Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Howard Hughes Corp | ex-99d1.htm |

| 8-K - 8-K - Howard Hughes Corp | f8-k.htm |

Exhibit 99.2

NYSE: HHC

|

Supplemental Information |

|

3/31/2017 |

|

|

|

|

The Howard Hughes Corporation |

|

|

13355 Noel Road, 22nd Floor |

Phone: 214.741.7744 |

|

Dallas, TX 75240 |

www.howardhughes.com |

|

|

Cautionary Statements |

Forward Looking Statements

This presentation includes forward-looking statements. Forward-looking statements give our current expectations relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to current or historical facts. These statements may include words such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “intend,” “likely,” “may,” “plan,” “project,” “realize,” “should,” “transform,” “would,” and other statements of similar expression. Forward-looking statements should not be relied upon. They give our expectations about the future and are not guarantees. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance and achievements to materially differ from any future results, performance and achievements expressed or implied by such forward-looking statements. For a discussion of the risk factors that could have an impact these forward-looking statements, see our Annual Report on Form 10-K for the fiscal year ended December 31, 2016. The statements made herein speak only as of the date of this presentation and we do not undertake to update this information except as required by law. Past performance does not guarantee future results. Performance during time periods shown is limited and may not reflect the performance in different economic and market cycles.

Non-GAAP Financial Measures

We use certain non-GAAP performance measures, in addition to the required GAAP presentations, as we believe these measures improve the understanding of our operational results and makes comparisons of operating results among peer companies more meaningful. Management continually evaluates the usefulness, relevance, limitations, and calculation of the Company’s reported non-GAAP performance measures to determine how best to provide relevant information to the public, and thus such reported measures could change. The non-GAAP financial measures used in this presentation are funds from operations, or FFO, core funds from operations, or Core FFO, and net operating income, or NOI.

FFO is defined by the National Association of Real Estate Investment Trusts (NAREIT) as net income calculated in accordance with GAAP, excluding gains or losses from real estate dispositions, plus real estate depreciation and amortization and impairment charges (which we believe are not indicative of the performance of our operating portfolio). We calculate FFO in accordance with NAREIT’s definition. Since FFO excludes depreciation and amortization and gains and losses from depreciable property dispositions, and impairments, it can provide a performance measure that, when compared year over year, reflects the impact on operations from trends in occupancy rates, rental rates, operating costs, acquisition and development activities, and financing costs. This provides a perspective of our financial performance not immediately apparent from net income determined in accordance with GAAP. Core FFO is calculated by adjusting FFO to exclude the impact of certain non-cash and/or nonrecurring income and expense items, as set forth in the calculation herein. These items can vary greatly from period to period, depending upon the volume of our acquisition activity and debt retirements, among other factors. We believe that by excluding these items, Core FFO serves as a useful, supplementary measure of the ongoing operating performance of our core operations, and we believe it is used by investors in a similar manner. Core FFO is a non-GAAP and non-standardized measure and may be calculated differently by other peer companies.

We define NOI as operating revenues (rental income, tenant recoveries and other revenue) less operating expenses (real estate taxes, repairs and maintenance, marketing and other property expenses). NOI excludes straight-line rents and amortization of tenant incentives, net interest expense, ground rent amortization, demolition costs, amortization, depreciation, and development-related marketing costs. We also generally include our share of NOI from equity method joint ventures and distributions from cost basis investments herein unless otherwise noted.

While Core FFO, FFO and NOI are relevant and widely used measures of operating performance of real estate companies, they do not represent cash flows from operations or net income as defined by GAAP and should not be considered an alternative to those measures in evaluating our liquidity or operating performance. FFO, Core FFO and NOI do not purport to be indicative of cash available to fund our future cash requirements. Further, our computations of FFO, Core FFO and NOI may not be comparable to FFO, Core FFO and NOI reported by other real estate companies. We have included a reconciliation of NOI, FFO and Core FFO to GAAP net income in this presentation. Non-GAAP financial measures should not be considered independently, or as a substitute, for financial information presented in accordance with GAAP.

Additional Information

Our website address is www.howardhughes.com. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other publicly filed documents are available and may be accessed free of charge through the “Investors” section of our website under the SEC Filings subsection, as soon as reasonably practicable after those documents are filed with, or furnished to, the SEC. Also available through our Investors section of our website are beneficial ownership reports filed by our directors and executive officers on Forms 3, 4 and 5.

|

1 |

www.howardhughes.com |

|

|

Table of Contents |

|

FINANCIAL OVERVIEW |

PORTFOLIO OVERVIEW |

PORTFOLIO PERFORMANCE |

DEBT & OTHER |

|||||||

| 3 | 10 | 12 | 19 | |||||||

| 4 | 11 | 13 | 20 | |||||||

| 5 | 14 | 21 | ||||||||

| 6 | 15 | 22 | ||||||||

| 7 | 16 |

Reconciliation of Non-GAAP |

23 | |||||||

| 8 | 17 | |||||||||

| 9 | 18 |

|

2 |

www.howardhughes.com |

|

Company Overview – Q1-17 |

|

Recent Company Highlights |

|||||||||

|

Exchange / Ticker Share Price - March 31, 2017 Earnings / share FFO / Share Core FFO / Share

|

NYSE: HHC $ 117.25 $ 0.13 $ 0.23 $ 1.66 |

|

LAS VEGAS--(BUSINESS WIRE)--May 1, 2017-- The Howard Hughes Corporation® (NYSE: HHC) announced today that it has finalized a 15-year, build-to-suit lease with Aristocrat Technologies, Inc., allowing the leading global provider of land-based and online gaming solutions to consolidate several of its Las Vegas facilities to a new campus in the Summerlin® master planned community. Aristocrat’s new campus will be located minutes away from Downtown Summerlin®, reflecting the growth of commercial offerings in the community’s urban core as Summerlin continues to gain appeal as a workplace. The relocation is in line with the growing corporate trend to locate workplaces closer to where employees live in an effort to shorten commutes and boost quality of life.

DALLAS--(BUSINESS WIRE)--Mar. 30, 2017-- The Howard Hughes Corporation® (NYSE: HHC) (the “Company”) today announced the expiration of its previously announced tender offer and consent solicitation (the “Tender Offer”) for any and all of its existing 6.875% senior notes due 2021 (the “Notes”), which commenced on March 2, 2017 and is described in the Offer to Purchase and Consent Solicitation Statement, dated March 2, 2017 (the “Offer to Purchase”), and a related Consent and Letter of Transmittal (together with the Offer to Purchase, the “Offer Documents”). The Company has also completed the redemption of all of its outstanding Notes not tendered in the Tender Offer at a redemption price equal to 105.156% of the unpaid principal amount (or $158.3 million, plus $8.2 million, or approximately $5.16 per $1,000 principal amount of Notes) plus accrued and unpaid interest on such Notes up to, but excluding, the redemption date. The Company used a portion of its offering of $800 million in aggregate principal amount of 5.375% senior notes due 2025, which closed on March 16, 2017, to redeem the outstanding Notes not tendered by the holders.

