Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Discover Financial Services | dfs2017331ex992.htm |

| EX-99.1 - EXHIBIT 99.1 - Discover Financial Services | dfs-earningsreleasex1q17ex.htm |

| 8-K - 8-K - Discover Financial Services | a1q178k.htm |

1Q17 Financial Results

April 25, 2017

©2017 DISCOVER FINANCIAL SERVICES

Notice

The following slides are part of a presentation by Discover Financial Services (the "Company") in connection with

reporting quarterly financial results and are intended to be viewed as part of that presentation. No representation is made

that the information in these slides is complete. For additional financial, statistical, and business related information, as

well as information regarding business and segment trends, see the earnings release and financial supplement included

as exhibits to the Company’s Current Report on Form 8-K filed today and available on the Company’s website

(www.discover.com) and the SEC’s website (www.sec.gov).

The information provided herein includes certain non-GAAP financial measures. The reconciliations of such measures to

the comparable GAAP figures are included at the end of this presentation, which is available on the Company’s website

and the SEC’s website.

The presentation contains forward-looking statements. You are cautioned not to place undue reliance on forward-looking

statements, which speak only as of the date on which they are made, which reflect management’s estimates,

projections, expectations or beliefs at that time, and which are subject to risks and uncertainties that may cause actual

results to differ materially. For a discussion of certain risks and uncertainties that may affect the future results of the

Company, please see "Special Note Regarding Forward-Looking Statements," "Risk Factors," "Business – Competition,"

"Business – Supervision and Regulation" and "Management’s Discussion and Analysis of Financial Condition and

Results of Operations" in the Company’s Annual Report on Form 10-K for the year ended December 31, 2016, which is

filed with the SEC and available at the SEC's website (www.sec.gov). The Company does not undertake to update or

revise forward-looking statements as more information becomes available.

Notic

2

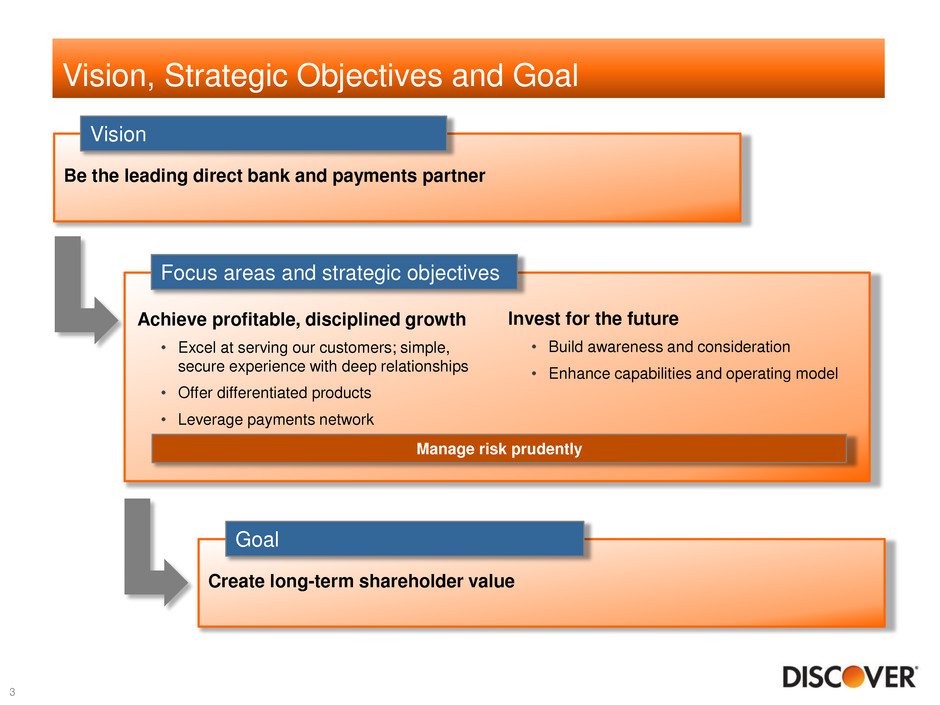

Be the leading direct bank and payments partner

Vision, Strategic Objectives and Goal

3

Vision

Create long-term shareholder value

Goal

Focus areas and strategic objectives

Invest for the future

• Build awareness and consideration

• Enhance capabilities and operating model

Achieve profitable, disciplined growth

• Excel at serving our customers; simple,

secure experience with deep relationships

• Offer differentiated products

• Leverage payments network

Manage risk prudently

1Q17 Highlights

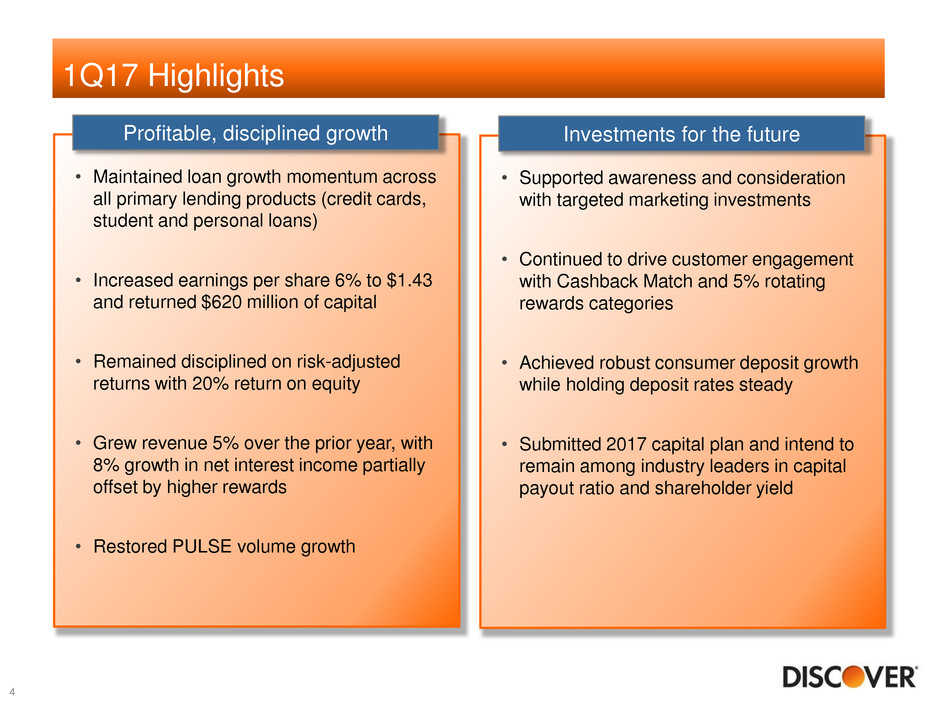

• Maintained loan growth momentum across

all primary lending products (credit cards,

student and personal loans)

• Increased earnings per share 6% to $1.43

and returned $620 million of capital

• Remained disciplined on risk-adjusted

returns with 20% return on equity

• Grew revenue 5% over the prior year, with

8% growth in net interest income partially

offset by higher rewards

• Restored PULSE volume growth

Profitable, disciplined growth

• Supported awareness and consideration

with targeted marketing investments

• Continued to drive customer engagement

with Cashback Match and 5% rotating

rewards categories

• Achieved robust consumer deposit growth

while holding deposit rates steady

• Submitted 2017 capital plan and intend to

remain among industry leaders in capital

payout ratio and shareholder yield

Investments for the future

4

($MM, except per share data) 1Q17 1Q16 $ ∆ % ∆

Revenue Net of Interest Expense $2,339 $2,224 $115 5%

Net Prinicpal Charge-off 489 372 (117) (31%)

Reserve Changes build/(release) 97 52 (45) NM

Provision for Loan Losses 586 424 (162) (38%)

Operating Expense 885 886 1 -%

Direct Banking 824 882 (58) (7%)

Payment Services 44 32 12 38%

Total Pre-Tax Income 868 914 (46) (5%)

Income Tax Expense 304 339 35 10%

Net Income $564 $575 ($11) (2%)

ROE 20% 21%

Diluted EPS $1.43 $1.35 $0.08 6%

Pre-Tax, Pre-Provision Income(1) $1,454 $1,338 $116 9%

B / (W)

1Q17 Summary Financial Results

5

Note(s)

1. Pre-tax, pre-provision income, which is derived by adding provision for loan losses to pre-tax income, is a non-GAAP financial measure which should be viewed in addition to,

and not as a substitute for, the Company’s reported results. Management believes this information helps investors understand the effect of provision for loan losses on reported

results and provides an alternate presentation of the Company’s performance; see appendix for a reconciliation

• Diluted EPS of $1.43, up 6% YOY

• Revenue net of interest expense of

$2.3Bn, up 5% YOY as higher net

interest income was partially offset

by higher rewards expense

• Provision for loan losses increased

$162MM YOY (38%) on higher net

charge-offs

• Expenses were flat, primarily driven

by lower professional fees, partially

offset by higher compensation and

benefits and higher marketing spend

Highlights

4Q16 Loan and Volume Growth

+8% +7% +3% +20%

+4% +4% +10% 2%

Note(s)

