Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - DAWSONVILLE JV - CatchMark Timber Trust, Inc. | pressrelease-dawsonvillejv.htm |

| 8-K - DAWSONVILLE JV ANNOUNCEMENT - CatchMark Timber Trust, Inc. | a8-kdawsonvillejvannouncem.htm |

1

CatchMark Timber Trust

N Y S E : C T T

M a y 2 0 1 6

Dawsonvi l le Acquis i t ion and Jo int Venture

A p r i l 2 0 1 7

F O R WA R D - L O O K I N G S TAT E M E N T S

2

This presentation contains certain forward-looking statements within the meaning of the safe harbor from civil liability provided for such

statements by the Private Securities Litigation Reform Act of 1995 (as set forth in Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended) that are subject to risks and uncertainties. Such forward-looking

statements can generally be identified by use of forward-looking terminology such as "may," "will," "expect," "intend," "anticipate,"

"estimate," "believe," "continue," or other similar words. These forward-looking statements are based on certain assumptions, discuss future

expectations, describe future plans and strategies, contain financial and operating projections or state other forward-looking information.

CatchMark's ability to predict results or the actual effect of future events, actions, plans or strategies is inherently uncertain. Although

CatchMark believes that the expectations reflected in such forward-looking statements are based on reasonable assumptions, the actual

results and performance of Catchmark and the joint venture describe herein could differ materially from those set forth in, or implied by, the

forward-looking statements. You should be aware that there are various factors that could cause actual results to differ materially from any

forward -looking statements made in this presentation. Factors that could cause or contribute to such differences include, but are not limited

to, (i) the joint venture may not generate the harvest volumes or the harvest mix from its timberlands that CatchMark currently anticipates

and the demand for the joint venture’s timber may not be as great as we currently expect; (ii) the cyclical nature of the real estate market

generally, including fluctuations in demand and valuations, may adversely impact the joint venture’s ability to generate income and cash

flow from sales of higher-and-better use properties; (iii) the joint venture may not be able to take advantage of the mitigation bank credits in

the amount that we currently anticipate; (iv) CatchMark may not be successful in raising additional institutional capital through other joint

ventures to fund its growth initiatives and enhance returns; and (v) the factors described in Item 1A. of CatchMark’s Annual Report on Form

10-K for the fiscal year ended December 31, 2016, under the heading “Risk Factors” and its other filings with Securities and Exchange

Commission. You are cautioned not to place undue reliance on any of these forward-looking statements, which reflect CatchMark's views

only as of this date. Furthermore, except as required by law, CatchMark is under no duty to, and does not intend to, update any of our

forward-looking statements after this date, whether as a result of new information, future events or otherwise.

D AW S O N V I L L E : G R O W T H O P P O R T U N I T Y W I T H S T R O N G PA R T N E R

3

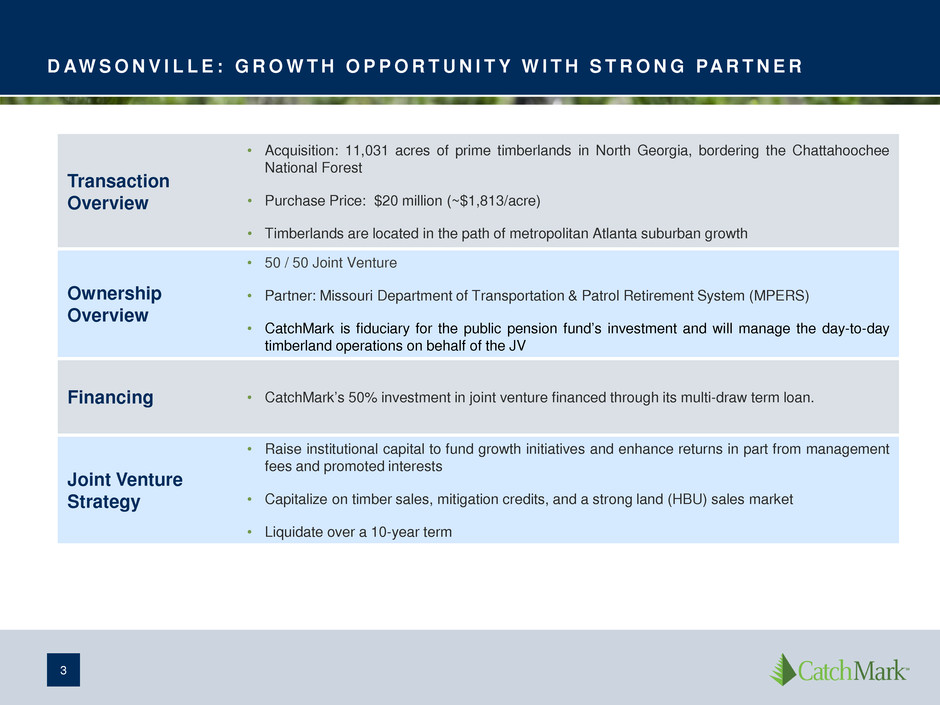

Transaction

Overview

• Acquisition: 11,031 acres of prime timberlands in North Georgia, bordering the Chattahoochee

