Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - SECURITY FEDERAL CORP | exhibit991-123116.htm |

| 10-K - 10-K - SECURITY FEDERAL CORP | sfdl-2016x1231x10k.htm |

| EX-99.2 - EXHIBIT 99.2 - SECURITY FEDERAL CORP | exhibit992-123116.htm |

| EX-32 - EXHIBIT 32 - SECURITY FEDERAL CORP | sfdl-ex32x123116.htm |

| EX-31.2 - EXHIBIT 31.2 - SECURITY FEDERAL CORP | sfdl-ex312x123116.htm |

| EX-31.1 - EXHIBIT 31.1 - SECURITY FEDERAL CORP | sfdl-ex311x123116.htm |

| EX-23 - EXHIBIT 23 - SECURITY FEDERAL CORP | exhibit23-123116.htm |

| EX-21 - EXHIBIT 21 - SECURITY FEDERAL CORP | exhibit21-123116.htm |

Exhibit 13

Annual Report to Stockholders

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Selected Consolidated Financial and Other Data

The following table provides selected consolidated financial and operating data of Security Federal Corporation at the dates and for the periods indicated. In conjunction with the data provided in the following tables and in order to more fully understand our historical consolidated financial and operating data, you should also read our “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our Consolidated Financial Statements and the accompanying notes included in this report.

Years Ended December 31, | Nine Months Ended December 31, | |||||||||||||||||||

2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||

Balance Sheet Data at End of Period | (Dollars in Thousands, Except Per Share Data) | |||||||||||||||||||

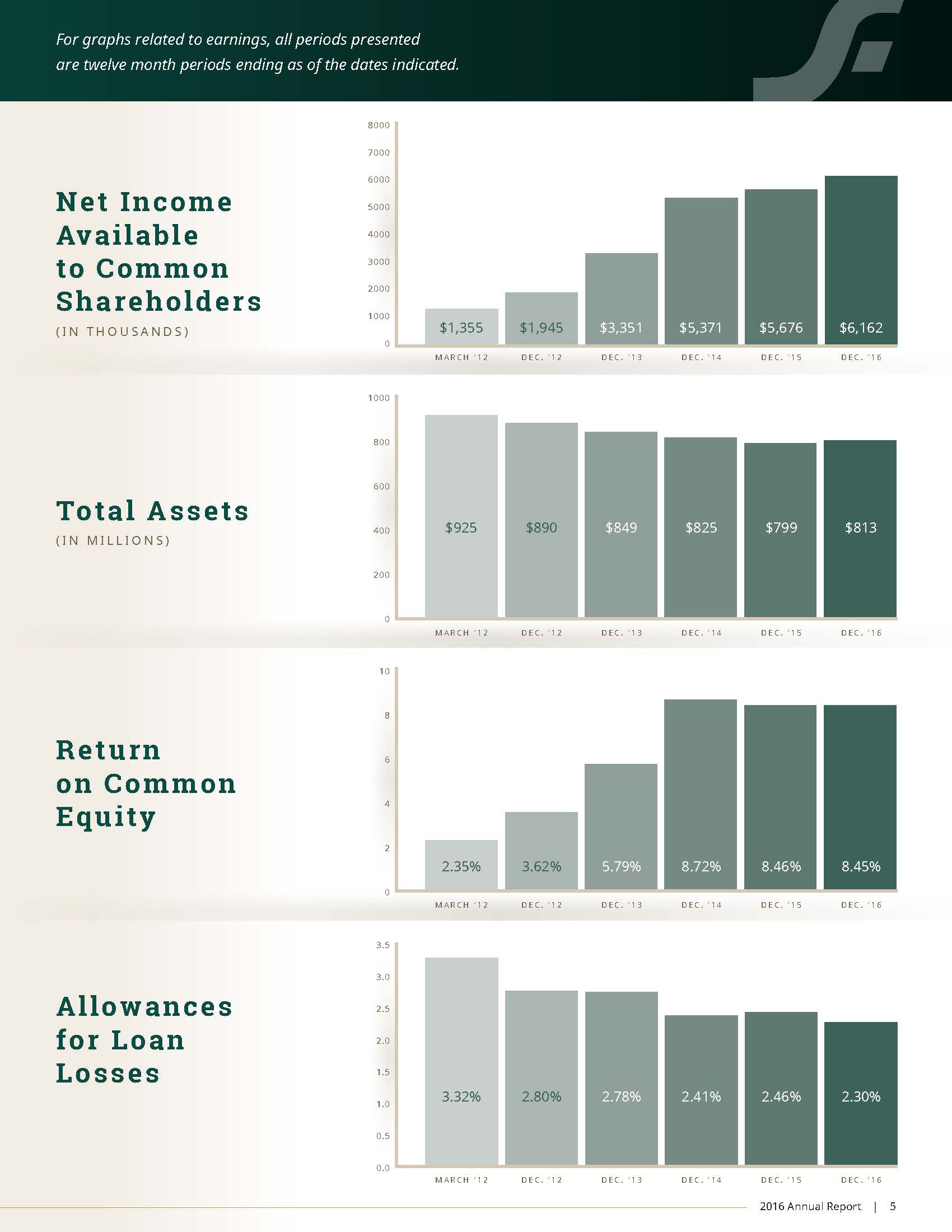

Total Assets | $ | 812,682 | $ | 799,728 | $ | 825,364 | $ | 849,248 | $ | 890,355 | ||||||||||

Cash and Cash Equivalents | 9,375 | 8,382 | 10,193 | 7,630 | 7,904 | |||||||||||||||

Certificates of Deposit With Other Banks | 2,445 | 3,445 | 2,095 | 2,100 | 1,729 | |||||||||||||||

Investment and Mortgage-Backed Securities | 387,643 | 405,387 | 429,701 | 431,003 | 430,988 | |||||||||||||||

Total Loans Receivable, Net (1) | 359,723 | 330,573 | 339,874 | 358,917 | 397,706 | |||||||||||||||

Deposits | 654,103 | 652,097 | 660,115 | 658,697 | 676,339 | |||||||||||||||

Advances From Federal Home Loan Bank | 48,395 | 34,640 | 52,900 | 87,740 | 105,257 | |||||||||||||||

Total Shareholders' Equity | 71,112 | 90,967 | 87,435 | 77,990 | 82,592 | |||||||||||||||

Income Data | ||||||||||||||||||||

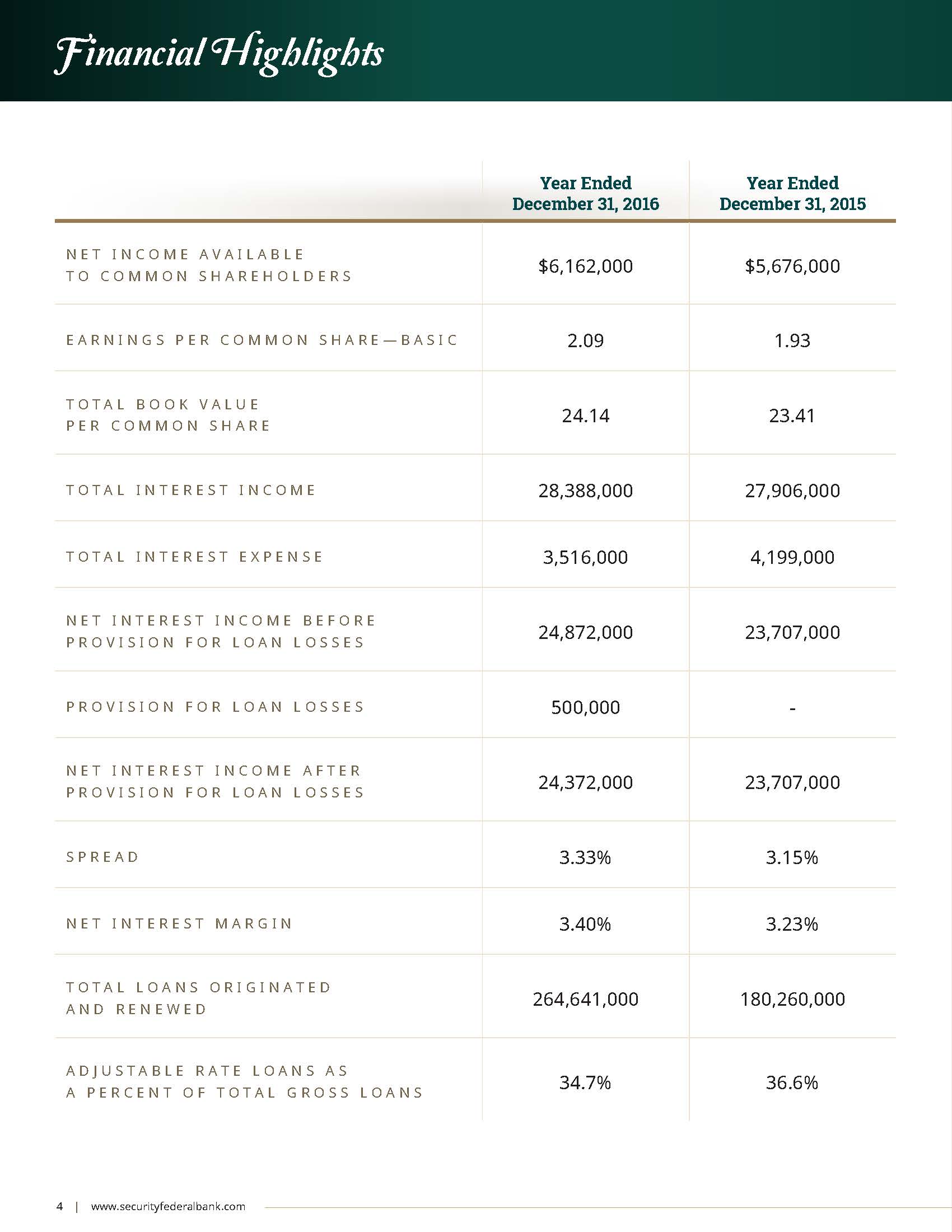

Total Interest Income | $ | 28,388 | $ | 27,906 | $ | 29,482 | $ | 30,447 | $ | 24,791 | ||||||||||

