Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - AMAG PHARMACEUTICALS, INC. | ex993ferahemedata.htm |

| EX-99.1 - EXHIBIT 99.1 - AMAG PHARMACEUTICALS, INC. | ex991q12017earningsrelease.htm |

| 8-K - 8-K - AMAG PHARMACEUTICALS, INC. | amagq12017earningsrelease8.htm |

AMAG Pharmaceuticals

Q1-2017 Financial Results &

Corporate Update

May 2, 2017

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of

1995 (PSLRA) and other federal securities laws. Any statements contained herein which do not describe historical facts,

including, among others, Makena’s position in the market and future growth drivers for Makena, including its ability to

continue to gain share from compounders, grow the Makena @Home administration, expand use in the late preterm birth

segment and launch the Makena subcutaneous auto-injector; growth drivers for Cord Blood Registry (CBR), including plans to

differentiate CBR’s offerings, build the value proposition on storing newborn stem cells and leveraging advancements in stem

cell research; expectations regarding the commercial opportunity of Intrarosa, including the number of women who suffer

from dyspareunia in the U.S., and the expected Intrarosa launch timing of mid-2017; AMAG’s ability to leverage its existing

strengths, hire a new commercial team and initiate a Phase 3 female sexual dysfunction study in post-menopausal women in

the second half of 2017; growth drivers for Feraheme, including plans to optimize net revenue per gram, complete recent

group purchasing organization (GPO) sales, grow in key segments and expectations that the size of the addressable market, if

the broader indication is approved, would double and would require minimal expansion of sales force; expectations

regarding 2017 quarterly Makena ex-factory sales; AMAG’s 2017 financial guidance, including forecasted GAAP and non-

GAAP revenues, GAAP net income and operating income, and non-GAAP adjusted EBITDA; and expectations regarding

regulatory timelines for the Makena subcutaneous auto-injector, Feraheme broader label, Intrarosa, bremelanotide and Velo,

including anticipated FDA action and commercial launch for each product; are forward-looking statements which involve

risks and uncertainties that could cause actual results to differ materially from those discussed in such forward-looking

statements.

Such risks and uncertainties include, among others, those risks identified in AMAG’s Securities and Exchange Commission

(“SEC”) filings, including its Annual Report on Form 10-K for the year ended December 31, 2016 and its Quarterly Report on

Form 10-Q for the quarter ended March 31, 2017 and subsequent filings with the SEC. AMAG cautions you not to place

undue reliance on any forward-looking statements, which speak only as of the date they are made. AMAG disclaims any

obligation to publicly update or revise any such statements to reflect any change in expectations or in events, conditions or

circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ

from those set forth in the forward-looking statements.

AMAG Pharmaceuticals® and Feraheme® are registered trademarks of AMAG Pharmaceuticals, Inc. MuGard® is a registered

trademark of Abeona Therapeutics, Inc. Makena® is a registered trademark of AMAG Pharmaceuticals IP, Ltd. Cord Blood

Registry® and CBR® are registered trademarks of CBR Systems, Inc. IntrarosaTM is a trademark of Endoceutics, Inc.

2

Q1-2017 Earnings Call Agenda

3

Q1-2017 and Recent Highlights 1

6 Q&A

2 Commercial Overview

5 2017 Key Priorities and Closing Remarks

4 Financial Results and Guidance

3 Feraheme Broad Label Study Results

Q1-2017 Highlights and Recent Events

4

Filed sNDA with the FDA for Makena subcutaneous (sub-q) auto-injector

Increased Makena market share by 2% over Q4-2016 to 44%

Reported positive Feraheme data from Phase 3 label expansion study

Closed licensing transactions in the women’s health space for rights to

IntrarosaTM and bremelanotide

Initiated the hiring of a new approximately 150-person women’s health

commercial team in preparation for mid-2017 launch of Intrarosa

Advanced ongoing clinical work with our partner Palatin for the planned

bremelanotide NDA submission in early 2018

Generated strong revenues in Q1-2017, including 33% growth in Makena

sales and 7% growth in Feraheme sales over Q1-2016

Ended Q1-2017 with $558 M of cash and investments

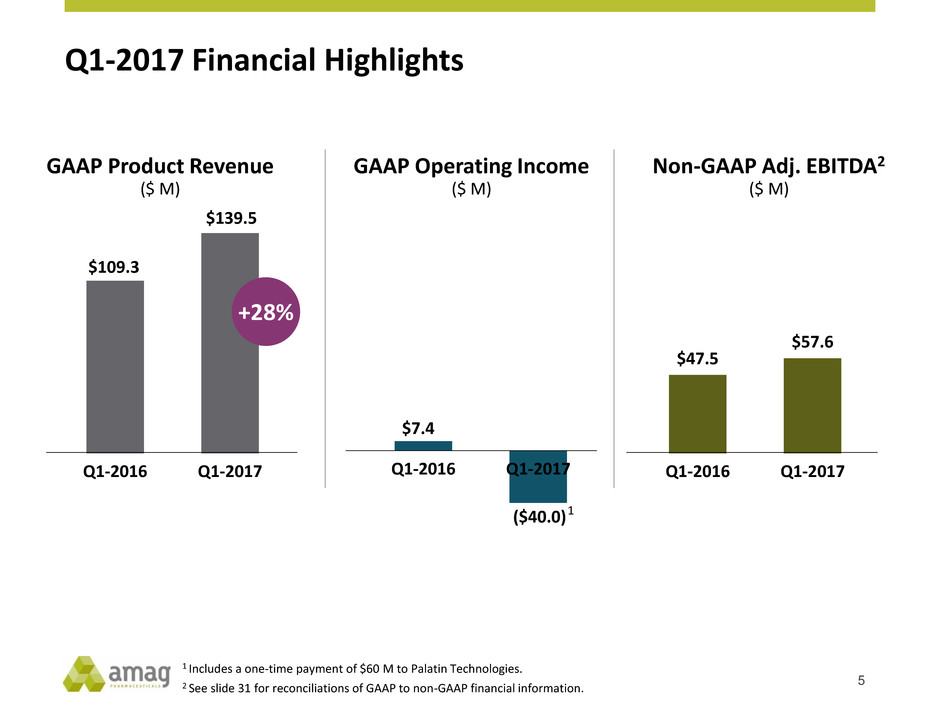

Q1-2017 Financial Highlights

5

GAAP Product Revenue

($ M)

$109.3

$139.5

Q1-2016 Q1-2017

+28%

1 Includes a one-time payment of $60 M to Palatin Technologies.

2 See slide 31 for reconciliations of GAAP to non-GAAP financial information.

GAAP Operating Income

($ M)

Non-GAAP Adj. EBITDA2

($ M)

$47.5

$57.6

Q1-2016 Q1-2017

$7.4

($40.0)

