Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - NOBLE ENERGY INC | nbl-20170331xearningsrelea.htm |

| 8-K - 8-K - NOBLE ENERGY INC | nbl-20170331x8kearningsrel.htm |

NBL

First Quarter 2017 Supplement

May 2017

2NBL

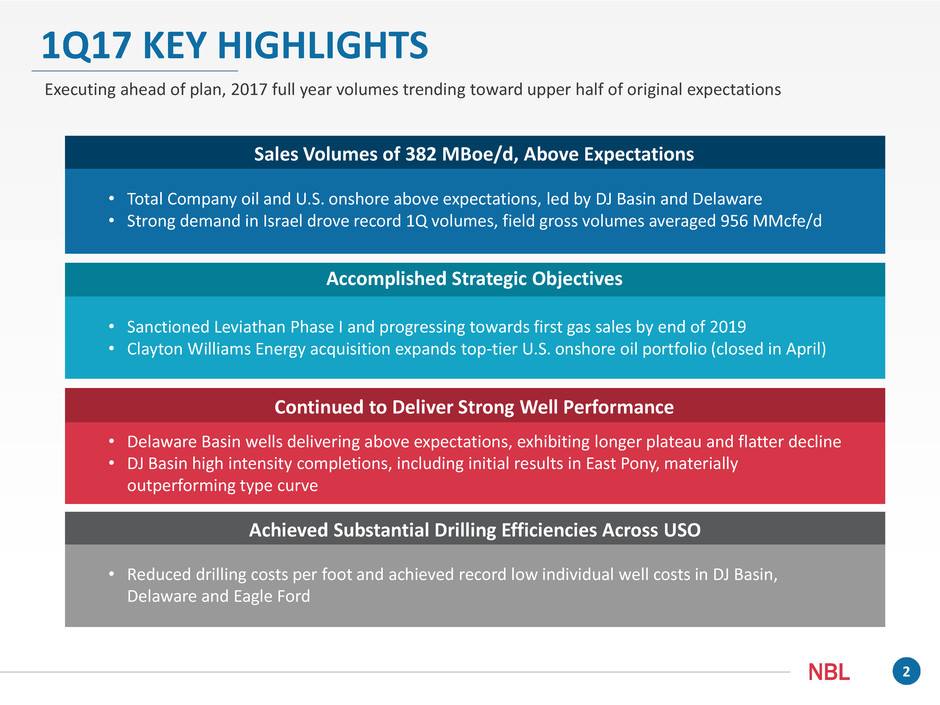

1Q17 KEY HIGHLIGHTS

Executing ahead of plan, 2017 full year volumes trending toward upper half of original expectations

Sales Volumes of 382 MBoe/d, Above Expectations

Continued to Deliver Strong Well Performance

Achieved Substantial Drilling Efficiencies Across USO

Accomplished Strategic Objectives

• Total Company oil and U.S. onshore above expectations, led by DJ Basin and Delaware

• Strong demand in Israel drove record 1Q volumes, field gross volumes averaged 956 MMcfe/d

• Sanctioned Leviathan Phase I and progressing towards first gas sales by end of 2019

• Clayton Williams Energy acquisition expands top-tier U.S. onshore oil portfolio (closed in April)

• Delaware Basin wells delivering above expectations, exhibiting longer plateau and flatter decline

• DJ Basin high intensity completions, including initial results in East Pony, materially

outperforming type curve

• Reduced drilling costs per foot and achieved record low individual well costs in DJ Basin,

Delaware and Eagle Ford

3NBL

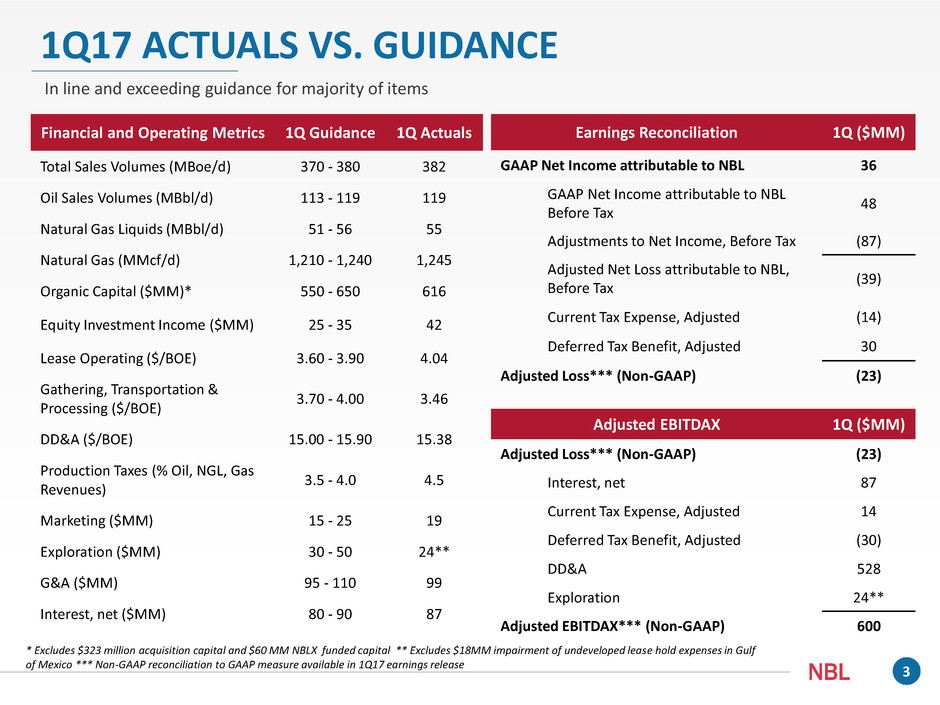

1Q17 ACTUALS VS. GUIDANCE

In line and exceeding guidance for majority of items

Financial and Operating Metrics 1Q Guidance 1Q Actuals

Total Sales Volumes (MBoe/d) 370 - 380 382

Oil Sales Volumes (MBbl/d) 113 - 119 119

Natural Gas Liquids (MBbl/d) 51 - 56 55

Natural Gas (MMcf/d) 1,210 - 1,240 1,245

Organic Capital ($MM)* 550 - 650 616

Equity Investment Income ($MM) 25 - 35 42

Lease Operating ($/BOE) 3.60 - 3.90 4.04

Gathering, Transportation &

Processing ($/BOE)

3.70 - 4.00 3.46

DD&A ($/BOE) 15.00 - 15.90 15.38

Production Taxes (% Oil, NGL, Gas

Revenues)

3.5 - 4.0 4.5

Marketing ($MM) 15 - 25 19

Exploration ($MM) 30 - 50 24**

G&A ($MM) 95 - 110 99

Interest, net ($MM) 80 - 90 87

Earnings Reconciliation 1Q ($MM)

GAAP Net Income attributable to NBL 36

GAAP Net Income attributable to NBL

Before Tax

48

Adjustments to Net Income, Before Tax (87)

Adjusted Net Loss attributable to NBL,

Before Tax

(39)

Current Tax Expense, Adjusted (14)

Deferred Tax Benefit, Adjusted 30

Adjusted Loss*** (Non-GAAP) (23)

Adjusted EBITDAX 1Q ($MM)

Adjusted Loss*** (Non-GAAP) (23)

Interest, net 87

Current Tax Expense, Adjusted 14

Deferred Tax Benefit, Adjusted (30)

DD&A 528

Exploration 24**

Adjusted EBITDAX*** (Non-GAAP) 600

* Excludes $323 million acquisition capital and $60 MM NBLX funded capital ** Excludes $18MM impairment of undeveloped lease hold expenses in Gulf

of Mexico *** Non-GAAP reconciliation to GAAP measure available in 1Q17 earnings release

