Attached files

| file | filename |

|---|---|

| EX-31.1 - EX-31.1 - CDI CORP | d385598dex311.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-K/A

(Amendment No. 1)

| ☒ | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Fiscal Year Ended December 31, 2016

or

| ☐ | Transition Report Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934 |

for the Transition Period from to

Commission file number: 001-05519

CDI Corp.

(Exact name of registrant as specified in its charter)

| Pennsylvania | ||

| (State of incorporation) | Securities registered pursuant to Section 12(b) of the Act: | |

| 1735 Market Street, Suite 200, Philadelphia, PA 19103 | Common stock, $0.10 par value | |

| (Address of principal executive offices) | (Title of each class) | |

| 23-2394430 | New York Stock Exchange | |

| (I.R.S. Employer Identification Number) | (Name of exchange on which registered) | |

| (215) 569-2200 | ||

| (Registrant’s telephone number, including area code) | Securities registered pursuant to Section 12(g) of the Act: None | |

Indicate by a check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ YES ☒ NO

Indicate by a check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ YES ☒ NO

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ YES ☐ NO

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (section 232.405 of this chapter) during the preceding 12 months (or for shorter period that the registrant was required to submit and post such files). ☒ YES ☐ NO

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☒ | |||

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) ☐ YES ☒ NO

As of June 30, 2016, the aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates was $84.3 million computed by reference to the reported price at which the common equity was last sold on the New York Stock Exchange on June 30, 2016, which was the last business day of the registrant’s most recently completed second fiscal quarter.

The number of shares outstanding of each of the registrant’s classes of common stock as of April 24, 2017 was as follows:

| Common stock, $0.10 par value | 18,692,201 Shares | |

| Class B common stock, $0.10 par value | None |

Documents Incorporated By Reference

None

Table of Contents

Unless expressly indicated or the context requires otherwise, the terms “CDI,” the “company,” the “Registrant”, “we,” “us,” and “our” in this document refer to CDI Corp., a Pennsylvania corporation.

This Amendment No. 1 on Form 10-K/A (this “Amendment”) amends our Annual Report on Form 10-K for the fiscal year ended December 31, 2016 (the “Original 10-K Filing”), filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 8, 2017 (the “Original Filing Date”). The purpose of this Amendment is to include the information required by Items 10 through 14 of Part III of Form 10-K. This information was previously omitted from the Original 10-K Filing in reliance on General Instruction G(3) to Form 10-K, which permits the information in the above-referenced items to be incorporated in the Form 10-K by reference from our definitive proxy statement if such proxy statement is filed no later than 120 days after our fiscal year-end. We are filing this Amendment to include Part III information in our Form 10-K because we will not be filing a definitive proxy statement containing such information within 120 days after the end of the fiscal year covered by the Original 10-K Filing. On March 20, 2017, CDI announced that it will be moving its annual shareholders’ meeting to the fourth quarter of this year. The reference on the cover of the Original 10-K Filing to the incorporation by reference to portions of our definitive proxy statement into Part III of the Original 10-K Filing is hereby deleted.

In accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Securities Exchange Act”), Part III, Items 10 through 14 and Part IV, Item 15 of the Original 10-K Filing are hereby amended and restated in their entirety. This Amendment does not amend, modify or otherwise update any other information in the Original 10-K Filing. Accordingly, this Amendment should be read in conjunction with the Original 10-K Filing and our other filings made with the SEC after the Original Filing Date.

Also in accordance with Rule 12b-15 under the Securities Exchange Act, this Amendment contains a new certification pursuant to Section 302 of the Sarbanes-Oxley Act of 2002, which is attached hereto. Because no financial statements are included in this Amendment and this Amendment does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4, and 5 of the certification have been omitted.

2

Table of Contents

CDI CORP.

FORM 10-K/A

For the Fiscal Year Ended December 31, 2016

Amendment No. 1

| Page Number | ||||||

| 2 | ||||||

| Item 10. |

4 | |||||

| Item 11. |

9 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters . |

50 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence. |

54 | ||||

| Item 14. |

55 | |||||

| Item 15. |

57 | |||||

| 58 | ||||||

3

Table of Contents

| Item 10. | Directors, Executive Officers and Corporate Governance. |

Directors and Executive Officers

The names of our directors and executive officers and information about them as of April 17, 2017 are set forth below. There are no family relationships among any of our directors or executive officers.

Directors

Below is information about the current members of CDI’s Board of Directors (the “Board”), including each person’s age, positions held, principal occupation and business experience for at least the past five years, and the names of other publicly-held companies of which the person currently serves as a director or has served as a director during at least the past five years. Information is also presented below regarding each director’s specific experience, qualifications, attributes and skills that led our Governance and Nominating Committee and our Board to the conclusion that he or she should serve as a director of CDI. All of the directors below were elected at CDI’s 2016 shareholders’ meeting, to serve until the next annual meeting of the shareholders of the company.

JOSEPH L. CARLINI

Mr. Carlini, age 54, has been a director of CDI since May 2014. Mr. Carlini has been the Chief Executive Officer of McKean Defense Group, Inc., an engineering and technology solutions firm that provides services to the U.S. Navy and other federal government customers, since 2006. From 1998 until 2006, he was a Group Senior Vice President of Science Applications International Corporation (SAIC), a provider of technical, engineering and enterprise IT services, primarily to the U.S. government.

Mr. Carlini has significant senior leadership, management and operational experience, including over ten years as the CEO of a professional services company. He brings to our Board extensive knowledge and experience in the engineering, IT and outsourcing fields and in the federal defense industry, all of which are important to CDI’s business. He has an engineering degree, which gives him a technical understanding of a major segment of CDI’s business.

MICHAEL J. EMMI

Mr. Emmi, age 75, has been a director of CDI since 1999. Since 2002, he has been the Chairman of the Board of IPR International LLC, which provides electronic data backup storage, archiving, business continuity and data center services. He was the Chief Executive Officer of IPR International LLC from 2002 to April 2013. From 1985 to 2002, he was the Chairman and CEO of Systems & Computer Technology Corporation, a public company which provided information technology services and software to higher education, local government, utilities and manufacturing customers. He served as a director of Metallurg, Inc. from 2003 to 2007 and as a director of Education Management Corporation from 2004 to 2006.

Mr. Emmi has significant senior leadership, management and operational experience, including many years as CEO of a public professional services company. He brings to our Board extensive knowledge and experience in the IT and outsourcing fields, which are important parts of CDI’s business. He has considerable experience in corporate transactions, such as mergers and acquisitions, which is valuable to our Board. He also has experience as a director of other public companies.

4

Table of Contents

WALTER R. GARRISON

Mr. Garrison, age 90, has been a director of CDI since 1958 and the Chairman of the Board of CDI since 1961. From 1961 until 1997, he was also the President and CEO of CDI.

As the long-time CEO and Chairman of the company, Mr. Garrison has demonstrated executive leadership and broad management skills in building CDI’s business. He brings to the Board his extensive knowledge of CDI and the engineering, staffing and outsourcing businesses. Due to his experience as a registered professional engineer, he possesses a technical understanding of a major segment of CDI’s business.

