Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NAKED BRAND GROUP INC. | v465812_8k.htm |

Exhibit 99.1

Pioneers Conference 2017

Additional Information and Where to Find It This investor presentation shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. This investor presentation does not constitute the solicitation of any vote or approval. On April 10, 2017, Naked Brand Group Inc. (“Naked”) entered into Amendment No. 3 to the Letter of Intent, dated December 19, 2016, as amended February 10, 2017 and March 9, 2017, entered into by Naked and Bendon Limited (“Bendon”) in connection with a proposed business combination (the “Business Combination”). As contemplated by the amend Letter of Intent, Naked will now merge with and into a subsidiary of a newly formed Australian holding company (“NewCo”) which will be the ultimate parent company of Bendon and Naked. The proposed Business Combination will be submitted to the stockholders of Naked for their consideration. In connection therewith, the NewCo, Bendon and Naked intend to file relevant materials with the Securities and Exchange Commission (“SEC”), including a Registration Statement on Form F-4 to be filed by NewCo that will include a proxy statement of Naked that also constitutes a prospectus of NewCo and a definitive proxy statement/prospectus (when they become available) will be sent to Naked stockholders. Such documents are not currently available. Before making any voting or investment decision with respect to the Business Combination, investors and security holders of Naked are urged to read the definitive proxy statement/prospectus and the other relevant materials filed or to be filed with the SEC carefully and in their entirety when they become available because they will contain important information about NewCo, Naked, Bendon and the proposed Business Combination. The definitive proxy statement/prospectus and other relevant materials (when they become available), and any other documents filed by NewCo or Naked with the SEC, may be obtained free of charge at the SEC web site at www.sec.gov. In addition, investors and security holders of Naked may obtain free copies of the documents filed with the SEC by Naked by directing a written request to: Naked Brand Group Inc., 95 Madison Avenue, 10th Floor, New York, New York 10016, Attention: Investor Relations. Participants in the Solicitation Naked and its directors, executive officers and certain other members of management and employees may be deemed to be participants in the solicitation of proxies from the stockholders of Naked in connection with the proposed Business Combination. Information regarding the participants in the proxy solicitation of the stockholders of Naked and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the definitive proxy statement/ prospectus regarding the proposed Business Combination and other relevant materials to be filed with the SEC by Naked when they become available. Additional information regarding the directors and executive officers of Naked is also included in Naked’s Annual Report on Form 10-K for the year ended January 31, 2017. This document is available free of charge at the SEC’s web site (www.sec.gov) and from Investor Relations at Naked at the address described above. Note About Financial Information Certain of Bendon’s financial information contained in this investor presentation is unaudited and/or was prepared by Bendon as a private company and do not necessarily conform to Regulation S-X and certain of Bendon’s financial information was not prepared in accordance with U.S. generally accepted accounting principles. Additionally, certain financial projections of Bendon contained in this investor presentation, such as those relating to revenue and gross margins on net sales, are forwardlooking statements (see note below on forward-looking statements) that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond Bendon’s control. There will be differences between actual and projected results, and actual results may be materially greater or materially less than those contained in this investor presentation. The inclusion of the projections in this investor presentation should not be regarded as an indication that Bendon or its representatives considered or consider the projections to be a reliable prediction of future events, and reliance should not be placed on the projections. Bendon has not warranted the accuracy, reliability, appropriateness or completeness of the projections to anyone, including to Naked. Neither Bendon’s management nor any of its representatives has made or makes any representation to any person regarding the ultimate performance of Bendon compared to the information contained in the projections, and none of them intends to or undertakes any obligation to update or otherwise revise the projections to reflect circumstances existing after the date when made or to reflect the occurrence of future events in the event that any or all of the assumptions underlying the projections are shown to be in error. Accordingly, they should not be looked upon as “guidance” of any sort. Forward-Looking Statements Certain statements either contained in or incorporated by reference into this investor presentation, other than purely historical information, including estimates, projections and statements relating to Naked’s or Bendon’s business plans, objectives and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, included in or incorporated by reference into this communication regarding strategy, future operations, future transactions, future financial position, future revenue, projected expenses, prospects, plans and objectives of management are forward-looking statements. Examples of such statements include, but are not limited to, statements regarding the structure, timing and completion of the proposed Business Combination, the transactions contemplated thereby or any other actions to be taken in connection therewith; the Company’s continued listing on the NASDAQ Capital Market until closing of the proposed Business Combination; the Company’s continued compliance with the minimum shareholders’ equity requirements at the time of the Company’s next periodic report; NewCo’s anticipated listing on the NASDAQ Capital Market upon closing of the proposed Business Combination; expectations regarding the capitalization, resources and ownership structure of the combined company; the adequacy of the combined company’s capital to support its future operations; the Company’s and Bendon’s plans, objectives, expectations and intentions; the nature, strategy and focus of the combined company; the executive and board structure of the combined company; and expectations regarding voting by the Company’s stockholders. Naked and/or Bendon may not actually achieve the plans, carry out the intentions or meet the expectations disclosed in the forward-looking statements and you should not place undue reliance on these forward-looking statements. Such statements are based on management’s current expectations and involve risks and uncertainties. Actual results and performance could differ materially from those projected in the forward-looking statements as a result of many factors, including, without limitation, risks and uncertainties associated with stockholder approval of and the ability to consummate the proposed Business Combination through the process being conducted by the Company, NewCo and Bendon, the ability of the Company, NewCo and Bendon to enter into a definitive agreement and consummate such transaction, the risk that one or more of the conditions to closing of the Business Combination may not be satisfied, including, without limitation, the effectiveness of the registration statement to be filed with the SEC or the listing of NewCo’s ordinary shares on the NASDAQ Capital Market, the lack of a public market for ordinary shares of NewCo and the possibility that a market for such shares may not develop, the ability to project future cash utilization and reserves needed for contingent future liabilities and business operations, the availability of sufficient resources of the combined company to meet its business objectives and operational requirements, the ability to realize the expected synergies or savings from the proposed Business Combination in the amounts or in the timeframe anticipated, the risk that competing offers or acquisition proposals will be made, the ability to integrate the Company’s and Bendon’s businesses in a timely and cost-efficient manner, the inherent uncertainty associated with financial projections, and the potential impact of the announcement or closing of the proposed Business Combination on customer, supplier, employee and other relationships. Caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. the Company’s disclaims any intent or obligation to update these forward-looking statements to reflect events or circumstances that exist after the date on which they were made. FORWARD LOOKING STATEMENTS

WE LOVE TALKING ABOUT OUR UNDERWEAR, AND SO WILL YOU. • Global intimate apparel market, currently a ~$82 billion market1, is expected to grow at a CAGR of 17%2 to 2020 • Unlike other consumer products, the intimate apparel market has emerged relatively unscathed through down-turns in global economies • Trend from just innerwear to intimates as outerwear is increasing demand and the average number of products per consumer • In the last few years, there has been an influx of smaller players enabled by e-commerce. Now highly fragmented, the intimates apparel market appears to be entering a consolidation phase Footnote: 1. Statista 2017 2. Research and Markets Report, April 2016 THE WORLD OF INTIMATE APPAREL PAGE 3

• Founded in 2010, Men’s and Women’s innerwear and lifestyle brand based in New York • Renowned for pioneering products developed using innovative second-skin, seam-free and silver-infused fabrics • Distributed through major department stores throughout the United States • Recently entered exclusive partnership with Home Shopping Network (HSN) • Led by a team of industry veterans, including Carole Hochman PAGE 4

PAGE 5 • 70 year history deeply rooted in innovation; Bendon’s founder pioneered lingerie that wouldn’t force women’s bodies into restrictive corsetry but would bend on women’s bodies • Put Australasian lingerie on the world map, competing on par with leading global brands • Inclusive of global brand Heidi Klum Intimates, portfolio of eight company owned brands and three licensed brands • Global distribution and operations platform, capable of supporting future acquisitions • Led by highly accomplished Executive team

PAGE 6 BUSINESS COMBINATION • On December 19, 2016, Naked Brand Group Inc. entered into a Letter of Intent, as amended on February 10, 2017, March 9, 2017, and April 10, 2017, with Bendon Limited for a proposed business combination –– The most recent amendment includes $34 million in positive adjustments to the net debt target for the anticipated combined company’s balance sheet at the close of the transaction, with total net debt of approximately $13 million compared to the previously contemplated total net debt of approximately $51 million • It is proposed that a new Australian holding company will be created and Naked and Bendon will become subsidiaries of that company • Assuming Naked and Bendon enter into a Definitive Agreement, the parties expect to seek approval from Naked’s shareholders in the second quarter of 2017 • Justin Davis-Rice, Chairman of Bendon, joined Naked’s Board of Directors on January 13, 2017 • It is proposed that Carole Hochman would have a seat on the Board of the new Australian holding company and would become its Chief Creative Officer • The proposed business combination is expected to have several significant benefits for both Naked and Bendon

[NASDAQ: NAKD]

NAKED / COMPANY HIGHLIGHTS 2017 • For the fourth quarter, net sales grew 22% as compared to last year, to $549,933 • For the fiscal year ended January 31, 2017, net sales increased by 33%, to $1,842,065 driven by: –– Expansion into new department & boutique stores including: Bloomingdale’s, Lord & Taylor, Saks Fifth Avenue, Chico’s and Dillard’s –– Increased penetration in existing stores: –– E-commerce growth of 15% –– Expansion into Amazon • Raised net proceeds of $5.3 million from at the market offering, selling 2,189,052 shares of common stock at an average price of $2.51 • Regained compliance with Nasdaq’s minimum stockholders’ equity listing requirement on March 17, 2017 PAGE 8

PAGE 9 CURVE SHOW, NEW YORK CITY BENDON • 48% increase in appointments since the August 2016 Curve Show • Nationwide accounts • The Fall 17 collections were well received and swim customers were looking for spring immediates NAKED • Increase in specialty account appointments • We received a positive response to our expanded offering and our new collection of large styles that come in a range of sizes from XS to 3XL

Global brands which include some of the most recognised lingerie brands in Australasia, USA and UK Evergreen partnership with Heidi Klum Core competency in the design and development of bras, briefs, swimwear and sleepwear Continuous revenue and earnings growth - TTM revenue $119m - TTM gross margin on net sales 50.3% Highly efficient sourcing and logistics network providing agility and economies of scale Track record of technical, functional and fashion innovation, and new product development Presence in 34 countries and distribution through over 4,000 doors Omni-channel platform with online, wholesale and company owned retail and outlet stores Loyal and diverse customer base, with customers ranging in age and social demographics BENDON / COMPANY HIGHLIGHTS PAGE 11 ICONIC BRAND AND PRODUCT PORTFOLIO STRONG FINANCIAL PERFORMANCE AND OPERATIONS PLATFORM GLOBAL DISTRIBUTION FOOTPRINT

