Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PG&E Corp | d372888d8k.htm |

| EX-99.1 - EX-99.1 - PG&E Corp | d372888dex991.htm |

Exhibit 99.2

FIRST QUARTER EARNINGS CALL May 2, 2017

Forward Looking Statements 2 This slide presentation contains forecasts and estimates of PG&E Corporation’s 2017 financial results, 2017 items impacting comparability, 2017 equity issuance, 2017-2019 capital expenditures and rate base growth, dividend policy, and general earnings sensitivities. These forecasts and estimates are based on 2017 assumptions, including but not limited to those relating to capital expenditures, authorized rate base and rate base growth assumptions, authorized cost of capital, and certain other factors, which constitute forward-looking statements that are necessarily subject to various risks and uncertainties and actual results may differ materially. PG&E Corporation and the Utility are not able to predict all the factors that may affect future results. Factors that could cause actual results to differ materially include, but are not limited to: the timing and outcomes of the 2017 GRC, the TO rate case, the cost of capital proceeding, and other ratemaking and regulatory proceedings; the timing and outcome of the Butte fire litigation, and whether the Utility’s insurance is sufficient to cover the Utility’s liability resulting therefrom or whether insurance is otherwise available; the effect, if any, the SED’s $8.3 million citations issued in connection with the Butte fire may have on such litigation; and whether additional investigations and proceedings in connection with the Butte fire will be opened and any additional fines or penalties imposed on the Utility; the outcome of the probation and the monitorship, the timing and outcomes of the debarment proceeding, the SED’s unresolved enforcement matters relating to the Utility’s compliance with natural gas-related laws and regulations, and other investigations that have been or may be commenced, and the ultimate amount of fines, penalties, and remedial and other costs that the Utility may incur as a result; the timing and outcomes of (i) the CPUC’s decision in connection with its investigation of the Utility’s compliance with its ex parte communication rules and the settlement agreement entered into by the Utility and certain parties, and (ii) the U.S. Attorney’s Office in San Francisco and the California Attorney General’s office investigations in connection with communications between the Utility’s personnel and CPUC officials; the outcomes of current and future self-reports, investigations or other enforcement proceedings that could be commenced or notices of violation that could be issued relating to the Utility’s compliance with laws, rules, regulations, or orders applicable to its operations; the Utility’s ability to control its costs within the authorized levels of spending and the extent to which the Utility incurs unrecoverable costs that are higher than the forecasts of such costs; the impact of the increasing cost of natural gas regulations; changes in cost forecasts or the scope and timing of planned work resulting from changes in customer demand for electricity and natural gas or other reasons; the impact that reductions in customer demand for electricity and natural gas have on the Utility’s ability to make and recover its investments through rates and earn its authorized return on equity, and whether the Utility is successful in addressing the impact of growing distributed and renewable generation resources, changing customer demand for natural gas and electric services, and an increasing number of customers departing for community choice aggregators; whether, as a result of Westinghouse Electric Company LLC’s Chapter 11 proceeding, the Utility will experience issues with nuclear fuel supply, nuclear fuel inventory, and related services and products that Westinghouse supplies, and whether such proceeding will affect the Utility’s contracts with Westinghouse; whether the Utility can continue to obtain insurance and whether insurance coverage is adequate for future losses or claims, especially following a major event that causes widespread third-party losses; the ability of PG&E Corporation and the Utility to access capital markets and other sources of debt and equity financing in a timely manner on acceptable terms, and the amount and timing of additional common stock and debt issuances by PG&E Corporation; changes in estimated environmental remediation costs, including costs associated with the Utility’s natural gas compressor sites; the outcome of federal or state tax audits and the impact of any changes in federal or state tax laws, policies, regulations, or their interpretation, including as a result of the recent changes in the federal government; the impact of changes in GAAP, standards, rules, or policies, including those related to regulatory accounting, and the impact of changes in their interpretation or application; and the other factors disclosed in PG&E Corporation and the Utility’s joint annual report on Form 10-K for the year ended December 31, 2016, their joint quarterly report on Form 10-Q for the quarter ended March 31, 2017, and other reports filed with the Securities and Exchange Commission (SEC). This presentation is not complete without the accompanying statements made by management during the webcast conference call held on May 2, 2017. The statements in this presentation are made as of May 2, 2017. PG&E Corporation undertakes no obligation to update information contained herein. This presentation, including Appendices, and the accompanying press release were attached to PG&E Corporation’s Current Report on Form 8-K that was furnished to the SEC on May 2, 2017 and, along with the replay of the conference call, is also available on PG&E Corporation’s website at www.pgecorp.com.

Well-positioned to Deliver Strong Returns Building on Safety and Operational Performance • Continuing focus on public, employee, and contractor safety • Delivering reliable gas and electric service Healthy 3-year Delivering on Customer Expectations growth profile • Improving customer service through continuous innovation • ~6.5-7% ratebase growth • Focusing on maintaining affordable service • Above average dividend growth Positioning PG&E for Success • Enabling California’s clean energy economy • Building coalitions See the Forward Looking Statements for factors that could cause actual results to differ materially from the guidance presented and underlying assumptions. 3

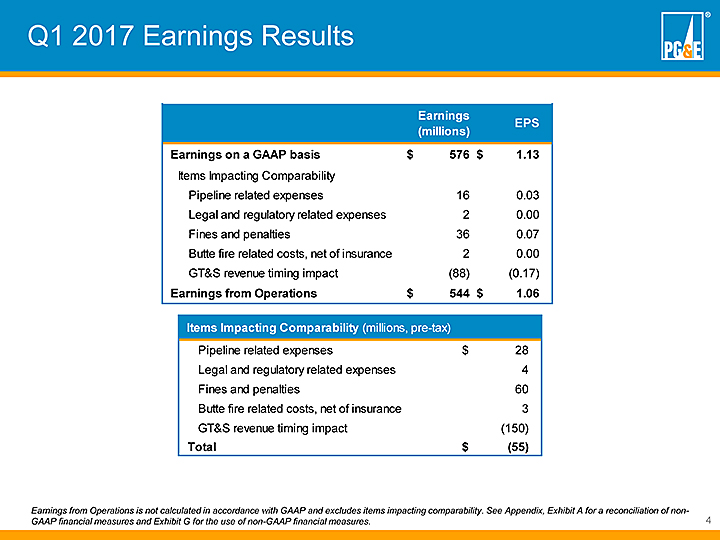

Q1 2017 Earnings Results Earnings EPS (millions) Earnings on a GAAP basis $ 576 $ 1.13 Items Impacting Comparability Pipeline related expenses 16 0.03 Legal and regulatory related expenses 2 0.00 Fines and penalties 36 0.07 Butte fire related costs, net of insurance 2 0.00 GT&S revenue timing impact (88) (0.17) Earnings from Operations $ 544 $ 1.06 Items Impacting Comparability (millions, pre-tax) Pipeline related expenses $ 28 Legal and regulatory related expenses 4 Fines and penalties 60 Butte fire related costs, net of insurance 3 GT&S revenue timing impact (150) Total $ (55) Earnings from Operations is not calculated in accordance with GAAP and excludes items impacting comparability. See Appendix, Exhibit A for a reconciliation of non- GAAP financial measures and Exhibit G for the use of non-GAAP financial measures. 4

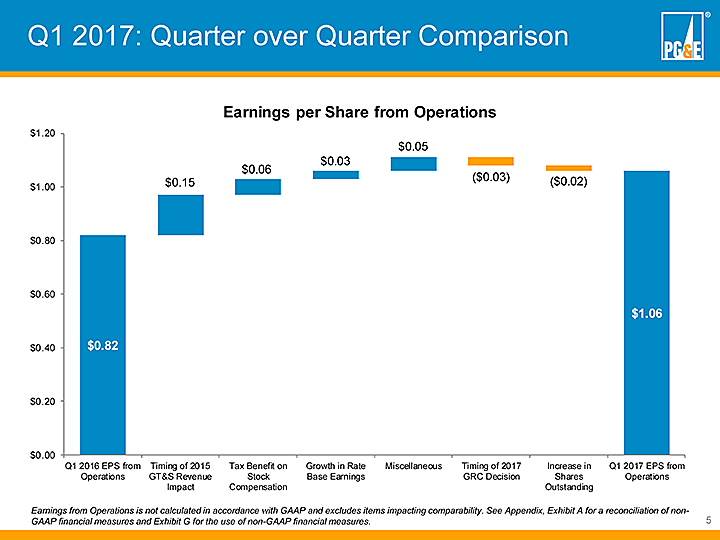

Earnings per Share from Operations $1.20 $ 0.05 $ 0.03 $ 0.06 ($ 0.03) $1.00 $ 0.15 ($ 0.02) Q1 2016 EPS from Timing of 2015 Tax Benefit on Growth in Rate Miscellaneous Timing of 2017 Increase in Q1 2017 EPS from Operations GT&S Revenue Stock Base Earnings GRC Decision Shares Operations Impact Compensation Outstanding Earnings from Operations is not calculated in accordance with GAAP and excludes items impacting comparability. See Appendix, Exhibit A for a reconciliation of non- GAAP financial measures and Exhibit G for the use of non-GAAP financial measures. 5