Total Interest Expense | 3,516 | 4,199 | 5,813 | 7,533 | 7,460 | |||||||||||||||

Net Interest Income | 24,872 | 23,707 | 23,669 | 22,914 | 17,331 | |||||||||||||||

Provision For Loan Losses | 500 | — | 450 | 2,645 | 1,975 | |||||||||||||||

Net Interest Income After Provision For Loan Losses | 24,372 | 23,707 | 23,219 | 20,269 | 15,356 | |||||||||||||||

Non-Interest Income | 6,401 | 7,007 | 6,163 | 6,896 | 4,365 | |||||||||||||||

Non-Interest Expense | 22,928 | 22,531 | 21,268 | 22,033 | 17,062 | |||||||||||||||

Income Taxes | 1,920 | 2,067 | 2,303 | 1,341 | 704 | |||||||||||||||

Net Income | 5,925 | 6,116 | 5,811 | 3,791 | 1,955 | |||||||||||||||

Preferred Stock Dividends | (423 | ) | (440 | ) | (440 | ) | (440 | ) | (330 | ) | ||||||||||

Gain on Redemption of Preferred Stock | 660 | — | — | — | — | |||||||||||||||

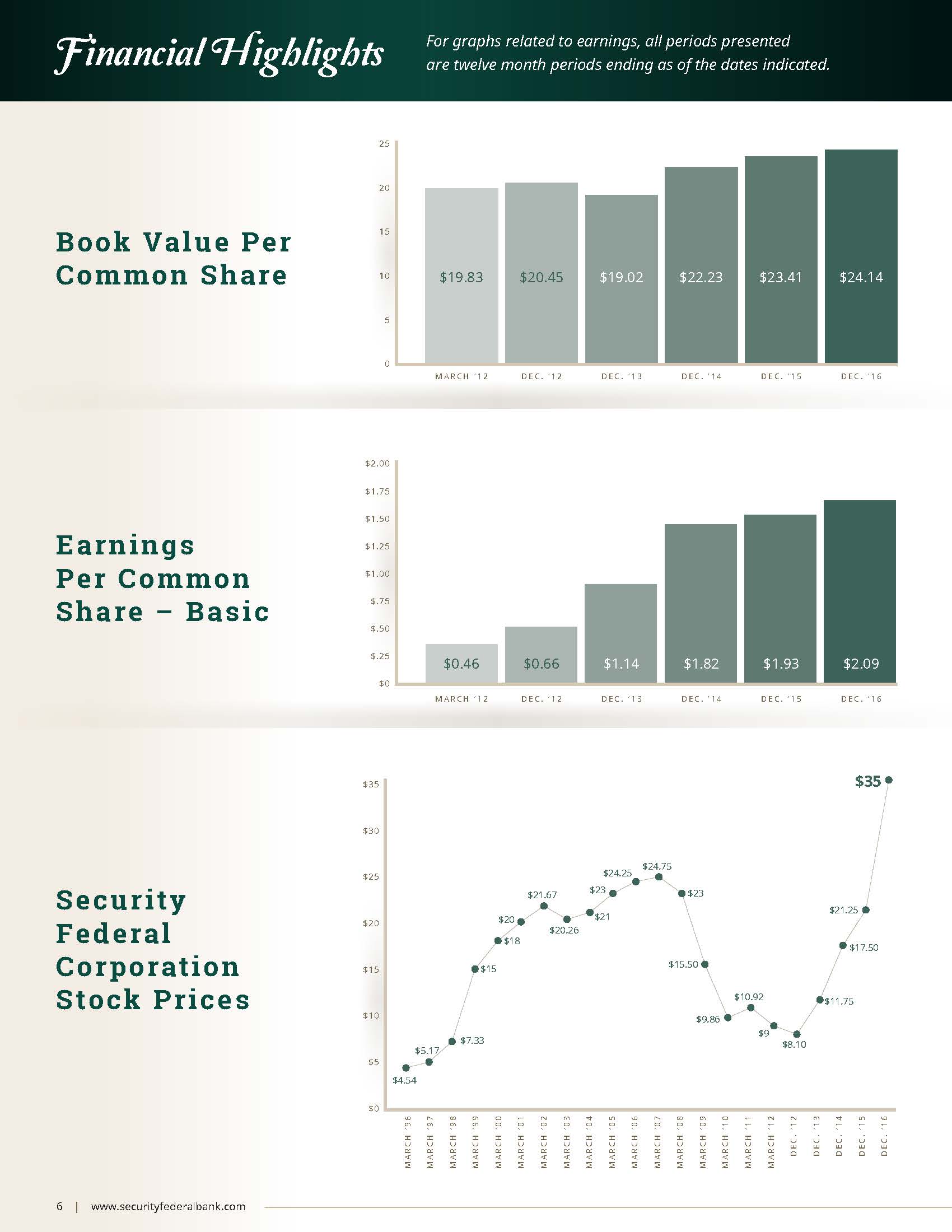

Net Income Available To Common Shareholders | $ | 6,162 | $ | 5,676 | $ | 5,371 | $ | 4,231 | $ | 2,285 | ||||||||||

Per Common Share Data | ||||||||||||||||||||

Net Income Per Common Share (Basic) | $ | 2.09 | $ | 1.93 | $ | 1.82 | $ | 1.14 | $ | 0.55 | ||||||||||

Cash Dividends | $ | 0.32 | $ | 0.32 | $ | 0.32 | $ | 0.32 | $ | 0.24 | ||||||||||

(1) INCLUDES LOANS HELD FOR SALE

7

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Selected Consolidated Financial and Other Data

Years Ended December 31, | Nine Months Ended December 31, | ||||||||||||||

2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||

Other Data | |||||||||||||||

Interest Rate Spread Information: | |||||||||||||||

Average During Period (4) | 3.33 | % | 3.15 | % | 2.98 | % | 2.81 | % | 2.70 | % | |||||

End of Period | 3.18 | % | 3.15 | % | 3.06 | % | 3.19 | % | 3.16 | % | |||||

Net Interest Margin (Net Interest Income/Average Earning Assets) (4) | 3.40 | % | 3.23 | % | 3.08 | % | 2.91 | % | 2.80 | % | |||||

Average Interest-Earning Assets to Average Interest-Bearing Liabilities | 115.08 | % | 114.60 | % | 113.01 | % | 110.71 | % | 108.08 | % | |||||

Common Equity to Total Assets | 8.75 | % | 8.62 | % | 7.93 | % | 6.59 | % | 6.81 | % | |||||

Non-Performing Assets to Total Assets (2) | 1.01 | % | 1.42 | % | 2.06 | % | 1.64 | % | 2.83 | % | |||||

Return on Assets (Net Income to Average Total Assets) (4) | 0.74 | % | 0.69 | % | 0.64 | % | 0.38 | % | 0.24 | % | |||||

Return on Common Equity (Net Income to Average Common Equity) (4) | 8.45 | % | 8.46 | % | 8.72 | % | 5.79 | % | 3.62 | % | |||||

Average Common Equity to Average Assets Ratio | 8.82 | % | 8.17 | % | 7.28 | % | 6.64 | % | 6.69 | % | |||||

Dividend Payout Ratio on Common Shares(3) | 15.16 | % | 16.61 | % | 17.54 | % | 28.11 | % | 43.48 | % | |||||

Number of Full-Service Offices | 14 | 14 | 13 | 13 | 13 | ||||||||||

(2) NON-PERFORMING ASSETS CONSIST OF NON-ACCRUAL LOANS AND OTHER REAL ESTATE OWNED ("OREO")

(3) RATIO OF DIVIDENDS PAID ON COMMON SHARES TO NET INCOME AVAILABLE TO COMMON SHAREHOLDERS

(4) ANNUALIZED FOR THE NINE MONTH TRANSITION PERIOD ENDED DECEMBER 31, 2012

8

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

General

The following discussion and analysis is presented to provide the reader with an understanding of the financial condition and the results of operations of Security Federal Corporation and its subsidiaries. The investment and other activities of the parent company, Security Federal Corporation (the “Company”), have had no significant impact on the results of operations for the periods presented in the Consolidated Financial Statements included herein. The information presented in the following discussion of financial results is indicative of the activities of Security Federal Bank (the “Bank”), a wholly owned subsidiary of the Company. The Bank was founded in 1922 as a mutual building and loan association. In 1987, the Bank converted to a federally chartered stock savings bank. On December 28, 2011, the Bank completed a charter conversion from a federally chartered stock savings bank to a South Carolina chartered commercial bank. In connection with this transaction, the Company reorganized from a savings and loan holding company into a bank holding company.

As a result of the Company's reorganization, in order to better align the financial reporting periods for the Company and the Bank with regulatory reporting periods, the Company elected to change its fiscal year end from March 31 to December 31. This change was effective for the reporting period ended December 31, 2012, and as a result, the Company filed a transition period annual report on Form 10-KT with the Securities and Exchange Commission for the nine month period ended December 31, 2012.

The Bank also has two wholly owned subsidiaries: Security Federal Insurance Inc. (“SFINS”) and Security Financial Services Corporation (“SFSC”). SFINS was formed in the fiscal year ended March 31, 2002 and began operating during the December 2001 quarter. SFINS is an insurance agency offering auto, business, health, and home insurance. SFINS has a wholly owned subsidiary, Collier Jennings Financial Corporation (“Collier Jennings”), which has three wholly owned subsidiaries: Security Federal Auto Insurance, The Auto Insurance Store Inc., and Security Federal Premium Pay Plans Inc. Security Federal Premium Pay Plans Inc. has one wholly owned premium finance subsidiary and also has an ownership interest in four other premium finance subsidiaries. SFSC was formed in 1975 and is currently inactive.

In addition to the Bank, the Company has another wholly owned subsidiary, Security Federal Statutory Trust (the “Trust”), which issued and sold fixed and floating rate capital securities of the Trust. Under current accounting guidance, however, the Trust is not consolidated in the Company’s financial statements. Unless the context indicates otherwise, references to the Company shall include the Bank and its subsidiaries.