4NBL

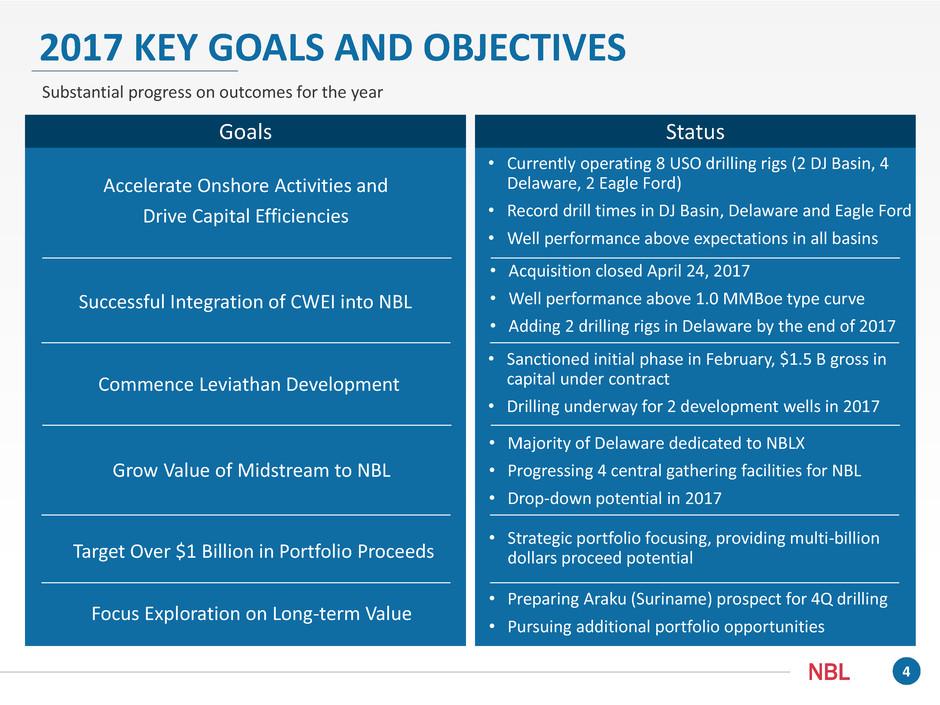

2017 KEY GOALS AND OBJECTIVES

Substantial progress on outcomes for the year

Accelerate Onshore Activities and

Drive Capital Efficiencies

• Currently operating 8 USO drilling rigs (2 DJ Basin, 4

Delaware, 2 Eagle Ford)

