Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - American Assets Trust, Inc. | a1q178-k.htm |

| EX-99.1 - PRESS RELEASE - American Assets Trust, Inc. | a1q17earningsrelease.htm |

FIRST QUARTER 2017 | |

Supplemental Information | |

| |

Investor and Media Contact | |

American Assets Trust | |

Robert F. Barton | |

Executive Vice President and Chief Financial Officer | |

858-350-2607 | |

| |

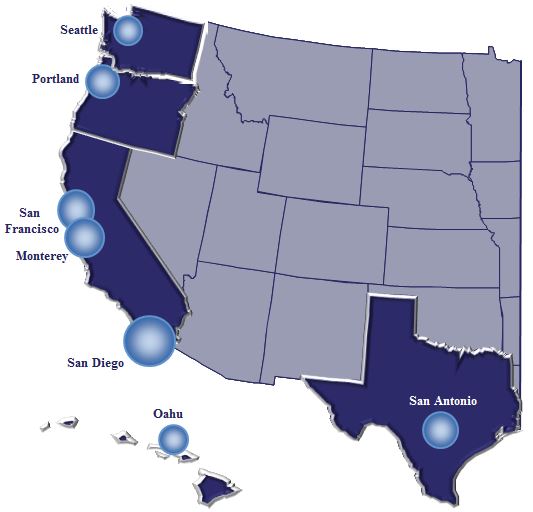

American Assets Trust, Inc.'s Portfolio is concentrated in high-barrier-to-entry markets

with favorable supply/demand characteristics

| ||||||||||||||||

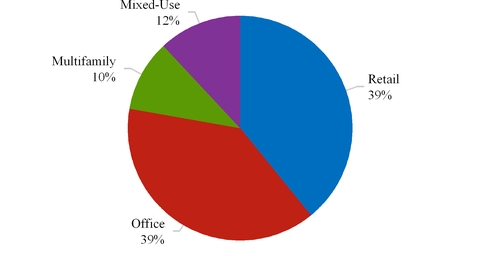

Retail | Office | Multifamily | Mixed-Use | |||||||||||||

Market | Square Feet | Square Feet | Units | Square Feet | Suites | |||||||||||

San Diego | 1,195,690 | 727,683 | 922 | (1) | — | — | ||||||||||

San Francisco | 35,156 | 516,985 | — | — | — | |||||||||||

Oahu | 549,308 | — | — | 96,707 | 369 | |||||||||||

Monterey | 675,486 | — | — | — | — | |||||||||||

San Antonio | 589,362 | — | — | — | — | |||||||||||

Portland | 44,153 | 942,311 | 657 | — | — | |||||||||||

Seattle | — | 494,658 | — | — | — | |||||||||||

Total | 3,089,155 | 2,681,637 | 1,579 | 96,707 | 369 | |||||||||||

Square Feet | % | |||||||

Note: Circled areas represent all markets in which American Assets Trust, Inc. (the "Company") currently owns and operates its real estate assets. Size of circle denotes approximation of square feet / units. Net rentable square footage may be adjusted from the prior periods to reflect re-measurement of leased space at the properties. | Retail | 3.1 | million | 53% | ||||

Office | 2.7 | million | 47% | |||||

Data is as of March 31, 2017. | Totals | 5.8 | million | |||||

(1) Includes 122 RV spaces. | ||||||||

First Quarter 2017 Supplemental Information | Page 2 |

INDEX |  |

FIRST QUARTER 2017 SUPPLEMENTAL INFORMATION | ||

1. | FINANCIAL HIGHLIGHTS | |

Consolidated Balance Sheets | ||

Consolidated Statements of Income | ||

Funds From Operations (FFO), FFO As Adjusted & Funds Available for Distribution | ||

Corporate Guidance | ||

Same-Store Portfolio Net Operating Income (NOI) | ||

Same-Store Portfolio NOI Comparison excluding Redevelopment | ||

Same-Store Portfolio NOI Comparison with Redevelopment | ||

NOI By Region | ||

NOI Breakdown | ||

Property Revenue and Operating Expenses | ||

Segment Capital Expenditures | ||

Summary of Outstanding Debt | ||

Market Capitalization | ||

Summary of Development Opportunities | ||

2. | PORTFOLIO DATA | |

Property Report | ||

Retail Leasing Summary | ||

Office Leasing Summary | ||

Multifamily Leasing Summary | ||

Mixed-Use Leasing Summary | ||

Lease Expirations | ||

Portfolio Leased Statistics | ||

Top Tenants - Retail | ||

Top Tenants - Office | ||

3. | APPENDIX | |

Glossary of Terms | ||

This Supplemental Information contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act). Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods which may be incorrect or imprecise and we may not be able to realize them. We do not guarantee that the transactions and events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: adverse economic or real estate developments in our markets; our failure to generate sufficient cash flows to service our outstanding indebtedness; defaults on, early terminations of or non-renewal of leases by tenants, including significant tenants; difficulties in identifying properties to acquire and completing acquisitions; difficulties in completing dispositions; our failure to successfully operate acquired properties and operations; our inability to develop or redevelop our properties due to market conditions; fluctuations in interest rates and increased operating costs; risks related to joint venture arrangements; our failure to obtain necessary outside financing; on-going litigation; general economic conditions; financial market fluctuations; risks that affect the general retail, office, multifamily and mixed-use environment; the competitive environment in which we operate; decreased rental rates or increased vacancy rates; conflicts of interests with our officers or directors; lack or insufficient amounts of insurance; environmental uncertainties and risks related to adverse weather conditions and natural disasters; other factors affecting the real estate industry generally; limitations imposed on our business and our ability to satisfy complex rules in order for us to continue to qualify as a REIT for U.S. federal income tax purposes; and changes in governmental regulations or interpretations thereof, such as real estate and zoning laws and increases in real property tax rates and taxation of REITs.

While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. We disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, or new information, data or methods, future events or other changes. For a further discussion of these and other factors that could impact our future results, refer to our most recent Annual Report on Form 10-K and other risks described in documents subsequently filed by us from time to time with the Securities and Exchange Commission.

First Quarter 2017 Supplemental Information | Page 3 |

| |

FINANCIAL HIGHLIGHTS

First Quarter 2017 Supplemental Information | Page 4 |

CONSOLIDATED BALANCE SHEETS |  |

(Amounts in thousands, except shares and per share data) | March 31, 2017 | December 31, 2016 | |||||

(unaudited) | (audited) | ||||||

ASSETS | |||||||

Real estate, at cost | |||||||

Operating real estate | $ | 2,244,865 | $ | 2,241,061 | |||

Construction in progress | 54,346 | 50,498 | |||||

Held for development | 9,447 | 9,447 | |||||

2,308,658 | 2,301,006 | ||||||

Accumulated depreciation | (485,335 | ) | (469,460 | ) | |||

Net real estate | 1,823,323 | 1,831,546 | |||||

Cash and cash equivalents | 190,110 | 44,801 | |||||

Restricted cash | 9,836 | 9,950 | |||||

Accounts receivable, net | 7,558 | 9,330 | |||||

Deferred rent receivable, net | 38,555 | 38,452 | |||||

Other assets, net | 45,959 | 52,854 | |||||

TOTAL ASSETS | $ | 2,115,341 | $ | 1,986,933 | |||

LIABILITIES AND EQUITY | |||||||

LIABILITIES: | |||||||

Secured notes payable, net | $ | 315,743 | $ | 445,180 | |||

Unsecured notes payable, net | 844,752 | 596,350 | |||||

Unsecured line of credit | — | 20,000 | |||||

Accounts payable and accrued expenses | 39,149 | 32,401 | |||||

Security deposits payable | 6,195 | 6,114 | |||||

Other liabilities and deferred credits, net | 47,793 | 48,337 | |||||

Total liabilities | 1,253,632 | 1,148,382 | |||||

Commitments and contingencies | |||||||

EQUITY: | |||||||

American Assets Trust, Inc. stockholders' equity | |||||||

Common stock, $0.01 par value, 490,000,000 shares authorized, 46,431,341 and 45,732,109 shares issued and outstanding at March 31, 2017 and December 31, 2016, respectively | 464 | 457 | |||||

Additional paid in capital | 905,304 | 874,597 | |||||

Accumulated dividends in excess of net income | (81,921 | ) | (77,296 | ) | |||

Accumulated other comprehensive income (loss) | 11,034 | 11,798 | |||||

Total American Assets Trust, Inc. stockholders' equity | 834,881 | 809,556 | |||||

Noncontrolling interests | 26,828 | 28,995 | |||||

Total equity | 861,709 | 838,551 | |||||

TOTAL LIABILITIES AND EQUITY | $ | 2,115,341 | $ | 1,986,933 | |||

First Quarter 2017 Supplemental Information | Page 5 |

CONSOLIDATED STATEMENTS OF INCOME |  |

(Unaudited, amounts in thousands, except shares and per share data) | Three Months Ended | ||||||

March 31, | |||||||

2017 | 2016 | ||||||

REVENUE: | |||||||

Rental income | $ | 70,040 | $ | 67,245 | |||

Other property income | 3,752 | 3,486 | |||||

Total revenue | 73,792 | 70,731 | |||||

EXPENSES: | |||||||

Rental expenses | 19,859 | 18,453 | |||||

Real estate taxes | 7,536 | 6,633 | |||||

General and administrative | 5,082 | 4,549 | |||||

Depreciation and amortization | 17,986 | 17,453 | |||||

Total operating expenses | 50,463 | 47,088 | |||||

OPERATING INCOME | 23,329 | 23,643 | |||||

Interest expense | (13,331 | ) | (12,946 | ) | |||

Other income, net | 310 | 24 | |||||

NET INCOME | 10,308 | 10,721 | |||||

Net income attributable to restricted shares | (60 | ) | (43 | ) | |||

Net income attributable to unitholders in the Operating Partnership | (2,861 | ) | (3,027 | ) | |||

NET INCOME ATTRIBUTABLE TO AMERICAN ASSETS TRUST, INC. STOCKHOLDERS | $ | 7,387 | $ | 7,651 | |||

EARNINGS PER COMMON SHARE | |||||||

Basic income attributable to common stockholders per share | $ | 0.16 | $ | 0.17 | |||

Weighted average shares of common stock outstanding - basic | 46,173,788 | 45,233,873 | |||||

Diluted income attributable to common stockholders per share | $ | 0.16 | $ | 0.17 | |||

Weighted average shares of common stock outstanding - diluted | 64,062,610 | 63,133,389 | |||||

First Quarter 2017 Supplemental Information | Page 6 |

FUNDS FROM OPERATIONS, FFO AS ADJUSTED & FUNDS AVAILABLE FOR DISTRIBUTION |  |

(Unaudited, amounts in thousands, except shares and per share data) | Three Months Ended | ||||||

March 31, | |||||||

2017 | 2016 | ||||||

Funds from Operations (FFO) (1) | |||||||

Net income | $ | 10,308 | $ | 10,721 | |||

Depreciation and amortization of real estate assets | 17,986 | 17,453 | |||||

FFO, as defined by NAREIT | 28,294 | 28,174 | |||||

Less: Nonforfeitable dividends on incentive stock awards | (59 | ) | (42 | ) | |||

FFO attributable to common stock and common units | $ | 28,235 | $ | 28,132 | |||

FFO per diluted share/unit | $ | 0.44 | $ | 0.45 | |||

Weighted average number of common shares and common units, diluted (2) | 64,066,561 | 63,136,341 | |||||