The principal business of the Bank is accepting deposits from the general public and originating consumer and commercial business loans as well as mortgage loans that enable borrowers to purchase or refinance one-to-four family residential real estate. The Bank also originates construction loans on single-family residences, multi-family dwellings, and commercial real estate, as well as loans for the acquisition, development and construction of residential subdivisions, and commercial projects. The Bank also provides trust services and it offers property, casualty and life insurance products through its subsidiary, Security Federal Insurance Inc.

The Bank's net income depends primarily on its interest rate spread which is the difference between the average yield earned on its loan and investment portfolios and the average rate paid on its deposits and borrowings. When the rate earned on interest-earning assets equals or exceeds the rate paid on interest-bearing liabilities, this positive interest rate spread will generate net interest income. The Bank’s interest spread is influenced by interest rates, deposit flows, and loan demands. Levels of non-interest income and operating expense are also significant factors in earnings.

9

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

This document, including information included or incorporated by reference, contents, and future filings by the Company on Form 10-K, Form 10-Q, and Form 8-K, and future oral and written statements by the Company and its management may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to our financial condition, results of operations, plans, objectives, future performance or business. Forward-looking statements are not statements of historical fact, are based on certain assumptions and are generally identified by use of the words "believes," "expects," "anticipates," "estimates," "forecasts," "intends," "plans," "targets," "potentially," "probably," "projects," "outlook" or similar expressions or future or conditional verbs such as "may," "will," "should," "would" and "could." Forward-looking statements include statements with respect to our beliefs, plans, objectives, goals, expectations, assumptions and statements about, among other things, expectations of the business environment in which we operate, projections of future performance or financial items, perceived opportunities in the market, potential future credit experience, and statements regarding our mission and vision. These forward-looking statements are based upon current management expectations and may, therefore, involve risk and uncertainties. Our actual results, performance, or achievements may differ materially from those suggested, expressed, or implied by forward-looking statements as a result of a wide variety or range of factors, including, but not limited to:

• | the credit risks of lending activities, including changes in the level and trend of loan delinquencies and write-offs and changes in our allowance for loan losses and provision for loan losses that may be affected by deterioration in the housing and commercial real estate markets which may lead to increased losses and non-performing assets in our loan portfolio, and may result in our allowance for loan losses not being adequate to cover actual losses, and require us to materially increase our allowance for loan losses; |

• | changes in general economic conditions, either nationally or in our market areas; |

• | changes in the levels of general interest rates, and the relative differences between short and long term interest rates, deposit interest rates, our net interest margin and funding sources; |

• | fluctuations in the demand for loans, the number of unsold homes, land and other properties and fluctuations in real estate values in our market areas; |

• | secondary market conditions for loans and our ability to sell loans in the secondary market; |

• | results of examinations of the Company by the Board of Governors of the Federal Reserve System ("Federal Reserve") and our bank subsidiary by the Federal Deposit Insurance Corporation ("FDIC") and the South Carolina State Board of Financial Institutions, or other regulatory authorities, including the possibility that any such regulatory authority may, among other things, require us to increase our reserve for loan losses, write-down assets, change our regulatory capital position or affect our ability to borrow funds or maintain or increase deposits, or impose additional requirements or restrictions on us, any of which could adversely affect our liquidity and earnings; |

• | legislative or regulatory changes that adversely affect our business, including the effect of the Dodd-Frank Wall Street Reform and Consumer Protection Act; changes in regulatory policies and principles, or the interpretation of regulatory capital requirements or other rules, including as a result of Basel III; |

• | our ability to attract and retain deposits; |

• | increases in premiums for deposit insurance; |

• | our ability to control operating costs and expenses; |

• | our ability to implement our business strategies; |

• | the use of estimates in determining the fair value of certain of our assets, which estimates may prove to be incorrect and result in significant declines in valuation; |

• | difficulties in reducing risks associated with the loans on our balance sheet; |

• | staffing fluctuations in response to product demand or the implementation of corporate strategies that affect our workforce and potential associated charges; |

• | computer systems on which we depend could fail or experience a security breach; |

• | our ability to retain key members of our senior management team; |

• | costs and effects of litigation, including settlements and judgments; |

• | our ability to manage loan delinquency rates; |

• | increased competitive pressures among financial services companies; |

10

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

• | changes in consumer spending, borrowing and savings habits; |

• | the availability of resources to address changes in laws, rules, or regulations or to respond to regulatory actions; |

• | our ability to pay dividends on our common stock; |

• | adverse changes in the securities markets; |

• | inability of key third-party providers to perform their obligations to us; |

• | changes in accounting policies and practices, as may be adopted by the financial institution regulatory agencies or the Financial Accounting Standards Board ("FASB"), including additional guidance and interpretation on accounting issues and details of the implementation of new accounting methods; and |

• | other economic, competitive, governmental, regulatory, and technological factors affecting our operations, pricing, products and services and the other risks described elsewhere in this document. |

Some of these and other factors are discussed in our Annual Report on Form 10-K for the year ended December 31, 2016 under Item 1A, “Risk Factors.” Such developments could have an adverse impact on our financial position and our results of operations.

Any of the forward-looking statements that we make may turn out to be inaccurate as a result of our beliefs and assumptions we make in connection with the factors set forth above or because of other unidentified and unpredictable factors. Because of these and other uncertainties, our actual future results may be materially different from the results indicated by these forward-looking statements and you should not rely on such statements. The Company undertakes no obligation to publish revised forward-looking statements to reflect the occurrence of unanticipated events or circumstances after the date hereof. These risks could cause our actual results for 2017 and beyond to differ materially from those expressed in any forward-looking statements by or on behalf of us, and could negatively affect the Company’s consolidated financial condition and consolidated results of operations, liquidity and stock price performance.

Critical Accounting Policies

The Company has adopted various accounting policies which govern the application of accounting principles generally accepted in the United States in the preparation of the Company’s Consolidated Financial Statements. The significant accounting policies of the Company are described in Note 1 of the Notes to the Consolidated Financial Statements included herein.

Certain accounting policies involve significant judgments and assumptions by management, which have a material impact on the carrying value of certain assets and liabilities; management considers these accounting policies to be critical accounting policies. The judgments, estimates and assumptions used by management are based on historical experience and other factors, which are believed to be reasonable under the circumstances. Because of the nature of the judgments, estimates and assumptions made by management, actual results could differ from these judgments, estimates and assumptions, which could have a material impact on the carrying values of assets and liabilities and the results of operations of the Company.

The Company believes the allowance for loan losses is a critical accounting policy that requires the most significant judgments, estimates and assumptions used in preparation of the Consolidated Financial Statements. The impact of an unexpected large loss could deplete the allowance and potentially require increased provisions to replenish the allowance, which would negatively affect earnings. The Company provides for loan losses using the allowance method. Accordingly, all loan losses are charged to the related allowance and all recoveries are credited to the allowance for loan losses. Additions to the allowance for loan losses are provided by charges to operations based on various factors, which, in management’s judgment, deserve current recognition in estimating possible losses. Such factors considered by management include the fair value of the underlying collateral, stated guarantees by the borrower (if applicable), the borrower’s ability to repay from other economic resources, growth and composition of the loan portfolio, the relationship of the allowance for loan losses to the outstanding loans, loss experience, delinquency trends, and general economic conditions. Management evaluates the carrying value of the loan portfolio monthly and adjusts the allowance accordingly.

While management uses the best information available to make evaluations, future adjustments may be necessary if economic conditions differ substantially from the assumptions used in making these evaluations. The allowance for loan losses is subject to periodic evaluations by bank regulatory agencies that may require adjustments to the allowance based upon the information that is available at the time of their examination. For a further discussion of the Company’s estimation process and methodology related to the allowance for loan losses, see the discussion under the section entitled “Financial Condition” and “Comparison of the Years Ended December 31, 2016 and 2015-Provision for Loan Losses” included herein.

11

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

The Company values an impaired loan at the loan’s fair value if it is probable that the Company will be unable to collect all amounts due according to the contractual terms of the original loan agreement at the present value of expected cash flows, the market price of the loan, if available, or the value of the underlying collateral. Expected cash flows are required to be discounted at the loan’s effective interest rate. When the ultimate collectibility of an impaired loan’s principal is in doubt, wholly or partially, all payments received are applied to principal. Once the recorded principal balance has been reduced to zero, any additional payments received are applied to interest income to the extent that any interest has been foregone. Any additional payments received are recorded as recoveries of any amounts previously charged off. When the repayment of the loan is not in doubt, payments are applied under the contractual terms of the loan agreement first to interest and then to principal.

The Company uses assumptions and estimates in determining income taxes payable or refundable for the current year, deferred income tax liabilities and assets for events recognized differently in its financial statements and income tax returns, and income tax expense. Determining these amounts requires analysis of certain transactions and interpretation of tax laws and regulations. The Company exercises considerable judgment in evaluating the amount and timing of recognition of the resulting tax liabilities and assets. These judgments and estimates are reevaluated on a continual basis as regulatory and business factors change.

No assurance can be given that either the tax returns submitted by the Company or the income tax reported on the Consolidated Financial Statements will not be adjusted by either adverse rulings by the United States Tax Court, changes in the tax code, or assessments made by the Internal Revenue Service.

Asset and Liability Management

The objective of the Bank’s program of asset and liability management is to limit the Bank’s vulnerability to material and prolonged increases or decreases in interest rates, or "interest rate risk." The principal determinant of the exposure of the Bank's earnings to interest rate risk is the timing difference (“gap”) between the repricing or maturity of the Bank's interest-earning assets and the repricing or maturity of its interest-bearing liabilities. If the maturities of the Bank's assets and liabilities were perfectly matched and the interest rates borne by its assets and liabilities were equally flexible and moved concurrently (neither of which is the case), the impact on net interest income of any material and prolonged changes in interest rates would be minimal.

A positive gap position generally has an adverse effect on net interest income during periods of falling interest rates. A positive one-year gap position occurs when the dollar amount of rate sensitive assets maturing or repricing within one year exceeds the dollar amount of rate sensitive liabilities maturing or repricing during that same one-year period. As a result, in a period of falling interest rates, the interest received on interest-earning assets will decrease faster than the interest paid on interest-bearing liabilities, causing a decrease in net interest income. During periods of rising interest rates, the interest received on interest-earning assets will increase faster than interest paid on interest-bearing liabilities, thus increasing net interest income.

