Attached files

| file | filename |

|---|---|

| EX-99.8 - EXHIBIT 99.8 - KKR Financial Holdings LLC | a998-kkrnautilusagg2014and.htm |

| EX-99.7 - EXHIBIT 99.7 - KKR Financial Holdings LLC | a997-kkrnautilusaggregator.htm |

| EX-99.6 - EXHIBIT 99.6 - KKR Financial Holdings LLC | a996-mfcunaudited_rf.htm |

| EX-99.5 - EXHIBIT 99.5 - KKR Financial Holdings LLC | a995-mcc2016auditedfs_rf.htm |

| EX-99.4 - EXHIBIT 99.4 - KKR Financial Holdings LLC | a994-tre2015and2014audited.htm |

| EX-99.1 - EXHIBIT 99.1 - KKR Financial Holdings LLC | a991-trinityaggunaudited_rf.htm |

| EX-32 - EXHIBIT 32 - KKR Financial Holdings LLC | ex3210ka.htm |

| EX-31.2 - EXHIBIT 31.2 - KKR Financial Holdings LLC | ex31210ka.htm |

| EX-31.1 - EXHIBIT 31.1 - KKR Financial Holdings LLC | ex31110ka.htm |

| 10-K/A - 10-KA - KKR Financial Holdings LLC | kfn-20161231x10xkamendment.htm |

Exhibit 99.3

Trinity River Energy, LLC Consolidated Financial Statements As of and for the Year Ended December 31, 2016 (Unaudited) These financial statements have not been audited by our independent accountants, and they assume no responsibility for such financial statements. | |