CHICAGO--(BUSINESS WIRE)--Mar. 17, 2017-- The Howard Hughes Corporation® (NYSE: HHC) received unanimous approval at today’s Chicago Planning Commission meeting for its future trophy-class office building to be built at 110 North Wacker Drive, in collaboration with Riverside Investment & Development, Goettsch Partners and CBRE – the development, design and leasing team behind the recently completed 150 North Riverside Plaza office tower. With its prominent riverfront location, 110 North Wacker is a highly desirable office development site in the heart of the city, designed to be a dynamic addition to Chicago’s iconic skyline.

For more press releases, please visit www.howardhughes.com/press |

||||||||

|

|

|

|

|

|

|||||||

|

Operating Portfolio by Region |

|

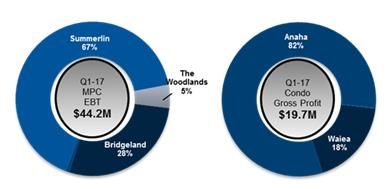

Q1-17 MPC & Condominium Results |

|||||||||

|

|

|

$ in millions |

|

$ in millions |

|||||||

|

|

|

||||||||||

|

|

Q1-17 MPC EBT |

|

Q1-17 Condo Gross Profit |

||||||||

|

|

Bridgeland |

|

$13.4 |

|

Waiea |

|

$3.5 |

||||

|

|

Columbia |

|

(0.3) |

|

Anaha |

|

16.2 |

||||

|

|

Summerlin |

|

30.0 |

|

Ke Kilohana |

|

0.0 |

||||

|

|

The Woodlands |

|

1.1 |

|

Ae`o |

|

— |

||||

|

|

Total |

|

$44.2 |

|

Total |

|

$19.7 |

||||

|

|

|

|

|

||||||||

|

|

|

|

|

||||||||

|

3 |

www.howardhughes.com |

|

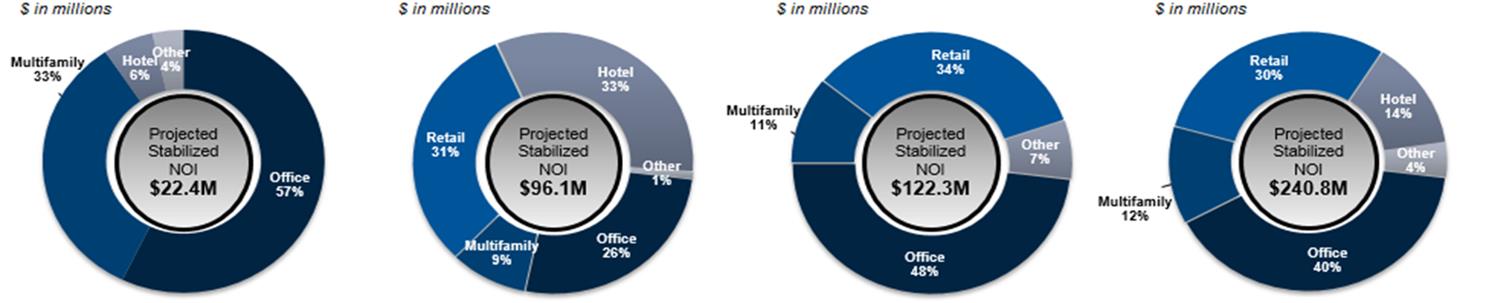

Path to Annual Stabilized NOI |

||||||||||||||

|

Currently Under Construction |

Currently Unstabilized |

Currently Stabilized |

Total |

|||||||||||

|

Retail & Office S.F. |

513,000 |

Retail & Office S.F. |

2,043,656 |

Retail & Office S.F. |

4,569,966 |

Retail & Office S.F. |

7,126,622 | |||||||

|

Multifamily Units |

729 |

Multifamily Units |

514 |

Multifamily Units |

1,108 |

Multifamily Units |

2,351 | |||||||

|

Hotel Keys |

72 |

Hotel Keys |

913 |

Hotel Keys |

- |

Hotel Keys |

985 | |||||||

|

Other Units |

784 |

Other Units |

654 |

Other Units |

- |

Other Units |

1,438 | |||||||

|

Projected Stabilized NOI |

$ 22.4

|

Projected Stabilized NOI |

$ 96.1

|

Projected Stabilized NOI |

$ 122.3

|

Projected Stabilized NOI |

$ 240.8

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

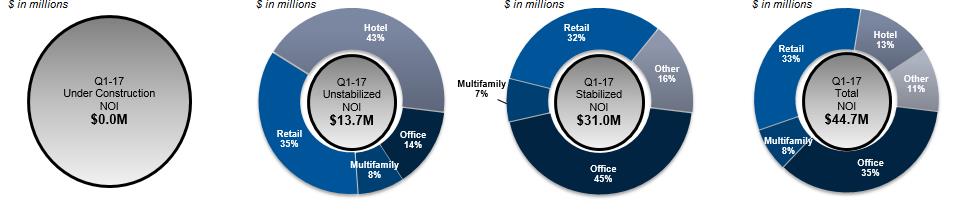

Q1-17 - Operating Results by Property Type |

|

Currently Under Construction |

|

Currently Unstabilized |

|

Currently Stabilized |

|

Total |

|

|

||||||

Note: Path to NOI Stabilization charts above exclude Seaport NOI until we have greater clarity with respect to the performance of our tenants. See page 13 for Stabilized NOI Yield and other project information.

|

4 |

www.howardhughes.com |

|

Company Profile |

|

Q1 2017 |

|

Q4 2016 |

|

Q3 2016 |

|

Q2 2016 |

|

Q1 2016 |

|

|

FY 2016 |

|

FY 2015 |

|

|||||||

|

Share price |

|

$ |

117.25 |

|

$ |

114.10 |

|

$ |

114.50 |

|

$ |

114.32 |

|

$ |

105.89 |

|

|

$ |

114.10 |

|

$ |

113.16 |

|

|

Market Capitalization |

|

$ |

5.1 |

b |

$ |

4.9 |

b |

$ |

4.9 |

b |

$ |

4.9b |

b |

$ |

4.5 |

b |

|

$ |

4.9 |

b |

$ |

4.9 |

b |

|

Enterprise Value1 |

|

$ |

7.3 |

b |

$ |

6.9 |

b |

$ |

7.1 |

b |

$ |

6.9b |

b |

$ |

6.3 |

b |

|

$ |

6.9 |

b |

$ |

6.9 |

b |

|

Dilutive effect of stock options |

|

|

241 |

|

|

289 |

|

|

299 |

|

|

277 |

|

|

239 |

|

|

|

277 |

|

|

316 |

|

|

Warrants2 |

|

|

2,641 |

|

|

2,894 |

|

|

2,892 |

|

|

2,835 |

|

|

2,570 |

|

|

|

2,894 |

|

|

2,873 |

|

|

Weighted avg. shares - basic |

|

|

39,799 |

|

|

39,492 |

|

|

39,502 |

|

|

39,492 |

|

|

39,473 |

|

|

|

39,492 |

|

|

39,470 |

|

|

Weighted avg. shares - diluted |

|

|

42,757 |

|

|

42,753 |

|

|

42,760 |

|

|

42,664 |

|

|

42,400 |

|

|

|

42,729 |

|

|

42,754 |

|

|

Diluted shares outstanding (in thousands) |

|

|

43,194 |

|

|

42,973 |

|

|

43,030 |

|

|

42,946 |

|

|

42,633 |

|

|

|

42,961 |

|

|

42,904 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings Profile |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Segment Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

