Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2016

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from: to

Commission File Number 000-50009

PACIFIC HEALTH CARE ORGANIZATION, INC.

(Exact name of registrant as specified in its charter)

|

Utah

|

87-0285238

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer I.D. No.)

|

|

|

|

|

1201 Dove Street, Suite 300

Newport Beach, California

|

92660

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant’s telephone number, including area code: (949) 721-8272

|

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

$.001 par value, common voting shares

(Title of class)

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

|||||

|

|

Yes

|

☐

|

No

|

☒

|

|

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act.

|

|||||

|

|

Yes

|

☐

|

No

|

☒

|

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

|||||

|

|

Yes

|

☒

|

No

|

☐

|

|

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files).

|

|||||

|

|

Yes

|

☒

|

No

|

☐

|

|

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§232.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

|

|

|

|

|

☐

|

|

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

||||||

|

|

|

||||||

|

|

Large accelerated filer

|

☐

|

|

Accelerated filer

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-accelerated filer

|

☐

|

|

Smaller reporting company

|

☒

|

|

|

|

|

(Do not check if smaller reporting company)

|

|

|

|

|

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

|||||

|

|

Yes

|

☐

|

No

|

☒

|

|

|

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter was approximately $2,546,000

|

|

As of March 16, 2017 the issuer had 800,000 shares of its $.001 par value common stock outstanding.

|

|

Documents incorporated by reference: None

|

|

|

|

Page

|

|

|

PART I

|

|||

|

|

|

|

|

|

Item 1.

|

5

|

||

|

|

|

|

|

|

Item 1A.

|

9

|

||

|

|

|

|

|

|

Item 1B.

|

13

|

||

|

|

|

|

|

|

Item 2.

|

13

|

||

|

|

|

|

|

|

Item 3.

|

13

|

||

|

|

|

|

|

|

Item 4.

|

13

|

||

|

|

|

|

|

|

PART II

|

|||

|

|

|

|

|

|

Item 5.

|

14

|

||

|

|

|

|

|

|

Item 6.

|

15

|

||

|

|

|

|

|

|

Item 7.

|

15

|

||

|

|

|

|

|

|

Item 7A.

|

22

|

||

|

|

|

|

|

|

Item 8.

|

23

|

||

|

|

|

|

|

|

Item 9.

|

36

|

||

|

|

|

|

|

|

Item 9A.

|

36

|

||

|

|

|

|

|

|

Item 9B.

|

37

|

||

|

|

|

|

|

|

PART III

|

|||

|

|

|

|

|

|

Item 10.

|

38

|

||

|

|

|

|

|

|

Item 11.

|

40

|

||

|

|

|

|

|

|

Item 12.

|

43

|

||

|

|

|

|

|

|

Item 13.

|

44

|

||

|

|

|

|

|

|

Item 14.

|

45

|

||

|

|

|

|

|

|

PART IV

|

|||

|

|

|

|

|

|

Item 15.

|

46

|

||

|

|

|

|

|

|

Item 16.

|

47

|

||

|

|

48

|

||

PACIFIC HEALTH CARE ORGANIZATION, INC.

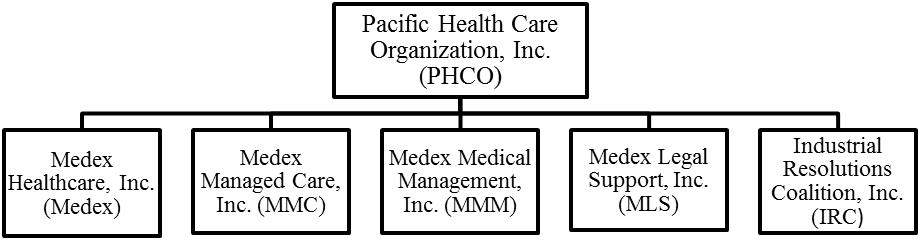

Throughout this Annual Report on Form 10-K, unless the context indicates otherwise, the terms, “we,” “us,” “our” or “the Company” refer to Pacific Health Care Organization, Inc., (“PHCO”) and our wholly-owned subsidiaries Medex Healthcare, Inc. (“Medex”), Industrial Resolutions Coalition, Inc. (“IRC”), Medex Managed Care, Inc. (“MMC”), Medex Medical Management, Inc. (“MMM”) and Medex Legal Support, Inc., (“MLS”).

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) that are based on our management’s beliefs and assumptions and on information currently available to our management. For this purpose any statement contained in this Annual Report on Form 10-K that is not a statement of historical fact may be deemed to be forward-looking, including, but not limited to statements about future demand for the products and services we offer, changes in the composition of the products and services we offer, the impact of the loss of one or more significant customers, our ability to add new customers to replace the loss of current customers, future revenues, expenses, results of operations, liquidity and capital resources or cash flows, or our actions, intentions, plans, strategies and objectives. Without limiting the foregoing, words such as “believe,” “expect,” “project,” “intend,” “estimate,” “budget,” “plan,” “forecast,” “predict,” “may,” “will,” “could,” “should,” or “anticipate” or comparable terminology are intended to identify forward-looking statements. These statements by their nature involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance or achievements or the industry to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, but are not limited to, economic conditions generally and in the industry in which we and our customers participate; cost reduction efforts by our existing and prospective customers; competition within our industry, including competition from much larger competitors; business combinations; legislative requirements or changes which could render our services less competitive or obsolete; our failure to successfully develop new services and/or products or to anticipate current or prospective customers’ needs; our ability to retain existing customers and to attract new customers; price increases; employee limitations; and delays, reductions, or cancellations of contracts we have previously entered.

Forward-looking statements are predictions and not guarantees of future performance or events. Forward-looking statements are based on current industry, financial and economic information, which we have assessed but which by its nature, is dynamic and subject to rapid and possibly abrupt change. Our actual results could differ materially from those stated or implied by such forward-looking statements due to risks and uncertainties associated with our business. We hereby qualify all our forward-looking statements by these cautionary statements. These forward-looking statements speak only as of their dates and should not be unduly relied upon. We undertake no obligation to publicly update or revise any forward-looking statements whether as a result of new information, future events or otherwise (other than pursuant to reporting obligations imposed on registrants pursuant to the Exchange Act) to reflect subsequent events or circumstances.

The following discussion should be read in conjunction with our consolidated financial statements and the related notes contained elsewhere in this Annual Report on Form 10-K and in our other filings with the Securities and Exchange Commission (the “Commission”).

PART I

Company History

Pacific Health Care Organization, Inc. is a Utah corporation incorporated in 1970. In 2001 PHCO acquired Medex Healthcare, Inc. and subsequently established several other operating subsidiary companies to create a workers’ compensation managed-care company that offers an integrated and layered array of complimentary business solutions that enable our clients to better manage their employee worker compensation related healthcare administration costs.