A negative gap position generally has an adverse effect on net interest income during periods of rising interest rates. A negative one-year gap position occurs when the dollar amount of rate sensitive liabilities maturing or repricing within one year exceeds the dollar amount of rate sensitive assets maturing or repricing during that same period. As a result, during periods of rising interest rates, the interest paid on interest-bearing liabilities will increase faster than interest received from interest-earning assets, thus reducing net interest income. The reverse is true in periods of declining interest rates, as discussed above, which generally results in an increase in net interest income.

At December 31, 2016 and 2015, the Bank's one-year gap position was a positive mismatch between asset and liability maturities and interest rates. At December 31, 2016, assets repricing exceeded liabilities repricing within one year by $47.2 million or 6.2% of total interest earning assets. At December 31, 2015, assets repricing exceeded liabilities repricing within one year by $36.6 million or 4.9% of total interest earning assets. For more information on the Bank’s repricing position at December 31, 2016, see the tables on pages 14 and 15.

During the year ended December 31, 2016, Bank originated $19.9 million in adjustable rate residential real estate loans (“ARMs”) for investment purposes. The Bank’s loan portfolio included $129.1 million of adjustable rate consumer loans, commercial loans, and mortgage loans or 34.7% of total loans at December 31, 2016.

12

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

During the year ended December 31, 2016, the Bank originated $209.4 million in new and renewed consumer and commercial loans, which are usually short term in nature. The Bank's portfolio of consumer and commercial loans was $289.5 million at December 31, 2016, $263.0 million at December 31, 2015, and $270.5 million at December 31, 2014. Consumer and commercial loans combined were 77.9%, 76.9% and 77.4% of total loans at December 31, 2016, 2015 and 2014, respectively.

At December 31, 2016, the Bank held approximately $13.1 million in longer term fixed rate residential mortgage loans. Typically, long term, newly originated fixed rate mortgage loans are not retained in the portfolio but are sold immediately in contrast to ARMs, which are typically retained in the portfolio.

Fixed rate residential loans sold to institutional investors, on a service-released basis totaled $35.4 million during the year ended December 31, 2016, $24.2 million during the year ended December 31, 2015 and $23.6 million during the year ended December 31, 2014. The Bank sells all its fixed rate mortgage loans on a service-released basis.

Certificates of deposit of $100,000 or more, referred to as “Jumbo Certificates,” are normally considered to be interest rate sensitive because of their relatively short maturities. At December 31, 2016, the Bank had $119.2 million outstanding in Jumbo Certificates compared to $132.0 million at December 31, 2015. Brokered deposits totaled $40.3 million at December 31, 2016 compared to $42.5 million at December 31, 2015. The majority of the Bank’s deposits are originated within the Bank’s immediate market area.

The following table sets forth the maturity schedule of certificates of deposit with balances of $100,000 or greater at December 31, 2016:

(In Thousands) | |||

Within 3 Months | $ | 18,075 | |

After 3 Months, Within 6 Months | 17,720 | ||

After 6 Months, Within 12 Months | 29,897 | ||

After 12 Months | 53,539 | ||

$ | 119,231 | ||

13

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

The following table sets forth the Bank’s interest-bearing liabilities and interest-earning assets repricing or maturing within one year. The table on the following page presents the Bank's entire interest-bearing liabilities and interest-earning assets into repricing or maturity time periods. Both tables present adjustable rate loans in the periods they are scheduled to reprice and fixed rate loans are shown in the time frame of corresponding principal amortization schedules. Adjustable and fixed rate loans are also adjusted for the Company’s estimates of pre-payments. Mortgage-backed securities are shown at repricing dates, but also include prepayment estimates. Both tables also assume that investments reprice at the earlier of maturity; the likely call date, if any, based on current interest rates; or the next scheduled interest rate change, if any. NOW accounts are assumed to have a decay rate of 20% the first year, money market accounts are assumed to have a decay rate of 65% the first year, and statement savings accounts are assumed to have a decay rate of 20% the first year. The balance, for all three products, is deemed to reprice in the one to three year category. Callable fixed rate Federal Home Loan Bank (“FHLB”) advances are included in borrowings, and are deemed to mature at the expected call date or maturity, based on the stated interest rate of the advance and current market rates. Junior subordinated debentures are shown at their repricing date or call date.

At December 31, | |||||||

(Dollars in thousands) | 2016 | 2015 | |||||

Interest Rate Sensitive Assets Repricing Within 1 Year | |||||||

Loans (1) | $ | 192,003 | $ | 188,160 | |||

Mortgage-Backed Securities: | |||||||

Available For Sale, at Fair Value | 111,659 | 94,426 | |||||

Held To Maturity, at Cost | 5,312 | 2,936 | |||||

Investment Securities: | |||||||

Available For Sale, at Fair Value | 86,246 | 90,154 | |||||

Other Interest-Earning Assets and FHLB Stock | 4,050 | 4,800 | |||||

Total Interest Rate Sensitive Assets Repricing Within 1 Year | $ | 399,270 | $ | 380,476 | |||

Interest Rate Sensitive Liabilities Repricing Within 1 Year | |||||||

Deposits | 309,203 | 315,571 | |||||

FHLB Advances and Other Borrowed Money | 42,888 | 28,307 | |||||

Total Interest Rate Sensitive Liabilities Repricing Within 1 Year | $ | 352,091 | $ | 343,878 | |||

Gap | $ | 47,179 | $ | 36,598 | |||

Interest Rate Sensitive Assets/Interest Rate Sensitive Liabilities | 113.4 | % | 110.6 | % | |||

Gap as a Percent of Total Interest-Earning Assets | 6.2 | % | 4.9 | % | |||

(1) | LOANS ARE NET OF UNDISBURSED FUNDS AND LOANS IN PROCESS. |

14

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

The following table sets forth the interest rate sensitivity of the Bank's assets and liabilities at December 31, 2016, on the basis of the factors and assumptions set forth in the table on the previous page.

(Dollars in thousands) | 3 Months or Less | Over 3 – 12 Months | Over 1 – 3 Years | Over 3 – 5 Years | Over 5 – 10 Years | Over 10 Years | Total | ||||||||||||||||||||

Interest-Earnings Assets | |||||||||||||||||||||||||||

Loans (1) | $ | 98,600 | $ | 93,403 | $ | 98,463 | $ | 51,724 | $ | 21,038 | $ | 5,017 | $ | 368,245 | |||||||||||||

Mortgage-Backed Securities: | |||||||||||||||||||||||||||

Held To Maturity, at Cost | 1,302 | 4,010 | 7,959 | 3,835 | 5,843 | 2,634 | 25,583 | ||||||||||||||||||||

Available For Sale, at Fair Value | 92,517 | 19,141 | 13,253 | 14,439 | 15,551 | 30,360 | 185,261 | ||||||||||||||||||||

Investment Securities: | |||||||||||||||||||||||||||

Available For Sale, at Fair Value | 84,286 | 1,961 | 4,196 | 4,697 | 69,229 | 12,430 | 176,799 | ||||||||||||||||||||

FHLB Stock, at Cost | — | 2,776 | — | — | — | — | 2,776 | ||||||||||||||||||||

Other Interest-Earning Assets | 179 | 1,095 | 1,350 | — | — | — | 2,624 | ||||||||||||||||||||

Total Interest-Earning Assets | $ | 276,884 | $ | 122,386 | $ | 125,221 | $ | 74,695 | $ | 111,661 | $ | 50,441 | $ | 761,288 | |||||||||||||

Interest-Bearing Liabilities | |||||||||||||||||||||||||||

Deposit Accounts: | |||||||||||||||||||||||||||

Certificates | $ | 39,248 | $ | 92,237 | $ | 55,844 | $ | 28,216 | $ | — | $ | — | $ | 215,545 | |||||||||||||

NOW | 5,082 | 15,246 | 81,310 | — | — | — | 101,638 | ||||||||||||||||||||

Money Markets | 36,944 | 113,142 | 80,816 | — | — | — | 230,902 | ||||||||||||||||||||

Statement Savings | 1,826 | 5,478 | 29,218 | — | — | — | 36,522 | ||||||||||||||||||||

Borrowings (2) | 32,888 | 10,000 | 30,000 | 3,000 | — | 6,084 | 81,972 | ||||||||||||||||||||

Total Interest-Bearing Liabilities | $ | 115,988 | $ | 236,103 | $ | 277,188 | $ | 31,216 | $ | — | $ | 6,084 | $ | 666,579 | |||||||||||||

Current Period Gap | $ | 160,896 | $ | (113,717 | ) | $ | (151,967 | ) | $ | 43,479 | $ | 111,661 | $ | 44,357 | $ | 94,709 | |||||||||||

Cumulative Gap | $ | 160,896 | $ | 47,179 | $ | (104,788 | ) | $ | (61,309 | ) | $ | 50,352 | $ | 94,709 | $ | 94,709 | |||||||||||

Cumulative Gap as a Percent of Total Interest-Earning Assets | 21.1 | % | 6.2 | % | (13.8 | )% | (8.1 | )% | 6.6 | % | 12.4 | % | 12.4 | % | |||||||||||||

(1) | LOANS INCLUDE LOANS HELD FOR SALE AND ARE NET OF UNDISBURSED FUNDS AND LOANS IN PROCESS. |

(2) | CALLABLE SECURITIES AND FHLB ADVANCES ARE SHOWN AT THEIR LIKELY CALL DATES BASED ON MANAGEMENT’S ESTIMATES AT DECEMBER 31, 2016. |

In evaluating the Bank's exposure to interest rate risk, certain shortcomings inherent in the method of analysis presented in the tables above are considered. For example, although certain assets and liabilities may have similar maturities or periods of repricing, they may react in different degrees to changes in market interest rates. Additionally, the interest rates of certain types of assets and liabilities may fluctuate in advance of changes in market interest rates. Loan repayment rates and withdrawals of deposits will likely differ substantially from the assumed rates previously set forth in the event of significant changes in interest rates due to the option of borrowers to prepay their loans and the ability of depositors to withdraw funds prior to maturity. Further, certain assets, such as ARMs, have features that restrict changes in interest rates on a short-term basis as well as over the life of the asset.