79,856 |

|

$ |

76,000 |

|

$ |

71,238 |

|

$ |

72,224 |

|

$ |

63,593 |

|

|

$ |

283,057 |

|

$ |

251,414 |

|

|

Expenses |

|

$ |

39,265 |

|

$ |

38,436 |

|

$ |

39,893 |

|

$ |

36,982 |

|

$ |

36,142 |

|

|

$ |

152,329 |

|

$ |

135,666 |

|

|

Company's Share of Equity Method Investments NOI and Cost Basis Investment |

|

$ |

4,129 |

|

$ |

888 |

|

$ |

569 |

|

$ |

2,272 |

|

$ |

3,932 |

|

|

$ |

8,893 |

|

$ |

4,951 |

|

|

Net Operating Income3 |

|

$ |

44,720 |

|

$ |

38,454 |

|

$ |

31,914 |

|

$ |

37,514 |

|

$ |

31,383 |

|

|

$ |

139,621 |

|

$ |

120,699 |

|

|

Avg. NOI margin |

|

|

56 |

% |

|

51 |

% |

|

45 |

% |

|

52 |

% |

|

49 |

% |

|

|

49 |

% |

|

48 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MPC Segment Earnings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues |

|

$ |

68,706 |

|

$ |

81,738 |

|

$ |

51,304 |

|

$ |

70,507 |

|

$ |

49,755 |

|

|

$ |

253,304 |

|

$ |

229,865 |

|

|

Total expenses4 |

|

$ |

35,357 |

|

$ |

45,429 |

|

$ |

30,720 |

|

$ |

36,895 |

|

$ |

25,365 |

|

|

$ |

138,409 |

|

$ |

133,612 |

|

|

Interest income, net5 |

|

$ |

5,557 |

|

$ |

5,468 |

|

$ |

5,253 |

|

$ |

5,009 |

|

$ |

5,355 |

|

|

$ |

21,085 |

|

$ |

18,113 |

|

|

Equity in earnings in Real Estate and |

|

|

5,280 |

|

|

20,928 |

|

|

13,699 |

|

|

8,874 |

|

|

— |

|

|

|

43,501 |

|

|

— |

|

|

MPC Segment EBT5 |

|

$ |

44,186 |

|

$ |

62,705 |

|

$ |

39,536 |

|

$ |

47,495 |

|

$ |

29,745 |

|

|

$ |

179,481 |

|

$ |

114,366 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condo Gross Profit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues6 |

|

$ |

80,145 |

|

$ |

123,021 |

|

$ |

115,407 |

|

$ |

125,112 |

|

$ |

122,094 |

|

|

$ |

485,634 |

|

$ |

305,284 |

|

|

Expenses6 |

|

$ |

60,483 |

|

$ |

81,566 |

|

$ |

83,218 |

|

$ |

79,726 |

|

$ |

74,815 |

|

|

$ |

319,325 |

|

$ |

191,606 |

|

|

Condo Net Income |

|

$ |

19,662 |

|

$ |

41,455 |

|

$ |

32,189 |

|

$ |

45,386 |

|

$ |

47,279 |

|

|

$ |

166,309 |

|

$ |

113,678 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt Summary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total debt payable7 |

|

$ |

2,771,492 |

|

$ |

2,708,460 |

|

$ |

2,865,456 |

|

$ |

2,668,522 |

|

$ |

2,561,944 |

|

|

$ |

2,708,460 |

|

$ |

2,463,122 |

|

|

Fixed rate |

|

$ |

1,324,634 |

|

$ |

1,184,141 |

|

$ |

1,152,897 |

|

$ |

1,114,735 |

|

$ |

1,120,393 |

|

|

$ |

1,184,141 |

|

$ |

1,121,669 |

|

|

Weighted avg. rate |

|

|

4.94 |

% |

|

5.89 |

% |

|

5.99 |

% |

|

6.29 |

% |

|

6.17 |

% |

|

|

5.89 |

% |

|

6.08 |

% |

|

Variable rate |

|

$ |

1,309,169 |

|

$ |

1,363,472 |

|

$ |

1,425,276 |

|

$ |

1,403,762 |

|

$ |

1,374,211 |

|

|

$ |

1,363,472 |

|

$ |

1,313,636 |

|

|

Weighted avg. rate |

|

|

3.45 |

% |

|

3.33 |

% |

|

3.08 |

% |

|

2.76 |

% |

|

2.8 |

% |

|

|

3.33 |

% |

|

2.92 |

% |

|

Short term condominium financing |

|

$ |

137,689 |

|

$ |

160,847 |

|

$ |

287,283 |

|

$ |

150,025 |

|

$ |

67,340 |

|

|

$ |

160,847 |

|

$ |

27,817 |

|

|

Weighted avg. rate |

|

|

7.68 |

% |

|

7.47 |

% |

|

7.28 |

% |

|

7.20 |

% |

|

7.19 |

% |

|

|

7.47 |

% |

|

7.11 |

% |

|

Leverage ratio (debt to enterprise value) |

|

|

38.0 |

% |

|

39.0 |

% |

|

39.9 |

% |

|

38.4 |

% |

|

40.1 |

% |

|

|

38.8 |

% |

|

35.6 |

% |

|

(1) |

Enterprise Value = (Market value of common stock + book value of debt + noncontrolling interest) - cash and equivalents |

|

(2) |

Warrants assume net share settlement. |

|

(3) |

Net Operating Income = Operating Assets NOI excluding properties sold or in redevelopment + Company's Share of Equity Method Investments NOI and the annual Distribution from our Cost Basis Investment. |

|

(4) |

Expenses include both actual and estimated future costs of sales allocated on a relative sales value to land parcels sold, including MPC-level G&A and real estate taxes on remaining residential and commercial land. |

|

(5) |

MPC Segment EBT (Earnings before tax, as discussed in our GAAP financial statements), includes negative interest expense relating to capitalized interest for the segment relating to debt held in other segments and at corporate. |

|

(6) |

Revenues represent "Condominium rights and unit sales" and expenses represent "Condominium rights and unit cost of sales" as stated in our GAAP financial statements, based on the percentage of completion method ("POC"). |

|

(7) |

Represents Total mortgages, notes, and loans payable, as stated in our GAAP financial statements, excluding unamortized deferred financing costs and underwriting fees. |

