Attached files

| file | filename |

|---|---|

| EX-32.2 - SECTION 906 CFO CERTIFICATION - NATIONAL RURAL UTILITIES COOPERATIVE FINANCE CORP /DC/ | nrufy2017q3form10-qxex322.htm |

| EX-32.1 - SECTION 906 CEO CERTIFICATION - NATIONAL RURAL UTILITIES COOPERATIVE FINANCE CORP /DC/ | nrufy2017q3form10-qxex321.htm |

| EX-31.2 - SECTION 302 CFO CERTIFICATION - NATIONAL RURAL UTILITIES COOPERATIVE FINANCE CORP /DC/ | nrufy2017q3form10-qxex312.htm |

| EX-31.1 - SECTION 302 CEO CERTIFICATION - NATIONAL RURAL UTILITIES COOPERATIVE FINANCE CORP /DC/ | nrufy2017q3form10-qxex311.htm |

| EX-12 - COMPUTATIONS OF RATIO OF EARNINGS TO FIXED CHARGES - NATIONAL RURAL UTILITIES COOPERATIVE FINANCE CORP /DC/ | nrufy2017q3form10-qxex12.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________

FORM 10-Q

__________________________

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended February 28, 2017

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 1-7102

__________________________

NATIONAL RURAL UTILITIES

COOPERATIVE FINANCE CORPORATION

(Exact name of registrant as specified in its charter)

__________________________

District of Columbia | 52-0891669 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. employer identification no.) | |

20701 Cooperative Way, Dulles, Virginia, 20166 |

(Address of principal executive offices) (Zip Code) |

Registrant’s telephone number, including area code: (703) 467-1800

__________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ Non-accelerated filer ☒ Smaller reporting company ☐ |

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

TABLE OF CONTENTS

Page | ||||

i

ii

INDEX OF MD&A TABLES

Table | Description | Page | |||

— | MD&A Tables: | ||||

1 | Summary of Selected Financial Data | 3 | |||

2 | Average Balances, Interest Income/Interest Expense and Average Yield/Cost | 9 | |||

3 | Rate/Volume Analysis of Changes in Interest Income/Interest Expense | 12 | |||

4 | Derivative Average Notional Amounts and Average Interest Rates | 14 | |||

5 | Derivative Gains (Losses) | 15 | |||

6 | Loans Outstanding by Type and Member Class | 17 | |||

7 | Historical Retention Rate and Repricing Selection | 18 | |||

8 | Total Debt Outstanding | 19 | |||

9 | Member Investments | 21 | |||

10 | Unencumbered Loans | 22 | |||

11 | Collateral Pledged | 22 | |||

12 | Guarantees Outstanding | 23 | |||

13 | Maturities of Guarantee Obligations | 24 | |||

14 | Unadvanced Loan Commitments | 24 | |||

15 | Notional Maturities of Unadvanced Loan Commitments | 25 | |||

16 | Maturities of Notional Amount of Unconditional Committed Lines of Credit | 26 | |||

17 | Loan Portfolio Security Profile | 27 | |||

18 | Credit Exposure to 20 Largest Borrowers | 28 | |||

19 | TDR Loans | 29 | |||

20 | Allowance for Loan Losses | 30 | |||

21 | Rating Triggers for Derivatives | 31 | |||

22 | Short-Term Borrowings | 32 | |||

23 | Liquidity Reserve | 33 | |||

24 | Committed Bank Revolving Line of Credit Agreements | 34 | |||

25 | Issuances and Maturities of Long-Term and Subordinated Debt | 35 | |||

26 | Principal Maturity of Long-Term Debt and Subordinated Debt | 36 | |||

27 | Credit Ratings | 36 | |||

28 | Projected Sources and Uses of Liquidity | 37 | |||

29 | Financial Covenant Ratios Under Committed Bank Revolving Line of Credit Agreements | 38 | |||

30 | Financial Ratios Under Debt Indentures | 38 | |||

31 | Interest Rate Gap Analysis | 40 | |||

32 | Adjusted Financial Measures — Income Statement | 41 | |||

33 | TIER and Adjusted TIER | 42 | |||

34 | Adjusted Financial Measures — Balance Sheet | 42 | |||

35 | Leverage and Debt-to-Equity Ratios | 43 | |||

iii

PART I—FINANCIAL INFORMATION

Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) |

FORWARD-LOOKING STATEMENTS |

This Quarterly Report on Form 10-Q contains certain statements that are considered “forward-looking statements” within the Securities Act of 1933, as amended, and the Exchange Act of 1934, as amended. Forward-looking statements, which are based on certain assumptions and describe our future plans, strategies and expectations, are generally identified by our use of words such as “intend,” “plan,” “may,” “should,” “will,” “project,” “estimate,” “anticipate,” “believe,” “expect,” “continue,” “potential,” “opportunity” and similar expressions, whether in the negative or affirmative. All statements about future expectations or projections, including statements about loan volume, the appropriateness of the allowance for loan losses, operating income and expenses, leverage and debt-to-equity ratios, borrower financial performance, impaired loans, and sources and uses of liquidity, are forward-looking statements. Although we believe that the expectations reflected in our forward-looking statements are based on reasonable assumptions, actual results and performance may differ materially from our forward-looking statements due to several factors. Factors that could cause future results to vary from our forward-looking statements include, but are not limited to, general economic conditions, legislative changes including those that could affect our tax status, governmental monetary and fiscal policies, demand for our loan products, lending competition, changes in the quality or composition of our loan portfolio, changes in our ability to access external financing, changes in the credit ratings on our debt, valuation of collateral supporting impaired loans, charges associated with our operation or disposition of foreclosed assets, regulatory and economic conditions in the rural electric industry, nonperformance of counterparties to our derivative agreements, the costs and effects of legal or governmental proceedings involving us or our members and the factors listed and described under “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended May 31, 2016 (“2016 Form 10-K”). Except as required by law, we undertake no obligation to update or publicly release any revisions to forward-looking statements to reflect events, circumstances or changes in expectations after the date on which the statement is made.

INTRODUCTION |

National Rural Utilities Cooperative Finance Corporation (“CFC”) is a member-owned cooperative association incorporated under the laws of the District of Columbia in April 1969. CFC’s principal purpose is to provide its members with financing to supplement the loan programs of the Rural Utilities Service (“RUS”) of the United States Department of Agriculture

(“USDA”). CFC makes loans to its rural electric members so they can acquire, construct and operate electric distribution, generation, transmission and related facilities. CFC also provides its members with credit enhancements in the form of letters of credit and guarantees of debt obligations. As a cooperative, CFC is owned by and exclusively serves its membership, which consists of not-for-profit entities or subsidiaries or affiliates of not-for-profit entities. CFC is exempt from federal income taxes. As a member-owned cooperative, CFC’s objective is not to maximize profit, but rather to offer its members cost-based financial products and services consistent with sound financial management. CFC funds its activities primarily through a combination of public and private issuances of debt securities, member investments and retained equity. As a tax-exempt, member-owned cooperative, we cannot issue equity securities.

Our financial statements include the consolidated accounts of CFC, Rural Telephone Finance Cooperative (“RTFC”), National Cooperative Services Corporation (“NCSC”) and subsidiaries created and controlled by CFC to hold foreclosed assets resulting from borrower defaults on loans or bankruptcy proceedings. RTFC is a taxable Subchapter T cooperative association that was established to provide private financing for the rural telecommunications industry. NCSC is a taxable cooperative that may provide financing to members of CFC, government or quasi-government entities which own electric utility systems that meet the Rural Electrification Act definition of “rural”, and the for-profit and nonprofit entities that are owned, operated or controlled by, or provide significant benefits to certain members of CFC. See “Item 1. Business—Overview” of our 2016 Form 10-K for additional information on the business activities of each of these entities. Unless stated otherwise, references to “we,” “our” or “us” relate to CFC and its consolidated entities. All references to members within this document include members, associates and affiliates of CFC and its consolidated entities.

1

Management monitors a variety of key indicators to evaluate our business performance. The following MD&A is intended to provide the reader with an understanding of our results of operations, financial condition and liquidity by discussing the drivers of changes from period to period and the key measures used by management to evaluate performance, such as leverage ratios, growth and credit quality metrics. MD&A is provided as a supplement to, and should be read in conjunction with our unaudited condensed consolidated financial statements and related notes in this Report, our audited consolidated financial statements and related notes in our 2016 Form 10-K and additional information contained in our 2016 Form 10-K, including the risk factors discussed under “Part I—Item 1A. Risk Factors,” as well as any risk factors identified under “Part II—Item 1A. Risk Factors” in this Report.