15

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

Financial Condition - Assets

Total assets increased $13.0 million or 1.6% to $812.7 million at December 31, 2016 from $799.7 million at December 31, 2015. This increase was primarily due to an increase in net loans receivable, which was partially offset by a decrease in investment and mortgage-backed securities.

Cash and cash equivalents increased $1.0 million or 11.8% to $9.4 million at December 31, 2016 compared to $8.4 million at December 31, 2015. Total investments and mortgage-backed securities decreased $17.7 million or 4.4% to $387.6 million at December 31, 2016 from $405.4 million at December 31, 2015. This decrease was due to the sale of 42 available for sale investment securities during the year ended December 31, 2016.

Total net loans receivable increased $29.2 million or 8.8% to $359.7 million at December 31, 2016 from $330.6 million at December 31, 2015 as a result of increases in all loan categories. Residential real estate loans held for investment increased $1.6 million or 2.1% to $78.0 million at December 31, 2016 from $76.4 million at December 31, 2015. Typically, long term, newly originated fixed rate mortgage loans are not retained in the portfolio but are sold immediately in contrast to ARMs, which are typically retained in the portfolio. At December 31, 2016, the Bank held 78.9% of its residential mortgage loans in ARMs and 21.1% in fixed rate residential mortgage loans. Consumer loans increased $288,000 or 0.6% to $50.7 million at December 31, 2016 from $50.4 million at December 31, 2015. Commercial business loans increased $3.8 million or 30.1% to $16.3 million at December 31, 2016 from $12.5 million at December 31, 2015 while commercial real estate loans increased $22.5 million or 11.3% to $222.6 million at December 31, 2016 from $200.1 million at December 31, 2015. Loans held for sale, which were $4.2 million at December 31, 2016, increased $1.8 million or 72.3% from $2.5 million at December 31, 2015.

Premises and equipment increased $1.1 million or 5.4% to $21.2 million at December 31, 2016 compared to $20.1 million at December 31, 2015. The increase is primarily due to additions to construction in progress related to the construction of the Bank's newest full-service branch in Evans, Georgia, which is scheduled to open in 2017.

In July 2006, the Company acquired Collier Jennings Financial Corporation, an insurance agency specializing in consumer automobile insurance and premium financing. The resulting goodwill from the acquisition was $1.2 million at December 31, 2016 and 2015 with no other intangibles recorded at those dates. Collier Jennings now operates as a subsidiary of Security Federal Insurance Inc., a subsidiary of the Bank.

The cash value of Bank Owned Life Insurance (“BOLI”) increased $528,000 or 3.2% to $17.1 million at December 31, 2016 from $16.6 million at December 31, 2015. The increase was entirely related to accrued interest credited to the cash surrender value underlying the Company's existing BOLI policies. There were no new policies purchased and no redemptions of BOLI during the year ended December 31, 2016. BOLI, which earns tax-free yields, is utilized to partially offset the cost of the Company’s employee benefits programs and to provide key person insurance on certain officers of the Company.

FHLB stock increased $562,000 or 25.4% to $2.8 million at December 31, 2016 compared to $2.2 million at December 31, 2015. The Bank, as a member of the FHLB of Atlanta, is required to acquire and hold shares of capital stock in the FHLB of Atlanta in an amount equal to a membership component, which is 0.09% of total assets plus a transaction component which equals 4.25% of outstanding advances (borrowings) from the FHLB of Atlanta. As our total assets and total advances have increased, so has the Bank’s required investment in FHLB stock.

Other assets increased $998,000 or 22.4% to $5.4 million at December 31, 2016 compared to $4.4 million at December 31, 2015 primarily due to a $1.4 million increase in net deferred tax assets, which was partially offset by a decrease of $420,000 in principal payments receivable from investment securities. The net unrealized gain on investment securities available for sale decreased $4.8 million during the year ended December 31, 2016 as a result of an increase in market rates. The majority of the increase in net deferred tax assets represents the tax impact of this change.

16

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

Financial Condition - Non-Performing Assets

The Company’s non-performing assets decreased $3.2 million or 27.7% to $8.2 million at December 31, 2016 from $11.4 million at December 31, 2015. The following table summarizes our non-performing assets for the periods indicated:

At December 31, 2016 | At December 31, 2015 | $ | % | ||||||||||||||||

Amount | Percent (1) | Amount | Percent (1) | Decrease | Decrease | ||||||||||||||

Loans 90 Days or More Past Due or Non-Accrual Loans: | |||||||||||||||||||

Residential Real Estate | $ | 2,488,158 | 0.7% | $ | 3,306,675 | 1.0% | $ | (818,517 | ) | (24.8 | )% | ||||||||

Commercial Business | 145,401 | — | 178,076 | 0.1 | (32,675 | ) | (18.3 | ) | |||||||||||

Commercial Real Estate | 2,639,837 | 0.7 | 2,973,135 | 0.8 | (333,298 | ) | (11.2 | ) | |||||||||||

Consumer | 241,571 | 0.1 | 575,866 | 0.2 | (334,295 | ) | (58.1 | ) | |||||||||||

Total Non-Performing Loans | 5,514,967 | 1.5% | 7,033,752 | 2.1% | (1,518,785 | ) | (21.6 | )% | |||||||||||

Other Non-Performing Assets: | |||||||||||||||||||

OREO | 2,721,214 | 0.8% | 4,361,411 | 1.3 | (1,640,197 | ) | (37.6 | ) | |||||||||||

Total Other Non-Performing Assets | 2,721,214 | 0.8% | 4,361,411 | 1.3% | (1,640,197 | ) | (37.6 | )% | |||||||||||

Total Non-Performing Assets | $ | 8,236,181 | 2.3% | $ | 11,395,163 | 3.4% | $ | (3,158,982 | ) | (27.7 | )% | ||||||||

Total Non-Performing Assets as a Percentage of Total Assets | 1.0 | % | 1.4 | % | |||||||||||||||

(1) PERCENT OF GROSS LOANS RECEIVABLE HELD FOR INVESTMENT, NET OF DEFERRED FEES AND LOANS IN PROCESS

The largest decrease in non-performing loans was in the residential real estate loan category, which decreased $819,000 or 24.8% to $2.5 million at December 31, 2016 from $3.3 million at December 31, 2015. Non-performing residential real estate loans at December 31, 2016 consisted of 17 loans to 17 borrowers with an average loan balance of $146,000, the largest of which was $352,000. At December 31, 2015, non-performing residential real estate loans consisted of 24 loans to 24 borrowers with an average loan balance of $138,000, the largest of which was $386,000.

Non-performing commercial real estate loans decreased $333,000 or 11.2% to $2.6 million at December 31, 2016 from $3.0 million at December 31, 2015. The balance in non-performing commercial real estate loans at December 31, 2016 consisted of 20 loans to 17 borrowers with an average loan balance of $132,000 compared to 17 loans to 14 borrowers with an average balance of $175,000 at December 31, 2015. Of the non-performing commercial real estate loans at December 31, 2016, $1.7 million consisted of 11 loans secured by commercial buildings or first mortgages on principal residences throughout the Bank's market area to 9 different borrowers. These loans, even though secured by principal residences, are considered commercial real estate because they were business purpose loans. The remaining non-performing commercial real estate loans at December 31, 2016 consisted of $335,000 for two loans secured by builder lots to two borrowers; $233,000 for six loans secured by raw land to six separate borrowers; and $406,000 for one loan secured by a church building . At December 31, 2016, our largest non-performing commercial real estate loan had a balance of $557,000 and was secured by a commercial building.

OREO decreased $1.6 million or 37.6% to $2.7 million at December 31, 2016 from $4.4 million at December 31, 2015. At December 31, 2016, the balance of OREO consisted of the following real estate properties: nine single-family residences and 22 lots within residential subdivisions located throughout our market area in South Carolina and Georgia; eight lots within a subdivision and the adjacent 22.96 acres of land in Aiken, South Carolina; four parcels of commercial land and two commercial buildings in Aiken, South Carolina.

The Bank reviews its loan portfolio and allowance for loan losses on a monthly basis. Future additions to the Bank's allowance for loan losses are dependent on, among other things, the performance of the Bank's loan portfolio, the economy, changes in real estate values, and interest rates. There can be no assurance that additions to the allowance will not be required in future periods. The determination of the appropriate level of the allowance for loan losses inherently involves a high degree of subjectivity and requires us to make significant estimates of current credit risks and future trends, all of which may undergo material changes.

17

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

Continuing deterioration in economic conditions affecting borrowers, new information regarding existing loans, identification of additional problem loans and other factors, both within and outside of our control, may require an increase in the allowance for loan losses. In addition, bank regulatory agencies periodically review our allowance for loan losses and may require an increase in the provision for possible loan losses or the recognition of further loan charge-offs, based on judgments different than those of management. In addition, if charge-offs in future periods exceed the allowance for loan losses, we will need additional provisions to increase the allowance for loan losses. Any increases in the allowance for loan losses will result in a decrease in net income and, possibly, capital, and may have a material adverse effect on our financial condition and results of operations. Management continually monitors its loan portfolio for the impact of local economic changes. The ratio of the allowance for loan losses to total loans was 2.30% and 2.46% at December 31, 2016 and 2015, respectively. The Bank closely monitors its past due loans.

The cumulative interest not accrued during the years ended December 31, 2016 and 2015 relating to all non-performing loans totaled $687,000 and $679,000, respectively. Our strategy is to work with our borrowers to reach acceptable payment plans while protecting our interests in the underlying collateral. In the event an acceptable arrangement cannot be reached, we may have to acquire these properties through foreclosure or other means and subsequently sell, develop, or liquidate them.

The balance of loans in troubled debt restructurings (“TDRs”) decreased $2.1 million or 31.6% during the year ended December 31, 2016. The Bank had 12 TDRs totaling $4.6 million at December 31, 2016 compared to 16 TDRs totaling $6.7 million at December 31, 2015. The 12 TDRs consisted of one consumer loan secured by a first mortgage on a residential dwelling and two automobiles totaling $60,000; one unsecured consumer loan with a balance of $21,000; and 10 commercial real estate loans to 9 separate borrowers, the largest of which had a balance of $2.5 million at December 31, 2016. The commercial real estate loans were secured primarily by first mortgages on one single family residence, two lots, one commercial building, one hotel, three churches and three parcels of land. At December 31, 2016, six of the TDRs totaling $1.3 million were non-accruing. All TDRs are reviewed for impairment loss. At December 31, 2016, the Bank had $8.3 million of impaired loans, including $4.6 million in TDRs, compared to $12.6 million of impaired loans, including $6.7 million in TDRs, at December 31, 2015.

