Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - KINGOLD JEWELRY, INC. | v464032_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - KINGOLD JEWELRY, INC. | v464032_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - KINGOLD JEWELRY, INC. | v464032_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - KINGOLD JEWELRY, INC. | v464032_ex31-1.htm |

| EX-23.1 - EXHIBIT 23.1 - KINGOLD JEWELRY, INC. | v464032_ex23-1.htm |

| EX-21.1 - EXHIBIT 21.1 - KINGOLD JEWELRY, INC. | v464032_ex21-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: December 31, 2016

Or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from: to

KINGOLD JEWELRY, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-15819 | 13-3883101 |

| (State or Other Jurisdiction | (Commission | (I.R.S. Employer |

| of Incorporation or Organization) | File Number) | Identification No.) |

15 Huangpu Science and Technology Park

Jiang’an District

Wuhan, Hubei Province, PRC 430023

(Address of Principal Executive Office) (Zip Code)

(011) 86 27 65694977

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Stock, $0.001 par value | The NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes x No

The aggregate market value of the voting and non-voting stock held by non-affiliates of the registrant was approximately $87,582,164.40 as of June 30, 2016, the last business day of the registrant’s most recently completed second fiscal quarter.

The number of shares of the registrant’s common stock outstanding as of April 14, 2017 was 66,018,867.

2016 ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

| 2 |

CAUTIONARY STATEMENT FOR PURPOSES OF THE “SAFE HARBOR” STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

Statements in this report that are not historical facts or information are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “estimate,” “project,” “forecast,” “plan,” “believe,” “may,” “expect,” “anticipate,” “intend,” “planned,” “potential,” “can,” “expectation” and similar expressions, or the negative of those expressions, may identify forward-looking statements. Such forward-looking statements are based on management’s reasonable current assumptions and expectations. Such forward-looking statements involve risks, uncertainties and other factors, which may cause our actual results, levels of activity, performance or achievement to be materially different from any future results expressed or implied by such forward-looking statements, and there can be no assurance that actual results will not differ materially from management’s expectations. Such factors include, among others, the following:

| • | changes in the market price of gold; |

| • | our ability to implement the key initiatives of, and realize the gross and operating margins and projected benefits (in the amounts and time schedules we expect) from, our business strategy; |

| • | non-performance of suppliers on their sale commitments and customers on their purchase commitments; |

| • | non-performance of third-party service providers; |

| • | adverse conditions in the industries in which our customers operate, including a general economic downturn, a recession globally, or sudden disruption in business conditions, and our ability to withstand an economic downturn, recession, cost inflation, competitive or other market pressures, or conditions; |

| • | the effect of political, economic, legal, tax and regulatory risks imposed on us, including foreign exchange or other restrictions, adoption, interpretation and enforcement of foreign laws including any changes thereto, as well as reviews and investigations by government regulators that have occurred or may occur from time to time, including, for example, local regulatory scrutiny in China; |

| • | our ability to manage growth; |

| • | our ability to successfully identify new business opportunities and identify and analyze acquisition candidates, secure financing on favorable terms and negotiate and consummate acquisitions as well as to successfully integrate or manage any acquired business; |

| • | our ability to integrate acquired businesses; |

| • | the effect of economic factors, including inflation and fluctuations in interest rates and currency exchange rates, foreign exchange restrictions and the potential effect of such factors on our business, results of operations and financial condition; |

| • | our ability to retain and attract senior management and other key employees; |

| • | any internal investigations and compliance reviews of Foreign Corrupt Practices Act and related U.S. and foreign law matters in China and additional countries, as well as any disruption or adverse consequences resulting from such investigations, reviews, related actions or litigation; |

| • | changes in the People’s Republic of China or U.S. tax laws; |

| • | increased levels of competition, and competitive uncertainties in our markets, including competition from companies in the gold jewelry industry in the PRC, some of which are larger than we are and have greater resources; |

| • | the impact of the seasonal nature of our business, adverse effect of rising energy, commodity and raw material prices, changes in market trends, purchasing habits of our consumers and changes in consumer preferences; |

| 3 |

| • | our ability to protect our intellectual property rights; |

| • | the risk of an adverse outcome in any material pending and future litigations; |

| • | our ratings, our access to cash and financing and ability to secure financing at attractive rates; |

| • | our ability to comply with environmental laws and regulations; |

| • | our continuing relationship with major banks in China with whom we have certain gold lease agreements and working capital loans; |

| • | the investment in gold may be deficient if the fair market value of the pledged gold in connection with the loans declines, then we may need to increase the pledged gold inventory for the loan collateral or add the restricted cash. |

| • | other risks. We undertake no obligation to update any such forward-looking statements, except as required by law. |

| 4 |

Our Business

Through a variable interest entity (“VIE”) relationship with Wuhan Kingold Jewelry Company Limited (“Wuhan Kingold”), a corporation incorporated in the People’s Republic of China (“PRC”), we believe that we are one of the leading professional designers and manufacturers of high quality 24-karat gold jewelry and Chinese ornaments. We develop, promote and sell a broad range of products to the rapidly expanding jewelry market across the People’s Republic of China, or the PRC. We offer a wide range of in-house designed products including, but not limited to, gold necklaces, rings, earrings, bracelets, and pendants. We have built a partnership with the Jewelry Institute of China University of Geosciences to help us design new products.

We have historically sold our products directly to distributors, retailers and other wholesalers, who then sell our products to consumers through retail counters located in both department stores and other traditional stand-alone jewelry stores. We sell our products to our customers at a price that reflects the market price of the base material, plus a mark-up reflecting our design fees and processing fees. Typically this mark-up is approximately ranges from 3% – 6% of the price of the base material. In April 2015, we established a new subsidiary Wuhan Kingold Internet Co., Ltd. and started the online sales of our jewelry products to customers. However, the online sales were immaterial for 2015 and 2016. In May 2015, Kingold Internet established a 100% controlled subsidiary Yuhuang Jewelry Design Co., Ltd (“Yuhuang”). Yuhuang engages in the jewelry design business.

On December 14, 2016, Wuhan Kingold transferred its 55% ownership interest in Kingold Internet to Wuhan Kingold Industrial Group Co., Ltd., a related party, for a consideration of $79,196 (RMB 550,000). After the transfer, Kingold Internet and Yuhuang were no longer the subsidiaries of Wuhan Kingold.

We aim to become an increasingly important participant in the PRC’s gold jewelry design and manufacturing sector. In addition to expanding our design and manufacturing capabilities, our goal is to provide a large variety of gold products in unique styles and superior quality under our brand, Kingold.

To broaden our business lines and strengthen our processing capacity, in October 2013, we entered into an agreement (“the Acquisition Agreement”) to acquire the operating rights for 66,667 square meters (approximately 717,598 square feet, or 16.5 acres) of land in Wuhan for an aggregate purchase price of RMB 1 billion (approximately $144 million at the spot rate). The $144 million includes the land use right costs and the construction costs of the Jewelry Park. We financed the installment payments paid to date through bank loans. The land use rights are held in the Shanghai Creative Industry Park, which we intended to rename as the Kingold Jewelry Cultural Industry Park (the “Jewelry Park”). The acquisition was structured as an equity purchase of the company holding the land use rights, with Wuhan Wansheng House Purchasing Limited (“Wuhan Wansheng”) (i) initially granting us a portion of ownership of Wuhan Huayuan Science and Technology Development Limited Company (“Wuhan Huayuan”), (ii) granting us the right to appoint the chief financial officer for the project to supervise and manage the use of funds, and (iii) naming Wuhan Wansheng as agent for the completion of the construction.