• Record drill times in DJ Basin, Delaware and Eagle Ford

• Well performance above expectations in all basins

Goals Status

Successful Integration of CWEI into NBL

Commence Leviathan Development

Target Over $1 Billion in Portfolio Proceeds

Focus Exploration on Long-term Value

• Acquisition closed April 24, 2017

• Well performance above 1.0 MMBoe type curve

• Adding 2 drilling rigs in Delaware by the end of 2017

• Sanctioned initial phase in February, $1.5 B gross in

capital under contract

• Drilling underway for 2 development wells in 2017

• Majority of Delaware dedicated to NBLX

• Progressing 4 central gathering facilities for NBL

• Drop-down potential in 2017

Grow Value of Midstream to NBL

• Preparing Araku (Suriname) prospect for 4Q drilling

• Pursuing additional portfolio opportunities

• Strategic portfolio focusing, providing multi-billion

dollars proceed potential

5NBL

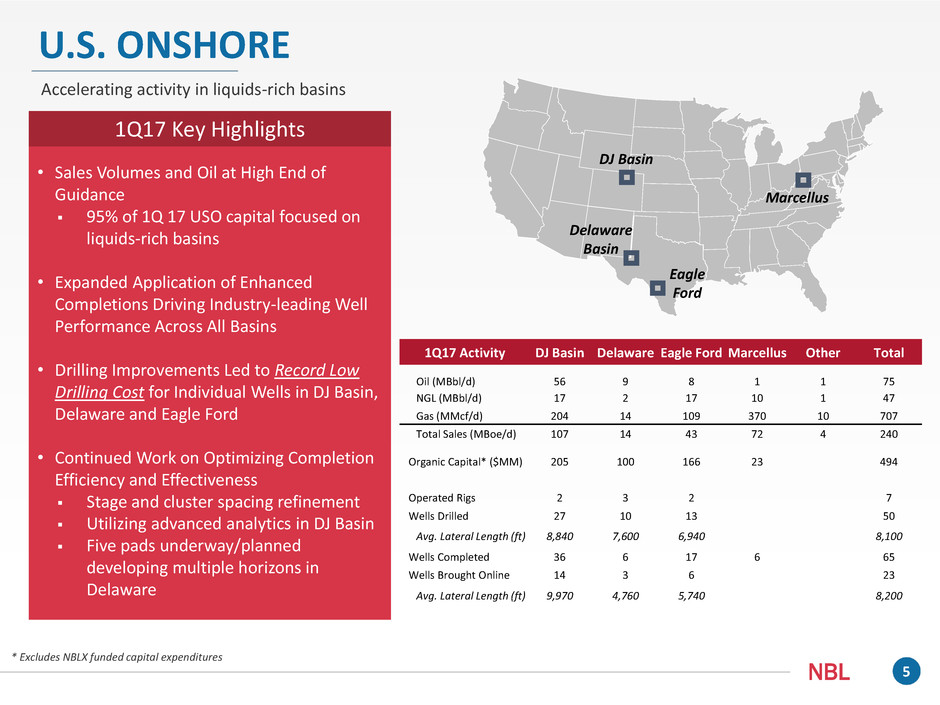

U.S. ONSHORE

Accelerating activity in liquids-rich basins

1Q17 Activity DJ Basin Delaware Eagle Ford Marcellus Other Total

Oil (MBbl/d) 56 9 8 1 1 75

NGL (MBbl/d) 17 2 17 10 1 47

Gas (MMcf/d) 204 14 109 370 10 707

Total Sales (MBoe/d) 107 14 43 72 4 240

Organic Capital* ($MM) 205 100 166 23 494

Operated Rigs 2 3 2 7

Wells Drilled 27 10 13 50

Avg. Lateral Length (ft) 8,840 7,600 6,940 8,100

Wells Completed 36 6 17 6 65

Wells Brought Online 14 3 6 23

Avg. Lateral Length (ft) 9,970 4,760 5,740 8,200

DJ Basin

Delaware

Basin

Marcellus

Eagle

Ford

1Q17 Key Highlights

• Sales Volumes and Oil at High End of

Guidance

95% of 1Q 17 USO capital focused on

liquids-rich basins

• Expanded Application of Enhanced

Completions Driving Industry-leading Well

Performance Across All Basins

• Drilling Improvements Led to Record Low

Drilling Cost for Individual Wells in DJ Basin,

Delaware and Eagle Ford

• Continued Work on Optimizing Completion

Efficiency and Effectiveness

Stage and cluster spacing refinement

Utilizing advanced analytics in DJ Basin

Five pads underway/planned

developing multiple horizons in

Delaware

* Excludes NBLX funded capital expenditures

6NBL

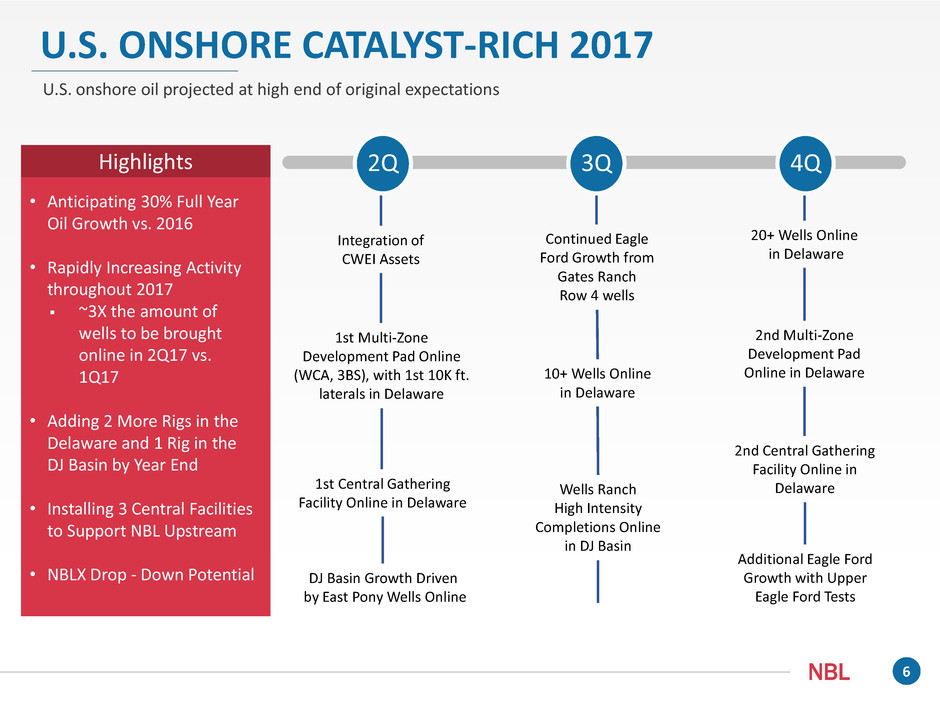

U.S. ONSHORE CATALYST-RICH 2017

U.S. onshore oil projected at high end of original expectations

2Q

Integration of

CWEI Assets

1st Multi-Zone

Development Pad Online

(WCA, 3BS), with 1st 10K ft.

laterals in Delaware

10+ Wells Online

in Delaware

1st Central Gathering

Facility Online in Delaware

Wells Ranch

High Intensity

Completions Online

in DJ Basin

20+ Wells Online

in Delaware

2nd Multi-Zone

Development Pad

Online in Delaware

4Q3Q

DJ Basin Growth Driven

by East Pony Wells Online

Additional Eagle Ford

Growth with Upper

Eagle Ford Tests

Highlights

• Anticipating 30% Full Year

Oil Growth vs. 2016

• Rapidly Increasing Activity

throughout 2017

~3X the amount of

wells to be brought

online in 2Q17 vs.

1Q17

• Adding 2 More Rigs in the

Delaware and 1 Rig in the

DJ Basin by Year End

• Installing 3 Central Facilities

to Support NBL Upstream

• NBLX Drop - Down Potential

2nd Central Gathering

Facility Online in

Delaware

Continued Eagle

Ford Growth from

Gates Ranch

Row 4 wells

7NBL

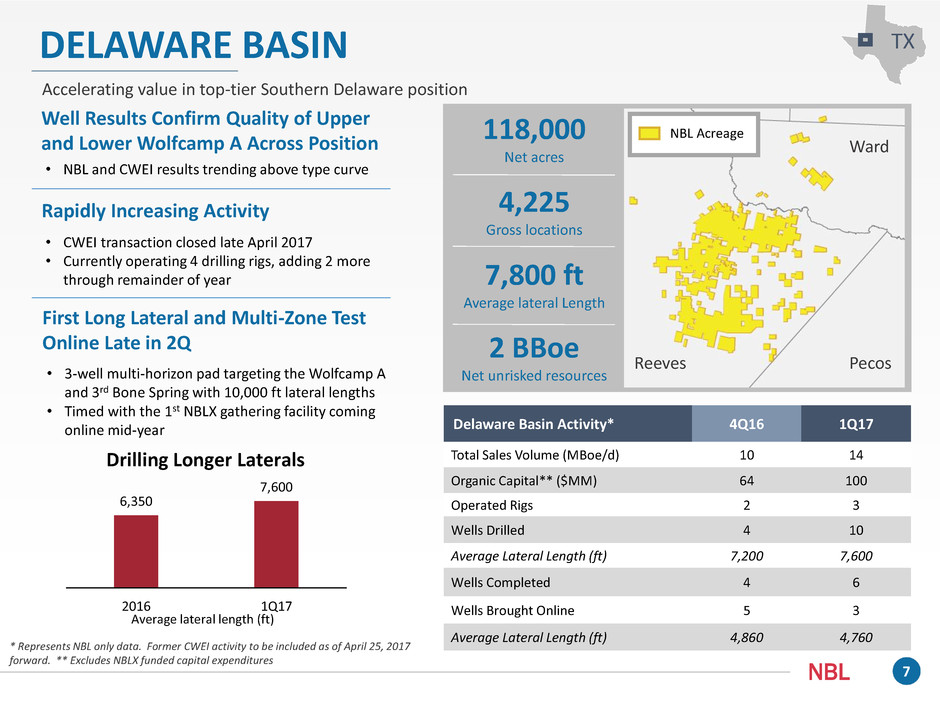

DELAWARE BASIN

Accelerating value in top-tier Southern Delaware position

Delaware Basin Activity* 4Q16 1Q17

Total Sales Volume (MBoe/d) 10 14

Organic Capital** ($MM) 64 100

Operated Rigs 2 3

Wells Drilled 4 10

Average Lateral Length (ft) 7,200 7,600

Wells Completed 4 6

Wells Brought Online 5 3

Average Lateral Length (ft) 4,860 4,760

118,000

Net acres

4,225

Gross locations

7,800 ft

Average lateral Length

2 BBoe

Net unrisked resources

Rapidly Increasing Activity

• CWEI transaction closed late April 2017

• Currently operating 4 drilling rigs, adding 2 more

through remainder of year

First Long Lateral and Multi-Zone Test

Online Late in 2Q

• 3-well multi-horizon pad targeting the Wolfcamp A

and 3rd Bone Spring with 10,000 ft lateral lengths

• Timed with the 1st NBLX gathering facility coming

online mid-year

6,350

7,600

2016 1Q17

Drilling Longer Laterals

* Represents NBL only data. Former CWEI activity to be included as of April 25, 2017

forward. ** Excludes NBLX funded capital expenditures

Average lateral length (ft)

