Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - BEACON ROOFING SUPPLY INC | v466063_ex99-1.htm |

| 8-K - FORM 8-K - BEACON ROOFING SUPPLY INC | v466063_8-k.htm |

Exhibit 99.2

NASDAQ: BECN May 4, 2017 2017 Second Quarter Earnings Call

2017 Second Quarter Earnings Call May 4, 2017 www.BECN.com 2 Forward Looking Statements This presentation contains information about management's view of the Company's future expectations, plans and prospects that constitute forward - looking statements for purposes of the safe harbor provisions under the Private Securities Litigation Reform Act of 1995 . Actual results may differ materially from those indicated by such forward - looking statements as a result of various important factors, including, but not limited to, those set forth in the "Risk Factors" section of the Company's latest Form 10 - K . In addition, the forward - looking statements included in this presentation represent the Company's views as of the date of this presentation and these views could change . However, while the Company may elect to update these forward - looking statements at some point, the Company specifically disclaims any obligation to do so, other than as required by federal securities laws . These forward - looking statements should not be relied upon as representing the Company's views as of any date subsequent to the date of this presentation . This presentation contains references to certain financial measures that are not presented in accordance with Generally Accepted Accounting Principles (“GAAP") . The Company utilizes non - GAAP financial measures to analyze and report operating results that are unaffected by differences in capital structures, capital investment cycles, and varying ages of related assets . Although the Company believes these measures provide a useful representation of performance, non - GAAP financial measures should not be considered in isolation or as a substitute for any items calculated in accordance with GAAP . A reconciliation of these non - GAAP financial measures to their most directly comparable GAAP financial measure can be found in the Appendix to this presentation as well as Company’s latest Form 8 - K, filed with the SEC on May 4 , 2017 .

2017 Second Quarter Earnings Call May 4, 2017 www.BECN.com 3 Highlights □ Record second quarter net sales of $871 million, 5.7% above the prior year □ Existing market growth of 2.4% on top of record breaking 25.7% growth in prior year □ Residential existing market same day growth of 9.3%...12 quarters in a row of resi growth □ Second quarter gross margins above 3 - year average □ Second quarter net loss of ($9.4) million vs. ($5.7) million loss in prior year □ Q2 loss ($0.16) and ($0.04) Adjusted vs. loss of ($0.10) and $0.03 Adjusted in the prior year □ Adjusted EBITDA at $31.8 million, or 3.7% of sales □ Net D ebt L everage Ratio unchanged from Q1 at 3.0x and down from 3.6x on 3/31/2016 □ Completed 5 acquisitions in the fiscal year to date, including Lowry’s which closed 5/1/2017

2017 Second Quarter Earnings Call May 4, 2017 www.BECN.com 4 0% 50% 100% FY 2017 FY 2016 15.0% 14.7% 28.9% 32.7% 56.1% 52.6% Residential Roofing Non-Residential Roofing Complementary $- $200 $400 $600 $800 $1,000 FY 2017 FY 2016 $843.4 $823.5 $196.4 $195.8 Sales Gross Profit / Margin Existing Market Product Mix Northeast (6.0%) Mid-Atlantic 3.6% Southeast 7.9% Southwest 4.9% Midwest 9.7% West (18.8%) Canada 8.2% Total 2.4% Existing Market Sales Growth (Decline)* $ in millions 23.8% Existing Market Sales, Gross Profit & Gross Margin 23.3% Existing Market results above exclude results from acquired branches until they have been under ownership for at least four full fiscal quarters at the start of the fiscal reporting period. Quarterly Results *Same days