Our clients include self-administered employers, insurers, third party administrators, municipalities and others. Although we have processed medical bill reviews in 25 states, our principal clients are located in the State of California where the high cost of workers’ compensation insurance is a critical problem. As of the end of December 31, 2015, according to the Workers’ Compensation Insurance Rating Bureau of California, the State of California has the highest per claim costs in the nation, reporting costs for workers’ compensation claims that exceed by also 200% the combined median cost of claims of all other states. Medical costs per indemnity claim have risen by more than 50% per claim since 2005. Workers’ compensation costs continue to increase in large measure due to rising medical costs, inflation, and fraud, among other factors. Medical and indemnity costs associated with workers’ compensation in the state of California cost employers billions of dollars annually.

Business of the Company

We are workers’ compensation cost containment specialists. Our business objective is to deliver value to our clients that reduces their workers’ compensation related medical claims expense in a manner that will assure that injured employees receive high quality healthcare that allows them to recover from injury and return to gainful employment without undue delay. According to studies conducted by auditing bodies on behalf of the California Division of Workers’ Compensation, (“DWC”) the two most significant cost drivers for workers’ compensation are claims frequency and medical treatment costs.

Our core service focuses on the reduction of medical treatment costs by enabling our client/employers to share the control over the medical treatment process. This control is obtained by participation in one of our medical treatment networks. We hold several valuable government-issued licenses to operate medical treatment networks. Through Medex we hold two of the total of nine licenses issued by the State of California to establish and manage a Health Care Organization (“HCO”) within the state of California. We also hold approvals issued by the State of California to act as a Medical Provider Network (“MPN”). Additionally, we offer a Nurse Case Management program that allows us to provide additional patient care and cost-saving medical treatment administration.

Health Care Organizations

An HCO is a network of health care professionals specializing in the treatment of workplace injuries and in back-to-work rehabilitation and training of our clients’ employees. HCOs were created to appeal to injured workers, while providing substantial savings to the client/employers. In most cases, our HCO programs gives the client/employer 180 days of medical control in a provider network within which the client/employer has the ability to direct the administration of the claim. The injured worker may change physicians once during this period, but the worker may not leave the provider network. The increased length of time during which the client/employer has control over administration of the claim is designed to decrease the incidence of fraudulent claims and disability awards. The right to control treatment within a network is also based upon the notion that if there is more control over medical treatment there will be more control over getting injured workers healthy and back on the job. A final outcome would be to control total claim treatment cost and related workers’ compensation insurance premiums.

Our HCO licenses allow us to cover the entire state of California. Our clients can offer their injured workers a choice of enrolling in an HCO with a network managed by primary care providers which require primary care physicians to make referrals to needed specialists or in an HCO where injured workers do not need any prior authorization to be seen and treated by specialists.

Our HCO networks have contracted with approximately 3,900 individual medical providers and clinics, as well as hospitals, pharmacies, rehabilitation centers and other ancillary services enabling our HCOs to provide comprehensive medical services throughout California. Our provider networks are composed of experts in treating worker injuries. We are continually reviewing and enhancing these networks based upon the nominations of new clients and the approvals of their claims administrators. All network provider credentials are reviewed and approved by our subsidiary Medex.

HCO guidelines impose certain medical oversight, reporting, information delivery and usage fees upon HCOs. These requirements increase the administrative costs and obligations on HCOs over those applicable to an MPN, although the obligations and cost differentials between the two types of organizations have been narrowing over the past few years.

Medical Provider Networks

Like an HCO, an MPN is a network of health care professionals, but MPN networks do not require the same level of medical expertise in treating work place injuries. Under an MPN program the client/employer dictates which physician the injured employee will see for the initial visit. Thereafter, the MPN program grants the employee discretion to choose which physician in the network will continue treatment of the claim; the client/employer is benefited by having that discretion limited for the life of the claim to physicians within the MPN network. In addition, the California MPN statute and regulations allow the injured employee to dispute treatment decisions, provide for second and third medical opinions, and then permits case review by an independent medical reviewer, whose decision can result in the client/employer losing control over medical treatment of the employee.

Unlike our HCOs, our MPN does not require our clients to pay annual fee assessments, nor does it require our clients to comply with annual enrollment notice delivery requirements. As a result, there are fewer administrative costs associated with an MPN program, which allows our MPN to market its services at a lower cost to employers than our HCOs. For this reason, many clients may opt to use the less complicated MPN even though it provides client/employers fewer rights to control medical treatment of employee injury claims.

HCO + MPN

As a licensed HCO and approved MPN, in addition to offering HCO and MPN programs, we are also able to offer our client/employers a combination of the HCO and MPN programs. Under this plan model a client/employer can enroll its employees in the HCO program, and then prior to the expiration of the 180-day treatment period under the HCO program, the client/employer can enroll the employee into the MPN program. This allows client/employers to take advantage of both programs. To our knowledge, PHCO is currently the only entity that offers clients/employers and HCO+MPN combination program.

Nurse Case Management

Nurse case management keeps medical treatment claims progressing to a resolution and assures treatment plans are aligned from a medical perspective. Nurse oversight is a collaborative process that assesses plans, implements, coordinates, monitors and evaluates the options and services required to meet an injured worker’s health needs. Nurse case managers act as a liaison between the injured worker, claims adjuster, medical providers and attorneys to achieve optimal results for injured workers and employer/clients.

Our credentialed nurses have expertise in various clinical areas and extensive backgrounds in workers’ compensation matters. This combination allows our nurses the opportunity to facilitate medical treatment while understanding the nuances of workers’ compensation up to and including litigation. By providing these services our client/employers contribute to effective delivery of medical treatment assuring the injured worker receives quality treatment in a timely and appropriate manner to return the worker to employment.

Workers’ Compensation Carve-outs

Some employers are able to opt out of the standard workers’ compensation regulatory scheme through carve-out agreements that comply with state law requirements. We facilitate the negotiation of legal agreements for the implementation of Workers’ Compensation Carve-Outs for California client/employers and provide services to the carve-out agreement parties. Under such carve-out agreements certain clients are able to access our HCOs, MPN and Nurse Case Management Program.

California law permits employers and employees to establish alternative dispute resolution systems to resolve disputes in the workers’ compensation context. These arrangements are called carve-outs because the employers and employees covered by such agreements are carved out from the standard state workers’ compensation scheme, provided applicable statutory and regulatory requirements covering the administration of carve-out programs are met. These carve-out agreements are made between client/employers and the collective bargaining units representing covered client employees.

Ancillary Services

Beyond the core services we provide to facilitate client/employers involvement in employee medical treatment claims administration and patient treatment options, we also provide to our HCO and MPN clients a number of claims-related services that bring efficiencies to claim processing and management that further reduce the overall burden of workers’ compensation claims resolution. These services include various back office type functions that assure cost efficiency and accuracy in claim processing, claim reimbursement and claim dispute resolution.

