Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Walker & Dunlop, Inc. | f8-k.htm |

Exhibit 99.1

Walker & Dunlop Begins 2017 with Record EPS of $1.35

and Revenue Growth of 68%

|

FIRST QUARTER 2017 HIGHLIGHTS |

|

|

|

|

|

● |

Total revenues of $158.5 million, up 68% from Q1’16 |

|

● |

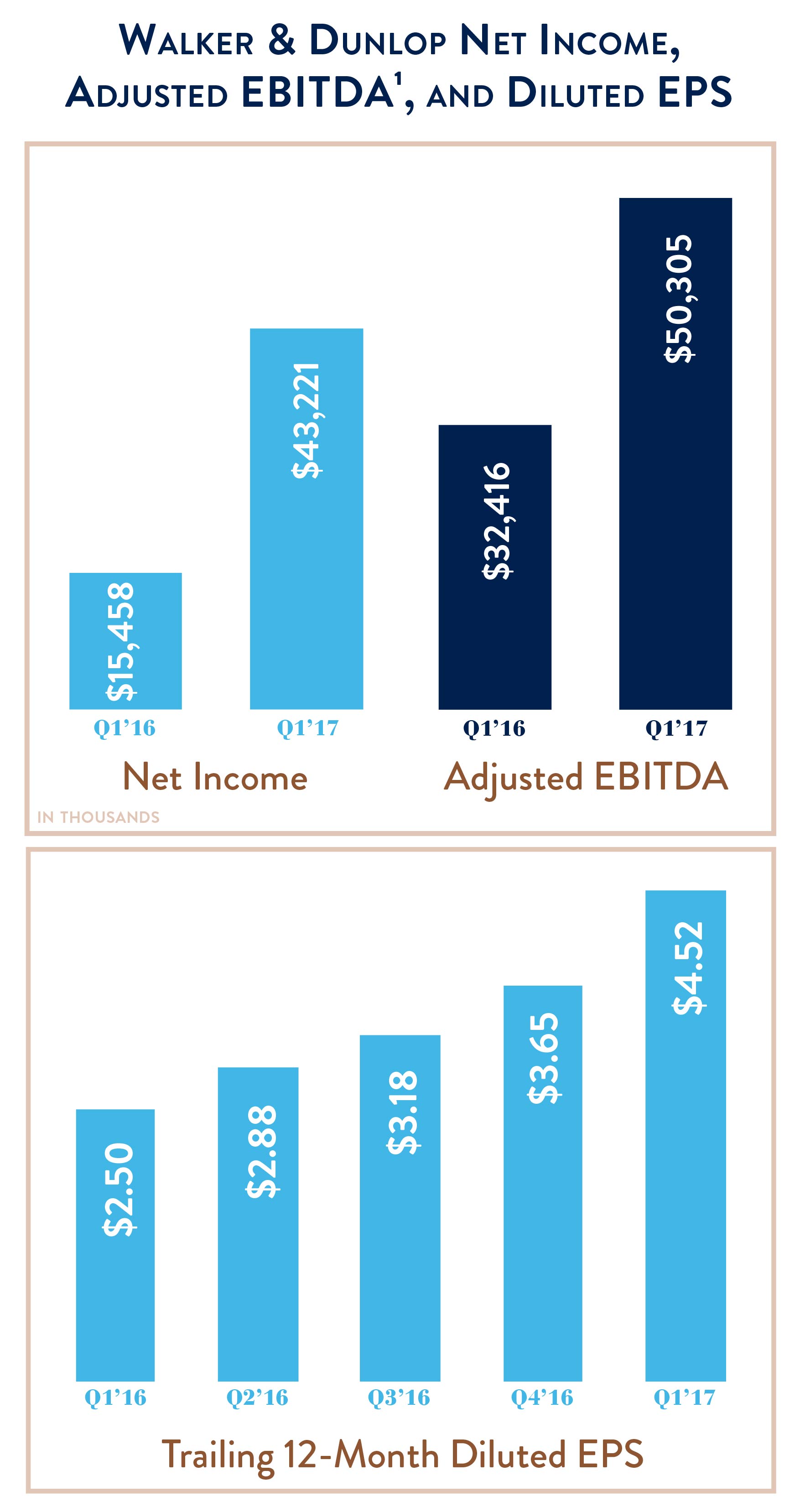

Net income of $43.2 million, or $1.35 per diluted share, up 180% from Q1’16 |

|

● |

Adjusted EBITDA1 of $50.3 million, up 55% from Q1’16 |

|

● |

Total transaction volume of $5.0 billion, up 92% from Q1’16 |

|

● |

Tax benefit of $8.7 million from vesting of employee stock awards |

|

● |

Operating margin of 35% compared to 26% for Q1’16 |

|

● |

Servicing portfolio of $64.4 billion at March 31, 2017, up 26% from March 31, 2016 |

|

Bethesda, MD – May 3, 2017 – Walker & Dunlop, Inc. (NYSE: WD) (the “Company”) reported first quarter 2017 net income of $43.2 million, or $1.35 per diluted share, representing a 180% increase in net income over first quarter 2016. Total revenues for the first quarter 2017 were $158.5 million, a 68% increase from the prior-year first quarter. Adjusted EBITDA for the first quarter 2017 was a record $50.3 million compared to $32.4 million for the first quarter 2016, a 55% increase.

"2017 is off to an extremely strong start for Walker & Dunlop," commented Chairman and CEO Willy Walker. "We recruited and acquired many talented mortgage bankers and brokers over the past year, which helped produce record first quarter 2017 transaction volume, revenues, adjusted EBITDA, and earnings." Walker continued, "Net income grew a staggering 180% to $43.2 million, while adjusted EBITDA grew 55% to $50 million. Operating margin far surpassed our target, and at 35%, demonstrates the financial results that can be achieved by maintaining cost discipline during a time of rapid growth. Our team continues to perform at a high level with a tremendous sense of teamwork. Our clients continue to ask us to do more. And our outlook is very strong as the economy expands, interest rates remain relatively low, and the demand for commercial real estate -- particularly rental housing -- continues forward.” |

