Attached files

| file | filename |

|---|---|

| EX-95.1 - Royal Energy Resources, Inc. | ex95-1.htm |

| EX-32.2 - Royal Energy Resources, Inc. | ex32-2.htm |

| EX-32.1 - Royal Energy Resources, Inc. | ex32-1.htm |

| EX-31.2 - Royal Energy Resources, Inc. | ex31-2.htm |

| EX-31.1 - Royal Energy Resources, Inc. | ex31-1.htm |

| EX-23.4 - Royal Energy Resources, Inc. | ex23-4.htm |

| EX-23.3 - Royal Energy Resources, Inc. | ex23-3.htm |

| EX-23.2 - Royal Energy Resources, Inc. | ex23-2.htm |

| EX-23.1 - Royal Energy Resources, Inc. | ex23-1.htm |

| EX-21 - Royal Energy Resources, Inc. | ex21.htm |

| EX-10.30 - Royal Energy Resources, Inc. | ex10-30.htm |

| EX-3.3 - Royal Energy Resources, Inc. | ex3-3.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2016 | |

| or | |

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to | |

Commission file number: 000-52547

Royal Energy Resources, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

11-3480036 (I.R.S. Employer Identification No.) |

| 56

Broad Street, Suite 2 Charleston, SC (Address of principal executive offices) |

29401 (Zip Code) |

Registrant’s telephone number, including area code: (843) 900-7693

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.00001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [X] | Non-accelerated

filer [ ] (Do not check if a smaller reporting company) |

Smaller reporting company [ ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

As of June 30, 2016, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the registrant’s equity held by non-affiliates of the registrant was approximately $91,808,202 based on the closing price of the registrant’s common stock on the OTC Bulletin Board on such date. As of March 20, 2017, the registrant had 17,184,095 shares of common stock and 51,000 shares of Series A Convertible Preferred Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Documents incorporated by reference in this report are listed in the Exhibit Index of this Form 10-K.

TABLE OF CONTENTS

| i |

GLOSSARY OF KEY TERMS

ash: Inorganic material consisting of iron, alumina, sodium and other incombustible matter that are contained in coal. The composition of the ash can affect the burning characteristics of coal.

assigned reserves: Proven and probable reserves that have the permits and infrastructure necessary for mining.

as received: Represents an analysis of a sample as received at a laboratory.

Btu: British thermal unit, or Btu, is the amount of heat required to raise the temperature of one pound of water one degree Fahrenheit.

Central Appalachia: Coal producing area in eastern Kentucky, western Virginia and southern West Virginia.

coal seam: Coal deposits occur in layers typically separated by layers of rock. Each layer is called a “seam.” A seam can vary in thickness from inches to a hundred feet or more.

coke: A hard, dry carbon substance produced by heating coal to a very high temperature in the absence of air. Coke is used in the manufacture of iron and steel.

fossil fuel: A hydrocarbon such as coal, petroleum or natural gas that may be used as a fuel.

GAAP: Generally accepted accounting principles in the United States.

high-vol metallurgical coal: Metallurgical coal that has a volatility content of 32% or greater of its total weight.

Illinois Basin: Coal producing area in Illinois, Indiana and western Kentucky.

limestone: A rock predominantly composed of the mineral calcite (calcium carbonate (CaCO3)).

lignite: The lowest rank of coal. It is brownish-black with high moisture content commonly above 35% by weight and heating value commonly less than 8,000 Btu.

low-vol metallurgical coal: Metallurgical coal that has a volatility content of 17% to 22% of its total weight.

mid-vol metallurgical coal: Metallurgical coal that has a volatility content of 23% to 31% of its total weight.

Metallurgical, or “met”, coal: The various grades of coal suitable for carbonization to make coke for steel manufacture. Its quality depends on four important criteria: volatility, which affects coke yield; the level of impurities including sulfur and ash, which affects coke quality; composition, which affects coke strength; and basic characteristics, which affect coke oven safety. Metallurgical coal typically has a particularly high Btu but low ash and sulfur content.

net mineral acre: The product of (i) the percentage of oil and natural gas mineral rights owned in a given tract of land and (ii) the total surface acreage of such tract.

non-reserve coal deposits: Non-reserve coal deposits are coal-bearing bodies that have been sufficiently sampled and analyzed in trenches, outcrops, drilling and underground workings to assume continuity between sample points, and therefore warrant further exploration stage work. However, this coal does not qualify as a commercially viable coal reserve as prescribed by standards of the SEC until a final comprehensive evaluation based on unit cost per ton, recoverability and other material factors concludes legal and economic feasibility. Non-reserve coal deposits may be classified as such by either limited property control or geologic limitations, or both.

Northern Appalachia: Coal producing area in Maryland, Ohio, Pennsylvania and northern West Virginia.

overburden: Layers of earth and rock covering a coal seam. In surface mining operations, overburden is removed prior to coal extraction.

| ii |

preparation plant: Usually located on a mine site, although one plant may serve several mines. A preparation plant is a facility for crushing, sizing and washing coal to prepare it for use by a particular customer. The washing process separates higher ash coal and may also remove some of the coal’s sulfur content.

probable (indicated) coal reserves: Coal reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation.

proven (measured) coal reserves: Coal reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established.

reclamation: The process of restoring land to its prior condition, productive use or other permitted condition following mining activities. The process commonly includes “re-contouring” or reshaping the land to its approximate original contour, restoring topsoil and planting native grass and shrubs. Reclamation operations are typically conducted concurrently with mining operations, but the majority of reclamation costs are incurred once mining operations cease. Reclamation is closely regulated by both state and federal laws.

recompletion: The process of re-entering an existing wellbore that is either producing or not producing and completing new oil and natural gas reservoirs in an attempt to establish or increase existing production.

reserve: That part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination.

steam coal: Coal used by power plants and industrial steam boilers to produce electricity, steam or both. It generally is lower in Btu heat content and higher in volatile matter than metallurgical coal.

sulfur: One of the elements present in varying quantities in coal that contributes to environmental degradation when coal is burned. Sulfur dioxide (SO2) is produced as a gaseous by-product of coal combustion.

surface mine: A mine in which the coal lies near the surface and can be extracted by removing the covering layer of soil overburden. Surface mines are also known as open-pit mines.

tons: A “short” or net ton is equal to 2,000 pounds. A “long” or British ton is 2,240 pounds. A “metric” tonne is approximately 2,205 pounds. The short ton is the unit of measure referred to in this report.

Western Bituminous region: Coal producing area located in western Colorado and eastern Utah.

| iii |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This report contains “forward-looking statements.” Statements included in this report that are not historical facts, that address activities, events or developments that we expect or anticipate will or may occur in the future, including things such as statements regarding our future financial position, expectations with respect to our liquidity, capital resources and ability to continue as a going concern, plans for growth of the business, future capital expenditures, references to future goals or intentions or other such references are forward-looking statements. These statements can be identified by the use of forward-looking terminology, including “may,” “believe,” “expect,” “anticipate,” “estimate,” “continue,” or similar words. These statements are made by us based on our past experience and our perception of historical trends, current conditions and expected future developments as well as other considerations we believe are reasonable as and when made. Whether actual results and developments in the future will conform to our expectations is subject to numerous risks and uncertainties, many of which are beyond our control. Therefore, actual outcomes and results could materially differ from what is expressed, implied or forecast in these statements. Known material factors that could cause our actual results to differ from those in the forward-looking statements are those described in “Part 1, Item 1A. Risk Factors.” The following factors are among those that may cause actual results to differ materially from our forward-looking statements:

| ● | our ability to maintain adequate cash flow and to obtain additional financing necessary to fund our capital expenditures, meet working capital needs and maintain and grow our operations or our ability to obtain alternative financing upon the expiration of our amended and restated senior secured credit facility and our related ability to continue as a going concern; | |