TRINITY RIVER ENERGY, LLC

TABLE OF CONTENTS

Page | |

CONSOLIDATED FINANCIAL STATEMENTS AS OF AND | |

FOR THE YEAR ENDED DECEMBER 31, 2016 (UNAUDITED): | |

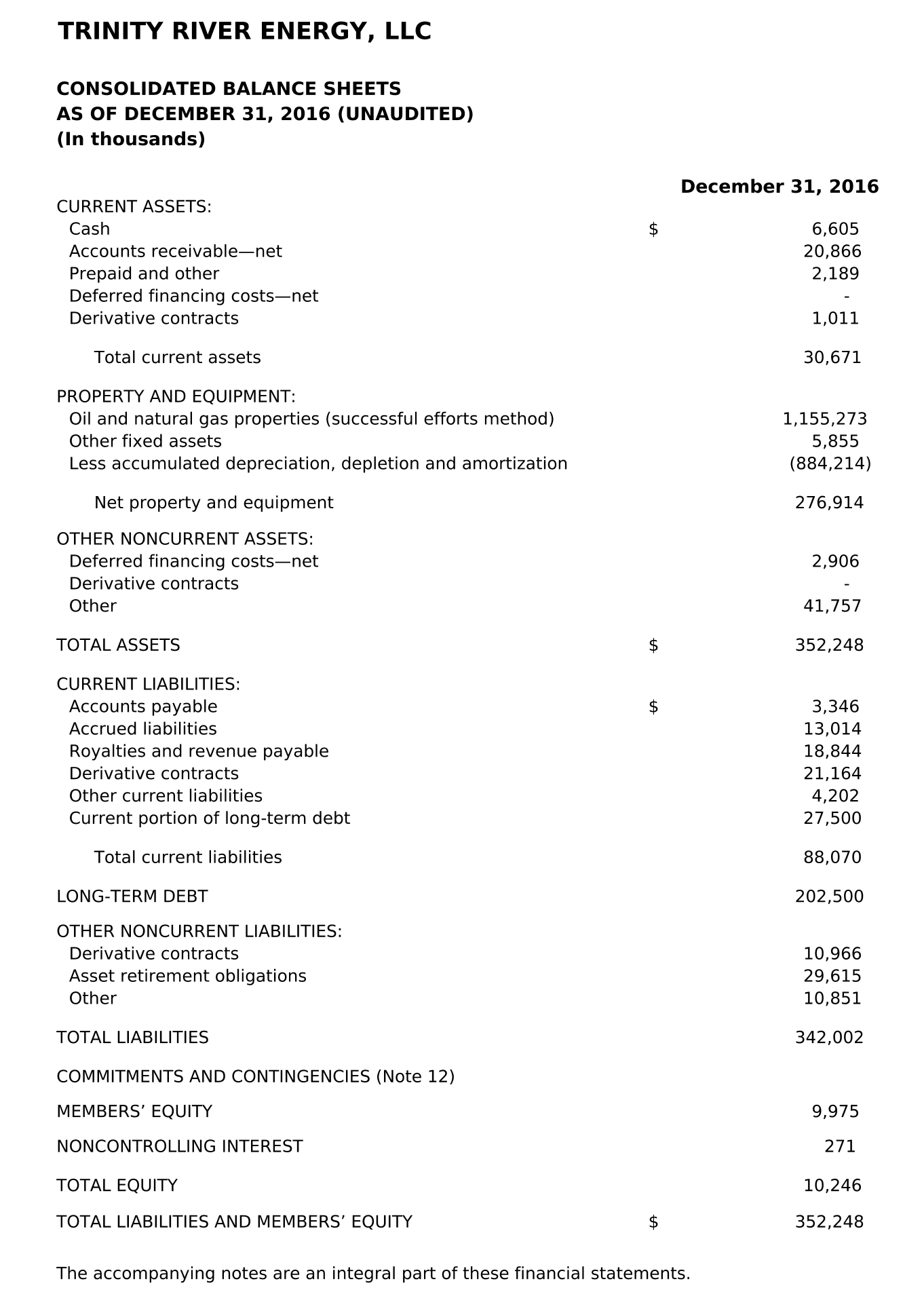

Consolidated Balance Sheets | 1 |

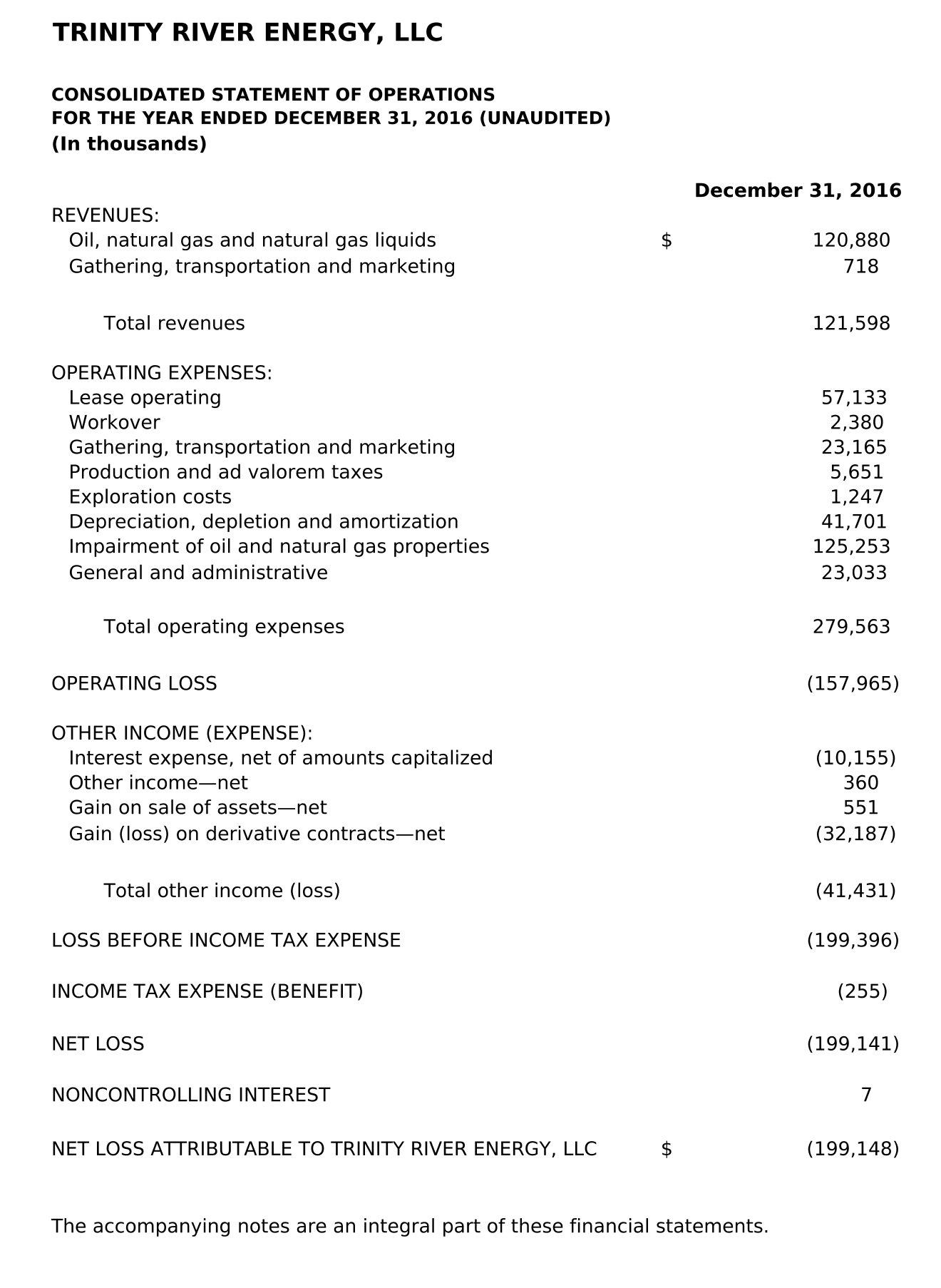

Consolidated Statement of Operation | 2 |

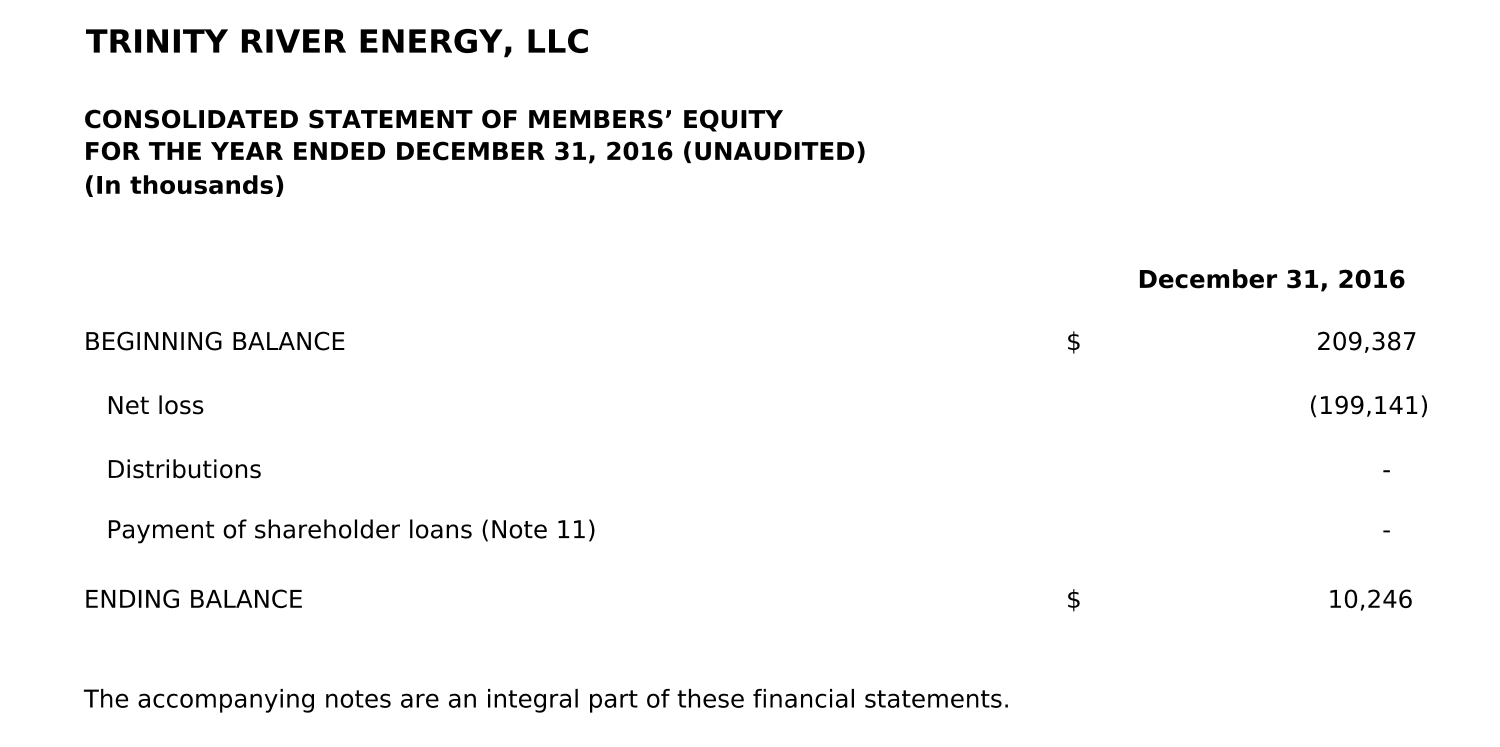

Consolidated Statement of Members’ Equity | 3 |

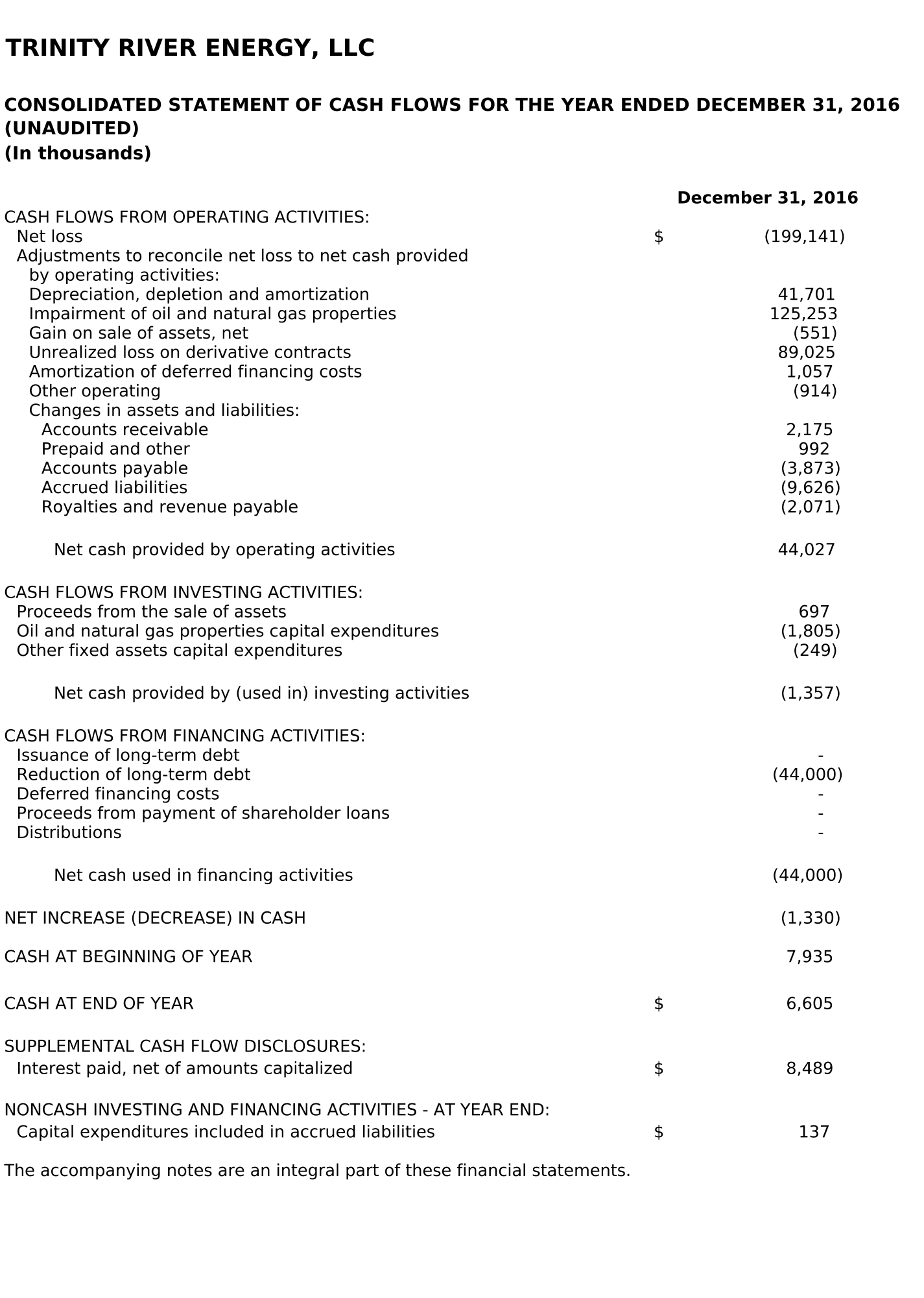

Consolidated Statement of Cash Flows | 4 |

Notes to the Consolidated Financial Statements | 5–17 |

2

1

2

3

4

TRINITY RIVER ENERGY, LLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS AS OF AND FOR THE YEAR ENDED DECEMBER 31, 2016 (UNAUDITED)

(Except per-unit amounts, or as noted within the context of each footnote disclosure, the dollar amounts presented in the tabular data within these footnote disclosures are stated in thousands of dollars.)

References to “we,” “us” and “our” mean Trinity River Energy, LLC (“TRE”) and Subsidiaries.

1. | ORGANIZATION, DESCRIPTION OF OPERATIONS AND BASIS OF PRESENTATION |

Organization—We are a Delaware limited liability company formed on September 30, 2014, through a merger of Legend Production Holdings, LLC (“Legend”), a majority owned subsidiary of Riverstone Holdings, LLC and the Carlyle Group (collectively, “Riverstone/Carlyle”), and certain investment entities (together, the “KNR Investors”) advised by Kohlberg Kravis Roberts & Co. L.P. (together with its affiliates, “KKR”), (collectively, the “Merger”). The Merger effectively combined subsidiaries of KFN NR Investors L.P. (“KFN”), subsidiaries of KKR NR Investors I L.P. (“KNR I”) and subsidiaries of KKR NR Investors I-A L.P. (“KNR I-A”), with Legend Natural Gas II, L.P., Legend Natural Gas III, L.P. and Legend Natural Gas IV, L.P.

KKR and Riverstone/Carlyle, are private equity investment firms, which, among other things, are engaged in the acquisition and development of oil and gas properties. We have authorized and issued approximately 831 million Class A units, of which investment entities advised by KKR own approximately 77% and Riverstone/Carlyle owns approximately 23%.

Description of Operations—We are an independent exploration and production company focused on the acquisition, exploration, development and production of oil, natural gas and natural gas liquids (“NGLs”) reserves. We operate and have non-operating interests in producing wells in the Barnett Shale in north central Texas and within various formations in south Texas, Louisiana and Mississippi.

Basis of Presentation—The accompanying consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and include our accounts and those of our majority-owned, controlled subsidiaries for the relevant periods and, in the opinion of management, reflect all adjustments necessary to present fairly the results of the periods presented. All intercompany transactions have been eliminated in consolidation. We operate in one oil and natural gas exploration and production segment. We evaluated subsequent events through March 30, 2017, the date our financial statements were available to be issued.