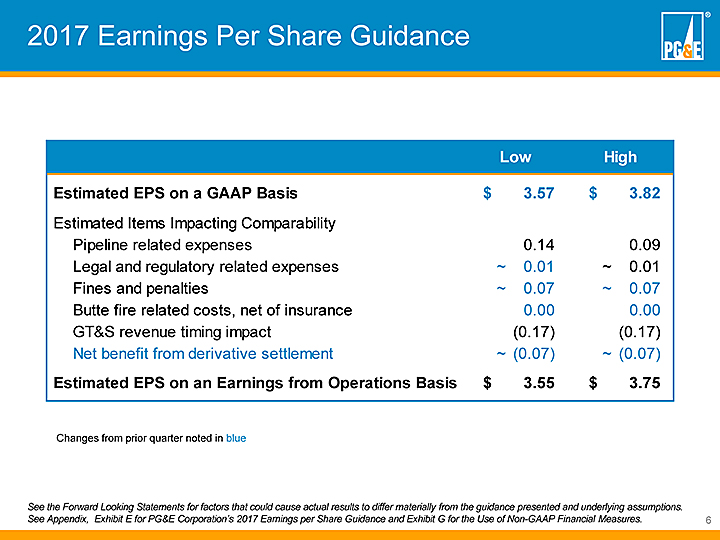

2017 Earnings Per Share Guidance Low High Estimated EPS on a GAAP Basis $ 3.57 $ 3.82 Estimated Items Impacting Comparability Pipeline related expenses 0.14 0.09 Legal and regulatory related expenses ~ 0.01 ~ 0.01 Fines and penalties ~ 0.07 ~ 0.07 Butte fire related costs, net of insurance 0.00 0.00 GT&S revenue timing impact (0.17) (0.17) Net benefit from derivative settlement ~ (0.07) ~ (0.07) Estimated EPS on an Earnings from Operations Basis $ 3.55 $ 3.75 Changes from prior quarter noted in blue See the Forward Looking Statements for factors that could cause actual results to differ materially from the guidance presented and underlying assumptions. See Appendix, Exhibit E for PG&E Corporation’s 2017 Earnings per Share Guidance and Exhibit G for the Use of Non-GAAP Financial Measures. 6

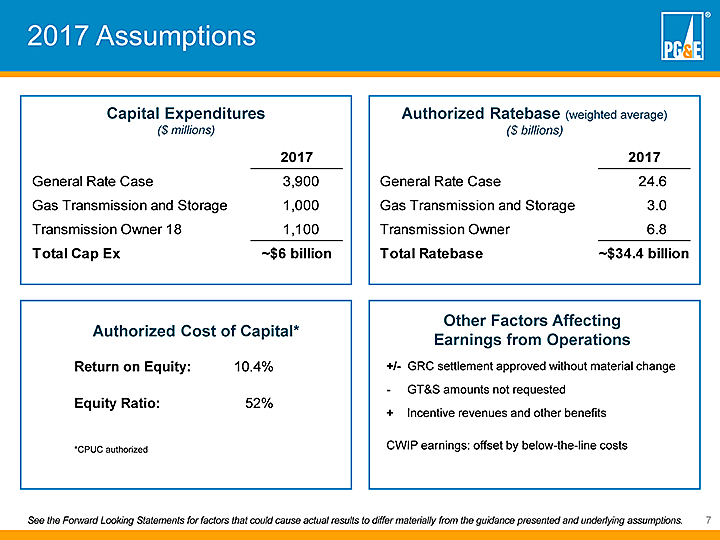

2017 Assumptions Capital Expenditures Authorized Ratebase (weighted average) ($ millions) ($ billions) 2017 2017 General Rate Case 3,900 General Rate Case 24.6 Gas Transmission and Storage 1,000 Gas Transmission and Storage 3.0 Transmission Owner 18 1,100 Transmission Owner 6.8 Total Cap Ex ~$6 billion Total Ratebase ~$34.4 billion Other Factors Affecting Authorized Cost of Capital* Earnings from Operations Return on Equity: 10.4% +/- GRC settlement approved without material change—GT&S amounts not requested Equity Ratio: 52% + Incentive revenues and other benefits *CPUC authorized CWIP earnings: offset by below-the-line costs See the Forward Looking Statements for factors that could cause actual results to differ materially from the guidance presented and underlying assumptions. 7

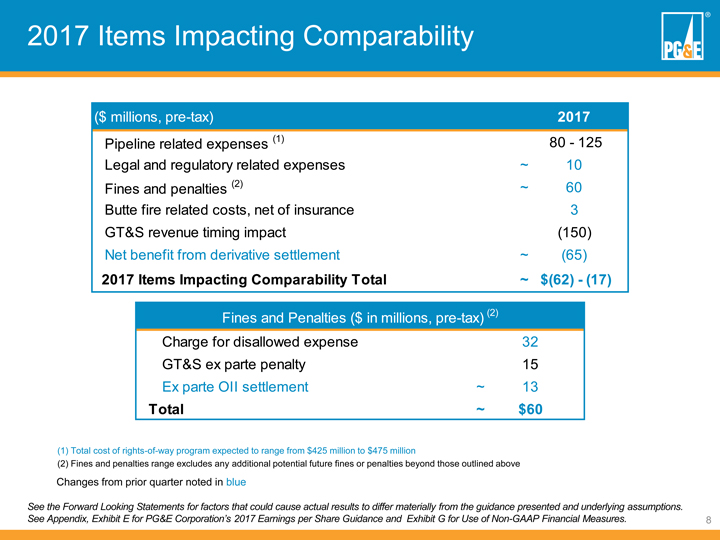

2017 Items Impacting Comparability 8 (1) Total cost of rights-of-way program expected to range from $425 million to $475 million (2) Fines and penalties range excludes any additional potential future fines or penalties beyond those outlined above See the Forward Looking Statements for factors that could cause actual results to differ materially from the guidance presented and underlying assumptions. See Appendix, Exhibit E for PG&E Corporation’s 2017 Earnings per Share Guidance and Exhibit G for Use of Non-GAAP Financial Measures. Changes from prior quarter noted in blue ($ millions, pre-tax) 2017 Pipeline related expenses (1) 80 - 125 Legal and regulatory related expenses ~ 10 Fines and penalties (2) ~ 60 Butte fire related costs, net of insurance 3 GT&S revenue timing impact (150) Net benefit from derivative settlement ~ (65) 2017 Items Impacting Comparability Total ~ $(62) - (17) Charge for disallowed expense 32 GT&S ex parte penalty 15 Ex parte OII settlement ~ 13 Total ~ $60 Fines and Penalties ($ in millions, pre-tax) (2)

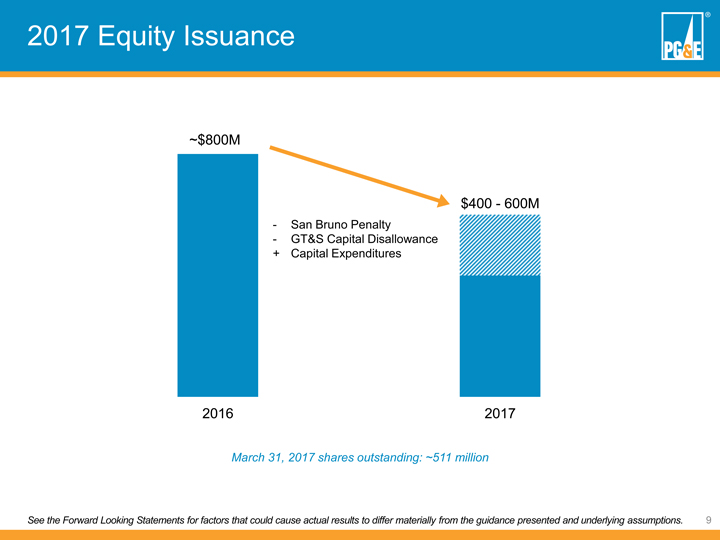

2017 Equity Issuance 9 See the Forward Looking Statements for factors that could cause actual results to differ materially from the guidance presented and underlying assumptions. - San Bruno Penalty - GT&S Capital Disallowance + Capital Expenditures March 31, 2017 shares outstanding: ~511 million ~$800M$400 -600M20162017