Financial Condition - Liabilities

Deposits at the Bank increased $2.0 million or 0.3% to $654.1 million at December 31, 2016 from $652.1 million at December 31, 2015. The Bank had brokered time deposits of $40.3 million and $42.5 million at December 31, 2016 and 2015, respectively. The Bank uses brokered time deposits to manage interest rate risk because they are accessible in bulk at rates typically only slightly higher than those in our market areas. In addition, a portion of these brokered time deposits give the Bank a call option that allows the Bank the choice to redeem them early should rates change. Total deposits at December 31, 2016, excluding brokered time deposits, increased $4.2 million or 0.7% to $613.8 million from $609.6 million at December 31, 2015. Brokered time deposits were 6.2% of total deposits at December 31, 2016 and 6.5% of total deposits at December 31, 2015.

Advances from the FHLB increased $13.8 million or 39.7% to $48.4 million at December 31, 2016 from $34.6 million at December 31, 2015 due to an increase in loan demand from customers and the construction of our newest branch in Evans, Georgia. During the years ended December 31, 2016 and 2015, as part of the Company's strategy to lower its cost of funds, management elected to prepay $17.9 million and $15.0 million, respectively, in higher rate FHLB advances.

Other borrowed money increased $2.9 million or 45.6% to $9.3 million at December 31, 2016 from $6.4 million at December 31, 2015. These borrowings consist of short-term repurchase agreements with certain commercial demand deposit customers for sweep accounts. The repurchase agreements typically mature within one to three days and the interest rate paid on these borrowings floats monthly with money market type rates. At both December 31, 2016 and 2015, the interest rate paid on the repurchase agreements was 0.15%.

In September 2006, Security Federal Statutory Trust issued and sold capital securities of the Trust (the “Capital Securities”). The Trust used the net proceeds from the sale of the Capital Securities to purchase a like amount of junior subordinated debentures (the “Debentures”) of the Company which are reported on the Consolidated Balance Sheet as junior subordinated debentures. The Capital Securities accrue and pay distributions at a floating rate of three month LIBOR plus 170 basis points annually which was equal to 2.66% at December 31, 2016. The distribution rate payable on the Capital Securities is cumulative and payable quarterly in arrears. The Capital Securities mature or are mandatorily redeemable upon maturity on December 15, 2036, or upon earlier optional redemption as provided in the indenture. The Company has the right to redeem the Capital Securities in whole or in part.

18

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

In December 2009, the Company issued $6.1 million in convertible senior debentures. The debentures mature on December 1, 2029 and accrue interest at the rate of 8.0% per annum until maturity or earlier redemption or repayment. The debentures are convertible into the Company’s common stock at a conversion price of $20 per share at the option of the holder at any time prior to maturity. The debentures are redeemable, in whole or in part, at the option of the Company at any time on or after December 1, 2019, at a price equal to 100% of the principal amount of the debentures to be purchased plus any accrued and unpaid interest to, but excluding, the date of redemption.

In October 2016, the Company obtained a $14.0 million term loan from another financial institution. The Company used the net proceeds from the loan for the sole purpose of financing a portion of the Company's redemption of its Series B Fixed Rate Cumulative Perpetual Preferred Stock ("Series B Preferred Stock"). The loan accrues and pays interest quarterly at a floating rate of the Wall Street Journal Prime index minus 30 basis points, which was equal to 3.45% at December 31, 2016. The note matures on October 1, 2019 and had a remaining principal balance of $13.0 million at December 31, 2016.

Total shareholders' equity was $71.1 million at December 31, 2016, a decrease of $19.9 million or 21.8% from $91.0 million at December 31, 2015. The majority of the decrease relates to the Company's redemption of its 22,000 shares of Series B Preferred Stock for a repurchase amount of $21.3 million plus accrued but unpaid interest of $93,000 for a total payment amount of $21.4 million. In connection with this transaction, the Company received a one time preferred stock redemption discount of $660,000 which was added to net income for the year ended December 31, 2016. The Company paid preferred stock dividends of $423,000, which partially offset the redemption discount, resulting in net income available to common shareholders of $6.2 million for the year ended December 31, 2016. Other changes in shareholders’ equity during the period included a net decrease in other comprehensive income of $3.1 million, representing the unrecognized gain in value of investment and mortgage-backed securities, and $943,000 in dividends paid to common shareholders.

19

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

Results of Operations

The following table presents the dollar amount of changes in interest income and interest expense for major components of interest-earning assets and interest-bearing liabilities. The table also distinguishes between the changes related to higher or lower outstanding balances and the changes related to the volatility of interest rates. For each category of interest-earning assets and interest-bearing liabilities, information is provided on changes attributable to: (1) changes in rate (multiplied by prior year volume); (2) changes in volume (multiplied by prior year rate); and (3) net change (the sum of the prior columns). For purposes of this table, changes attributable to both rate and volume, which cannot be segregated, have been allocated proportionately to the change attributable to volume and the change attributable to rate. Changes in income are calculated on a tax equivalent basis using a 34% federal income tax rate.

Year Ended December 31, 2016 Compared to Year Ended December 31, 2015 | Year Ended December 31, 2015 Compared to Year Ended December 31, 2014 | |||||||||||||||||||||||

Volume | Rate | Net | Volume | Rate | Net | |||||||||||||||||||

(In Thousands) | ||||||||||||||||||||||||

Interest-Earning Assets: | ||||||||||||||||||||||||

Loans: (1) | ||||||||||||||||||||||||

Mortgage Loans | $ | 59 | $ | 37 | $ | 96 | $ | (133 | ) | $ | 70 | $ | (63 | ) | ||||||||||

Other Loans | 927 | (228 | ) | 699 | (1,247 | ) | 321 | (926 | ) | |||||||||||||||

Total Loans | 986 | (191 | ) | 795 | (1,380 | ) | 391 | (989 | ) | |||||||||||||||

Mortgage-Backed Securities (2) | (163 | ) | (219 | ) | (382 | ) | (567 | ) | (197 | ) | (764 | ) | ||||||||||||

Investments (2)(3) | (256 | ) | 348 | 92 | 362 | (19 | ) | 343 | ||||||||||||||||

Other Interest-Earning Assets | — | 14 | 14 | 3 | (6 | ) | (3 | ) | ||||||||||||||||

Total Interest-Earning Assets | $ | 567 | $ | (48 | ) | $ | 519 | $ | (1,582 | ) | $ | 169 | $ | (1,413 | ) | |||||||||

Interest-Bearing Liabilities: | ||||||||||||||||||||||||

Deposits: | ||||||||||||||||||||||||

Certificate Accounts | $ | (134 | ) | $ | (24 | ) | $ | (158 | ) | $ | (76 | ) | $ | (102 | ) | $ | (178 | ) | ||||||

NOW Accounts | (4 | ) | — | (4 | ) | 4 | (31 | ) | (27 | ) | ||||||||||||||

Money Market Accounts | (2 | ) | — | (2 | ) | (4 | ) | (107 | ) | (111 | ) | |||||||||||||

Savings Accounts | 4 | — | 4 | 3 | — | 3 | ||||||||||||||||||

Total Deposits | (136 | ) | (24 | ) | (160 | ) | (73 | ) | (240 | ) | (313 | ) | ||||||||||||

Borrowings | 201 | (725 | ) | (524 | ) | (1,159 | ) | (141 | ) | (1,300 | ) | |||||||||||||

Total Interest-Bearing Liabilities | 65 | (749 | ) | (684 | ) | (1,232 | ) | (381 | ) | (1,613 | ) | |||||||||||||

Effect on Net Interest Income | $ | 502 | $ | 701 | $ | 1,203 | $ | (350 | ) | $ | 550 | $ | 200 | |||||||||||

(1) INTEREST ON NON-ACCRUAL LOANS IS NOT INCLUDED IN INCOME, ALTHOUGH THEIR LOAN BALANCES ARE INCLUDED IN AVERAGE LOANS OUTSTANDING.

(2) | SECURITIES AVAILABLE FOR SALE ARE COMPUTED USING THEIR HISTORICAL COST. |

(3) | TAX EQUIVALENT BASIS RECOGNIZES THE INCOME TAX SAVINGS WHEN COMPARING TAXABLE AND TAX-EXEMPT ASSETS AND WAS CALCULATED USING AN EFFECTIVE TAX RATE OF 34%. THE TAX-EQUIVALENT ADJUSTMENT RELATES TO THE TAX EXEMPT MUNICIPAL BONDS AND WAS $700,573 AND $663,419 FOR THE YEARS ENDED DECEMBER 31, 2016 AND 2015, RESPECTIVELY. |

20

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

The following tables present the total dollar amount of interest income on a tax equivalent basis from average interest-earning assets for the periods indicated and the resultant yields, as well as the interest expense on average interest-bearing liabilities expressed both in dollars and rates.

