Attached files

| file | filename |

|---|---|

| EX-32.2 - MamaMancini's Holdings, Inc. | ex32-2.htm |

| EX-32.1 - MamaMancini's Holdings, Inc. | ex32-1.htm |

| EX-31.2 - MamaMancini's Holdings, Inc. | ex31-2.htm |

| EX-31.1 - MamaMancini's Holdings, Inc. | ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the year ended January 31, 2017

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

MAMAMANCINI’S HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 000-54954 | 27-0607116 | ||

| (State

or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(I.R.S.

Employer Identification Number) |

25 Branca Road

East Rutherford, NJ 07073

(Address of Principal Executive Offices)

(Former name or former address, if changed since last report)

(201) 531-1212

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.00001 par value

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| Non-accelerated filer | [ ] | Smaller reporting company | [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant on July 29, 2016, based on a closing price of $0.74 was approximately $10,142,983.

As of March 20, 2017, the registrant had 27,805,750 shares of its common stock, 0.00001 par value per share, issued and outstanding.

Documents Incorporated By Reference: None.

Table of Contents

| 2 |

FORWARD LOOKING STATEMENTS

Included in this Form 10-K are “forward-looking” statements, as well as historical information. Although we believe that the expectations reflected in these forward-looking statements are reasonable, we cannot assure you that the expectations reflected in these forward-looking statements will prove to be correct. Our actual results could differ materially from those anticipated in forward- looking statements as a result of certain factors, including matters described in the section titled “Risk Factors.” Forward-looking statements include those that use forward-looking terminology, such as the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “project,” “plan,” “will,” “shall,” “should,” and similar expressions, including when used in the negative. Although we believe that the expectations reflected in these forward-looking statements are reasonable and achievable, these statements involve risks and uncertainties and we cannot assure you that actual results will be consistent with these forward-looking statements. We undertake no obligation to update or revise these forward-looking statements, whether to reflect events or circumstances after the date initially filed or published, to reflect the occurrence of unanticipated events or otherwise.

Our History

MamaMancini’s Holdings, Inc. (formerly Mascot Properties, Inc.) was incorporated in the State of Nevada on July 22, 2009. Mascot Properties, Inc.’s (“Mascot”) activities since its inception consisted of trying to locate real estate properties to manage, primarily related to student housing, and services which included general property management, maintenance and activities coordination for residents. Mascot did not have any significant development of such business and did not derive any revenue. Due to the lack of results in its attempt to implement its original business plan, management determined it was in the best interests of the shareholders to look for other potential business opportunities.

On February 22, 2010, MamaMancini’s LLC was formed as a limited liability company under the laws of the state of New Jersey in order to commercialize our initial products. On March 5, 2012, the members of MamaMancini’s, LLC, holders of 4,700 units (the “Units”) of MamaMancini’s LLC, exchanged the Units for 15,000,000 shares of common stock and those certain options to purchase an additional 223,404 shares of MamaMancini’s Inc. (the “Exchange”). Upon consummation of the Exchange, MamaMancini’s LLC ceased to exist and all further business has been and continues to be conducted by MamaMancini’s Inc.

On January 24, 2013, Mascot, Mascot Properties Acquisition Corp, a Delaware corporation and wholly-owned subsidiary of the Company (“Merger Sub”), MamaMancini’s Inc., a privately-held Delaware Corporation headquartered in New Jersey (“Mama’s”) and David Dreslin, an individual (the “Majority Shareholder”), entered into an Acquisition Agreement and Plan of Merger (the “Agreement”) pursuant to which the Merger Sub was merged with and into Mama’s, with Mama’s surviving as a wholly-owned subsidiary of the Company (the “Merger”). The transaction (the “Closing”) took place on January 24, 2013 (the “Closing Date”). Mascot acquired, through a reverse triangular merger, all of the outstanding capital stock of Mama’s in exchange for issuing Mama’s shareholders (the “Mama’s Shareholders”), pro-rata, a total of 20,054,000 shares of the Company’s common stock. As a result of the Merger, the Mama’s Shareholders became the majority shareholders of Mascot.

Immediately following the Closing of the Agreement, Mascot changed its business plan to that of Mama’s. On March 8, 2013, Mascot received notice from the Financial Industry Regulatory Authority (“FINRA”) that its application to change its name and symbol had been approved and effective Monday, March 11, 2013, Mascot began trading under its new name, “MamaMancini’s Holdings, Inc.” (“MamaMancini’s” or the “Company”) and under its new symbol, “MMMB”.

| 3 |

Our Company

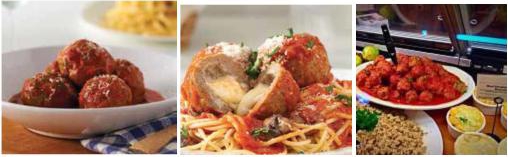

MamaMancini’s roots go back to our founder Dan Dougherty, whose grandmother Anna “Mama” Mancini emigrated from Bari, Italy to Bay Ridge, Brooklyn in 1921. Our products were developed using her old world Italian recipes that were handed down to her grandson, Dan Dougherty. Today we market a line of all natural specialty prepared, frozen and refrigerated foods for sale in retailers around the country. Our primary products include beef, turkey, chicken and pork meatballs, all with slow cooked Italian Sauce.

Our products are all natural, contain a minimum number of ingredients and are generally derived from the original recipes of Anna “Mama” Mancini. Our products appeal to health-conscious consumers who seek to avoid artificial flavors, synthetic colors and preservatives that are used in many conventional packaged foods.

The United States Department of Agriculture (the “USDA”) defines all natural as a product that contains no artificial ingredients, coloring ingredients or chemical preservatives and is minimally processed. The Company’s products were submitted to the USDA and approved as all natural. The Food and Safety and Inspection Service (“FSIS”) Food Standards and Labeling Policy Book (2003) requires meat and poultry labels to include a brief statement directly beneath or beside the “natural” Label claim that “explains what is meant by the term natural i.e., that the product is a natural food because it contains no artificial ingredients and is only minimally processed”. The term “natural” may be used on a meat label or poultry label if the product does not contain any artificial flavor or flavoring, coloring ingredient, chemical preservative, or any other artificial or synthetic ingredient. Additionally, the term “all natural” can be used if the FSIS approves your product and label claims. The Company’s product and label claims have been approved by the FSIS to contain the all-natural label.

Our products are principally sold to supermarkets and mass-market retailers. Our products are principally sold in multiple sections of the supermarket, including: hot bars, salad bars, prepared foods (meals), sandwich, as well as cold deli and foods-to-go sections. Our products are also sold in the frozen food and fresh meat sections. Consumers can find our products at leading food retailers (supermarkets), including:

| Albertsons | Key Foods | Safeway | ||

| Central Market | King Kullen | Sam’s Club | ||

| Demoulas (Market Basket) | Kings | Save Mart | ||

| Foodtown | Kroger | Shaw’s | ||

| Fresh Market | Lowes | Shop Rite | ||

| Giant | Lucky’s | Shoppers Food & Pharmacy | ||

| Giant Eagle | Lunds and Byerlys | SpartanNash | ||

| Gristedes | Marsh | Stop & Shop | ||

| Hy-Vee | Meatball Obsession | Topps | ||

| Ingles | Price Chopper | Weis Markets | ||

| Jewel | Publix | Whole Foods Market | ||

| Roche Bros. |

We sell directly to both food retailers and food distributors. Some of the leading food distributors we sell to include:

| Associated Wholesale Grocers | Driscoll Foods | SUPERVALU | ||

| Bozzuto’s | Gourmet Guru | Sysco | ||

| Burris Logistics | Monterrey Provision Co. | UNFI | ||

| C&S Wholesale Grocers | Porky Products | Wakefern | ||

| DPI Mid Atlantic | Super Store Industries | |||

We also sell our products on QVC through live on-air offerings, auto ship programs and for every day purchases on their web site. QVC is the world’s largest direct to consumer marketer.