Q1-2016 Q1-2017

1

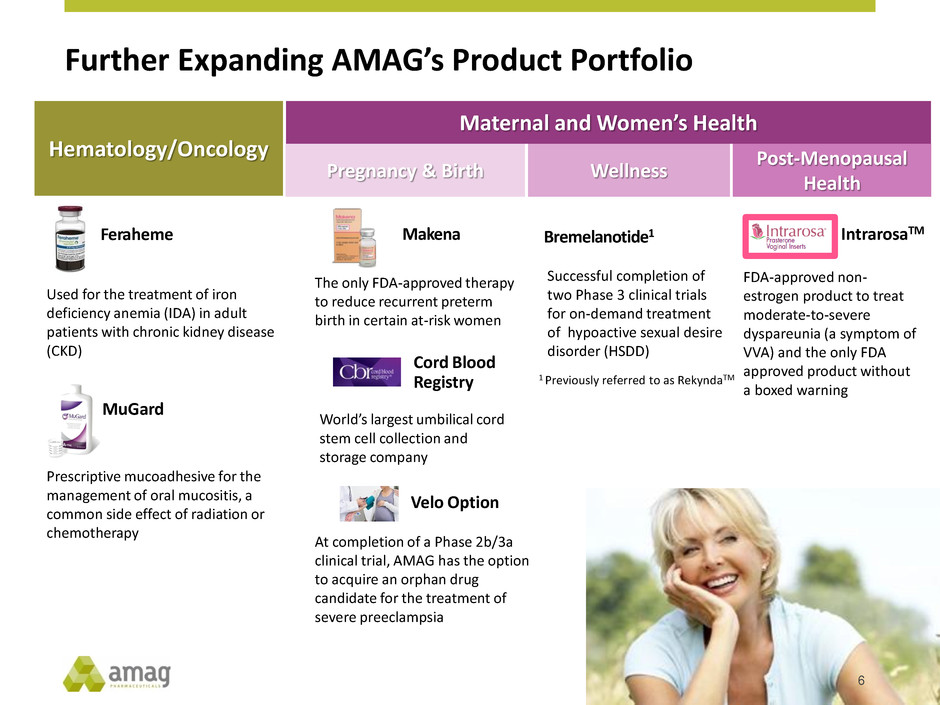

Further Expanding AMAG’s Product Portfolio

6

Pregnancy & Birth Wellness

Post-Menopausal

Health

Feraheme Makena

Velo Option

Cord Blood

Registry

Used for the treatment of iron

deficiency anemia (IDA) in adult

patients with chronic kidney disease

(CKD)

The only FDA-approved therapy

to reduce recurrent preterm

birth in certain at-risk women

World’s largest umbilical cord

stem cell collection and

storage company

At completion of a Phase 2b/3a

clinical trial, AMAG has the option

to acquire an orphan drug

candidate for the treatment of

severe preeclampsia

IntrarosaTM

FDA-approved non-

estrogen product to treat

moderate-to-severe

dyspareunia (a symptom of

VVA) and the only FDA

approved product without

a boxed warning

Successful completion of

two Phase 3 clinical trials

for on-demand treatment

of hypoactive sexual desire

disorder (HSDD)

Bremelanotide1

MuGard

Prescriptive mucoadhesive for the

management of oral mucositis, a

common side effect of radiation or

chemotherapy

Maternal and Women’s Health

Hematology/Oncology

1 Previously referred to as RekyndaTM

Product Portfolio

Commercial Overview

Nik Grund

Chief Commercial Officer

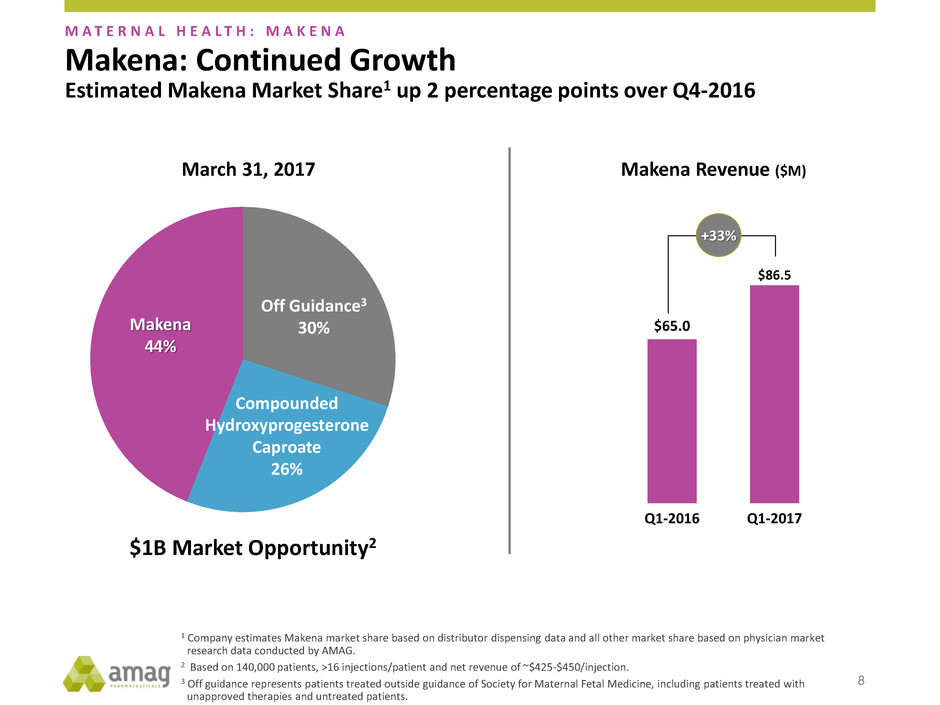

Makena: Continued Growth

8

$65.0

$86.5

Q1-2016 Q1-2017

Makena Revenue ($M)

M A T E R N A L H E A L T H : M A K E N A

+33%

1 Company estimates Makena market share based on distributor dispensing data and all other market share based on physician market

research data conducted by AMAG.

2 Based on 140,000 patients, >16 injections/patient and net revenue of ~$425-$450/injection.

3 Off guidance represents patients treated outside guidance of Society for Maternal Fetal Medicine, including patients treated with

unapproved therapies and untreated patients.

Off Guidance3

30%

March 31, 2017

Makena

44%

Compounded

Hydroxyprogesterone

Caproate

26%

$1B Market Opportunity2

Estimated Makena Market Share1 up 2 percentage points over Q4-2016

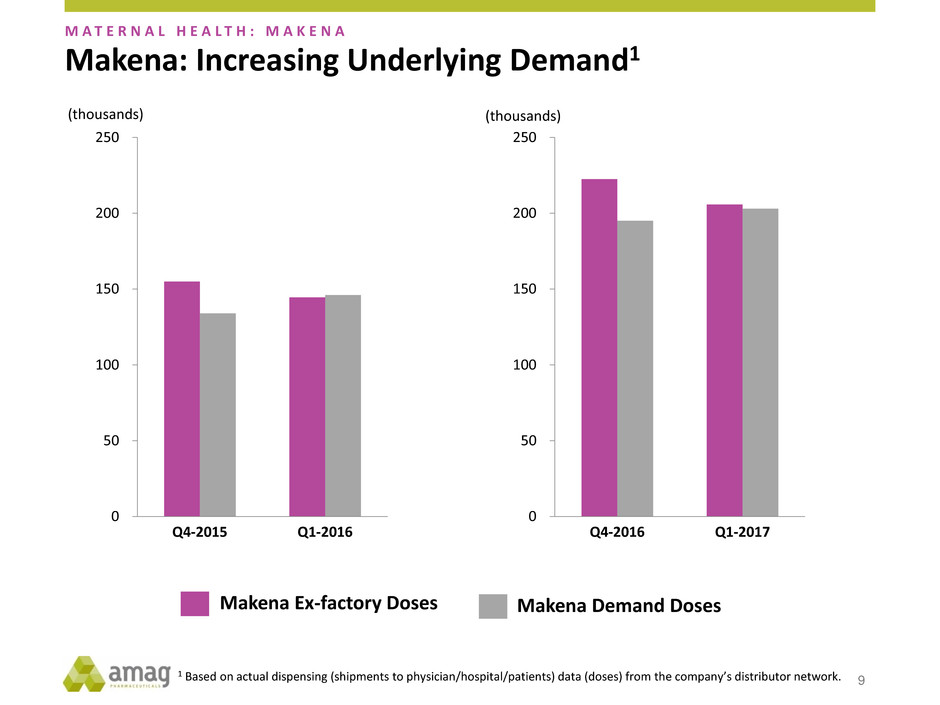

Makena: Increasing Underlying Demand1

9

M A T E R N A L H E A L T H : M A K E N A

0

50

100

150

200

250

Q4-2015 Q1-2016

Makena Ex-factory Doses Makena Demand Doses

0

50

100

150

200

250

Q4-2016 Q1-2017

(thousands) (thousands)