Funds Available for Distribution (FAD) (1) | $ | 25,625 | $ | 21,381 | |||

Dividends | |||||||

Dividends declared and paid | $ | 16,723 | $ | 15,827 | |||

Dividends declared and paid per share/unit | $ | 0.2600 | $ | 0.2500 | |||

First Quarter 2017 Supplemental Information | Page 7 |

FUNDS FROM OPERATIONS, FFO AS ADJUSTED & FUNDS AVAILABLE FOR DISTRIBUTION (CONTINUED) |  |

(Unaudited, amounts in thousands, except shares and per share data) | Three Months Ended | ||||||

March 31, | |||||||

2017 | 2016 | ||||||

Funds Available for Distribution (FAD) (1) | |||||||

FFO | $ | 28,294 | $ | 28,174 | |||

Adjustments: | |||||||

Tenant improvements, leasing commissions and maintenance capital expenditures | (4,909 | ) | (7,549 | ) | |||

Net effect of straight-line rents (3) | (182 | ) | (250 | ) | |||

Amortization of net above (below) market rents (4) | (851 | ) | (830 | ) | |||

Net effect of other lease assets (5) | 977 | 135 | |||||

Amortization of debt issuance costs and debt fair value adjustment | 1,716 | 1,125 | |||||

Non-cash compensation expense | 639 | 618 | |||||

Nonforfeitable dividends on incentive stock awards | (59 | ) | (42 | ) | |||

FAD | $ | 25,625 | $ | 21,381 | |||

Summary of Capital Expenditures | |||||||

Tenant improvements and leasing commissions | $ | 2,675 | $ | 2,716 | |||

Maintenance capital expenditures | 2,234 | 4,833 | |||||

$ | 4,909 | $ | 7,549 | ||||

Notes:

(1) | See Glossary of Terms. |

(2) | For the three months ended March 31, 2017 and 2016, the weighted average common shares and common units used to compute FFO per diluted share/unit include operating partnership common units and unvested restricted stock awards that are subject to time vesting. The shares/units used to compute FFO per diluted share/unit include additional shares/units which were excluded from the computation of diluted EPS, as they were anti-dilutive for the periods presented. |

(3) | Represents the straight-line rent income recognized during the period offset by cash received during the period and the provision for bad debts recorded for deferred rent receivable balances. |

(4) | Represents the adjustment related to the acquisition of buildings with above (below) market rents. |

(5) | Represents adjustments related to amortization of lease incentives paid to tenants, amortization of lease intangibles, lease termination fees at City Center Bellevue and straight-line rent expense for our leases of the Annex at The Landmark at One Market and retail space at Waikiki Beach Walk - Retail. |

First Quarter 2017 Supplemental Information | Page 8 |

CORPORATE GUIDANCE |  |

(Unaudited, amounts in thousands, except share and per share data) | ||||||||||||||||

Prior 2017 Guidance Range (1) (2) | Revised 2017 Guidance Range (2) | |||||||||||||||

Funds from Operations (FFO): | ||||||||||||||||

Net income | $ | 50,386 | $ | 55,464 | $ | 48,618 | $ | 52,529 | ||||||||

Depreciation and amortization of real estate assets | 75,471 | 75,471 | 81,972 | 81,972 | ||||||||||||

FFO, as defined by NAREIT | 125,857 | 130,935 | 130,590 | 134,501 | ||||||||||||

Less: Nonforfeitable dividends on incentive stock awards | (174 | ) | (174 | ) | (236 | ) | (236 | ) | ||||||||

FFO attributable to common stock and units | $ | 125,683 | $ | 130,761 | $ | 130,354 | $ | 134,265 | ||||||||

Weighted average number of common shares and units, diluted | 63,476,325 | 63,476,325 | 65,177,168 | 65,177,168 | ||||||||||||

FFO per diluted share, updated | $ | 1.98 | $ | 2.06 | $ | 2.00 | $ | 2.06 | ||||||||

Notes:

(1) | Prior 2017 Guidance Range as reported in the Company's Third Quarter 2016 Supplemental Information report. |

(2) | The Company's guidance excludes any impact from future acquisitions, dispositions, equity issuances or repurchases, future debt financings or repayments. |

These estimates are forward-looking and reflect management's view of current and future market conditions, including certain assumptions with respect to leasing activity, rental rates, occupancy levels, interest rates and the amount and timing of acquisition and development activities. Our actual results may differ materially from these estimates.

First Quarter 2017 Supplemental Information | Page 9 |

SAME-STORE PORTFOLIO NET OPERATING INCOME (NOI) |  |

(Unaudited, amounts in thousands) | Three Months Ended March 31, 2017 | ||||||||||||||||||

Retail | Office | Multifamily | Mixed-Use | Total | |||||||||||||||

Real estate rental revenue | |||||||||||||||||||

Same-store portfolio | $ | 24,410 | $ | 21,870 | $ | 4,883 | $ | 15,120 | $ | 66,283 | |||||||||

Non-same store portfolio (1) | 381 | 4,120 | 3,008 | — | 7,509 | ||||||||||||||

Total | 24,791 | 25,990 | 7,891 | 15,120 | 73,792 | ||||||||||||||

Real estate expenses | |||||||||||||||||||

Same-store portfolio | 6,586 | 6,381 | 1,686 | 9,692 | 24,345 | ||||||||||||||

Non-same store portfolio (1) | 105 | 1,420 | 1,525 | — | 3,050 | ||||||||||||||

Total | 6,691 | 7,801 | 3,211 | 9,692 | 27,395 | ||||||||||||||

Net Operating Income (NOI), GAAP basis | |||||||||||||||||||

Same-store portfolio | 17,824 | 15,489 | 3,197 | 5,428 | 41,938 | ||||||||||||||

Non-same store portfolio (1) | 276 | 2,700 | 1,483 | — | 4,459 | ||||||||||||||

Total | $ | 18,100 | $ | 18,189 | $ | 4,680 | $ | 5,428 | $ | 46,397 | |||||||||

Same-store portfolio NOI, GAAP basis | $ | 17,824 | $ | 15,489 | $ | 3,197 | $ | 5,428 | $ | 41,938 | |||||||||

Net effect of straight-line rents (2) | 13 | (29 | ) | — | (15 | ) | (31 | ) | |||||||||||

Amortization of net above (below) market rents (3) | (289 | ) | (539 | ) | — | (23 | ) | (851 | ) | ||||||||||

Net effect of other lease intangibles (4) | — | (5 | ) | — | (18 | ) | (23 | ) | |||||||||||

Same-store portfolio NOI, cash basis | $ | 17,548 | $ | 14,916 | $ | 3,197 | $ | 5,372 | $ | 41,033 | |||||||||

Notes:

(1) | Same-store portfolio and non-same store portfolio are determined based on properties held on March 31, 2017 and 2016. See Glossary of Terms. |

(2) | Represents the straight-line rent income recognized during the period offset by cash received during the period and the provision for bad debts recorded for deferred rent receivable balances. |

(3) | Represents the adjustment related to the acquisition of buildings with above (below) market rents. |

(4) | Represents adjustments related to amortization of lease incentives paid to tenants, amortization of lease intangibles, lease termination fees at City Center Bellevue and straight-line rent expense for our leases of the Annex at The Landmark at One Market and retail space at Waikiki Beach Walk - Retail. |

First Quarter 2017 Supplemental Information | Page 10 |

SAME-STORE PORTFOLIO NOI COMPARISON EXCLUDING REDEVELOPMENT |  |

(Unaudited, amounts in thousands) | Three Months Ended | |||||||||

March 31, | ||||||||||

2017 | 2016 | Change | ||||||||

Cash Basis: | ||||||||||

Retail | $ | 17,548 | $ | 18,183 | (3.5 | )% | ||||

Office | 14,916 | 14,149 | 5.4 | |||||||

Multifamily | 3,197 | 3,119 | 2.5 | |||||||

Mixed-Use | 5,372 | 6,242 | (13.9 | ) | ||||||

$ | 41,033 | $ | 41,693 | (1.6 | )% | |||||

GAAP Basis: | ||||||||||

Retail | $ | 17,824 | $ | 18,344 | (2.8 | )% | ||||

Office | 15,489 | 14,711 | 5.3 | |||||||

Multifamily | 3,197 | 3,119 | 2.5 | |||||||

Mixed-Use | 5,428 | 6,262 | (13.3 | ) | ||||||

$ | 41,938 | $ | 42,436 | (1.2 | )% | |||||

First Quarter 2017 Supplemental Information | Page 11 |

SAME-STORE PORTFOLIO NOI COMPARISON WITH REDEVELOPMENT |  |

(Unaudited, amounts in thousands) | Three Months Ended | |||||||||

March 31, | ||||||||||

2017 | 2016 | Change | ||||||||

Cash Basis: | ||||||||||

Retail | $ | 17,548 | $ | 18,183 | (3.5 | )% | ||||

Office | 17,480 | 16,921 | 3.3 | |||||||

Multifamily | 3,197 | 3,119 | 2.5 | |||||||

Mixed-Use | 5,372 | 6,242 | (13.9 | ) | ||||||

$ | 43,597 | $ | 44,465 | (2.0 | )% | |||||

GAAP Basis: | ||||||||||

Retail | $ | 17,824 | $ | 18,344 | (2.8 | )% | ||||

Office | 18,191 | 17,620 | 3.2 | |||||||

Multifamily | 3,197 | 3,119 | 2.5 | |||||||

Mixed-Use | 5,428 | 6,262 | (13.3 | ) | ||||||

$ | 44,640 | $ | 45,345 | (1.6 | )% | |||||

First Quarter 2017 Supplemental Information | Page 12 |

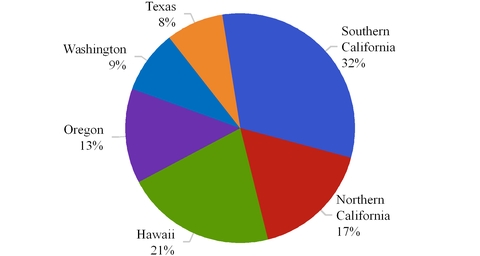

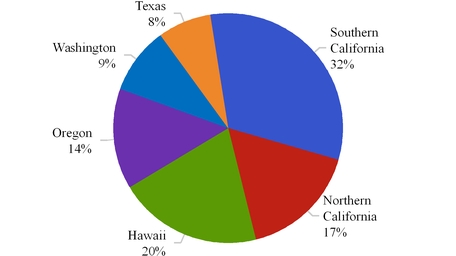

NOI BY REGION |  |

(Unaudited, amounts in thousands) | Three Months Ended March 31, 2017 | ||||||||||||||||||

Retail | Office | Multifamily | Mixed-Use | Total | |||||||||||||||

Southern California | |||||||||||||||||||

NOI, GAAP basis (1) | $ | 7,628 | $ | 4,115 | $ | 3,197 | $ | — | $ | 14,940 | |||||||||

Net effect of straight-line rents (2) | (235 | ) | (174 | ) | — | — | (409 | ) | |||||||||||

Amortization of net above (below) market rents (3) | (199 | ) | — | — | — | (199 | ) | ||||||||||||

Net effect of other lease intangibles (4) | — | — | — | — | — | ||||||||||||||

NOI, cash basis | 7,194 | 3,941 | 3,197 | — | 14,332 | ||||||||||||||

Northern California | |||||||||||||||||||

NOI, GAAP basis (1) | 2,786 | 4,913 | — | — | 7,699 | ||||||||||||||

Net effect of straight-line rents (2) | (26 | ) | 374 | — | — | 348 | |||||||||||||

Amortization of net above (below) market rents (3) | (97 | ) | (194 | ) | — | — | (291 | ) | |||||||||||

Net effect of other lease intangibles (4) | — | (19 | ) | — | — | (19 | ) | ||||||||||||

