Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - PRIVATEBANCORP, INC | pvtb1231201610-kaex312.htm |

| EX-31.1 - EXHIBIT 31.1 - PRIVATEBANCORP, INC | pvtb1231201610-kaex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Mark One) | |

[X] | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2016

or

[ ] | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission File Number 001-34066

Delaware | 36-3681151 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

120 South LaSalle Street

Chicago, Illinois 60603

(Address of principal executive offices) (Zip code)

Registrant’s telephone number, including area code: (312) 564-2000

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | ||

Common Stock, No Par Value | Nasdaq Global Select Stock Market | ||

10% Trust Preferred Securities of PrivateBancorp Capital Trust IV | Nasdaq Global Select Stock Market | ||

7.125% Subordinated Debentures due 2042 | New York Stock Exchange | ||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [X] No [ ].

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X].

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ].

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ].

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act). (Check one): Large accelerated filer [X] Accelerated filer [ ] Non-accelerated filer [ ] (Do not check if a smaller reporting company) Smaller reporting company [ ] Emerging growth company [ ].

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act [ ].

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).Yes [ ] No [X].

The aggregate market value of the registrant’s outstanding voting and non-voting common stock held by non-affiliates on June 30, 2016, determined using a per share closing price on that date of $44.03, as quoted on The Nasdaq Stock Market, was $3,446,864,642.

As of February 27, 2017, there were 80,026,661 shares of the issuer’s voting common stock, no par value, outstanding. There are no shares of the issuer’s non-voting common stock outstanding.

1

EXPLANATORY NOTE

PrivateBancorp, Inc. (the “Company,” or “we,” “our” and “us”) filed its Annual Report on Form 10-K for the fiscal year ended December 31, 2016 with the U.S. Securities and Exchange Commission (SEC) on March 1, 2017 (the “Original Form 10-K”). We are filing this Amendment No. 1 to the Original Form 10-K (this “Amendment”) solely for the purpose of including the information required by Items 10 through 14 of Part III of Form 10-K that was to be incorporated by reference from our definitive proxy statement for the 2017 annual meeting of shareholders, because our definitive proxy statement will not be filed with the SEC within 120 days after the end of our fiscal year ended December 31, 2016. This Form 10-K/A hereby amends and restates in their entirety the Form 10-K cover page and Items 10 through 14 of Part III.

Pursuant to Rule 12b-15 under the Securities Exchange Act of 1934, as amended, Part III, Items 10 through 14, of the Original 10-K are hereby amended and restated in their entirety. and Part IV, Item 15(a)(3), of the Original Form 10-K is hereby amended and restated in its entirety, with the only changes being the filing of new currently dated certifications by the principal executive officer and the principal financial officer as required by Section 302 of the Sarbanes-Oxley Act of 2002. Because no financial statements have been included in this Amendment and this Amendment does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4 and 5 of the certifications have been omitted.

Except as expressly noted in this Amendment, this Amendment does not reflect events occurring after the filing of the Original Form 10-K or modify or update in any way any of the other disclosures contained in the Original Form 10-K including, without limitation, the financial statements. Accordingly, this Amendment should be read in conjunction with our Original Form 10-K and our other filings with the SEC.

2

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE

DIRECTORS

Our Board consists of 11 members. Set forth below are each director’s name, age, tenure, principal occupation (or former principal occupation if currently retired), business experience and public company directorships held during the past five years. We also discuss the relevant qualifications, attributes and skills of each director.

DIANE M. AIGOTTI

Age: 52

Director Since: 2015

Principal Occupation: Executive Vice President, Managing Director & Chief Financial Officer, Ryan Specialty Group, LLC

Public Boards: GATX Corporation (NYSE: GATX)

Qualifications, Attributes and Skills

Ms. Aigotti’s responsibility for financial planning, reporting, operations, risk management, treasury management, mergers and acquisitions and tax and regulatory compliance as chief financial officer of a large privately-held global insurance organization provides her with extensive experience and functional expertise that contributes to the Board’s financial, risk management and strategic oversight. Her prior experience as chief risk officer and treasurer at an NYSE-listed global insurance, risk management and human resources firm gave her broad experience with respect to identifying, measuring and managing key risks, focusing investment decisions and enhancing governance.

Professional Highlights

• | Since 2010, has served as Executive Vice President, Managing Director and Chief Financial Officer of Ryan Specialty Group, LLC, joining as part of the founding team together with the founder and former executive chairman of Aon Corp. |

• | Prior to Ryan Specialty, spent nearly eight years with Aon plc (f/k/a Aon Corp.) (NYSE: AON) as Senior Vice President, Chief Risk Officer and Treasurer. |

• | Currently serves on the board of GATX Corporation (NYSE: GATX), a lessor and operator of assets in the rail and marine markets. |

• | Earlier in career, served as Vice President of Finance at the University of Chicago Hospitals and Health System and as budget director for the City of Chicago. |

Other Leadership Experience and Service

• | Served on the board of directors of the Federal Home Loan Bank of Chicago from 2008 until joining the our Board in 2015. |

NORMAN R. BOBINS

Age: 74

Director Since: 2008

Principal Occupation: Chief Executive Officer, Norman Bobins Consulting LLC; Former Chairman, CEO and President of LaSalle Bank, N.A.

Public Boards: AAR Corp (NYSE: AIR); ; Omega Healthcare Investors, Inc. (NYSE: OHI)

Other Public Boards in Past 5 Years: AGL Resources, Inc. (NYSE: GAS) (until June 2016); Sims Metal Management Ltd. (NYSE: SMS) (until November 2014)

Qualifications, Attributes and Skills

With 50 years of banking experience and leadership, Mr. Bobins brings to the Board significant business acumen and commercial banking expertise, along with well-established relationships across Chicago’s banking, business and civic communities. He also provides valuable insight regarding financial regulation from his years of working closely with regulators.

Professional Highlights

• | Since 2008, has served as the Chief Executive Officer of Norman Bobins Consulting LLC. |

• | Currently serves on the boards of AAR Corp (NYSE: AIR), an aerospace and defense products and services provider, Omega Healthcare Investors, Inc. (NYSE: OHI), a real estate investment trust focusing on the healthcare industry, REEF |

3

America REIT II, Inc., a private real estate investment trust, Transco Inc., a privately-held diversified industrial company, ForwardLine Financial, LLC, a provider of small business merchant loans and cash advances, and Pangea Properties, a private real estate investment trust focusing on distressed and value-add multifamily properties. Until June 2016, was on the board of AGL Resources, Inc. (NYSE: GAS), a natural gas company, and until November 2014, was on the board of directors of Sims Metal Management Ltd. (NYSE: SMS), a metals recycling company.

• | Retired in 2007 as Chairman, Chief Executive Officer and President of LaSalle Bank, N.A., which was the 15th largest bank in the United States at the time of its acquisition by Bank of America Corp. He joined LaSalle Bank in 1990 through its acquisition of Exchange National Bank of Chicago. |

• | Prior to its acquisition by LaSalle Bank in 1990, was Senior Executive Vice President and Chief Lending Officer at Exchange National Bank for nine years. Prior to that, was with American National Bank and Trust Company as Senior Vice President, holding various commercial lending positions over 14 years. |

Other Leadership Experience and Service

• | Recognized civic leader in Chicago, serving on the boards or advisory councils of a number of civic, philanthropic and other non-profit organizations. |

• | Among others, currently serves on the boards of The Field Museum, Illinois Sports Facility Authority, Navy Pier, Inc. (the non-profit maintaining and overseeing the redevelopment of Chicago’s Navy Pier) and WTTW Communications, Inc. (the public television network in Chicago). |

• | Former member of the Board of Education of the City of Chicago, having been appointed by Mayor Daley for four consecutive four-year terms. |

MICHELLE L. COLLINS

Age: 57

Director Since: 2014

Principal Occupation: President of Cambium, LLC; Former Managing Director, Svoboda, Collins L.L.C.

