Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Four Corners Property Trust, Inc. | d334722d8k.htm |

Exhibit 99.1

FOUR CORNERS PROPERTY TRUST

NYSE: FCPT

INVESTOR PRESENTATION | MARCH 2017 www.fcpt.Com

FORWARD LOOKING STATEMENTS AND DISCLAIMERS

Cautionary Note Regarding Forward-Looking Statements:

This presentation contains

forward-looking statements within the meaning of the federal securities laws. Forward-looking statements include all statements that are not historical statements of fact and those regarding the Company’s intent, belief or expectations,

including, but not limited to, statements regarding: operating and financial performance; and expectations regarding the making of distributions and the payment of dividends. Words such as “anticipate(s),” “expect(s),”

“intend(s),” “plan(s),” “believe(s),” “may,” “will,” “would,” “could,” “should,” “seek(s)” and similar expressions, or the negative of these terms, are

intended to identify such forward-looking statements. Forward-looking statements speak only as of the date on which such statements are made and, except in the normal course of the Company’s public disclosure obligations, the

Company expressly disclaims any obligation to publicly release any updates or revisions to any forward-looking statements to reflect any change in the Company’s expectations

or any change in events, conditions or circumstances on which any statement is based. Forward-looking statements are based on management’s current expectations and beliefs and the Company can give no assurance that its expectations or the

events described will occur as described. Forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by such forward-looking statements.

Factors that could have a material adverse effect on the Company’s operations and future prospects or that could cause actual results to differ materially from the Company’s expectations are included in the sections entitled

“Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of the Company’s Annual Report on Form 10-K filed

with the Securities and Exchange Commission on February 27, 2017.

Notice Regarding Non-GAAP Financial Measures:

The information in this communication contains and refer to certain non-GAAP financial measures, including FFO and AFFO.

These non-GAAP financial measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. These

non-GAAP financial measures should not be considered replacements for, and should be read together with, the most comparable GAAP financial measures. Reconciliations to the most directly comparable GAAP

financial measures and statements of why management believes these measures are useful to investors are included in the supplemental financial and operating report, which can be found in the investor relations section of our website at www.fcpt.com.

2 | FCPT | MARCH 2017

AG E N D A

Company

Overview and Update Page 3 Key Investment Highlights Page 9 Diversification and Acquisition Strategy Page 16 Financial Update & Key Credit Strengths Page 23

3 | FCPT | MARCH 2017

SENIOR MANAGEMENT TEAM

Former Board member and Chair of the Finance and Real Estate Committee at Darden Restaurants, Inc. Private investor in net lease retail real estate

Member of the Board of Directors of Macy’s, Inc.

William Lenehan

President and CEO? Former Board member and Chairman of the Investment Committee at Gramercy Property Trust, Inc. Former CEO of Granite REIT, an investment grade single-tenant, triple-net REIT listed on the TSX

Ten years at Farallon Capital Management? B.A. from the Claremont McKenna College

Former CFO of Amstar Advisers, served on Amstar’s Executive and Investment Committees

Former Managing Director of Financial Strategy & Planning at Prologis, Inc.? Former President and CFO of American Residential Communities

Gerald Morgan

CFO Served as a Senior Officer with Archstone prior to the company’s sale

Former consultant at Bain & Co.

B.S. in Mechanical Engineering and

MBA from Stanford University

Former Partner in the real estate department at the law firm of Pircher, Nichols & Meeks where he had practiced since 1998

B.A. from Macalester College James Brat Juris Doctorate from the UCLA School of Law

General Counsel

4| FCPT | MARCH 2017

OVER VIEW OF FCPT

Four

Corners Property Trust (“FCPT”) is primarily engaged in the ownership, acquisition, and leasing of restaurant properties 484 properties, diversified by geography and brand, 416 of which are leased to Darden under long-term triple-net leases

5 initial Darden restaurant brands:

Olive Garden, LongHorn Steakhouse, Bahama Breeze, Seasons 52, Wildfish Seafood Grille

14

additional brands acquired to date:

KFC, Burger King, Arby’s, Pizza Hut, Buffalo Wild Wings, Wendy’s, Steak ‘n Shake, Dairy Queen, Denny’s,

Fazoli’s, Zaxby’s, Taco Bell, Hardee’s, McAlister’s Deli

Fully leased with no vacancies, unoccupied stores, assets under development, or

watch-list assets

Portfolio tenants are principally investment grade (93%) with positive operating trends, fulsome public disclosure, and strong rent coverage

(EBITDAR / rent of 4.2x) Strategy to grow and diversify portfolio through acquisitions and sale leasebacks Low leverage and flexible unsecured capital structure to support diversification strategy As of March 17, 2017, FCPT had an equity market

capitalization of $1.3 billion and a total market capitalization of $1.8 billion

Figures as of 3/17/2017, unless otherwise stated

5 | FCPT | MARCH 2017

COMPANY UPDATE

Since the spin-off was completed in late 2015, FCPT has made significant progress achieving its goals, including portfolio diversification and improved access to capital

Highlights Since Spin-Off Areas of Focus through 2017

Darden Restaurants is performing well and continues to • Continue to close on sensible acquisitions and build our be an exceptional tenant from which to grow

and forward pipeline diversify our portfolio Continue thoughtful disposition strategy • when

Focused investor outreach and index inclusion has presented with non-solicited offers helped attract a strong shareholder base including many Became Sarbanes-Oxley compliant as part of filing REIT-dedicated owners • 2016 10-K

Built out the rest of core management and acquisition to strengthen access across capital team and began closing acquisitions in Q3 2016 Continue markets

Initiated an At-The-Market (ATM) equity

follow-on Acquisitions platform activated program to access incremental equity to match fund

Total acquisitions of

$111 million from July 2016 acquisitions as necessary in December 2016 through March 2017 comprising 68 restaurants and 14 new brands at a weighted average initial cash

- Obtained Investment Grade rating from Fitch (BBB-) yield of 6.6% and lease term of 16 years on January 24, 2017 to gain access to

unsecured

- Closed on two dispositions at highly attractive 4.75% debt market and extend debt maturity schedule cap rate for $25 million of proceeds, recycled

accretively on properties at 6.5-6.6% cap rates

- First OP unit transaction closed with a potential future strategic

partner and experienced buyer of restaurant real estate

• Stable operations from Kerrow restaurant subsidiary, despite regional Texas headwinds

