Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - TYSON FOODS, INC. | tsnpressrelease8k42517.htm |

| 8-K - 8-K - TYSON FOODS, INC. | tsn8-k42517.htm |

Acquisition of

AdvancePierre

Investor Presentation

April 2017

2

Forward-Looking Statements

This communication contains forward-looking statements, including statements regarding the expected consummation of

the acquisition, which involve a number of risks and uncertainties, including the satisfaction of closing conditions for the

acquisition (such as regulatory approval for the transaction and the tender of at least a majority of the outstanding shares

of capital stock of AdvancePierre Foods); the possibility that the transaction will not be completed; the impact of general

economic, industry, market or political conditions; risks related to the ultimate outcome and results of integrating the

operations of Tyson and AdvancePierre Foods; the ultimate outcome of Tyson’s operating strategy applied to

AdvancePierre Foods and the ultimate ability to realize synergies; the effects of the business combination on Tyson and

AdvancePierre Foods, including on the combined company’s future financial condition, operating results, strategy and

plans; and other risks and uncertainties, including those identified in AdvancePierre Foods’ periodic filings, including

AdvancePierre Foods’ Annual Report on Form 10-K for the year ended December 31, 2016 and AdvancePierre Foods’

Registration Statement on Form S-1 filed with the U.S. Securities Exchange Commission (“SEC”) on April 5, 2017 and

any subsequent quarterly reports on Form 10-Q, as well as the tender offer documents to be filed with the SEC by Tyson

and the Solicitation/Recommendation statement on Schedule 14D-9 to be filed by AdvancePierre Foods. These

statements constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. The words “may,” “might,” “will,” “should,” “estimate,” “project,”

“plan,” “anticipate,” “expect,” “intend,” “outlook,” “believe” and other similar expressions (or the negative of such terms)

are intended to identify forward-looking statements. If underlying assumptions prove inaccurate or unknown risks or

uncertainties materialize, actual results and the timing of events may differ materially from the results and/or timing

discussed in the forward-looking statements, and readers are cautioned not to place undue reliance on these forward-

looking statements. Forward-looking statements speak only as of the date of this communication, and neither Tyson nor

AdvancePierre Foods undertakes any obligation to update any forward-looking statement except as required by law.

3

Forward-Looking Statements

ADDITIONAL INFORMATION AND WHERE TO FIND IT

The tender offer referenced in this communication has not yet commenced. This announcement is for informational purposes

only and is neither an offer to purchase nor a solicitation of an offer to sell securities, nor is it a substitute for the tender offer

materials that will be filed with the SEC. The solicitation and offer to buy AdvancePierre Foods stock will only be made

pursuant to an Offer to Purchase and related tender offer materials. At the time the tender offer is commenced, Tyson and its

acquisition subsidiary will file a tender offer statement on Schedule TO and thereafter AdvancePierre Foods will file a

Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the tender offer. THE TENDER

OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN

OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE

14D-9 WILL CONTAIN IMPORTANT INFORMATION. ADVANCEPIERRE FOODS STOCKHOLDERS ARE URGED TO

READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION THAT HOLDERS OF ADVANCEPIERRE FOODS SECURITIES SHOULD CONSIDER

BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SECURITIES. The Offer to Purchase, the related

Letter of Transmittal and certain other tender offer documents, as well as the Solicitation/Recommendation Statement, will be

made available to all holders of AdvancePierre Foods stock at no expense to them. The tender offer materials and the

Solicitation/Recommendation Statement will be made available for free at the SEC's website at www.sec.gov. Copies of the

documents filed with the SEC by Tyson will be available free of charge on Tyson’s internet website at http://www.tyson.com or

by contacting Jon Kathol at Tyson’s Investor Relations Department at (479) 290-4235 or by email at jon.kathol@tyson.com.

Copies of the documents filed with the SEC by AdvancePierre Foods will be available free of charge on AdvancePierre Foods’

internet website at http://www.advancepierre.com or by contacting John Morgan at AdvancePierre Foods’ Investor Relations

Department at (513) 372-9338 or by email at ir@advancepierre.com.