National Forest

• Purchase Price: $20 million (~$1,813/acre)

• Timberlands are located in the path of metropolitan Atlanta suburban growth

Ownership

Overview

• 50 / 50 Joint Venture

• Partner: Missouri Department of Transportation & Patrol Retirement System (MPERS)

• CatchMark is fiduciary for the public pension fund’s investment and will manage the day-to-day

timberland operations on behalf of the JV

Financing • CatchMark’s 50% investment in joint venture financed through its multi-draw term loan.

Joint Venture

Strategy

• Raise institutional capital to fund growth initiatives and enhance returns in part from management

fees and promoted interests

• Capitalize on timber sales, mitigation credits, and a strong land (HBU) sales market

• Liquidate over a 10-year term

C AT C H M A R K B E N E F I T S

4

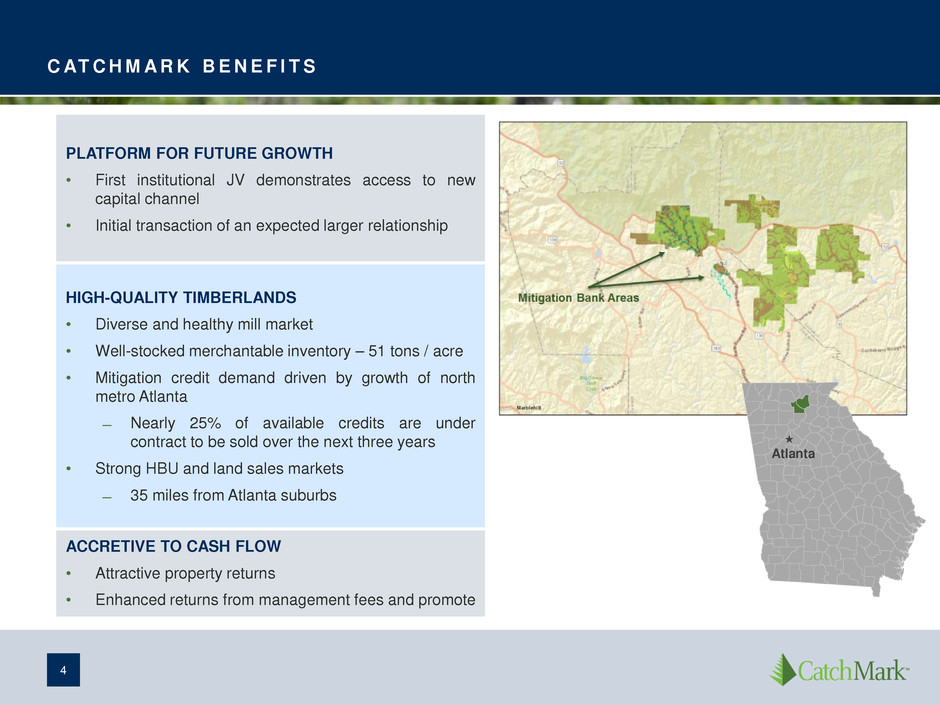

PLATFORM FOR FUTURE GROWTH

• First institutional JV demonstrates access to new

capital channel

• Initial transaction of an expected larger relationship

HIGH-QUALITY TIMBERLANDS

• Diverse and healthy mill market

• Well-stocked merchantable inventory – 51 tons / acre

• Mitigation credit demand driven by growth of north

metro Atlanta

̶ Nearly 25% of available credits are under

contract to be sold over the next three years

• Strong HBU and land sales markets

̶ 35 miles from Atlanta suburbs

ACCRETIVE TO CASH FLOW

• Attractive property returns

• Enhanced returns from management fees and promote

Atlanta

T I M B E R S A L E S A N D M A R K E T S

5

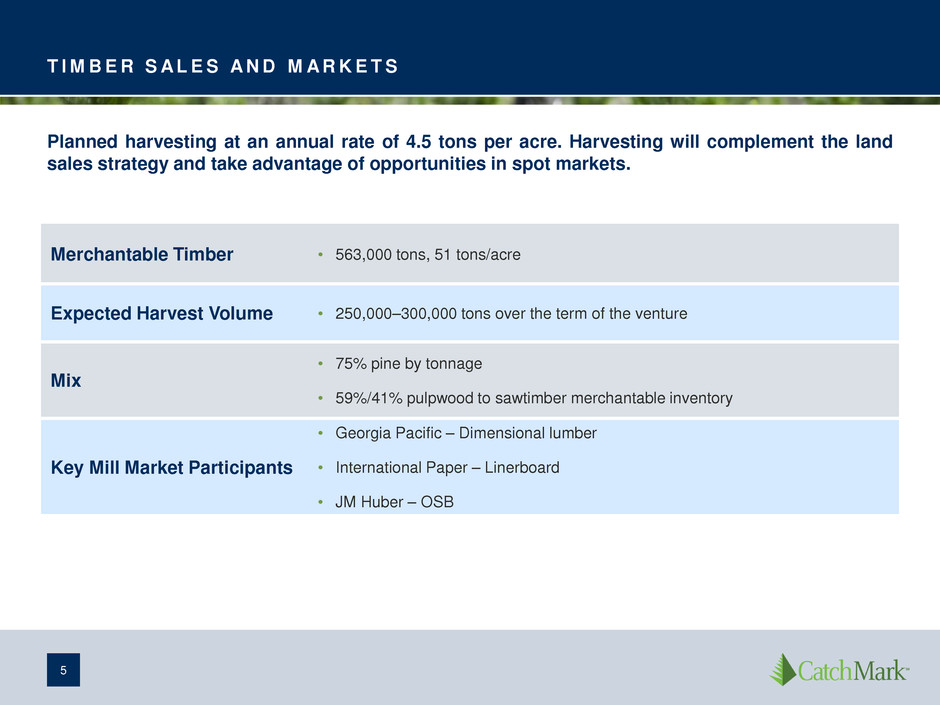

Planned harvesting at an annual rate of 4.5 tons per acre. Harvesting will complement the land

sales strategy and take advantage of opportunities in spot markets.

Merchantable Timber • 563,000 tons, 51 tons/acre

Expected Harvest Volume • 250,000–300,000 tons over the term of the venture

Mix

• 75% pine by tonnage

• 59%/41% pulpwood to sawtimber merchantable inventory

Key Mill Market Participants

• Georgia Pacific – Dimensional lumber

• International Paper – Linerboard

• JM Huber – OSB