Public Boards: Ulta Beauty, Inc. (NASDAQ: ULTA)

Other Public Boards in Past 5 Years: Integrys Energy Group, Inc. (NYSE: TEG) (until June 2015); Molex, Inc. (NASDAQ: MOLX) (until December 2013)

Qualifications, Attributes and Skills

With significant financial analysis skills and capital markets and corporate transactional experience in a variety of industries, as well as significant public company board experience, Ms. Collins brings valuable knowledge and new perspectives to the Board. In particular, she has served on various public company audit and governance committees. Her mergers and acquisitions and business consulting experience with, and understanding of, small and medium-sized businesses also enables her to provide valuable insights to risk management and effective oversight of the Company’s growth strategy. Ms. Collins’s prior roles as an investment banker, private equity executive, public company audit committee member and her designation as an “audit committee financial expert” assist the Board and its Audit Committee with the oversight of financial and accounting issues.

Professional Highlights

• | Since 2007, has been the President of Cambium, LLC, a business and financial advisory firm serving small and medium-sized businesses. |

• | Currently serves on the board of directors of Health Care Service Corp., the largest customer-owned health insurer in the United States and an independent licensee of the Blue Cross and Blue Shield Association, and Ulta Beauty, Inc. (NASDAQ: ULTA), a beauty products retailer. Also serves on the board of directors of Strategic Marketing, Inc., a privately-held company. |

• | Prior public company director experience includes Integrys Energy Group, Inc. (NYSE: TEG) (from 2011 to 2015), Molex, Inc. (NASDAQ: MOLX) (from 2003 to 2013), Bucyrus International, Inc. (NASDAQ: BUCY) (from 2009 to 2011), Coldwater Creek, Inc. (NASDAQ: CWTR) (from 1997 to 2004), and CDW Corp. (NASDAQ: CDW) (from 1996 to 2007). |

• | In 1997, co-founded Svoboda, Collins L.L.C., a private equity firm, serving as Managing Director from 1998 through 2006. Has served as an Advisory Board Member for Svoboda Capital Partners LLC (successor to Svoboda, Collins) from 2007 through the present. |

• | Began her career with William Blair & Company, LLC, advancing to the position of Principal in the Corporate Finance Department. |

4

Other Leadership Experience and Service

• | Serves on the boards of a number of civic, philanthropic and other non-profit organizations, including the Erikson Institute (as Chairman), the Chicago Public Library Foundation, the Museum of Science and Industry, Navy Pier, Inc. (the non-profit maintaining and overseeing the redevelopment of Chicago’s Navy Pier) and WTTW Communications, Inc. (the public television network in Chicago). |

JAMES M. GUYETTE, Chairman of the Board

Age: 71

Director Since: 1990

Principal Occupation: Former Chairman, Chief Executive Officer and President, Rolls-Royce North America Inc.

Public Boards: The Priceline Group, Inc. (NASDAQ: PCLN)

Other Public Boards in Past 5 Years: Rolls-Royce plc (LSE: RR) (until May 2015)

Qualifications, Attributes and Skills

Mr. Guyette has extensive executive management experience involving complex business operations, with particular focus in corporate strategy, marketing, operations, risk management and corporate governance. As the former Chief Executive Officer and President of Rolls-Royce North America, he had overall management responsibility for businesses with nearly 8,000 employees and over 60 locations in the United States and Canada. In addition, Rolls-Royce’s status as a defense contractor has provided valuable insights to confronting cybersecurity challenges currently facing regulated industries, including the banking industry. His strong management skills, strategic expertise and significant executive and board leadership experience contribute to effective Board oversight of management plans, strategic direction and talent management and succession planning. Mr. Guyette’s service on the Board since our founding provides important historical insight to our Board and continuity of leadership.

Professional Highlights

• | Retired in May 2015 as Chairman, President and Chief Executive Officer of Rolls-Royce North America Inc., a subsidiary of Rolls-Royce plc (LSE: RR), where he also served as a director for many years. In leadership role at Rolls-Royce over 18 years, oversaw all Rolls-Royce companies and business units in North America, encompassing nearly 8,000 people at more than 60 locations throughout the U.S. and Canada. |

• | Previously, enjoyed a long and successful career with United Air Lines, Inc. In more than 28 years with the carrier, held a wide range of increasingly senior positions offering breadth and depth into all facets of airline management, including marketing, sales and daily operations. |

• | Currently the independent lead director of The Priceline Group, Inc. (NASDAQ: PCLN), a major online travel and restaurant reservation provider. |

Other Leadership Experience and Service

• | Served on the Board of Regents of St. Mary’s College until early 2017. |

CHERYL MAYBERRY MCKISSACK

Age: 61

Director Since: 2003

Principal Occupation: Founder and CEO, Nia Enterprises, LLC, an online research, marketing and digital consulting firm

Public Boards: Deluxe Corporation (NYSE: DLX)

Qualifications, Attributes and Skills

A leader of several corporate and entrepreneurial ventures, Ms. Mayberry McKissack’s experience gives her a unique perspective regarding the challenges of managing growth. This knowledge and experience is relevant to the oversight of the strategic direction of the Company. Ms. Mayberry McKissack also brings sales, marketing, entrepreneurial and technology experience, areas of experience less well represented in other Board members. Through her years of corporate board experience and ongoing educational focus, Ms. Mayberry McKissack has developed strong knowledge of corporate governance best practices of board effectiveness.

Professional Highlights

• | Founder and CEO of Nia Enterprises, LLC, a Chicago-based online research, marketing and digital consulting firm. |

• | From June 2016 to March 2017, served as Chief Executive Officer of Ebony Media Operations LLC, the leading African-American publishing, digital, mobile and events company connecting advertisers and consumers for over 70 years, consisting of global brands Ebony, Ebony.com and Jet.mag.com with over 10 million readers. |

5

• | From January 2013 to June 2016, served as Chief Operating Officer of Johnson Publishing Company (a predecessor to Ebony Media Operations) and President of its digital business unit, JPC Digital. |

• | Previously, served as a Worldwide Senior Vice President and General Manager for Open Port Technology and as Vice President for the Americas and a founding member of the Network Systems Division for 3Com (formerly U.S. Robotics). |

• | Since 2007, has served on the board of directors for Deluxe Corporation (NYSE: DLX), a business services and products provider for small businesses and financial services firms, currently serving on its finance and compensation committees. |

Other Leadership Experience and Service

• | Serves as a director of the University of Chicago Medical Center, the Shedd Aquarium, the Chicago Public Library Foundation and the Gaylord and Dorothy Donnelley Foundation. |

• | Previously served for ten years as an Associate Adjunct Professor of Entrepreneurship at the Kellogg School of Management at Northwestern University. |

JAMES B. NICHOLSON

Age: 73

Director Since: 2009

Principal Occupation: Chairman and Former Chief Executive Officer and President, PVS Chemicals

Public Boards: DTE Energy Co. (NYSE: DTE)

Qualifications, Attributes and Skills

Mr. Nicholson has a strong background in economics and finance, as well as experience in banking and financial services, including serving on bank and financial institution boards of directors. Mr. Nicholson’s significant business management and leadership experience gained from his long career at PVS Chemicals, a privately-held global manufacturer, distributor and marketer of chemicals, provides him with skills in strategic planning and operations and insight into the needs and issues facing our core client base of middle market commercial businesses. Additionally, his corporate board expertise from years of board service equip him with valuable governance insight and knowledge.

Professional Highlights

• | Chairman and former Chief Executive Officer and President of PVS Chemicals, a global manufacturer, distributor and marketer of chemicals based in Detroit, Michigan. |

• | Before joining PVS Chemicals in 1972, held positions with First National Bank of Chicago in London and Dublin. |

• | From April 2005 until October 2007, was chairman of the board of LaSalle Bank Midwest, N.A., an affiliate of LaSalle Bank, N.A. |

• | Since 2012, has served on the board of directors of DTE Energy Co. (NYSE: DTE), an electric and gas utility based in Detroit, Michigan. |

• | Served on the board of directors of the Amerisure Companies, a commercial property and casualty insurer, from 1982 until 2016, including as chairman from 1996 through the end of his tenure. |

Other Leadership Experience and Service

• | Recognized civic leader in his hometown of Detroit, Michigan, serving on the boards or advisory councils of a number of civic, philanthropic and other non-profit organizations. |

• | Among others, currently serves on the boards of the Detroit Symphony Orchestra (Chairman Emeritus), the Detroit Economic Club, the Community Foundation for Southeastern Michigan (Chairman) and Detroit Public Television (Chairman Emeritus). |

• | Also is a member of the advisory council of the University of Chicago Graduate School of Business. |

RICHARD S. PRICE

Age: 69

Director Since: 2015

Principal Occupation: Chairman and Chief Executive Officer, Mesirow Financial Holdings, Inc.