Well Results Confirm Quality of Upper

and Lower Wolfcamp A Across Position

• NBL and CWEI results trending above type curve

TX

NBL Acreage

Ward

Reeves Pecos

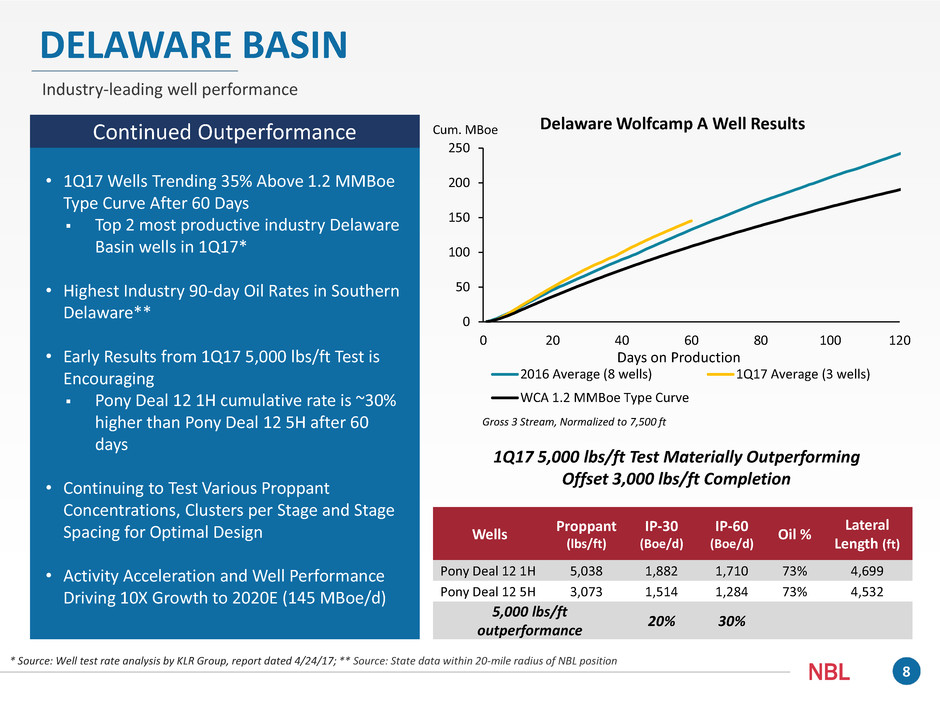

8NBL

0

50

100

150

200

250

0 20 40 60 80 100 120

Days on Production

2016 Average (8 wells) 1Q17 Average (3 wells)

WCA 1.2 MMBoe Type Curve

DELAWARE BASIN

Industry-leading well performance

Continued Outperformance

• 1Q17 Wells Trending 35% Above 1.2 MMBoe

Type Curve After 60 Days

Top 2 most productive industry Delaware

Basin wells in 1Q17*

• Highest Industry 90-day Oil Rates in Southern

Delaware**

• Early Results from 1Q17 5,000 lbs/ft Test is

Encouraging

Pony Deal 12 1H cumulative rate is ~30%

higher than Pony Deal 12 5H after 60

days

• Continuing to Test Various Proppant

Concentrations, Clusters per Stage and Stage

Spacing for Optimal Design

• Activity Acceleration and Well Performance

Driving 10X Growth to 2020E (145 MBoe/d)

Wells

Proppant

(lbs/ft)

IP-30

(Boe/d)

IP-60

(Boe/d)

Oil %

Lateral

Length (ft)

Pony Deal 12 1H 5,038 1,882 1,710 73% 4,699

Pony Deal 12 5H 3,073 1,514 1,284 73% 4,532

5,000 lbs/ft

outperformance

20% 30%

Gross 3 Stream, Normalized to 7,500 ft

Cum. MBoe

1Q17 5,000 lbs/ft Test Materially Outperforming

Offset 3,000 lbs/ft Completion

* Source: Well test rate analysis by KLR Group, report dated 4/24/17; ** Source: State data within 20-mile radius of NBL position

Delaware Wolfcamp A Well Results

9NBL

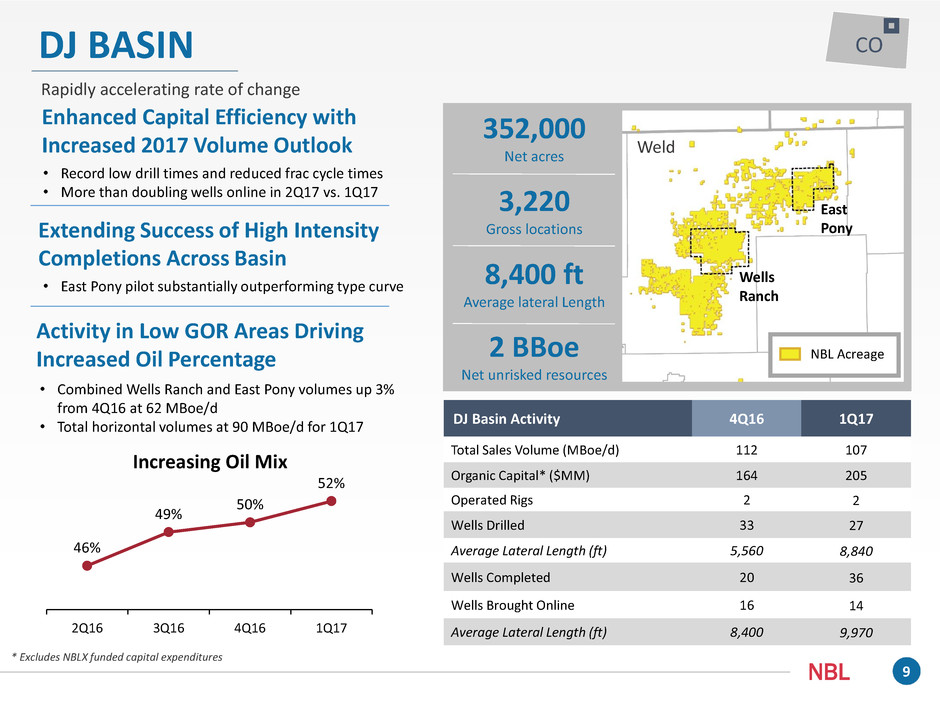

DJ BASIN

Rapidly accelerating rate of change

CO

352,000

Net acres

3,220

Gross locations

8,400 ft

Average lateral Length

2 BBoe

Net unrisked resources

DJ Basin Activity 4Q16 1Q17

Total Sales Volume (MBoe/d) 112 107

Organic Capital* ($MM) 164 205

Operated Rigs 2 2

Wells Drilled 33 27

Average Lateral Length (ft) 5,560 8,840

Wells Completed 20 36

Wells Brought Online 16 14

Average Lateral Length (ft) 8,400 9,970

Enhanced Capital Efficiency with

Increased 2017 Volume Outlook

• Record low drill times and reduced frac cycle times

• More than doubling wells online in 2Q17 vs. 1Q17

Extending Success of High Intensity

Completions Across Basin

Activity in Low GOR Areas Driving

Increased Oil Percentage

• East Pony pilot substantially outperforming type curve

• Combined Wells Ranch and East Pony volumes up 3%

from 4Q16 at 62 MBoe/d

• Total horizontal volumes at 90 MBoe/d for 1Q17

46%

49%

50%

52%

2Q16 3Q16 4Q16 1Q17

Increasing Oil Mix

* Excludes NBLX funded capital expenditures

Weld

Wells

Ranch

East

Pony

NBL Acreage

10NBL

0

20

40

60

80

100

120

140

0 10 20 30 40 50 60 70 80 90 100 110

Days on Production

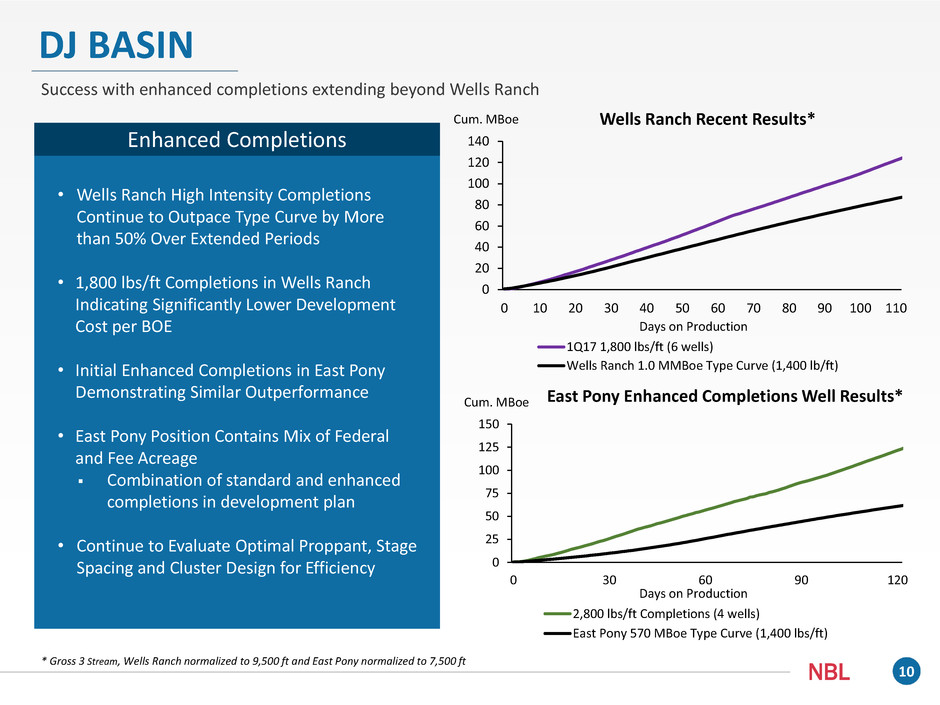

Wells Ranch Recent Results*

1Q17 1,800 lbs/ft (6 wells)