SUMMARY OF SELECTED FINANCIAL DATA |

Table 1 provides a summary of selected financial data for the three and nine months ended February 28, 2017 and February 29, 2016, and as of February 28, 2017 and May 31, 2016. In addition to financial measures determined in accordance with GAAP, management also evaluates performance based on certain non-GAAP measures, which we refer to as “adjusted” measures. Our primary non-GAAP metrics include adjusted net income, adjusted net interest income and net interest yield, adjusted times interest earned ratio (“adjusted TIER”), adjusted debt-to-equity ratio and adjusted leverage ratio. The most comparable GAAP measures are net income, net interest income, TIER, debt-to-equity ratio and leverage ratio, respectively. The primary adjustments we make to calculate these non-GAAP measures consist of (i) adjusting interest expense and net interest income to include the impact of net periodic derivative cash settlements; (ii) adjusting net income, senior debt and total equity to exclude the non-cash impact of the accounting for derivative financial instruments; (iii) adjusting senior debt to exclude the amount that funds CFC member loans guaranteed by RUS, subordinated deferrable debt and members’ subordinated certificates; and (iv) adjusting total equity to include subordinated deferrable debt and members’ subordinated certificates. We believe our non-GAAP adjusted metrics, which are not a substitute for GAAP and may not be consistent with similarly titled non-GAAP measures used by other companies, provide meaningful information and are useful to investors because management evaluates performance based on these metrics, and the financial covenants in our committed bank revolving line of credit agreements and debt indentures are based on adjusted TIER and the adjusted debt-to-equity ratio. See “Non-GAAP Financial Measures” for a detailed reconciliation of these adjusted measures to the most comparable GAAP measures.

2

Table 1: Summary of Selected Financial Data

Three Months Ended | Nine Months Ended | |||||||||||||||||||

(Dollars in thousands) | February 28, 2017 | February 29, 2016 | Change | February 28, 2017 | February 29, 2016 | Change | ||||||||||||||

Statement of operations | ||||||||||||||||||||

Interest income | $ | 259,920 | $ | 253,633 | 2% | $ | 773,911 | $ | 756,074 | 2% | ||||||||||

Interest expense | (186,740 | ) | (171,189 | ) | 9 | (551,474 | ) | (504,013 | ) | 9 | ||||||||||

Net interest income | 73,180 | 82,444 | (11) | 222,437 | 252,061 | (12) | ||||||||||||||

Provision for loan losses | (2,065 | ) | 1,735 | ** | (4,731 | ) | (4,067 | ) | 16 | |||||||||||

Fee and other income | 5,810 | 5,604 | 4 | 15,437 | 17,336 | (11) | ||||||||||||||

Derivative gains (losses)(1) | 42,455 | (243,036 | ) | ** | 194,822 | (356,237 | ) | ** | ||||||||||||

Results of operations of foreclosed assets | (29 | ) | 1,472 | ** | (1,690 | ) | 1,605 | ** | ||||||||||||

Operating expenses(2) | (20,710 | ) | (22,352 | ) | (7) | (62,201 | ) | (65,418 | ) | (5) | ||||||||||

Other non-interest expense | (294 | ) | (842 | ) | (65) | (1,254 | ) | (1,208 | ) | 4 | ||||||||||

Income (loss) before income taxes | 98,347 | (174,975 | ) | ** | 362,820 | (155,928 | ) | ** | ||||||||||||

Income tax expense | (385 | ) | 593 | ** | (1,815 | ) | 153 | ** | ||||||||||||

Net income (loss) | $ | 97,962 | $ | (174,382 | ) | ** | $ | 361,005 | $ | (155,775 | ) | ** | ||||||||

Adjusted operational financial measures | ||||||||||||||||||||

Adjusted interest expense(3) | $ | (206,094 | ) | $ | (193,745 | ) | 6% | $ | (615,805 | ) | $ | (569,298 | ) | 8% | ||||||

Adjusted net interest income(3) | 53,826 | 59,888 | (10) | 158,106 | 186,776 | (15) | ||||||||||||||

Adjusted net income(3) | 36,153 | 46,098 | (22) | 101,852 | 135,177 | (25) | ||||||||||||||

Ratios | ||||||||||||||||||||

Fixed-charge coverage ratio/TIER (4) | 1.52 | — | 152 bps | 1.65 | 0.69 | 96 bps | ||||||||||||||

Adjusted TIER(3) | 1.18 | 1.24 | (6) | 1.17 | 1.24 | (7) | ||||||||||||||

February 28, 2017 | May 31, 2016 | Change | ||||||||||||||||||

Balance sheet | ||||||||||||||||||||

Cash, investments and time deposits | $ | 955,855 | $ | 632,480 | 51% | |||||||||||||||

Loans to members(5) | 24,260,837 | 23,162,696 | 5 | |||||||||||||||||

Allowance for loan losses | (36,029 | ) | (33,258 | ) | 8 | |||||||||||||||

Loans to members, net | 24,224,808 | 23,129,438 | 5 | |||||||||||||||||

Total assets | 25,609,565 | 24,270,200 | 6 | |||||||||||||||||

Short-term borrowings | 3,388,078 | 2,938,848 | 15 | |||||||||||||||||

Long-term debt | 18,254,301 | 17,473,603 | 4 | |||||||||||||||||

Subordinated deferrable debt | 742,241 | 742,212 | — | |||||||||||||||||

Members’ subordinated certificates | 1,420,608 | 1,443,810 | (2) | |||||||||||||||||

Total debt outstanding | 23,805,228 | 22,598,473 | 5 | |||||||||||||||||

Total liabilities | 24,462,227 | 23,452,822 | 4 | |||||||||||||||||

Total equity | 1,147,338 | 817,378 | 40 | |||||||||||||||||

Guarantees (6) | 887,484 | 909,208 | (2) | |||||||||||||||||

Ratios | ||||||||||||||||||||

Leverage ratio(7) | 22.09 | 29.81 | (772) bps | |||||||||||||||||

Adjusted leverage ratio(3) | 6.36 | 6.08 | 28 | |||||||||||||||||

Debt-to-equity ratio(8) | 21.32 | 28.69 | (737) | |||||||||||||||||

Adjusted debt-to-equity ratio(3) | 6.11 | 5.82 | 29 | |||||||||||||||||

____________________________

3

** Change is less than one percent or not meaningful.

(1)Consists of derivative cash settlements and derivative forward value amounts. Derivative cash settlement amounts represent net periodic contractual interest accruals related to derivatives not designated for hedge accounting. Derivative forward value amounts represent changes in fair value during the period, excluding net periodic contractual accruals, related to derivatives not designated for hedge accounting and expense amounts reclassified into income related to the cumulative transition loss recorded in accumulated other comprehensive income as of June 1, 2001, as a result of the adoption of the derivative accounting guidance that required derivatives to be reported at fair value on the balance sheet.

(2)Consists of the salaries and employee benefits and the other general and administrative expenses components of non-interest expense, each of which are presented separately on our consolidated statements of operations.

(3)See “Non-GAAP Financial Measures” for details on the calculation of these non-GAAP adjusted measures and the reconciliation to the most comparable GAAP measures.

(4)Calculated based on net income (loss) plus interest expense for the period divided by interest expense for the period. The fixed-charge coverage ratios and TIER were the same during each period presented because we did not have any capitalized interest during these periods. For the three months ended February 29, 2016, we reported a net loss of $174 million, which resulted in no fixed-charge coverage ratio and TIER coverage.

(5)Loans to members consists of the outstanding principal balance of member loans plus unamortized deferred loan origination costs, which totaled $11 million and $10 million as of February 28, 2017 and May 31, 2016, respectively.

(6)Reflects the total amount of member obligations for which CFC has guaranteed payment to a third party as of the end of each period. This amount represents our maximum exposure to loss, which significantly exceeds the guarantee liability recorded on our consolidated balance sheets as the guarantee liability is determined based on anticipated losses. See “Note 11—Guarantees” for additional information.

(7)Calculated based on total liabilities and guarantees at period end divided by total equity at period end.

(8)Calculated based on total liabilities at period end divided by total equity at period end.

EXECUTIVE SUMMARY |

Our primary objective as a member-owned cooperative lender is to provide cost-based financial products to our rural electric members while maintaining a sound financial position required for investment-grade credit ratings on our debt instruments. Our objective is not to maximize net income; therefore, the rates we charge our member-borrowers reflect our adjusted interest expense plus a spread to cover our operating expenses, a provision for loan losses and earnings sufficient to achieve interest coverage to meet our financial objectives. Our goal is to earn an annual minimum adjusted TIER of 1.10 and to maintain an adjusted debt-to-equity ratio at approximatively or below 6.00-to-1.

We are subject to period-to-period volatility in our reported GAAP results due to changes in market conditions and differences in the way our financial assets and liabilities are accounted for under GAAP. Our financial assets and liabilities expose us to interest-rate risk. We use derivatives, primarily interest rate swaps, as part of our strategy in managing this risk. Our derivatives are intended to economically hedge and manage the interest-rate sensitivity mismatch between our financial assets and liabilities. We are required under GAAP to carry derivatives at fair value on our consolidated balance sheet; however, our other financial assets and liabilities are carried at amortized cost. Changes in interest rates and spreads result in periodic fluctuations in the fair value of our derivatives, which may cause volatility in our earnings because we do not apply hedge accounting. As a result, the mark-to-market changes in our derivatives are recorded in earnings. Based on the composition of our derivatives, we generally record derivative losses in earnings when interest rates decline and derivative gains when interest rates rise. This earnings volatility generally is not indicative of the underlying economics of our business, as the derivative forward fair value gains or losses recorded each period may or may not be realized over time, depending on the terms of our derivative instruments and future changes in market conditions that impact actual derivative cash settlement amounts. As such, management uses our adjusted non-GAAP results, which include realized net periodic derivative settlements but exclude the impact of unrealized derivative forward fair value gains and losses, to evaluate our operating performance. Because derivative forward fair value gains and losses do not impact our cash flows, liquidity or ability to service our debt costs, our financial debt covenants are also based on our non-GAAP adjusted results.