For The Year Ended December 31, | |||||||||||||||||||||||

Yield/ Rate at | 2016 | 2015 | |||||||||||||||||||||

December 31, 2016 | Average Balance | Interest | Annualized Yield/Rate | Average Balance | Interest | Annualized Yield/Rate | |||||||||||||||||

(Dollars In Thousands) | |||||||||||||||||||||||

Interest-Earning Assets: | |||||||||||||||||||||||

Mortgage Loans | 4.49% | $ | 76,231 | $ | 3,393 | 4.45 | % | $ | 74,903 | $ | 3,297 | 4.40 | % | ||||||||||

Other Loans | 5.44% | 268,134 | 15,830 | 5.90 | % | 252,624 | 15,131 | 5.99 | % | ||||||||||||||

Total Loans (1) | 5.24% | 344,365 | 19,223 | 5.58 | % | 327,527 | 18,428 | 5.63 | % | ||||||||||||||

Mortgage-Backed Securities(2) | 2.26% | 218,242 | 4,891 | 2.24 | % | 225,440 | 5,273 | 2.34 | % | ||||||||||||||

Investments (2) (3) | 2.58% | 186,114 | 4,952 | 2.66 | % | 196,268 | 4,860 | 2.48 | % | ||||||||||||||

Other Interest-Earning Assets | 0.80% | 4,071 | 22 | 0.54 | % | 4,103 | 8 | 0.19 | % | ||||||||||||||

Total Interest-Earning Assets | 3.74% | $ | 752,792 | $ | 29,088 | 3.86 | % | $ | 753,338 | $ | 28,569 | 3.79 | % | ||||||||||

Interest-Bearing Liabilities: | |||||||||||||||||||||||

Certificate Accounts | 0.76% | $ | 227,415 | $ | 1,654 | 0.73 | % | $ | 246,422 | $ | 1,812 | 0.74 | % | ||||||||||

NOW Accounts | 0.05% | 95,792 | 34 | 0.04 | % | 91,575 | 38 | 0.04 | % | ||||||||||||||

Money Market Accounts | 0.18% | 232,727 | 390 | 0.17 | % | 231,720 | 392 | 0.17 | % | ||||||||||||||

Savings Accounts | 0.10% | 34,437 | 34 | 0.10 | % | 30,362 | 30 | 0.10 | % | ||||||||||||||

Total Interest-Bearing Deposits | 0.36% | 590,371 | 2,112 | 0.36 | % | 600,079 | 2,272 | 0.38 | % | ||||||||||||||

Other Borrowings | 0.15% | 9,318 | 17 | 0.18 | % | 8,560 | 16 | 0.19 | % | ||||||||||||||

Note Payable | 3.45% | 2,369 | 77 | 3.25 | % | — | — | — | % | ||||||||||||||

Junior Subordinated Debt | 2.66% | 5,155 | 125 | 2.42 | % | 5,155 | 104 | 2.02 | % | ||||||||||||||

Senior Convertible Debt | 8.00% | 6,084 | 487 | 8.00 | % | 6,084 | 487 | 8.00 | % | ||||||||||||||

FHLB Advances | 1.05% | 40,848 | 698 | 1.71 | % | 37,484 | 1,321 | 3.52 | % | ||||||||||||||

Total Interest-Bearing Liabilities | 0.56% | $ | 654,145 | $ | 3,516 | 0.54 | % | $ | 657,362 | $ | 4,200 | 0.64 | % | ||||||||||

Net Interest Income | $ | 25,572 | $ | 24,369 | |||||||||||||||||||

Interest Rate Spread | 3.18% | 3.33 | % | 3.15 | % | ||||||||||||||||||

Net Yield on Earning Assets (Net Interest Margin) | 3.40 | % | 3.23 | % | |||||||||||||||||||

(1) INTEREST ON NON-ACCRUAL LOANS IS NOT INCLUDED IN INCOME, ALTHOUGH THEIR LOAN BALANCES ARE INCLUDED IN AVERAGE LOANS OUTSTANDING.

(2) | SECURITIES AVAILABLE FOR SALE ARE COMPUTED USING THEIR HISTORICAL COST. |

(3) | TAX EQUIVALENT BASIS RECOGNIZES THE INCOME TAX SAVINGS WHEN COMPARING TAXABLE AND TAX-EXEMPT ASSETS AND WAS CALCULATED USING AN EFFECTIVE TAX RATE OF 34%. THE TAX-EQUIVALENT ADJUSTMENT RELATES TO THE TAX EXEMPT MUNICIPAL BONDS AND WAS $700,573 AND $663,419 FOR THE YEARS ENDED DECEMBER 31, 2016 AND 2015. |

21

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

For The Year Ended December 31, | |||||||||||||||||||||||

Yield/ Rate at | 2015 | 2014 | |||||||||||||||||||||

December 31, 2015 | Average Balance | Interest | Annualized Yield/Rate | Average Balance | Interest | Annualized Yield/Rate | |||||||||||||||||

(Dollars In Thousands) | |||||||||||||||||||||||

Interest-Earning Assets: | |||||||||||||||||||||||

Mortgage Loans | 4.44% | $ | 74,903 | $ | 3,297 | 4.40 | % | $ | 78,022 | $ | 3,360 | 4.31 | % | ||||||||||

Other Loans | 5.71% | 252,624 | 15,131 | 5.99 | % | 273,383 | 16,057 | 5.87 | % | ||||||||||||||

Total Loans (1) | 5.42% | 327,527 | 18,428 | 5.63 | % | 351,405 | 19,417 | 5.53 | % | ||||||||||||||

Mortgage-Backed Securities(2) | 2.34% | 225,440 | 5,273 | 2.34 | % | 249,066 | 6,037 | 2.42 | % | ||||||||||||||

Investments (2) (3) | 2.42% | 196,268 | 4,860 | 2.48 | % | 181,419 | 4,517 | 2.49 | % | ||||||||||||||

Other Interest-Earning Assets | 0.28% | 4,103 | 8 | 0.19 | % | 3,120 | 11 | 0.35 | % | ||||||||||||||

Total Interest-Earning Assets | 3.73% | $ | 753,338 | $ | 28,569 | 3.79 | % | $ | 785,010 | $ | 29,982 | 3.82 | % | ||||||||||

Interest-Bearing Liabilities: | |||||||||||||||||||||||

Certificate Accounts | 0.69% | $ | 246,422 | $ | 1,812 | 0.74 | % | $ | 256,315 | $ | 1,990 | 0.78 | % | ||||||||||

NOW Accounts | 0.05% | 91,575 | 38 | 0.04 | % | 86,553 | 65 | 0.08 | % | ||||||||||||||

Money Market Accounts | 0.16% | 231,720 | 392 | 0.17 | % | 233,676 | 503 | 0.22 | % | ||||||||||||||

Savings Accounts | 0.10% | 30,362 | 30 | 0.10 | % | 26,640 | 27 | 0.10 | % | ||||||||||||||

Total Interest-Bearing Deposits | 0.36% | 600,079 | 2,272 | 0.38 | % | 603,184 | 2,585 | 0.43 | % | ||||||||||||||

Other Borrowings | 0.15% | 8,560 | 16 | 0.19 | % | 9,450 | 17 | 0.18 | % | ||||||||||||||

Junior Subordinated Debt | 2.21% | 5,155 | 104 | 2.02 | % | 5,155 | 101 | 1.96 | % | ||||||||||||||

Senior Convertible Debt | 8.00% | 6,084 | 487 | 8.00 | % | 6,084 | 487 | 8.00 | % | ||||||||||||||

FHLB Advances | 2.85% | 37,484 | 1,321 | 3.52 | % | 70,739 | 2,623 | 3.71 | % | ||||||||||||||

Total Interest-Bearing Liabilities | 0.58% | $ | 657,362 | $ | 4,200 | 0.64 | % | $ | 694,612 | $ | 5,813 | 0.84 | % | ||||||||||

Net Interest Income | $ | 24,369 | $ | 24,169 | |||||||||||||||||||

Interest Rate Spread | 3.15% | 3.15 | % | 2.98 | % | ||||||||||||||||||

Net Yield on Earning Assets (Net Interest Margin) | 3.23 | % | 3.08 | % | |||||||||||||||||||

(1) INTEREST ON NON-ACCRUAL LOANS IS NOT INCLUDED IN INCOME, ALTHOUGH THEIR LOAN BALANCES ARE INCLUDED IN AVERAGE LOANS OUTSTANDING.

(2) | SECURITIES AVAILABLE FOR SALE ARE COMPUTED USING THEIR HISTORICAL COST. |

(3) | TAX EQUIVALENT BASIS RECOGNIZES THE INCOME TAX SAVINGS WHEN COMPARING TAXABLE AND TAX-EXEMPT ASSETS AND WAS CALCULATED USING AN EFFECTIVE TAX RATE OF 34%. THE TAX-EQUIVALENT ADJUSTMENT RELATES TO THE TAX EXEMPT MUNICIPAL BONDS AND WAS $663,419 AND $499,594 FOR THE YEARS ENDED DECEMBER 31, 2015 AND 2014. |

.

22

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

Comparison of the Years Ended December 31, 2016 and 2015

General

The Company’s earnings available to common shareholders were $6.2 million or $1.99 per diluted common share for the year ended December 31, 2016, compared to $5.7 million or $1.84 per diluted common share for the year ended December 31, 2015. The $486,000 or 8.6% increase in earnings was primarily the result of an increase in net interest income offset partially by an increase in the provision for loan losses. Also contributing to the increase in earnings was a one-time gain on the redemption of preferred stock of $660,000 received in the fourth quarter of 2016.

Net Interest Income

Net interest margin on a tax equivalent basis increased 17 basis points to 3.40% for the year ended December 31, 2016 from 3.23% for the year ended December 31, 2015. The improvement in net interest spread was primarily achieved through an increase in interest income from loans combined with lower cost of funds. Interest income from loans increased $795,000 or 4.3% to $19.2 million for the year ended December 31, 2016 compared to $18.4 million for the year ended December 31, 2015. The increase was attributable to a $16.8 million increase in average total loans outstanding offset by a five basis point decrease in the average yield earned on the Bank’s loans during the year ended December 31, 2016. Total interest expense decreased $683,000 or 16.3% to $3.5 million for the year ended December 31, 2016, compared to $4.2 million for the year ended December 31, 2015. Consistent with the increase in net interest spread, tax equivalent net interest income increased $1.2 million or 4.9% to $25.6 million for the year ended December 31, 2016, compared to $24.7 million for the year ended December 31, 2015.

Tax equivalent interest income on investment securities, mortgage-backed securities, and other investments decreased $276,000 as a result of a $17.4 million decrease in the aggregate average balance of these interest earning assets offset by an increase of four basis points in the yield earned.

Interest expense on deposits decreased $160,000 or 7.0% to $2.1 million during the year ended December 31, 2016 from $2.3 million during the year ended December 31, 2015. Average interest bearing deposits decreased $9.7 million or 1.6% to $590.4 million during the year ended December 31, 2016 compared to $600.1 million during 2015, while the average cost of those deposits decreased two basis points to 0.36% during the year ended December 31, 2016 from 0.38% in 2015.

