Attached files

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended

|

December 31, 2016

|

OR

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from

|

to

|

Commission file number 0-23367

|

BIRNER DENTAL MANAGEMENT SERVICES, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

COLORADO

|

84-1307044

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(IRS Employer Identification No.)

|

|

1777 S. HARRISON STREET, SUITE 1400

DENVER, COLORADO

|

80210

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (303) 691-0680

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Common Stock, without par value

|

OTCQX Market

|

Securities registered pursuant to Section 12(g) of the Act:

|

None

|

|

(Title of Class)

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such Files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

Non-accelerated filer ☐

|

Smaller reporting company ☒

|

|||

|

|

|

(Do not check if a smaller reporting company)

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the registrant’s common equity held by non-affiliates computed by reference to the last reported sale price of its Common Stock as of June 30, 2016, the last business day of the registrant’s most recently completed second fiscal quarter, was $10,474,554. This calculation assumes that the registrant’s executive officers, directors and persons owning 5% or more of the outstanding Common Stock as of such date are affiliates of the registrant. This determination of affiliated status is not necessarily a conclusive determination for other purposes.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

|

Class

|

Shares Outstanding as of March 25, 2017

|

|

|

Common Stock, without par value

|

1,860,261

|

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this Annual Report on Form 10-K (Items 10, 11, 12, 13 and 14) is incorporated by reference from the registrant’s definitive proxy statement for the 2017 Annual Meeting of Shareholders to be filed pursuant to Regulation 14A within 120 days from December 31, 2016.

FORWARD-LOOKING STATEMENTS

Statements contained in this Annual Report on Form 10-K (“Annual Report”) of Birner Dental Management Services, Inc. (together with its subsidiaries, the “Company”), which are not historical in nature, are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act, as amended, and the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements in Item 1, “Business,” Item 1A, “Risk Factors,” Item 5, “Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities” and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” regarding, for example, the intent, belief or current expectations of the Company or its officers with respect to the company’s prospects and performance in future periods, including the amount of bank debt, performance of de novo offices, the payment or non payment of dividends, dentist count, dentist turnover and recruitment, dentist productivity, new patient visits and patient flow and the impact of certain shareholders matters.

Investors and prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Such forward-looking statements involve certain risks and uncertainties that could cause actual results to differ materially from anticipated results. These risks and uncertainties include the future to successfully recruit, retain and integrate dentists and other employees, the Company’s indebtedness and potential actions by its lending bank, financial and credit markets and the availability of capital, actions by shareholders, Competition, regulatory constraints, changes in health care laws and others laws or regulations concerning the practice of dentistry or dental service organizations, the availability of suitable locations within the Company's markets, changes in the Company’s strategy, the general economy of the United States and the specific markets in which the Company’s dental practices are located trends and other developments in the health care, dental care and managed care industries, as well as the risk factors set forth in Item 1A, “Risk Factors,” of this Annual Report, and other factors as may be identified from time to time in the Company’s filings with the Securities and Exchange Commission or in the Company’s press releases. The Company assumes no obligation to update any forward-looking statements after the date of this Annual Report as a result of new information, future events or developments, except as required by applicable laws and regulations.

2

Birner Dental Management Services, Inc.

Form 10-K

|

Part

|

Item(s)

|

Page

|

|

|

I.

|

1.

|

4

|

|

|

1A.

|

12

|

||

|

1B.

|

20

|

||

|

2.

|

20

|

||

|

3.

|

22

|

||

|

4.

|

22

|

||

|

II.

|

5.

|

23

|

|

|

6.

|

24

|

||

|

7.

|

24

|

||

|

7A.

|

37

|

||

|

8.

|

38

|

||

|

9.

|

61

|

||

|

9A.

|

61

|

||

|

9B.

|

62

|

||

|

III.

|

10.

|

63

|

|

|

11.

|

63

|

||

|

12.

|

63

|

||

|

13.

|

63

|

||

|

14.

|

63

|

||

|

IV.

|

15.

|

64

|

|

|

16.

|

64

|

||

|

65

|

PART I

General

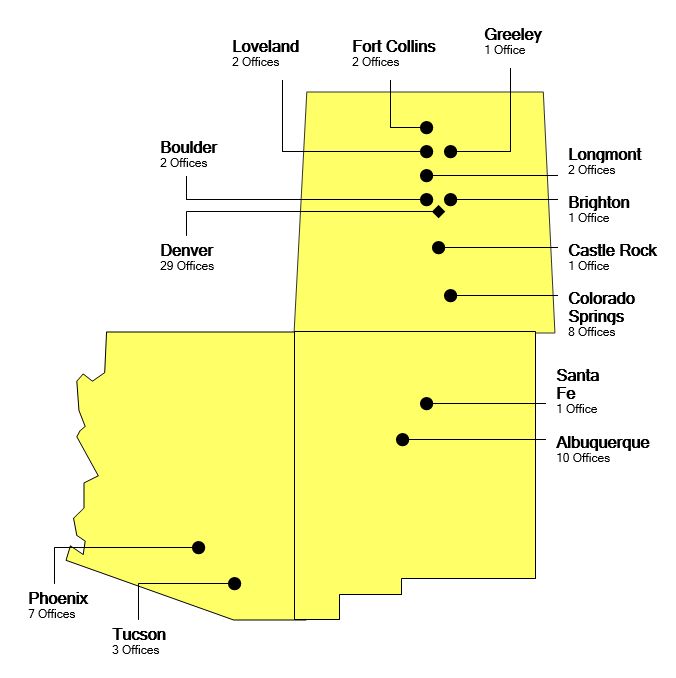

The Company is a dental service organization devoted to servicing geographically dense dental practice networks in select markets, currently including Colorado, New Mexico and Arizona. With 48 affiliated dental practices (“Offices”) in Colorado and 11 in New Mexico, the Company believes that its affiliated Offices comprise the largest provider of dental care in Colorado and New Mexico. In addition, the Company has ten affiliated Offices in Arizona. As of December 31, 2016, the Company provided business services to 69 Offices, of which 36 were acquired and 33 were developed internally (“de novo Offices”). The Company provides a solution to the needs of dentists, patients and third-party payors by allowing the Company’s affiliated dentists to provide high-quality, efficient dental care in patient-friendly, family practice settings. Dentists practicing at the various locations provide comprehensive general dentistry services, and the Company offers specialty dental services through affiliated specialists at some of its locations. The Company was incorporated as a Colorado corporation in May 1995.

Dental Services Industry

According to the Centers for Medicare and Medicaid Services (“CMS”), dental expenditures in the U.S. increased from $38.9 billion in 1993 to an estimated $117.5 billion in 2015. CMS also projects that dental expenditures will reach approximately $191.3 billion by 2022, representing an increase of approximately 62.8% over 2015 dental expenditures.

Traditionally, many dental patients have paid for dental services themselves rather than through third-party payment arrangements such as indemnity insurance, preferred provider plans or managed dental plans. Factors such as increased consumer demand for dental services and the desire of employers to provide enhanced benefits for their employees have resulted in an increase in third-party payment arrangements for dental services. The rise of third-party payment arrangements has contributed to the increased consolidation of practices in the dental services industry and to the formation of dental service organizations.