Financial Performance

Reported Results

We reported net income of $98 million and a TIER of 1.52 for the quarter ended February 28, 2017 (“current quarter”), compared with a net loss of $174 million for the same prior-year quarter, which resulted in no TIER coverage for the prior-year quarter. We reported net income of $361 million and a TIER of 1.65 for the nine months ended February 28, 2017, compared with a net loss of $156 million and a TIER of 0.69 for the same prior-year period. Our debt-to-equity ratio decreased to 21.32-to-1 as of February 28, 2017, from 28.69-to-1 as of May 31, 2016, largely attributable to an increase in

4

equity resulting from our reported net income of $361 million for the nine months ended February 28, 2017, which was partially offset by patronage capital retirements totaling $43 million.

The variance of $272 million between our reported net income of $98 million for the current quarter and net loss of $174 million for the same prior-year quarter was primarily driven by mark-to-market changes in the fair value of our derivatives. We recognized derivative gains of $42 million in the current quarter, largely due to an overall increase in interest rates during the quarter. In contrast, we recognized derivative losses of $243 million in the same prior year quarter due to a decline in longer-term interest rates and flattening of the swap yield curve. The favorable impact of the shift of $285 million to derivative gains in the current quarter from derivative losses in the same prior-year quarter was partially offset by a reduction in net interest income of $9 million, resulting from a decrease in the net interest yield of 21 basis points to 1.19%, which was partially offset by an increase in average interest-earning assets of 6%.

The variance of $517 million between our reported net income of $361 million for the nine months ended February 28, 2017 and our net loss of $156 million for the same prior-year period also was driven primarily by mark-to-market changes in the fair value of our derivatives. We recognized derivative gains of $195 million for the nine months ended February 28, 2017 attributable to an overall increase in interest rates, compared with derivative losses of $356 million during the same prior-year period attributable to a flattening of the swap yield curve resulting from an increase in short-term interest rates and a decline in longer-term interest rates. The variance between periods also reflects a reduction in net interest income of $30 million, attributable to a decrease in the net interest yield of 25 basis points to 1.22%, which was partially offset by an increase in average interest-earning assets of 7%.

Adjusted Non-GAAP Results

Our adjusted net income totaled $36 million and our adjusted TIER was 1.18 for the current quarter, compared with adjusted net income of $46 million and adjusted TIER of 1.24 for the same prior-year quarter. Our adjusted net income totaled $102 million and our adjusted TIER was 1.17 for the nine months ended February 28, 2017, compared with adjusted net income of $135 million and adjusted TIER of 1.24 for the same prior-year period. Our adjusted debt-to-equity ratio increased to 6.11-to-1 as of February 28, 2017, from 5.82-to-1 as of May 31, 2016, largely due to an increase in debt outstanding to fund asset growth.

The decreases in adjusted net income in the current quarter and nine months ended February 28, 2017 from the same prior-year periods were primarily driven by a decrease in adjusted net interest income attributable to a reduction in the adjusted net interest yield by 15 basis points to 0.87% for the current quarter and by 23 basis points to 0.86% for the nine months ended February 28, 2017. The decrease in the adjusted net interest yield during each period was partially offset by the increase in average interest-earning assets of 6% and 7% in the current quarter and nine months ended February 28, 2017, respectively.

Lending Activity

Total loans outstanding, which consists of the unpaid principal balance and excludes deferred loan origination costs, was $24,250 million as of February 28, 2017, an increase of $1,098 million, or 5%, from May 31, 2016. The increase was primarily due to increases in CFC distribution and power supply loans of $1,016 million and $121 million, respectively, which were largely attributable to member advances for capital investments and members refinancing with us loans made by other lenders.

CFC had long-term fixed-rate loans totaling $792 million that repriced during the nine months ended February 28, 2017. Of this total, $659 million repriced to a new long-term fixed rate, $112 million repriced to a long-term variable rate and $22 million were repaid in full.

Financing Activity

Our outstanding debt volume generally increases and decreases in response to member loan demand. As outstanding loan balances increased during the nine months ended February 28, 2017, our debt volume also increased. Total debt outstanding was $23,805 million as of February 28, 2017, an increase of $1,207 million, or 5%, from May 31, 2016. The increase was primarily attributable to a net increase in commercial paper outstanding of $476 million, a net increase in notes payable

5

under the note purchase agreements with the Federal Agricultural Mortgage Corporation (“Farmer Mac”) of $321 million, a net increase in notes payable to the Federal Financing Bank under the Guaranteed Underwriter Program of the USDA (“Guaranteed Underwriter Program”) of $221 million, a net increase in collateral trust bonds of $153 million and a net increase in medium-term notes of $85 million.

During the nine months ended February 28, 2017, we issued $750 million aggregate principal amount of dealer medium-term notes and collateral trust bonds and received advances of $600 million under the Guaranteed Underwriter Program and the revolving note purchase agreements with Farmer Mac.

On December 1, 2016, we closed on a $375 million committed loan facility (“Series L”) from the Federal Financing Bank guaranteed by RUS pursuant to the Guaranteed Underwriter Program. Under the Series L facility, we are able to borrow any time before October 15, 2019, with each advance subject to quarterly amortization and a final maturity not longer than 20 years from the advance date. As a result of this new commitment, the total for committed facilities under the Guaranteed Underwriter Program increased to $5,798 million, with up to $725 million available under these facilities as of February 28, 2017.

We provide additional information on our financing activities under “Consolidated Balance Sheets Analysis—Debt” and “Liquidity Risk.”

Sale of CAH

On July 1, 2016, the sale of Caribbean Asset Holdings, LLC (“CAH”) to ATN VI Holdings, LLC (“Buyer”) was completed. As a result, we did not carry any foreclosed assets on our consolidated balance sheet as of February 28, 2017. Our net proceeds at closing totaled $109 million, which represents the purchase price of $144 million less agreed-upon purchase price adjustments as of the closing date. Upon closing, $16 million of the sale proceeds was deposited into escrow to fund potential indemnification claims for a period of 15 months following the closing. In connection with the sale, RTFC provided a loan in the amount of $60 million to Buyer to finance a portion of the transaction. ATN International, Inc., the parent corporation of Buyer, has provided a guarantee on an unsecured basis of Buyer’s obligations to RTFC pursuant to the financing.

The net proceeds at closing were subject to post-closing adjustments. The Buyer provided a statement of post-closing adjustments and we agreed upon a net amount due to us for post-closing adjustments of approximately $1 million, which we received during the second quarter of fiscal year 2017. See “Consolidated Results of Operations—Non-Interest Income—Results of Operations of Foreclosed Assets” below in this Report and “Note 5—Foreclosed Assets” in our 2016 Form 10-K for additional information on the sale of CAH.

Outlook for the Next 12 Months

We currently expect the amount of long-term loan advances to slightly exceed anticipated loan repayments over the next 12 months. We expect relatively flat net interest income and adjusted net interest income over the next 12 months, reflecting a slight projected increase in average total loans, which we anticipate will be offset by a projected modest decline in the net interest yield and adjusted net interest yield.

Long-term debt scheduled to mature over the next 12 months totaled $2,590 million as of February 28, 2017. Of this amount, we have long-term debt totaling $1,440 million that matures in the fourth quarter of fiscal year 2017. We believe we have sufficient liquidity from the combination of existing cash and time deposits, member loan repayments, committed bank revolving lines of credit and our ability to issue debt in the capital markets, to our members and in private placements to meet the demand for member loan advances and satisfy our obligations to repay long-term debt maturing over the next 12 months. As of February 28, 2017, we had access to liquidity reserves totaling $6,931 million, which consisted of (i) $866 million in cash and cash equivalents and time deposits, (ii) up to $725 million available under committed loan facilities from the Federal Financing Bank under the Guaranteed Underwriter Program, (iii) up to $3,164 million available under committed bank revolving line of credit agreements, (iv) up to $200 million available under a committed revolving note purchase agreement with Farmer Mac, and (v) up to $1,976 million available under a revolving note purchase agreement with Farmer Mac, subject to market conditions.

6

We believe we can continue to roll over the member outstanding short-term debt of $2,348 million as of February 28, 2017, based on our expectation that our members will continue to reinvest their excess cash in our commercial paper, daily liquidity fund, select notes and medium-term notes. We expect to continue to roll over our outstanding dealer commercial paper of $1,040 million as of February 28, 2017. We intend to manage our short-term wholesale funding risk by maintaining outstanding dealer commercial paper at an average amount below $1,250 million for the foreseeable future. We expect to continue to be in compliance with the covenants under our committed bank revolving line of credit agreements, which will allow us to mitigate our roll-over risk as we can draw on these facilities to repay dealer or member commercial paper that cannot be rolled over.