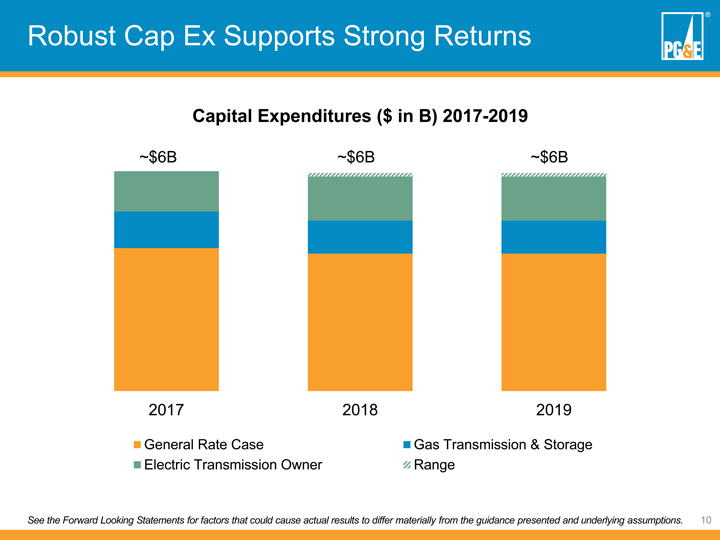

2017 2018 2019 Capital Expenditures ($ in B) 2017-2019 General Rate Case Gas Transmission & Storage Electric Transmission Owner Range Robust Cap Ex Supports Strong Returns 10 ~$6B ~$6B ~$6B See the Forward Looking Statements for factors that could cause actual results to differ materially from the guidance presented and underlying assumptions.

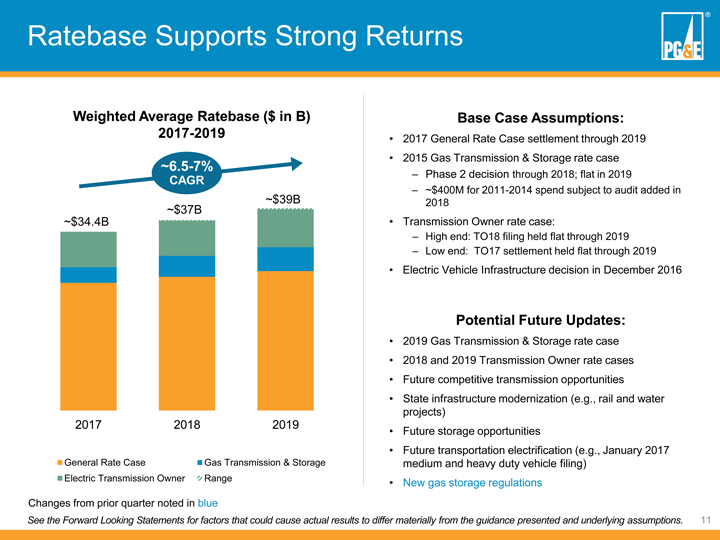

Ratebase Supports Strong Returns Weighted Average Ratebase ($ in B) 2017-2019 ~6.5-7% CAGR ~$37B ~$39B ~$34.4B 2017 2018 2019 General Rate Case Gas Transmission & Storage Electric Transmission Owner Range Base Case Assumptions: 2017 General Rate Case settlement through 2019 2015 Gas Transmission & Storage rate case - Phase 2 decision through 2018; flat in 2019 - ~$400M for 2011-2014 spend subject to audit added in 2018 Transmission Owner rate case: - High end: TO18 filing held flat through 2019 - Low end: TO17 settlement held flat through 2019 Electric Vehicle Infrastructure decision in December 2016 Potential Future Updates: 2019 Gas Transmission & Storage rate case 2018 and 2019 Transmission Owner rate cases Future competitive transmission opportunities State infrastructure modernization (e.g., rail and water projects) Future storage opportunities Future transportation electrification (e.g., January 2017 medium and heavy duty vehicle filing) New gas storage regulations Changes from prior quarter noted in blue See the Forward Looking Statements for factors that could cause actual results to differ materially from the guidance presented and underlying assumptions. 11

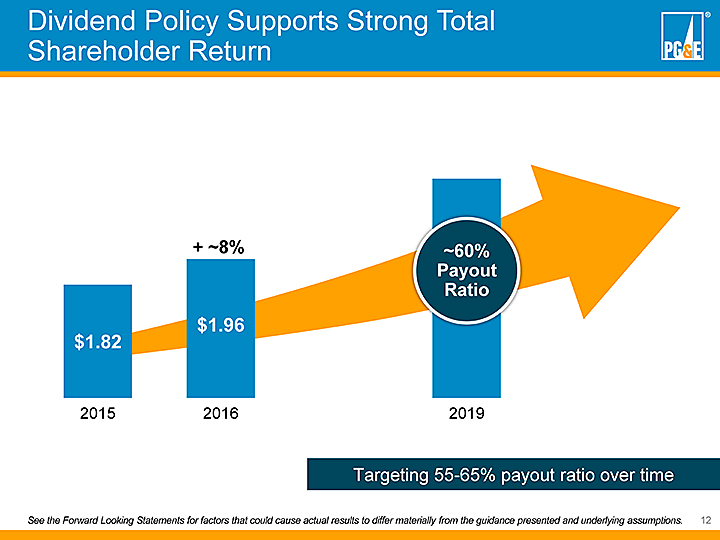

Targeting 55-65% payout ratio over time See the Forward Looking Statements for factors that could cause actual results to differ materially from the guidance presented and underlying assumptions. 12

Appendix

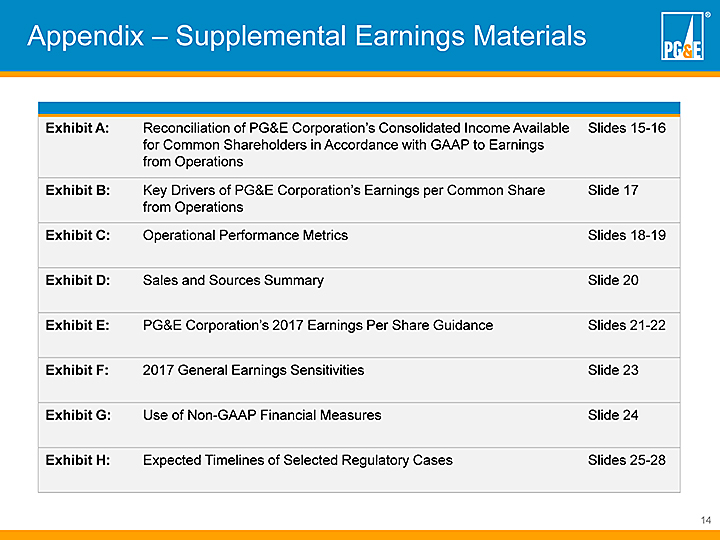

Appendix – Supplemental Earnings Materials Exhibit A: Reconciliation of PG&E Corporation’s Consolidated Income Available Slides 15-16 for Common Shareholders in Accordance with GAAP to Earnings from Operations Exhibit B: Key Drivers of PG&E Corporation’s Earnings per Common Share Slide 17 from Operations Exhibit C: Operational Performance Metrics Slides 18-19 Exhibit D: Sales and Sources Summary Slide 20 Exhibit E: PG&E Corporation’s 2017 Earnings Per Share Guidance Slides 21-22 Exhibit F: 2017 General Earnings Sensitivities Slide 23 Exhibit G: Use of Non-GAAP Financial Measures Slide 24 Exhibit H: Expected Timelines of Selected Regulatory Cases Slides 25-28 14