Wells Ranch 1.0 MMBoe Type Curve (1,400 lb/ft)

DJ BASIN

Success with enhanced completions extending beyond Wells Ranch

Enhanced Completions

• Wells Ranch High Intensity Completions

Continue to Outpace Type Curve by More

than 50% Over Extended Periods

• 1,800 lbs/ft Completions in Wells Ranch

Indicating Significantly Lower Development

Cost per BOE

• Initial Enhanced Completions in East Pony

Demonstrating Similar Outperformance

• East Pony Position Contains Mix of Federal

and Fee Acreage

Combination of standard and enhanced

completions in development plan

• Continue to Evaluate Optimal Proppant, Stage

Spacing and Cluster Design for Efficiency 0

25

50

75

100

125

150

0 30 60 90 120

Days on Production

East Pony Enhanced Completions Well Results*

2,800 lbs/ft Completions (4 wells)

East Pony 570 MBoe Type Curve (1,400 lbs/ft)

* Gross 3 Stream, Wells Ranch normalized to 9,500 ft and East Pony normalized to 7,500 ft

Cum. MBoe

Cum. MBoe

11NBL

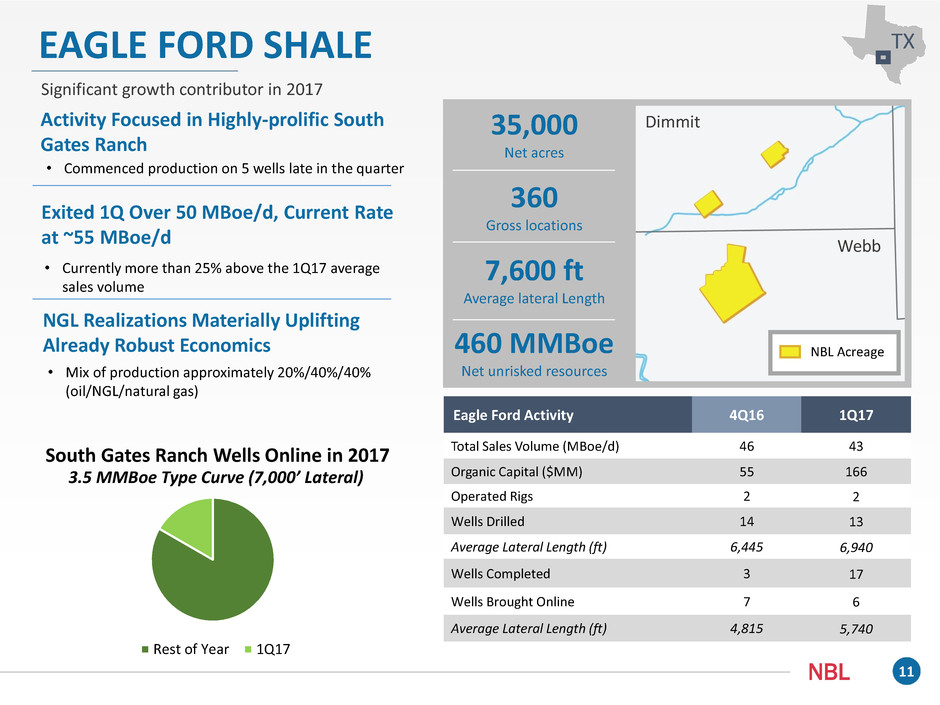

EAGLE FORD SHALE

Significant growth contributor in 2017

TX

Eagle Ford Activity 4Q16 1Q17

Total Sales Volume (MBoe/d) 46 43

Organic Capital ($MM) 55 166

Operated Rigs 2 2

Wells Drilled 14 13

Average Lateral Length (ft) 6,445 6,940

Wells Completed 3 17

Wells Brought Online 7 6

Average Lateral Length (ft) 4,815 5,740

35,000

Net acres

360

Gross locations

7,600 ft

Average lateral Length

460 MMBoe

Net unrisked resources

Activity Focused in Highly-prolific South

Gates Ranch

• Commenced production on 5 wells late in the quarter

Exited 1Q Over 50 MBoe/d, Current Rate

at ~55 MBoe/d

NGL Realizations Materially Uplifting

Already Robust Economics

• Currently more than 25% above the 1Q17 average

sales volume

• Mix of production approximately 20%/40%/40%

(oil/NGL/natural gas)