1 Based on actual dispensing (shipments to physician/hospital/patients) data (doses) from the company’s distributor network.

M A T E R N A L H E A L T H : M A K E N A

10

Continue share gains from compounders

and grow Makena @Home administration 1

Expand use in late preterm birth segment 2

Launch subcutaneous auto-injector1 3

Makena 2017 Growth Drivers

1 If regulatory approval is received.

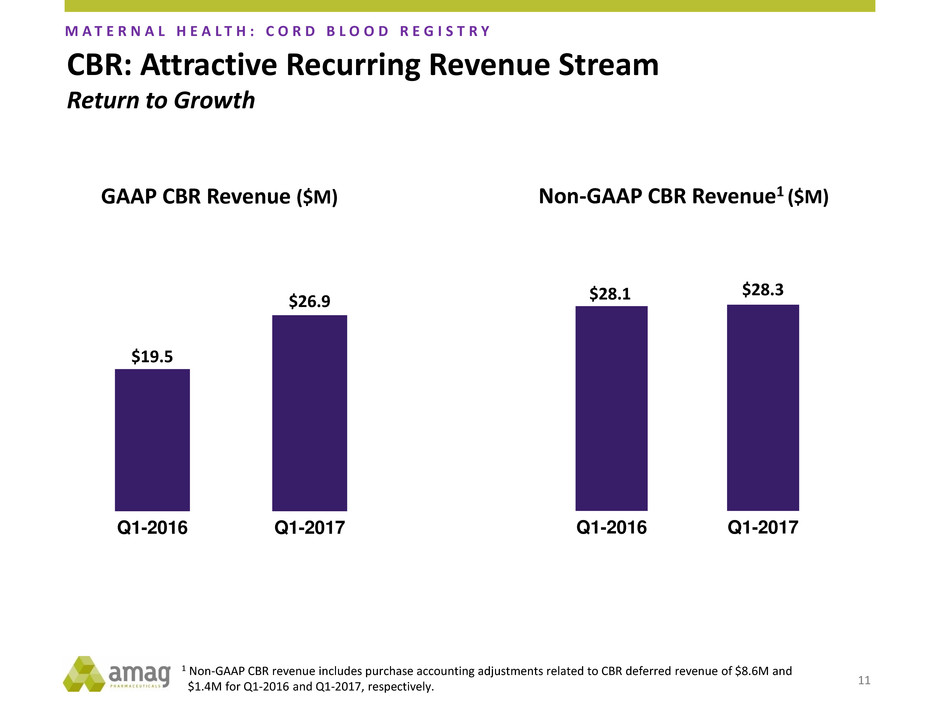

11

$19.5

$26.9

Q1-2016 Q1-2017

$28.1 $28.3

Q1-2016 Q1-2017

GAAP CBR Revenue ($M) Non-GAAP CBR Revenue1 ($M)

CBR: Attractive Recurring Revenue Stream

Return to Growth

M A T E R N A L H E A L T H : C O R D B L O O D R E G I S T R Y

1 Non-GAAP CBR revenue includes purchase accounting adjustments related to CBR deferred revenue of $8.6M and

$1.4M for Q1-2016 and Q1-2017, respectively.

CBR 2017 Growth Drivers

12

Differentiate CBR’s offerings

– Highlight cord tissue storage offering

– Enhance product offerings

1

Build value proposition on storing newborn

stem cells

– Harmonizing annual storage price across

client base

2

Leverage advancements in stem cell research

with OB/GYN’s and pregnant families 3

M A T E R N A L H E A L T H : C O R D B L O O D R E G I S T R Y

Advancements in Stem Cell Research

13

M A T E R N A L H E A L T H : C O R D B L O O D R E G I S T R Y

Affected, but not yet seeking treatment

Utilizing OTC treatments

Previous estrogen

therapy users

Dyspareunia: Sizable Untapped Treatment Market

14

1 Based on IMS SMART Tool NSP and NPA data.

2 IMS Health Plan Claims (April 2008-11).

3 AMAG estimates based on:

a) Wysocki et al. Management of Vaginal Atrophy: Implications from the REVIVE Survey. Clinical Medicine Insights: Reproductive Health 2014:8 23–30;

b) Kingsberg et al. Vulvar and Vaginal Atrophy in Postmenopausal Women: Findings from the REVIVE Survey. J Sex Med 2013;101790-1799;

c) F. Palma et al: Vaginal atrophy of women in postmenopause. Results from a multicentric observational study: The AGATA study; and

d) Trinity Partners, Quantitative Market Assessment, December 2016 (n=100 PCPs, 100 OBGYNS).

4 Assumes parity pricing to current therapies (WAC ~$200/month).

Currently

on Rx estrogen

therapy

Local (intra-vaginal)

estrogen therapies = sales

of >$1B per year1

1.7M

women2

~6M

women3

~12M

women3

W O M E N ’ S H E A L T H : I N T R A R O S A

~20 M women in U.S. suffer from dyspareunia, a symptom of VVA

New potential

patients represent a

market opportunity

of ~$14 B/year4

Prasterone

Vaginal Inserts

Intent-to-prescribe market

research indicates sales potential:

>$500M/year

Leveraging existing strengths:

– Medical affairs

– Market access team

– Analytics team

– Digital consumer platform

Preparing for Launch

– In process of hiring a new approximately 150-person women’s health commercial team

– Conducting market research, including product positioning and concept testing

– Large presence at upcoming ACOG Annual Meeting (May 6-9)

Future Expansion

– Initiate Phase 3 female sexual dysfunction study in post-menopausal women in 2H-2017