All of our services are fully integrated to allow for partial and full bundling of services and sharing of information across all our platforms. Our bundled services have allowed some client/employers to achieve up to a 70% reduction in the cost of injury claim resolution while maintaining superior treatment for injured workers. Seamless integration between services enhances cost-savings by providing concurrent access to complete, accurate and timely information relating to our HCOs, MPNs or PPO networks and all our ancillary services as claims are managed to completion. Among such services are:

|

·

|

Utilization Review

|

Using skilled staff and an automated review system we deliver utilization review services to self-insured clients, insurance companies and public entities. Utilization review cuts overhead costs of these clients. Utilization review is a safeguard against unnecessary and inappropriate medical treatment from the perspective of medical necessity, quality of care, appropriateness of decision-making, etc. applied in accordance with the applicable workers’ compensation law.

|

·

|

Medical Bill Review

|

We provide professional analysis of medical provider services and equipment billing to ascertain proper reimbursement. Such services include, but are not limited to, coding review and rebundling, confirming that the services are customary and reasonable, fee schedule compliance, out-of-network bill review, pharmacy review, and preferred provider organization repricing arrangements. These services result in significant network savings.

|

·

|

Lien Representation Services

|

When a worker is injured in the scope of employment the client/employer is required to provide workers’ compensation benefits. If the provider of services is not paid because the services were not authorized, or if the provider disputes the amount of reimbursement, the provider may file a lien against the workers’ compensation claim. We provide comprehensive lien representation services from negotiation through litigation and petitions for reconsideration.

|

·

|

Legal Support Services

|

We provide expert witness testimony before the California Workers Compensation Appeals Board. The fees include reimbursement of witness fees, travel and lodging expenses.

|

·

|

Medicare Set Aside Fees

|

In December 2015, we commenced offering Medicare Set Aside services for workers’ compensation claims which is a financial agreement that allocates a portion of a workers’ compensation settlement to pay for future medical services related to the work-place injury, illness, or disease. The purpose of the set aside arrangement is to provide funds to the injured party to pay for future medical expenses that would otherwise be covered by Medicare. This program affords our client/employers an effective way to overcome complications after settlement and avoids unnecessary costs attached to the claim.

Significant Customers

We provide services to virtually any size employer in the state of California as well as insurers, third party administrators, self-administered employers, municipalities and other industries. We also provide some client/employers utilization review, nurse case management and medical provider network, medical bill review, network access fee services and Medicare set aside services outside the state of California.

During 2016, TriStar Risk Management and Carl Warren & Company (“Carl Warren”) accounted for approximately 14% and 12%, respectively, of our total sales.

Competition

We were one of the first commercial enterprises capable of offering HCO services and MPN services in California. Now there are many companies who compete in this market. Many of these competitors are larger than PHCO and may have greater financial, research and marketing experience and resources than we do, and they may therefore represent substantial long-term competition. As of December 31, 2016, in California there were nine certified health care organization licenses issued to seven companies. We own two of the nine licenses and have six possible direct HCO competitors. Only two of these HCO competitors, however, are currently writing HCO business due to the complexity of the HCO regulations. There are minimal requirements for establishing MPNs and therefore, as of October 2016, there were in excess of 2,500 MPNs in the state of California according to the DWC MPN website. Of these, we administer 92 MPNs.

We compete on both quality of service delivery and price of services. We maintain quality of service by virtue of the training, skill and experience of our professional staff and numerous outside consultants. We compete on price through our integrated and robust information technology systems. We focus our business primarily to those employers and payers who use our HCO and/or MPN services. We anticipate that this focus will keep the majority of this business stable and renewable. However, periodically we expect that some large clients may establish the in-house capability of performing the services we offer, as this has occurred in the past. If we are unable to compete effectively, it will be difficult for us to retain current customers or add new customers, and our business, financial condition, and results of operations could be materially and adversely affected.

We rely on our well-trained and knowledgeable in-house professionals to develop service offerings aligned with market need. We target the needs of insurers, third party administrators, self-administered employers. We contract directly with medical providers based on quality determinations rather than the provision of discounted medical services. We believe this provides us a competitive advantage because we can market a direct relationship with providers who have demonstrated expertise in treating work related injuries and writing credible medical reports rather than relying on third party relationships or discounts alone.

We offer both HCO and MPN programs to potential clients, as well as an HCO/MPN combination model, which we believe also gives us a competitive advantage, because of the manner in which the network was created. While some of our competitors offer either HCO or MPN services, to our knowledge, none of our competitors offer this type of HCO/MPN combination model, nor, in our opinion, do they have the legal and medical expertise to administer one.

Governmental Regulation

Managed care programs for workers’ compensation are subject to various laws and regulations. The nature and degree of applicable regulation varies by state and by the specific services provided. Parties that provide or arrange for the provision of healthcare services are subject to numerous complex regulatory requirements that govern many aspects of their conduct and operations. Because managed healthcare is a rapidly changing and expanding industry and the cost of providing healthcare continues to increase, it is possible that the applicable federal and state regulatory frameworks will expand to have a greater impact upon the conduct and operation of our business.

As discussed above, the provision of workers’ compensation managed care in the state of California is governed by legislation and secondary regulations. The services we provide have developed largely in response to legislation or other governmental action. Changes in the legislation regulating workers’ compensation may create greater or lesser demand for the services we offer or require us to develop new or modified services to meet the needs of the marketplace and compete effectively. We could also be materially and adversely affected if the state of California were to elect to reduce the extent of medical cost containment strategies available to insurance companies and other payers, or adopt other strategies for cost containment that would not support demand for our services.

There has been considerable discussion of healthcare reform at both the federal and state level in recent years. Due to uncertainties regarding the ultimate features of reform initiatives and the timing of their enactment, we cannot predict which, if any, reforms will be adopted, when they may be adopted, or what impact they may have on our business or within the industry in which we participate.

Employees

Including the employees of our subsidiaries, as of March 16, 2017 we employed thirty-six full-time employees and one part-time employee. We also use the services of a number of consultants. In addition, all executive officers of the Company work on a full-time basis. Over the next twelve months, we anticipate hiring additional employees only if business revenues increase and our operating requirements warrant such hiring.

Reports to Security Holders

We file Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy and information statements and other filings pursuant to Sections 13, 14 and 15(d) of the Exchange Act, and amendments to such filings with the Commission. The public may read and copy any materials we file with the Commission at its Public Reference Room at 100 F Street N.E., Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The Commission maintains its internet site www.sec.gov, which contains reports, proxy and information statements and our other Commission filings. We also post an electronic copy of our Annual Report on Form 10-K on our website www.pacifichealthcareorganization.com, which you can view or download free of charge. Materials posted on our website are not part of this report.