During the year ended January 31, 2017, the Company earned revenues from two customers representing approximately 28% and 13% of gross sales. During the year ended January 31, 2016, the Company earned revenues from four customers representing approximately 16%, 14%, 13% and 10% of gross sales. As of January 31, 2017, these two customers represented approximately 44% and 12% of total gross outstanding receivables, respectively. As of January 31, 2016, these four customers represented approximately 18%, 7%, 9% and 30% of total gross outstanding receivables, respectively. We depend heavily on these customers. We have grown the number of food retailers (supermarkets) carrying our products to approximately 11,700 supermarkets in January 2017. In the supermarkets that carry our products, we sell an average of 3.3 of our stock keeping units (“SKUs”). The number of supermarkets carrying our products multiplied by the number of our SKUs carried at those supermarkets equals shelf placements for our products. We have grown the number of shelf placements to approximately 38,700 in January 2017.

| 4 |

The Company continually reviews it accounts in order focus on maximum performance, and as a result periodically eliminates under-performing accounts.

For the years ended January 31, 2017 and 2016, one vendor (a related party) represented approximately 100% and 95% of the Company’s purchases, respectively.

Industry Overview

Our products are considered specialty prepared foods, in that they are all natural, taste great, are authentic Italian and are made with high quality ingredients. The market for specialty and prepared foods spans several sections of the supermarket, including frozen, deli- prepared foods, and the specialty meat segment of the meat department. The overall size of the specialty prepared food business was calculated by the National Association for the Specialty Food Trade in association with Mintel Research at over $109 billion in 2015 and has grown 22% since 2012.

Packaged Facts, a leading publisher of market research on the food, beverage, consumer packaged goods, and demographic sectors, projects the overall sales of Refrigerated Meats and Meals to be approximately $31 billion by 2018, up from $23 billion in 2013. According to Packaged Facts, this 5.5% implied CAGR is likely driven by trends including a focus on convenience and healthy and creative new products. In addition, Packaged Facts projects that retail sales of Natural/Organic Foods and Beverages will reach $53.5 billion in 2014 and will grow to $86.7 billion by 2019. This implied CAGR of 10.1% is likely driven by the growing social and environmental issues surrounding the interest in and health benefits of natural and organic foods. Technomic, a consulting firm in the fresh prepared foods industry, projects fresh food sales to be $33.4 billion in 2017, up from $26 billion in 2012.

Our Strengths

We believe that the following strengths differentiate our products and our brand:

| ● | Authentic recipes and great taste. Our products are founded upon Anna “Mama” Mancini’s old world Italian recipes. We believe the authenticity of our products has enabled us to build and maintain loyalty and trust among our current customers and will help us attract new customers. Additionally, we continuously receive positive customer testimonials regarding the great taste and quality of our products. | |

| ● | Healthy and convenient. Our products are made only from high quality natural ingredients, including domestic inspected beef, whole Italian tomatoes, genuine imported Pecorino Romano, real eggs, natural breadcrumbs, olive oil and other herbs and spices. Our products are also simple to prepare. Virtually every product we offer is ready-to-serve within 12 minutes, thereby providing quick and easy meal solutions for our customers. By including the sauce and utilizing a tray with our packaging, our meatballs can be prepared quickly and easily. | |

| ● | Great value. We strive to provide our customers with a great tasting product using all natural ingredients at an affordable price. Typical retail prices for 16 oz. packages ranges from $5.99 to $7.49, and $5.99 to $8.99 for bulk products sold in delis or hot bars. We believe the sizes of our product offerings represent a great value for the price. | |

| ● | New products and innovation. Since our inception, we have continued to introduce new and innovative products. While we pride on ourselves on our traditional beef, turkey, chicken and pork meatballs, we have continuously made efforts to grow and diversify our line of products while maintaining our high standards for all natural, healthy ingredients and great taste. New items introduced in the last year include: |

| Five Cheese Stuffed Beef Meatballs | Antibiotic Free Beef and Turkey Meatballs |

| Chicken Parmigiana Stuffed Meatballs | Gluten Free Beef and Turkey Meatballs |

| Chicken Florentine Stuffed Meatballs | Cocktail Beef and Turkey Meatballs |

| Grass-Fed, Antibiotic-Free Beef Meatballs | Beef and Turkey Original Meat Loaves |

| Beef and Turkey Parmigiana Meat Loaves | Beef Bacon Gorgonzola Meat Loaves |

| Stuffed Pepper Filling | Chicken Parmigiana |

| 5 |

Sales/Brokers

| ● | Strong consumer loyalty. Many of our consumers are loyal and enthusiastic brand advocates. Our consumers trust us to deliver great-tasting products made with all natural ingredients. Consumers have actively communicated with us through our website and/or social media channels. We believe that this consumer interaction has generated interest in our products and has inspired enthusiasm for our brand. We also believe that enthusiasm for our products has led and will continue to lead to repeat purchases and new consumers trying our products. | |

| ● | Experienced leadership. We have a proven and experienced senior management team. Our Chief Executive Officer and Chairman, Carl Wolf, has been with us since inception and has over 35 years of experience in the management and operations of food companies. Mr. Wolf was the founder, majority shareholder, Chairman of the Board, and CEO of Alpine Lace Brands, Inc., a public company engaged in the development, marketing and distribution of cheese, deli meats and other specialty food products, which was sold to Land O’Lakes, Inc. In addition, the other members of our board of directors also have significant experience in the food industry. |

Our Growth Strategy

We are actively executing a strategy to build our brand’s reputation, grow sales and improve our product and operating margins by pursuing the following growth initiatives:

| ● | Increase product placements in the perimeter within retail locations. We strive for product placements in the perishable departments of retail locations. We believe adding shelf placements within the supermarkets that carry our products will increase customer awareness, leading to more consumers purchasing our products and expanding our market share. | |

| ● | Increase Sales in “Fresh” Section. Increase sales in the “Fresh” section (in the perimeter of the retainer), where there is significant sales growth and higher margins, over products in the “Frozen” section which are showing zero to negative growth. | |

| ● | Increase retail locations. We intend to increase sales by expanding the number of retail stores that sell our products in the mainstream grocery and mass merchandiser channels. | |

| ● | Increase Overall Sales. We have an experienced sales staff and now employ one full time Vice President of sales as well as our Co-Founder Dan Dougherty, Carl Wolf, our Chief Executive Officer and Chairman, and Matthew Brown, our President, each of whom is involved with selling to, and managing sales with, major supermarket chains. | |

| ● | Expand food brokerage network. We currently work with retail food brokers nationwide and intend to add additional food brokers to increase our geographical coverage in the United States to approximately 90%. | |

| ● | Enhance awareness through marketing. We have increased our social media activity with Facebook, Twitter, Pinterest, and YouTube. We also engage with consumers through newsletter mailings, blogs, and special projects, including a bank of recipe videos and contests and giveaways. Targeted consumer merchandising activity, including virtual couponing, on-pack couponing, mail-in rebates, product demonstrations, and co-op retail advertising will continue into the future in order to increase sales and generate new customers. | |

| ● | Adding new products. Our market research and consumer testing enable us to identify attractive new product opportunities. We intend to continue to introduce new products in both existing and new product lines that appeal to a wide range of consumers. We currently have approximately 26 product offerings. |

| 6 |

| ● | Maintain a Strong Relationship with QVC. The Company currently offers various lines through QVC and intends to increase its product line offerings offered through QVC. | |

| ● | Increase Media Exposure. Increase the visibility of Dan Dougherty (Mancini) in the media as a product spokesman. We have hired 5WPR as our consumer public relations firm to undertake an extensive publicity campaign. | |

| ● | “Club Stores”. The Company is aggressively pursuing sales to “Club Stores” |

Products

Our principal products are meatballs with slow cooked Italian Sauce, Meatloaf and Italian Entrees. We currently offer our products using the following meats: beef, turkey, chicken and pork.

Our current products include:

BEEF MEATBALLS:

PACKAGED:

BULK DELI

| 7 |

TURKEY MEATBALLS:

PACKAGED:

BULK DELI

| 8 |

MEATLOAF, STUFFED PEPPERS, BAKED ZITI, AND SPECIALTY ITEMS:

Pricing

Our pricing strategy focuses on being competitively priced with other premium brands. Since our products are positioned in the authentic premium prepared food category, we maintain prices competitive with those of similar products and prices slightly higher than those in the commodity prepared foods section. This pricing strategy also provides greater long-term flexibility as we grow our product line through the growth curve of our products. Current typical retail prices for 16 oz. packages range from $5.99 to $7.99, and $5.99 to $8.99 per pound for prepared food products sold to delis or hot bars. Increases in raw materials costs, among other factors, may lead to us consider price increases in the future.

Suppliers/Manufacturers

None of our raw materials or ingredients are grown or purchased directly by us. We employ one company, JEFE to order all raw materials or ingredients, as well as manufacture all of our products to date. JEFE is owned by both the CEO and President of the Company.

We are negotiating with several other manufacturers to supplement the services provided by JEFE. We currently purchase modest quantities from other manufacturers. All of the raw materials and ingredients in our products are readily available and are readily ascertainable by our suppliers. We have not experienced any material shortages of ingredients or other products necessary to our operations and do not anticipate such shortages in the foreseeable future.

Sales/Brokers

As of January 31, 2017, our products are carried by approximately 11,700 food retail locations with an average of 3.3 different items per retail location, thereby totaling approximately 38,700 product placements on shelves in such retail locations. Our products are sold in the frozen meat case, the frozen Italian specialty section, the fresh meat case, the deli (in bulk and grab n’ go pre-packaged formats) as well as hot bars and sandwich shops in food retailers.

Our products are sold primarily through a commission broker network. We sell to large retail chains who direct our products to their own warehouses or to large food distributors.

In December 2015, the Company increased its sales management efforts with the result that the Company is now actively soliciting business with almost every major retail supermarket chain in the country. Currently, all of our full-time employees and Dan Dougherty sell our products directly to supermarkets and mass retailers. MamaMancini’s products are currently sold primarily in the Northeast and Southeast.

Marketing

The majority of our marketing activity has been generated through promotional discounts, consumer trial, consumer product tastings and demonstrations, in-store merchandising and signage, couponing, word of mouth, consumer public relations, social media, special merchandising events with retailers and consumer advertising.

| 9 |

The Company has also developed a brand ambassador program for consumer advocates of MamaMancini’s. Advocates receive coupons, hats, tote bags and other incentives to promote our brand. In addition, the Company has an active on-line and traditional paper couponing activity and employees outside services to deliver coupons to consumers such as Facebook, newspaper free standing inserts, and on pack coupons as well as our web site. Dan Dougherty has been the principal spokesperson for MamaMancini’s, and has made appearances or had article features including the Martha Stewart Show, Entertainment Tonight, Today Cooking School, New York Times, Wall Street Journal, USA Today and People Magazine.

Based on the Company’s metrics for determining brand awareness, which includes market studies and analysis of consumer recognition of the MamaMancini’s brand, the Company believes that brand awareness for MamaMancini’s has grown significantly in the past 12 months.

Investments - Meatball Obsession

During 2011 the Company acquired a 34.62% interest in Meatball Obsession, LLC (“MO”) for a total investment of $27,032. This investment is accounted for using the equity method of accounting. Accordingly, investments are recorded at acquisition cost plus the Company’s equity in the undistributed earnings or losses of the entity. At December 31, 2011 the investment was written down to $0 due to losses incurred by MO. The Company’s ownership interest in MO has decreased due to dilution. At January 31, 2017 and 2016, the Company’s ownership interest in MO was 12% and 12%, respectively. One of our directors, Steven Burns, serves as the Chairman of the Board of Directors of Meatball Obsession.

Competition

The gourmet and specialty pre-packaged and frozen food industry has many large competitors specializing in various types of cuisine from all over the world. Our product lines are currently concentrated on Italian specialty foods. While it is our contention that our competition is much more limited than the entire frozen and pre-packaged food industry based on our products’ niche market, there can be no assurances that we do not compete with the entire frozen and pre-packaged food industry. We believe our principal competitors include Quaker Maid / Philly-Gourmet Meat Company, Hormel, Rosina Company, Inc., Casa Di Bertacchi, Inc., Farm Rich, Inc., Mama Lucia, and Buona Vita, Inc.

Intellectual Property

Our current intellectual property consists of trade secret recipes and cooking processes for our products and three trademarks for “MamaMancini’s”, “Mac N’ Mamas” and “The Meatball Lovers Meatball”. The recipes and use of the trademarks have been assigned in perpetuity to the Company.

We rely on a combination of trademark, copyright and trade secret laws to establish and protect our proprietary rights. We will also use technical measures to protect our proprietary rights.

Royalty Agreement

In accordance with a Development and License Agreement (the “Development and License Agreement”) entered into on January 1, 2009 with Dan Dougherty relating to the use of his grandmother’s recipes for the products to be created by MamaMancini’s, Mr. Dougherty granted us a 50 year exclusive license (subject to certain minimum payments being made), with a 25 year extension option, to use and commercialize the licensed items. Under the terms of the Development and License Agreement, Mr. Dougherty shall develop a line of beef meatballs with sauce, turkey meatballs with sauce and other similar meats and sauces for commercial manufacture, distribution and sale (each a “Licensor Product” and collectively the “Licensor Products”). Mr. Dougherty shall work with us to develop Licensor Products that are acceptable to us. Upon acceptance of a Licensor Product by us, Mr. Dougherty’s trade secret recipes, formulas methods and ingredients for the preparation and production of such Licensor Products shall be subject to the Development and License Agreement. In connection with the Development and License Agreement, we pay Mr. Dougherty a royalty fee on net sales.

| 10 |

Supply Agreement

On March 1, 2010, the Company entered into a five-year agreement with JEFE. JEFE is owned by both the CEO and President of the Company. Under the terms of the agreement, the Company granted to JEFE a revocable license to use the Company’s recipes, formulas, methods and ingredients for the preparation and production of Company’s products, for manufacturing the Company’s product and all future improvements, modifications, substitutions and replacements developed by the Company. JEFE in turn granted to the Company the exclusive right to purchase the product. Under the terms of the agreement JEFE agreed to manufacture, package, and store the Company’s products. The Company has the right to purchase products from one or more other manufacturers, distributors or suppliers. The agreement contains a perpetual automatic renewal clause for a period of one year after the expiration of the initial term. During the renewal period either party may cancel the contract with written notice nine months prior to the termination date. The agreement was automatically renewed in February 2016.

On August 1, 2016, the Company entered into an Amended and Restated Supply Agreement with JEFE which extended the term of the Agreement to July 31, 2021 (notwithstanding, in the event of a Change of Control of the Company, the Agreement will expire on the later of July 31, 20121 or a date which is three (3) years following the Change of Control. The Amended Agreement also provides for a Minimum Volume Guaranty, whereby during the Term of this Agreement, the Company agrees to deliver Purchase Orders to JEFE of not less than $963,000 per calendar month, which will result in gross profit to JEFE (at a 12% margin) of at least $115,560 per month. The Company further agreed to pay JEFE, on a monthly basis, any shortfall in JEFE’s net profit (calculated on a 12% margin) below $115,560 per month. To the extent JEFE’s profit for any month (calculated on a 12% margin) exceeds $115,560, any such excess shall be paid to the Company as a reduction against any then outstanding account payable owing by JEFE to the Company.

Under the terms of the Agreement if the Company specifies any change in packaging or shipping materials which results in JEFE incurring increased expense for packaging and shipping materials or in JEFE being unable to utilize obsolete packaging or shipping materials in ordinary packaging or shipping, the Company agrees to pay as additional product cost the additional cost for packaging and shipping materials and to purchase at cost such obsolete packaging and shipping materials. If the Company requests any repackaging of the product, other than due to defects in the original packaging, the Company will reimburse JEFE for any labor costs incurred in repackaging. Per the Agreement, all product delivery shipping costs are the expense of the Company.

Finally, it was agreed that the Company will pay JEFE $5,000 per month during the Term of the Agreement on account of certain shared expenses. In all other material respects, the terms of the original Agreement remain unchanged.

USDA approval / Regulations

Our food products, which are manufactured in third-party facilities, are subject to various federal, state and local regulations and inspection, and to extensive regulations and inspections, regarding sanitation, quality, packaging and labeling. In order to distribute and sell our products outside the State of New Jersey, the third-party food processing facilities must meet the standards promulgated by the U.S. Department of Agriculture (the “USDA”). Our third party manufacturers processing facilities and products are subject to periodic inspection by federal, state, and local authorities. In January 2011, the FDA’s Food Safety Modernization Act was signed into law. The law will increase the number of inspections at food facilities in the U.S. in an effort to enhance the detection of food borne illness outbreaks and order recalls of tainted food products. The facilities in which our products are manufactured are inspected regularly and comply with all the requirements of the FDA and USDA.

We are subject to the Food, Drug and Cosmetic Act and regulations promulgated thereunder by the FDA. This comprehensive regulatory program governs, among other things, the manufacturing, composition and ingredients, packaging, and safety of food. Under this program, the FDA regulates manufacturing practices for foods through, among other things, its current “good manufacturing practices” regulations, or GMP’s, and specifies the recipes for certain foods. Specifically, the USDA defines “all natural” as a product that contains no artificial ingredients, coloring ingredients or chemical preservatives and is minimally processed. The Company’s products were submitted to the USDA and approved as “all natural”. However, should the USDA change their definition of “all natural” at some point in the future, or should MamaMancini’s change their existing recipes to include ingredients that do not meet the USDA’s definition of “all natural”, our results of operations could be adversely affected.

| 11 |

The FTC and other authorities regulate how we market and advertise our products, and we are currently in compliance with all regulations related thereto, although we could be the target of claims relating to alleged false or deceptive advertising under federal and state laws and regulations. Changes in these laws or regulations or the introduction of new laws or regulations could increase the costs of doing business for us or our customers or suppliers or restrict our actions, causing our results of operations to be adversely affected.

Quality Assurance

We take precautions designed to ensure the quality and safety of our products. In addition to routine third-party inspections of our contract manufacturer, we have instituted regular audits to address topics such as allergen control, ingredient, packaging and product specifications and sanitation. Under the FDA Food Modernization Act, each of our contract manufacturers is required to have a hazard analysis critical control points plan that identifies critical pathways for contaminants and mandates control measures that must be used to prevent, eliminate or reduce relevant food-borne hazards.

Our current contract manufacturer, JEFE, is certified in the Safe Quality Food Program. These standards are integrated food safety and quality management protocols designed specifically for the food sector and offer a comprehensive methodology to manage food safety and quality simultaneously. Certification provides an independent and external validation that a product, process or service complies with applicable regulations and standards.

We work with suppliers who assure the quality and safety of their ingredients. These assurances are supported by our purchasing contracts or quality assurance specification packets, including affidavits, certificates of analysis and analytical testing, where required. The quality assurance staff of both our contract manufacturer and our own internal operations department conducts periodic on-site routine audits of critical ingredient suppliers.

Where You Can Find More Information

The public may read and copy any materials the Company files with the U.S. Securities and Exchange Commission (the “SEC”) at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0030. The SEC maintains an Internet website (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

Smaller reporting companies are not required to provide the information required by this item.

Item 1B. Unresolved Staff Comments.

Not applicable.

Our principal executive office is located at 25 Branca Road East Rutherford, NJ 07073. We currently pay an administrative fee of $5,000 per month to JEFE which includes use of office space and telephones, computers and photocopy and fax use. We utilize approximately 1,000 square feet of office space on a month-to-month basis. This space is utilized for office purposes and it is our belief that the space is adequate for our immediate needs. Additional space may be required as we expand our business activities. We do not foresee any significant difficulties in obtaining additional facilities if deemed necessary.

| 12 |

We are not currently involved in any litigation that we believe could have a materially adverse effect on our financial condition or results of operations. There is no action, suit, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory organization or body pending or, to the knowledge of the executive officers of our Company or any of our subsidiaries, threatened against or affecting our Company, our common stock, any of our subsidiaries or of our Company’s or our Company’s subsidiaries’ officers or directors in their capacities as such, in which an adverse decision could have a material adverse effect.

Item 4. Mine Safety Disclosures.

Not applicable.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

(a) Market Information

Our shares of common stock are currently quoted on the OTCQB under the symbol “MMMB” The following table sets forth (i) the intra-day high and low sales price per share for our common stock, as reported on the OTCQB, for the fiscal years ended January 31, 2017 and January 31, 2016. The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission, and may not represent actual transactions.

| Fiscal Year Ended January 31, 2017 | High | Low | ||||||

| First Quarter | $ | 0.60 | $ | 0.31 | ||||

| Second Quarter | $ | 0.85 | $ | 0.51 | ||||

| Third Quarter | $ | 0.74 | $ | 0.45 | ||||

| Fourth Quarter | $ | 0.73 | $ | 0.38 | ||||

| Fiscal Year Ended January 31, 2016 | High | Low | ||||||

| First Quarter | $ | 1.65 | $ | 1.00 | ||||

| Second Quarter | $ | 1.48 | $ | 0.73 | ||||

| Third Quarter | $ | 0.75 | $ | 0.51 | ||||

| Fourth Quarter | $ | 0.75 | $ | 0.31 | ||||

The market price of our common stock, like that of other early stage companies, is highly volatile and is subject to fluctuations in response to variations in operating results, announcements of new products, or other events or factors. Our stock price may also be affected by broader market trends unrelated to our performance.

(b) Holders

As of March 20, 2017, a total of 27,805,750 shares of the Company’s common stock are currently outstanding held by approximately 133 shareholders of record. This figure does not take into account those shareholders whose certificates are held in the name of broker-dealers or other nominees.

(c) Dividends

Preferred Stock. The holders of the Series A Convertible Preferred are entitled to receive dividends at a rate of eight percent (8%) per annum payable quarterly in cash or Company Common Stock at the option of the holder We have not paid any cash dividends to he holders of our Common Stock.

| 13 |

Common Stock. The declaration of any future cash dividends is at the discretion of our board of directors and depends upon our earnings, if any, our capital requirements and financial position, general economic conditions, and other pertinent conditions. It is our present intention not to pay any cash dividends on our Common Stock in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

(d) Securities Authorized for Issuance under Equity Compensation Plans

At the present time, we have 450,000 shares of common stock authorized for issuance under our equity compensation plan. For more information on our equity compensation plan please refer to the Current Report on Form 8-K filed with the Securities and Exchange Commission on June 5, 2013.

Recent Sales of Unregistered Securities

During the period between February 1, 2016 and January 31, 2017, the Company issued an aggregate of 1,329,111 shares of its Common stock as follows:

| Stock in lieu of compensation | 646,548 shares | |

| Series A Preferred Stock Dividends | 528,481 shares | |

| Consultants | 154,082 shares |

These shares were all issued under an exemption from registration pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended.

There were no other sales of unregistered securities not already reported on the Company’s quarterly filings on Form 10-Q or on a Current Report on Form 8-K.

Item 6. Selected Financial Data.

Pursuant to permissive authority under Regulation S-K, Rule 301, we have omitted Selected Financial Data.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

THE FOLLOWING DISCUSSION OF OUR PLAN OF OPERATION AND RESULTS OF OPERATIONS SHOULD BE READ IN CONJUNCTION WITH THE FINANCIAL STATEMENTS AND RELATED NOTES TO THE FINANCIAL STATEMENTS INCLUDED ELSEWHERE IN THIS REPORT. THIS DISCUSSION CONTAINS FORWARD-LOOKING STATEMENTS THAT RELATE TO FUTURE EVENTS OR OUR FUTURE FINANCIAL PERFORMANCE. THESE STATEMENTS INVOLVE KNOWN AND UNKNOWN RISKS, UNCERTAINTIES AND OTHER FACTORS THAT MAY CAUSE OUR ACTUAL RESULTS, LEVELS OF ACTIVITY, PERFORMANCE OR ACHIEVEMENTS TO BE MATERIALLY DIFFERENT FROM ANY FUTURE RESULTS, LEVELS OF ACTIVITY, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR IMPLIED BY THESE FORWARD- LOOKING STATEMENTS. THESE RISKS AND OTHER FACTORS INCLUDE, AMONG OTHERS, THOSE LISTED UNDER “FORWARD-LOOKING STATEMENTS” AND “RISK FACTORS” AND THOSE INCLUDED ELSEWHERE IN THIS REPORT.

Plan of Operation

The Company plans to sell more of its products into new and existing food retail outlets. The Company has refined its customer base to concentrate on more profitable accounts. The Company is focusing its sales and marketing effort toward the fresh prepared food section of retailers where margins are higher and sales volume per retailer is stronger and growing. Social media activity has increased with Facebook, Twitter, Pinterest, YouTube, newsletter mailings, blogs, and helpful consumer content and special projects including a recipe bank of videos and MamaMancini’s contest and giveaways. Increased consumer merchandising activity, including virtual couponing, on-pack couponing, mail-in rebates, product demonstrations, and co-op retail advertising has commenced to increase sales to existing customers and new customers.

| 14 |

We believe that the ongoing introduction of the Company’s new all natural brand Slow Cooked Italian Sauce and various meatball and entrée products show promise for additional product placements and sales in the future. These products include Five Cheese Stuffed Beef Meatballs, Chicken Parmigiana Style Stuffed Meatballs, Chicken Florentine Stuffed Meatballs, Gluten Free Beef and Turkey Meatballs, Antibiotic Free Beef and Turkey Meatballs, Cocktail Meat Balls, Hearty Beef and Turkey Sauce, Original Beef and Turkey Meat Loaves, Beef and Turkey Parmigiana Meat Loaves, Beef and Turkey Bacon Gorgonzola Meat Loaves and Grass-fed Beef Meatballs. In addition, the Company has introduced Stuffed Pepper kits in December, 2016 and will be introducing Chicken Parmigiana in the Spring of 2017. This line is available in bulk food service pack, retail packages in fresh varieties, and club store pack in fresh varieties. Additionally, the Company plans to continue expansion into various new retailers with placement of its existing product line of Beef, Turkey, Pork and Chicken Meatballs and Sauce, as well as Marinara and Italian Sauce with beef flavors.

The Company has key sales personnel and a sales network of paid broker representatives. We currently work with approximately 35 retail food brokers.

The Company currently has supply agreement with JEFE, a related party, which has been extended to July 31, 2021. This agreement automatically renews for periods of one year unless otherwise terminated by nine months prior written notice. JEFE is owned by the CEO and President of the Company.

In February 2017, the Company purchased additional production equipment to handle anticipated demand for its products.

We believe that MamaMancini’s products have the ability to expand sales and deliver more products within several areas of consumption by consumers such as fresh meat, prepared foods, hot bars, cold bars in delis, and sandwich sections of supermarkets and other food retailers. In addition, we believe that MamaMancini’s products can be sold into food service channels, mass market, and exported or as a component of other products.

Results of Operations for the Year ended January 31, 2017 and January 31, 2016

The following table sets forth the summary statements of operations for the years ended January 31, 2017 and January 31, 2016:

| Years Ended | ||||||||

| January 31, 2017 | January 31, 2016 | |||||||

| Sales - Net of Slotting Fees and Discounts (1) | $ | 18,048,792 | $ | 12,603,447 | ||||

| Gross Profit | $ | 6,492,816 | $ | 3,597,227 | ||||

| Operating Expenses | $ | (6,085,807 | ) | $ | (5,856,544 | ) | ||

| Other Expense | $ | (696,149 | ) | $ | (1,252,301 | ) | ||

| Net Loss | $ | (289,140 | ) | $ | (3,511,618 | ) | ||

| (1) | Slotting fees are required in new placements with some, but not a majority of supermarket chains that the Company does business with. They are negotiated with each chain depending upon the expected return to the Company. We believe that we have successfully negotiated such slotting fees to a relatively low expense. We have taken into account future fees currently being negotiated in preliminary negotiations for new placements. We do not believe our size or financial limitations are an impediment to being able to pay such slotting fees. Slotting fee costs are an expense in growing the business as are other marketing and sales costs and the Company has accounted for these fees in assessing its estimated working capital for the next 12 months. |

For the years ended January 31, 2017 and January 31, 2016, the Company reported a net loss of $289,140 and $3,511,618, respectively. The change in net loss between the years ended January 31, 2017 and January 31, 2016, which was primarily attributable to an increase in sales, a higher gross profit margin, and operating expenses only increased 4% on a 43% sales increase.

| 15 |

Sales: Sales, net of slotting fees and discounts increased by approximately 43% to $18,048,792 during the year ended January 31, 2017, from $12,603,447 during the year ended January 31, 2016. During the year ended January 31, 2017, the Company sold into higher volume locations compared to the year ended January 31, 2016. The Company has sold into approximately 38,700 SKU’s in 11,700 retail and grocery locations at January 31, 2017 as compared to approximately 32,000 SKU’s in 10,000 retail and grocery locations at January 31, 2016. In addition, during the year ended January 31, 2017, the Company was able to increase its sales through new customers as well as its existing customer base.

Gross Profit: The gross profit margin was 36% for the year ended January 31, 2017 compared to 29% for the year ended January 31, 2016. The increase in gross profit is attributable to the increase in customer base, improved product mix and production efficiencies.