| ● | our future levels of indebtedness and compliance with debt covenants; | |

| ● | sustained depressed levels or further declines in coal prices, which depend upon several factors such as the supply of domestic and foreign coal, the demand for domestic and foreign coal, governmental regulations, price and availability of alternative fuels for electricity generation and prevailing economic conditions; | |

| ● | declines in demand for electricity and coal; | |

| ● | current and future environmental laws and regulations, which could materially increase operating costs or limit our ability to produce and sell coal; | |

| ● | extensive government regulation of mine operations, especially with respect to mine safety and health, which imposes significant actual and potential costs; | |

| ● | difficulties in obtaining and/or renewing permits necessary for operations; | |

| ● | a variety of operating risks, such as unfavorable geologic conditions, adverse weather conditions and natural disasters, mining and processing equipment unavailability, failures and unexpected maintenance problems and accidents, including fire and explosions from methane; | |

| ● | poor mining conditions resulting from the effects of prior mining; | |

| ● | the availability and costs of key supplies and commodities such as steel, diesel fuel and explosives; | |

| ● | fluctuations in transportation costs or disruptions in transportation services, which could increase competition or impair our ability to supply coal; | |

| ● | a shortage of skilled labor, increased labor costs or work stoppages; | |

| ● | our ability to secure or acquire new or replacement high-quality coal reserves that are economically recoverable; | |

| ● | material inaccuracies in our estimates of coal reserves and non-reserve coal deposits; |

| iv |

| ● | existing and future laws and regulations regulating the emission of sulfur dioxide and other compounds, which could affect coal consumers and reduce demand for coal; | |

| ● | federal and state laws restricting the emissions of greenhouse gases; | |

| ● | our ability to acquire or failure to maintain, obtain or renew surety bonds used to secure obligations to reclaim mined property; | |

| ● | our dependence on a few customers and our ability to find and retain customers under favorable supply contracts; | |

| ● | changes in consumption patterns by utilities away from the use of coal, such as changes resulting from low natural gas prices; | |

| ● | changes in governmental regulation of the electric utility industry; | |

| ● | defects in title in properties that we own or losses of any of our leasehold interests; | |

| ● | our ability to retain and attract senior management and other key personnel; | |

| ● | material inaccuracy of assumptions underlying reclamation and mine closure obligations; and | |

| ● | weakness in global economic conditions. |

Readers are cautioned not to place undue reliance on forward-looking statements. The forward-looking statements speak only as of the date made, and we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

| v |

Unless the context clearly indicates otherwise, references in this report to “Royal,” “we,” “our,” “us” or similar terms refer to Royal Energy Resources, Inc. and its subsidiaries. Unless the context clearly indicates otherwise, references in this report to “Rhino” or “the Partnership” or similar terms refer to Rhino Resource Partners, LP and its subsidiaries.

We were originally organized in Delaware on March 22, 1999, with the name Webmarketing, Inc. (“Webmarketing”). On July 7, 2004, we revived our charter and changed our name from Webmarketing to World Marketing, Inc. In December 2007, we changed our name to Royal Energy Resources, Inc.

Prior to March 2015, we pursued gold, silver, copper and rare earth metals mining concessions in Romania and mining leases in the United States. We engaged in these activities through two subsidiaries, Development Resources, Inc., a Delaware corporation, and S.C. Golden Carpathian Resources S.R.L., a Romanian subsidiary (collectively, the “Subsidiaries”). Effective January 31, 2015, we entered into a Subsidiaries Option Agreement with Jacob Roth, our chairman and chief executive officer at that time. Under the Subsidiaries Option Agreement, we conveyed all of our assets to the Subsidiaries, to the extent any assets were not already owned by the Subsidiaries. The Subsidiaries Option Agreement also granted Mr. Roth an option to acquire the Subsidiaries for 49,000 shares of Series A Preferred Stock owned by Mr. Roth. The Subsidiaries Option Agreement also granted us a put option to acquire 49,000 shares of Series A Preferred Stock owned by Mr. Roth in consideration for the Subsidiaries. Both options could be exercised at any time within 45 days after closing of the stock purchase agreement among Mr. Roth, E-Starts Money Co. and William Tuorto.

On March 6, 2015, E-Starts Money Co. (“E-Starts”) acquired an aggregate of 7,188,560 shares of common stock from two holders. At the same time, William Tuorto acquired 810,316 shares of common stock from Mr. Roth, and 51,000 shares of Mr. Roth’s Series A Preferred Stock. Mr. Tuorto controls E-Starts. As a result, Mr. Tuorto became the beneficial owner of 7,998,876 shares of common stock (representing 92.3% of the outstanding common stock at that time) and 51% of the outstanding shares of Series A Preferred Stock. In connection with these transactions: (i) Frimet Taub resigned as a director and from all positions as an officer, employee, or independent contractor of us; (ii) Mr. Tuorto was appointed to the board seat vacated by Ms. Taub; (iii) Mr. Roth resigned as chairman of the board and Mr. Tuorto was appointed chairman of the board; (iv) Mr. Roth resigned as the Chief Executive Officer and Chief Financial Officer of us, and any other position as an officer, employee or independent contractor of us, and Mr. Tuorto was appointed as the Chief Executive Officer, Interim Chief Financial Officer, Secretary and Treasurer; and (v) Mr. Roth resigned as a director of us, provided that his resignation was not effective until the close of business on the 10th day after we distributed an information statement to its shareholders in accordance with SEC Rule 14f-1.

Since acquiring control of us, Mr. Tuorto has repositioned us to focus on the acquisition of natural resources assets, including coal, oil, gas and renewable energy, seeking to acquire high quality assets at distressed pricing in today’s fragmented energy markets. To that effect, we have entered into the following initial transactions:

| ● | On April 17, 2015, we completed the acquisition of all issued and outstanding membership units of Blaze Minerals, LLC, a West Virginia limited liability company (“Blaze Minerals”), from Wastech, Inc. Blaze Minerals’ sole asset consists of 40,976 net acres of coal and coal-bed methane mineral rights, located across 22 counties in West Virginia (the “Mineral Rights”). We acquired Blaze Minerals by the issuance of 2,803,621 shares of common stock. The shares were valued at $7,009,053 based upon a per share value of $2.50 per share, which was the price at which we issued our common stock in a private placement at the time. | |

| ● | On April 20, 2015, we exercised the put option to acquire the remaining 49,000 shares of Series A Preferred Stock owned by Mr. Roth in consideration for the Subsidiaries. As a result, Mr. Tuorto became the sole owner of all outstanding shares of Series A Preferred Stock, and we ceased to be in the business of pursuing gold, silver, copper and rare earth metals mining concessions in Romania. | |

| ● | On May 14, 2015, we entered into an Option Agreement to acquire substantially all the assets of Wellston Coal, LLC (“Wellston”) for 500,000 shares of common stock. We paid a nominal sum for the option and had the right to complete the purchase through September 1, 2015 (which was later extended to December 31, 2016). Wellston owns approximately 1,600 acres of surface and 2,200 acres of mineral rights in McDowell County, West Virginia. We planned to close on the acquisition of Wellston after the satisfactory completion of due diligence on the assets and operations. On September 13, 2016, Wellston sold its assets to an unrelated third party, and we received a royalty of $1 per ton on the first 250,000 tons of coal mined from the property in consideration for a release of our lien on Wellston’s assets. |