You should consider carefully the following risk factors, together with the other information contained in this report and the other reports we file with the Commission, in evaluating us or making an investment in our common stock. The risks described below are the material risks, although not the only risks, relating to us and our common stock. If any of the following risks and uncertainties develop into actual material events, it could have a material adverse effect on our business, operations and financial condition. You should not draw any inference as to the magnitude or likelihood of any particular risk from its position in the following discussion.

A significant percentage of our revenue is generated from a few customers, the loss of one or more of which could have a material impact on our results of operations, cash flows and financial condition.

A significant portion of operating revenue is received from a relatively small group of our customers. Sales to three customers accounted for approximately 35% of our total revenue in 2016.

We cannot guarantee that significant customers will not, at some point, terminate or reduce our services. The loss of one or more significant customers will likely have an adverse impact on our business, results of operations, cash flows and financial condition, perhaps materially, until such time as we are able to retain new customers to replace them.

Most of our customer contracts permit either party to terminate without cause. Many organizations in the insurance industry have consolidated and this could result in the loss of one or more of our customers through a merger or acquisition. Additionally, we could lose customers due to competitive pricing pressures or other reasons. If several customers terminate their contracts, or do not renew or extend their contracts with us, our results could be materially adversely affected.

Our revenues may decline if we cannot compete successfully in an intensely competitive market.

We target our products to employers seeking to control the cost of employee workers’ compensation claims. We face competition from a variety of companies and the markets for our services are fragmented and competitive. Our competitors include national managed care providers, preferred provider networks, smaller independent providers and insurance companies. Many of our current and potential competitors have significantly greater financial, technical, marketing, and other resources than we do. As a result, our competitors may be able to respond more quickly to new or emerging ways to manage treatment costs, including enhanced technology, changes in regulations and standards, and shifts in customer requirements. We believe that as managed care techniques continue to gain acceptance in the marketplace, our competitors will increasingly consist of insurance companies, large workers’ compensation managed care service companies and other significant providers of managed care products. These competitors may also be able to devote greater resources to the development, promotion and sale of services and may be able to deliver competitive services or solutions at a lower end user price. Any of these competitive pressures could have a material adverse effect on our business, results of operations and financial condition.

Our business is driven substantially by the relation between the value we provide and the amounts we charge of that value. If the scope and quality of our services lag behind the market or lower cost participants are able to provide competitive services at lower prices, we may lose client/employers which could have an adverse impact on our results of operations and financial condition.

As noted in the description of business, we are in the business of assisting our client/employers control the cost of their employee workers’ compensation claims. While we believe that factors, including the quality of care provided to the employee, the rapidity at which the employee returns to work, and the service provided to the customer, play a part in the selection and retention process of our customers, we understand that price is a primary determining factor in whether client/employers selects or retains our services. While our competitors may offer direct fees less than those we charge, they have traditionally added fees to their other associated services and thus raised total cost of our services. If our competitors are able to reduce the cost at which they provide services, we anticipate that we would have to likewise attempt to reduce the cost at which we provide our services or risk losing employer customers. Either outcome could have a material adverse impact on our business, results of operations and financial condition.

Our financial performance is tied to the quality of the information technology platform we use to provide our services and communicate with our clients. The information technology business evolves rapidly and advancements can disrupt or alter the competitive environment.

Effective and competitive delivery of our services is increasingly dependent upon information technology resources and processes, both those provided internally as well as those provided through third-party vendors. In addition to better serving customers, the effective use of technology increases efficiency and enables us to reduce costs. Our future success will depend, in part, on our ability to address the needs of our client/employers by using technology to provide services to enhance customer convenience, as well as to create additional efficiencies in our operations. Many of our competitors have greater resources to invest in technological improvements. Additionally, as technology in the industry changes and evolves, keeping pace may become increasingly complex and expensive. There can be no assurance that we will be able to effectively implement new technology-driven products and services, which could reduce our ability to compete effectively.

An interruption in our ability to access, review or deliver critical data may cause customers to cancel their service and/or may reduce our ability to effectively compete.

Certain aspects of our business are dependent upon our ability to store, retrieve, process and manage data and to maintain and upgrade our data processing capabilities. Interruption of data processing capabilities for any extended length of time, loss of stored data, programming errors or other system failures could cause our client/employers to cancel their service and could have a material adverse effect on our business and results of operations.

In addition, we expect that a considerable amount of our future growth will depend on our ability to process and manage claims data more efficiently and to provide more meaningful healthcare information to customers and payors of healthcare. There can be no assurance that our current data processing capabilities will be adequate for our future growth, that we will be able to efficiently upgrade our systems to meet future demands, or that we will be able to develop, license or otherwise acquire software to address these market demands as well or as timely as our competitors.

Declines in workers’ compensation claims could materially impact our financial condition and results of operations.

Changes in the strength of the economy affect the size and activity of the work force and consequently alters the size of the work force and the level of workers’ compensation claims. In addition to working with our client/employers, we also provide outsource services to payors of worker’s compensation benefits. These payors include third party administrators, insurance companies, self-insured, self-administered employers and municipalities. If these payors reduce the amount of work they outsource, our financial condition and results of operations could be affected negatively.

Failure to maintain our licenses would have material impact on our business.

We require state issued licenses to operate our HCO and MPN networks in the state of California. If the state of California were to determine that we have failed to comply with the licensure requirements, it has the authority to deny, suspend or revoke our licenses. If our licenses were suspended or revoked, we would no longer be able to operate our HCO and/or MPN networks. In addition to the reduction in revenue we would experience from the loss of our HCO and/or MPN operations, the other services we offer would likely also be impacted negatively as many of the customers for our utilization review, medical bill review and nurse case management services are derived from our HCO and MPN clientele.

Our business is subject to online security risks, and if we are unable to safeguard the security and privacy of confidential data, our reputation and business could be harmed.

Our services involve the collection and storage of confidential information and the transmission of this information. For example, we collect personal information, information regarding medical history, and information regarding medical treatments. In certain cases, such information is provided to third-parties, and we may therefore be unable to control the use of such information or the security protections employed by such third-parties. We may be required to expend significant capital and other resources to protect against security breaches or to alleviate problems caused by security breaches. Despite our implementation of security measures, techniques used to obtain unauthorized access or to sabotage systems change frequently. As a result, we may be unable to anticipate these techniques or to implement adequate preventative measures. Any compromise or perceived compromise of our security (or the security of our third-party service providers who have access to our enrollees’ confidential information) could damage our reputation and our relationship with our customers, third-party administrators, insurers and enrollees, could reduce demand for our services and could subject us to significant liability as well as regulatory action. In addition, in the event that new data security laws are implemented, or our customers determine to impose new requirements on us relating to data security, we may be unable to timely comply with such requirements, or such requirements may not be compatible with our current processes. Changing our processes could be time consuming and expensive, and failure to timely implement required changes could result in our inability to sell our services.