Operating Expenses: Operating expenses increased by 4% during the year ended January 31, 2017, as compared to the year ended January 31, 2016. The $229,263 increase in operating expenses is primarily attributable to the following approximate increases in operating expenses:

| ● | Stock-based compensation for services rendered by employees and consultants increased by of $274,900 compared to the prior year; |

| ● | Postage and freight of $338,700 due to higher sales offset by better efficiency, |

| ● | Commission expenses of $147,800 related to increased sales; |

| ● | Research and development costs increased by $36,400 due to offering new products and the related increase in sales; |

| ● | Depreciation expense of $63,300 due to new fixed asset purchases during the period; and |

| ● | Royalty expense of $32,300 related to increased sales. |

These expense increases were offset by decreases in the following expenses:

| ● | Advertising, social media and promotional expenses of $514,000 related to a decrease in spending on our radio advertising campaign and special promotions; and |

| ● | Professional fees decreased by $155,600 due to better management of this expense. |

Other Expense: Other expenses decreased by $556,152 to $696,149 for the year ended January 31, 2017 as compared to $1,252,301 during the year ended January 31, 2016. For year ended January 31, 2017, other expenses consisted of $667,623 in interest expense incurred on the Company’s line of credit and term loan with EGC, the note payable with Manatuck Hill Partners, LLC (“Manatuck”), the promissory notes and the related party notes payable. In addition, the Company recorded $28,526 of amortization expense related to the debt discount and finance arrangements. For the year ended January 31, 2016, other expenses consisted of $555,071 in interest expense incurred on the Company’s line of credit and term loan with EGC and the convertible debenture with Manatuck. In addition, the Company recorded $317,141 of amortization expense related to the debt discount and finance arrangements. During the year ended January 31, 2016, the Company also recorded $380,089 from a loss on debt extinguishment related to the amendment to the Manatuck agreement in October 2015.

| 16 |

Liquidity and Capital Resources

The following table summarizes total current assets, liabilities and working capital at January 31, 2017 compared to January 31, 2016:

| January 31, 2017 | January 31, 2016 | Increase/(Decrease) | ||||||||||

| Current Assets | $ | 5,143,478 | $ | 4,719,995 | $ | 423,483 | ||||||

| Current Liabilities | $ | 3,139,807 | $ | 4,754,360 | $ | (1,614,553 | ) | |||||

| Working Capital (Deficiency) | $ | 2,003,671 | $ | (34,365 | ) | $ | 2,038,036 | |||||

As of January 31, 2017, we had a working capital of $2,003,671 as compared to a working capital deficiency of $(34,365) as of January 31, 2016, an increase of $2,038,036. The increase in working capital is primarily attributable to increases in cash, accounts receivable, inventories and decreases in accounts payable and accrued expenses, promissory notes and related party notes all of which were offset by decreases in prepaid expenses, due from manufacturer and increases in term loan and note payable.

Net cash provided by (used in) operating activities for the year ended January 31, 2017 and 2016 was $482,792 and ($1,260,259), respectively. The net loss for the year ended January 31, 2017 and 2016 was $289,140 and $3,511,618, respectively.

Net cash used in all investing activities for the year ended January 31, 2017 was $476,867 as compared to $208,226 for the year ended January 31, 2016, respectively, to acquire new machinery and equipment and leasehold improvements.

Net cash provided by all financing activities for the year ended January 31, 2017 was $73,233 as compared to cash provided by financing activities of $1,200,912 for the year ended January 31, 2016. During the year ended January 31, 2017, the Company had an increase in net borrowings of $403,524 and $340,000 for transactions pursuant to the line of credit and term loan, respectively. These increases were offset by $126,668 and $336,575 paid for repayments on a term loan and net payments of promissory notes, respectively. During the year ended January 31, 2016, the Company raised net proceeds of $1,580,000 from the issuance of preferred stock, $650,000 from the issuance of demand notes which were converted into preferred stock in June 2016 and $125,000 from the proceeds of a note payable from related parties. This increase was offset by $436,330 stock offering costs, $10,021 deferred offering costs, and $449,477 net repayments of line of credit, $120,000 repayments of term loan, and $138,260 repayments of promissory notes, respectively.

As reflected in the accompanying consolidated financial statements, the Company has a net loss and net cash provided by operations of $289,138 and $482,792, respectively, for the year ended January 31, 2017.

Although the continued revenue growth coupled with improved gross margins and control of expenses leads management to believe that it is probable that the Company’s cash resources will be sufficient to meet our cash requirements through the first quarter of fiscal year ended January 31, 2019, the Company may require additional funding to finance the growth of its current and expected future operations as well as to achieve its strategic objectives. There can be no assurance that financing will be available in amounts or terms acceptable to the Company, if at all. In that event, the Company would be required to change its growth strategy and seek funding on that basis, though there is no guarantee it will be able to do so.

Going Concern Analysis

The Company had a net loss of $289,140 and $3,511,618 for the years ended January 31, 2017 and 2016. As a result, these conditions had raised substantial doubt regarding our ability to continue as a going concern beyond 2017. However, as of January 31, 2017, we had cash and working capital of $666,580 and $1,753,671, respectively. During the year ended January 31, 2017, the Company generated cash from operations of $482,792. In addition, management was able to negotiate the terms of its note payable with one of the lenders and intends to exercise an option to extend the maturity date of the note payable to May 1, 2018. Also, the continued revenue growth coupled with improved gross margins and control of expenses leads management to believe that it is probable that the Company’s cash resources will be sufficient to meet our cash requirements through the first quarter of fiscal year ended January 31, 2019. If necessary, management also believes that it is probable that external sources of debt and/or equity financing could be obtained based on management’s history of being able to raise capital coupled with current favorable market conditions. As a result of both management’s plans and current favorable trends in improving cash flow, the Company believes the initial conditions which raised substantial doubt regarding the ability to continue as a going concern have been alleviated. Therefore, the accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern.

| 17 |

The consolidated financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result from the matters discussed herein. While we believe in the viability of management’s strategy to generate sufficient revenue, control costs and the ability to raise additional funds if necessary, there can be no assurances to that effect. The Company’s ability to continue as a going concern is dependent upon the ability to further implement the business plan, generate sufficient revenues and to control operating expenses.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

Smaller reporting companies are not required to provide the information required by this item.

Our consolidated financial statements appear at the end of this Annual Report.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

There are no reportable events under this item for the year ended January 31, 2017.

Item 9A. Controls and Procedures.

(a) EVALUATION OF DISCLOSURE CONTROLS AND PROCEDURES

Based on their evaluation as of the end of the period covered by this Annual Report on Form 10-K, our principal executive officer and principal financial officer have concluded that our disclosure controls and procedures (as defined in Rules 13a-15(c) and 15d-15(e) under the Exchange Act) are not effective to ensure that information required to be disclosed by us in report that we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the U.S. Securities and Exchange Commission’s rules and forms and to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is accumulated and communicated to our management, including our chief executive officer and chief financial officer, as appropriate to allow timely decisions regarding required disclosure.

(b) MANAGEMENT’S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

This Company’s management is responsible for establishing and maintaining internal controls over financial reporting and disclosure controls. Internal Control Over Financial Reporting is a process designed by, or under the supervision of, the Company’s principal executive and principal financial officers, or persons performing similar functions, and effected by the issuer’s board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that:

| (1) | Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the issuer; |

| (2) | Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the issuer are being made only in accordance with authorizations of management and directors of the registrant; and |

| (3) | Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the issuer’s assets that could have a material effect on the financial statements. |

| 18 |

Disclosure controls and procedures are designed to ensure that information required to be disclosed in reports filed under the Securities Exchange Act of 1934, as amended, is appropriately recorded, processed, summarized and reported within the specified time periods.

Management has conducted an evaluation of the effectiveness of our internal control over financial reporting as of January 31, 2017, based on the framework established in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”).

Based on this assessment, management concluded that as of the period covered by this Annual Report on Form 10-K, it had material weaknesses in its internal control procedures.