NOI, cash basis | 2,663 | 5,074 | — | — | 7,737 | ||||||||||||||

Hawaii | |||||||||||||||||||

NOI, GAAP basis (1) | 3,959 | — | — | 5,428 | 9,387 | ||||||||||||||

Net effect of straight-line rents (2) | 271 | — | — | (15 | ) | 256 | |||||||||||||

Amortization of net above (below) market rents (3) | 83 | — | — | (23 | ) | 60 | |||||||||||||

Net effect of other lease intangibles (4) | — | — | — | (18 | ) | (18 | ) | ||||||||||||

NOI, cash basis | 4,313 | — | — | 5,372 | 9,685 | ||||||||||||||

Oregon | |||||||||||||||||||

NOI, GAAP basis (1) | 295 | 4,801 | 1,483 | — | 6,579 | ||||||||||||||

Net effect of straight-line rents (2) | (68 | ) | (406 | ) | 52 | — | (422 | ) | |||||||||||

Amortization of net above (below) market rents (3) | — | (93 | ) | — | — | (93 | ) | ||||||||||||

Net effect of other lease intangibles (4) | — | 6 | — | — | 6 | ||||||||||||||

NOI, cash basis | 227 | 4,308 | 1,535 | — | 6,070 | ||||||||||||||

Texas | |||||||||||||||||||

NOI, GAAP basis (1) | 3,432 | — | — | — | 3,432 | ||||||||||||||

Net effect of straight-line rents (2) | 4 | — | — | — | 4 | ||||||||||||||

Amortization of net above (below) market rents (3) | (76 | ) | — | — | — | (76 | ) | ||||||||||||

NOI, cash basis | 3,360 | — | — | — | 3,360 | ||||||||||||||

Washington | |||||||||||||||||||

NOI, GAAP basis (1) | — | 4,360 | — | — | 4,360 | ||||||||||||||

Net effect of straight-line rents (2) | — | 41 | — | — | 41 | ||||||||||||||

Amortization of net above (below) market rents (3) | — | (252 | ) | — | — | (252 | ) | ||||||||||||

Net effect of other lease intangibles (4) | — | 8 | — | — | 8 | ||||||||||||||

NOI, cash basis | — | 4,157 | — | — | 4,157 | ||||||||||||||

Total | |||||||||||||||||||

NOI, GAAP basis (1) | 18,100 | 18,189 | 4,680 | 5,428 | 46,397 | ||||||||||||||

Net effect of straight-line rents (2) | (54 | ) | (165 | ) | 52 | (15 | ) | (182 | ) | ||||||||||

Amortization of net above (below) market rents (3) | (289 | ) | (539 | ) | — | (23 | ) | (851 | ) | ||||||||||

Net effect of other lease intangibles (4) | — | (5 | ) | — | (18 | ) | (23 | ) | |||||||||||

NOI, cash basis | $ | 17,757 | $ | 17,480 | $ | 4,732 | $ | 5,372 | $ | 45,341 | |||||||||

Notes:

(1) | See Glossary of Terms. |

(2) | Represents the straight-line rent income recognized during the period offset by cash received during the period and the provision for bad debts recorded for deferred rent receivable balances. |

(3) | Represents the adjustment related to the acquisition of buildings with above (below) market rents. |

(4) | Represents adjustments related to amortization of lease incentives paid to tenants, amortization of lease intangibles, lease termination fees at City Center Bellevue, and straight-line rent expense for our leases of the Annex at The Landmark at One Market and retail space at Waikiki Beach Walk - Retail. |

First Quarter 2017 Supplemental Information | Page 13 |

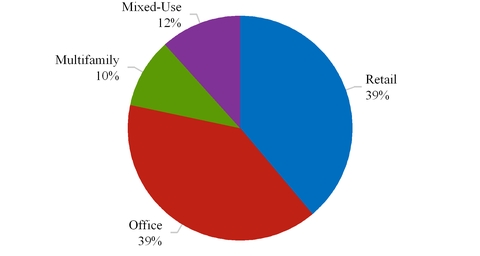

NOI BREAKDOWN |  |

Three Months Ended March 31, 2017 |

Portfolio NOI, Cash Basis Breakdown |

Portfolio Diversification by Geographic Region |

Portfolio NOI, GAAP Basis Breakdown |

Portfolio Diversification by Geographic Region |

Portfolio Diversification by Segment |

Portfolio Diversification by Segment |

First Quarter 2017 Supplemental Information | Page 14 |

PROPERTY REVENUE AND OPERATING EXPENSES |  |

(Unaudited, amounts in thousands) | Three Months Ended March 31, 2017 | |||||||||||||||

Additional | Property | |||||||||||||||

Property | Billed Expense | Operating | ||||||||||||||

Property | Base Rent (1) | Income (2) | Reimbursements (3) | Expenses (4) | ||||||||||||

Retail Portfolio | ||||||||||||||||

Carmel Country Plaza | $ | 885 | $ | 23 | $ | 187 | $ | (175 | ) | |||||||

Carmel Mountain Plaza | 2,978 | 43 | 726 | (797 | ) | |||||||||||

South Bay Marketplace | 558 | 31 | 181 | (170 | ) | |||||||||||

Lomas Santa Fe Plaza | 1,338 | 14 | 274 | (375 | ) | |||||||||||

Solana Beach Towne Centre | 1,478 | 18 | 453 | (442 | ) | |||||||||||

Del Monte Center | 2,403 | 134 | 920 | (1,096 | ) | |||||||||||

Geary Marketplace | 300 | — | 132 | (130 | ) | |||||||||||

The Shops at Kalakaua | 479 | 24 | 41 | (122 | ) | |||||||||||

Waikele Center | 4,087 | 319 | 985 | (1,500 | ) | |||||||||||

Alamo Quarry Market | 3,495 | 32 | 1,613 | (1,780 | ) | |||||||||||

Hassalo on Eighth - Retail | 202 | 56 | 52 | (78 | ) | |||||||||||

Subtotal Retail Portfolio | $ | 18,203 | $ | 694 | $ | 5,564 | $ | (6,665 | ) | |||||||

Office Portfolio | ||||||||||||||||

Torrey Reserve Campus (5) | $ | 4,146 | $ | 44 | $ | 262 | $ | (1,418 | ) | |||||||

Solana Beach Corporate Centre | 1,892 | 7 | 45 | (495 | ) | |||||||||||

The Landmark at One Market | 6,074 | 25 | 100 | (1,977 | ) | |||||||||||

One Beach Street | 1,012 | 1 | 105 | (266 | ) | |||||||||||

First & Main | 2,746 | 174 | 413 | (843 | ) | |||||||||||

Lloyd District Portfolio (5) | 2,750 | 476 | 50 | (1,374 | ) | |||||||||||

City Center Bellevue | 4,435 | 752 | 415 | (1,445 | ) | |||||||||||

Subtotal Office Portfolio | $ | 23,055 | $ | 1,479 | $ | 1,390 | $ | (7,818 | ) | |||||||

Multifamily Portfolio | ||||||||||||||||

Loma Palisades | $ | 2,985 | $ | 197 | $ | — | $ | (1,085 | ) | |||||||

Imperial Beach Gardens | 861 | 70 | — | (300 | ) | |||||||||||

Mariner's Point | 416 | 27 | — | (133 | ) | |||||||||||

Santa Fe Park RV Resort | 298 | 28 | — | (167 | ) | |||||||||||

Hassalo on Eighth - Multifamily | 2,887 | 333 | — | (1,525 | ) | |||||||||||

Subtotal Multifamily Portfolio | $ | 7,447 | $ | 655 | $ | — | $ | (3,210 | ) | |||||||

First Quarter 2017 Supplemental Information | Page 15 |

PROPERTY REVENUE AND OPERATING EXPENSES (CONTINUED) |  |

(Unaudited, amounts in thousands) | Three Months Ended March 31, 2017 | |||||||||||||||

Additional | Property | |||||||||||||||

Property | Billed Expense | Operating | ||||||||||||||

Property | Base Rent (1) | Income (2) | Reimbursements (3) | Expenses (4) | ||||||||||||

Mixed-Use Portfolio | ||||||||||||||||

Waikiki Beach Walk - Retail | $ | 2,533 | $ | 1,069 | $ | 934 | $ | (1,670 | ) | |||||||

Waikiki Beach Walk - Embassy Suites™ | 9,865 | 691 | — | (8,050 | ) | |||||||||||

Subtotal Mixed-Use Portfolio | $ | 12,398 | $ | 1,760 | $ | 934 | $ | (9,720 | ) | |||||||

Total | $ | 61,103 | $ | 4,588 | $ | 7,888 | $ | (27,413 | ) | |||||||

Notes:

(1) | Base rent for our retail and office portfolio and the retail portion of our mixed-use portfolio represents base rent for the three months ended March 31, 2017 (before abatements) and excludes the impact of straight-line rent and above (below) market rent adjustments. Total abatements for our retail and office portfolio were approximately $19 and $624, respectively, for the three months ended March 31, 2017. There were no abatements for the retail portion of our mixed-use portfolio for the three months ended March 31, 2017. In the case of triple net or modified gross leases, annualized base rent does not include tenant reimbursements for real estate taxes, insurance, common area or other operating expenses. Multifamily portfolio base rent represents base rent (including parking, before abatements) less vacancy allowance and employee rent credits and includes additional rents (additional rents include insufficient notice penalties, month-to-month charges and pet rent). There were $160 of abatements for our multifamily portfolio for the three months ended March 31, 2017. For Waikiki Beach Walk - Embassy SuitesTM, base rent is equal to the actual room revenue for the three months ended March 31, 2017. |

(2) | Represents additional property-related income for the three months ended March 31, 2017, which includes: (i) percentage rent, (ii) other rent (such as storage rent, license fees and association fees) and (iii) other property income (such as late fees, default fees, lease termination fees, parking revenue, the reimbursement of general excise taxes, laundry income and food and beverage sales). |

(3) | Represents billed tenant expense reimbursements for the three months ended March 31, 2017. |

(4) | Represents property operating expenses for the three months ended March 31, 2017. Property operating expenses includes all rental expenses, except non cash rent expense and the provision for bad debt recorded for deferred rent receivables. |

(5) | Base rent shown includes amounts related to American Assets Trust, L.P.'s leases at Torrey Reserve Campus and Lloyd District Portfolio. This intercompany rent is eliminated in the consolidated statement of operations. The base rent and abatements were both $277 for the three months ended March 31, 2017. |

First Quarter 2017 Supplemental Information | Page 16 |

SEGMENT CAPITAL EXPENDITURES |  |

(Unaudited, amounts in thousands) | Three Months Ended March 31, 2017 | |||||||||||||||||||||||

Segment | Tenant Improvements and Leasing Commissions | Maintenance Capital Expenditures | Total Tenant Improvements, Leasing Commissions and Maintenance Capital Expenditures | Redevelopment and Expansions | New Development | Total Capital Expenditures | ||||||||||||||||||

Retail Portfolio | $ | 899 | $ | 347 | $ | 1,246 | $ | — | $ | — | $ | 1,246 | ||||||||||||

Office Portfolio | 1,716 | 1,398 | 3,114 | — | 3,246 | 6,360 | ||||||||||||||||||

Multifamily Portfolio | — | 459 | 459 | — | — | 459 | ||||||||||||||||||

Mixed-Use Portfolio | 60 | 30 | 90 | — | — | 90 | ||||||||||||||||||

Total | $ | 2,675 | $ | 2,234 | $ | 4,909 | $ | — | $ | 3,246 | $ | 8,155 | ||||||||||||