NBL Acreage

3.5 MMBoe Type Curve (7,000’ Lateral)

Dimmit

Webb

South Gates Ranch Wells Online in 2017

Rest of Year 1Q17

12NBL

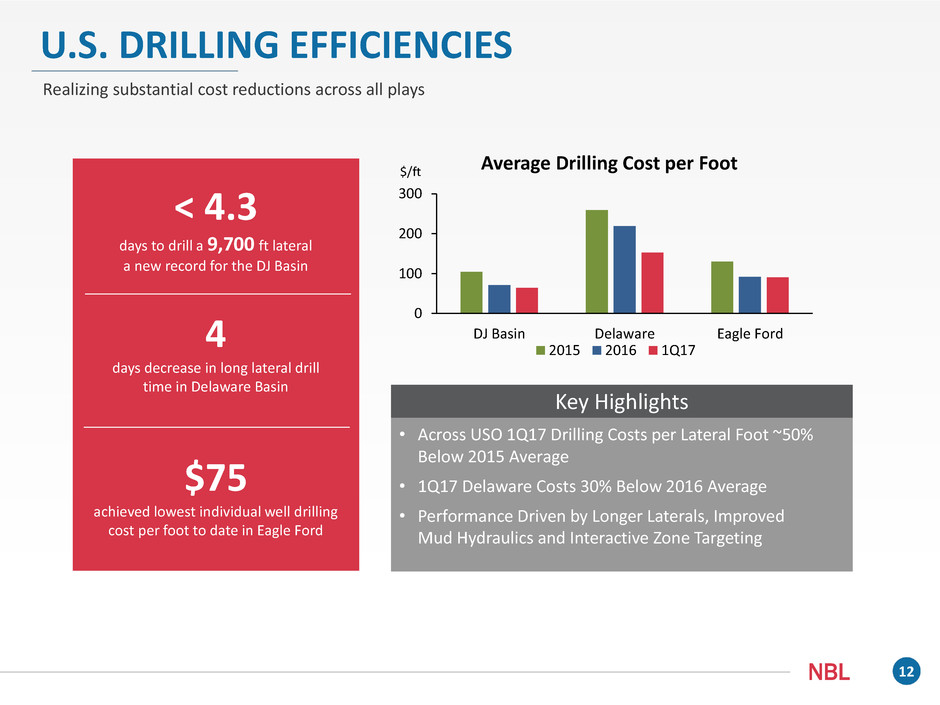

U.S. DRILLING EFFICIENCIES

Realizing substantial cost reductions across all plays

• Across USO 1Q17 Drilling Costs per Lateral Foot ~50%

Below 2015 Average

• 1Q17 Delaware Costs 30% Below 2016 Average

• Performance Driven by Longer Laterals, Improved

Mud Hydraulics and Interactive Zone Targeting

< 4.3

days to drill a 9,700 ft lateral

a new record for the DJ Basin

4

days decrease in long lateral drill

time in Delaware Basin

$75

achieved lowest individual well drilling

cost per foot to date in Eagle Ford

0

100

200

300

DJ Basin Delaware Eagle Ford

2015 2016 1Q17

Average Drilling Cost per Foot

Key Highlights

$/ft

13NBL

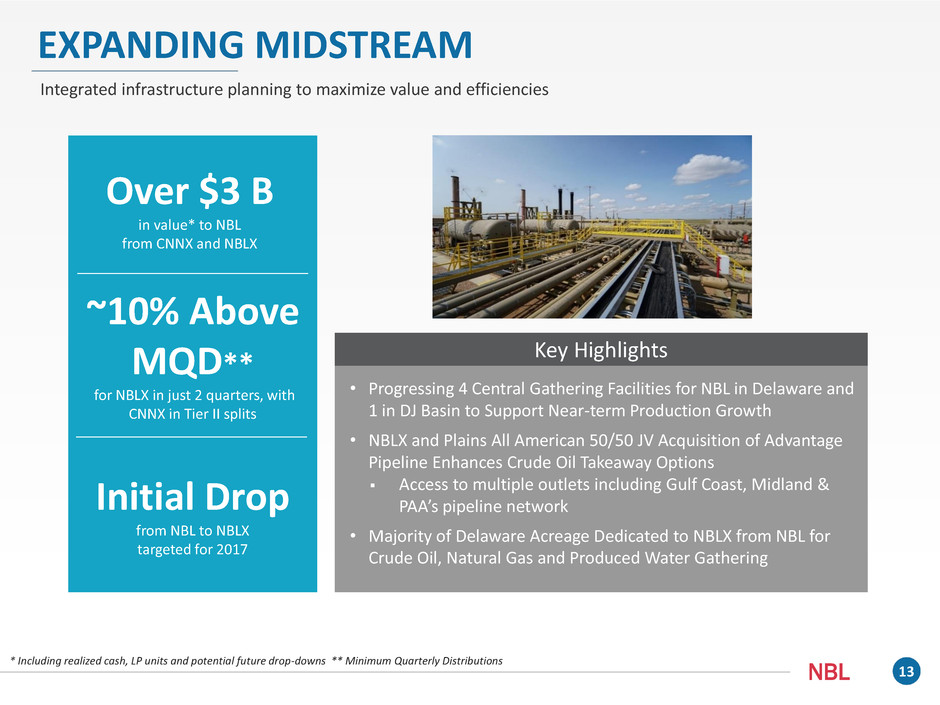

EXPANDING MIDSTREAM

Integrated infrastructure planning to maximize value and efficiencies

Over $3 B

in value* to NBL

from CNNX and NBLX

~10% Above

MQD**

for NBLX in just 2 quarters, with

CNNX in Tier II splits

Initial Drop

from NBL to NBLX

targeted for 2017

• Progressing 4 Central Gathering Facilities for NBL in Delaware and

1 in DJ Basin to Support Near-term Production Growth

• NBLX and Plains All American 50/50 JV Acquisition of Advantage

Pipeline Enhances Crude Oil Takeaway Options

Access to multiple outlets including Gulf Coast, Midland &

PAA’s pipeline network

• Majority of Delaware Acreage Dedicated to NBLX from NBL for

Crude Oil, Natural Gas and Produced Water Gathering

Key Highlights

* Including realized cash, LP units and potential future drop-downs ** Minimum Quarterly Distributions