LAWRENCE C. KARLSON

Mr. Karlson, age 74, has been a director of CDI since 1989. He is currently a private investor and independent consultant for industrial and technology companies. He was the Chairman and CEO of Berwind Financial Corporation, a leveraged buyout group, from 2001 to 2004. Prior to that time, he served as Chairman of Spectra-Physics AB, a provider of laser technology and products, President and CEO of Pharos AB, an instrumentation manufacturer, President and CEO of Nobel Electronics, a manufacturer of transducers, and President, U.S. Operations of Fischer & Porter Co., a designer and manufacturer of process instrumentation. He has served as a director of H&E Equipment Services, Inc. since 2005. He was a director of Campbell Soup Company from 2009 until November 2015. He was the Chairman of the Board of Mikron Infrared Company, Inc. from 2000 until 2007. Mr. Karlson is the author of “Corporate Value Creation”, published by John Wiley & Sons in 2015.

Mr. Karlson has broad senior leadership, management and operational experience. He has held senior executive positions at companies based outside the United States, giving him a global perspective that may be helpful for CDI. He has substantial experience in corporate transactions, such as mergers and acquisitions, which is valuable to our Board. He also has experience as a director of numerous public companies over the years, including service as the chairman of public company boards, which benefits our Board.

RONALD J. KOZICH

Mr. Kozich, age 78, has been a director of CDI since 2003. He was the Managing Partner of the Philadelphia region of Ernst & Young LLP, a large accounting firm, from 1991 to 1999, when he retired. He is a Certified Public Accountant. He served as a director of Tasty Baking Company from 2000 to 2011.

Mr. Kozich’s extensive financial and accounting knowledge and experience is valuable to our Board and the Audit Committee. He fills an important role as an “audit committee financial expert”. He brings to the Board management, human resources and operational experience from his career at Ernst & Young LLP. He also served for many years on the board of directors of a public company and as an audit committee financial expert at that public company.

5

Table of Contents

ANNA M. SEAL

Ms. Seal, age 61, has been a director of CDI since 2010. Since 2015, she has been actively involved in the launch of Falcon Therapeutics Inc., a biotechnology company focused on stem cell therapies for the treatment and cure of brain cancer. From 2001 to 2012, she was Senior Vice President and Chief Financial Officer of the Global Manufacturing and Supply Division of GlaxoSmithKline, a major pharmaceutical and consumer healthcare company. She previously served as General Manager and CFO of Smithkline Beecham’s Animal Health Division, effecting a turnaround and subsequent sale of that business. Ms. Seal is a Certified Public Accountant and is a member of the Financial Executives Institute and American Institute of Certified Public Accountants. She served as a director of Arrow International, Inc. from 2005 until 2007 and served on that company’s Audit Committee as the “audit committee financial expert”.

Ms. Seal has substantial financial, executive and operational experience. Her extensive financial and accounting knowledge is valuable to our Board and to our Audit Committee. She serves as one of CDI’s “audit committee financial experts”. She also has significant experience in the areas of general management, strategic planning, business restructuring, and corporate acquisitions and dispositions, both domestically and internationally, which is beneficial to our Board.

ALBERT E. SMITH

Mr. Smith, age 67, has been a director of CDI since 2008 and served as Lead Director from February 2014 to November 2016. He was the Chairman of Tetra Tech, Inc., an environmental engineering and consulting firm, from 2006 until 2008. He was Executive Vice President of Lockheed Martin Corporation, an aerospace, defense, security and technology company, from 2000 to 2004. He has served as a director of Tetra Tech, Inc. since 2005 and as a director of Curtiss-Wright Corporation since 2006.

Mr. Smith has significant executive, management and operational experience, including his leadership roles at Tetra Tech, Inc. and Lockheed Martin Corporation. He brings broad knowledge of the engineering services business and the federal defense industry, which are important parts of CDI’s business. Mr. Smith has an engineering degree, which gives him a technical understanding of CDI’s engineering business. He also has experience as a director of other public companies.

BARTON J. WINOKUR

Mr. Winokur, age 77, has been a director of CDI since 1968. He has been a partner at Dechert LLP, an international law firm, since 1972. He was the Chairman and CEO of Dechert LLP from 1996 to 2011.

Mr. Winokur has extensive experience as a lawyer in representing public and private companies in complex transactions such as mergers, acquisitions, divestitures and joint ventures. He has counseled many boards of directors of public companies in connection with a wide variety of corporate governance matters. His knowledge and background in those areas are valuable to CDI’s Board. Mr. Winokur also has demonstrated executive leadership as the Chairman and CEO of a large global law firm. As a long-serving director of CDI, Mr. Winokur has extensive knowledge of the company and its business. He also has experience as a director of other public companies.

6

Table of Contents

Executive Officers

Below is information about the current executive officers of CDI, including each person’s age, positions held, and business experience for at least the past five years. Our executive officers are appointed by, and serve at the discretion of, our Board of Directors.

MICHAEL S. CASTLEMAN

Mr. Castleman, age 49, has been the President and interim Chief Executive Officer of CDI since September 15, 2016. He is, and has been since March 2015, CDI’s Chief Financial Officer. He was an Executive Vice President of CDI from October 2014 until September 15, 2016. From October 2014 to March 2015, he was CDI’s Executive Vice President - Corporate Development and Operations. Prior to joining CDI, Mr. Castleman was President of the Kenmore, Craftsman and DieHard business unit of Sears Holdings Corporation (“SHC”) and a Corporate Senior Vice President of SHC (from September 2011 to October 2014). He was the Chief Financial Officer of the Kenmore, Craftsman and DieHard business unit of SHC and a Corporate Vice President of SHC from April 2011 to August 2011. From January 2009 to January 2011, he was a founding partner of EHP Capital, LLC and Springline Advisors LLC (value-focused investment vehicles). He previously served as a Managing Director of Lehman Brothers Inc. and co-founder and co-head of Lehman Brothers Venture Partners.

BRIAN D. SHORT

Mr. Short, age 44, has been the Chief Administrative Officer and General Counsel of CDI since March 2009. He became an Executive Vice President in March 2015. Prior to joining CDI, he was a partner in the law firm of Dechert LLP and practiced in the firm’s Corporate and Securities group.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act requires CDI’s directors and executive officers, as well as beneficial owners of more than 10% of the outstanding shares of common stock, par value $.10 per share, of CDI (which is referred to in this Amendment as “CDI stock”), to file with the SEC initial reports of ownership and reports of changes in ownership of CDI stock. To the company’s knowledge, based on a review of copies of such reports furnished to CDI and on written representations made by such persons, all of CDI’s directors, executive officers and beneficial owners of more than 10% of CDI stock in 2016 complied with all Section 16(a) filing requirements for 2016.

Code of Conduct

The Board has adopted a Code of Conduct that sets forth the principles, policies and obligations that must be adhered to by CDI and its directors, officers and employees (including CDI’s principal executive officer, principal financial officer, principal accounting officer and controller). The Code of Conduct is designed to foster a culture at CDI in which legal and ethical conduct is recognized, practiced and valued. Associated with the Code of Conduct are various conduct policies focusing on specific topics, such as our Insider Trading Policy, Disclosure Policy, Conflicts of Interest Policy, Anti-Corruption Policy and Policy on Privacy of Personal Data. A copy of the Code of Conduct can be found on our website at www.cdicorp.com (in the Investor Relations section) and will be provided in print to any shareholder who delivers a written request to Investor Relations, CDI Corp., 1735 Market Street, Suite 200, Philadelphia, PA 19103.

Any amendments to, or waivers of, provisions in our Code of Conduct that apply to our CEO, CFO, principal accounting officer or controller will be posted on our website at www.cdicorp.com (in the Investor Relations section) within four business days following the date of the amendment or waiver and will remain available on our website for at least a twelve-month period.

