Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - Armstrong Energy, Inc. | arms12311610kexhibit993.htm |

| EX-95.1 - EXHIBIT 95.1 - Armstrong Energy, Inc. | arms-12311610kexhibit951.htm |

| EX-32.2 - EXHIBIT 32.2 - Armstrong Energy, Inc. | arms12311610kexhibit322.htm |

| EX-32.1 - EXHIBIT 32.1 - Armstrong Energy, Inc. | arms12311610kexhibit321.htm |

| EX-31.2 - EXHIBIT 31.2 - Armstrong Energy, Inc. | arms12311610kexhibit312.htm |

| EX-31.1 - EXHIBIT 31.1 - Armstrong Energy, Inc. | arms12311610kexhibit311.htm |

| EX-23.1 - EXHIBIT 23.1 - Armstrong Energy, Inc. | arms12311610kexhibit231.htm |

| EX-21.1 - EXHIBIT 21.1 - Armstrong Energy, Inc. | arms12311610kexhibit211.htm |

| EX-10.34 - EXHIBIT 10.34 - Armstrong Energy, Inc. | arms12311610kexhibit1034.htm |

| EX-10.11 - EXHIBIT 10.11 - Armstrong Energy, Inc. | arms12311610kexhibit1011.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 333-191182

Armstrong Energy, Inc.

(Exact name of registrant as specified in its charter)

Delaware | 20-8015664 | |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |

7733 Forsyth Boulevard, Suite 1625 St. Louis, Missouri | 63105 | |

(Address of principal executive offices) | (Zip code) | |

(314) 721 – 8202

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes ý No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes ý No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ý Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes ý No

As of June 30, 2016, there was no established public market for the registrant’s voting and non-voting common stock and therefore the aggregate market value of the voting and non-voting common equity held by non-affiliates is not determinable.

As of March 30, 2017, there were 21,883,224 shares of Armstrong Energy, Inc.’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

TABLE OF CONTENTS

Page | ||

PART I | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

PART II | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

PART III | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

PART IV | ||

Item 15. | ||

i

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

Various statements contained in this annual report, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, (the Securities Act) and Section 21E of the Securities Exchange Act of 1934, as amended (the Exchange Act). These forward-looking statements may include projections and estimates concerning the timing and success of specific projects and our future production, revenues, income and capital spending. Our forward-looking statements are generally accompanied by words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “potential,” “plan,” “goal” or other words that convey the uncertainty of future events or outcomes. The forward-looking statements in this annual report speak only as of the date of this annual report; we disclaim any obligation to update these statements unless required by law, and we caution you not to rely on them unduly. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. These and other important factors may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. These risks, contingencies and uncertainties include, but are not limited to, the following:

• | our ability to continue as a going concern within one year beyond the filing of this Annual Report on Form 10-K; |

• | liquidity constraints and our ability to service our outstanding indebtedness; |

• | our ability to comply with the restrictions imposed by the indenture governing our notes and other financing arrangements; |

• | market demand for coal and electricity; |

• | geologic conditions, weather and other inherent risks of coal mining that are beyond our control; |

• | competition within our industry and with producers of competing energy sources; |

• | excess production and production capacity; |

• | our ability to acquire or develop coal reserves in an economically feasible manner; |

• | inaccuracies in our estimates of our coal reserves; |

• | availability and price of mining and other industrial supplies, including steel-based supplies, diesel fuel, rubber tires and explosives; |

• | the continued weakness in global economic conditions or in any industry in which our customers operate, or sustained uncertainty in financial markets, which may cause conditions we cannot predict; |

• | coal users switching to other fuels in order to comply with various environmental standards related to coal combustion; |

• | volatility in the capital and credit markets; |

• | availability of skilled employees and other workforce factors; |

• | our ability to collect payments from our customers; |

• | defects in title or the loss of a leasehold interest; |

• | railroad, barge, truck and other transportation performance and costs; |

• | our ability to secure new coal supply arrangements or to renew existing coal supply arrangements; |

• | the deferral of contracted shipments of coal by our customers; |

• | our ability to obtain or renew surety bonds on acceptable terms; |

• | our ability to obtain and renew various permits, including permits authorizing the disposition of certain mining waste; |

ii

• | existing and future legislation and regulations affecting both our coal mining operations and our customers’ coal usage, governmental policies and taxes, including those aimed at reducing emissions of elements such as mercury, sulfur dioxide, nitrogen oxides, or toxic gases, such as hydrogen chloride, particulate matter or greenhouse gases; |

• | the accuracy of our estimates of reclamation and other mine closure obligations; |

• | our ability to attract and retain key management personnel; |

• | efforts to organize our workforce for representation under a collective bargaining agreement; and |

• | other factors, including those discussed in Item 1A – “Risk Factors” of this Annual Report on Form 10-K. |

iii

PART I

Item 1. Business

Overview

Our History

Armstrong Energy, Inc. (together with its subsidiaries, we, Armstrong Energy, or the Company) is a producer of low chlorine, high sulfur thermal coal from the Illinois Basin, with both surface and underground mines. We market our coal primarily to proximate and investment grade electric utility companies as fuel for their steam-powered generators. Based on 2016 production, we are the sixth largest producer in the Illinois Basin and the second largest in Western Kentucky.