M I T I G AT I O N B A N K C R E D I T S

6

A mitigation bank is a site that has restored, established, enhanced, and/or preserved

environmental resources (e.g. wetlands, streams, riparian areas) for the purpose of providing

compensatory mitigation for impacts authorized by Department of the Army permits. The credits

are then sold to permittees who are legally required to offset their impacts.

Available Dawsonville Mitigation Credits to be

Monetized

• 640 acres of mitigation banks with minimal ongoing costs

• Assuming existing contracts with nearby reservoir projects

• High future demand expected from developers

S T R O N G L A N D S A L E S M A R K E T

7

The acquisition is well positioned to take advantage of the consistent strength in North Georgia’s

land sales market.

Favorable Market Dynamics

• Growing population

• Attractive area for weekend and vacation residences

• Convenient access to shopping, hospitals, and other

amenities

• University of North Georgia in Dahlonega is the 6th

largest university in the state (~19,000 students)

Significant Population Growth

Georgia – 2010 Census Results

Percent Change in Population

by County: 2000 to 2010

Percent Change

50.0 to 78.4

25.0 to 49.9

0.0 to 24.9

(10.0) to (0.1)

(24.3) to (10.1)

Percent Change for State: 18.3%

Source: US Census Bureau, Census 2000 and 2010 Census

Redistricting Data Summary File

For more information visit www.census.gov

ATLANTA

S U M M A R Y O F E X P E C T E D A C C O U N T I N G T R E AT M E N T

EQUITY METHOD OF ACCOUNTING

8

I n c o m e

S t a t e m e n t

• Management fees will be

included in other revenue

• CTT’s 50% share of JV

earnings will be reported as

income from unconsolidated

joint venture below the

operating line

B a l a n c e

S h e e t

• Assets and liabilities of the JV

will not be consolidated into

CTT’s balance sheet

C a s h F l o w

S t a t e m e n t

• Management fees recognized

as cash from operations

• JV distributions will be recorded

in operating / investing sections

• Capital contributions will be

included in investing section