W O M E N ’ S H E A L T H : I N T R A R O S A

15

Intrarosa: Investing Today for a Significant Tomorrow

Mid-2017 commercial launch

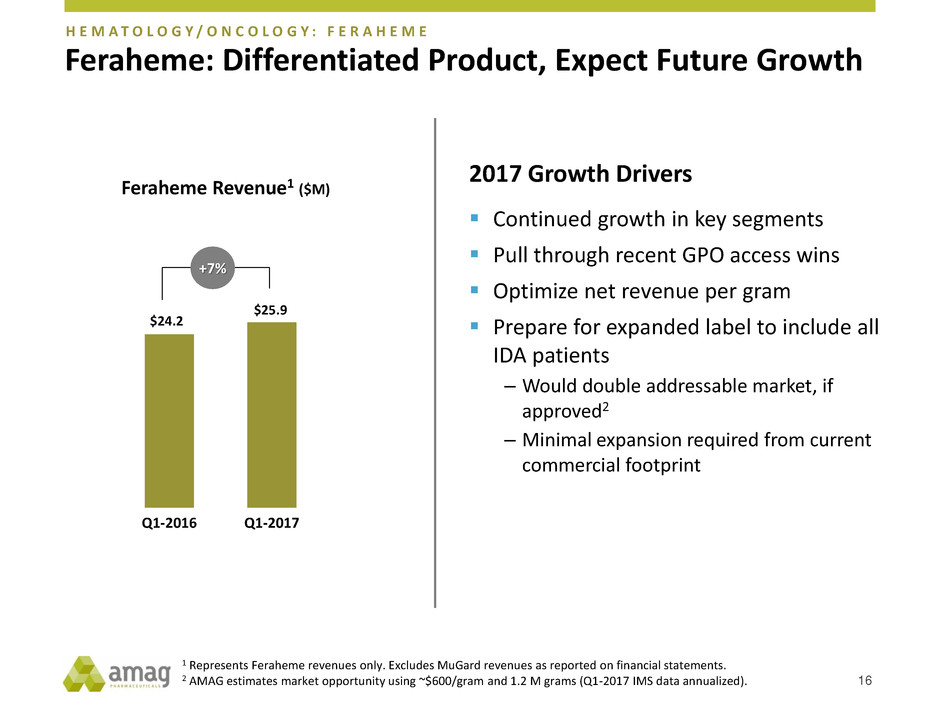

Feraheme: Differentiated Product, Expect Future Growth

16

$24.2

$25.9

Q1-2016 Q1-2017

Feraheme Revenue1 ($M)

+7%

H E M A T O L O G Y / O N C O L O G Y : F E R A H E M E

2017 Growth Drivers

Continued growth in key segments

Pull through recent GPO access wins

Optimize net revenue per gram

Prepare for expanded label to include all

IDA patients

– Would double addressable market, if

approved2

– Minimal expansion required from current

commercial footprint

1 Represents Feraheme revenues only. Excludes MuGard revenues as reported on financial statements.

2 AMAG estimates market opportunity using ~$600/gram and 1.2 M grams (Q1-2017 IMS data annualized).

Feraheme Broad Label Study

Results

Julie Krop, MD

Chief Medical Officer

Feraheme Phase 3 Label Expansion Study Overview

Sample size • 1,997 patients randomized in a 1:1 ratio

Dosing Regimen • 2 doses of Feraheme (1.02g)* or Injectafer (1.5g)*, dosed 7 days apart

Key entry criteria

• Subjects with IDA and in whom intravenous iron treatment is indicated

and have failed previous course of oral iron

Primary endpoint

• Incidence of moderate-to-severe hypersensitivity reactions (including

anaphylaxis) and/or moderate-to-severe hypotension

Secondary endpoints

• Incidence of any of the following: moderate-to-severe hypersensitivity

reactions (including anaphylaxis), serious cardiovascular events, death

• Mean change in hemoglobin/g of iron delivered

• Mean change in hemoglobin from baseline to week 5

# of sites/Region • ~130 sites, global (U.S., Canada, Europe)

18

H E M A T O L O G Y / O N C O L O G Y : F E R A H E M E

* FDA approved dose

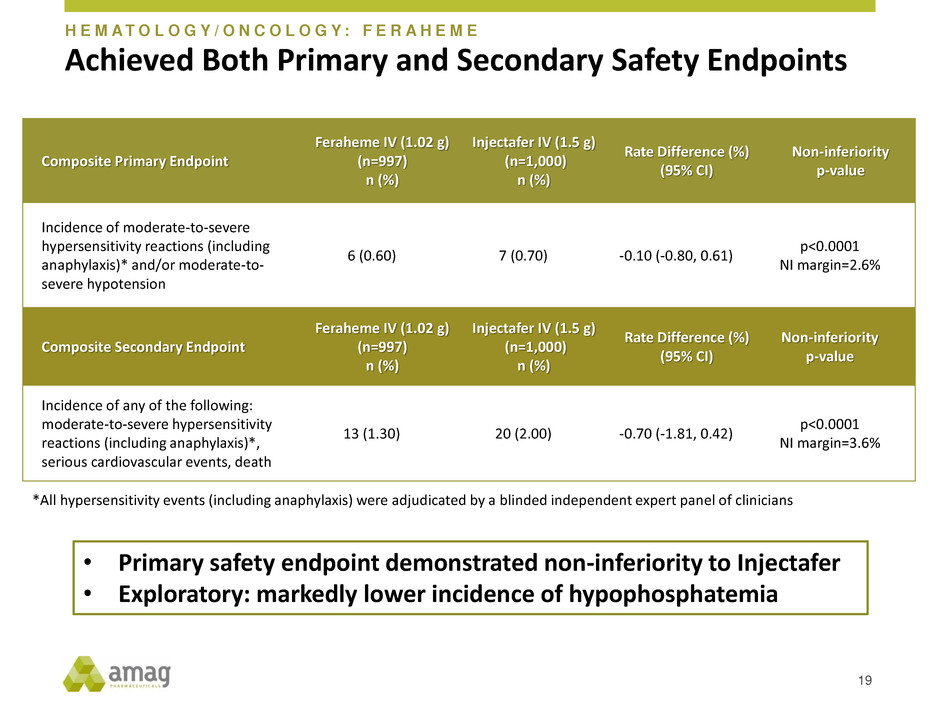

Achieved Both Primary and Secondary Safety Endpoints

Composite Primary Endpoint

Feraheme IV (1.02 g)

(n=997)

n (%)

Injectafer IV (1.5 g)

(n=1,000)

n (%)

Rate Difference (%)

(95% CI)

Non-inferiority

p-value

Incidence of moderate-to-severe

hypersensitivity reactions (including

anaphylaxis)* and/or moderate-to-

severe hypotension

6 (0.60) 7 (0.70) -0.10 (-0.80, 0.61)

p<0.0001

NI margin=2.6%

Composite Secondary Endpoint

Feraheme IV (1.02 g)

(n=997)

n (%)

Injectafer IV (1.5 g)

(n=1,000)

n (%)

Rate Difference (%)

(95% CI)

Non-inferiority

p-value

Incidence of any of the following:

moderate-to-severe hypersensitivity

reactions (including anaphylaxis)*,

serious cardiovascular events, death

13 (1.30) 20 (2.00) -0.70 (-1.81, 0.42)

p<0.0001

NI margin=3.6%

19

• Primary safety endpoint demonstrated non-inferiority to Injectafer

• Exploratory: markedly lower incidence of hypophosphatemia

H E M A T O L O G Y / O N C O L O G Y : F E R A H E M E

*All hypersensitivity events (including anaphylaxis) were adjudicated by a blinded independent expert panel of clinicians