|

1

FIRST QUARTER 2017 OPERATING RESULTS

TOTAL REVENUES were $158.5 million for the first quarter 2017 compared to $94.2 million for the first quarter 2016. The 68% increase was primarily driven by a 92% increase in total transaction volume, which included increased activity across all lending products and investment sales, but most significantly a 147% increase in lending with Fannie Mae, one of our most profitable products. Additionally, the continued growth of the Company’s servicing portfolio contributed an additional $9.9 million in servicing fees quarter over quarter.

GAINS FROM MORTGAGE BANKING ACTIVITIES for the first quarter 2017 were $96.4 million compared to $46.3 million for the first quarter 2016, a 108% increase. LOAN ORIGINATION FEES were $50.9 million for the first quarter 2017 compared to $22.4 million for the first quarter 2016, a 127% increase. GAINS ATTRIBUTABLE TO MORTGAGE SERVICING RIGHTS (“MSRs”) were $45.5 million for the first quarter 2017, a 90% increase from $23.9 million for the first quarter 2016. The increases in loan origination fees and gains attributable to MSRs were the result of the 92% increase in loan origination activity in the first quarter 2017 compared to the prior-year first quarter.

SERVICING FEES were $41.5 million for the first quarter 2017 compared to $31.6 million for the first quarter 2016, a 31% increase. During the past 12 months, the Company has originated $19.0 billion of loans, facilitating growth in servicing fees and expansion of the servicing portfolio to $64.4 billion at March 31, 2017, up 26% from $51.0 billion at March 31, 2016.

NET WAREHOUSE INTEREST INCOME, which includes net interest earned on loans held for sale and loans held for investment (the Company’s on balance sheet interim loan portfolio), was $6.6 million for the first quarter 2017, a 2% decrease compared to the prior-year first quarter, as the increase in loans held for investment was offset by a decrease in the average balance of loans held for sale during the quarter.