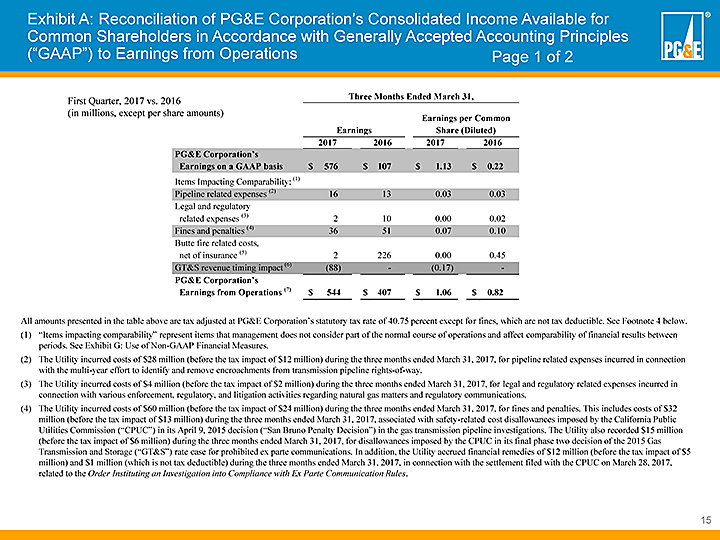

Exhibit A: Reconciliation of PG&E Corporation’s Consolidated Income Available for Common Shareholders in Accordance with Generally Accepted Accounting Principles (“GAAP”) to Earnings from Operations Page 1 of 2 All amounts presented in the table above are tax adjusted at PG&E Corporation’s statutory tax rate of 40.75 percent except for fines, which are not tax deductible. See Footnote 4 below. (1) “Items impacting comparability” represent items that management does not consider part of the normal course of operations and affect comparability of financial results between periods. See Exhibit G: Use of Non-GAAP Financial Measures. (2) The Utility incurred costs of $28 million (before the tax impact of $12 million) during the three months ended March 31, 2017, for pipeline related expenses incurred in connection with the multi-year effort to identify and remove encroachments from transmission pipeline rights-of-way. (3) The Utility incurred costs of $4 million (before the tax impact of $2 million) during the three months ended March 31, 2017, for legal and regulatory related expenses incurred in connection with various enforcement, regulatory, and litigation activities regarding natural gas matters and regulatory communications. (4) The Utility incurred costs of $60 million (before the tax impact of $24 million) during the three months ended March 31, 2017, for fines and penalties. This includes costs of $32 million (before the tax impact of $13 million) during the three months ended March 31, 2017, associated with safety-related cost disallowances imposed by the California Public Utilities Commission (“CPUC”) in its April 9, 2015 decision (“San Bruno Penalty Decision”) in the gas transmission pipeline investigations. The Utility also recorded $15 million (before the tax impact of $6 million) during the three months ended March 31, 2017, for disallowances imposed by the CPUC in its final phase two decision of the 2015 Gas Transmission and Storage (“GT&S”) rate case for prohibited ex parte communications. In addition, the Utility accrued financial remedies of $12 million (before the tax impact of $5 million) and $1 million (which is not tax deductible) during the three months ended March 31, 2017, in connection with the settlement filed with the CPUC on March 28, 2017, related to the Order Instituting an Investigation into Compliance with Ex Parte Communication Rules. 15

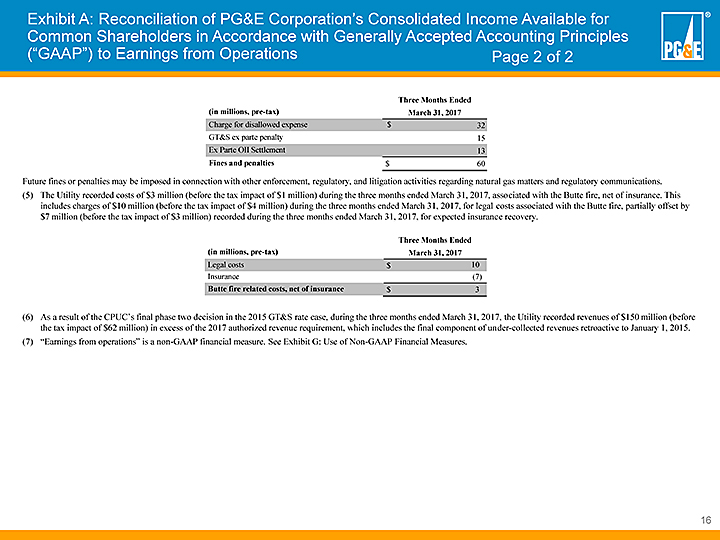

Exhibit A: Reconciliation of PG&E Corporation’s Consolidated Income Available for Common Shareholders in Accordance with Generally Accepted Accounting Principles (“GAAP”) to Earnings from Operations Page 2 of 2 Three Months Ended (in millions, pre-tax) March 31, 2017 Charge for disallowed expense $ 32 GT&S ex parte penalty 15 Ex Parte OII Settlement 13 Fines and penalties $ 60 Future fines or penalties may be imposed in connection with other enforcement, regulatory, and litigation activities regarding natural gas matters and regulatory communications. (5) The Utility recorded costs of $3 million (before the tax impact of $1 million) during the three months ended March 31, 2017, associated with the Butte fire, net of insurance. This includes charges of $10 million (before the tax impact of $4 million) during the three months ended March 31, 2017, for legal costs associated with the Butte fire, partially offset by $7 million (before the tax impact of $3 million) recorded during the three months ended March 31, 2017, for expected insurance recovery. Three Months Ended (in millions, pre-tax) March 31, 2017 Legal costs $ 10 Insurance (7) Butte fire related costs, net of insurance $ 3 (6) As a result of the CPUC’s final phase two decision in the 2015 GT&S rate case, during the three months ended March 31, 2017, the Utility recorded revenues of $150 million (before the tax impact of $62 million) in excess of the 2017 authorized revenue requirement, which includes the final component of under-collected revenues retroactive to January 1, 2015. (7) “Earnings from operations” is a non-GAAP financial measure. See Exhibit G: Use of Non-GAAP Financial Measures. 16

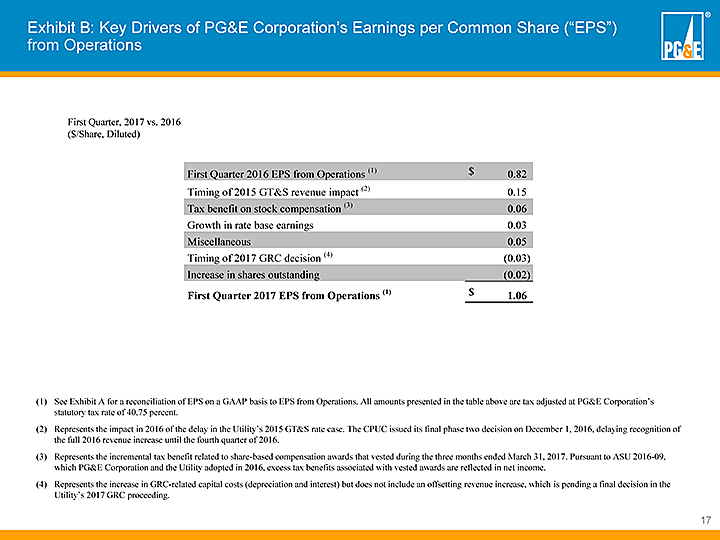

Exhibit B: Key Drivers of PG&E Corporation’s Earnings per Common Share (“EPS”) from Operations First Quarter, 2017 vs. 2016 ($/Share, Diluted) First Quarter 2016 EPS from Operations (1) $ 0.82 Timing of 2015 GT&S revenue impact (2) 0.15 Tax benefit on stock compensation (3) 0.06 Growth in rate base earnings 0.03 Miscellaneous 0.05 Timing of 2017 GRC decision (4) (0.03) Increase in shares outstanding (0.02) First Quarter 2017 EPS from Operations (1) $ 1.06 (1) See Exhibit A for a reconciliation of EPS on a GAAP basis to EPS from Operations. All amounts presented in the table above are tax adjusted at PG&E Corporation’s statutory tax rate of 40.75 percent. (2) Represents the impact in 2016 of the delay in the Utility’s 2015 GT&S rate case. The CPUC issued its final phase two decision on December 1, 2016, delaying recognition of the full 2016 revenue increase until the fourth quarter of 2016. (3) Represents the incremental tax benefit related to share-based compensation awards that vested during the three months ended March 31, 2017. Pursuant to ASU 2016-09, which PG&E Corporation and the Utility adopted in 2016, excess tax benefits associated with vested awards are reflected in net income. (4) Represents the increase in GRC-related capital costs (depreciation and interest) but does not include an offsetting revenue increase, which is pending a final decision in the Utility’s 2017 GRC proceeding. 17

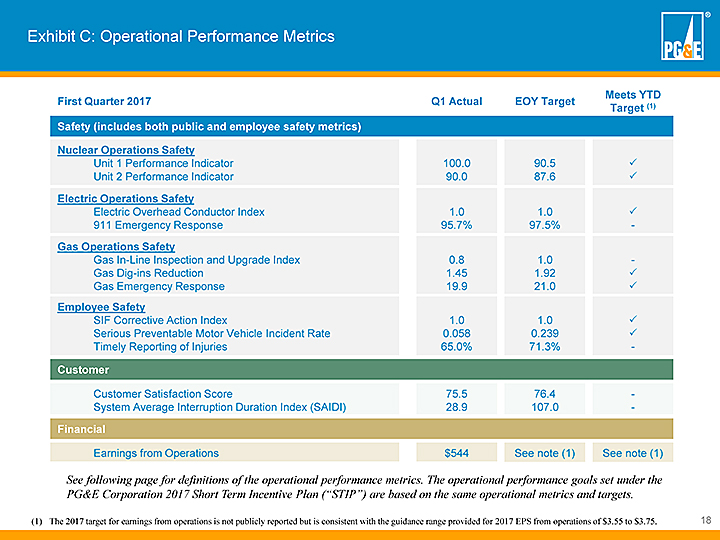

Exhibit C: Operational Performance Metrics First Quarter 2017 Q1 Actual EOY Target Meets YTD Target (1) Safety (includes both public and employee safety metrics) Nuclear Operations Safety Unit 1 Performance Indicator 100.0 90.5 P Unit 2 Performance Indicator 90.0 87.6 P Electric Operations Safety Electric Overhead Conductor Index 1.0 1.0 P 911 Emergency Response 95.7% 97.5%—Gas Operations Safety Gas In-Line Inspection and Upgrade Index 0.8 1.0—Gas Dig-ins Reduction 1.45 1.92 P Gas Emergency Response 19.9 21.0 P Employee Safety SIF Corrective Action Index 1.0 1.0 P Serious Preventable Motor Vehicle Incident Rate 0.058 0.239 P Timely Reporting of Injuries 65.0% 71.3%—Customer Customer Satisfaction Score 75.5 76.4—System Average Interruption Duration Index (SAIDI) 28.9 107.0—Financial Earnings from Operations $544 See note (1) See note (1) See following page for definitions of the operational performance metrics. The operational performance goals set under the PG&E Corporation 2017 Short Term Incentive Plan (“STIP”) are based on the same operational metrics and targets. (1) The 2017 target for earnings from operations is not publicly reported but is consistent with the guidance range provided for 2017 EPS from operations of $3.55 to $3.75. 18

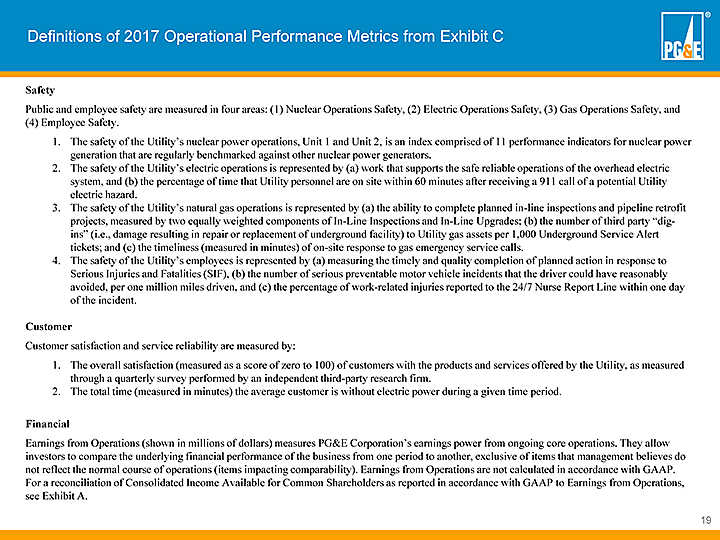

Definitions of 2017 Operational Performance Metrics from Exhibit C Safety Public and employee safety are measured in four areas: (1) Nuclear Operations Safety, (2) Electric Operations Safety, (3) Gas Operations Safety, and (4) Employee Safety. 1. The safety of the Utility’s nuclear power operations, Unit 1 and Unit 2, is an index comprised of 11 performance indicators for nuclear power generation that are regularly benchmarked against other nuclear power generators. 2. The safety of the Utility’s electric operations is represented by (a) work that supports the safe reliable operations of the overhead electric system, and (b) the percentage of time that Utility personnel are on site within 60 minutes after receiving a 911 call of a potential Utility electric hazard. 3. The safety of the Utility’s natural gas operations is represented by (a) the ability to complete planned in-line inspections and pipeline retrofit projects, measured by two equally weighted components of In-Line Inspections and In-Line Upgrades; (b) the number of third party “dig- ins” (i.e., damage resulting in repair or replacement of underground facility) to Utility gas assets per 1,000 Underground Service Alert tickets; and (c) the timeliness (measured in minutes) of on-site response to gas emergency service calls. 4. The safety of the Utility’s employees is represented by (a) measuring the timely and quality completion of planned action in response to Serious Injuries and Fatalities (SIF), (b) the number of serious preventable motor vehicle incidents that the driver could have reasonably avoided, per one million miles driven, and (c) the percentage of work-related injuries reported to the 24/7 Nurse Report Line within one day of the incident. Customer Customer satisfaction and service reliability are measured by: 1. The overall satisfaction (measured as a score of zero to 100) of customers with the products and services offered by the Utility, as measured through a quarterly survey performed by an independent third-party research firm. 2. The total time (measured in minutes) the average customer is without electric power during a given time period. Financial Earnings from Operations (shown in millions of dollars) measures PG&E Corporation’s earnings power from ongoing core operations. They allow investors to compare the underlying financial performance of the business from one period to another, exclusive of items that management believes do not reflect the normal course of operations (items impacting comparability). Earnings from Operations are not calculated in accordance with GAAP. For a reconciliation of Consolidated Income Available for Common Shareholders as reported in accordance with GAAP to Earnings from Operations, see Exhibit A. 19

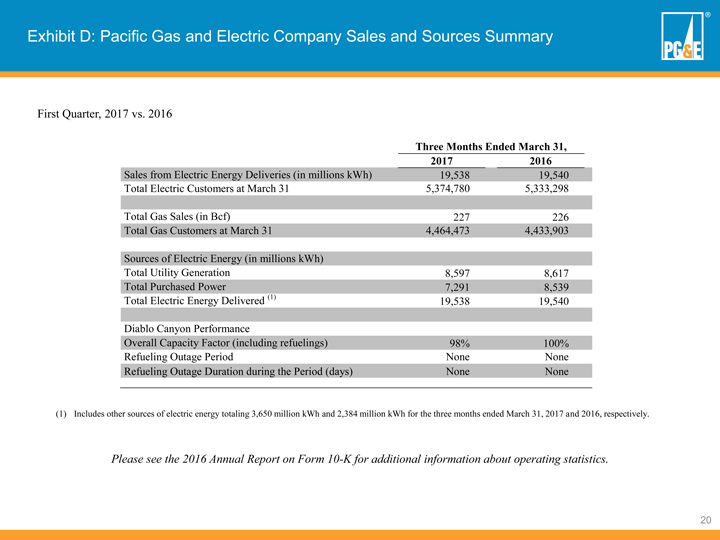

Exhibit D: Pacific Gas and Electric Company Sales and Sources Summary 20 First Quarter, 2017 vs. 2016 (1)Includes other sources of electric energy totaling 3,650 million kWh and 2,384 million kWh for the three months ended March 31, 2017 and 2016, respectively. Please see the 2016 Annual Report on Form 10-K for additional information about operating statistics. Three Months Ended March 31, 2017 2016 Sales from Electric Energy Deliveries (in millions kWh) 19,538 19,540 Total Electric Customers at March 31 5,374,780 5,333,298 Total Gas Sales (in Bcf) 227 226 Total Gas Customers at March 31 4,464,473 4,433,903 Sources of Electric Energy (in millions kWh) Total Utility Generation 8,597 8,617 Total Purchased Power 7,291 8,539 Total Electric Energy Delivered (1) 19,538 19,540 Diablo Canyon Performance Overall Capacity Factor (including refuelings) 98% 100% Refueling Outage Period None None Refueling Outage Duration during the Period (days) None None

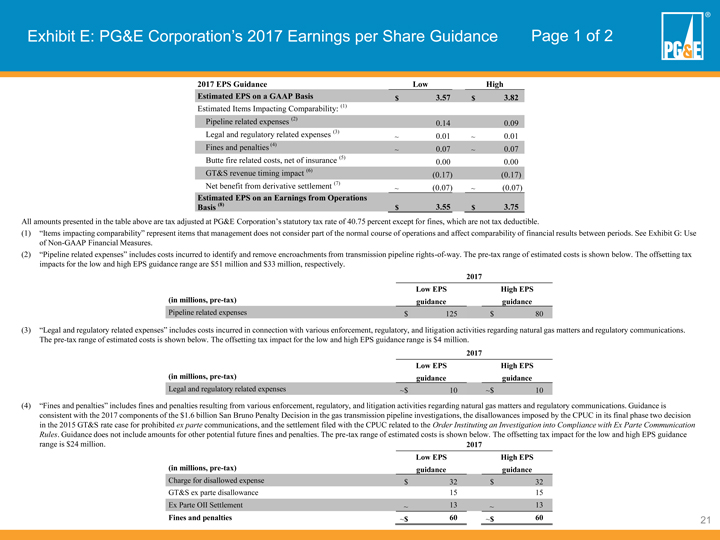

Exhibit E: PG&E Corporation’s 2017 Earnings per Share Guidance 21 All amounts presented in the table above are tax adjusted at PG&E Corporation’s statutory tax rate of 40.75 percent except for fines, which are not tax deductible. (1) “Items impacting comparability” represent items that management does not consider part of the normal course of operations and affect comparability of financial results between periods. See Exhibit G: Use of Non-GAAP Financial Measures. (2) “Pipeline related expenses” includes costs incurred to identify and remove encroachments from transmission pipeline rights-of-way. The pre-tax range of estimated costs is shown below. The offsetting tax impacts for the low and high EPS guidance range are $51 million and $33 million, respectively. (3) “Legal and regulatory related expenses” includes costs incurred in connection with various enforcement, regulatory, and litigation activities regarding natural gas matters and regulatory communications. The pre-tax range of estimated costs is shown below. The offsetting tax impact for the low and high EPS guidance range is $4 million. (4) “Fines and penalties” includes fines and penalties resulting from various enforcement, regulatory, and litigation activities regarding natural gas matters and regulatory communications. Guidance is consistent with the 2017 components of the $1.6 billion San Bruno Penalty Decision in the gas transmission pipeline investigations, the disallowances imposed by the CPUC in its final phase two decision in the 2015 GT&S rate case for prohibited ex parte communications, and the settlement filed with the CPUC related to the Order Instituting an Investigation into Compliance with Ex Parte Communication Rules. Guidance does not include amounts for other potential future fines and penalties. The pre-tax range of estimated costs is shown below. The offsetting tax impact for the low and high EPS guidance range is $24 million. Page 1 of 2 2017 Low EPS High EPS (in millions, pre-tax) guidance guidance Pipeline related expenses $ 125 $ 80 2017 Low EPS High EPS (in millions, pre-tax) guidance guidance Legal and regulatory related expenses ~$ 10 ~$ 10 2017 Low EPS High EPS (in millions, pre-tax) guidance guidance Charge for disallowed expense $ 32 $ 32 GT&S ex parte disallowance 15 15 Ex Parte OII Settlement ~ 13 ~ 13 Fines and penalties ~$ 60 ~$ 60 2017 EPS Guidance Low High Estimated EPS on a GAAP Basis $ 3.57 $ 3.82 Estimated Items Impacting Comparability: (1) Pipeline related expenses (2) 0.14 0.09 Legal and regulatory related expenses (3) ~ 0.01 ~ 0.01 Fines and penalties (4) ~ 0.07 ~ 0.07 Butte fire related costs, net of insurance (5) 0.00 0.00 GT&S revenue timing impact (6) (0.17) (0.17) Net benefit from derivative settlement (7) ~ (0.07) ~ (0.07) Estimated EPS on an Earnings from Operations Basis (8) $ 3.55 $ 3.75

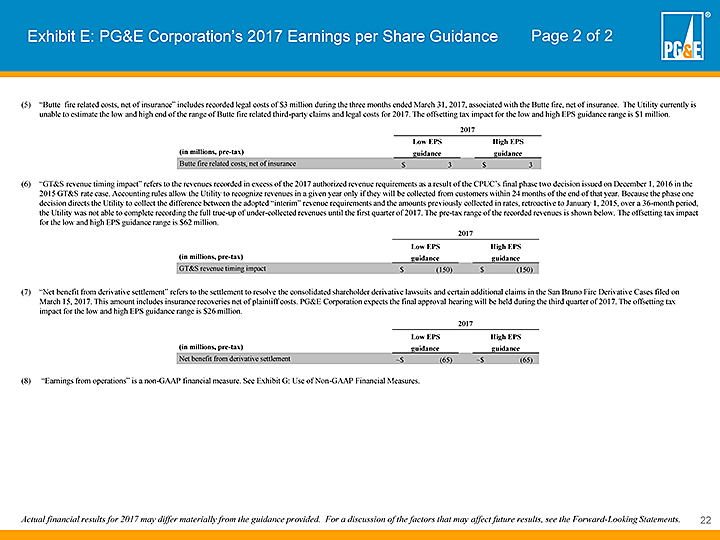

Exhibit E: PG&E Corporation’s 2017 Earnings per Share Guidance Page 2 of 2 (5) “Butte fire related costs, net of insurance” includes recorded legal costs of $3 million during the three months ended March 31, 2017, associated with the Butte fire, net of insurance. The Utility currently is unable to estimate the low and high end of the range of Butte fire related third-party claims and legal costs for 2017. The offsetting tax impact for the low and high EPS guidance range is $1 million. 2017 Low EPS High EPS (in millions, pre-tax) guidance guidance Butte fire related costs, net of insurance $ 3 $ 3 (6) “GT&S revenue timing impact” refers to the revenues recorded in excess of the 2017 authorized revenue requirements as a result of the CPUC’s final phase two decision issued on December 1, 2016 in the 2015 GT&S rate case. Accounting rules allow the Utility to recognize revenues in a given year only if they will be collected from customers within 24 months of the end of that year. Because the phase one decision directs the Utility to collect the difference between the adopted “interim” revenue requirements and the amounts previously collected in rates, retroactive to January 1, 2015, over a 36-month period, the Utility was not able to complete recording the full true-up of under-collected revenues until the first quarter of 2017. The pre-tax range of the recorded revenues is shown below. The offsetting tax impact for the low and high EPS guidance range is $62 million. 2017 Low EPS High EPS (in millions, pre-tax) guidance guidance GT&S revenue timing impact $ (150) $ (150) (7) “Net benefit from derivative settlement” refers to the settlement to resolve the consolidated shareholder derivative lawsuits and certain additional claims in the San Bruno Fire Derivative Cases filed on March 15, 2017. This amount includes insurance recoveries net of plaintiff costs. PG&E Corporation expects the final approval hearing will be held during the third quarter of 2017. The offsetting tax impact for the low and high EPS guidance range is $26 million. 2017 Low EPS High EPS (in millions, pre-tax) guidance guidance Net benefit from derivative settlement ~$ (65) ~$ (65) (8) “Earnings from operations” is a non-GAAP financial measure. See Exhibit G: Use of Non-GAAP Financial Measures. Actual financial results for 2017 may differ materially from the guidance provided. For a discussion of the factors that may affect future results, see the Forward-Looking Statements. 22

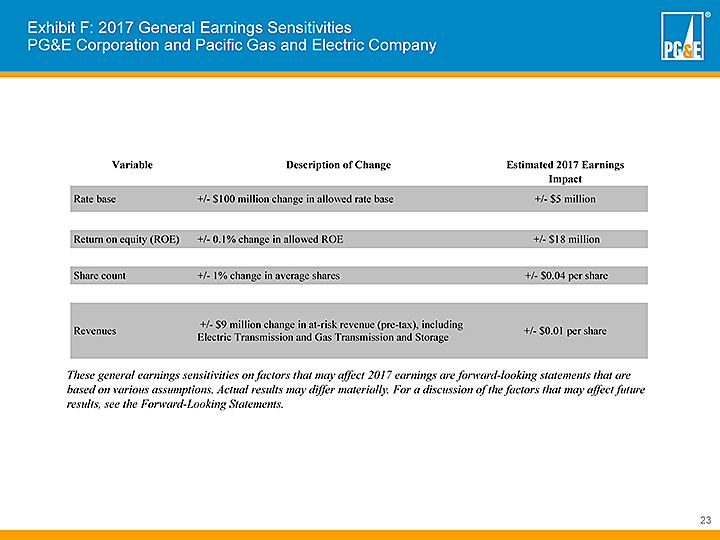

Exhibit F: 2017 General Earnings Sensitivities PG&E Corporation and Pacific Gas and Electric Company Variable Description of Change Estimated 2017 Earnings Impact Rate base +/- $100 million change in allowed rate base +/- $5 million Return on equity (ROE) +/- 0.1% change in allowed ROE +/- $18 million Share count +/- 1% change in average shares +/- $0.04 per share +/- $9 million change in at-risk revenue (pre-tax), including Revenues +/- $0.01 per share Electric Transmission and Gas Transmission and Storage These general earnings sensitivities on factors that may affect 2017 earnings are forward-looking statements that are based on various assumptions. Actual results may differ materially. For a discussion of the factors that may affect future results, see the Forward-Looking Statements. 23

Exhibit G: Use of Non-GAAP Financial Measures PG&E Corporation and Pacific Gas and Electric Company: Use of Non-GAAP Financial Measures PG&E Corporation discloses historical financial results and provides guidance based on “earnings from operations” in order to provide a measure that allows investors to compare the underlying financial performance of the business from one period to another, exclusive of items impacting comparability. “Earnings from operations” is a non-GAAP financial measure and is calculated as income available for common shareholders less items impacting comparability. “Items impacting comparability” represent items that management does not consider part of the normal course of operations and affect comparability of financial results between periods, including certain pipeline related expenses, certain legal and regulatory related expenses, fines and penalties, Butte fire related costs, impacts of the 2015 GT&S rate case, and insurance recoveries for natural gas matters. PG&E Corporation uses earnings from operations to understand and compare operating results across reporting periods for various purposes including internal budgeting and forecasting, short- and long-term operating planning, and employee incentive compensation. PG&E Corporation believes that earnings from operations provide additional insight into the underlying trends of the business allowing for a better comparison against historical results and expectations for future performance. Earnings from operations are not a substitute or alternative for GAAP measures such as consolidated income available for common shareholders and may not be comparable to similarly titled measures used by other companies. 24

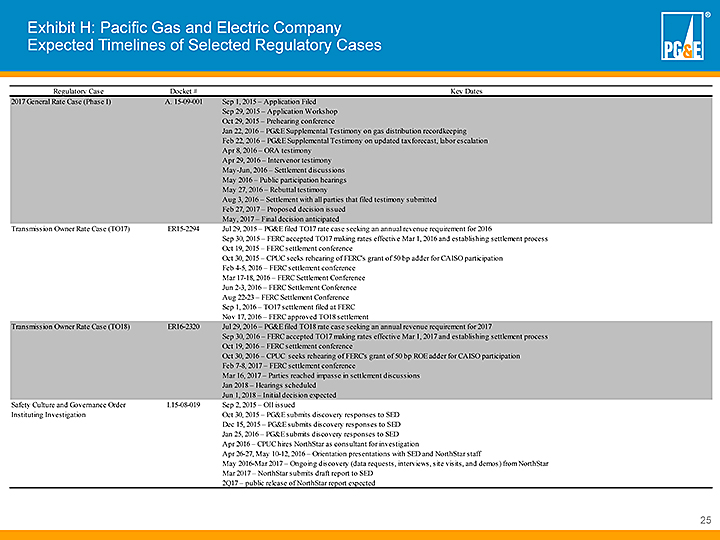

Exhibit H: Pacific Gas and Electric Company Expected Timelines of Selected Regulatory Cases Regulatory Case Docket # Key Dates 2017 General Rate Case (Phase I) A. 15-09-001 Sep 1, 2015 – Application Filed Sep 29, 2015 – Application Workshop Oct 29, 2015 – Prehearing conference Jan 22, 2016 – PG&E Supplemental Testimony on gas distribution recordkeeping Feb 22, 2016 – PG&E Supplemental Testimony on updated tax forecast, labor escalation Apr 8, 2016 – ORA testimony Apr 29, 2016 – Intervenor testimony May-Jun, 2016 – Settlement discussions May 2016 – Public participation hearings May 27, 2016 – Rebuttal testimony Aug 3, 2016 – Settlement with all parties that filed testimony submitted Feb 27, 2017 – Proposed decision issued May, 2017 – Final decision anticipated Transmission Owner Rate Case (TO17) ER15-2294 Jul 29, 2015 – PG&E filed TO17 rate case seeking an annual revenue requirement for 2016 Sep 30, 2015 – FERC accepted TO17 making rates effective Mar 1, 2016 and establishing settlement process Oct 19, 2015 – FERC settlement conference Oct 30, 2015 – CPUC seeks rehearing of FERC’s grant of 50 bp adder for CAISO participation Feb 4-5, 2016 – FERC settlement conference Mar 17-18, 2016 – FERC Settlement Conference Jun 2-3, 2016 – FERC Settlement Conference Aug 22-23 – FERC Settlement Conference Sep 1, 2016 – TO17 settlement filed at FERC Nov 17, 2016 – FERC approved TO18 settlement Transmission Owner Rate Case (TO18) ER16-2320 Jul 29, 2016 – PG&E filed TO18 rate case seeking an annual revenue requirement for 2017 Sep 30, 2016 – FERC accepted TO17 making rates effective Mar 1, 2017 and establishing settlement process Oct 19, 2016 – FERC settlement conference Oct 30, 2016 – CPUC seeks rehearing of FERC’s grant of 50 bp ROE adder for CAISO participation Feb 7-8, 2017 – FERC settlement conference Mar 16, 2017 – Parties reached impasse in settlement discussions Jan 2018 – Hearings scheduled Jun 1, 2018 – Initial decision expected Safety Culture and Governance Order I.15-08-019 Sep 2, 2015 – OII issued Instituting Investigation Oct 30, 2015 – PG&E submits discovery responses to SED Dec 15, 2015 – PG&E submits discovery responses to SED Jan 25, 2016 – PG&E submits discovery responses to SED Apr 2016 – CPUC hires NorthStar as consultant for investigation Apr 26-27, May 10-12, 2016 – Orientation presentations with SED and NorthStar staff May 2016-Mar 2017 – Ongoing discovery (data requests, interviews, site visits, and demos) from NorthStar Mar 2017 – NorthStar submits draft report to SED 2Q17 – public release of NorthStar report expected 25

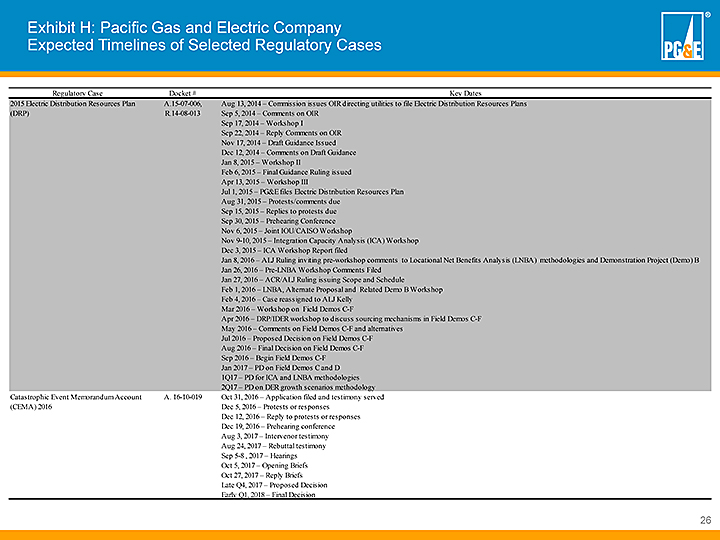

Exhibit H: Pacific Gas and Electric Company Expected Timelines of Selected Regulatory Cases Regulatory Case Docket # Key Dates 2015 Electric Distribution Resources Plan A.15-07-006, Aug 13, 2014 – Commission issues OIR directing utilities to file Electric Distribution Resources Plans (DRP) R.14-08-013 Sep 5, 2014 – Comments on OIR Sep 17, 2014 – Workshop I Sep 22, 2014 – Reply Comments on OIR Nov 17, 2014 – Draft Guidance Issued Dec 12, 2014 – Comments on Draft Guidance Jan 8, 2015 – Workshop II Feb 6, 2015 – Final Guidance Ruling issued Apr 13, 2015 – Workshop III Jul 1, 2015 – PG&E files Electric Distribution Resources Plan Aug 31, 2015 – Protests/comments due Sep 15, 2015 – Replies to protests due Sep 30, 2015 – Prehearing Conference Nov 6, 2015 – Joint IOU/CAISO Workshop Nov 9-10, 2015 – Integration Capacity Analysis (ICA) Workshop Dec 3, 2015 – ICA Workshop Report filed Jan 8, 2016 – ALJ Ruling inviting pre-workshop comments to Locational Net Benefits Analysis (LNBA) methodologies and Demonstration Project (Demo) B Jan 26, 2016 – Pre-LNBA Workshop Comments Filed Jan 27, 2016 – ACR/ALJ Ruling issuing Scope and Schedule Feb 1, 2016 – LNBA, Alternate Proposal and Related Demo B Workshop Feb 4, 2016 – Case reassigned to ALJ Kelly Mar 2016 – Workshop on Field Demos C-F Apr 2016 – DRP/IDER workshop to discuss sourcing mechanisms in Field Demos C-F May 2016 – Comments on Field Demos C-F and alternatives Jul 2016 – Proposed Decision on Field Demos C-F Aug 2016 – Final Decision on Field Demos C-F Sep 2016 – Begin Field Demos C-F Jan 2017 – PD on Field Demos C and D 1Q17 – PD for ICA and LNBA methodologies 2Q17 – PD on DER growth scenarios methodology Catastrophic Event Memorandum Account A. 16-10-019 Oct 31, 2016 – Application filed and testimony served (CEMA) 2016 Dec 5, 2016 – Protests or responses Dec 12, 2016 – Reply to protests or responses Dec 19, 2016 – Prehearing conference Aug 3, 2017 – Intervenor testimony Aug 24, 2017 – Rebuttal testimony Sep 5-8 , 2017 – Hearings Oct 5, 2017 – Opening Briefs Oct 27, 2017 – Reply Briefs Late Q4, 2017 – Proposed Decision Early Q1, 2018 – Final Decision 26