| 1 |

| ● | On May 29, 2015, we entered into an Option Agreement with Blaze Energy Corp. (“Blaze Energy”) to acquire all of the membership units of Blaze Mining Company, LLC (“Blaze Mining”), which is a wholly-owned subsidiary of Blaze Energy. Under the Option Agreement, as amended, we had the right to complete the purchase through March 31, 2016 by the issuance of 1,272,858 shares of the Company’s common stock and payment of $250,000 in cash. Blaze Mining controlled operations for and had the right to acquire 100% ownership of the Alpheus Coal Impoundment reclamation site in McDowell County, West Virginia under a contract with Gary Partners, LLC, which owned the property. On February 22, 2016, we facilitated a series of transactions wherein: (i) Blaze Mining and Blaze Energy entered into an Asset Purchase Agreement to acquire substantially all of the assets of Gary Partners, LLC; (ii) Blaze Mining entered into an Assignment Agreement to assign its rights under the Asset Purchase Agreement to a third party; and (iii) we and Blaze Energy entered into an Option Termination Agreement, as amended, whereby the following royalties granted to Blaze Mining under the Assignment Agreement were assigned to us: a $1.25 per ton royalty on raw coal or coal refuse mined or removed from the property, and a $1.75 per ton royalty on processed or refined coal or coal refuse mined or removed from the property (the “Royalties”). Pursuant to the Option Termination Agreement, the parties thereby agreed to terminate the Option Agreement by the issuance of 1,750,000 shares of our common stock to Blaze Energy in consideration for the payment by Blaze Energy of $350,000 to us and the assignment by Blaze Mining of the Royalties to us. The transactions closed on March 22, 2016. Pursuant to an Advisory Agreement with East Coast Management Group, LLC (“ECMG”), we agreed to compensate ECMG $200,000 in cash; $0.175 of the $1.25 royalty on raw coal or coal refuse; and $0.25 of the $1.75 royalty on processed or refined coal for its services in facilitating the Option Termination Agreement. | |

| ● | On June 10, 2015, we completed the acquisition of Blue Grove Coal, LLC (“Blue Grove”) and entered into an agreement to acquire G.S. Energy, LLC (“GS Energy”). GS Energy owns and leases approximately 6,000 acres of mineral rights in McDowell County, West Virginia. Blue Grove is an affiliate company of GS Energy and is the operator of the mine. We acquired Blue Grove by the issuance of 350,000 shares of common stock (which amount was later reduced to 10,000 shares by an amendment). We initially agreed to acquire GS Energy by the issuance of common shares with a market value of $9,600,000 on the date of closing, subject to a minimum and maximum number of shares of 1,250,000 and 1,750,000, respectively; however, the agreement was terminated in December 2015. We are still in discussions to acquire GS Energy. | |

| ● | As described in more detail below, we acquired control of the Partnership on March 17, 2016. | |

| ● | We are currently evaluating a number of additional coal mining assets for acquisition, including expanding and balancing our portfolio in the thermal coal space. |

Acquisition of Rhino GP, LLC and Rhino Resource Partners, LLC

On January 21, 2016, we entered into a Securities Purchase Agreement (the “Purchase Agreement”) with Wexford Capital, LP, and certain of its affiliates (collectively, “Wexford”), under which we agreed to purchase, and Wexford agreed to sell, a controlling interest in the Partnership in two separate transactions. Pursuant to the Purchase Agreement, in an initial closing, we purchased 676,912 common units of the Partnership from three holders for total consideration of $3,500,000. The common units purchased by us represented approximately 40.0% of the issued and outstanding common units of the Partnership and 23.1% of the total outstanding common units and subordinated units. The subordinated units are convertible into common units on a one for one basis upon the occurrence of certain conditions.

At a second closing held on March 17, 2016, we purchased all of the membership interest of Rhino GP, LLC (“Rhino GP”), and 945,526 subordinated units of the Partnership from two holders thereof, for aggregate consideration of $1,000,000. The subordinated units purchased by us represented approximately 76.5% of the issued and outstanding subordinated units of the Partnership, and when combined with the common units already owned by us, resulted in us owning approximately 55.4% of the outstanding Units of the Partnership. Rhino GP is the general partner of the Partnership, and in that capacity controls the Partnership.

| 2 |

On March 21, 2016, we entered into a Securities Purchase Agreement (the “SPA”) with the Partnership, under which we purchased 6,000,000 newly issued common units of the Partnership for $1.50 per common unit, for a total investment in the Partnership of $9,000,000. Closing under the SPA occurred on March 22, 2016. We paid a cash payment of $2,000,000 and issued a promissory note in the amount of $7,000,000 to the Partnership, which was payable without interest on the following schedule: $3,000,000 on or before July 31, 2016; $2,000,000 on or before September 30, 2016; and $2,000,000 on or before December 31, 2016. On May 13, 2016 and September 30, 2016, we paid the Partnership $3.0 million and $2.0 million, respectively, for the promissory note installments that were due July 31, 2016 and September 30, 2016, respectively. On December 30, 2016, we and the Partnership agreed to extend the maturity date of the final installment of the note to December 31, 2018, and agreed that the note may be converted, at our option, at any time prior to December 31, 2018, into unregistered shares of our common stock at a price per share equal to seventy five percent (75%) of the volume weighted average closing price for the ninety (90) trading days preceding the date of conversion, provided that the average closing price shall be no less than $3.50 per share and no more than $7.50 per share.

Yorktown Transactions

On September 30, 2016, we entered into an Equity Exchange Agreement with the Partnership, Yorktown Partners LLC (“Yorktown”), Resources Partners Holdings, LLC (“Rhino Holdings”), an entity wholly-owned by Yorktown, and Rhino GP. The Equity Exchange Agreement provided that Yorktown would cause investment partnerships it controls to contribute their shares of common stock of Armstrong Energy, Inc. (“Armstrong”) to Rhino Holdings and Rhino Holdings would contribute those shares to the Partnership in exchange for 10 million newly issued common units of the Partnership. The Agreement also contemplated that Rhino GP would issue a 50% ownership of Rhino GP to Rhino Holdings.

On December 30, 2016, we entered into an Option Agreement with the Partnership, Rhino Holdings, Yorktown, and Rhino GP. Upon execution of the Option Agreement, the Partnership received an option (the “Call Option”) from Rhino Holdings to acquire all of the shares of common stock of Armstrong Energy that are currently owned by investment partnerships managed by Yorktown (the “Armstrong Shares”), which currently represents approximately 97% of the outstanding common stock of Armstrong Energy. Armstrong Energy is a coal producing company with approximately 554 million tons of proven and probable reserves and six mines located in the Illinois Basin in western Kentucky as of September 30, 2016. The Option Agreement stipulates that the Partnership can exercise the Call Option no earlier than January 1, 2018 and no later than December 31, 2019. In exchange for Rhino Holdings granting the Partnership the Call Option, the Partnership issued 5.0 million common units (the “Call Option Premium Units”) to Rhino Holdings upon the execution of the Option Agreement. The Option Agreement stipulates the Partnership can exercise the Call Option and purchase the Armstrong Shares in exchange for a number of common units to be issued to Rhino Holdings, which when added with the Call Option Premium Units, will result in Rhino Holdings owning 51% of the fully diluted common units of the Partnership (determined without considering any common units issuable upon conversion of subordinated units or Series A Preferred Units of the Partnership). The purchase of the Armstrong Shares through the exercise of the Call Option would also require us to transfer a 51% ownership interest in Rhino GP to Rhino Holdings. The Partnership’s ability to exercise the Call Option is conditioned upon (i) sixty (60) days having passed since the entry by Armstrong Energy into an agreement with its bondholders to restructure its bonds and (ii) the amendment of the Partnership’s revolving credit facility to permit the acquisition of Armstrong Energy. The percentage ownership of Armstrong Energy represented by the Armstrong Shares as of the date the Call Option is exercised is subject to dilution based upon the terms under which Armstrong Energy restructures its indebtedness, the terms of which have not been determined.

The Option Agreement also contains an option (the “Put Option”) granted by the Partnership to Rhino Holdings whereby Rhino Holdings has the right, but not the obligation, to cause the Partnership to purchase the Armstrong Shares from Rhino Holdings under the same terms and conditions discussed above for the Call Option. The exercise of the Put Option is dependent upon (i) the entry by Armstrong into an agreement with its bondholders to restructure its bonds and (ii) the termination and repayment of any outstanding balance under the Partnership’s revolving credit facility. In the event either the Partnership or Rhino GP fail to perform their obligations in the event Rhino Holdings exercises the Put Option, then Rhino Holdings and the Partnership each have the right to terminate the Option Agreement, in which event no party thereto shall have any liability to any other party under the Option Agreement, although Rhino Holdings shall be allowed to retain the Call Option Premium Units.