6 | FCPT | MARCH 2017

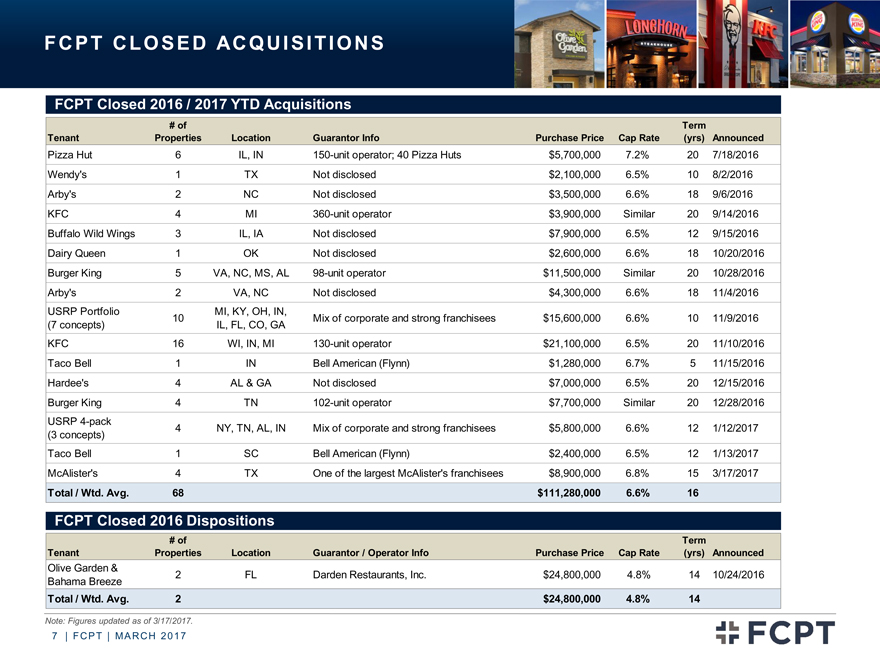

FCPT CLOSED ACQUISITIONS

FCPT Closed 2016 / 2017 YTD Acquisitions

# of Term

Tenant Properties Location Guarantor Info Purchase Price Cap Rate (yrs) Announced

Pizza Hut 6

IL, IN 150-unit operator; 40 Pizza Huts $5,700,000 7.2% 20 7/18/2016 Wendy’s 1 TX Not disclosed $2,100,000 6.5% 10 8/2/2016 Arby’s 2 NC Not disclosed $3,500,000 6.6% 18 9/6/2016 KFC 4 MI 360-unit operator $3,900,000 Similar 20 9/14/2016 Buffalo Wild Wings 3 IL, IA Not disclosed $7,900,000 6.5% 12 9/15/2016 Dairy Queen 1 OK Not disclosed $2,600,000 6.6% 18 10/20/2016 Burger King 5 VA, NC, MS, AL 98-unit operator $11,500,000 Similar 20 10/28/2016 Arby’s 2 VA, NC Not disclosed $4,300,000 6.6% 18 11/4/2016 USRP Portfolio MI, KY, OH, IN,

10 Mix of corporate and strong franchisees $15,600,000 6.6% 10 11/9/2016 (7 concepts) IL, FL, CO, GA

KFC 16 WI, IN, MI 130-unit operator $21,100,000 6.5% 20 11/10/2016 Taco Bell 1 IN Bell American (Flynn) $1,280,000 6.7% 5 11/15/2016

Hardee’s 4 AL & GA Not disclosed $7,000,000 6.5% 20 12/15/2016 Burger King 4 TN 102-unit operator $7,700,000 Similar 20 12/28/2016 USRP 4-pack

4 NY, TN, AL, IN Mix of corporate and strong franchisees $5,800,000 6.6% 12 1/12/2017 (3 concepts) Taco Bell 1 SC Bell American (Flynn) $2,400,000 6.5% 12 1/13/2017

McAlister’s 4 TX One of the largest McAlister’s franchisees $8,900,000 6.8% 15 3/17/2017

Total / Wtd. Avg. 68 $111,280,000 6.6% 16

FCPT Closed 2016 Dispositions

# of Term

Tenant Properties Location Guarantor / Operator Info Purchase Price Cap Rate (yrs) Announced

Olive Garden &

2 FL Darden Restaurants, Inc. $24,800,000 4.8% 14

10/24/2016 Bahama Breeze

Total / Wtd. Avg. 2 $24,800,000 4.8% 14

Note:

Figures updated as of 3/17/2017.

7 | FCPT | MARCH 2017

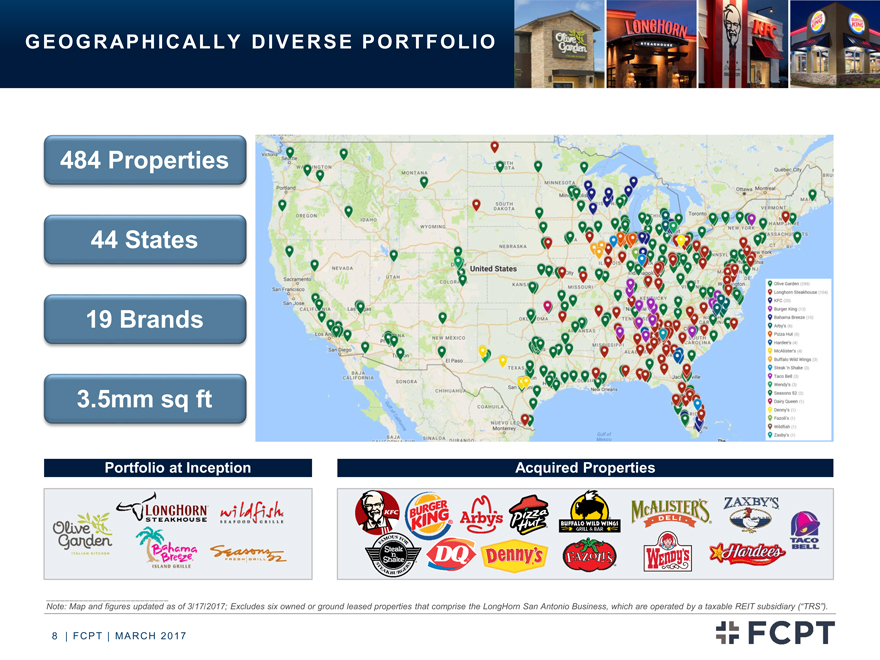

GEOGRAPHICALLY DIVERSEPORTFOLIO

484 Properties

44 States

19 Brands

3.5mm sq ft

Portfolio at Inception Acquired Properties

Note: Map and figures updated as of 3/17/2017;

Excludes six owned or ground leased properties that comprise the LongHorn San Antonio Business, which are operated by a taxable REIT subsidiary (“TRS”).