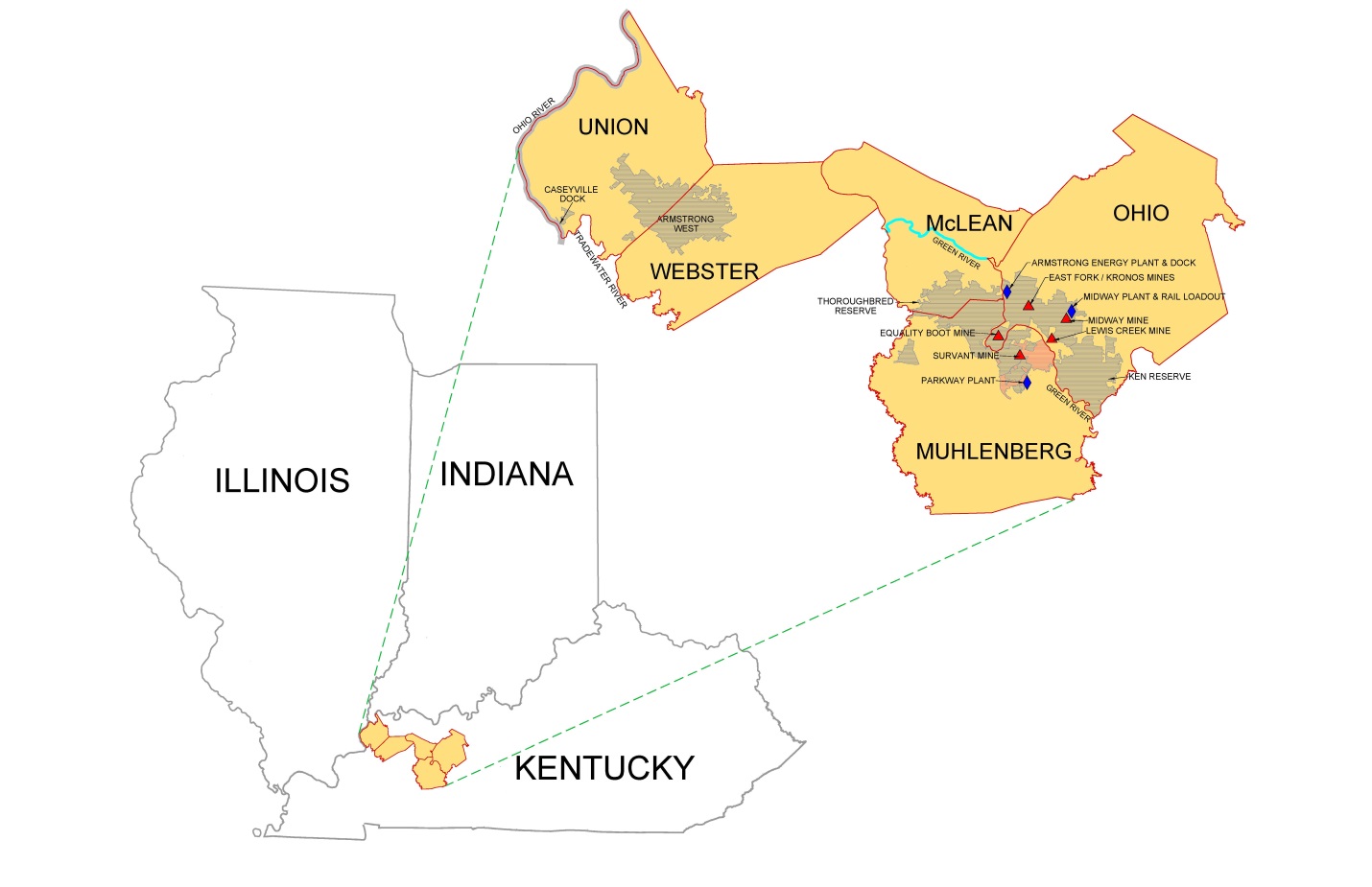

We were formed in 2006 to acquire and develop a large coal reserve holding. Between 2006 and 2011, we completed six transactions, either directly or through our affiliate, Thoroughbred Resources, L.P. (Thoroughbred), to acquire mineral reserves and land from Peabody Energy, Inc. (Peabody). We commenced production in the second quarter of 2008 and currently operate five mines, including three surface and two underground. Since 2008, we have continued to acquire additional mineral reserves, which are strategic to our operating plans and currently control approximately 567 million tons of proven and probable coal reserves. We also own and operate three coal processing plants, which support our mining operations. From our reserves, we mine coal from multiple seams that, in combination with our coal processing facilities, enhance our ability to meet customer requirements for blends of coal with different characteristics. The locations of our coal reserves and operations, adjacent to the Green River, together with our river dock coal handling and rail loadout facilities, allow us to optimize our coal blending and handling, and provide our customers with rail, barge and truck transportation options.

We are majority-owned by investment funds managed by Yorktown Partners LLC (Yorktown). Yorktown was formed in 1991 and has approximately $3.0 billion in assets under management. Yorktown invests exclusively in the energy industry with an emphasis on North American oil and gas production, coal mining and midstream businesses. Yorktown’s investors include university endowments, foundations, families, insurance companies and other institutional investors. As a result of its significant ownership of Armstrong Energy, Yorktown has, and can be expected to have, a significant influence in our operations, in the outcome of stockholder voting concerning the election of directors, the adoption or amendment of provisions in our charter and bylaws, the approval of mergers, and other significant corporate matters.

We operate in one reporting segment. For information regarding our revenue, long-lived assets, and total assets, please see Item 7 – “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Item 8 – “Financial Statements and Supplementary Data.”

Liquidity and Going Concern

Our consolidated financial statements have been prepared assuming we will continue as a going concern, which contemplates continuity of operations, realization of assets and the satisfaction of liabilities in the normal course of business. As such, the accompanying consolidated financial statements do not include any adjustments relating to the recoverability and classification of assets and their carrying amounts, or the amount and classification of liabilities that may result should we be unable to continue as a going concern.

Although we are taking steps to minimize our capital expenditures, reduce costs and maximize cash flows from operations, our liquidity outlook has continued to deteriorate since the third quarter of 2016. Continued depressed coal market fundamentals are expected to negatively impact our operating results and lead to significantly lower levels of cash flow from operating activities in the near-term. As a result of these and other factors, there is substantial doubt about our ability to continue as a going concern. See Note 3, “Liquidity and Going Concern,” to our audited consolidated financial statements, included in Item 8 - “Financial Statements and Supplementary Data,” of this Annual Report on Form 10-K.

Our Relationship with Thoroughbred Resources, L.P.

Thoroughbred was formed in 2008 to engage in the business of management and leasing of coal properties and collection of royalties in the Western Kentucky region of the Illinois Basin. Prior to September 1, 2016, our wholly-owned subsidiary, Elk Creek GP, LLC (ECGP), was the sole general partner of, and had an approximate 0.2% ownership in, Thoroughbred. The various limited partners of Thoroughbred are related parties, as the majority of the limited partnership interests (common units) of Thoroughbred are owned by Yorktown. Effective September 1, 2016, Yorktown exercised its right under the Second Amended and Restated Agreement of Limited Partnership of Thoroughbred Resources, LP to remove ECGP as the general partner of Thoroughbred. We continue to maintain a 0.9% interest in Thoroughbred through our subsidiary, Armstrong Energy

1

Holdings, Inc. We account for our remaining investment in Thoroughbred under the cost method, and we do not consolidate the financial results of Thoroughbred.

Beginning in 2011, Thoroughbred acquired, through multiple transactions, an undivided interest in certain land and mineral reserves of Armstrong Energy in Muhlenberg and Ohio Counties, Kentucky. As of December 31, 2016, Thoroughbred owns a 79.19% undivided interest in approximately 179 million tons of our mineral reserves. In conjunction with the aforementioned acquisitions, Armstrong Energy entered into lease agreements with Thoroughbred pursuant to which Thoroughbred granted Armstrong Energy leases to its undivided interest in the mining properties acquired and licenses to mine coal on those properties in exchange for a production royalty.

In addition, we have also leased approximately 250 million tons of mineral reserves wholly-owned by Thoroughbred in exchange for a production royalty. See Item 13 - “Certain Relationships and Related-Party Transactions, and Director Independence.”

Starting in December 2016, we received the first of multiple communications from Thoroughbred Holdings GP, LLC (Thoroughbred Holdings), the general partner of Thoroughbred, and their legal counsel alleging claims associated with various transactions between the parties. Thoroughbred Holdings claimed the third-party valuations prepared annually in order to determine the percentage interest in certain jointly-owned land and mineral reserves (the Jointly-Owned Property) to be transferred from us to Thoroughbred pursuant to the First Amended and Restated Royalty Deferment and Option Agreement (the Royalty Agreement) were inaccurate in 2016 and prior, which resulted in the underpayment of production royalties to Thoroughbred. In addition, Thoroughbred Holdings has taken exception to our calculation of the amount of deferred royalties for the year ended December 31, 2016, the amount of certain offsets from these deferred royalties by amounts due from Thoroughbred to us pursuant to an Administrative Services Agreement, and the offset of certain production royalties that we have overpaid to Thoroughbred on properties other than the Jointly-Owned Property.

Following a series of negotiations, Armstrong and certain of its affiliates, and Thoroughbred Holdings and certain of its affiliates, entered into a settlement agreement effective March 29, 2017 (the Settlement Agreement) to resolve all of these claims and to avoid the uncertainties of a potential lengthy arbitration. Refer to Note 13, “Related-Party Transactions,” to our audited consolidated financial statements, included in Item 8 - “Financial Statements and Supplementary Data,” of this Annual Report on Form 10-K for further information regarding the settlement agreement.

Our Mining Operations

We currently operate five active mines, all of which are located in the Illinois Basin coal region in western Kentucky. Our active operations are comprised of three surface mines and two underground mines, and we have three preparation plants serving these operations. In 2016, approximately 44% of the coal that we produced came from our surface mining operations.

Our current operating mines are all located in Muhlenberg and Ohio Counties, Kentucky. The Western Kentucky Parkway crosses our properties from Southwest to Northeast, and the Green River separates our properties in Ohio and Muhlenberg Counties. Our barge loading facility on the Green River is located near the town of Kirtley, Kentucky. In addition, we have a network of off-highway truck haul roads, which connect the majority of our active mines and provide access to our barge loading and rail loadout facilities. In general, we have developed our mines and preparation plants at strategic locations in close proximity to rail or barge shipping facilities.