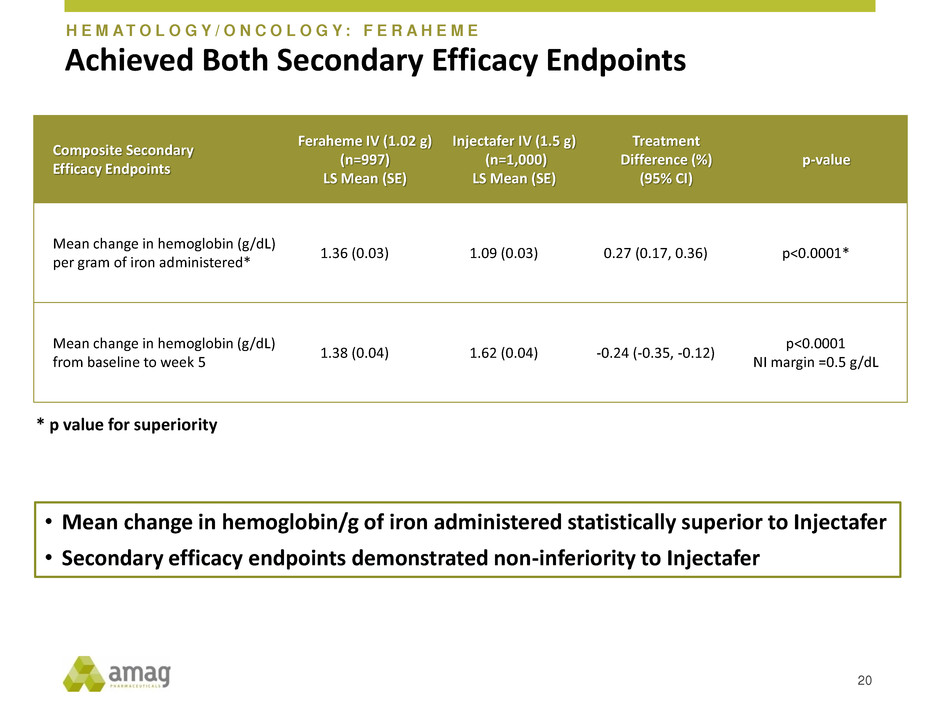

Achieved Both Secondary Efficacy Endpoints

Composite Secondary

Efficacy Endpoints

Feraheme IV (1.02 g)

(n=997)

LS Mean (SE)

Injectafer IV (1.5 g)

(n=1,000)

LS Mean (SE)

Treatment

Difference (%)

(95% CI)

p-value

Mean change in hemoglobin (g/dL)

per gram of iron administered*

1.36 (0.03) 1.09 (0.03) 0.27 (0.17, 0.36) p<0.0001*

Mean change in hemoglobin (g/dL)

from baseline to week 5

1.38 (0.04) 1.62 (0.04) -0.24 (-0.35, -0.12)

p<0.0001

NI margin =0.5 g/dL

20

* p value for superiority

• Mean change in hemoglobin/g of iron administered statistically superior to Injectafer

• Secondary efficacy endpoints demonstrated non-inferiority to Injectafer

H E M A T O L O G Y / O N C O L O G Y : F E R A H E M E

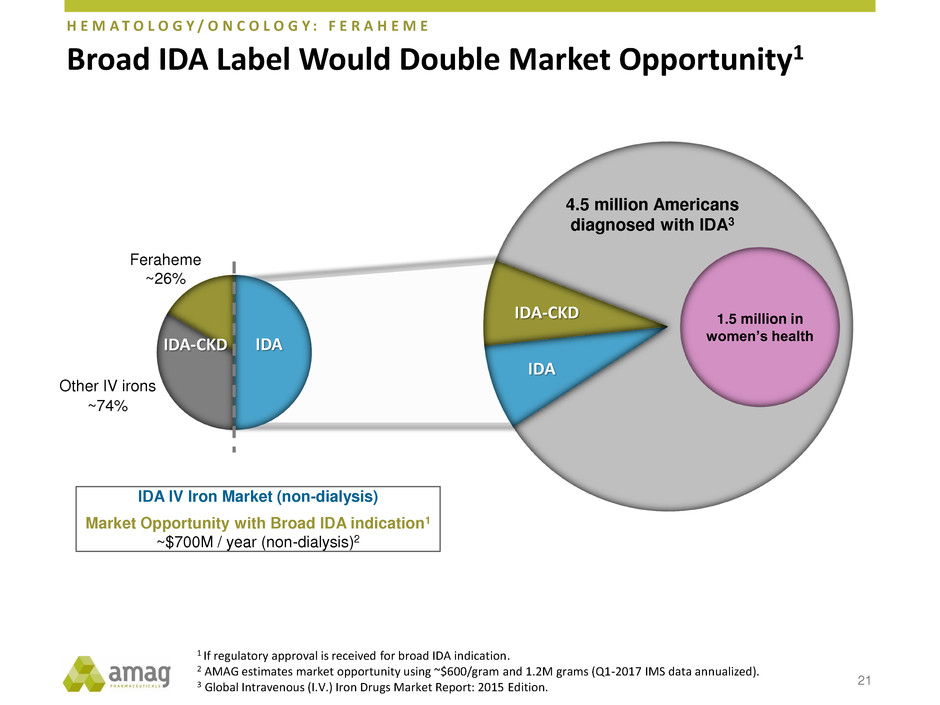

Broad IDA Label Would Double Market Opportunity1

21

Feraheme

~26%

Other IV irons

~74%

IDA IV Iron Market (non-dialysis)

Market Opportunity with Broad IDA indication1

~$700M / year (non-dialysis)2

IDA IDA-CKD

IDA-CKD

IDA

4.5 million Americans

diagnosed with IDA3

1.5 million in

women’s health

1 If regulatory approval is received for broad IDA indication.

2 AMAG estimates market opportunity using ~$600/gram and 1.2M grams (Q1-2017 IMS data annualized).

3 Global Intravenous (I.V.) Iron Drugs Market Report: 2015 Edition.

H E M A T O L O G Y / O N C O L O G Y : F E R A H E M E

Financial Overview

Ted Myles

Chief Financial Officer

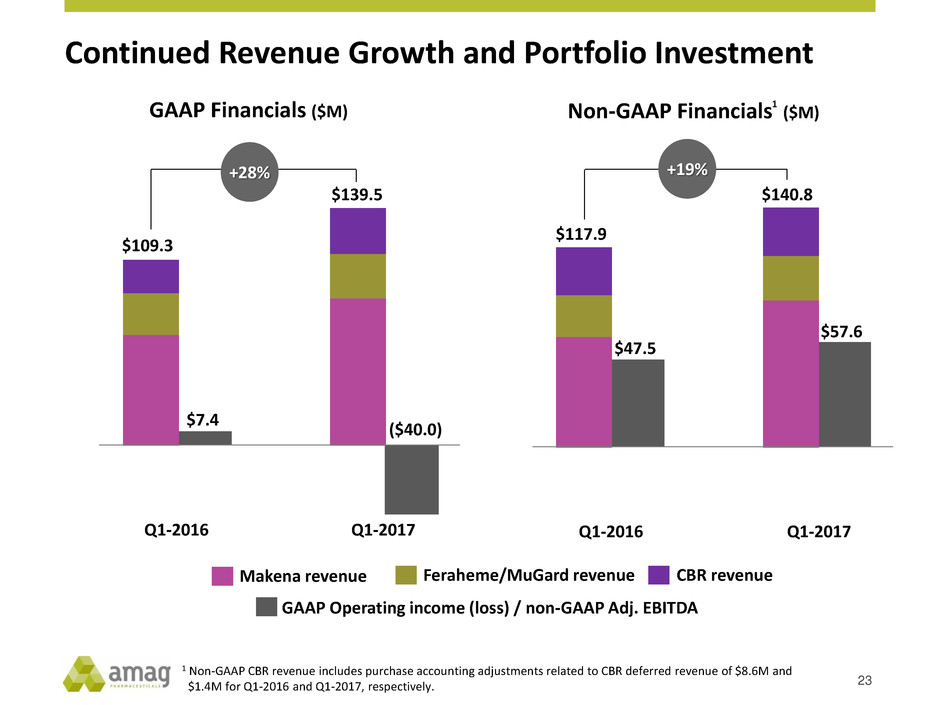

23

$109.3

$139.5

($40.0)

$7.4

Q1-2016 Q1-2017

+28%

Makena revenue CBR revenue Feraheme/MuGard revenue

GAAP Operating income (loss) / non-GAAP Adj. EBITDA

GAAP Financials ($M)

$117.9

$140.8

$47.5

$57.6

Q1-2016 Q1-2017

+19%

Non-GAAP Financials ($M)

1 Non-GAAP CBR revenue includes purchase accounting adjustments related to CBR deferred revenue of $8.6M and

$1.4M for Q1-2016 and Q1-2017, respectively.