8 | FCPT | MARCH 2017

AGENDA

Company Overview

and Update Page 3 Key Investment Highlights Page 9 Diversification and Acquisition Strategy Page 16 Financial Update & Key Credit Strengths Page 23

9 |

FCPT | MARCH 2017

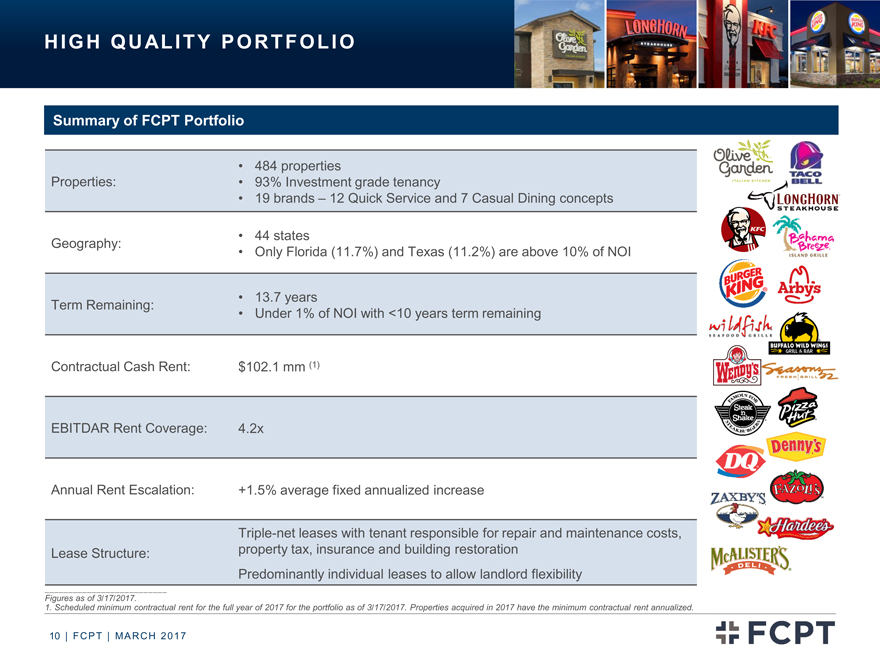

HIGH QUALITY PORT FOLIO

Summary of FCPT Portfolio

484 properties

Properties: • 93% Investment grade tenancy

19 brands – 12 Quick Service and 7 Casual

Dining concepts

44 states Geography:

Only Florida (11.7%) and Texas (11.2%)

are above 10% of NOI

13.7 years Term Remaining:

Under 1% of NOI with <10

years term remaining Contractual Cash Rent: $102.1 mm (1) EBITDAR Rent Coverage: 4.2x

Annual Rent Escalation: +1.5% average fixed annualized increase

Triple-net leases with tenant responsible for repair and maintenance costs, Lease Structure: property tax, insurance and

building restoration Predominantly individual leases to allow landlord flexibility

__________________________ Figures as of 3/17/2017.

1. Scheduled minimum contractual rent for the full year of 2017 for the portfolio as of 3/17/2017. Properties acquired in 2017 have the minimum contractual rent annualized.

10 | FCPT | MARCH 2017

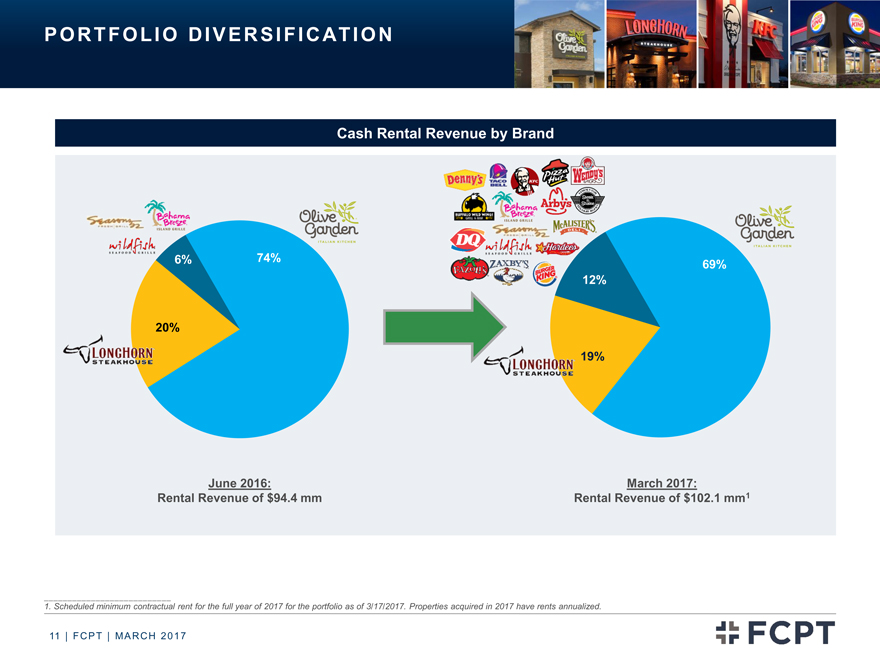

PORT FOLIO DIVERSIFICATION

Cash Rental Revenue by Brand

6% 74%

69% 12%

20%

19%

June 2016: March 2017:

Rental Revenue of $94.4 mm Rental Revenue of $102.1 mm1

1. Scheduled minimum contractual rent

for the full year of 2017 for the portfolio as of 3/17/2017. Properties acquired in 2017 have rents annualized.

11 | FCPT | MARCH 2017

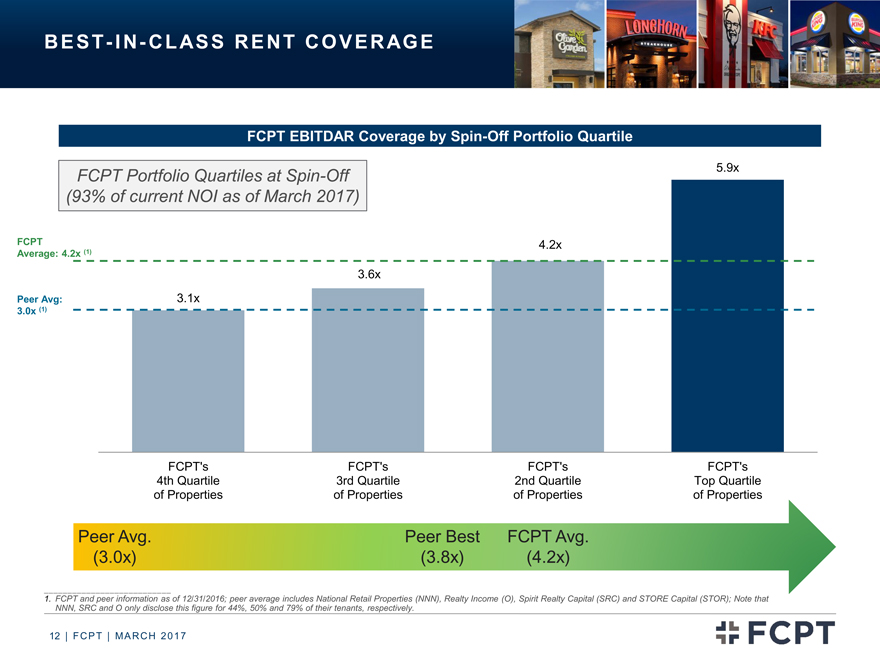

BEST—IN—CLASS RENT COVERAGE

FCPT EBITDAR Coverage by Spin-Off Portfolio Quartile

5.9x

FCPT Portfolio Quartiles at

Spin-Off (93% of current NOI as of March 2017)