We control approximately 567 million tons of proven and probable coal reserves in Ohio, Muhlenberg, McLean, Webster, and Union counties in Western Kentucky, of which we lease or sublease approximately 133 million tons from various unaffiliated landowners.

The following map shows the locations of our mining operations and coal reserves:

2

Equality Boot Mine. The Equality Boot mine is a surface mining operation located eight miles southwest of Centertown, Kentucky, which commenced operations in September 2010. The Equality Boot mine extracts thermal coal from the West Kentucky #14, #13, #12 and #11 seams and produced approximately 1.6 million tons of coal in 2016. The Equality Boot mine currently uses one dragline equipped with a 45 yard bucket and a spread of surface equipment, including power shovels, excavators, loaders and haul trucks, to remove overburden and interburden and construct the dragline bench. The Equality Boot mine had approximately 11.6 million tons of proven and probable reserves as of December 31, 2016. Coal from the Equality Boot mine is primarily transported less than one mile by truck to a 4,400 foot overland conveyor system, which is used to transport the coal to the 2,500 tons per hour barge loadout facility located on the Green River. The coal is then loaded onto barges and transported approximately five miles to the Armstrong Dock Preparation Plant where it is unloaded, processed, reloaded onto barges and then shipped to customers.

Lewis Creek Mine. The Lewis Creek mine is a surface mine located approximately five miles south of Centertown, Kentucky, and approximately 3.5 miles from the Midway Preparation Plant. Production commenced in June 2011 at the Lewis Creek mine, and thermal coal is being mined from the West Kentucky seams #13A and #13. Lewis Creek produced approximately 0.9 million tons of clean coal in 2016. A dragline equipped with a 20 yard bucket is used in conjunction with mobile mining equipment to remove overburden and construct the dragline bench at the Lewis Creek mine. As of December 31, 2016, there were approximately 7.2 million tons of proven and probable reserves at the Lewis Creek surface mine. Coal mined at the Lewis Creek mine is primarily transported by truck to the Midway Preparation Plant for processing and subsequent delivery to our customers.

Kronos Underground Mine. The Kronos underground mine, which commenced operations in September 2011, is located approximately three miles southwest of Centertown, Kentucky. It extracts thermal coal from the West Kentucky #9 seam. The Kronos underground mine produced approximately 2.1 million clean tons of coal in 2016. The mine utilizes four continuous miner super sections, and there were approximately 30.9 million tons of proven and probable reserves at the Kronos underground mine as of December 31, 2016. Coal mined at the Kronos underground mine is transported by truck to the Midway Preparation Plant and by conveyor to the Armstrong Dock Preparation Plant for processing and delivery to our customers.

Survant Underground Mine. The Survant underground mine, which is located at our Parkway complex, came out of development in August 2015. The Survant underground mine extracts coal from the West Kentucky #8 seam and produced

3

approximately 0.7 million clean tons of coal in 2016 through the operation of primarily one continuous miner super section. As of December 31, 2016, there were approximately 55.4 million tons of proven and probably reserves at the Survant underground mine. Coal mined from the Survant underground mine is primarily processed at the Parkway Preparation Plant prior to shipment to the ultimate customer.

Midway Mine. The Midway mine is a surface mine located two miles southeast of Centertown, Kentucky in Ohio County and is west of and adjacent to the Midway Preparation Plant. The Midway mine commenced production in April 2008 and extracted thermal coal from the West Kentucky #13a, #13, and #11 seams utilizing one dragline (45 yard bucket) and a spread of surface mining equipment, including power shovels, excavators, loaders and haul trucks. Coal from the Midway mine was primarily transported less than one mile by truck to the Midway Preparation Plant for processing, where it is then shipped to customers via truck, rail or barge. On December 31, 2015, production at the Midway mine was temporarily idled due to declining market conditions. Our reserve studies indicate the Midway mine has approximately 14.2 million tons of proven and probable reserves as of December 31, 2016.

Parkway Underground Mine. The Parkway underground mine was located northeast of Central City, Kentucky in Muhlenberg County. The Parkway underground mine extracted thermal coal primarily from the West Kentucky #9 seam and accessed that seam from an older surface mining pit that was abandoned prior to our acquisition of the Parkway underground mine. The Parkway underground mine produced approximately 0.5 million tons of clean coal in 2016. In October 2016, production ceased at the Parkway underground mine as the economically recoverable reserves had been depleted.

Future Mines. We continue to evaluate our mine plans and expect to open additional mines in order to replace existing mines as the reserves are depleted.

Our Coal Preparation Facilities

The majority of coal from each of our mining operations is processed at a coal preparation plant located near the mine or connected to the mine by an overland conveyor system. Currently, we have three preparation plants, Midway, Parkway and Armstrong Dock. These coal preparation plants allow us to process the coal we extract from our mines to ensure a consistent quality and to enhance its suitability for particular end-users. In 2016, our preparation plants processed approximately 96% of the raw coal we produced. In addition, depending on coal quality and customer requirements, we may blend coal mined from different locations in order to achieve a more suitable product. At the current time, our preparation plants do not process coal from other companies, and we do not have any present intention to do so.

The following chart provides information regarding our preparation plants:

Midway | Parkway | Armstrong Dock | |||

Location: | Centertown, Kentucky | Central City, Kentucky | Centertown, Kentucky | ||

Inception: | July 2008 | April 2009 | March 2010 | ||

Mines Serviced: | Midway, Lewis Creek, Kronos Underground | Survant Underground | Equality Boot, Kronos Underground | ||

Current Capacity (Tons Per Hour): | 1,200 | 400 | 1,200 | ||

Average Capacity Utilization: | 66.9% | 69.7% | 98.4% | ||

Loadout Tons Per Hour: | 2,500 (Rail) | — | 2,500 (Barge) | ||

Transportation: | Rail, Truck | Truck | Barge | ||

The treatments we employ at our preparation plants depend on the size of the raw coal. For coarse material, the separation process relies on the difference in the density between coal and waste rock where, for the very fine fractions, the separation process relies on the difference in surface chemical properties between coal and the waste minerals. To remove impurities, we crush raw coal and classify it into various sizes. For the largest size fractions, we use dense media vessel separation techniques in which we float coal in a tank containing a liquid of a pre-determined specific gravity. Since coal is lighter than its impurities, it floats, and we can separate it from rock and shale. We treat intermediate sized particles with dense medium cyclones, in which a liquid is spun at high speeds to separate coal from rock. Fine coal is treated in spirals, in which the differences in density between coal and rock allow them, when suspended in water, to be separated. Ultra fine coal is recovered in column flotation cells utilizing the differences in surface chemistry between coal and rock. By injecting stable air bubbles through a suspension of ultra fine coal and rock, the coal particles adhere to the bubbles and rise to the surface of the column where they are removed. To minimize the moisture content in coal, we process most coal sizes through centrifuges. A

4

centrifuge spins coal very quickly, causing water accompanying the coal to separate. Coarse refuse from our preparation plants is back-hauled and disposed of in our mining pits or other locations in accordance with applicable regulations and permits.

Customers

Our primary customers are electric utilities. We may also sell coal to industrial companies, brokers and other coal producers. For the year ended December 31, 2016, approximately 99% of our coal revenues related to sales to electric utilities. The majority of our electric utility customers purchase coal for terms of one to four years, but we also supply coal on a spot basis for some of our customers.

In 2016, we sold coal to six domestic customers with operations located in numerous states. The majority of those customers operate power plants in the Midwestern and Southern regions of the United States. For the year ended December 31, 2016, we derived approximately 45% and 40% of our total coal revenues from sales to our two largest customers, Louisville Gas & Electric Company and the Tennessee Valley Authority, respectively.