14NBL

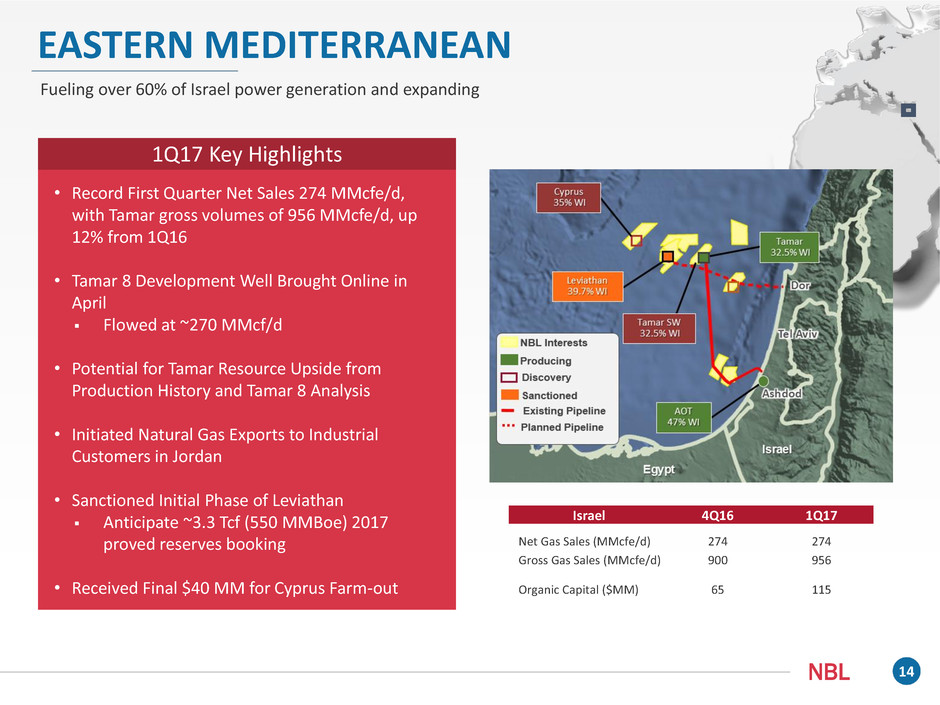

EASTERN MEDITERRANEAN

Fueling over 60% of Israel power generation and expanding

Israel 4Q16 1Q17

Net Gas Sales (MMcfe/d) 274 274

Gross Gas Sales (MMcfe/d) 900 956

Organic Capital ($MM) 65 115

1Q17 Key Highlights

• Record First Quarter Net Sales 274 MMcfe/d,

with Tamar gross volumes of 956 MMcfe/d, up

12% from 1Q16

• Tamar 8 Development Well Brought Online in

April

Flowed at ~270 MMcf/d

• Potential for Tamar Resource Upside from

Production History and Tamar 8 Analysis

• Initiated Natural Gas Exports to Industrial

Customers in Jordan

• Sanctioned Initial Phase of Leviathan

Anticipate ~3.3 Tcf (550 MMBoe) 2017

proved reserves booking

• Received Final $40 MM for Cyprus Farm-out

15NBL

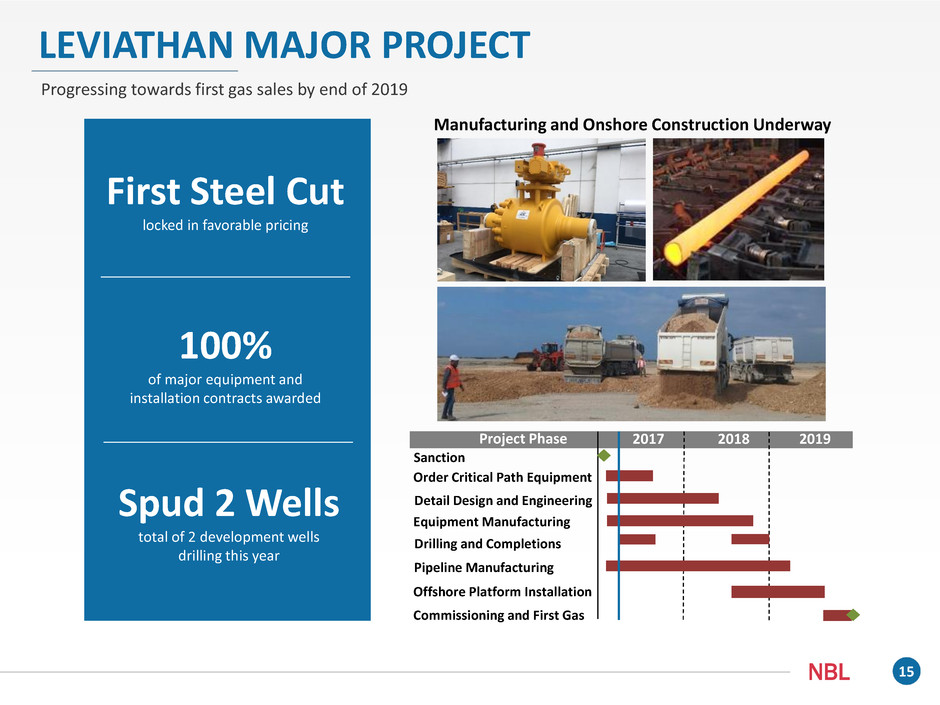

LEVIATHAN MAJOR PROJECT

Progressing towards first gas sales by end of 2019

First Steel Cut

locked in favorable pricing

100%

of major equipment and

installation contracts awarded

Spud 2 Wells

total of 2 development wells

drilling this year

Project Phase 2017 2018 2019

Sanction

Order Critical Path Equipment

Detail Design and Engineering

Pipeline Manufacturing

Equipment Manufacturing

Commissioning and First Gas

Drilling and Completions

Offshore Platform Installation

Manufacturing and Onshore Construction Underway

16NBL

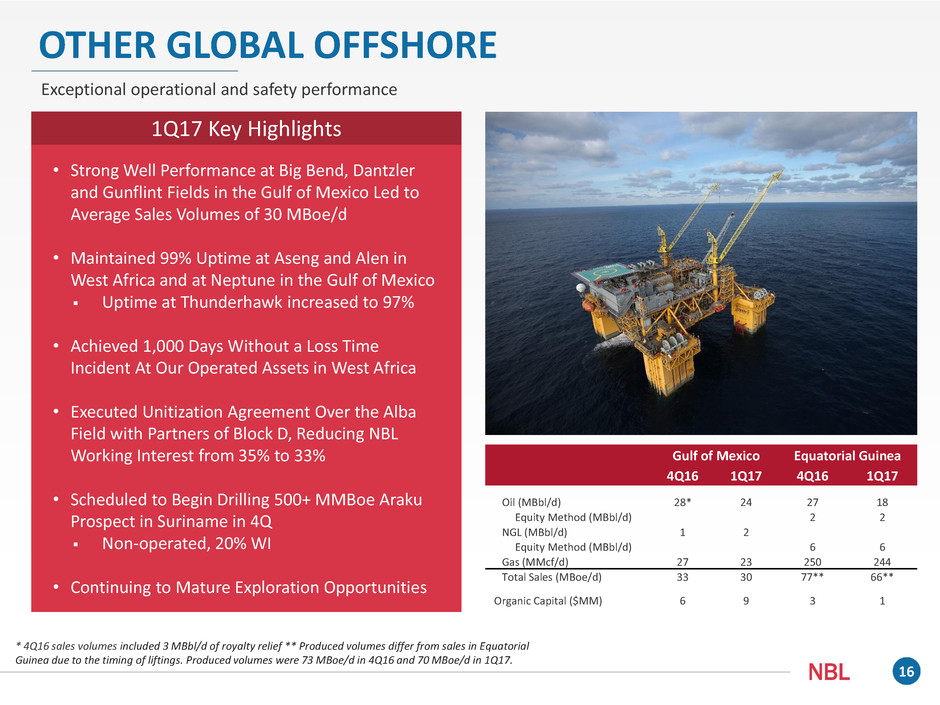

OTHER GLOBAL OFFSHORE

Exceptional operational and safety performance

1Q17 Key Highlights

• Strong Well Performance at Big Bend, Dantzler

and Gunflint Fields in the Gulf of Mexico Led to

Average Sales Volumes of 30 MBoe/d

• Maintained 99% Uptime at Aseng and Alen in

West Africa and at Neptune in the Gulf of Mexico

Uptime at Thunderhawk increased to 97%

• Achieved 1,000 Days Without a Loss Time

Incident At Our Operated Assets in West Africa

• Executed Unitization Agreement Over the Alba

Field with Partners of Block D, Reducing NBL

Working Interest from 35% to 33%

• Scheduled to Begin Drilling 500+ MMBoe Araku

Prospect in Suriname in 4Q

Non-operated, 20% WI

• Continuing to Mature Exploration Opportunities

Gulf of Mexico Equatorial Guinea

4Q16 1Q17 4Q16 1Q17

Oil (MBbl/d) 28* 24 27 18

Equity Method (MBbl/d) 2 2

NGL (MBbl/d) 1 2

Equity Method (MBbl/d) 6 6

Gas (MMcf/d) 27 23 250 244

Total Sales (MBoe/d) 33 30 77** 66**

Organic Capital ($MM) 6 9 3 1

* 4Q16 sales volumes included 3 MBbl/d of royalty relief ** Produced volumes differ from sales in Equatorial

Guinea due to the timing of liftings. Produced volumes were 73 MBoe/d in 4Q16 and 70 MBoe/d in 1Q17.

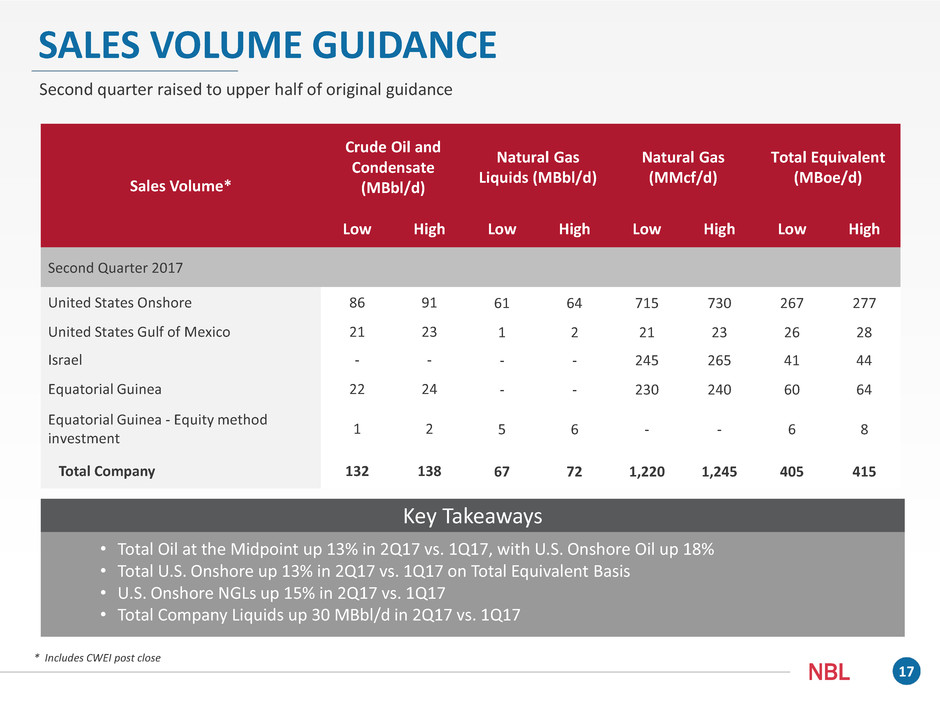

17NBL

Sales Volume*

Crude Oil and

Condensate

(MBbl/d)