Patient Services

The Company’s affiliated Offices seek to develop long-term relationships with patients. Dentists practicing at the Offices provide comprehensive general dentistry services including crowns and bridges, fillings (including gold, porcelain and composite inlays/onlays), implants and aesthetic procedures such as porcelain veneers and bleaching. In addition, dental hygienists provide cleanings and periodontal services including root planing and scaling. If appropriate, the patient is offered specialty dental services, such as orthodontics, oral surgery, pediatrics, endodontics and periodontics, which are available at certain of the Offices. Affiliated specialists rotate through certain Offices to provide these services. By offering a broad range of dental services within its dental practice network, the Company is able to distinguish itself from its competitors and realize operating efficiencies and economies of scale through higher utilization of its facilities.

The Company’s Dentist Philosophy

The Company seeks to develop long-term relationships with its dentists by building the practice at each of its Offices around a managing dentist. The Company’s dental service model provides managing dentists a leadership role and ability to practice in a style they are most accustomed to without the capital commitment and administrative burdens such as billing/collections, payroll, accounting and marketing. This gives dentists the ability to focus primarily on providing high-quality dental care to their patients, team building and developing long-term relationships with patients and staff by building trust and providing a friendly, relaxed atmosphere in their Offices. The managing dentists exercise clinical judgment in matters of patient care. In addition, managing dentists have a financial incentive to improve the operating performance of their Offices through a bonus system based upon the operating performance of the Office.

When the revenues of an Office justify expansion, associate dentists are added to the team. Depending on performance and abilities, an associate dentist may be given the opportunity to become a managing dentist.

Dental Service Model

The Company’s dental service model is designed to achieve its goal of providing personalized, high-quality dental care in a patient-friendly setting similar to that found in a traditional private dental practice. The Company’s dental service model consists of the following components:

Recruiting of Dentists. The Company seeks to recruit and retain dentists with excellent skills and experience, who are sensitive to patient needs, interested in establishing long-term patient relationships and motivated by financial incentives to enhance Office operating performance. The Company believes that practicing in its network of Offices offers dentists advantages over a solo or smaller group practice, including relief from the burden of most administrative responsibilities and the resulting ability to focus more time on practicing dentistry. Other advantages include relief from capital commitments, a compensation structure that rewards productivity, employee benefits such as health insurance, a 401(k) plan, continuing education, paid holidays and vacation and payment of professional membership fees and malpractice insurance. The Company seeks to recruit managing dentists with three or more years of practice experience, although from time to time the Company recruits associate dentists graduating from residency programs.

The Company advertises for dentists through various platforms, including, but not limited to, national and regional journals, job boards, state association websites, networking, sponsoring regional dental societies, search engine optimization, professional conferences, dental schools and residencies and our PERFECT TEETH careers website. In addition, the Company’s existing affiliated dentists provide a good referral source for recruiting future dentists.

Training of Non-Dental Employees. The Company has developed a formalized training program for non-dental employees, which is conducted by the Company’s staff. This program includes training in patient interaction, scheduling, use of computer systems, office procedures and protocols, and third-party payment arrangements. The Company also offers formalized mandatory training programs for employees regarding occupational safety and environmental issues, state dental practice law, state and local regulations and the Health Insurance Portability and Accountability Act (“HIPAA”) to ensure compliance with government regulations. Additionally, the Company encourages its employees to attend continuing education seminars as a supplement to the Company’s formalized training program. Company regional directors meet with senior management and administrative staff to review pertinent and timely topics and generate ideas that can be shared with all Offices. Management believes that its training program and ongoing meetings with employees have contributed to the success of the Offices.

Staffing Model. The Company’s staffing model attempts to maximize profitability in the Offices by adjusting personnel according to an Office’s revenue level. Staffing at mature Offices varies based on the number of treatment rooms, but generally includes one to three dentists, two to four dental assistants, one to three dental hygienists, one to three hygiene assistants and one to five front office personnel. Staffing at de novo Offices typically consists initially of one dentist, one dental assistant and one front office person. As the patient base builds at an Office, additional staff is added to accommodate the growth. The Company currently has a staff of regional directors who are responsible for groups of Offices, overseeing operations, training and development of non-dental employees, recruitment and implementing the Company’s dental service model.

Management Information Systems. The Company has a networked management information system through which it receives uniform data that is analyzed to measure and improve operating performance in the Offices. The Company’s system enables it to maintain on-line contact with each of its Offices and allows it to monitor the Office’s performance with real-time data relating to patient and insurance information, treatment plans, scheduling, revenues and collections. The Company provides each Office with monthly operating and financial data, which is analyzed and used to improve the Office’s performance.

GOLD STANDARD Commitment. The Company strongly believes that developing long-term relationships with patients is of mutual benefit to both patients and the Company and recognizes that an integral part of these relationships is focused on the interaction that the patient has before, during and after his or her experience in an Office. The Company has developed a commitment to exceptional patient care and customer service, internally referred to as the GOLD STANDARD. All affiliated dentists, field employees and support employees are trained to provide GOLD STANDARD patient care and service every day with every patient. The Company believes its commitment to the GOLD STANDARD will further enhance the Company’s reputation within the markets in which it operates as well as drive new patient visits and increase patient retention.

Advertising and Marketing. The Company uses the PERFECT TEETH™ name to distinguish the Company’s Offices from other dental offices in the markets in which it operates. Also, the Company promotes brand awareness and generates demand through marketing and advertising utilizing the PERFECT TEETH™ name. The Company seeks to stimulate demand and increase patient volume at its Offices through internet, social media, television, radio and print advertising and other marketing techniques. The Company’s advertising efforts are primarily aimed at increasing patient awareness and emphasize the high-quality care provided as well as the timely, individualized attention received from the Company’s affiliated dentists. During 2016, the Company used social media and internet advertising in all of its markets. During 2015, the Company used television advertising in the Denver, Colorado market, radio advertising in the Denver, Colorado and Colorado Springs, Colorado markets and social media and internet advertising in all of its markets. During 2014, the Company used television and radio advertising in the Albuquerque, New Mexico market and social media and internet advertising in all of its markets.

Purchasing/Vendor Relationships. The Company has negotiated arrangements with a number of vendors, including dental laboratory and supply providers, to reduce unit costs. By aggregating supply purchasing and laboratory usage, the Company believes that it has received favorable pricing compared to solo or smaller group practices. The Company purchased approximately $2.5 million of dental supplies and equipment from Henry Schein and incurred approximately $382,000 in laboratory expenses from Pro Dental Laboratory during 2016. The Company believes that other sources of supply are available and that the loss of either of these vendors will not have a material adverse effect on the Company. The Company’s system of centralized buying and distribution on an as-needed basis reduces the storage of inventory and supplies at the Offices.

