Attached files

| file | filename |

|---|---|

| EX-31.4 - EX-31.4 - RAIT Financial Trust | ras-ex314_7.htm |

| EX-31.3 - EX-31.3 - RAIT Financial Trust | ras-ex313_6.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

or

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______to _________

Commission file number 1-14760

RAIT FINANCIAL TRUST

(Exact name of registrant as specified in its charter)

|

Maryland |

|

23-2919819 |

|

(State or other jurisdiction of incorporation or organization) |

|

(IRS Employer Identification No.) |

|

Two Logan Square, 100 N. 18th Street, 23rd Floor Philadelphia, PA |

|

19103 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (215) 207-2100

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Name of Each Exchange on Which Registered |

|

Common Shares of Beneficial Interest |

|

New York Stock Exchange |

|

7.75% Series A Cumulative Redeemable |

|

|

|

Preferred Shares of Beneficial Interest |

|

New York Stock Exchange |

|

8.375% Series B Cumulative Redeemable |

|

|

|

Preferred Shares of Beneficial Interest |

|

New York Stock Exchange |

|

8.875% Series C Cumulative Redeemable |

|

|

|

Preferred Shares of Beneficial Interest |

|

New York Stock Exchange |

|

7.625% Senior Notes Due 2024 |

|

New York Stock Exchange |

|

7.125% Senior Notes Due 2019 |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Date File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☒ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☐ (Do not check if a small reporting company) |

|

Small reporting company |

|

☐ |

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the common shares of the registrant held by non-affiliates of the registrant, based upon the closing price of such shares on June 30, 2016 of $3.13, was approximately $283,962,915.

As of April 28, 2017, 92,715,999 common shares of beneficial interest, par value $0.03 per share, of the registrant were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

This Amendment No. 1 to Form 10-K (this “Amendment”) amends the Annual Report on Form 10-K for the fiscal year ended December 31, 2016 of RAIT Financial Trust, as originally filed with the Securities and Exchange Commission (“SEC”) on March 13, 2017 (the “Original Form 10-K”). We are filing this Amendment to present the information required by Part III of Form 10-K that was previously omitted from the Original Form 10-K in reliance on General Instruction G.(3) to Form 10-K.

Part IV, Item 15(b) (Exhibits 31.3 and 31.4) have also been amended and restated in their entirety to contain the currently dated certifications from the Company’s principal executive officer and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. The certifications of the Company’s principal executive officer and principal financial officer are attached to this Amendment No. 1 as Exhibits 31.3 and 31.4. Because no financial statements have been included in this Amendment No. 1 and this Amendment No. 1 does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4 and 5 of the certifications have been omitted. The Exhibit Index has also been amended and restated in its entirety to include the certifications as exhibits.

Except as described above, no other changes have been made to the Original Form 10-K. This Amendment does not otherwise update information in the Original Form 10-K to reflect facts or events occurring subsequent to the filing date of the Original Form 10-K. This Amendment should be read in conjunction with the Original Form 10-K and with any of our filings made with the SEC subsequent to filing of the Original Form 10-K.

1

Names of Trustees, Principal Occupations and Other Information

Michael J. Malter, age 59, has served as chairman of the Board of Trustees of RAIT since October 2016 and as a Trustee of RAIT since November 2015. He is a retired investment banker having served in a variety of senior management positions at JPMorgan Chase & Co., or JPM, a financial services firm, and its predecessor firms from 1988 until 2005. He retired as the Co-Head of the Global Financial Institutions Group of JPM in 2005. From 2003 to 2005, he was responsible for oversight of JPM’s banking and investment banking activities with banks and other financial institutions; oversaw mergers and acquisitions assignments, strategic advisory work, capital raising, hedging and derivatives assignments and lending; and was a member of the management committee of JPM’s investment banking division. From 2001 to 2003, he was responsible for JPM’s structured finance businesses in North America and the investment grade capital markets and origination business and was a member of the management committee of the North American Credit Markets Division. In the period from 1988 to 2001, he held a series of management positions with JPM’s predecessors responsible for commercial mortgage loan origination, securitization and trading, asset-backed securities and conduit lending. Mr. Malter currently serves as a director or member of the advisory committee of four investment vehicles that each use Varadero Capital, L.P., an SEC registered investment adviser, as their respective investment manager. Several of these investment vehicles use strategies that focus primarily on investing in asset-backed securities, including investment- and non-investment-grade residential and commercial mortgage-backed securities and collateralized debt obligations.

Andrew Batinovich, age 58, has served as a Trustee of RAIT since March 2013. Mr. Batinovich currently serves as President and Chief Executive Officer of Glenborough, LLC, a privately held full service real estate investment and management company focused on the acquisition, management and leasing of institutional quality commercial properties. Since August 2013, an affiliate of Glenborough, LLC has served as the advisor of Strategic Realty Trust, Inc., a public non-traded REIT that owns primarily grocery anchored shopping centers, and Mr. Batinovich has served as CEO and a director of Strategic Realty Trust. In 2010, Mr. Batinovich led a private investor group in acquiring Glenborough, LLC and related real estate assets that were originally part of Glenborough Realty Trust, a NYSE listed real estate investment trust, or REIT, which was sold to affiliates of Morgan Stanley in 2006. From December 2006 to October 2010, Mr. Batinovich served as President and Chief Executive Officer of Glenborough, LLC, a company formed by an affiliate of Morgan Stanley to acquire Glenborough Realty Trust. In connection with the 2006 transaction, Mr. Batinovich and the Glenborough Realty Trust senior management team were retained to operate the new private entity, and the team remains together in the newly re-acquired Glenborough, LLC. In 1996, Mr. Batinovich co-founded Glenborough Realty Trust and was President and Chief Executive Officer and a director at the time of the sale in 2006. Mr. Batinovich was appointed President of Glenborough Realty Trust in 1997 and Chief Executive Officer in 2003. He also served as Chief Operating Officer and Chief Financial Operator during his tenure at Glenborough Realty Trust. Prior to founding Glenborough Realty Trust, Mr. Batinovich served as Chief Operating Officer and Chief Financial Officer of Glenborough Corporation until 1996 when it was merged into Glenborough Realty Trust. Glenborough Corporation was a private real estate investment and management company that completed a number of private placements of office, industrial, residential and hotel properties. Prior to joining Glenborough Corporation in 1983, Mr. Batinovich was an officer of Security Pacific National Bank. Mr. Batinovich is a director of Sunstone Hotel Investors, Inc., a NYSE listed real estate investment trust focused on hotel properties. He also serves as a Trustee of the American University of Paris.

Scott L.N. Davidson, age 48, has served as RAIT’s chief executive officer since December 2016 and as RAIT’s president since January 2014 and served as a Managing Director of RAIT from April 2010 to January 2014. Prior to joining RAIT, Mr. Davidson served as a portfolio manager for Carlyle Blue Wave, an asset management firm, from January 2007 to June 2008. From September 2005 to November 2006, Mr. Davidson served as a portfolio manager for Amaranth LLC, an asset management firm. From 1993 to January 2005, Mr. Davidson served as Managing Director and Group Head at JPMorgan and its predecessors, where his responsibilities included running their commercial mortgage backed securities business, asset backed securities business and their respective risk and trading operations.

Frank A. Farnesi, age 70, has served as a Trustee of RAIT since December 2006 when he joined the Board in connection with our acquisition of Taberna Realty Finance Trust, or TRFT, in December 2006 (the “TRFT Acquisition”). He was a member of TRFT’s Board from April 2005 until the TRFT Acquisition in December 2006. He is a retired partner of the international accounting firm of KPMG LLP, where he worked from 1969 to 2001. Before retiring from KPMG, he was the Pennsylvania business unit partner in charge of tax. He also served as national partner in charge of tax compliance and worked with a wide variety of clients in the banking, real estate, technology and private equity fields. He currently serves as the non-executive chairman of the Board of directors of Beneficial Bancorp, Inc., a publicly held stock holding company for Beneficial Bank, a Pennsylvania chartered savings bank. Mr. Farnesi is a Board Leadership Fellow of the National Association of Corporate Directors (NACD). He also currently serves on the Board of Directors of the Faith in the Future Foundation, a not-for-profit organization.