7

Table of Contents

The Director Nominating Process

The Governance and Nominating Committee is responsible for identifying qualified Board candidates and recommending their nomination for election to the Board as well as for recommending the slate of nominees for election to the Board at each annual meeting of shareholders. The Board has concluded that all of the members of the Governance and Nominating Committee meet the standards for independence established by the NYSE. No member of the Governance and Nominating Committee is a former officer or employee of CDI.

The Governance and Nominating Committee is willing to consider prospective candidates recommended by CDI’s shareholders. There have been no material changes to the procedures by which shareholders may recommend nominees to CDI’s board of directors from the procedures described in CDI’s 2016 proxy statement, except that the address to which shareholders should submit the required information regarding prospective candidates has changed to the following:

Governance and Nominating Committee

Attention: Company Secretary

CDI Corp.

1735 Market Street, Suite 200

Philadelphia, PA 19103

Audit Committee Membership

The Audit Committee assists the Board in fulfilling its oversight responsibilities by: (a) reviewing the financial reports and other financial information provided by CDI to shareholders, the SEC and others; (b) monitoring the company’s financial reporting processes and internal control systems; (c) retaining the company’s independent registered public accounting firm (subject to shareholder ratification); (d) overseeing the company’s independent registered public accounting firm and internal auditors; and (e) monitoring CDI’s compliance with ethics policies and with applicable legal and regulatory requirements. No member of the Audit Committee is a current or former officer or employee of CDI. The NYSE and the SEC have adopted standards for independence of Audit Committee members. The Board has determined that each of the current members of the Audit Committee satisfies those independence standards.

The members of the Audit Committee are Lawrence Karlson (Chairman), Joseph Carlini, Ronald Kozich and Anna Seal. The Board has also determined that Ronald Kozich and Anna Seal each qualifies as an “audit committee financial expert” and has accounting and related financial management expertise within the meaning of the listing standards of the NYSE. The rules of the SEC define an “audit committee financial expert” as a person who has acquired certain attributes through education and experience that are particularly relevant to the functions of an audit committee. Mr. Kozich is a former Managing Partner of the Philadelphia region of the accounting firm Ernst & Young LLP and is a Certified Public Accountant. Ms. Seal is the former Senior Vice President and Chief Financial Officer of the Global Manufacturing and Supply Division of GlaxoSmithKline and is a Certified Public Accountant.

8

Table of Contents

| Item 11. | Executive Compensation. |

Item 11 of this Amendment contains information regarding our compensation programs and policies and, in particular, their application to a specific group of individuals that are referred to as our “Named Executive Officers”. Under applicable SEC rules, our Named Executive Officers for this Amendment, who are also sometimes referred to as the “NEOs” or the “executives”, consist of Michael Castleman and Brian Short (current executives), as well as Scott Freidheim, Jill Albrinck and Hugo Malan (former executives).

Compensation Discussion and Analysis

Overview and Executive Summary

This Compensation Discussion and Analysis focuses on the following:

| • | our executive compensation philosophy and guiding principles; |

| • | paying for performance; |

| • | how we make executive compensation decisions; and |

| • | the principal components of our executive compensation program and an analysis of 2016 compensation. |

2016 Performance

CDI is going through a time of significant change and our Board of Directors and management team are working diligently to transform the company and position CDI for success.

Throughout 2016, we enhanced our position to more effectively implement our strategy. We created the Energy Chemical & Infrastructure vertical and the Specialty Talent & Technology Solutions segment, increasing our market focus. We improved our North America Staffing recruitment capabilities by shifting to skill-based practices, supported by offshore candidate sourcing and research. We implemented improved quality management and work-sharing processes within our Engineering Solutions units. We streamlined our portfolio with the disposition of AndersElite. And, we maintained our financial strength and flexibility through active expense and capital management, which contributed to positive cash flows, debt reduction, and a 5% decrease in shares outstanding. However, we are accelerating our transformation through more dramatic sales and operational execution discipline. Our current transformation plan is differentiated from past efforts through its deep operational focus that is based upon bringing together the best of the company’s capabilities, and engaging all members of the CDI team in a cohesive effort to increase value for CDI, as a whole.

Our company has faced financial pressure because many of our customers are within the industrial and oil and gas sectors that have experienced a downturn. As a result, the company is accelerating its transformation through the five enterprise-wide programs described above. This focus and discipline has been put in sharper focus with the executive management changes announced during 2016.

9

Table of Contents

Below is a summary of the company’s financial results in 2016, as compared to the previous year:

| Revenue | $864.4 million in 2016 versus $985.5 million in 2015 (excluding AndersElite, $805.1 million in 2016 vesrsus $880.5 million in 2015) | |

| Net Income/Loss | Net loss of $31.6 million in 2016 versus net loss of $37 million in 2015 | |

| Adjusted EBITDA1 | Adjusted EBITDA loss of $2.1 million in 2016 versus Adjusted EBITDA of $13.2 million in 2015 | |

| Earnings/Loss Per Share | Net loss per share of $(1.66) in 2016 versus net loss per share of $(1.88) in 2015 | |

| Adjusted Earnings Per Share1 | Adjusted loss per diluted share of $(0.26) in 2016 versus adjusted earnings per share of $0.04 in 2015 | |

Despite the company’s financial results, the company made progress in its transformation as described above. For example, during 2016, the company simplified its business with the sale of the UK-based AndersElite business and the managed exit from the non-core CommTech service line within the Energy, Chemical &Infrastructure vertical, which provided municipal 911 consulting services. In addition, the company grew its Government Services business by 6.4%, which exemplifies the potential of our new sales programs.

The company’s executive compensation program is structured so that a significant percentage of compensation is tied to the achievement of challenging levels of company performance – both short-term and long-term. As a result of the company’s financial results, no performance-based short-term or long-term incentive compensation was earned by executives participating in the short-term incentive compensation program for 2016, the value creation contingent awards granted in 2014 or 2015 or the performance share grants made in prior years. This reflects the pay-for-performance nature of CDI’s incentive compensation program.

Role of Say-on Pay and Shareholder Outreach

While the annual say-on-pay vote is not binding on the company, we believe that it is important for our shareholders to have an opportunity to vote on this proposal on an annual basis as a means to express their views regarding our executive compensation philosophy, our compensation policies and programs, and our decisions regarding executive compensation, all as disclosed in this Annual Report. Our Board of Directors and the Compensation Committee (referred to sometimes in this CD&A as the “Committee”) value the opinions of our shareholders.

At the 2016 annual meeting of shareholders, 84% of the votes cast on the advisory vote on our executive compensation proposal were in favor of our executive compensation as disclosed in the 2016 proxy statement, and 16% were opposed, and as a result our executive compensation was approved in that advisory vote. Though the shareholders overwhelmingly approved the executive compensation, we are committed to understanding the views of all the shareholders.

| 1 | Adjusted EBITDA excludes from net income (loss) attributable to CDI: interest, income taxes, depreciation and amortization expense, impairment charges, restructuring and other related costs, share-based compensation expense, leadership transition costs, loss on disposition, certain acquisition and litigation items, gain from the sale of a non-operating corporate asset, impairment related costs and sales and use tax recovery benefit. Adjusted Earnings Per Share excludes from diluted earnings per common share impairment charges, restructuring and other related costs, leadership transition costs, loss on disposition, certain acquisition and litigation items, amortization of acquired intangibles, gain on sale of non-operating asset, impairment related costs, sales and use tax recovery benefit and the related income tax effect, including certain deferred tax adjustments. See the financial tables in Appendix A for more information on non-GAAP financial measures and the reconciliation of these measures to GAAP measures. |

10

Table of Contents

We believe that regular, transparent communication with our shareholders and other stakeholders is essential. Accordingly, throughout 2016, our CEO, CFO, CAO and head of investor relations met with shareholders and discussed, among other things, our executive compensation. Our management team met in-person or via telephone calls with shareholders holding over 40% of our common stock in 2016. Management takes the feedback from these investor meetings and shares it with the Board to understand investors’ views regarding executive compensation and other matters. In addition, a director spoke directly with two shareholders regarding governance matters, among other things, and the feedback from these shareholders was shared with the entire Board.

