Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - Mylan II B.V. | d384694dex312.htm |

| EX-31.1 - EX-31.1 - Mylan II B.V. | d384694dex311.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K/A

(Amendment No. 1)

| ☑ | Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Fiscal Year Ended December 31, 2016

OR

| ☐ | Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to .

Commission file number 333-199861

MYLAN N.V.

(Exact name of registrant as specified in its charter)

| The Netherlands | 98-1189497 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

Building 4, Trident Place, Mosquito Way, Hatfield, Hertfordshire, AL10 9UL, England

(Address of principal executive offices)

+44 (0) 1707 853 000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class: | Name of Each Exchange on Which Registered: | |

| Ordinary shares, nominal value €0.01 | The NASDAQ Stock Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☑

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.:

| Large accelerated filer |

☑ |

Accelerated filer |

☐ | |||

| Non-accelerated filer |

☐ (Do not check if a smaller reporting company) |

Smaller reporting company |

☐ | |||

| Emerging growth company |

☐ |

|||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the outstanding ordinary shares, nominal value €0.01, of the registrant other than shares held by persons who may be deemed affiliates of the registrant, as of June 30, 2016, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $21,822,318,620.

The number of ordinary shares outstanding, nominal value €0.01, of the registrant as of April 26, 2017 was 535,946,383.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Table of Contents

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (this “Amendment”) amends our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, originally filed on March 1, 2017 (the “Original Filing”). We are filing this Amendment to include the information required by Part III and not included in the Original Filing, as we do not intend to file a definitive proxy statement for an annual general meeting of stockholders within 120 days of the end of our fiscal year ended December 31, 2016. In addition, in connection with the filing of this Amendment and pursuant to the rules of the Securities and Exchange Commission (the “SEC”), we are including with this Amendment new certifications of our principal executive officer and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Accordingly, Item 15 of Part IV has also been amended to reflect the filing of these new certifications.

Except as described above, no other changes have been made to the Original Filing. The Original Filing continues to speak as of the date of the Original Filing, and we have not updated the disclosures contained therein to reflect any events which occurred at a date subsequent to the filing of the Original Filing.

As used in this Amendment, unless the context requires otherwise, the “Company,” “Mylan,” “our,” and “we” mean Mylan N.V. and its consolidated subsidiaries, “NASDAQ” means The NASDAQ Global Select Stock Market, and “U.S. GAAP” means accounting principles generally accepted in the United States of America.

Forward-Looking Statements

This Amendment contains “forward-looking statements.” These statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements may include, without limitation, statements about the acquisition of Meda AB (publ.) (“Meda”) by Mylan (the “Meda Transaction”), Mylan’s acquisition (the “EPD Transaction”) of Mylan Inc. and Abbott Laboratories’ (“Abbott”) non-U.S. developed markets specialty and branded generics business (the “EPD Business”), the potential benefits and synergies of the EPD Transaction and the Meda Transaction, future opportunities for Mylan and products, and any other statements regarding Mylan’s future operations, anticipated business levels, future earnings, planned activities, anticipated growth, market opportunities, strategies, competition, and other expectations and targets for future periods. These may often be identified by the use of words such as “will,” “may,” “could,” “should,” “would,” “project,” “believe,” “anticipate,” “expect,” “plan,” “estimate,” “forecast,” “potential,” “intend,” “continue,” “target,” and variations of these words or comparable words. Because forward-looking statements inherently involve risks and uncertainties, actual future results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to: the ability to meet expectations regarding the accounting and tax treatments of the EPD Transaction and the Meda Transaction; changes in relevant tax and other laws, including but not limited to changes in the U.S. tax code and healthcare and pharmaceutical laws and regulations in the U.S. and abroad; actions and decisions of healthcare and pharmaceutical regulators; the integration of the EPD Business and Meda being more difficult, time-consuming, or costly than expected; operating costs, customer loss, and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, clients, or suppliers) being greater than expected following the EPD Transaction and the Meda Transaction; the retention of certain key employees of the EPD Business and Meda being difficult; the possibility that Mylan may be unable to achieve expected synergies and operating efficiencies in connection with the EPD Transaction, the Meda Transaction, and the December 2016 announced restructuring program in certain locations, within the expected time-frames or at all and to successfully integrate the EPD Business and Meda; with respect to the Company agreeing to the terms of a $465 million settlement with the U.S. Department of Justice and other government agencies related to the classification of the EpiPen® Auto-Injector and EpiPen Jr® Auto-Injector (collectively, “EpiPen® Auto-Injector”) for purposes of the Medicaid Drug Rebate Program, the inability or unwillingness on the part of any of the parties to finalize the settlement, any legal or regulatory challenges to the settlement, and any failure by third parties to comply with their contractual obligations; expected or targeted future financial and operating performance and results; the capacity to bring new products to market, including but not limited to where Mylan uses its business judgment and decides to manufacture, market, and/or sell products, directly or through third parties, notwithstanding the fact that allegations of patent

Table of Contents

infringement(s) have not been finally resolved by the courts (i.e., an “at-risk launch”); any regulatory, legal, or other impediments to Mylan’s ability to bring new products to market; success of clinical trials and Mylan’s ability to execute on new product opportunities; any changes in or difficulties with our inventory of, and our ability to manufacture and distribute, the EpiPen® Auto-Injector to meet anticipated demand; the potential impact of any change in patient access to the EpiPen® Auto-Injector and the introduction of a generic version of the EpiPen® Auto-Injector; the scope, timing, and outcome of any ongoing legal proceedings, including government investigations, and the impact of any such proceedings on financial condition, results of operations, and/or cash flows; the ability to protect intellectual property and preserve intellectual property rights; the effect of any changes in customer and supplier relationships and customer purchasing patterns; the ability to attract and retain key personnel; changes in third-party relationships; the impact of competition; changes in the economic and financial conditions of the businesses of Mylan; the inherent challenges, risks, and costs in identifying, acquiring, and integrating complementary or strategic acquisitions of other companies, products, or assets and in achieving anticipated synergies; uncertainties and matters beyond the control of management; and inherent uncertainties involved in the estimates and judgments used in the preparation of financial statements, and the providing of estimates of financial measures, in accordance with U.S. GAAP and related standards or on an adjusted basis. For more detailed information on the risks and uncertainties associated with Mylan’s business activities, see the risks described in the Original Filing, and our other filings with the SEC. You can access Mylan’s filings with the SEC through the SEC website at www.sec.gov, and Mylan strongly encourages you to do so. Mylan undertakes no obligation to update any statements herein for revisions or changes after the filing date of this Amendment.

Reconciliation of Non-GAAP Financial Measures

This Amendment includes the presentation and discussion of certain financial information that differs from what is reported under U.S. GAAP. These non-GAAP financial measures, including, but not limited to, adjusted diluted earnings per share (“adjusted EPS”), adjusted free cash flow, and return on invested capital, are presented in order to supplement investors’ and other readers’ understanding and assessment of Mylan’s financial performance. Management uses these measures internally for forecasting, budgeting, measuring its operating performance, and incentive-based awards. In addition, primarily due to acquisitions, Mylan believes that an evaluation of its ongoing operations (and comparisons of its current operations with historical and future operations) would be difficult if the disclosure of its financial results were limited to financial measures prepared only in accordance with U.S. GAAP. We believe that non-GAAP financial measures are useful supplemental information for our investors and when considered together with our U.S. GAAP financial measures and the reconciliation to the most directly comparable U.S. GAAP financial measure, provide a more complete understanding of the factors and trends affecting our operations. The financial performance of the Company is measured by senior management, in part, using the adjusted metrics included herein, along with other performance metrics. Management’s annual incentive compensation is derived, in part, based on the adjusted EPS metric and the adjusted free cash flow metric. Appendix A to this Amendment contains reconciliations of such non-GAAP financial measures to the most directly comparable U.S. GAAP financial measures. Investors and other readers are encouraged to review the related U.S. GAAP financial measures and the reconciliations of the non-GAAP measures to their most directly comparable U.S. GAAP measures set forth in Appendix A, and investors and other readers should consider non-GAAP measures only as supplements to, not as substitutes for or as superior measures to, the measures of financial performance prepared in accordance with U.S. GAAP.