First Quarter 2017 Supplemental Information | Page 17 |

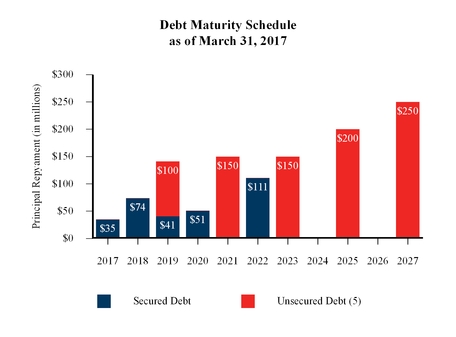

SUMMARY OF OUTSTANDING DEBT |  |

(Unaudited, amounts in thousands) | Amount | ||||||||||||||||

Outstanding at | Annual Debt | Balance at | |||||||||||||||

Debt | March 31, 2017 | Interest Rate | Service (1) | Maturity Date | Maturity | ||||||||||||

Solana Beach Corporate Centre III-IV (2)(3) | 35,306 | 6.39 | % | 36,962 | August 1, 2017 | 35,136 | |||||||||||

Loma Palisades (4) | 73,744 | 6.09 | % | 4,553 | July 1, 2018 | 73,744 | |||||||||||

One Beach Street (4) | 21,900 | 3.94 | % | 875 | April 1, 2019 | 21,900 | |||||||||||

Torrey Reserve - North Court (2) | 20,308 | 7.22 | % | 1,836 | June 1, 2019 | 19,443 | |||||||||||

Torrey Reserve - VCI, VCII, VCIII (2) | 6,853 | 6.36 | % | 560 | June 1, 2020 | 6,439 | |||||||||||

Solana Beach Corporate Centre I-II (2) | 10,875 | 5.91 | % | 855 | June 1, 2020 | 10,169 | |||||||||||

Solana Beach Towne Centre (2) | 36,249 | 5.91 | % | 2,849 | June 1, 2020 | 33,898 | |||||||||||

City Center Bellevue (4) | 111,000 | 3.98 | % | 4,479 | November 1, 2022 | 111,000 | |||||||||||

Secured Notes Payable / Weighted Average (5) | $ | 316,235 | 5.29 | % | $ | 52,969 | $ | 311,729 | |||||||||

Series A Notes (6) | $ | 150,000 | 3.88 | % | $ | 6,060 | October 31, 2021 | $ | 150,000 | ||||||||

Series B Notes | 100,000 | 4.45 | % | 4,450 | February 2, 2025 | 100,000 | |||||||||||

Series C Notes | 100,000 | 4.50 | % | 4,500 | April 1, 2025 | 100,000 | |||||||||||

Term Loan A (7) | 100,000 | 3.08 | % | 3,125 | January 9, 2019 | 100,000 | |||||||||||

Term Loan B (8) | 100,000 | 3.15 | % | 3,149 | March 1, 2023 | 100,000 | |||||||||||

Term Loan C (9) | 50,000 | 3.14 | % | 1,571 | March 1, 2023 | 50,000 | |||||||||||

Series D Notes (10) | 250,000 | 3.87 | % | 10,725 | March 1, 2027 | 250,000 | |||||||||||

Unsecured Notes Payable / Weighted Average (11) | $ | 850,000 | 3.79 | % | $ | 33,580 | $ | 850,000 | |||||||||

Notes:

(1) | Includes principal balance of outstanding debt for Solana Beach Corporate Center III-IV, as such debt is due within the next twelve (12) months. |

(2) | Principal payments based on a 30-year amortization schedule. |

(3) | Loan repaid in full, without premium or penalty, on April 3, 2017. |

(4) | Interest only. |

(5) | The Secured Notes Payable total does not include debt issuance costs, net of $0.5 million. |

(6) | $150 million of 4.04% Senior Guaranteed Notes, Series A, due October 31, 2021. Net of the settlement of the forward-starting interest rate swap, the fixed interest rate in accordance with GAAP for the Series A Notes is approximately 3.88% per annum, through maturity. |

(7) | Term Loan A has a maturity date of January 9, 2018 and we have one 12-month option remaining to extend its maturity to 2019, which we intend to exercise. Term Loan A accrues interest at a variable rate, which we fixed as part of an interest rate swap for an all-in interest rate of 3.08%, subject to adjustments based on our consolidated leverage ratio. |

(8) | Term Loan B matures on March 1, 2023. Term Loan B accrues interest at a variable rate, which we fixed as part of an interest rate swap for an all-in interest rate of 3.15%, subject to adjustments based on our consolidated leverage ratio. |

(9) | Term Loan C matures on March 1, 2023. Term Loan C accrues interest at a variable rate, which we fixed as part of an interest rate swap for an all-in interest rate of 3.14%, subject to adjustments based on our consolidated leverage ratio. |

(10) | $250 million of 4.29% Senior Guaranteed Notes, Series D, due March 1, 2027. Net of the settlement of the forward-starting interest rate swap, the fixed interest rate in accordance with GAAP for the Series D Notes is approximately 3.87% per annum, through maturity. |

(11) | The Unsecured Notes Payable total does not include $5.2 million of debt issuance costs. |

First Quarter 2017 Supplemental Information | Page 18 |

MARKET CAPITALIZATION |  |

(Unaudited, amounts in thousands, except per share data) | ||||

Market data | March 31, 2017 | |||

Common shares outstanding | 46,431 | |||

Common units outstanding | 17,889 | |||

Common shares and common units outstanding | 64,320 | |||

Market price per common share | $ | 41.84 | ||

Equity market capitalization | $ | 2,691,149 | ||

Total debt | $ | 1,166,235 | ||

Total market capitalization | $ | 3,857,384 | ||

Less: Cash on hand | $ | (190,110 | ) | |

Total enterprise value | $ | 3,667,274 | ||

Total assets, gross | $ | 2,600,676 | ||

Total unencumbered assets, gross | $ | 1,844,815 | ||

Total debt/Total capitalization | 30.2 | % | ||

Total debt/Total enterprise value | 31.8 | % | ||

Net debt/Total enterprise value (1) | 26.6 | % | ||

Total debt/Total assets, gross | 44.8 | % | ||

Net debt/Total assets, gross (1) | 37.5 | % | ||

Total unencumbered assets, gross/Unsecured debt | 217.0 | % | ||

Total debt/EBITDA (2)(3) | 7.1 | x | ||

Net debt/EBITDA (1)(2)(3) | 5.9 | x | ||

Interest coverage ratio (4) | 3.5 | x | ||

Fixed charge coverage ratio (4) | 3.5 | x | ||

Weighted Average Fixed Interest Rate | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | |||||||||||

6.4 | % | 6.1 | % | 3.8 | % | 6.0 | % | 3.9 | % | 4.0 | % | 3.1 | % | — | % | 4.5 | % | — | % | 3.9 | % | |

Total Weighed Average Fixed Interest Rate: | 4.2% |

Weighted Average Term to Maturity: | 5.8 years |

Credit Ratings | ||

Rating Agency | Rating | Outlook |

Fitch | BBB | Stable |

Moody's | Baa3 | Stable |

Standard & Poors | BBB- | Stable |

Notes:

(1) | Net debt is equal to total debt less cash on hand. |

(2) | See Glossary of Terms for discussion of EBITDA. |

(3) | As used here, EBITDA represents the actual for the three months ended March 31, 2017 annualized. |

(4) | Calculated as EBITDA divided by interest on borrowed funds, including capitalized interest and excluding debt fair value adjustments and loan fee amortization. |

(5) | Assumes the exercise of the one 12-month option remaining to extend the maturity of the unsecured term loan to January 2019. |

First Quarter 2017 Supplemental Information | Page 19 |

SUMMARY OF DEVELOPMENT OPPORTUNITIES |  |

Our portfolio has numerous potential opportunities to create future shareholder value. These opportunities could be subject to government approvals, lender consents, tenant consents, market conditions, availability of debt and/or equity financing, etc. Many of these opportunities are in their preliminary stages and may not ultimately come to fruition. This schedule will update as we modify various assumptions and markets conditions change. Square footages and units set forth below are estimates only and ultimately may differ materially from actual square footages and units. | |||||||||

In-Process Development Projects | |||||||||

Project Costs (in thousands) (2) | |||||||||

Start Date | Estimated Completion Date | Estimated Stabilization Date (1) | Estimated Rentable Square Feet | Three Months | Cost Incurred to Date | Total Estimated Investment | Estimated Stabilized Yield (3) | ||

Ended | |||||||||

Property | Location | March 31, 2017 | |||||||

Office Property: | |||||||||

Torrey Point | San Diego, CA | 2015 | 2017 | 2018 | 88,000 | $2,123 | $34,246 | $55,800 | 7% - 8% |

Development/Redevelopment Pipeline | |||||

Property | Property Type | Location | Estimated Rentable Square Feet | Multifamily Units | |

Solana Beach Corporate Centre (Building 5) | Retail | Solana Beach, CA | 10,000 | N/A | |

Lomas Santa Fe Plaza | Retail | Solana Beach, CA | 45,000 | N/A | |

Solana Beach - Highway 101 (4) | Mixed Use | Solana Beach, CA | 48,000 | 36 | |

Lloyd District Portfolio - multiple phases (5) | Mixed Use | Portland, OR | TBD | TBD | |

Notes:

(1) | Based on management's estimation of stabilized occupancy (90%). |

(2) | For all properties, project costs exclude capitalized interest cost which is calculated in accordance with Accounting Standards Codification 835-20-50-1. |

(3) | The estimated stabilized yield is calculated based on total estimated project costs, as defined above, when the project has reached stabilized occupancy. |

(4) | Represents commercial portion of development opportunity for Solana Beach - Highway 101. A third party has been granted an option to acquire this property exercisable on or prior to August 22, 2018 at a price ranging from $9.0 million to $9.45 million in consideration for a non-refundable $0.6 million option payment. |

(5) | The Lloyd District Portfolio was acquired in 2011 consisting of approximately 600,000 rentable square feet on more than 16 acres located in the Lloyd District of Portland, Oregon. The portion of the property that has been designated for additional development to include a high density, transit oriented, mixed-use urban village, with the potential to be in excess of approximately three million square feet. The entitlement for such development opportunity allows a 12:1 Floor Area Ratio with a 250 foot height limit and provides for retail, office and/or multifamily development. Additional development plans are in the early stages and will continue to progress as demand and economic conditions allow. |

First Quarter 2017 Supplemental Information | Page 20 |

| |

PORTFOLIO DATA

First Quarter 2017 Supplemental Information | Page 21 |

PROPERTY REPORT |  |

As of March 31, 2017 | Retail and Office Portfolios | ||||||||||||||||||||||

Net | Annualized | ||||||||||||||||||||||

Number | Rentable | Base Rent | |||||||||||||||||||||

Year Built/ | of | Square | Percentage | Annualized | per Leased | ||||||||||||||||||

Property | Location | Renovated | Buildings | Feet (1) | Leased (2) | Base Rent (3) | Square Foot (4) | Retail Anchor Tenant(s) (5) | Other Principal Retail Tenants (6) | ||||||||||||||

Retail Properties | |||||||||||||||||||||||

Carmel Country Plaza | San Diego, CA | 1991 | 9 | 78,098 | 91.1% | $ | 3,540,292 | $49.76 | Sharp Healthcare, San Diego County Credit Union | ||||||||||||||

Carmel Mountain Plaza (7) | San Diego, CA | 1994/2014 | 15 | 528,416 | 99.1 | 11,925,861 | 22.77 | Sears | Dick's Sporting Goods, Saks Fifth Avenue Off 5th | ||||||||||||||

South Bay Marketplace (7) | San Diego, CA | 1997 | 9 | 132,877 | 100.0 | 2,090,626 | 15.73 | Ross Dress for Less, Grocery Outlet | |||||||||||||||

Lomas Santa Fe Plaza | Solana Beach, CA | 1972/1997 | 9 | 209,569 | 97.2 | 5,406,930 | 26.54 | Vons, Home Goods | |||||||||||||||