Use of Estimates—The preparation of these consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities, if any, at the date of these consolidated financial statements and the reported amounts of revenues and expenses during the respective reporting periods. The most significant estimates pertain to:

• | Oil, natural gas and NGL proved reserves; |

• | Expected future cash flows used in determining possible impairments of oil and natural gas properties and the assumptions used in these calculations; |

• | Cut-off of production volumes used to calculate the oil and natural gas sales accrual; |

5

• | Mark-to-market valuation of derivative instruments; |

• | Asset retirement obligations (“AROs”). |

Actual results may differ from our estimates, judgments and assumptions used in the preparation of our consolidated financial statements. See Note 8 for further information.

2. | GOING CONCERN |

In connection with the audit of our financial statements for the year ended December 31, 2015, our predecessor auditors issued their report which included an explanatory paragraph describing the existence of conditions that raised substantial doubt about our ability to continue as a going concern due to our inability to demonstrate that we would meet our total debt to EBITDAX (earnings before interest, taxes, depreciation, depletion and amortization, and exploration) financial performance covenant contained in our senior secured revolving credit agreement (the “Credit Agreement”) in the fourth quarter of 2016. If noncompliance occurred, it would have resulted in an acceleration of the maturity of our debt under the Revolving Credit Facility leading to a possible lack of liquidity, raising substantial doubt about our ability to continue as a going concern.

During 2016, management aggressively took steps to increase liquidity and strengthen our financial position for the calendar year 2016 and beyond. Efforts demonstrated by management were entering into additional hedge positions, paying down borrowings under the Revolving Credit Facility and significantly reducing general and administrative costs and field operating expenses. Management reduced general and administrative costs by 42% primarily as a result of a reduction in the corporate workforce reducing salaries and related costs, reduced annual reoccurring costs through competitive bid processes and executed a sublease agreement for office space in our Fort Worth, Texas office. Operations reduced overall field operating costs by 40% while maintaining expected production levels, by negotiating cost reductions with vendors relating to compression services, water hauling costs and chemicals. As a result of these cost reduction efforts, we were in compliance with our fourth quarter 2016 financial performance covenants.

3. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Cash—Cash represents unrestricted cash on hand and highly liquid investments with original maturities of three months or less from the date of original issuance.