The Option Agreement contains customary covenants, representations and warranties and indemnification obligations for losses arising from the inaccuracy of representations or warranties or breaches of covenants contained in the Option Agreement and the GP Amendment (defined below). The Partnership has entered into a non-disclosure agreement with Armstrong Energy under which it has inspection rights with regard to the books, records and operations of Armstrong Energy, and the Option Agreement provides that those rights shall continue until the Call Option or Put Option are exercised or expire. Upon the request by Rhino Holdings, the Partnership will also enter into a registration rights agreement that provides Rhino Holdings with the right to demand two shelf registration statements and registration statements on Form S-1, as well as piggyback registration rights for as long as Rhino Holdings owns at least 10% of the outstanding common units.

| 3 |

Pursuant to the Option Agreement, Rhino GP amended its Second Amended and Restated Limited Liability Company Agreement (“GP Amendment”). Pursuant to the GP Amendment, Mr. Bryan H. Lawrence was appointed to the board of directors of Rhino GP as a designee of Rhino Holdings and Rhino Holdings has the right to appoint an additional independent director. Rhino Holdings has the right to appoint two members to the Rhino GP board of directors for as long as it continues to own 20% of the common units on an undiluted basis. The GP Amendment also provided Rhino Holdings with the authority to consent to any delegation of authority to any committee of Rhino GP’s board. Upon the exercise of the Call Option or the Put Option, the Second Amended and Restated Limited Liability Company Agreement of Rhino GP, as amended, will be further amended to provide that Royal and Rhino Holdings will each have the ability to appoint three directors, and that the remaining director will be the chief executive officer of Rhino GP unless agreed otherwise.

Transactions with Weston Energy, LLC

First Weston Loan

On September 30, 2016, we entered into a Secured Promissory Note and a Pledge and Security Agreement with Weston Energy, LLC (“Weston”), under which we borrowed $2,000,000 from Weston (the “Loan”). Weston is an affiliate of Yorktown. The Loan bears interest at 8% per annum. All principal and accrued interest was originally due and payable on December 31, 2016. The Loan is payable, at our option of the Company, either in cash or in common units of the Partnership (“Rhino Units”). In the event we elect to pay the Loan in Rhino Units, the number of Rhino Units that will be conveyed to satisfy the Loan will be equal to Loan balance divided by 80% of the average of the high and low price of the Partnership’s common units for the twenty trading days prior to the date of payment. The proceeds of the Loan were used to make an installment payment of $2,000,000 due to the Partnership on September 30, 2016.

On December 30, 2016, Weston contributed the Loan to the Partnership in payment for 200,000 shares of Series A Preferred Stock issued by the Partnership at $10 per unit. We simultaneously entered into a letter agreement with the Partnership which extended the maturity date of the Loan to December 31, 2018, and provided that the Loan may be converted, at our option, at any time prior to December 31, 2018, into unregistered shares of our common stock at a price per share equal to seventy five percent (75%) of the volume weighted average closing price for the ninety (90) trading days preceding the date of conversion, provided that the such average closing price shall be no less than $3.50 per share and no more than $7.50 per share.

Second Weston Loan

On December 30, 2016, we entered into a second Secured Promissory Note and a Pledge and Security Agreement with Weston, under which we borrowed $2.0 million from Weston (the “Second Loan”). The Second Loan bears interest at 8% per annum. All principal and accrued interest was due and payable on January 15, 2017. The Loan was payable, at the option of Royal, either in cash or Rhino Units. In the event Royal elected to pay the Second Loan in Rhino Units, the number of Rhino Units that would be conveyed to satisfy the Second Loan would be equal to Second Loan balance divided by 80% of the average of the high and low price of the Partnership’s common units for the twenty trading days prior to the date of payment. The proceeds of the Second Loan were used to make an investment of $2.0 million in Series A Preferred Units of the Partnership on December 30, 2016.

On January 27, 2017, we sold the 2.0 million in Series A Preferred Units for their purchase price, and used the proceeds to repay the Second Loan in full.

About Rhino

History

The Partnership’s predecessor was formed in April 2003 by Wexford Capital. The Partnership was formed in April 2010 to own and control the coal properties and related assets owned by Rhino Energy LLC. On October 5, 2010, the Partnership completed its IPO. Its common units were originally listed on the New York Stock Exchange under the symbol “RNO”. In connection with the IPO, Wexford contributed their membership interests in Rhino Energy LLC to the Partnership, and in exchange the Partnership issued subordinated units and common units to Wexford and issued incentive distribution rights to Rhino GP, its general partner.

| 4 |

Since the formation of the Partnership’s predecessor in April 2003, it has completed numerous coal asset acquisitions with a total purchase price of approximately $357.5 million. Through these acquisitions and coal lease transactions, it has substantially increased its proven and probable coal reserves and non-reserve coal deposits. In addition, it has successfully grown its production through internal development projects. In addition to its coal acquisitions, in 2011 it began to invest in oil and natural gas assets and operations.

The Partnership is managed by the board of directors and executive officers of Rhino GP. Its operations are conducted through, and its operating assets are owned by its wholly owned subsidiary, Rhino Energy LLC, and its subsidiaries.

Current Operations

The Partnership is a diversified energy limited partnership formed in Delaware that is focused on coal and energy related assets and activities, including energy infrastructure investments. The Partnership produces, processes and sells high quality coal of various steam and metallurgical grades from multiple coal producing basins in the United States. The Partnership markets its steam coal primarily to electric utility companies as fuel for their steam powered generators. Customers for its metallurgical coal are primarily steel and coke producers who use its coal to produce coke, which is used as a raw material in the steel manufacturing process. Its business includes investments in joint ventures to provide for the transportation of hydrocarbons and drilling support services in the Utica Shale region. The Partnership has also invested in joint ventures that provide sand for fracking operations to drillers in the Utica Shale region and other oil and natural gas basins in the United States.

The Partnership has a geographically diverse asset base with coal reserves located in Central Appalachia, Northern Appalachia, the Illinois Basin and the Western Bituminous region. As of December 31, 2016, it controlled an estimated 256.9 million tons of proven and probable coal reserves, consisting of an estimated 203.5 million tons of steam coal and an estimated 53.4 million tons of metallurgical coal. In addition, as of December 31, 2016, it controlled an estimated 196.5 million tons of non-reserve coal deposits. Both its estimated proven and probable coal reserves and non-reserve coal deposits as of December 31, 2016 decreased when compared to the estimated tons and deposits reported as of December 31, 2015 due to the sale of its Elk Horn coal leasing business in August 2016. As part of the recent audits of its coal reserves and deposits performed by Marshall Miller & Associates, Inc., this outside expert performed an independent pro forma economic analysis using industry-accepted guidelines and this was used, in part, to classify tonnage as either proven and probable coal reserves or non-reserve coal deposits, based on current market conditions.

The Partnership operates underground and surface mines located in Kentucky, Ohio, West Virginia and Utah. The number of mines that it operates will vary from time to time depending on a number of factors, including the existing demand for and price of coal, depletion of economically recoverable reserves and availability of experienced labor. In the third quarter of 2015, it temporarily idled a majority of its Central Appalachia operations due to ongoing weak coal market conditions for met and steam coal produced from this region. The Partnership resumed mining operations at all of its Central Appalachia operations in 2016 to fulfill customer contracts that it secured for 2016 and 2017.

For the year ended December 31, 2016, the Partnership produced and sold approximately 3.3 million tons of coal.

The Partnership’s principal business strategy is to safely, efficiently and profitably produce and sell both steam and metallurgical coal from its diverse asset base in order to resume, and, over time, increase its quarterly cash distributions. In addition, it continues to seek opportunities to expand and diversify its operations through strategic acquisitions, including the acquisition of long-term, cash generating natural resource assets. We believe that such assets will allow the Partnership to grow its cash available for distribution and enhance stability of its cash flow.