TOTAL EXPENSES were $102.4 million for the first quarter 2017 compared to $70.1 million for the first quarter 2016, a 46% increase. The increase in total expenses is primarily attributable to a 64% increase in personnel costs and a 29% increase in amortization and depreciation. Fixed compensation costs increased following the recent acquisitions of George Elkins Mortgage Banking Company and Deerwood Real Estate Capital and due to hiring to support the growth of the Company. Variable compensation costs increased as a result of increased commissions expense resulting from the significant growth in transaction volumes and the Company’s record financial performance in the first quarter 2017. Although compensation costs have increased, personnel expense as a percentage of total revenues decreased to 35% for the first quarter 2017 from 36% in the prior-year first quarter. Amortization and depreciation costs increased due to the growth of the servicing portfolio year over year.

PROVISION (BENEFIT) FOR CREDIT LOSSES was a net benefit of $0.1 million for the first quarter 2017 compared to a net benefit of $0.4 million for the first quarter 2016. There were no delinquent or defaulted loans in the at risk portfolio at March 31, 2017.

OPERATING MARGIN was 35% for the first quarter 2017, up from 26% for the first quarter 2016. The increase in operating margin was driven by the scale of our transaction and servicing platform and efficient operation of the business, which drove total revenues up 68%, while total expenses grew only 46%.

INCOME TAX EXPENSE was $13.1 million in the first quarter 2017 compared to $8.8 million for the first quarter 2016, an increase of 48%. In the first quarter of 2016, the Company adopted a new accounting standard that requires excess tax benefits or tax deficiency arising from stock compensation arrangements to be recognized as an income tax benefit or expense. First quarter 2017 includes an $8.7 million reduction of income tax expense related to the vesting of employee stock awards during the quarter, compared to only $0.3 million in the first quarter 2016.

NET INCOME was $43.2 million, or $1.35 per diluted share, for the first quarter 2017 compared to net income of $15.5 million, or $0.50 per diluted share, for the first quarter 2016. The 180% increase in net income was driven by increased gains from

2

mortgage banking activities, growth in servicing fees, and the aforementioned excess tax benefit from stock compensation, partially offset by the rise in personnel expense.

ADJUSTED EBITDA was $50.3 million for the first quarter 2017 compared to $32.4 million for the first quarter 2016, a 55% increase driven by increases in loan origination fees and servicing fees, partially offset by the increase in personnel costs.

ANNUALIZED RETURN ON EQUITY was 28% for the first quarter 2017, up from 13% for the first quarter 2016. In the first quarter 2017, return on equity benefitted from the significant growth in net income.

FIRST QUARTER 2017 TOTAL TRANSACTION VOLUME

TOTAL TRANSACTION VOLUME for the first quarter 2017 was $5.0 billion, up 92% from $2.6 billion for the first quarter 2016. Total transaction volume includes loan origination and investment sales volumes. LOAN ORIGINATION VOLUME was up 92% from the first quarter 2016 to $4.7 billion. Loan originations with Fannie Mae were $1.9 billion, an increase of 147% from the first quarter 2016. Brokered loan originations totaled $1.3 billion, a 53% increase from the first quarter 2016. Loan originations with Freddie Mac were $1.2 billion, a 65% increase from the first quarter 2016. HUD loan originations totaled $207 million, a 67% increase from the first quarter 2016. Interim loan originations were $137 million, compared to zero for the first quarter 2016. INVESTMENT SALES VOLUME was $287 million for the first quarter 2017, an 83% increase from the first quarter 2016.

SERVICING PORTFOLIO

The SERVICING PORTFOLIO totaled $64.4 billion at March 31, 2017, an increase of 26% from $51.0 billion at March 31, 2016. During the first quarter 2017, there were $1.3 billion of net loan additions to the servicing portfolio. At March 31, 2017, the weighted average remaining term of the portfolio increased to 10.2 years from 9.4 years at the end of the first quarter 2016, and the WEIGHTED AVERAGE SERVICING FEE increased to 27 basis points from 25 basis points at March 31, 2016.

CREDIT QUALITY

The Company’s AT RISK SERVICING PORTFOLIO, which is comprised of loans subject to a defined risk-sharing formula, was $25.2 billion at March 31, 2017 compared to $20.1 billion at March 31, 2016. There were no 60+ DAY DELINQUENCIES or defaults in the Company’s at risk servicing portfolio at March 31, 2017.