Accounts Receivable—Our accounts receivable are primarily from purchasers of our oil, natural gas and NGL production and exploration and production companies which own interests in properties we operate. Receivables from purchasers of oil, natural gas and NGL production were $18.6 million at December 31, 2016. We generally rely on credit ratings and ongoing monitoring procedures, and in some cases we have required that certain purchasers provide a letter of credit to collateralize their purchases.

We establish provisions for losses on accounts receivable if we determine that it is probable that we will not collect all or part of the outstanding balance. We regularly review collectability and establish or adjust the allowance as necessary using relevant attributes, such as recent loss experience, current economic conditions and other factors. We recorded an allowance for doubtful accounts of $1.1 million at December 31, 2016.

Asset Retirement Obligations—AROs associated with the legal obligation to retire tangible long-lived assets are recognized as liabilities with an increase to the carrying amounts of the related long-lived

6

assets in the period incurred. AROs are recorded at estimated fair value, measured by reference to the expected future cash outflows required to satisfy the retirement obligations discounted at our credit-adjusted risk-free interest rate. Accretion expense is recognized over time as the discounted liabilities are accreted to their expected settlement value. If estimated future costs of AROs change, an adjustment is recorded to both the asset retirement obligation and the long-lived asset. Revisions to estimated AROs can result from changes in retirement cost estimates, revisions to estimated inflation rates, and changes in the estimated timing of abandonment. Accretion expense is included in depreciation, depletion and amortization expense in the consolidated statement of operations. See Note 10 for further information.

Contingencies—We are subject to legal proceedings, claims, and liabilities that arise in the ordinary course of business. Except for legal contingencies acquired in a business combination, which are recorded at fair value at the time of acquisition, we accrue losses associated with legal claims when such losses are probable and can be reasonably estimated. If we determine that a loss is probable and cannot estimate a specific amount for that loss, but can estimate a range of loss, the best estimate within the range is accrued. If no amount within the range is a better estimate than any other, the minimum amount of the range is accrued. Estimates are adjusted as additional information becomes available or circumstances change. Legal defense costs associated with loss contingencies are expensed in the period incurred. See Note 13 for further information.

Concentration of Credit Risk—We sell a significant amount of our oil, natural gas and NGL production to a limited number of purchasers. One of our purchasers accounted for 16% of our revenues for the year ended December 31, 2016. No other purchaser accounted for 10% or more of our revenues for the year ended December 31, 2016.

Derivative Contracts—We use derivative contracts to reduce our exposure to commodity price volatility, basis swings and interest rate changes. We do not use derivative contracts for trading purposes. We record all derivative contracts at fair value on the consolidated balance sheets as either an asset or liability and do not designate any of our derivative contracts as hedging instruments for accounting purposes. Therefore, unrealized gains and losses from valuation changes in our unsettled derivative contracts are reported in gain on derivative contracts, net, in our consolidated statement of operations.

We are party to various physical commodity contracts for the sale of oil and natural gas that have varying terms and pricing provisions. While some of these physical commodity contracts meet the definition of a derivative instrument, the contracts qualify for and we elect the normal purchase and normal sale exception at inception and, therefore, are not subject to hedge or mark-to-market accounting. The financial impact of physical commodity contracts is included in oil, natural gas and natural gas liquids revenues at the time of settlement.

We are exposed to the credit risk of our counterparties. Credit risk is the potential failure of the counterparty to perform under the terms of the derivative contract. To minimize the credit risk in derivative contracts, the majority of our derivative contracts are with counterparties that are lenders under our revolving credit facility. As of December 31, 2016 and 2015, we had no past-due receivables from any counterparty. See Notes 8 and 9 for a discussion of the use of financial instruments, management of credit risk inherent in financial instruments and fair value information.

Oil and Natural Gas Properties—We follow the successful efforts method of accounting for exploration and development expenditures. Under this method, costs of acquiring unproved and proved oil and natural gas leasehold acreage are capitalized. When proved reserves are found on unproved property, the associated leasehold cost is transferred to proved properties. The value of unproved leases

7

included in oil and natural gas properties is $0.2 million at December 31, 2016. Unproved leases are reviewed annually, and an impairment loss is recorded for any estimated decline in value. Development costs are capitalized, including the costs of unsuccessful development wells.

Exploration expenditures, including geological and geophysical costs, delay rentals and exploratory dry hole costs, are expensed as incurred. Costs of drilling exploratory wells are initially capitalized pending determination of whether proved reserves have been found and are subsequently expensed if it is determined that commercial quantities of hydrocarbons have not been discovered.

Depreciation, depletion and amortization (“DD&A”) of producing oil and natural gas properties is calculated using the units-of-production method. Proved developed reserves are used to compute the DD&A rate for unamortized tangible and intangible drilling and completion costs, and total proved reserves are used to compute the DD&A rate for unamortized leasehold costs.

Gains and losses on asset sales are included in other income (expense). Costs related to maintenance, repairs and minor renewals necessary to maintain properties in operating condition are expensed as incurred and recorded as lease operating expense. Major betterments, replacements and renewals are capitalized to the appropriate oil and natural gas property accounts.

We capitalize interest on capital invested in projects related to unevaluated properties and significant development projects. As proved reserves are established, the related capitalized interest is transferred into costs subject to amortization. We did not have any projects which we capitalized interest in 2016.

Impairment of Oil and Natural Gas Properties—Our oil and natural gas properties are assessed for impairment on a field-by-field basis annually and when events or changes in circumstances indicate that the carrying value may not be recoverable. The asset impairment review compares the carrying value of an oil and natural gas property to its estimated undiscounted future cash flows. When estimated undiscounted future cash flows are less than its carrying value, an impairment loss is recognized, and the oil and natural gas property is reduced to its estimated fair value. Fair value is calculated by discounting the future cash flows at an appropriate risk-adjusted discount rate consistent with that used by market participants.

The factors used to determine fair value include, but are not limited to, recent sales prices of comparable properties, the present value of future cash flows, net of estimated operating and development costs using estimates of reserves, future commodity pricing, future production estimates, anticipated capital expenditures and discount rates commensurate with the risk associated with realizing the projected cash flows. See Note 9 for further information.

Oil and Natural Gas Reserves—Proved oil, natural gas and NGL reserves are defined by the Financial Accounting Standards Board (“FASB”) and the US Securities and Exchange Commission (“SEC”). This definition includes oil, natural gas, and NGLs that geological and engineering data demonstrate with reasonable certainty to be economically producible in future periods from known reservoirs under existing economic conditions, operating methods and government regulations, using price and cost assumptions as of the date the reserve estimates are made. Reserves are determined using a beginning-of-period 12-month average price with no provision for price and cost escalations in future years except by contractual arrangements. Our reserve estimates were prepared by third-party reservoir engineers.

The reserve estimation process is inherently uncertain for numerous reasons, including many factors beyond our control. Reservoir engineering is a subjective process of estimating underground accumulations of oil and natural gas that cannot be measured in an exact manner.

8

The accuracy of any reserve estimate is a function of the quality of data available and of engineering and geological interpretation and judgment. In addition, estimates of reserves may be revised based on actual production, results of subsequent exploration and development activities, prevailing commodity prices, operating costs and other factors. These revisions may be material and could materially affect future DD&A expense, plugging and abandonment costs and impairment expense.

Income Taxes—We are not a taxpaying entity for federal income tax purposes and, accordingly, do not recognize any expense for such taxes. The federal income tax liability resulting from our activities is the responsibility of the members.