As of period covered by this Annual Report on Form 10-K, we have concluded that our internal control over financial reporting was ineffective. The Company’s assessment identified certain material weaknesses which are set forth below:

Functional Controls and Segregation of Duties

Because of the Company’s limited resources, there are limited controls over information processing.

There is an inadequate segregation of duties consistent with control objectives. Our Company’s management is composed of a small number of individuals resulting in a situation where limitations on segregation of duties exist. In order to remedy this situation we would need to hire additional staff to provide greater segregation of duties. Currently, it is not feasible to hire additional staff to obtain optimal segregation of duties. Management will reassess this matter in the following year to determine whether improvement in segregation of duty is feasible.

Accordingly, as the result of identifying the above material weakness we have concluded that these control deficiencies resulted in a reasonable possibility that a material misstatement of the annual or interim financial statements will not be prevented or detected on a timely basis by the Company’s internal controls.

Management believes that the material weaknesses set forth above were the result of the scale of our operations and are intrinsic to our small size. Management believes these weaknesses did not have a material effect on our financial results and intends to take remedial actions upon receiving funding for the Company’s business operations.

This annual report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by our registered public accounting firm pursuant to temporary rules of the SEC that permit the Company to provide only management’s report herein.

(c) CHANGES IN INTERNAL CONTROLS OVER FINANCIAL REPORTING

We are committed to improving our financial organization. As part of this commitment, we will create a position to segregate duties consistent with control objectives and will increase our personnel resources and technical accounting expertise within the accounting function when funds are available to us by preparing and implementing sufficient written policies and checklists which will set forth procedures for accounting and financial reporting with respect to the requirements and application of US GAAP and SEC disclosure requirements.

Management believes that preparing and implementing sufficient written policies and checklists will remedy the material weaknesses pertaining to insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and application of US GAAP and SEC disclosure requirements.

| 19 |

We intend to take appropriate and reasonable steps to make the necessary improvements to remediate these deficiencies, including:

| (1) | We will revise processes to provide for a greater role of independent board members in the oversight and review until such time that we are adequately capitalized to permit hiring additional personnel to address segregation of duties issues, ineffective controls over the revenue cycle and insufficient supervision and review by our corporate management. |

| (2) | We will update the documentation of our internal control processes, including formal risk assessment of our financial reporting processes. |

We intend to consider the results of our remediation efforts and related testing as part of our year-end 2018 assessment of the effectiveness of our internal control over financial reporting.

Subsequent to January 31, 2017, we intend to undertake the following steps to address the deficiencies stated above:

| ● | Continued the development and documentation of internal controls and procedures surrounding the financial reporting process, primarily through the use of account reconciliations, and supervision. | |

| ● | Added additional accounting staff to further segregate duties and help the Company maintain timely reporting of financial results. |

None.

Item 10. Directors, Executive Officers and Corporate Governance.

Directors and Executive Officers

The following table discloses our directors and executive officers as of April 1, 2016.

| Name | Age | Position | ||

| Carl Wolf | 73 | Chief Executive Officer and Chairman of the Board of Directors | ||

| Matthew Brown | 48 | President and Director | ||

| Lewis Ochs | 70 | Chief Financial Officer | ||

| Steven Burns | 56 | Director | ||

| Alfred D’Agostino | 63 | Director | ||

| Thomas Toto | 62 | Director | ||

| Dan Altobello | 76 | Director | ||

| Dean Janeway | 73 | Director |

| 20 |

Carl Wolf has over 35 years of experience in the management and operations of companies in the food industry. Mr. Wolf has served as Chief Executive Officer and Chairman of the Board of MamaMancini’s from February 2010 through the Present. Mr. Wolf was the founder, majority shareholder, Chairman of the Board, and CEO of Alpine Lace Brands, Inc., a NASDAQ-listed public company with over $125 million in wholesale sales. He also founded, managed, and sold MCT Dairies, Inc., a $60 million international dairy component resource company. Other experience in the food industry includes his role as Co-chairman of Saratoga Beverage Company, a publicly traded (formerly NASDAQ: TOGA) bottled water and fresh juice company prior to its successful sale to a private equity firm. Mr. Wolf served an advisor to Mamma Sez Biscotti, a snack and bakery product company (which was sold in a later period to Nonnis, the largest biscotti company in the United States) from 2002 to 2004. Previously he served as Director and on the Audit and Development committees of American Home Food Products, Inc. a publically traded marketer Artisanal Brand Cheeses, from 2007 to 2009. Mr. Wolf also served as Chairman of the Board of Media Bay, which was a NASDAQ-listed public company which ally traded direct seller of spoken word through its audio book club and old time radio classic activities and download spoken content, from 2002 to 2004.

Mr. Wolf received his B.A. in 1965 from Rutgers University (Henry Rutgers Scholar) and his M.B.A. in 1966 from the University of Pittsburgh (with honors).

In evaluating Mr. Wolf’s specific experience, qualifications, attributes and skills in connection with his appointment to our board, we took into account his numerous years of experience in the food industry, as a serial entrepreneur in growing business, his knowledge of publicly traded companies, and his proven track record of success in such endeavors.

Matthew Brown has over 20 years of experience in the sales and marketing of products in the food industry. Beginning in February 2010 through the present, he has served as President of MamaMancini’s. From April 2001 until January of 2012, he served as the President of Hors D’oeuvres Unlimited, overseeing the day to day operations of their food manufacturing business. He previously worked as a marketing associate from September 1993 to December 1998 at Kraft Foods, Inc., where he dealt with numerous aspects of the company’s marketing of their food products.

Mr. Brown received his B.A. from the University of Michigan in 1991 and his M.B.A. from the University of Illinois in 1993.

In evaluating Mr. Brown’s specific experience, qualifications, attributes and skills in connection with his appointment to our board, we took into account his numerous years of experience in sales and marketing, and his proven track record of success in such endeavors.

Lewis Ochs has over 40 years of experience in the financial and accounting industry. From February 2010 through the present he has served as the Executive Vice President of Finance for MamaMancini’s. Effective September 5, 2014 Mr. Ochs was named our Chief Financial Officer. Additionally, beginning in January 2003 and still presently, he serves as the CFO of Hors D’oeuvres Unlimited, overseeing all of the financial aspects of the company. From 1979 through 1991, he also was an owner of Captive Plastics, Inc., a large molding manufacturer, directly contributing to the overseeing of over 500 union and non-union employees. At various times in his career he also acted as an independent consultant utilizing his financial skills including forensic accounting, restructuring of businesses, and as a field examiner for lending institutions.

Mr. Ochs received his B.S. in Accounting from the University of Akron in 1970.

In evaluating Mr. Ochs’ specific experience, qualifications, attributes and skills in connection with his appointment to our board, we took into account his numerous years of experience in finance and accounting, and his proven track record of success in such endeavors.

Steven Burns has over 20 years of experience in the management and operations of various companies. Mr. Burns has served as a director of MamaMancini’s from February 2010 through the present. Beginning in June 2011 and still presently, he serves as the Chairman of the Board of Directors of Meatball Obsession, LLC. Additionally, beginning in 2006 and still Presently he works as the President and CEO of Point Prospect, Inc., where he oversees the day to day operations of the company, which primarily deal with investments and services in real estate, clean and efficient energy sources, high-quality and healthy food services, and healthcare technology. Prior to that, for a period of 24 years he worked at and was senior executive at Accenture where he led the U.S. Health Insurance Industry Program comprised of approximately 600 professionals. He also has sat on various financial committees and boards of directors throughout his career.

| 21 |

Mr. Burns received his B.S. in Business Management from Boston College in 1982.