The on-balance sheet INTERIM LOAN PORTFOLIO, which is comprised of loans for which the Company has full risk of loss, was $313.4 million at March 31, 2017 compared to $191.8 million at March 31, 2016. All of the Company’s interim loans are current and performing at March 31, 2017.

1 Adjusted EBITDA is a non-GAAP financial measure the Company presents to help investors better understand our operating performance. For a reconciliation of adjusted EBITDA to net income, refer to the sections of this press release below titled “Non-GAAP Financial Measures” and “Adjusted Financial Metric Reconciliation to GAAP.”

Conference Call Information

The Company will host a conference call to discuss its quarterly results on Wednesday, May 3, 2017 at 8:30 a.m. Eastern time. Analysts and investors interested in participating are invited to call (888) 632-3381 from within the United States or (785) 424‑1678 from outside the United States and are asked to reference the Conference ID: WDQ117. A simultaneous

3

webcast of the call will be available on the Investor Relations section of the Walker & Dunlop website at http://www.walkerdunlop.com. Presentation materials related to the conference call will be posted to the Investor Relations section of the Company’s website prior to the call.

A telephonic replay of the call will also be available from approximately 11:00 a.m. Eastern time May 3, 2017 through May 17, 2017. Please call (800) 283-8183 from the United States or (402) 220-0867 from outside the United States. An audio replay will also be available on the Investor Relations section of the Company’s website, along with the presentation materials.

About Walker & Dunlop

Walker & Dunlop (NYSE: WD), headquartered in Bethesda, Maryland, is one of the largest commercial real estate services and finance companies in the United States providing financing and investment sales to owners of multifamily and commercial properties. Walker & Dunlop, which is included in the S&P SmallCap 600 Index, has over 550 professionals in 28 offices across the nation with an unyielding commitment to client satisfaction.

Non-GAAP Financial Measures

To supplement our financial statements presented in accordance with United States generally accepted accounting principles (GAAP), the Company uses adjusted EBITDA, a non-GAAP financial measure. The presentation of adjusted EBITDA is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. When analyzing our operating performance, readers should use adjusted EBITDA in addition to, and not as an alternative for, net income. Adjusted EBITDA represents net income before income taxes, interest expense on our term loan facility, and amortization and depreciation, adjusted for provision for credit losses net of write-offs, stock-based incentive compensation charges, non-cash revenues such as gains attributable to MSRs, and mark to market effects from CMBS activities. Because not all companies use identical calculations, our presentation of adjusted EBITDA may not be comparable to similarly titled measures of other companies. Furthermore, adjusted EBITDA is not intended to be a measure of free cash flow for our management's discretionary use, as it does not reflect certain cash requirements such as tax and debt service payments. The amounts shown for adjusted EBITDA may also differ from the amounts calculated under similarly titled definitions in our debt instruments, which are further adjusted to reflect certain other cash and non-cash charges that are used to determine compliance with financial covenants.

We use adjusted EBITDA to evaluate the operating performance of our business, for comparison with forecasts and strategic plans, and for benchmarking performance externally against competitors. We believe that this non-GAAP measure, when read in conjunction with the Company's GAAP financials, provides useful information to investors by offering:

|

· |

the ability to make more meaningful period-to-period comparisons of the Company's on-going operating results; |

|

· |

the ability to better identify trends in the Company's underlying business and perform related trend analyses; and |

|

· |

a better understanding of how management plans and measures the Company's underlying business. |

We believe that adjusted EBITDA has limitations in that it does not reflect all of the amounts associated with the Company's results of operations as determined in accordance with GAAP and that adjusted EBITDA should only be used to evaluate the Company's results of operations in conjunction with net income. For more information on adjusted EBITDA, refer to the section of this press release below titled "Adjusted Financial Metric Reconciliation to GAAP."

Forward-Looking Statements

Some of the statements contained in this press release may constitute forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, projections, plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as ''may,'' ''will,'' ''should,'' ''expects,'' ''intends,''

4

''plans,'' ''anticipates,'' ''believes,'' ''estimates,'' ''predicts,'' or ''potential'' or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions.