The Partnership’s common units currently trade on the OTCQB Marketplace under the symbol “RHNO.” The Partnership’s common units previously traded on the NYSE until December 17, 2015, when the NYSE suspended trading after the Partnership failed to maintain an average global market capitalization over a consecutive 30 trading-day period of at least $15 million for its common units. The Partnership is exploring the possibility of listing its common units on the NASDAQ Stock Market (“NASDAQ”), pending its capability to meet the NASDAQ initial listing standards.

| 5 |

Current Liquidity and Outlook of Rhino

As of December 31, 2016, the Partnership’s available liquidity was $13.0 million, including cash on hand of $0.1 million and $12.9 million available under its amended and restated credit agreement. On May 13, 2016, the Partnership entered into a fifth amendment (the “Fifth Amendment”) of its amended and restated agreement that initially extended the term of the senior secured credit facility to July 31, 2017. Per the Fifth Amendment, the term of the credit facility automatically extended to December 31, 2017 when the revolving credit commitments were reduced to $55 million or less as of December 31, 2016. The Fifth Amendment also immediately reduced the revolving credit commitments under the credit facility to a maximum of $75 million and maintained the amount available for letters of credit at $30 million. As of December 31, 2016, the Partnership met the requirements to extend the maturity date of the credit facility to December 31, 2017. In December 2016, the Partnership entered into a seventh amendment of its amended and restated credit agreement (the “Seventh Amendment”). The Seventh Amendment immediately reduced the revolving credit commitments by $11.0 million to a maximum of $55 million and provides for additional revolving credit commitment reductions of $2.0 million each on June 30, 2017 and September 30, 2017. The Seventh Amendment further reduces the revolving credit commitments over time on a dollar-for-dollar basis for the net cash proceeds received from any asset sales after the Seventh Amendment date once the aggregate net cash proceeds received exceeds $2.0 million. For more information about its amended and restated credit agreement, please read “Part 1, Item 1-- Recent Developments-Amendments to Amended and Restated Credit Agreement.”

Since the Partnership’s credit facility has an expiration date of December 2017, we determined that its credit facility debt liability of $10.0 million at December 31, 2016 should be classified as a current liability on our consolidated balance sheet. The classification of the Partnership’s our credit facility balance as a current liability raises substantial doubt of our ability to continue as a going concern for the next twelve months. The Partnership is also considering alternative financing options that could result in a new long-term credit facility. However, the Partnership may be unable to complete such a transaction on terms acceptable to us or at all. If the Partnership is unable to extend the expiration date of the Partnership’s amended and restated credit facility, it will have to secure alternative financing to replace the credit facility by the expiration date of December 31, 2017 in order to continue its business operations. If the Partnership is unable to extend the expiration date of the Partnership’s amended and restated credit facility or secure a replacement facility, it will lose a primary source of liquidity, and it may not be able to generate adequate cash flow from operations to fund its business, including amounts that may become due under its credit facility. Furthermore, although met coal prices and demand have improved in recent months, if weak demand and low prices for steam coal persist and if met coal prices and demand weaken, the Partnership may not be able to continue to give the required representations or meet all of the covenants and restrictions included in its credit facility. If the Partnership violates any of the covenants or restrictions in its amended and restated credit agreement, including the maximum leverage ratio, some or all of its indebtedness may become immediately due and payable, and its lenders’ commitment to make further loans to it may terminate. If the Partnership is unable to give a required representation or it violates a covenant or restriction, then it will need a waiver from its lenders in order to continue to borrow under its amended and restated credit agreement. Although we believe the Partnership’s lenders loans are well secured under the terms of its amended and restated credit agreement, there is no assurance that the lenders would agree to any such waiver. Failure to obtain financing or to generate sufficient cash flow from operations could cause the Partnership to further curtail our operations and reduce its spending and to alter its business plan. The Partnership may also be required to consider other options, such as selling additional assets or merger opportunities, and depending on the urgency of its liquidity constraints, it may be required to pursue such an option at an inopportune time. If the Partnership is not able to fund its liquidity requirements for the next twelve months, it may not be able to continue as a going concern. For more information about our liquidity and the Partnership’s credit facility, please read “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations —Liquidity and Capital Resources.”

| 6 |

The Partnership continues to take measures, including the suspension of cash distributions on its common and subordinated units and cost and productivity improvements, to enhance and preserve its liquidity so that it can fund its ongoing operations and necessary capital expenditures and meet its financial commitments and debt service obligations.

Recent Developments - Rhino

Fourth Amended and Restated Partnership Agreement of Limited Partnership

On December 30, 2016, Rhino GP amended the Partnership’s partnership agreement to create, authorize and issue the Series A preferred units. The Series A preferred units are a new class of equity security that rank senior to all classes or series of its equity securities with respect to distribution rights and rights upon liquidation. The holders of the Series A preferred units shall be entitled to receive annual distributions equal to the greater of (i) 50% of the CAM Mining free cash flow (as defined below) and (ii) an amount equal to the number of outstanding Series A preferred units multiplied by $0.80. “CAM Mining free cash flow” is defined in its partnership agreement as (i) the total revenue of its Central Appalachia business segment, minus (ii) the cost of operations (exclusive of depreciation, depletion and amortization) for its Central Appalachia business segment, minus (iii) an amount equal to $6.50, multiplied by the aggregate number of met coal and steam coal tons sold by the Partnership from its Central Appalachia business segment. If the Partnership fails to pay any or all of the distributions in respect of the Series A preferred units, such deficiency will accrue until paid in full and it will not be permitted to pay any distributions on its partnership interests that rank junior to the Series A preferred units, including its common units. The Series A preferred units will be liquidated in accordance with their capital accounts and upon liquidation will be entitled to distributions of property and cash in accordance with the balances of their capital accounts prior to such distributions to equity securities that rank junior to the Series A preferred units.

The Series A preferred units vote on an as-converted basis with the common units, and the Partnership is restricted from taking certain actions without the consent of the holders of a majority of the Series A preferred units, including: (i) the issuance of additional Series A preferred units, or securities that rank senior or equal to the Series A preferred units; (ii) the sale or transfer of CAM Mining or a material portion of its assets; (iii) the repurchase of common units, or the issuance of rights or warrants to holders of common units entitling them to purchase common units at less than fair market value; (iv) consummation of a spin off; (v) the incurrence, assumption or guaranty of indebtedness for borrowed money in excess of $50.0 million except indebtedness relating to entities or assets that are acquired by the Partnership or its affiliates that is in existence at the time of such acquisition or (vi) the modification of CAM Mining’s accounting principles or the financial or operational reporting principles of its Central Appalachia business segment, subject to certain exceptions.

Series A Preferred Unit Purchase Agreement

On December 30, 2016, the Partnership entered into a Series A Preferred Unit Purchase Agreement (the “Preferred Unit Agreement”) with Weston, an entity wholly owned by certain investment partnerships managed by Yorktown, and Royal. Under the Preferred Unit Agreement, Weston and Royal agreed to purchase 1,300,000 and 200,000, respectively, of Series A preferred units representing limited partner interests in the Partnership at a price of $10.00 per Series A preferred unit. The Series A preferred units have the preferences, rights and obligations set forth in the Partnership’s Fourth Amended and Restated Agreement of Limited Partnership, which is described below. In exchange for the Series A preferred units, Weston and Royal paid cash of $11.0 million and $2.0 million, respectively, to the Partnership, and Weston assigned to the Partnership a $2.0 million note receivable from Royal originally dated September 30, 2016 (the “Weston Promissory Note”).

The Preferred Unit Agreement contains customary representations, warrants and covenants, which include among other things, that, for as long as the Series A preferred units are outstanding, the Partnership will cause CAM Mining, LLC, one of its subsidiaries, (“CAM Mining”) to conduct its business in the ordinary course consistent with past practice and use reasonable best efforts to maintain and preserve intact its current organization, business and franchise and to preserve the rights, franchises, goodwill and relationships of its employees, customers, lenders, suppliers, regulators and others having business relationships with CAM Mining.