Healthcare providers are becoming increasingly resistant to the application of certain healthcare cost containment techniques; this may cause revenue from some of our cost containment operations to decrease.

Healthcare providers have become more active in their efforts to minimize the use of certain cost containment techniques and are engaging in litigation to avoid application of certain cost containment practices. Recent litigation between healthcare providers and insurers has challenged certain insurers’ claims adjudication and reimbursement decisions. Although these lawsuits do not directly involve us or any services we provide, these cases may affect the use by insurers of certain cost containment services that we provide and may result in a decrease in revenue from our cost containment business.

If utilization by payors, including employers, of early intervention services continues to increase, the revenue from our later stage network and healthcare management services could be negatively affected.

The performance of early intervention services, including injury occupational healthcare, first notice of loss, and telephonic case management services, often result in a decrease in the average length of, and the total costs associated with, a healthcare claim. By successfully intervening at an early stage in a claim, the need for additional cost containment services for that claim often can be reduced or even eliminated. As employers continue to increase their utilization of early intervention services, the revenue from our later stage network and healthcare management services will decrease.

If we are unable to continue to attract and retain key employees with the skills our business requires, our business could be impacted negatively.

We compete with other workers’ compensation managed care companies and healthcare providers in recruiting qualified management and staff personnel. Employees with industry expertise are critical to our competitive strategy. There is intense competition for the services of such persons. We cannot guarantee that we will be able to attract and retain such persons if our competitors, many of whom have greater financial resources and larger organizations than ours, offer higher salaries, better benefit packages and broader opportunities than we are able to offer. If we are unable to attract or retain key employees, our business and financial condition could be affected.

Changes in government regulations could increase our costs of operations and/or reduce the demand for our services.

California has licensing and other regulatory requirements applicable to our business. These laws typically establish minimum standards for qualifications of personnel, confidentiality, internal quality control and dispute resolution procedures. These regulatory programs may result in increased costs of operation for us, which may have an adverse impact upon our ability to compete with other available alternatives for healthcare cost control. Regulation in the healthcare and workers’ compensation fields is constantly evolving. We are unable to predict what additional government initiatives affecting our business, if any, may be promulgated in the future. Our business may be adversely affected by failure to comply with existing laws and regulations, failure to obtain necessary licenses and government approvals or failure to adapt to new or modified regulatory requirements. Proposals for healthcare legislative reforms are regularly considered at the federal and state levels. To the extent that such proposals affect workers’ compensation, such proposals may affect adversely our business, financial condition and results of operations. In addition, changes in workers’ compensation and managed health care laws or regulations may reduce demand for our services, require us to develop new or modified services to meet the demands of the marketplace or reduce the fees that we may charge for our services. Any of these factors could materially impact our results of operations.

Exposure to potential litigation and legal liability may adversely affect our financial condition and results of operations.

Through our utilization review and nurse case management services, we make recommendations concerning the appropriateness of providers’ medical treatment plans of patients, and as a result, could be exposed to claims for adverse medical consequences. We do not grant or deny claims for payment of benefits and we do not believe that we engage in the practice of medicine or the delivery of medical services. There can be no assurance, however, that we will not be subject to claims or litigation related to the authorization or denial of claims for payment of benefits or allegations that we engage in the practice of medicine or the delivery of medical services.

In addition, there can be no assurance that we will not be subject to other litigation that may adversely affect our business, financial condition or results of operations, including but not limited to being joined in litigation brought against our customers in the managed care industry. We maintain professional liability insurance and such other coverages as we believe are reasonable in light of our experience to date. We also cannot assure you that our insurance will provide sufficient coverage or that insurance companies will make insurance available at a reasonable cost to protect us from significant future liability.

The price and trading volume of our common stock may be volatile, which may negative affect the value and liquidity of your shares.

The market price of our common stock may be highly volatile and subject to wide fluctuations. During the twelve month period ended December 31, 2016, the low bid price for our common stock was $7.10 per share and the high bid price was $12.50 per share. Our common stock is currently quoted on the OTC Markets, which is generally a thinly traded market that lacks the liquidity of certain other public markets. Additionally, there are a limited number of our shares of common stock outstanding, which may further limit the liquidity of our shares. Moreover, in the past, stock markets have experienced price and volume fluctuations that have particularly affected companies in the healthcare and managed care markets resulting in changes in the market price of the stock of many companies, which may not have been directly related to the operating performance of those companies. We cannot assure you that the market price for our common stock will not fluctuate or decline significantly in the future or that there will be sufficient trading volume in our common stock to allow you to sell your shares in the market when you desire to do so.

Our Chief Executive Officer, President and Chairman of the board of directors has the ability to exercise significant control over the Company.

Tom Kubota, our Chief Executive Officer, President and Chairman of the board of directors beneficially owns 483,000 shares, or approximately 60%, of our outstanding common stock. Since 2008, Mr. Kubota has a majority of our outstanding common stock and voting control of the Company. During 2016, the Company sold 1,000 shares of Series A Preferred Stock to Mr. Kubota, which represents 100% of the outstanding shares of Series A Preferred Stock of the Company. This transaction did not materially increase his economic interest in the Company, but it did increase his voting control to effectively 98%. In most matters, our Series A Preferred Stock is treated on parity with our common stock on a share-for-share basis, with the exception that each share of Series A Preferred Stock is entitled to 20,000 votes of common stock on all matters submitted to a vote of our common stock holders. The Series A Preferred Stock is convertible to shares of common stock on a one share for one share basis at the election of the holder thereof. The board of directors elected to sell shares of Series A Preferred Stock to Mr. Kubota because they believed the limited number of common shares outstanding restricted the Company’s ability to pursue potential acquisitions and other growth opportunities without jeopardizing the continuity of its strategic vision and business objectives. This capital structure may be viewed positively, negatively or indifferently by the market, investors and potential acquisition targets. If, it is viewed negatively, it could affect the liquidity and/or market price for our common stock.

This information is not required for smaller reporting companies.

We lease approximately 9,500 square feet of office space located at 1201 Dove Street, Suites 300 and 350 Newport Beach California, 92660. This office space lease expires in March 2022. This space serves as our principal executive offices, as well as, the principal offices of our subsidiaries. We believe this space will be sufficient for our needs for the foreseeable future.

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. Litigation is subject to inherent uncertainties, and an adverse result in such matters may arise from time to time that may harm our business. To the knowledge of management, there is no material litigation or governmental agency proceeding pending or threatened against us or any of our subsidiaries. Further, we are not aware of any material proceeding to which any director, member of senior management or owner of record or beneficially of more than five percent of any class of our voting securities or any of our subsidiaries, or any associate of any of them is a party adverse to or has a material interest adverse to us or any of our subsidiaries.