While we are not subject to bank regulatory capital rules, we generally aim to maintain an adjusted debt-to-equity ratio at approximately or below 6.00-to-1. Our adjusted debt-to-equity ratio was 6.11 as of February 28, 2017, slightly above our targeted threshold. We expect to maintain our adjusted debt-to-equity ratio at approximately 6.00-to-1 over the next 12 months.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES |

The preparation of financial statements in accordance with GAAP requires management to make a number of judgments, estimates and assumptions that affect the amount of assets, liabilities, income and expenses in the consolidated financial statements. Understanding our accounting policies and the extent to which we use management’s judgment and estimates in applying these policies is integral to understanding our financial statements. We provide a discussion of our significant accounting policies under “Note 1—Summary of Significant Accounting Policies” in our 2016 Form 10-K.

We have identified certain accounting policies as critical because they involve significant judgments and assumptions about highly complex and inherently uncertain matters, and the use of reasonably different estimates and assumptions could have a material impact on our results of operations or financial condition. Our most critical accounting policies and estimates involve the determination of the allowance for loan losses and fair value. We evaluate our critical accounting estimates and judgments required by our policies on an ongoing basis and update them as necessary based on changing conditions. There were no material changes in the assumptions used in our critical accounting policies and estimates during the current quarter. Management has discussed significant judgments and assumptions in applying our critical accounting policies with the Audit Committee of our board of directors. We provide information on the methodologies and key assumptions used in our critical accounting policies and estimates under “MD&A—Critical Accounting Policies and Estimates” in our 2016 Form 10-K. See “Item 1A. Risk Factors” in our 2016 Form 10-K for a discussion of the risks associated with management’s judgments and estimates in applying our accounting policies and methods.

ACCOUNTING CHANGES AND DEVELOPMENTS |

See “Note 1—Summary of Significant Accounting Policies” for information on accounting standards adopted during the nine months ended February 28, 2017, as well as recently issued accounting standards not yet required to be adopted and the expected impact of these accounting standards. To the extent we believe the adoption of new accounting standards has had or will have a material impact on our results of operations, financial condition or liquidity, we discuss the impact in the applicable section(s) of MD&A.

7

CONSOLIDATED RESULTS OF OPERATIONS |

The section below provides a comparative discussion of our condensed consolidated results of operations between the three months ended February 28, 2017 and February 29, 2016 and between the nine months ended February 28, 2017 and February 29, 2016. Following this section, we provide a comparative analysis of our condensed consolidated balance sheets as of February 28, 2017 and May 31, 2016. You should read these sections together with our “Executive Summary—Outlook for the Next 12 Months” where we discuss trends and other factors that we expect will affect our future results of operations.

Net Interest Income

Net interest income represents the difference between the interest income and applicable fees earned on our interest-earning assets, which include loans and investment securities, and the interest expense on our interest-bearing liabilities. Our net interest yield represents the difference between the yield on our interest-earning assets and the cost of our interest-bearing liabilities plus the impact from non-interest bearing funding. We expect net interest income and our net interest yield to fluctuate based on changes in interest rates and changes in the amount and composition of our interest-earning assets and interest-bearing liabilities. We do not fund each individual loan with specific debt. Rather, we attempt to minimize costs and maximize efficiency by funding large aggregated amounts of loans.

Table 2 presents our average balance sheets for the three and nine months ended February 28, 2017 and February 29, 2016, and for each major category of our interest-earning assets and interest-bearing liabilities, the interest income earned or interest expense incurred, and the average yield or cost. Table 2 also presents non-GAAP adjusted interest expense, adjusted net interest income and adjusted net interest yield, which reflect the inclusion of net accrued periodic derivative cash settlements in interest expense. We provide reconciliations of our non-GAAP adjusted measures to the most comparable GAAP measures under “Non-GAAP Financial Measures.”

8

Table 2: Average Balances, Interest Income/Interest Expense and Average Yield/Cost

Three Months Ended | ||||||||||||||||||||||

(Dollars in thousands) | February 28, 2017 | February 29, 2016 | ||||||||||||||||||||

Assets: | Average Balance | Interest Income/Expense | Average Yield/Cost | Average Balance | Interest Income/Expense | Average Yield/Cost | ||||||||||||||||

Long-term fixed-rate loans(1) | $ | 22,106,076 | $ | 245,480 | 4.50 | % | $ | 21,105,238 | $ | 240,933 | 4.59 | % | ||||||||||

Long-term variable-rate loans | 811,080 | 5,047 | 2.52 | 732,970 | 5,077 | 2.79 | ||||||||||||||||

Line of credit loans | 1,162,268 | 6,538 | 2.28 | 1,032,204 | 6,335 | 2.47 | ||||||||||||||||

TDR loans(2) | 13,381 | 228 | 6.91 | 12,737 | 163 | 5.15 | ||||||||||||||||

Nonperforming loans | — | — | — | 7,772 | 81 | 4.19 | ||||||||||||||||

Other income, net(3) | — | (230 | ) | — | — | (279 | ) | — | ||||||||||||||

Total loans | 24,092,805 | 257,063 | 4.33 | 22,890,921 | 252,310 | 4.43 | ||||||||||||||||

Cash, investments and time deposits | 875,438 | 2,857 | 1.32 | 645,268 | 1,323 | 0.82 | ||||||||||||||||

Total interest-earning assets | $ | 24,968,243 | $ | 259,920 | 4.22 | % | $ | 23,536,189 | $ | 253,633 | 4.33 | % | ||||||||||

Other assets, less allowance for loan losses | 617,010 | 756,264 | ||||||||||||||||||||

Total assets | $ | 25,585,253 | $ | 24,292,453 | ||||||||||||||||||

Liabilities: | ||||||||||||||||||||||

Short-term debt | $ | 3,673,501 | $ | 7,907 | 0.87 | % | $ | 3,308,003 | $ | 4,387 | 0.53 | % | ||||||||||

Medium-term notes | 3,377,615 | 25,166 | 3.02 | 3,457,086 | 21,773 | 2.53 | ||||||||||||||||

Collateral trust bonds | 7,256,227 | 85,582 | 4.78 | 6,973,746 | 83,810 | 4.83 | ||||||||||||||||

Long-term notes payable | 7,208,711 | 43,929 | 2.47 | 6,809,807 | 41,412 | 2.45 | ||||||||||||||||

Subordinated deferrable debt | 742,217 | 9,410 | 5.14 | 395,741 | 4,785 | 4.86 | ||||||||||||||||

Subordinated certificates | 1,430,089 | 14,746 | 4.18 | 1,421,538 | 15,022 | 4.25 | ||||||||||||||||

Total interest-bearing liabilities | $ | 23,688,360 | $ | 186,740 | 3.20 | % | $ | 22,365,921 | $ | 171,189 | 3.08 | % | ||||||||||

Other liabilities | 798,848 | 1,075,182 | ||||||||||||||||||||

Total liabilities | 24,487,208 | 23,441,103 | ||||||||||||||||||||

Total equity | 1,098,045 | 851,350 | ||||||||||||||||||||

Total liabilities and equity | $ | 25,585,253 | $ | 24,292,453 | ||||||||||||||||||

Net interest spread(4) | 1.02 | % | 1.25 | % | ||||||||||||||||||

Impact of non-interest bearing funding(5) | 0.17 | 0.15 | ||||||||||||||||||||

Net interest income/net interest yield(6) | $ | 73,180 | 1.19 | % | $ | 82,444 | 1.40 | % | ||||||||||||||

Adjusted net interest income/adjusted net interest yield: | ||||||||||||||||||||||

Interest income | $ | 259,920 | 4.22 | % | $ | 253,633 | 4.33 | % | ||||||||||||||

Interest expense | 186,740 | 3.20 | 171,189 | 3.08 | ||||||||||||||||||

Add: Net accrued periodic derivative cash settlements(7) | 19,354 | 0.74 | 22,556 | 0.90 | ||||||||||||||||||

Adjusted interest expense/adjusted average cost(8) | $ | 206,094 | 3.53 | % | $ | 193,745 | 3.48 | % | ||||||||||||||

Adjusted net interest spread(4) | 0.69 | % | 0.85 | % | ||||||||||||||||||

Impact of non-interest bearing funding | 0.18 | 0.17 | ||||||||||||||||||||

Adjusted net interest income/adjusted net interest yield(9) | $ | 53,826 | 0.87 | % | $ | 59,888 | 1.02 | % | ||||||||||||||

9

Nine Months Ended | ||||||||||||||||||||||

(Dollars in thousands) | February 28, 2017 | February 29, 2016 | ||||||||||||||||||||

Assets: | Average Balance | Interest Income/Expense | Average Yield/Cost | Average Balance | Interest Income/Expense | Average Yield/Cost | ||||||||||||||||

Long-term fixed-rate loans(1) | $ | 21,832,967 | $ | 733,425 | 4.49 | % | $ | 20,509,790 | $ | 716,736 | 4.67 | % | ||||||||||

Long-term variable-rate loans | 763,831 | 14,561 | 2.55 | 703,489 | 14,919 | 2.83 | ||||||||||||||||