FCPT 4.2x Average: 4.2x (1)

3.6x

Peer Avg: 3.1x

3.0x (1)

FCPT’s FCPT’s FCPT’s FCPT’s 4th Quartile 3rd Quartile 2nd

Quartile Top Quartile of Properties of Properties of Properties of Properties

Peer Avg. Peer Best FCPT Avg. (3.0x) (3.8x) (4.2x)

1. FCPT and peer information as of 12/31/2016; peer average includes National Retail Properties (NNN), Realty Income (O), Spirit Realty Capital (SRC) and STORE Capital (STOR); Note

that NNN, SRC and O only disclose this figure for 44%, 50% and 79% of their tenants, respectively.

12 | FCPT | MARCH 2017

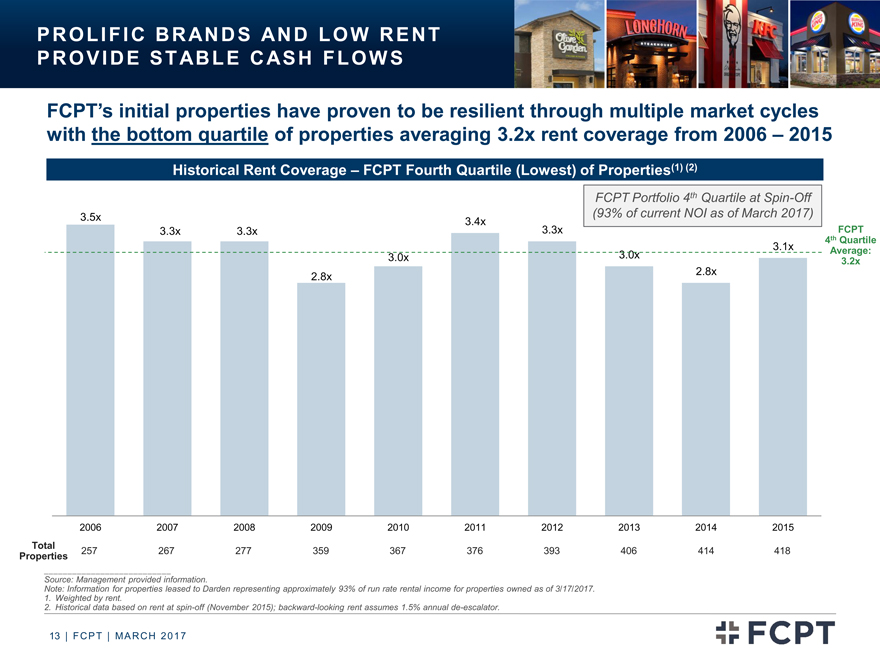

PROLIFIC BRANDS AN D LOW RENT PROVIDE STABLE CASH FLOWS

FCPT’s initial properties have proven to be resilient through multiple market cycles with the bottom quartile of properties averaging 3.2x rent coverage from 2006 – 2015

Historical Rent Coverage – FCPT Fourth Quartile (Lowest) of Properties(1) (2)

FCPT Portfolio 4th Quartile at Spin-Off 3.5x (93% of current NOI as of March 2017)

3.4x

3.3x 3.3x 3.3x FCPT

3.1x 4th Quartile 3.0x Average:

3.0x 3.2x 2.8x 2.8x

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Total

257 267 277 359 367 376 393 406 414 418

Properties

Source: Management provided information.

Note: Information for properties leased to Darden

representing approximately 93% of run rate rental income for properties owned as of 3/17/2017.

1. Weighted by rent.

2. Historical data based on rent at spin-off (November 2015); backward-looking rent assumes 1.5% annual

de-escalator.

13 | FCPT | MARCH 2017

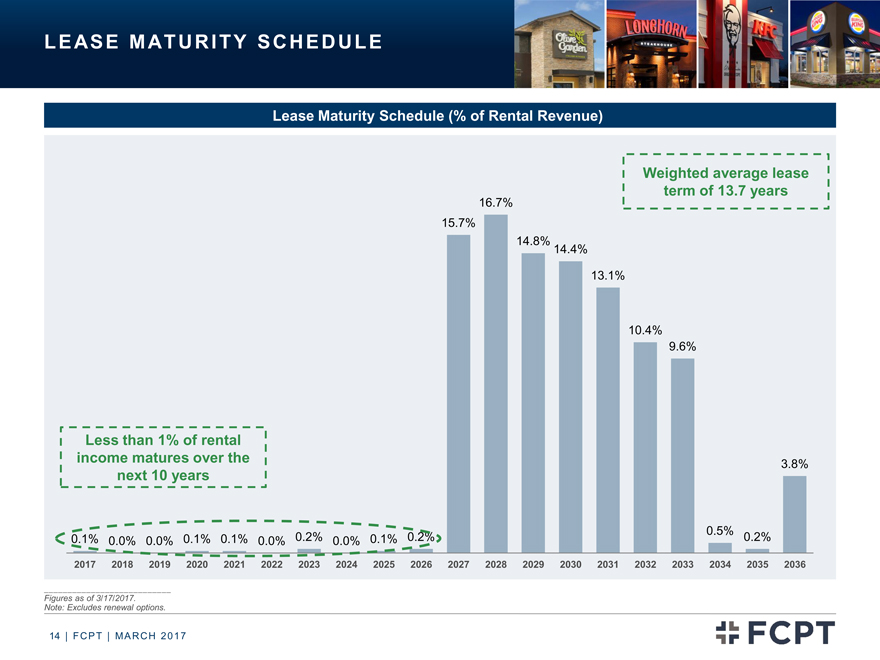

LEASE MATURITY SCHEDULE

Lease Maturity Schedule (% of Rental Revenue)

Weighted average lease 16.7%

term of 13.7 years

15.7%

14.8% 14.4%

13.1%

10.4%

9.6%

Less than 1% of rental income matures over the next 10 years 3.8%

0.5%

0.1% 0.0% 0.0% 0.1% 0.1% 0.0% 0.2% 0.0% 0.1% 0.2% 0.2%

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036

Figures as of 3/17/2017.