We are subject to Texas margin tax and recognize deferred taxes for the future tax consequences of differences between the tax basis of assets and liabilities and their financial reporting amounts based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Such differences arise primarily from the differences in accounting treatment of intangible drilling costs and impairment losses for tax and financial reporting purposes, and basis adjustments for assets recorded at fair value for GAAP versus historical cost for tax.

Revenue Recognition—Oil, natural gas and NGL sales are recognized based on actual volumes sold to customers and the contracted sales prices, and are reported net of royalties. Sales require delivery of the product to the customer, passage of title and probability of collection of customer amounts owed.

We use the sales method of accounting for natural gas imbalances. An imbalance is created when the volumes of natural gas sold by us pertaining to a property do not equate to the volumes produced to which we are entitled based on our interest in the property. An asset or liability is recognized to the extent that we have an imbalance in excess of our share of the remaining reserves on the underlying properties.

Defined Contribution Plan—We sponsor a 401(k) tax deferred savings plan, whereby we match a portion of our employees’ contributions in cash. Participation in the plan is voluntary and all full-time employees and part-time employees of the Company are eligible to participate. For the year ended December 31, 2016, our matching contributions to the 401(k) plan recognized in the consolidated statements of operations was $0.7 million.

4. | RECENT ACCOUNTING PRONOUNCEMENTS |

In May, 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers. This ASU supersedes the revenue recognition requirements in Topic 605, Revenue Recognition, and industry-specific guidance in Subtopic 932-605, Extractive Activities—Oil and Gas—Revenue Recognition, and requires an entity to recognize revenue when it transfers promised goods or services to customers in an amount that reflects the consideration the entity expects to be entitled to in exchange for those goods or services. ASU 2014-09 will be effective for us beginning on January 1, 2019 considering the one year deferral provided by ASU 2015-14, Revenue from Contracts with Customers (Topic 606): Deferral of the Effective Date. The standard permits the use of either the retrospective or cumulative effect transition method and early adoption is permitted. We have not selected a transition method and is evaluating the impact this standard will have on our consolidated financial statements and related disclosures.

In August, 2014, the FASB issued ASU 2014-15, Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern. This guidance requires management to perform interim and annual assessments of an entity’s ability to continue as a going concern within one year of the date the financial

9

statements are issued. The standard also provides guidance on determining when and how to disclose going-concern uncertainties in the financial statements. We adopted the new guidance for the year ended December 31, 2016. The new guidance did not have a material impact on our consolidated financial statements.

On February 25, 2016, the FASB issued ASU No. 2016-02, Leases (Topic 842). The new guidance introduces a lessee model that brings most leases on the balance sheet and eliminates the required use of bright-line tests in current GAAP for determining lease classification. The scope of the new guidance is limited to leases of property, plant and equipment and excludes leases to explore for or use minerals, oil, natural gas, and similar nonregenerative resources. The new standard is effective for calendar periods beginning on January 1, 2019, for public business entities and January 1, 2020, for all other entities. We are currently evaluating the impact of the adoption of this ASU on our consolidated financial statements.

In January 2017, the FASB issued ASU 2017-01, Clarifying the Definition of a Business. This guidance assists in determining whether a transaction should be accounted for as an acquisition or disposal of assets or as a business. This ASU provides a screen that when substantially all of the fair value of the gross assets acquired, or disposed of, are concentrated in a single identifiable asset, or a group of similar identifiable assets, the set will not be considered a business. If the screen is not met, a set must include an input and a substantive process that together significantly contribute to the ability to create an output to be considered a business. This ASU is effective for annual and interim periods beginning in 2018 and is required to be adopted using a prospective approach, with early adoption permitted for transactions not previously reported in issued financial statements. We expect that the adoption of this ASU could have a material impact on future consolidated financial statements as goodwill would not be recorded for acquisitions that are not considered to be businesses.

5. | BUSINESS DISPOSITIONS |

On February 1, 2017, we completed a sale of our Mississippi assets to an unaffiliated third party for $31.0 million. At December 31, 2016, the Mississippi assets are classified as held-for-sale and included in other noncurrent assets on the Consolidated Balance Sheet in the amount of $41.8 million, net of accumulated depreciation, depletion and amortization. At December 31, 2016, the associated Mississippi royalties and revenues payable of $4.2 million were included in other current liabilities and the associated asset retirement obligations of $10.2 million were included in other non-current liabilities on the Consolidated Balance Sheet. During 2016 we recorded a write-down to fair value less estimated costs to sell of $51.2 million for our Mississippi assets.

In November 2016, we engaged an investment banker to assist in a bid process to potentially sell either the entire company, our entire portfolio of assets located in north Texas, south Texas and Louisiana or individual fields within our portfolio. During the first quarter of 2017, we initiated the sales process with the opening of a data room and solicited bids from potential unaffiliated buyers. As of March 30, 2017, we have selected a couple of potential buyers of which discussions continue regarding a potential sale of individual fields within our portfolio, however the outcome of this process is uncertain. As a result of the bids received and our evaluating of assets for impairment as of December 31, 2016, we have recorded a write-down to fair value less estimated costs to sell of $56.4 million for our Louisiana assets. In the event we are successful in completing the sale of any of our assets, we would expect to close in the second quarter of 2017 and use the proceeds to pay down our Revolving Credit Facility.

On September 1, 2015, we completed a sale of our Permian assets to an unaffiliated third party for $148.3 million in cash net of selling expenses of $0.5 million. We recorded a net gain of $80.6 million,

10

included in gain on sale of assets, net on our consolidated statement of operations. The net book value of the assets sold was $67.7 million. Our Permian assets contributed to $8.5 million of net income for the eight months ended September 1, 2015.

6. | RELATED-PARTY TRANSACTIONS |

Other Transactions—Former members of the management team have minority ownership interests in companies which provided oilfield services to us. We have contracts with the oilfield service vendors and have implemented controls surrounding the purchase and approval for such services. For the year ended December 31, 2016, we paid these vendors approximately $0.8 million. Additionally, we do not have any outstanding payables to these vendors as of December 31, 2016.

Beginning in April 2016, certain members of management began to provide management related services to us under a Management Service Agreement, and payments for these services are made to an unrelated entity. For the year ended December 31, 2016, we paid service fees of $1.1 million. Additionally, as of December 31, 2016, we have outstanding payables of $0.4 million relating to management service fees, which were paid in the first quarter of 2017.

7. | LONG-TERM DEBT |

On September 30, 2014, we entered into a senior secured revolving credit agreement (the “Credit Agreement”) with a group of financial institutions (the “Lenders”) that provides a facility with a $1.0 billion commitment and a borrowing base of $245.0 million (the “Revolving Credit Facility”). The borrowing base is re-determined on a semi-annual basis, or as requested by our Lenders or us. To the extent that the borrowing base is re-determined at an amount that is below the amount currently outstanding, we have options under the Credit Agreement, including repayment over a period of up to six months, provision of additional collateral, or other negotiated alternatives with the Lenders. We used the borrowings from the Revolving Credit Facility to repay existing indebtedness of Legend and KNR Investors and provide additional working capital. The obligations under the Credit Agreement and guarantees of those obligations are secured by substantially all of our oil and natural gas properties. The maturity date of the revolving credit facility is September 30, 2019. As of December 31, 2016, the amount outstanding under the credit agreement was $230.0 million.