Solana Beach Towne Centre | Solana Beach, CA | 1973/2000/2004 | 12 | 246,730 | 98.2 | 6,248,910 | 25.79 | Dixieline Probuild, Marshalls | |||||||||||||||

Del Monte Center (7) | Monterey, CA | 1967/1984/2006 | 16 | 675,486 | 98.5 | 10,184,820 | 15.31 | Macy's, KLA Monterrey | Century Theatres, Macy's Furniture Gallery | ||||||||||||||

Geary Marketplace | Walnut Creek, CA | 2012 | 3 | 35,156 | 100.0 | 1,198,166 | 34.08 | Sprouts Farmer Market, Freebirds Wild Burrito | |||||||||||||||

The Shops at Kalakaua | Honolulu, HI | 1971/2006 | 3 | 11,671 | 100.0 | 1,917,969 | 164.34 | Hawaii Beachware & Fashion, Diesel U.S.A. Inc. | |||||||||||||||

Waikele Center | Waipahu, HI | 1993/2008 | 9 | 537,637 | 90.7 | 16,507,918 | 33.85 | Lowe's, Kmart(8) | UFC Gym, Old Navy | ||||||||||||||

Alamo Quarry Market (7) | San Antonio, TX | 1997/1999 | 16 | 589,362 | 99.6 | 14,114,411 | 24.04 | Regal Cinemas | Bed Bath & Beyond, Whole Foods Market | ||||||||||||||

Hassalo on Eighth (8) | Portland, OR | 2015 | 3 | 44,153 | 76.6 | 809,337 | 23.93 | Providence Health & Services, Green Zebra Grocery | |||||||||||||||

Subtotal/Weighted Average Retail Portfolio | 104 | 3,089,155 | 96.9% | $ | 73,945,240 | $24.70 | |||||||||||||||||

Office Properties | |||||||||||||||||||||||

Torrey Reserve Campus | San Diego, CA | 1996-2000/2014-2016 | 14 | 515,192 | 78.5% | $ | 16,605,736 | $41.06 | |||||||||||||||

Solana Beach Corporate Centre | Solana Beach, CA | 1982/2005 | 4 | 212,491 | 91.9 | 7,502,881 | 38.42 | ||||||||||||||||

The Landmark at One Market (9) | San Francisco, CA | 1917/2000 | 1 | 419,371 | 100.0 | 24,295,287 | 57.93 | ||||||||||||||||

One Beach Street | San Francisco, CA | 1924/1972/1987/1992 | 1 | 97,614 | 100.0 | 4,051,590 | 41.51 | ||||||||||||||||

First & Main | Portland, OR | 2010 | 1 | 360,641 | 98.7 | 11,001,725 | 30.91 | ||||||||||||||||

Lloyd District Portfolio | Portland, OR | 1940-2015 | 6 | 581,670 | 75.8 | 11,000,359 | 24.95 | ||||||||||||||||

City Center Bellevue | Bellevue, WA | 1987 | 1 | 494,658 | 97.5 | 17,912,337 | 37.14 | ||||||||||||||||

Subtotal/Weighted Average Office Portfolio | 28 | 2,681,637 | 89.3% | $ | 92,369,915 | $38.57 | |||||||||||||||||

Total/Weighted Average Retail and Office Portfolio | 132 | 5,770,792 | 93.4% | $ | 166,315,155 | $30.86 | |||||||||||||||||

First Quarter 2017 Supplemental Information | Page 22 |

PROPERTY REPORT (CONTINUED) |  |

As of March 31, 2017 | |||||||||||||||||||||||||

Number | Average Monthly | ||||||||||||||||||||||||

Year Built/ | of | Percentage | Annualized | Base Rent per | |||||||||||||||||||||

Property | Location | Renovated | Buildings | Units | Leased (2) | Base Rent (3) | Leased Unit (4) | ||||||||||||||||||

Loma Palisades (10) | San Diego, CA | 1958/2001-2008 | 80 | 548 | 95.3% | $ | 11,977,260 | $ | 1,911 | ||||||||||||||||

Imperial Beach Gardens | Imperial Beach, CA | 1959/2008 | 26 | 160 | 98.1 | 3,507,744 | $ | 1,862 | |||||||||||||||||

Mariner's Point | Imperial Beach, CA | 1986 | 8 | 88 | 97.7 | 1,666,164 | $ | 1,615 | |||||||||||||||||

Santa Fe Park RV Resort (11) | San Diego, CA | 1971/2007-2008 | 1 | 126 | 81.0 | 1,359,780 | $ | 1,110 | |||||||||||||||||

Hassalo on Eighth - Velomor | Portland, OR | 2015 | 1 | 177 | 92.7 | 3,225,948 | $ | 1,638 | |||||||||||||||||

Hassalo on Eighth - Aster Tower | Portland, OR | 2015 | 1 | 337 | 91.4 | 6,011,100 | $ | 1,626 | |||||||||||||||||

Hassalo on Eighth - Elwood | Portland, OR | 2015 | 1 | 143 | 94.4 | 2,424,204 | $ | 1,497 | |||||||||||||||||

Total/Weighted Average Multifamily Portfolio (10) | 118 | 1,579 | 93.4% | $ | 30,172,200 | $ | 1,705 | ||||||||||||||||||

Mixed-Use Portfolio | |||||||||||||||||||||||||

Number | Net Rentable | Annualized Base | |||||||||||||||||||||||

Year Built/ | of | Square | Percentage | Annualized | Rent per Leased | Retail | |||||||||||||||||||

Retail Portion | Location | Renovated | Buildings | Feet (1) | Leased (2) | Base Rent (3) | Square Foot (4) | Anchor Tenant(s) (5) | Other Principal Retail Tenants (6) | ||||||||||||||||

Waikiki Beach Walk - Retail | Honolulu, HI | 2006 | 3 | 96,707 | 94.1 | % | $ | 10,195,628 | $ | 112.04 | Yard House, Roy's | ||||||||||||||

Number | Annualized | ||||||||||||||||||||||||

Year Built/ | of | Average | Average | Revenue per | |||||||||||||||||||||

Hotel Portion | Location | Renovated | Buildings | Units | Occupancy (12) | Daily Rate(12) | Available Room (12) | ||||||||||||||||||

Waikiki Beach Walk - Embassy Suites™ | Honolulu, HI | 2008/2014 | 2 | 369 | 91.5 | % | $ | 324.74 | $ | 297.05 | |||||||||||||||

Notes:

(1) | The net rentable square feet for each of our retail properties and the retail portion of our mixed-use property is the sum of (1) the square footages of existing leases, plus (2) for available space, the field-verified square footage. The net rentable square feet for each of our office properties is the sum of (1) the square footages of existing leases, plus (2) for available space, management’s estimate of net rentable square feet based, in part, on past leases. The net rentable square feet included in such office leases is generally determined consistently with the Building Owners and Managers Association, or BOMA, 1996 measurement guidelines. Net rentable square footage may be adjusted from the prior periods to reflect re-measurement of leased space at the properties. |

(2) | Percentage leased for each of our retail and office properties and the retail portion of the mixed-use property includes square footage under leases as of March 31, 2017, including leases which may not have commenced as of March 31, 2017. Percentage leased for our multifamily properties includes total units rented as of March 31, 2017. |

(3) | Annualized base rent is calculated by multiplying base rental payments (defined as cash base rents (before abatements)) for the month ended March 31, 2017 by 12. In the case of triple net or modified gross leases, annualized base rent does not include tenant reimbursements for real estate taxes, insurance, common area or other operating expenses. |

(4) | Annualized base rent per leased square foot is calculated by dividing annualized base rent, by square footage under lease as of March 31, 2017. Annualized base rent per leased unit is calculated by dividing annualized base rent by units under lease as of March 31, 2017. |

(5) | Retail anchor tenants are defined as retail tenants leasing 50,000 square feet or more. |

(6) | Other principal retail tenants are defined as the two tenants leasing the most square footage, excluding anchor tenants. |

(7) Net rentable square feet at certain of our retail properties includes pad sites leased pursuant to the ground leases in the following table:

Property | Number of Ground Leases | Square Footage Leased Pursuant to Ground Leases | Aggregate Annualized Base Rent | ||||||

Carmel Mountain Plaza | 6 | 125,477 | $ | 1,193,816 | |||||

South Bay Marketplace | 1 | 2,824 | $ | 91,320 | |||||

Del Monte Center | 2 | 295,100 | $ | 201,291 | |||||

Alamo Quarry Market | 4 | 31,994 | $ | 470,075 | |||||

(8) | In December 2016, the Kmart store at Waikele Center ceased its operations, but continues to remain fully liable for all of its lease obligations until the lease's scheduled expiration on June 30, 2018. |

(9) | This property contains 419,371 net rentable square feet consisting of The Landmark at One Market (375,151 net rentable square feet) as well as a separate long-term leasehold interest in approximately 44,220 net rentable square feet of space located in an adjacent six-story leasehold known as the Annex. We currently lease the Annex from an affiliate of the Paramount Group pursuant to a long-term master lease effective through June 30, 2021, which we have the option to extend until 2031 pursuant to two five-year extension options. |

First Quarter 2017 Supplemental Information | Page 23 |

PROPERTY REPORT (CONTINUED) |  |

(10) | Excluding the 21 units associated with the Loma Palisades repositioning, Loma Palisades was 99.1% leased and total multifamily was 94.6% leased at March 31, 2017. |

(11) | The Santa Fe Park RV Resort is subject to seasonal variation, with higher rates of occupancy occurring during the summer months. During the 12 months ended March 31, 2017, the highest average monthly occupancy rate for this property was 100%, occurring in August 2016. The number of units at the Santa Fe Park RV Resort includes 122 RV spaces and four apartments. |

(12) | Average occupancy represents the percentage of available units that were sold during the three months ended March 31, 2017, and is calculated by dividing the number of units sold by the product of the total number of units and the total number of days in the period. Average daily rate represents the average rate paid for the units sold and is calculated by dividing the total room revenue (i.e., excluding food and beverage revenues or other hotel operations revenues such as telephone, parking and other guest services) for the three months ended March 31, 2017 by the number of units sold. Revenue per available room, or RevPAR, represents the total unit revenue per total available units for the three months ended March 31, 2017 and is calculated by multiplying average occupancy by the average daily rate. RevPAR does not include food and beverage revenues or other hotel operations revenues such as telephone, parking and other guest services. |

First Quarter 2017 Supplemental Information | Page 24 |

RETAIL LEASING SUMMARY |  |

As of March 31, 2017 | |||||||||||||||||||||||||||||||||

Total Lease Summary - Comparable (1) | |||||||||||||||||||||||||||||||||

Number of Leases Signed | % of Comparable Leases Signed | Net Rentable Square Feet Signed | Contractual Rent Per Sq. Ft. (2) | Prior Rent Per Sq. Ft. (3) | Annual Change in Rent | Cash Basis % Change Over Prior Rent | Straight-Line Basis % Change Over Prior Rent | Weighted Average Lease Term (4) | Tenant Improvements & Incentives | Tenant Improvements & Incentives Per Sq. Ft. | |||||||||||||||||||||||

Quarter | |||||||||||||||||||||||||||||||||

1st Quarter 2017 | 12 | 100% | 33,114 | $45.40 | $44.41 | $ | 32,606 | 2.2 | % | 10.2 | % | 5.0 | $ | 382,595 | $11.55 | ||||||||||||||||||

4th Quarter 2016 | 14 | 100% | 28,604 | $44.50 | $42.67 | $ | 52,501 | 4.3 | % | 17.5 | % | 7.3 | $ | 555,445 | $19.42 | ||||||||||||||||||