|

5 |

www.howardhughes.com |

|

In thousands |

|

|

|

|

|

|

|

|

|

||||

|

ASSETS |

|

Q1 2017 |

|

Q1 2016 |

|

|

FY 2016 |

|

FY 2015 |

||||

|

Real estate assets |

|

|

Unaudited |

|

|

Unaudited |

|

|

|

|

|

|

|

|

Master Planned Community assets |

|

$ |

1,672,484 |

|

$ |

1,647,947 |

|

|

$ |

1,669,561 |

|

$ |

1,642,842 |

|

Land |

|

|

314,259 |

|

|

325,412 |

|

|

|

320,936 |

|

|

322,462 |

|

Buildings and equipment |

|

|

2,131,973 |

|

|

1,884,772 |

|

|

|

2,027,363 |

|

|

1,772,401 |

|

Less: accumulated depreciation |

|

|

(266,260) |

|

|

(252,095) |

|

|

|

(245,814) |

|

|

(232,969) |

|

Developments |

|

|

994,864 |

|

|

806,862 |

|

|

|

961,980 |

|

|

1,036,927 |

|

Net property and equipment |

|

|

4,847,320 |

|

|

4,412,898 |

|

|

|

4,734,026 |

|

|

4,541,663 |

|

Net investment in Real Estate and Other Affiliates |

|

|

70,381 |

|

|

56,295 |

|

|

|

76,376 |

|

|

57,811 |

|

Total Real Estate Assets |

|

$ |

4,917,701 |

|

$ |

4,469,193 |

|

|

$ |

4,810,402 |

|

$ |

4,599,474 |

|

Cash and cash equivalents |

|

|

541,508 |

|

|

736,834 |

|

|

|

665,510 |

|

|

445,301 |

|

Accounts Receivable |

|

|

10,177 |

|

|

54,194 |

|

|

|

10,038 |

|

|

11,626 |

|

MUD receivables, net |

|

|

160,189 |

|

|

157,282 |

|

|

|

150,385 |

|

|

139,946 |

|

Deferred expenses |

|

|

64,155 |

|

|

63,532 |

|

|

|

64,531 |

|

|

61,804 |

|

Prepaid expenses and other assets |

|

|

714,412 |

|

|

550,939 |

|

|

|

666,516 |

|

|

463,431 |

|

Total Assets |

|

$ |

6,408,142 |

|

$ |

6,031,974 |

|

|

$ |

6,367,382 |

|

$ |

5,721,582 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mortgages, notes and loans payable |

|

$ |

2,750,254 |

|

$ |

2,543,638 |

|

|

$ |

2,690,747 |

|

$ |

2,443,962 |

|

Deferred tax liabilities |

|

|

210,043 |

|

|

141,972 |

|

|

|

200,945 |

|

|

89,221 |

|

Warrant liabilities |

|

|

313,797 |

|

|

277,940 |

|

|

|

332,170 |

|

|

307,760 |

|

Uncertain tax position liability |

|

|

— |

|

|

3,340 |

|

|

|

— |

|

|

1,396 |

|

Accounts payable and accrued expenses |

|

|

516,742 |

|

|

564,621 |

|

|

|

572,010 |

|

|

515,354 |

|

Total Liabilities |

|

$ |

3,790,836 |

|

$ |

3,531,511 |

|

|

$ |

3,795,872 |

|

$ |

3,357,693 |

|

Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital stock |

|

$ |

404 |

|

$ |

398 |

|

|

$ |

398 |

|

$ |

398 |

|

Additional paid-in capital |

|

|

2,893,042 |

|

|

2,851,343 |

|

|

|

2,853,269 |

|

|

2,847,823 |

|

Accumulated deficit |

|

|

(272,253) |

|

|

(336,450) |

|

|

|

(277,912) |

|

|

(480,215) |

|

Accumulated other loss |

|

|

(6,428) |

|

|

(17,760) |

|

|

|

(6,786) |

|

|

(7,889) |

|

Treasury stock |

|

|

(1,231) |

|

|

(840) |

|

|

|

(1,231) |

|

|

— |

|

Total stockholders' equity |

|

|

2,613,534 |

|

|

2,496,691 |

|

|

|

2,567,738 |

|

|

2,360,117 |

|

Non-controlling interest |

|

|

3,772 |

|

|

3,772 |

|

|

|

3,772 |

|

|

3,772 |

|

Total Equity |

|

$ |

2,617,306 |

|

$ |

2,500,463 |

|

|

$ |

2,571,510 |

|

$ |

2,363,889 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Equity |

|

$ |

6,408,142 |

|

$ |

6,031,974 |

|

|

$ |

6,367,382 |

|

$ |

5,721,582 |

|

Share Count Details (in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares outstanding |

|

|

40,312 |

|

|

39,824 |

|

|

|

39,790 |

|

|

39,715 |

|

Dilutive effect of stock options |

|

|

241 |

|

|

239 |

|

|

|

277 |

|

|

316 |

|

Warrants (assumes net share settlement) |

|

|

2,641 |

|

|

2,570 |

|

|

|

2,894 |

|

|

2,873 |

|

Total Diluted Share Equivalents Outstanding |

|

|

43,194 |

|

|

42,633 |

|

|

|

42,961 |

|

|

42,904 |

|

6 |

www.howardhughes.com |

|

In thousands |

|

Q1 2017 |

|

Q1 2016 |

|

|

FY 2016 |

|

FY 2015 |

||||

|

Revenues: |

|

Unaudited |

|

Unaudited |

|

|

|

|

|

|

|

||

|

Condominium rights and unit sales |

|

$ |

80,145 |

|

$ |

122,094 |

|

|

$ |

485,634 |

|

|

305,284 |

|

Master Planned Community land sales |

|

|

53,481 |

|

|

41,942 |

|

|

|

215,318 |

|

|

187,399 |

|

Builder price participation |

|

|

4,661 |

|

|

4,647 |

|

|

|

21,386 |

|

|

26,846 |

|

Minimum rents |

|

|

46,326 |

|

|

41,309 |

|

|

|

173,268 |

|

|

150,805 |

|

Tenant recoveries |

|

|

11,399 |

|

|

10,528 |

|

|

|

44,330 |

|

|

39,542 |

|

Hospitality revenues |

|

|

19,711 |

|

|

12,909 |

|

|

|

62,252 |

|

|

45,374 |

|

Other land revenues |

|

|

10,582 |

|

|

3,033 |

|

|

|

16,232 |

|

|

14,803 |

|

Other rental and property revenues |

|

|

5,457 |

|

|

3,204 |

|

|

|

16,585 |

|

|

27,035 |

|

Total revenues |

|

$ |

231,762 |

|

$ |

239,666 |

|

|

$ |

1,035,005 |

|

$ |

797,088 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condominium rights and unit cost of sales |