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our common stock is currently traded on the OTCQB under the ticker symbol “PFHO”. The following table presents the quarterly high and low bid quotations for the periods indicated. The following table sets forth the published high and low bid quotations furnished to us by OTC Markets Group, Inc. These quotations reflect inter-dealer prices without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

|

|

High

|

Low

|

||||||

|

|

||||||||

|

Fiscal year ended December 31, 2016

|

||||||||

|

|

||||||||

|

Fourth Quarter

|

$

|

12.50

|

$

|

8.60

|

||||

|

Third Quarter

|

$

|

10.25

|

$

|

8.50

|

||||

|

Second Quarter

|

$

|

10.25

|

$

|

7.10

|

||||

|

First Quarter

|

$

|

10.00

|

$

|

7.36

|

||||

|

|

||||||||

|

Fiscal year ended December 31, 2015

|

||||||||

|

|

||||||||

|

Fourth Quarter

|

$

|

22.90

|

$

|

7.40

|

||||

|

Third Quarter

|

$

|

31.00

|

$

|

16.25

|

||||

|

Second Quarter

|

$

|

34.01

|

$

|

29.05

|

||||

|

First Quarter

|

$

|

42.50

|

$

|

30.00

|

||||

Holders

As of March 16, 2017, we had approximately 295 shareholders of record holding 800,000 shares of our common stock. The number of record shareholders was determined from the records of our stock transfer agent and does not include beneficial owners of common stock whose shares are held in “nominee” or “street” name.

Dividends

On September 4, 2015, our board of directors declared a special one-time cash dividend of $1.25 per share payable to the record holders of our common stock on September 14, 2015. Prior to September 2015, we had not declared a cash dividend on any class of equity securities and the board of directors does not currently anticipate declaring cash dividends in the future.

Our ability to pay dividends is subject to limitations imposed by Utah law. Under Utah law, dividends may not be made if, after giving effect to the dividend; a) the company would be unable to pay its debts as they become due in the usual course of business; or b) the company’s total assets would be less than the sum of its total liabilities plus the amount that would be needed to satisfy the rights of any holders of preferential rights whose rights are superior to those receiving the dividend.

Securities Authorized for Issuance Under Equity Compensation Plans

Information regarding securities authorized for issuance under our equity compensation plans is set forth in Item 12 – Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters of this Annual Report on Form 10-K under the heading “Equity Compensation Plans”.

Performance Graph

This information is not required for smaller reporting companies.

Recent Sales of Unregistered Securities

Except as previously reported in our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K, we have not sold any other equity securities during the year ended December 31, 2016, which were not registered under the Securities Act of 1933, as amended.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

Neither we, nor any affiliated purchaser, purchased any of our equity securities during the year ended December 31, 2016.

This information is not required for smaller reporting companies.

The following is a discussion of our consolidated financial condition and results of operations for the years ended December 31, 2016 and 2015, and other factors that are expected to affect our prospective financial condition. The following discussion and analysis should be read together with our Consolidated Financial Statements and related notes beginning on page 23 of this Annual Report on Form 10-K.

Some of the statements set forth in this section are forward-looking statements relating to our future results of operations, liquidity and capital resources. Our actual results, liquidity and capital resources may vary from the results anticipated by these statements. We disclaim any obligation to update or revise any forward-looking statements based on the occurrence of future events, the receipt of new information, or otherwise. Actual future results may differ materially from those expressed in the forward-looking statement made by the Company or its management as a rest of a number of risks, uncertainties and assumptions. Please see “Cautionary Statement Regarding Forward-Looking Statements” on page 4 of this Annual Report on Form 10-K.

Overview

We are workers’ compensation cost containment specialists. Our business objective is to deliver value to our clients that reduces their workers’ compensation related medical claims expense in a manner that will assure that injured employees receive high quality healthcare that allows them to recover from injury and return to gainful employment without undue delay. Our clients include self-administered employers, insurers, third party administrators, municipalities and others. Although we have processed medical bill reviews in 25 states, our principal clients are located in the State of California where the high cost of workers’ compensation insurance is a critical problem.

Our core service focuses on reducing medical treatment costs by enabling employer/clients to share the control over the medical treatment process. This control is obtained by participation in one of our medical treatment networks. We realize revenues from enrollment of the employees of our client/employers into our various networks. To assist our client/employers to ensure quality, timely and cost effective treatment of their injured employees, we make our staff of credentialed registered nurses available to provide case management to assure treatment plans are properly aligned from a medical perspective.

Beyond the core services we also provide claims-related services including utilization review, medical bill review, lien representation and legal support and Medicare set aside service that bring efficiencies to claims processing and management that further reduces the overall burden of worker compensation claims resolution.

Our business generally has a long sales cycle, typically in excess of one year. Once we have established a customer relationship and enrolled employees of our client/employers, our revenue adjusts with the growth or retraction of client/employers’ managed headcount. Throughout the year, new employees and client/employers are added while others terminate from the program for a variety of reasons.

In the current economic environment, we anticipate businesses will continue to seek ways to control their workers’ compensation program costs. Even though our HCO and MPN programs have been shown to create a favorable return on investment for our client/employers, (as our services are a significant component of the employers’ loss prevention programs), from time-to-time we experience customer volatility in the form of existing client/employers terminating or seeking to renegotiate the scope and terms of existing services, or seeking to reduce costs by managing their workers’ compensation care services in-house.

Summary of Fiscal 2016

During the year ended December 31, 2016, total revenues decreased 31% due primarily to the loss of several large customers during the latter part of 2015 and early 2016. Revenue from utilization review, MPN and medical bill review were most directly impacted decreasing 78%, 39%, and 37%, respectively. Offsetting those reductions, revenue from nurse case management services and HCO increased 85% and 13%, respectively. During fiscal 2016, we were successful in adding a number of new clients whose combined revenues totaled $527,215, which helped offset some of the impact of the losses experienced in the latter part of 2015 and early 2016.

During fiscal 2016, we were able to reduce operating expenses by 13%, primarily as a result of lower outsource service fees. This reduction was partially offset by higher data maintenance fees. As a result, our income from operations was $969,328 during fiscal 2016, compared to $2,822,211 in fiscal 2015.

Our provision for income tax expense decreased 65% during fiscal 2016 as a result of the decrease in income from operations.

Our net income decreased 66% to $566,748. Basic and fully diluted earnings per share during fiscal 2016 was $0.71, compared to $2.10 during fiscal 2015.