Continued Revenue Growth and Portfolio Investment

1

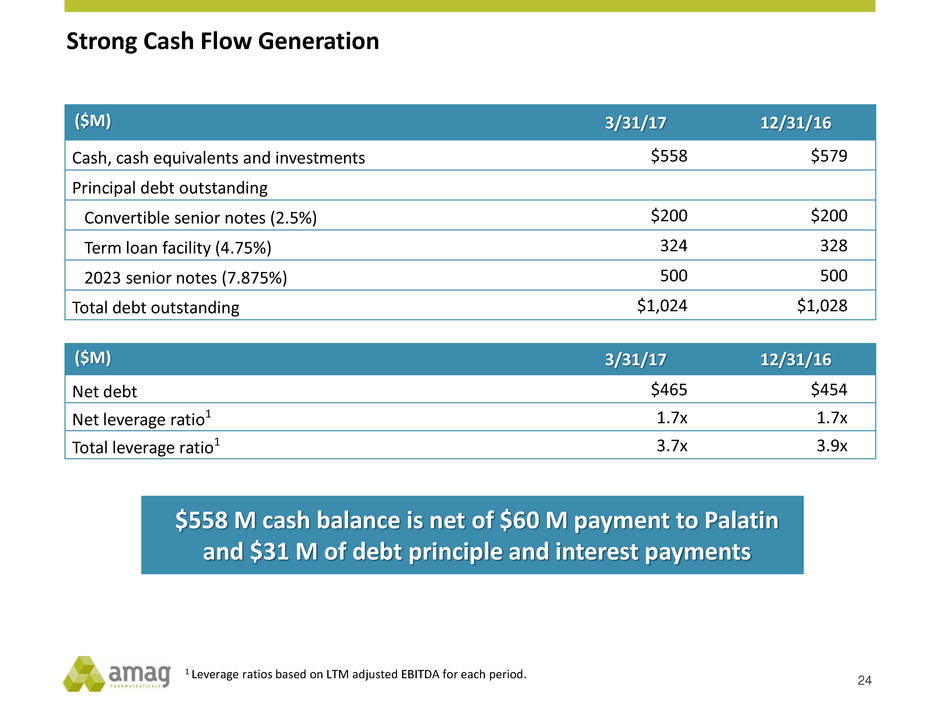

Strong Cash Flow Generation

($M) 3/31/17 12/31/16

Cash, cash equivalents and investments $558 $579

Principal debt outstanding

Convertible senior notes (2.5%) $200 $200

Term loan facility (4.75%) 324 328

2023 senior notes (7.875%) 500 500

Total debt outstanding $1,024 $1,028

($M) 3/31/17 12/31/16

Net debt $465 $454

Net leverage ratio1 1.7x 1.7x

Total leverage ratio1 3.7x 3.9x

$558 M cash balance is net of $60 M payment to Palatin

and $31 M of debt principle and interest payments

24

1 Leverage ratios based on LTM adjusted EBITDA for each period.

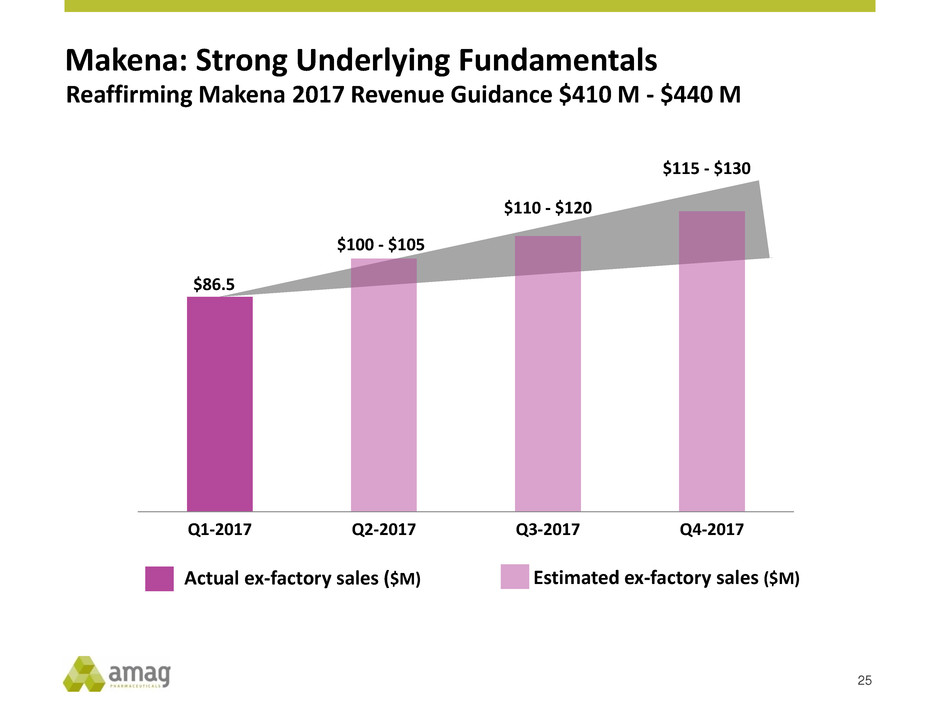

Actual ex-factory sales ($M) Estimated ex-factory sales ($M)