In evaluating Mr. Burns’ specific experience, qualifications, attributes and skills in connection with his appointment to our board, we took into account his numerous years of experience in serving on board of directors, his knowledge of running and managing companies, and his proven track record of success in such endeavors.

Alfred D’Agostino has over 34 years of experience in the management and ownership of food brokerage and food distribution companies. Mr. D’Agostino has served as a director of MamaMancini’s from February 2010 through the Present. Beginning in March 2001 and still presently, he serves as the President for World Wide Sales Inc., a perishable food broker that services the New York / New Jersey Metropolitan and Philadelphia marketplace. Prior to this he worked from September 1995 until February 2001 as Vice- President of the perishable business unit at Marketing Specialists, a nationwide food brokerage. Previously, from February 1987 until August 1995 he worked as a Partner for the perishable division of Food Associates until its merger with Merket Enterprises.

In evaluating Mr. D’Agostino’s specific experience, qualifications, attributes and skills in connection with his appointment to our board, we took into account his numerous years of experience in the food brokerage and other food related industries, his knowledge of running and managing companies, and his proven track record of success in such endeavors.

Mr. D’Agostino received his B.S. in Business Management from the City College of New York in 1974.

Thomas Toto has over 32 years of experience in the management and ownership of food brokerage and food distribution companies. Mr. Toto has served as a director of MamaMancini’s from February 2010 through the Present. Beginning in June 2009 and still presently, he serves as the Senior Business manager for World Wide Sales Inc., a perishable food broker that services the New York / New Jersey Metropolitan and Philadelphia marketplace. Prior to this he worked from September 2007 until May 2009 as a Division President for DCI Cheese Co., a company that imported and distributed various kinds of cheeses. Previously from March 1993 until September 2007 he was the President and owner of Advantage International Foods Corporation, where he ran the day to day operations of importing and distributing cheeses around the world.

Mr. Toto received his B.A. from Seton Hall University in 1976 and his M.B.A. from Seton Hall University in 1979.

In evaluating Mr. Toto’s specific experience, qualifications, attributes and skills in connection with his appointment to our board, we took into account his numerous years of experience in the food brokerage and other food related industries, his knowledge of running and managing companies, and his proven track record of success in such endeavors.

Dan Altobello has served as a director of MamaMancini’s since 2012. Since October 2000, Mr. Altobello, Chairman of Altobello Family LP, has been a private investor and active board member of several companies. From September 1995 until October 2000, Mr. Altobello was the Chairman of Onex Food Services, Inc., the parent of Caterair International, Inc. and LSG/SKY Chefs. He is a current member of the boards of directors of DiamondRock Hospitality Company, a publicly-traded hotel REIT, Northstar Senior Care Trust, Inc., a private company that intends to qualify as a REIT, Mesa Air Group, Inc. and Arlington Asset Investment, Corp, a principal investment firm that acquires and holds mortgage-related and other assets. From 2004 to December 2010, he served as a member of the board of JER Investors Trust, Inc., a specialty finance company. Mr. Altobello serves on the advisory board of Thayer | Hidden Creek, a private equity firm. Mr. Altobello is also a trustee of Loyola Foundation, Inc.

The Board of Directors determined that Mr. Altobello’s qualifications to serve as a director include his notable business and leadership experience in the areas of specialty finance. He also has experience in the area of food service distribution, due to his past position as Chairman of Onex Food Services, Inc. His past and present service on multiple public and private company boards, including his service on the audit committee of DiamondRock Hospitality Company and Northstar Senior Care Trust, Inc., provides him with comprehensive experience in the area of corporate governance that can be extremely valuable to Board and Company operations.

| 22 |

Mr. Altobello, received his B.A. from Georgetown University in June 1963 and his M.B.A. from Loyola University Maryland in June 1978.

Dean Janeway has served as a director of MamaMancini’s since 2012. Mr. Janeway is an executive with more than 40 years of broad leadership skills and extensive experience in the areas of corporate strategy, business development, operational oversight and financial management. From 1966 through 2011, Mr. Janeway served in various positions at Wakefern Food Corp., the largest retailer- owned cooperative in the United States. From 1966 through 1990, Mr. Janeway advanced through various positions of increasing responsibility including positions in Wakefern’s accounting, merchandising, dairy-deli, and frozen foods divisions. From 1990 through 1995 Mr. Janeway provided oversight for all of Wakefern’s procurement, marketing, merchandising, advertising and logistics divisions. From 1995 until his retirement in 2011, Mr. Janeway served as President and Chief Operating Officer of “Wakefern” providing primary oversight for the company’s financial and treasury functions, human resources, labor relations, new business development, strategic acquisitions, government relations, corporate social responsibility, sustainability initiatives and member relations. Mr. Janeway previously served as the chairman for the National Grocers Association from 1993 through 2001. From 2009 through the present, Mr. Janeway has served as the Chairman of the Foundation for the University of Medicine and Dentistry of New Jersey.

The Board of Directors determined that Mr. Janeway’s qualifications to serve as a director include his notable business and leadership experience in the all areas of management, particularly in the food industry. He also has experience in the area of whole sale wholesale distribution, due to his past position at Wakefern and his knowledge of running and managing companies and his proven track record of success in such endeavors will be invaluable to the Company going forward.

Mr. Janeway received his B.A. in Marketing from Rutgers University, and his M.B.A from Wharton School of Business, University of Pennsylvania.

Family Relationships

Mr. Matthew Brown, our President, is the son-in-law of Mr. Carl Wolf, our Chief Executive Officer.

Board Committees and Charters

Our board of directors has established the following committees: an audit committee, a compensation committee and a nominating/corporate governance committee. Copies of each committee’s charter are posted on our website, www.mamamancini’s.com. Our board of directors may from time to time establish other committees.

Audit Committee

The purpose of the Audit Committee is to oversee the processes of accounting and financial reporting of the Company and the audits and financial statements of the Company. The Audit Committee’s primary duties and responsibilities are to:

| ● | Monitor the integrity of the Company’s financial reporting process and systems of internal controls regarding finance, accounting and legal compliance. | |

| ● | Monitor the independence and performance of the Company’s independent auditors and the Company’s accounting personnel. | |

| ● | Provide an avenue of communication among the independent auditors, management, the Company’s accounting personnel, and the Board. | |

| ● | Appoint and provide oversight for the independent auditors engaged to perform the audit of the financial statements. |

| 23 |

| ● | Discuss the scope of the independent auditors’ examination. | |

| ● | Review the financial statements and the independent auditors’ report. | |

| ● | Review areas of potential significant financial risk to the Company. | |

| ● | Monitor compliance with legal and regulatory requirements. | |

| ● | Solicit recommendations from the independent auditors regarding internal controls and other matters. | |

| ● | Make recommendations to the Board. | |

| ● | Resolve any disagreements between management and the auditors regarding financial reporting. | |

| ● | Prepare the report required by Item 407(d) of Regulation S-K, as required by the rules of the Securities and Exchange Commission (the “SEC”). | |

| ● | Perform other related tasks as requested by the Board. |

The Audit Committee has the authority to conduct any investigation appropriate to fulfilling its responsibilities, and it has direct access to the independent auditors as well as anyone in the organization. The Committee has the ability to retain, at the Company’s expense, special legal, accounting, or other consultants or experts it deems necessary in the performance of its duties.

Our Audit Committee consists of Mr. Burns, Mr. Toto and Mr. Altobello. Mr. Toto serves as the Chairman of our Audit Committee. Mr. Burns is our Audit Committee financial expert as currently defined under applicable SEC rules.

Compensation Committee