Multi-year Coal Supply Agreements

As is customary in the coal industry, we enter into multi-year coal supply agreements with many of our customers. Multi-year coal supply agreements usually have specific volume and pricing arrangements for each year of the agreement. These agreements allow customers to secure a supply for their future needs and provide us with greater predictability of sales volume and sales prices. In 2016, we sold approximately 99% of our coal under multi-year coal supply agreements. The majority of our multi-year coal supply agreements include a fixed price for the term of the agreement or a pre-determined escalation in price for each year. Some of our multi-year coal supply agreements may include a variable pricing system. At December 31, 2016, we had multi-year coal supply agreements with remaining terms ranging from one to four years, and we are contractually committed to sell 5.3 million tons of coal in 2017.

We typically enter into multi-year coal supply agreements through a “request-for-proposal” process and after competitive bidding and negotiations. Therefore, the terms of these agreements vary by customer. Our multi-year coal supply agreements typically contain provisions to adjust the base price due to new laws and regulations that affect our costs. Additionally, some of our agreements contain provisions that allow for the recovery of costs affected by modifications or changes in the interpretations or application of any applicable statute by local, state or federal government authorities.

The price of coal sold under certain of our agreements is subject to fluctuation. For example, some of our agreements include index provisions that change the price based on changes in market-based indices and or changes in economic indices. Other agreements contain price reopener provisions that may allow a party to renegotiate pricing at a set time. Price reopener provisions may automatically set a new price based on then-current market prices or require us to negotiate a new price. In a limited number of agreements, if the parties do not agree on a new price, either party has an option to terminate the agreement. In addition, certain of our agreements contain clauses that may allow customers to terminate the agreement in the event of certain changes in environmental laws and regulations that affect their operations.

The coal supply agreements establish the quality and volume of coal to be sold. Most of our agreements fix annual pricing and volume obligations, though, in certain instances, the volume obligations may change depending on the customer’s needs. Most of our coal supply agreements contain provisions requiring us to deliver coal within certain ranges for specific coal characteristics, such as heat content, sulfur, ash and moisture content as well as others. Failure to meet these specifications can result in economic penalties, suspension or cancellation of shipments or termination of the agreements.

Our coal supply agreements also typically contain force-majeure provisions allowing temporary suspension of performance by us or our customers in the event that circumstances beyond the control of the affected party occur, including events such as strikes, adverse mining conditions, mine closures or serious transportation problems that affect us or unanticipated plant outages that may affect the buyer. Our agreements also generally provide that in the event a force-majeure event exceeds a certain time period, the unaffected party may have the option to terminate the purchase or sale in whole or in part.

Transportation

We ship our coal to domestic customers by means of railcars, barges or trucks, or a combination of these means of transportation. We generally sell coal free on board at the mine or nearest loading facility. Our customers normally bear the costs of transporting coal by rail or barge. Historically, most domestic electricity generators have arranged long-term shipping agreements with rail or barge companies to assure stable delivery costs. Approximately 65% of our coal shipped in 2016 was

5

delivered by barge, which is generally less expensive than transporting coal by truck or rail. The Armstrong Dock, which is located on the Green River, can load up to six million tons of coal annually for shipment on inland waterways. In 2016, approximately 16% and 19% of our coal sales tonnage was shipped by truck and rail, respectively.

Competition

The coal industry is highly competitive. There are numerous large and small producers in all coal producing regions of the United States, and we compete with many of these producers. Our main competitors include Alliance Resource Partners, L.P., Peabody, Foresight Energy L.P., and Murray Energy Corp., all of which are companies mining in the Illinois Basin. Many of these coal producers have greater financial resources and more proven and probable reserves than we do. Based on data from the Mine Safety and Health Administration (MSHA), we were the sixth largest producer of Illinois Basin coal in fiscal 2016, producing approximately 6% of the total Illinois Basin coal. Outside of the Illinois Basin, we compete broadly with other United States based producers of thermal coal and internationally with numerous global coal producers.

The most important factors on which we compete are price, quality and characteristics, transportation costs and reliability of supply. The demand for our coal and the prices that we will be able to obtain for our coal are closely related to coal consumption patterns of the U.S. electric generation industry and international consumers. The patterns of coal consumption are affected by various factors beyond our control, including economic conditions; temperatures in the United States; government regulation; technological developments; and the location, quality, price and availability of competing sources of fuel such as natural gas, oil and nuclear sources, as well as alternative energy sources such as hydroelectric power and wind.

Suppliers

We use various supplies and raw materials in our coal mining operations, such as petroleum-based fuels, explosives, tires and steel, as well as spare parts and other consumables. We use third-party suppliers for a significant portion of our equipment rebuilds and repairs, drilling services and construction. We use sole source suppliers for certain parts of our business, such as explosives and fuel, and preferred suppliers for other parts at our business, such as dragline and shovel parts and related services. We believe adequate substitute suppliers are available.

Employees

At December 31, 2016, we employed approximately 637 employees, none of whom is represented for collective bargaining by a union. We believe that our relations with all employees are good, and, since our inception, we have had no history of work stoppages or union organizing campaigns.

Seasonality

Our business has historically experienced some variability in its results due to the effect of seasons. Demand for coal-fired power can increase due to unusually hot or cold weather as power consumers use more air conditioning or heating. Conversely, mild weather can result in softer demand for our coal. Adverse weather conditions, such as floods or blizzards, can affect our ability to mine and ship our coal and our customers’ ability to take delivery of coal.

Regulation and Laws

Federal, state and local authorities regulate the U.S. coal mining industry with respect to matters such as:

• | employee health and safety; |

• | permitting and licensing requirements; |

• | air quality standards; |

• | water pollution; |

• | storage, treatment and disposal of wastes; |

• | protection of plant life and wildlife, including endangered or threatened species; |

• | reclamation and restoration of mining properties after mining is completed; |

6

• | remediation of contaminated soil and groundwater; |

• | surface subsidence from underground mining; |

• | the effects of mining on surface and groundwater quality and availability; and |

• | competing uses of adjacent, overlying or underlying lands, pipelines, roads and public facilities. |

The costs of compliance with these laws and regulations have been and are expected to continue to be significant. Future laws, regulations or orders, as well as differing interpretations and more rigorous enforcement of existing laws, regulations or orders in the future, may substantially increase equipment and operating costs, result in delays and disrupt operations or termination of operations, the extent of which cannot be predicted with any degree of certainty. We are committed to operating our mines in compliance with applicable federal, state and local laws and regulations. However, because of extensive and comprehensive regulatory requirements, violations during mining operations occur from time to time. Violations, including violations of any permit or approval, can result in substantial civil and criminal fines and penalties, including revocation or suspension of permits required for mining. None of the violations we have experienced to date or the monetary penalties assessed have had a material impact on our operations.

In addition, our customers are subject to extensive regulation regarding the environmental impacts associated with the combustion or other use of coal, which could affect demand for our coal. Changes in applicable laws or the adoption of new laws relating to energy production may cause coal to become a less attractive source of energy, which may adversely affect our mining operations, cost structure or the demand for coal. For example, if emissions rates or caps on greenhouse gases are enacted or a tax on carbon is imposed, the market share of coal as fuel used to generate electricity would be expected to decrease.

The Company is continuously monitoring actions by the regulatory agencies that govern coal mining operations, as potential changes within such agencies as a result of the 2016 presidential and Congressional elections may result in revisions and amendments to certain of the environmental initiatives discussed below.

