Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - DEBT RESOLVE INC | drsv_ex321.htm |

| EX-31.1 - CERTIFICATION - DEBT RESOLVE INC | drsv_ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

|

¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to ____________

Commission File No.: 001-33110

|

DEBT RESOLVE, INC. |

|

(Exact Name of Registrant as Specified in Its Charter) |

|

Delaware |

|

33-0889197 |

|

(State or other Jurisdiction of |

|

(I.R.S. Employer |

|

Incorporation or Organization) |

|

Identification No.) |

|

| ||

|

1133 Westchester Ave., Suite S-223 |

| |

|

White Plains, New York |

|

10604 |

|

(Address of principal executive offices) |

|

(Zip Code) |

(914) 949-5500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Name of Each Exchange on Which Registered |

|

Common Stock, par value $.001 per share |

|

None |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Sec. 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

¨ |

Accelerated filer |

¨ |

|

Non-accelerated filer |

¨ |

Smaller reporting company |

x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12 b-2 of the Act). Yes ¨ No x

On June 30, 2016, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value (based on the closing sales price on that date) of the voting stock held by non-affiliates of the registrant was $724,627. Shares of common stock held by each current executive officer and director and by each person who is known by the registrant to own 10% or more of the outstanding common stock have been excluded from this computation in that such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not a conclusive determination for other purposes.

As of April 17, 2017, 121,264,809 shares of the registrant’s Common Stock were outstanding.

Documents Incorporated by Reference: None

DEBT RESOLVE, INC.

| 2 |

This report contains forward-looking statements regarding our business, financial condition, results of operations and prospects. Words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates" and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this report. Additionally, statements concerning future matters such as the development or regulatory approval of new products, enhancements of existing products or technologies, revenue and expense levels and other statements regarding matters that are not historical are forward-looking statements.

Although forward-looking statements in this report reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include without limitation those discussed under the heading "Risk Factors" below, as well as those discussed elsewhere in this report. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. Except as required by federal securities laws, we undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report. Readers are urged to carefully review and consider the various disclosures made in this report, including under Item 1A, "Risk Factors," which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

Overview

Debt Resolve, Inc. is a Delaware corporation formed in April 1997. Our traditional business has been providing software solutions to consumer lenders or those collecting on consumer loans using a Software-as-a-Service (SaaS) model. These solutions facilitate web-based payments or the resolution of delinquent or defaulted consumer debt. We have marketed our services primarily to consumer banks, collection agencies, and the buyers of defaulted debt in the United States. Other opportunities exist for marketing our software to hospitals and large physician groups. In addition, client results show that our solution is attractive for the collection of low balance debt, such as that held by utility companies and online service providers, where the cost of traditionally labor intensive collection efforts may exceed the value collected. We are pursuing these markets as well as our traditional markets.

In December 2014, the Company, jointly with LSH, LLC, organized Progress Advocates LLC, a Delaware limited liability company for the purpose to provide services in the Federal Student Loan document preparation industry with ownership interests of 51% and 49% for the Company and LSH, LLC, respectively. This joint venture was operated under service agreements with LSH companies. In February, 2016, sales and marketing operations were suspended due to unmanaged marketing costs and customer retention issues that resulted in current and forecasted future net losses. This joint venture provided 12 months of operating experience in this growing industry as well as positive feedback as the first company in our joint venture strategy, described below.

In February 2016, the Company, jointly with Patient Online Services, LLC, organized Payment Resolution Systems LLC, a Delaware limited liability company for the purpose of assisting Medical Groups and Hospitals in the online negotiation and settlement of delinquent accounts, with ownership interests of 51% and 49% for the Company and Patient Online Services, LLC, respectively.

In May 2016, the Company, jointly with Hutton Ventures LLC, organized Student Loan Care LLC, a Delaware limited liability company for the purpose of providing document preparation services for holders of Federal Direct Student Loans, with ownership interests of 51% and 49% for the Company and Hutton Ventures LLC, respectively. The business model for this joint venture addresses the issues noted above that caused the suspension of sales at Progress Advocates LLC.

| 3 |

| Table of Contents |

The Company operates Payment Resolution Systems within Debt Resolve, Inc., whereas Progress Advocates LLC and Student Loan Care LLC operate as independent subsidiaries.

Business Growth Strategy Update

During the year ending December 31, 2016, significant progress was made in the implementation of our new strategies. While individual setbacks were expected and did occur, each was addressed and positive momentum resumed for the respective strategy. The following is a brief review of the important progress achieved in each strategy:

|

· |

Student Loan Care LLC was launched in June 2016 and established itself as a financially viable company in the year ending December 31, 2016. This new joint venture is a partnership with Hutton Ventures LLC., a California based company with extensive experience in the federal student loan document preparation industry. The business model for Student Loan Care, specifically addresses the issues of high marketing costs and customer churn, both of which were significant negative impacts on the Company’s majority owned joint venture, Progress Advocates LLC. From its first month of operation in June 2016, Revenue grew every month from $104,818 in June, to $1,927,702 in the quarter ending December 31, 2016. Over the same period, operating income turned positive and grew every month from ($170,305) June to $464,906 in the quarter ending December 31, 2016. Gross margins were positive for the last six months, growing sequentially to 26% of sales. These margins were over 10% higher than the best monthly margin achieved by Progress Advocates in 2015. These margin improvements are a direct result of Student Loan Care’s new marketing model that reduced the cost of customer acquisition by 40% as compared to the customer acquisition cost at Progress Advocates.

To enhance the sales efforts, in November 2016, Student Loan Care contracted with a non-related party to act as a sales affiliate. In this role, the affiliate will provide an external sales team to function as Student Loan Care salespeople. Each will be remotely integrated into the Student Loan Care sales infrastructure and will generate Student Loan Care sales for which the affiliate will be paid a sales commission. Early tests during the fourth quarter indicate this sales model can generate sales with only a modest 10% increase in customer acquisition cost. As the affiliate’s sales team becomes more familiar with the Student Loan Care sales process, it is anticipated that sales productivity will be the same as Student Loan Care’s internal sales team. | |

|

· |

Progress Advocates continues to support its current customers as it evaluates other business options. As previously reported in both the Company's 2015 Form 10-K and Form 10-Q for the quarter ending March 31, 2016, the Company suspended all marketing and sales activities during February of 2016. After continued discussions with our joint venture partner who was also the operator of Progress Advocates, the Company reached the conclusion that the changes necessary to reach profitability were not going to be made by our partner. By the beginning of 2016, it was evident that high marketing and sales costs, along with a higher than expected default of customer payments, resulted in a business cost structure that was unsupportable by current revenues. Progress Advocates will continue to support its current customers and provide to them all contracted services. In September, Progress Advocates initiated discussions to explore the sale of its loan portfolio. Initial response has been positive. However, no offers have been made to indicate the relative market value of this asset. | |