In these discussions, some investors expressed concerns regarding the prior value creation contingent awards and their potential lack of incentive and retention based on the company’s financial performance and associated stock price performance over the last two years. With this feedback, the say-on-pay results and other factors, the Committee continued to apply its pay-for-performance philosophy for 2016, but did not make any further value creation contingent awards in 2016.

Key Executive Compensation Actions Taken in 2016

Below are some of the key actions and decisions made regarding the company’s executive compensation in 2016:

| • | Incentive and Retention. Given the turnaround setting of the company, we structured bonuses across the company to balance retention and incentive elements. A portion of each employee’s bonus was guaranteed as a retention tool – 25% of target bonus payout for each bonus-eligible employee – and paid in two tranches (March 2017 and March 2018). This was a special program for 2016 designed to encourage retention during a turnaround period. |

| • | Incentive Plan Metrics for 2016. For the annual cash incentive plan, the metrics were EBITDA and return on invested capital. |

Executive Management Changes in 2016

Scott Freidheim, the former CEO and President, left the company in September 2016. Hugo Malan, the former Executive Vice President and President, Talent and Technology Solutions, left the company in November 2016. Jill Albrinck, the former Executive Vice President and President, MRI, left the company in February 2017. The section below titled “Former Officers” discusses the compensation arrangements with Mr. Freidheim, Mr. Malan and Ms. Albrinck. As described above, these management changes were part of the company’s transformation to heighten operational focus and bring together all of the company’s service offerings and support functions in a more efficient structure.

Our Compensation Philosophy and Guiding Principles

In support of our business and our strategic plan, CDI’s compensation program is designed to attract, motivate, reward and retain the high quality executives necessary to provide company leadership and create shareholder value. The company’s executive compensation philosophy is reflected in the following design principles:

| • | There should be a strong link between pay and performance. |

| • | The interests of executives should be aligned with the interests of our shareholders. |

| • | Compensation programs should reinforce business strategies and drive long-term sustained shareholder value. |

11

Table of Contents

Paying for Performance

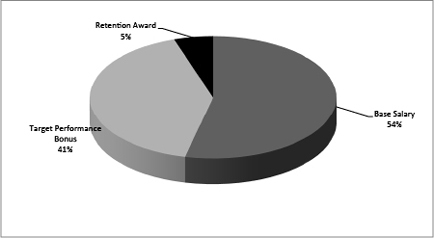

There are three primary components of our executive compensation program: base salary, short-term (annual) incentives and long-term incentives. The company’s executive compensation program is structured so that a meaningful percentage of compensation is tied to the achievement of challenging levels of company performance. As illustrated in the chart below, 41% of Mr. Castleman’s (President and Interim CEO) target total direct compensation opportunity for 2016 was dependent upon company performance.

Percent of total direct compensation at-risk = 41%

Due to the company’s financial performance in 2016, our Interim CEO did not earn any portion of his target bonus award and only earned the guaranteed component (equal to 12.5% of his target payout) of his bonus that was retention focused and part of the broader program described above. In addition, Mr. Castleman received a significant long-term value creation contingent award (in the form of a performance based award) upon his hiring. The value creation contingent award only vests if significant shareholder value is created through achieving share prices between two and three times the market price near the grant date. This award has not vested and due to the company’s stock price performance since the time of grant, the fair value of this award at the end of 2015 was $5,065 (the fair value has not been calculated as of 12/31/16, though we do not believe there has been a material change in the value since the end of 2015). We believe this demonstrates that while we provide our executives with the opportunity to earn meaningful compensation if challenging results are achieved, failure to achieve those performance levels will result in our executives not realizing those compensation opportunities.

How We Make Compensation Decisions

Role of the Compensation Committee

The Committee regularly reviews the alignment of our executive compensation program with the strategies and needs of our business, market trends, changes in competitive practices, individual performance, company performance, and the interests of our shareholders. Based on these factors, the Committee approves the compensation of the NEOs, including base salary, short-term incentive awards (which are in the form of an annual cash performance bonus), long-term equity awards, and benefits and perquisites.

Generally, compensation decisions, together with individual performance reviews, are made at the first and second regularly-scheduled Committee meetings of the fiscal year. The short-term incentive goals and targets are also generally approved by the Committee at that time.

12

Table of Contents

Role of Management

The Committee combines input from senior management and the Committee’s and Board’s own individual experiences and best judgment to arrive at the proper alignment of compensation philosophy, objectives, and programs. During 2016, the CEO was the member of senior management who interacted most closely with the Committee. Management provides the Committee with their perspectives on the design and administration of the executive compensation program and awards. In particular, the CEO worked with the Committee to enable the Committee to formulate the specific plan and award designs, performance measures, and performance levels (i.e., threshold and target) necessary to align the executive compensation program with CDI’s business strategies and objectives.

The CEO reviewed with the Committee performance evaluations for each of the other NEOs and his recommendations (except with respect to his own compensation) regarding base salary, short-term incentive awards, and long-term incentive awards for the other NEOs to ensure alignment with the Committee’s design principles. However, all final decisions regarding the compensation of the NEOs are made by the Committee. The Committee conducts its own performance assessment of the CEO and no management recommendation is made with regard to his compensation.

Components of the Executive Compensation Program

The table below provides an overview of the principal components of CDI’s executive compensation program, including the objectives of each component. The table illustrates that most of the components are tied (directly or indirectly) to either company or individual performance, in ways that we believe serve to enhance shareholder value. In designing our executive compensation program, the Committee seeks to balance (a) cash and non-cash compensation, (b) compensation that is fixed and compensation that is contingent on performance, and (c) for contingent compensation, compensation that is based on the company’s short-term performance and compensation based on long-term performance. However, the Committee does not target any specific percentage of compensation to be cash versus non-cash, or fixed versus contingent on performance, or short-term versus long-term. More information and analysis regarding each of these components is contained below in this CD&A.

| Component of CDI’s Executive Compensation Program |

Key Features |

Performance Relationship |

Principal Purpose(s) | |||

| Base Salary | Fixed cash payments | Salary levels are based on roles, responsibilities, experience, skill set and past performance by the executives | Attract and retain executives; reward executives for level of responsibility, experience and sustained individual performance; provide income certainty for executives | |||

| Short-Term (Non-Equity) Incentive |

Annual incentive program, paid in cash | Align executives with annual goals and objectives; create direct link to annual financial and operational performance | Motivate executives to achieve annual business goals | |||

| Long-Term (Equity and Non-Equity) Incentive Awards | Awards granted on a multi-year basis using a mix of stock options, TVDS and value creation contingent awards (performance units and non-equity awards) | Accelerate growth and balance this growth with profitability; value creation contingent awards only have value with appreciable performance | Align the interests of CDI’s executives with those of shareholders; executive retention; promote stock ownership by executives | |||

| Benefits | Provide employee benefits | We do not view this as a significant component of our executive compensation program | Attract and retain executives by providing benefits consistent with our employees | |||

13

Table of Contents

Competitive Compensation

To determine what comparable companies are paying their executives, the Committee has, in the past, retained independent outside compensation consulting firms to do periodic studies. Consultant compensation studies looked at proxy statement data from peer group companies which are in businesses similar to CDI, as well as survey data of similar-size companies. The Committee looks at the results of these periodic compensation studies to see whether CDI’s executive compensation levels have remained competitive, taking into consideration the company’s size relative to the peers. The Committee did not retain a consulting firm or perform such a study in 2016. The Committee’s objective is to establish compensation packages for the executive officers that would be competitive with those offered by other employers, appropriately reflecting each officer’s skill set and experience, and encouraging retention of top performers.