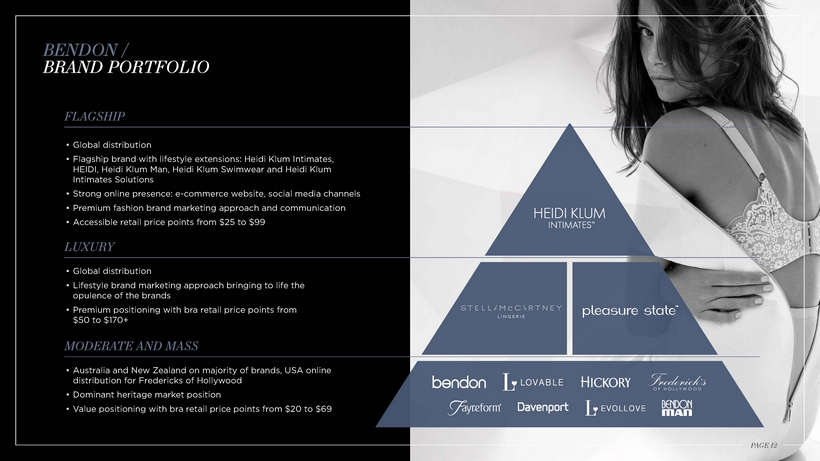

BENDON / BRAND PORTFOLIO FLAGSHIP • Global distribution • Flagship brand with lifestyle extensions: Heidi Klum Intimates, HEIDI, Heidi Klum Man, Heidi Klum Swimwear and Heidi Klum Intimates Solutions • Strong online presence: e-commerce website, social media channels • Premium fashion brand marketing approach and communication • Accessible retail price points from $25 to $99 LUXURY • Global distribution • Lifestyle brand marketing approach bringing to life the opulence of the brands • Premium positioning with bra retail price points from $50 to $170+ MODERATE AND MASS • Australia and New Zealand on majority of brands, USA online distribution for Fredericks of Hollywood • Dominant heritage market position • Value positioning with bra retail price points from $20 to $69 PAGE 12

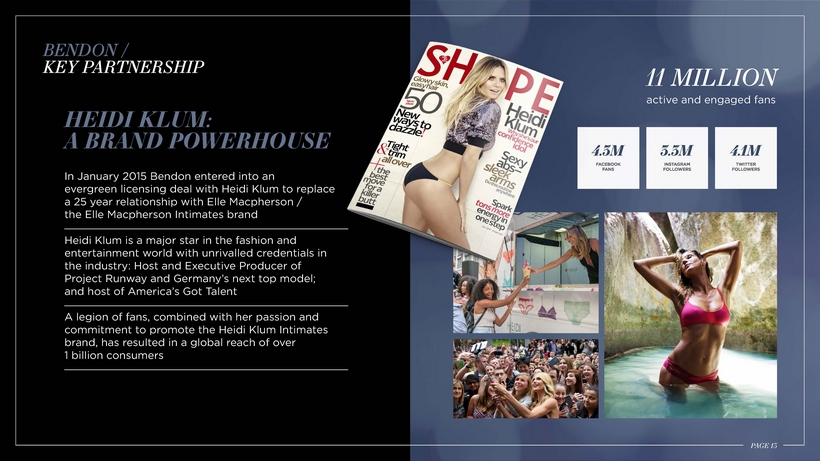

HEIDI KLUM: A BRAND POWERHOUSE In January 2015 Bendon entered into an evergreen licensing deal with Heidi Klum to replace a 25 year relationship with Elle Macpherson / the Elle Macpherson Intimates brand Heidi Klum is a major star in the fashion and entertainment world with unrivalled credentials in the industry: Host and Executive Producer of Project Runway and Germany’s next top model; and host of America’s Got Talent A legion of fans, combined with her passion and commitment to promote the Heidi Klum Intimates brand, has resulted in a global reach of over 1 billion consumers BENDON / KEY PARTNERSHIP PAGE 13 active and engaged fans 11 MILLION