Qualifications, Attributes and Skills

Mr. Price’s decades of experience as an executive, including as chairman and chief executive officer for the past five years, of a large, Chicago-based independent diversified financial services firm provides him with extensive knowledge of the financial services industry and deep insight and connections in the middle market business community in Chicago and the Midwest. In this role, he has dealt with a wide range of issues important to our company, including corporate strategy and strategic growth,

6

mergers and acquisitions, risk management, talent development and overall governance. Mr. Price’s executive responsibilities also provide him insight into the needs and issues facing our core client base of middle market commercial businesses.

Professional Highlights

• | Chairman and Chief Executive Officer of Mesirow Financial Holdings, Inc., a privately-held diversified financial services firm headquartered in Chicago, a position held since March 2011. |

• | Joined Mesirow Financial in 1972 and has held a number of positions, including president and chief operating officer (from March 2006 through March 2011) and president of its Insurance Services Division for 25 years. |

Other Leadership Experience and Service

• | Actively involved as a board or advisory member with a wide array of civic, philanthropic and other nonprofit organizations in the Chicago area. |

• | Among others, currently serves on the boards of World Business Chicago (appointed by Mayor Rahm Emanuel), Rush University Medical Center, Big Shoulders Fund, and Illinois Sports Facilities Authority. |

• | Member of the United States Holocaust Memorial Museum Council (appointed by former President Barack Obama). |

EDWARD W. RABIN

Age: 70

Director Since: 2003

Principal Occupation: Former President, Hyatt Hotels Corporation

Public Boards: Sally Beauty Holdings Inc. (NYSE: SBH)

Other Public Boards in Past 5 Years: WMS Industries, Inc. (NYSE: WMS) (through October 2013)

Qualifications, Attributes and Skills

With significant executive management and board of director experience, Mr. Rabin brings valuable knowledge and perspective to the Board. He has public company experience on audit, compensation and corporate governance committees, both at the Company and on other public boards. Mr. Rabin also has significant experience in real estate, mergers and acquisitions and corporate strategy gained from his tenure as an executive at Hyatt Hotels Corporation, one of the largest owners and operators of hotels in the world.

Professional Highlights

• | Served as President of Hyatt Hotels Corporation from 2003 until retirement in 2006. Also served as its Chief Operating Officer beginning in 2000. |

• | Currently serves as a director of Sally Beauty Holdings Inc. (NYSE: SBH), a beauty supply distributor, serving on its compensation committee (as chairman) and nominating and corporate governance committee. Also currently serves on the board of advisors of First Hospitality Group, Inc., a privately held company engaged in the ownership, development and management of hotels nationally. |

• | Previously served as a director of WMS Industries, Inc. (NYSE: WMS), a manufacturer and distributor of gaming machines, serving as lead director and as a member of its audit, compensation and ethics committees until the company was acquired in October 2013. |

LARRY D. RICHMAN

Age: 64

Director Since: 2007

Principal Occupation: President and CEO, PrivateBancorp, Inc. and The PrivateBank and Trust Company

Qualifications, Attributes and Skills

Mr. Richman brings to the Company over 35 years of banking experience and leadership skills gained from his employment at large, sophisticated financial institutions. Long recognized as a leading commercial banker in Chicago and the Midwest, in his role as CEO, Mr. Richman provides valuable insight to Board strategy discussions and all aspects of the Board’s business, commercial lending and risk management oversight. Since joining the Company in 2007 as our CEO, Mr. Richman has led the strategic transformation of our Company with the vision to be the premier commercial bank in the Midwest. The Board believes that the CEO should also serve as a director and act as a liaison between directors and management.

Professional Highlights

• | Joined the Company and the Bank in 2007 as our President and CEO and as a director. |

7

• | Prior to joining us, served as President and CEO of LaSalle Bank, N.A., and President of LaSalle Bank Midwest, N.A., until their acquisition by Bank of America Corporation. |

• | Began career with American National Bank and joined Exchange National Bank of Chicago in 1981, which was acquired by LaSalle Bank in 1990. |

Other Leadership Experience and Service

• | Involved in many civic and philanthropic organizations in Chicago, including serving on the boards of World Business Chicago (appointed by Mayor Rahm Emanuel), the Museum of Science and Industry, Northwestern Memorial Hospital, Big Shoulders Fund and participating as a member of the Economic Club of Chicago and the Executives Club of Chicago. |

• | Also a member of the Dean’s Advisory Council at Indiana University’s Kelley School of Business and a life member of the Global Advisory Board for the Kellogg School of Management at Northwestern University. |

WILLIAM R. RYBAK

Age: 66

Director Since: 2003

Principal Occupation: Former Executive Vice President and CFO, Van Kampen Investments, Inc.

Public Boards: Mutual funds in the Calamos Investments family; mutual funds in the Jackson National Life Funds family

Qualifications, Attributes and Skills

Mr. Rybak’s background as both an audit partner at a major accounting firm and a chief financial officer of a financial services firm provides him with in-depth financial knowledge and insight. He brings this valuable insight, as well as financial reporting and audit expertise and analytical and assessment skills, to enhance board oversight. Additionally, Mr. Rybak’s risk management background and knowledge of risk management functions position him to enhance the effectiveness of the Board’s risk oversight. Mr. Rybak’s prior roles as an audit partner and chief financial officer and his designation as an “audit committee financial expert” assist the Board and its Audit Committee with the oversight of financial reporting, accounting and internal audit issues.

Professional Highlights

• | From 1986 until retirement in 2000, held the position of Executive Vice President and CFO of Van Kampen Investments, Inc., a mutual fund company that was acquired by Morgan Stanley in 1996. |

• | Prior to Van Kampen, was a Partner at the accounting firm KPMG LLP (formerly Peat, Marwick, Mitchell & Co.). He is a Certified Public Accountant. |

• | Currently a member of the board of trustees of mutual funds in the Calamos Investments family and Jackson National Life Funds family. |

• | Previously served as a director of Alliance Bancorp, Inc. and its predecessor, Hinsdale Financial Corp., publicly traded banking organizations based in the Chicago area, from 1986 until 2001, and as a member of the board of directors of Howe Barnes Hoefer & Arnett, Inc., a broker-dealer firm later acquired by Raymond James Financial, Inc. |

Other Leadership Experience and Service

• | Serves on the board of directors of Christian Brothers Investment Services, Inc., which provides investment management services to Catholic institutions worldwide. Currently serves as Chairman (since February 2016). |

• | Also serves on the board of trustees of Lewis University. |

ALEJANDRO SILVA

Age: 69

Director Since: 2005

Principal Occupation: Former Chairman and CEO, Evans Food Group, Ltd.

Other Public Boards in Past 5 Years: Walgreens Boots Alliance, Inc. (NASDAQ: WBA) (through May 2015)

Qualifications, Attributes and Skills

A successful entrepreneur as a founder and former Chairman and CEO of Evans Food Group, Mr. Silva has valuable experience in the areas of strategy, operations and managing growth, which contributes to his effectiveness on the Board. Mr. Silva’s public company board experience and leadership in the community are also valuable to the Company and the Board.