Comparison of the Fiscal Years Ended December 31, 2016 and 2015

Results of Operations

The following represents selected components of our consolidated results of operations, for the years ended December 31, 2016 and 2015, respectively, together with changes from year-to-year:

|

Year Ended December 31,

|

||||||||||||||||

|

2016

|

2015

|

Amount Change

|

% Change

|

|||||||||||||

|

Revenues

|

||||||||||||||||

|

HCO fees

|

$

|

1,427,936

|

$

|

1,268,635

|

$

|

159,301

|

13

|

%

|

||||||||

|

MPN fees

|

578,646

|

947,903

|

(369,257

|

)

|

(39

|

%)

|

||||||||||

|

UR fees

|

775,610

|

3,458,398

|

(2,682,788

|

)

|

(78

|

%)

|

||||||||||

|

MBR fees

|

625,492

|

988,731

|

(363,239

|

)

|

(37

|

%)

|

||||||||||

|

NCM fees

|

1,735,772

|

939,675

|

796,097

|

85

|

%

|

|||||||||||

|

Other

|

544,240

|

621,132

|

(76,892

|

)

|

(12

|

%)

|

||||||||||

|

Total revenues

|

5,687,696

|

8,224,474

|

(2,536,778

|

)

|

(31

|

%)

|

||||||||||

|

Expense

|

||||||||||||||||

|

Depreciation

|

84,700

|

69,254

|

15,446

|

22

|

%

|

|||||||||||

|

Bad debt provision

|

13,500

|

14,417

|

(917

|

)

|

(6

|

%)

|

||||||||||

|

Consulting fees

|

340,653

|

370,956

|

(30,303

|

)

|

(8

|

%)

|

||||||||||

|

Salaries and wages

|

2,316,571

|

2,324,977

|

(8,406

|

)

|

(0

|

%)

|

||||||||||

|

Professional fees

|

328,943

|

395,627

|

(66,684

|

)

|

(17

|

%)

|

||||||||||

|

Insurance

|

339,235

|

339,619

|

(384

|

)

|

(0

|

%)

|

||||||||||

|

Outsource service fees

|

402,894

|

1,094,944

|

(692,050

|

)

|

(63

|

%)

|

||||||||||

|

Data maintenance

|

230,619

|

154,524

|

76,095

|

49

|

%

|

|||||||||||

|

General and administrative

|

661,253

|

637,945

|

23,308

|

4

|

%

|

|||||||||||

|

Total expenses

|

4,718,368

|

5,402,263

|

(683,895

|

)

|

(13

|

%)

|

||||||||||

|

Income from operations

|

969,328

|

2,822,211

|

(1,852,883

|

)

|

(66

|

%)

|

||||||||||

|

Other expense

|

||||||||||||||||

|

Interest expense

|

-

|

202

|

(202

|

)

|

(100

|

%)

|

||||||||||

|

Total other expense

|

-

|

202

|

(202

|

)

|

(100

|

%)

|

||||||||||

|

Income before income tax provision

|

969,328

|

2,822,009

|

(1,852,681

|

)

|

(66

|

%)

|

||||||||||

|

Income tax provision

|

402,580

|

1,144,785

|

(742,205

|

)

|

(65

|

%)

|

||||||||||

|

Net income

|

$

|

566,748

|

$

|

1,677,224

|

$

|

(1,110,476

|

)

|

(66

|

%)

|

|||||||

Revenue

Total revenues during the year ended December 31, 2016, decreased 31% to $5,687,696 compared to $8,224,474 during the year ended December 31, 2015.

During 2016, HCO and nurse case management revenues increased 13% and 85%, respectively, and MPN, utilization review, medical bill review and other revenues decreased by 39%, 78%, 37%, and 12%, respectively. Other revenues consisted of revenues derived primarily from network claims repricing services, lien representation services, legal support services, workers’ compensation carve out revenues and Medicare set aside revenues. The loss of several large customers during the latter part of 2015 had a significant negative impact on our revenues during 2016.

The following table summarizes approximate enrollment in our HCO and MPN networks as of December 31, 2016 and 2015, respectively, together with changes from year-to-year:

|

As of December 31,

|

||||||||||||||||

|

2016

|

2015

|

Amount Change

|

% Change

|

|||||||||||||

|

HCO

|

182,000

|

145,000

|

37,000

|

26

|

%

|

|||||||||||

|

MPN

|

136,000

|

206,000

|

(70,000

|

)

|

(34

|

%)

|

||||||||||

|

Total enrollment

|

318,000

|

351,000

|

(33,000

|

)

|

(9

|

%)

|

||||||||||

The net increase during 2016 in HCO enrollment when compared to the previous year was primarily the result of several existing HCO customers increasing their enrollment and the addition of a new customer. MPN enrollment decreased primarily as a result of the loss of a major MPN customer, and reductions in employee enrollment from several of our self-insured MPN clients.

Utilization Review

During the year ended December 31, 2016, utilization review revenue decreased $2,682,788 to $775,610. During the fourth quarter 2015, the largest customer of our utilization review services, terminated our services. During 2016 we recorded $0 revenue from that former customer compared to $2,564,042 in 2015. The loss of that customer had a significant negative impact on our utilization review fees and total revenue during 2016.

Medical Bill Review

During the twelve months ended December 31, 2016, revenue from medical bill review decreased by $363,239 to $625,492 when compared the same period a year earlier. This was largely the result of the loss of a large customer in June 2015 and lower revenues realized from two other customers. During 2016, we recorded no revenue from the customer lost in June 2015 compared to $330,429 in revenues realized from this customer in 2015.

HCO

During the years ended December 31, 2016 and 2015, HCO revenue was $1,427,936 and $1,268,635, respectively. HCO revenue increased 13% during 2016 and HCO employee enrollment increased 26% when compared to the same period a year earlier. Increases in HCO revenue generally lag several months behind increases in HCO enrollment because there is typically a ramp up period between the time new employees are enrolled and when we begin generating revenue from claims processing and other HCO services. The increase in HCO revenue of $159,301 was primarily attributable to revenue derived from initial notification fees and mailing fees from a new HCO customer. These initial notification and mailing fees occur at the time new employees are enrolled and reoccur in future periods based on the terms of the customer’s contract.

MPN

MPN revenue for 2016 was $578,646 compared to $947,903 for 2015, a decrease of 39%. During the same period, employee enrollment decreased by 34% resulting primarily from terminations by a large customer in each of the third and fourth fiscal quarters of 2015. These customer losses were partially offset by adding new customers in the third quarter of 2015 and the first and second quarters of 2016, coupled with increases in revenue from existing customers.

Nurse Case Management

During the twelve-month periods ended December 31, 2016 and 2015, revenue from nurse case management revenue was $1,735,772 and $939,675, respectively. The increase in nurse case management revenue of $796,097 was primarily attributable to adding three new customers, and net increases from existing customers which contributed $306,999 and $489,098, respectively, to the total increase in nurse case management revenue.

Other

Other fees consist of revenue derived from network access and claims repricing, lien representation, legal support services, Medicare set aside, and worker’s compensation carve-outs services. Other fee revenue for the years ended December 31, 2016 and 2015, was $544,240 and $621,132, respectively.