Mine Safety and Health Laws

Stringent health and safety standards have been in effect since the enactment of the Federal Coal Mine Health and Safety Act of 1969. The Federal Mine Safety and Health Act of 1977 (the Mine Act) provided for MSHA and significantly expanded the enforcement of safety and health standards and imposed safety and health standards on all aspects of mining operations. It requires regular inspections of surface and underground coal mines and the issuance of citations or orders for violations of mandatory health and safety standards. Serious violations of mandatory health and safety standards or circumstances deemed to constitute an imminent danger to health or safety may result in the issuance of an order requiring the immediate withdrawal of miners from the mine or shutting down a mine or any section of a mine or any piece of mine equipment. The Mine Act also imposes criminal liability for corporate operators who knowingly falsify records required to be kept under the Mine Act or who knowingly or willfully violate a mandatory health and safety standard or order and provides that civil and criminal penalties may be assessed against individual agents, officers and directors who knowingly or willfully violate a mandatory health and safety standard or order. The State of Kentucky also has programs for mine safety and health regulation and enforcement. Collectively, federal and state safety and health regulation in the coal mining industry provides one of the most comprehensive systems for protection of employee health and safety affecting any segment of U.S. industry. In the wake of several recent underground mine accidents, enforcement scrutiny has also increased, including increased number of inspections, more inspection hours at mine sites and increased number and severity of enforcement actions. Such regulation and enforcement has a significant effect on our operating costs.

In 2006, in response to an increase in fatal mine accidents, Congress enacted the Federal Mine Improvement and New Emergency Response Act of 2006 (the MINER Act). Among other things, the MINER Act: (i) imposed additional obligations on coal operators related to (a) developing new emergency response plans that address post-accident communications, tracking of miners, breathable air, lifelines, training and communication with local emergency response personnel; (b) establishing additional requirements for mine rescue teams; and (c) notifying federal authorities of incidents that pose a reasonable risk of death; and (ii) increased penalties for violations of applicable federal laws and regulations.

Subsequent to passage of the MINER Act, Kentucky and several other states enacted legislation addressing issues such as mine safety and accident reporting, increased civil and criminal penalties and increased inspections and oversight.

7

On January 23, 2013, MSHA published a revision to the pattern of violations (POV) regulation allowing, among other things, the use of non-final citations and orders in determining whether a pattern of violations exists at a coal mine. Under the new rule, citations and orders which an operator has challenged but that have not yet been adjudicated may nonetheless be used to determine that a pattern of violations exists at a mine. If a POV notice is issued to a mine operator, each subsequent significant and substantial violation results in a withdraw order until the violation is abated. The revised POV regulation also eliminated the “potential pattern of violations” (PPOV) designation along with the subsequent period during with a mine receiving PPOV notice could regain compliance before receiving a POV notice.

On April 23, 2014, MSHA published a final rule, which, among other things, reduces the overall respirable coal dust standard from 2.0 mg to 1.5 mg per cubic meter of air and cuts in half the standard from 1.0 to 0.5 for certain mine entries and miners with pneumoconiosis. The rule also increases sampling requirements, requires use of continuous personal dust monitors (CPDMs) to provide real-time information about dust levels and requires immediate corrective action when a single, full-shift sample finds an excessive concentration of dust. Legal challenges to the rule have been unsuccessful, and as of August 1, 2016, the rule has been fully implemented.

On January 15, 2015, MSHA published a final rule requiring underground coal mine operators to equip continuous mining machines, except full-face continuous mining machines, with proximity detection systems. This final rule is intended to strengthen protections for miners by reducing the potential for pinning, crushing or striking accidents in underground coal mines. The new rule was effective March 16, 2015, but has staggered implementation deadlines through early 2018 depending upon the manufacturing date of the equipment and whether or not the equipment has been previously equipped with a proximity detection system.

On September 2, 2015, MSHA published a proposed rule requiring underground coal mine operators to equip all haulage equipment and scoops on non-longwall sections with proximity detection systems. The comment period closed, and a final rule was expected in 2016; however, on January 9, 2017, MSHA reopened the comment period for 30 days. Given the reopened comment period, it is unclear when a final rule will be issued. Based upon the proposed rule, the final rule is expected to have a staggered implementation schedule from 8 to 36 months after the effective date of the final rule.

Our compliance with current or future mine health and safety regulations could increase our mining costs. At this time, it is not possible to predict the full effect that the new or proposed statutes, regulations and policies will have on our operating costs, but if they increase our costs, they will also increase the costs of our competitors. Some, but not all, of these additional costs may be passed on to our customers.

Workers’ Compensation

We provide income replacement and medical treatment for work-related traumatic injury claims as required under state workers’ compensation laws. Our costs will vary based on the number of accidents that occur at our mines and other facilities and our costs of addressing these claims. We provide benefits to our employees by being insured through state-sponsored programs or an insurance carrier where there is no state-sponsored program.

Black Lung

Under the Black Lung Benefits Revenue Act of 1977 and the Black Lung Benefits Reform Act of 1977, as amended in 1981, each coal mine operator must pay federal black lung benefits to eligible current and former employee claimants and also make payments to a trust fund for the payment of benefits and medical expenses to eligible claimants who last worked in the coal industry prior to January 1, 1973. The trust fund is funded by an excise tax on production of up to $1.10 per ton for coal mined via underground mining methods and up to $0.55 per ton for coal mined via surface mining methods, neither amount to exceed 4.4% of the gross sales price. The excise tax does not apply to coal shipped outside the United States. We recorded $5.0 million and $6.3 million of expense related to this excise tax in 2016 and 2015, respectively.

With the implementation of the Patient Protection and Affordable Care Act in 2010 and the amendment of federal black lung regulations, the number of claimants who are awarded federal black lung benefits has increased and will likely continue to increase, as will the amounts of those awards. Our payment obligations for federal black lung benefits are either secured by insurance coverage or paid from a tax exempt trust established for that purpose. Based on required funding levels, we may have to supplement the trust corpus to cover the anticipated liabilities going forward. In addition, we could be held liable under various state statutes for black lung claims.

8

Mining Permits and Approval

Numerous governmental permits and approvals are required for our coal mining operations. When we apply for some of these permits, we are required to assess the effect or impact that any proposed production or processing of coal may have on the environment. The authorization and permitting requirements imposed by governmental authorities are costly and may delay or prevent commencement or continuation of mining operations in certain locations. These permitting requirements may also be supplemented, modified or re-interpreted from time to time. Past or ongoing violations of federal and state mining laws could provide a basis to modify or revoke existing permits and to deny the issuance of additional permits.

In order to obtain the permits and approvals necessary for mining from federal and state regulatory authorities, mine operators or applicants must submit a reclamation plan for restoring the mined land to its prior productive use, better condition or other approved use. Typically, we submit the necessary permit applications several months, or even years, before we plan to mine a new area. Some required permits for mining have become increasingly difficult to obtain in a timely manner, or at all, particularly those permits involving the federal Clean Water Act (CWA) and the U.S. Army Corps of Engineers (Corps). Specifically, issuance of Corps permits allowing placement of material in valleys or streams has been slowed in recent years due to ongoing disputes over the requirements for obtaining such permits. While we do not engage in mountaintop mining, we are required to obtain permits from the Corps, and our mining operations do affect bodies of water regulated by the Corps. The permit application review process takes longer to complete, and permit applications are increasingly being challenged by environmental and other advocacy groups, although we are not aware of any such challenges to any of our pending permit applications. We may experience difficulty or delays in obtaining the permits or other approvals necessary for mining in the future or even face denials of permits altogether. Violations of federal, state and local laws, regulations or any permit, order, or approval issued under such authorization can result in substantial fines and penalties, including modification, revocation or suspension of mining permits and, in certain circumstances, criminal sanctions.

Surface Mining Control and Reclamation Act

The Surface Mining Control and Reclamation Act of 1977 (SMCRA), which is administered by the Office of Surface Mining Reclamation and Enforcement within the Department of the Interior (OSM), establishes operational, reclamation and closure standards for all aspects of surface mining, including the surface effects of underground coal mining. Mining operators must obtain SMCRA permits and permit renewals from OSM or from the applicable state agency if the state has obtained primacy. A state may achieve primacy if it develops a regulatory program that is no less stringent than the federal program and approved by OSM. Our mines are located in Kentucky, which has primacy to administer the SMCRA program. SMCRA stipulates compliance with many other major environmental statutes, including the federal Clean Air Act (CAA), the CWA, the Resource Conservation and Recovery Act (RCRA) and the Comprehensive Environmental Response, Compensation and Liability Act (CERCLA or Superfund).

Some SMCRA mine permits take us over a year to prepare, depending on the size and complexity of the mine. Once a permit application is prepared and submitted to the regulatory agency, it goes through a completeness and technical review. Also, before a SMCRA permit is issued, a mine operator must submit a bond or otherwise secure the performance of all reclamation obligations. After the application is submitted, public notice or advertisement of the proposed permit action is required, which is followed by a public comment period. It is not uncommon for it to take more than a year for a SMCRA mine permit to be issued.

The OSM’s “stream buffer zone rule” (SBZ Rule) prohibits mining disturbances within 100 feet of streams if there would be a negative effect on water quality. In December 2008, the OSM finalized a revised SBZ Rule, which purported to clarify certain aspects of the SBZ Rule; however, the U.S. District Court for the District of Columbia struck down the revised SBZ Rule in early 2014. As such, the 1983-era SBZ rule remains in place pending further action by OSM to proceed with new rulemaking.

On June 11, 2009, the Secretary of the Department of the Interior, the Administrator of the EPA, and the Acting Assistant Secretary of the Army for Civil Works entered into a memorandum of understanding to reduce the environmental impacts of surface coal mining operations in certain Appalachian states, committing OSM to revising provisions of current SMCRA regulations, including the SBZ rule. On July 27, 2015, OSM published its proposed Stream Protection Rule (SPR). The SPR proposed extensive revisions to the current regulation of coal mining, including but not limited to, changes to bonding requirements, “approximate original contour” requirements, subsidence restrictions, and post-mining restoration requirements. The proposal included newly defined terms and concepts such as “material damage to the hydrologic balance outside the permit area,” new monitoring and data collection requirements, stream restoration requirements and new procedures and requirements related to the protection of threatened or endangered species under the federal Endangered Species Act.

9

The final SPR was published in the Federal Register on December 20, 2016, with an effective date of January 19, 2017. On January 17, 2017, thirteen states sued the Department of the Interior seeking to invalidate the rule and enjoin its enforcement. In February 2017, both the U.S. House of Representatives and the Senate passed resolutions disapproving the SPR under the Congressional Review Act. President Trump signed legislation repealing the SPR on February 16, 2017. Whether Congress or the states will enact future legislation with requirements similar to, or more stringent than, the SPR remains uncertain.

Surety Bonds

Federal and state laws require a mine operator to secure the performance of its reclamation obligations required under SMCRA through the use of surety bonds or other approved forms of performance security to cover the costs the state would incur if the mine operator was unable to fulfill its obligations. The cost of surety bonds have fluctuated in recent years, and the market terms of these bonds have generally become more unfavorable to mine operators. For example, in connection with our current bonds, we are required to post substantial security in the form of cash collateral. These changes in the terms of the bonds have been accompanied at times by a decrease in the number of companies willing to issue surety bonds. Some mine operators have therefore used letters of credit to secure the performance of a portion of their reclamation obligations. Many of these bonds are renewable on a yearly basis. We cannot predict our ability to obtain bonds or other approved forms of performance security, or the cost of such security, in the future. As of December 31, 2016, we had approximately $32.2 million in surety bonds outstanding to secure the performance of our reclamation obligations, which are collateralized by cash deposits of approximately $6.0 million.

In addition to the bond requirement for an active or proposed permit, the Abandoned Mine Land Fund, which was created by SMCRA, imposes a fee on all coal produced in the United States. The proceeds of the fee are used to restore mines closed or abandoned prior to SMCRA’s adoption in 1977 and to pay health care benefit costs of orphan beneficiaries of the Combined Fund created by the Coal Industry Retiree Health Benefit Act of 1992. Currently and through 2021, the fee is $0.28 per ton for coal mined via surface mining methods and $0.12 per ton on coal via underground mining methods. In 2016 and 2015, we recorded approximately $1.1 million and $1.5 million, respectively, of expense related to these reclamation fees.

In January 2011, OSM determined that the Kentucky regulatory program contained several reclamation bonding deficiencies. During May 2012, OSM required the implementation of program changes to address the deficiencies. Prominent among those changes was the promulgation of legislation that established the Kentucky Reclamation Guaranty Fund (RGF), the RGF Commission and the Office of the RGF, to support the commission and administer its affairs. The RGF is a revolving, interest-bearing account that will provide financial assistance in the event the permit-specific reclamation bond is insufficient to complete reclamation on a mine site. Participation in the RGF is mandatory, unless permittees elect to provide a full-cost bond in accordance with specific calculation methods. The RGF received initial capitalization from the assets of the former voluntary Kentucky Bond Pool, which was abolished by the new legislation. A start-up assessment and a one-time acreage fee provided additional initial capitalization. Beginning January 2014, additional revenue for the RGF is generated from tonnage and acreage fees paid annually, depending on the operational status of each permit.

Air Emissions

A. General Air Quality Regulations

The CAA, the amendments thereto, and state laws that regulate air emissions affect coal mining operations, both directly and indirectly. Direct impacts on our coal mining and processing operations include CAA permitting requirements and control requirements for particulate matter, which includes fugitive dust from roadways, parking lots and equipment such as conveyors and storage piles. The CAA also indirectly affects coal mining operations by extensively regulating the emissions of particulate matter, sulfur dioxide (SO2), nitrogen oxide (NOx), carbon monoxide, ozone, mercury and other compounds emitted by coal-fired power plants, which are the largest end users of our coal. Costs to comply with current, new and emerging regulations applicable to coal-fired power plants could have an adverse effect on our customers, thereby reducing demand for coal. Moreover, these regulations may cause some users of coal to switch from coal to natural gas or renewable energy for electric power generation.

In addition to the greenhouse gas (GHG) issues discussed below, the air emissions programs that may directly or indirectly impact our operations include, but are not limited to, the following:

• | The EPA’s Acid Rain Program under the CAA regulates emissions of SO2, a by-product of coal combustion, from electric generating facilities. Affected facilities purchase or are otherwise allocated SO2 emissions allowances, which must be surrendered annually in an amount equal to a facility’s SO2 emissions in that year. Facilities may sell or trade excess allowances to other facilities that require additional allowances to offset their SO2 emissions. In addition to |

10

purchasing or trading for additional SO2 allowances, affected power facilities can satisfy the requirements of the EPA’s Acid Rain Program by switching to lower-sulfur fuels, installing pollution control devices such as flue gas desulfurization systems, or “scrubbers,” or by reducing electricity generating levels.

• | The Clean Air Interstate Rule (CAIR) calls for power plants in 28 states and Washington, D.C. to reduce emission levels of SO2 and NOx pursuant to a cap-and-trade program similar to the system in effect for acid rain. In June 2011, the EPA finalized the Cross-State Air Pollution Rule (CSAPR), a replacement rule for CAIR, which requires 28 states in the Midwest and Eastern seaboard to reduce power plant SO2 and NOx emissions that cross state lines and contribute to ozone and/or fine particle pollution in other states. Though some issues with CSAPR remain subject to litigation, the EPA began implementation of CSAPR’s Phase 1 emission reduction requirements on January 1, 2015, and Phase 2 limits governing annual SO2 and NOx emissions took effect on January 1, 2017. On September 7, 2016, the EPA finalized an update to CSAPR which would reduce summertime NOx emissions from power plants in 22 states in the Eastern U.S. These season limits for NOx are scheduled to become effective on May 1, 2017. The final impact of CSAPR are unknown at the present time due to the implementation of Mercury and Air Toxic Standards (MATS), discussed below, the recent updates to CSAPR and the significant number of coal retirements that have resulted and that potentially will result from MATS. |

• | In February 2012, the EPA adopted the MATS, which regulates the emission of mercury and other metals, fine particulates, and acid gases such as hydrogen chloride from coal and oil-fired power plants. In March 2013, the EPA finalized a reconsideration of the MATS rule as it pertains to new power plants, principally adjusting emissions limits to levels attainable by existing control technologies. Appeals were filed and oral arguments were heard by the D.C. Circuit Court of Appeals in December 2013. On April 15, 2014, the D.C. Circuit Court of Appeals upheld MATS. On June 29, 2015, the Supreme Court remanded the final rule back to the D.C. Circuit holding that the agency must consider cost before deciding whether regulation is necessary and appropriate. On December 1, 2015, the EPA issued, for comment, the proposed Supplemental Finding. The EPA issued the Supplemental Finding on April 15, 2016, finding that the rule was necessary and appropriate despite the costs. Regardless of the various court actions, many electric generators had already announced retirements due to the MATS rule. MATS would force generators to make capital investments to retrofit power plants and could lead to additional retirements of older coal-fired generating units. The announced and possible additional retirements are likely to reduce the demand for coal. Apart from MATS, several states have enacted or proposed regulations requiring reductions in mercury emissions from coal-fired power plants, and federal legislation to reduce mercury emissions from power plants has been proposed. Regulation of mercury emissions may decrease the future demand for coal. We continue to evaluate the possible scenarios associated with CSAPR and MATS and the effects they may have on our business and our results of operations, financial condition or cash flows. |

• | In January 2013, the EPA issued final Maximum Achievable Control Technology (MACT) standards for several classes of boilers and process heaters, including large coal-fired boilers and process heaters (Boiler MACT), which require owners of industrial, commercial, and institutional boilers to comply with standards for air pollutants, including mercury and other metals, fine particulates, and acid gases such as hydrogen chloride. Businesses and environmental groups have filed legal challenges to Boiler MACT and petitioned the EPA to reconsider the rule. On December 1, 2014, the EPA announced reconsideration of the standard and will accept public comment on five issues for its standards on area sources, will review three issues related to its major-source boiler standards, and four issues relating to commercial and solid waste incinerator units. Before reconsideration, the EPA estimated the rule will affect 1,700 existing major source facilities with an estimated 14,316 boilers and process heaters. While some owners would make capital expenditures to retrofit boilers and process heaters, a number of boilers and process heaters could be prematurely retired. Retirements are likely to reduce the demand for coal. The impact of the regulations will depend on the EPA’s reconsideration and the outcome of ongoing and subsequent legal challenges. |

• | The EPA is required by the CAA to periodically re-evaluate the available health effects information to determine whether the national ambient air quality standards (NAAQS) should be revised. As a result of this process, the EPA has adopted more stringent NAAQS for fine particulate matter, ozone, SO2 and NOx. As a result, some states will be required to amend their existing individual state implementation plans (SIPs) to achieve and compliance with the new air quality standards. Other states will be required to develop new SIPs for areas that were previously in “attainment,” but do not meet the revised standards. In addition, under the revised ozone NAAQS, significant additional emissions control expenditures may be required at coal-fired power plants. Attainment dates for the new standards range between 2013 and 2030, depending on the severity of the non-attainment. The final rule has been challenged in litigation by industry and state petitioners and several environmental groups, some aspects of which have been vacated and some of which have been remanded to the EPA for further consideration. The final rules and new standards may impose additional emissions control requirements on new and expanded coal-fired power plants and industrial boilers. |

11

Because coal mining operations and coal-fired electric generating facilities emit particulate matter and SO2, our mining operations and our customers could be affected when the new standards are implemented by the applicable states, and developments might indirectly reduce the demand for coal.

• | The EPA’s regional haze program is designed to protect and improve visibility at and around national parks, national wilderness areas and international parks. Under the program, states are required to develop SIPs to improve visibility. Typically, these plans call for reductions in SO2 and NOx emissions from coal-fueled electric plants. In recent cases, the EPA has decided to negate the SIPs and impose stringent requirements through federal implementation plans (FIPs). The regional haze program, including particularly the EPA’s FIPs, and any future regulations may restrict the construction of new coal-fired power plants whose operation may impair visibility at and around federally protected areas and may require some existing coal-fired power plants to install additional control measures designed to limit haze-causing emissions. These requirements could limit the demand for coal in some locations. |

• | The EPA’s new source review (NSR) program under the CAA in certain circumstances requires existing coal-fired power plants, when modifications to those plants significantly increase emissions, to install more stringent air emissions control equipment. The Department of Justice, on behalf of the EPA, has filed lawsuits against a number of coal-fired electric generating facilities alleging violations of the NSR program. The EPA has alleged that certain modifications have been made to these facilities without first obtaining certain permits issued under the program. Several of these lawsuits have settled, but others remain pending. Depending on the ultimate resolution of these cases, demand for coal could be affected. |

B. Greenhouse Gas Regulations

Carbon dioxide (CO2) is a GHG, the man-made emission of which is of major concern under any regulatory framework intended to control what is sometimes referred to “climate change.” CO2 is a major by-product of the combustion process within coal-fired power plants. Methane, which must be expelled from our underground coal mines for mining safety reasons, is also classified as a GHG.

Future regulation of GHGs in the United States could occur pursuant to, for example, future U.S. treaty commitments; new domestic legislation that imposes a tax on GHG emissions, a GHG cap-and-trade program or other programs aimed at GHG reduction; or regulatory programs that may be established by the EPA. Internationally, the Kyoto Protocol set binding emission targets for developed countries that ratified it (the U.S. did not ratify, and Canada officially withdrew from its Kyoto commitment in 2012) to reduce their global GHG emissions. The Kyoto Protocol was nominally extended past its expiration date of December 2012, with a requirement for a new legal construct to be put into place by 2015. Most recently, the United Nations Framework Convention on Climate Change met in Paris, France in December 2015 and agreed to an international climate agreement. Although this agreement does not create any binding obligations for nations to limit their GHG emissions, it does include pledges to voluntarily limit or reduce future emissions. These commitments could further reduce demand and prices for our coal. The U.S. is currently a party to the Paris agreement; however, whether the U.S. will remain a party is uncertain given President Trump’s statements regarding cancellation of U.S. participation. Notwithstanding this uncertainty, many states, regions and governmental bodies have adopted GHG initiatives and have or are considering the imposition of fees or taxes based on the emission of GHGs by certain facilities, including coal-fired electric generating facilities. Depending on the particular regulatory program that may be enacted, at either the federal or state level, the demand for coal could be negatively impacted, which would have an adverse effect on our operations.

Even in the absence of new federal legislation, the EPA has already begun to regulate GHG emissions under the CAA. In 2009, the EPA issued a final rule, known as the Endangerment Finding, declaring that GHG emissions, including CO2 and methane, endanger public health and welfare.

In May 2010, the EPA issued its final “tailoring rule” for GHG emissions, a policy aimed at shielding small emission sources from CAA permitting requirements. The EPA’s rule phases in various GHG-related permitting requirements beginning in January 2011. Beginning July 1, 2011, the EPA requires facilities that must already obtain NSR permits for other pollutants to include GHGs in their permits for new construction projects that emit at least 100,000 tons per year of GHGs and existing facilities that increase their emissions by at least 75,000 tons per year. These permits require that the permittee adopt the Best Available Control Technology (BACT). In June 2012, the D.C. Circuit Court of Appeals upheld these permitting regulations. In June 2014, the U.S. Supreme Court invalidated the EPA’s position that power plants and other sources can be subject to permitting requirements based on their GHG emissions alone. For CO2 BACT to apply, CAA permitting must be triggered by another regulated pollutant, such as SO2. As a result of litigation filed by industry groups, the D.C. Circuit ordered the EPA regulations under review to be vacated, with certain limitations. On August 19, 2015, the EPA issued a final rule amending its regulations to remove portions of those regulations that were vacated by the D.C. Circuit. Currently the impacts are uncertain.

12

As a result of revisions to its preconstruction permitting rules that became fully effective in 2011, the EPA is now requiring new sources, including coal-fired power plants, to undergo control technology reviews for GHGs as a condition of permit issuance. These reviews may impose limits on GHG emissions, or otherwise be used to compel consideration of alternative fuels and generation systems, as well as increase litigation risk for-and so discourage development of-coal-fired power plants.

In March 2012, the EPA proposed New Source Performance Standards (NSPS) for CO2 emissions from new fossil fuel-fired power plants. The proposal requires new coal units to meet a CO2 emissions standard of 1,000 lbs. CO2/MWh, which is equivalent to the CO2 emitted by a natural gas combined cycle unit. In January 2014, the EPA formally published its re-proposed NSPS for CO2 emissions from new power plants. The re-proposed rule requires an emissions standard of 1,100 lbs. CO2/MWh for new coal-fired power plants. To meet such a standard, new coal plants would be required to install carbon capture and storage (CCS) technology. In August 2015, the EPA released final rules requiring newly constructed coal-fired steam electric generating units (EGUs) to emit no more than 1,400 lbs. CO2/MWh (gross) and be constructed with CCS to capture 16% of CO2 produced by an electric generating unit burning bituminous coal. At the same time, the EPA finalized GHG emissions regulations for modified and existing power plants. The rule for modified sources required reducing GHG emissions from any modified or reconstructed source and could limit the ability of generators to upgrade coal-fired power plants, thereby reducing the demand for coal. The rule for existing sources proposes to establish different target emission rates (lbs. per megawatt hour) for each state and has an overall goal to achieve a 32% reduction of CO2 emissions from 2005 levels by 2030. The compliance period begins in 2022, and in 2030, CO2 emissions goals must be met. Collectively, these requirements have led to premature retirements and could lead to additional premature retirements of coal-fired generating units and reduce the demand for coal. Congress has rejected legislation to restrict CO2 emissions from existing power plants, and it is unclear whether the EPA has the legal authority to regulate CO2 emissions for existing and modified power plants without additional Congressional authority. Challenges to the rule by a number of states and industry groups are pending before the D.C. Circuit Court of Appeals. On March 28, 2017, President Trump signed an executive order requiring the EPA to review the CPP, a first step in rolling back the CPP.

In June 2014, the EPA proposed CO2 emission “guidelines” for modified and existing fossil fuel-fired power plants known as the Clean Power Plan (CPP). The CPP was finalized in August 2015 and established carbon pollution standards for power plants, called CO2 emission performance rates. The EPA expects each state to develop implementation plans for power plants in its state to meet the individual state targets established in the CPP. The EPA has given states the option to develop compliance plans for annual rate-based reductions (pounds per megawatt hour) or mass-based tonnage limits for CO2. The state plans were due in September 2016, subject to potential extensions of up to two years for final plan submission. The compliance period begins in 2022, and emission reductions will be phased in up to 2030. The EPA also proposed a federal compliance plan to implement the CPP in the event that an approvable state plan is not submitted to the EPA. Although each state can determine its own method of compliance, the requirements rely on decreased use of coal and increased use of natural gas and renewables for electricity generation, as well as reductions in the amount of electricity used by consumers. Judicial challenges have been filed. On February 9, 2016, the U.S. Supreme Court issued a stay, halting implementation of the regulations. The stay will be in place until the D.C. Circuit Court of Appeals rules on the merits of the legal challenges and, if following a ruling by the D.C. Circuit Court of Appeals, a writ of certiorari from the Supreme Court is sought and granted, the stay will remain in place until the Supreme Court issues its decision on the merits. If, despite the legal challenges, the rules are implemented in their current form, demand for coal will likely be further decreased, potentially significantly, and adversely impact our business.

On June 28, 2010, the EPA issued the Final Mandatory Reporting of Greenhouse Gases Rule requiring all stationary sources that emit more than 25,000 tons of GHGs per year to collect and report annually to the EPA data regarding such emissions occurring after January 1, 2010. These GHG rules affect many of our customers, as well as additional source categories, including all underground mines subject to quarterly methane sampling by MSHA. Underground mines subject to these rules, including ours, were required to begin monitoring GHG emissions on January 1, 2011 and began reporting to the EPA in 2012.

In October 2013, the U.S. Supreme Court granted a number of petitions for certiorari seeking review of the EPA’s approach to GHG regulation. The Supreme Court heard oral arguments in February 2014. On June 23, 2014, the Supreme Court issued an opinion affirming the D.C. Circuit decision in part and reversing the decision in part. The Court struck down the EPA’s tailoring rule, making permanent a temporary exclusion that the EPA had provided for small sources. However, the Court’s holding affirmed the EPA’s authority to regulate GHG emissions from the vast majority of sources subject to the CAA’s permitting provisions, and did not affect the EPA’s ability to regulate GHG emissions from new and existing sources. Future legislation or new regulations imposing reporting obligations on, or limiting emissions of GHGs from, our equipment and operations could require us to incur costs to reduce emissions of GHGs associated with our operations. Substantial limitations on GHG emissions could adversely affect demand for the coal we produce.

13

There have been numerous protests of and challenges to the permitting of new coal-fired power plants by environmental organizations and state regulators for concerns related to GHG emissions. For instance, various state regulatory authorities have rejected the construction of new coal-fueled power plants based on the uncertainty surrounding the potential costs associated with GHG emissions from these plants under future laws limiting the emissions of CO2. In addition, several permits issued to new coal-fueled power plants without limits on GHG emissions have been appealed to the EPA’s Environmental Appeals Board.

In addition, over 30 states have currently adopted “renewable energy standards” or “renewable portfolio standards,” which encourage or require electric utilities to obtain a certain percentage of their electric generation portfolio from renewable resources by a certain date. These standards range generally from 10% to 30%, over time periods that generally extend from the present until between 2020 and 2030. Many states have now begun re-visiting some of these standards and have adjusted or in some cases revoked these standards. To the extent these requirements remain in place and potentially affect our current and prospective customers, they may reduce the demand for coal-fired power, and may affect long-term demand for our coal.

Finally, a federal appeals court allowed a lawsuit pursuing federal common law claims to proceed against certain utilities on the basis that they may have created a public nuisance due to their emissions of CO2, while a second federal appeals court dismissed a similar case on procedural grounds. The U.S. Supreme Court overturned that decision in June 2011, holding that federal common law provides no basis for public nuisance claims against utilities due to their CO2 emissions. The Supreme Court did not, however, decide whether similar claims can be brought under state common law. As a result, despite this favorable ruling, tort-type liabilities remain a concern.

In addition, environmental advocacy groups have filed a variety of judicial challenges claiming that the environmental analyses conducted by federal agencies before granting permits and other approvals necessary for certain coal activities do not satisfy the requirements of the National Environmental Policy Act (NEPA). These groups assert that the environmental analyses in question do not adequately consider the climate change impacts of these particular projects. In December 2014, the Council on Environmental Quality released updated draft guidance discussing how federal agencies should consider the effects of GHG emissions and climate change in their NEPA evaluations. The guidance encourages agencies to provide more detailed discussion of the direct, indirect, and cumulative impacts of a proposed action’s reasonably foreseeable emissions and effects. This guidance could create additional delays and costs in the NEPA review process or in our operations, or even an inability to obtain necessary federal approvals for our future operations, including due to the increased risk of legal challenges from environmental groups seeking additional analysis of climate impacts. These arguments, though, have generally not yet been successful in stopping infrastructure and other projects.

Many states and regions have adopted GHG initiatives and certain governmental bodies have or are considering the imposition of fees or taxes based on the emission of GHG by certain facilities, including coal-fired electric generating facilities. For example, in 2005, ten Northeastern states entered into the Regional Greenhouse Gas Initiative agreement (RGGI), calling for implementation of a cap-and-trade program aimed at reducing CO2 emissions from power plants in the participating states. The members of RGGI have established a CO2 trading program. Auctions for CO2 allowances under the program began in September 2008. Though New Jersey withdrew from RGGI in 2011, since its inception, several additional Northeastern states and Canadian provinces have joined as participants or observers.