The Principal Components of CDI’s Executive Compensation Program

The principal components of our compensation packages are base salary, an annual cash incentive plan and long-term equity and non-equity incentives.

Base Salary

The Committee annually reviews the base salaries of the executive officers as part of the overall review and determination of our executive compensation program for the relevant fiscal year. With respect to base salary, the Committee’s objective is to offer a level of fixed cash compensation, determined with reference to the factors described above, that will enable us to attract and retain top talent. There were no changes to executive officers’ base salaries in 2016, except that pursuant to the letter agreement entered into between the company and Mr. Castleman in January 2017 (as described in more detail below in the section titled “Potential Payments Upon Termination of Employment or Change in Control”) Mr. Castleman’s base salary was retroactively adjusted to $500,000 from the date of his appointment as President and Interim CEO in September 2016.

The Short-Term Incentive Compensation Program

In addition to receiving a base salary, the NEOs participate in an annual incentive compensation program under which they can earn additional cash compensation depending principally on the company’s financial performance during the year and, to a lesser extent, on their individual performance. The short-term incentive compensation program is designed to reward short-term (one year) business results whereas the long-term awards are tied to multi-year performance.

Under our short-term incentive compensation program, a percentage of each executive’s salary is established as the target incentive compensation payout amount for that executive. The executive would earn this target amount for 100% achievement of the executive’s incentive compensation goals. The percentage of an executive’s salary for his or her target payout amount is based on roles and responsibilities and internal equity, and higher percentages generally apply to executives at higher levels in the organization and for positions which have a greater impact on and accountability for the company’s financial results. Accordingly, these executives have a greater percentage of their total cash compensation at risk but also are given greater potential rewards under the short-term incentive compensation program. For our CEOs in 2016, Mr. Freidheim’s target incentive compensation was 100% of his salary and Mr. Castleman’s target incentive compensation was increased to 90% of his salary effective when he became our President and Interim CEO.

Under CDI’s short-term incentive compensation program, the Committee can decrease, in its discretion, the amounts to be paid to executives. The Committee believes that having this discretion is important in order to take into account unexpected events that may occur after the incentive compensation criteria are set which could otherwise result in payouts that are too high under the circumstances. In addition, the Committee retains the discretion to award bonuses outside the short-term incentive compensation program to recognize unique or special accomplishments by executives during a given year, take into consideration market changes in executive compensation, discourage executives from taking unnecessary or excessive risks to achieve performance goals, and otherwise carry out the broad objectives of our compensation program.

In addition, in 2016, a portion of the short-term incentive award – 25% of the target bonus award for each recipient – was converted to a retention award that was payable in two equal parts in 2017 and 2018. This was a special program for 2016 designed to encourage retention during a turnaround period.

The CDI Corp. Executive Bonus Plan, (the “Executive Bonus Plan”), approved by our shareholders in 2015, is structured to permit the payment of cash bonuses that would not be subject to the deduction limitations of Section 162(m) of the Internal Revenue Code, and therefore permits negative discretion only. However, the company does not guarantee that amounts paid to the NEOs under such plan will be exempt from the deduction limitations of Section 162(m) of the Internal Revenue Code, and the company has the discretion to pay bonuses that are not so exempt (such as the retention bonuses described above).

14

Table of Contents

The Portion of Short-Term Incentive Compensation Based on CDI Financial Results

Under our 2016 short-term incentive compensation program, 85% of an executive’s target incentive was based on the company’s achievement of its financial targets. The Committee chose EBITDA (earnings before interest, taxes, depreciation and amortization, and before bonus and stock compensation) and ROIC (return on invested capital) as the financial measures for the 2016 program, with EBITDA given the greatest weight (80%). The Committee determined that EBITDA would have the most direct impact on increasing shareholder value. ROIC was selected because it is a valuable measure of the company’s ability to efficiently use its capital. For purposes of the incentive compensation program, ROIC was calculated as the EBITA (earnings before interest, taxes and amortization) for 2016 divided by the average amount of invested capital (total borrowings net of cash plus equity) at the end of each quarter in 2016, expressed as a percentage.

To earn the target level of cash incentive compensation based on EBITDA and ROIC, the company needed to exceed the target levels of EBITDA and ROIC in CDI’s 2016 financial plan. The financial plan is developed by management, and reviewed and approved by the Finance Committee, which in turn recommends it for final approval by the Board. The specific financial targets for a given year depend on a number of factors, including where CDI is in its business cycle and the size and strength of the pipeline of business with which CDI enters the year. We believe that if CDI consistently attains or exceeds its target levels of EBITDA and ROIC, shareholder value will increase over the long term. Our targets are intended to be challenging, yet realistic and achievable at the time they are established.

Under our short-term cash incentive compensation program, we establish a payout scale for each financial measure for performance above and below the target. Each scale sets a threshold level of performance (below which no cash incentive compensation would be earned). Additional amounts can be earned for performance which exceeds the target level. However, no annual payout may exceed 200% of the target amount.

15

Table of Contents

The following table provides basic information about the payout levels established for CDI’s 2016 corporate short-term incentive compensation financial metrics.

| 2016 EBITDA (Before Bonus and Stock Compensation) |

2016 ROIC* | |||||||||||||||||||||||

| $ in millions |

Achievement Needed |

% of Target |

Payout as a % of Target |

Achievement Needed |

% of Target |

Payout as a % of Target |

||||||||||||||||||

| Threshold Payout Level |

$ | 16.5 | 70 | % | 35 | % | 2.3 | % | 70 | % | 35 | % | ||||||||||||

| Target Performance Level |

$ | 23.6 | 100 | % | 75 | % | 3.3 | % | 100 | % | 75 | % | ||||||||||||

| Target Payout Level |

$ | 29.5 | 125 | % | 100 | % | 4.1 | % | 125 | % | 100 | % | ||||||||||||

| Maximum Payout Level |

$ | 40.2 | 170 | % | 200 | % | 5.6 | % | 170 | % | 200 | % | ||||||||||||

| * | ROIC target is an average of the quarterly ROIC calculation based on a rolling 12 months at each quarter point. |

As noted in the above table, target payout levels were set at performance levels exceeding the target financial performance levels. These stretch performance goals reflected the turnaround nature of the business and the target performance amounts took into account the declining business results at the end of 2015.

CDI’s EBITDA achievement for 2016, for purposes of the short-term incentive compensation program, was $2.2 million, which represented 14.4% of the target level. The company’s reported operating loss for 2016 was $31.6 million. EBITDA excludes interest ($1.1 million in 2016), income tax expense ($0.1 million), and depreciation and amortization ($10.3 million). In determining CDI’s EBITDA in 2016 for purposes of the short-term incentive compensation program, the following items were also excluded: a loss of $11.3 million on the sale of a UK business, bonuses and stock compensation of $6.3 million, restructuring charges of $3.8 million, certain prior year project-related costs of $1.0 million and leadership transition costs of $0.5 million. In addition, a net positive $0.5 million of acquisition-related adjustments and a favorable currency adjustment of $0.1 million were not taken into account. The Committee excluded these items so employees are not penalized for taking actions in the long-term best interests of the company and the shareholders and in order to focus on core operating performance. The ROIC achieved by CDI for 2016 for purposes of the incentive compensation program was -4.6%, which was below the threshold payout level. See Appendix A for details concerning the reconciliation of adjusted EBITDA to CDI’s net loss in 2016.