Revenue from network access and claims repricing fees contributed 79% and 89% of total Other fees during 2016 and 2015, respectively. We realized a 23% decrease in network access fees as a result of one customer realizing lower savings from using our network. During fiscal 2016, Medicare set aside contributed 14% to Other fees. We did not offer Medicare set aside services during fiscal 2015.

Expenses

Total expenses for the years ended December 31, 2016 and 2015, were $4,718,368 and $5,402,263, respectively. The decrease of $683,895 was primarily the result of decreases in outsource service and professional fees. These decreases were partially offset by increased data maintenance expense.

Depreciation

During the twelve-month period ended December 31, 2016, we recorded depreciation expense of $84,700 compared to $69,254 during the comparable 2015 period. The increase in depreciation was primarily attributable to the purchase of additional furniture, fixtures and computer equipment.

Bad Debt

During the years ended December 31, 2016 and 2015, we recorded bad debt provisions of $13,500 and $14,417, respectively, to cover potential uncollectible receivables from various customers. At December 31, 2016 and 2015, our allowances for bad debt balances were $64,150 and $55,000, respectively. The accrual for bad debt provision was lower in 2016, compared to 2015, due to a lower number of potential uncollectable accounts.

Consulting Fees

During the year ended December 31, 2016, consulting fees decreased approximately 8% to $340,653 from $370,956 during 2015. This decrease of $30,303 was primarily the result of hiring a consultant in December 2015, whose position was changed to an employee position in March 2016.

Salaries and Wages

During the twelve months ended December 31, 2016, salaries and wages decreased less than 1%. This decrease was primarily the result of employee vacancies during the year and salary reductions of 10% realized from three senior executives partially offset by writing off of deferred compensation and higher levels of commissions. As of December 31, 2016 and 2015, the Company employed 37 and 36 full-time employees, respectively.

Professional Fees

For the year ended December 31, 2016, we incurred professional fees of $328,943 compared to $395,627 during the same period in 2015. This 17% decrease was primarily the result of lower professional fees paid for field case management services which was partially offset by higher legal fees.

Insurance

During 2016, we incurred insurance expenses of $339,235, a decrease of $384 when compared to 2015. We expect insurance fees to moderately increase starting in May of 2017.

Outsource Service Fees

Outsource service fees consist of costs incurred by our subsidiaries in outsourcing utilization review, medical bill review and nurse case management services, and typically tends to increase and decrease in correspondence with increases and decreases in demand for those services. We incurred $402,894 and $1,094,944 in outsource service fees during the twelve-month periods ended December 2016 and 2015, respectively. The decrease of $692,050 was primarily the result of the termination of business with a large customer in September 2015. We anticipate our outsource service fees will continue to move in correspondence with the level of utilization review, medical bill review and certain nurse case management services we provide in the future.

Data Maintenance

During the year ended December 31, 2016, we incurred data maintenance fees of $230,619, an increase of $76,095 over 2015. During the same twelve–month period we experienced an HCO employee enrollment increase of 25% when compared to 2015. The data maintenance fees increase was primarily attributable to data maintenance fees incurred for enrollment of a new HCO customer in March 2016.

General and Administrative

General and administrative expenses increased 4% to $661,253 during the twelve months ended December 31, 2016, when compared to 2015. The increase in general and administrative expense was primarily attributable to increases in charitable contributions, IT enhancement expense, license and permits, office supplies, postage expense, telephone expense, office rent and vacation expense, partially offset by decreases in advertising, dues and subscriptions, loss on settlement, moving expense, shareholders expense, travel and entertainment, and miscellaneous general and administrative expense.

Income from Operations

As a result of the 31% decrease in total revenue during fiscal 2016, which was only partially offset by the 13% decrease increase in total expenses, our income from operations decreased 66% during the fiscal year ended December 31, 2016, when compared to the same fiscal period of 2015.

Other Expense

During 2016, we realized zero other expense, compared to $202 during 2015. This decrease in other expense was the result of no interest expense incurred in 2016.

Income Tax Provision

Because we realized income from operations of $969,328 during the year ended December 31, 2016, compared to $2,822,211 during the year ended December 31, 2015, we realized a $742,205, or 65%, decrease in our income tax provision.

Net Income

During the year ended December 31, 2016, total revenues of $5,687,696 were lower by $2,536,778 when compared to the same period 2015. This decrease in total revenues was partially offset by decreases in total expenses of $683,895, resulting in income from operations of $969,328, compared to income from operations of $2,822,211 during 2015. We realized net income of $566,748 in 2016, compared to net income of $1,677,224 during 2015. As discussed in this report, the loss of several major clients during 2015 and early 2016, contributed to the lower net income in 2016. Although the loss of these customers substantially negatively impacted our net income in 2016, we were able to add a number of new customers during 2016. Revenue from these new customers accounted for approximately 10% of our total revenue during 2016.

Liquidity and Capital Resources

We realized net income and an increase in cash during fiscal 2016. As of December 31, 2016, we had cash on hand of $5,005,617 compared to $3,834,924 at December 31, 2015. The $1,170,693 increase in cash on hand was primarily the result of net cash provided by our operating activities and net cash provided by financing activities, partially offset by cash used in investing activities. Net cash provided by our operating activities was the result of realizing net income coupled with decreases in our account receivables, deferred tax assets, prepaid income tax, deferred compensation and increases in depreciation, bad debt provision, accounts payable, accrued expenses, income tax payable and deferred rent. We used $42,484 in investing activities for purchases of computers, furniture and equipment. Cash flow from financing activities was the result of the issuance of Series A Preferred Stock, partially offset by payments of outstanding dividends payable. Barring a significant downturn in the economy or the loss of major customers, we believe that cash on hand and anticipated revenues from operations will be sufficient to cover our operating expenses over the next twelve months.

We currently have planned certain capital expenditures during 2016, to expand our IT capabilities. We believe we have adequate capital on hand to cover these expenditures and do not anticipate this will require us to seek outside sources of funding. We continue to investigate potential opportunities to expand our business either through the creation of new business lines or the acquisition of existing businesses. We have not identified any suitable opportunity at the current time. We anticipate an expansion or acquisition of this sort may require greater capital resources than we currently possess. Should we need additional capital resources, we could seek to obtain such through debt and/or equity financing. We do not currently possess an institutional source of financing and there is no assurance that we could be successful in obtaining equity or debt financing when needed on favorable terms, or at all. We could also use shares of our capital stock as consideration for a business acquisition transaction.

During the third fiscal quarter 2015, the Company terminated its common stock repurchase program. As of December 31, 2015, we had repurchased 8,269 shares as treasury stock for approximately $254,057. During the year 2016, all of the treasury stock was retired.