S. Kristin Kim, age 54, has served as a Trustee of RAIT since October 2003. Ms. Kim is the founder of Sansori, which has provided innovative educational programs and offered strategic planning services for social ventures since 2009. Prior to Sansori, Ms. Kim was president of AllLearn, an online education venture among Oxford, Stanford, and Yale Universities from November 2002 until 2006, having joined AllLearn in January 2001 as its general counsel. From 1999 to 2001, Ms. Kim held several senior positions at Harvard University’s John F. Kennedy School of Government, including Director for New Initiatives. From 1989 to 1999, she was an attorney at the law firm of Simpson Thacher & Bartlett.

2

Jon C. Sarkisian, age 55, has served as a Trustee of RAIT since December 2011. Mr. Sarkisian has been an executive vice president of CBRE Group, Inc., or CBRE, a publicly traded commercial real estate services firm, since July 2003. Mr. Sarkisian joined CBRE when it acquired Insignia/ESG, or Insignia, a commercial real estate services firm, in July 2003. Mr. Sarkisian was an executive vice president at Insignia from June 1998 to July 2003. Mr. Sarkisian joined Insignia when it acquired Jackson-Cross Company, or Jackson-Cross, a commercial real estate services firm, in June 1998. Mr. Sarkisian was a senior vice president for Jackson-Cross from October 1988 to June 1998.

Andrew M. Silberstein, age 49, has served as a Trustee of RAIT since October 2012 when he was designated by ARS VI Investor I, LP (f/k/a ARS VI Investor I, LLC) (the “Investor”) to serve on our Board of Trustees pursuant to the securities purchase agreement, or the purchase agreement, dated as of October 1, 2012 among ourselves, designated subsidiaries of ours and the Investor. We refer to the transactions contemplated by the purchase agreement as the investor transactions. The investor is an affiliate of Almanac Realty Investors, LLC, or Almanac, a provider of capital to real estate companies. Mr. Silberstein is a partner of Almanac and joined the predecessor to Almanac, Rothschild Realty Managers, as a managing director in 2009. From 2004 to 2008, Mr. Silberstein served as the chief investment officer and chief operating officer for Stoltz Real Estate, a real estate company. Prior to that, Mr. Silberstein worked in real estate investment banking and private equity, first at Bear Stearns & Company from 1994 to 1998 as a vice president and then at Morgan Stanley from 1999 to 2004 as an executive director. Mr. Silberstein serves on boards of the following real estate companies: Westcore Properties, Westcore Properties II, Slate Asset Management and Claros REIT Holdings.

Murray Stempel, III, age 62, has served as a Trustee of RAIT since December 2006 and served as the Lead Trustee (defined below) of RAIT from January 2014 to October 2016. Mr. Stempel joined the Board in connection with the TRFT Acquisition. He was a member of TRFT’s Board of Trustees from April 2005 until the TRFT Acquisition in December 2006. Mr. Stempel has served as a director of Royal Bancshares of Pennsylvania, Inc., or Royal Bancshares, a publicly traded bank holding company, since 2008, including service as the vice chairman of Royal Bancshares through 2012. From 2004 until 2008, he served as executive vice president and chief lending officer at Royal Bank America, a wholly-owned bank subsidiary of Royal Bancshares, responsible for the day-to-day management of the bank. From 2000 to 2004, he was a senior vice president at Royal Bank America.

Thomas D. Wren, age 65, has served as a Trustee of RAIT since February 2017. Mr. Wren was a special advisor at Promontory Financial Group, a bank and financial services consulting firm, from March 2006 to October 2011. Prior to that, Mr. Wren was group head and treasurer of MBNA Corporation, or MBNA, a publicly-held bank holding company, from July 1995 to January 2006. At MBNA, Mr. Wren was responsible for the daily management of the global money market and fixed income investment portfolios and the wholesale funding programs for the $140.0 billion total managed assets credit card bank. From May 1992 to June 1995, Mr. Wren served as executive vice president-chief investment and funding officer of Shawmut National Corporation, a publicly-held bank holding company. From June 1973 to April 1992, Mr. Wren served in numerous roles at the Office of the Comptroller of the Currency, or OCC, a federal banking regulatory agency, ending as manager large bank supervision in the OCC’s Washington D.C. office. Mr. Wren has served on the governing Boards of numerous financial institutions, including service as an independent director of each of ACM Financial Trust, Inc., a privately-held residential mortgage backed securities real estate investment trust, or REIT, since December 2005, and Hatteras Financial Corp., or Hatteras, a publicly-traded mortgage backed securities REIT, from November 2007 until Hatteras was acquired by Annaly Capital Management, Inc. in July 2016.

Our Nominating Committee has not adopted specific, minimum qualifications or specific qualities or skills that must be met by a Nominating Committee-recommended nominee. For a discussion of the methods the Nominating Committee uses for identifying and evaluating nominees for Trustee, see “Information Concerning Our Board of Trustees, Committees and Governance-Nominating and Governance Committee.” Set forth below is a brief discussion of the specific experience, qualifications, attributes or skills that led to the conclusion that each person listed above should serve as a Trustee of RAIT:

Mr. Malter has significant investment banking and capital markets experience, including commercial real estate lending and financing, and has advised numerous public companies on matters of corporate finance, capital structure, and accessing public and private markets across the capital spectrum.

Mr. Davidson has served as an executive officer of RAIT since 2014 and currently serves as our CEO and President. He has spent the past 25 years with RAIT and other businesses focused on investing in commercial real estate and securitized products, which gives him broad knowledge of, and experience addressing, the operational, financial and strategic issues and opportunities facing specialty finance companies like RAIT.

Mr. Batinovich has a significant real estate-related professional background and many years of real estate-related experience, including previously held senior-executive level positions, other public company Board experience, an extensive background and experience with REITs and in real estate and finance transactions.

Mr. Farnesi’s experience in leadership roles within KPMG, including his position as national partner in charge of tax compliance, and his years of experience providing advisory services to a wide variety of clients give him a significant financial, accounting and tax background.

Ms. Kim has significant experience founding, leading or having senior roles in organizations focused on leadership and education. She also has broad legal experience in the international capital markets.

3

Mr. Sarkisian has over 28 years’ experience in commercial real estate and plays a leading role in the Philadelphia region for a major commercial real estate company.

Mr. Silberstein has substantial experience in real estate and finance transactions. Mr. Silberstein was also designated by the Investor to serve on our Board of Trustees pursuant to the purchase agreement.

Mr. Stempel is a director, and previously served as a senior officer, of a publicly traded bank holding company with broad finance and operational experience, including real estate and real estate lending experience.

Mr. Wren has substantial senior leadership experience at large publicly-traded financial services companies and experience as a federal banking regulator, including extensive and relevant experience serving as an independent director at a publicly-traded mortgage-backed securities REIT.

Non-Trustee Executive Officers

Information is set forth below regarding the background of each of our executive officers who is not also a Trustee. For our executive officer who is also a Trustee, Scott L.N. Davidson, this information can be found above.

Paul W. Kopsky, Jr., age 52, joined RAIT in February 2017 and has served as RAIT’s CFO and Treasurer since March 2017. Prior to joining RAIT, Mr. Kopsky was executive vice president and chief operating officer for Hunt Companies, Inc., or Hunt, a diversified financial services holding company, from August 2013 to November 2016. While at Hunt, Mr. Kopsky served as a director and officer of Hunt Investment Management Company, a Hunt affiliate and an SEC registered investment advisor, from September 2013 to November 2016. From March 2011 to September 2013, Mr. Kopsky was Managing Director- Investment Banking and Project Finance of Jefferies & Company, Inc., a global investment banking company and broker-dealer. In the period from October 1997 to August 2010, Mr. Kopsky served in various executive finance/accounting leadership roles for companies including Capmark Financial Group, Inc., a publicly listed commercial mortgage company, Reinsurance Group of America, Incorporated, a publicly traded life reinsurance company, Nationwide Insurance Group, a diversified insurance and financial services company, Lincoln Financial Group, a publicly-traded life insurance company, and Conning Corporation, an asset manager, and its majority owners – MetLife, an insurance company, and Swiss Re, a reinsurance company. From June 1986 to October 1997, Mr. Kopsky worked for KPMG LLP, a public accounting firm where, in his last role, he served as a senior manager. Mr. Kopsky is a certified public accountant and has the Series 7, 24, 63, and 79 Financial Industry Regulatory Authority securities license designations.

Glenn Riis, age 53, has served as our Senior Managing Director-Chief Credit Risk Officer since January 2015 and joined RAIT in June 2013. Since joining RAIT, Mr. Riis has been primarily responsible for credit and risk management, in addition to alternative investment and lending opportunities. He began his CMBS career in 1995 at Merrill Lynch and was initially responsible for credit analysis, trading desk risk management and primary issuance deal structuring. During his tenure at Merrill Lynch, he was a senior CMBS trader, with responsibility for trading and managing risk related to credit products for the commercial real estate business. In 1999, he moved to a similar role at Chase Bank, and following the Chase merger with JPMorgan in September 2000, he also acted as a senior member of the businesses’ various credit committees. Until 2009, Mr. Riis was responsible for trading, risk management, loan pricing/structuring and new issue distribution at JPMorgan Chase. Subsequently, he worked as a CMBS portfolio manager at Treesdale Partners and as head of CMBS Trading at Gleacher & Co.

John J. Reyle, age 38, has served as our General Counsel since February 2017, served as our senior managing director—chief legal officer from January 2015 to February 2017, as our senior vice president—corporate counsel from January 2014 to December 2014, as our vice president—corporate counsel from May 2012 to December 2013 and as our corporate counsel from August 2009 to May 2012. Prior to joining RAIT, Mr. Reyle was an associate in the real estate legal departments of Ledgewood, P.C., a law firm, from October 2005 to February 2009, and Cozen O’Conner, P.C., a law firm, from August 2004 to October 2005. During that time, Mr. Reyle concentrated his practice in the area of commercial real estate representing a variety of clients in connection with real estate-based financing, acquisitions and dispositions of commercial real estate, commercial leasing matters, real estate development and basic corporate transactions related to the foregoing.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our officers, Trustees and persons who own more than ten percent of a registered class of our equity securities to file reports of ownership and changes in ownership with the SEC and to furnish RAIT with copies of all such reports.

Based solely on our review of the reports received by us, or representations from certain reporting persons that no Form 5 filings were required for those persons, we believe that during fiscal 2016, no officers, Trustees or beneficial owners failed to file reports of ownership and changes of ownership on a timely basis. As of the date of this proxy statement, we believe that all reports of ownership and changes in ownership required to be filed with the SEC relating to transactions in fiscal 2016 have been filed.

Code of Ethics

We have also adopted a code of business conduct and ethics (the “Code”) for our Trustees, officers and employees intended to satisfy NYSE listing standards and the definition of a “code of ethics” set forth in applicable SEC rules. This Code is available on our website at http://www.rait.com.

4

Trustee Candidates Recommended by Shareholders

Our Board, through our Nominating and Governance Committee, will consider nominees recommended by shareholders. A shareholder wishing to recommend a candidate must submit the following documents to the Secretary, RAIT Financial Trust, Two Logan Square, 100 N. 18th Street, 23rd Floor, Philadelphia, Pennsylvania, 19103, not less than 120 calendar days before the shareholders meet to elect Trustees:

|

|

• |

A recommendation that identifies the candidate and provides contact information for that candidate; |

|

|

• |

The written consent of the candidate to serve as a Trustee of RAIT, if elected; and |

|

|

• |

If the candidate is to be evaluated by the Nominating and Governance Committee, the Secretary will request from the candidate a detailed resume, an autobiographical statement explaining the candidate’s interest in serving as a Trustee of RAIT, a completed statement regarding conflicts of interest, and a waiver of liability for a background check. |

These documents must be received from the candidate before the first day of February preceding the annual meeting of shareholders.

The Nominating and Governance Committee evaluates all candidates, regardless of who recommended the candidate, based on the same criteria.

Audit Committee

The Audit Committee is appointed by the Board to assist Board oversight of:

|

|

• |

the integrity of our financial statements, |

|

|

• |

our compliance with legal and regulatory requirements, |

|

|

• |

the independent registered public accounting firm’s qualifications and independence, |

|

|

• |

the performance of our internal audit function and of our independent registered public accounting firm, and |

|

|

• |

related party transactions (as defined in the trust governance guidelines). |

The Audit Committee is comprised of Mr. Farnesi, as Chairman, Mr. Batinovich and Ms. Kim. The Board has determined that Mr. Farnesi, Mr. Batinovich and Ms. Kim meet the independence standards, including the independence standards for Audit Committee members set forth in the listing standards of the NYSE and those set forth in Rule 10A-3(b)(1) of the Securities Exchange Act of 1934, or the Exchange Act, and that Mr. Farnesi qualifies as an “audit committee financial expert” as that term is defined in applicable rules and regulations under the Exchange Act.

ITEM 11. EXECUTIVE COMPENSATION

EXECUTIVE OFFICER AND TRUSTEE COMPENSATION

Compensation Discussion and Analysis

Executive Summary

The Compensation Discussion and Analysis explains the objectives of our executive compensation programs, outlines the elements of executive officer compensation and describes the factors considered by the compensation committee to determine the amounts of compensation for our Named Executive Officers for 2016 performance. During 2016, we began a strategic transition to concentrate primarily on our CRE lending business. This is a strategic transition to a more cost efficient, lower leveraged and focused business model from being a multi-strategy REIT which also owned and managed CRE assets throughout the United States and managed our interest in IRT. As described below and in the Annual Report, our key accomplishments in 2016 towards implementing our strategic transition included completing the IRT Management Internalization and changes in RAIT’s leadership and Board. As part of these accomplishments, the Compensation Committee had to consider the importance to RAIT of successfully implementing the succession of a new CEO, Mr. Davidson, and CFO, Mr. Kopsky, for RAIT as Mr. Schaeffer, the former CEO, and Mr. Sebra, the former CFO, each resigned from RAIT to remain with IRT as part of the IRT Management Internalization. Because Mr. Kopsky became CFO and Mr. Riis was determined to be an executive officer in 2017, they are not included in the Named Executive Officers for 2016. Our Named Executive Officers and their principal offices during 2016 were:

|

|

• |

Mr. Davidson, our CEO; |

|

|

• |

Mr. Schaeffer, our former CEO; |

|

|

• |

Mr. Sebra, our former CFO; and |

|

|

• |

Mr. Reyle, our General Counsel. |

During 2016 and 2017 in this transformative period for RAIT, the Compensation Committee sought to implement compensation arrangements that would both appropriately incentivize RAIT’s new executive management team, recognize achievements by RAIT’s executive team for achievements implementing RAIT’s strategic transition and establish severance arrangements that would ensure a smooth

5

transition with respect to RAIT’s departing executives. In applying our compensation policies to the Named Executive Officers in 2016, the Compensation Committee sought to recognize the executive management’s accomplishments in 2016 described below relating to implementation of our strategic plan that we believe will enhance shareholder value, and respond to changes in RAIT’s executive management team while continuing to maintain significant portion of executive compensation at risk based on our performance and also provide for measuring our success across both short-term and long-term performance periods. 2016 compensation decisions are described in greater detail below. See “2016 Compensation decisions-Impact of the Leadership Transition on 2016 Compensation” below.

In 2016, the Compensation Committee relied on short-term and long-term incentive compensation plans for Messr. Davidson, Schaeffer and Sebra (the “2016 Eligible Officers”) that (i) provide clear objectives and targets, (ii) improve alignment with measurable company performance and shareholder returns, and (iii) recognize and adjust for individual contributions to our success. The Compensation Committee approved 2016 award opportunities pursuant to RAIT’s 2015 Annual Incentive Compensation Plan (the “Annual Cash Bonus Plan”) and RAIT’s 2015 Long Term Incentive Plan (the “Long Term Equity Plan”) for the 2016 Eligible Officers. The Compensation Committee had previously adopted the Annual Cash Bonus Plan and the Long Term Equity Plan as sub-plans of the 2012 IAP, which was previously approved by the shareholders of RAIT. The terms of the awards (the “2016 Target Cash Bonus Awards”) under the Annual Cash Bonus Plan and the awards (the “2016 Long Term Equity Awards”) under the Long Term Equity Plan are described below. See “2016 Compensation Decisions” below for further description of these incentive plans and the compensation paid thereunder.

The role of our Compensation Committee, its use of an independent compensation consultant and the participation of executive officers in the compensation process are discussed above in “Information Concerning Our Board of Trustees, Committees and Governance-Compensation Committee.”

2016 RAIT Performance.

During 2016, we began to implement our strategy to focus on our core CRE lending business line. We also managed our own real estate owned (“REO”) portfolio, managed third-party properties and assets and, prior to the IRT Management Internalization, owned the external advisor of IRT, a REIT which owns a portfolio of multifamily properties, and owned approximately 15.5% of the outstanding IRT common stock. We believe we made significant progress executing our strategy to return to our focus on CRE lending, including the following key accomplishments:

|

|

• |

Sale of Our Investment in IRT and Our Multifamily Property Management Business through the IRT Management Internalization. |

|

|

o |

RAIT sold the external advisor of IRT and RAIT’s multifamily property management business to IRT for $43.0 million in aggregate gross proceeds. |

|

|

o |

RAIT sold its IRT stock ownership position to IRT, generating $62.2 million in aggregate gross proceeds. |

|

|

o |

RAIT deconsolidated IRT from its financial statements. |

|

|

• |

Property Sales |

|

|

o |

RAIT sold 18 properties which generated aggregate gross proceeds of $337.9 million. |

|

|

o |

After repayment of debt, RAIT received aggregate net proceeds of approximately $35 million. |

|

|

• |

Reductions in Compensation & General and Administrative (“G&A”)Expenses |

|

|

o |

RAIT’s compensation and G&A expenses were $49.0 million for the year ended December 31, 2015 ($18.9 million of which was related to discontinued operations and Urban Retail) and would have been $56.2 million for the year ended December 31, 2016 ($24.5 million of which was related to discontinued operations and Urban Retail). As a result of 2016 strategic initiatives, RAIT’s compensation and G&A expenses declined to $31.7 million for the year ended December 31, 2016. |

|

|

o |

Reduced our number of employees by approximately 460 employees, from approximately 700 employees to 240 employees. |

|

|

• |

Debt Reductions |

|

|

o |

RAIT’s indebtedness, based on principal amount, declined by $664.6 million, or 27.1%, during the year ended December 31, 2016. Total recourse debt, excluding RAIT’s secured warehouse facilities, declined by $56.7 million, or 13.6%, during the year ended December 31, 2016. |

6

|

|

o |

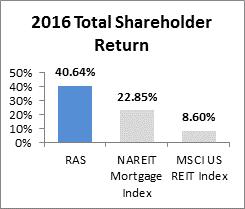

RAIT’s total shareholder return (stock price appreciation plus aggregate dividends) to investors during 2016 was just over 40%, which largely outperformed our closest peers in the mortgage REIT industry as well as that of the broader U.S. public REIT industry. |

During 2016, we generated GAAP net income (loss) allocable to Common Shares of $(9.8) million, or $(0.11) per Common Share-diluted, as compared to $7.2 million, or $0.08 per Common Share-diluted, during 2015. During 2016, our cash available for distribution (“CAD”) decreased to $40.6 million, or $0.45 per Common Share, from $66.1 million, or $0.77 per Common Share for 2015. CAD is a non-GAAP financial measure. For management’s definitions and discussion of the usefulness of CAD to investors and management and a reconciliation of our reported net income (loss) to our CAD, see “Non-GAAP Financial Measures” in our Annual Report. For 2016, our CRE lending business originated $157 million of loans and completed its 6th floating rate loan securitization in November 2016 (“RAIT FL6”). RAIT FL6 was a $258 million floating rate loan securitization and issued $217 million of investment grade bonds with a weighted average interest cost of LIBOR plus 2%.

|

2016 Compensation Highlights

The following summarizes key aspects of our compensation policies and programs:

|

|||

|

What We Do: |

What We Don’t Do: |

||

|

|

|

||

|

Ö |

We Align with Shareholders and Pay for Performance: A substantial portion of our compensation is not guaranteed but rather linked to the achievement of key financial metrics that are disclosed to our shareholders. |

c |

No Automatic Salary Increases or Uncapped Bonuses: We do not guarantee annual salary increases or allow uncapped bonuses; none of the employment agreements with our named executive officers contain such provisions. |

|

Ö |

We Balance Short‑Term and Long‑Term Incentives: Our incentive programs provide a balance of annual and longer‑term incentives, including a variety of performance metrics that measure both absolute and relative performance. |

c |

We Do Not Pay Dividends or Dividend Equivalents on Unvested Performance‑Based Restricted Stock Units: Holders of performance‑based restricted stock units do not receive dividends or dividend equivalents until the shares are vested. |

|

Ö |

We Maintain Stock Ownership Guidelines: Our RAIT has established the following minimum share ownership requirements: CEO – four times base salary; other Section 16b officers – two times base salary, all other designated officers - one times base salary, and outside Trustees – five times the annual cash retainer then in effect. |

c |

We Do Not Allow Hedging of Securities: We prohibit RAIT’s Trustees and executive officers from entering into hedging transactions with respect to RAIT’s securities and from holding RAIT’s securities in margin accounts or otherwise pledging such securities as collateral for loans. |

|

|

|

|

|

7

|

We Can Claw Back Compensation: Our independent Trustees have the ability to recoup incentive compensation paid to our named executive officers if RAIT’s financial results are restated or materially misstated due in whole or in part to intentional fraud or misconduct by one or more of such officers. |

c |

We Do Not Have Tax Gross‑Ups: We do not provide tax gross‑ups on any severance, change‑in‑control or other payments.

|

|

|

Ö |

We Retain an Independent Compensation Consultant: Our Compensation Committee engages an independent consultant, which specializes in the REIT industry, to provide guidance on a variety of compensation matters. |

c |

We Do Not Provide Excessive Perquisites: Our named executive officers receive limited perquisites and benefits. |

|

Ö |

We Retain Independent Compensation Legal Counsel: Our Compensation Committee engages independent legal counsel to advise it on compensation matters. |

|

|

|

|

|

|

|

Objectives of Our Compensation Policies

Our compensation policies for our Named Executive Officers have the following objectives:

We seek to appropriately incentivize RAIT’s new executive team and assure a smooth transition from RAIT’s former executives as RAIT’s leadership changes to encourage the implementation of RAIT’s strategic plan. As discussed above in “Executive Summary,” the Compensation Committee needed to address the transition of RAIT’s executive management team throughout the year by modifying compensation arrangements to respond to changing circumstances. Similarly, the IRT Management Internalization was not contemplated at the time the Compensation Committee set the quantitative metrics for the 2016 Target Cash Bonus Awards and the Compensation Committee felt those metrics did not sufficiently reflect the benefits to RAIT from the IRT Management Internalization to adequately reward the 2016 Eligible Officers for their efforts on the IRT Internalization Transactions and so approved an additional discretionary bonus (the “Executive Transaction Bonus”) to each 2016 Eligible Officer relating to the contributions of the 2016 Eligible Officers to completing the IRT Management Internalization.

We seek to attract and retain key executives, including the Named Executive Officers, by motivating them to achieve superior performance and rewarding them for that performance. Key elements of compensation may include one or more of the following:

|

|

• |

a base salary that is determined in part by the named executive’s history of performance and prior compensation; |

|

|

• |

quantitative criteria-based bonus programs, discretionary bonuses, other forms of cash awards or some combination of these alternatives, that would be based on the Compensation Committee’s assessment of the named executive’s duties and performance within the context of the performance of RAIT or some designated portion of RAIT and whether quantitative criteria can be set that relate to the executive’s duties and performance and the performance of RAIT or some designated portion of RAIT; and |

|

|

• |

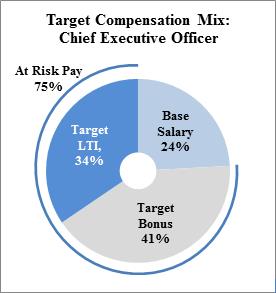

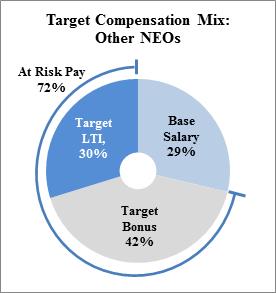

equity-based compensation in amounts that are based on the executive’s role and strategic impact with respect to long term objectives, the value of which is contingent upon the performance of RAIT’s Common Share price, and subject to vesting schedules that require continued service with RAIT. The illustrations below show the mix of compensation provided to our NEOs, in which a substantial portion is at-risk in the form of incentive pay and/or tied to shareholder interests. |

8

We seek to align the interests of our Named Executive Officers with our shareholders through long-term incentives in the form of equity-based compensation. As discussed above in “Executive Summary,” the Compensation Committee believes equity-based compensation is important to align the interests of our Named Executive Officers with our shareholders. The Compensation Committee accordingly has made the 2016 Long Term Equity Awards to Messrs. Davidson, Schaeffer and Sebra and awards of SARs and restricted Common Shares to Mr. Reyle as described below.

The Elements of Our Compensation

The Named Executive Officers’ 2016 compensation consisted of three principal components:

|

|

• |

Base salary; |

|

|

• |

Short‑term incentive program (annual cash bonus); and |

|

|

• |

Long‑term incentive program (equity‑based compensation). |

9

|

|

Link to Program Objectives |

Type of Compensation |

Important Features |

|

Base Salary |

•Fixed level of cash compensation to support attraction and retention of key executives in a competitive marketplace •Preserves an employee’s commitment during downturns in the REIT industry and/or in equity markets |

Cash |

•Determined based on evaluation of individual’s experience, current performance, and internal pay equity and a comparison to peers •Each executive officer’s employment agreement sets the executive’s base salary and provides that base salary may be increased but not decreased during the term of the agreement. |

|

Annual Cash Bonus |

•Target cash incentive opportunity (set as a percentage of base salary) that encourages executives to achieve annual RAIT financial goals •Assists in retaining, attracting and motivating employees in the short-term |

Cash |

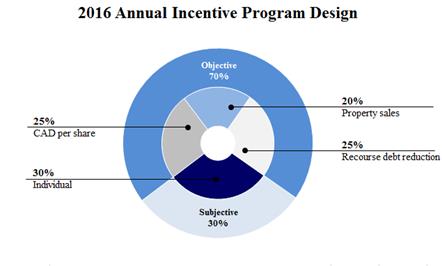

•70% of funding for performance year 2016 tied to the performance measures of CAD per share, property sales, and recourse debt reduction •30% based on individual performance •Additional Executive Transaction Bonuses discussed above made to reward achievements advancing RAIT’s transformative strategic plan. |

|

Long-Term Incentives Program: Restricted shares |

•Focuses executives on achievement of long-term RAIT financial and strategic goals and total shareholder return, thereby creating long-term shareholder value (pay-for-performance) •Assists in maintaining a stable, continuous management team in a competitive market •Maintains shareholder-management alignment •Easy to understand and track performance •Limits dilution to existing shareholders relative to utilizing options or stock appreciation rights |

Long-Term Equity |

•25% of 2016 annual long-term incentive award •Provides upside incentive in up market, with some down market protection •Vest in four annual increments •Retention and Severance Awards Made to manage Executive Team Transition |

|

Long-Term Incentives Program: PSUs |

Long-Term Equity |

•75% of 2016 annual long-term incentive award •Three-year performance period in which the 2016-2018 awards were entirely based on future total shareholder return requirements •Provides some upside in up- or down-market based on balance of absolute and relative performance |

Other Compensation

RAIT provides certain other limited forms of compensation and benefits to the Named Executive Officers, including limited perquisites and 401(k) matching contributions, as discussed below. The Compensation Committee has reviewed these other components of compensation in relation to the total compensation of the Named Executive Officers and determined that they are reasonable and appropriate. As discussed above, the Compensation Committee reviewed any proposed compensation directly from IRT to our Named Executive Officers. In 2015, two of our Named Executive Officers received compensation directly from IRT for the Named Executive Officers’ service to IRT. The Compensation Committee considers such service, and any compensation from IRT for such service, in determining each named executive’s compensation from RAIT.

Perquisites. Mr. Schaeffer received a car allowance of $9,590 and we paid his membership dues of $8,554 for his membership in an organization in 2016. None of our other Named Executive Officers received perquisites equal to or greater than $10,000 in 2016. In general, we do not emphasize perquisites as part of the compensation packages we offer and seek to emphasize other elements.

401(k) Plan. The RAIT 401(k) plan offers eligible employees the opportunity on the same terms and conditions to make long-term investments on a regular basis through salary contributions, which are supplemented by our matching cash contributions and potential profit sharing payments. RAIT currently provides a cash match equal to each employee’s contributions to the extent the contributions do not exceed 4% of the employee’s compensation and may provide an additional cash match of 2% of eligible compensation as discretionary cash profit sharing payments. No discretionary profit sharing payments were made in 2016. Any matching contribution made by RAIT pursuant to the RAIT 401(k) plan vests immediately. All of the Named Executive Officers participated in the RAIT Financial Trust 401(k) Plan in 2016. RAIT contributed employer matches on behalf of the Named Executive Officers as set forth in footnote 4 in the Summary Compensation Table.

Post-Termination Compensation. We have employment agreements or other severance arrangements with our Named Executive Officers. Each of our agreements with 2016 Eligible Officers provides for payments and other benefits if the executive’s employment terminates under specified circumstances. See “Executive Compensation—Narrative to Summary Compensation Table and Grants of Plan-Based Awards Table in 2015—Employment Agreements” and “Executive Compensation—Potential Payments on Termination or Change in Control” for a

10

description of these severance benefits with the Named Executive Officers. In 2016, as described above, the Compensation Committee approved the SD MOU, the SD Employment Agreement, the SS MOU, the SS Separation Agreement, the SS Consulting Agreement, the JS MOU and the JS Separation Agreement to address the transition of RAIT’s executive management team and, in the case of Messrs. Schaeffer and Sebra, to provide for appropriate severance. The Compensation Committee believes generally that these severance and change in control arrangements can be an important part of overall compensation for RAIT’s executive officers because they help to secure the continued employment and dedication of these executive officers, notwithstanding any concern that they might have regarding their own continued employment in general and prior to or following a change in control. The Compensation Committee also believes that these arrangements are important as a recruitment and retention device, as most of the companies with which we compete for executive talent have customarily had similar agreements in place for their senior employees.

The executive employment agreements also contain provisions that prohibit the executive from disclosing RAIT’s confidential information and prohibit the executive from engaging in certain competitive activities or soliciting any of our employees or customers following termination of their employment with RAIT. An executive will forfeit his right to receive post-termination compensation if he breaches these or other restrictive covenants in the employment agreements. We believe that these provisions help ensure the long-term success of RAIT.

2016 Compensation Decisions

Impact of the Leadership Transition on 2016 Compensation

As discussed above in “Executive Summary,” during 2016, we began a strategic transition to concentrate primarily on our CRE lending business and the Compensation Committee had to consider the importance to RAIT of successfully implementing the succession of a new CEO, Mr. Davidson, and CFO, Mr. Kopsky, for RAIT as Mr. Schaeffer, the former CEO, and Mr. Sebra, the former CFO, each resigned from RAIT to remain with IRT as part of the IRT Management Internalization. In addition, as discussed above in “Executive Summary, the Compensation Committee sought to implement compensation arrangements that would both appropriately incentivize RAIT’s new executive management team, recognize achievements by RAIT’s executive team for achievements implementing RAIT’s strategic transition and establish severance arrangements that would ensure a smooth transition with respect to RAIT’s departing executives.

In applying our compensation policies to the Named Executive Officers in 2016, the Compensation Committee sought to recognize the executive management’s accomplishments in 2016 described below relating to implementation of our strategic plan that we believe will enhance shareholder value, and respond to changes in RAIT’s executive management team while continuing to maintain significant portion of executive compensation at risk based on our performance and also provide for measuring our success across both short-term and long-term performance periods. The steps taken by the Compensation Committee to address these objectives included those described below.

Incentivize Successful Implementation of RAIT’s Strategic Plan

|

|

• |

The Compensation Committee rewarded steps accomplished to implement RAIT’s strategic plan by approving amounts payable under the 2016 Target Cash Bonus Awards and approving the Executive Transaction Bonus for each of the 2016 Eligible Officers for completing the IRT Management Internalization. See “Annual Incentives and Long-Term Incentives-2016 Incentive Awards” below for a discussion of the 2016 Target Cash Bonus Awards. The Executive Transaction Bonus amounts paid to Messrs. Davidson, Schaeffer and Sebra were $430,000, $325,000 and $95,000, respectively and were made to compensate the recipients for their significant contributions towards accomplishing the IRT Management Internalization which the Compensation Committee determined was key to executing on RAIT’s transformative strategy and beneficial to RAIT’s shareholders. |

|

|

• |

The Compensation Committee sought to establish continuing incentives to implement RAIT’s strategic plan by approving the 2017 Target Cash Bonus Awards and 2017 Long Term Equity Awards (defined below) for the 2017 Eligible Officers. See “Annual Incentives and Long-Term Incentives-2017 Incentive Awards” below. |

Create Appropriate Compensation Arrangements for RAIT’s New Executive Team

|

|

• |

The Compensation Committee sought to address Mr. Davidson’s importance to RAIT’s CEO succession planning and establish appropriate compensation arrangements when he was identified to replace Mr. Schaeffer as RAIT’s new CEO by approving a retention award for Mr. Davidson (the “SD Retention Award”), Memorandum of Understanding (the “SD MOU”) and an amended and restated employment agreement (the “SD Employment Agreement”). |

|

|

• |

In 2017, the Compensation Committee approved an offer letter (the “PK Offer Letter”) and an employment agreement (the “PK Employment Agreement”) described below for Mr. Kopsky to plan for his succession as RAIT’s new CFO. |

|

|

• |

In 2017, the Compensation Committee approved new employments agreements for Messrs. Reyle and Riis in recognition of their increased responsibilities in light of the leadership transition and included them in the 2017 Eligible Officers. |

Ensure a Smooth Transition by Establishing Appropriate Severance Arrangements for RAIT’s Departing Executives

|

|

• |

The Compensation Committee approved a Memorandum of Understanding (the “SS MOU”), Separation Agreement (the “SS Separation Agreement”) and a Consulting Agreement for Mr. Schaeffer to plan for the transition when Mr. Schaeffer was to resign from his RAIT positions. |

11

Annual Base Salary

The base salary of each of our executive officers is based on the review of the Compensation Committee described above and the following:

|

|

• |

any requirements of the named executive’s employment agreement; |

|

|

• |

an assessment of the scope of the executive officer’s responsibilities and leadership; |

|

|

• |

the executive officer’s expertise and experience within the industry; |

|

|

• |

RAIT’s overall financial and business performance; and |

|

|

• |

the executive officer’s contributions to RAIT. |

This determination is not formulaic and is not based on specific RAIT or individual performance targets objectives, but rather is subjective and made in light of our compensation philosophy and objectives described above. Mr. Davidson’s base salary was increased from $650,000 to $850,000 upon his appointment as CEO. Mr. Schaeffer’s, Mr. Sebra’s and Mr. Reyle’s base salary remained the same during 2016.

Annual Incentives and Long-Term Incentives

2016 Incentive Awards

As described above, effective April 22, 2016, the Compensation Committee approved 2016 award opportunities pursuant to the “Annual Cash Bonus Plan and the Long Term Equity Plan for the 2016 2016 Eligible Officers. The terms of the 2016 Target Cash Bonus Awards under the Annual Cash Bonus Plan and the 2016 Long Term Equity Awards under the Long Term Equity Plan are described below.

2016 Target Cash Bonus Awards

|

|

• |

The 2016 Target Cash Bonus Awards were composed of two components, as described below. |

|

|

• |

“Quantitative Bonus Award” — the Quantitative Bonus Award component of the 2016 Target Cash Bonus Award that may be earned by each 2016 Eligible Officer was equal to 70% of the 2016 Target Cash Bonus Award for each participant, to be determined by RAIT’s performance relative to specified objective performance criteria established by the Compensation Committee as described below. The actual Quantitative Bonus Award earned by a participant could range from 0% and 150% of target based on actual performance for the year. |

|

|

• |

“Qualitative Bonus Award” – the Qualitative Bonus Award component of the 2016 Target Cash Bonus Award that may be earned by each 2016 Eligible Officer was equal to 30% of the 2016 Target Cash Bonus Award for each participant, to be determined based on the Compensation Committee’s subjective evaluation of such participant’s performance relative to specified individual and/or collaborative criteria established by the Compensation Committee for each 2016 Eligible Officer, as described below. The actual Qualitative Bonus Award earned by a participant could range from 0% and 150% of target based on actual performance for the year. |

2016 Target Cash Bonus Award Levels

The 2016 Target Cash Bonus Award levels set by the Compensation Committee for each of RAIT’s 2016 Eligible Officers based on 2016 performance were as follows:

|

2016 Eligible Officer |

2016 Quantitative Bonus Target |

|

|

2016 Qualtitative Bonus Target |

|

|

Total 2016 Target Cash Bonus Award |

|

|||

|

Scott F. Schaeffer, |

$ |

840,000 |

|

|

$ |

360,000 |

|

|

$ |

1,200,000 |

|

|

Chief Executive Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Scott L. N. Davidson, |

$ |

805,000 |

|

|

$ |

345,000 |

|

|

$ |

1,150,000 |

|

|

President |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

James J. Sebra, |

$ |

245,000 |

|

|

$ |

105,000 |

|

|

$ |

350,000 |

|

|

Chief Financial Officer and Treasurer |

|

|

|

|

|

|

|

|

|

|

|

12

2016 Quantitative Bonus Award Criteria

The Compensation Committee established the following objective performance metrics to be utilized in determining any payout with respect to the Quantitative Bonus Award portion of the 2016 Target Cash Bonus Award weighted based on these performance measurements:

|

|

• |

Cash Available for Distribution (“CAD”) per share, calculated as that term has been used by RAIT in its public reporting, subject to a limitation that no CAD that results from the gain or loss on the sale of RAIT owned real property may be included in calculating CAD for purposes of performance pursuant to this plan. |

|

|

• |

Property sales, and |

|

|

• |

Recourse debt reduction, other than CMBS Facilities. Recourse debt and CMBS Facilities are defined as those terms have been defined by RAIT in its public reporting. The term “CMBS Facilities” includes RAIT’s fixed rate and floating rate warehouse lines of credit. |

The actual Quantitative Bonus Award payment realized by a 2016 Eligible Officer for 2016 with respect to each applicable metric would depend on RAIT’s achievement of at least a “Threshold” level of performance established by the Compensation Committee with respect to that metric. There would be no Quantitative Bonus Award payable for that metric in the event RAIT achieved less than the Threshold level for the applicable annual performance period. RAIT’s achievement of the Threshold level for a designated metric would result in a payout of 50% of the proportion of the Quantitative Bonus Award allocated to that metric; the achievement of the Target level for a designated metric would result in a payout of 100% of the proportion of the Quantitative Bonus Award allocated to that metric; and the achievement of the Maximum level for a designated metric would result in a payout of 150% of the proportion of the Quantitative Bonus Award allocated to that metric. If the calculated percentage was between Threshold and Target or between Target and Maximum for an annual performance period, then the earned percentage would be prorated. The number of shares used for any per share metric was the weighted average number of shares outstanding for the relevant period. The achievement of these levels and allocated payments are illustrated by the following table:

|

Quantitative Metric |

|

Weighting |

|

|

Range |

|

Resulting Cash Payout* |

|

||

|

CAD per share |

|

|

25 |

% |

|

Threshold |

|

|

50 |

% |

|

|

|

|

|

|

|

Target |

|

|

100 |

% |

|

|

|

|

|

|

|

Maximum |

|

|

150 |

% |

|

Property sales |

|

|

20 |

% |

|

Threshold |

|

|

50 |

% |

|

|

|

|

|

|

|

Target |

|

|

100 |

% |

|

|

|

|

|

|

|

Maximum |

|

|

150 |

% |

|

Recourse debt reduction |

|

|

25 |

% |

|

Threshold |

|

|

50 |

% |

|

|

|

|

|

|

|

Target |

|

|

100 |

% |

|

|

|

|

|

|

|

Maximum |

|

|

150 |

% |

2016 Qualitative Bonus Award Criteria

The Qualitative Bonus Award portion of each 2016 Eligible Officer’s 2016 Target Cash Bonus, which was the remaining 30% of the overall target cash bonus, was based on the Compensation Committee’s subjective evaluation of the 2016 Eligible Officer’s performance relative to achieving specified individual criteria established for 2016 for each participant, which the Compensation Committee determined were also important elements of each 2016 Eligible Officer’s contribution to the creation of overall shareholder value.

13

2016 Target Cash Bonus Award Payments

|

|

• |

All 2016 Target Cash Bonus Award payments were to be made in the year following the completion of the annual performance period to which the 2016 Target Cash Bonus Award payment relates. The actual payment to each 2016 Eligible Officer was to be made as soon as practical after final certification of the underlying performance results and approval of such payment by the Compensation Committee; provided, however, that, in order to comply with certain rules concerning the regulation of deferred compensation under the IRC, in no event was any such payment to be made later than March 15 of such year. |

|

|

• |

Should a 2016 Eligible Officer terminate employment with RAIT prior to the conclusion of the applicable performance period, their 2016 Target Cash Bonus Award payment was to be determined by the terms of such 2016 Eligible Officer’s employment agreement. These employment agreements generally provide that if defined conditions are met, in the event of the 2016 Eligible Officer’s death, disability, termination without cause, resignation for good reason or, under two 2016 Eligible Officers’ employment agreements, a change of control followed by termination in defined circumstances, the 2016 Eligible Officer would receive a lump sum cash payment equal to a pro rata portion of such 2016 Eligible Officer’s target annual cash bonus for and applicable to the fiscal year of his termination. |

|

|

• |

An individual who became a 2016 Eligible Officer, pursuant to SEC rules, after the beginning of an applicable annual incentive period, could be considered for a pro-rated bonus payment under the Annual Cash Bonus Plan at the discretion of the Compensation Committee. |

2016 Target Cash Bonus Awards Payments and Performance Metrics and Discretionary Bonus

In March 2017, the Compensation Committee certified payments under the 2016 Target Cash Bonus Awards to each of the eligible officers.

The threshold, target and maximum values, the actual performance and the resulting payout percentage for each performance metric for the quantitative bonus award portion of the 2016 Target Cash Bonus Awards were as follows:

|

(in 000s, except per share) |

Threshold |

Target |

Maximum |

Actual |

Payout % |

||||||||||

|

Payout percentage |

|

50 |

% |

|

100 |

% |

|

150 |

% |

|

|

|

|

|

|

|

CAD per share |

$ |

0.47 |

|

$ |

0.55 |

|

$ |

0.64 |

|

$ |

0.45 |

|

|

0.0 |

% |

|

Property Sales |

$ |

130,000 |

|

$ |

155,000 |

|

$ |

185,000 |

|

$ |

337,867 |

|

|

150.0 |

% |

|

Debt Reductions |

$ |

25,000 |

|

$ |

50,000 |

|

$ |

75,000 |

|

$ |

56,716 |

|

|

113.6 |

% |

The Compensation Committee set the qualitative bonus earned under the 2016 Target Cash Awards between the target and the threshold level at 135.0% for each of Mr. Schaeffer and Mr. Sebra and, as required by the SD MOU, at the 150.0% maximum level for Mr. Davidson. In determining the appropriate level of the qualitative bonuses, the Compensation Committee used its discretion to identify and analyze the factors to consider. As described above, the Compensation Committee also exercised its discretion to make a separate discretionary Executive Transaction Award to each 2016 Eligible Officer.

14

As a result, the 2016 Target Cash Bonus Award and Executive Transaction Award for each of the 2016 Eligible Officers, were as follows:

|

|

|

|

|

Target Bonus |

|

|

Payout % |

|

|

Bonus |

|

||||

|

|

Scott F. Schaeffer |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

CAD per share |

|

$ |

300,000 |

|

|

|

0.0 |

% |

|

$ |

- |

|

|

|

|

|

Property Sales |

|

$ |

240,000 |

|

|

|

150.0 |

% |

|

$ |

360,000 |

|

|

|

|

|

Debt Reductions |

|

$ |

300,000 |

|

|

|

113.6 |

% |

|

$ |

340,883 |

|

|

|

|

|

Qualitative |

|

$ |

360,000 |

|

|

|

135.0 |

% |

|

$ |

486,000 |

|

|

|

|

|

Executive transaction bonus |

|

|

|

|

|

|

|

|

$ |

325,000 |

|

||

|

|

|

Total |

|

$ |

1,200,000 |

|

|

|

|

|

|

$ |

1,511,883 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Scott L.N. Davidson |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

CAD per share |

|

$ |

287,500 |

|

|

|

0.0 |

% |

|

$ |

- |

|

|

|

|

|

Property Sales |

|

$ |

230,000 |

|

|

|

150.0 |

% |

|

$ |

345,000 |

|

|

|

|

|

Debt Reductions |

|

$ |

287,500 |

|

|

|

113.6 |

% |

|

$ |

326,680 |

|

|

|

|

|

Qualitative |

|

$ |

345,000 |

|

|

|

150.0 |

% |

|

$ |

517,500 |

|

|

|

|

|

Executive transaction bonus |

|

|

|

|

|

|

|

|

$ |

430,000 |

|

||

|

|

|

Total |

|

$ |

1,150,000 |

|

|

|

|

|

|

$ |

1,619,180 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

James J. Sebra |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

CAD per share |

|

$ |

87,500 |

|

|

|

0.0 |

% |

|

$ |

- |

|

|

|

|

|

Property Sales |

|

$ |

70,000 |

|

|

|

150.0 |

% |

|

$ |

105,000 |

|

|

|

|

|

Debt Reductions |

|

$ |

87,500 |

|

|

|

113.6 |

% |

|

$ |

99,424 |

|

|

|

|

|

Qualitative |

|

$ |

105,000 |

|

|

|

135.0 |

% |

|

$ |

141,750 |

|

|

|

|

|

Executive transaction bonus |

|

|

|

|

|

|

|

|

$ |

95,000 |

|

||

|

|

|

Total |

|

$ |

350,000 |

|

|

|

|

|

|

$ |

441,174 |

|

|

Long Term Equity Awards

The 2016 Long Term Equity Awards for the 2016 Eligible Officers consist of the following two components:

|

|

• |

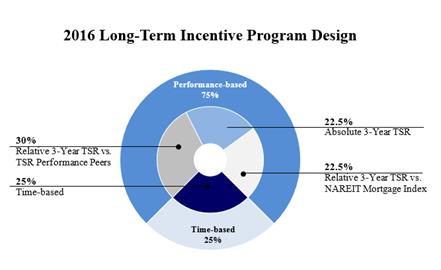

“2016 Performance Share Unit Awards” — 75% of the target value of each 2016 Eligible Officer’s annual 2016 Long Term Equity Award consist of Performance Share Unit Awards (the “2016 PSUs”) authorized by the Compensation Committee under the Long Term Equity Plan adopted pursuant to the 2012 IAP, with the number of RAIT Common Shares of beneficial interest (“Common Shares”) issued or their equivalent value in cash paid, at the Compensation Committee’s option, at the conclusion of the relevant performance period. The number of 2016 PSUs earned will be determined 100% by RAIT’s performance for the three year period commencing January 1, 2016 and ending December 31, 2018 relative to three long term performance metrics established by the Compensation Committee, as described in greater detail below. The Compensation Committee did not allocate any portion of the 2016 PSUs to subjective factors. |

The actual number of 2016 PSUs earned by a participant may range from 0% to 150% of target based on actual performance for the performance period. The performance based awards vest 50% at December 31, 2018 based on performance for 2016-2018, and the 50% balance, consisting of the same number of shares that were awarded at December 31, 2018, become time vesting and vest one year thereafter, subject to forfeiture in such year only in the event RAIT has terminated the 2016 Eligible Officer’s employment for cause or the 2016 Eligible Officer has resigned without good reason as determined, in each situation, under such 2016 Eligible Officer’s employment agreement. The Compensation Committee currently intends to redeem any vested 2016 PSUs with Common Shares, subject to the availability of Common Shares under the 2012 IAP at the time of vesting.

|

|

• |

“Annual Restricted Share Awards” – 25% of the target value of each 2016 Eligible Officer’s 2016 Long Term Equity Awards consists of a grant of time-vesting Restricted Shares determined by dividing the dollar value of that portion of the annual 2016 Long Term Equity Award allocated to such Restricted Shares by the closing price of a Common Share on the New York Stock Exchange on the date of grant. |

Structure of 2016 PSUs

|

|

• |

The number of 2016 PSUs was determined by dividing the maximum dollar value of that portion of the annual 2016 Long Term Equity Award allocated to such 2016 PSUs by the closing price of a Common Share on the New York Stock Exchange on the date of grant. |

|

|

• |

The number of Common Shares issued, or their equivalent value in cash paid, at the Compensation Committee’s option, to a 2016 Eligible Officer upon the maturity of a Performance Share Unit Award at the end of the relevant performance period will depend on RAIT’s achievement of at least a “Threshold” level of three metrics: (1) Total Shareholder Return or “TSR” (stock price appreciation plus aggregate dividends) as compared to a peer group of public companies (the “TSR Performance Peers”) over the same time period, using the relative percentile ranking approach for such comparison, (2) TSR as compared to the TSR for the FTSE NAREIT Mortgage REIT Index (the “NAREIT Mortgage Index”), and (3) TSR for holders of Common Shares on an absolute basis. |

15

The “Threshold,” “Target,” and “Maximum” benchmarks to be established for the TSR achieved by RAIT over each relevant three-year performance period in comparison to the performance metrics listed below and the resulting impact on the number of shares earned by each 2016 Eligible Officer upon the maturity of Performance Share Units at the conclusion of each three-year performance period, is summarized in the following table:

|

Metric |

Weighting |

|

|

Threshold 0.5x Payout |

|

|

Target 1x Payout |

|

|

Maximum 1.5x Payout |

|

||||

|

Relative 3-Year TSR vs. TSR Performance Peers |

|

40% |

|

|

50th Percentile |

|

|

65th Percentile |

|

|

90th Percentile |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Relative 3-Year TSR vs. NAREIT Mortgage Index |

|

30% |

|

|

50th Percentile |

|

|

65th Percentile |

|

|

90th Percentile |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Absolute 3-Year TSR |

|

30% |

|

|

|

52.09% |

|

|

|

64.30% |

|

|

|

90.66% |

|

No awards will be earned if below threshold performance is achieved for a particular metric. If performance falls between Threshold and Target or Target and Maximum for any performance period, then the number of Performance Share Units earned will be prorated.

Structure of Annual Restricted Share Awards

|

|

• |

At the initial date of grant, 25% of the target value of each 2016 Eligible Officer’s 2016 Long Term Equity Awards were allocated to an Annual Restricted Share Award. |

|

|

• |

The number of shares issued with respect to the time-vesting Annual Restricted Share component of each 2016 Long Term Equity Award will be determined by dividing the dollar value of that portion of the annual 2016 Long Term Equity Award allocated to such Restricted Shares by the closing price of a Common Share on the New York Stock Exchange on the date of grant. |

|

|

• |

Common Shares subject to the Annual Restricted Share Awards will vest 25% per annum on the first four anniversaries from the date of grant. |

Grant of 2016 Long Term Equity Awards

Effective as of April 22, 2016, each of the 2016 Eligible Officers was granted a 2016 Long Term Equity Award, consisting of both a 2016 PSU, having the target value shown in the table below for the 2016–2018 performance period, and an Annual Restricted Share Award having the target value shown in the table below for fiscal year 2016:

|

2016 Eligible Officer |

Target Value of Initial Long Term Equity Award |

|

|

Target Value of Performance Share Units Award |

|

|

Number of Performance Share Units Issued (1) |

|

|

Target Value of Annual Restricted Award |

|

|

Number of Shares Issued for Annual Restricted Share Award (2) |

|

|||||

|

Scott F. Schaeffer, |

$ |

1,000,000 |

|

|

$ |

750,000 |

|

|

$ |

391,986 |

|

|

$ |

250,000 |

|

|

$ |

87,108 |

|

|

Chief Executive Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Scott L. N. Davidson, |

$ |

950,000 |

|

|

$ |

712,500 |

|

|

$ |

372,386 |

|

|

$ |

237,500 |

|

|

$ |

82,752 |

|

|

President |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|