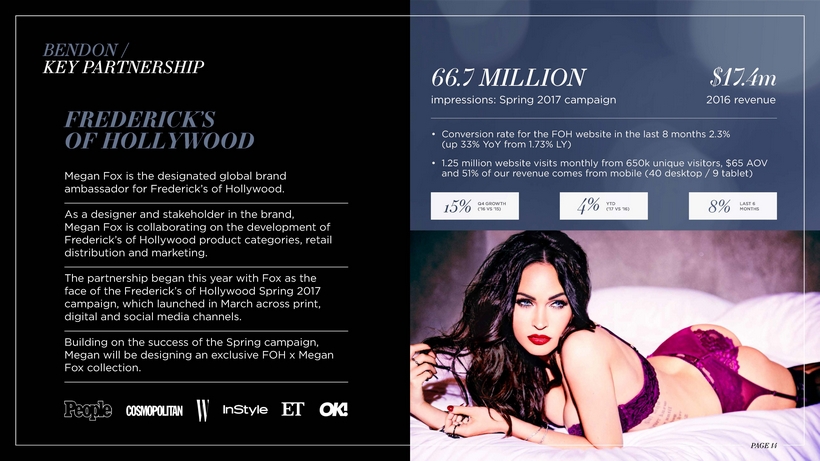

FREDERICK’S OF HOLLYWOOD • Conversion rate for the FOH website in the last 8 months 2.3% (up 33% YoY from 1.73% LY) • 1.25 million website visits monthly from 650k unique visitors, $65 AOV and 51% of our revenue comes from mobile (40 desktop / 9 tablet) BENDON / KEY PARTNERSHIP PAGE 14 Megan Fox is the designated global brand ambassador for Frederick’s of Hollywood. As a designer and stakeholder in the brand, Megan Fox is collaborating on the development of Frederick’s of Hollywood product categories, retail distribution and marketing. The partnership began this year with Fox as the face of the Frederick’s of Hollywood Spring 2017 campaign, which launched in March across print, digital and social media channels. Building on the success of the Spring campaign, Megan will be designing an exclusive FOH x Megan Fox collection. 2016 revenue $17.4m impressions: Spring 2017 campaign 66.7 MILLION Q4 GROWTH (’16 VS ’15) YTD (’17 VS ’16) LAST 6 MONTHS

Footnote: 1. Comp base to Jan 2017 BENDON / OMNI-CHANNEL: CLICKS, BRICKS AND IN-BETWEEN PAGE 15 DIVERSIFIED WHOLESALE CUSTOMERS COMPANY OWNED STORES Portfolio of 60 highly productive retail and outlet stores across New Zealand and Australia High store-level contribution of 20%1 High margin clearance mechanism for excess stock 50% engineered product generating high margin Partners across all tiers of retail from high-end to mass Long term partnerships with the pre-eminent names in retail globally Strong position and high recognition in Australia and New Zealand heritage markets Substantial growth potential in underpenetrated USA market EMERGING E-COMMERCE CHANNEL c. 3 million visits to brand sites in 2016 (up 79% in 3 years) Conversion percentage up 40% in 3 years Revenue up 88% in 3 years Established platform for accelerated growth TTM TTM TTM

BENDON / OPERATIONS PLATFORM AND PRODUCT SUITE GLOBAL OPERATIONS PLATFORM • Over 30 production partner facilities across Asia • Company owned Distribution Centre in New Zealand. 3PL centres in USA, China and Hong Kong • Offices in New Zealand, Australia, Hong Kong USA and UK COMPREHENSIVE PRODUCT SUITE • Highly diversified product offering with no style accounting for more than 1% of sales • Fashion represents about 60% of products sales • Entered adjacent categories including recent launch of swimwear for Heidi Klum and Stella McCartney PAGE 17

POSITIONED FOR GROWTH

PAGE 19 ORGANIC GROWTH REVENUE GROWTH CHANNEL • We expect an incremental roll-out of new retail stores across existing (Australia and New Zealand) and new (USA, Europe and Canada) markets ~ 90 stores within Australia, New Zealand and USA to 2020 • Bendon’s distribution channels are anticipated to accelerate growth of Naked’s brands • We plan to globalise e-commerce assets CATEGORY • Leverage Carole Hochman’s expertise to build a compelling sleepwear business • We plan to launch new categories including resortwear, athleisure and tween MARKET • Deeper and wider distribution within USA and the European markets • Potential to expand into untapped markets such as Asia, Africa and the Middle East MARGIN IMPROVEMENT Target gross margin 53.8% in 2020, driven by: • Product sourcing and engineering improvements • Higher margin store and e-commerce expansion

LEVERAGE THE CAPITAL MARKETS PLATFORM TO CONSOLIDATE SYNERGISTIC BUSINESSES A highly fragmented market offers significant roll-up opportunity We believe the Group will be well positioned to consolidate the industry Identified deal pipeline with potential to significantly increase revenue ACQUISITIVE GROWTH PAGE 20

THANK YOU QUESTIONS?