Note: Excludes renewal options.

14 | FCPT | MARCH 2017

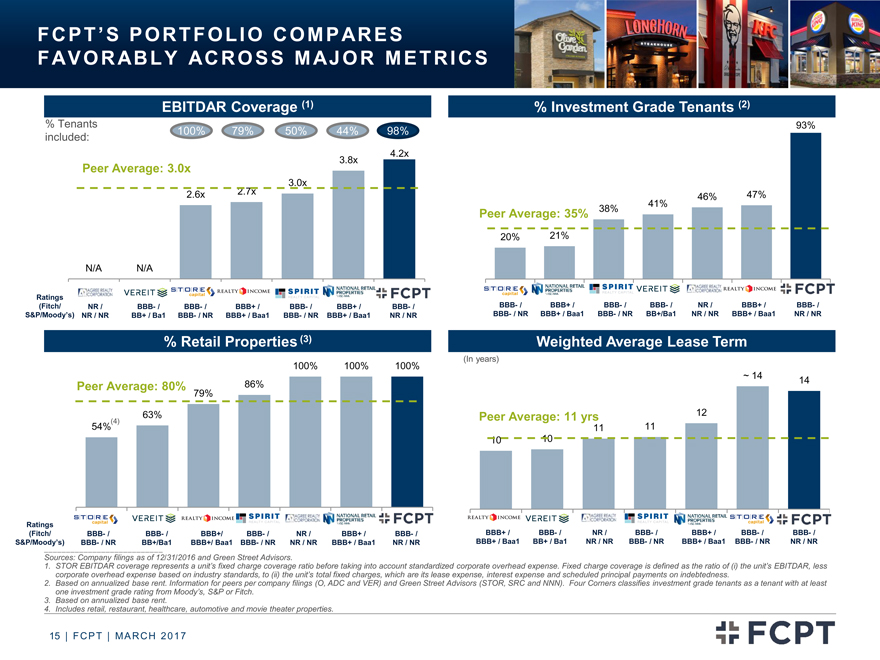

FCPT’S PORTFOLIO COMPARES

FAVORABLY ACROSS MAJOR METRICS

EBITDAR Coverage (1) % Investment Grade Tenants (2)

% Tenants 93% 100% 79% 50% 44% 98% included:

4.2x 3.8x

Peer Average: 3.0x

2.7x 3.0x

2.6x 41% 46% 47%

Peer Average: 35% 38% 20% 21%

N/A N/A

Ratings VEREIT STORE Realty Spirit N STOR SRC VER O

(Fitch/ NR / BBB- / BBB- / BBB+ / BBB- / BBB+ / BBB- / BBB- / BBB+ / BBB- / BBB- / NR / BBB+ / BBB- /

S&P/Moody’s) NR / NR BB+ / Ba1 BBB- / NR BBB+ / Baa1 BBB- / NR BBB+ / Baa1 NR / NR BBB- / NR BBB+ / Baa1 BBB- / NR BB+/Ba1 NR / NR BBB+ / Baa1 NR / NR

% Retail Properties (3) Weighted Average Lease Term

(In years)

100% 100% 100%

~ 14

86% 14

Peer Average: 80%

79%

63% Peer Average: 11 yrs 12

(4)

54% 11 11

10 10

Ratings STOR VER O SRC O VER ADC SRC STOR

(Fitch/ BBB-

/ BBB- / BBB+/ BBB- / NR / BBB+ / BBB- / BBB+ / BBB- / NR / BBB- / BBB+ / BBB- / BBB- / S&P/Moody’s) BBB- / NR BB+/Ba1 BBB+/ Baa1 BBB- / NR NR / NR BBB+ / Baa1 NR / NR BBB+ / Baa1 BB+ / Ba1 NR / NR BBB- / NR BBB+ / Baa1 BBB- / NR NR / NR

Sources: Company filings as of 12/31/2016 and Green Street Advisors.

1. STOR EBITDAR coverage

represents a unit’s fixed charge coverage ratio before taking i corporate overhead expense. Fixed charge coverage is defined as the ratio of (i) the unit’s EBITDAR, less corporate overhead expense based on industry standards, to

(ii) the unit’s total fixed charges, pense, interest expense and scheduled principal payments on indebtedness.

2. Based on annualized base rent.

Information for peers per company filings (O, ADC and sors (STOR, SRC and NNN). Four Corners classifies investment grade tenants as a tenant with at least one investment grade rating from Moody’s, S&P or Fitch.

3. Based on annualized base rent.

4. Includes retail, restaurant, healthcare, automotive and

movie theater properties.

15 | FCPT | MARCH 2017

AGENDA

Company Overview

and Update Page 3 Key Investment Highlights Page 9 Diversification and Acquisition Strategy Page 16 Financial Update & Key Credit Strengths Page 23

16 |

FCPT | MARCH 2017

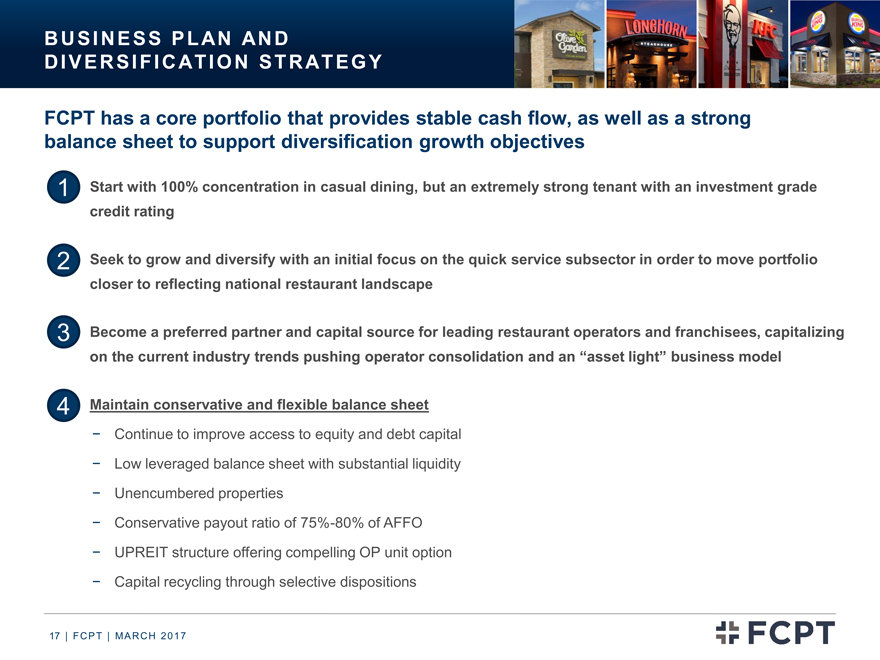

BUSINESS PLAN AND

DIVERSIFICATION STRATEGY

FCPT has a core portfolio that provides stable cash

flow, as well as a strong balance sheet to support diversification growth objectives