Interest expense on FHLB advances decreased $623,000 or 47.1% to $698,000 during the year ended December 31, 2016 from $1.3 million in 2015. The decrease was the result of a decrease of 181 basis points in the average cost of advances to 1.71% during 2016 compared to 3.52% during 2015. This decrease was offset by a $3.4 million increase in the average balance of FHLB advances outstanding during the year ended December 31, 2016.

Total average interest-earning assets decreased $546,000 or 0.1% to $752.8 million for the year ended December 31, 2016 from $753.3 million for the year ended December 31, 2015 while average interest-bearing liabilities decreased $3.2 million or 0.5% to $654.1 million for the year ended December 31, 2016 from $657.4 million for the year ended December 31, 2015. The interest rate spread was 3.33% for the year ended December 31, 2016 compared to 3.15% for the year ended December 31, 2015.

Provision for Loan Losses

The provision for loan losses was $500,000 for the year ended December 31, 2016 compared to a net provision of $0 for the year ended December 31, 2015. The increase was the result of an increase in net charge-offs combined with growth in total loans outstanding. The Company had net charge-offs of $419,000 for the year ended December 31, 2016 compared to $82,000 for the year ended December 31, 2015. Net charge-offs were 0.12% of gross loans during the year ended December 31, 2016 compared to 0.02% for the same period in 2015.

The amount of the provision is determined by management’s on-going monthly analysis of the loan portfolio and the adequacy of the allowance for loan losses. The Company has established policies and procedures for evaluating and monitoring the credit quality of the loan portfolio and for the timely identification of potential problem loans including internal and external loan reviews. The adequacy of the allowance for loan losses is reviewed monthly by the Asset Classification Committee and quarterly by the Board of Directors. Management’s monthly review of the adequacy of the allowance includes three main components.

23

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

The first component is an analysis of loss potential in various homogeneous segments of the portfolio based on historical trends and the risk inherent in each category. The historical loss periods used to calculate these ratios can range from one to five years depending on which period is deemed a more relevant indicator of future losses.

The second component of management’s monthly analysis is the specific review and evaluation of significant problem credits identified through the Company’s internal monitoring system, including but not limited to classified loans, non-accrual loans and TDRs. These loans are evaluated for impairment and recorded in accordance with accounting guidance. All TDRs and substantially all non-accrual loans are individually for impairment. In accordance with our policy, non-accrual commercial loans with a balance less than $200,000 and non-accrual consumer loans with a balance less than $100,000 are deemed immaterial and therefore excluded from the individual impairment review. For each loan deemed impaired, management calculates a specific reserve for the amount in which the recorded investment in the loan exceeds the fair value. This estimate is based on a thorough analysis of the most probable source of repayment, which is typically liquidation of the collateral.

The third component is an analysis of changes in qualitative factors that may affect the portfolio, including but not limited to: relevant economic trends that could impact borrowers’ ability to repay, industry trends, changes in the volume and composition of the portfolio, credit concentrations, or lending policies and the experience and ability of the staff and Board of Directors. Management also reviews and incorporates certain ratios such as percentage of classified loans, average historical loan losses by loan category, delinquency percentages, and the assignment of percentage targets of reserves in each loan category when evaluating the allowance. Once the analysis is completed, the three components are combined and compared to the allowance amount. Based on this, charges are made to the provision as needed.

Management believes the allowance for loan losses is adequate based on its best estimates of the losses inherent in the loan portfolio, although there can be no guarantee as to these estimates. In addition, bank regulatory agencies may require additional provisions to the allowance for loan losses based on their judgments and estimates as part of their examination process. Because the allowance for loan losses is an estimate, there can be no guarantee that actual loan losses will not exceed the allowance for loan losses, or that additional increases in the allowance for loan losses will not be required in the future.

Non-Interest Income

Non-interest income decreased $606,000 or 8.7% to $6.4 million for the year ended December 31, 2016 from $7.0 million for the year ended December 31, 2015. The decrease is primarily the result of a decrease in the gain on sale of investment securities partially offset by an increase in the gain on sale of loans in 2016.

Gain on sale of investment securities decreased $1.2 million or 62.7% to $704,000 during the year ended December 31, 2016 from $1.9 million for the same period in 2015. The decrease was due to a decrease in the number of investment securities sold. The Company sold 42 available for sale investment securities during 2016 compared to 56 in 2015. Gain on sale of loans increased $266,000 or 38.6% to $956,000 for the year ended December 31, 2016 compared to $690,000 in 2015. The Company sold 201 loans to investors with an average balance of $176,000 in 2016 compared to 154 loans sold to investors with an average balance of $157,000 during 2015.

Service fees on deposit accounts decreased $36,000 or 3.3% to $1.0 million during the year ended December 31, 2016 from $1.1 million during the year ended December 31, 2015. Income from insurance agency commissions was $556,000 during the year ended December 31, 2016, an increase of $84,000 or 17.7% compared to $472,000 during the year ended December 31, 2015. Trust income increased $79,000 or 13.0% to $688,000 during the year ended December 31, 2016 from $609,000 during 2015. Check card fee income increased $25,000 or 2.6% to $995,000 for the year ended December 31, 2016 compared to $970,000 for the same period in the prior year. Income from BOLI increased $105,000 or 24.8% to $528,000 during the year ended December 31, 2016 from $423,000 during the year ended December 31, 2015. All BOLI income recognized in 2016 and 2015 was related to accrued interest credited to the cash surrender value underlying the BOLI policies. There was no additional income received for death benefits during those periods. Other non-interest income including annuity and investment brokerage commissions, bank credit life insurance on loans, and other miscellaneous income increased slightly from $652,000 for the year ended December 31, 2015 to $669,000 in 2016.

The Bank received $265,000 in grant income during the year ended December 31, 2016, which was awarded by the Bank Enterprise Award (BEA) Program in recognition of the Bank’s investments in distressed communities and its continued commitment to community development. The amount of the award increases as the Bank’s investment in these areas increases, but is also subject to changes in program funding levels from the federal government.

24

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

In 2012, the United States Department of the Treasury's ("U.S. Treasury") Community Development Financial Institutions ("CDFI") Fund awarded the Bank a grant totaling $1.5 million in connection with a CDFI program that recognizes organizations who serve low income and distressed communities. As part of the award, the Bank committed to establish a small business micro lending program that lends specifically in low to moderate income areas. The Bank was required to lend $1.2 million over a five year period to qualifying customers, with the related grant income to be recognized during the period in which the loans were funded. During the year ended December 31, 2015, the Bank recognized $230,000 in grant income related to this award and as of that date there was no income remaining to be recognized related to unfunded microloans.

Non-Interest Expense

Non-interest expense increased $397,000 or 1.8% to $22.9 million during the year ended December 31, 2016 compared to $22.5 million during the same period one year earlier. The increase in non-interest expense was primarily due to increases in compensation and employee benefits expense and depreciation and maintenance expense, both of which increased as a result of our recent expansion. Since December 2015, we opened a fourth branch in our Midlands market and broke ground on our second branch in Evans, Georgia.

Compensation and employee benefits increased $854,000 or 7.0% to $13.0 million during the year ended December 31, 2016 from $12.2 million for the year ended December 31, 2015. The increase was a result of general cost of living increases combined with an increase in the number of full time equivalent employees within the branches. The Company recognized $250,000 and $150,000 in accrued bonuses related to its incentive compensation plan offered to employees during the years ended December 31, 2016 and 2015, respectively. The incentive compensation plan, first implemented in 2014, was designed to maximize achievement of the Bank’s overall goals by setting performance objectives for employees that are directly linked to the financial and strategic performance of the Bank. It encourages employees to focus on the success and profitability of the Bank and provides a means for the Bank to offer competitive pay to attract and retain the highest quality and highest performing employees.

Depreciation and maintenance of equipment increased $255,000 or 15.0% to $2.0 million for the year ended December 31, 2016 compared to $1.7 million in 2015 as a result of the new branches mentioned above. Occupancy expense increased $56,000 or 2.9% to $2.0 million for the year ended December 31, 2016 compared to $1.9 million for the year ended December 31, 2015. Advertising expense increased $116,000 or 14.0% to $533,000 for the year ended December 31, 2016 from $416,000 for the year ended December 31, 2015. Other non-interest expenses increased $416,000 or 9.5% to $4.8 million for the year ended December 31, 2016 compared to $4.4 million during 2015. Other expenses include legal, professional, and consulting expenses, office supplies and other miscellaneous expenses.

As part of the Company's strategy to lower its cost of funds, management elected to prepay some higher rate FHLB advances during 2016 and 2015, which resulted in prepayment penalties of $789,000 and $788,000 during the years ended December 31, 2016 and 2015, respectively.

The increase in non-interest expense was offset by a $609,000 net gain on the operation of OREO during the year ended December 31, 2016, a decrease of $1.1 million compared to net expense of $524,000 during the same period in 2015. The majority of the net gain was related to the sale of one OREO property in February 2016, which resulted in a $739,000 gain that was recorded as an offset to the cost of operating OREO properties during the period. A lower OREO balance and a decrease in OREO writedowns also contributed to the decrease in related expense. OREO was $2.7 million at December 31, 2016 compared to $4.4 million at December 31, 2015. OREO is recorded at the lower of cost or estimated fair value less costs to sell. As local real estate values declined significantly in the prior years, the Bank was required to write down these properties to their fair values. As a result of the improvement in real estate values within our market areas, write downs on OREO decreased to $40,000 for the year ended December 31, 2016 compared to write downs of $312,000 during 2015.

Income Taxes

The provision for income taxes decreased $147,000 or 7.1% to $1.9 million during the year ended December 31, 2016 compared to $2.1 million for the year ended December 31, 2015. The Company's combined federal and state effective tax rate was 24.5% for 2016 compared to 25.3% for 2015.

25

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

Comparison of the Years Ended December 31, 2015 and 2014

General

The Company’s earnings available to common shareholders were $5.7 million or $1.84 per diluted common share for the year ended December 31, 2015, compared to $5.4 million or $1.75 per diluted common share for the year ended December 31, 2014. The $305,000 or 5.7% increase in earnings was attributable primarily to an increase in non-interest income combined with a decrease in the provision for loan losses.

Net Interest Income