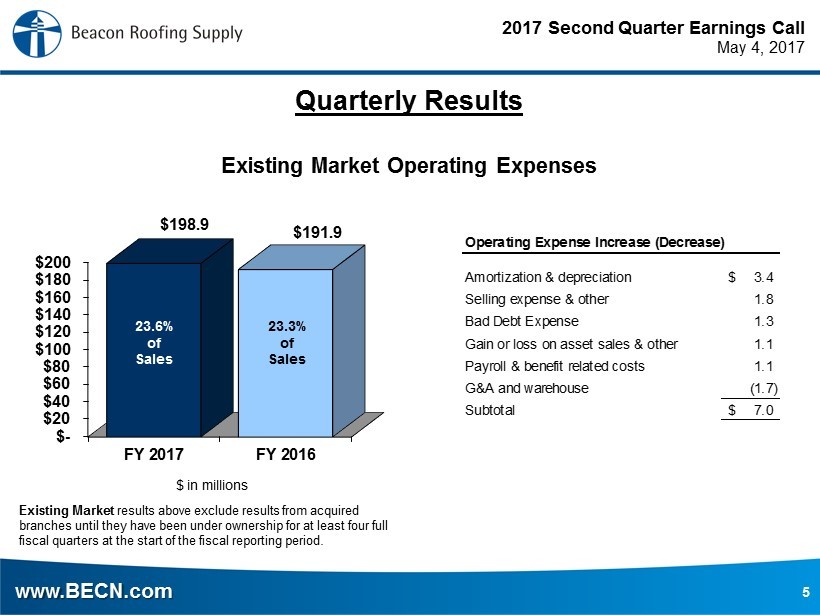

2017 Second Quarter Earnings Call May 4, 2017 www.BECN.com 5 $- $20 $40 $60 $80 $100 $120 $140 $160 $180 $200 FY 2017 FY 2016 $ 198.9 $191.9 $ in millions 23.6% of Sales 23.3% of Sales Existing Market Operating Expenses Existing Market results above exclude results from acquired branches until they have been under ownership for at least four full fiscal quarters at the start of the fiscal reporting period. Amortization & depreciation 3.4$ Selling expense & other 1.8 Bad Debt Expense 1.3 Gain or loss on asset sales & other 1.1 Payroll & benefit related costs 1.1 G&A and warehouse (1.7) Subtotal 7.0$ Operating Expense Increase (Decrease) Quarterly Results

2017 Second Quarter Earnings Call May 4, 2017 www.BECN.com 6 19.8% of Sales $30 $0 $10 $20 $30 $40 $50 $60 FY16 Target FY16 Achievement FY17 Goal in millions ~$40 ~$55 RSG Synergy Highlights

2017 Second Quarter Earnings Call May 4, 2017 www.BECN.com 7 RSG and Other Fiscal 2016 - 2017 Acquisition Costs (In millions) Q2 Q2 2017 2016 Integration Costs $1.6 $5.5 Misc. SG&A $1.6 $5.5 Transaction Costs $1.5 $1.2 Interest Expense $1.5 $1.2 Incremental Amortization $7.9 $5.7 Total $11.0 $12.4

2017 Second Quarter Earnings Call May 4, 2017 www.BECN.com 8 $- $50 $100 $150 $200 FY 2016 FY 2017 $150.4 $80.7 in millions Cash Flow From Operations CF from Ops $139.3 $79.3 Non - Cash & WC Adj. $11.1 $1.4 Net Income FY 2017 FY 2016 Y TD Results

2017 Second Quarter Earnings Call May 4, 2017 www.BECN.com 9 4.3x 4.2x 3.6x 3.3x 3.0x 2.0x 10/1/2015 Pro Forma 12/31/2015 3/31/2016 9/30/2016 3/31/2017 FY18 Goal Net Debt Leverage Ratio 1.6% 0.8% 0.6% 1.0% 0.8% - 1.3% 2014 2015 2016 2017 Est. Long Term Capital Expenditures as % of Sales 20.6% 18.6% 18.5% 17.5 - 18.5% 20 - 40 bps Impr . 2014 2015 2016 2017 Est. Long Term Working Capital as % of Sales Inventory Turns Balance Sheet Metrics 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 FYQ1 FYQ2 FYQ3 FYQ4 FY14 FY15 FY16 FY17

2017 Second Quarter Earnings Call May 4, 2017 www.BECN.com 10 Sales Growth Assumptions • Raising sales growth from 3 - 7% to 6 - 9% driven by 2017 acquisitions and stronger 1H existing market growth • Expect 2H’17 boosts in Northeast and West geographies, and limited/no drag from softer pricing • Organic growth framework • 1H: Better than expected (Up 0.9%) • 2H: Up Mid - High Single Digits Organic Growth Rate by Product Line • Residential: • Up mid - high single digits • Continued strength in core re - roofing • Above normal storm demand • Non - residential: • Up low single digits • Easier 2nd half comparisons • Complementary products: • Up mid - high single digits • Beneficiary of growth initiatives • Favorable macro backdrop 2017 Revenue Growth