|

$ |

60,483 |

|

$ |

74,815 |

|

|

$ |

319,325 |

|

$ |

191,606 |

|

Master Planned Community cost of sales |

|

|

25,869 |

|

|

15,688 |

|

|

|

95,727 |

|

|

88,065 |

|

Master Planned Community operations |

|

|

9,394 |

|

|

9,594 |

|

|

|

42,371 |

|

|

44,907 |

|

Other property operating costs |

|

|

18,508 |

|

|

15,742 |

|

|

|

65,978 |

|

|

72,751 |

|

Rental property real estate taxes |

|

|

7,537 |

|

|

6,748 |

|

|

|

26,847 |

|

|

24,138 |

|

Rental property maintenance costs |

|

|

3,028 |

|

|

3,132 |

|

|

|

12,392 |

|

|

10,712 |

|

Hospitality operating costs |

|

|

13,845 |

|

|

10,475 |

|

|

|

49,359 |

|

|

34,839 |

|

Provision for doubtful accounts |

|

|

535 |

|

|

3,041 |

|

|

|

5,664 |

|

|

4,030 |

|

Demolition costs |

|

|

65 |

|

|

472 |

|

|

|

2,212 |

|

|

3,297 |

|

Development-related marketing costs |

|

|

4,205 |

|

|

4,531 |

|

|

|

22,184 |

|

|

25,466 |

|

General and administrative |

|

|

18,117 |

|

|

20,324 |

|

|

|

86,588 |

|

|

81,345 |

|

Depreciation and amortization |

|

|

25,524 |

|

|

22,972 |

|

|

|

95,864 |

|

|

98,997 |

|

Total expenses |

|

$ |

187,110 |

|

$ |

187,534 |

|

|

$ |

824,511 |

|

$ |

680,153 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income before other items |

|

|

44,652 |

|

|

52,132 |

|

|

|

210,494 |

|

|

116,935 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for impairment |

|

|

— |

|

|

— |

|

|

|

(35,734) |

|

|

— |

|

Gain on sale of properties |

|

|

32,215 |

|

|

140,479 |

|

|

|

140,549 |

|

|

— |

|

Other income, net |

|

|

687 |

|

|

359 |

|

|

|

11,453 |

|

|

1,829 |

|

Total other |

|

$ |

32,902 |

|

$ |

140,838 |

|

|

$ |

116,268 |

|

$ |

1,829 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Income |

|

$ |

77,554 |

|

$ |

192,970 |

|

|

$ |

326,762 |

|

$ |

118,764 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net of interest income |

|

|

(17,236) |

|

|

(15,724) |

|

|

|

(64,365) |

|

|

(59,158) |

|

Loss on early extinguishment of debt |

|

|

(46,410) |

|

|

— |

|

|

|

— |

|

|

— |

|

Warrant liability (loss) / gain |

|

|

(12,562) |

|

|

29,820 |

|

|

|

(24,410) |

|

|

58,320 |

|

Gain on acquisition of joint venture partner's interest |

|

|

5,490 |

|

|

— |

|

|

|

27,088 |

|

|

— |

|

(Loss) / gain on disposal of operating assets |

|

|

— |

|

|

— |

|

|

|

(1,117) |

|

|

29,073 |

|

Equity in earnings from Real Estate and Other Affiliates |

|

|

8,520 |

|

|

1,932 |

|

|

|

56,818 |

|

|

3,721 |

|

Income (loss) before taxes |

|

|

15,356 |

|

|

208,998 |

|

|

|

320,776 |

|

|

150,720 |

|

Provision for income taxes |

|

|

(9,697) |

|

|

(65,233) |

|

|

|

(118,450) |

|

|

(24,001) |

|

Net income |

|

|

5,659 |

|

|

143,765 |

|

|

|

202,326 |

|

|

126,719 |

|

Net income attributable to noncontrolling interests |

|

|

— |

|

|

— |

|

|

|

(23) |

|

|

— |

|

Net income (loss) attributable to common stockholders |

|

$ |

5,659 |

|

$ |

143,765 |

|

|

$ |

202,303 |

|

$ |

126,719 |

|

7 |

www.howardhughes.com |

|

In thousands |

|

Q1 2017 |

|

Q1 2016 |

|

|

FY 2016 |

|

FY 2015 |

|

||||

|

RECONCILIATION OF NET INCOME TO FFO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to common shareholders |

|

$ |

5,659 |

|

$ |

143,765 |

|

|

$ |

202,303 |

|

$ |

126,719 |

|

|

Add: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Segment real estate related depreciation and amortization |

|

|

23,549 |

|

|

21,943 |

|

|

|

89,368 |

|

|

92,955 |

|

|

Loss (gain) on disposal of depreciable real estate operating assets |

|

|

— |

|

|

— |

|

|

|

1,117 |

|

|

(29,073) |

|

|

Gains on sales of properties |

|

|

(32,215) |

|

|

(140,549) |

|

|

|

(140,549) |

|

|

— |

|

|

Income tax expense (benefit) adjustments - deferred |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss (gain) on disposal of depreciable real estate operating assets |

|

|

— |

|

|

— |

|

|

|

(419) |

|

|

10,176 |

|

|

Gains on sales of properties |

|

|

12,081 |

|

|

52,706 |

|

|

|

52,706 |

|

|

— |

|

|

Impairment of depreciable real estate properties |

|

|

— |

|

|

— |

|

|

|

35,734 |

|

|

— |

|

|

Reconciling items related to noncontrolling interests |

|

|

— |

|

|

— |

|

|

|

23 |

|

|

— |

|

|

Our share of the above reconciling items included in earnings from unconsolidated joint ventures |

|

|

830 |

|

|

1,196 |

|

|

|

863 |

|

|

2,255 |

|

|

FFO |

|

|

9,904 |

|

|

79,061 |

|

|

|

241,146 |

|

|

203,032 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments to arrive at Core FFO: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition expenses |

|

|

32 |

|

|

— |

|

|

|

526 |

|

|

— |

|

|

Loss on redemption of senior notes due 2021 |

|

|

46,410 |

|

|

— |

|

|

|

— |

|

|

— |

|

|

Gain on acquisition of joint venture partner's interest |

|

|

(5,490) |

|

|

— |

|

|

|

(27,088) |

|

|

— |

|

|

Warrant (gain) loss |

|

|

12,562 |

|

|

(29,820) |

|

|

|

24,410 |

|

|

(58,320) |

|

|

Severance expenses |

|

|

828 |

|

|

190 |

|

|

|

487 |

|

|

767 |

|

|

Non-real estate related depreciation and amortization |

|

|

1,975 |

|

|

1,029 |

|

|

|

6,496 |

|

|

6,042 |

|

|

Straight-line rent adjustment |

|

|

1,961 |

|

|

3,121 |

|

|

|

10,689 |

|

|

7,391 |

|

|

Deferred income tax expense (benefit) |

|

|

(3,193) |

|

|

7,509 |

|

|

|

61,411 |

|

|

10,976 |

|

|

Non-cash fair value adjustments related to hedging instruments |

|

|

(198) |

|

|

351 |

|

|

|

1,364 |

|

|

1,745 |

|

|

Share based compensation |

|

|

1,906 |

|

|

2,722 |

|

|

|

6,707 |

|

|

7,284 |

|

|

Other non-recurring expenses (development related marketing and demolition costs) |