In addition to the Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as well as the

Solicitation/Recommendation Statement, AdvancePierre Foods files annual, quarterly and current reports and other

information with the SEC. You may read and copy any reports or other information filed by AdvancePierre Foods at the SEC

public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further

information on the public reference room. AdvancePierre Foods’ filings with the SEC are also available to the public from

commercial document-retrieval services and at the website maintained by the SEC at http://www.sec.gov.

4

Transaction Overview

Summary and

Terms

• Tender offer to acquire all AdvancePierre outstanding common shares for $40.25 per

share in cash

• Enterprise value of ~$4.2 billion, including $3.2 billion in equity value and $1.1 billion in

assumed debt

Financing • Not subject to financing condition • Committed bridge financing from Morgan Stanley

Synergies • Expect cost synergies of more than $200 million within three years• Revenue synergies over time through utilizing Tyson’s sales and distribution platform

Conditions • Tender of majority of outstanding AdvancePierre shares• Regulatory approvals

• Tender and support agreement with Oaktree

Closing • Expected in third quarter of Tyson’s fiscal 2017

Important step in our growth strategy and

opportunity to refine the shape of our portfolio

5

Compelling Strategic Rationale

GROWING OUR PORTFOLIO OF

PROTEIN-PACKED BRANDS

> Expands prepared foods offering by joining

complementary market-leading portfolios

DELIVERING SUSTAINABLE

FOOD AT SCALE

> AdvancePierre’s strength in foodservice

enhances current distribution and sales

footprint

CREATING FUEL FOR REINVESTMENT THROUGH A DISCIPLINED

FINANCIAL FITNESS MODEL

> Enhances Tyson’s financial profile

S

TR

AT

E

G

IC

E

N

A

B

LE

R

S

DRIVING PROFITABLE GROWTH WITH AND FOR OUR

CUSTOMERS THROUGH DIFFERENTIATED CAPABILITIES

> AdvancePierre’s recent growth has outpaced category growth

SUSTAINABLY FEED THE WORLD WITH FASTEST

GROWING PORTFOLIO OF PROTEIN-PACKED BRANDS

6

Logical Next Step in Strategy

Expands prepared

foods offering; joins

complementary

market-leading

portfolios

• Expands Tyson’s prepared foods offerings with AdvancePierre’s portfolio of ready-to-eat lunch

and dinner sandwiches, sandwich components, entrees, and snacks

• Broadens Tyson’s competitive position across poultry, beef and pork

• Improves competitiveness and sustainable long-term growth through increased scale and

refined portfolio of prepared foods and protein-packed brands

• Also planning to divest existing Tyson non-protein branded assets to sharpen strategic focus

Valuable addition to

current distribution

and sales footprint

• Represents natural extension of our supply chain – Tyson’s fresh meats business to provide

many of AdvancePierre’s raw material components

• Increases Tyson’s exposure to the convenience distribution channel

• Accelerates growth of AdvancePierre’s brands by leveraging Tyson’s existing infrastructure

and distribution channel

Enhances Tyson’s

financial profile

• Expected to be immediately accretive to Tyson’s EPS on both a GAAP and cash basis

• Net debt to adjusted EBITDA ratio expected to be 2.7x

• Significant and achievable annual synergies of approximately $200 million within three years

AdvancePierre’s

recent growth has

outpaced category

growth

• Significant growth across all operating segments

− Foodservice: well-positioned in growing and resilient industry

− Retail: leading private label provider with significant growth opportunity

− Convenience: fastest growing segment, with consistent growth since 2012

Strong cultural fit

• Shared goals; sustainable, holistic solutions to food manufacturing and long-term growth

• Provides stability and opportunities for employees, customers, and shareholders