Natural Gas

Liquids (MBbl/d)

Natural Gas

(MMcf/d)

Total Equivalent

(MBoe/d)

Low High Low High Low High Low High

Second Quarter 2017

United States Onshore 86 91 61 64 715 730 267 277

United States Gulf of Mexico 21 23 1 2 21 23 26 28

Israel - - - - 245 265 41 44

Equatorial Guinea 22 24 - - 230 240 60 64

Equatorial Guinea - Equity method

investment

1 2 5 6 - - 6 8

Total Company 132 138 67 72 1,220 1,245 405 415

* Includes CWEI post close

Second quarter raised to upper half of original guidance

SALES VOLUME GUIDANCE

• Total Oil at the Midpoint up 13% in 2Q17 vs. 1Q17, with U.S. Onshore Oil up 18%

• Total U.S. Onshore up 13% in 2Q17 vs. 1Q17 on Total Equivalent Basis

• U.S. Onshore NGLs up 15% in 2Q17 vs. 1Q17

• Total Company Liquids up 30 MBbl/d in 2Q17 vs. 1Q17

Key Takeaways

18NBL

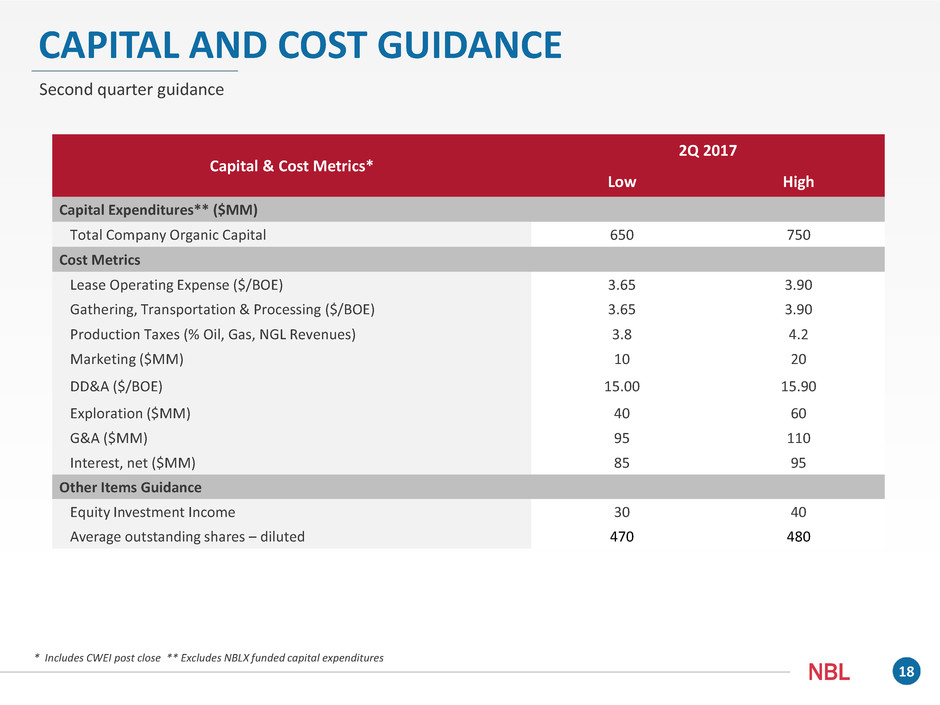

* Includes CWEI post close ** Excludes NBLX funded capital expenditures

Capital & Cost Metrics*

2Q 2017

Low High

Capital Expenditures** ($MM)

Total Company Organic Capital 650 750

Cost Metrics

Lease Operating Expense ($/BOE) 3.65 3.90

Gathering, Transportation & Processing ($/BOE) 3.65 3.90

Production Taxes (% Oil, Gas, NGL Revenues) 3.8 4.2

Marketing ($MM) 10 20

DD&A ($/BOE) 15.00 15.90

Exploration ($MM) 40 60

G&A ($MM) 95 110

Interest, net ($MM) 85 95

Other Items Guidance

Equity Investment Income 30 40

Average outstanding shares – diluted 470 480

CAPITAL AND COST GUIDANCE

Second quarter guidance

19NBL

Forward-Looking Statements and Other Matters

This presentation contains certain "forward-looking statements" within the meaning of federal securities laws. Words such as "anticipates", "believes,"

"expects", "intends", "will", "should", "may", and similar expressions may be used to identify forward-looking statements. Forward-looking statements

are not statements of historical fact and reflect Noble Energy's current views about future events. Such forward-looking statements may include, but

are not limited to, future financial and operating results, and other statements that are not historical facts, including estimates of oil and natural gas

reserves and resources, estimates of future production, assumptions regarding future oil and natural gas pricing, planned drilling activity, future results

of operations, projected cash flow and liquidity, business strategy and other plans and objectives for future operations. No assurances can be given

that the forward-looking statements contained in this presentation will occur as projected and actual results may differ materially from those

projected. Forward-looking statements are based on current expectations, estimates and assumptions that involve a number of risks and uncertainties

that could cause actual results to differ materially from those projected. These risks and uncertainties include, without limitation, the risk that the cost

savings and any other synergies from the recent merger with Clayton Williams Energy, Inc. may not be fully realized or may take longer to realize than

expected, disruption from the merger transaction making it more difficult to maintain relationships with customers, employees or suppliers, the

diversion of management time on post-merger related issues, the volatility in commodity prices for crude oil and natural gas, the presence or

recoverability of estimated reserves, the ability to replace reserves, environmental risks, drilling and operating risks, exploration and development

risks, competition, government regulation or other actions, the ability of management to execute its plans to meet its goals and other risks inherent in

Noble Energy's businesses that are discussed in Noble Energy's and Clayton Williams' most recent annual reports on Form 10-K, respectively, and in

other Noble Energy and Clayton Williams reports on file with the Securities and Exchange Commission (the "SEC"). These reports are also available

from the sources described above. Forward-looking statements are based on the estimates and opinions of management at the time the statements

are made. Noble Energy does not assume any obligation to update any forward-looking statements should circumstances or management’s estimates

or opinions change.

The SEC requires oil and gas companies, in their filings with the SEC, to disclose proved reserves that a company has demonstrated by actual

production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. The SEC permits

the optional disclosure of probable and possible reserves, however, we have not disclosed our probable and possible reserves in our filings with the

SEC. We use certain terms in this presentation, such as “net unrisked resources”, “type curve” or “MMBoe type curve”, which are by their nature more

speculative than estimates of proved, probable and possible reserves and accordingly are subject to substantially greater risk of being actually realized.

The SEC guidelines strictly prohibit us from including these estimates in filings with the SEC. Investors are urged to consider closely the disclosures and

risk factors in our and Clayton Williams’ most recent Form 10-K and in other reports on file with the SEC, available from Noble Energy’s offices or

website, http://www.nblenergy.com.

This presentation also contains certain historical non-GAAP measures of financial performance that management believes are good tools for internal

use and the investment community in evaluating Noble Energy’s overall financial performance. These non-GAAP measures are broadly used to value

and compare companies in the crude oil and natural gas industry. Please see the Noble Energy’s respective earnings release for reconciliations of the

differences between any historical non-GAAP measures used in this presentation and the most directly comparable GAAP financial measures.