|

|

4,270 |

|

|

5,003 |

|

|

|

24,396 |

|

|

28,763 |

|

|

Our share of the above reconciling items included in earnings from unconsolidated joint ventures |

|

|

75 |

|

|

227 |

|

|

|

206 |

|

|

(3) |

|

|

Core FFO |

|

$ |

71,042 |

|

$ |

69,393 |

|

|

$ |

350,750 |

|

$ |

207,677 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FFO per diluted share value |

|

$ |

0.23 |

|

$ |

1.86 |

|

|

$ |

5.64 |

|

$ |

4.75 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core FFO per diluted share value |

|

$ |

1.66 |

|

$ |

1.64 |

|

|

$ |

8.21 |

|

$ |

4.86 |

|

|

8 |

www.howardhughes.com |

|

Dollars in thousands |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

1Q17 |

|

|

|

Time to |

||

|

Property |

|

Ownership |

|

Total |

|

1Q17 SF/Units |

|

1Q17 |

|

1Q17 |

|

1Q17 |

|

|

Annualized |

|

Stabilized |

|

Stabilize |

|

|

|

|

(a) |

|

SF / Units |

|

Occupied |

|

SF/Units Leased |

|

% Occupied |

|

% Leased |

|

|

Cash NOI (a) (b) |

|

NOI (a) (c) |

|

(Years) |

|

|

Stabilized Properties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Office - Houston |

|

100 |

% |

1,452,473 |

|

1,420,111 |

|

1,430,452 |

|

98 |

% |

98 |

% |

$ |

35,972 |

|

$ |

38,200 |

|

NA |

|

Office - Columbia |

|

100 |

% |

1,085,070 |

|

978,897 |

|

1,010,821 |

|

90 |

% |

93 |

% |

|

13,544 |

|

|

14,500 |

|

NA |

|

Office - Other |

|

100 |

% |

226,000 |

|

226,000 |

|

226,000 |

|

100 |

% |

100 |

% |

|

6,064 |

|

|

6,100 |

|

NA |

|

Retail - Houston (d) |

|

100 |

% |

233,362 |

|

224,308 |

|

225,948 |

|

96 |

% |

97 |

% |

|

6,952 |

|

|

6,500 |

|

NA |

|

Retail - Columbia |

|

100 |

% |

88,556 |

|

68,100 |

|

88,556 |

|

77 |

% |

100 |

% |

|

1,564 |

|

|

2,200 |

|

NA |

|

Retail - Hawaii |

|

100 |

% |

1,143,533 |

|

1,070,347 |

|

1,078,352 |

|

94 |

% |

94 |

% |

|

23,600 |

|

|

25,600 |

|

NA |

|

Retail - Other |

|

100 |

% |

340,972 |

|

333,699 |

|

333,699 |

|

98 |

% |

98 |

% |

|

7,352 |

|

|

7,200 |

|

NA |

|

Multi-Family - Houston |

|

100 |

% |

707 |

|

617 |

|

646 |

|

87 |

% |

91 |

% |

|

6,204 |

|

|

9,100 |

|

NA |

|

Multi-Family - Columbia |

|

50 |

% |

380 |

|

350 |

|

355 |

|

92 |

% |

93 |

% |

|

2,764 |

|

|

3,500 |

|

NA |

|

Multi-Family - New York |

|

100 |

% |

21 |

|

20 |

|

20 |

|

96 |

% |

96 |

% |

|

476 |

|

|

600 |

|

NA |

|

Other Assets (e) |

|

NA |

|

NA |

|

NA |

|

NA |

|

NA |

|

NA |

|

|

8,821 |

|

|

8,821 |

|

NA |

|

Total Stabilized Properties (f) |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

113,313 |

|

$ |

122,321 |

|

NA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unstabilized Properties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Office - Houston |

|

100 |

% |

676,688 |

|

243,609 |

|

306,095 |

|

36 |

% |

45 |

% |

$ |

2,384 |

|

$ |

14,500 |

|

3.0 |

|

Office - Columbia |

|

100 |

% |

204,020 |

|

97,930 |

|

122,412 |

|

48 |

% |

60 |

% |

|

1,488 |

|

|

5,100 |

|

3.0 |

|

Office - Summerlin |

|

100 |

% |

208,347 |

|

137,926 |

|

160,636 |

|

66 |

% |

77 |

% |

|

3,720 |

|

|

5,700 |

|

1.0 |

|

Retail - Houston (d) |

|

100 |

% |

157,641 |

|

104,208 |

|

110,182 |

|

66 |

% |

70 |

% |

|

2,504 |

|

|

3,600 |

|

0.5 |

|

Retail - Summerlin |

|

100 |

% |

796,443 |

|

670,605 |

|

699,277 |

|

84 |

% |

88 |

% |

|

17,916 |

|

|

26,300 |

|

1.0 |

|

Multi-Family - Houston |

|

100 |

% |

390 |

|

300 |

|

336 |

|

77 |

% |

86 |

% |

|

4,244 |

|

|

7,500 |

|

1.0 |

|

Multi-Family - Summerlin |

|

50 |

% |

124 |

|

96 |

|

106 |

|

77 |

% |

86 |

% |

|

— |

|

|

1,100 |

|

1.0 |

|

Hospitality - Houston |

|

100 |

% |

913 |

|

605 |

|

605 |

|

66 |

% |

66 |

% |

|

23,464 |

|

|

31,500 |

|

2.9 |

|

Self Storage - Houston |

|

100 |

% |

654 |

|

— |

|

— |

|

NA |

|

NA |

|

|

— |

|

|

800 |

|

2.0 |

|

Total Unstabilized Properties |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

55,720 |

|

$ |

96,100 |

|

1.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Under Construction Properties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Office - Houston |

|

100 |

% |

203,000 |

|

— |

|

203,000 |

|

NA |

|

100 |

% |

|

NA |

|

$ |

5,100 |

|

2.0 |

|

Office - Columbia |

|

100 |

% |

130,000 |

|

— |

|

97,500 |

|

NA |

|

75 |

% |

|

NA |

|

|

3,600 |

|

4.0 |

|

Office - Summerlin |

|

100 |

% |

180,000 |

|

— |

|

180,000 |

|

0 |

% |

100 |

% |

|

NA |

|

|

4,100 |

|

2.0 |

|

Multi-Family - Houston |

|

100 |

% |

292 |

|

— |

|

— |

|

NA |

|

0 |

% |

|

NA |

|

|

3,500 |

|

2.0 |

|

Multi-Family - Columbia |

|

50 |

% |

437 |

|

— |

|

— |

|

NA |

|

0 |

% |

|

NA |

|

|

4,000 |

|

2.0 |

|

Hospitality - New York |

|

35 |

% |

72 |

|

— |

|

— |

|

NA |

|

0 |

% |

|

NA |

|

|

1,300 |

|

1.0 |

|

Self Storage - Houston |

|

100 |

% |

784 |

|

— |

|

— |

|

NA |

|

NA |

|

|

NA |

|

|

800 |

|

2.0 |

|

Total Under Construction Properties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NA |

|

$ |

22,400 |

|

2.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total/ Wtd. Avg for Portfolio |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