The forward-looking statements contained in this press release reflect our current views about future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause actual results to differ significantly from those expressed or contemplated in any forward-looking statement.

While forward-looking statements reflect our good faith projections, assumptions and expectations, they are not guarantees of future results. Furthermore, we disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, data or methods, future events or other changes, except as required by applicable law. Factors that could cause our results to differ materially include, but are not limited to: (1) general economic conditions and multifamily and commercial real estate market conditions, (2) regulatory and or legislative changes to Freddie Mac, Fannie Mae or HUD, (3) our ability to retain and attract loan originators and other professionals, and (4) changes in federal government fiscal and monetary policies, including any constraints or cuts in federal funds allocated to HUD for loan originations.

For a further discussion of these and other factors that could cause future results to differ materially from those expressed or contemplated in any forward-looking statements, see the section titled ''Risk Factors" in our most recent Annual Report on Form 10-K, as it may be updated or supplemented by our Quarterly Reports on Form 10-Q and our other filings with the SEC. Such filings are available publicly on our Investor Relations web page at www.walkerdunlop.com.

Contacts:

|

Investors: |

Media: |

|

Claire Harvey |

Susan Weber |

|

Vice President, Investor Relations |

Chief Marketing Officer |

|

Phone 301.634.2143 |

Phone 301.215.5515 |

|

investorrelations@walkeranddunlop.com |

info@walkeranddunlop.com |

|

Phone 301.215.5500 7501 Wisconsin Avenue, Suite 1200E Bethesda, Maryland 20814 |

|

5

Walker & Dunlop, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

March 31, 2017 and December 31, 2016

(In thousands, except per share data)

|

|

|

March 31, |

|

December 31, |

|

||

|

|

|

2017 |

|

2016 |

|

||

|

|

|

(unaudited) |

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

50,745 |

|

$ |

118,756 |

|

|

Restricted cash |

|

|

9,313 |

|

|

9,861 |

|

|

Pledged securities, at fair value |

|

|

86,900 |

|

|

84,850 |

|

|

Loans held for sale, at fair value |

|

|

1,230,311 |

|

|

1,858,358 |

|

|

Loans held for investment, net |

|

|

311,242 |

|

|

220,377 |

|

|

Servicing fees and other receivables, net |

|

|

35,882 |

|

|

29,459 |

|

|

Derivative assets |

|

|

15,446 |

|

|

61,824 |

|

|

Mortgage servicing rights |

|

|

562,530 |

|

|

521,930 |

|

|

Goodwill and other intangible assets |

|

|

124,670 |

|

|

97,372 |

|

|

Other assets |

|

|

54,499 |

|

|

49,645 |

|

|

Total assets |

|

$ |

2,481,538 |

|

$ |

3,052,432 |

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

Accounts payable and other liabilities |

|

$ |

205,100 |

|

$ |

232,231 |

|

|

Performance deposits from borrowers |

|

|

9,424 |

|

|

10,480 |

|

|

Derivative liabilities |

|

|

9,449 |

|

|

4,396 |

|

|

Guaranty obligation, net of accumulated amortization |

|

|

35,311 |

|

|

32,292 |

|

|

Allowance for risk-sharing obligations |

|

|

3,546 |

|

|

3,613 |

|

|

Warehouse notes payable |

|

|

1,406,462 |

|

|

1,990,183 |

|

|

Note payable |

|

|

164,088 |

|

|

164,163 |

|

|

Total liabilities |

|

$ |

1,833,380 |

|

$ |

2,437,358 |

|

|

|

|

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

|

|

Preferred shares, Authorized 50,000, none issued. |

|

$ |

— |

|

$ |

— |

|

|

Common stock, $0.01 par value. Authorized 200,000; issued and outstanding 30,095 shares at March 31, 2017 and 29,551 shares at December 31, 2016 |

|

|

301 |

|

|

296 |

|

|

Additional paid-in capital |

|

|

218,908 |

|

|

228,889 |

|

|

Retained earnings |

|

|

424,252 |

|

|

381,031 |

|

|

Total stockholders’ equity |

|

$ |

643,461 |

|

$ |

610,216 |

|

|

Noncontrolling interests |

|

|

4,697 |

|

|

4,858 |

|

|

Total equity |

|

$ |

648,158 |

|

$ |

615,074 |

|

|

Commitments and contingencies |

|

|

— |

|

|

— |

|

|

Total liabilities and equity |

|

$ |

2,481,538 |

|

$ |

3,052,432 |

|

6

Walker & Dunlop, Inc. and Subsidiaries

Condensed Consolidated Statements of Income

(In thousands, except per share data)