The Portion of Short-Term Incentive Compensation Based on Individual Performance

We include individual performance as a component of our cash incentive compensation program for executives because we believe that each executive should demonstrate executive leadership behaviors and achieve individual objectives in any given year. An executive’s bonus amount is funded based on corporate and business unit results, and then 10% of that amount is allocated based on performance relative to individual performance. Because the company’s financial performance in 2016 was below the threshold levels, the executives did not earn short-term incentive compensation based on their individual performance.

Summary of Bonuses Earned in 2016

Under our 2016 short-term incentive compensation program, the threshold level of performance was not achieved for either performance metric. Accordingly, there were no performance bonuses earned in 2016 under our short-term incentive compensation program.

16

Table of Contents

As described above, the 2016 program included a retention component. Based on the foregoing, two of the NEOs received the following 2016 bonuses:

| Name of Executive |

2016 Bonus | |||

| Michael Castleman |

$ | 41,198 | * | |

| Brian Short |

$ | 28,125 | * | |

* retention awards paid in March 2017

Mr. Castleman and Mr. Short are eligible to receive the second portion of this retention award if they remain with the company through the pay-out date in 2018 or are terminated without cause prior to such date. Retention bonuses were not paid to the other NEOs because they were not employed through the vesting date.

The Long-Term Incentive Compensation Program

We believe that ownership of CDI stock by our executives creates an important link between the financial interests of the executives and the interests of our other shareholders. We also believe that long-term performance-based awards help our executives focus on the sustained success of the company and maximizing shareholder returns. Accordingly, we regard the stock-based and long-term award elements of our executive compensation program as a critical part of the program’s effectiveness.

A portion of CDI’s executive compensation is in the form of equity, the value of which is dependent upon the future value of CDI stock. In addition, our guidelines call for our executives to achieve a significant amount of CDI stock ownership. This helps to align the financial interests of our executives with the financial interests of our other shareholders.

Prior to 2015, we granted annual equity awards to our executives under the CDI Corp. Amended and Restated Omnibus Stock Plan (the “Omnibus Stock Plan”). With the hiring of our former CEO and certain other NEOs in 2014, we made special multi-year equity-based awards. The former CEO’s awards consisted of stock options, TVDS and value creation contingent awards (performance units). Each of these awards generally vest over a five-year period for performance and retention purposes.

In connection with her hiring, Ms. Albrinck received equity awards as part of her new hire compensation package. Upon her leaving the company in February 2017, those awards were forfeited by Ms. Albrinck. The other NEOs received significant awards in prior years consisting of TVDS and value creation contingent awards (performance units). These TVDS awards generally vest over a four-year period. The value creation contingent awards for certain of the NEO’s can vest as soon as three years after grant depending on achievement of performance hurdles and vesting elections.

Value creation contingent awards (in the form of performance units and non-equity based awards) were an integral piece of CDI’s incentive compensation. The form of the value creation contingent awards further increased management’s alignment with shareholders. The awards do not compensate at all in the event of unattractive or modest performance. This creates a model in which the awards deliver no compensation when there are not attractive shareholder returns, yet are designed to deliver sufficient levels of compensation to attract and motivate talented executives when there are attractive shareholder returns.

All value creation contingent awards described above are ultimately cash settled.

The Committee has generally not considered previously-granted and vested equity awards when structuring the compensation arrangements of the executives because the Committee focuses on the value of a person’s job for the year or years to which a compensation arrangement relates and not on past earned and vested compensation arrangements. We seek to motivate the future performance of the company’s executives, while previously-granted and vested equity awards reflect their past performance. In determining the overall amount of equity-based awards to grant executives, the Committee considers CDI’s stock “overhang” (the potential dilution the awards would have on the ownership held by the company’s shareholders), the number of shares available for grant under the Omnibus Stock Plan and the financial expense the company would incur in connection with the awards.

17

Table of Contents

We believe that long-term incentive compensation programs provide CDI the ability to attract and fairly compensate its executives and also helps us to retain our executives. Since these awards vest over a period of years, they are designed to encourage executives to remain with the company in order for them to realize the full potential value of their awards.

Other than the grant to Ms. Albrinck described above, no other NEO received an equity-based award in 2016.

In January 2017, the company granted certain equity awards under the Omnibus Stock Plan to Messrs. Castleman and Short, which were structured in part to promote retention. Messrs. Castleman and Short were granted 87,500 and 59,500 shares of TVDS, respectively, that vest 20% on October 1, 2017, 30% on each of October 1, 2018 and October 1, 2019, and 20% on October 1, 2020, subject to continued employment on the applicable vesting date. No equity awards had been granted to them since March 2015 (in the case of Mr. Castleman) and May 2015 (in the case of Mr. Short). In the event of a sale of the company, a minimum of the next two tranches then due to vest will become vested (and additional TVDS may vest depending on the value of CDI stock realized in the transaction) and the vesting dates of any remaining tranches will be accelerated by one year. The TVDS awards also provide for vesting of a portion of the awards in connection with certain involuntary terminations of employment. Messrs. Castleman and Short also were granted a target number of 37,500 and 25,500 Performance Units, respectively, that are earned based on the company’s achievement of operating profit targets in 2018. Up to 150% of the Performance Units could be earned for the maximum level of operating profit. Any Performance Units that are earned will vest on March 31, 2019 subject to continued employment by CDI through that date. In the event of a sale of the company that occurs prior to December 31, 2018, all Performance Units will be immediately forfeited with no compensation due.

Personal Benefits and Perquisites (Perks)

Our basic philosophy is that executives should receive a minimal amount of perks in comparison to their total compensation. However, we believe that some perks, such as relocation-related expenses and distance and transitional living expenses, are in certain circumstances part of a competitive executive compensation package and are necessary and appropriate in order to attract and retain highly competent executives. See the Summary Compensation Table (and in particular the notes to the All Other Compensation column) for information regarding the NEOs’ perks in 2016.

Retirement Benefits and the Deferred Compensation Plan

Our philosophy with respect to retirement benefits is to have a basic tax-qualified retirement savings plan in place – a 401(k) plan – which is available to all employees. The 401(k) plan provides CDI’s employees with a savings program in which each employee can control how his or her savings are invested.

Federal tax rules impose a limit on employee contributions to a 401(k) plan (that limit was $18,000 in 2016, though participants over the age of 50 can contribute more) and, due to the Internal Revenue Code nondiscrimination testing required of such plans, a lower limit typically applies to the company’s highly-compensated employees (as defined by the Internal Revenue Code) such as the NEOs. For this reason, we have also established a nonqualified Deferred Compensation Plan for our highly-compensated employees. This is a voluntary program under which the company does not make any contributions. It allows highly-compensated employees who can’t contribute the maximum allowable amount to their 401(k) plan account because of Internal Revenue Code limitations to save for retirement in a tax-effective way at minimal cost to the company. None of our NEOs participated in the Deferred Compensation Plan for 2016.