Line of credit loans | 1,083,863 | 18,057 | 2.23 | 1,043,293 | 18,919 | 2.42 | ||||||||||||||||

TDR loans(2) | 14,717 | 677 | 6.15 | 11,492 | 293 | 3.41 | ||||||||||||||||

Nonperforming loans | — | — | — | 3,507 | 110 | 4.19 | ||||||||||||||||

Other income, net(3) | — | (795 | ) | — | — | (808 | ) | — | ||||||||||||||

Total loans | 23,695,378 | 765,925 | 4.32 | 22,271,571 | 750,169 | 4.50 | ||||||||||||||||

Cash, investments and time deposits | 749,508 | 7,986 | 1.42 | 666,755 | 5,905 | 1.18 | ||||||||||||||||

Total interest-earning assets | $ | 24,444,886 | $ | 773,911 | 4.23 | % | $ | 22,938,326 | $ | 756,074 | 4.40 | % | ||||||||||

Other assets, less allowance for loan losses | 634,590 | 836,066 | ||||||||||||||||||||

Total assets | $ | 25,079,476 | $ | 23,774,392 | ||||||||||||||||||

Liabilities: | ||||||||||||||||||||||

Short-term debt | $ | 3,209,128 | $ | 18,198 | 0.76 | % | $ | 3,084,884 | $ | 10,311 | 0.45 | % | ||||||||||

Medium-term notes | 3,353,107 | 73,456 | 2.93 | 3,395,871 | 62,745 | 2.47 | ||||||||||||||||

Collateral trust bonds | 7,255,745 | 255,582 | 4.71 | 6,805,318 | 248,410 | 4.88 | ||||||||||||||||

Long-term notes payable | 7,170,901 | 131,319 | 2.45 | 6,699,774 | 122,766 | 2.45 | ||||||||||||||||

Subordinated deferrable debt | 742,186 | 28,247 | 5.09 | 395,723 | 14,356 | 4.85 | ||||||||||||||||

Subordinated certificates | 1,438,578 | 44,672 | 4.15 | 1,463,180 | 45,425 | 4.15 | ||||||||||||||||

Total interest-bearing liabilities | $ | 23,169,645 | $ | 551,474 | 3.18 | % | $ | 21,844,750 | $ | 504,013 | 3.08 | % | ||||||||||

Other liabilities | 1,019,306 | 1,032,779 | ||||||||||||||||||||

Total liabilities | 24,188,951 | 22,877,529 | ||||||||||||||||||||

Total equity | 890,525 | 896,863 | ||||||||||||||||||||

Total liabilities and equity | $ | 25,079,476 | $ | 23,774,392 | ||||||||||||||||||

Net interest spread(4) | 1.05 | % | 1.32 | % | ||||||||||||||||||

Impact of non-interest bearing funding(5) | 0.17 | 0.15 | ||||||||||||||||||||

Net interest income/net interest yield(6) | $ | 222,437 | 1.22 | % | $ | 252,061 | 1.47 | % | ||||||||||||||

Adjusted net interest income/adjusted net interest yield: | ||||||||||||||||||||||

Interest income | $ | 773,911 | 4.23 | % | $ | 756,074 | 4.40 | % | ||||||||||||||

Interest expense | 551,474 | 3.18 | 504,013 | 3.08 | ||||||||||||||||||

Add: Net accrued periodic derivative cash settlements(7) | 64,331 | 0.82 | 65,285 | 0.88 | ||||||||||||||||||

Adjusted interest expense/adjusted average cost(8) | $ | 615,805 | 3.55 | % | $ | 569,298 | 3.48 | % | ||||||||||||||

Adjusted net interest spread(4) | 0.68 | % | 0.92 | % | ||||||||||||||||||

Impact of non-interest bearing funding | 0.18 | 0.17 | ||||||||||||||||||||

Adjusted net interest income/adjusted net interest yield(9) | $ | 158,106 | 0.86 | % | $ | 186,776 | 1.09 | % | ||||||||||||||

____________________________

(1)Interest income includes loan conversion fees, which are generally deferred and recognized in interest income using the effective interest method.

(2)Troubled debt restructuring (“TDR”) loans.

(3)Consists of late payment fees and net amortization of deferred loan fees and loan origination costs.

(4)Net interest spread represents the difference between the average yield on interest-earning assets and the average cost of interest-bearing funding. Adjusted net interest spread represents the difference between the average yield on interest-earning assets and the adjusted average cost of interest-bearing funding.

10

(5)Includes other liabilities and equity.

(6)Net interest yield is calculated based on annualized net interest income for the period divided by average interest-earning assets for the period.

(7)Represents the impact of net accrued periodic derivative cash settlements during the period, which is added to interest expense to derive non-GAAP adjusted interest expense. The average (benefit)/cost associated with derivatives is calculated based on the annualized net accrued periodic derivative cash settlements during the period divided by the average outstanding notional amount of derivatives during the period. The average outstanding notional amount of derivatives was $10,610 million and $10,082 million for the three months ended February 28, 2017 and February 29, 2016, respectively. The average outstanding notional amount of derivatives was $10,532 million and $9,930 million for the nine months ended February 28, 2017 and February 29, 2016, respectively.

(8)Adjusted interest expense represents interest expense plus net accrued derivative cash settlements during the period. Net accrued derivative cash settlements are reported on our consolidated statements of operations as a component of derivative gains (losses). Adjusted average cost is calculated based on annualized adjusted interest expense for the period divided by average interest-bearing funding during the period.

(9)Adjusted net interest yield is calculated based on annualized adjusted net interest income for the period divided by average interest-earning assets for the period.

Table 3 displays the change in our net interest income between periods and the extent to which the variance is attributable to: (i) changes in the volume of our interest-earning assets and interest-bearing liabilities or (ii) changes in the interest rates of these assets and liabilities. The table also presents the change in adjusted net interest income between periods.

11

Table 3: Rate/Volume Analysis of Changes in Interest Income/Interest Expense

Three Months Ended | Nine Months Ended | |||||||||||||||||||||||

February 28, 2017 versus February 29, 2016 | February 28, 2017 versus February 29, 2016 | |||||||||||||||||||||||

Variance due to:(1) | Variance due to:(1) | |||||||||||||||||||||||

(Dollars in thousands) | Total Variance | Volume | Rate | Total Variance | Volume | Rate | ||||||||||||||||||

Interest income: | ||||||||||||||||||||||||

Long-term fixed-rate loans | $ | 4,547 | $ | 9,336 | $ | (4,789 | ) | $ | 16,689 | $ | 45,538 | $ | (28,849 | ) | ||||||||||

Long-term variable-rate loans | (30 | ) | 495 | (525 | ) | (358 | ) | 1,265 | (1,623 | ) | ||||||||||||||

Line of credit loans | 203 | 739 | (536 | ) | (862 | ) | 718 | (1,580 | ) | |||||||||||||||

Restructured loans | 65 | 7 | 58 | 384 | 82 | 302 | ||||||||||||||||||

Nonperforming loans | (81 | ) | (81 | ) | — | (110 | ) | (110 | ) | — | ||||||||||||||

Other income, net | 49 | — | 49 | 13 | — | 13 | ||||||||||||||||||

Total loans | 4,753 | 10,496 | (5,743 | ) | 15,756 | 47,493 | (31,737 | ) | ||||||||||||||||

Cash, investments and time deposits | 1,534 | 457 | 1,077 | 2,081 | 727 | 1,354 | ||||||||||||||||||

Interest income | 6,287 | 10,953 | (4,666 | ) | 17,837 | 48,220 | (30,383 | ) | ||||||||||||||||

Interest expense: | ||||||||||||||||||||||||

Short-term debt | 3,520 | 444 | 3,076 | 7,887 | 405 | 7,482 | ||||||||||||||||||

Medium-term notes | 3,393 | (677 | ) | 4,070 | 10,711 | (847 | ) | 11,558 | ||||||||||||||||

Collateral trust bonds | 1,772 | 2,673 | (901 | ) | 7,172 | 16,198 | (9,026 | ) | ||||||||||||||||

Long-term notes payable | 2,517 | 2,063 | 454 | 8,553 | 8,512 | 41 | ||||||||||||||||||

Subordinated deferrable debt | 4,625 | 4,115 | 510 | 13,891 | 12,544 | 1,347 | ||||||||||||||||||

Subordinated certificates | (276 | ) | (35 | ) | (241 | ) | (753 | ) | (805 | ) | 52 | |||||||||||||

Interest expense | 15,551 | 8,583 | 6,968 | 47,461 | 36,007 | 11,454 | ||||||||||||||||||

Net interest income | $ | (9,264 | ) | $ | 2,370 | $ | (11,634 | ) | $ | (29,624 | ) | $ | 12,213 | $ | (41,837 | ) | ||||||||

Adjusted net interest income: | ||||||||||||||||||||||||

Interest income | $ | 6,287 | $ | 10,953 | $ | (4,666 | ) | $ | 17,837 | $ | 48,220 | $ | (30,383 | ) | ||||||||||

Interest expense | 15,551 | 8,583 | 6,968 | 47,461 | 36,007 | 11,454 | ||||||||||||||||||

Net accrued periodic derivative cash settlements(2) | (3,202 | ) | 984 | (4,186 | ) | (954 | ) | 3,893 | (4,847 | ) | ||||||||||||||

Adjusted interest expense(3) | 12,349 | 9,567 | 2,782 | 46,507 | 39,900 | 6,607 | ||||||||||||||||||

Adjusted net interest income | $ | (6,062 | ) | $ | 1,386 | $ | (7,448 | ) | $ | (28,670 | ) | $ | 8,320 | $ | (36,990 | ) | ||||||||

____________________________

(1)The changes for each category of interest income and interest expense are divided between the portion of change attributable to the variance in volume and the portion of change attributable to the variance in rate for that category. The amount attributable to the combined impact of volume and rate has been allocated to each category based on the proportionate absolute dollar amount of change for that category.

(2)For net accrued periodic derivative cash settlements, the variance due to average volume represents the change in derivative cash settlements resulting from the change in the average notional amount of derivative contracts outstanding. The variance due to average rate represents the change in derivative cash settlements resulting from the net difference between the average rate paid and the average rate received for interest rate swaps during the period.

(3)See “Non-GAAP Financial Measures” for additional information on our adjusted non-GAAP measures.

Net interest income of $73 million for the current quarter decreased by $9 million, or 11%, from the same prior-year quarter, driven by a decrease in net interest yield of 15% (21 basis points) to 1.19%, which was partially offset by an increase in average interest-earning assets of 6%. Net interest income of $222 million for the nine months ended February 28, 2017 decreased by $30 million, or 12%, from the same prior-year period, driven by a decrease in net interest yield of 17% (25 basis points) to 1.22%, which was partially offset by an increase in average interest-earning assets of 7%.

12

• | Average Interest-Earning Assets: The increase in average interest-earning assets for the current quarter and nine months ended February 28, 2017 was primarily attributable to growth in average total loans of $1,202 million, or 5% and $1,424 million, or 6%, respectively, over the same prior-year periods, as members refinanced with us loans made by other lenders and obtained advances to fund capital investments. |

• | Net Interest Yield: The decrease in the net interest yield for the current quarter and nine months ended February 28, 2017 reflects the combined impact of a decline in the average yield on interest-earning assets and an increase in our average cost of funds. The average yield on interest-earning assets declined by 11 basis points and 17 basis points during the current quarter and nine months ended February 28, 2017, respectively, to 4.22% and 4.23%, respectively. The decrease resulted from repayments on existing long-term loans with higher weighted-average fixed rates than the weighted-average fixed rates on new long-term loan advances, coupled with the repricing of higher-rate loans to lower fixed rates. Our average cost of funds increased by 12 basis points and 10 basis points, respectively, during the current quarter and nine months ended February 28, 2017 to 3.20% and 3.18%, respectively. This increase was largely attributable to a shift in our funding mix resulting from the replacement of a portion of our variable-rate debt with higher cost, longer-term debt to fund the growth in our loan portfolio and manage our refinancing risk. |

Adjusted net interest income of $54 million for the current quarter decreased by $6 million, or 10%, from the same prior-year quarter, driven by a decrease in the adjusted net interest yield of 15% (15 basis points) to 0.87%, which was partially offset by the increase in average interest-earning assets of 6%. Adjusted net interest income of $158 million for the nine months ended February 28, 2017 decreased by $29 million, or 15%, from the same prior-year period, driven by a decrease in the adjusted net interest yield of 21% (23 basis points) to 0.86%, which was partially offset by the increase in average interest-earning assets of 7%.

The decreases in the adjusted net interest yield in the current quarter and nine months ended February 28, 2017 from the same prior-year periods were attributable to the combined impact of the decline in the average yield on interest-earning assets and an increase in our adjusted average cost of funds.

Our adjusted net interest income and adjusted net interest yield include the impact of net accrued periodic derivative cash settlements during the period. We recorded net periodic derivative cash settlement expense of $19 million and $23 million for the three months ended February 28, 2017 and February 29, 2016, respectively, and $64 million and $65 million for the nine months ended February 28, 2017 and February 29, 2016, respectively. See “Non-GAAP Financial Measures” for additional information on our adjusted measures.

Provision for Loan Losses

Our provision for loan losses in each period is primarily driven by the level of allowance that we determine is necessary for probable incurred loan losses inherent in our loan portfolio as of each balance sheet date.

We recorded a provision for loan losses of $2 million for the three months ended February 28, 2017, compared with a benefit for loan losses of $2 million for the same prior-year period. We recorded a provision for loan losses of $5 million and $4 million for the nine months ended February 28, 2017 and February 29, 2016, respectively.

The unfavorable shift in the provision for loan losses of $4 million between the current quarter and the same prior-year quarter was primarily attributable to the increase in total loans outstanding, coupled with a slight deterioration in the credit quality of certain loans collectively evaluated for impairment during the current quarter. The increase in the provision for loan losses of $1 million for the nine months ended February 28, 2017 from the same prior year period was primarily due to the increase in the balance of total loans outstanding, which was partially offset by a decrease in the reserve for individually impaired loans.

We provide additional information on our allowance for loan losses under “Credit Risk—Allowance for Loan Losses” and “Note 4—Loans and Commitments” of this Report. For information on our allowance methodology, see “MD&A—Critical Accounting Policies and Estimates” and “Note 1—Summary of Significant Accounting Policies” in our 2016 Form 10-K.

13

Non-Interest Income

Non-interest income consists of fee and other income, gains and losses on derivatives not accounted for in hedge accounting relationships and results of operations of foreclosed assets.

We recorded non-interest income gains of $48 million and $209 million for the three and nine months ended February 28, 2017, respectively. In comparison, we recorded non-interest income losses of $236 million and $337 million for the three and nine months ended February 29, 2016, respectively. The significant variance in non-interest income for the three and nine months ended February 28, 2017 from the same prior-year periods were primarily attributable to changes in net derivative gains (losses) recognized in our consolidated statements of operations.

Derivative Gains (Losses)

Our derivative instruments are an integral part of our interest rate risk management strategy. Our principal purpose in using derivatives is to manage our aggregate interest rate risk profile within prescribed risk parameters. The derivative instruments we use primarily include interest rate swaps, which we typically hold to maturity. The primary factors affecting the fair value of our derivatives and derivative gains (losses) recorded in our results of operations include changes in interest rates, the shape of the yield curve and the composition of our derivative portfolio. We generally do not designate our interest rate swaps, which currently account for all of our derivatives, for hedge accounting. Accordingly, changes in the fair value of interest rate swaps are reported in our consolidated statements of operations under derivative gains (losses). We did not have any derivatives designated as accounting hedges as of February 28, 2017 or May 31, 2016.

We currently use two types of interest rate swap agreements: (i) we pay a fixed rate and receive a variable rate (“pay-fixed swaps”) and (ii) we pay a variable rate and receive a fixed rate (“receive-fixed swaps”). The benchmark rate for the substantial majority of the floating rate payments under our swap agreements is the London Interbank Offered Rate (“LIBOR”). Table 4 displays the average notional amount outstanding, by swap agreement type, and the weighted-average interest rate paid and received for derivative cash settlements during the three and nine months ended February 28, 2017 and February 29, 2016. As indicated in Table 4, our derivative portfolio currently consists of a higher proportion of pay-fixed swaps than receive-fixed swaps. The profile of our derivative portfolio may change as a result of changes in market conditions and actions taken to manage our interest rate risk.

Table 4: Derivative Average Notional Amounts and Average Interest Rates

Three Months Ended | ||||||||||||||||||||

February 28, 2017 | February 29, 2016 | |||||||||||||||||||

(Dollars in thousands) | Average Notional Balance | Weighted- Average Rate Paid | Weighted- Average Rate Received | Average Notional Balance | Weighted- Average Rate Paid | Weighted- Average Rate Received | ||||||||||||||

Pay-fixed swaps | $ | 6,389,187 | 2.89 | % | 0.97 | % | $ | 6,476,600 | 3.00 | % | 0.54 | % | ||||||||

Receive-fixed swaps | 4,220,667 | 1.40 | 2.68 | 3,601,198 | 0.94 | 2.93 | ||||||||||||||

Total | $ | 10,609,854 | 2.29 | % | 1.65 | % | $ | 10,077,798 | 2.25 | % | 1.41 | % | ||||||||

Nine Months Ended | ||||||||||||||||||||

February 28, 2017 | February 29, 2016 | |||||||||||||||||||

(Dollars in thousands) | Average Notional Balance | Weighted- Average Rate Paid | Weighted- Average Rate Received | Average Notional Balance | Weighted- Average Rate Paid | Weighted- Average Rate Received | ||||||||||||||

Pay-fixed swaps | $ | 6,673,175 | 2.91 | % | 0.82 | % | $ | 6,202,082 | 3.06 | % | 0.39 | % | ||||||||

Receive-fixed swaps | 3,858,890 | 1.24 | 2.75 | 3,728,197 | 0.85 | 3.01 | ||||||||||||||

Total | $ | 10,532,065 | 2.29 | % | 1.53 | % | $ | 9,930,279 | 2.22 | % | 1.38 | % | ||||||||

The average remaining maturity of our pay-fixed and receive-fixed swaps was 19 years and four years, respectively, as of February 28, 2017. In comparison, the average remaining maturity of our pay-fixed and receive-fixed swaps was 18 years and three years, respectively, as of February 29, 2016.

14

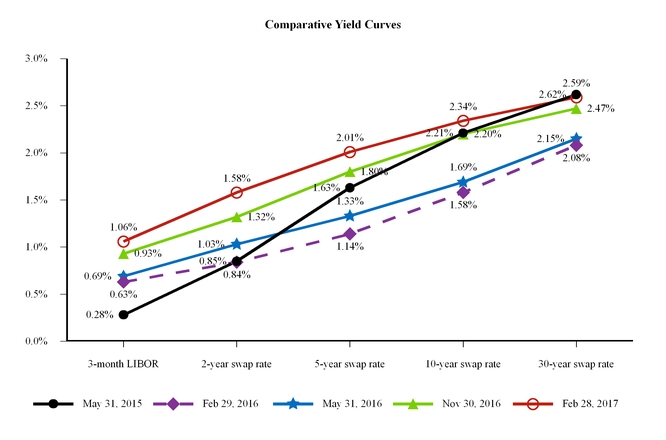

Pay-fixed swaps generally decrease in value as interest rates decline and increase in value as interest rates rise. In contrast, receive-fixed swaps generally increase in value as interest rates decline and decrease in value as interest rates rise. Because our pay-fixed and receive-fixed swaps are referenced to different maturity terms along the swap yield curve, different changes in the swap yield curve— parallel, flattening or steepening—will result in differences in the fair value of our derivatives. The chart below provides comparative swap yield curves as of the end of February 28, 2017, November 30, 2016, May 31, 2016, February 29, 2016 and May 31, 2015.

____________________________

Benchmark rates obtained from Bloomberg.

Table 5 presents the components of net derivative gains (losses) recorded in our condensed consolidated results of operations for the three and nine months ended February 28, 2017 and February 29, 2016. Derivative cash settlements represent the net interest amount accrued during the reporting period for interest-rate swap payments. The derivative forward value represents the change in fair value of our interest rate swaps during the reporting period due to changes in expected future interest rates over the remaining life of our derivative contracts.

Table 5: Derivative Gains (Losses)

Three Months Ended | Nine Months Ended | |||||||||||||||

(Dollars in thousands) | February 28, 2017 | February 29, 2016 | February 28, 2017 | February 29, 2016 | ||||||||||||

Derivative gains (losses) attributable to: | ||||||||||||||||

Derivative cash settlements | $ | (19,354 | ) | $ | (22,556 | ) | $ | (64,331 | ) | $ | (65,285 | ) | ||||

Derivative forward value gains (losses) | 61,809 | (220,480 | ) | 259,153 | (290,952 | ) | ||||||||||

Derivative gains (losses) | $ | 42,455 | $ | (243,036 | ) | $ | 194,822 | $ | (356,237 | ) | ||||||

15

The derivative gains of $42 million and $195 million recorded for the three and nine months ended February 28, 2017, respectively, were primarily attributable to a net increase in the fair value of our swaps due to an overall increase in interest rates, as depicted in the February 28, 2017 swap yield curve presented in the above chart.

The derivative losses of $243 million and $356 million recorded for the three and nine months ended February 29, 2016, respectively, were primarily attributable to a net decrease in the fair value of our swaps due to a flattening of the swap yield curve resulting from an increase in short-term interest rates and a decline in long-term interest rates.

See “Note 9—Derivative Instruments and Hedging Activities” for additional information on our derivative instruments.

Results of Operations of Foreclosed Assets

Results of operations of foreclosed assets consist of the operating results of entities controlled by CFC that hold foreclosed assets, impairment charges related to those entities and gains or losses related to the disposition of the entities.

As discussed above in “Executive Summary,” on July 1, 2016, the sale of CAH was completed. As a result, we did not carry any foreclosed assets on our consolidated balance sheet as of February 28, 2017. Our net proceeds at closing totaled $109 million, which represents the purchase price of $144 million less agreed-upon purchase price adjustments as of the closing date.

We recorded expense of less than $1 million for the current quarter and expense of $2 million for the nine months ended February 28, 2017 related to CAH. These amounts include the combined impact of adjustments recorded at the closing date of the sale of CAH, post-closing purchase price adjustments and certain legal costs incurred pertaining to CAH.

We recorded gains related to CAH of $1 million and $2 million for the three and nine months ended February 29, 2016, respectively. The gains recorded during the three and nine months ended February 29, 2016 were attributable to CAH valuation adjustments.

See “Note 5—Foreclosed Assets” in our 2016 Form 10-K for additional information on the sale of CAH.

Non-Interest Expense

Non-interest expense consists of salaries and employee benefit expense, general and administrative expenses, losses on early extinguishment of debt and other miscellaneous expenses.

We recorded non-interest expense of $21 million and $23 million for the three months ended February 28, 2017 and February 29, 2016, respectively, and $63 million and $67 million for the nine months ended February 28, 2017 and February 29, 2016, respectively. The decreases in non-interest expense of $2 million and $4 million for the three and nine months ended February 28, 2017, respectively, were primarily attributable to a reduction in other general and administrative expenses during the respective periods.

Net Income (Loss) Attributable to Noncontrolling Interests

Net income (loss) attributable to noncontrolling interests represents 100% of the results of operations of RTFC and NCSC, as the members of RTFC and NCSC own or control 100% of the interest in their respective companies. The fluctuations in net income (loss) attributable to noncontrolling interests are primarily due to fluctuations in the fair value of NCSC’s derivative instruments.

We recorded net income attributable to noncontrolling interests of less than $1 million during the three months ended February 28, 2017 and $2 million during the nine months ended February 28, 2017. In comparison, we recorded net losses attributable to noncontrolling interests of $1 million and $2 million for the three and nine months ended February 29, 2016, respectively. The variance in the results of operations of noncontrolling interests was due to fluctuations in the fair value of NCSC’s derivative instruments.

16

CONSOLIDATED BALANCE SHEET ANALYSIS |

Total assets of $25,610 million as of February 28, 2017 increased by $1,339 million, or 6%, from May 31, 2016, primarily due to growth in our loan portfolio. Total liabilities of $24,462 million as of February 28, 2017 increased by $1,009 million, or 4%, from May 31, 2016, primarily due to debt issuances to fund our loan portfolio growth. Total equity increased by $330 million to $1,147 million as of February 28, 2017. The increase in total equity for the nine months ended February 28, 2017 was primarily attributable to our reported net income of $361 million, which was partially offset by patronage capital retirements totaling $43 million.

Following is a discussion of changes in the major components of our assets and liabilities during the nine months ended February 28, 2017.

Loan Portfolio

We offer long-term fixed- and variable-rate loans and line of credit variable-rate loans. Under our long-term facilities, borrowers have the option of choosing a fixed or variable interest rate for periods of one to 35 years.

Loans Outstanding

Loans outstanding consist of advances from either new approved loans or from the unadvanced portion of loans previously approved. Table 6 summarizes total loans outstanding, by type and by member class, as of February 28, 2017 and May 31, 2016.

Table 6: Loans Outstanding by Type and Member Class

February 28, 2017 | May 31, 2016 | Increase/ | ||||||||||||||||

(Dollars in thousands) | Amount | % of Total | Amount | % of Total | (Decrease) | |||||||||||||

Loans by type:(1) | ||||||||||||||||||

Long-term loans: | ||||||||||||||||||

Long-term fixed-rate loans | $ | 22,066,751 | 91 | % | $ | 21,390,576 | 93 | % | $ | 676,175 | ||||||||

Long-term variable-rate loans | 925,267 | 4 | 757,500 | 3 | 167,767 | |||||||||||||

Total long-term loans(2) | 22,992,018 | 95 | 22,148,076 | 96 | 843,942 | |||||||||||||

Line of credit loans | 1,258,152 | 5 | 1,004,441 | 4 | 253,711 | |||||||||||||

Total loans outstanding(3) | $ | 24,250,170 | 100 | % | $ | 23,152,517 | 100 | % | $ | 1,097,653 | ||||||||

Loans by member class:(1) | ||||||||||||||||||

CFC: | ||||||||||||||||||

Distribution | $ | 18,690,627 | 77 | % | $ | 17,674,335 | 76 | % | $ | 1,016,292 | ||||||||

Power supply | 4,522,551 | 19 | 4,401,185 | 20 | 121,366 | |||||||||||||

Statewide and associate | 56,597 | — | 54,353 | — | 2,244 | |||||||||||||

CFC total(2) | 23,269,775 | 96 | 22,129,873 | 96 | 1,139,902 | |||||||||||||

RTFC | 363,006 | 1 | 341,842 | 1 | 21,164 | |||||||||||||

NCSC | 617,389 | 3 | 680,802 | 3 | (63,413 | ) | ||||||||||||

Total loans outstanding(3) | $ | 24,250,170 | 100 | % | $ | 23,152,517 | 100 | % | $ | 1,097,653 | ||||||||

____________________________

(1) Includes TDR loans.