Payor Mix

The Company’s third-party payors include indemnity insurers, preferred provider plans, managed dental care plans, and uninsured cash patients including payments under the Company’s discount dental plan. The Company negotiates managed dental care contracts and preferred provider networks on behalf of the Offices, and each Office enters into a contract with the various managed care plans. Under a capitated managed dental care contract, the dental practice provides dental services to the members of the plan and receives a fixed monthly capitation payment for each plan member covered for a specific schedule of services regardless of the quantity or cost of services to the participating dental practice that is obligated to provide them, and may receive a co-pay for each service provided. Capitated managed dental care plans, including revenue from associated co-payments, accounted for 16.0% of the Company’s revenue in 2016 compared to 16.8% in 2015 and 17.7% in 2014.

Expansion Program

Since its formation in May 1995, the Company has acquired 45 practices, including eight practices that have been consolidated into existing Offices and one practice that was closed during 2004. Of those acquired practices (including the eight practices consolidated into existing Offices and the one practice closed during 2004), 35 were located in Colorado, five were located in New Mexico and five were located in Arizona. Although the Company has acquired and integrated several group practices, many of the Company’s acquisitions have been solo dental practices.

Since its formation, the Company has developed 37 de novo Offices (including two practices that have been consolidated with existing Offices and two that were closed during 2010). During 2009, the Company acquired two practices in Tucson, Arizona and one practice in Denver, Colorado. During 2010, the Company opened two de novo Offices, one in Albuquerque, New Mexico and one in Denver, Colorado. No de novo Offices were opened during 2011. During 2012, the Company opened two de novo Offices, one in Tucson, Arizona and one in Denver, Colorado. During 2013, the Company opened two de novo Offices, one in Loveland, Colorado and one in Monument, Colorado. During 2014, the Company opened two de novo Offices, one in Fort Collins, Colorado and one in Scottsdale, Arizona. During 2015, the Company opened one de novo Office, in Albuquerque, New Mexico. During 2016, the Company opened one de novo Office in Commerce City, Colorado. The Company does not intend to open any additional de novo Offices during 2017. Instead, the Company will focus on gaining profitability in its most recently opened Offices and its existing facilities, filling excess capacity in its Offices, and paying down bank debt. During the first quarter of 2017, the Company consolidated the dental services of one of its Fort Collins, Colorado Offices into another Office and subsequently closed the first Office.

The Company seeks to increase revenue in existing markets by enhancing the operating performance of its existing Offices and through de novo Offices, acquisitions and other development activity. The Company seeks to enhance operating performance through the expansion of specialty services and the recruitment of additional dentists and dental hygienists to further utilize existing physical capacity in the Offices. Additionally, the Company has remodeled certain Offices to expand the number of treatment rooms in the Office so that more patients can be treated. The Company is committed to upgrading its existing Offices through extensive remodels and/or Office relocations as well as converting its Offices to digital radiography. All Office remodels and/or Office relocations include conversion to digital radiography. During 2014, the Company completed remodels and/or relocations of three of its Offices and converted six additional Offices to digital radiography. During 2016, the Company converted one Office to digital radiography.

Affiliation Model

Relationship with Professional Corporations (P.C.s)

Each Office is operated by a P.C. that is owned by one of four different licensed dentists affiliated with the Company. The Company has entered into agreements with the owners of the P.C.s, which provide that upon the death, disability, incompetence or insolvency of the owner, a loss of the owner’s license to practice dentistry, a termination of the owner’s employment by the P.C., a conviction of the owner for a criminal offense, or a breach by the P.C. of the Management Agreement (as defined below) with the Company, or a determination by the Company in its sole discretion that it is in its best interest, the Company may require the owner to sell the shares in the P.C. for a nominal amount to a third-party designated by the Company. These agreements also prohibit the owner from transferring or pledging the shares in the P.C.s except to parties approved by the Company who agree to be bound by the terms of the agreements. Upon a transfer of the shares to another party, the owner agrees to resign all positions held as an officer or director of the P.C.

Management Agreements with Affiliated Offices

The Company derives all of its revenue from its management agreements with the P.C.s (the “Management Agreements”). Under each of the Management Agreements, the Company provides business and marketing services to the Offices, including (i) providing capital, (ii) designing and implementing marketing programs, (iii) negotiating for the purchase of supplies, (iv) staffing, (v) recruiting, (vi) training of non-dental personnel, (vii) billing and collecting patient fees, (viii) arranging for certain legal and accounting services, and (ix) negotiating with managed care organizations. The P.C. is responsible for, among other things, (i) supervision of all dentists, dental hygienists and dental assistants, (ii) ensuring compliance with all laws, rules and regulations relating to dentists, dental hygienists and dental assistants, and (iii) maintaining proper patient records. The Company has made, and intends to make in the future, loans to the P.C.s to fund their acquisition of dental assets from third parties in order to comply with state dental practice laws. Because the Company’s financial statements are consolidated with the financial statements of the P.C.s, these loans are eliminated in consolidation.

Under the typical Management Agreement, the P.C. pays the Company a management fee equal to the Adjusted Gross Center Revenue of the P.C. less compensation paid to the dentists, dental hygienists and dental assistants employed at the Office of the P.C. Adjusted Gross Center Revenue is comprised of all fees and charges booked by or on behalf of the P.C. as a result of dental services provided to patients at the Office, less any adjustments for uncollectible accounts, professional courtesies and other activities that do not generate a collectible fee. The Company’s costs include all direct and indirect costs, overhead and expenses relating to the Company’s provision of management services to the Office under the Management Agreement, including (i) salaries, benefits and other direct costs of Company employees who work at the Office (other than dentists’, dental hygienists’ and dental assistants’ salaries), (ii) direct costs of all Company employees or consultants who provide services to or in connection with the Office, (iii) utilities, janitorial, laboratory, supplies, advertising and other expenses incurred by the Company in carrying out its obligations under the Management Agreement, (iv) depreciation expense associated with the P.C.’s assets and the assets of the Company used at the Office, and the amortization of intangible asset value relating to the Office, (v) interest expense on indebtedness incurred by the Company to finance any of its obligations under the Management Agreement, (vi) general and malpractice insurance expenses, lease expenses and dentist recruitment expenses, (vii) personal property and other taxes assessed on the Company’s or the P.C.’s assets used in connection with the operation of the Office, (viii) out-of-pocket expenses of the Company’s personnel related to mergers or acquisitions involving the P.C., (ix) corporate overhead charges or any other expenses of the Company including the P.C.’s pro rata share of the expenses of the accounting and computer services provided by the Company, and (x) a collection reserve in the amount of 5.0% of Adjusted Gross Center Revenue. As a result, substantially all costs associated with the provision of dental services at the Office are borne by the Company, except for the compensation of the dentists, dental hygienists and dental assistants who work at the Office. This enables the Company to manage the profitability of the Offices. Each Management Agreement is for a term of 40 years. Each Management Agreement generally may be terminated by the P.C. only for cause, which includes a material default by or bankruptcy of the Company. Upon expiration or termination of a Management Agreement by either party, the P.C. must satisfy all obligations it has to the Company.