18

Table of Contents

Severance and Post-Employment Compensation

We seek to provide a generally competitive severance benefit to our senior management personnel, including the NEOs. As part of Mr. Castleman’s employment arrangements, we have agreed to a specified severance arrangement. Mr. Short is grandfathered under our former Executive Severance Program. As described in more detail below in the section titled “Potential Payments Upon Termination of Employment or Change in Control,” the severance arrangements for Messrs. Castleman and Short were amended in 2017 in recognition of the additional roles and responsibilities taken on by these executives, in part due to the executive management changes previously described. These arrangements are intended to assist executives in transition from employment by CDI when that employment is terminated by the company without cause. Additional details regarding the post-termination benefits that our executives can receive can be found in the section titled “Potential Payments Upon Termination of Employment or Change in Control”.

In structuring a severance program, the Committee does not consider an executive’s accumulated wealth because the Committee does not believe it has adequate insight into an executive’s overall individual financial condition and it believes that a severance program such as that offered by the company is needed to remain competitive in the market for executive talent.

Former Officers

Our former CEO and President, Scott Freidheim, left the company in September 2016 and entered into a separation agreement with CDI pursuant to which, among other things, Mr. Freidheim agreed to a release and waiver of claims in order to receive severance-related compensation as described in more detail in the section titled “Potential Payments Upon Termination of Employment or Change in Control”.

Our former Executive Vice President and President, Talent and Technology Solutions, Hugo Malan, left the company in November 2016 and entered into a separation agreement with CDI pursuant to which, among other things, Mr. Malan agreed to a release and waiver of claims in order to receive the severance provided under his employment arrangement, as described in more detail in the section titled “Potential Payments Upon Termination of Employment or Change in Control”.

Our former Executive Vice President and President, MRI, Jill Albrinck, left the company in February 2017 and entered into a separation agreement with CDI pursuant to which, among other things, Ms. Albrinck agreed to a release and waiver of claims in order to receive severance provided under her employment arrangement, as described in more detail in the section titled “Potential Payments Upon Termination of Employment or Change in Control”.

19

Table of Contents

Other Important Programs, Policies and Factors Affecting Executive Compensation

Our Stock Ownership Guidelines

The company has stock ownership guidelines based on accumulating and holding shares of CDI with a value equal to a specified multiple of base pay. The multiples for specific executive levels are shown below.

| Target | ||

| CEO |

5x base salary | |

| Executive Vice Presidents |

3x base salary | |

| Other Direct Reports to CEO |

2x base salary |

Only shares owned by an NEO are counted towards meeting the guideline. Stock options, stock appreciation rights and unvested TVDS awards are not included in determining whether an executive has achieved the ownership levels. Executives who have not met their ownership guidelines are required to retain 75% of shares earned from the equity compensation program until the guideline is met. The current NEOs have not yet attained their ownership requirements.

The Executive Stock Purchase Opportunity Program

The Executive Stock Purchase Opportunity Program is designed to offer executives an incentive to make a personal financial investment in the future success of CDI, in order to further tie their interests to the company’s shareholders. Only Ms. Albrinck was eligible to participate in this program for 2016, but she did not participate.

Under this program, which is typically a one-time opportunity for each executive upon their joining the company or becoming an executive, for every share of CDI stock that the executive purchases within a specified 20-day period, the company grants 0.4 shares of TVDS, which vest at the rate of 20% per year over five years so long as all of the underlying purchased shares are retained by the executive. The TVDS is forfeited if the executive resigns or is terminated for cause prior to vesting. Executives at higher levels and with greater impact on the company’s financial performance are given a greater opportunity to purchase shares under this program.

The Timing and Pricing of Equity Awards

In the past, the Committee generally made equity awards to executives once a year. The Committee normally met to approve the annual awards to the NEOs shortly after the issuance of the company’s earnings release for the previous year. The exercise price of stock options and the per share value of TVDS are equal to or greater than the closing market price of CDI stock on the award date. We have typically scheduled the grants of annual equity awards to take place shortly after the release of our annual earnings so that this information is reflected in CDI’s stock price at the time of the awards. In 2014 and 2015, the Committee made special multi-year awards generally with five year performance periods while evaluating future awards in light of the company’s performance against the targets during this period. In 2016, no equity awards were made to the NEOs (except for Ms. Albrinck in connection with her hiring). However, equity awards were made to Mr. Castleman and Mr. Short on January 25, 2017, which were intended to cover both 2016 and 2017.

In addition, equity awards are sometimes made in the event of a significant new hire or a significant promotion. In order to allow the company to react quickly, the authority to grant awards in these situations has been delegated by the Committee. For high-level managers who report directly to the CEO and may receive larger awards, the awards are typically recommended by the CEO and approved by the Chair of the Committee, with notice given to the other members of the Committee.

20

Table of Contents

For lower-level managers who typically receive smaller awards, the CEO has been delegated authority by the Committee to approve awards that adhere to the Committee’s guidelines and are consistent with past practice in size and type. For new hires, the award date is the recipient’s first day of employment. In the case of significant promotions, the award date is on or around the time of the recipient’s promotion. However, an award date may not be earlier than the date on which the grant was approved. In all cases, the exercise price of stock options and the per share value of performance shares or deferred stock is equal to or greater than the closing price of CDI stock on the date of grant.

Our practices regarding the timing and pricing of equity awards are the same for executives as they are for awards made to other employees. Our policies and procedures applicable to the timing of equity awards are designed to provide assurances that grant timing is not being manipulated to result in a price that is more favorable to employees.

Our Clawback Policy

CDI has a “clawback” policy under which the company can cancel and recoup from any employee in the CDI organization any incentive compensation or equity awards that were based on incorrect information, whether the error in the information occurred as a result of oversight, negligence or intentional misconduct (including fraud). The Committee has discretion to treat employees who received an award based on incorrect information differently depending on an employee’s degree of involvement in causing the error, an employee’s assistance in discovering and/or correcting the error, and any other facts that the Committee determines to be relevant.

The Effect of the Compensation Program on Risk

We believe that our compensation program does not encourage excessive and unnecessary risk taking. In particular, although a substantial portion of the compensation provided to our NEOs is performance-based, our executive compensation program is designed to balance risk. Among the reasons for this belief are the following:

| • | The existence of the clawback policy described above. |

| • | Base salaries provide a fixed element of compensation at levels which we consider sufficient not to encourage undue risk taking. |

| • | In the case of our NEOs, the design of our compensation program encourages CDI’s executives to remain focused on both the short- and long-term operational and financial goals of the company, with substantial value based on the long-term performance of CDI. |

| • | Stock ownership guidelines for our NEOs result in executives maintaining levels of CDI stock ownership, which provides motivation for them to take into account CDI’s long-term interests. |

The Impact of Tax Deductibility Limitations on our Compensation Design and Decisions

The Committee evaluates the impact of Section 162(m) of the Internal Revenue Code on our executive compensation program. Section 162(m) limits the deductibility by the company of certain compensation paid to our NEOs (other than to our CFO) in excess of $1 million per year. The Section 162(m) regulations provide an exemption for “qualified performance-based compensation”.

21

Table of Contents

Over the years, the Committee has attempted to structure executive compensation arrangements to be deductible to the extent consistent with the goals and objectives of our executive compensation program. However, the Committee believes that, in some circumstances and particularly for the CEO, factors other than tax deductibility may be more important in determining the forms and levels of executive compensation that are most appropriate and in the best interests of CDI and its shareholders. Therefore, the Committee reserves the flexibility to approve executive compensation that may not be deductible.