Table of Contents

MYLAN N.V.

For the Year Ended December 31, 2016

| Page | ||||||

| PART III | ||||||

| ITEM 10. |

1 | |||||

| ITEM 11. |

Executive Compensation | 14 | ||||

| ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 57 | ||||

| ITEM 13. |

Certain Relationships and Related Transactions, and Director Independence | 60 | ||||

| ITEM 14. |

Principal Accounting Fees and Services | 62 | ||||

| PART IV | ||||||

| ITEM 15. |

Exhibits | 63 | ||||

| 64 | ||||||

| Appendix A — Reconciliation of Non-GAAP Measures (Unaudited) |

||||||

Table of Contents

PART III

| ITEM 10. | Directors, Executive Officers and Corporate Governance |

Executive Officers

The names, ages, and positions of Mylan’s executive officers as of May 1, 2017, are as follows:

| Heather Bresch |

47 |

Chief Executive Officer (principal executive officer) | ||

| Daniel M. Gallagher |

44 |

Chief Legal Officer | ||

| Rajiv Malik |

56 |

President | ||

| Anthony Mauro |

44 |

Chief Commercial Officer | ||

| Kenneth S. Parks |

53 |

Chief Financial Officer (principal financial officer) |

Each executive officer listed above other than Mr. Gallagher and Mr. Parks was an executive officer of Mylan Inc. on February 27, 2015, the date on which Mylan N.V. completed the EPD Transaction, and became an executive officer of Mylan N.V. on such date in connection with the EPD Transaction.

Ms. Bresch and Mr. Malik are both also members of Mylan’s Board of Directors (the “Mylan Board”). A discussion of their respective business experience and other relevant biographical information is provided under “Mylan Board” below.

Mr. Gallagher has served as Chief Legal Officer since April 2017. Mr. Gallagher previously served as president of Patomak Global Partners, a consulting firm providing strategic advice, compliance consulting, and litigation and regulatory enforcement services, from January 2016 to March 2017. As president, Mr. Gallagher was responsible for originating and managing client matters, and assisting the Chief Executive Officer in overseeing operations of the firm. From November 2011 to October 2015, Mr. Gallagher served as a commissioner of the SEC. During his tenure at the SEC, Mr. Gallagher focused on initiatives aimed at strengthening the U.S. capital markets and encouraging capital formation, among others. Before being appointed commissioner, Mr. Gallagher served on the staff of the SEC in several capacities, including as counsel to both SEC Commissioner Paul Atkins and Chairman Christopher Cox, working on matters involving the Division of Enforcement and the Division of Trading and Markets. Mr. Gallagher served as deputy director and co-acting director of the Division of Trading and Markets from 2008 to 2010. In addition to his tenure in public service, Mr. Gallagher spent a number of years in the private sector. Following law school, he joined the Washington, D.C. law firm Wilmer Cutler & Pickering. He later returned to Wilmer (now WilmerHale) as a partner following his staff service at the SEC. Mr. Gallagher also served as senior vice president and general counsel of Fiserv Securities, Inc., where he was responsible for managing all of the firm’s legal and regulatory matters. Mr. Gallagher serves as non-executive director of both the Irish Stock Exchange and Symbiont.io, and is on the advisory board of the Drexel LeBow Center for Corporate Governance.

1

Table of Contents

Mr. Mauro has served as Chief Commercial Officer since January 2016. Prior to that date, Mr. Mauro served as President, North America of Mylan since January 1, 2012. He served as President of Mylan Pharmaceuticals Inc. from 2009 through February 2013. In his 21 years at Mylan, Mr. Mauro has held roles of increasing responsibility, including Chief Operating Officer for Mylan Pharmaceuticals ULC in Canada and Vice President of Strategic Development, North America, and Vice President of Sales, North America for Mylan.

Mr. Parks has served as Chief Financial Officer since June 2016. Mr. Parks previously served as chief financial officer for WESCO International (“WESCO”), a leading provider of electrical, industrial, and communication products, from June 2012 to May 2016, where he led all aspects of the finance function at WESCO. From June 2012 to December 2013, Mr. Parks also served as a vice president, and starting in January 2014, he also served as senior vice president. Prior to joining WESCO, Mr. Parks spent the majority of his career at United Technologies Corporation (“UTC”) in a variety of U.S. and international finance roles. He most recently served as vice president, Finance, for the $7 billion UTC Fire & Security division from 2008 to February 2012.

Pursuant to Mylan’s Rules for the Board of Directors of Mylan N.V. (the “Board Rules”), the Mylan Board appoints the Chief Executive Officer (“CEO”) and may appoint, or delegate authority to the Chairman or the CEO to appoint, a President, a Chief Financial Officer, a Chief Legal Officer, a Secretary, and any other officers of Mylan as the Mylan Board, the Chairman, or the CEO may desire. Each officer appointed by the Mylan Board, or appointed by the Chairman or the CEO, holds office until his or her successor shall have been appointed, or until his or her death, resignation, or removal. Officers of Mylan who are appointed by the Mylan Board can be removed by the Mylan Board, and the Mylan Board may delegate to the Chairman or the CEO the right to remove any officer the Chairman or the CEO has appointed (but not any officer directly appointed by the Mylan Board). A copy of the Board Rules is available on Mylan’s website at http://www.mylan.com/company/corporate-governance or in print to shareholders upon request, addressed to Mylan N.V.’s Corporate Secretary at Building 4, Trident Place, Mosquito Way, Hatfield, Hertfordshire, AL10 9UL, England.

Mylan Board

The Mylan Board currently consists of 13 directors, each of whom is either an executive director or a non-executive director pursuant to applicable Dutch law. As discussed below, 11 directors are being nominated for election at Mylan’s 2017 annual general meeting of shareholders to be held on June 22, 2017 (the “2017 AGM”). Executive directors are responsible for the daily management and operation of the Company and non-executive directors are responsible for overseeing and monitoring the performance of the executive directors. Currently, Ms. Bresch and Mr. Malik are executive directors while the other directors listed below are non-executive directors. Consistent with established Dutch law and the Company’s articles of association, executive directors and non-executive directors are appointed by the general meeting from a binding nomination proposed by the Mylan Board. If appointed, each director’s term begins at the general meeting at which he or she is appointed and, unless such director resigns or is suspended or dismissed at an earlier date, his or her term of office lapses immediately after the next annual general meeting held after his or her appointment.

2

Table of Contents

| Name |

Age# | Other Positions with Mylan and Principal Occupation |

Has | |||

| Heather Bresch^ |

47 |

Chief Executive Officer | 2011 | |||

| Wendy Cameron |

57 |

Director and Co-Owner, Cam Land LLC | 2002 | |||

| Hon. Robert J. Cindrich |

73 |

President, Cindrich Consulting; Counsel, Schnader Harrison Segal & Lewis | 2011 | |||

| Robert J. Coury |

56 |

Chairman | 2002 | |||

| JoEllen Lyons Dillon |

53 |

Executive Vice President, Chief Legal Officer, and Corporate Secretary, The ExOne Company | 2014 | |||

| Neil Dimick, C.P.A.* |

67 |

Retired Executive Vice President and Chief Financial Officer, AmerisourceBergen Corporation | 2005 | |||

| Melina Higgins |

49 |

Retired Partner and Managing Director, Goldman Sachs | 2013 | |||

| Douglas J. Leech, C.P.A.*+ |

62 |

Founder and Principal, DLJ Advisors | 2000 | |||

| Rajiv Malik^ |

56 |

President | 2013 | |||

| Joseph C. Maroon, M.D.+ |

76 |

Professor, Heindl Scholar in Neuroscience, and Vice Chairman of the Department of Neurosurgery for the University of Pittsburgh Medical Center; Neurosurgeon for the Pittsburgh Steelers | 2003 | |||

| Mark W. Parrish |

61 |

Chief Executive Officer, TridentUSA Health Services | 2009 | |||

| Rodney L. Piatt, C.P.A.*+ |

64 |

Lead Independent Director and Vice Chairman; President and Owner, Horizon Properties Group, LLC; Chief Executive Officer, Lincoln Manufacturing Inc. | 2004 | |||

| Randall L. (Pete) Vanderveen, Ph.D., R.Ph. |

66 |

Professor of Pharmaceutical Policy and Economics, Senior Adviser to the Leonard D. Schaeffer Center of Health Policy and Economics, Director of the Margaret and John Biles Center for Leadership, and Senior Adviser to the Dean for Advancement, School of Pharmacy, University of Southern California | 2002 | |||

| Nominated for election for the first time at the 2017 annual general meeting |

||||||

| Sjoerd S. Vollebregt |

62 |

Chairman, Supervisory Board of Heijmans N.V.; Chairman, Advisory Board of Airbus Defence and Space Netherlands B.V. |

| ^ | Refers to an executive director. All other directors listed above are non-executive directors. |

| * | C.P.A. distinctions refer to “inactive” status. |

| # | Ages as of May 1, 2017 |

| ** | Includes service as director of Mylan Inc. and Mylan N.V. Each director listed above, other than Mr. Vollebregt (who is not currently a director of Mylan but will be nominated for the first time at the 2017 AGM), was a director of Mylan Inc. on February 27, 2015, the date on which Mylan N.V. completed the EPD Transaction, and became a director of Mylan N.V. on such date in connection with the EPD Transaction. |

| + | As discussed on page 8 of this Amendment, Mr. Leech, Dr. Maroon, and Mr. Piatt have not been nominated for election at the 2017 AGM. |

3

Table of Contents

Heather Bresch. Ms. Bresch has served as Mylan’s CEO since January 1, 2012. Throughout her 25-year career with Mylan, Ms. Bresch has held roles of increasing responsibility in more than 15 functional areas. Prior to becoming CEO, Ms. Bresch was Mylan’s President commencing in July 2009 and was responsible for the day-to-day operations of the Company. Before that, she served as Mylan’s Chief Operating Officer and Chief Integration Officer from October 2007 to July 2009, leading the successful integration of two transformational international acquisitions — Matrix Laboratories Limited (n/k/a Mylan Laboratories Limited) and Merck KGaA’s generics and specialty pharmaceuticals businesses. Under Ms. Bresch’s leadership, Mylan has continued to expand its portfolio and geographic reach, acquiring Meda, the EPD Business, the female healthcare business of Famy Care Ltd., the non-sterile, topicals-focused business of Renaissance Acquisition Holdings, LLC, and India-based Agila Specialties, a global leader in injectable products and an innovative respiratory technology platform; partnering on portfolios of biologic and insulin products; entering new commercial markets such as China, Southeast Asia, Russia, the Middle East, Mexico, India, Brazil, and Africa; and expanding its leadership in the treatment of HIV/AIDS through the distribution of novel testing devices. During her career, Ms. Bresch has championed initiatives aimed at improving product quality and removing barriers to patient access to medicine. Ms. Bresch’s qualifications to serve on the Mylan Board include, among others, her extensive industry, policy, and leadership experience and abilities, as well as her strategic vision, judgment, and unique and in-depth knowledge about the Company.

Wendy Cameron. Ms. Cameron has served as Co-Owner and Director of Cam Land LLC, a harness racing business in Washington, Pennsylvania, since January 2003. From 1981 to 1998, she was Vice President, Divisional Sales & Governmental Affairs, Cameron Coca-Cola Bottling Company, Inc. Ms. Cameron served as Chairman of the Washington Hospital Board of Trustees and of the Washington Hospital Executive Committee until she stepped down in 2012. She was a member of the hospital’s Board of Trustees from 1997 through 2012 and a member of the Washington Hospital Foundation Board from 1993 through 2012. In addition to being a business owner and having held an executive position with one of the nation’s largest bottlers for nearly 20 years, Ms. Cameron has invaluable experience and knowledge regarding the business, platforms, strategies, challenges, opportunities, and management of the Company, among other matters. Ms. Cameron’s qualifications to serve on the Mylan Board include, among others, this experience, as well as her independence, business experience, leadership, and judgment.

Hon. Robert J. Cindrich. Since February 2011, Judge Cindrich has been serving as the President of Cindrich Consulting, LLC, a business and healthcare consulting company that advises clients on corporate governance, compliance, and business strategies, and from October 1, 2013 through January 31, 2014 he served as Interim General Counsel for United States Steel Corporation (NYSE: X), an integrated steel producer of flat-rolled and tubular products. Judge Cindrich joined Schnader Harrison Segal & Lewis (“Schnader”), a law firm, as legal counsel in April 2013 and took a temporary leave of absence on October 1, 2013 to join United States Steel Corporation as Interim General Counsel, returning to Schnader after his time at United States Steel Corporation. In May 2012, he joined the Board of Directors of Allscripts Healthcare Solutions, Inc. (NASDAQ: MDRX), which provides healthcare information technology solutions, where he served until April 2015. From 2011 through 2012, Judge Cindrich served as a senior advisor to the Office of the President of the University of Pittsburgh Medical Center (“UPMC”), an integrated global health enterprise. From 2004 through 2010, Judge Cindrich was a Senior Vice President and the Chief Legal Officer of UPMC. From 1994 through January 2004, Judge Cindrich served as a judge on the United States District Court for the Western District of Pennsylvania. Prior to that appointment, he was active as an attorney in both government and private practice, including positions as the U.S. Attorney for the Western District of Pennsylvania and as the Allegheny County Assistant Public Defender and Assistant District Attorney. Judge Cindrich’s qualifications to serve on the Mylan Board include, among others, his extensive legal and leadership experience and judgment, as well as his independence and in-depth knowledge of the healthcare industry.

Robert J. Coury. Robert J. Coury is the Chairman of Mylan N.V. Under his visionary leadership, Mylan has transformed from the third largest generics pharmaceutical company in the U.S. into one of the largest pharmaceutical companies in the world in terms of revenue, earning spots in both the S&P 500 and, prior to the

4

Table of Contents

Company’s reincorporation outside of the U.S. in 2015, the Fortune 500. Mr. Coury was first elected to the Mylan Board in February 2002, having served since 1995 as a strategic advisor to the Company. He became the Mylan Board’s Vice Chairman shortly after his election and served as CEO from September 2002 until January 2012, and as Executive Chairman from 2012 until he became Chairman as a director who is not an employee of the Company or Mylan Inc. (a “Non-Employee Director”, with all such directors being the “Non-Employee Directors”) in June 2016.

Since 2007, Mr. Coury has led the Company through a series of transactions totaling approximately $25 billion, which transformed Mylan into a global powerhouse within the highly competitive pharmaceutical industry, with a global workforce of over 35,000 and products sold in more than 165 countries. In 2007, Mylan purchased India-based Matrix Laboratories Limited, a major producer of active pharmaceutical ingredients, and the generics and specialty pharmaceuticals business of Europe-based Merck KGaA. Subsequent acquisitions under Mr. Coury’s leadership further expanded the Company into new therapeutic categories and greatly enhanced its geographic and commercial footprint. In 2010, Mylan acquired Bioniche Pharma, a global injectables business in Ireland; in 2013, Mylan acquired India-based Agila Specialties, a global injectables company; and in 2015, Mylan acquired the EPD Business and Famy Care Ltd.’s women’s healthcare businesses. Most recently, Mylan acquired Meda, a leading international specialty pharmaceutical company that sells both prescription and over-the-counter products and the non-sterile, topicals-focused business of Renaissance Acquisition Holdings, LLC.

During this period of expansion, the Company built an unmatched, high quality foundation for the future supporting Mylan’s mission of providing the world’s 7 billion people with access to high quality medicine, and benefiting patients, customers, investors, and other stakeholders. Before becoming Executive Chairman in 2012, Mr. Coury also executed a successful executive leadership transition after cultivating and developing a powerful leadership team. Grooming executive talent from within and recruiting dynamic leaders from outside the Company were both key components of the Company’s past, current, and future growth strategies.

