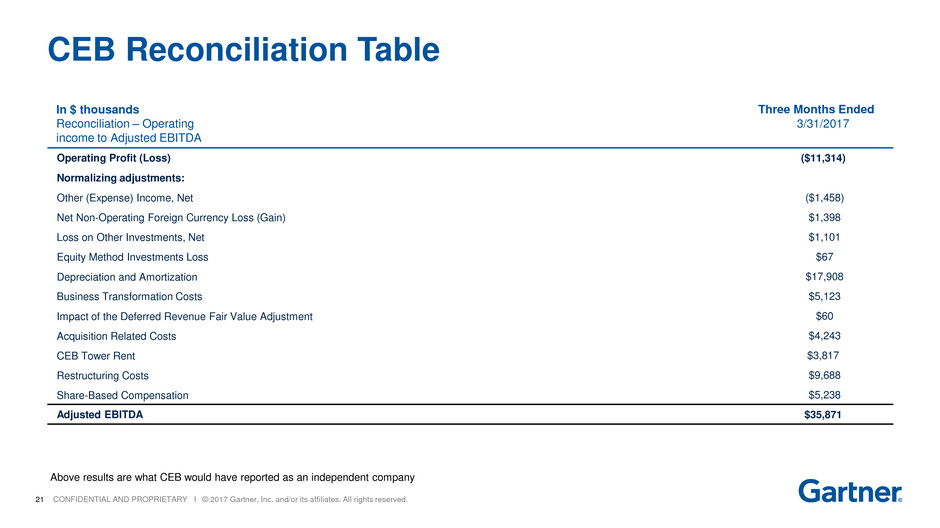

CEB Reconciliation Table

In $ thousands

Reconciliation – Operating

income to Adjusted EBITDA

3/31/2017

Operating Profit (Loss) ($11,314)

Normalizing adjustments:

Other (Expense) Income, Net ($1,458)

Net Non-Operating Foreign Currency Loss (Gain) $1,398

Loss on Other Investments, Net $1,101

Equity Method Investments Loss $67

Depreciation and Amortization $17,908

Business Transformation Costs $5,123

Impact of the Deferred Revenue Fair Value Adjustment $60

Acquisition Related Costs $4,243

CEB Tower Rent $3,817

Restructuring Costs $9,688

Share-Based Compensation $5,238

Adjusted EBITDA $35,871

Three Months Ended

Above results are what CEB would have reported as an independent company

22 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

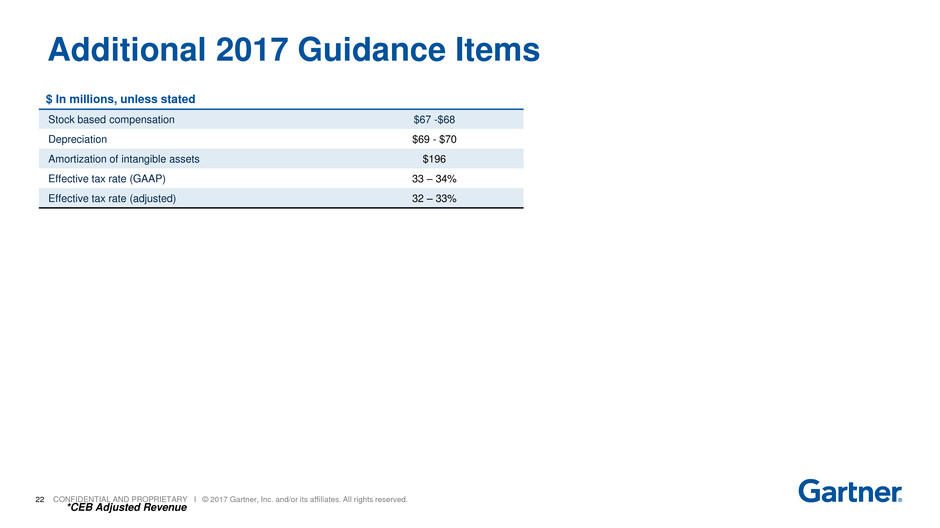

Additional 2017 Guidance Items

$ In millions, unless stated

Stock based compensation $67 -$68

Depreciation $69 - $70

Amortization of intangible assets $196

Effective tax rate (GAAP) 33 – 34%

Effective tax rate (adjusted) 32 – 33%

*CEB Adjusted Revenue

23 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.

Definitions

Adjusted Revenue: Represents revenue calculated in accordance with GAAP plus non-cash fair value adjustments on pre

acquisition deferred revenues. The majority of the pre-acquisition deferred revenue is recognized ratably over the remaining

period of the underlying revenue contract

Gartner Adjusted EBITDA: Represents GAAP operating income excluding stock-based compensation expense, depreciation

and amortization, accretion on obligations related to excess facilities, acquisition and integration adjustments, and

other charges.

CEB Adjusted EBITDA: refers to net income (loss), excluding: provision for income taxes; interest expense, net; debt

modification costs; net non-operating foreign currency gain (loss); loss on other investments, net; equity method investment

loss; depreciation and amortization; business transformation costs, the impact of the deferred revenue fair value adjustment;

acquisition related costs; CEO non-competition obligation; restructuring costs and share-based compensation.

Adjusted Earnings Per Share: Represents GAAP diluted earnings per share adjusted for the impact of certain items

directly related to acquisitions and other charges.

Free Cash Flow: Represents cash provided by operating activities plus cash acquisition and integration payments less

payments for capital expenditures.

24 CONFIDENTIAL AND PROPRIETARY I © 2017 Gartner, Inc. and/or its affiliates. All rights reserved.