|

| ||

|

· |

Enhance the Debt Resolve Solution by integrating it with other services to become a total solution for the medical ARM market. Our majority owned joint venture, Payment Resolution Systems offers a service to Medical Practices and Hospitals looking to give patients with unpaid accounts one last chance to pay. The one last chance will be a negotiated settlement offering using Debt Resolve's patented double blind bidding technology. A pilot of this business was run in March and April of 2016 with a NYC Anesthesiology practice. The results were better than expected and a second pilot was run for an Atlanta GA Anesthesiology Group. This effort confirmed our initial results and demonstrated our ability to negotiate settlements for high and low account balances. A national sales effort has been initiated with significant interest by healthcare providers, however, the sales cycle has been longer than anticipated due to push back from the prospective client’s current ARM vendors. |

| 4 |

| Table of Contents |

|

· |

Leverage our technology and knowledge of consumer debt collection to launch a new internet based product in the small business to consumer debt negotiation and collection space. As resources were diverted to support the launch and development of Student loan Care LLC (see above), the development effort on Settl.it/Pro was postponed to the first quarter of 2017. A soft launch of this small business product is scheduled for April 2017. Pending market response, national availability is anticipated in May 2017.

| |

|

|

· |

Leverage our public equity financial structure by purchasing equity interests in private companies that will benefit from the experience and skills of our management and consultants as well as from holding our publicly traded equity. During the second quarter of 2016, , Student Loan Care LLC was formed with Hutton Ventures LLC to offer document preparation services for Federal student loan holders wanting to apply for various U.S. Department of Education Student loan payment consolidation and modification programs. The principles of Hutton Ventures are experienced in the federal student loan document preparation industry and in the use of advanced communications techniques to increase productivity and profitability in a traditional people based business environment. To reward their successful participation in Student Loan Care LLC, goals for Student Loan Care revenue growth and net profit attainment have been established. Hutton Venture partners will be granted warrants for Debt Resolve common stock upon the attainment of each of these goals.

For additional information on the Company’s product, visit these websites; 1. The Settl.it Family of Products website, www.settl.com, and 2. Payment Resolution Systems, www.paymentresolutionsustems.com. In addition, the Settl.it consumer to consumer product can be utilized at www.settl.it and our Student Loan Care federal student loan document preparation services can be obtained at www.studentloancare.com. |

Corporate and Background Information

We were incorporated as a Delaware corporation in April 1997 under our former name, Lombardia Acquisition Corp. On May 7, 2003, our certificate of incorporation was amended to change our corporate name to Debt Resolve, Inc.

Our principal executive offices are located at 1133 Westchester Ave., Suite S-223, White Plains, New York 10604, and our telephone number is (914) 949-5500. As of December 31, 2016, we had a core Debt Resolve software business and two operating subsidiaries, Progress Advocates LLC and Student Loan Care LLC. Our website is located at http://www.debtresolve.com. Information contained in our website is not part of this report.

Our Strengths

While our products often offer unique and exclusive features that are beneficial to our customers, our strength is understanding the markets that we serve. In the Federal Student Loan document preparation space, we saw a need to overcome the perceived complexity of the DOE programs, educate the consumer on the important features of each program, and eliminate the high upfront cost associated with the use of a third party preparer. Our financing option allows prospective customers to benefit from our services at a low monthly cost. An additional result of the financing option is the positive impact that making payments has on the credit score of these low credit score customers. We also saw the need to match our receipt of payment to when the work is done for the customer. Our initial billing is designed to coincide with the customer’s successful consolidation notification. In addition, our customer care representatives are available to provide guidance and assistance to keep the clients successfully in these valuable federal programs.

In the traditional Debt Resolve service space, the advantage is not having just a standalone debt collection product, but in having an integrated solution where the consumer decides which channel to be serviced through, which medium to be communicated through, and how to balance their financial resources with their financial obligations. During 2016, our offerings have changed to embrace these tenets. As described earlier, new offerings will further this evolution of the traditional Debt Resolve service with offerings for the large enterprise customer, small and medium businesses, and the consumer.

| 5 |

| Table of Contents |

Lastly, we recognized the opportunity that we, as a publicly held company, could offer to small successful businesses that populate much of our industries. Partnering with Debt Resolve offers these companies the equity benefits of a publicly held company and an exit strategy that will be on their terms rather than those of an unknown buyer. Working together, their business will grow faster, utilizing the financial and senior management skills available from Debt Resolve. The attractiveness of these potential benefits were validated in 2015 by the companies that are currently partnering with us or in partnership discussions with us.

Our Industry

Debt Collections Industry

According to the U.S. Federal Reserve Board, consumer credit has increased from $133.7 billion in 1970 to $3,543.9 billion in January 2016, a compound annual growth rate of approximately 7.3% for the period. In parallel, the accounts receivables management ("ARM") industry accounts for $15 billion in annual revenues according to industry analyst Kaulkin Ginsberg.

There are several major collection industry trends:

|

· |

Profit margins are stagnating or declining due to the fixed costs of telephone-based collections. In addition, periods when the economy is weak means more delinquencies to collect but a higher inability on the part of debtors to pay. Thus, costs increase to generate the same level of revenue. The ACA International's 2012 Benchmarking & Agency Operations Survey shows that more than 50% of the operating costs are directly related to the cost of the collections agents, making the business difficult to scale using traditional staffing and collections methods. | |

|

| ||

|

· |

Small to mid-size agencies will need to offer competitive pricing and more services to compete with larger agencies, as well as focus on niche areas that require specialized expertise. | |

|

| ||

|

· |

Off-shoring has been used by both creditors and third-party collectors, but their results were less than expected due to cultural differences. | |

|

| ||

|

· |

Healthcare industry has been hit by rising costs, increased patient deductibles, and a significant increase in high deductible plans available on the government health insurance exchanges. These factors have caused patient out-of-pocket costs to double in the last 5 years. This combined with a reduction in available consumer credit have created a huge burden for Healthcare providers, including increased delinquency resulting in slower payments and increased patient account defaults. |

Federal Student Loan Document Preparation Industry

In 1992, President H.W. Bush signed the first bill authorizing U.S. government backed student loans. The William D. Ford Federal Direct loan Program, in 2007, was the beginning of Department of Education involvement in the issuance of student loans directly to students. Then, in 2010, President Obama signed the Health Care and Education Reconciliation Act (HCERA), beginning government programs aimed at reducing the cost and burden of these Federal Direct Student Loan repayment for new graduates. Subsequently, in 2012 and 2015, President Obama signed Executive orders to expand these programs to all Federal Direct Student Loan borrowers who have graduated from 2007 to present. While there are three separate programs, they all fall into the categories of Income Based Repayment Plans, known as 'Pay as you Earn' and 'Student Loan Forgiveness'.