169,033 |

|

$ |

240,821 |

|

1.9 |

Notes

|

(a) |

Includes our share of NOI where we do not own 100%. |

|

(b) |

Annualized 1Q17 NOI includes distribution received from our cost basis investment. For purposes of this calculation, these one time annual distributions are not annualized. |

|

(c) |

Table above excludes Seaport NOI until we have greater clarity. Please reference page 13 for Stabilized NOI Yield and other project information. |

|

(d) |

Retail - Houston is inclusive of retail in The Woodlands and Bridgeland. |

|

(e) |

Other Assets are primarily made up of income from Kewalo Basin, Summerlin Baseball and Hockey ground lease, and our share of other equity method investments not included in other categories. |

|

(f) |

For Stabilized Properties, the difference between 1Q17 cash NOI and Stabilized NOI is attributable to a number of factors which may include timing, free rent or other temporary abatements, tenant turnover and market factors considered nonpermanent. |

|

9 |

www.howardhughes.com |

|

(Dollars in thousands) |

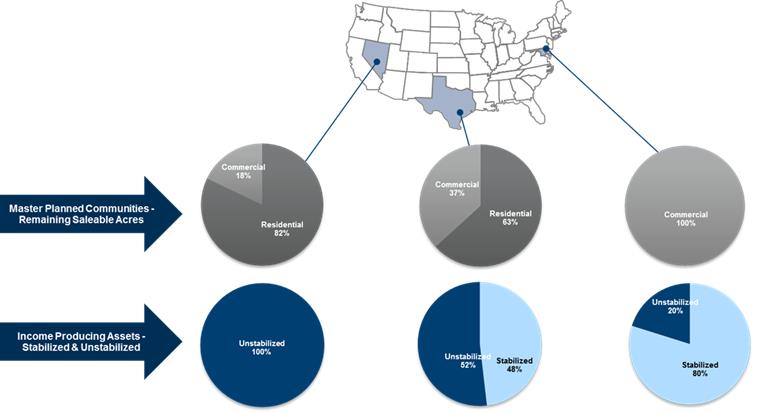

Nevada |

Texas |

Maryland |

Total |

|||

|

MPC Performance - FY-16 & Q1-17 |

|||||||

|

MPC Net Contribution (FY-16) (a) |

$136,500 |

$7,583 |

($1,179) |

$142,904 |

|||

|

MPC Net Contribution (Q1-17) (a) |

$20,395 |

$2,478 |

($303) |

$22,570 |

|||

|

Operating Asset Performance - 2017 & Future |

|||||||

|

Annualized 1Q17 In-Place Cash NOI |

$25,016 |

$81,724 |

$19,360 |

$126,100 |

|||

|

Est. Stabilized NOI (Future) |

$40,580 |

$121,100 |

$32,900 |

$194,580 |

|||

|

Wtd. Avg. Time to Stab. (yrs.) |

1.0 |

1.9 |

3.0 |

— |

Note

|

(a) |

Reconciliation from GAAP MPC segment EBT to MPC Net Contribution for the three months ended March 31, 2017 is found on Reconciliation of non-GAAP Measures. |

|

10 |

www.howardhughes.com |

|

|

|

MPC Regions |

|

|

|

Non-MPC Regions |

||||||||||||||

|

|

|

Woodlands |

|

Woodlands Hills |

|

Bridgeland |

|

Summerlin |

|

Columbia |

|

Total |

|

Hawaii |

|

Seaport |

|

Other |

|

Total |

|

|

|

Houston, TX |

|

Houston, TX |

|

Houston, TX |

|

Las Vegas, NV |

|

Columbia, MD |

|

MPC Regions |

|

Honolulu, HI |

|

New York, NY |

|

|

|

Non-MPC |

|

Operating - Stabilized Properties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Office s.f. |

|

1,452,473 |

|

— |

|

— |

|

— |

|

1,085,070 |

|

2,537,543 |

|

— |

|

— |

|

226,000 |

|

226,000 |

|

Retail s.f. |

|

233,362 |

|

— |

|

— |

|

— |

|

88,556 |

|

321,918 |

|

1,143,533 |

|

— |

|

340,972 |

|

1,484,505 |

|

Multifamily units |

|

707 |

|

— |

|

— |

|

— |

|

380 |

|

1,087 |

|

— |

|

21 |

|

— |

|

21 |

|

Hotel Rooms |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

Self Storage |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating - Unstabilized Properties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Office s.f. |

|

676,688 |

|

— |

|

— |

|

208,347 |

|

204,020 |

|

1,089,055 |

|

— |

|

— |

|

— |

|

— |

|

Retail s.f. (a) |

|

74,669 |

|

— |

|

82,972 |

|

796,443 |

|

— |

|

954,084 |

|

— |

|

— |

|

— |

|

— |

|

Multifamily units |

|

390 |

|

— |

|

— |

|

124 |

|

— |

|

514 |

|

— |

|

— |

|

— |

|

— |

|

Hotel rooms |

|

913 |

|

— |

|

— |

|

— |

|

— |

|

913 |

|

— |

|

— |

|

— |

|

— |

|

Self Storage |

|

654 |

|

— |

|

— |

|

— |

|

— |

|

654 |

|

— |

|

— |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating - Under Construction Properties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Office s.f. |

|

203,000 |

|

— |

|

— |

|

180,000 |

|

130,000 |

|

513,000 |

|

— |

|

— |

|

— |

|

— |

|

Retail s.f. (b) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

Multifamily units |

|

292 |

|

— |

|

— |

|

— |

|

437 |

|

729 |

|

— |

|

— |

|

— |

|

— |

|

Hotel rooms |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

72 |

|

— |

|

72 |

|

Self Storage |

|

784 |

|

— |

|

— |

|

— |

|

— |

|

784 |

|

— |

|

— |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Residential Land |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total gross acreage/condos (c) |

|

28,475 ac. |

|

2,055 ac. |

|

11,400 ac. |

|

22,500 ac. |

|

16,450 ac. |

|

80,880 ac. |

|

1,381 |

|

n.a. |

|

n.a. |

|

1,381 |

|

Current Residents (c) |

|

115,000 |

|

— |

|

8,300 |

|

107,000 |

|

112,000 |

|

342,300 |

|

n.a. |

|

n.a. |

|

n.a. |

|

— |

|

Remaining saleable acres/condos |

|

307 |

|

1,439 |

|

2,474 |

|

3,740 |

|

n.a. |

|

7,998 |

|

241 |

|

n.a. |

|

n.a. |

|

241 |

|

Estimated price per acre (d) |

|

$560 |

|

$207 |

|

$372 |

|

$577 |

|

n.a. |

|

|

|

n.a. |

|

n.a. |

|

n.a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial Land |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total acreage remaining |

|

752 |

|

171 |

|

1,530 |

|

826 |

|

108 |

|

3,387 |

|

n.a. |

|

n.a. |

|

n.a. |

|

— |

|

Estimated price per acre (e) |

|

$957 |

|

$552 |

|

$394 |

|

$759 |

|

$316 |

|

|

|

n.a. |

|

n.a. |

|

n.a. |

|

|

Notes

Portfolio key metrics herein include square feet, units and rooms included in joint venture projects.