(Unaudited)

|

|

For the three months ended |

|

||||

|

|

March 31, |

|

||||

|

|

2017 |

|

2016 |

|

||

|

Revenues |

|

|

|

|

|

|

|

Gains from mortgage banking activities |

$ |

96,432 |

|

$ |

46,323 |

|

|

Servicing fees |

|

41,525 |

|

|

31,649 |

|

|

Net warehouse interest income |

|

6,620 |

|

|

6,731 |

|

|

Escrow earnings and other interest income |

|

3,292 |

|

|

1,640 |

|

|

Other |

|

10,643 |

|

|

7,898 |

|

|

Total revenues |

$ |

158,512 |

|

$ |

94,241 |

|

|

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

Personnel |

$ |

56,172 |

|

$ |

34,230 |

|

|

Amortization and depreciation |

|

32,338 |

|

|

25,155 |

|

|

Provision (benefit) for credit losses |

|

(132) |

|

|

(409) |

|

|

Interest expense on corporate debt |

|

2,403 |

|

|

2,469 |

|

|

Other operating expenses |

|

11,608 |

|

|

8,614 |

|

|

Total expenses |

$ |

102,389 |

|

$ |

70,059 |

|

|

Income from operations |

$ |

56,123 |

|

$ |

24,182 |

|

|

Income tax expense |

|

13,063 |

|

|

8,849 |

|

|

Net income before noncontrolling interests |

$ |

43,060 |

|

$ |

15,333 |

|

|

Less: net income (loss) from noncontrolling interests |

|

(161) |

|

|

(125) |

|

|

Walker & Dunlop net income |

$ |

43,221 |

|

$ |

15,458 |

|

|

|

|

|

|

|

|

|

|

Basic earnings per share |

$ |

1.45 |

|

$ |

0.52 |

|

|

Diluted earnings per share |

$ |

1.35 |

|

$ |

0.50 |

|

|

|

|

|

|

|

|

|

|

Basic weighted average shares outstanding |

|

29,809 |

|

|

29,489 |

|

|

Diluted weighted average shares outstanding |

|

32,006 |

|

|

30,782 |

|

|

|

|

|

|

|

|

|

7

SUPPLEMENTAL OPERATING DATA

Unaudited

|

|

|

|

|

||||

|

|

|

For the three months ended |

|

||||

|

|

|

March 31, |

|

||||

|

(dollars in thousands) |

|

2017 |

|

2016 |

|

||

|

Transaction Volume: |

|

|

|

|

|

|

|

|

Loan Origination Volume by Product Type |

|

|

|

|

|

|

|

|

Fannie Mae |

|

$ |

1,888,936 |

|

$ |

763,244 |

|

|

Freddie Mac |

|

|

1,162,950 |

|

|

703,807 |

|

|

Ginnie Mae - HUD |

|

|

207,032 |

|

|

124,208 |

|

|

Brokered (1) |

|

|

1,330,298 |

|

|

867,491 |

|

|

Interim Loans |

|

|

136,550 |

|

|

— |

|

|

Total Loan Origination Volume |

|

$ |

4,725,766 |

|

$ |

2,458,750 |

|

|

Investment Sales Volume |

|

|

286,730 |

|

|

156,950 |

|

|

Total Transaction Volume |

|

$ |

5,012,496 |

|

$ |

2,615,700 |

|

|

|

|

|

|

|

|

|

|

|

Key Performance Metrics: |

|

|

|

|

|

|

|

|

Operating margin |

|

|

35 |

% |

|

26 |

% |

|

Return on equity |

|

|

28 |

% |

|

13 |

% |

|

Walker & Dunlop net income |

|

$ |

43,221 |

|

$ |

15,458 |

|

|

Adjusted EBITDA (2) |

|

$ |

50,305 |

|

$ |

32,416 |

|

|

Diluted EPS |

|

$ |

1.35 |

|

$ |

0.50 |

|

|

|