The Company plans to continue to use the current form of its Management Agreement to the extent possible. However, the terms of the Management Agreement are subject to change to comply with existing or new regulatory requirements or to enable the Company to compete more effectively.

Employment Agreements

Dentists practicing at the Offices have entered into employment agreements with a P.C. The majority of these agreements can be terminated by either party without cause with 90 days notice. The agreements typically contain non-competition provisions for a period of three years following their termination within a specified geographic area, usually a specified number of miles from the associated Office, and restrict solicitation of patients and employees. Managing dentists receive compensation based upon the greatest of (i) an amount per hour or monthly guarantee, or (ii) a percentage of production attributable to their work, or (iii) a percentage based upon the operating performance of the Office. Associate dentists are compensated based upon the greater of (i) an amount per hour or monthly guarantee, or (ii) a percentage of production attributable to their work. Specialists are compensated based upon the greater of (i) an amount per hour or monthly guarantee, or (ii) a percentage of production attributable to their work.

Competition

The dental services industry is fragmented, consisting primarily of solo and smaller group practices. The dental service organization segment of this industry is highly competitive and is expected to become more competitive. In this regard, the Company expects that the provision of multi-specialty dental services at convenient locations will become increasingly more common. The Company is aware of several dental service organizations that are operating in its markets, including Dental One, Bright Now, Pacific Dental, American Dental Partners, Inc., Comfort Dental and Dental Health Centers of America. Companies with dental service organization businesses similar to that of the Company, which currently operate in other parts of the country, may begin targeting the Company’s existing markets for expansion. Such competitors may have a greater financial track record and resources, superior affiliation models, a better reputation at existing affiliated practices, more management expertise or otherwise enjoy competitive advantages, which may make it difficult for the Company to compete against them or to acquire additional Offices on terms acceptable to the Company, or at all.

The business of providing general and specialty dental services is highly competitive in the markets in which the Company operates. The Company believes it competes with other providers of dental and specialty services on the basis of factors such as brand name recognition, convenience, cost and the quality and range of services provided. Competition may include practitioners who have more established practices and reputations. The Company also competes against established practices in the retention and recruitment of general dentists, specialists, dental hygienists and other personnel. If the availability of such individuals declines in the Company’s markets, it may become more difficult to attract and retain qualified personnel to sufficiently staff the Company’s Offices. Such competition has intensified in recent years, and the loss of dentists and other personnel and challenges presented in recruiting replacement personnel adversely affected the Company’s results of operations in 2016.

Government Regulation

The practice of dentistry is regulated at both the state and federal levels, and the regulation of health care-related companies is increasing. There can be no assurance that the regulatory environment in which the Company or the P.C.s operate will not change significantly in the future. The laws and regulations of all states in which the Company operates impact the Company’s operations but do not currently materially restrict the Company’s operations in those states. In addition, state and federal laws regulate health maintenance organizations and other managed care organizations for which dentists may be providers. In connection with its operations in existing markets and expansion into new markets, the Company may become subject to additional laws, regulations and interpretations or enforcement actions. The laws regulating health care are broad and subject to varying interpretations, and there is currently a lack of case law construing such statutes and regulations. The ability of the Company to operate profitably will depend in part upon the ability of the Company and the P.C.s to operate in compliance with applicable health care regulations.

Although the Company believes its operations as currently conducted are in material compliance with existing applicable laws and regulations, there can be no assurance that the Company’s contractual arrangements will not be successfully challenged as violating applicable laws and regulations or that the enforceability of such arrangements will not be limited as a result of such laws and regulations. In addition, there can be no assurance that the business structure under which the Company operates, or the advertising strategy the Company employs, will not be deemed to constitute the unlicensed practice of dentistry, or the operation of an unlicensed clinic or health care facility or a violation of a state dental practice act. The Company has not sought judicial or regulatory interpretations with respect to the manner in which it conducts its business. There can be no assurance that a review of the business of the Company and the P.C.s by courts or regulatory authorities will not result in a determination that could materially and adversely affect their operations or that the regulatory environment will not change so as to restrict the Company’s existing or future operations. In the event that any legislative measures, regulatory provisions or rulings or judicial decisions restrict or prohibit the Company from carrying on its business or from expanding its operations to certain jurisdictions, structural and organizational modifications of the Company’s organization and arrangements may be required which could have a material adverse effect on the Company, or the Company may be required to cease operations.

State Regulation

The laws of many states, including Colorado and New Mexico, permit a dentist to conduct a dental practice only as an individual, a member of a partnership or an employee of a professional corporation, limited liability company or limited liability partnership. These laws typically prohibit, either by specific provision or as a matter of general policy, non-dental entities, such as the Company, from practicing dentistry, from employing dentists and, in certain circumstances, dental hygienists or dental assistants, or from otherwise exercising control over the provision of dental services. Under the Management Agreements, the P.C.s control all clinical aspects of the practice of dentistry and the provision of dental services at the Offices, including the exercise of independent professional judgment regarding the diagnosis or treatment of any dental disease, disorder or physical condition. Persons to whom dental services are provided at the Offices are patients of the P.C.s and not of the Company. The Company does not employ the dentists who provide dental services at the Offices nor does the Company have or exercise any control or direction over the manner or methods in which dental services are performed or interfere in any way with the exercise of professional judgment by the dentists.

Many states, including Colorado, limit the ability of a person other than a licensed dentist to own or control dental equipment or offices used in a dental practice. Some states allow leasing of equipment and office space to a dental practice under a bona fide lease, if the equipment and office remain under the control of the dentist. Some states, including New Mexico, require all advertisements to be in the name of the dentist. A number of states, including Arizona, Colorado and New Mexico, also regulate the content of advertisements of dental services. In addition, Arizona, Colorado and New Mexico and many other states impose limits on the tasks that may be delegated by dentists to dental hygienists and dental assistants. Some states require entities designated as “clinics” to be licensed, and may define clinics to include dental practices that are owned or controlled in whole or in part by non-dentists. These laws and their interpretations vary from state to state and are enforced by the courts and by regulatory authorities with broad discretion.

Many states have fraud and abuse laws that are similar to the federal fraud and abuse law described below, and that in many cases apply to referrals for items or services reimbursable by any third-party payor, not just by Medicare and Medicaid. A number of states, including Arizona, Colorado and New Mexico, prohibit the submitting of false claims for dental services.

Many states, including Colorado and New Mexico, also prohibit “fee-splitting” by dentists with any party except other dentists in the same professional corporation or practice entity. In most cases, these laws have been construed to apply to the practice of paying a portion of a fee to another person for referring a patient or otherwise generating business, and not to prohibit payment of reasonable compensation for facilities and services (other than the generation of referrals), even if the payment is based on a percentage of the practice’s revenues, but some courts have found that the percentage allocation of fees to a practice management company to be impermissible “fee splitting.”

Many states also have laws prohibiting paying or receiving any remuneration, direct or indirect, which are intended to include referrals for health care items or services, including dental items and services.