Change in Borrowing Base of our Revolving Credit Facility—Effective January 2, 2017, as a result of our year end borrowing base redetermination process, the borrowing base of our Revolving Credit Facility was reduced to $230.0 million.

Pursuant to the credit agreement, interest on borrowings is calculated using the adjusted base rate plus an applicable margin or the London Interbank Offered Rate (“LIBOR”) plus an applicable margin. The adjusted base rate is defined as the greater of (a) the prime rate established by the administrative agent; (b) the federal funds rate in effect plus 0.50%; and (c) the daily one-month LIBOR plus 1.00%. The applicable margin ranges from 1.50% to 2.50% for the adjusted base rate loans and from 2.50% to 3.50% for LIBOR loans, depending on the percentage of the borrowing base utilization level. In addition to interest, the banks receive various fees, including a commitment fee on the unutilized commitment, which ranges from 0.375% to 0.50% per annum. The weighted-average interest rate on loan amounts outstanding during the twelve months ended December 31, 2015, was 3.32%.

Our credit agreement contains financial covenants typical for these types of agreements, including a total debt to EBITDAX (earnings before interest, taxes, depreciation, depletion, and amortization, and

11

exploration) ratio and a current assets to current liabilities ratio. At December 31, 2016, we were in compliance with all of our covenants under the credit agreement.

Deferred Financing Costs—We capitalize costs incurred in connection with obtaining financing and amortize such costs as additional interest expense over the life of the underlying indebtedness. Deferred financing costs charged to interest expense were $1.1 million for the year ended December 31, 2016.

8. | FINANCIAL INSTRUMENTS |

In the normal course of business, we are exposed to certain risks, including changes in the prices of oil, natural gas and NGLs and interest rates. We enter into derivative contracts to manage our exposure to these risks. Our risk management activity is generally accomplished through over-the-counter derivative contracts with large financial institutions.

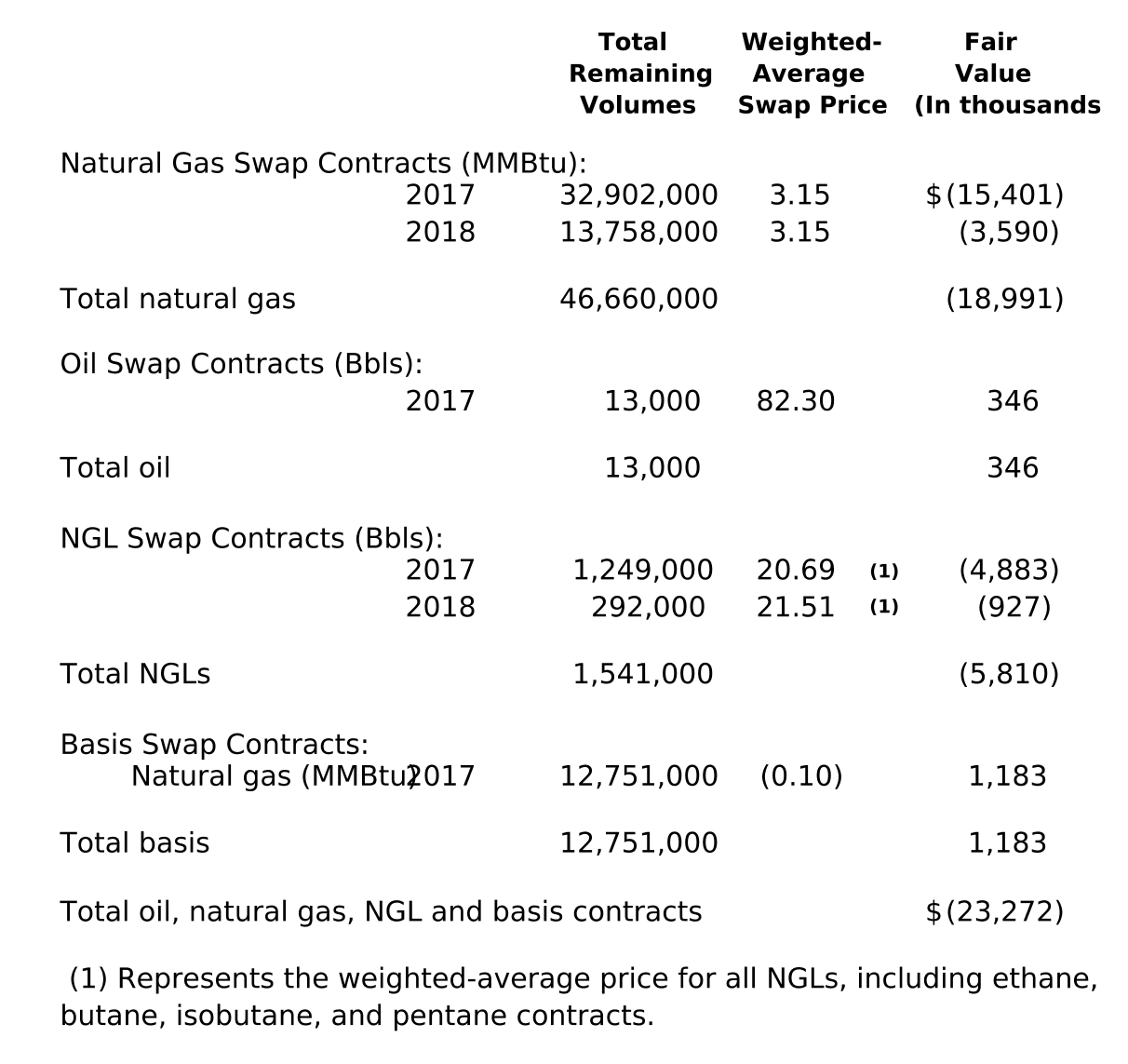

Commodity Derivative Contracts—As of December 31, 2016, we had natural gas swap contracts based on West Texas hub (WAHA) index prices, oil swap contracts and natural gas swap contracts based on the New York Mercantile Exchange (“NYMEX”) futures index and NGL swap contracts based on the trading prices at Mont Belvieu, Texas. The fair values, notional quantities and weighted-average swap prices of these contracts as of December 31, 2016, are summarized in the table below.

Volumes are presented in million British Thermal Units (“MMBtu”) for natural gas and in barrels (“Bbls”) for oil.