Prior to joining Mylan, Mr. Coury was the principal of Coury Consulting, a boutique business advisory firm he formed in 1989, and The Coury Financial Group, a successful financial and estate planning firm, which he founded in 1984.

Mr. Coury is also the founder and president of the Robert J. Coury Family Foundation, which is a charitable organization formed to help support his philanthropic efforts and his mission of giving back. He has served as a member of the University of Southern California President’s Leadership Council since 2014.

Mr. Coury’s qualifications to serve on the Mylan Board include, among others, his prior business experience, his in-depth knowledge of the industry, the Company, its businesses, and management, and his leadership experience as the Company’s CEO, as well as his judgment, strategic vision, and service and leadership as Vice Chairman and then Chairman of the Mylan Board for more than ten years — the most transformational and successful time in the Company’s history.

JoEllen Lyons Dillon. Ms. Dillon has served as Chief Legal Officer and Corporate Secretary of The ExOne Company (NASDAQ: XONE), a global provider of three-dimensional printing machines, since March 2013, and as Executive Vice President since December 2014. Previously, she was a legal consultant on ExOne’s initial public offering. Prior to that experience, Ms. Dillon was a partner with Reed Smith LLP, a law firm, from 2002 until 2011. She had previously been at the law firm Buchanan Ingersoll & Rooney PC from 1988 until 2002, where she became a partner in 1997. Ms. Dillon is a member of the Board of Trustees of the Allegheny District chapter of the National Multiple Sclerosis Society and has previously served as Chair and Audit Committee Chair. Ms. Dillon’s qualifications to serve on the Mylan Board include, among others, this experience, as well as her independence, judgment, and substantial legal and leadership experience.

Neil Dimick, C.P.A.* Currently retired, Mr. Dimick previously served as Executive Vice President and Chief Financial Officer of AmerisourceBergen Corporation (NYSE: ABC), a wholesale distributor of pharmaceuticals,

5

Table of Contents

from 2001 to 2002. From 1992 to 2001, he was Senior Executive Vice President and Chief Financial Officer of Bergen Brunswig Corporation, a wholesale drug distributor. Prior to that experience, Mr. Dimick served as a partner with Deloitte & Touche LLP (“Deloitte”) for eight years. Mr. Dimick also serves on the Boards of Directors of WebMD Health Corp. (NASDAQ: WBMD), Alliance HealthCare Services, Inc. (NASDAQ: AIQ), and Resources Connection, Inc. (NASDAQ: RECN). Mr. Dimick also served on the Boards of Directors of Thoratec Corporation from 2003 to October 2015, at which time it was purchased by St. Jude Medical, Inc. Mr. Dimick has invaluable experience and knowledge regarding the business, platforms, strategies, challenges, opportunities, and management of the Company, among other matters. Mr. Dimick’s qualifications to serve on the Mylan Board include, among others, this experience, as well as his independence, substantial industry experience, business and accounting background, and judgment.

Melina Higgins. Currently retired, Ms. Higgins held senior roles of increasing responsibility at The Goldman Sachs Group, Inc. (NYSE: GS) (“Goldman Sachs”), a global investment banking, securities, and investment management firm, including Partner and Managing Director, during her nearly 20-year career at the firm from 1989 to 1992 and 1994 to 2010. During her tenure at Goldman Sachs, Ms. Higgins served as a member of the Investment Committee of the Principal Investment Area, which oversaw and approved global private equity and private debt investments and was one of the largest alternative asset managers in the world. She also served as head of the Americas and as co-chairperson of the Investment Advisory Committee for the GS Mezzanine Partners funds, which managed over $30 billion of assets and were global leaders in their industry. Ms. Higgins also serves on the Women’s Leadership Board of Harvard University’s John F. Kennedy School of Government. In September 2013, Ms. Higgins joined the Board of Directors of Genworth Financial Inc. (NYSE: GNW), an insurance company. In January 2016, Ms. Higgins became non-executive Chairman of Antares Midco Inc., a private company that provides financing solutions for middle-market, private equity-backed transactions. Ms. Higgins’ qualifications to serve on the Mylan Board include, among others, her independence, broad experience in finance, and judgment.

Douglas J. Leech, C.P.A.* Mr. Leech is the founder and principal of DLJ Advisors, a consulting company. From 1999 to 2011, he was Founder, Chairman, President and Chief Executive Officer of Centra Bank, Inc. and Centra Financial Holdings, Inc., prior to which he was Chief Executive Officer, President of the southeast region, and Chief Operating Officer of Huntington National Bank. Mr. Leech also served on the Board of Directors of United Bankshares, Inc. (NASDAQ: UBSI) from 2011 to 2015. Mr. Leech’s public accounting, audit, and professional experience has provided him financial and business expertise and leadership experience. In addition, Mr. Leech has invaluable experience and knowledge regarding the business, platforms, strategies, challenges, opportunities, and management of the Company, among other matters. Mr. Leech’s qualifications to serve on the Mylan Board include, among others, this experience, as well as his independence, years of business experience, and judgment.

Rajiv Malik. Mr. Malik has served as Mylan’s President since January 1, 2012. Previously, Mr. Malik held various senior roles at Mylan, including Executive Vice President and Chief Operating Officer from July 2009 to December 2012, and Head of Global Technical Operations from January 2007 to July 2009. In addition to his oversight of day-to-day operations of the Company as President, Mr. Malik has been instrumental in identifying, evaluating, and executing on significant business development opportunities, expanding and optimizing Mylan’s product portfolio, and leveraging Mylan’s global research and development capabilities, among other important contributions. Previously, he served as Chief Executive Officer of Matrix Laboratories Limited (n/k/a Mylan Laboratories Limited) from July 2005 to June 2008. Prior to joining Matrix, he served as Head of Global Development and Registrations for Sandoz GmbH from September 2003 to July 2005. Prior to joining Sandoz GmbH, Mr. Malik was Head of Global Regulatory Affairs and Head of Pharma Research for Ranbaxy from October 1999 to September 2003. Mr. Malik’s qualifications to serve on the Mylan Board include, among others, his extensive industry and leadership experience, his understanding of the Asia-Pacific region and other growth markets, his knowledge about the Company, and judgment.

Joseph C. Maroon, M.D. Dr. Maroon is Professor, Heindl Scholar in Neuroscience and Vice Chairman of the Department of Neurosurgery, UPMC, and has held other positions at UPMC since 1998. He also has served as

6

Table of Contents

the team neurosurgeon for the Pittsburgh Steelers since 1981. From 1995 to 1998, Dr. Maroon was Professor and Chairman of the Department of Surgery at Allegheny General Hospital, and from 1984 to 1999 he was Professor and Chairman of the Department of Neurosurgery at Allegheny General Hospital. Dr. Maroon has earned numerous awards for his contributions to neurosurgery from various national and international neurological societies throughout his career, and patients travel from all over the world to seek his care. In addition, Dr. Maroon has invaluable experience and knowledge regarding the business, platforms, strategies, challenges, opportunities, and management of the Company, among other matters. Dr. Maroon’s qualifications to serve on the Mylan Board include, among others, this experience, as well as his independence, exceptional medical and leadership experience, and judgment.

Mark W. Parrish. Mr. Parrish has served as Chief Executive Officer of TridentUSA Health Services, a provider of mobile X-ray and laboratory services to the long-term care industry, since 2008 and also served as Chairman from 2008 to 2013. Since January 2013, Mr. Parrish has also served on the Board of Directors of Omnicell, Inc. (NASDAQ: OMCL), a company that specializes in healthcare technology. Mr. Parrish also serves on the Boards of Directors of Silvergate Pharmaceuticals, a private company that develops and commercializes pediatric medications, and GSMS, a private company that specializes in meeting unique labeling and sizing needs for its customers and pharmaceutical packaging, serialization, and distribution. From 2001 to 2007, Mr. Parrish held management roles of increasing responsibility with Cardinal Health Inc. (NYSE: CAH) and its affiliates, including Chief Executive Officer of Healthcare Supply Chain Services for Cardinal Health from 2006 to 2007. Mr. Parrish also serves as President of the International Federation of Pharmaceutical Wholesalers, an association of pharmaceutical wholesalers and pharmaceutical supply chain service companies, and senior adviser to Frazier Healthcare Ventures, a healthcare oriented growth equity firm. Mr. Parrish’s qualifications to serve on the Mylan Board include, among others, his independence, extensive industry, business, and leadership experience, knowledge of the healthcare industry, and judgment.