1? Start with 100% concentration in casual dining, but an extremely strong

tenant with an investment grade credit rating

2? Seek to grow and diversify with an initial focus on the quick service subsector in order to move portfolio closer

to reflecting national restaurant landscape

3? Become a preferred partner and capital source for leading restaurant operators and franchisees, capitalizing on the

current industry trends pushing operator consolidation and an “asset light” business model

4? Maintain conservative and flexible balance sheet

- Continue to improve access to equity and debt capital

- Low leveraged

balance sheet with substantial liquidity

- Unencumbered properties

-

Conservative payout ratio of 75%-80% of AFFO

- UPREIT structure offering compelling OP unit option

- Capital recycling through selective dispositions

17 | FCPT | MARCH 2017

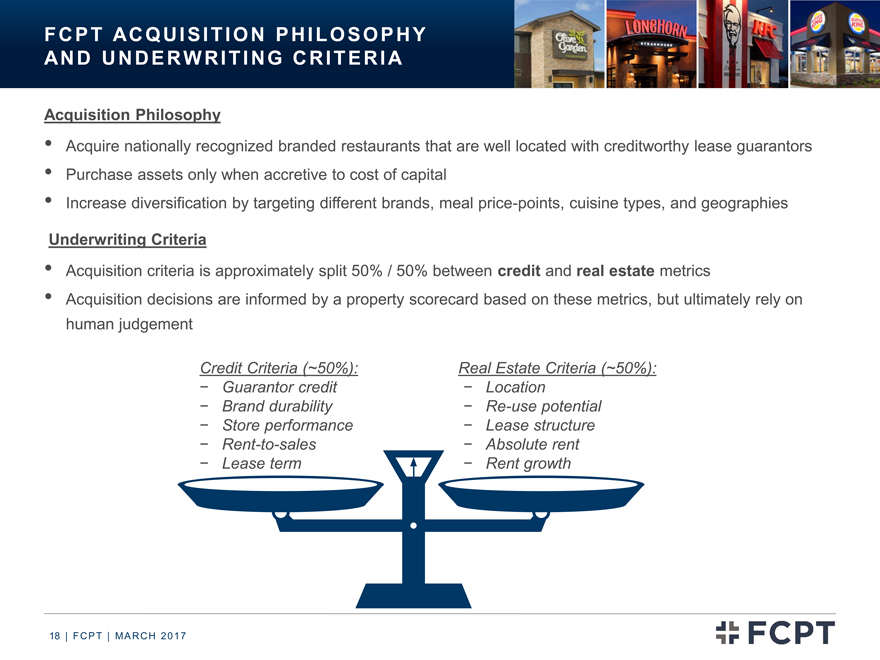

FCPT ACQUISITION PHILOSOPHY AND UNDERWRITING CRITERIA

Acquisition Philosophy

• Acquire nationally recognized branded restaurants that are well

located with creditworthy lease guarantors

• Purchase assets only when accretive to cost of capital

• Increase diversification by targeting different brands, meal price-points, cuisine types, and geographies

Underwriting Criteria

• Acquisition criteria is approximately split 50% / 50% between

credit and real estate metrics

• Acquisition decisions are informed by a property scorecard based on these metrics, but ultimately rely on human judgement

Credit Criteria (~50%): Real Estate Criteria (~50%):

- Guarantor credit -

Location

- Brand durability - Re-use potential

- Store performance - Lease structure

- Rent-to-sales - Absolute rent

- Lease term - Rent growth

18 | FCPT | MARCH 2017

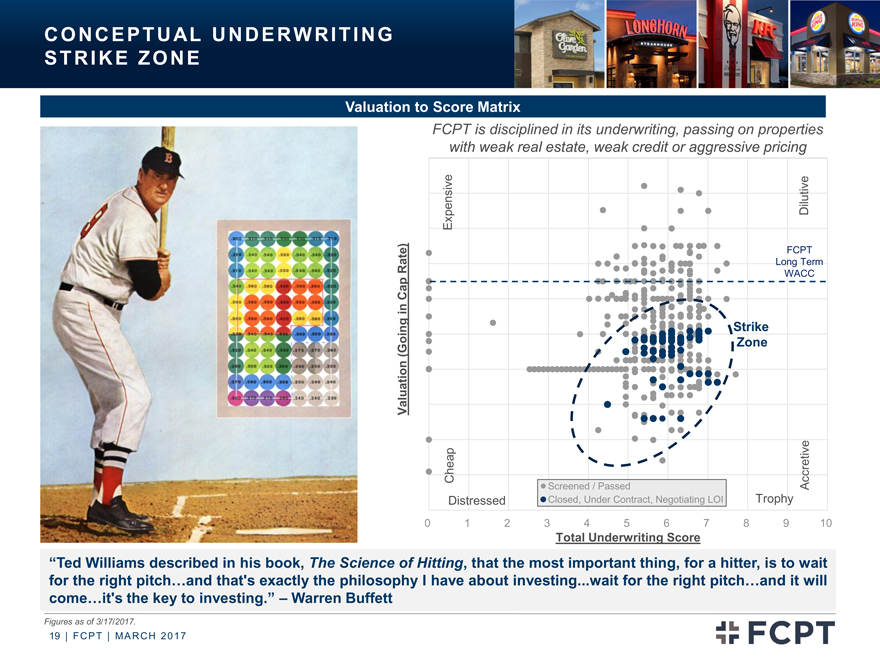

CONCEPTUAL UNDERWRITING STRIKEZONE

Valuation to Score Matrix

FCPT is disciplined in its underwriting, passing on properties with

weak real estate, weak credit or aggressive pricing

Expensive Dilutive

FCPT

Rate) Long Term

Cap WACC in

Strike

(Going Zone Valuation

Cheap

Screened / Passed Accretive Distressed Closed, Under Contract, Negotiating LOI Trophy

0 1 2 3

4 5 6 7 8 9 10

Total Underwriting Score

“Ted Williams described in his

book, The Science of Hitting, that the most important thing, for a hitter, is to wait for the right pitch…and that’s exactly the philosophy I have about investing...wait for the right pitch…and it will come…it’s the key to

investing.” – Warren Buffett

Figures as of 3/17/2017.