|

|

|

|

|

|

|

|

Key Expense Metrics (as a percentage of total revenues): |

|

|

|

|

|

|

|

|

Personnel expenses |

|

|

35 |

% |

|

36 |

% |

|

Other operating expenses |

|

|

7 |

% |

|

9 |

% |

|

Key Origination Metrics (as a percentage of loan origination volume): |

|

|

|

|

|

|

|

|

Origination related fees |

|

|

1.08 |

% |

|

0.91 |

% |

|

Gains attributable to MSRs |

|

|

0.96 |

% |

|

0.97 |

% |

|

Gains attributable to MSRs, as a percentage of Agency loan origination volume (3) |

|

|

1.40 |

% |

|

1.50 |

% |

|

|

|

As of March 31, |

|

|

||||

|

Servicing Portfolio by Product: |

|

2017 |

|

2016 |

|

|

||

|

Fannie Mae |

|

$ |

28,741,065 |

|

$ |

23,304,910 |

|

|

|

Freddie Mac |

|

|

21,426,315 |

|

|

18,146,813 |

|

|

|

Ginnie Mae - HUD |

|

|

9,073,355 |

|

|

5,645,282 |

|

|

|

Brokered (1) |

|

|

4,829,934 |

|

|

3,751,925 |

|

|

|

Interim Loans |

|

|

313,355 |

|

|

191,822 |

|

|

|

Total Servicing Portfolio |

|

$ |

64,384,024 |

|

$ |

51,040,752 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Key Servicing Metric (end of period): |

|

|

|

|

|

|

|

|

|

Weighted-average servicing fee rate (basis points) |

|

|

26.5 |

|

|

25.1 |

|

|

|

(1) |

Brokered transactions for commercial mortgage backed securities, life insurance companies, and commercial banks. |

|

(2) |

This is a non-GAAP financial measure. For more information on adjusted EBITDA, refer to the section above titled “Non-GAAP Financial Measures.” |

|

(3) |

The fair value of the expected net cash flows associated with the servicing of the loan, net of any guaranty obligations retained, as a percentage of GSE and HUD volume. |

8

ADJUSTED FINANCIAL METRIC RECONCILIATION TO GAAP

Unaudited

|

|

|

For the three months ended |

|

||||

|

|

|

March 31, |

|

||||

|

(in thousands) |

|

2017 |

|

2016 |

|

||

|

Reconciliation of Walker & Dunlop Net Income to Adjusted EBITDA |

|

|

|

|

|

|

|

|

Walker & Dunlop Net Income |

|

$ |

43,221 |

|

$ |

15,458 |

|

|

Income tax expense |

|

|

13,063 |

|

|

8,849 |

|

|

Interest expense |

|

|

2,403 |

|

|

2,469 |

|

|

Amortization and depreciation |

|

|

32,338 |

|

|

25,155 |

|

|

Provision (benefit) for credit losses |

|

|

(132) |

|

|

(409) |

|

|

Net write-offs |

|

|

— |

|

|

— |

|

|

Stock compensation expense |

|

|

4,947 |

|

|

3,858 |

|

|

Gains attributable to mortgage servicing rights (1) |

|

|

(45,535) |

|

|

(23,917) |

|

|

Unrealized (gains) losses from proprietary CMBS mortgage banking activities |

|

|

— |

|

|

953 |

|

|

Adjusted EBITDA |

|

$ |

50,305 |

|

$ |

32,416 |

|

|

(1) |

Represents the fair value of the expected net cash flows from servicing recognized at commitment, net of the expected guaranty obligation. |