The Preferred Unit Agreement stipulates that upon the request of the holder of the majority of the Partnership’s common units following their conversion from Series A preferred units, the Partnership will enter into a registration rights agreement with such holder. Such majority holder has the right to demand two shelf registration statements and registration statements on Form S-1, as well as piggyback registration rights.

On January 27, 2017, we sold 100,000 of our Series A preferred units to Weston and the other 100,000 Series A preferred units to another third party.

| 7 |

Elk Horn Coal Leasing Disposition

In August 2016, the Partnership entered into an agreement to sell its Elk Horn coal leasing company to a third party for total cash consideration of $12.0 million. The Partnership received $10.5 million in cash consideration upon the closing of the Elk Horn transaction and the remaining $1.5 million of consideration will be paid in ten equal monthly installments of $150,000 on the 20th of each calendar month beginning on September 20, 2016. Elk Horn is a coal leasing company located in eastern Kentucky that provided us with coal royalty revenues from coal properties owned by Elk Horn and leased to third-party operators.

Amended and Restated Credit Agreement Amendments

On March 17, 2016, the Partnership’s Operating Company, as borrower, and the Partnership and certain of its subsidiaries, as guarantors, entered into a fourth amendment (the “Fourth Amendment”) of its Amended and Restated Credit Agreement. The Fourth Amendment amended the definition of change of control in the Amended and Restated Credit Agreement to permit Royal to purchase the membership interests of its general partner.

On May 13, 2016, the Partnership entered into the Fifth Amendment of the Amended and Restated Credit Agreement (“Fifth Amendment”), which extended the term to July 31, 2017.

In July 2016, the Partnership entered into a sixth amendment (the “Sixth Amendment”) of its amended and restated senior secured credit facility that permitted the sale of Elk Horn that was discussed earlier.

In December, 2016, the Partnership entered into a seventh amendment of its amended and restated credit agreement (the “Seventh Amendment”). The Seventh Amendment allows for the Series A preferred units discussed above. The Seventh Amendment immediately reduces the revolving credit commitments by $11.0 million and provides for additional revolving credit commitment reductions of $2.0 million each on June 30, 2017 and September 30, 2017. A condition precedent to the effectiveness of the Seventh Amendment was the receipt of the $13.0 million of cash proceeds received by us from the issuance of the Series A preferred units discussed above, which was used to repay outstanding borrowings under the revolving credit facility. Per the Seventh Amendment, the receipt of $13.0 million cash proceeds fulfills the required Royal equity contributions as outlined in the previous amendments to its credit agreement. (See “—Liquidity and Capital Resources—Amended and Restated Credit Agreement” for further details on the debt amendments).

| 8 |

Distribution Suspension

Pursuant to its partnership agreement, the Partnership’s common units accrue arrearages every quarter when the distribution level is below the minimum level of $4.45 per unit. For each of the quarters ended September 30, 2014, December 31, 2014 and March 31, 2015, the Partnership announced cash distributions per common unit at levels lower than the minimum quarterly distribution. Beginning with the quarter ended June 30, 2015 and continuing through the quarter ended December 31, 2016, the Partnership has suspended the cash distribution on its common units. The Partnership has not paid any distribution on its subordinated units for any quarter after the quarter ended March 31, 2012. The distribution suspension and prior reductions were the result of prolonged weakness in the coal markets, which has continued to adversely affect its cash flow, as well as covenants in its loan agreement that prevent it from making distributions on its units. The inability of the Partnership to make distributions on its common units could impact Royal’s cash flow while it lacks other revenue generating operations.

Coal Operations

Mining and Leasing Operations

As of December 31, 2016, the Partnership operated two mining complexes located in Central Appalachia (Tug River and Rob Fork). In the third quarter of 2015, the Partnership temporarily idled a majority of its Central Appalachia operations due to ongoing weak coal market conditions for met and steam coal produced from this region. The Partnership resumed mining operations at all of its Central Appalachia operations in 2016 to fulfill customer contracts that it secured for 2016 and 2017.

In addition, the Partnership operated two mining complexes located in Northern Appalachia (Hopedale and Sands Hill). In the Western Bituminous region, the Partnership operated one mining complex located in Emery and Carbon Counties, Utah (Castle Valley). During 2014, the Partnership developed a new mining complex in the Illinois Basin, its Riveredge mine at its Pennyrile mining complex, which began production in mid-2014. The Pennyrile complex consists of one underground mine, a preparation plant and river loadout facility.

The Partnership defines a mining complex as a central location for processing raw coal and loading coal into railroad cars or trucks for shipment to customers. These mining complexes include seven active preparation plants and/or loadouts, each of which receive, blend, process and ship coal that is produced from one or more of its active surface and underground mines. All of the preparation plants are modern plants that have both coarse and fine coal cleaning circuits.

| 9 |

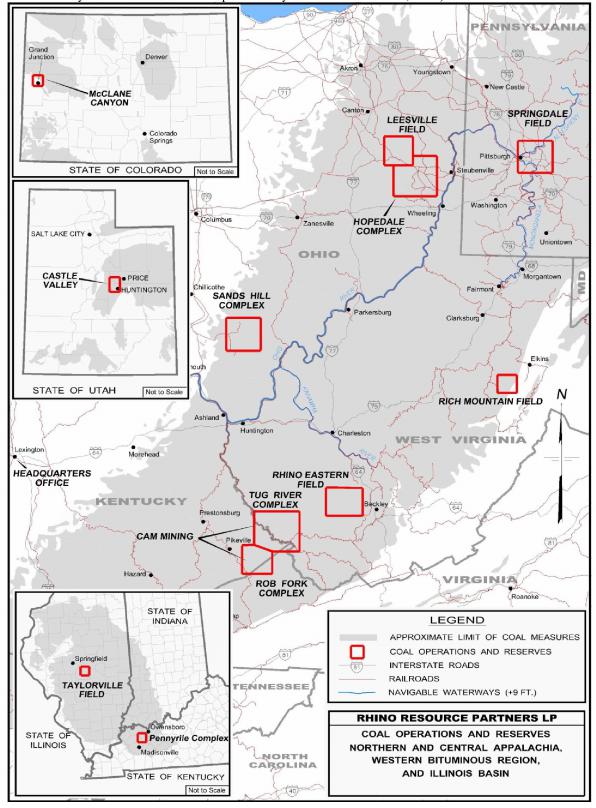

The following map shows the location of its coal mining and leasing operations as of December 31, 2016 (Note: the McClane Canyon mine in Colorado was permanently idled at December 31, 2013):

| 10 |

The Partnership’s surface mines include area mining and contour mining. These operations use truck and wheel loader equipment fleets along with large production tractors and shovels. The Partnership’s underground mines utilize the room and pillar mining method. These operations generally consist of one or more single or dual continuous miner sections which are made up of the continuous miner, shuttle cars, roof bolters, feeder and other support equipment. The Partnership currently owns most of the equipment utilized in its mining operations. The Partnership employs preventive maintenance and rebuild programs to ensure that its equipment is modern and well-maintained. The rebuild programs are performed either by an on-site shop or by third-party manufacturers.