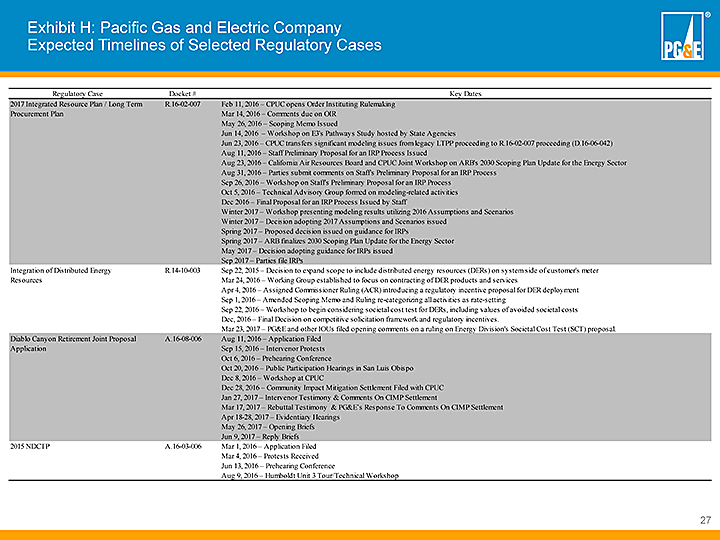

Exhibit H: Pacific Gas and Electric Company Expected Timelines of Selected Regulatory Cases Regulatory Case Docket # Key Dates 2017 Integrated Resource Plan / Long Term R.16-02-007 Feb 11, 2016 – CPUC opens Order Instituting Rulemaking Procurement Plan Mar 14, 2016 – Comments due on OIR May 26, 2016 – Scoping Memo Issued Jun 14, 2016 – Workshop on E3’s Pathways Study hosted by State Agencies Jun 23, 2016 – CPUC transfers significant modeling issues from legacy LTPP proceeding to R.16-02-007 proceeding (D.16-06-042) Aug 11, 2016 – Staff Preliminary Proposal for an IRP Process Issued Aug 23, 2016 – California Air Resources Board and CPUC Joint Workshop on ARB’s 2030 Scoping Plan Update for the Energy Sector Aug 31, 2016 – Parties submit comments on Staff’s Preliminary Proposal for an IRP Process Sep 26, 2016 – Workshop on Staff’s Preliminary Proposal for an IRP Process Oct 5, 2016 – Technical Advisory Group formed on modeling-related activities Dec 2016 – Final Proposal for an IRP Process Issued by Staff Winter 2017 – Workshop presenting modeling results utilizing 2016 Assumptions and Scenarios Winter 2017 – Decision adopting 2017 Assumptions and Scenarios issued Spring 2017 – Proposed decision issued on guidance for IRPs Spring 2017 – ARB finalizes 2030 Scoping Plan Update for the Energy Sector May 2017 – Decision adopting guidance for IRPs issued Sep 2017 – Parties file IRPs Integration of Distributed Energy R.14-10-003 Sep 22, 2015 – Decision to expand scope to include distributed energy resources (DERs) on system side of customer’s meter Resources Mar 24, 2016 – Working Group established to focus on contracting of DER products and services Apr 4, 2016 – Assigned Commissioner Ruling (ACR) introducing a regulatory incentive proposal for DER deployment Sep 1, 2016 – Amended Scoping Memo and Ruling re-categorizing all activities as rate-setting Sep 22, 2016 – Workshop to begin considering societal cost test for DERs, including values of avoided societal costs Dec, 2016 – Final Decision on competitive solicitation framework and regulatory incentives. Mar 23, 2017 – PG&E and other IOUs filed opening comments on a ruling on Energy Division’s Societal Cost Test (SCT) proposal. Diablo Canyon Retirement Joint Proposal A.16-08-006 Aug 11, 2016 – Application Filed Application Sep 15, 2016 – Intervenor Protests Oct 6, 2016 – Prehearing Conference Oct 20, 2016 – Public Participation Hearings in San Luis Obispo Dec 8, 2016 – Workshop at CPUC Dec 28, 2016 – Community Impact Mitigation Settlement Filed with CPUC Jan 27, 2017 – Intervenor Testimony & Comments On CIMP Settlement Mar 17, 2017 – Rebuttal Testimony & PG&E’s Response To Comments On CIMP Settlement Apr 18-28, 2017 – Evidentiary Hearings May 26, 2017 – Opening Briefs Jun 9, 2017 – Reply Briefs 2015 NDCTP A.16-03-006 Mar 1, 2016 – Application Filed Mar 4, 2016 – Protests Received Jun 13, 2016 – Prehearing Conference Aug 9, 2016 – Humboldt Unit 3 Tour/Technical Workshop 27

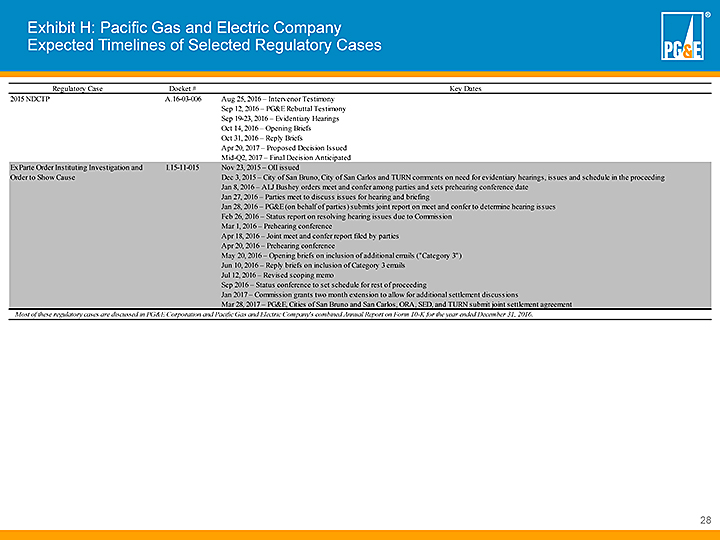

Exhibit H: Pacific Gas and Electric Company Expected Timelines of Selected Regulatory Cases Regulatory Case Docket # Key Dates 2015 NDCTP A.16-03-006 Aug 25, 2016 – Intervenor Testimony Sep 12, 2016 – PG&E Rebuttal Testimony Sep 19-23, 2016 – Evidentiary Hearings Oct 14, 2016 – Opening Briefs Oct 31, 2016 – Reply Briefs Apr 20, 2017 – Proposed Decision Issued Mid-Q2, 2017 – Final Decision Anticipated Ex Parte Order Instituting Investigation and I.15-11-015 Nov 23, 2015 – OII issued Order to Show Cause Dec 3, 2015 – City of San Bruno, City of San Carlos and TURN comments on need for evidentiary hearings, issues and schedule in the proceeding Jan 8, 2016 – ALJ Bushey orders meet and confer among parties and sets prehearing conference date Jan 27, 2016 – Parties meet to discuss issues for hearing and briefing Jan 28, 2016 – PG&E (on behalf of parties) submits joint report on meet and confer to determine hearing issues Feb 26, 2016 – Status report on resolving hearing issues due to Commission Mar 1, 2016 – Prehearing conference Apr 18, 2016 – Joint meet and confer report filed by parties Apr 20, 2016 – Prehearing conference May 20, 2016 – Opening briefs on inclusion of additional emails (“Category 3”) Jun 10, 2016 – Reply briefs on inclusion of Category 3 emails Jul 12, 2016 – Revised scoping memo Sep 2016 – Status conference to set schedule for rest of proceeding Jan 2017 – Commission grants two month extension to allow for additional settlement discussions Mar 28, 2017 – PG&E, Cities of San Bruno and San Carlos, ORA, SED, and TURN submit joint settlement agreement Most of these regulatory cases are discussed in PG&E Corporation and Pacific Gas and Electric Company’s combined Annual Report on Form 10-K for the year ended December 31, 2016. 28