Companies in this industry, 1) advise the clients on the availability and details of each program, 2) determine an initial estimate of the loan modification and subsequent cost savings available for the client, 3) with input from the clients, prepare the documentation for submission to the U. S. Department of Education (DOE), 4) with client approval, submit the documentation to DOE on the client's behalf. Based on the data provided, DOE responds with an offer of loan consolidation or modification directly to the client. For the work processed on behalf of the client, companies charge a fee.

| 6 |

| Table of Contents |

While many companies in the industry end their services upon submission, others offer to monitor the clients account for delinquency and work with clients on the required annual renewal submissions to DOE. One mistake removes the client from the DOE program and restores the client's higher student loan payment requirement. For these services, an additional small fee is usually paid.

The opportunity within this industry is significant. As of 2015, over 20 million students per year were graduating with student loan debt, both Federal and private. Since the 2010 HCERA, government subsidies for private loans has ended and the majority of student loans are Federal. The gravity of the student loan burden is reflected in this data: DOE states that as of FY 2015 Q3, there is $98 billion in Federal Loans in default (unpaid for over 270 days), which represents 7 million borrowers. The DOE programs are complicated and many consumers have difficulties selecting the correct program and completing the appropriate documentation without assistance. In addition, the first line of support to these consumers should be the DOE approved Student Loan Processors, who are paid on how much they collect. However, student loan processors have not done a good job in providing this assistance, perhaps because of the dilemma they face. If they help the consumer reduce their student loan payments, they reduce their collections and revenues. Much like the tax preparation industry, where everybody can do their own tax forms but don't, complicated government forms and programs have created a need for the Federal Student Loan document preparation services.

Technology License and Proprietary Technology

At the core of our Debt Resolve Solution and Settl.it online product is a patent-protected bidding methodology co-invented by the co-founders of our company. We originally entered into a license agreement in February 2003 with the co-founders for the licensed usage of the intellectual property rights relating to U.S. Patent No. 6,330,551, issued by the U.S. Patent and Trademark Office on December 11, 2001 for "Computerized Dispute and Resolution System and Method" worldwide. This patent, which expires August 5, 2018, covers automated and online, double blind-bid systems that generate high-speed settlements by matching offers and demands in rounds. Four subsequent patents have been issued and form a five patent "cluster" underpinning our license agreement. In June 2005, we amended and restated the license agreement in its entirety. The license agreement can be found in our SEC filings.

The licensed usage is limited to the creation of software and other code enabling an automated system used solely for the settlement and collection of delinquent, defaulted and other types of credit card receivables and other consumer debt and specifically excludes the settlement and collection of insurance claims, tax and other municipal fees of all types. The licensed usage also includes the creation, distribution and sale of software products or solutions for the same aim as above and with the same exclusions. In lieu of cash royalty fees, the co-founders have agreed to accept stock options to purchase shares of our common stock.

The term of the license agreement extends until the expiration of the last-to-expire patents licensed (now 5 patents) and is not terminable by the co-founders, the licensors. The license agreement also provides that we will have the right to control the ability to enforce the patent rights licensed to us against infringers and defend against any third-party infringement actions brought with respect to the patent rights licensed to us subject, in the case of pleadings and settlements, to the reasonable consent of the co-founders. The terms of the license agreement, including the exercise price and number of stock options granted under the agreement, were negotiated in an arm's-length transaction between the co-founders, on the one hand, and our independent directors, on the other hand.

Technology and Service Providers

We outsource our web hosting to CyrusOne LLC, a Tier 1 data center providing our security in a SSAE 16 and PCI certified environment. The CyrusOne hosting facility is located in Wappingers Falls, New York. We use CyrusOne's servers to operate our proprietary software developed in our corporate offices.

| 7 |

| Table of Contents |

Competition

Internet-based technology was introduced to the collections industry in 2004 and has many participants at this time. A large number of collection agency software providers now offer an internet payment portal included with their software.

There are many new competitors entering the online collections market at this time. We are very closely monitoring their functionality to prevent an infringement of our patented settlement engine. Several cease and desist letters were sent in 2012 and 2014 to potential infringers to stop using technology that appears to use our protected process, and we will vigorously enforce our rights to protect our technology.

The Federal Student Loan document preparation industry is comprised of numerous small companies. Due to the relative newness of the industry, little data is available on the economics of participation. What is known is the cost of entry into the market is low, but the cost of compliance and adherence to regulatory guidelines is significant. This may explain the churn of small competitors into and out of the business. Those who decide to keep their costs low by ignoring regulators, do so at their own risk. State Attorneys General are keenly aware of some abuses in this industry and have taken action against the offending competitors.

Government Regulation

We believe that our traditional Internet technology business is not subject to any regulations by governmental agencies other than those routinely imposed on corporate and Internet technology businesses. We believe it is unlikely that state or foreign regulators would take the position that our solutions effectively constitute the collection of debts that is subject to licensing and other laws regulating the activities of collection agencies, as we have no client funds in our custody at any time. We simply provide a software suite that our clients use to conduct their business.

Also, as we move into the healthcare space, our healthcare clients have required us to include in their contracts with us that we meet the data protection provisions of the Health Insurance Portability and Accountability Act. This law is designed to ensure that patient care data is not personally identifiable in the event of a breach of our solutions. Again, this type of information is very susceptible to misuse in the commission of identity theft. We believe we have adequate policies and procedures in place to protect this information.

Our joint-venture, Student Loan Care LLC, operates within the sphere of influence of the U.S. Department of Education and could be impacted by any ensuing regulatory change. In addition, the laws under which DOE issues student loans and subsequent loan modification and forgiveness could be subject to new laws or Presidential orders.

Employees

As of April 17, 2016, we had two full-time employees and one independent contractor. Our employees and contractor are based at our corporate headquarters in White Plains, New York. Our majority owned joint venture, Student Loan Care LLC employs 41 full time employees in Santa Ana, CA. None of our employees is subject to a collective bargaining agreement, and we believe that our relations with our employees and contractor are good.

Cautionary Statements and Risk Factors

Set forth below and elsewhere in this report and in other documents we file with the SEC are important risks and uncertainties that could cause our actual results of operations, business and financial condition to differ materially from the results contemplated by the forward looking statements contained in this report.

| 8 |

| Table of Contents |

Risks Related to Our Business

We have experienced significant and continuing losses from operations which could impede the process of raising capital.

For the years ended December 31, 2016 and 2015, we had inadequate revenues and incurred net loss attributable to Debt Resolve, Inc. of $1,778,178 and $778,427, respectively. Cash used in operating activities for operations was $3,775,802 and $1,060,362 for the years ended December 31, 2016 and 2015, respectively.

However, on a cash flow basis, operating results for the fourth quarter of 2016 and first two months of 2017 have been cash flow positive. Further, our ability to run our business has been greatly enhanced by the Student loan Care operating results. In addition, as can be seen from our Consolidated Statement of Cash Flows (F-7), in the year ending December 31, 2016, we had a net increase in cash/cash equivalents of $562,621. And we reduced our reliance on debt funding in the year ending December 31, 2016 to $635,781 as compared to $1,010,393 in the year ending December 31, 2015. Based upon projected operating expenses, while we understand our working capital as of April 17, 2017 may not be sufficient to fund our plan of operations for the next 12 months, we believe that our current operations will be able to generate enough cash to meet our operating needs.

If this were to change, any continued net operating losses increase the difficulty in meeting such goals and there can be no assurances that we will prove successful. We have raised capital for our day-to-day operations since our inception in January 2003; however, no assurance can be provided that we will continue to be able to do so. There is no assurance that any funds secured will be sufficient to enable us to attain profitable operations or continue as a going concern. To the extent that we are unsuccessful, we may need to curtail our operations and implement a plan to extend payables and reduce overhead until sufficient additional capital is raised to support further operations. At any time until substantial capital is raised, there is also a significant risk of bankruptcy. There can be no assurance that any plan to raise additional funding will be successful. The financial statements contained in this filing do not include any adjustments that might result from the outcome of this uncertainty.

We may rely heavily on the financial success of Student Loan Care LLC.

Going forward, we expect a large part of our revenue to come from our new subsidiary, Student loan Care LLC. While we have over two years of experience in the federal student loan document preparation sector, our business partners have 5 years of experience in this sector. We are relying heavily on their expertise, systems and guidance to manage this new business. However, there is substantial risk to this endeavor even though adequate revenue has been established for it to be profitable. the full recourse loan portfolio created by the financing payment option has no historical experience to indicate what the future default rate may be. A high level of client defaults may not be adequately covered by the loan portfolio reserve account and the current provision for bad debt.

As discussed earlier in “Our Business Growth Strategy” section, additional joint venture businesses will be created to mitigate the financial impact on the Company from these potential issues.

Potential conflicts of interest exist with respect to the intellectual property rights that we license from our co-founders, and it is possible our interests and their interests may diverge.

We do not hold patents on our consumer debt-related product, but rather license technology for our Debt Resolve Solution and our Settl.it product from the co-founders of our company, whose patented technology is now, and is anticipated to continue to be, incorporated into the Debt Resolve Solution as a key component. This license agreement presents the possibility of a conflict of interest in the event that issues arise with respect to the licensed intellectual property rights, including the prosecution or defense of intellectual property infringement actions, where our interests may diverge from those of the co-founders. The license agreement provides that we will have the right to control and defend or prosecute, as the case may require, the patent rights licensed to us subject, in the case of pleadings and settlements, to the reasonable consent of the co-founders. Our interests with respect to such pleadings and settlements may be at odds with those of the co-founders.

Our auditors have issued a Going Concern Statement.

The accompanying financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. As shown in the accompanying consolidated financial statements, we incurred a net loss attributable to Debt Resolve, Inc. of $1,778,178 and $778,427 for the years ended December 31, 2016 and 2015, respectively. Additionally, we have negative working capital (total current liabilities exceeded total current assets) of $10,955,052 as of December 31, 2016. These factors among others raise substantial doubt about our ability to continue as a going concern.

Our continued existence is dependent upon management's ability to develop profitable operations and resolve its liquidity problems. The accompanying consolidated financial statements do not include any adjustments relating to the recoverability and classification of asset carrying amounts or the amount and classification of liabilities that might result should we be unable to continue as a going concern.

| 9 |

| Table of Contents |

We have issued preferred stock convertible to common stock that may have the effect of diluting then current stockholder interests and impairing their voting rights, and provisions in our charter documents and under Delaware law could discourage a takeover that stockholders may consider favorable.

Our certificate of incorporation authorizes the issuance of up to 10,000,000 shares of preferred stock with designations, rights and preferences as may be determined from time to time by our board of directors. Accordingly, our board of directors is empowered, without stockholder approval, to issue a series of preferred stock with dividend, liquidation, conversion, voting or other rights which could dilute the interests of, or impair the voting power of, our common stockholders.

On May 2, 2014, our board of directors designated 5,000,000 shares of preferred stock as Series A Convertible Stock ("Series A") with a $0.001 par value. The Series A preferred stock ranks senior to common stock and all other preferred stock, and equal or junior to any preferred stock that may be issued in regard to liquidation; is not entitled to dividends and is convertible, at the holders' option, at 10 shares of common stock for each share of Series A preferred stock. On July 2, 2015, we issued 47,500 shares of Series A preferred stock for services rendered. In 2016, all previously issued Series A was converted to common stock. In 2014, we issued an aggregate of 414,500 warrants to purchase Series A preferred stock for services rendered and a debt obligation, with exercise prices ranging from $0.50 to $1.50 per share, expiring three years from the date of issuance. In 2015, we issued an aggregate of 705,000 warrants to purchase Series A preferred stock for services rendered , with exercise prices ranging from $0.50 to $1.50 per share, expiring three years from the date of issuance. In 2016, we issued an aggregate of warrants to purchase 40,000 shares of Series A preferred stock for services rendered, with exercise price of $1.50 per share, expiring three years from the date of issuance.

In connection with entering into the Progress Advocates LLC joint venture with LSH, LLC, we issued to LSH, LLC two five-year warrants to purchase an aggregate of 1,500,000 shares of Series A convertible preferred stock at an exercise price of $0.50 per share. The first warrant for 1,000,000 shares preferred stock vests and becomes exercisable 25% upon issuance and the balance upon the achievement by Progress Advocates of specific increasing revenue goals. As of December 30, 2015, these revenue goals have been achieved and these warrants have vested. The second warrant for 500,000 shares of preferred stock vests and becomes exercisable when Progress Advocates achieves at least $1,000,000 in cumulative "operating income." A third five year warrant to purchase 500,000 shares of Series A preferred stock was issued in October 2015 based upon Progress Advocates achievement of six months of positive operating income.

Delaware law also could make it more difficult for a third party to acquire us. Specifically, Section 203 of the Delaware General Corporation Law may have an anti-takeover effect with respect to transactions not approved in advance by our board of directors, including discouraging attempts that might result in a premium over the market price for the shares of common stock held by our stockholders.

Risks Related to Our Industry

The ability of our solution's clients to recover and enforce defaulted consumer debt may be limited under federal, state, local and foreign laws, which would negatively impact our revenues.

Federal, state, local and foreign laws may limit our creditor clients' ability to recover and enforce defaulted consumer debt. Additional consumer protection and privacy protection laws may be enacted that would impose additional requirements on the enforcement and collection of consumer debt. The Consumer Financial Protection Bureau is actively looking at the debt collection industry for new regulation. Any new laws, rules or regulations that may be adopted, as well as existing consumer protection and privacy protection laws, may adversely affect our ability to settle defaulted consumer debt accounts on behalf of our clients and could result in decreased revenues to us. We cannot predict if or how any future legislation would impact our business or our clients. In addition, we cannot predict how foreign laws will impact our ability to expand our business internationally or the cost of such expansion. Our failure to comply with any current or future applicable laws or regulations could limit our ability to settle defaulted consumer debt claims on behalf of our clients, which could adversely affect our revenues.

Changes in Federal laws and regulations may limit Student Loan Care LLC’s ability to offer document preparation services for the modification and consolidation of U.S. student loans. We cannot predict if the current government programs allowing these modifications will continue to be offered by the U.S. Department of Education in similar form or substance to the current offering upon which Student Loan Care offers its services.

| 10 |

| Table of Contents |

Compliance with changing regulation of corporate governance and public disclosure may result in additional expenses, which as a smaller public company may be disproportionately high.

Changing laws, regulations and standards relating to corporate governance and public disclosure are creating uncertainty for small capitalization companies like us. These new and changing laws, regulations and standards are subject to varying interpretations in many cases due to their lack of specificity, and as a result, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies, which could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. As a result, our efforts to comply with evolving laws, regulations and standards will likely result in increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities.

A poor performance by the economy may adversely impact our business.

When economic conditions deteriorated, more borrowers became delinquent on their consumer debt. However, while volumes of debt to settle have risen, borrowers have less ability in a downturn to make payment arrangements to pay their delinquent or defaulted debt. As a result, our Debt Resolve service revenues may decline, or it may be more costly to generate the same revenue levels, resulting in reduced earnings. In addition, a poor economy would put pressure on our Student Loan Care and Progress Advocates clients to maintain monthly financing payments. Thus, potentially increasing Accounts Receivable bad debt expense.

Risks Related to our Common Stock

The daily trading volume of our stock varies widely.

The daily volume in our stock varies widely and is often limited. At this time, it is not possible to liquidate a significant position in a relatively short time period. In addition, because we are not traded on a national exchange, there may be additional restrictions on the purchase or sale of our common stock.

Our stock price may exhibit a high degree of volatility.

Because our stock is traded with relatively low volume, the price can move significantly on small trading volumes. The release of positive news would be expected to move our stock price up, but we have large illiquid blocks discussed above that sell into any upward momentum. These blocks exert a downward influence or may place a temporary or long-term cap on our stock price appreciation. Over time, we would expect these blocks to be broadly sold into the market, increasing our shareholder base and trading volume and mitigating the effect of these blocks over time. While we currently do not provide sales or earnings guidance as some larger companies do, we may do so in the future, and our stock price reaction may be volatile depending on our revenue and earnings performance relative to the guidance.

All of our assets are subject to liens as security for indebtedness under our series D convertible notes.

All of our assets now owned or hereafter acquired, and all proceeds therefrom, including accounts receivable and technology, are subject to liens in favor of certain investors who purchased our series D convertible notes (see Note 9 to our Notes to Financial Statements). If we were unable to service the obligations, the lien holders could foreclose on the assets that serve as collateral. As a result, following an event of default under these obligations and enforcement against the collateral, the lien holders will be entitled to be repaid in full from the proceeds of all the pledged assets owned by us now or hereafter acquired securing the obligations owed to them before any payment is made to the holders of our common stock from the proceeds of that collateral. Additionally, the holders of the liens will receive all proceeds from any realization on the collateral or from the collateral or proceeds thereof in any insolvency proceeding, until the obligations secured by the liens are paid in full.

| 11 |

| Table of Contents |

ITEM 1B. Unresolved Staff Comments

Not applicable

We currently occupy office space at 1133 Westchester Avenue, Suite S-223, White Plains, NY 10604, under a short term lease with an unaffiliated third party at a monthly rate of $3,500.

Lawsuits from Noteholders

On April 11, 2016, a Decision was entered in the matter of a noteholder's claim against Debt Resolve Inc., granting the noteholder's motion for summary judgment in part, and denying it in part, and denying Debt Resolve's cross motion for summary judgment. A stipulation with respect to damages was entered by the Court on August 29, 2016 providing that the total outstanding principal and interest due the noteholder as of July 31, 2016 is $322,152. The noteholder is seeking an award of his attorneys' fees from the Court. No decision has been rendered by the Court with respect to noteholder's attorneys' fee claim.

Lawsuits from vendors

There are currently no lawsuits from vendors.

New York State Attorney General Subpoena

In December 2015, the Company and Progress Advocates, its majority owned subsidiary, received a subpoena requesting documents regarding the operations of Progress Advocates. It is our understanding that this request was one of several requests sent to companies operating in the Federal Student Loan document preparation space in New York State. We have provided the requested information that was available, both from Progress Advocates and its vendors. Additional information has been provided subsequent to the Company's initial response. We are confident that our compliance with payments aligned to the consumer's receipt of benefit and our vendor's responsible marketing has been accurately demonstrated in the information provided.

ITEM 4. Mine Safety Disclosures

Not applicable

| 12 |

| Table of Contents |

Market Information

Our shares of common stock are quoted on the OTC marketplace under the symbol DRSV.

The following table sets forth the high and low closing prices for our common stock for the periods indicated as reported on the OTC Pink marketplace from January 1, 2015 to present:

|

|

|

Year ended December 31, |

| |||||||||||||

|

|

|

2016 |

|

|

2015 |

| ||||||||||

|

Quarter |

|

High |

|

|

Low |

|

|

High |

|

|

Low |

| ||||

|

First |

|

$ | 0.0295 |

|

|

$ | 0.009 |

|

|

$ | 0.01 |

|

|

$ | 0.005 |

|

|

Second |

|

$ | 0.03 |

|

|

$ | 0.01 |

|

|

$ | 0.01 |

|

|

$ | 0.004 |

|

|

Third |

|

$ | 0.069 |

|

|

$ | 0.01 |

|

|

$ | 0.06 |

|

|

$ | 0.004 |

|

|

Fourth |

|

$ | 0.0239 |

|

|

$ | 0.008 |

|

|

$ | 0.06 |

|

|

$ | 0.008 |

|

As of April 17, 2017, there were approximately 2,000 record holders of our common stock. We believe that a significant number of beneficial owners of our common stock hold shares in "nominee" or "street" name.

Dividends

We have not paid to date, nor do we expect to pay in the future, a dividend on our common stock. The payment of dividends on our common stock is within the discretion of our board of directors, subject to our certificate of incorporation. We intend to retain any earnings for use in our operations and the expansion of our business. Payment of dividends in the future will depend on our future earnings, future capital needs and our operating and financial condition, among other factors.

Recent Sales of Unregistered Securities

None

Purchases of Equity Securities

We did not repurchase any shares of our common stock in the fourth quarter of the year ended December 31, 2016.

ITEM 6. Selected Financial Data

Not applicable

ITEM 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion of our financial condition and results of operations should be read in conjunction with our financial statements and related notes included in this report. This discussion includes forward-looking statements that involve risks and uncertainties. As a result of many factors, our actual results may differ materially from those anticipated in these forward-looking statements.

Overview

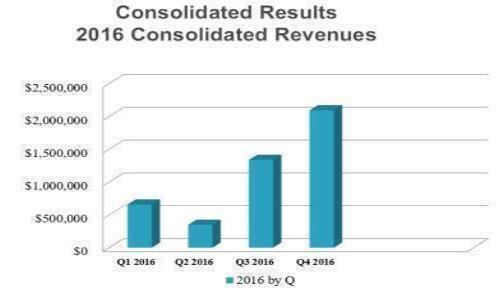

The year 2016 was a tale of two half years. As previously mentioned, in February of 2016, we suspended sales and marketing by our majority owned subsidiary Progress Advocates LLC. Given the market opportunity in the Federal Student loan document preparation, we realized the business model being followed by our minority partner (and Progress Advocates operator) was flawed and unprofitable. Consequently, we found a new partner who shared our vision for developing a high growth and profitable company in this space. This new majority owned company, Student loan Care LLC, started operations on June 1, 2016. The suspension of sales at Progress Advocates in February and the opening of Student Loan Care in June, significantly reduced the Company’s revenue in the months of March through May (see revenue chart below).

| 13 |

| Table of Contents |

In addition, the benefit of changing the business model with lower customer acquisition costs and streamlined document preparation processing costs has already been demonstrated in our first seven months of operations (see operating income chart below). Our majority owned subsidiary, Student Loan Care LLC, posted an operating income in the last five months of 2016.

Further, our ability to run our business has been greatly enhanced by the Student loan Care operating results. As can be seen from our Consolidated Statement of Cash Flows (F-7), in the year ending December 31, 2016, we had a net increase in cash/cash equivalents of $562,621. And we reduced our reliance on debt funding in the year ending December 31, 2016 to $635,781 as compared to $1,010,393 in the year ending December 31, 2015.

| 14 |

| Table of Contents |

Results of Operations for the Years Ended December 31, 2016 and December 31, 2015

Revenues

Revenues totaled $4,434,770 and $5,713,905 for the years ended December 31, 2016 and 2015, respectively. We earned revenue during the year ended December 31, 2016 and 2015 primarily providing student loan document preparation services and in our core business as a percent of debt clients’ collected, on a fee per settlement and on a flat monthly fee basis. The decreased revenue mainly resulted from the February 2016 suspension of sales at our majority owned subsidiary, Progress Advocates LLC. This resulted in revenue from Progress Advocates of $1,169,847 for the year ended December 31, 2016 as compared to $5,593,182 for the same period last year. To offset this revenue loss, our majority owned subsidiary, Student Loan Care LLC started offering services on June 1, 2016 and had revenues of $3,186,594 in the year ended December 31, 2016.

Operating Expenses

Payroll and related expenses. Payroll and related expenses amounted to $1,798,871 for the year ended December 31, 2016, as compared to $2,076,220 for the year ended December 31, 2015, a decrease of $277,349. The decrease mainly resulted from the Progress Advocates reduction of $1,439,917, net of an increase in Student Loan Care LLC of $1,105,206.

Selling and marketing expenses. Selling and marketing expenses decreased from $2,036,727 in 2015 to $640,395 in 2016. The significant decrease is due to the reduction in sales and marketing activities of Progressive Advocates, Inc., our majority owned subsidiary and the new lower cost marketing model employed by Student Loan Care LLC, our second majority owned subsidiary which commenced operations June 1, 2016.

General and administrative expenses. General and administrative expenses amounted to $2,473,739 for the year ended December 31, 2016, as compared to $2,014,604 for the year ended December 31, 2015, an increase of $459,135. Service fees were $294,846 and $259,854 for the year ended December 31, 2016 and 2015, respectively, the increase being primarily attributable to cash paid consulting fees. Occupancy expense was $145,523 and $111,719 for the years ended December 31, 2016 and 2015, respectively. The increase is primarily due to facilities of Student Loan Care. Telecommunications expense was $70,593 and $41,562 for the year ended December 31, 2016 and 2015, respectively. Accounting expenses decreased to $76,000 for the year ended December 31, 2016 from $232,844 for the year ended December 31, 2015. We had additional accounting services and billings received in 2015 to become current in our SEC reporting. Travel, insurance and legal expense were $25,510, $67,281 and $83,707 in the year ended December 31, 2016 compared with $19,729, $50,616 and $48,458 in the year ended December 31, 2015. In addition, we incurred an aggregate of $1,415,029 for current bad debt charges and allowances for future Accounts Receivable bad debt relating to the student loan document preparation services in 2016 as compared to $932,506 in 2015 which also included current bad debt and an allowance for future bad debt.

Gain on change in fair value of derivative liabilities. During the year ended December 31, 2016 and 2015, we had the possibility of exceeding common shares authorized when considering the number of possible shares that may be issuable to satisfy settlement provisions of these agreements after consideration of all existing instruments that could be settled in shares. In addition, in 2016, with issued convertible notes with embedded conversion features. The accounting treatment of derivative financial instruments requires us to reclassify the derivative from equity to a liability at their fair values as of the date possible issuable shares exceeded the authorized level and at fair value as of each subsequent balance sheet date. For the year ended December 31, 2016 and 2015, we recorded a gain on change in fair value of these derivative liabilities of $30,317 and $381,968, respectively. On December 22, 2015, upon increasing our number of authorized common shares, the fair value of the derivative liability was reclassified to equity and on August 17, 2016, we modified our previously issued notes payable to eliminate the embedded derivative.

Gain on settlement of debt. For the year ended December 31, 2015, we settled outstanding accounts payable for less than the recorded liability. As such, we reported a gain of $650,319 for the year ended December 31, 2015.

| 15 |

| Table of Contents |

Interest Expense. We recorded financing expenses of $1,159,019 for the year ended December 31, 2016 compared to interest expenses of $1,666,238 for the year ended December 31, 2015. Interest expenses decreased primarily due to the factoring agreement we have with our student loan document preparation receivables in 2015 and 2016 with our majority owned subsidiary, Progressive Advocates and in 2016 with both Progress Advocates and another majority owned subsidiary, Student Loan Care LLC.

Amortization of deferred debt discount. Amortization expense of $259,037 and $95,428 was incurred for the year ended December 31, 2016 and 2015, respectively, for the amortization of the value of the deferred debt discount associated with certain of our notes payable. Amortization expense increased due to additional (newer) notes issued in 2015 and 2016.

Liquidity and Capital Resources

As of December 31, 2016, we had a working capital deficiency (total current liabilities exceeded total current assets) in the amount of $10,955,052 and cash and cash equivalents totaling $593,101. We reported a net loss attributable to Debt Resolve, Inc. of $1,778,178 for the year ended December 31, 2016. Net cash used in operating activities was $3,775,802 for the year ended December 31, 2016. Cash flow provided by financing activities was $4,338,423 for the year ended December 31, 2016. As of December 31, 2015, we had a working capital deficiency (total current liabilities exceeded total current assets) in the amount of $10,313,663 and cash and cash equivalents totaling $30,480.

Our working capital as of the date of this report is negative and may not be sufficient to fund our plan of operations for the next year.

We have raised capital for our day-to-day operations since our inception through year end 2016; however, no assurance can be provided that we will continue to be able to do so. There is no assurance that any funds secured will be sufficient to enable us to attain profitable operations. To the extent that we are unsuccessful, we may need to curtail our operations and implement a plan to extend payables and reduce overhead until sufficient additional capital is raised to support further operations. At any time until substantial capital is raised or we reach cash flow breakeven, there is also a significant risk of insolvency. There can be no assurance that any plan to raise additional funding will be successful. It is quite challenging in the current environment to raise money given our delay in generating meaningful and sustainable revenue. Unless our revenue grows quickly, it may not be possible to demonstrate the progress investors require to secure additional funding. Our Consolidated Financial Statements do not include any adjustments that might result from the outcome of this uncertainty.

A discussion on current loan defaults is included in included in Note 9 to the Financial Statements, titled "Convertible Notes".

Off-Balance Sheet Arrangements

As of April 17, 2017, we have not entered into any transactions with unconsolidated entities in which we have financial guarantees, subordinated retained interests, derivative instruments or other contingent arrangements that expose us to material continuing risks, contingent liabilities or any other obligations under a variable interest in an unconsolidated entity that provides us with financing, liquidity, market risk or credit risk support.

Impact of Inflation

We believe that inflation has not had a material impact on our results of operations for the years ended December 31, 2016 and 2015. We cannot assure you that future inflation will not have an adverse impact on our operating results and financial condition.

Application of Critical Accounting Policies and Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires our management to make estimates and assumptions that affect the amounts reported in the financial statements and the accompanying notes. These estimates and assumptions are based on our management's judgment and available information and, consequently, actual results could be different from these estimates. The significant accounting policies that we believe are the most critical to aid in fully understanding and evaluating our reported financial results are as follows:

| 16 |

| Table of Contents |

Accounts Receivable

We extend credit to large, mid-size and small companies for collection services. We did not have a concentration in receivables in 2016 or 2015. We do not generally require collateral or other security to support customer receivables. Accounts receivable are carried at their estimated collectible amounts. Accounts receivable are periodically evaluated for collectability and the allowance for doubtful accounts is adjusted accordingly. Management determines collectability based on their experience and knowledge of the customers. As of December 31, 2016 and 2015, allowance for doubtful accounts was $1,622,208 and $600,000, respectively.

Derivative Liability

We account for derivatives in accordance with ASC 815, which establishes accounting and reporting standards for derivative instruments and hedging activities, including certain derivative instruments embedded in other financial instruments or contracts and requires recognition of all derivatives on the balance sheet at fair value, regardless of hedging relationship designation. Accounting for changes in fair value of the derivative instruments depends on whether the derivatives qualify as hedge relationships and the types of relationships designated are based on the exposures hedged. At December 31, 2016 and 2015, we did not have any derivative instruments that were designated as hedges.

At December 31, 2014 and through December 22, 2015, we had the possibility of exceeding our common shares authorized when considering the number of possible shares that may be issuable to satisfy settlement provisions for all existing instruments that could be settled in shares.

Stock-based compensation

We follow Accounting Standards Codification subtopic 718-10, Stock-based Compensation ("ASC 718-10"). The standards require the measurement of compensation cost at the grant date, based upon the estimated fair value of the award, and requires amortization of the related expense over the employee's requisite service period.

We account for equity awards to non-employees at fair value on the date of grant. Equity awards to non-employees are subject to periodic revaluation until the completion of any requisite performance requirements in accordance with ASC 505-50.

Fair Values

Accounting Standards Codification subtopic 825-10, Financial Instruments ("ASC 825-10") requires disclosure of the fair value of certain financial instruments. The carrying value of cash and cash equivalents, accounts payable and accrued liabilities, and short-term borrowings, as reflected in the balance sheets, approximate fair value because of the short-term maturity of these instruments. All of our other significant financial assets, financial liabilities and equity instruments are either recognized or disclosed in the financial statements together with other information relevant for making a reasonable assessment of future cash flows, interest rate risk and credit risk. Where practicable the fair values of financial assets and financial liabilities have been determined and disclosed; otherwise only available information pertinent to fair value has been disclosed.

We follow Accounting Standards Codification subtopic 820-10, Fair Value Measurements and Disclosures ("ASC 820-10") and Accounting Standards Codification subtopic 825-10, Financial Instruments ("ASC 825-10"), which permits entities to choose to measure many financial instruments and certain other items at fair value.

| 17 |

| Table of Contents |

Accounting Standards Codification subtopic 825-10, Financial Instruments ("ASC 825-10") requires disclosure of the fair value of certain financial instruments. ASC 825-10 defines fair value as the price that would be received from selling an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. When determining the fair value measurements for assets and liabilities required or permitted to be recorded at fair value, we consider the principal or most advantageous market in which it would transact and considers assumptions that market participants would use when pricing the asset or liability, such as inherent risk, transfer restrictions, and risk of nonperformance. ASC 825-10 establishes a fair value hierarchy that requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. ASC 825-10 establishes three levels of inputs that may be used to measure fair value:

Level 1 - Quoted prices in active markets for identical assets or liabilities.

Level 2 - Observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities; quoted prices in markets with insufficient volume or infrequent transactions (less active markets); or model-derived valuations in which all significant inputs are observable or can be derived principally from or corroborated by observable market data for substantially the full term of the assets or liabilities.

Level 3 - Unobservable inputs to the valuation methodology that are significant to the measurement of fair value of assets or liabilities.

To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement is disclosed and is determined based on the lowest level input that is significant to the fair value measurement.

As of December 31, 2016 or 2015, we did not have any items that would be classified as level 1 or 2 disclosures. The Company recognized its derivative liabilities as level 3 and values its derivatives using the methods discussed in note 10. While we believe that our valuation methods are appropriate and consistent with other market participants, it recognizes that the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different estimate of fair value at the reporting date. The primary assumptions that would significantly affect the fair values using the methods discussed in Note 9 to the financial statements are that of volatility and market price of our underlying common stock.

Revenue Recognition

In recognition of the principles expressed in Accounting Standards Codification subtopic 605-10, Revenue should not be recognized until it is realized or realizable and earned, and given the element of doubt associated with collectability of an agreed settlement on past due debt, we postpone recognition of all contingent revenue until the client receives payment from the debtor. As is required by SAB 104, revenues are considered to have been earned when we have substantially accomplished the agreed-upon deliverables to be entitled to payment by the client. For most current active Debt Resolve clients, these deliverables consist of the successful collection of past due debts using our system and/or, for clients under a flat fee arrangement, the successful availability of our system for their customers.

Revenues for the preparation of student loan documentation are earned when we have substantially accomplished the agreed-upon deliverables to be entitled to payment by the client. For most current active clients, these deliverables consist of the completed, delivered and accepted student loan package. We may sell our products separately or in various bundles that include multiple elements such as the initial application completion and acceptance as well as ongoing assistance to maintain program compliance.

We also earn revenue from collection agencies, healthcare providers and lenders that implemented our online system. Our current contracts provide for revenue based on a percentage of the amount of debt collected, a fee per settlement or through a flat monthly fee. Although other revenue models have been proposed, most revenue earned to date has been determined using these methods, and such revenue is recognized when the settlement amount of debt is collected by the client or at the beginning of the month for a flat fee. While the percent of debt collected will continue to be a revenue recognition method going forward, other payment models are also being offered to clients. Dependent upon the structure of future contracts, revenue may be derived from a combination of set up fees or flat monthly or annual fees with transaction fees upon debt settlement, fees per account loaded or fees per settlement.

| 18 |

| Table of Contents |

Payment Resolution Systems, our 51% owned subsidiary, works as an extended business office to medical groups around the U.S. Revenue is earned in this business by the online negotiations and collection of group's accounts receivable and paid via a service fee.

Revenues for set-up fees, percentage contingent collection fees, fixed settlement fees, monthly fees, etc. are accounted for as Multiple-Element Arrangements under ASC 605-10 which incorporates Accounting Standards Codification subtopic 605-25, Multiple-Element Arrangements ("ASC 605-25"). ASC 605-25 addresses accounting for arrangements that may involve the delivery or performance of multiple products, services and/or rights to use assets.

We defer any revenue for which the product or service has not been delivered or is subject to refund until such time that we and the customer jointly determine that the product has been delivered or no refund will be required. At December 31, 2016 and 2015, the Company had deferred revenues of $1,442,949 and $1,260,137, respectively.

Recently-Issued Accounting Pronouncements

There were various updates recently issued, most of which represented technical corrections to the accounting literature or application to specific industries and are not expected to a have a material impact on our financial position, results of operations or cash flows. Refer to page F-13 in Our Consolidated Financial Statements for details regarding recent accounting pronouncements.

ITEM 7A. Quantitative and Qualitative Disclosures About Market Risk

Not applicable

ITEM 8. Financial Statements and Supplementary Data

Our audited financial statements for the years ended December 31, 2016 and 2015 are included as a separate section of this report beginning on page F-1.

ITEM 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None

ITEM 9A. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

We maintain disclosure controls and procedures that are designed to ensure that material information required to be disclosed in our periodic reports filed under the Securities Exchange Act of 1934, as amended, or Exchange Act, is recorded, processed, summarized, and reported within the time periods specified in the SEC's rules and forms and to ensure that such information is accumulated and communicated to our management, including our Chief Executive Officer and acting Chief Financial Officer (Principal Financial Officer), which are the same person, to allow timely decisions regarding required disclosure. During the fourth quarter ended December 31, 2016, we carried out an evaluation, under the supervision and with the participation of our management, including the Chief Executive Officer and the acting Chief Financial Officer (Principal Financial Officer), of the effectiveness of the design and operation of our disclosure controls and procedures, as defined in Rule 13(a)-15(e) under the Exchange Act. Based on this evaluation, because of our limited resources and limited number of employees, management concluded that our disclosure controls and procedures were ineffective as of December 31, 2016.

| 19 |

| Table of Contents |

Management's Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. Our internal control over financial reporting is designed to provide reasonable assurances regarding the reliability of financial reporting and the preparation of our financial statements in accordance with U.S. generally accepted accounting principles, or GAAP. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree or compliance with the policies or procedures may deteriorate.

With the participation of our Principal Executive Officer and Principal Financial Officer, currently the same person, our management conducted an evaluation of the effectiveness of our internal control over financial reporting as defined under Rule 13a-15, as of December 31, 2016 based on the framework in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission, or COSO. Based on our evaluation and the material weaknesses described below, management concluded that the Company did not maintain effective internal control over financial reporting as of December 31, 2016, based on the COSO framework criteria. Management has identified the major control deficiencies as the lack of segregation of duties and limited accounting knowledge of our debt and equity transactions. Our management believes that these material weaknesses are due to the small size of our accounting staff. The small size of our accounting staff may prevent adequate controls in the future, such as segregation of duties, due to the high cost of such remediation relative the benefit expected to be derived thereby.

To mitigate the current limited resources and limited employees, we rely heavily on direct management oversight of transactions, along with the use of external legal and accounting professionals. As we grow, we expect to increase our number of employees, which will enable us to implement adequate segregation of duties within the internal control framework. These control deficiencies could result in a misstatement of account balances that would result in a reasonable possibility that a material misstatement to our consolidated financial statements may not be prevented or detected on a timely basis. Accordingly, we have determined that these control deficiencies as described above together constitute a material weakness.

In light of this material weakness, we performed additional analyses and procedures in order to conclude that our consolidated financial statements for the year ended December 31, 2016 included in this Annual Report on Form 10-K were fairly stated in accordance with U.S. GAAP. Accordingly, management believes that, despite our material weaknesses, our financial statements for the year ended December 31, 2016 are fairly stated, in all material respects, in accordance with U.S. GAAP.

This report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Management's report was not required to attestation by our registered public accounting firm under section 404(a) of the Sarbanes-Oxley Act.

Limitations on Effectiveness of Controls and Procedures

Our management, including our Principal Executive Officer and Principal Financial Officer, which are the same person, does not expect that our disclosure controls and procedures or our internal controls will prevent all errors and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been detected. These inherent limitations include, but are not limited to, the realities that judgments in decision-making can be faulty and that breakdowns can occur because of simple error or mistake. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or by management override of the control. The design of any system of controls also is based in part upon certain assumptions about the likelihood of future events and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions.

Over time, controls may become inadequate because of changes in conditions, or the degree of compliance with the policies or procedures may deteriorate. Because of the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and not be detected.

Changes in Internal Controls

During the fourth quarter ended December 31, 2016, there have been no changes in our internal control over financial reporting that have materially affected or are reasonably likely to materially affect our internal controls over financial reporting.

None

| 20 |

| Table of Contents |

ITEM 10. Directors, Executive Officers and Corporate Governance

The following table shows the positions held by our board of directors and executive officers, as well as a key employee, and their ages, as of April 17, 2017:

|

Name |

Age |

Position | ||

|

Bruce E. Bellmare |

68 |

Chief Executive Officer, Acting Chief Financial Officer, and Director | ||

|

William M. Mooney, Jr. |

77 |

Chairman of Board | ||

|

James G. Brakke |

74 |

Director | ||

|

Gary T. Martin |

71 |

Director | ||

|

Raymond A. Conta |

46 |

Director | ||

|

Stanley E. Freimuth |

70 |

Director | ||

|

Rene A. Samson |

38 |

Vice President -Technology |