7

Complementary Portfolios of Strong Brands

8

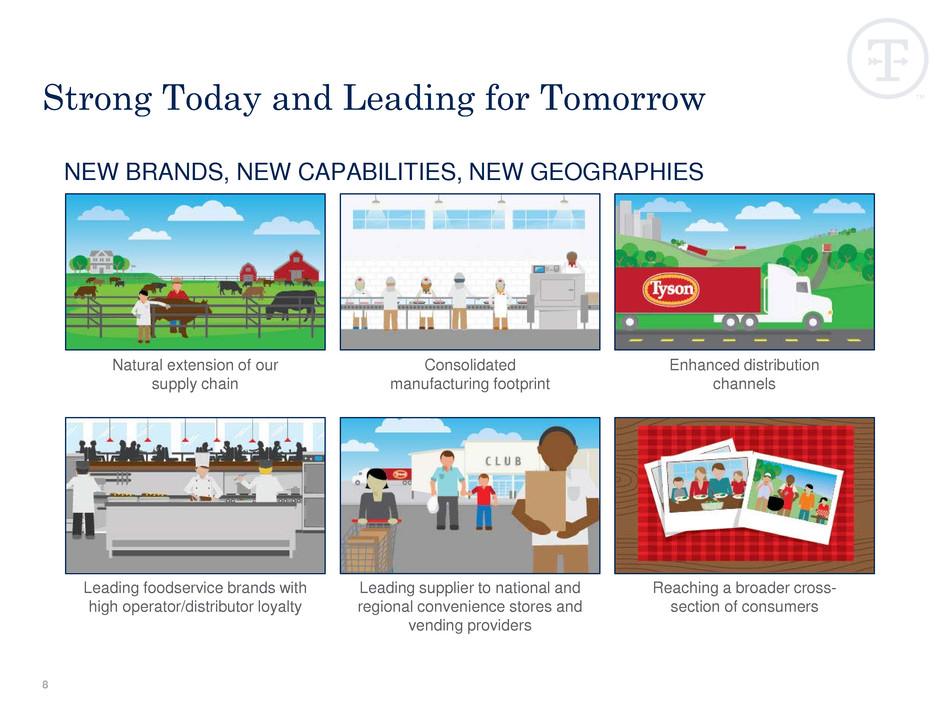

Strong Today and Leading for Tomorrow

Natural extension of our

supply chain

Consolidated

manufacturing footprint

Enhanced distribution

channels

Reaching a broader cross-

section of consumers

Leading supplier to national and

regional convenience stores and

vending providers

Leading foodservice brands with

high operator/distributor loyalty

NEW BRANDS, NEW CAPABILITIES, NEW GEOGRAPHIES

CREATES SIGNIFICANT SYNERGIES

• Expected to result in cost synergies of approximately $200 million to be fully

realized within three years

• Cost synergies created by consolidated manufacturing footprint, lower input pricing,

and addressing redundant foodservice and retail distribution channels, redundant

sales and marketing functions and duplicative corporate overhead

• Revenue synergies expected over time by utilizing Tyson’s sales and distribution

platform to drive growth across AdvancePierre’s leading sandwich/snack brands

ENHANCES BALANCE SHEET

• Expected to be immediately accretive to Tyson’s EPS on both a GAAP and a cash

basis, excluding one-time costs

• Net debt to adjusted EBITDA ratio initially expected to be 2.7x; will be reduced

steadily by strong cash flow and support investment grade profile

9

Driving Financial Results

10

Tyson and AdvancePierre Combine

to Create Long-Term Value

Next step in growth strategy and opportunity to refine the shape of our

portfolio

Financially compelling; expected to be immediately accretive to Tyson EPS

based on $200 million in cost synergies

Significant value for AdvancePierre shareholders and significant ongoing

benefits to Tyson shareholders and both companies’ customers and

employees

Complementary, market-leading products and brands

Natural extension of supply chain and sales footprint, including fast-growing

convenience distribution channel

Contributing to our mission to sustainably feed the world with the fastest

growing portfolio of protein-packed brands

Thank

You