19 | FCPT |

MARCH 2017

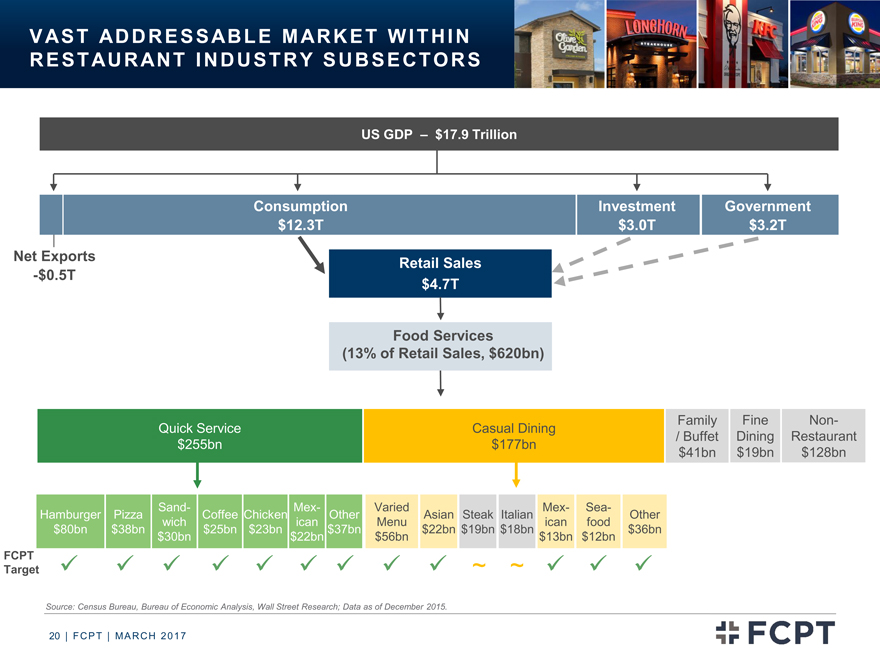

VAST ADDRESSABLE MARKET WITHIN RESTAURANT INDUSTRY SUBSECTORS

US GDP – $17.9 Trillion

Consumption Investment Government $12.3T $3.0T $3.2T

Net Exports

Retail Sales

-$0.5T

$4.7T

Food Services (13% of Retail Sales, $620bn)

Family Fine Non-Quick Service Casual Dining

Buffet Dining Restaurant $255bn $177bn $41bn $19bn $128bn

Sand- Mex- Varied

Mex- Sea-

Hamburger Pizza Coffee Chicken Other Asian Steak Italian Other wich ican Menu ican food $80bn $38bn $25bn $23bn $37bn $22bn $19bn $18bn $36bn $30bn $22bn

$56bn $13bn $12bn

FCPT

Target

Source: Census Bureau, Bureau of Economic Analysis, Wall Street Research; Data as of December 2015.

20 | FCPT | MARCH 2017

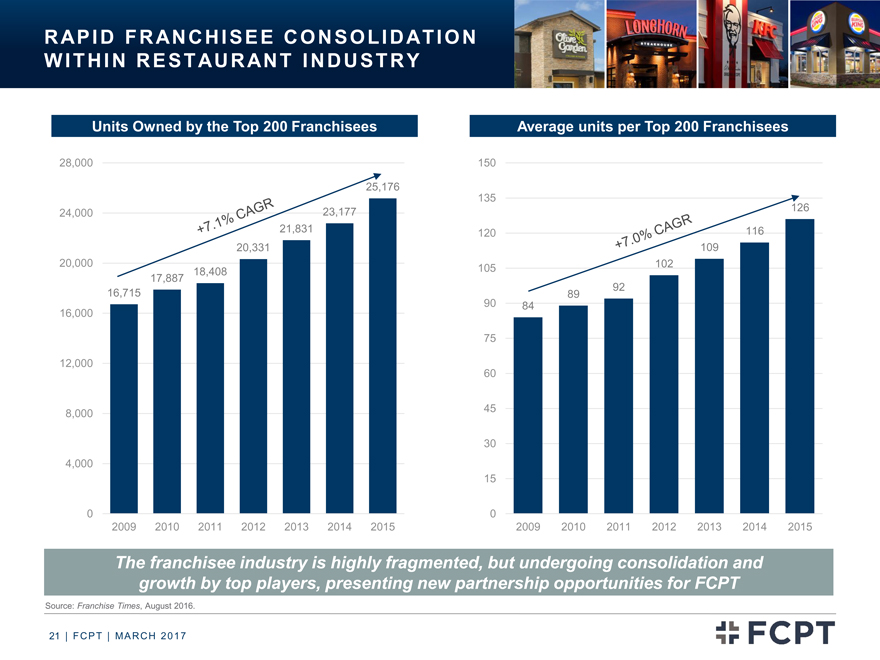

RAPID FRANCHISEE CONSOLIDATION WITHIN REST AURANT INDUSTRY

Units Owned by the Top 200 Franchisees Average units per Top 200 Franchisees

28,000 150

25,176

135 126 24,000 23,177 21,831 120 116 20,331 109 20,000 102 17,887

18,408 105 92 16,715 89 16,000 90 84 75

12,000 60

45 8,000

30 4,000 15

0 0

2009 2010 2011 2012 2013 2014 2015 2009 2010 2011 2012 2013 2014 2015

The franchisee industry

is highly fragmented, but undergoing consolidation and growth by top players, presenting new partnership opportunities for FCPT

Source: Franchise Times, August

2016.

21 | FCPT | MARCH 2017

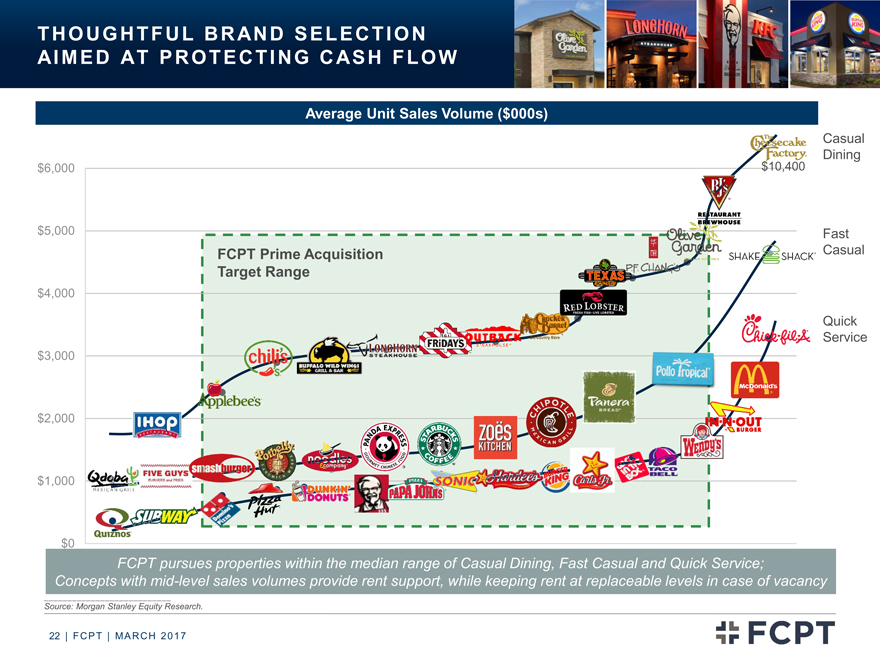

THOUGHTFUL BRAND SELECTION AIMED ATPROTECTING CASH FLOW

Average Unit Sales Volume ($000s)