Professional Highlights

• | From 1985 until its acquisition in 2016 by a private equity group, served as Chairman and CEO of Evans Food Group, Ltd., a privately-held snack food manufacturer and distributor and one of the largest Hispanic-owned companies in the Chicago area. Currently remains a director of the company. |

8

• | Served as a director of Walgreens Boots Alliance, Inc. (NASDAQ: WBA) (and its predecessor, Walgreen Co. (NASDAQ: WAG)) from January 2008 through May 2015, most recently serving on its audit and nominating committees. |

Other Leadership Experience and Service

• | Recognized civic leader in Chicago, serving on the boards of, among others, Rush University Medical Center, Chicago Transit Authority, The Field Museum, Chicago Symphony Orchestra and Ravinia Festival. |

• | Also very active in Latino community affairs, serving as chairman of the advisory board of Chicago of Nafinsa ProMexico, the largest development bank in Mexico, and on the board of ABC Holding, the second largest Sociedad Financiera de Objeto Limitado (a type of financial institution) in Mexico, which focuses on developing low income housing. |

EXECUTIVE OFFICERS

Certain information regarding our executive officers is included under the heading “Executive Officers” in Item 1 of the Original Form 10-K and the information therein is included herein by reference.

CODE OF ETHICS

We have adopted a Code of Ethics as required by the NASDAQ listing standards and the rules of the SEC. The Code of Ethics applies to all of our directors, officers, including our Chief Executive Officer, Chief Financial Officer, and Controller, and employees. The Code of Ethics is publicly available on our website at http://investor.theprivatebank.com under “Governance Documents.” If we make substantive amendments to the Code of Ethics or grant any waiver, including any implicit waiver, that applies to any of our directors or executive officers, we will disclose the date and nature of such amendment or waiver on our website or in a report on Form 8-K in accordance with applicable NASDAQ and SEC rules.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16 of the Securities Exchange Act of 1934, as amended, requires our directors and executive officers and certain other beneficial owners of our common stock to periodically file notices of changes in beneficial ownership of common stock with the Securities and Exchange Commission. To the best of our knowledge, we believe that for 2016 all required filings were timely filed by each of our directors and executive officers, except that the Form 5 we filed on behalf of Mr. Bobins in February 2017 to report a charitable gift of shares in 2016 was filed one business day late due to an unexpected administrative issue with his SEC filing codes.

AUDIT COMMITTEE

The Audit Committee is comprised solely of directors who have been determined by the Board to be independent under the listing standards of The Nasdaq Stock Market, and includes Messrs. Rybak (Chair), Guyette, Rabin, Silva and Ms. Collins. Additionally, all members of the Audit Committee satisfy the heightened independence requirements applicable to audit committee members under SEC rules. The Board, consistent with the recommendation of the Corporate Governance Committee, has determined that Mr. Rybak and Ms. Collins each qualify as an “audit committee financial expert.”

The Audit Committee charter can be found on our website at http://investor.theprivatebank.com under “Governance Documents.” The charter describes the primary oversight responsibilities of these committees.

• | Major Risks Overseen: financial statements, systems and reporting; internal controls; internal and external audit; legal and compliance risk; related party transactions. |

• | Oversees the internal audit function; Director of Internal Audit reports directly to the Committee. |

• | Oversees the independent credit review function, which is designed to ensure credit policies and processes are functioning effectively and risk ratings and regulatory credit classifications are accurate. |

• | Receives reporting on the internal audit program, credit review program and compliance program no less frequently than quarterly. |

9

ITEM 11. EXECUTIVE COMPENSATION

COMPENSATION COMMITTEE REPORT

The following Compensation Committee Report shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended (the “Acts”), except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

The Compensation Committee of the Board of Directors of the Company oversees the Company’s compensation program on behalf of the Board. In fulfilling its oversight responsibilities, the Compensation Committee reviewed and discussed with management the following Compensation Discussion and Analysis.

In reliance on the review and discussions referred to above, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in this Amendment No. 1 to the Annual Report on Form 10-K for the fiscal year ended December 31, 2016.

Compensation Committee

Edward W. Rabin (Chair)

Michelle L. Collins

Cheryl Mayberry McKissack

James B. Nicholson

COMPENSATION DISCUSSION AND ANALYSIS

This section describes our executive compensation program, including 2016 compensation, for our named executive officers:

Larry D. Richman President and CEO

Kevin M. Killips Chief Financial Officer

Bruce R. Hague Head of National Commercial Banking and Regional Markets

Bruce S. Lubin Head of Illinois Commercial Banking

Karen B. Case Head of Commercial Real Estate

We present our Compensation Discussion and Analysis in the following sections:

Effect of Merger Agreement with CIBC | Summarizes the impact our June 29, 2016 merger agreement, as subsequently amended on March 30, 2017, with Canadian Imperial Bank of Commerce, or CIBC, and subsequent merger-related activities had on 2016 compensation. |

Pay for Performance Analysis | Summarizes 2016 operating performance and total stockholder return, our CEO’s 2016 pay, and key 2016 executive compensation decisions. |

Compensation Program Highlights | Indicates the compensation and compensation-related governance “best practices” we follow. |

What We Pay and Why We Pay It | Discusses our compensation philosophy, pay mix, the structure of our 2016 program and the rationales underlying the Compensation Committee’s 2016 pay decisions. |

How We Make Compensation Decisions | Describes the Committee’s procedures for making compensation analyses and decisions, including its use of an independent compensation consultant, how the Committee incorporates risk considerations in its incentive compensation decisions, how it defines our peer group and how it uses peer group data. |

10

Additional Information | Describes our clawback policies, employment agreements, practices regarding tax deductibility of compensation, the Committee’s consideration of say-on-pay votes and our investor outreach. |

Effect of Merger Agreement with CIBC

On June 29, 2016, we entered into an Agreement and Plan of Merger with CIBC and CIBC Holdco Inc., which was amended on March 30, 2017, pursuant to which CIBC agreed to acquire the Company in a stock and cash transaction. In this Compensation Discussion and Analysis, we refer to the Agreement and Plan of Merger, as amended, as the “merger agreement” and the transaction as the “merger.” If the merger agreement receives the requisite approvals of our stockholders and the U.S. and Canadian banking regulators, we currently expect the merger to be completed by the end of the second quarter 2017.

Our entry into the merger agreement in mid-2016 and the merger-related activities had the following impact on our compensation programs and compensation decisions for 2016:

• | Under the merger agreement, CIBC agreed that when determining the level of achievement against the pre-established performance metrics under the 2016 annual bonus program or the performance share unit (“PSU”) component of our long-term incentive plan, the Committee could adjust our results for costs, expenses and nonrecurring charges associated with the merger agreement and merger-related activities. The Committee made such adjustment in determining the corporate pool funding percentage under our 2016 annual incentive program. Such adjustments did not materially impact the corporate pool funding percentage and had no impact on the amounts earned under the PSU awards. |

• | Additionally, under the merger agreement, CIBC agreed that with respect to our outstanding PSUs that had performance periods that had not ended prior to the date of the merger agreement and that end prior to the closing, the Committee is permitted to certify the level of achievement of performance at the maximum level if the closing had not occurred by year-end 2016. This provision did not impact the Committee’s certification in February 2017 of performance under the PSUs granted in 2014 as the actual performance for the period 2014–2016 exceeded the maximum level. If the CIBC merger is completed, performance under our outstanding PSUs that were granted in 2015 and 2016 also will be certified at the maximum level prior to the closing in accordance with the merger agreement. |

• | In anticipation of the CIBC merger, the Committee eliminated the additional delayed settlement feature of time-vested restricted stock units (“RSUs”) granted to our executive officers as the mandatory deferral component of the 2016 annual bonus program, made annual awards under our long-term incentive plan in early 2017 entirely in the form of RSUs rather than PSUs, and made certain other changes to the terms of our equity awards. |

• | The negotiation of the merger agreement and merger-related activities required significant attention and focus of our CEO and certain other executive officers, which was in addition to these officers’ day-to-day obligations executing our strategic and business plans. The important contributions of our CEO and those executive officers to our successful entry into the merger agreement and the strong performance of our business were recognized in the compensation decisions made by the Committee. |

Information relating to amounts which may be payable upon or after the closing of the merger and the effect of the merger upon our compensation plans and programs may be found in our proxy statement for the special stockholders meeting schedule for May 12, 2017, which document we filed with the SEC on April 12, 2017.