The following table summarizes the Partnership’s mining complexes and production by region as of December 31, 2016.

| Region | Preparation Plants and Loadouts | Transportation to Customers(1) | Number and Type of Active Mines(2) | Tons

Produced for the Year Ended December 31, 2016 (3) | ||||||

| (in million tons) | ||||||||||

| Central Appalachia | ||||||||||

| Tug River Complex (KY, WV) | Tug Fork & Jamboree(4) | Truck, Barge, Rail (NS) | 2S | 0.4 | ||||||

| Rob Fork Complex (KY) | Rob Fork | Truck, Barge, Rail (CSX) | 1U,1S | 0.3 | ||||||

| Northern Appalachia | ||||||||||

| Hopedale Complex (OH) | Nelms | Truck, Rail (OHC, WLE) | 1U | 0.3 | ||||||

| Sands Hill Complex (OH) | Sands Hill(5) | Truck, Barge | 1S | 0.1 | ||||||

| Illinois Basin | ||||||||||

| Taylorville Field (IL) | n/a | Rail (NS) | — | — | ||||||

| Pennyrile Complex (KY) | Preparation plant & river loadout | Barge | 1U | 1.3 | ||||||

| Western Bituminous | ||||||||||

| Castle Valley Complex (UT) | Truck loadout | Truck | 1U | 0.9 | ||||||

| McClane Canyon Mine (CO)(6) | n/a | Truck | — | — | ||||||

| Total | 4U,4S | 3.3 | ||||||||

| (1) | NS = Norfolk Southern Railroad; CSX = CSX Railroad; OHC = Ohio Central Railroad; WLE = Wheeling & Lake Erie Railroad. |

| (2) | Numbers indicate the number of active mines. U = underground; S = surface. All of its mines as of December 31, 2016 were company-operated. |

| (3) | Total production based on actual amounts and not rounded amounts shown in this table. |

| (4) | Jamboree includes only a loadout facility. |

| (5) | Includes only a preparation plant. |

| (6) | The McClane Canyon mine was permanently idled as of December 31, 2013. |

Central Appalachia. For the year ended December 31, 2016, the Partnership operated two mining complexes located in Central Appalachia consisting of one active underground mine and three surface mines. For the year ended December 31, 2016, the mines at its Tug River and Rob Fork mining complexes produced an aggregate of approximately 0.4 million tons of steam coal and an estimated 0.3 million tons of metallurgical coal.

Tug River Mining Complex. The Partnership’s Tug River mining complex is located in Kentucky and West Virginia bordering the Tug River. This complex produces coal from two surface mines, which includes one high-wall mining unit. Coal production from these operations is delivered to the Tug Fork preparation plant for processing and then transported by truck to the Jamboree rail loadout for blending and shipping. Coal suitable for direct-ship to customers is delivered by truck directly to the Jamboree rail loadout from the mine sites. The Tug Fork plant is a modern, 350 tons per hour preparation plant utilizing heavy media circuitry that is capable of cleaning coarse and fine coal size fractions. The Jamboree loadout is located on the Norfolk Southern Railroad and is a modern unit train, batch weigh loadout. This mining complex produced approximately 0.3 million tons of steam coal and approximately 0.1 million tons of metallurgical coal for the year ended December 31, 2016.

| 11 |

Rob Fork Mining Complex. The Partnership’s Rob Fork mining complex is located in eastern Kentucky and produces coal from one surface mine and one underground mine. The Rob Fork mining complex is located on the CSX Railroad and consists of a modern preparation plant utilizing heavy media circuitry that is capable of cleaning coarse and fine coal size fractions and a unit train loadout with batch weighing equipment. The mining complex has significant blending capabilities allowing the blending of raw coals with washed coals to meet a wide variety of customers’ needs. The Rob Fork mining complex produced approximately 0.1 million tons of steam coal and 0.2 million tons of metallurgical coal for the year ended December 31, 2016.

Northern Appalachia. For the year ended December 31, 2016, the Partnership operated two mining complexes located in Northern Appalachia consisting of one underground mine and two surface mines.

Hopedale Mining Complex. The Hopedale mining complex includes an underground mine located in Hopedale, Ohio approximately five miles northeast of Cadiz, Ohio. Coal produced from the Hopedale mine is first cleaned at its Nelms preparation plant located on the Ohio Central Railroad and the Wheeling & Lake Erie Railroad and then shipped by train or truck to its customers. The infrastructure includes a full-service loadout facility. This underground mining operation produced approximately 0.3 million tons of steam coal for the year ended December 31, 2016.

Sands Hill Mining Complex. The Partnership currently operates one surface mine at its Sands Hill mining complex, located near Hamden, Ohio, and it permanently idled the second surface mine at this complex during the second half of 2016. The infrastructure includes a preparation plant along with a river front barge and dock facility on the Ohio River. The Sands Hill mining complex produced approximately 0.1 million tons of steam coal and approximately 0.4 million tons of limestone aggregate for the year ended December 31, 2016. Coal mining at its Sands Hill complex will cease during the first quarter of 2017 as market conditions for coal from this complex have continued to be weak. The Partnership will continue its limestone aggregate business at the Sands Hill complex for the next twelve to eighteen months as it has enough limestone inventory to process and sell for this time period. For the year ended December 31, 2016, these mines produced an aggregate of approximately 0.4 million tons of steam coal.

Western Bituminous Region. The Partnership operates one mining complex in the Western Bituminous region that produces coal from an underground mine located in Emery and Carbon Counties, Utah. The Partnership also had one underground mine located in the Western Bituminous region in Colorado (McClane Canyon) that was permanently idled at the end of 2013.

Castle Valley Mining Complex. The Partnership’s Castle Valley mining complex includes one underground mine located in Emery and Carbon Counties, Utah and includes coal reserves and non-reserve coal deposits, underground mining equipment and infrastructure, an overland belt conveyor system, a loading facility and support facilities. The Partnership produced approximately 0.9 million tons of steam coal from one underground mine at this complex for the year ended December 31, 2016.

Illinois Basin. In May 2012, the Partnership completed the purchase of certain rights to coal leases and surface property that is contiguous to the Green River and located in Daviess and McLean counties in western Kentucky where it constructed a new underground mining complex. The coal leases and property are contiguous to the Green River. The property is fully permitted and provides us with access to Illinois Basin coal that is adjacent to a navigable waterway, which could allow for exports to non-U.S. customers.

Pennyrile Mining Complex. In mid-2014, it completed the initial construction of a new underground mining operation on the purchased property, referred to as its Pennyrile mining complex, which includes one underground mine, a preparation plant and river loadout facility. Production from this underground mine began in mid-2014 and it produced approximately 1.3 million tons for the year ended December 31, 2016. The Partnership believes the possibility exists to expand production up to 2.0 million tons per year with further development of the mine at the Pennyrile complex. The Partnership has long-term sales contracts with local electric utility customers and it has other potential customers that it believes could lead to additional long-term sales agreements if it can successfully expand its production capacity at this operation.

| 12 |

Other Non-Mining Operations

In addition to its mining operations, the Partnership operates several subsidiaries which provide auxiliary services for its coal mining operations. Rhino Trucking provides its southeastern Ohio coal operations with reliable transportation to its customers where rail is not available. Rhino Services is responsible for mine-related construction, site and roadway maintenance and post-mining reclamation. Through Rhino Services, the Partnership plans and monitors each phase of its mining projects as well as the post-mining reclamation efforts. The Partnership also performs the majority of its drilling and blasting activities at its surface mines in-house rather than contracting to a third party.

Other Natural Resource Assets - Rhino

Oil and Natural Gas

In addition to its coal operations, the Partnership has invested in oil and natural gas assets and operations.

In September 2014, the Partnership made an initial investment of $5.0 million in a new joint venture, Sturgeon Acquisitions LLC (“Sturgeon”), with affiliates of Wexford Capital and Gulfport Energy (“Gulfport”). Sturgeon subsequently acquired 100% of the outstanding equity interests of certain limited liability companies located in Wisconsin that provide frac sand for oil and natural gas drillers in the United States. The Partnership accounts for the investment in this joint venture and results of operations under the equity method. The Partnership recorded its proportionate portion of the operating (losses)/gains for this investment during the nine months ended December 31, 2016 of approximately ($0.2 ) million.