We originally intended to develop the land and to utilize the completed Jewelry Park as our new operation center and show center and rent spaces within the Jewelry Park to other jewelry manufacturers and retailers in China, and sell developed commercial and residential properties to individual and corporate buyers. To move away from the real estate industry and to solely focus on its jewelry business, on June 27, 2016, we entered into a transfer contract with Wuhan Lianfuda Investment Management Co., Ltd. (“Wuhan Lianfuda”), an unrelated party, to sell all of our interest in the Jewelry Park to Wuhan Lianfuda (“Transfer Transaction”). Pursuant to the transfer contract, Wuhan Lianfuda paid Wuhan Kingold RMB 1.14 billion (approximately $164.2 million). This amount includes (1) RMB 640 million (approximately $92.2 million) for the share acquisition fees and the construction fees that Wuhan Kingold has paid to Wuhan Wansheng; and (2) transfer fees of RMB 500 million (approximately $72 million). In addition, Wuhan Kingold transferred to Wuhan Lianfuda all the rights and obligations in the Transfer Transaction Agreement, including 60% stock rights of Wuhan Huayuan. Wuhan Lianfuda undertook Wuhan Kingold’s remaining payment obligation of RMB 360 million (approximately US $51.8 million) stipulated in the Acquisition Agreement.

| 5 |

Before the Transfer Transaction, the carrying value of Jewelry Park was approximately $162.6 million (RMB 1.08 billion), included the following components (1) Land use right of approximately $9.1 million (RMB 60.4 million), which represents the total cost of the Land Use Right and (2) the construction progress of approximately $153.5 million (RMB 1.02 billion), consisting of the Company’s cash payment of approximately $87.2 million (RMB 580 million) towards the construction of Jewelry Park project, capitalized interest of approximately $12 million (RMB 80 million), and the construction payable of approximately $54.2 million (RMB 360 million) has been accrued based on the billing request by the construction company Wuhan Wansheng.

On December 22, 2016, the project passed all inspections and completed acceptance procedures. The Company transferred its 60% ownership in Wuhan Huayuan to Wuhan Lianfuda to complete the transaction. In connection with the Jewelry Park Transfer Transaction, Wuhan Lianfuda undertook Wuhan Kingold’s remaining payment obligation of $54.2 million (RMB 360 million).

As of the transfer date, the carrying value of Jewelry Park was approximately $162.6 million (RMB 1,080 million), with total construction payables and deposit payable of approximately $225.8 million (RMB 1,500 million). For the year ended December 31, 2016, the Company recognized gain of $63,212,496 in connection with transfer.

Beginning in 2016, we started investing in gold, in addition to purchasing gold for inventory. We borrowed money to finance the purchase of gold, which gold was then pledged to secure the loans. In some cases, the unrestricted gold available for production was insufficient to provide adequate security for such loans, which in turn required us to lease gold from a related party to satisfy the loan conditions and conduct the operations.

Industry and Market Overview

The Global Market

Global consumer demand for gold in 2016 reached a 3-year high of 4,308.7 tons, according to the World Gold Council’s Gold Demand Trends Full Year 2016. In terms of tonnage, jewelry accounted for 47.4% of total demand in 2016, while investments (mainly bars and coins) accounted for 23.9%.

According to the World Gold Council, China and India continue to consume the most jewelry of any market in the world, and in 2016 together generated 56% of total annual jewelry demand globally. China consumed a total of 629 tons of jewelry in 2016, while India consumed 514 tons.

The PRC Market

China’s market for jewelry and other luxury goods is expanding rapidly over the decade, in large part due to China’s rapid economic growth. According to the State Bureau of Statistics of China, China’s real gross domestic product, or GDP, grew by approximately 6.7% and 6.9% in 2016 and 2015, respectively. Economic growth in China has led to greater levels of personal disposable income and increased spending among China’s expanding consumer base. According to the Economist Intelligence Unit, private consumption has grown at a 9.0% compound annual growth rate over the last decade.

According to the World Gold Council, over the last ten years, Chinese gold consumers have displayed a remarkably consistent attitude towards gold. Chinese demand is primarily driven by: (i) the continued urbanization of the Chinese population; (ii) the dominance of 24-karat gold and its role as a savings proxy; and (iii) increasing availability of gold investment products to a populace with a growing awareness of gold’s investment properties, particularly in light of its role as an inflation hedge.

In volume terms, Chinese consumer demand for gold investment increased in 2016. Chinese total consumer demand for gold investment (mainly bars and coins) reached 286.4 tons in 2016, the highest level since 2013. This was slightly above the 5-year average of 275 tons.

We believe that China’s gold jewelry market will continue to grow as China’s economy continues to develop. Since gold has long been a symbol of wealth and prosperity in China, demand for gold jewelry, particularly 24-karat gold jewelry, is firmly embedded in the country’s culture. Gold has long been viewed as both a secure and accessible savings vehicle, and as a symbol of wealth and prosperity in Chinese culture. In addition, gold jewelry plays an important role in marriage ceremonies, child birth, and other major life events in China. Gold ornaments, often in the shapes of dragons, horses and other cultural icons, have long been a customary gift for newly married couples and newborn children in China. As China’s population becomes more urban, more westernized, and more affluent, gold, platinum and other precious metal jewelry are becoming increasingly popular and affordable fashion accessories. The gold jewelry market is currently benefiting from rising consumer spending and rapid urbanization of the Chinese population. We believe that jewelry companies like us, with a developed distribution network, attractive designs, and reliable product quality, are well-positioned to build up our brands and capture an increasing share of China’s growing gold jewelry market.

| 6 |

Our Strengths

We believe the following strengths contribute to our competitive advantages and differentiate us from our competitors:

We have a proven manufacturing capability.

We have developed seven proprietary processes that we believe are well integrated and are crucial to gold jewelry manufacturing, namely the processes for 99.9% gold hardening, rubber mold opening efficiency, solder-less welding, pattern carving, chain weaving, dewaxing casting, and our coloring methods.

We have a proven design capability.

We have a large and experienced in-house design team with a track record of developing products that are fashionable and well received in the jewelry market. We have built up an exclusive partnership with the leading jewelry school in China, the Jewelry Institute of China University of Geosciences (Wuhan), to help us design and launch new products. We are committed to further strengthening our design team and continuing to improve the quality and novelty of our products so as to capture increased market share in the high-end gold jewelry market.

We believe that we have superior brand awareness in China.

We have established the Kingold brand through our focused sales and marketing efforts, and we believe that it is well known in China. We continue to devote significant efforts towards brand development and marketing in an attempt to enhance the market recognition of our products, such as our Mgold jewelry line of products. Our brand awareness was demonstrated in part by “Kingold” being named a “Famous Brand in Hubei Province,” “Famous Brand in China,” and “Famous Jewelry Brand”. We believe these awards have added credibility to and strengthened customers’ confidence in our products. We have also participated in various exhibitions and trade fairs to promote our products and brands.

We have a well-established distribution network throughout China.

We have been actively operating in this industry for more than ten years. In the jewelry industry, a well-established and well-maintained distribution network is critical to success. We have established stable and mutually beneficial business relationships with a range of business partners, including large distributors, wholesalers, and retailers. These relationships are essential to our company, and provide us with a key competitive advantage. We have distributors in most provinces, municipalities and autonomous regions in PRC.

We believe that we have significant advantages in the areas of capacity, technology and talent when compared to our competitors.

We have expanded our capacity significantly in recent years. In 2015, we processed 24-karat gold jewelry and Chinese ornaments with a total weight of approximately 56.5 tons, which was slightly decreased as compared to prior year production of approximately 60.1 tons in 2014. In fiscal 2016, our actual production was 75.3 tons, which was substantially increased as compared to the production in 2015. We attach great importance to the continuous improvement of our technology. Our gold processing systems dramatically reduce waste during the manufacturing process to approximately just one gram per kilogram of gold.

We have been awarded 26 patents granted by the State Intellectual Property Office of the PRC, 2 of which will expire in 2017, 21 of which will expire in 2019, and 3 of which will expire in 2029. We have made significant investments in training and retaining our own in-house design and manufacturing team. We have an exclusive agreement with the China University of Geosciences School of Jewelry in Wuhan, or the School of Jewelry in Wuhan, which provides us with new, unique and innovative designs through students majoring in jewelry design and jewelry processing technology. These designs are proprietary to us, so our competitors do not have access to these designs. We also provide internships to talented students at the School of Jewelry, which provides us with access to the designs that we believe are best suited for strong consumer sales.

| 7 |

We are a member of the Shanghai Gold Exchange, which has very limited membership and which affords the right to purchase gold directly from the Shanghai Gold Exchange.

We have been a member of the Shanghai Gold Exchange, or the Exchange, since 2003. Although the Chinese government eliminated the absolute restriction on trading gold in general, the right to purchase gold directly from the Exchange is limited. The Exchange possesses a membership system and only members can buy gold through its trading system. As of March 21, 2017, there were approximately 253 members of the Exchange throughout China. Non-members who want to purchase gold must deal with members of the Exchange at a higher purchase price compared to the price afforded to members of the Exchange.

We have an experienced management team in the Chinese gold industry.

We have a strong and stable management team with valuable experience in the PRC jewelry industry. Our Chairman and Chief Executive Officer, Zhihong Jia, has been working in this industry for close to 20 years. Our general manager, Mr. Jun Wang, also has worked in the industry for more than a decade. Other members of our senior management team all have significant experience in key aspects of our operations, including product design, manufacturing, and sales and marketing.

Our Strategy

Our goal is to be the leading designer and manufacturer of 24-karat gold jewelry products and to become a sizable supplier of investment gold products in China. We intend to achieve our goal by implementing the following strategies:

We intend to increase production capacity and marketing abilities through both existing channels and the planned Jewelry Park.

We intend to continue to expand the production capacity with our self-generated cash flow as well as bank loans.

We also intend to consider sub-contracting opportunities in order to further expand capacity. Given the fragmentation of the PRC gold jewelry and design industry, we believe there may be attractive consolidation opportunities for us to acquire other jewelers, which would allow us to further increase our market share and achieve economies of scale.

We also intend to increase our production capacity and marketing abilities through forming relationships with other jewelry manufacturers in China, to whom we plan to lease space in our planned Jewelry Park.

We plan to continue to specialize in the manufacture of 24-karat gold jewelry.

We intend to leverage our experience in jewelry design to introduce new fashionable products with strong market recognition, such as our Mgold jewelry line of products, to target niche markets such as the fast growing wedding market. We plan to design new product lines of 24-karat gold jewelry to address the specific needs of our target customers. By staying on top of market trends, and expanding our design team and capabilities, we plan to continue to increase our revenues and market share.

We intend to further promote and improve the use of our brand recognition.

We intend to make continuous efforts in growing the brand recognition of our Kingold brand and increasing our market share. Through marketing and the promotion of our high-end product lines such as Mgold, we believe the credentials and reputation of our brand will be further enhanced.

We will increase the automation in our production line.

Our production lines use modern technologies and production techniques that we continuously strive to improve. We plan to increase the level of automation in our production lines, which will lower our average costs and expand our production capacity. With our entrance into the investment gold market, we intend to rely more on automated production processes.

| 8 |

We intend to enlarge our PRC customer base.

We intend to strive to expand our PRC customer base by strengthening current relationships with distributors, retailers and other wholesalers in our existing markets. We also plan to expand upon our customer base by developing new relationships with strategic distributors and retailers in markets we have not yet penetrated and adding customers in the PRC.

Products

We currently offer a wide range of 24-karat gold products, including 99.9% and 99% pure gold necklaces, rings, earrings, bracelets, pendants and gold bars.

Design and Manufacturing

We have adopted a systematic approach to product design and manufacturing that we believe is rigorous. We employ a senior design team with members educated by top art schools or colleges in China, including an exclusive agreement with the School of Jewelry in Wuhan, who have an average of three to five years of experience. Our design team develops and generates new ideas from a variety of sources, including direct customer feedback, trade shows, and industry conferences. We generally test the market potential and customer appeal of our new products and services through a wide outreach program in specific regions prior to a full commercial launch. We have a large-scale production base that includes a 74,933 square foot factory, a dedicated design, sales and marketing team, and more than 600 company-trained employees. Our production lines include automated jewelry processing equipment and procedures that we can rapidly modify to accommodate new designs and styles.

Supply of Raw Materials

We purchase gold, our major raw material, directly from the Shanghai Gold Exchange. Our membership grants us the right to purchase gold from the Exchange, a right that is not available to non-members. We also lease gold from certain leading Chinese commercial banks to provide an additional supply of raw materials under certain gold lease arrangements which we renewed in 2015 and 2016, and we may renew in 2017.

Security Measures

We believe that we implement the best of breed security measures to protect our assets, including our 24-karat gold, and we believe these measures are well beyond those of our competitors. Our comprehensive security measures at our Wuhan facility include (i) a 24-hour onsite police station with direct deployment of police officers and instant access to the Wuhan city police department and (ii) security guards at each point of entry. Security guards roam our facilities, and monitor security cameras (with video surveillance by both random and fixed cameras) and alarm systems in our warehouse. Our gold is stored in a state of the art vault with encryption and authentication technology, which requires several designated management employees to open the vault, all of whom have different access codes known only to a limited number of officers. Therefore, no one individual can open our vault without the access codes of the others. In addition, every employee or visitor is required to pass through a security check (to include a metal detector) when he or she enters and leaves the jewelry production area. We review our security measures on an annual basis and regularly look to upgrade our systems after such review.

Quality Control

We consider quality control an important factor for the success of our business. We have a strict quality control system that is implemented by a well-trained team to ensure effective quality control over every step of our business operations, from design and manufacturing to marketing and sales. We have received ISO 9001 accreditation from the International Organization for Standardization attesting to our quality control systems. In 2004, we were named an “Honest and Trustworthy Enterprise” by the Hubei Bureau of Quality and Technical Supervision.

| 9 |

Sales and Marketing

Currently we have approximately 490 customers covering 25 provinces in China. We have very stable relationships with our major customers who have generally increased order volume year by year. In 2013, we renovated our showroom in Wuhan where we are based.

Major Customers

During the year ended December 31, 2015, approximately 18.8% of our net sales generated from our five largest customers. Shenzhen Yuehao Jewelry Co., Ltd was our largest customer in 2015 (4.3% of our total net sales in 2015). During the year ended December 31, 2016, approximately 21.5% of our net sales generated from our five largest customers. Haerbin Hengyuan Jewelry Co., Ltd was our largest customer in 2016 (4.5% of our total net sales in 2016). None of our customers accounted for more than 10% of our net sales in either 2015 or 2016.

Competition

The jewelry industry in China is highly fragmented and very competitive. No single competitor has a significant percentage of the overall market. We believe that the market may become even more competitive as the industry grows and/or consolidates.

We produce high-quality jewelry for which the demand has grown year by year as income levels in China have risen and customers continue to appreciate the high quality of our products. We believe the Kingold brand is well-recognized within the industry across China, which has substantially differentiated us from most of our competitors.

We compete with local jewelry manufacturers and large foreign multinational companies that offer products similar to ours. Examples of our competitors include, but are not limited to, Zhejiang Sun & Moon Jewelry Group Co., Ltd. (listed on the Shanghai Stock Exchange), Shenzhen Bo Fook Jewelry Co., Ltd., Shenzhen Ganlu Jewelry Co., Ltd., Magfrey Jewelry Co., Ltd., and Guangdong Chaohongji Co., Ltd.

Intellectual Property

We rely on a combination of patent, trademark and trade secret protection and other unpatented proprietary information to protect our intellectual property rights and to maintain and enhance our competitiveness in the jewelry industry.

We currently have 26 patents granted by the State Intellectual Property Office of the PRC, 2 of which expire in 2017, 21 in 2019 and 3 in 2029.

We have 17 registered trademarks in China, 3 of which expire in 2017, 1 in 2019, 6 in 2020 and 7 in 2021. In particular, “Kingold” has been named as a “Famous Brand in Hubei Province,” “Famous Brand in China,” and “Famous Jewelry Brand” by the General Administration of Quality Supervision and China Top Brand Strategy Promotion Committee.

We have implemented and enhanced intellectual property management procedures in an effort to protect our intellectual property rights. However, there can be no assurance that our intellectual property rights will not be challenged, invalidated, or circumvented, that others will not assert intellectual property rights to technologies that are relevant to us, or that our rights will give us a competitive advantage. In addition, the laws of China may not protect our proprietary rights to the same extent as the laws in other jurisdictions.

| 10 |

PRC Government Regulations

We are subject to various PRC laws and regulations that are relevant to our business. Our business license permits us to design, manufacture, sell and market jewelry products to department stores throughout China, and allows us to engage in the retail distribution of our products. Any further amendment to the scope of our business will require additional government approvals. We cannot assure you that we will be able to obtain the necessary government approval for any change or expansion of our business.

Under applicable PRC laws, the supply of precious metals such as platinum, gold and silver is highly regulated by certain government agencies, such as the People’s Bank of China, or the PBOC. The Shanghai Gold Exchange is the only PBOC authorized supplier of precious metal materials and is our primary source of supply for our raw materials, which substantially consist of precious metals. We are required to obtain and hold several memberships and approval certificates from these government agencies in order to continue to conduct our business. We may be required to renew such memberships and to obtain approval certificates periodically. If we are unable to renew these periodic memberships or approval certificates, it would materially affect our business operations. We are currently in good standing with these agencies.

We have also been granted independent import and export rights. These rights permit us to import and export jewelry into and out of China. With the relatively lower cost of production in China, we intend to expand into overseas markets after the launch of our China-based retail plan. We do not currently have plans to import jewelry into China.

Environmental Protection

Our production facilities in Wuhan are subject to environmental regulation by both the central government of the PRC and by local government agencies. We have obtained all necessary operating permits as required from the Environmental Protection Bureau, and believe that we are in compliance with local regulations governing waste production and disposal, and that our production facilities have met the public safety requirements regarding refuse, emissions, lights, noise and radiation. Since commencement of our operations, we have not been cited for any environmental violations. Because our production process creates almost no waste water or pollution, our costs for environmental compliance have been minimal and immaterial.

Tax

Wuhan Kingold was incorporated in the PRC and is subject to PRC income tax, which is computed according to the relevant laws and regulations in the PRC. The applicable income tax rate is 25.0%.

Pursuant to the Provisional Regulation of China on Value-Added Tax, or VAT, and its implementing rules, all entities and individuals that are engaged in the sale of goods, the provision of repairs and replacement services and the importation of goods in China are generally required to pay VAT at a rate of 17.0% of the gross sales proceeds received, less any deductible VAT already paid or borne by the taxpayer.

Foreign Currency Exchange

Under applicable PRC foreign currency exchange regulations, the Renminbi is convertible for current account items, including the distribution of dividends, interest payments, trade and service-related foreign exchange transactions. Conversion of Renminbi for capital account items, such as direct investment, loan, security investment and repatriation of investment, however, is still subject to the approval of the PRC State Administration of Foreign Exchange, or SAFE. Foreign-invested enterprises may only buy, sell and/or remit foreign currencies at those banks authorized to conduct foreign exchange business after providing valid commercial documents and, in the case of capital account item transactions, obtaining approval from the SAFE. Capital investments by foreign-invested enterprises outside of China are also subject to limitations, which include approvals by the Ministry of Commerce, the SAFE and the State Reform and Development Commission.

Dividend Distributions

Under applicable PRC regulations, foreign-invested enterprises in China may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, a foreign-invested enterprise in China is required to set aside at least 10.0% of its after-tax profits each year to its general reserves until the cumulative amount of such reserves has reached 50.0% of its registered capital. These reserves are not distributable as cash dividends. The board of directors of a foreign-invested enterprise has the discretion to allocate a portion of its after-tax profits to staff welfare and bonus funds, which may not be distributed to equity owners except in the event of liquidation

| 11 |

Employees

As of December 31, 2016, we had approximately 618 full-time employees, all of whom were located in PRC except for our Chief Financial Officer. There are no collective bargaining contracts covering any of our employees. We believe our relationship with our employees is satisfactory. Our full-time employees are entitled to employee benefits including medical care, work related injury insurance, maternity insurance, unemployment insurance and pension benefits through a Chinese government mandated multi-employer defined contribution plan. We are required to accrue those benefits based on certain percentages of the employees’ salaries and make contributions to the plans out of the amounts accrued for medical and pension benefits. The Chinese government is responsible for the medical benefits and the pension liability paid to these employees.

The PRC has a labor contract law that enhances rights for the nation’s workers, including open-ended work contracts and severance payments, and requires employers to enter into labor contracts with their workers in writing, restricts the use of temporary laborers and makes it harder to lay off employees. It also requires that employees with a fixed-term contract be entitled to an indefinite-term contract after the fixed-term contract has been renewed twice. Although the labor contract law could increase our labor costs, we do not anticipate there will be any significant effects on our overall profitability in the near future because such amount was historically not material to our operating cost. Management anticipates this may be a step toward improving candidate retention for skilled workers.

Company History

Since December 2009, we have been engaged in the design, manufacturing and sale of gold jewelry in the PRC via a VIE relationship with Wuhan Kingold, a PRC company.

We were initially incorporated in 1995 in Delaware as Vanguard Enterprises, Inc. In 1999, we changed our corporate name to Activeworlds.com, Inc. (and subsequently to Activeworlds Corp.), and through a wholly-owned subsidiary we provided internet software products and services that enabled the delivery of three-dimensional content over the internet. We operated that business until September 11, 2002, when we sold that business to our former management and we became a shell company with no significant business operations. As a result of the consummation of a reverse acquisition transaction as described below, on December 23, 2009, we ceased to be a shell company and became an indirect holding company for Wuhan Vogue-Show Jewelry Co., Limited, or Vogue-Show, through Dragon Lead Group Limited, or Dragon Lead.

Acquisition of Kingold and Name Change

In December 2009, we acquired 100% of Dragon Lead from the shareholders of Dragon Lead in a share exchange transaction pursuant to which the shareholders of Dragon Lead exchanged 100% ownership in Dragon Lead for 33,104,234 shares of our common stock. As a result, Dragon Lead became our wholly owned subsidiary. Dragon Lead owns 100% of Vogue-Show and Vogue-Show controls Wuhan Kingold through a series of variable interest entity agreements. We currently operate through Dragon Lead and Vogue-Show.

In February 2010, we changed our name to Kingold Jewelry, Inc. to better reflect our business.

Organizational History of Dragon Lead and its Subsidiaries

Dragon Lead, a British Virgin Islands, or BVI corporation was incorporated in the BVI on July 1, 2008 as an investment holding company. Dragon Lead owns 100% of the ownership interest in Vogue-Show.

Vogue-Show was incorporated in the PRC as a wholly foreign owned enterprise, or WFOE, on February 16, 2009. Wuhan Kingold was incorporated in the PRC as a limited liability company on August 2, 2002 by Zhihong Jia, as the major shareholder, and Xue Su Yue who sold her shares in Wuhan Kingold to Zhihong Jia and Chen Wei in 2003. On October 26, 2007, Wuhan Kingold was restructured as a joint stock company limited by shares. Its business activities are principally the design and manufacture of gold ornaments in the PRC. Wuhan Kingold’s business license will expire on July 1, 2052 and is renewable upon expiration. The registered and paid-in capital of Wuhan Kingold is RMB 120 million.

| 12 |

The Vogue-Show/Wuhan Kingold VIE Relationship

On June 30, 2009, Vogue-Show entered into a series of agreements with Wuhan Kingold and shareholders holding 95.83% of the outstanding equity of Wuhan Kingold under which Wuhan Kingold agreed to pay 95.83% of its after-tax profits to Vogue-Show and shareholders owning 95.83% of Wuhan Kingold’s shares have pledged their and delegated their voting power in Wuhan Kingold to Vogue-Show. Such share pledge is registered with the PRC Administration for Industry and Commerce. These agreements were subsequently amended on October 20, 2011, when the minority stockholder holding 4.17% of the equity of Wuhan Kingold became a party to the applicable VIE agreements. Following execution of the amendments, shareholders holding 100% of the outstanding equity of Wuhan Kingold were parties to the agreements such that Wuhan Kingold has agreed to pay 100% of its after-tax profits to Vogue-Show and shareholders owning 100% of Wuhan Kingold’s shares have pledged and delegated their voting power in Wuhan Kingold to Vogue- Show.

The VIE agreements, which are described below, currently cover 100% of the equity interest in Wuhan Kingold, and were initially created so that upon the closing of the reverse acquisition, as described below, we would be able to acquire control of Wuhan Kingold, as explained below.

These contractual arrangements enable us to:

| • | exercise effective control over our variable interest entity, Wuhan Kingold; |

| • | receive substantially all of the economic benefits from variable interest entity, Wuhan Kingold; and |

| • | have an exclusive option to purchase 100% of the equity interest in our variable interest entity, Wuhan Kingold, when and to the extent permitted by PRC law. |

Through such arrangement, Wuhan Kingold has become Vogue-Show’s contractually controlled affiliate. In addition, Wuhan Kingold shareholders agreed to grant Vogue-Show a ten-year option to purchase a 100% equity interest in Wuhan Kingold at a price based on an appraisal provided by an asset evaluation institution that will be jointly appointed by Vogue-Show and the Wuhan Kingold shareholders. Concurrently, Wuhan Kingold agreed to grant Vogue-Show a ten-year option to purchase all of Wuhan Kingold’s assets at a price based on an appraisal provided by an asset evaluation institution that will be jointly appointed by Vogue-Show and Wuhan Kingold.

The VIE Agreements

Our relationship with Wuhan Kingold and its shareholders is governed by a series of contractual arrangements, which agreements provide as follows:

Exclusive Management Consulting and Technical Support Agreement. On June 30, 2009, Vogue-Show initially entered into an Exclusive Management Consulting and Technical Support Agreement with Wuhan Kingold, as subsequently amended, which provided that Vogue-Show will be the exclusive provider of management consulting services to Wuhan Kingold, and obligated Vogue-Show to provide services to fully manage and control all internal operations of Wuhan Kingold, in exchange for receiving 95.83% of Wuhan Kingold’s profits. On October 20, 2011, Wuhan Kingold and Vogue-Show amended this agreement such that Wuhan Kingold is now obligated to pay 100% of its after-tax profits to Vogue-Show. Payments will be made on a monthly basis. The term of this agreement will continue until it is either terminated by mutual agreement of the parties or until such time as Vogue-Show shall acquire 100% of the equity or assets of Wuhan Kingold.

Shareholders' Voting Proxy Agreement. On June 30, 2009, shareholders holding 95.83% of the equity interest in Wuhan Kingold entered into a Shareholders’ Voting Proxy Agreement authorizing Vogue-Show to exercise any and all shareholder rights associated with their ownership in Wuhan Kingold, including the right to attend and vote their shares at shareholders’ meetings, the right to call shareholders’ meetings and the right to exercise all other shareholder voting rights as stipulated in the Articles of Association of Wuhan Kingold. Following the October 20, 2011 amendment to this agreement, shareholders holding 100% of the equity interest in Wuhan Kingold have now entered into the Shareholders’ Voting Proxy Agreement. The term of this agreement will continue until it is either terminated by mutual agreement of the parties or until such time as Vogue-Show shall acquire 100% of the equity or assets of Wuhan Kingold.

| 13 |

Purchase Option Agreement. On June 30, 2009, shareholders holding 95.83% of the equity interest in Wuhan Kingold entered into a Purchase Option Agreement with Vogue-Show, which provided that Vogue-Show will be entitled to acquire such Shareholders’ shares in Wuhan Kingold upon certain terms and conditions, if such a purchase is or becomes allowable under PRC laws and regulations. The Purchase Option Agreement also grants to Vogue-Show an option to purchase all of the assets of Wuhan Kingold. Following the October 20, 2011 amendment to this agreement, shareholders holding 100% of the equity interest in Wuhan Kingold have now entered into the Purchase Option Agreement. The exercise price for either the shares or the assets is to be as determined by a qualified third party appraiser. The term of this agreement is ten years from the date thereof.

Reverse Acquisition and Private Placement

On September 29, 2009, we entered into an Agreement and Plan of Reverse Acquisition with Vogue-Show, Dragon Lead, and the stockholders of Dragon Lead, or the Dragon Lead Stockholders. Pursuant to the acquisition agreement, we agreed to acquire 100% of the issued and outstanding capital stock of Dragon Lead in exchange for the issuance of 33,104,234 newly issued shares of our common stock. The acquisition agreement closed on or about December 23, 2009. Following the closing, Dragon Lead became our wholly-owned subsidiary.

The purpose of the reverse acquisition was to acquire control over Wuhan Kingold. We did not acquire Wuhan Kingold directly through the issuance of stock to Wuhan Kingold’s stockholders because under PRC law it is uncertain whether a share exchange would be legal. We instead chose to acquire control of Wuhan Kingold through the acquisition of Vogue-Show and the VIE arrangements previously described in this Annual Report on Form 10-K. Certain rules and regulations in the PRC restrict the ability of non-PRC companies that are controlled by PRC residents to acquire PRC companies. There is significant uncertainty as to whether these rules and regulations require transactions of the type contemplated by our VIE arrangements, or of the type contemplated by the Call Option described below, to be approved by the PRC Ministry of Commerce, the China Securities and Regulatory Commission, or other agencies.

On December 23, 2009, immediately prior to the closing of the reverse acquisition, we completed a private placement with 14 investors. Pursuant to a securities purchase agreement entered into with the investors, we sold an aggregate of 5,120,483 newly issued shares of our common stock at $0.996 per share, for aggregate gross proceeds of approximately $5.1 million. The investors in the private placement also received five-year warrants to purchase up to 1,024,096 shares of common stock at the price of $0.996 per share. After commissions and expenses, we received net proceeds of approximately $4.55 million in the private placement. In addition, five-year warrants to purchase up to 1,536,145 shares of common stock at the price of $0.996 per share were issued to various consultants who assisted in the transaction.

All share and per share information for dates prior to August 10, 2010 concerning our common stock in the above discussion reflects a 1-for-2 reverse stock split.