2017 Second Quarter Earnings Call May 4, 2017 www.BECN.com 11 • Gross Margins • Targeting 24.6% - 24.8%, levels up ~15 bps vs. 2016 • Positives: Full - year procurement synergies, private label, complementary products expansion, greenfield maturation, favorable product mix shift • Headwinds: Competitive pricing pressures • Operating Costs • Adjusted Existing SG&A % of Net Sales – flat vs. 2016 • Positives: Full - year RSG synergies, fixed cost leverage, operating cost efficiencies • Headwinds: Higher D&A, growth oriented investments, rising variable expenses, growth in higher cost - to - serve product categories 2017 Margin Expectations

2017 Second Quarter Earnings Call May 4, 2017 www.BECN.com 12 Source: Freedonia and Company Estimates Strong Investment Thesis Solid Financial Performance • Fragmented, but consolidating industry • Significant advantages to size and scale • Recurring base revenue stream (80% re - roof) • Favorable cyclical characteristics • Strong management team and Board • Established growth strategy • Proven acquisition integration process • Customer focused operational execution • Net Sales CAGR ~17% since 2004 • Target organic sales growth of 5 - 10% • Target gross margin 23.5% - 25.5% • SG&A leverage from 40% fixed cost structure • Target Adjusted EBITDA of 8 - 11% • Low capital expenditures of 0.8% - 1.3% • Net Debt Leverage Ratio reduced from 4.3x (10/1/15) to 3.0x with target of 2.0x

2017 Second Quarter Earnings Call May 4, 2017 www.BECN.com 13 19.8% of Sales Adjusted Net Income (Loss) is defined as net income excluding certain non - recurring costs and the incremental amortization of acquired intangibles related to major acquisitions completed in fiscal years 2016 and 2017. We believe that Adjusted Net Income (Loss) is an operating performance metric that is useful to investors because it permits investors to better understand year - over - year changes in underlying operating performance. Adjusted net income per share or “Adjusted EPS” is calculated by dividing the Adjusted Net Income (Loss) for the period by the weighted - average diluted shares outstanding for the period. Non - GAAP Adjustments are comprised entirely of non - recurring costs related to major acquisitions completed in fiscal years 2016 and 2017 - See "RSG and Other Fiscal 2016 - 2017 Acquisition Costs" slide for further detail. While we believe Adjusted Net Income (Loss) and Adjusted EPS are useful measures for investors, these are not measurements presented in accordance with United States Gen era lly Accepted Accounting Principles (“GAAP”). You should not consider Adjusted Net Income (Loss) or Adjusted EPS in isolation or as a substitute for net income and net loss per share or diluted earnings per share calculate d i n accordance with GAAP. Reconciliation: Adjusted Net Income (Loss) /Adjusted EPS Quarter - To - Date (In millions) Actual Non-GAAP Adjustments Actual (Adjusted) Actual Non-GAAP Adjustments Actual (Adjusted) Net sales 870.7$ -$ 870.7$ 823.5$ -$ 823.5$ Cost of products sold 666.2 - 666.2 627.8 - 627.8 Gross profit 204.5 - 204.5 195.7 - 195.7 Operating expense 207.5 (9.5) 198.0 191.9 (11.2) 180.7 Income (loss) from operations (3.0) 9.5 6.5 3.9 11.2 15.1 Interest expense, financing costs and other 12.3 (1.6) 10.7 13.0 (1.2) 11.8 Income (loss) before provision for income taxes (15.3) 11.1 (4.2) (9.1) 12.4 3.3 Provision (benefit from) for income taxes (5.9) 4.3 (1.6) (3.4) 5.0 1.6 Net income (loss) (9.4)$ 6.8$ (2.6)$ (5.7)$ 7.4$ 1.7$ Reconciliation of EPS to Adjusted EPS: EPS (0.16)$ (0.10)$ Non-GAAP Adjustments per share impact 0.12 0.13 Adjusted EPS (0.04)$ 0.03$ Three Months Ended March 31, 2017 Three Months Ended March 31, 2016