Pay for Performance Analysis

Strong 2016 Performance

In 2016, in addition to their efforts and focus on the merger agreement and the merger-related activities, our senior leadership team successfully executed on our business plan, continuing our profitability and growth trends. 2016 performance highlights included:

• | The eighth consecutive year of improving our bottom line results while continuing our growth. |

• | Earnings per share were up 11% to $2.57 in 2016 from $2.32 in 2015 and net income increased 12% compared to 2015. |

• | We increased total loans by 13% and total deposits by 12% during 2016 to $15.1 billion and $16.1 billion, respectively. |

• | Credit quality remained strong, with our nonperforming loans representing 0.56% of total loans at year end. |

11

• | Our return on average assets (“ROA”) for 2016 was 1.13%, consistent with 2015 and fourth highest among our 20 peers. |

• | Our return on average common equity (“ROE”) for 2016 was 11.4%, also fourth highest among our 20 peers. |

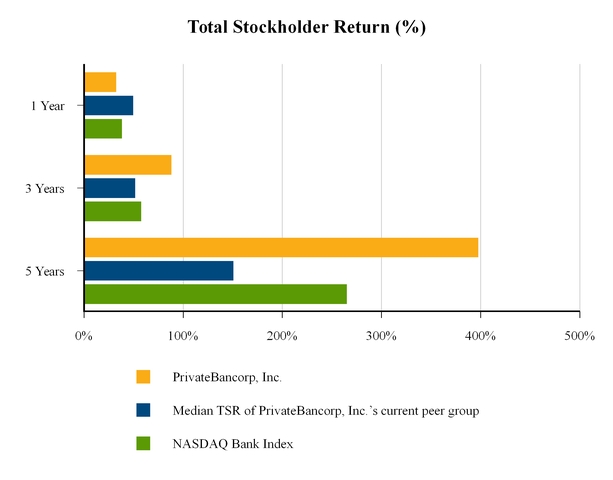

Our Total Stockholder Return

Total return to our stockholders (“TSR”) during 2016 was 32.2%. Over the past three years, our TSR was 87.9%, compared to the 51.5% median three-year TSR of our peer group.

* | The published industry total return index used for this comparison is the Center for Research in Security Prices index for NASDAQ Bank Stocks. TSR is the total return of common stock over a specified period, expressed as a percentage (calculated based on the change in stock price over the measurement period, assuming reinvestment of dividends). |

Source: SNL

2016 CEO Compensation

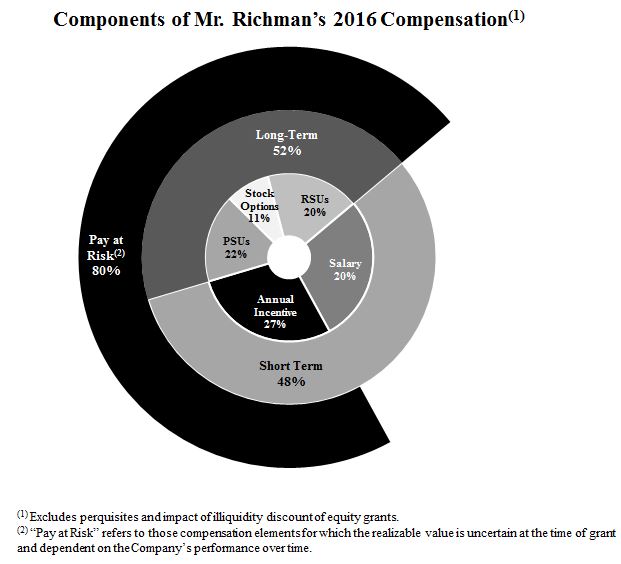

In keeping with our pay for performance philosophy and in recognition of Mr. Richman’s contributions to a successful 2016, including his leadership in negotiating our merger agreement with CIBC and merger-related activities, as well as his overall guidance of our long-term strategies, which we believe have contributed to continued growth, the Committee awarded him increased compensation for 2016 compared to the prior year. As in 2015, the Committee structured Mr. Richman’s 2016 pay to include a large proportion of variable performance incentives. We believe these incentives place an appropriate balance on both our short-term and long-term success, in alignment with stockholder interests. The components of his 2016 pay, as awarded, are graphically reflected below and fully explained in “—What We Pay and Why We Pay It.”

12

For 2016, Mr. Richman received a merit-based 2016 base salary increase of $30,000 compared to the prior year. In approving the increase, the Committee recognized Mr. Richman’s effective leadership, performance against his personal objectives and the recent growth of the company. The Committee also considered internal pay equity and decided to increase Mr. Richman’s base salary by a percentage that was no more than the percentage increase in aggregate salaries for the other executive officers as a group.

Mr. Richman’s annual incentive target opportunity for 2016 was 125% of his base salary, a level set by the terms of his employment agreement and unchanged since 2007. He earned a 2016 incentive award of approximately 180% of base salary. In approving this award, the Compensation Committee evaluated the Company’s above-target performance against the Company-wide annual bonus plan metrics, Mr. Richman’s contribution to accomplishing the pending merger and other merger-related activities and his individual performance relative to the Company’s and his personal strategic goals. Related to Mr. Richman’s success in implementing the company’s strategies, the Committee also considered the Company’s growth and profitability trends over the past few years under Mr. Richman’s leadership. The dollar value of this 2016 annual incentive award was $1.85 million. As in prior years, 75% of this incentive was paid in cash and 25% was reflected in an award of restricted stock units (“RSUs”) granted in February 2017. Similar to 2015, the portion of Mr. Richman’s 2016 annual incentive paid in equity is not reflected in the Summary Compensation Table for 2016 but will appear in the table in 2017 because it was granted in February 2017. Finally, in early 2016, the Committee awarded Mr. Richman a 2016 long-term equity incentive award of $2.2 million for the reasons described below under “—What We Pay and Why We Pay It – Long Term Incentives.”

Mr. Richman’s total 2016 pay compared to the prior year increased 18% as set forth in the table below. We note that the amounts in the table below differ from the amounts in the Summary Compensation Table due to SEC reporting rules which require us to report equity in the Summary Compensation Table in the year granted, regardless of the performance year to which the awards relate. The reporting rules also require us to report equity in amounts that oftentimes reflect accounting values based on required calculations and certain assumptions, rather than actual dollar amounts as approved by the Compensation Committee.

13

Comparison of 2015 and 2016 CEO Compensation | |||||||

Base Salary | Annual Incentive | Long-Term Equity Incentive | TOTAL | ||||

2015 CEO Compensation | $1,000,000 | $1,700,000 | $1,600,000 | $4,300,000 | |||

2016 CEO Compensation | $1,030,000 | $1,850,000 | $2,200,000 | $5,080,000 | |||

Key 2016 Compensation Decisions

We continued our emphasis on incentivizing and rewarding advancement of our longer-term strategic priorities in the 2016 executive compensation programs. The Committee believed that the 2015 executive programs were appropriately incentivizing executives while balancing short-term incentives with the long-term safety and soundness of the Company. As a result, other than certain metric changes in our annual incentive program, the Committee did not make significant changes to our 2016 programs from the prior year. The Committee did, however, take into account the efforts and favorable contributions of certain named executive officers relative the merger agreement as well as subsequent merger-related activities in its deliberations and determinations with respect to the final 2016 compensation of our executives. Specifically, the Committee made the key decisions in 2016 that are outlined below, each as discussed under “—What We Pay and Why We Pay It.”