$86.5

$100 - $105

$110 - $120

$115 - $130

Q1-2017 Q2-2017 Q3-2017 Q4-2017

Makena: Strong Underlying Fundamentals

Reaffirming Makena 2017 Revenue Guidance $410 M - $440 M

25

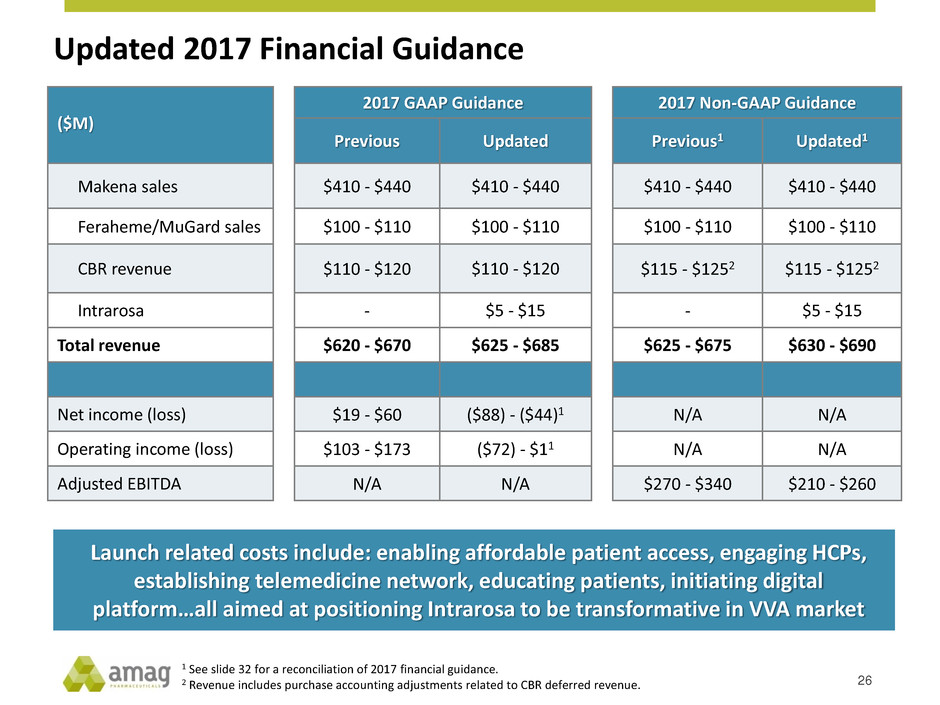

Updated 2017 Financial Guidance

26

($M)

2017 GAAP Guidance 2017 Non-GAAP Guidance

Previous Updated Previous1 Updated1

Makena sales $410 - $440 $410 - $440 $410 - $440 $410 - $440

Feraheme/MuGard sales $100 - $110 $100 - $110 $100 - $110 $100 - $110

CBR revenue $110 - $120 $110 - $120 $115 - $1252 $115 - $1252

Intrarosa - $5 - $15 - $5 - $15

Total revenue $620 - $670 $625 - $685 $625 - $675 $630 - $690

Net income (loss) $19 - $60 ($88) - ($44)1 N/A N/A

Operating income (loss) $103 - $173 ($72) - $11 N/A N/A

Adjusted EBITDA N/A N/A $270 - $340 $210 - $260

1 See slide 32 for a reconciliation of 2017 financial guidance.

2 Revenue includes purchase accounting adjustments related to CBR deferred revenue.

Launch related costs include: enabling affordable patient access, engaging HCPs,

establishing telemedicine network, educating patients, initiating digital

platform…all aimed at positioning Intrarosa to be transformative in VVA market

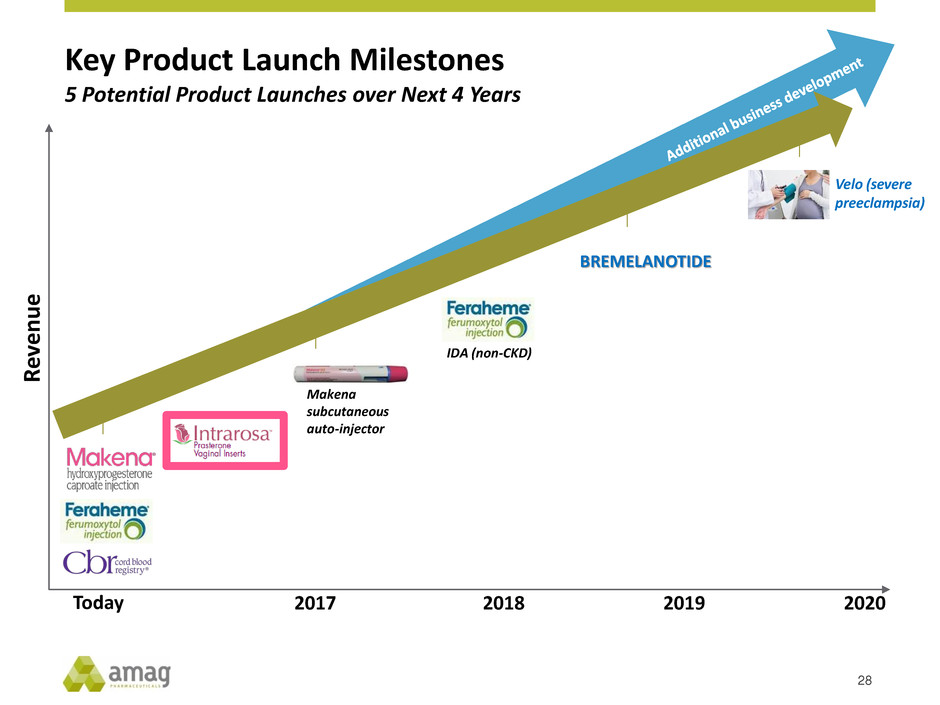

AMAG Portfolio: Multiple Value Drivers

27

Milestone 2017 2018

MAKENA AUTO-INJECTOR PROGRAM Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Topline PK data

sNDA submission

Expected FDA action and commercial launch

FERAHEME IDA LABEL EXPANSION Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Enrollment completed

Topline data

sNDA submission

Expected FDA action and commercial launch

INTRAROSA Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Commercial launch in dyspareunia

Initiate Phase 3 female sexual dysfunction study

BREMELANOTIDE Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

NDA submission

Expected FDA action and commercial launch

VELO – SEVERE PREECLAMPSIA

Initiate Phase 2b/3a study

Key Product Launch Milestones

28

5 Potential Product Launches over Next 4 Years

Velo (severe

preeclampsia)

R

ev

e

nu

e

Today 2017 2018 2019 2020

Makena

subcutaneous

auto-injector

IDA (non-CKD)

BREMELANOTIDE

AMAG Pharmaceuticals

Q1-2017 Financial Results &

Corporate Update

May 2, 2017

Appendix

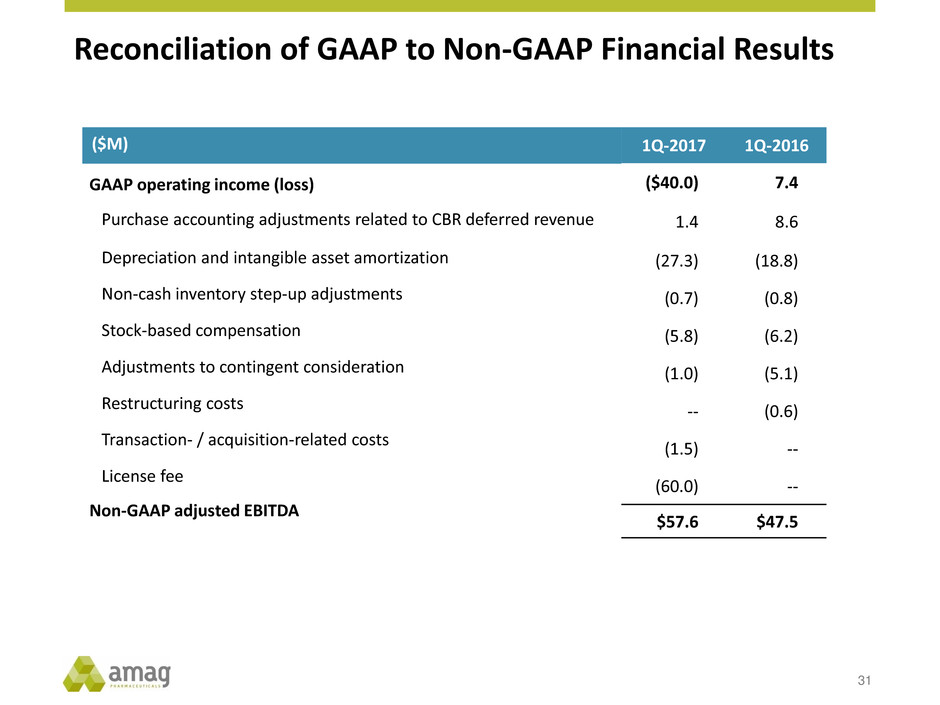

Reconciliation of GAAP to Non-GAAP Financial Results

31

($M)

GAAP operating income (loss)

Purchase accounting adjustments related to CBR deferred revenue

Depreciation and intangible asset amortization

Non-cash inventory step-up adjustments

Stock-based compensation

Adjustments to contingent consideration

Restructuring costs

Transaction- / acquisition-related costs

License fee

Non-GAAP adjusted EBITDA

1Q-2017 1Q-2016

($40.0) 7.4

1.4 8.6

(27.3) (18.8)

(0.7) (0.8)

(5.8) (6.2)

(1.0) (5.1)

-- (0.6)

(1.5) --

(60.0) --

$57.6 $47.5

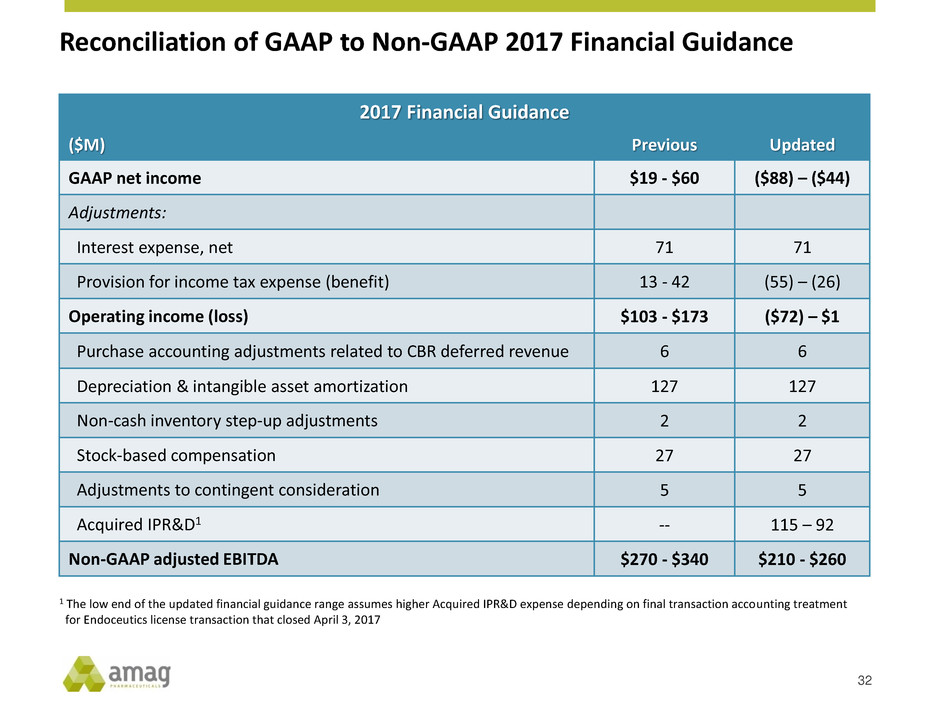

Reconciliation of GAAP to Non-GAAP 2017 Financial Guidance

2017 Financial Guidance

($M) Previous Updated

GAAP net income $19 - $60 ($88) – ($44)

Adjustments:

Interest expense, net 71 71

Provision for income tax expense (benefit) 13 - 42 (55) – (26)

Operating income (loss) $103 - $173 ($72) – $1

Purchase accounting adjustments related to CBR deferred revenue 6 6

Depreciation & intangible asset amortization 127 127

Non-cash inventory step-up adjustments 2 2

Stock-based compensation 27 27

Adjustments to contingent consideration 5 5

Acquired IPR&D1 -- 115 – 92

Non-GAAP adjusted EBITDA $270 - $340 $210 - $260

1 The low end of the updated financial guidance range assumes higher Acquired IPR&D expense depending on final transaction accounting treatment

for Endoceutics license transaction that closed April 3, 2017

32

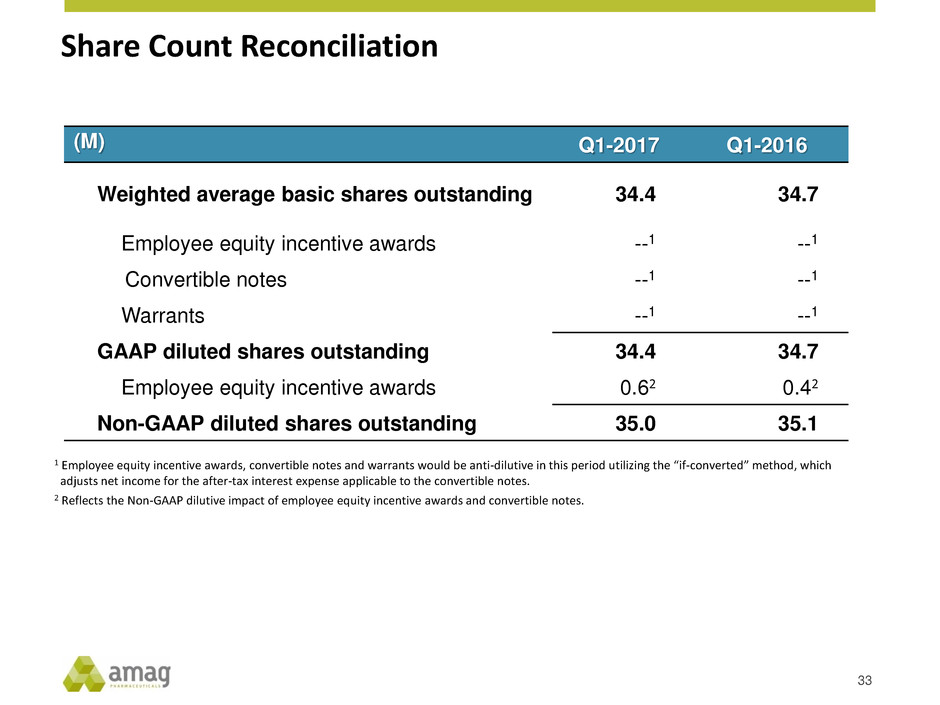

Share Count Reconciliation

1 Employee equity incentive awards, convertible notes and warrants would be anti-dilutive in this period utilizing the “if-converted” method, which

adjusts net income for the after-tax interest expense applicable to the convertible notes.

2 Reflects the Non-GAAP dilutive impact of employee equity incentive awards and convertible notes.

(M) Q1-2017 Q1-2016

Weighted average basic shares outstanding 34.4 34.7

Employee equity incentive awards --1 --1

Convertible notes --1 --1

Warrants --1 --1

GAAP diluted shares outstanding 34.4 34.7

Employee equity incentive awards 0.62 0.42

Non-GAAP diluted shares outstanding 35.0 35.1

33

AMAG Pharmaceuticals

Q1-2017 Financial Results &

Corporate Update

May 2, 2017