|

(a) |

Retail s.f. within the Summerlin region excludes 381,767 sq. ft. of anchors. |

|

(b) |

Retail s.f. within New York region excludes Pier 17 and Uplands, pending final plans for this project. |

|

(c) |

Acreage and current residents shown as of December 31, 2016. |

|

(d) |

Residential pricing: average 2016 acreage pricing for Bridgeland, Summerlin and The Woodlands. Summerlin avarage pricing excludes the sale of approximately 117 acres to Pulte with an atypical economic structure. Pro forma acreage pricing for The Woodlands Hills. |

|

(e) |

Commercial pricing: estimate of current value based upon recent sales, third party appraisals and third party MPC experts. The Woodlands Hills commercial is valued at cost. |

|

11 |

www.howardhughes.com |

|

|

|

Office Expirations |

|

Retail Expirations |

||||||||||

|

|

|

Annualized Cash |

|

Percentage of |

|

Wtd. Avg. Annualized |

|

Annualized Cash |

|

Percentage of |

|

Wtd. Avg. Annualized |

||

|

|

|

Rent |

|

Annualized Cash |

|

Cash Rent Per Leased Sq. |

|

Rent |

|

Annualized Cash |

|

Cash Rent Per Leased Sq. |

||

|

Expiration Year |

($ in thousands) |

|

Rent |

|

Ft. |

|

($ in thousands) |

|

Rent |

|

Ft. |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2017 |

|

$ |

5,022 |

|

6.25 |

% |

28.47 |

|

$ |

8,843 |

|

8.56 |

% |

29.43 |

|

2018 |

|

|

3,768 |

|

4.69 |

% |

25.16 |

|

|

7,975 |

|

7.72 |

% |

40.44 |

|

2019 |

|

|

7,187 |

|

8.95 |

% |

29.67 |

|

|

4,368 |

|

4.23 |

% |

36.55 |

|

2020 |

|

|

8,537 |

|

10.63 |

% |

28.19 |

|

|

7,183 |

|

6.95 |

% |

48.47 |

|

2021 |

|

|

5,179 |

|

6.45 |

% |

32.97 |

|

|

7,123 |

|

6.89 |

% |

28.65 |

|

2022 |

|

|

8,965 |

|

11.16 |

% |

29.92 |

|

|

4,734 |

|

4.58 |

% |

50.17 |

|

2023 |

|

|

9,411 |

|

11.71 |

% |

28.71 |

|

|

6,296 |

|

6.09 |

% |

47.13 |

|

2024 |

|

|

10,345 |

|

12.88 |

% |

29.55 |

|

|

4,442 |

|

4.30 |

% |

34.90 |

|

2025 |

|

|

8,908 |

|

11.09 |

% |

33.55 |

|

|

27,854 |

|

26.95 |

% |

55.98 |

|

2026 |

|

|

947 |

|

1.18 |

% |

35.99 |

|

|

5,536 |

|

5.36 |

% |

37.79 |

|

Thereafter |

|

|

12,069 |

|

15.02 |

% |

23.17 |

|

|

18,991 |

|

18.38 |

% |

15.08 |

|

Total |

|

$ |

80,337 |

|

100.00 |

% |

|

|

$ |

103,345 |

|

100.00 |

% |

|

|

12 |

www.howardhughes.com |

|

Dollars in thousands, except per sq. ft. and unit amounts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Owned & Managed |

|

|

|

|

|

|

|

|

|

|

|

|

Const. |

|

Est. |

|

Develop. |

|

Est. |

|

Est. |

|

Stabilized |

|

|||

|

Project |

|

City, |

|

% |

|

Est. Rentable |

|

|

Percent |

|

|

|

Start |

|

Stabilized |

|

Costs |

|

Total |

|

Stabilized |

|

NOI |

|

|||

|

Name |

|

State |

|

Ownership |

|

Sq. Ft. |

|

|

Pre-Leased1 |

|

Project Status |

|

Date |

|

Date2 |

|

Incurred |

|

Cost |

|

NOI3 |

|

Yield |

|

|||

|

Office |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100 Fellowship Dr |

|

Houston, TX |

|

100 |

% |

203,000 |

|

|

100 |

% |

Under construction |

|

Q2 2017 |

|

Q4 2019 |

|

$ |

1,323 |

|

$ |

63,278 |

|

$ |

5,062 |

|

8 |

% |

|

Two Merriweather |

|

Columbia, MD |

|

100 |

% |

130,000 |

|

|

58 |

% |

Under construction |

|

Q3 2016 |

|

Q2 2020 |

|

$ |

8,833 |

|

$ |

40,941 |

|

$ |

3,685 |

|

9 |

% |

|

Aristocrat |

|

Las Vegas, NV |

|

100 |

% |

180,000 |

|

|

100 |

% |

Under construction |

|

Q2 2017 |

|

2019 |

|

$ |

201 |

|

$ |

45,085 |

|

$ |

4,071 |

|

9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retail |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Seaport - Uplands / Pier 17 |

|

New York, NY |

|

100 |

% |

401,787 |

|

|

49 |

% |

Under construction |

|

Q4 2013 |

|

Q1 2021 |

|

$ |

364,227 |

|

$ |

731,000 |

|

$ |

43,000 - $58,000 |

|

6%-8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

914,787 |

|

|

|

|

|

|

|

|

|

|

$ |

374,584 |

|

$ |

880,304 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Monthly |

|

|

|

Const. |

|

Est. |

|

|

Develop. |

|

|

Est. |

|

|

Est. |

|

Stabilized |

|

|

Project |

|

City, |

|

% |

|

Est. Number |

|

|

Est. Rent |

|

|

|

Start |

|

Stabilized |

|

|

Costs |

|

|

Total |

|

|

Stabilized |

|

NOI |

|

|

Name |

|

State |

|

Ownership |

|

of Units |

|

|

Per Unit |

|

Project Status |

|

Date |

|

Date2 |

|

|

Incurred |

|

|

Cost |

|

|

NOI3 |

|

Yield |

|

|

Multifamily |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Creekside Apartments |

|

Houston, TX |

|

100 |

% |

292 |

|

$ |

1,538 |

|

Under construction |

|

Q1 2017 |

|

Q4 2019 |

|

$ |

1,403 |

|

$ |

42,111 |

|

$ |

3,499 |

|

8 |

% |

|

m.flats/Ten.M Building4 |

|

Columbia, MD |

|

50 |

% |

437 |

|

$ |

1,982 |

|

Under construction |

|

Q1 2016 |

|

Q3 2019 |

|

$ |

63,900 |

|

$ |

109,345 |

|

$ |

8,100 |

|

7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Self-Storage |

|

|

|