Annual Incentive Plan

• | Our 2016 annual incentive plan continued to focus our executives on strategic imperatives to improve earnings, strengthen our balance sheet, increase fee income, and continue to develop an improved deposit funding base. The Committee chose metrics and assigned relative weightings to create balanced incentives among driving profitability and continuing efforts to develop appropriate funding sources, all while maintaining a strong balance sheet from both a credit quality and capital adequacy perspective. |

• | We exceeded target performance on all four performance metrics under our 2016 annual incentive plan, exceeding the “superior” performance level in three of the metrics. Based on the above-target performance for all four performance metrics, the Committee approved a corporate-wide 2016 bonus pool funding at 117.3% of target. |

• | We continued our historical practice of deferring 25% of each executive’s annual incentive in the form of RSUs. These RSUs granted in February 2017 vest ratably over three years. In accordance with the merger agreement and in a departure from recent practice, the shares of stock underlying the RSUs will be distributed ratably on the vesting dates. In recent years, the shares of stock underling the RSUs were distributed to executives three years after the last vesting date. |

Long-Term, Performance-Based Focus/Aligning Executives’ and Stockholders’ Interests

• | We increased the portion of our named executive officers’ aggregate 2016 total direct pay that is variable pay at risk from 71% in 2015 to 73% in 2016. |

• | We maintained the mix of executives’ 2016 long-term equity awards at 50% performance share units (“PSUs”), 25% RSUs and 25% stock options to continue to emphasize performance-based compensation. Unlike RSUs which vest over time based solely on continued employment at a quantity equal to the number granted, the vesting and ultimate value of the PSUs depends on our three-year performance against two metrics as described in the immediately following bullet. |

• | Consistent with our 2015 PSU design, the PSUs granted in early 2016 provided that the amount earned at the end of the performance period will depend on both our cumulative earnings per share against a three-year target and our stock price performance relative to other banks within a pre-selected reported banking company index. Shares earned based on our 2016-2018 cumulative EPS performance can range from 0% to 150% of target and those earned shares will then be adjusted up or down by 33% based on our three-year relative TSR performance. |

• | As in 2015, earned 2016 PSUs will not settle for two years after vesting, thereby reducing costs (due to a lack-of-marketability accounting discount), reinforcing long-term alignment, balancing risk and providing us the opportunity to recoup (clawback) some or all of the value of the PSUs if an executive engaged in inappropriate or excessively risky behavior. |

14

• | The RSUs granted to our executives as part of their 2016 long-term incentives in early 2016 vest ratably over three years. However, to enhance long-term alignment, awards to executives other than Mr. Richman include a delayed settlement feature under which, for all executives other than our CEO, the shares underlying the RSUs will generally not be distributed to the executives until early 2022 (three years after the final tranche vests). Settlement of the RSUs granted to Mr. Richman in early 2016 as part of his long-term incentive provide similar long-term alignment, with a delay of distribution until he resigns or otherwise separates from the Company for any reason or, if earlier, until the tax benefits associated with such distribution of the vested shares would not be limited. |

Risk Considerations

• | During 2016, the Committee enhanced and formalized its consideration of risks relating to incentive compensation and believes it has structured an executive compensation program with incentives that appropriately balance risk and financial results in a manner that does not encourage executives to expose the Company to imprudent or excessive risks. For more information, see “—How We Make Compensation Decisions – Risk Considerations.” |

15

Compensation Program Highlights

Our executive compensation program features many “best practices.”

Practices We Followed in 2016 | |

ü | Pay for performance – A significant percentage of total 2016 compensation for executives (80% for our CEO) is variable “pay at risk,” the value of which will depend upon Company performance and/or stock price performance. |

ü | Linkage between performance measures and strategic objectives – Performance measures for incentives are linked to financial plans, profitability and other strategic objectives we believe will enhance long-term stockholder value. |

ü | Post-vesting delayed settlement for executive officers – To enhance alignment with creation of long-term stockholder value, assist in balancing risk and reward and manage expense associated with long-term incentives, we have embedded a significant post-vesting delayed settlement feature in our awards. Shares underlying RSUs granted in 2016 to executive officers generally will not be settled (or distributed to them) until early 2022 (three years after the final tranche vests) so that the executives may not sell such shares until approximately six years from grant. Similarly, 2016 PSUs earned after a three-year performance period are not settled (and therefore the underlying shares of common stock may not be sold) for an additional two years after vesting. In connection with the merger agreement, the awards we granted in early 2017 did not include any post-vesting delayed settlement feature. |

ü | Clawback policies – We have the right to recoup annual and long-term incentive compensation from our executive officers and others. See “—Additional Information – Clawback Policies” below. |

ü | Periodic compensation risk reviews – The Committee periodically (but at least annually) reviews the risks associated with behaviors incented by our compensation plans as well as related mitigating controls to confirm that our compensation policies and practices are not reasonably likely to have a material adverse effect on the Company. |

ü | Independent compensation consultant – The Committee retains an independent compensation consultant to review and advise on our executive compensation program and practices. |

ü | “Double trigger” for executives’ severance – Our executives’ employment agreements entitle them to severance benefits upon a change in control, but only if they are involuntarily terminated without cause or they voluntarily resign for good reason within two years following, or six months prior to, the change in control. In the case of Mr. Richman, “good reason” includes his voluntary termination of employment during the 90-day period beginning on the first anniversary of a change in control; however, Mr. Richman agreed to relinquish this right under a new employment agreement with CIBC, which will become effective upon consummation of the merger. |

ü | No automatic vesting of equity on a change in control – Under our equity plan, if outstanding awards are assumed or replaced with an award of equal or greater value upon a change in control, and meet certain other requirements, such awards will not vest automatically but will remain outstanding. However, if within two years of the change in control, an employee is involuntarily terminated other than for cause, then his or her unvested awards vest fully upon such termination. |

ü | Robust stock ownership guidelines – The Board believes that significant stock ownership by executives and directors aligns their interests with stockholders and promotes long-term business objectives. All of our executives and directors have exceeded the guideline level applicable to them other than our three newest directors and one of our executive officers (who is not a named executive officer), each of whom is still in the accumulation period. See “Corporate Governance—Stock Ownership Guidelines.” |

ü | Anti-Hedging & Pledging Policy – The policy, applicable to directors and executive officers, prohibits both hedging and pledging of our stock. None of our executives or directors has outstanding hedges or pledges of our stock. See “Corporate Governance—Anti-Hedging & Pledging Policy.” |

Consideration of Results of 2016 Stockholder Advisory Vote on Executive Compensation

At our 2016 annual meeting of stockholders, 98.1% of votes were cast in support of the proposal to approve, on an advisory basis, our executive compensation, compared to 97.5%, 95.2%, and 94.6% in 2015, 2014 and 2013, respectively. The Committee considers the results of annual “say-on-pay” votes among many other factors in discharging its responsibilities. In recognition of the substantial stockholder approval of our executive compensation in recent years, we did not make significant changes to our 2016 executive compensation programs.

16

What We Pay and Why We Pay It

Executive Compensation Philosophy

Decisions regarding the compensation program design for our executives, as well as individual pay decisions, are made in the context of our compensation philosophy, which seeks to link executive compensation to our short-term and long-term financial success and strategic priorities. We believe our executive compensation program should:

• | Enable us to appropriately compete for and retain talented employees; |

• | Reward performance and focus on long-term stockholder value creation by emphasizing variable pay; |

• | Reflect an appropriate mix of cash and equity; |

• | Reflect good corporate governance and compensation practices; |

• | Take into consideration an assessment of the risk profile of our compensation programs to reduce unnecessary or excessive risks and to confirm that any such risks are not reasonably likely to have a material adverse effect on us; |

• | Link rewards to behaviors that are demonstrative of our values and further our strategic objectives, while also taking into account the long-term safety and soundness of our company; |

• | Consider the risk-management effectiveness of our executives; and |

• | Contain appropriate risk clawbacks. |

17

Summary of the Elements of Our 2016 Executive Compensation Program

The table below summarizes the elements of our 2016 executive compensation program. Approximately 80% of our CEO’s and 68% of the other named executive officers’ aggregate total 2016 direct compensation was variable and at risk, with 52% and 37%, respectively, of the total in the form of long-term incentive compensation.