12

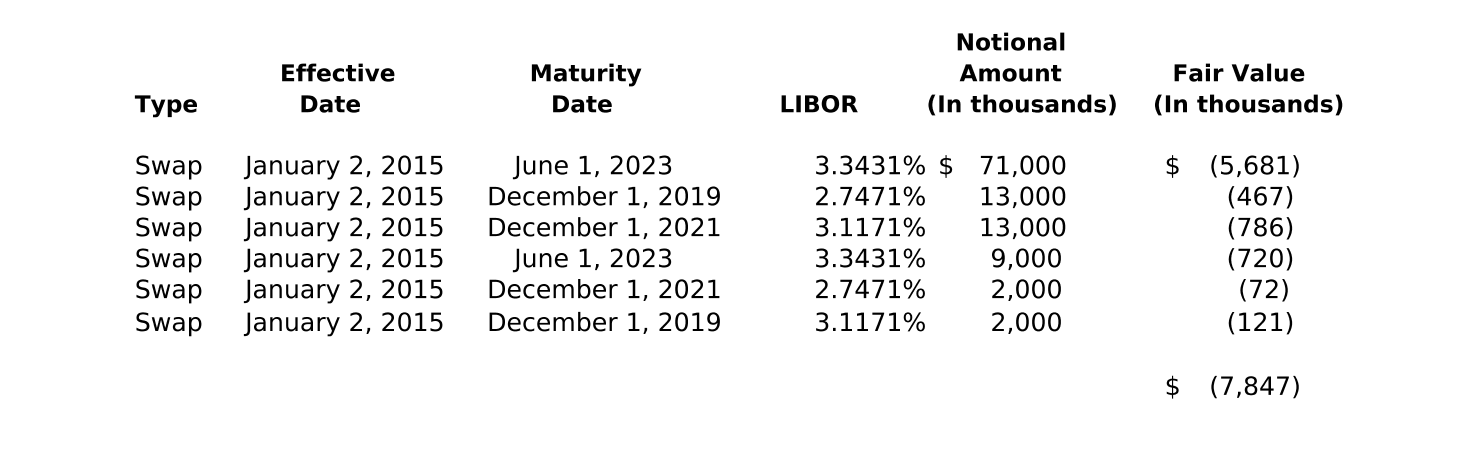

Interest Rate Derivative Contracts—The following table summarizes the fair value, notional amount and swap rate of the interest rate swap contracts in place at December 31, 2016:

We have not designated any of our derivative contracts as hedging instruments.

13

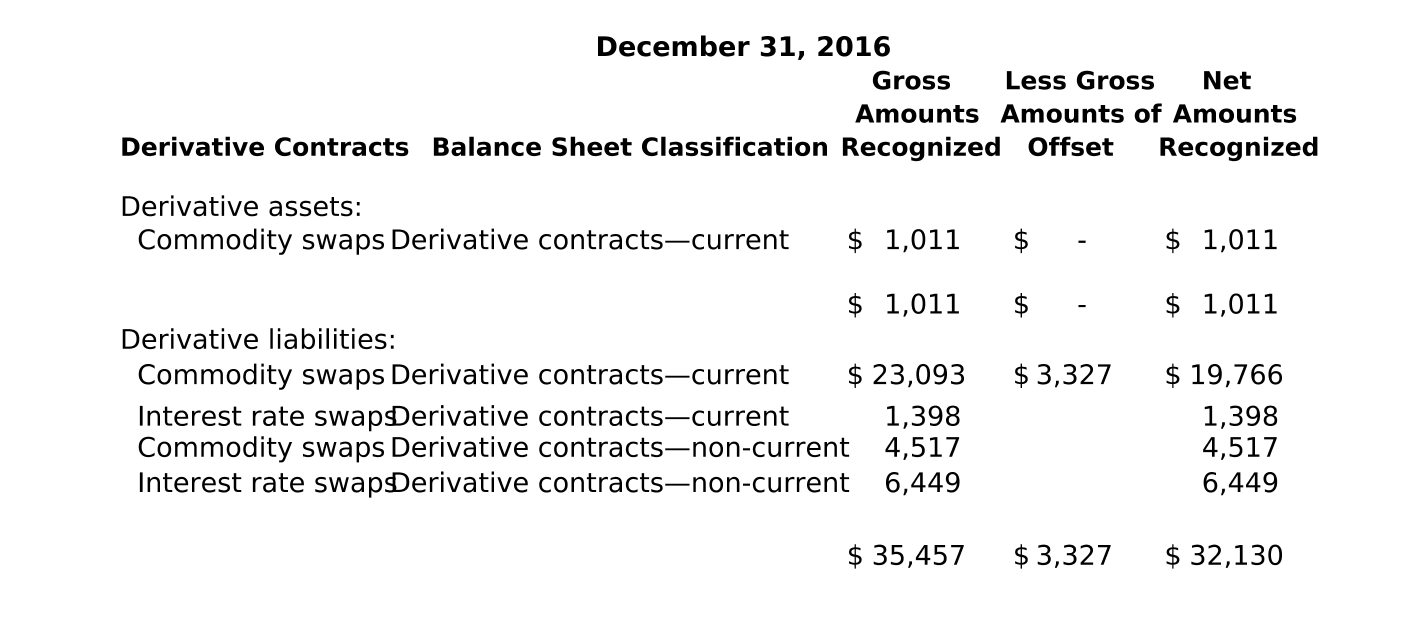

Our derivative contracts are subject to master netting arrangements and are presented on a net basis in our consolidated balance sheets. The following table summarizes the location and fair value of our derivative contracts as of December 31, 2016 (in thousands):

The following table summarizes the effects of our derivative contracts on the consolidated statements of operations for the years ended December 31, 2016 (in thousands):

Location of Gain (Loss) Recognized in Other Income (Expense | Amount of Gain (Loss) Recognized in Net Loss 2016 | ||||

Commodity swaps: | |||||

Realized | Gain (loss)on derivative contracts—net | $ | 58,066 | ||

Unrealized | Gain (loss)on derivative contracts—net | (89,575 | ) | ||

Interest rate swaps: | |||||

Realized | Gain (loss)on derivative contracts—net | (1,228 | ) | ||

Unrealized | Gain (loss)on derivative contracts—net | 550 | |||

Total realized and unrealized gain (loss) on derivative contracts | $ | (32,187 | ) | ||

9. FAIR VALUE MEASUREMENTS

We classify financial assets and liabilities that are measured and reported at fair value on a recurring basis using a hierarchy based on the inputs used in measuring fair value. GAAP defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (exit price). We classify the inputs used to measure fair value into the following hierarchy:

• | Level 1: Inputs based on quoted market prices in active markets for identical assets or liabilities at the measurement date. |

14

• | Level 2: Inputs based on quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets and liabilities in markets that are not active or other inputs that are observable and can be corroborated by observable market data. |

• | Level 3: Inputs that reflect management’s best estimates and assumptions of what market participants would use in pricing the asset or liability at the measurement date. The inputs are unobservable in the market and significant to the valuation of the instruments. |

Changes in economic conditions or model-based valuation techniques may require the transfer of financial instruments from one fair value level to another. In such instances, the transfer would be reported at the beginning of the period in which the change occurs.

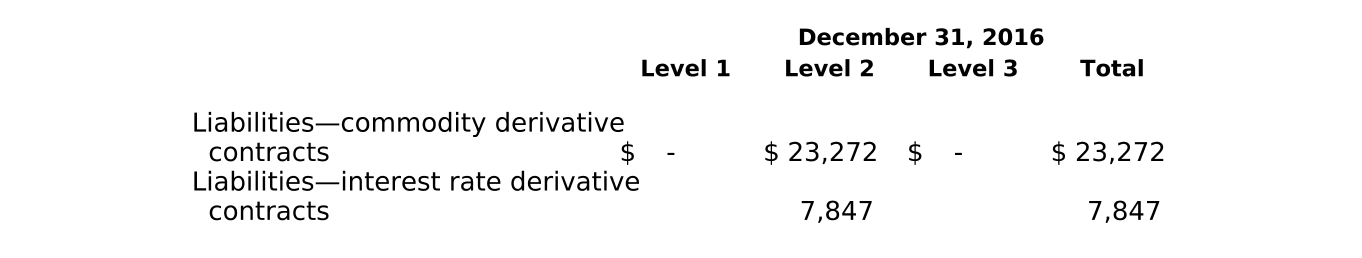

Recurring Fair Value Measurements—Our financial assets and liabilities that were accounted for at fair value on a recurring basis at December 31, 2016 are as follows (in thousands):

Our derivative contracts consist of swaps for oil, natural gas, NGLs, natural gas basis, and interest rates and are carried at fair value. Commodity derivative contracts are valued using market inputs such as indexes, pricing and interest rates in a discounted cash flow model. Interest rate derivative contracts are valued using inputs such as LIBOR futures and interest rates using a discounted cash flow model. As such, these derivative contracts are classified within Level 2.