In addition, there are certain regulatory risks associated with the Company’s role in negotiating and administering managed care contracts. The application of state insurance laws to third-party payor arrangements, other than fee-for-service arrangements, is an unsettled area of law with little guidance available. As the P.C.s contract with third-party payors, on a capitation or other basis under which the relevant P.C. assumes financial risk, the P.C.s may become subject to state insurance laws. Specifically, in some states, regulators may determine that the Company or the P.C.s are engaged in the business of insurance, particularly if they contract on a financial-risk basis directly with self-insured employers or other entities that are not licensed to engage in the business of insurance. In Arizona, Colorado and New Mexico, the P.C.s currently only contract on a financial-risk basis with entities that are licensed to engage in the business of insurance and thus are not subject to the insurance laws of those states. To the extent that the Company or the P.C.s are determined to be engaged in the business of insurance, the Company may be required to change the method of payment from third-party payors and the Company’s revenue may be materially and adversely affected.

Federal Regulation

Federal laws generally regulate reimbursement, billing and self-referral practices under Medicare and Medicaid programs. The federal fraud and abuse statute prohibits, among other things, the payment, offer, solicitation or receipt of any form of remuneration, directly or indirectly, in cash or in kind to induce or in exchange for (i) the referral of a person for services reimbursable by Medicare or Medicaid, or (ii) the purchasing, leasing, ordering or arranging for or recommending the purchase, lease or order of any item, good, facility or service which is reimbursable under Medicare or Medicaid. In January 2016, the Company started the process of credentialing some of its Offices for Medicaid. As of December 31, 2016, the Company had 24 Offices credentialed for Medicaid in Colorado and two Offices credentialed for Medicaid in New Mexico. Revenue from Medicaid accounted for 1.1% of the Company’s revenue in 2016.

Federal regulations also allow state licensing boards to revoke or restrict a dentist’s license in the event the dentist defaults in the payment of a government-guaranteed student loan, and further allow the Medicare program to offset overdue loan payments against Medicare income due to the defaulting dentist’s employer. The Company cannot assure compliance by dentists with the payment terms of their student loans, if any.

Revenue of the P.C.s or the Company from all insurers, including governmental insurers, is subject to significant regulation. Some payors limit the extent to which dentists may assign their revenue from services rendered to beneficiaries. Under these “reassignment” rules, the Company may not be able to require dentists to assign their third-party payor revenue unless certain conditions are met, such as acceptance by dentists of assignment of the payor receivable from patients, reassignment to the Company of the sole right to collect the receivables, and written documentation of the assignment. In addition, governmental payment programs such as Medicare and Medicaid limit reimbursement for services provided by dental assistants and other ancillary personnel to those services which were provided “incident to” a dentist’s services. Under these “incident to” rules, the Company may not be able to receive reimbursement for services provided by certain members of the Company’s Offices’ staff unless certain conditions are met, such as requirements that services must be of a type commonly furnished in a dentist’s office and must be rendered under the dentist’s direct supervision and that clinical Office staff must be employed by the dentist or the P.C. The Company does not currently derive a significant portion of its revenue under such programs.

The operations of the Offices are also subject to compliance with regulations promulgated by the Occupational Safety and Health Administration (“OSHA”) relating to such matters as heat sterilization of dental instruments and the use of barrier techniques such as masks, goggles and gloves. The operation of the Offices are also subject to compliance with regulations promulgated by the Environmental Protection Agency (“EPA”) relating to such matters as hazardous waste disposal. The Company incurs expenses on an ongoing basis relating to OSHA and EPA monitoring and compliance.

As a result of recent legislative and administrative initiatives, federal and state enforcement efforts against the health care industry have increased dramatically, subjecting all health care providers to increased risk of scrutiny and increased compliance costs. For example, health care providers, including the Company, are required to comply with the electronic data security and privacy requirements of HIPAA. HIPAA delegates enforcement authority to the CMS Office for Civil Rights. Many HIPAA provisions apply directly to business associates of covered entities, and state attorneys general may pursue civil actions under HIPAA. Violations of HIPAA could result in civil penalties of up to $1,500,000 per type of violation in each calendar year and criminal penalties of up to $250,000 per violation and/or up to ten years in prison per violation. As of December 31, 2016, the Company believes that it was in material compliance with all requirements of HIPAA and there has been no material impact on the Company due to the implementation of these regulations.

In March 2010, the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Affordability Reconciliation Act (the “ACA”) was enacted. Since then, significant regulations have been enacted to implement the ACA. The legislation and regulations are far-reaching and are intended to expand access to health insurance coverage over time by increasing the eligibility thresholds for most state Medicaid programs and providing individuals and small businesses with tax credits to subsidize a portion of the cost of health insurance coverage. Federal and state agencies are expected to continue to implement provisions of the ACA. There are both potentially positive and negative impacts of the ACA on the business of the Company. The Company continues to evaluate the net impact of the ACA on its business but thus far has not seen any direct material impact. Given the complexity and the number of changes expected as a result of the ACA, as well as the implementation timetable and delays for many of them, the ultimate impact of the ACA on the Company is uncertain. In addition, with the change in the Presidential administration, legislation has been introduced to repeal and/or replace the ACA. Even if the ACA is not amended, repealed or replaced, the new administration could propose changes impacting implementation of the ACA. The Company is unable to predict the impact from any future changes to the ACA or its implementation.

Federal and state governments may propose other health care initiatives and revisions to the health care and health insurance systems. It is uncertain what legislative programs, if any will be adopted in the future, or what action Congress or state legislatures may take regarding other health care reform proposals or legislation. In addition, changes in the health care industry, such as the growth of accountable care organizations, managed care organizations and provider networks, may result in lower payments for the services of the Company’s managed practices.

Insurance

The Company believes that its existing insurance coverage is adequate to protect it from the risks associated with the ongoing operation of its business. This coverage includes property and casualty, general liability, workers compensation, director’s and officer’s corporate liability, employment practices liability, excess liability and professional liability insurance for the Company and for dentists, dental hygienists and dental assistants at the Offices.

Seasonality

The Company’s past financial results have fluctuated somewhat due to seasonal variations in the dental service industry, with revenue typically lower in the fourth calendar quarter. The Company expects this seasonal fluctuation to continue in the future.

Trademark

The Company is the registered owner of the PERFECT TEETH™ trademark in the United States. The Company uses the PERFECT TEETH™ name to distinguish the Company’s Offices from other dental offices in the markets in which it operates. Also, the Company promotes brand awareness and generates demand through marketing and advertising utilizing the PERFECT TEETH™ name. The trademark is effective until 2027, when it will be subject to renewal.

Employees

As of December 31, 2016, the Company had 68 general dentists, 30 specialists and 236 dental hygienists and assistants who were employed by the P.C.s, and 155 non-dental employees. As of December 31, 2016, the Company had 489 full-time employees.

Company Website

Information related to the Company’s filings with the Securities and Exchange Commission (the “SEC”) can be found on the Company’s website at www.perfectteeth.com. The Company’s website is not a part of, or incorporated by reference in, this Annual Report.