In November 2014, the Partnership contributed its investment interest in a joint venture, Muskie Proppant LLC (“Muskie”) with affiliates of Wexford Capital that was formed to provide sand for fracking operations to drillers in the Utica Shale Region and other oil and natural gas basins in the United States to Mammoth Energy Partners LP (“Mammoth”) in return for a limited partner interest in Mammoth. Mammoth was formed to provide services to companies, which engage in the exploration and development of North American onshore unconventional oil and natural gas reserves. Mammoth provides services that include completion and production services, contract land and directional drilling services and remote accommodation services. The non-cash transaction was a contribution of its investment interest in the Muskie entity for an investment interest in Mammoth. Thus, the Partnership determined that the non-cash exchange of its ownership interest in Muskie did not result in any gain or loss. In October 2016, the Partnership contributed its limited partner interests in Mammoth to Mammoth Energy Services, Inc. (“Mammoth Inc.”) in exchange for 234,300 shares of common stock of Mammoth Inc. The common stock of Mammoth Inc. began trading on the NASDAQ Global Select Market in October 2016 under the ticker symbol TUSK and the Partnership sold 1,953 shares during the initial public offering of Mammoth Inc. and received proceeds of approximately $27,000. The Partnership’s remaining shares of Mammoth Inc. are subject to a 180 day lock-up period from the date of Mammoth Inc.’s initial public offering. As of December 31, 2016, the Partnership recorded a fair market value adjustment of $1.6 million for the available-for-sale investment, which was recorded in other comprehensive income. The Partnership has included its investment in Mammoth and its prior investment in Muskie in its Other category for segment reporting purposes.

Limestone

Incidental to its coal mining process, the Partnership mines limestone from reserves located at its Sands Hill mining complex and sell it as aggregate to various construction companies and road builders that are located in close proximity to the mining complex when market conditions are favorable. The Partnership believes that its production of limestone will provide us with an additional source of revenues at low incremental capital cost for the next twelve to eighteen months.

Coal Customers - Rhino

General

The Partnership’s primary customers for its steam coal are electric utilities, and the metallurgical coal the Partnership produces is sold primarily to domestic and international steel producers. For the year ended December 31, 2016, approximately 90.0% of its coal sales tons consisted of steam coal and approximately 10.0% consisted of metallurgical coal. For the year ended December 31, 2016, approximately 83.0% of its coal sales tons that the Partnership produced were sold to electric utilities. The majority of its electric utility customers purchase coal for terms of one to three years, but it also supplies coal on a spot basis for some of its customers. For the year ended December 31, 2016, the Partnership derived approximately 87.4% of its total coal revenues from sales to its ten largest customers, with affiliates of its top three customers accounting for approximately 48.5% of its coal revenues for that period: PPL Corporation (26.2%); PacificCorp Energy (12.2%); and Big Rivers (10.1%).

| 13 |

Coal Supply Contracts

For the year ended December 31, 2016, approximately 90% of the Partnership’s aggregate coal tons sold were sold through supply contracts. The Partnership expects to continue selling a significant portion of its coal under supply contracts. As of December 31, 2016, the Partnership had commitments under supply contracts to deliver annually scheduled base quantities as follows:

| Year | Tons (in thousands) | Number of customers | ||||||

| 2017 | 3,669 | 14 | ||||||

| 2018 | 701 | 5 | ||||||

Some of the contracts have sales price adjustment provisions, subject to certain limitations and adjustments, based on a variety of factors and indices.

Quality and volumes for the coal are stipulated in coal supply contracts, and in some instances buyers have the option to vary annual or monthly volumes. Most of the Partnership’s coal supply contracts contain provisions requiring it to deliver coal within certain ranges for specific coal characteristics such as heat content, sulfur, ash, hardness and ash fusion temperature. Failure to meet these specifications can result in economic penalties, suspension or cancellation of shipments or termination of the contracts. Some of its contracts specify approved locations from which coal may be sourced. Some of its contracts set out mechanisms for temporary reductions or delays in coal volumes in the event of a force majeure, including events such as strikes, adverse mining conditions, mine closures, or serious transportation problems that affect it or unanticipated plant outages that may affect the buyers.

The terms of its coal supply contracts result from competitive bidding procedures and extensive negotiations with customers. As a result, the terms of these contracts, including price adjustment features, price re-opener terms, coal quality requirements, quantity parameters, permitted sources of supply, future regulatory changes, extension options, force majeure, termination and assignment provisions, vary significantly by customer.

Transportation

The Partnership ships coal to its customers by rail, truck or barge. The majority of its coal is transported to customers by either the CSX Railroad or the Norfolk Southern Railroad in eastern Kentucky and by the Ohio Central Railroad or the Wheeling & Lake Erie Railroad in Ohio. In addition, in southeastern Ohio, the Partnership uses its own trucking operations to transport coal to its customers where rail is not available. The Partnership uses third-party trucking to transport coal to its customers in Utah. For its Pennyrile complex in western Kentucky, coal is transported to its customers via barge from its river loadout on the Green River located on its Pennyrile mining complex. In addition, coal from certain of its Central Appalachia and southern Ohio mines is located within economical trucking distance to the Big Sandy River and/or the Ohio River and can be transported by barge. It is customary for customers to pay the transportation costs to their location.

The Partnership believes that it has good relationships with rail carriers and truck companies due, in part, to its modern coal-loading facilities at its loadouts and the working relationships and experience of its transportation and distribution employees.

| 14 |

Suppliers - Rhino

Principal supplies used in the Partnership’s business include diesel fuel, explosives, maintenance and repair parts and services, roof control and support items, tires, conveyance structures, ventilation supplies and lubricants. The Partnership uses third-party suppliers for a significant portion of its equipment rebuilds and repairs, drilling services and construction.

The Partnership has a centralized sourcing group for major supplier contract negotiation and administration, for the negotiation and purchase of major capital goods and to support the mining and coal preparation plants. The Partnership is not dependent on any one supplier in any region. The Partnership promotes competition between suppliers and seek to develop relationships with those suppliers whose focus is on lowering its costs. The Partnership seeks suppliers who identify and concentrate on implementing continuous improvement opportunities within their area of expertise.

Competition - Rhino

The coal industry is highly competitive. There are numerous large and small producers in all coal producing regions of the United States and the Partnership competes with many of these producers. The Partnership’s main competitors include Alliance Resource Partners LP, Alpha Natural Resources, Inc., Arch Coal, Inc., Booth Energy Group, Murray Energy Corporation, Foresight Energy LP, Westmoreland Resource Partners, LP and Bowie Resource Partners LLC.

The most important factors on which the Partnership competes are coal price, coal quality and characteristics, transportation costs and the reliability of supply. Demand for coal and the prices that the Partnership will be able to obtain for its coal are closely linked to coal consumption patterns of the domestic electric generation industry and international consumers. These coal consumption patterns are influenced by factors beyond its control, including demand for electricity, which is significantly dependent upon economic activity and summer and winter temperatures in the United States, government regulation, technological developments and the location, availability, quality and price of competing sources of fuel such as natural gas, oil and nuclear, and alternative energy sources such as hydroelectric power and wind power.

Regulation and Laws

The Partnership’s current operations are, and future coal mining operations that we acquire will be, subject to regulation by federal, state and local authorities on matters such as:

| ● | employee health and safety; | |

| ● | governmental approvals and other authorizations such as mine permits, as well as other licensing requirements; | |

| ● | air quality standards; | |

| ● | water quality standards; | |

| ● | storage, treatment, use and disposal of petroleum products and other hazardous substances; | |

| ● | plant and wildlife protection; | |

| ● | reclamation and restoration of mining properties after mining is completed; | |

| ● | the discharge of materials into the environment, including waterways or wetlands; | |

| ● | storage and handling of explosives; | |

| ● | wetlands protection; | |

| ● | surface subsidence from underground mining; | |

| ● | the effects, if any, that mining has on groundwater quality and availability; and | |

| ● | legislatively mandated benefits for current and retired coal miners. |

| 15 |

In addition, many of our customers are subject to extensive regulation regarding the environmental impacts associated with the combustion or other use of coal, which could affect demand for our coal. The possibility exists that new laws or regulations, or new interpretations of existing laws or regulations, may be adopted that may have a significant impact on our mining operations, oil and natural gas investments, or our customers’ ability to use coal. Moreover, environmental citizen groups frequently challenge coal mining, terminal construction, and other related projects.