Element | Why We Pay this Element | How Size is Determined/Links to Performance | ||||

Fixed | Base Salary | Fixed pay for knowledge, skills and abilities | Ÿ | Set upon an executive’s hire at competitive levels in consideration of knowledge, skills, abilities, experience and job scope. | ||

Ÿ | Executive salaries are reviewed annually to consider merit increases and market adjustments. This review includes an assessment of compensation survey data and comparative proxy peer group information. Comparative salary information is only one among several factors used to set salaries. | |||||

Variable | Annual Incentive | Drives the achievement of key business results as determined by the Board | Ÿ | Annual incentive targets (expressed as a percentage of base salary) are set forth in each executive’s employment agreement. | ||

Ÿ | Actual payouts are generally based on the Company’s performance against metrics chosen to drive our strategic priorities, individual performance, performance of the business unit or support group overseen by that executive, individual contributions to the Company’s strategic progress, an assessment of competitive pay practices and an assessment of various risk matters. | |||||

Ÿ | 75% of the award paid in cash as an annual incentive and 25% deferred in the form of RSUs that vest ratably over three years. | |||||

Long-Term Equity Awards | Ÿ | Motivates and rewards behaviors critical to our long-term success | 2016 Long-Term Incentive Comprised of Three Vehicles – Aggregate dollar value of the long-term awards determined in consideration of Company performance trends, individual and business unit performance and competitive market practices | |||

PSUs – 50% of each executive’s 2016 long-term equity award | ||||||

Ÿ | Number of shares to be earned is based in part on three-year cumulative EPS (2016-2018). PSUs will convert into common stock at 0-150% of target level based on performance against a pre-determined cumulative EPS metric. After assessment of EPS performance against that metric, the number of shares to be issued upon settlement will be further adjusted by reference to a total stockholder return factor that can range from 0.67 to 1.33 based on our three-year TSR during the performance period relative to the banks in the KRX index. | |||||

Ÿ | Aligns executives’ interests with long-term stockholder value | |||||

Ÿ | Delayed settlement in common stock in 2021 (two years after vesting), subject to any application of the PSUs’ clawback provisions. | |||||

Ÿ | Encourages retention through the use of both multi-year performance-based and time-based vesting schedules, as well as delayed settlement after vesting for RSUs and PSUs | |||||

RSUs – 25% of each executive’s 2016 long-term equity award | ||||||

Ÿ | Three-year ratable vest. | |||||

Ÿ | Delayed settlement feature under which executive officers (other than our CEO) will generally not receive the underlying shares until 2022 (three years after the last vesting date). The CEO will generally not receive the underlying shares until he resigns or otherwise separates from the Company. | |||||

Options – 25% of each executive’s 2016 long-term equity award | ||||||

Ÿ | Cliff vest 100% in 2019, three years after grant. | |||||

Ÿ | Balances risk | |||||

18

Base Salary

In approving executives’ salaries for 2016, the Committee considered competitive pay data and Mr. Richman made recommendations for merit and market adjustments for the other executives. Executive salary adjustments (in the aggregate relating to merit-based increases for all executive officers other than Mr. Richman) were managed to 3.2%, substantially in line with the Company-wide level. If any executive’s base salary after the recommended base salary increase was not firmly within the 50th to 75th percentile of a broad market salary range for his or her position, then that executive also received a market-based adjustment. For all executive officers other than Mr. Richman, market-based adjustments ranged from 1.4% to 7.4%. With respect to Mr. Richman, the Committee recognized his effective leadership, performance against his personal objectives and recent growth of the Company. The Committee also considered that while the Section 162(m) limit on the deductibility of Mr. Richman’s salary was a consideration, the Committee’s goal was to approve a 2016 base salary that, in light of all factors, was appropriate. Finally, the Committee considered internal pay equity and decided to increase Mr. Richman’s base salary by no more than the 3.0% merit-based increase in the other executive officers’ base salaries, in the aggregate. Based on these factors, the Committee approved the following base salaries:

Name | 2015 Base Salary (1) | 2016 Base Salary(2) | ||||||

Larry D. Richman | $ | 1,000,000 | $ | 1,030,000 | ||||

Kevin M. Killips | 545,000 | 560,000 | ||||||

Bruce R. Hague | 500,000 | 512,500 | ||||||

Bruce S. Lubin | 495,000 | 510,000 | ||||||

Karen B. Case | 410,000 | 450,000 | ||||||

(1) Effective March 1, 2015.

(2) Effective March 1, 2016.

2016 Annual Incentive

Under our annual executive incentive program, executives’ annual incentive payouts are determined formulaically by the Committee as the product of (a) 2016 base salary, (b) the target bonus percentage, as set forth in each executive’s employment agreement, (c) the corporate pool funding percentage and (d) a performance factor of 125% (to set the maximum bonus opportunity for exceptional performance) or such lower amount as determined by the Committee based on its evaluation of the performance of each executive and any business unit or support group he or she oversees as well as any other considerations deemed appropriate by the Committee. In this way, the Committee can use its negative discretion to establish bonuses that are above or below target, but always below the maximum opportunity set within the program’s structure. For 2016, 75% of the annual incentive was paid in cash and 25% was deferred in the form of grants of RSUs that vest ratably over three years. The annual incentive amounts earned by our named executive officers for 2016 performance were as follows:

Name | Target Annual Incentive Opportunity, as a % of 2016 Base Salary (%) (1) | 2016 Annual Incentive Award Allocation ($) | 2016 Annual Incentive Award Allocation, as a % of 2016 Base Salary (%) | ||||||

Larry D. Richman | 125 | 1,850,000 | 180 | ||||||

Kevin M. Killips | 90 | 700,000 | 125 | ||||||

Bruce R. Hague | 110 | 625,000 | 122 | ||||||

Bruce S. Lubin | 90 | 625,000 | 123 | ||||||

Karen B. Case | 90 | 594,000 | 132 | ||||||

(1) Per employment agreement.

Corporate Bonus Pool Metrics

Under the 2016 annual incentive program, a Company-wide incentive pool funding percentage was calculated based on Company achievement against various pre-established forecasts that aligned with our 2016 operating plan. For 2016, the metrics and

19

weightings were generally the same as those used in the 2015 program. The 2016 metrics were established to motivate and reward performance aligned with our goals, which included a focus on maintaining good credit quality and improving our deposit funding base. The table below sets forth each metric, performance bands and actual performance levels approved by the Committee.

2016 Annual Corporate Incentive Program | ||||||||||||||||

Metric Weighting | Threshold | Target | Superior | Maximum | 2016 Actual | |||||||||||

Pool Funding Percentage | 40% | 100% | 125% | 150% | 117.3 | % | ||||||||||

2016 Corporate Bonus Pool Metrics: (Dollars in millions except per share amounts) | ||||||||||||||||

Diluted earnings per share(1) | 50% | $1.76 | $2.50 | $2.81 | $2.97 | $2.62(1) | ||||||||||

Average criticized loans as a percentage of average loans | 15% | 3.45 | % | 2.77 | % | 2.43 | % | 2.02 | % | 2.41 | % | |||||

Average non-brokered deposits(2) | 20% | $8,387 | $8,937 | $9,166 | $9,338 | $9,378 | ||||||||||

Total non-interest income, excluding mortgage banking revenue and security gains/losses | 15% | $95.9 | $115.3 | $123.4 | $132.0 | $130.8(1) | ||||||||||

(1) Adjusted to exclude merger-related costs and expenses. See discussion below this chart for more information.

(2) Calculated as average total deposits less: (a) average brokered deposits, (b) average cash sweep program deposits and any future deposits re-classified as program deposits (as described in our Form 10-K for the year ended December 31, 2016); (c) average public funds deposits; (d) average deposits in our Palladian deposit service; (e) average deposits from our top 20 large clients (clients with deposits over $50 million at the end of 2015 not included in (a), (b) or (c) above); (f) deposits of new customers in 2016 that average in excess of $50 million for 2016; and (g) deposits of existing customers as of the end of 2015 that average in excess of $75 million in 2016 and are not otherwise included in (a), (b), (c) or (e) above.

Each metric contributed to corporate bonus pool funding independently, provided that if EPS did not reach the “superior” level, then none of the remaining metrics could fund above 125%. Performance below threshold for any metric would result in 0% funding for that metric. Performance levels for each metric were based upon our 2016 Board-approved operating plan which represented projected performance based upon management’s internal budgeting and strategic initiatives for the year. Execution at levels consistent with our 2016 internal operating plan would result in funding of the 2016 bonus pool at 100% of target.

In February 2017, the Committee approved a 117.3% funding for the corporate bonus pool based on formulaic calculations, reflected in the table above. In accordance with the merger agreement with CIBC, the Committee adjusted earnings per share to exclude merger-related costs. The Company’s GAAP diluted EPS for 2016 was $2.57 and its GAAP non-interest income was $147.8 million (or $130.8 million excluding securities gains of approximately $1.1 million and mortgage banking revenue of approximately $15.9 million).