The Company is heavily dependent upon the recruitment and retention of dentists and other personnel.

The profitability and operations of the Company’s Offices heavily depend on the availability and successful recruitment and retention of dentists, dental assistants, dental hygienists, specialists, and other personnel. The Company’s results of operations were adversely impacted in 2016 by the loss of dentists and other personnel and challenges presented in recruiting and replacing such personnel. The Company may not be able to recruit or retain dentists and other personnel for its Offices, which may have a material adverse effect on the Company’s business, financial condition and operating results. See Item 1. “Business - Dental Service Model.”

The Company’s indebtedness creates risks, and its Credit Facility contains financial and other covenants that may limit its flexibility.

On March 29, 2016, the Company entered into a Loan and Security Agreement with Guaranty Bank and Trust Company, which was subsequently amended, most recently on March 30, 2017 (as amended, the “Credit Facility”). The Credit Facility is collateralized by substantially all of the assets of the Company. The Credit Facility requires the Company to comply with certain affirmative and negative covenants. As amended by the March 2017 amendment, the Credit Facility requires the Company to maintain (i) a funded debt-to-EBITDA ratio of no more than 2.5 to 1.00 for the twelve months ending December 31, 2017 and thereafter, (ii) net worth of at least $1.0 million (increased by 25% of any net income after taxes of the Company in 2017 and thereafter), and (iii) a fixed charge coverage ratio of not less than 1.25 to 1.00 for the quarter ending December 31, 2017 and each quarter thereafter, and to generate at least $870,000 of EBITDA in each of the first three quarters of 2017. During 2016, dividends and stock repurchases were prohibited under the Credit Facility, and, as a result of the March 2017 amendment to the Credit Facility, dividends and stock repurchases are not currently permitted under the Credit Facility. In addition, capital expenditures may not exceed $180,000 per quarter. This indebtedness and these restrictions could limit the Company’s ability to obtain future financing, make capital expenditures, pay dividends, withstand economic downturns or otherwise take advantage of business opportunities that may arise, any of which could place the Company at a competitive disadvantage relative to its competitors that have less debt and are not subject to such restrictions. The March 2017 amendment to the Credit Facility also included a forbearance by the bank regarding covenant defaults by the Company with respect to the then-existing funded debt-to-EBITDA ratio of no more than 3.15 to 1.00 for the twelve months ended December 31, 2016, fixed charge coverage ratio of at least 1.35 to 1.00 for the quarter ended December 31, 2016 and EBITDA of at least $650,000 for the quarter ended December 31, 2016. The forbearance remains in effect provided that the Company complies with the amended Credit Agreement covenants. There can be no assurances that the bank will not change the terms of the Credit Facility or cease to forbear or continue to extend credit to the Company. Any such actions or failure by the Company to maintain compliance with the Credit Facility in the future could have a material adverse effect on the Company.

The Company may need additional capital and there is no guarantee additional financing would be available.

Implementation of the Company’s expansion strategy has required significant capital resources. Such resources, which have included available cash and bank borrowings, have been used to establish additional de novo Offices and maintain and upgrade the Company’s management information systems, and for the effective integration, operation and expansion of the Offices. The Company historically has primarily used cash and promissory notes as consideration in acquisitions of dental practices. If the Company’s capital requirements exceed cash flow generated from operations and borrowings available under the Company’s existing bank credit facility or any successor credit facility, the Company may need to issue additional equity securities or incur additional debt. If additional funds are raised through the issuance of equity securities, dilution to the Company’s existing shareholders may result. Additional debt or non-Common Stock equity financings could be required to the extent that the Common Stock fails to maintain a market value sufficient to warrant its use for future financing needs. If additional funds are raised through the incurrence of debt, such debt instruments will likely contain restrictive financial, maintenance and security covenants. The Company may not be able to obtain additional required capital on satisfactory terms, if at all. The failure to raise the funds necessary to finance the Company’s operations or the Company’s other capital requirements could have a material and adverse effect on the Company’s ability to pursue its strategy and on its business, financial condition and operating results. See Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.”

The Company’s business could be negatively affected as a result of a potential proxy contest for the election of directors and proposal to certain amend certain aspects of the Company’s governing documents at its 2017 annual meeting and other activist shareholder activities.

On March 9, 2017, a group of shareholders submitted a notice of the group’s intention to nominate certain directors and submit certain proposals at the Company’s 2017 annual meeting of shareholders. If the group does not withdraw its nominations and proposals or the Company is are unable to reach an agreement with the group relating to the 2017 annual meeting, a proxy contest is likely to occur. A proxy contest would require the Company’ to incur significant legal fees and proxy solicitation and other expenses and require significant time and attention by management and the Board of Directors. In addition, the potential of a proxy contest, or other activist shareholder activities, could interfere with the Company’s ability to execute its business strategy, create uncertainties as to the Company’s future direction, make it more difficult to attract and retain qualified dentists, adversely affect the Company’s relationships with dentists, other employees and patients and result in the loss of potential business opportunities, any of which could materially and adversely affect the Company’s business and operating results. In addition, under certain theoretical circumstances, if the shareholder group is successful in its proposals to change certain provisions of the Company’s governing documents and having certain of its nominees approved, the shareholder group’s nominees could constitute more than one-half of the Board. Such a change in the composition of the Board would result in a change of control under our equity incentive plan, which would result in the acceleration of our outstanding equity awards, and under certain contracts with third parties, including our Credit Facility, if the Company is unable to secure appropriate waivers or amendments to or approvals under any such contracts. A change of control as defined in the Credit Facility that is not approved by the bank constitutes an event of default under the Credit Facility. The Company’s business and financial condition could be impaired and the market price of its common stock could be subject to significant fluctuation or otherwise be adversely affected by these events, risks and uncertainties.

The Company’s operations place significant demands on management.

The Company’s ability to compete effectively depends upon its ability to hire, train, and assimilate additional management and other employees, and its ability to expand, improve and effectively utilize its operating, management, marketing and financial systems. Any failure by the Company to effectively anticipate, implement and manage the changes required to sustain the Company may have a material adverse effect on the Company’s business, financial condition and operating results. See Item 1. “Business – Expansion Program.”

The success of the Company depends on the continued services of two members of the Company’s senior management, its Chief Executive Officer, Fred Birner and its Chief Financial Officer, Treasurer and Secretary, Dennis Genty. The Company believes its future success will depend in part upon its ability to attract and retain qualified management personnel. Competition for such personnel is intense and the Company competes for qualified personnel with numerous other employers, some of which have greater financial and other resources than the Company. The loss of the services of one or more members of the Company’s senior management or the failure to add or retain qualified management personnel could have a material adverse effect on the Company’s business, financial condition and operating results.

The Company’s ability to pay dividends is restricted by its credit facility and several other factors.