3rd Quarter 2016 | 21 | 100% | 98,723 | $31.94 | $28.20 | $ | 370,189 | 13.3 | % | 18.2 | % | 7.2 | $ | 1,974,000 | $20.00 | ||||||||||||||||||

2nd Quarter 2016 | 15 | 100% | 50,733 | $41.90 | $40.05 | $ | 94,165 | 4.6 | % | 5.5 | % | 4.2 | $ | 166,260 | $3.28 | ||||||||||||||||||

Total 12 months | 62 | 100% | 211,174 | $38.14 | $35.55 | $ | 549,461 | 7.3 | % | 13.0 | % | 6.1 | $ | 3,078,300 | $14.58 | ||||||||||||||||||

New Lease Summary - Comparable (1) | |||||||||||||||||||||||||||||||||

Number of Leases Signed | % of Comparable Leases Signed | Net Rentable Square Feet Signed | Contractual Rent Per Sq. Ft. (2) | Prior Rent Per Sq. Ft. (3) | Annual Change in Rent | Cash Basis % Change Over Prior Rent | Straight-Line Basis % Change Over Prior Rent | Weighted Average Lease Term (4) | Tenant Improvements & Incentives | Tenant Improvements & Incentives Per Sq. Ft. | |||||||||||||||||||||||

Quarter | |||||||||||||||||||||||||||||||||

1st Quarter 2017 | 3 | 25% | 10,381 | $50.05 | $53.92 | $ | (40,120 | ) | (7.2 | )% | (1.0 | )% | 8.2 | $ | 361,545 | $34.83 | |||||||||||||||||

4th Quarter 2016 | 4 | 29% | 3,246 | $80.62 | $77.70 | $ | 9,477 | 3.8 | % | 12.4 | % | 6.1 | $ | 51,745 | $15.94 | ||||||||||||||||||

3rd Quarter 2016 | 3 | 14% | 47,066 | $24.25 | $19.01 | $ | 246,521 | 27.6 | % | 30.4 | % | 10.5 | $ | 1,974,000 | $41.94 | ||||||||||||||||||

2nd Quarter 2016 | 3 | 20% | 5,974 | $72.08 | $70.79 | $ | 7,706 | 1.8 | % | (11.1 | )% | 7.3 | $ | 163,260 | $27.33 | ||||||||||||||||||

Total 12 months | 13 | 21% | 66,667 | $35.30 | $31.94 | $ | 223,584 | 10.5 | % | 11.6 | % | 9.6 | $ | 2,550,550 | $38.26 | ||||||||||||||||||

Renewal Lease Summary - Comparable (1)(5) | |||||||||||||||||||||||||||||||||

Number of Leases Signed | % of Comparable Leases Signed | Net Rentable Square Feet Signed | Contractual Rent Per Sq. Ft. (2) | Prior Rent Per Sq. Ft. (3) | Annual Change in Rent | Cash Basis % Change Over Prior Rent | Straight-Line Basis % Change Over Prior Rent | Weighted Average Lease Term (4) | Tenant Improvements & Incentives | Tenant Improvements & Incentives Per Sq. Ft. | |||||||||||||||||||||||

Quarter | |||||||||||||||||||||||||||||||||

1st Quarter 2017 | 9 | 75% | 22,733 | $43.27 | $40.07 | $ | 72,726 | 8.0 | % | 17.0 | % | 3.5 | $ | 21,050 | $0.93 | ||||||||||||||||||

4th Quarter 2016 | 10 | 71% | 25,358 | $39.88 | $38.18 | $ | 43,024 | 4.4 | % | 18.9 | % | 7.5 | $ | 503,700 | $19.86 | ||||||||||||||||||

3rd Quarter 2016 | 18 | 86% | 51,657 | $38.96 | $36.57 | $ | 123,668 | 6.5 | % | 12.3 | % | 4.1 | $ | — | $0.00 | ||||||||||||||||||

2nd Quarter 2016 | 12 | 80% | 44,759 | $37.87 | $35.94 | $ | 86,459 | 5.4 | % | 10.2 | % | 3.8 | $ | 3,000 | $0.07 | ||||||||||||||||||

Total 12 months | 49 | 79% | 144,507 | $39.46 | $37.21 | $ | 325,877 | 6.1 | % | 13.6 | % | 4.5 | $ | 527,750 | $3.65 | ||||||||||||||||||

Total Lease Summary - Comparable and Non-Comparable (1) | |||||||||||||||||||||||||||||||||

Number of Leases Signed | Net Rentable Square Feet Signed | Contractual Rent Per Sq. Ft. (2) | Weighted Average Lease Term (4) | Tenant Improvements & Incentives | Tenant Improvements & Incentives Per Sq. Ft. | ||||||||||||||||||||||||||||

Quarter | |||||||||||||||||||||||||||||||||

1st Quarter 2017 | 15 | 42,915 | $43.67 | 5.7 | $ | 1,049,120 | $24.45 | ||||||||||||||||||||||||||

4th Quarter 2016 | 16 | 31,064 | $43.51 | 7.1 | $ | 599,245 | $19.29 | ||||||||||||||||||||||||||

3rd Quarter 2016 | 24 | 103,348 | $32.02 | 7.1 | $ | 2,188,512 | $21.18 | ||||||||||||||||||||||||||

2nd Quarter 2016 | 17 | 55,405 | $41.18 | 4.2 | $ | 361,513 | $6.52 | ||||||||||||||||||||||||||

Total 12 months | 72 | 232,732 | $37.88 | 6.2 | $ | 4,198,390 | $18.04 | ||||||||||||||||||||||||||

Notes:

(1) | Comparable leases represent those leases signed on spaces for which there was a previous lease, including leases signed for the retail portion of our mixed-use property. |

(2) | Contractual rent represents contractual minimum rent under the new lease for the first twelve months of the term. |

(3) | Prior rent represents the minimum rent paid under the previous lease in the final twelve months of the term. |

(4) | Weighted average is calculated on the basis of square footage. |

(5) | Excludes renewals at fixed contractual rates specified in the lease. |

First Quarter 2017 Supplemental Information | Page 25 |

OFFICE LEASING SUMMARY |  |

As of March 31, 2017 | |||||||||||||||||||||||||||||||||

Total Lease Summary - Comparable (1) | |||||||||||||||||||||||||||||||||

Number of Leases Signed | % of Comparable Leases Signed | Net Rentable Square Feet Signed | Contractual Rent Per Sq. Ft. (2) | Prior Rent Per Sq. Ft. (3) | Annual Change in Rent | Cash Basis % Change Over Prior Rent | Straight-Line Basis % Change Over Prior Rent | Weighted Average Lease Term (4) | Tenant Improvements & Incentives | Tenant Improvements & Incentives Per Sq. Ft. | |||||||||||||||||||||||

Quarter | |||||||||||||||||||||||||||||||||

1st Quarter 2017 | 12 | 100% | 92,029 | $41.79 | $40.08 | $ | 157,322 | 4.3 | % | 6.7 | % | 4.2 | $ | 2,577,621 | $28.01 | ||||||||||||||||||

4th Quarter 2016 | 11 | 100% | 103,401 | $38.81 | $33.78 | $ | 519,828 | 14.9 | % | 31.8 | % | 4.6 | $ | 1,218,128 | $11.78 | ||||||||||||||||||

3rd Quarter 2016 | 12 | 100% | 38,822 | $41.43 | $37.79 | $ | 141,420 | 9.6 | % | 16.8 | % | 4.2 | $ | 729,389 | $18.79 | ||||||||||||||||||

2nd Quarter 2016 | 8 | 100% | 22,535 | $39.42 | $35.76 | $ | 82,428 | 10.2 | % | 21.4 | % | 4.2 | $ | 221,004 | $9.81 | ||||||||||||||||||

Total 12 months | 43 | 100% | 256,787 | $40.33 | $36.82 | $ | 900,998 | 9.5 | % | 18.4 | % | 4.4 | $ | 4,746,142 | $18.48 | ||||||||||||||||||

New Lease Summary - Comparable (1) | |||||||||||||||||||||||||||||||||

Number of Leases Signed | % of Comparable Leases Signed | Net Rentable Square Feet Signed | Contractual Rent Per Sq. Ft. (2) | Prior Rent Per Sq. Ft. (3) | Annual Change in Rent | Cash Basis % Change Over Prior Rent | Straight-Line Basis % Change Over Prior Rent | Weighted Average Lease Term (4) | Tenant Improvements & Incentives | Tenant Improvements & Incentives Per Sq. Ft. | |||||||||||||||||||||||

Quarter | |||||||||||||||||||||||||||||||||

1st Quarter 2017 | 8 | 67% | 69,802 | $41.32 | $37.73 | $ | 250,566 | 9.5 | % | 10.6 | % | 4.9 | $ | 2,547,352 | $36.49 | ||||||||||||||||||

4th Quarter 2016 | 5 | 45% | 46,060 | $40.17 | $34.77 | $ | 248,871 | 15.5 | % | 30.7 | % | 3.5 | $ | 700,600 | $15.21 | ||||||||||||||||||

3rd Quarter 2016 | 4 | 33% | 10,953 | $43.51 | $38.64 | $ | 53,277 | 12.6 | % | 13.5 | % | 4.1 | $ | 73,700 | $6.73 | ||||||||||||||||||

2nd Quarter 2016 | 2 | 25% | 5,131 | $34.34 | $33.08 | $ | 6,437 | 3.8 | % | 9.3 | % | 7.4 | $ | 144,018 | $28.07 | ||||||||||||||||||

Total 12 months | 19 | 44% | 131,946 | $40.83 | $36.59 | $ | 559,151 | 11.6 | % | 17.4 | % | 4.4 | $ | 3,465,670 | $26.26 | ||||||||||||||||||

Renewal Lease Summary - Comparable (1)(5) | |||||||||||||||||||||||||||||||||

Number of Leases Signed | % of Comparable Leases Signed | Net Rentable Square Feet Signed | Contractual Rent Per Sq. Ft. (2) | Prior Rent Per Sq. Ft. (3) | Annual Change in Rent | Cash Basis % Change Over Prior Rent | Straight-Line Basis % Change Over Prior Rent | Weighted Average Lease Term (4) | Tenant Improvements & Incentives | Tenant Improvements & Incentives Per Sq. Ft. | |||||||||||||||||||||||

Quarter | |||||||||||||||||||||||||||||||||

1st Quarter 2017 | 4 | 33% | 22,227 | $43.24 | $47.44 | $ | (93,244 | ) | (8.8 | )% | (1.6 | )% | 1.8 | $ | 30,269 | $1.36 | |||||||||||||||||

4th Quarter 2016 | 6 | 55% | 57,341 | $37.71 | $32.98 | $ | 270,957 | 14.3 | % | 32.8 | % | 5.5 | $ | 517,528 | $9.03 | ||||||||||||||||||

3rd Quarter 2016 | 8 | 67% | 27,869 | $40.61 | $37.45 | $ | 88,143 | 8.4 | % | 18.2 | % | 4.3 | $ | 655,689 | $23.53 | ||||||||||||||||||

2nd Quarter 2016 | 6 | 75% | 17,404 | $40.91 | $36.55 | $ | 75,991 | 11.9 | % | 24.9 | % | 3.2 | $ | 76,986 | $4.42 | ||||||||||||||||||

Total 12 months | 24 | 56% | 124,841 | $39.79 | $37.05 | $ | 341,847 | 7.4 | % | 19.5 | % | 4.3 | $ | 1,280,472 | $10.26 | ||||||||||||||||||

Total Lease Summary - Comparable and Non-Comparable | |||||||||||||||||||||||||||||||||