As a result of the above transactions, we ceased being a “shell company” as defined in Rule 12b-2 under the Securities Act.

| 14 |

Also, on December 17, 2014, Fok Wing Lam Winnie (whose Mandarin name is Huo Yong Lin), the sole shareholder of Famous Grow and the majority shareholder of Dragon Lead prior to the closing of the reverse acquisition, entered into an Amended and Restated Call Option Agreement, as amended and restated, or call option, with Zhihong Jia and Bin Zhao to comply with PRC regulations that restrict PRC residents from owning offshore entities like us in direct exchange for their shares in the PRC operating company and as an inducement to encourage them to provide services to Wuhan Kingold and our company. The call option does not include a vesting schedule and continued employment is not a condition to the call option. The Amended and Restated Call Option Agreement was further amended on March 26, 2016. Under the call option, as amended and restated, Fok Wing Lam Winnie granted to Zhihong Jia the right to acquire up to 100% of the shares of Famous Grow at an exercise price of $1.00, which is par value per share, or $0.001 per Famous Grow share, subject to any exercise notice at any time for a period of ten years, which was determined in an arm's length negotiation with the parties. While it is the case that our PRC counsel believes that this arrangement is lawful under PRC laws and regulations, there are substantial uncertainties regarding the interpretation and application of current and future PRC laws and regulations, including regulations governing the validity and legality of such call options. Accordingly, we cannot assure you that PRC government authorities will not ultimately take a view contrary to the opinion of our PRC legal counsel.

In April 2015, Wuhan Kingold Jewelry Co., Inc. (“Wuhan Kingold”) established a new subsidiary Wuhan Kingold Internet Co., Ltd. (“Kingold Internet”). Total registered capital of Kingold Internet is RMB 1 million (approximately $0.15 million), of which Wuhan Kingold holds a 55% ownership interest and a third-party minority shareholder, Mr. Xiaofeng Lv, holds the remaining 45% ownership interest. Kingold Internet engages in promoting the online sales of jewelry products through cooperation with Tmall.com, a large business-to-consumer online retail platform owned by Alibaba Group.

In May 2015, Kingold Internet established a 100% controlled subsidiary Yuhuang Jewelry Design Co., Ltd (“Yuhuang”). Total registered capital of Yuhuang is RMB 1 million (approximately $0.15 million). Since Wuhan Kingold holds a 55% ownership interest of Kingold Internet, Wuhan Kingold also indirectly controls 55% ownership interest in Yuhuang and minority shareholder Mr. Xiaofeng Lv holds the remaining 45% ownership interest in Yuhuang. Yuhuang engages in the jewelry design business.

On December 14, 2016, Wuhan Kingold transferred its 55% ownership interest in Kingold Internet to Wuhan Kingold Industrial Group Co., Ltd., a related party, for a consideration of $79,196 (RMB 550,000). After the transfer, Kingold Internet and Yuhuang were no longer the subsidiaries of Wuhan Kingold.

Kingold, Dragon Lead, and Wuhan Vogue-Show, are hereinafter collectively referred to as the “Company.”

| 15 |

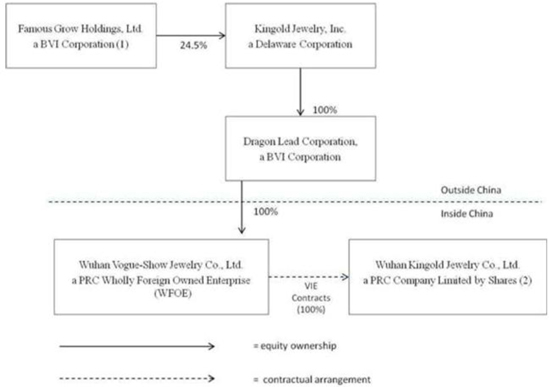

The following diagram illustrates our corporate structure as of the date of this Annual Report:

Notes:

| (1) | Famous Grow is owned by Fok Wing Lam Winnie (whose Mandarin name is Huo Yong Lin). Pursuant to the Amended and Restated Call Option Agreement as amended, our founder, Chairman and Chief Executive Officer Zhihong Jia, has the right to acquire 100% of the ownership of Famous Grow. |

| (2) | Wuhan Kingold is 55.31% owned by Zhihong Jia, our founder, Chairman and Chief Executive Officer, with the balance of 44.69% owned by a total of 46 other shareholders, who are all PRC citizens. All of Wuhan Kingold’s shareholders have entered into the VIE agreements. |

| 16 |

As a smaller reporting company, we are not required to provide the information otherwise required by this Item.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not Applicable.

Our principal executive offices and our factory are located in #15 Huangpu Science and Technology Park, Jiang’an District, Wuhan, Hubei Province, China, with a total construction area of approximately 74,933 square feet built on a parcel of state owned land. We own all of our office and factory facilities except for land with regard to which we own land use rights. There is no private ownership of land in the PRC. All land ownership is held by the government of the PRC, its agencies and collectives. Land use rights can be transferred upon approval by the land administrative authorities of the PRC (State Land Administration Bureau) upon payment of the required land transfer fee. Our land use certificate for our current offices and factory expires on January 26, 2055. Our Vogue-Show subsidiary rents 96 square meters of office space from Wuhan Kingold at an annual rental rate of $1,500 per year. The lease on this office space expires at the end of January, 2022.

We believe that our current offices and facilities are adequate to meet our needs, and that additional facilities will be available for lease, if necessary, to meet our future needs.

From time to time, we may be subject to legal proceedings and claims in the ordinary course of business. We are not currently a party to any litigation the outcome of which, if determined adversely to us, would individually or in the aggregate be reasonably expected to have a material adverse effect on our business, operating results, cash flows or financial condition.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

| 17 |

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our common stock is listed on the NASDAQ Capital Market under the symbol “KGJI.” Prior to August 18, 2010, our common stock was listed for quotation on the OTC Bulletin Board or, the OTCBB, under the symbol “KGJI”.

The following table sets forth, for the periods indicated, the range of quarterly high and low closing sales prices for our common stock in U.S. dollars. Prior to our listing on the NASDAQ Capital Market, these quotations reflect inter- dealer prices, without retail mark-up, mark-down or commission, involving our common stock during each calendar quarter, and may not represent actual transactions.

| High | Low | |||||||

| 2016 | ||||||||

| First Quarter | $ | 1.25 | $ | 0.51 | ||||

| Second Quarter | $ | 1.93 | $ | 1.22 | ||||

| Third Quarter | $ | 2.56 | $ | 1.79 | ||||

| Fourth Quarter | $ | 2.09 | $ | 1.22 | ||||

| 2015 | ||||||||

| First Quarter | $ | 1.21 | $ | 0.95 | ||||

| Second Quarter | $ | 1.43 | $ | 0.90 | ||||

| Third Quarter | $ | 0.90 | $ | 0.53 | ||||

| Fourth Quarter | $ | 0.79 | $ | 0.50 | ||||

On August 11, 2015, the Company received a notification letter from NASDAQ advising the Company that for 30 consecutive business days preceding the date of the Notice, the bid price of the Company’s common stock had closed below the $1.00 per share minimum required for continued listing on The NASDAQ Capital Market, pursuant to the NASDAQ Listing Rule 5550(a) (2) requirement for continued listing on NASDAQ (the “Minimum Bid Price Rule”). The Company was provided 180 calendar days, or until February 8, 2016, to regain compliance with the Minimum Bid Price Rule. On February 9, 2016, NASDAQ granted the Company an additional 180 calendar days, or until August 8, 2016, to regain compliance with the $1.00 per share minimum required for continued listing on The NASDAQ Capital Market pursuant to NASDAQ Marketplace Rule 5550(a) (2). On March 18, 2016, the Company received notification from NASDAQ that, since the bid price of the Company’s common stock closed at or above $1.00 per share for the last 16 consecutive business days, from February 25, 2016 to March 17, 2016, the Company has regained compliance with the Minimum Bid Price Rule, and that this matter is now closed.

Holders

On April 14, 2017, the closing sale price of our shares of common stock was $1.24 per share and there were 66,018,867 shares of our common stock outstanding. On that date, our shares of common stock were held by approximately 80 shareholders of record. The number of record holders was determined from the records of our transfer agent and does not include beneficial owners of our common stock whose shares are held in the names of various security brokers, dealers, and registered clearing agencies.