1. Volume is derived from data provided by licensees for Diners Club branded cards issued outside of North America and is subject to subsequent revision or amendment

(1)

Total Network Volume up 5% YOY

Payment Services

1Q17 Loan and olume r

Ending Loans ($Bn) Volume ($Bn)

6

($MM) 1Q17 1Q16 $ ∆ % ∆

Interest Income $2,278 $2,084 $194 9%

Interest Expense 386 334 (52) (16%)

Net Interest Income 1,892 1,750 142 8%

Discount/Interchange Revenue 596 565 31 5%

Rewards Cost 363 292 (71) (24%)

Net Discount/Interchange Revenue 233 273 (40) (15%)

Protection Products Revenue 58 61 (3) (5%)

Loan Fee Income 89 80 9 11%

Transaction Processing Revenue 39 36 3 8%

Other Income 28 24 4 17%

Total Non-Interest Income 447 474 (27) (6%)

Revenue Net of Interest Expense $2,339 $2,224 $115 5%

Direct Banking $2,267 $2,156 $111 5%

Payment Services 72 68 4 6%

Revenue Net of Interest Expense $2,339 $2,224 $115 5%

($MM) 1Q17 1Q16 QOQ YOY

Discover Card Sales Volume $29,134 $27,552 (10%) 6%

Rewards Rate(1) 1.25% 1.06% -1 bp 19 bps

B / (W)

Change

1Q17 Revenue Detail

7

Note(s)

1. Rewards cost divided by Discover card sales volume

• Net interest income of $1.9Bn, up

8% YOY on higher loan growth and

some NIM expansion

• Discount and interchange revenue of

$596MM, up 5% YOY, driven by

increased card sales

• Net discount and interchange

revenue declined $40MM (15%) on

higher rewards cost

• Rewards rate increased 19 bps YOY,

driven by higher promotional

rewards, primarily due to greater

customer engagement in rotating 5%

categories

Highlights

1Q17 Net Interest Margin

8

• Net interest margin on receivables

increased 13 bps YOY on higher

card yield, partially offset by higher

funding costs

• Credit card yield increased 23 bps

YOY as the prime rate increased

and portfolio mix changed

• Average direct to consumer and

affinity deposits grew 15% YOY and

composed 46% of total average

funding

• Funding costs on interest-bearing

liabilities increased 12 bps YOY

driven by higher market rates and

funding mix

Highlights

Average Average

($MM) Balance Rate Balance Rate

Credit Card $60,122 12.65% $56,124 12.42%

Private Student 9,197 7.29% 8,967 7.02%

Personal 6,582 12.18% 5,503 12.20%

Other 284 5.39% 243 5.18%

Total Loans 76,185 11.94% 70,837 11.69%

Other Interest-Earning Assets 16,243 0.89% 14,253 0.70%

Total Interest-Earning Assets $92,428 9.99% $85,090 9.85%

Direct to Consumer and Affinity $36,316 1.25% $31,529 1.22%

Brokered Deposits and Other 16,242 1.98% 15,982 1.68%

Interest Bearing Deposits 52,558 1.48% 47,511 1.37%

Borrowings 26,561 2.97% 24,886 2.79%

Total Interest-Bearing Liabilities $79,119 1.98% $72,397 1.86%

(%) 1Q17 QOQ YOY

Total Interest Yiel 11.94% 6 bps 25 bps

NIM on Receivables 10.07% - 13 bps

NIM on Interes -E rning Assets 8.30% -17 bps 3 bps

Change

1Q17 1Q16

1Q17 Operating Expense Detail

9

Note(s)

1. Defined as reported total operating expense divided by revenue net of interest expense

2. 1Q16 operating efficiency ratio adjusted for $30 million in look back related anti-money laundering remediation expenses. Management believes adjusted operating efficiency,

which is a non-GAAP measure, helps investors understand the effect of activities that are not expected to continue and provides investors with a useful metric to evaluate the

company’s ongoing operating performance; see appendix for a reconciliation

• Employee compensation and

benefits up 5% YOY primarily on

higher regulatory and compliance

staffing, as well as higher average

salaries

• Marketing and business

development expenses increased

4% YOY, primarily driven by higher

card acquisition and brand spend

• Professional fees down 8% YOY,

primarily due to look back related

anti-money laundering remediation

expenses in 1Q16

• Operating efficiency improved 190

bps

Highlights

($MM) 1Q17 1Q16 $ ∆ % ∆

Employee Compensation and Benefits $363 $345 ($18) (5%)

Marketing and Business Development 168 162 (6) (4%)

Information Processing & Communications 80 88 8 9%

Professional Fees 147 160 13 8%

Premises and Equipment 25 24 (1) (4%)