Number of Leases Signed | Net Rentable Square Feet Signed | Contractual Rent Per Sq. Ft. (2) | Weighted Average Lease Term (4) | Tenant Improvements & Incentives | Tenant Improvements & Incentives Per Sq. Ft. | ||||||||||||||||||||||||||||

Quarter | |||||||||||||||||||||||||||||||||

1st Quarter 2017 | 16 | 123,929 | $39.46 | 5.2 | $ | 4,136,001 | $33.37 | ||||||||||||||||||||||||||

4th Quarter 2016 | 16 | 125,836 | $39.48 | 5.0 | $ | 2,796,553 | $22.22 | ||||||||||||||||||||||||||

3rd Quarter 2016 | 15 | 47,637 | $42.59 | 4.8 | $ | 1,256,475 | $26.38 | ||||||||||||||||||||||||||

2nd Quarter 2016 | 12 | 35,320 | $41.15 | 4.6 | $ | 510,132 | $14.44 | ||||||||||||||||||||||||||

Total 12 months | 59 | 332,722 | $40.10 | 5.0 | $ | 8,699,161 | $26.14 | ||||||||||||||||||||||||||

Notes:

(1) | Comparable leases represent those leases signed on spaces for which there was a previous lease. |

(2) | Contractual rent represents contractual minimum rent under the new lease for the first twelve months of the term. |

(3) | Prior rent represents the minimum rent paid under the previous lease in the final twelve months of the term. |

(4) | Weighted average is calculated on the basis of square footage. |

(5) | Excludes renewals at fixed contractual rates specified in the lease. |

First Quarter 2017 Supplemental Information | Page 26 |

MULTIFAMILY LEASING SUMMARY |  |

As of March 31, 2017 | ||||||||

Lease Summary - Loma Palisades | ||||||||

Number of Leased Units | Percentage leased (1) | Annualized Base Rent (2) | Average Monthly Base Rent per Leased Unit (3) | |||||

Quarter | ||||||||

1st Quarter 2017 | 522 | 95.3% | (4) | $11,977,260 | $1,911 | |||

4th Quarter 2016 | 521 | 95.1% | $11,930,772 | $1,908 | ||||

3rd Quarter 2016 | 536 | 97.8% | $12,083,664 | $1,879 | ||||

2nd Quarter 2016 | 532 | 97.1% | $12,102,696 | $1,895 | ||||

Lease Summary - Imperial Beach Gardens | ||||||||

Number of Leased Units | Percentage leased (1) | Annualized Base Rent (2) | Average Monthly Base Rent per Leased Unit (3) | |||||

Quarter | ||||||||

1st Quarter 2017 | 157 | 98.1% | $3,507,744 | $1,862 | ||||

4th Quarter 2016 | 155 | 96.9% | $3,402,948 | $1,829 | ||||

3rd Quarter 2016 | 156 | 97.6% | $3,422,268 | $1,826 | ||||

2nd Quarter 2016 | 155 | 96.9% | $3,302,964 | $1,775 | ||||

Lease Summary - Mariner's Point | ||||||||

Number of Leased Units | Percentage leased (1) | Annualized Base Rent (2) | Average Monthly Base Rent per Leased Unit (3) | |||||

Quarter | ||||||||

1st Quarter 2017 | 86 | 97.7% | $1,666,164 | $1,615 | ||||

4th Quarter 2016 | 86 | 97.7% | $1,626,312 | $1,576 | ||||

3rd Quarter 2016 | 86 | 97.7% | $1,617,708 | $1,568 | ||||

2nd Quarter 2016 | 86 | 97.7% | $1,520,064 | $1,473 | ||||

Lease Summary - Santa Fe Park RV Resort | ||||||||

Number of Leased Units | Percentage leased (1) | Annualized Base Rent (2) | Average Monthly Base Rent per Leased Unit (3) | |||||

Quarter | ||||||||

1st Quarter 2017 | 102 | 81.0% | $1,359,780 | $1,110 | ||||

4th Quarter 2016 | 101 | 80.2% | $1,173,324 | $968 | ||||

3rd Quarter 2016 | 97 | 77.0% | $1,123,284 | $965 | ||||

2nd Quarter 2016 | 123 | 97.6% | $1,475,328 | $1,000 | ||||

First Quarter 2017 Supplemental Information | Page 27 |

MULTIFAMILY LEASING SUMMARY (CONTINUED) |  |

As of March 31, 2017 | ||||||||

Lease Summary - Hassalo on Eighth - Velomor | ||||||||

Number of Leased Units | Percentage leased (1) | Annualized Base Rent (2) | Average Monthly Base Rent per Leased Unit (3) | |||||

Quarter | ||||||||

1st Quarter 2017 | 164 | 92.7% | $3,225,948 | $1,638 | ||||

4th Quarter 2016 | 156 | 88.1% | $3,130,644 | $1,673 | ||||

3rd Quarter 2016 | 163 | 92.1% | $3,211,500 | $1,642 | ||||

2nd Quarter 2016 | 167 | 94.3% | $3,202,296 | $1,599 | ||||

Lease Summary - Hassalo on Eighth - Aster Tower | ||||||||

Number of Leased Units | Percentage leased (1) | Annualized Base Rent (2) | Average Monthly Base Rent per Leased Unit (3) | |||||

Quarter | ||||||||

1st Quarter 2017 | 308 | 91.4% | $6,011,100 | $1,626 | ||||

4th Quarter 2016 | 287 | 85.2% | $5,843,700 | $1,696 | ||||

3rd Quarter 2016 | 288 | 85.5% | $6,294,240 | $1,820 | ||||

2nd Quarter 2016 | 286 | 84.8% | $4,928,244 | $1,437 | ||||

Lease Summary - Hassalo on Eighth - Elwood | ||||||||

Number of Leased Units | Percentage leased (1) | Annualized Base Rent (2) | Average Monthly Base Rent per Leased Unit (3) | |||||

Quarter | ||||||||

1st Quarter 2017 | 135 | 94.4% | $2,424,204 | $1,497 | ||||

4th Quarter 2016 | 120 | 83.9% | $2,208,456 | $1,534 | ||||

3rd Quarter 2016 | 122 | 85.3% | $2,424,792 | $1,657 | ||||

2nd Quarter 2016 | 111 | 77.6% | $1,936,200 | $1,454 | ||||

Total Multifamily Lease Summary | ||||||||

Number of Leased Units | Percentage leased (1) | Annualized Base Rent (2) | Average Monthly Base Rent per Leased Unit (3) | |||||

Quarter | ||||||||

1st Quarter 2017 | 1,474 | 93.4% | (5) | $30,172,200 | $1,705 | |||

4th Quarter 2016 | 1,426 | 90.3% | $29,316,156 | $1,713 | ||||

3rd Quarter 2016 | 1,448 | 91.7% | $30,177,456 | $1,737 | ||||

2nd Quarter 2016 | 1,460 | 92.5% | $28,467,792 | $1,624 | ||||

Notes:

(1) | Percentage leased for our multifamily properties includes total units rented as of each respective quarter end date. |

(2) | Annualized base rent is calculated by multiplying base rental payments (defined as cash base rents (before abatements)) as of each respective quarter end date. |

(3) | Annualized base rent per leased unit is calculated by dividing annualized base rent, by units under lease as of each respective quarter end date. |

(4) | Excluding the 21 units associated with the Loma Palisades repositioning, Loma Palisades was 99.1% leased at March 31, 2017. |

(5) | Excluding the 21 units associated with the Loma Palisades repositioning, total multifamily was 94.6% leased at March 31, 2017. |

First Quarter 2017 Supplemental Information | Page 28 |

MIXED-USE LEASING SUMMARY |  |

As of March 31, 2017 | ||||||||

Lease Summary - Retail Portion | ||||||||

Number of Leased Square Feet | Percentage leased (1) | Annualized Base Rent (2) | Annualized base Rent per Leased Square Foot (3) | |||||

Quarter | ||||||||

1st Quarter 2017 | 90,979 | 94.1% | $10,195,628 | $112 | ||||

4th Quarter 2016 | 95,450 | 98.7% | $10,838,934 | $114 | ||||

3rd Quarter 2016 | 95,588 | 98.8% | $10,810,032 | $113 | ||||

2nd Quarter 2016 | 95,085 | 98.3% | $10,785,430 | $113 | ||||

Lease Summary - Hotel Portion | ||||||||

Number of Leased Units | Average Occupancy (4) | Average Daily Rate (4) | Annualized Revenue per Available Room (4) | |||||

Quarter | ||||||||

1st Quarter 2017 | 338 | 91.5% | $325 | $297 | ||||

4th Quarter 2016 | 326 | 88.4% | $311 | $275 | ||||

3rd Quarter 2016 | 346 | 93.9% | $357 | $335 | ||||

2nd Quarter 2016 | 332 | 89.9% | $307 | $276 | ||||

Notes:

(1) | Percentage leased for mixed-use property includes square footage under leases as of March 31, 2017, including leases which may not have commenced as of March 31, 2017. |

(2) | Annualized base rent is calculated by multiplying base rental payments (defined as cash base rents (before abatements)) for the month ended March 31, 2017 by 12. In the case of triple net or modified gross leases, annualized base rent does not include tenant reimbursements for real estate taxes, insurance, common area or other operating expenses. |

(3) | Annualized base rent per leased square foot is calculated by dividing annualized base rent, by square footage under lease as of March 31, 2017. |

(4) | Average occupancy represents the percentage of available units that were sold during the three months ended March 31, 2017, and is calculated by dividing the number of units sold by the product of the total number of units and the total number of days in the period. Average daily rate represents the average rate paid for the units sold and is calculated by dividing the total room revenue (i.e., excluding food and beverage revenues or other hotel operations revenues such as telephone, parking and other guest services) for each respective quarter period by the number of units sold. Revenue per available room, or RevPAR, represents the total unit revenue per total available units for each respective quarter period and is calculated by multiplying average occupancy by the average daily rate. RevPAR does not include food and beverage revenues or other hotel operations revenues such as telephone, parking and other guest services. |

First Quarter 2017 Supplemental Information | Page 29 |

LEASE EXPIRATIONS |  |

As of March 31, 2017 | |||||||||||||||||||||||||||||||||||||||||

Assumes no exercise of lease options | |||||||||||||||||||||||||||||||||||||||||

Office | Retail | Mixed-Use (Retail Portion Only) | Total | ||||||||||||||||||||||||||||||||||||||

% of | % of | Annualized | % of | % of | Annualized | % of | % of | Annualized | % of | Annualized | |||||||||||||||||||||||||||||||

Expiring | Office | Total | Base Rent | Expiring | Retail | Total | Base Rent | Expiring | Mixed-Use | Total | Base Rent | Expiring | Total | Base Rent | |||||||||||||||||||||||||||

Year | Sq. Ft. | Sq. Ft. | Sq. Ft. | Per Sq. Ft.(1) | Sq. Ft. | Sq. Ft. | Sq. Ft. | Per Sq. Ft.(1) | Sq. Ft. | Sq. Ft. | Sq. Ft. | Per Sq. Ft.(1) | Sq. Ft. | Sq. Ft. | Per Sq. Ft.(1) | ||||||||||||||||||||||||||

Month to Month | 16,961 | 0.6 | % | 0.3 | % | $1.61 | 14,843 | 0.5 | % | 0.3 | % | $40.39 | 2,629 | 2.7 | % | — | % | $86.16 | 34,433 | 0.6 | % | $24.78 | |||||||||||||||||||

2017 | 230,969 | 8.6 | 3.9 | $42.16 | 228,214 | 7.4 | 3.9 | $24.99 | 8,397 | 8.7 | 0.1 | $125.60 | 467,580 | 8.0 | $35.28 | ||||||||||||||||||||||||||