2017 Second Quarter Earnings Call May 4, 2017 www.BECN.com 14 19.8% of Sales Adjusted Net Income (Loss) is defined as net income excluding certain non - recurring costs and the incremental amortization of acquired intangibles related to major acquisitions completed in fiscal years 2016 and 2017. We believe that Adjusted Net Income (Loss) is an operating performance metric that is useful to investors because it permits investors to better understand year - over - year changes in underlying operating performance. Adjusted net income per share or “Adjusted EPS” is calculated by dividing the Adjusted Net Income (Loss) for the period by the weighted - average diluted shares outstanding for the period. Non - GAAP Adjustments are comprised entirely of non - recurring costs related to major acquisitions completed in fiscal years 2016 and 2017 - See "RSG and Other Fiscal 2016 - 2017 Acquisition Costs" slide for further detail. While we believe Adjusted Net Income (Loss) and Adjusted EPS are useful measures for investors, these are not measurements presented in accordance with United States Gen era lly Accepted Accounting Principles (“GAAP”). You should not consider Adjusted Net Income (Loss) or Adjusted EPS in isolation or as a substitute for net income and net loss per share or diluted earnings per share calculate d i n accordance with GAAP. Reconciliation: Adjusted Net Income (Loss) /Adjusted EPS Year - To - Date (In millions) Actual Non-GAAP Adjustments Actual (Adjusted) Actual Non-GAAP Adjustments Actual (Adjusted) Net sales 1,872.9$ -$ 1,872.9$ 1,800.0$ -$ 1,800.0$ Cost of products sold 1,417.4 - 1,417.4 1,371.1 - 1,371.1 Gross profit 455.5 - 455.5 428.9 - 428.9 Operating expense 411.6 (18.6) 393.0 398.2 (36.9) 361.3 Income from operations 43.9 18.6 62.5 30.7 36.9 67.6 Interest expense, financing costs and other 25.8 (3.1) 22.7 29.3 (5.0) 24.3 Income before provision for income taxes 18.1 21.7 39.8 1.4 41.9 43.3 Provision for income taxes 7.0 8.4 15.4 0.1 17.0 17.1 Net income 11.1$ 13.3$ 24.4$ 1.4$ 24.9$ 26.4$ Reconciliation of EPS to Adjusted EPS: EPS 0.18$ 0.02$ Non-GAAP Adjustments per share impact 0.22 0.42 Adjusted EPS 0.40$ 0.44$ Six Months Ended March 31, 2017 Six Months Ended March 31, 2016