Use of Tally Sheets

The Committee annually reviews tally sheets prepared for each executive officer of CDI by the company’s Human Resources department. The tally sheets are designed to show the total compensation (broken down into each element of compensation) which has been paid to each executive and the compensation which would be paid to the executive following termination of his or her employment under various scenarios. Committee members believe that tally sheets provide a comprehensive picture of an executive’s total compensation, give the Committee a better understanding of how the various components of an executive’s compensation package fit together and provide a context for making pay decisions. In its February 2016 and February 2017 review of tally sheets, the Committee determined that the annual compensation amounts for the NEOs were consistent with the Committee’s expectations and aligned with our objectives.

Compensation Committee Report

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis set forth above with CDI’s management. Based on such review and discussion, the Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Amendment No. 1 to Form 10-K.

| COMPENSATION COMMITTEE: |

| Michael J. Emmi, Chair |

| Ronald J. Kozich |

| Albert E. Smith |

22

Table of Contents

Summary Compensation Table

The first table below (the Summary Compensation Table, or SCT) summarizes the compensation during the past three years for CDI’s Named Executive Officers (NEOs), reported in accordance with SEC rules for the SCT. Only three of the NEOs (Michael Castleman, Brian Short and Jill Albrinck) were executive officers as of the end of 2016. Ms. Albrinck’s employment ended in February 2017. Of the other two NEOs, Scott Freidheim’s employment ended in September 2016 and Hugo Malan’s employment ended in November 2016. Three of the NEOs (Michael Castleman, Scott Freidheim and Hugo Malan) joined CDI during 2014, so their 2014 compensation in the SCT reflects a partial year. Ms. Albrinck’s first year as an NEO was 2016, so only her 2016 compensation is reported in the SCT.

The second table below is a supplemental table showing the actual realized compensation for our CEOs, Mr. Freidheim (who served as CEO during part of 2016, all of 2015 and part of 2014) and Mr. Castleman (who served as Interim CEO for part of 2016). This supplemental table is not a substitute for the SCT. “Total Actual Compensation Realized” differs substantially from “Total Compensation” as set forth in the SCT. The principal differences between the two tables is that the second table: (a) reports the actual value realized on equity-based compensation, including amounts associated with equity-based awards granted in prior years, only during the year in which an equity-based award becomes vested or is exercised, rather than the grant date accounting value of the award in the year of grant; (b) does not include severance and other post-employment compensation; and (c) does not include the 401(k) plan employer match generally available to CDI employees. As shown in the second table, the total actual compensation realized by Mr. Freidheim was 7.3% of his total compensation reflected in the SCT for 2014, 16.4% of his SCT total for 2015, and 41.6% of his SCT total for 2016, while the total actual compensation realized by Mr. Castleman was 30.0% higher than his SCT total for 2016 (primarily because of the partial vesting of an equity award Mr. Castleman received when he joined CDI in 2014).

Summary Compensation Table

| Name and Principal Position |

Year | Salary ($) |

Bonus ($) |

Stock Awards ($) |

Option Awards ($) |

Non- Equity Incentive Plan Compen- sation ($) |

All Other Compen- sation ($) |

Total ($) |

||||||||||||||||||||||||

| Michael S. Castleman President, Interim Chief Executive Officer, Chief Financial Officer |

2016 | 429,241 | 41,198 | 0 | 0 | 0 | 21,166 | 491,605 | ||||||||||||||||||||||||

| 2015 | 400,004 | 280,000 | 28,400 | 0 | 0 | 107,595 | 815,999 | |||||||||||||||||||||||||

| 2014 | 71,234 | 299,863 | 1,725,756 | 0 | 0 | 12,758 | 2,109,611 | |||||||||||||||||||||||||

| Brian D. Short Executive Vice President, Chief Administrative Officer and General Counsel |

2016 | 375,003 | 28,125 | 0 | 0 | 0 | 5,788 | 408,916 | ||||||||||||||||||||||||

| 2015 | 375,003 | 0 | 249,995 | 0 | 0 | 11,811 | 636,809 | |||||||||||||||||||||||||

| 2014 | 375,003 | 0 | 126,402 | 44,998 | 151,693 | 8,952 | 707,048 | |||||||||||||||||||||||||

| Scott J. Freidheim Former President and Chief Executive Officer (his employment ended in September 2016) |

2016 | 424,590 | 0 | 0 | 0 | 0 | 620,902 | 1,045,492 | ||||||||||||||||||||||||

| 2015 | 600,000 | 0 | 3,121,508 | 0 | 0 | 41,334 | 3,762,842 | |||||||||||||||||||||||||

| 2014 | 177,534 | 177,534 | 4,011,024 | 272,045 | 0 | 211,252 | 4,849,389 | |||||||||||||||||||||||||

| Jill M. Albrinck Former Executive Vice President and President, Management Recruiters International (her employment ended in February 2017) |

2016 | 360,006 | 226,002 | 200,000 | 0 | 0 | 57,206 | 843,214 | ||||||||||||||||||||||||

| D. Hugo Malan Former Executive Vice President and President, Talent and Technology Solutions (his employment ended in November 2016) |

2016 | 353,009 | 0 | 0 | 0 | 0 | 255,964 | 608,973 | ||||||||||||||||||||||||

| 2015 | 400,004 | 280,000 | 0 | 0 | 0 | 52,561 | 732,565 | |||||||||||||||||||||||||

| 2014 | 72,329 | 300,630 | 1,607,497 | 0 | 0 | 12,134 | 1,992,590 | |||||||||||||||||||||||||

23

Table of Contents

Supplemental Table – Actual Compensation Realized by CEOs

| Name and Principal Position |

Year | Salary ($) |

Bonus ($) |

Long-Term Incentive Plan Performance Awards ($) |

Exercised Option Awards ($) |

Vested Stock Awards, including Dividends ($) |

Total Actual Compensation Realized ($) |

Total Reported in SCT ($) |

||||||||||||||||||||||||

| Michael S. Castleman President, Interim Chief Executive Officer, Chief Financial Officer |

2016 | 429,241 | 41,198 | 0 | 0 | 168,842 | 639,281 | 491,605 | ||||||||||||||||||||||||

| Scott J. Freidheim Former President and Chief Executive Officer |

2016 | 424,590 | 0 | 0 | 0 | 10,014 | 434,604 | 1,045,492 | ||||||||||||||||||||||||

| 2015 | 600,000 | 0 | 0 | 0 | 15,716 | 615,716 | 3,762,842 | |||||||||||||||||||||||||

| 2014 | 177,534 | 177,534 | 0 | 0 | 0 | 355,068 | 4,849,389 | |||||||||||||||||||||||||

Notes to the Summary Compensation Table:

The “Salary” Column

This column reflects the base salary earned by each executive in the given year. The amounts shown in the Salary column include amounts which the NEOs elected to defer in connection with CDI’s 401(k) savings plan.

The “Bonus” Column

The amounts in this column consist of: (a) for Mr. Castleman and Mr. Short, 12.5% of their 2016 target bonus, paid in March 2017 under a retention bonus arrangement; (b) for Ms. Albrinck, guaranteed bonuses of $226,002 paid in accordance with her employment agreement; (c) guaranteed 2015 and 2014 bonuses for Mr. Castleman and Mr. Malan equal to 70% of the salary each of them earned in the respective year, in accordance with their employment agreements; (d) a 2014 bonus of $177,534 for Mr. Freidheim as determined by the Compensation Committee; and (e) $250,000 sign-on bonuses to Mr. Castleman and to Mr. Malan in 2014 pursuant to their employment agreements when they joined CDI that year. The amounts shown in the Bonus column include amounts which the NEOs elected to defer in connection with CDI’s 401(k) savings plan.

24

Table of Contents

The “Stock Awards” Column

The following Stock Awards granted to the NEOs are reflected in the Summary Compensation Table: