Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - SUFFOLK BANCORP | ex32_2.htm |

| EX-32.1 - EXHIBIT 32.1 - SUFFOLK BANCORP | ex32_1.htm |

| EX-31.2 - EXHIBIT 31.2 - SUFFOLK BANCORP | ex31_2.htm |

| EX-31.1 - EXHIBIT 31.1 - SUFFOLK BANCORP | ex31_1.htm |

| EX-23.1 - EXHIBIT 23.1 - SUFFOLK BANCORP | ex23_1.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM _______ TO ______

Commission File Number: 001-37658

SUFFOLK BANCORP

(Exact name of registrant as specified in its charter)

|

New York

|

11-2708279

|

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

(I.R.S. Employer Identification No.)

|

|

4 West Second Street, P.O. Box 9000, Riverhead, NY

|

11901

|

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (631) 208-2400

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Common Stock, par value $2.50 per share

|

New York Stock Exchange

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files) YES ☒ NO ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☒ Non-accelerated filer ☐ Smaller reporting company ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ☐ NO ☒

The aggregate market value of the common equity held by non-affiliates of the Registrant as of the last business day of the Registrant’s most recently completed second fiscal quarter was $359 million.

As of February 10, 2017, there were 11,943,789 shares of Registrant’s Common Stock outstanding.

SUFFOLK BANCORP

Annual Report on Form 10-K

For the Year Ended December 31, 2016

|

Page

|

||

|

PART I

|

||

|

Item 1.

|

3

|

|

|

Item 1A.

|

7

|

|

|

Item 1B.

|

13

|

|

|

Item 2.

|

14

|

|

|

Item 3.

|

14

|

|

|

Item 4.

|

14

|

|

|

PART II

|

||

|

Item 5.

|

14

|

|

|

Item 6.

|

17

|

|

|

Item 7.

|

18

|

|

|

Item 7A.

|

34

|

|

|

Item 8.

|

37

|

|

|

Item 9.

|

76

|

|

|

Item 9A.

|

76

|

|

|

Item 9B.

|

78

|

|

|

PART III

|

||

|

Item 10.

|

78

|

|

|

Item 11.

|

81

|

|

|

Item 12.

|

99

|

|

|

Item 13.

|

100

|

|

|

Item 14.

|

101

|

|

|

PART IV

|

||

|

Item 15.

|

103

|

|

| Item 16. | Form 10-K Summary | 103 |

|

104

|

PART I

Suffolk Bancorp (the “Company”) was incorporated in 1985 as a bank holding company. The Company currently owns all of the outstanding capital stock of Suffolk County National Bank (the “Bank”). The Bank was organized under the national banking laws of the United States in 1890. The Bank is a member of the Federal Reserve System and its deposits are insured by the Federal Deposit Insurance Corporation (“FDIC”) to the extent provided by law. The income of the Company is primarily derived through the operations of the Bank and its subsidiaries, consisting of the real estate investment trust (“REIT”) Suffolk Greenway, Inc., an insurance agency and two corporations used to acquire foreclosed real estate. The insurance agency and the two corporations used to acquire foreclosed real estate are immaterial to the Company’s operations. The Company had 296 full-time equivalent employees as of December 31, 2016.

On June 26, 2016, the Company entered into an Agreement and Plan of Merger (the “merger agreement”) with People’s United Financial, Inc. (“People’s United”) pursuant to which the Company will merge into People’s United (the “merger”). People’s United will be the surviving corporation in the merger. Subject to the terms and conditions of the merger agreement, the Company’s shareholders will have the right to receive 2.225 shares of People’s United common stock in exchange for each share of Company common stock. The merger agreement was adopted by the Company’s shareholders, and both the Office of the Comptroller of the Currency (the “OCC”) and the Board of Governors of the Federal Reserve System (the “Federal Reserve Board”) have approved the merger. The merger remains subject to other customary conditions to closing.

The Bank is a full-service bank serving the needs of its local residents through 27 branch offices in Nassau, Suffolk and Queens Counties, New York and loan production offices in Garden City, Melville and Long Island City. The Bank offers a full line of domestic commercial and retail banking services. The Bank makes commercial real estate floating and fixed rate loans, multifamily and mixed use commercial loans primarily in the boroughs of New York City, commercial and industrial loans to manufacturers, wholesalers, distributors, developers/contractors and retailers and agricultural loans. The Bank also makes loans secured by residential mortgages, and both floating and fixed rate second mortgage loans with a variety of plans for repayment. Real estate construction loans are also offered.

One of the largest community banks headquartered on Long Island, the Company serves clients in its traditional markets on the east end of Long Island, western Suffolk County and in its newer markets of Nassau County and New York City. The Company considers its business to be highly competitive in its market area with numerous competitors for its core niche of small business and middle market clients, as well as retail clients ancillary to these commercial relationships. The Company competes with local, regional and national depository financial institutions, including commercial banks, savings banks, insurance companies, credit unions and money market funds, and other businesses with respect to its lending services and in attracting deposits. Although the New York metropolitan area has a high density of financial institutions, a number of which are significantly larger than the Company, the core deposit franchise the Company has built over its more than 125 years of doing business by focusing its deposit gathering efforts on low cost deposits is unique in the local marketplace and gives it a significant competitive advantage on cost of funds. In addition to serving the banking needs of the communities in its market area, the Company is also known, along with its employees, for its active community involvement.

At December 31, 2016, the Company, on a consolidated basis, had total assets of approximately $2.1 billion, total deposits of approximately $1.8 billion and stockholders’ equity of approximately $215 million.

Unless the context otherwise requires, references herein to the Company include the Company and the Bank on a consolidated basis.

Business Segment Reporting

The Bank is a community bank, which offers a wide array of products and services to its customers. Pursuant to its banking strategy, emphasis is placed on building relationships with its customers and operations are managed and financial performance is evaluated on a Company-wide basis. As a result, the Company, the only reportable segment, is not organized around discernible lines of business and prefers to work as an integrated unit to customize solutions for its customers, with business line emphasis and product offerings changing over time as needs and demands change.

Available Information

The Company files Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements on Schedule 14A, and any amendments to those reports, with the United States Securities and Exchange Commission (“SEC”). The public may read and copy any of these materials at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330 (1-800-732-0330). The SEC also maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers, including the Company, that file electronically with the SEC. The Company also makes these reports available free of charge through its Internet website (www.scnb.com) as soon as practicably possible after the Company files these reports electronically with the SEC. Information on the Company’s website is not incorporated by reference into this Form 10-K.

Supervision and Regulation

References in this section to applicable statutes and regulations are brief summaries only and do not purport to be complete. It is suggested that the reader review such statutes and regulations in their entirety for a full understanding.

As a consequence of the extensive regulation of commercial banking activities in the United States, the business of the Company and the Bank is particularly susceptible to federal and state legislation that may affect the cost of doing business, modifying permissible activities or enhancing the competitive position of other financial institutions.

The Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”) signed into law in 2011 makes extensive changes to the laws regulating financial services firms. The Dodd-Frank Act also requires significant rulemaking and mandates multiple studies which could result in additional legislative or regulatory action. Under the Dodd-Frank Act, federal banking regulatory agencies are required to draft and implement enhanced supervision, examination and capital standards for depository institutions and their holding companies. The enhanced requirements include, among other things, changes to capital, leverage and liquidity standards and numerous other requirements. The Dodd-Frank Act authorizes various new assessments and fees, expands supervision and oversight authority over non-bank subsidiaries, increases the standards for certain covered transactions with affiliates and requires the establishment of minimum leverage and risk-based capital requirements for insured depository institutions. The Dodd-Frank Act also established a new federal Consumer Financial Protection Bureau with broad authority and permits states to adopt stricter consumer protection laws and enforce consumer protection rules issued by the Consumer Financial Protection Bureau. Due to the passage of the Dodd-Frank Act, the standard deposit insurance amount is $250 thousand per depositor per insured bank for each account ownership category. In addition, the FDIC assessment is now based on the Bank’s total average assets less tier 1 capital, instead of deposits, and is computed at lower rates. Following the 2016 U.S. elections, it is possible that the new administration may seek to revise or repeal certain regulations adopted pursuant to the Dodd-Frank Act, although the extent of any such change remains uncertain.

Bank Holding Company Regulation

The Company is a bank holding company registered under the Bank Holding Company Act (“BHC Act”) and is subject to supervision and regulation by the Federal Reserve Board. Federal laws subject bank holding companies to particular restrictions on the types of activities in which they may engage and to a range of supervisory requirements and activities, including regulatory enforcement actions, for violation of laws and policies.

Activities Closely Related to Banking

The BHC Act prohibits a bank holding company, with certain limited exceptions, from acquiring direct or indirect ownership or control of any voting shares of any company that is not a bank or from engaging in any activities other than those of banking, managing or controlling banks and certain other subsidiaries or furnishing services to or performing services for its subsidiaries. Bank holding companies also may engage in or acquire interests in companies that engage in a limited set of activities that are closely related to banking or managing or controlling banks. If a bank holding company has become a financial holding company (an “FHC”), it may engage in a broader set of activities, including insurance underwriting and broker-dealer services as well as activities that are jointly determined by the Federal Reserve Board and the Treasury Department to be financial in nature or incidental to such financial activity. FHCs may also engage in activities that are determined by the Federal Reserve to be complementary to financial activities. The Company has not elected to be an FHC at this time but may make such an election at any time so long as the statutory criteria are satisfied. In order to become an FHC, the bank holding company and all subsidiary depository institutions must be well managed and well capitalized. Additionally, all subsidiary depository institutions must have received at least a “satisfactory” rating on its most recent Community Reinvestment Act (“CRA”) examination. At December 31, 2016, the Bank’s CRA rating was “outstanding.”

Safe and Sound Banking Practices

Bank holding companies are not permitted to engage in unsafe and unsound banking practices. The Federal Reserve Board may order a bank holding company to terminate an activity or control of a nonbank subsidiary if such activity or control constitutes a significant risk to the financial safety, soundness or stability of a subsidiary bank and is inconsistent with sound banking principles. Regulation Y also requires a holding company to give the Federal Reserve Board prior notice of any redemption or repurchase of its own equity securities if the consideration to be paid, together with the consideration paid for any repurchases or redemptions in the preceding year, is equal to 10% or more of the company’s consolidated net worth.

The Federal Reserve Board has broad authority to prohibit activities of bank holding companies and their non-banking subsidiaries which represent unsafe and unsound banking practices or which constitute violations of laws or regulations. Notably, the Financial Institutions Reform, Recovery and Enforcement Act of 1989 (“FIRREA”) provides that the Federal Reserve Board can assess civil money penalties for such practices or violations which can be as high as $1 million per day. FIRREA contains expansive provisions regarding the scope of individuals and entities against which such penalties may be assessed.

Annual Reporting and Examinations

The Company is required to file an annual report with the Federal Reserve Board and such additional information as the Federal Reserve Board may require pursuant to the BHC Act. The Federal Reserve Board may examine a bank holding company or any of its subsidiaries and charge the company for the cost of such an examination. The Company is also subject to reporting and disclosure requirements under state and federal securities laws.

Rules on Regulatory Capital

Regulatory capital rules, released in July 2013, implement higher minimum capital requirements for bank holding companies and banks. The rules include a common equity tier 1 capital requirement and establish criteria that instruments must meet in order to be considered common equity tier 1 capital, additional tier 1 capital or tier 2 capital. These enhancements are expected to both improve the quality and increase the quantity of capital required to be held by banking organizations, better equipping the U.S. banking system to deal with adverse economic conditions. The capital rules require banks and bank holding companies to maintain a minimum common equity tier 1 capital ratio of 4.5%, a tier 1 capital ratio of 6%, a total capital ratio of 8% and a leverage ratio of 4%. Bank holding companies are also required to hold a capital conservation buffer of common equity tier 1 capital of 2.5% to avoid limitations on capital distributions and executive compensation payments. The capital rules also require banks to maintain a common equity tier 1 capital ratio of 6.5%, a tier 1 capital ratio of 8%, a total capital ratio of 10% and a leverage ratio of 5% to be deemed “well capitalized” for purposes of certain rules and prompt corrective action requirements.

The rules attempt to improve the quality of capital by implementing changes to the definition of capital. Among the most important changes are stricter eligibility criteria for regulatory capital instruments that would disallow the inclusion of instruments, such as trust preferred securities, in tier 1 capital going forward and constraints on the inclusion of minority interests, mortgage-servicing assets, deferred tax assets and certain investments in the capital of unconsolidated financial institutions. In addition, the rules require that most regulatory capital deductions be made from common equity tier 1 capital.

Under the rules, in order to avoid limitations on capital distributions, including dividend payments and certain discretionary bonus payments to executive officers, a banking organization must hold a capital conservation buffer composed of common equity tier 1 capital above its minimum risk-based capital requirements. This buffer will help to ensure that banking organizations conserve capital when it is most needed, allowing them to better weather periods of economic stress. The buffer is measured relative to risk-weighted assets.

Community banks, such as the Bank, began transitioning to these rules on January 1, 2015. The new minimum capital requirements were effective on January 1, 2015, whereas the capital conservation buffer and the deductions from common equity tier 1 capital phase in over time. Phase-in of the capital conservation buffer requirements was effective January 1, 2016. The Company’s and the Bank’s capital buffers are in excess of both the current and fully phased-in requirements.

The Federal Reserve Board may also set higher capital requirements for holding companies whose circumstances warrant it. For example, holding companies experiencing internal growth or making acquisitions are expected to maintain strong capital positions substantially above the minimum supervisory levels, without significant reliance on intangible assets. At this time, the bank regulatory agencies are more inclined to impose higher capital requirements in order to meet well capitalized standards and future regulatory changes could impose higher capital standards as a routine matter. The Company’s regulatory capital ratios and those of the Bank are in excess of the levels established for “well capitalized” institutions.

Imposition of Liability for Undercapitalized Subsidiaries

The Federal Deposit Insurance Corporation Improvement Act of 1991 (“FDICIA”) required each federal banking agency to revise its risk-based capital standards to ensure that those standards take adequate account of interest rate risk, concentration of credit risk and the risks of nontraditional activities, as well as reflect the actual performance and expected risk of loss on multifamily mortgages. In accordance with the law, each federal banking agency has specified, by regulation, the levels at which an insured institution would be considered well capitalized, adequately capitalized, undercapitalized, significantly undercapitalized and critically undercapitalized. As of December 31, 2016, the Bank exceeded the capital levels required in order to be deemed well capitalized.

By statute and regulation a bank holding company must serve as a source of financial and managerial strength to each bank that it controls and, under appropriate circumstances, may be required to commit resources to support each such controlled bank. This support may be required at times when the bank holding company may not have the resources to provide the support.

Under the prompt corrective action provisions of FDICIA, if a controlled bank is undercapitalized, then the regulators could require the bank holding company to guarantee the bank’s capital restoration plan. In addition, if the Federal Reserve Board believes that a bank holding company’s activities, assets or affiliates represent a significant risk to the financial safety, soundness or stability of a controlled bank, then the Federal Reserve Board could require the bank holding company to terminate the activities, liquidate the assets or divest the affiliates. The regulators may require these and other actions in support of controlled banks even if such actions are not in the best interests of the bank holding company or its stockholders.

The appropriate federal banking agency may also require a holding company to provide financial assistance to a bank with impaired capital. Under this requirement, in the future the Company could be required to provide financial assistance to the Bank should it experience financial distress. Based on our ownership of a national bank subsidiary, the OCC could assess us if the capital of the Bank were to become impaired. If we failed to pay the assessment within three months, the OCC could order the sale of our stock in the Bank to cover the deficiency.

Additionally, FDICIA requires bank regulators to take prompt corrective action to resolve problems associated with insured depository institutions. In the event an institution becomes undercapitalized, it must submit a capital restoration plan. If an institution becomes significantly undercapitalized or critically undercapitalized, additional and significant limitations are placed on the institution. The capital restoration plan of an undercapitalized institution will not be accepted by the regulators unless each company having control of the undercapitalized institution guarantees the subsidiary’s compliance with the capital restoration plan until it becomes adequately capitalized. The Company has control of the Bank for the purpose of this statute.

Acquisitions by Bank Holding Companies

The BHC Act requires every bank holding company to obtain the prior approval of the Federal Reserve Board before it may acquire all or substantially all of the assets of any bank or ownership or control of any voting shares of any bank if after such acquisition it would own or control, directly or indirectly, more than 5% of the voting shares of such bank. In approving bank acquisitions by bank holding companies, the Federal Reserve Board is required to consider the financial and managerial resources and future prospects of the bank holding company and banks concerned, the convenience and needs of the communities to be served and the effect on competition. The Attorney General of the United States may, within 30 days after approval of an acquisition by the Federal Reserve Board, bring an action challenging such acquisition under the federal antitrust laws, in which case the effectiveness of such approval is stayed pending a final ruling by the courts. Under certain circumstances, the 30-day period may be shortened to 15 days.

Interstate Acquisitions

Under the Riegle-Neal Interstate Banking and Branching Efficiency Act (“Riegle-Neal Act”), a bank holding company may acquire banks in states other than its home state, subject to any state requirement that the bank has been organized and operating for a minimum period of time, not to exceed five years, and the requirement that the bank holding company not control, prior to or following the proposed acquisition, more than 10% of the total amount of deposits of insured depository institutions nationwide or, unless the acquisition is the bank holding company’s initial entry into the state, more than 30% of such deposits in the state (or such lesser or greater amount set by the state). The Riegle-Neal Act also authorizes banks to merge across state lines, thereby creating interstate branches. The Dodd-Frank Act permits a national or state bank, with the approval of its regulator, to open a branch in any state if the law of the state in which the branch is located would permit the establishment of the branch if the bank were a bank chartered in that state. National banks may provide trust services in any state to the same extent as a trust company chartered by that state.

Bank Regulation

The Bank is a national bank, which is subject to regulation and supervision primarily by the OCC and secondarily by the Federal Reserve Board and the FDIC. The Bank is subject to requirements and restrictions under federal law, including requirements to maintain reserves against deposits, restrictions on the types and amounts of loans that may be granted and the interest that may be charged thereon and limitations on the types of investments that may be made and the types of services that may be offered. Various consumer laws and regulations also affect the operations of the Bank.

The OCC regularly examines the Bank and records of the Bank. The FDIC may also periodically examine and evaluate insured banks.

Standards for Safety and Soundness

As part of FDICIA’s efforts to promote the safety and soundness of depository institutions and their holding companies, appropriate federal banking regulators are required to have in place regulations specifying operational and management standards (addressing internal controls, loan documentation, credit underwriting and interest rate risk), asset quality and earnings. As discussed above, the Federal Reserve Board, the OCC, and the FDIC have extensive authority to police unsafe or unsound practices and violations of applicable laws and regulations by depository institutions and their holding companies. For example, the FDIC may terminate the deposit insurance of any institution that it determines has engaged in an unsafe or unsound practice. The agencies can also assess civil money penalties of up to $1 million per day, issue cease-and-desist or removal orders, seek injunctions and publicly disclose such actions.

Restrictions on Transactions with Affiliates

Section 23A of the Federal Reserve Act imposes quantitative and qualitative limits on transactions between a bank and any affiliate and requires certain levels of collateral for such loans. It also limits the amount of advances to third parties which are collateralized by the securities or obligations of the Company. Section 23B of the Federal Reserve Act requires that certain transactions between the Bank and its affiliates must be on terms substantially the same, or at least as favorable, as those prevailing at the time for comparable transactions with or involving other nonaffiliated companies. In the absence of such comparable transactions, any transaction between the Bank and its affiliates must be on terms and under circumstances, including credit standards, which in good faith would be offered to or would apply to nonaffiliated companies.

Governmental Monetary Policies and Economic Conditions

The principal sources of funds essential to the business of banks and bank holding companies are deposits, stockholders’ equity and borrowed funds. The availability of these various sources of funds and other potential sources, such as preferred stock or commercial paper, and the extent to which they are utilized depends on many factors, the most important of which are the Federal Reserve Board’s monetary policies and the relative costs of different types of funds. An important function of the Federal Reserve Board is to regulate the national supply of bank credit in order to combat recession and curb inflationary pressure. Among the instruments of monetary policy used by the Federal Reserve Board to implement these objectives are open market operations in United States government securities, changes in the discount rate on bank borrowings and changes in reserve requirements against bank deposits. The monetary policies of the Federal Reserve Board have had a significant effect on the operating results of commercial banks in the past and are expected to continue to do so in the future. In view of the recent changes in regulations affecting commercial banks and other actions and proposed actions by the federal government and its monetary and fiscal authorities, no prediction can be made as to future changes in interest rates, availability of credit, deposit balances or the overall performance of banks generally or the Company and the Bank in particular.

Because the market price of People’s United common stock will fluctuate, the Company’s shareholders cannot be certain of the market value of the merger consideration they will receive.

Upon completion of the merger, each outstanding share of Company common stock (except for certain shares specified in the merger agreement) will be converted into the right to receive 2.225 shares of People’s United common stock. The market value of the People’s United common stock to be issued in the merger will depend upon the market price of People’s United common stock. This market price may vary from the closing price of People’s United common stock on the date the merger was announced, on the date that the proxy statement/prospectus relating to the merger was mailed to the Company’s shareholders and on the date on which Company shareholders voted to adopt the merger agreement at a special meeting of shareholders. There will be no adjustment to the consideration paid to Company shareholders in the merger for changes in the market price of either shares of People’s United common stock or Company common stock.

The market price of People’s United common stock could be subject to significant fluctuations due to changes in sentiment in the market regarding People’s United’s operations or business prospects, including market sentiment regarding People’s United’s entry into the merger agreement. These risks may be affected by:

| · |

operating results that vary from the expectations of People’s United’s management or of securities analysts and investors;

|

| · |

developments in People’s United’s business or in the financial services sector generally;

|

| · |

regulatory or legislative changes affecting People’s United’s industry generally or its business and operations;

|

| · |

operating and securities price performance of companies that investors consider to be comparable to People’s United;

|

| · |

changes in estimates or recommendations by securities analysts or rating agencies;

|

| · |

announcements of strategic developments, acquisitions, dispositions, financings and other material events by People’s United or its competitors; and

|

| · |

changes in global financial markets and economies and general market conditions, such as interest or foreign exchange rates, stock, commodity, credit or asset valuations or volatility.

|

Accordingly, at the time Company shareholders decided to adopt the merger agreement at the special meeting, they did not necessarily know or were not able to calculate the value of the merger consideration they would be entitled to receive upon completion of the merger. Company shareholders are encouraged to obtain current market quotations for both People’s United common stock and Company common stock.

The merger agreement may be terminated in accordance with its terms, and the merger may not be completed.

The merger agreement is subject to a number of conditions that must be fulfilled in order to complete the merger. These conditions to the closing of the merger may not be fulfilled in a timely manner or at all, and, accordingly, the merger may be delayed or may not be completed. In addition, if the merger is not completed by June 26, 2017, either People’s United or the Company may choose not to proceed with the merger, and the parties may mutually decide to terminate the merger agreement at any time. In addition, People’s United and the Company may elect to terminate the merger agreement in certain other circumstances and the Company may be required to pay a termination fee.

Failure to complete the merger could negatively impact the stock price, future business and financial results of the Company.

If the merger is not completed, the ongoing business of the Company may be adversely affected, and the Company will be subject to several risks, including the following:

| · |

the Company may be required, under certain circumstances, to pay People’s United a termination fee of $16 million under the merger agreement;

|

| · |

the Company will be required to pay certain costs relating to the merger, whether or not the merger is completed, such as legal, accounting, financial advisor and printing fees;

|

| · |

under the merger agreement, the Company is subject to certain restrictions on the conduct of its business prior to completing the merger, which may adversely affect its ability to execute certain of its business strategies; and

|

| · |

matters relating to the merger may require substantial commitments of time and resources by Company management, which could otherwise have been devoted to other opportunities that may have been beneficial to the Company.

|

In addition, if the merger is not completed, the Company may experience negative reactions from the financial markets and from its customers and employees. For example, the Company’s business may be impacted adversely by the failure to pursue other beneficial opportunities due to the focus of management on the merger, without realizing any of the anticipated benefits of completing the merger. The market price of Company common stock could decline to the extent that the current market price reflects a market assumption that the merger will be completed. The Company also could be subject to litigation related to any failure to complete the merger or to proceedings commenced against the Company to perform its obligations under the merger agreement. If the merger is not completed, the Company cannot assure its shareholders that the risks described above will not materialize and will not materially affect the business, financial results and stock price of the Company.

Lawsuits challenging the merger have been filed against the Company, the Company’s board of directors and People’s United, and an adverse judgment in any such lawsuit or any future similar lawsuits could prevent or delay completion of the merger and result in substantial costs to the Company, including any costs associated with the indemnification of directors and officers.

The Company, its board of directors and People’s United are named as defendants in two purported class action lawsuits in the Supreme Court of the State of New York, Suffolk County, and one purported class action lawsuit in the federal district court for the Eastern District of New York, challenging the merger and seeking, among other things, to enjoin the defendants from completing the merger on the agreed-upon terms, and rescission of the merger and/or awarding of damages to the extent the merger is completed. The parties to these actions have entered into a memorandum of understanding regarding a settlement—which, if finally approved by the court, would resolve and release all claims that were brought or could have been brought in these actions—although there can be no assurance that the court will approve such settlement. In addition, additional plaintiffs may also file lawsuits against the Company or People’s United and/or their directors and officers in connection with the merger. The outcome of any such litigation is uncertain. If the cases are not resolved, these lawsuits could prevent or delay completion of the merger and result in substantial costs to the Company, including any costs associated with the indemnification of directors and officers.

One of the conditions to the closing of the merger is that no order, injunction or decree issued by any court or agency of competent jurisdiction or other legal restraint or prohibition that prevents the consummation of the merger or any of the other transactions contemplated by the merger agreement be in effect. If any plaintiff were successful in obtaining an injunction prohibiting the Company or People’s United from completing the merger on the agreed upon terms, then such injunction may prevent the merger from becoming effective or from becoming effective within the expected timeframe.

The Company will be subject to business uncertainties and contractual restrictions while the merger is pending.

Uncertainty about the effect of the merger on employees and customers may have an adverse effect on the Company. These uncertainties may impair the Company’s ability to attract, retain and motivate key personnel until the merger is completed and could cause customers and others that deal with the Company to seek to change existing business relationships with the Company. Retention of certain employees may be challenging while the merger is pending, as certain employees may experience uncertainty about their future roles with the combined company. If key employees depart because of issues relating to the uncertainty and difficulty of integration or a desire not to remain with the combined company, the Company’s business could be harmed. In addition, the merger agreement restricts the Company from making certain acquisitions and taking other specified actions until the merger occurs without the consent of People’s United. These restrictions may prevent the Company from pursuing attractive business opportunities that may arise prior to the completion of the merger.

If the merger is not completed, the Company will have incurred substantial expenses without realizing the expected benefits of the merger.

The Company has incurred and will incur substantial expenses in connection with the negotiation and completion of the transactions contemplated by the merger agreement. If the merger is not completed, the Company would have to recognize these expenses without realizing the expected benefits of the merger.

The Company’s results may be adversely affected if it suffers higher than expected losses on its loans or is required to increase its allowance for loan losses.

The Company assumes credit risk from the possibility that it will suffer losses because borrowers, guarantors and related parties fail to perform under the terms of their loans. Management tries to minimize and monitor this risk by adopting and implementing what management believes are effective underwriting and credit policies and procedures, including how the Company establishes and reviews the allowance for loan losses. The allowance for loan losses is determined by continuous analysis of the loan portfolio and the analytical process is regularly reviewed and adjustments may be made based on the assessments of internal and external influences on credit quality. Those policies and procedures may still not prevent unexpected losses that could adversely affect the Company’s results. Weak economic conditions could adversely impact the ability of borrowers to repay outstanding loans or the value of collateral securing those loans. In particular, earlier this year the Company saw worrisome signs of certain commercial real estate markets becoming overheated, and a decline in property values could materially and adversely affect the value of the collateral securing the Company’s commercial real estate loans. In addition, deterioration in economic conditions affecting borrowers, new information regarding existing loans, identification of additional problem loans, changes in regulation and regulatory interpretation and other factors, both within and outside of the Company’s control, may require an increase in the allowance for loan losses.

The Company operates in a highly regulated environment and its operations and income may be affected adversely by changes in laws and regulations governing its operations. The Company may be unable to satisfy the individual minimum capital requirements imposed by the OCC, and lack of compliance may result in regulatory enforcement actions and adversely impact the Company’s business, financial condition or results of operations.

The Company is subject to extensive regulation and supervision by the Federal Reserve Board, the OCC and the FDIC. Such regulators govern the activities in which the Company may engage. These regulatory authorities have extensive discretion in connection with their supervisory and enforcement activities, including the ability to impose restrictions on a bank’s operations, limit growth rates, reclassify assets, determine the adequacy of a bank’s allowance for loan losses and determine the level of deposit insurance premiums assessed. Any change in such regulation and oversight, whether in the form of regulatory policy, new regulations or legislation or additional deposit insurance premiums could materially and adversely impact on the Company’s business, financial condition or results of operations. Any new laws, rules and regulations could also make compliance more difficult or expensive or otherwise materially and adversely affect the Company’s business, financial condition or results of operations. Such changes could subject the Company to additional costs, limit the types of financial services and products the Company may offer and/or increase the ability of non-banks to offer competing financial services and products, among other things.

As a result of its commercial real estate concentrations, the OCC established individual minimum capital ratios for the Bank that require it to maintain a tier 1 leverage ratio of at least 9%, a tier 1 risk-based capital ratio of at least 11% and a total risk-based capital ratio of at least 12%. There is no guarantee that the Bank will be able to maintain compliance with these heightened capital ratios. Any failure by the Bank to comply with these individual minimum capital ratios (including as a result of increases to the Bank’s allowance for loan losses), may result in regulatory enforcement actions and adversely impact the Company’s business, financial condition or results of operations.

The Company’s loan portfolio has a high concentration of commercial real estate loans (inclusive of multifamily and mixed use commercial loans), and its business may be adversely affected by credit risk associated with commercial real estate and a decline in property values. The Company’s limitation on the growth of its commercial real estate loan portfolio due to the Company’s concentrated position in such assets could materially and adversely affect the Company’s ability to generate interest income and the Company’s business, financial condition and results of operations.

At December 31, 2016, $1.2 billion, or 72% of the Company’s total gross loan portfolio, was comprised of commercial real estate (inclusive of multifamily and mixed use commercial loans). This type of lending is generally sensitive to regional and local economic conditions. Unlike larger national or regional banks that serve a broader and more diverse geographic region, the Company’s business depends significantly on general economic conditions in the New York metropolitan and Long Island markets, where the majority of the properties securing the multifamily and commercial real estate loans the Company originates, and the businesses of the customers to whom the Company makes its C&I loans, are located. Accordingly, the ability of borrowers to repay their loans, and the value of the collateral securing such loans, may be significantly affected by economic conditions in this region, including changes in the local real estate market, making loan loss levels difficult to predict and increasing the risk that the Company would incur material losses if borrowers default on their loans. A decline in general economic conditions could therefore have an adverse effect on the Company’s business, financial condition and results of operations. In addition, because multifamily and CRE loans represent the large majority of the Company’s loan portfolio, a decline in tenant occupancy or rents could adversely impact the ability of borrowers to repay their loans on a timely basis, which could have a negative impact on the Company’s net income, as well as the Company’s ability to maintain or increase the level of cash dividends it currently pays to its stockholders. While the Company seeks to minimize these risks through its underwriting policies, which generally require that such loans be qualified on the basis of the collateral property’s cash flows, appraised value and debt service coverage ratio, among other factors, there can be no assurance that the Company’s underwriting policies will protect it from credit-related losses or delinquencies.

Furthermore, during 2016, the Company became increasingly concerned with conditions in many of its local CRE markets, particularly those in the boroughs of New York City. The Company saw worrisome signs of markets that were becoming overheated. As a result of these concerns, the Company stopped accepting new applications for multifamily loans in the boroughs of New York City during the first quarter of 2016. The CRE lending market is also an area which has attracted significant regulatory scrutiny. The OCC, the Company’s primary bank regulator, has publicly expressed broadly applicable concerns over the last year about overheated conditions in many CRE markets. The OCC established individual minimum capital ratios for the Bank as a result of its concentration of CRE loans. In response, the Company decided to temporarily pull back from the CRE lending markets, which could have a material and adverse impact on the Company’s net income and the Company’s business, financial condition and results of operation. Following the Company’s implementation of enhanced risk management processes in order to remain compliant with applicable regulatory guidance, the Company re-entered certain commercial real estate markets that it backed away from, although it has no plans to re-enter the multifamily lending markets in New York City.

Recent financial reforms and related regulations may affect our results of operations, financial condition or liquidity.

The Dodd-Frank Act could result in additional legislative or regulatory action. For a description of the Dodd-Frank Act see Part I, Item 1. Business, Supervision and Regulation contained in this Form 10-K. At this time, it is difficult to predict the extent to which the Dodd-Frank Act or the resulting regulations will impact the Company’s business. However, compliance with these new laws and regulations have resulted in and will likely continue to result in additional costs and these additional costs may adversely impact our results of operations, financial condition or liquidity.

As a bank holding company that conducts substantially all of its operations through its banking subsidiary, our ability to pay dividends to stockholders depends upon the results of operations of the Bank and its ability to pay dividends to the Company. Dividends paid by the Bank are subject to limits imposed by law and regulation.

Substantially all of the Company’s activities are conducted through the Bank, and the Company receives substantially all of its funds (other than the net proceeds of any capital raising transactions that the Company may undertake) through dividends from the Bank. The Company’s ability to pay dividends to stockholders depends primarily on the Bank’s ability to pay dividends to the Company. Various laws and regulations limit the amount of dividends that the Bank may pay to the Company. If the Bank is unable to pay dividends to the Company, the Company may not be able to pay dividends to its stockholders.

Changes in interest rates could adversely affect the Company’s results of operations and financial condition.

The Company’s ability to generate net income depends primarily upon our net interest income. Net interest income is income that remains after deducting from total income generated by earning assets the interest expense attributable to the acquisition of the funds required to support earning assets. Income from earning assets includes income from loans, investment securities and short-term investments. The amount of interest income is dependent on many factors including the volume of earning assets, the general level of interest rates, the dynamics of the change in interest rates and the levels of non-performing loans. The cost of funds varies with the amount of funds necessary to support earning assets, the rates paid to attract and hold deposits, rates paid on borrowed funds and the levels of non-interest-bearing demand deposits and equity capital.

Different types of assets and liabilities may react differently, at different times, to changes in market interest rates. Management expects that the Company will periodically experience gaps in the interest-rate sensitivities of its assets and liabilities. That means either our interest-bearing liabilities will be more sensitive to changes in market interest rates than our interest earning assets or vice versa. When interest-bearing liabilities mature or reprice more quickly than interest-earning assets, an increase in market rates of interest could reduce our net interest income. Likewise, when interest-earning assets mature or reprice more quickly than interest-bearing liabilities, falling interest rates could reduce net interest income. Management is unable to predict changes in market interest rates which are affected by many factors beyond our control including inflation, recession, unemployment, money supply and other governmental monetary and fiscal policies, domestic and international events and changes in the United States and other financial markets. Net interest income is not only affected by the level and direction of interest rates, but also by the shape of the yield curve, relationships between interest sensitive instruments and key driver rates, as well as balance sheet growth, client loan and deposit preferences and the timing of changes in these variables.

Management attempts to manage risk from changes in market interest rates, in part, by controlling the mix of interest rate-sensitive assets and interest rate-sensitive liabilities. Management reviews the Company's interest rate risk position and modifies its strategies based on projections to minimize the impact of future interest rate changes. However, interest rate risk management techniques are not exact. A rapid increase or decrease in interest rates could adversely affect our results of operations and financial condition.

The Company is subject to risks associated with taxation that could adversely affect the Company’s results of operations and financial condition.

The amount of income taxes the Company is required to pay on its earnings is based on federal, state and city laws and regulations. The Company provides for current and deferred taxes in its financial statements, based on its results of operations, business activity, legal structure, interpretation of tax statutes, assessment of risk of adjustment upon audit and application of financial accounting standards. The Company may take tax return filing positions for which the final determination of tax is uncertain. The Company’s net income and earnings per share may be reduced if a federal, state or local authority assesses additional taxes that have not been provided for in the consolidated financial statements. There can be no assurance that the Company will achieve its anticipated effective tax rate either due to a change in tax law, a change in regulatory or judicial guidance or an audit assessment that denies previously recognized tax benefits. The new tax provisions of New York State Article 9A allow banking corporations to exclude from income 160% of the dividends it has received from subsidiaries such as a REIT, which is now included in the mandatory combined group. Going forward, the Company may not realize the benefits of the exclusion from income of 160% of the dividends received from the REIT, if the bank’s assets were in excess of $8 billion, resulting in a higher effective state income tax rate. The occurrence of any of these tax-related risks could adversely affect the Company’s results of operations and financial condition.

The Company’s financial condition and results of operations are dependent on the economy, as well as competition from other banks. Changing economic conditions could adversely impact the Company’s earnings and increase the credit risk of the Company’s loan portfolio.

The Company’s primary market area includes Suffolk County, Nassau County and New York City. Adverse economic conditions in that market area could reduce the Company’s rate of growth, affect customers’ ability to repay loans and result in higher levels of loan delinquencies, problem assets and foreclosures and a decline in the values of the collateral (including residential and commercial real estate) securing the Company’s loans, any of which could have a material adverse effect on the Company’s business, financial condition and results of operations. General economic conditions, including inflation, unemployment and money supply fluctuations, also may adversely affect the Company’s business, financial condition and results of operations. In addition, competition in the banking industry is intense and the Company’s profitability depends upon its continued ability to successfully compete in its market.

The Company may not be able to maintain a strong core deposit base or other low-cost funding sources.

The Company expects to depend on checking, savings and money market deposit account balances and other forms of deposits as the primary source of funding for its lending activities. The Company’s future growth will largely depend on its ability to maintain a strong core deposit base. There may be competitive pressures to pay higher interest rates on deposits, which would increase the Company’s funding costs. If deposit clients move money out of bank deposits and into other investments (or into similar products at other institutions that may provide a higher rate of return), the Company could lose a relatively low cost source of funds, increasing its funding costs and reducing net interest income and net income. Additionally, any such loss of funds could result in reduced loan originations, which could adversely impact the Company’s results of operations and financial condition.

The Company is subject to significant operational risks that could result in charges, increased operational costs, harm to the Company’s reputation or foregone business opportunities.

Operational risk is the risk of loss from operations, including fraud by employees or outside persons, employees’ execution of incorrect or unauthorized transactions and breaches of internal control systems. Operational risk also encompasses technology, compliance and legal risk, which is the risk of loss from violations of, or noncompliance with, laws, rules, regulations, prescribed practices or ethical standards, as well as the risk of our noncompliance with contractual and other obligations. The Company is also exposed to operational risk through its outsourcing arrangements and the effect that changes in circumstances or capabilities of its outsourcing vendors can have on the Company’s ability to continue to perform operational functions necessary to its business. Control weaknesses or failures or other operational risks could result in charges, increased operational costs, harm to the Company’s reputation or foregone business opportunities.

A failure in or breach of the Company’s security systems or infrastructure, or those of our third-party service providers, could result in financial losses or in the disclosure or misuse of confidential or proprietary information, including client information.

As a financial institution, the Company may be the target of fraudulent activity that may result in financial losses to the Company and its clients, privacy breaches against its clients or damage to its reputation. Such fraudulent activity may take many forms, including check fraud, electronic fraud, wire fraud, phishing, unauthorized intrusion into or use of the Company’s systems and other dishonest acts. The Company provides its customers with the ability to bank remotely, including online over the Internet. The secure transmission of confidential information is a critical element of remote banking. The Company’s network could be vulnerable to unauthorized access, computer viruses, phishing schemes, spam attacks, human error, natural disasters, power loss and other security breaches. The Company may be required to spend significant capital and other resources to protect against the threat of cybersecurity breaches and computer viruses, or to alleviate problems caused by such breaches or viruses. Given the volume of Internet transactions, certain errors may be repeated or compounded before they can be discovered and rectified. To the extent that the Company’s activities or the activities of its customers involve the storage and transmission of confidential information, security breaches and viruses could expose the Company to claims, litigation and other possible liabilities. Any inability to prevent cybersecurity breaches or computer viruses could also cause existing customers to lose confidence in the Company’s systems and could adversely affect its reputation, results of operations and ability to attract and maintain customers and businesses. In addition, a security breach could also subject the Company to additional regulatory scrutiny, expose it to civil litigation and possible financial liability and cause reputational damage. The Company’s risk and exposure to these matters remains heightened because of the evolving nature and complexity of the threats from organized cybercriminals and hackers, and the Company’s plans to continue to provide electronic banking services to its customers.

The Company depends on its key employees.

The Company’s success will, to some extent, depend on the continued employment of its executive officers. The unexpected loss of the services of any of these individuals could have a detrimental effect on the Company’s business. No assurance can be given that these individuals will continue to be employed by the Company. The loss of any of these individuals could negatively affect the Company’s ability to achieve its growth strategy and could have a material adverse effect on the Company’s results of operations and financial condition.

Liquidity risk could impair the Company’s ability to fund operations and jeopardize its financial condition.

Liquidity is essential to the Company’s business. An inability to raise funds through deposits, borrowings, the sale of loans or securities and other sources could have a substantial negative effect on the Company’s liquidity. The Company’s access to funding sources in amounts adequate to finance its activities or on terms that are acceptable to it could be impaired by factors that affect the Company specifically or the banking industry or economy in general. Factors that could detrimentally impact the Company’s access to liquidity sources include a decrease in the level of its business activity as a result of a downturn in the markets in which its loans are concentrated or adverse regulatory action against the Company. The Company’s ability to borrow could also be impaired by factors that are not specific to it, such as a disruption in the financial markets or negative views and expectations about the prospects for the banking or financial services industries.

The Company may elect or be compelled to seek additional capital in the future, but that capital may not be available when it is needed.

The Company is required by federal regulatory authorities to maintain adequate levels of capital to support its operations. At some point, the Company may need to raise additional capital. If the Company raises additional capital, it may seek to do so through the issuance of, among other things, its common stock. The issuance of additional shares of common stock or convertible securities to new stockholders would be dilutive to the Company’s current stockholders.

The Company’s ability to raise additional capital, if needed, will depend on conditions in the capital markets, economic conditions and a number of other factors, many of which are outside the Company’s control, and on the Company’s financial performance. Accordingly, the Company cannot be assured of its ability to raise additional capital if needed or to raise capital on terms acceptable to the Company. If the Company cannot raise additional capital when needed, its ability to further expand its operations could be materially impaired and its financial condition and liquidity could be materially and adversely affected.

The Company is subject to risks associated with litigation that could have a material adverse effect on the Company’s business and financial condition and cause significant reputational harm to the Company.

The Company is subject to litigation risks as a result of a number of factors and from various sources, including the highly regulated nature of the banking industry. Given the inherent uncertainties involved in litigation, and the large or indeterminate damages that may be sought, there can be significant uncertainty as to the ultimate liability the Company may incur from litigation matters. Substantial liability against the Company could have a material adverse effect on the Company’s business and financial condition and cause significant reputational harm to the Company, which could seriously harm the Company’s business.

The price of the Company’s common stock may fluctuate significantly, making it difficult to resell shares of the Company’s common stock at times and prices that stockholders may find attractive.

The Company cannot predict how its common stock will trade in the future. The market value of the Company’s common stock will likely continue to fluctuate in response to a number of factors including the following, many of which are beyond the Company’s control, as well as the other risk factors described herein:

| • |

the market price of People’s United’s common stock, upon which the consideration to be paid to the Company’s stockholders in the merger is based;

|

| • |

actual or anticipated quarterly fluctuations in the Company’s operating and financial results;

|

| • |

developments related to investigations, proceedings or litigation involving the Company;

|

| • |

changes in financial estimates and recommendations by financial analysts;

|

| • |

dispositions, acquisitions and financings;

|

| • |

actions of the Company’s current stockholders, including sales of common stock by existing stockholders and the Company’s directors and executive officers;

|

| • |

fluctuations in the stock price and operating results of the Company’s competitors;

|

| • |

regulatory developments; and

|

| • |

developments related to the financial services industry.

|

The market value of the Company’s common stock may also be affected by conditions affecting the financial markets in general, including price and trading fluctuations. These conditions may result in volatility in the market prices of stocks generally and, in turn, the Company’s common stock and sales of substantial amounts of the Company’s common stock in the market, in each case that could be unrelated or disproportionate to changes in the Company’s operating performance. These broad market fluctuations may adversely affect the market value of the Company’s common stock.

There may be future sales of additional common stock or other dilution of the Company’s stockholders’ equity, which may adversely affect the market price of the Company’s common stock.

Subject to the limitations under the rules of the New York Stock Exchange and the number of shares of the Company’s authorized capital stock, the Company is not restricted from issuing additional common stock, including securities that are convertible into or exchangeable for, or that represent the right to receive, common stock or any substantially similar securities. The market value of the Company’s common stock could decline as a result of sales by the Company of a large number of shares of common stock or similar securities in the market or the perception that such sales could occur.

Anti-takeover provisions could negatively impact the Company’s stockholders.

Provisions in the Company’s charter and bylaws, the corporate law of the State of New York and federal laws and regulations could delay, defer or prevent a third party from acquiring the Company, despite the possible benefit to its stockholders, or otherwise adversely affect the market price of the Company’s common stock. These provisions include the election of directors to staggered terms of three years, advance notice requirements for nominations for election to the Company’s Board of Directors and for proposing matters that stockholders may act on at stockholder meetings and the requirement that directors fill vacancies on the Company’s Board of Directors. In addition, the BHC Act, as amended, and the Change in Bank Control Act of 1978, as amended, together with federal regulations, require that, depending on the particular circumstances, either regulatory approval must be obtained or notice must be furnished to the appropriate regulatory agencies and not disapproved prior to any person or entity acquiring control of a national bank, such as the Bank. These provisions may prevent a merger or acquisition that may be attractive to stockholders and could limit the price investors would be willing to pay in the future for the Company’s common stock. These provisions could also discourage proxy contests and make it more difficult for holders of the Company’s common stock to elect directors other than the candidates nominated by the Company’s Board of Directors.

The following table sets forth certain information relating to properties owned or used in the Company’s banking activities at December 31, 2016:

|

Location

|

Primary Use

|

Owned or Leased

|

|

4 West Second Street, Riverhead, NY

|

Corporate Headquarters

|

Owned

|

|

3880 Veterans Memorial Highway, Bohemia, NY

|

Branch Office

|

Owned

|

|

351 Pantigo Road, East Hampton, NY

|

Branch Office

|

Owned

|

|

168 West Montauk Highway, Hampton Bays, NY

|

Branch Office

|

Owned

|

|

746 Montauk Highway, Montauk, NY

|

Branch Office

|

Owned

|

|

135 West Broadway, Port Jefferson, NY

|

Branch Office

|

Owned

|

|

1201 Ostrander Avenue, Riverhead, NY

|

Branch Office

|

Owned

|

|

6 West Second Street, Riverhead, NY

|

Branch Office

|

Owned

|

|

17 Main Street, Sag Harbor, NY

|

Branch Office

|

Owned

|

|

295 North Sea Road, Southampton, NY

|

Branch Office

|

Owned

|

|

2065 Wading River-Manor Road, Wading River, NY

|

Branch Office

|

Owned

|

|

144 Sunset Avenue, Westhampton Beach, NY

|

Branch Office

|

Owned

|

|

206 Griffing Avenue, Riverhead, NY

|

Administrative Office

|

Owned

|

|

400 Merrick Road, Amityville, NY

|

Branch Office

|

Leased

|

|

502 Main Street, Center Moriches, NY

|

Branch Office

|

Leased

|

|

31525 Main Road, Cutchogue, NY

|

Branch Office

|

Leased

|

|

21 East Industry Court, Deer Park, NY

|

Branch Office

|

Leased

|

|

99 Newtown Lane, East Hampton, NY

|

Branch Office

|

Leased

|

|

110 Marcus Boulevard, Hauppauge, NY

|

Branch Office

|

Leased

|

|

2801 Route 112, Medford, NY

|

Branch Office

|

Leased

|

|

159 Route 25A, Miller Place, NY

|

Branch Office

|

Leased

|

|

228 East Main Street, Port Jefferson, NY

|

Branch Office

|

Leased

|

|

161 North Main Street, Sayville, NY

|

Branch Office

|

Leased

|

|

9926 Route 25A, Shoreham, NY

|

Branch Office

|

Leased

|

|

222 Middle Country Road, Smithtown, NY

|

Branch Office

|

Leased

|

|

955 Little East Neck Road, West Babylon, NY

|

Branch Office

|

Leased

|

|

1055 Franklin Avenue, Garden City, NY

|

Loan Production and Branch Office

|

Leased

|

|

290 Broad Hollow Road, Melville, NY

|

Loan Production and Branch Office

|

Leased

|

|

31-00 47th Avenue, Long Island City, NY

|

Loan Production and Branch Office

|

Leased

|

See the information set forth in Note 17. Legal Proceedings in the Notes to Consolidated Financial Statements under Part II, Item 8, which information is incorporated by reference in response to this item.

PART II

| ITEM 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

At December 31, 2016, the approximate number of common equity stockholders was as follows:

Title of Class: Common Stock

Number of Record Holders: 1,190

The Company’s common stock commenced trading on the New York Stock Exchange under the symbol SCNB on December 18, 2015. Prior to that date, it traded on the NASDAQ Global Select Market under the symbol SUBK. Following are quarterly high and low sale prices of the Company’s common stock for the years ended December 31, 2016 and 2015.

|

2016

|

High Sale

|

Low Sale

|

||||||

|

1st Quarter

|

$

|

28.14

|

$

|

23.80

|

||||

|

2nd Quarter

|

31.36

|

22.88

|

||||||

|

3rd Quarter

|

35.80

|

30.45

|

||||||

|

4th Quarter

|

44.70

|

33.58

|

||||||

|

2015

|

High Sale

|

Low Sale

|

||||||

|

1st Quarter

|

$

|

23.89

|

$

|

20.66

|

||||

|

2nd Quarter

|

26.14

|

23.05

|

||||||

|

3rd Quarter

|

29.99

|

23.91

|

||||||

|

4th Quarter

|

31.75

|

25.97

|

||||||

The following schedule summarizes the Company’s dividends paid for the years ended December 31, 2016 and 2015.

|

Record Date

|

Dividend Payment Date

|

Cash Dividends Paid

Per Common Share

|

|||

|

November 9, 2016

|

November 23, 2016

|

$

|

0.10

|

||

|

August 10, 2016

|

August 24, 2016

|

0.10

|

|||

|

May 11, 2016

|

May 25, 2016

|

0.10

|

|||

|

February 10, 2016

|

February 24, 2016

|

0.10

|

|||

|

November 11, 2015

|

November 25, 2015

|

0.10

|

|||

|

August 12, 2015

|

August 26, 2015

|

0.10

|

|||

|

May 13, 2015

|

May 27, 2015

|

0.06

|

|||

|

February 11, 2015

|

February 25, 2015

|

0.06

|

|||

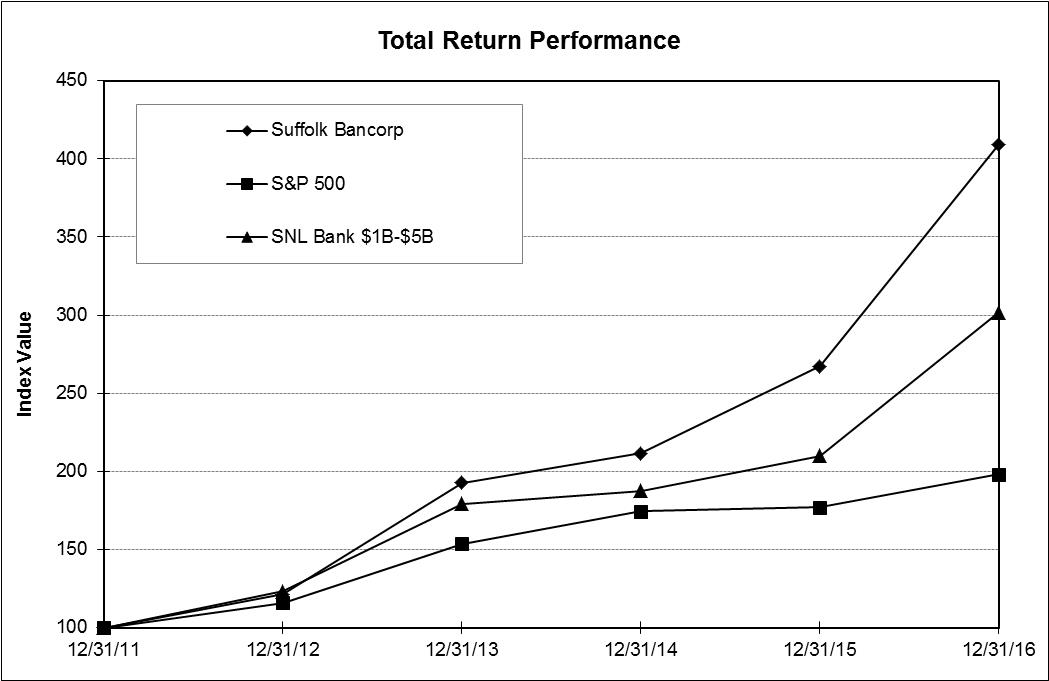

The following Performance Graph compares the yearly percentage change in the Company’s cumulative total stockholder return on its common stock with the cumulative total return of the S&P 500 index and the cumulative total return of the SNL Bank $1B - $5B index.

|

Period Ending

|

|||||||||||||||||||||||||

|

Index

|

12/31/11

|

12/31/12

|

12/31/13

|

12/31/14

|

12/31/15

|

12/31/16

|

|||||||||||||||||||

|

Suffolk Bancorp

|

100.00

|

121.41

|

192.77

|

211.60

|

267.30

|

409.37

|

|||||||||||||||||||

|

SNL Bank $1B-$5B

|

100.00

|

123.31

|

179.31

|

187.48

|

209.86

|

301.92

|

|||||||||||||||||||

| S&P 500 |

100.00

|

116.00

|

153.57

|

174.60

|

177.01

|

198.18

|

|||||||||||||||||||

Source: Performance Graph prepared by SNL Financial, Charlottesville, VA

For information about the Company’s equity compensation plans, please see Part III, Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters contained in this Form 10-K.

The Company’s selected financial data for the last five years follows.

FIVE-YEAR SUMMARY (dollars in thousands, except per share data)

|

As of or for the year ended December 31,

|

2016

|

2015

|

2014

|

2013

|

2012

|

|||||||||||||||

|

OPERATING RESULTS:

|

||||||||||||||||||||

|

Interest income

|

$

|

77,719

|

$

|

72,780

|

$

|

65,053

|

$

|

59,678

|

$

|

60,447

|

||||||||||

|

Interest expense

|

3,929

|

3,247

|

2,519

|

2,930

|

3,719

|

|||||||||||||||

|

Net interest income

|

73,790

|

69,533

|

62,534

|

56,748

|

56,728

|

|||||||||||||||

|

(Credit) provision for loan losses

|

(500

|

)

|

600

|

1,000

|

1,250

|

8,500

|

||||||||||||||

|

Net interest income after (credit) provision

|

74,290

|

68,933

|

61,534

|

55,498

|

48,228

|

|||||||||||||||

|

Non-interest income

|

8,483

|

8,594

|

10,900

|

19,507

|

10,881

|

|||||||||||||||

|

Operating expenses

|

55,320

|

53,954

|

53,419

|

58,565

|

61,571

|

|||||||||||||||

|

Income (loss) before income taxes

|

27,453

|

23,573

|

19,015

|

16,440

|

(2,462

|

)

|

||||||||||||||

|

Provision (benefit) for income taxes

|

7,622

|

5,886

|

3,720

|

3,722

|

(714

|

)

|

||||||||||||||

|

Net income (loss)

|

$

|

19,831

|

$

|

17,687

|

$

|

15,295

|

$

|

12,718

|

$

|

(1,748

|

)

|

|||||||||

|

FINANCIAL CONDITION:

|

||||||||||||||||||||

|

Investment securities

|

$

|

198,022

|

$

|

308,408

|

$

|

360,940

|

$

|

412,446

|

$

|

410,388

|

||||||||||

|

Loans

|

1,676,564

|

1,666,447

|

1,355,427

|

1,068,848

|

780,780