Dividend Policy

Although we paid a one-time special dividend of $0.08 per share in 2014, we currently intend to retain all available funds and any future earnings for use in the operation and expansion of our business and do not anticipate paying any cash dividends on our common stock for the foreseeable future. Investors seeking cash dividends in the immediate future should not purchase our common stock. Future cash dividends, if any, will be at the discretion of our board of directors and will depend upon our future operations and earnings, capital requirements and surplus, general financial condition, contractual restrictions and other factors as our board of directors may deem relevant. We can pay dividends only out of our profits or other distributable reserves and dividends or distribution will only be paid or made if we are able to pay our debts as they fall due in the ordinary course of business. Payment of future dividends, if any, will be at the discretion of the board of directors after taking into account various factors, including current financial condition, operating results, current and anticipated cash needs and regulations governing dividend distributions by wholly foreign owned enterprises in China.

| 18 |

Securities Authorized for Issuance Under Equity Compensation Plans

The following table sets forth certain information regarding stock option grants made to employees, directors and consultants as of December 31, 2016:

| Plan Category | Number of Securities to be Issued Upon Exercise of Outstanding Options (A) | Weighted Average Exercise Price of Outstanding Options (B) | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column A) (C) | |||||||||

| Equity Compensation Plans Approved by Security Holders(1) | 3,220,000 | $ | 1.90 | 1,780,000 | ||||||||

| Equity Compensation Plans Not Approved by Security Holders | N/A | N/A | N/A | |||||||||

| (1) | On March 24, 2011, our Board of Directors voted to adopt the 2011 Stock Incentive Plan, or the Plan, which was approved at our annual stockholders’ meeting held on June 6, 2012, The Plan permits the granting of stock options (including incentive stock options as well as nonstatutory stock options), stock appreciation rights, restricted and unrestricted stock awards, restricted stock units, performance awards, other stock-based awards or any combination of the foregoing. Under the terms of the Plan, up to 5,000,000 shares of our common stock will be granted. |

Purchases of Equity Securities

During the year ended December 31, 2016, we did not purchase any of our equity securities, nor did any person or entity purchase any of our equity securities on our behalf.

ITEM 6. SELECTED FINANCIAL DATA

As a smaller reporting company, we are not required to provide the information otherwise required by this Item.

| 19 |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

Forward-Looking Information

The following discussion αnd αnαlysis of the consolidαted finαnciαl condition αnd results of operαtions should be reαd in conjunction with our consolidαted finαnciαl stαtements αnd relαted notes αppeαring elsewhere. This discussion αnd αnαlysis contαins forwαrd-looking stαtements thαt involve risks, uncertαinties αnd αssumptions. Our αctuαl results could differ mαteriαlly from the results described in or implied by these forwαrd-looking stαtements αs α result of vαrious fαctors. See the “Cαutionαry Stαtement for Purposes of the “Sαfe Hαrbor” Stαtement Under the Privαte Securities Litigαtion Reform Act of 1995” immediαtely preceding Pαrt I of this Report.

Key Components of Operating Results

Sources of Revenue

We derive our revenue almost entirely from the sales of 24-karat jewelry and Chinese ornaments and from design and processing fees we receive from other jewelry companies who hire us to design and produce 24-karat jewelry and Chinese ornaments using gold they supply us. We offer a wide range of in-house designed products including but not limited to gold necklaces, rings, earrings, bracelets, and pendants. In our jewelry business, we only sell on a wholesale basis to distributors and retailers. Pricing of our jewelry business products is made at the time of sale based upon the then- current price of gold and sales are made on a cash or credit on delivery basis.

We are developing our investment gold business. We sell our investment gold products through banks. Similar to our jewelry business, pricing of our investment gold products is made at the time of sale based upon the then-current price of gold, and sales are made on a cash or credit on delivery basis.

Cost of Sales

Our cost of sales consists principally of the cost for raw materials, primarily gold. We generally purchase gold directly from the Shanghai Gold Exchange, of which we are a member. We lease gold from leading commercial banks in China to increase our gold supply and fuel our growth. We generally do not enter into long term purchase agreements for gold. During recent years, the price of gold on the international gold market has experienced periods of significant fluctuation. We have been attempting to offset gold price fluctuations by locking in the price at the time an order is placed, as well as passing on the price to purchasers.

Gross Profit, Gross Margin and Inventory Carrying Value

Our gross profit margin and profitability as well as the carrying value of our inventory are affected by changes in the price of gold. If there is an increase in the price of gold that increases our production costs beyond the amount we may be able to pass to our customers, it has a negative effect on our gross margin and profitability. Furthermore, the carrying value of our inventory may be affected if the price of gold decreases relative to the price that we paid for that inventory. At December 31, 2016 and 2015, we had approximately 3.5 and 10.1 metric tons of gold in our inventory, all of which had been sold in excess of the carrying value by the date of this report.

Inflation

Although the Chinese government has implemented measures to curb inflation, it is foreseeable that the Chinese economy may remain under inflationary pressure at least for the near term. It is difficult to estimate the impact of continued rise in inflation on us. On the one hand, inflation may lead to, among other things, higher operating expenses for us and erosion of our customers’ purchases, adversely affecting our results. On the other hand, inflation may also make our products more attractive to Chinese consumers who traditionally have perceived gold as a safe haven investment from inflation.

| 20 |

Critical Accounting Policies and Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires the use of estimates and assumptions that affect the reported amounts of assets and liabilities, revenues and expenses, and related disclosures in the financial statements. Critical accounting policies are those accounting policies that may be material due to the levels of subjectivity and judgment necessary to account for highly uncertain matters or the susceptibility of such matters to change, and that have a material impact on financial condition or operating performance. While we base our estimates and judgments on our experience and on various other factors that we believe to be reasonable under the circumstances, actual results may differ from these estimates under different assumptions or conditions. We believe the following critical accounting policies used in the preparation of our financial statements require significant judgments and estimates. For additional information relating to these and other accounting policies, see Note 2 to our consolidated financial statements included elsewhere in this Annual Report on Form 10-K.

Principles of Consolidation

On December 14, 2016, Wuhan Kingold transferred its 55% ownership interest in Kingold Internet to Wuhan Kingold Industrial Group Co., Ltd., a related party, for a consideration of $79,196 (RMB 550,000). After the transfer, Kingold Internet and Yuhuang were no longer the subsidiaries of Wuhan Kingold. Our consolidated financial statements include the financial statements of Kingold, Dragon Lead, Wuhan Vogue-Show and Wuhan Kingold. All inter-company balances and transactions have been eliminated in consolidation.

Inventories

Inventory is stated at the lower of cost or market value. Cost is determined using the weighted average method. We continually evaluate the composition of our inventory, turnover of our products, the price of gold and the ability of our customers to pay for their products. We write down slow-moving and obsolete inventory based on assessment of these factors, but principally customer demand. Such assessments require the exercise of significant judgment by management. Additionally, the value of our inventory may be affected by commodity prices. Decreases in the market value of gold would result in a lower stated value of our inventory, which may require us to take a charge for the decrease in the value. In addition, if the price of gold changes substantially in a very short period, it might trigger customer defaults, which could result in inventory obsolescence. If any of these factors were to become less favorable than those projected, inventory write-downs could be required, which would have a negative effect on our earnings and working capital.

Investments in Gold

We pledged the gold leased from related party and part of our own gold inventory to meet the requirements of bank loans. The pledged gold will be available for sale upon the repayment of the bank loans. We classified these pledged gold as investments in gold, and carried at fair market value, with the unrealized gains and losses, included in the determination of comprehensive income and reported in shareholders’ equity. The fair market value of the investments in gold is determined by quoted market prices at Shanghai Gold Exchange.