Rodney L. Piatt, C.P.A.* Mr. Piatt is the Lead Independent Director and has served as Vice Chairman of the Mylan Board since May 2009. Since 1996, he has also been President and owner of Horizon Properties Group, LLC, a real estate and development company. Since 2003, Mr. Piatt has also served as Chief Executive Officer and Director of Lincoln Manufacturing Inc., a steel and coal manufacturing company. Mr. Piatt is also on the Board of Directors of AccuTrex Products, Inc., a private company that manufactures a wide range of custom products for diverse and demanding industries throughout the world. Mr. Piatt brings extensive experience to the Mylan Board as an auditor and a successful business owner. In addition, Mr. Piatt has invaluable experience and knowledge regarding the business, platforms, strategies, challenges, opportunities, and management of the Company, among other matters. Mr. Piatt’s qualifications to serve on the Mylan Board include, among others, this experience, as well as his independence, financial and business expertise, leadership experience, and judgment.

Randall L. (Pete) Vanderveen, Ph.D., R.Ph. Dr. Vanderveen is currently Professor of Pharmaceutical Policy and Economics, Senior Adviser to the Leonard D. Schaeffer Center of Health Policy and Economics, Director of the Margaret and John Biles Center for Leadership, and Senior Adviser to the Dean for Advancement at the School of Pharmacy, University of Southern California in Los Angeles, California. Dr. Vanderveen previously served as Dean, Professor and John Stauffer Decanal Chair of the USC School of Pharmacy from 2005 to 2015 where he was named “Outstanding Pharmacy Dean in the Nation” in 2013 by the American Pharmacist Association. From 1998 to 2005, he served as Dean and Professor of Pharmacy of the School of Pharmacy and the Graduate School of Pharmaceutical Sciences at Duquesne University, before which he was Assistant Dean at Oregon State University from 1988 to 1998. Dr. Vanderveen has an extensive pharmaceutical and academic background. In addition, Dr. Vanderveen has invaluable experience and knowledge regarding the business, platforms, strategies, challenges, opportunities, and management of the Company, among other matters. Dr. Vanderveen’s qualifications to serve on the Mylan Board include, among others, this experience, as well as his independence, pharmaceutical and leadership experience, and judgment.

| * | C.P.A. distinctions refer to “inactive” status. |

7

Table of Contents

On April 30, 2017, the Mylan Board voted to reduce the size of the Mylan Board to 11 directors, effective after the 2017 AGM. Mr. Leech, Dr. Maroon, and Mr. Piatt will retire from the Mylan Board effective June 22, 2017 and have not been nominated for re-election. On April 30, 2017, the Mylan Board also nominated Sjoerd S. Vollebregt to be elected by shareholders at the 2017 AGM to serve as a non-executive director for a term ending immediately after the next annual general meeting held after his election. Mr. Vollebregt has been Chairman of the Supervisory Board of Heijmans N.V., a Euronext Amsterdam listed company that operates in property development, residential building, non-residential building, roads, and civil engineering, since 2015, and Chairman of the Advisory Board of Airbus Defence and Space Netherlands B.V., a subsidiary of Airbus SE, a Euronext Paris listed company, that develops solar arrays, satellite instruments, and structures for launchers, since 2015. Mr. Vollebregt had served as Chairman of the Executive Board of Stork B.V. and its predecessor from 2002 to 2014, which was an Amsterdam Stock Exchange listed industrial group until 2008, consisting of a global provider of knowledge-based maintenance, modification, and asset integrity products and services, food and textile equipment manufacturer, and Chief Executive Officer of Fokker Technologies Group B.V., an aerospace company and a Stork B.V. subsidiary from 2010 to 2014. Previously, Mr. Vollebregt served as a member of the Supervisory Board of TNT Express N.V., an international courier delivery services company, from 2013 to 2016 and has held various other senior positions at Excel plc, Ocean plc, Intexo Holding, and Royal Van Ommeren. Mr. Vollebregt’s qualifications to serve on the Mylan Board include, among others, this experience as well as his independence, judgment, business and leadership experience, and understanding of and familiarity with managing and serving on the board of directors of other Dutch companies.

Meetings of the Mylan Board

The Mylan Board met six times in 2016. In addition to meetings of the Mylan Board, directors attended meetings of individual Mylan Board committees of which they were members. Each of the directors attended at least 75% of the aggregate of the Mylan Board meetings and meetings of Mylan Board committees of which they were a member during the periods for which they served in 2016. Directors are expected to attend the annual general meeting of shareholders of Mylan where practicable. All 13 current members of the Mylan Board attended Mylan’s annual general meeting of shareholders on June 24, 2016 (the “2016 AGM”).

Non-management members of the Mylan Board met in executive session from time to time during 2016. As noted, Rodney L. Piatt, the Vice Chairman of the Mylan Board, is the Lead Independent Director and has presided at such executive sessions.

Mylan Board Committees

The standing committees of the Mylan Board include the Audit Committee, the Compensation Committee, the Compliance Committee, the Executive Committee, the Finance Committee, the Governance and Nominating Committee, and the Science and Technology Committee. Each committee operates pursuant to a written charter.

8

Table of Contents

The table below provides the current membership and 2016 meeting information for the noted Mylan Board committees of Mylan.

| Director |

Audit | Compensation | Compliance | Executive | Finance | Governance and Nominating |

Science and Technology | |||||||

| Heather Bresch |

X | |||||||||||||

| Wendy Cameron |

C | X | ||||||||||||

| Hon. Robert J. Cindrich |

X | X | X | |||||||||||

| Robert J. Coury |

C | |||||||||||||

| JoEllen Lyons Dillon (1) |

X | X | X | |||||||||||

| Neil Dimick (1) |

C | X | X | X | ||||||||||

| Melina Higgins |

X | C | ||||||||||||

| Douglas J. Leech |

X | X | C | |||||||||||

| Rajiv Malik |

X | |||||||||||||

| Joseph C. Maroon, M.D. |

X | X | C | |||||||||||

| Mark W. Parrish |

X | C | X | |||||||||||

| Rodney L. Piatt |

X | X | X | X | ||||||||||

| Randall L. (Pete) Vanderveen, Ph.D., R.Ph. | X | X | ||||||||||||

| Meetings during 2016 |

4 | 6 | 4 | 2 | 4 | 4 | 3 |

| (1) | Ms. Dillon joined the Audit Committee and Governance and Nominating Committee on June 24, 2016. Mr. Dimick joined the Governance and Nominating Committee on June 24, 2016 and served on the Finance Committee until June 24, 2016. |

C = Chair

X = Member

Copies of the committee charters of Mylan are available on Mylan’s website at http://www.mylan.com/company/corporate-governance or in print to shareholders upon request, addressed to Mylan N.V.’s Corporate Secretary at Building 4, Trident Place, Mosquito Way, Hatfield, Hertfordshire, AL10 9UL, England.

Audit Committee and Audit Committee Financial Expert

The Audit Committee’s responsibilities include, among others: the appointment (other than the independent auditor of annual accounts prepared in accordance with Dutch law), compensation, retention, oversight, and replacement of the Company’s independent registered public accounting firm; approving the scope, procedures, and fees for the proposed audit for the current year and reviewing the scope, conduct, and findings of any financial or internal control-related audit performed by the independent registered public accounting firm; reviewing the organization, responsibilities, plans, and resources of the internal audit function; reviewing with management both the Company’s financial statements and management’s assessment of the Company’s internal control over financial reporting; reviewing, including reviewing and discussing with management (including the Company’s internal audit function) and the independent registered public accounting firm, as appropriate, the Company’s processes and procedures with respect to risk assessment and risk management; and reviewing, approving, ratifying, or rejecting “transactions” between the Company and “related persons” (each as defined in Item 404 of Regulation S-K). All of the members of the Audit Committee are independent directors, as required by and as defined in the audit committee independence standards of the SEC and the applicable NASDAQ listing standards. The Mylan Board has determined that Mr. Dimick, Ms. Higgins, Mr. Leech, and Mr. Piatt are each an “audit committee financial expert,” as that term is defined in the rules of the SEC. The Mylan Board has also approved Mr. Dimick’s concurrent service on the audit committees of more than two other public companies.