The initial measurement of ARO at fair value is calculated using discounted cash flow techniques and based on internal estimates of future retirement costs associated with property and equipment. Significant Level 3 inputs used in the calculation of ARO include plugging costs and reserve lives. A reconciliation of our ARO is presented in Note 10.

Nonrecurring Fair Value Measurements—Certain nonfinancial assets and liabilities are measured at fair value on a nonrecurring basis (e.g., oil and natural gas properties) and are subject to fair value adjustments under certain circumstances. The inputs used to determine such fair value are primarily based upon internally developed cash flow models and are classified within Level 3.

During the year ended December 31, 2016, considering recent market bids for the purchase of certain of our assets by unaffiliated third parties, we adjusted the carrying value of certain oil and natural gas properties and recorded an impairment charge of $125.3 million.

Other Fair Value Measurements—The estimated fair value of cash, accounts receivable and accounts payable approximates their carrying value due to their short-term nature. The estimated fair value of our long-term debt approximates carrying value because it carries a variable interest rate reflective of market rates. We categorized our long-term debt within Level 2 of the fair value hierarchy.

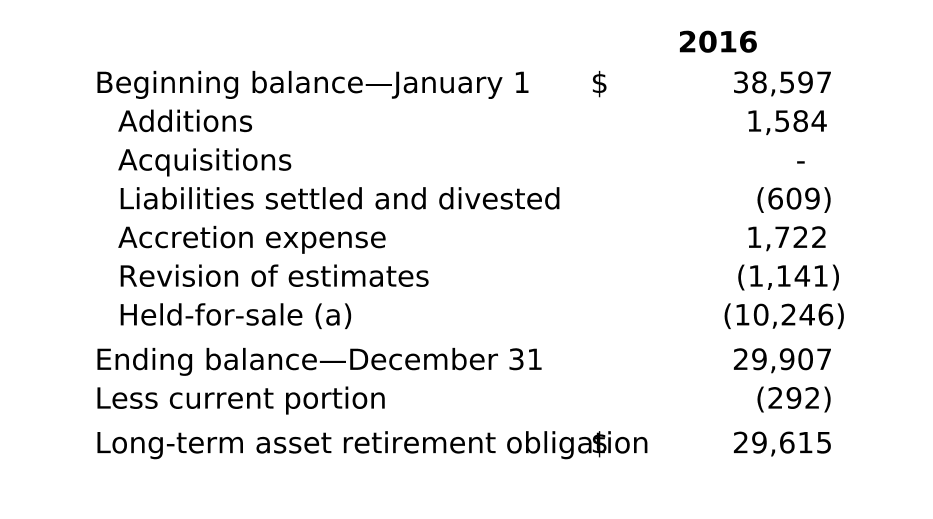

10. | ASSET RETIREMENT OBLIGATIONS |

15

We record an ARO for our future plugging, abandonment and site restoration costs related to our oil and natural gas properties. The changes in our AROs for the years ended December 31, 2016 are presented in the table below (in thousands):

(a) | Includes sale of Mississippi assets. See Note 5. |

The amount of the obligation expected to be incurred in the upcoming year is included in accrued liabilities in our consolidated balance sheets.

11. | INCOME TAXES |

We record deferred income taxes related to Texas margin tax for the net effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for Texas margin tax provisions. At December 31, 2016, we recorded a long-term deferred tax asset of $4.8 million and a valuation allowance of the same amount, due to low probability of realization.

12. | MEMBERS’ EQUITY |

We maintain separate capital accounts for each of our members and capital contributions, distributions and net income (loss) are recorded pro rata to each in accordance with their ownership percentage. We did not distribute any available cash to our members in 2016. There were no cash contributions during the year ended December 31, 2016.

13. | COMMITMENTS AND CONTINGENCIES |

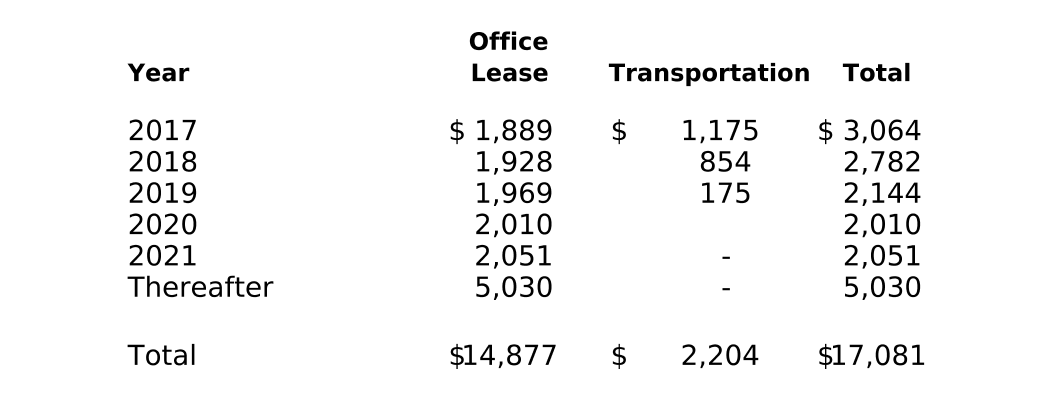

Commitments—We lease office space under operating leases in Houston, Texas, and Fort Worth, Texas, and rent expense related to these lease agreements was $2.5 million for the year ended December 31, 2016.

We contract with various companies to transport the natural gas we produce to purchasers and processing plants. The contracts are based on actual amounts transported with minimum amounts committed to be paid.

16

The future minimum payments related to these contracts as of December 31, 2016, are presented in the table below (in thousands):

Contingencies—We are party to various legal actions arising in the normal course of business. Management believes the disposition of these outstanding legal actions will not have a material impact on our financial condition, results of operations or cash flows.

14. | SUBSEQUENT EVENTS |

During the fourth quarter of 2016, we entered into discussions with a potential buyer of our Mississippi assets which later closed on February 1, 2017. Effective February 1, 2017, with the sale of our Mississippi assets, the borrowing base of our Revolving Credit Facility was reduced to $205.0 million and, as required, we used proceeds of $27.5 million from the sale to pay down outstanding borrowings to remain in compliance with our Revolving Credit Facility requirements. As of March 30, 2017, the amount outstanding under the credit agreement was $202.5 million.

In November 2016, we engaged an investment banker to assist in a bid process to potentially sell north Texas, south Texas and Louisiana, the remaining assets in our portfolio. During the first quarter of 2017, we initiated the sales process with the opening of a data room and solicited bids from potential unaffiliated buyers. As of March 30, 2017, we have selected a couple of potential buyers of which discussions continue regarding a potential sale of individual fields within our portfolio, however the outcome of this process is uncertain. In the event we are successful in completing a sale of any of our remaining assets, we expect net proceeds received from a sale to satisfy outstanding borrowings under our Revolving Credit Facility and will pay down outstanding borrowings upon the execution of a sale.

17