2018 | 287,495 | 10.7 | 4.9 | $50.83 | 891,342 | 28.9 | 15.2 | $20.41 | 14,749 | 15.3 | 0.3 | $113.41 | 1,193,586 | 20.3 | $28.89 | ||||||||||||||||||||||||||

2019 | 335,325 | 12.5 | 5.7 | $42.79 | 353,216 | 11.4 | 6.0 | $28.79 | 19,519 | 20.2 | 0.3 | $94.97 | 708,060 | 12.1 | $37.24 | ||||||||||||||||||||||||||

2020 | 379,528 | (2) | 14.2 | 6.5 | $40.78 | 299,718 | 9.7 | 5.1 | $22.08 | 19,798 | 20.5 | 0.3 | $68.23 | 699,044 | 11.9 | $33.54 | |||||||||||||||||||||||||

2021 | 293,216 | 10.9 | 5.0 | $43.45 | 165,472 | 5.4 | 2.8 | $42.58 | 12,383 | 12.8 | 0.2 | $238.51 | 471,071 | 8.0 | $48.27 | ||||||||||||||||||||||||||

2022 | 146,032 | (3)(4) | 5.4 | 2.5 | $36.19 | 278,896 | 9.0 | 4.8 | $31.95 | 11,464 | 11.9 | 0.2 | $78.23 | 436,392 | 7.4 | $34.58 | |||||||||||||||||||||||||

2023 | 154,621 | 5.8 | 2.6 | $34.10 | 96,511 | 3.1 | 1.6 | $20.79 | 1,004 | 1.0 | — | $186.24 | 252,136 | 4.3 | $29.61 | ||||||||||||||||||||||||||

2024 | 143,513 | 5.4 | 2.4 | $34.46 | 241,687 | 7.8 | 4.1 | $24.29 | — | — | — | — | 385,200 | 6.6 | $28.08 | ||||||||||||||||||||||||||

2025 | 210,320 | 7.8 | 3.6 | $29.66 | 162,586 | 5.3 | 2.8 | $22.97 | — | — | — | — | 372,906 | 6.4 | $26.74 | ||||||||||||||||||||||||||

2026 | 22,750 | 0.8 | 0.4 | $26.09 | 51,045 | 1.7 | 0.9 | $36.13 | — | — | — | — | 73,795 | 1.3 | $33.03 | ||||||||||||||||||||||||||

Thereafter | 108,818 | 4.1 | 1.9 | $28.39 | 147,376 | 4.8 | 2.5 | $22.05 | — | — | — | — | 256,194 | 4.4 | $24.74 | ||||||||||||||||||||||||||

Signed Leases Not Commenced | 65,842 | 2.5 | 1.1 | — | 63,316 | 2.0 | 1.1 | — | 1,036 | 1.1 | — | — | 130,194 | 2.2 | — | ||||||||||||||||||||||||||

Available | 286,247 | 10.7 | 4.9 | — | 94,933 | 3.1 | 1.6 | — | 5,728 | 5.9 | 0.1 | — | 386,908 | 6.6 | — | ||||||||||||||||||||||||||

Total (5) | 2,681,637 | 100.0 | % | 45.7 | % | $34.45 | 3,089,155 | 100.0 | % | 52.6 | % | $23.94 | 96,707 | 100.0 | % | 1.6 | % | $105.43 | 5,867,499 | 100.0 | % | $30.09 | |||||||||||||||||||

Assumes all lease options are exercised | |||||||||||||||||||||||||||||||||||||||||

Office | Retail | Mixed-Use (Retail Portion Only) | Total | ||||||||||||||||||||||||||||||||||||||

% of | % of | Annualized | % of | % of | Annualized | % of | % of | Annualized | % of | Annualized | |||||||||||||||||||||||||||||||

Expiring | Office | Total | Base Rent | Expiring | Retail | Total | Base Rent | Expiring | Mixed-Use | Total | Base Rent | Expiring | Total | Base Rent | |||||||||||||||||||||||||||

Year | Sq. Ft. | Sq. Ft. | Sq. Ft. | Per Sq. Ft.(1) | Sq. Ft. | Sq. Ft. | Sq. Ft. | Per Sq. Ft.(1) | Sq. Ft. | Sq. Ft. | Sq. Ft. | Per Sq. Ft.(1) | Sq. Ft. | Sq. Ft. | Per Sq. Ft.(1) | ||||||||||||||||||||||||||

Month to Month | 16,961 | 0.6 | % | 0.3 | % | $1.61 | 14,843 | 0.5 | % | 0.3 | % | $40.39 | 2,629 | 2.7 | % | — | % | $86.16 | 34,433 | 0.6 | % | $24.78 | |||||||||||||||||||

2017 | 167,649 | 6.3 | 2.9 | $39.34 | 79,817 | 2.6 | 1.4 | $34.12 | 8,397 | 8.7 | 0.1 | $125.60 | 255,863 | 4.4 | $40.54 | ||||||||||||||||||||||||||

2018 | 53,316 | 2.0 | 0.9 | $41.56 | 51,249 | 1.7 | 0.9 | $38.57 | 14,749 | 15.3 | 0.3 | $113.41 | 119,314 | 2.0 | $49.16 | ||||||||||||||||||||||||||

2019 | 129,027 | 4.8 | 2.2 | $40.38 | 88,327 | 2.9 | 1.5 | $36.35 | 7,829 | 8.1 | 0.1 | $145.66 | 225,183 | 3.8 | $42.46 | ||||||||||||||||||||||||||

2020 | 156,437 | 5.8 | 2.7 | $38.03 | 81,552 | 2.6 | 1.4 | $27.37 | 2,436 | 2.5 | — | $194.89 | 240,425 | 4.1 | $36.00 | ||||||||||||||||||||||||||

2021 | 125,715 | 4.7 | 2.1 | $36.25 | 93,040 | 3.0 | 1.6 | $45.77 | 12,383 | 12.8 | 0.2 | $238.51 | 231,138 | 3.9 | $50.92 | ||||||||||||||||||||||||||

2022 | 89,120 | 3.3 | 1.5 | $41.33 | 100,224 | 3.2 | 1.7 | $35.58 | 11,894 | 12.3 | 0.2 | $82.11 | 201,238 | 3.4 | $40.88 | ||||||||||||||||||||||||||

2023 | 195,886 | (2) | 7.3 | 3.3 | $45.62 | 92,872 | 3.0 | 1.6 | $33.99 | 1,004 | 1.0 | — | $186.24 | 289,762 | 4.9 | $42.38 | |||||||||||||||||||||||||

2024 | 121,181 | 4.5 | 2.1 | $34.93 | 217,771 | 7.0 | 3.7 | $29.21 | — | — | — | — | 338,952 | 5.8 | $31.25 | ||||||||||||||||||||||||||

2025 | 152,450 | 5.7 | 2.6 | $34.79 | 99,529 | 3.2 | 1.7 | $29.89 | — | — | — | — | 251,979 | 4.3 | $32.85 | ||||||||||||||||||||||||||

2026 | 148,054 | 5.5 | 2.5 | $36.94 | 38,642 | 1.3 | 0.7 | $43.54 | — | — | — | — | 186,696 | 3.2 | $38.31 | ||||||||||||||||||||||||||

Thereafter | 973,752 | (3)(4) | 36.3 | 16.6 | $41.27 | 1,973,040 | 63.9 | 33.6 | $20.88 | 28,622 | 29.6 | 0.5 | $52.74 | 2,975,414 | 50.7 | $27.86 | |||||||||||||||||||||||||

Signed Leases Not Commenced | 65,842 | 2.5 | 1.1 | — | 63,316 | 2.0 | 1.1 | — | 1,036 | 1.1 | — | — | 130,194 | 2.2 | — | ||||||||||||||||||||||||||

Available | 286,247 | 10.7 | 4.9 | — | 94,933 | 3.1 | 1.6 | — | 5,728 | 5.9 | 0.1 | — | 386,908 | 6.6 | — | ||||||||||||||||||||||||||

Total (5) | 2,681,637 | 100.0 | % | 45.7 | % | $34.45 | 3,089,155 | 100.0 | % | 52.6 | % | $23.94 | 96,707 | 100.0 | % | 1.6 | % | $105.43 | 5,867,499 | 100.0 | % | $30.09 | |||||||||||||||||||

First Quarter 2017 Supplemental Information | Page 30 |

LEASE EXPIRATIONS (CONTINUED) |  |

As of March 31, 2017 | |||

Notes:

(1) | Annualized base rent per leased square foot is calculated by dividing (i) annualized base rent for leases expiring during the applicable period, by (ii) square footage under such expiring leases. Annualized base rent is calculated by multiplying (i) base rental payments (defined as cash base rents (before abatements)) for the month ended March 31, 2017 for the leases expiring during the applicable period by (ii) 12 months. |

(2) | The expirations include 12,282 square feet leased by Inome, Inc. at City Center Bellevue through July 31, 2017, for which Point Inside, Inc. has signed an agreement to lease such space beginning August 1, 2017 through October 31, 2020 with option to extend the lease through November 30, 2023 |

(3) | The expirations include 18,740 square feet leased by Inome, Inc. at City Center Bellevue through July 31, 2017, for which VMWare, Inc. has signed an agreement to lease such space beginning December 1, 2017 through November 30, 2022 with options to extend the lease through November 30, 2032 |

(4) | The expirations include 18,552 square feet leased by Scantron Corporation at City Center Bellevue through April 30, 2018, for which VMWare, Inc. has signed an agreement to lease such space beginning May 1, 2018 through November 30, 2022 with options to extend the lease through November 30, 2032 |

(5) | Individual items may not add up to total due to rounding. |

First Quarter 2017 Supplemental Information | Page 31 |

PORTFOLIO LEASED STATISTICS |  |

At March 31, 2017 | At March 31, 2016 | |||||||||||||||||

Type | Size | Leased (1) | Leased % | Size | Leased (1) | Leased % | ||||||||||||

Overall Portfolio (2) Statistics | ||||||||||||||||||

Retail Properties (square feet) | 3,089,155 | 2,994,222 | 96.9 | % | 3,045,194 | 3,002,403 | 98.6 | % | ||||||||||

Office Properties (square feet) | 2,681,637 | 2,395,390 | 89.3 | % | 2,658,574 | 2,428,180 | 91.3 | % | ||||||||||

Multifamily Properties (units) | 1,579 | 1,474 | 93.4 | % | (7) | 1,579 | 1,253 | 79.4 | % | |||||||||

Mixed-Use Properties (square feet) | 96,707 | 90,979 | 94.1 | % | 96,707 | 94,601 | 97.8 | % | ||||||||||

Mixed-Use Properties (units) | 369 | 338 | (3) | 91.5 | % | 369 | 321 | (3) | 87.0 | % | ||||||||

Same-Store(2) Statistics | ||||||||||||||||||

Retail Properties (square feet) | 3,045,002 | (4) | 2,960,398 | 97.2 | % | 3,045,194 | (4) | 3,002,403 | 98.6 | % | ||||||||

Office Properties (square feet) | 2,166,445 | (5) | 1,991,121 | 91.9 | % | 2,165,139 | (5) | 1,986,609 | 91.8 | % | ||||||||

Multifamily Properties (units) | 922 | (6) | 867 | 94.0 | % | (7) | 922 | (6) | 889 | 96.4 | % | |||||||

Mixed-Use Properties (square feet) | 96,707 | 90,979 | 94.1 | % | 96,707 | 94,601 | 97.8 | % | ||||||||||

Mixed-Use Properties (units) | 369 | 338 | (3) | 91.5 | % | 369 | 321 | (3) | 87.0 | % | ||||||||

Notes:

(1) | Leased square feet includes square feet under lease as of each date, including leases which may not have commenced as of that date. Leased units for our multifamily properties include total units rented as of that date. |