Other Expense 102 107 5 5%

Total Operating Expense $885 $886 $1 -%

Direct Banking $849 $851 $2 -%

Payment Services 36 35 (1) (3%)

Total Operating Expense $885 $886 $1 -%

Operating Efficiency(1) 37.9% 39.8% 190 bps

Adjusted Operating Efficiency(2) 37.9% 38.5% 60 bps

B / (W)

Credit Performance Trends

Total Company Loans Credit Card Loans

Private Student Loans Personal Loans

2.18 2.26 2.16

1.94

2.11 2.21

2.27

2.10

2.39

2.69

1.66 1.57 1.49 1.60

1.67 1.64 1.60

1.79

1.97 1.97

4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17

NCOs ex-PCI (%) 30 day DQ rate ex-PCI (%)

2.26 2.40 2. 8

2.04 2.18

2.34 2.39

2.17

2.47

2.84

1.73 1.64 1.55 1.65

1.72 1.68 1.63

1.87

2.04 2.06

4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17

NCO rate (%) 30 day DQ rate (%)

1.40

1.03 1.02 0.94

1.30

0.85

1.10 1.02

1.42

0.83

1.80

1.66 1.78

1.88 .91 .92 1.88 1.87

2.22

2.04

4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17

NCO rate ex-PCI (%) 30 day DQ rate ex-PCI (%)

2.20 2.22 2.10 1.99

2.28 2.45 2.38

2.63 2.70

3.16

0.79 0.76 0.71 0.80

0.89 0.97 1.02 0.98

1.12 1.12

4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17

NCO rate (%) 30 day DQ rate (%)

10

Note(s)

1. Excludes PCI loans which are accounted for on a pooled basis. Since a pool is accounted for as a single asset with a single composite interest rate and aggregate expectation

of cash flows, the past-due status of a pool, or that of the individual loans within a pool, is not meaningful. Because the Company is recognizing interest income on a pool of

loans, it is all considered to be performing

14.8

14.5

14.4

13.9

14.3 14.3

13.9

13.2

13.4

88

102 95 93 95 94 99 99

104

1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17

Common Equity Tier 1 Capital Ratio (%) Payout Ratio (%)

Key Capital Metrics

11

Note(s)

1. Common Equity Tier 1 Capital Ratio (Basel III Transition)

2. Payout Ratio is displayed on a trailing twelve month basis. This represents the trailing twelve months’ Capital Return to Common Stockholders divided by the trailing twelve

months’ Net Income Allocated to Common Stockholders

(1) (2)

Capital Trends

1Q17 Financial Summary

12

• Net income of $564MM

and diluted EPS of $1.43

• Revenue growth of 5% on

higher net interest income,

partially offset by higher

rewards

• NIM of 10.07%, up 13 bps

YOY

• Return on equity stable at

20%

• Efficiency ratio low at 38%

Profitability

• Total loans grew 8%

($5.5Bn) YOY with strong

contributions from all

primary products

• Credit card loans grew 7%

($4.1Bn) YOY as sales

volume increased 6%

• Average DTC deposits

grew 15% ($4.8Bn) YOY

with steady deposit rates

Balance Sheet

• Credit fundamentals

remain favorable relative to

historical standards

• Card NCO rate of 2.84%,

up 50 bps YOY, primarily

on seasoning of recent

loan growth

• Payout ratio of 104%

(trailing twelve months)

• CET1 ratio of 13.4%, down

90 bps YOY, on capital

return and loan growth

Credit and Capital

Appendix

13

Reconciliation of GAAP to Non-GAAP Data

Note(s)

1. Pre-tax, pre-provision income, which is derived by adding provision for loan losses to pre-tax income, is a non-GAAP financial measure which should be viewed in addition to,

and not as a substitute for, the Company's reported results. Management believes this information helps investors understand the effect of provision for loan losses on reported

results and provides an alternate presentation of the Company's performance

2. Adjusted operating efficiency, which is a non-GAAP measure, helps investors understand the effect of activities that are not expected to continue and provides investors with a

useful metric to evaluate the company’s ongoing operating performance

Reconciliati of GA t Non- t

14

(unaudited, in millions, except per share statistics)

Mar 31,

2017

Mar 31,

2016

Provision for loan losses $586 $424

Income before income taxes 868 914

Pre-tax, pre-provision income(1) $1,454 $1,338

eve ue net of interest expense $2,339 $2,224

Total operating expense 885 886

Excluding anti-money laundering and related compliance program expenses - 30

Adjusted operating expense $885 $856

Adjusted operating efficiency(2) 37.9% 38.5%

Quarter Ended