Determination of Final 2016 Annual Incentive Amount for Our CEO and Named Executive Officers

In exercising its discretion on final annual incentive award amounts, the Committee consulted with the Board regarding its assessment of Mr. Richman’s performance and considered Mr. Richman’s recommendations regarding other executive officers. Mr. Richman’s recommendations reflected the corporate-wide bonus pool funding percentage discussed above as well as his assessment of each executive’s individual and business unit or functional group performance, his or her relative contributions toward Company-wide 2016 performance and individual risk-management effectiveness. Mr. Richman also considered any specific risk and compliance matters relating to each executive’s 2016 performance as assessed by the Company’s Risk department balanced by any mitigating actions taken by the respective executives relating to such matters, the relative level of significance and impact on the Company of the risks considered and other counterbalancing contributions of such executive during the year.

In assessing Mr. Richman’s performance and determining his final 2016 annual incentive award, the Committee evaluated the Company’s performance against the corporate-wide annual bonus plan metrics, the strength of the entire executive team which was hand-picked, and is overseen by, Mr. Richman, as well as his individual performance relative to the Company’s and his personal strategic goals. The Committee also considered Mr. Richman’s success in guiding the Company to execution of the merger agreement with CIBC and merger-related activities, as well as in maintaining the Company’s growth and profitability

20

trends over the past few years. As a result, the Committee awarded Mr. Richman an above-target annual incentive of $1.85 million.

With respect to the other named executive officers, Mr. Richman’s evaluation noted that each was a strong performer and contributor to the senior leadership team, noting where applicable, significant contributions to the merger-related activities. Mr. Richman provided the Committee with his recommendation of an annual incentive award for each of the named executive officers, differentiating the amounts based on line of business performance, contributions to strategic initiatives and other accomplishments of each executive, balanced by a risk-based assessment.

The decisions regarding Mr. Killips reflect the Committee’s view that he is a strong contributor with respect to financial management and risk oversight, as well as the strategic direction of the Company. The Committee also took into account that Mr. Killips oversees not only the finance function, but also operations and information technology. Additionally, he provided significant contributions to merger-related activities during 2016, both during the due diligence, analysis and negotiation stages and in connection with integration planning. Consistent with Mr. Richman’s recommendation, the Committee also factored into its recommendation the input of the Company’s Risk and Compliance departments regarding the improvement in performance of the units overseen by Mr. Killips with respect to risk control and compliance responsibilities, including in remediating outstanding identified issues.

Regarding Mr. Hague, the Committee’s annual incentive decision took into account the continued strong overall financial performance of the National Commercial Banking line of business that he oversees, including exceptional performance against loan and deposit goals, operating profit and net income that exceeded targets, greater than 10% year-over-year growth in net income and strong credit quality during the year. In line with Mr. Richman’s recommendations, the Committee also considered the strong referral business that National Commercial Banking generated for other business units in the Bank, which included the two largest referral relationships during 2016. Cross-selling products and services is one of our key strategic objectives. The Committee also took into account the strong performance of both the Capital Markets and Syndications line of businesses that are overseen by Mr. Hague, which generate non-interest income for the Company and provide sophisticated product capabilities to our middle-market commercial banking clients.

For Mr. Lubin, the Committee considered the continued strong financial performance and magnitude of the Illinois Commercial Banking line of business that Mr. Lubin oversees, as well as Mr. Lubin’s leadership over a core deposit gathering initiative that yielded substantial results in 2016. In line with Mr. Richman’s recommendations, the Committee also considered Mr. Lubin’s leadership efforts in implementing a customer relationship management system and improving relationship profitability in his line of business.

With respect to Ms. Case, the Committee’s decision reflected the exceptional 2016 performance of the Company’s Commercial Real Estate (“CRE”) line of business that she oversees. The strong CRE performance included exceptional year-over-year loan and deposit growth, respectively, with such growth constituting a significant portion of the Company’s overall loan and deposit growth in 2016. Ms. Case’s line of business also experienced very strong asset quality metrics in addition to the substantial loan growth. In line with Mr. Richman’s recommendations, the Committee also considered Ms. Case’s leadership in managing the CRE line of business to achieve certain risk management objectives and in building and retaining a strong team in her business.

Based on each of these considerations and Mr. Richman’s recommendations, the Committee approved the annual incentive awards to the named executive officers set forth above at the levels recommended.

As described above, 25% of the 2016 annual incentive awards for each executive officer was deferred in the form of RSUs that vest over three years. All of our named executive officers are retirement eligible under the terms of these equity awards. This means that such awards will continue to vest on their normal vesting schedule if the executive voluntarily retires from the Company and is no longer active in the banking industry. The delayed settlement provision included in the RSUs related to the 2015 annual incentive awards, under which the actual distribution of the shares was generally deferred until six years from the grant date, was eliminated for the RSU grants related to the 2016 annual incentive grants as contemplated by the merger agreement.

Long-Term Incentives

For 2016 long-term incentives granted in early 2016, the Committee determined to continue the relative mix of equity vehicles that comprised the 2015 long-term incentive awards under which a large percentage of the award to executives is performance-based. With this mix of equity vehicles, an executive will likely realize the intended full value of the equity award only if the Company continues to perform well.

21

There was no specific target value for individual long-term equity awards to executives, expressed as a percentage of base salary or otherwise. However, prior to approving the awards, the Committee reviewed market and peer group equity award practices and considered its and the Board’s assessment of Mr. Richman’s performance as well as Mr. Richman’s recommendations for his direct reports based on his assessment of their differentiated individual performance and individual contributions to the strategic progress of the Company. For the executive officers that report to him, Mr. Richman recommended a pool for long-term incentives equal to approximately 80% of the executives’ aggregate 2015 base salaries. Individual award recommendations were then adjusted from this guideline based on relative performance rankings, while also taking into account each executive’s positioning against the 75th percentile of a broad market survey of total direct compensation. Mr. Richman believed that due to the Company’s strong performance over the past few years relative to peers, positioning executives’ total direct compensation near the 75th percentile was appropriate and would offer strong retention benefits. With respect to Mr. Richman’s award, the Committee considered that a long-term equity incentive should serve as a reward for strong performance. The Committee believed that the size of Mr. Richman’s 2016 long-term incentive should be increased from the prior year due to the Company’s strong performance.

Based on these considerations, the Committee approved the following awards:

2016 Long-Term Incentive Awards | |||||||||||||||

Name | Aggregate Value of 2016 Long-Term Incentive ($)(1) | % of 2015 Base Salary | PSUs [50% of Award Value] (# at Target) | RSUs(2) [25% of Award Value] (#) | Options(3) [25% of Award Value] (#) | ||||||||||

Larry D. Richman | 2,200,000 | 220 | 28,416 | 16,115 | 35,722 | ||||||||||

Kevin M. Killips | 490,000 | 90 | 6,329 | 3,589 | 7,511 | ||||||||||

Bruce R. Hague | 400,000 | 80 | 5,167 | 2,930 | 6,131 | ||||||||||

Bruce S. Lubin | 440,000 | 89 | 5,683 | 3,223 | 6,744 | ||||||||||

Karen B. Case | 365,000 | 89 | 4,715 | 2,674 | 5,595 | ||||||||||

(1) | Prior to the accounting valuation impacts of (a) lack of marketability discounts associated with delayed settlement of vested shares under the PSUs and RSUs and (b) the TSR performance factor for PSUs. |

(2) | One-third of the RSUs vested on March 1, 2017, and the remaining two-thirds will vest in equal portions on March 1, 2018 and March 1, 2019. For all executives other than Mr. Richman, the shares underlying vested RSUs comprising a portion of this 2016 long-term equity incentive award are generally not distributable until the earliest of March 1, 2022, the holder’s death or disability, or in certain instances relating to a change in control as defined in IRC Section 409A, in each case, subject to clawback provisions. For Mr. Richman, the underlying shares are generally not settled until he resigns or otherwise separates from the Company. |