2017 Second Quarter Earnings Call May 4, 2017 www.BECN.com 15 Adjusted EBITDA is defined as net income plus interest expense (net of interest income), income taxes, depreciation and amort iza tion, adjustments to contingent consideration, stock - based compensation and certain non - recurring costs from major acquisitions completed in fiscal years 2016 and 2017. We believe that Adjusted EBITDA is an operating performance measure that provides in ves tors and analysts with a measure of operating results unaffected by differences in capital structures, capital investment cycles, and ages of related assets amon g o therwise comparable companies. Acquisition costs reflect certain non - recurring charges related to major acquisitions completed in fiscal years 2016 and 2017 (excluding the impact of tax) that are not embedded in other balances of the table. Cer tain portions of the total acquisition costs incurred are included in interest expense, income taxes, depreciation and amortizatio n, and stock - based compensation. While we believe Adjusted EBITDA is a useful measure for investors, it is not a measurement presented in accordance GAAP. You sh ould not consider Adjusted EBITDA in isolation or as a substitute for net income, cash flows from operations, or any other items calculated in accordance with GAAP. In addition, Adjusted EBITDA has inherent mat erial limitations as a performance measure. It does not include interest expense. Because we have borrowed money, interest expense is a necessary element of our costs. In addition, Adjusted EBITDA does not i ncl ude depreciation and amortization expense. Because we have capital and intangible assets, depreciation and amortization expense is a necessary element of our costs. Adjusted EBITDA also does not i ncl ude stock - based compensation, which is a necessary element of our costs because we make stock awards to key members of management as an important incentive to maximize overall company performance and as a ben efit. Moreover, Adjusted EBITDA does not include taxes, and payment of taxes is a necessary element of our operations. Accordingly, since Adjusted EBITDA excludes these items, it has material limi tat ions as a performance measure. We separately monitor capital expenditures, which impact depreciation expense, as well as amortization expense, interest expense, stock - based compensation expense, and income tax expense. Because not all companies use identical calculations, our presentation of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies. Reconciliation: Adjusted EBITDA (In millions) Trailing Twelve Months Ended September 30, 2017 2016 2017 2016 2016 Net Sales 870.7$ 823.5$ 1,872.9$ 1,800.0$ 4,127.1$ Net income (loss) (9.4)$ (5.7)$ 11.1$ 1.4$ 89.9$ Acquisition costs 1.6 5.5 2.7 21.2 24.7 Interest expense, net 13.3 13.1 26.5 29.3 58.1 Income taxes (6.0) (3.4) 7.0 0.1 56.6 Depreciation and amortization 28.5 24.0 57.0 47.6 100.2 Stock-based compensation 3.8 3.5 7.6 10.7 17.7 Adjusted EBITDA 31.8$ 36.9$ 111.8$ 110.3$ 347.2$ Adjusted EBITDA as a % of net sales 3.7% 4.5% 6.0% 6.1% 8.4% Three Months Ended March 31, Six Months Ended March 31,

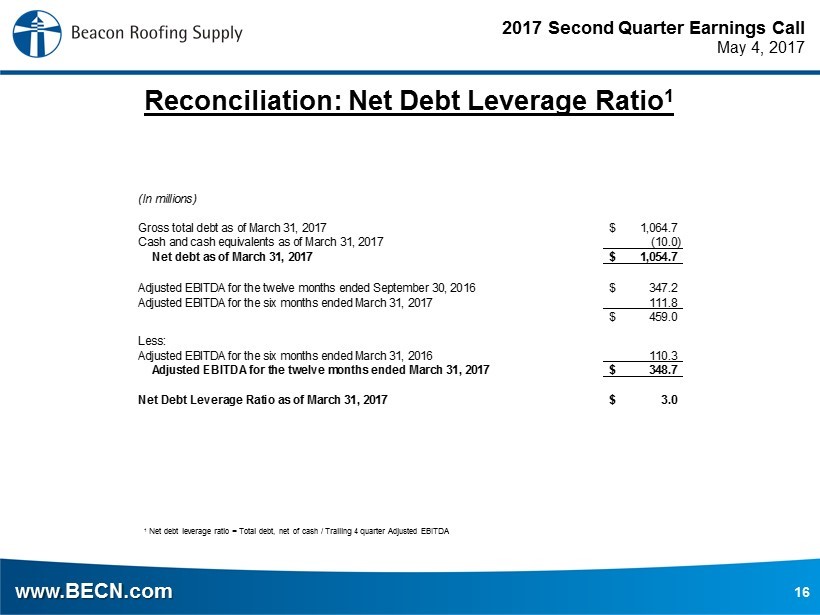

2017 Second Quarter Earnings Call May 4, 2017 www.BECN.com 16 Reconciliation: Net Debt Leverage Ratio 1 1 Net debt leverage ratio = Total debt, net of cash / Trailing 4 quarter Adjusted EBITDA (In millions) Gross total debt as of March 31, 2017 1,064.7$ Cash and cash equivalents as of March 31, 2017 (10.0) Net debt as of March 31, 2017 1,054.7$ Adjusted EBITDA for the twelve months ended September 30, 2016 347.2$ Adjusted EBITDA for the six months ended March 31, 2017 111.8 459.0$ Less: Adjusted EBITDA for the six months ended March 31, 2016 110.3 Adjusted EBITDA for the twelve months ended March 31, 2017 348.7$ Net Debt Leverage Ratio as of March 31, 2017 3.0$