The Company paid quarterly cash dividends from 2004 through the first quarter of 2016. During the remainder of 2016, dividends were prohibited under the Credit Facility and, as a result of the March 2017 amendment to the Credit Facility, dividends are not currently permitted under the Credit Facility. If permitted in the future, the payment of dividends is subject to the discretion of the Company’s Board of Directors, and various factors may prevent the Company from paying dividends or may require the Company to reduce the dividends. Such factors include the Company’s financial position and results of operations, capital requirements and liquidity, the existence of a stock repurchase program, any loan agreement restrictions or other requirements of or actions by lenders, state corporate law restrictions, and other factors the Company’s Board of Directors may consider relevant. There is no assurance that the Company will be able to pay dividends in the future.

The Company operates in a competitive market, which may reduce gross profit margins and market share.

The dental service organization segment of the dental services industry is highly competitive and is expected to become increasingly more competitive. Several dental service organizations operate in the Company’s markets. A number of companies with dental service organization businesses similar to that of the Company currently operate in other parts of the country and may enter the Company’s existing markets in the future. If the Company seeks to expand its operations into new markets, it is likely to face competition from other dental service organizations that already have established a strong business presence in such locations. The Company’s competitors may have a more successful financial track record and greater resources, a better reputation of existing affiliated practices, more management expertise or otherwise enjoy competitive advantages, which may make it difficult for the Company to compete against them or to acquire additional Offices on terms acceptable to the Company, or at all. See Item 1. “Business - Competition.”

The business of providing general dental and specialty dental services is highly competitive in the markets in which the Company operates. Competition for providing dental services may include practitioners who have more established practices and reputations. The Company competes against established practices in the retention and recruitment of general dentists, specialists, dental hygienists and other personnel. If the availability of such dentists, specialists, dental hygienists and other personnel declines in the Company’s markets, it may become more difficult to attract qualified dentists, specialists, dental hygienists and other personnel. Competition has intensified in recent years, and the loss of dentists and other personnel and challenges presented in recruiting replacement personnel adversely affected the Company’s results of operations in 2016. There is no assurance that the Company will be able to compete effectively against other existing practices or against new single or multi-specialty dental practices that enter its markets, or to compete against such practices in the recruitment and retention of qualified dentists, specialists, dental hygienists and other personnel. See Item 1. “Business - Competition.”

The Company is exposed to uncertainty and risks associated with de novo Office development.

The Company utilizes internal and external resources to identify locations in suitable markets for the development of de novo Offices. Identifying locations in suitable geographic markets and negotiating leases can be a lengthy and costly process. Furthermore, the Company will need to provide each de novo Office with the appropriate equipment, furnishings, materials and supplies and other capital resources. Additionally, de novo Offices must be staffed with one or more dentists. Because a de novo Office may be staffed with a dentist with no previous patient base, significant advertising and marketing expenditures may be required to attract patients. The Company’s de novo Offices typically take a period of time after opening before they generate positive net income. The Company’s two most recently opened de novo Offices, which opened during the third quarter of 2015 and the first quarter of 2016, had a net loss of $(737,000) for the year ended December 31, 2016. There can be no assurance that a de novo Office will become profitable. See Item 1. “Business - Expansion Program.”

General economic conditions and other factors outside of the Company’s control may affect the Company’s stock price and results of operations.

The market price of the Company’s Common Stock could be subject to wide fluctuations in response to quarterly variations in operating results of the Company or its competitors, developments in the industry or changes in general economic conditions. A recessionary economic cycle, higher levels of unemployment, higher consumer debt levels, higher tax rates and other changes in tax laws or other economic factors could adversely affect consumer demand for the Company’s services and in particular, discretionary or elective dental services, which could adversely affect the Company’s results of operations. In addition, worsening economic conditions could adversely affect the Company’s collection of accounts receivable.

The Company’s Offices are concentrated in Colorado.

The majority of the Company’s affiliated dental Offices are located in Colorado. The Offices in Colorado generated 68%, 68% and 66% of the Company’s total revenue for the years ended December 31, 2014, 2015 and 2016, respectively. Adverse changes or conditions affecting the Colorado market, such as health care reform, changes in laws and regulations, governmental investigations, competition and general economic conditions may have a particularly significant impact on the business of our affiliated dentists and our business, financial condition and results of operations. The Company’s current concentration in the Colorado market as well as the Company’s strategy of focused expansion in areas in and around the Company’s existing markets increases the risk that adverse economic or regulatory developments in this market may have a material and adverse impact on the Company’s operations.

The Company is not the owner of the P.C.s and is heavily dependent on its affiliated dentists and management agreements.

The Company receives management fees for services provided to the P.C.s under the Management Agreements. The Company owns most of the non-dental operating assets of the Offices but does not employ or contract with dentists, dental hygienists or dental assistants, or control the provision of dental care in the Offices, which exercise sole decision-making authority with respect to all clinical matters. The Company’s revenue is dependent on the revenue generated by the P.C.s. Therefore, effective and continued performance of dentists providing services for the P.C.s is essential to the Company’s long-term success. Under each Management Agreement, the Company pays substantially all of the operating and non-operating expenses associated with the provision of dental services except for the salaries and benefits of the dentists, dental hygienists and dental assistants. Any material loss of revenue by the P.C.s would have a material adverse effect on the Company’s business, financial condition and operating results, and any termination of a Management Agreement (which is permitted in the event of a material default or bankruptcy by either party) could have such an effect. In the event of a breach of a Management Agreement by a P.C., there can be no assurance that the legal remedies available to the Company will be adequate to compensate the Company for its damages resulting from such breach. See Item 1. “Business - Affiliation Model.” Furthermore, state regulatory authorities may review the Management Agreements for legal and regulatory compliance. If a Management Agreement with a P.C. was deemed by a regulatory or judicial authority to be in violation of any law or regulation, the Company’s relationship with the applicable Office may terminate, the shares in the P.C. may need to be transferred, the Management Agreement may require material amendments with uncertain consequences or the Company might be required to restructure its business model.

The Company is subject to federal, state and other laws and regulations that could give rise to substantial liabilities or otherwise adversely affect its cost, manner or feasibility of doing business.

The practice of dentistry is regulated at both the state and federal levels. There can be no assurance that the regulatory environment in which the Company or the P.C.s operate will not change significantly in the future. In addition, state and federal laws regulate health maintenance organizations and other managed care organizations for which dentists may be providers. In general, regulation of health care companies is increasing. In connection with its operations in existing markets and expansion into new markets, the Company may become subject to additional laws, regulations and interpretations or enforcement actions. The laws regulating health care are broad and subject to varying interpretations, and there is currently a lack of case law construing such statutes and regulations. The ability of the Company to operate profitably will depend in part upon the ability of the Company to operate in compliance with applicable health care regulations.

The laws of many states, including Colorado and New Mexico, permit a dentist to conduct a dental practice only as an individual, a member of a partnership or an employee of a professional corporation, limited liability company or limited liability partnership. These laws typically prohibit, either by specific provision or as a matter of general policy, non-dental entities, such as the Company, from practicing dentistry, from employing dentists and, in certain circumstances, dental hygienists or dental assistants, or from otherwise exercising control over the provision of dental services.