9

Table of Contents

Compensation Committee

The Compensation Committee’s responsibilities include, among others: reviewing and recommending to the non-executive, independent (in accordance with the NASDAQ listing standards) members of the Mylan Board corporate goals and objectives relevant to the Executive Chairman’s (if applicable), CEO’s, and other executive directors’ compensation, evaluating such individual’s performance, and determining (with respect to the CEO’s and other executive directors’ compensation) and providing recommendations to the non-executive, independent members of the Mylan Board with respect to such individual’s compensation based on these evaluations. In making such recommendations, the Compensation Committee may consider pay for performance, alignment with long-term shareholder interests, promotion of Company strategic goals, maintenance of the appropriate level of fixed and at-risk compensation, remaining competitive with companies within the Company’s peer group, internal pay equity, an executive’s leadership and mentoring skills and contributions, talent management, the executive’s contributions to establishment or execution of corporate strategy, retention, and recognition of individual performance and contributions, and/or any other factors determined by the Mylan Board or the Compensation Committee to be in the interests of the Company. The Compensation Committee also exercises oversight of, and provides recommendations to the Mylan Board as appropriate regarding, the compensation of the other executive officers of the Company and applicable compensation programs and incentive compensation plans, as well as the compensation of independent directors. The Compensation Committee may, in its sole discretion, delegate any of its responsibilities to one or more subcommittees of one or more directors who are members of the Compensation Committee as the Compensation Committee may deem appropriate. All of the members of the Compensation Committee are independent directors as defined in the applicable NASDAQ listing standards.

Compliance Committee

The Compliance Committee oversees the Chief Compliance Officer’s implementation of the Company’s Corporate Compliance Program and, as appropriate, makes recommendations to the Mylan Board with respect to the formulation or re-formulation of, and the implementation, maintenance, and monitoring of, the Company’s Corporate Compliance Program and Code of Business Conduct and Ethics as may be modified, supplemented, or replaced from time to time, designed to support and promote compliance with corporate policies and legal rules and regulations. All of the members of the Compliance Committee are independent directors as defined in the NASDAQ listing standards.

Executive Committee

The Executive Committee exercises those powers of the Mylan Board not otherwise limited by a resolution of the Mylan Board or by law.

Finance Committee

The Finance Committee advises the Mylan Board with respect to, and by discharging the duties and responsibilities delegated to it by the Mylan Board in respect of, material financial matters and transactions of the Company including, but not limited to: reviewing and overseeing material mergers, acquisitions, and combinations with other companies; swaps and other derivatives transactions; the establishment of credit facilities; potential financings with commercial lenders; and the issuance and repurchase of the Company’s debt, equity, hybrid, or other securities. All of the members of the Finance Committee are independent directors as defined in the applicable NASDAQ listing standards.

Governance and Nominating Committee

The Governance and Nominating Committee advises the Mylan Board with respect to corporate governance matters as well as the nomination or re-nomination of director candidates and its responsibilities also include

10

Table of Contents

overseeing both the Mylan Board’s review and consideration of shareholder recommendations for director candidates and the Mylan Board’s annual self-evaluation. Additionally, the Governance and Nominating Committee oversees director orientation and Mylan Board continuing education programs and makes recommendations to the Mylan Board with respect to the annual evaluation of independence of each director and, as needed, the appointment of directors to committees of the Mylan Board and the appointment of a chair of each committee. All of the members of the Governance and Nominating Committee are independent directors as defined in the applicable NASDAQ listing standards.

Science and Technology Committee

The Science and Technology Committee serves as a sounding board as requested by management and, at the Mylan Board’s request, reviews the Company’s research and development (“R&D”) strategy and portfolio from time to time from a scientific and technological perspective.

Board Education

From time-to-time, the Mylan Board or individual Mylan Board members participate in director educational programs.

Mylan Board Leadership Structure

The Mylan Board elects one of its own members as the Chairman of the Board. Mr. Coury has served as the Chairman of the Board of Mylan Inc. and Mylan N.V. since being elected in May 2009. On June 3, 2016, the independent members of the Mylan Board unanimously approved the transition of Mr. Coury from Executive Chairman to the role of Chairman of the Mylan Board as a Non-Employee Director effective as of the close of the 2016 AGM (June 24, 2016). Based on significant interaction and experience with Mr. Coury, the independent directors on the Mylan Board continue to believe that Mr. Coury’s highly collaborative relationship with the independent directors, including the Lead Independent Director, his extensive knowledge of the industry, Mylan’s management, businesses, and global platform, and the opportunities and challenges anticipated in the future, as well as his proven leadership abilities, vision, and insight, and the continued outstanding performance of the Company, make him the ideal person to lead the Mylan Board. Mr. Coury previously served as CEO of the Company from September 2002 to January 2012.

In his capacity as Chairman as a Non-Employee Director, Mr. Coury continues to be actively focused on his role of providing the overall strategic leadership for the Company, consistent with Dutch law and the Company’s organizational documents. Mr. Coury also continues to be directly involved on behalf of the Mylan Board in any material transactions involving the Company, as well as in other matters considered significant by the Mylan Board, including providing guidance to the senior management team as well as interactions with shareholders. During Mr. Coury’s leadership over approximately the last 15 years as both Executive Chairman and, prior to that role, as CEO, he has served as a key architect in helping Mylan become a global leader in the generic and specialty pharmaceutical industry with a leading and differentiated global operating platform and commercial infrastructure. Mr. Coury, who has agreed with Mylan to remain in the role of non-executive Chairman for at least the next five years, will more intently focus, with the Mylan Board and in collaboration with the senior executive management team, on the strategy for Mylan for the next decade and beyond.

In his previous capacity as Executive Chairman, Mr. Coury’s primary responsibilities included certain executive responsibilities, providing overall leadership and strategic direction of the Company; providing guidance to the CEO and senior management; coordinating the activities of the Mylan Board; overseeing talent management; communicating with shareholders and other stakeholders; strategic business development; and mergers and acquisitions.

Effective January 1, 2012, the Mylan Board implemented an enhanced management structure, appointing Ms. Bresch as CEO and Mr. Malik as President, among other changes described in previous public filings.

11

Table of Contents

In connection with this enhanced management structure implemented in 2012, the Mylan Board also appointed Mr. Piatt as Lead Independent Director based on, among other factors, Mr. Piatt’s independence, outstanding contributions as a director of the Company, excellent business judgment, and recognized leadership abilities. The Mylan Board believes that this appointment only further enhanced the Mylan Board’s already strong independent oversight of the Company. As Lead Independent Director, Mr. Piatt presides at executive sessions of the independent directors, and he has the authority to call meetings of the independent directors. He also serves on the Executive Committee of the Mylan Board. In addition, the Chairman, in consultation with the Lead Independent Director, as applicable, determines the information sent to the Mylan Board, the meeting agendas, and meeting schedules to assure that there is sufficient time for discussion of agenda items. The Lead Independent Director in turn is charged with separately approving information sent to the Mylan Board, its meeting agendas, and its meeting schedules. He also serves as the contact person for stakeholders wishing to communicate with the Mylan Board and as a liaison between the Chairman and independent directors.

As of 2012, in her role as CEO, Ms. Bresch’s primary responsibilities include the day-to-day running and oversight of the Company’s global operations, business, and functions; executing on and overseeing implementation of strategies developed or approved by the Mylan Board; continued oversight of process and operational enhancements; and continued implementation of a blueprint for an organizational design to help ensure the sustainability of our success into the future.