Casual Dining $6,000 $10,400

$5,000 Fast

FCPT Prime Acquisition Casual Target Range

$4,000

Quick Service $3,000

$2,000

$1,000

$0

FCPT pursues properties within the median range of Casual Dining, Fast Casual and Quick

Service;

Concepts with mid-level sales volumes provide rent support, while keeping rent at replaceable levels in case of

vacancy

Source: Morgan Stanley Equity Research.

22 | FCPT | MARCH 2017

AGENDA

Company Overview

and Update Page 3 Key Investment Highlights Page 9 Diversification and Acquisition Strategy Page 16 Financial Update & Key Credit Strengths Page 23

23 |

FCPT | MARCH 2017

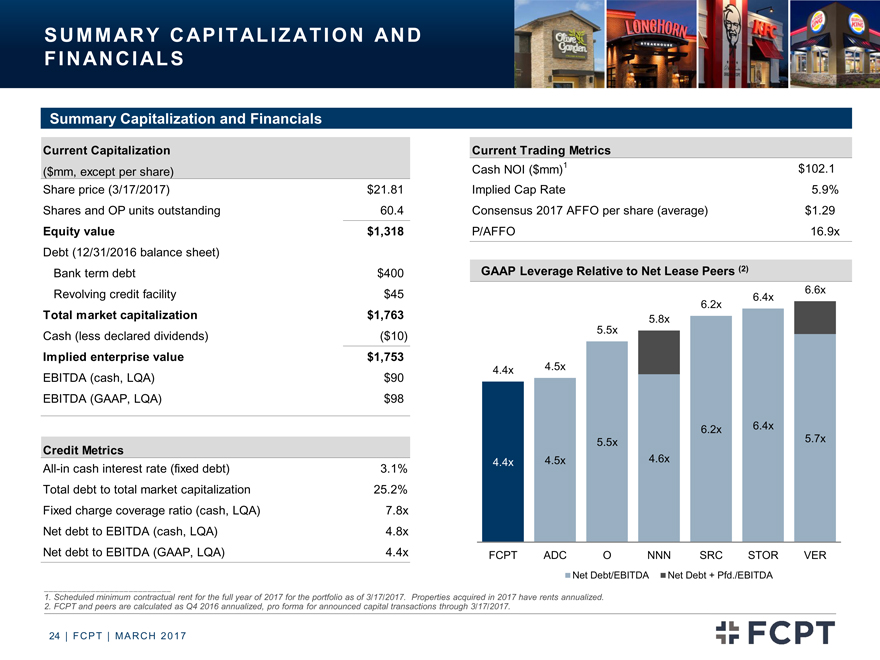

SUMMARY CAPITALIZATION AND FINANCIALS

Summary Capitalization and Financials

Current Capitalization Current Trading Metrics

Cash NOI ($mm)1 $102.1 ($mm, except per share) Share price (3/17/2017) $21.81 Implied Cap Rate 5.9% Shares and OP units outstanding 60.4 Consensus 2017 AFFO per

share (average) $1.29

Equity value $1,318 P/AFFO 16.9x Debt (12/31/2016 balance sheet) Bank term debt $400 GAAP Leverage Relative to Net Lease Peers (2)

Revolving credit facility $45 6.6x 6.4x

Total market capitalization $1,763

6.2x 5.8x 5.5x

Cash (less declared dividends) ($10)

Implied enterprise value

$1,753 4.5x 4.4x

EBITDA (cash, LQA) $90 EBITDA (GAAP, LQA) $98

6.2x 6.4x

5.5x 5.7x

Credit Metrics

All-in cash interest rate (fixed debt) 3.1% 4.4x 4.5x 4.6x Total debt to total market capitalization 25.2% Fixed charge coverage ratio

(cash, LQA) 7.8x Net debt to EBITDA (cash, LQA) 4.8x

Net debt to EBITDA (GAAP, LQA) 4.4x FCPT ADC O NNN SRC STOR VER

Net Debt/EBITDA Net Debt + Pfd./EBITDA

1. Scheduled minimum contractual rent for the full year

of 2017 for the portfolio as of 3/17/2017. Properties acquired in 2017 have rents annualized.

2. FCPT and peers are calculated as Q4 2016 annualized, pro forma for

announced capital transactions through 3/17/2017.

24 | FCPT | MARCH 2017

FCPT KEY INVESTMENT HIGHLIGHTS

High Quality Well-located assets diversified geographically across 44 states in the U.S. Portfolio Darden property-level revenue 50% above casual dining peers

Diversified by Recent sales of Darden branded assets demonstrates strong underlying property Geography value and liquidity and Brand Strong acquisition platform with $111mm in

acquisitions over past 8 months

14-year average lease term with substantially all leases > 10 years

Strong, Stable

Annualized rent escalators of ~1.5% and Growing? 100% occupancy

Cash Flow

Best-in-class EBITDAR / rent coverage of 4.2x and appropriate rents FCPT received BBB- investment grade rating from Fitch on 1/24/2017

Investment

Grade Credit FCPT’s largest tenant, Darden, who also provides a corporate guarantee on its

Profile leases, is rated BBB/BBB/Baa3 and continues to perform well and increase market share? Financially disciplined acquisition strategy Current leverage of

4.4x Net Debt / EBITDA (GAAP LQA), with no near term maturities

Conservative

Financial 100% unencumbered asset base

Policies Conservative dividend payout

ratio of 75-80% of AFFO

Strong liquidity profile ($350 million revolver with $305mm undrawn as of 3/17/2017) Strong

institutional shareholder support Highly regarded leadership with extensive retail net lease and public market REIT experience

Experienced

Board with significant relevant experience and a strong track record

Management? All members

of management and board are meaningfully invested in FCPT; interests

and Board

are aligned with shareholders

Best-in-class corporate governance

25 | FCPT | MARCH 2017

FOUR CORNERS PROPERTY TRUST

NYSE : FCPT