(2) Includes long-term loans guaranteed by RUS totaling $169 million and $174 million as of February 28, 2017 and May 31, 2016, respectively, and long-term loans covered under the Farmer Mac standby purchase commitment agreement totaling $852 million and $926 million as of February 28, 2017 and May 31, 2016, respectively.

(3)Total loans outstanding represents the outstanding unpaid principal balance of loans. Unamortized deferred loan origination costs, which totaled $11 million and $10 million as of February 28, 2017 and May 31, 2016, respectively, are excluded from total loans outstanding. These costs, however, are included in loans to members reported on the condensed consolidated balance sheets.

17

Total loans outstanding of $24,250 million as of February 28, 2017 increased by $1,098 million, or 5%, from May 31, 2016. The increase was primarily due to increases in CFC distribution and power supply loans of $1,016 million and $121 million, respectively, which were largely attributable to member advances for capital investments and members refinancing with us loans made by other lenders.

We provide additional information on our loan product types in “Item 1. Business—Loan Programs” and “Note 4—Loans and Commitments” in our 2016 Form 10-K. See “Debt—Secured Borrowings” below for information on encumbered and unencumbered loans and “Credit Risk Management” for information on the credit risk profile of our loan portfolio.

Loan Retention Rate

Table 7 presents a comparison between the historical retention rate of CFC’s long-term fixed-rate loans that repriced during the nine months ended February 28, 2017 and loans that repriced during fiscal year 2016, and provides information on the percentage of borrowers that selected either another fixed-rate term or a variable rate. The retention rate is calculated based on the election made by the borrower at the repricing date. As indicated in Table 7, the average retention rate of CFC’s repriced loans has been 98% over the presented periods.

Table 7: Historical Retention Rate and Repricing Selection(1)

Nine Months Ended February 28, 2017 | Year Ended May 31, 2016 | |||||||||||||

(Dollars in thousands) | Amount | % of Total | Amount | % of Total | ||||||||||

Loans retained: | ||||||||||||||

Long-term fixed rate selected | $ | 658,626 | 83 | % | $ | 1,001,118 | 93 | % | ||||||

Long-term variable rate selected | 111,661 | 14 | 54,796 | 5 | ||||||||||

Loans repriced and sold by CFC | — | — | 4,459 | — | ||||||||||

Total loans retained by CFC | 770,287 | 97 | 1,060,373 | 98 | ||||||||||

Total loans repaid | 21,728 | 3 | 17,956 | 2 | ||||||||||

Total | $ | 792,015 | 100 | % | $ | 1,078,329 | 100 | % | ||||||

____________________________

(1)Does not include NCSC and RTFC loans.

Debt

We utilize both short-term and long-term borrowings as part of our funding strategy and asset/liability management. We seek to maintain diversified funding sources across products, programs and markets to manage funding concentrations and reduce our liquidity or debt roll-over risk. Our funding sources include a variety of secured and unsecured debt securities in a wide range of maturities to our members and affiliates and in the capital markets.

Debt Outstanding

Table 8 displays the composition, by product type, of our outstanding debt as of February 28, 2017 and May 31, 2016. Table 8 also displays the composition of our debt based on several additional selected attributes.

18

Table 8: Total Debt Outstanding

(Dollars in thousands) | February 28, 2017 | May 31, 2016 | Increase/ (Decrease) | |||||||||

Debt product type: | ||||||||||||

Commercial paper: | ||||||||||||

Members, at par | $ | 944,111 | $ | 848,007 | $ | 96,104 | ||||||

Dealer, net of discounts | 1,039,734 | 659,935 | 379,799 | |||||||||

Total commercial paper | 1,983,845 | 1,507,942 | 475,903 | |||||||||

Select notes to members | 711,455 | 701,849 | 9,606 | |||||||||

Daily liquidity fund notes to members | 494,752 | 525,959 | (31,207 | ) | ||||||||

Collateral trust bonds | 7,406,021 | 7,253,096 | 152,925 | |||||||||

Guaranteed Underwriter Program notes payable | 4,997,613 | 4,777,111 | 220,502 | |||||||||

Farmer Mac notes payable | 2,624,228 | 2,303,123 | 321,105 | |||||||||

Medium-term notes: | ||||||||||||

Members, at par | 613,363 | 654,058 | (40,695 | ) | ||||||||

Dealer, net of discounts | 2,773,932 | 2,648,369 | 125,563 | |||||||||

Total medium-term notes | 3,387,295 | 3,302,427 | 84,868 | |||||||||

Other notes payable | 37,170 | 40,944 | (3,774 | ) | ||||||||

Subordinated deferrable debt | 742,241 | 742,212 | 29 | |||||||||

Members’ subordinated certificates: | ||||||||||||

Membership subordinated certificates | 629,982 | 630,063 | (81 | ) | ||||||||

Loan and guarantee subordinated certificates | 569,529 | 593,701 | (24,172 | ) | ||||||||

Member capital securities | 221,097 | 220,046 | 1,051 | |||||||||

Total members’ subordinated certificates | 1,420,608 | 1,443,810 | (23,202 | ) | ||||||||

Total debt outstanding | $ | 23,805,228 | $ | 22,598,473 | $ | 1,206,755 | ||||||

Security type: | ||||||||||||

Unsecured debt | 37 | % | 37 | % | ||||||||

Secured debt | 63 | 63 | ||||||||||

Total | 100 | % | 100 | % | ||||||||

Funding source: | ||||||||||||

Members | 18 | % | 18 | % | ||||||||

Private placement: | ||||||||||||

Guaranteed Underwriter Program notes payable | 21 | 21 | ||||||||||

Farmer Mac notes payable | 11 | 10 | ||||||||||

Other | — | 1 | ||||||||||

Total private placement | 32 | 32 | ||||||||||

Capital markets | 50 | 50 | ||||||||||

Total | 100 | % | 100 | % | ||||||||

Interest rate type: | ||||||||||||

Fixed-rate debt | 74 | % | 74 | % | ||||||||

Variable-rate debt | 26 | 26 | ||||||||||

Total | 100 | % | 100 | % | ||||||||

Interest rate type, including the impact of swaps: | ||||||||||||

Fixed-rate debt(1) | 83 | % | 88 | % | ||||||||

Variable-rate debt(2) | 17 | 12 | ||||||||||

Total | 100 | % | 100 | % | ||||||||

Maturity classification:(3) | ||||||||||||

Short-term borrowings | 14 | % | 13 | % | ||||||||

Long-term and subordinated debt(4) | 86 | 87 | ||||||||||

Total | 100 | % | 100 | % | ||||||||

19

____________________________

(1) Includes variable-rate debt that has been swapped to a fixed rate net of any fixed-rate debt that has been swapped to a variable rate.

(2) Includes fixed-rate debt that has been swapped to a variable rate net of any variable-rate debt that has been swapped to a fixed rate. Also includes commercial paper notes, which generally have maturities of less than 90 days. The interest rate on commercial paper notes does not change once the note has been issued; however, the rates on new commercial paper notes change daily.

(3) Borrowings with an original contractual maturity of one year or less are classified as short-term borrowings. Borrowings with an original contractual maturity of greater than one year are classified as long-term debt.

(4) Consists of long-term debt, subordinated deferrable debt and total members’ subordinated debt reported on the condensed consolidated balance sheets. Maturity classification is based on the original contractual maturity as of the date of issuance of the debt.

Our outstanding debt volume generally increases and decreases in response to member loan demand. As outstanding loan balances increased during the nine months ended February 28, 2017, our debt volume also increased. Total debt outstanding was $23,805 million as of February 28, 2017, an increase of $1,207 million, or 5%, from May 31, 2016. The increase was primarily attributable to a net increase in commercial paper outstanding of $476 million, a net increase in notes payable under the note purchase agreements with Farmer Mac of $321 million, a net increase in notes payable under the Guaranteed Underwriter Program of $221 million, a net increase in collateral trust bonds of $153 million and a net increase in medium-term notes of $85 million. Significant financing-related developments during the nine months ended February 28, 2017 are summarized below.

• | On August 30, 2016, we received an advance of $100 million, with a 20-year final maturity, under the Guaranteed Underwriter Program. |

• | On November 1, 2016, we issued $300 million aggregate principal amount of 1.50% dealer medium-term notes due 2019, as part of our strategy in managing and reducing the refinancing risk associated with the near-term maturity of long-term debt in the fourth quarter of fiscal year 2017. |

• | On November 18, 2016, we amended and restated the three-year and five-year committed bank revolving line of credit agreements to extend the maturity dates to November 19, 2019 and November 19, 2021, respectively, and to terminate certain third-party bank commitments. See “Note 6—Short-Term Borrowings” for additional information. |

• | On December 1, 2016, we closed a $375 million Series L committed loan facility from the Federal Financing Bank guaranteed by RUS pursuant to the Guaranteed Underwriter Program. |

• | On February 7, 2017, we issued $450 million aggregate principal amount of 2.95% collateral trust bonds due 2024. |