The Mylan Board strongly believes, and the Company’s short- and long-term performance demonstrates, that the current Mylan Board and management structures are ideal for Mylan, and that they have produced outstanding results for shareholders and have benefited the interests of other stakeholders, as illustrated on pages 15 to 27 of this Amendment. We believe that the Company and its stakeholders have benefited, and continue to benefit, from the respective leadership, judgment, vision, experience — and performance — of the Mylan Board and management structure, and that the CEO, Ms. Bresch, and the President, Mr. Malik, share a vision for the Company that is consistent with the Mylan Board’s philosophy.

This determination is based on, among other factors, senior management’s demonstrated leadership abilities; the performance of the Company; the Mylan Board’s deep and unique knowledge of the complexity, size, and dramatic growth of the Company, the Company’s businesses, operations, vision, and strategies; the respective talents and capabilities of our fellow directors and management; and the opportunities and challenges anticipated in the future.

Our governance structure also provides effective independent oversight by the Mylan Board in the following additional ways, among others:

| • | ten of the 13 current members of the Mylan Board are independent; |

| • | the Mylan Board has established robust Corporate Governance Principles; |

| • | the Audit, Compensation, Compliance, Finance, and Governance and Nominating Committees are all composed entirely of independent directors (as defined in the applicable NASDAQ listing standards); |

| • | the independent directors on the Mylan Board and its committees receive extensive information and input from management and external advisors, engage in detailed discussion and analysis regarding matters brought before them (including in executive session), and consistently and actively engage in the development and approval of significant corporate strategies; |

| • | the Mylan Board and its committees have unrestricted access to management; |

| • | the Mylan Board and its committees (other than the Science and Technology Committee) can retain, at their discretion and at Company expense, any advisors they deem necessary with respect to any matter brought before the Mylan Board or any of its committees (the Science and Technology Committee retains advisors in consultation with the Chairman and the Lead Independent Director); |

12

Table of Contents

| • | the Mylan Board and its committees are intimately familiar with the business and management of the Company and collectively met 33 times in 2016; and |

| • | in 2016, the Mylan Board held five executive sessions of non-management members while its committees collectively held 20 executive sessions. |

Board of Directors Risk Oversight

The Audit Committee is primarily responsible for overseeing the Company’s risk management processes on behalf of the full Mylan Board. The Audit Committee focuses on financial reporting risk and oversight of the internal audit function. It receives reports from management at least quarterly regarding, among other matters, the Company’s assessment of risks and the adequacy and effectiveness of internal controls. The Audit Committee also receives reports from management addressing risks impacting the day-to-day operations of the Company. Mylan’s internal audit function meets with the Audit Committee on at least a quarterly basis to discuss potential risk or control issues. The Audit Committee reports regularly to the full Mylan Board, which also considers the Company’s risk profile. The full Mylan Board focuses on the most significant risks facing the Company and the Company’s general risk management strategy, and also seeks to ensure that risks undertaken by the Company are consistent with the Mylan Board’s risk management expectations. While the Mylan Board oversees the Company’s overall risk management strategy, management is responsible for the day-to-day risk management processes. We believe this division of responsibility continues to remain a highly effective approach for addressing the risks facing the Company and that the Mylan Board’s leadership structure supports this approach.

In addition, the Compensation Committee is responsible for overseeing the Company’s compensation risks as discussed further beginning on page 39 of this Amendment under “Consideration of Risk in Company Compensation Policies.”

Also, the Compliance Committee is responsible for overseeing the Company’s corporate compliance program and related policies and controls.

Code of Ethics; Corporate Governance Principles; Code of Business Conduct and Ethics

The Mylan Board has adopted a Code of Ethics for the Company’s Chief Executive Officer, Chief Financial Officer and Controller. The Mylan Board also has adopted Corporate Governance Principles as well as a Code of Business Conduct and Ethics applicable to all directors, officers, and employees.

Copies of the Code of Ethics for the Company’s Chief Executive Officer, Chief Financial Officer and Controller, the Corporate Governance Principles, and the Code of Business Conduct and Ethics for Mylan N.V. are posted on Mylan N.V.’s website at http://www.mylan.com/company/corporate-governance. Copies of the Code of Ethics for the Company’s Chief Executive Officer, Chief Financial Officer and Controller, the Corporate Governance Principles, and the Code of Business Conduct and Ethics for Mylan N.V. are also available in print to shareholders upon request, addressed to Mylan N.V.’s Corporate Secretary at Building 4, Trident Place, Mosquito Way, Hatfield, Hertfordshire, AL10 9UL, England. Mylan N.V. intends to post any amendments to and waivers from the Code of Ethics for the Company’s Chief Executive Officer, Chief Financial Officer and Controller on its website as identified above.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires all directors and certain executive officers and persons who own more than 10% of a registered class of Mylan’s equity securities to file with the SEC within specified due dates reports of ownership and reports of changes of ownership of Mylan ordinary shares and our other equity securities. These persons are required by SEC regulations to furnish us with copies of all Section 16(a) reports they file. Based on reports and written representations furnished to us by these persons,

13

Table of Contents

we believe that all Mylan directors and relevant executive officers complied with these filing requirements during 2016.

| ITEM 11. | Executive Compensation |

Executive Compensation for 2016

Compensation Discussion and Analysis

NAMED EXECUTIVE OFFICERS

This Compensation Discussion and Analysis (“CD&A”) describes the compensation of the following named executive officers (“NEOs”) for 2016.

| Name | Position | |

| Heather Bresch |

Chief Executive Officer | |

| Kenneth S. Parks |

Chief Financial Officer | |

| Rajiv Malik |

President | |

| Anthony Mauro |

Chief Commercial Officer | |

|

John D. Sheehan, CPA(1) |

Former Executive Vice President and Chief Financial Officer | |

| Robert J. Coury(2) |

Former Executive Chairman, currently Chairman of the Mylan Board as a Non-Employee Director |

| (1) |

Mr. Sheehan departed Mylan effective April 1, 2016. |

| (2) | In June 2016, the Mylan Board, in another step toward further ensuring strong and stable long-term leadership of the Company, as discussed in further detail below, unanimously approved Mr. Coury’s retirement and transition from Executive Chairman to the role of Chairman of the Mylan Board as a Non-Employee Director. This change was effective as of the close of the 2016 AGM. |

EXECUTIVE SUMMARY

Leading Global Pharmaceutical Company Providing Access to High Quality Medicine

| Company Mission |

At Mylan, we are committed to setting new standards in healthcare. Working together around the world to provide 7 billion people access to high quality medicine, we:

• Innovate to satisfy unmet needs; • Make reliability and service excellence a habit; • Do what’s right, not what’s easy; and • Impact the future through passionate global leadership.

|

14

Table of Contents

| Business Overview |

Global Reach:

• One of the largest pharmaceutical companies in the world today in terms of revenue • Develops, licenses, manufactures, markets, and distributes generic, brand name, and over-the-counter (“OTC”) products, as well as active pharmaceutical ingredients (“API”) • One of the industry’s broadest product portfolios, including more than 7,500 marketed products globally; supplies antiretroviral therapies to approximately 50% of people being treated for HIV/AIDS in the developing world • Balanced and diversified global commercial footprint with products sold in more than 165 countries and territories • Operates a global, high quality, vertically-integrated manufacturing platform with 50 manufacturing sites worldwide • Strong and innovative R&D network that has consistently delivered a robust product pipeline, including complex products such as injectables, respiratory products, insulin analogs, and biosimilars • A talented global workforce of more than 35,000 employees as of December 31, 2016

| |

| U.S. Business Overview:

• Mylan holds a top two ranking within the U.S. generics prescription market in terms of both sales and prescriptions dispensed • More than 635 brand, generic, and OTC products marketed in the U.S. • Our medicines filled one of every 13 prescriptions in the U.S. — more than Pfizer, GlaxoSmithKline, Johnson & Johnson, AstraZeneca, Merck, Sanofi, and Eli Lilly combined — representing more than 22 billion doses at an average price of just 25 cents per dose • Nearly 80% of Mylan’s products sold in the U.S. are manufactured in the U.S. • A talented workforce of approximately 7,000 located in the U.S. |

Looking Back: Over 15 Years of Outstanding Long-Term Value Creation and Superior Results