Many states, including Colorado, limit the ability of a person other than a licensed dentist to own or control dental equipment or offices used in a dental practice. In addition, Arizona, Colorado, New Mexico and many other states impose limits on the tasks that may be delegated by dentists to dental hygienists and dental assistants. Some states, including Arizona, Colorado and New Mexico, regulate the content of advertisements of dental services. Some states require entities designated as “clinics” to be licensed, and may define clinics to include dental practices that are owned or controlled in whole or in part by non-dentists. These laws and their interpretations vary from state to state and are enforced by the courts and by regulatory authorities with broad discretion.

Many states, including Colorado and New Mexico, also prohibit “fee-splitting” by dentists with any party except other dentists in the same professional corporation or practice entity. In most cases, these laws have been construed as applying to the practice of paying a portion of a fee to another person for referring a patient or otherwise generating business, and not to prohibit payment of reasonable compensation for facilities and services (other than the generation of referrals), even if the payment is based on a percentage of the practice’s revenues, but some courts have found that the percentage allocation of fees to a practice management company to be impermissible “fee splitting.”

Regulatory uncertainties could adversely affect the Company’s business and operations.

Many states have fraud and abuse laws, which apply to referrals for items or services reimbursable by any third-party payor, not just by Medicare and Medicaid. A number of states, including Arizona, Colorado and New Mexico, prohibit the submitting of false claims for dental services.

In addition, there are certain regulatory risks associated with the Company’s role in negotiating and administering managed care contracts. The application of state insurance laws to third-party payor arrangements, other than fee-for-service arrangements, is an unsettled area of law with little guidance available. Specifically, in some states, regulators may determine that the P.C.s are engaged in the business of insurance, particularly if they contract on a financial-risk basis directly with self-insured employers or other entities that are not licensed to engage in the business of insurance. If the P.C.s are determined to be engaged in the business of insurance, the Company may be required to change the method of payment from third-party payors and the Company’s business, financial condition and operating results may be materially and adversely affected.

Federal laws generally regulate reimbursement and billing practices under Medicare and Medicaid programs. The federal fraud and abuse statute prohibits, among other things, the payment, offer, solicitation or receipt of any form of remuneration, directly or indirectly, in cash or in kind to induce or in exchange for (i) the referral of a person for services reimbursable by Medicare or Medicaid, or (ii) the purchasing, leasing, ordering or arranging for or recommending the purchase, lease or order of any item, good, facility or service which is reimbursable under Medicare or Medicaid. In January 2016, the Company started the process of credentialing some of its Offices for Medicaid. As of December 31, 2016, the Company had 24 Offices credentialed for Medicaid in Colorado and 2 Offices credentialed for Medicaid in New Mexico. Revenue from Medicaid accounted for 1.1% of the Company’s revenue in 2016. The Company expects revenue from Medicaid to increase in 2017. As a result, these laws and regulations impact the Company to a greater degree currently than in previous years.

Health care providers, including the Company, are required to comply with the electronic data security and privacy requirements of HIPAA. HIPAA delegates enforcement authority to the CMS Office for Civil Rights. Many HIPAA provisions apply directly to business associates of covered entities, and state attorneys general may pursue civil actions under HIPAA. Violations of HIPAA could result in civil penalties of up to $1,500,000 per type of violation in each calendar year and criminal penalties of up to $250,000 per violation and/or up to ten years in prison per violation. As of December 31, 2016, the Company believes that it was in material compliance with all requirements of HIPAA and there has been no material impact on the Company due to the implementation of these regulations.

Although the Company believes that its operations as currently conducted are in compliance with applicable laws, there can be no assurance that the Company’s contractual arrangements will not be successfully challenged as violating applicable fraud and abuse, self-referral, false claims, fee-splitting, insurance, facility licensure or certificate-of-need laws or that the enforceability of such arrangements will not be limited as a result of such laws. In addition, there can be no assurance that the business structure under which the Company operates, or the advertising strategy the Company employs, will not be deemed to constitute the unlicensed practice of dentistry, or the operation of an unlicensed clinic or health care facility or a violation of a state dental practice act. The Company has not sought judicial or regulatory interpretations with respect to the manner in which it conducts its business. There can be no assurance that a review of the business of the Company and the P.C.s by courts or regulatory authorities will not result in a determination that could materially and adversely affect their operations or that the regulatory environment will not change so as to restrict the Company’s existing or future operations. In the event that any legislative measures, regulatory provisions or rulings or judicial decisions restrict or prohibit the Company from carrying on its business or from expanding its operations to certain jurisdictions, structural and organizational modifications of the Company’s organization and arrangements may be required, which could have a material adverse effect on the Company, or the Company may be required to cease operations or change the way it conducts business. See Item 1. “Business - Government Regulation.”

The health care industry’s cost-containment initiatives may reduce per patient profit margins.

The health care industry, including the dental services market, is experiencing a trend toward cost containment, as payors seek to impose lower reimbursement rates upon providers. The Company believes that this trend will continue and will increasingly affect the provision of dental services. This may result in a reduction in per-patient and per-procedure revenue from historical levels. Significant reductions in payments to dentists or other changes in reimbursement by payors for dental services may have a material adverse effect on the Company’s business, financial condition and operating results.

If federal or state regulations change to require licensure, the Company’s business model may be adversely affected.

Federal and state laws regulate insurance companies and certain other managed care organizations. Many states, including Colorado, also regulate the establishment and operation of networks of health care providers. In most states, these laws do not apply to discounted-fee-for-service arrangements. These laws also do not generally apply to networks that are paid on a capitated basis, unless the entity with which the network provider is contracting is not a licensed health insurer or other managed care organization. There are exceptions to these rules in some states. For example, certain states require a license for a capitated arrangement with any party unless the risk-bearing entity is a professional corporation that employs the professionals. The Company believes its current activities do not constitute the provision of insurance in Arizona, Colorado or New Mexico, and thus, it is in compliance with the insurance laws of these states with respect to the operation of its Offices. There can be no assurance that these laws will not be changed or that interpretations of these laws by the regulatory authorities in those states, or in the states in which the Company expands, will not require licensure or a restructuring of some or all of the Company’s operations. In the event that the Company is required to become licensed under these laws, the licensure process can be lengthy and time consuming and, unless the regulatory authority permits the Company to continue to operate while the licensure process is progressing, the Company could experience a material adverse change in its business while the licensure process is pending. In addition, many of the licensing requirements mandate strict financial and other requirements, which the Company may not immediately be able to meet. Further, once licensed, the Company would be subject to continuing oversight by and reporting to the respective regulatory agency. The regulatory framework of certain jurisdictions may limit the Company’s expansion into, or ability to continue operations within, such jurisdictions if the Company is unable to modify its operational structure to conform to such regulatory framework. Any limitation on the Company’s ability to expand could have a material adverse effect on the Company’s business, financial condition and operating results.

The Company may see increased costs or lower revenue arising from the ACA or other health care reforms.