9

Key Credit Metrics

Unaudited

|

|

|

March 31, |

|

||||

|

(dollars in thousands) |

|

2017 |

|

2016 |

|

||

|

Key Credit Metrics |

|

|

|

|

|

|

|

|

Risk-sharing servicing portfolio: |

|

|

|

|

|

|

|

|

Fannie Mae Full Risk |

|

$ |

21,465,009 |

|

$ |

17,642,364 |

|

|

Fannie Mae Modified Risk |

|

|

7,035,879 |

|

|

4,905,037 |

|

|

Freddie Mac Modified Risk |

|

|

53,359 |

|

|

53,498 |

|

|

GNMA - HUD Full Risk |

|

|

4,391 |

|

|

4,547 |

|

|

Total risk-sharing servicing portfolio |

|

$ |

28,558,638 |

|

$ |

22,605,446 |

|

|

|

|

|

|

|

|

|

|

|

Non risk-sharing servicing portfolio: |

|

|

|

|

|

|

|

|

Fannie Mae No Risk |

|

$ |

240,177 |

|

$ |

757,509 |

|

|

Freddie Mac No Risk |

|

|

21,372,956 |

|

|

18,093,315 |

|

|

GNMA - HUD No Risk |

|

|

9,068,964 |

|

|

5,640,735 |

|

|

Brokered |

|

|

4,829,934 |

|

|

3,751,925 |

|

|

Total non risk-sharing servicing portfolio |

|

$ |

35,512,031 |

|

$ |

28,243,484 |

|

|

|

|

|

|

|

|

|

|

|

Total loans serviced for others |

|

$ |

64,070,669 |

|

$ |

50,848,930 |

|

|

|

|

|

|

|

|

|

|

|

Interim loans (full risk) servicing portfolio |

|

|

313,355 |

|

|

191,822 |

|

|

|

|

|

|

|

|

|

|

|

Total servicing portfolio unpaid principal balance |

|

$ |

64,384,024 |

|

$ |

51,040,752 |

|

|

|

|

|

|

|

|

|

|

|

At risk servicing portfolio (1) |

|

$ |

25,187,219 |

|

$ |

20,066,881 |

|

|

Maximum exposure to at risk portfolio (2) |

|

|

5,183,874 |

|

|

4,165,215 |

|

|

60+ day delinquencies, within at risk portfolio |

|

|

— |

|

|

— |

|

|

At risk loan balances associated with allowance for risk-sharing obligations |

|

$ |

— |

|

$ |

16,884 |

|

|

|

|

|

|

|

|

|

|

|

60+ day delinquencies as a percentage of the at risk portfolio |

|

|

0.00 |

% |

|

0.00 |

% |

|

Allowance for risk-sharing as a percentage of the at risk portfolio |

|

|

0.01 |

% |

|

0.03 |

% |

|

Allowance for risk-sharing as a percentage of the specifically identified at risk balances |

|

|

N/A |

|

|

30.50 |

% |

|

Allowance for risk-sharing as a percentage of maximum exposure |

|

|

0.07 |

% |

|

0.12 |

% |

|

Allowance for risk-sharing and guaranty obligation as a percentage of maximum exposure |

|

|

0.75 |

% |

|

0.81 |

% |

|

(1) |

At risk servicing portfolio is defined as the balance of Fannie Mae DUS loans subject to the risk-sharing formula described below, as well as an immaterial balance of Freddie Mac and GNMA-HUD loans on which we share in the risk of loss. Use of the at risk portfolio provides for comparability of the full risk-sharing and modified risk-sharing loans because the provision and allowance for risk-sharing obligations are based on the at risk balances of the associated loans. Accordingly, we have presented the key statistics as a percentage of the at risk portfolio. |

For example, a $15 million loan with 50% DUS risk-sharing has the same potential risk exposure as a $7.5 million loan with full DUS risk-sharing. Accordingly, if the $15 million loan with 50% DUS risk-sharing was to default, the Company would view the overall loss as a percentage of the at risk balance, or $7.5 million, to ensure comparability between all risk-sharing obligations. To date, substantially all of the risk-sharing obligations that we have settled have been from full risk-sharing loans.

|

(2) |

Represents the maximum loss we would incur under our risk-sharing obligations if all of the loans we service, for which we retain some risk of loss, were to default and all of the collateral underlying these loans was determined to be without value at the time of settlement. The maximum exposure is not representative of the actual loss we would incur. |

10