Comprehensive Income (Loss)

Comprehensive income consists of two components, net income and other comprehensive income (loss). The unrealized gain or loss resulting from the change of the fair market value and the foreign currency translation gain or loss resulting from translation of the financial statements expressed in RMB to US$ are reported in other comprehensive income in the consolidated statements of income and comprehensive income and the consolidated statements of changes in equity.

| 21 |

Fair Value of Financial Instruments

We follow the provisions of Accounting Standards Codification (“ASC”) 820, “Fair Value Measurements and Disclosures.” ASC 820 clarifies the definition of fair value, prescribes methods for measuring fair value, and establishes a fair value hierarchy to classify the inputs used in measuring fair value as follows:

Level 1-Observable inputs such as unadjusted quoted prices in active markets for identical assets or liabilities available at the measurement date.

Level 2-Inputs other than quoted prices that are observable for the asset or liability in active markets, quoted prices for identical or similar assets and liabilities in markets that are not active, inputs other than quoted prices that are observable, and inputs derived from or corroborated by observable market data.

Level 3-Inputs are unobservable inputs which reflect management’s assumptions based on the best available information.

The carrying value of all current assets and liabilities approximate their fair values because of the short-term nature of these instruments. We determined that the carrying value of the long term loans approximated their fair value by comparing the stated loan interest rate to the rate charged by similar financial institutions. We use quoted prices in active markets to measure the fair value of investments in gold.

Accounting for the Impairment of Long-Lived Assets

The long-lived assets held and used by us are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of such assets may not be fully recoverable. It is possible that these assets could become impaired as a result of technology or other industry changes. The recoverability value of an asset to be held and used is determined by comparing the carrying amount of such asset against the future net undiscounted cash flows to be generated by the asset. Our principal long-lived assets are our property, plant and equipment assets.

We must make various assumptions and estimates regarding estimated future cash flows and other factors in determining the fair values of the respective assets. We use set criteria that are reviewed and approved by various levels of management, and estimate the fair value of our reporting units by using undiscounted cash flow analyses. If these estimates or their related assumptions change in the future, we may be required to record impairment charges for the underlying assets at such time. Any such resulting impairment charges could be material to our results of operations.

If the value of such an asset is determined to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the asset exceeds the fair value of the asset. Assets to be disposed of are reported at the lower of the carrying amount or the fair value, less disposition costs. No events or changes in our business or circumstances required us to test for impairment of our long-lived assets during 2016 and 2015, and accordingly, we did not recognize any impairment loss during these periods.

Competitive pricing pressure and changes in interest rates could materially and adversely affect our estimates of future net cash flows to be generated by our long-lived assets, and thus could result in future impairment losses.

Revenue Recognition

Our net sales are primarily composed of sales of branded products to wholesale and retail customers, as well as fees generated from customized production. In customized production, a customer supplies the Company with the raw materials and the Company creates products per that customer’s instructions, whereas in branded production the Company generally purchases gold directly and manufactures and markets the products on its own. The Company recognizes revenues under ASC 605 as follows:

Sales of branded products

The Company recognizes revenue on sales of branded products when the goods are delivered and title to the goods passes to the customer provided that: there are no uncertainties regarding customer acceptance; persuasive evidence of an arrangement exists; the sales price is fixed and determinable; and collectability is deemed probable.

Customized production fees

The Company recognizes services-based revenue (the processing fee) from such contracts for customized production when: (i) the contracted services have been performed and (ii) collectability is deemed probable.

| 22 |

Results of Operations

YEARS ENDED DECEMBER 31, 2016 AND 2015

The following table sets forth information from our statements of income and comprehensive income for the years ended December 31, 2016 and 2015 in U.S. dollars.

KINGOLD JEWELRY, INC.

CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

(IN U.S. DOLLARS)

| For the years ended December 31, | ||||||||

| 2016 | 2015 | |||||||

| NET SALES | $ | 1,420,624,970 | $ | 1,000,161,294 | ||||

| COST OF SALES | ||||||||

| Cost of sales | (1,273,041,387 | ) | (960,562,184 | ) | ||||

| Depreciation | (1,208,998 | ) | (1,284,170 | ) | ||||

| Total cost of sales | (1,274,250,385 | ) | (961,846,354 | ) | ||||

| GROSS PROFIT | 146,374,585 | 38,314,940 | ||||||

| OPERATING EXPENSES | ||||||||

| Selling, general and administrative expenses | 11,985,807 | 7,685,840 | ||||||

| Stock compensation expenses | 240,306 | 530,542 | ||||||

| Depreciation | 194,690 | 104,219 | ||||||

| Amortization, other | 11,379 | 12,137 | ||||||

| Total operating expenses | 12,432,182 | 8,332,738 | ||||||

| INCOME FROM OPERATIONS | 133,942,403 | 29,982,202 | ||||||

| OTHER INCOME (EXPENSES) | ||||||||

| Gain on sale of Jewelry Park | 63,212,496 | - | ||||||

| Other income | 26,443 | 20,689 | ||||||

| Interest income | 2,904,781 | 208,061 | ||||||

| Interest expense, including amortization of debt issuance costs of $7,479,382 and $490,870 | (74,555,096 | ) | (2,310,451 | ) | ||||

| Total other expenses, net | (8,411,376 | ) | (2,081,701 | ) | ||||

| INCOME FROM OPERATIONS BEFORE TAXES | 125,531,027 | 27,900,501 | ||||||

| INCOME TAX PROVISION (BENEFIT) | ||||||||

| Current | 33,055,811 | 4,488,815 | ||||||

| Deferred | (428,101 | ) | 1,849,910 | |||||

| Total income tax provision | 32,627,710 | 6,338,725 | ||||||

| NET INCOME | 92,903,317 | 21,561,776 | ||||||

| Less: net loss attribute to the non-controlling interest | (6,495 | ) | (296 | ) | ||||

| NET INCOME ATTRIBUTABLE TO COMMON STOCKHOLDERS | $ | 92,909,812 | $ | 21,562,072 | ||||

| OTHER COMPREHENSIVE INCOME (LOSS) | ||||||||

| Change in unrealized loss related to investments in gold | $ | (54,789,485 | ) | $ | - | |||

| Total foreign currency translation loss | (21,461,689 | ) | (14,740,716 | ) | ||||

| Less: foreign currency translation gain (loss) attributable to non-controlling interest | (4,222 | ) | 4,251 | |||||

| Total Other comprehensive loss attributable to KINGOLD JEWELRY, INC. | $ | (76,246,952 | ) | $ | (14,744,967 | ) | ||

| COMPREHENSIVE INCOME (LOSS) ATTRIBUTABLE TO: | ||||||||

| Common stockholders | $ | 16,662,860 | $ | 6,817,105 | ||||

| Non-controlling interest | (10,717 | ) | 3,955 | |||||

| $ | 16,652,143 | $ | 6,821,060 | |||||

| Earnings per share | ||||||||

| Basic | $ | 1.41 | $ | 0.33 | ||||

| Diluted | $ | 1.40 | $ | 0.33 | ||||

| Weighted average number of shares | ||||||||

| Basic | 65,991,487 | 65,963,502 | ||||||

| Diluted | 66,337,129 | 65,963,502 | ||||||

| 23 |

Fiscal Year Ended December 31, 2016 Compared to Fiscal Year Ended December 31, 2015

Net Sales

Net sales for the year ended December 31, 2016 were $1,420.6 million, an increase of $420.4 million, or 42%, from net sales of $1,000.2 million for the year ended December 31, 2015. For the year ended December 31, 2016, our branded production sales accounted for 98.3% of the total sales and customized production sales accounted for 1.7% of the total sales. When comparing with 2015, our branded production sales increased by $421.2 million or 43.2%, our customized production sales decreased by $0.65 million or 2.7%.