Long-Term Leadership Team Delivered Long-Term Results. Over the course of the last 15 years, Mylan has transformed from being a strong presence in the U.S. domestic generic pharmaceutical industry into a global pharmaceutical market leader with strong positions in generic, brand, and OTC medicines, as well as API. Our leadership team drove this transformation through a consistent, carefully devised, and executed growth strategy. As one of the most stable and longest tenured leadership teams in our industry, our Chairman, CEO, President, and Chief Commercial Officer have combined for over 70 years of dedicated service to Mylan. This stability has been very important, given the breadth and complexity of Mylan’s global platform, the complex and differing regulatory environments in which Mylan operates around the world, and the on-going consolidation and disruption in our highly volatile, intensely competitive industry, among other reasons. Each of these leaders has been focused on a unique aspect of our business. This leadership structure has created sustained value for shareholders, and has allowed Mylan to focus on executing on our long-term strategy even during periods of potential disruption caused by industry and other headwinds and forces outside our control in various

15

Table of Contents

jurisdictions and geographies. Among other matters, Mr. Coury has been responsible for the overall strategic direction of Mylan; Ms. Bresch has been responsible for executing our strategy and overall company performance; and Mr. Malik has been responsible for the oversight of day-to-day operations, R&D, and other disciplines within the Company. Mr. Mauro, who was promoted to the role of Chief Commercial Officer in early 2016, is responsible for overseeing all of Mylan’s commercial businesses around the world. As discussed below, 2016 was another transformational year for the Company.

|

Over 70 Years of Combined Service and Experience Among a Leadership Team that has Delivered Sustained Value

• Our Chairman, Mr. Coury, joined the Mylan Board and became CEO and Vice Chairman in 2002 and CEO and Chairman in 2009, transitioning to the role of Executive Chairman in 2012, a position he held through June 24, 2016, when he became Chairman as a Non-Employee Director.

• Our CEO, Ms. Bresch, has served Mylan for 25 years in roles of increasing responsibility in more than 15 functional areas.

• Our President, Mr. Malik, has served Mylan for approximately ten years since joining Mylan in 2007 through the acquisition of Matrix Laboratories, one of the world’s largest suppliers of API (and prior to that had another 20 years of experience in the pharmaceutical industry).

• Our Chief Commercial Officer, Mr. Mauro, has been with Mylan for over 20 years, in roles of increasing responsibility in our commercial businesses.

|

Successful Long-Term Results. The Mylan Board has overseen the development of a differentiated, clear, and consistent long-term strategy, and partnered with and empowered our unique and talented management team to execute on that vision. Mylan has been successful at creating sustained long-term shareholder value while acting in the best interests of shareholders, employees, customers, patients, our communities, and our other stakeholders in pursuit of the Company’s mission to provide access to a broad range of high quality medicine to the global population. We have created this long-term value to shareholders by consistently operating based on the principle that a well-run company delivers value to all its stakeholders.

In addition to creating billions of dollars in shareholder value for our investors, our results have benefited our entire range of stakeholders. For example:

| • | Over the last 15 years, the market capitalization of Mylan has increased from ~$3 billion (as of March 31, 2001) to ~$20 billion (as of December 31, 2016), an increase of ~$17 billion |

| • | Over the five-, ten-, and fifteen- year periods ending on December 31, 2016, Mylan has delivered exceptional absolute stock price appreciation of 78%, 93%, and 140%, respectively |

| • | Since going global in 2008, Mylan has increased its U.S. workforce by ~2,500, and now totals ~7,000 as part of a more than 35,000-member talented global workforce as of December 31, 2016 |

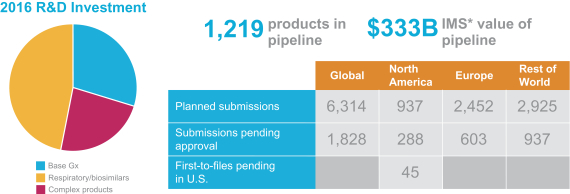

| • | Mylan has invested approximately $3 billion on R&D in the last five years alone, and today has more than 1,800 new product submissions pending regulatory approval around the world, with more than 6,000 planned submissions globally |

| • | Leveraging our differentiated, global operating platform, Mylan has decreased annual average net prices over the last five years across its entire U.S. business, including EpiPen® Auto-Injector |

16

Table of Contents

| • | Mylan has saved the U.S. healthcare system an estimated $180 billion over the last ten years by developing high quality generic alternatives to more costly branded pharmaceuticals |

Successful 2016 Financial and Operational Results with Industry-Wide Challenges. Despite industry-wide headwinds in 2016, including volatility and valuation contraction in the generic and specialty pharmaceutical industry due in part to industry-wide drug pricing concerns, Mylan delivered successful financial and operational results for 2016.

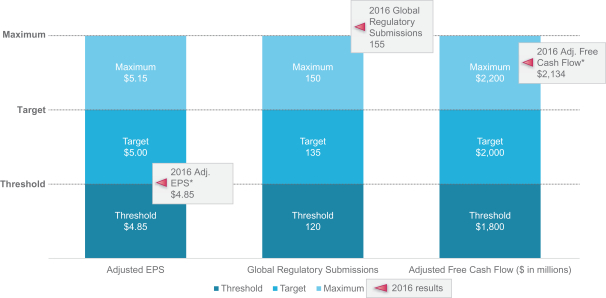

Shown below are certain financial and operational metrics used in our 2016 annual incentive program and results against those metrics.

Performance Against 2016 Annual Incentive Plan Metrics

| * | The adjusted EPS amount is derived from Mylan’s audited financial statements in the same manner as Mylan publicly reports adjusted EPS (which for 2016 is reconciled to the most directly comparable U.S. GAAP measure in Appendix A), but for annual incentive plan purposes is measured on a constant currency basis. Adjusted free cash flow is derived from Mylan’s audited financial statements in the same manner as Mylan publicly reports adjusted free cash flow (which for 2016 is reconciled to the most directly comparable U.S. GAAP measure in Appendix A). |

Continued Growth Through Successful Strategic Acquisitions in 2016. Over the last decade, Mylan has carefully planned, executed, and integrated acquisitions that, together with robust organic growth, have been key to our long-term growth, and 2016 was no exception. In 2016, we completed and began integrating our acquisitions of Meda and the non-sterile topicals-focused specialty and generics business of Renaissance Acquisition Holdings, LLC. These transactions further built our scale and breadth from a product and geographic perspective and further positioned the Company for ongoing value creation.

17

Table of Contents

Looking Ahead: Mylan is Positioned for Future Growth and Value Creation

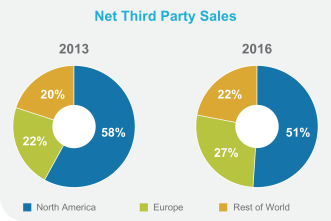

Global Company with Diversified Strategy to Drive Growth and Value Creation. Our strategy over the past decade has produced a highly differentiated global company capable of making high quality medicines available to those who need them, and we believe will continue to drive growth going forward. As just one example, over the last four years, including as a result of the EPD Transaction and the Meda Transaction, among other things, we have diversified the geographic sources of our net third party sales.

Percentages reflect total Net Third Party Sales

| As our customers continue to consolidate and global demand for medicines increases, Mylan is uniquely positioned to meet these needs through our scale, global supply chain, and commitment to driving access. |

We believe there simply is no other company that combines our unique operating platform, tremendous work ethic, willingness to challenge the status quo, and desire to champion the cause of better health for the world’s 7 billion people in order to serve the interests of all stakeholders. |

|||||||||

|

• We continue to leverage our differentiated, global operating platform. This vertically-integrated platform includes 50 manufacturing sites around the world, with extensive capabilities and the capacity to produce approximately 80 billion oral solid doses, 4,800 kiloliters of APIs, 500 million injectable units, and 1.5 billion complex-product units annually to high quality standards and with the efficiency to manage costs. |

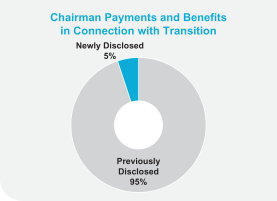

|